Overview

This article serves as a comprehensive step-by-step guide for CFOs aiming to effectively restructure business debt, thereby enhancing economic stability. It underscores the critical importance of:

- Evaluating financial status

- Engaging stakeholders

- Negotiating with creditors

- Implementing strategic changes

Furthermore, it addresses the potential risks and benefits associated with the restructuring process, ensuring that decision-making is informed and strategic.

Introduction

Navigating the complexities of business debt presents a formidable challenge for CFOs, particularly in an environment where economic pressures are escalating and cash flow is increasingly strained. Debt restructuring emerges as a viable pathway, not only to alleviate financial burdens but also to bolster a company's overall economic stability.

However, with a myriad of strategies available and potential risks lurking in the shadows, how can CFOs effectively implement a restructuring plan that genuinely benefits their organization? This guide explores the fundamental principles and step-by-step processes of debt restructuring, equipping financial leaders with the insights necessary to transform their companies' financial futures.

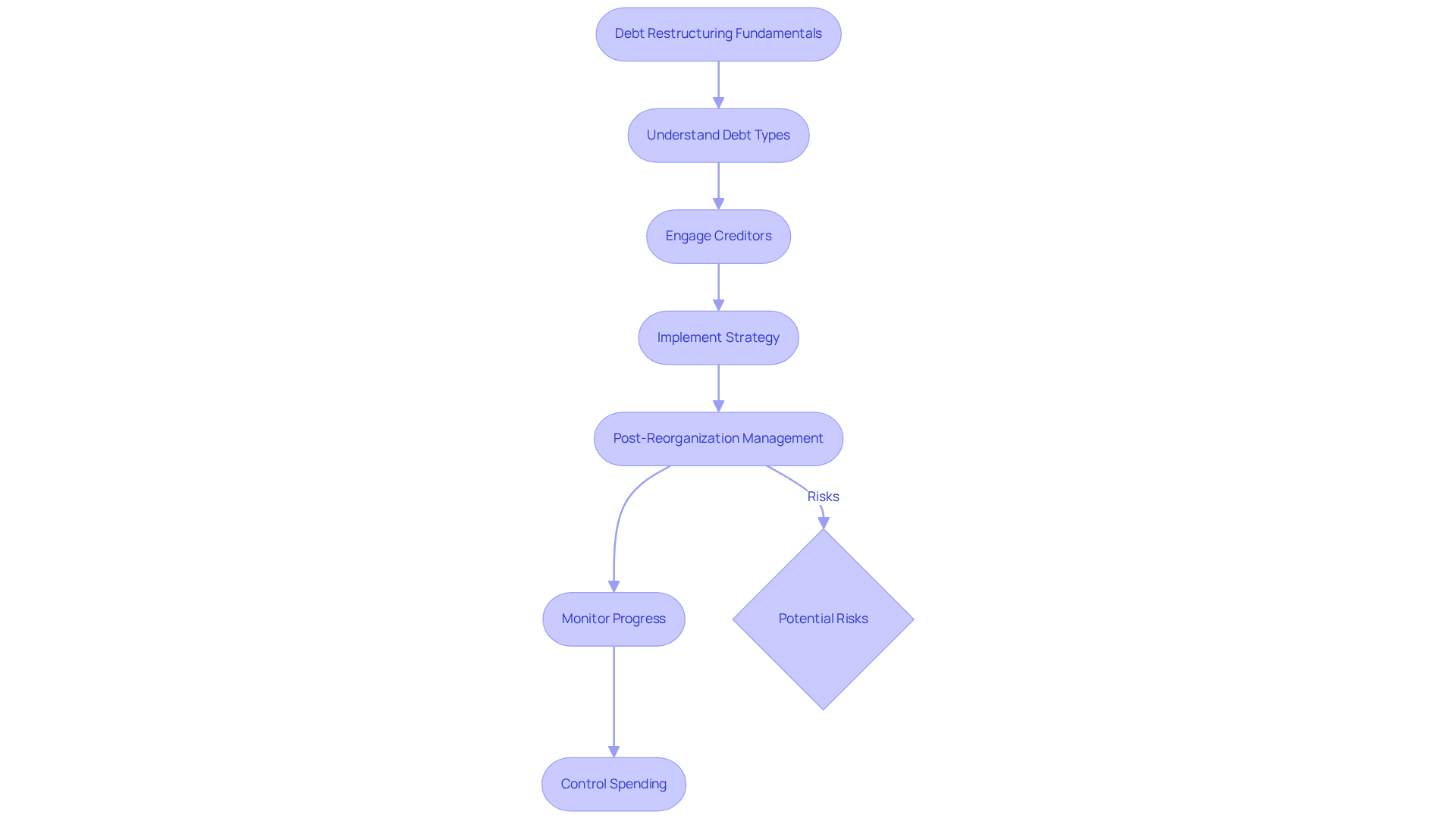

Understand Debt Restructuring Fundamentals

Liability reorganization is a strategic process designed to restructure business debt by renegotiating current obligations, ultimately enhancing a company's economic stability. This approach is particularly vital for organizations grappling with cash flow challenges, as it aims to restructure business debt, thereby alleviating the burden and making it more manageable.

Understanding the nuances between secured and unsecured debt is essential; this distinction significantly influences negotiation strategies and potential outcomes. Furthermore, recognizing the pivotal role of creditors is crucial; fostering open communication can pave the way for negotiations that may yield altered interest rates, extended repayment schedules, or even reductions in principal amounts.

By mastering these fundamentals, CFOs can formulate a clear strategy and informed perspective, positioning their companies for successful reorganization and the opportunity to restructure business debt for improved economic health.

To effectively implement these strategies, CFOs should embrace a 'Decide & Execute' approach, facilitating swift decision-making throughout the turnaround process. Additionally, leveraging real-time analytics via client dashboards allows for continuous monitoring of business performance, aligning with the 'Update & Adjust' strategy to ensure that decisions are informed and responsive to evolving circumstances.

It is also imperative to establish a follow-up strategy to manage expenses and encourage prudent savings post-reorganization, as this will bolster economic stability. CFOs must remain vigilant regarding potential risks, such as creditor reluctance to negotiate or the short-term adverse effects on credit scores.

By applying the insights gained during the reorganization process, CFOs can effectively prepare their companies for transformative success and enhanced economic well-being.

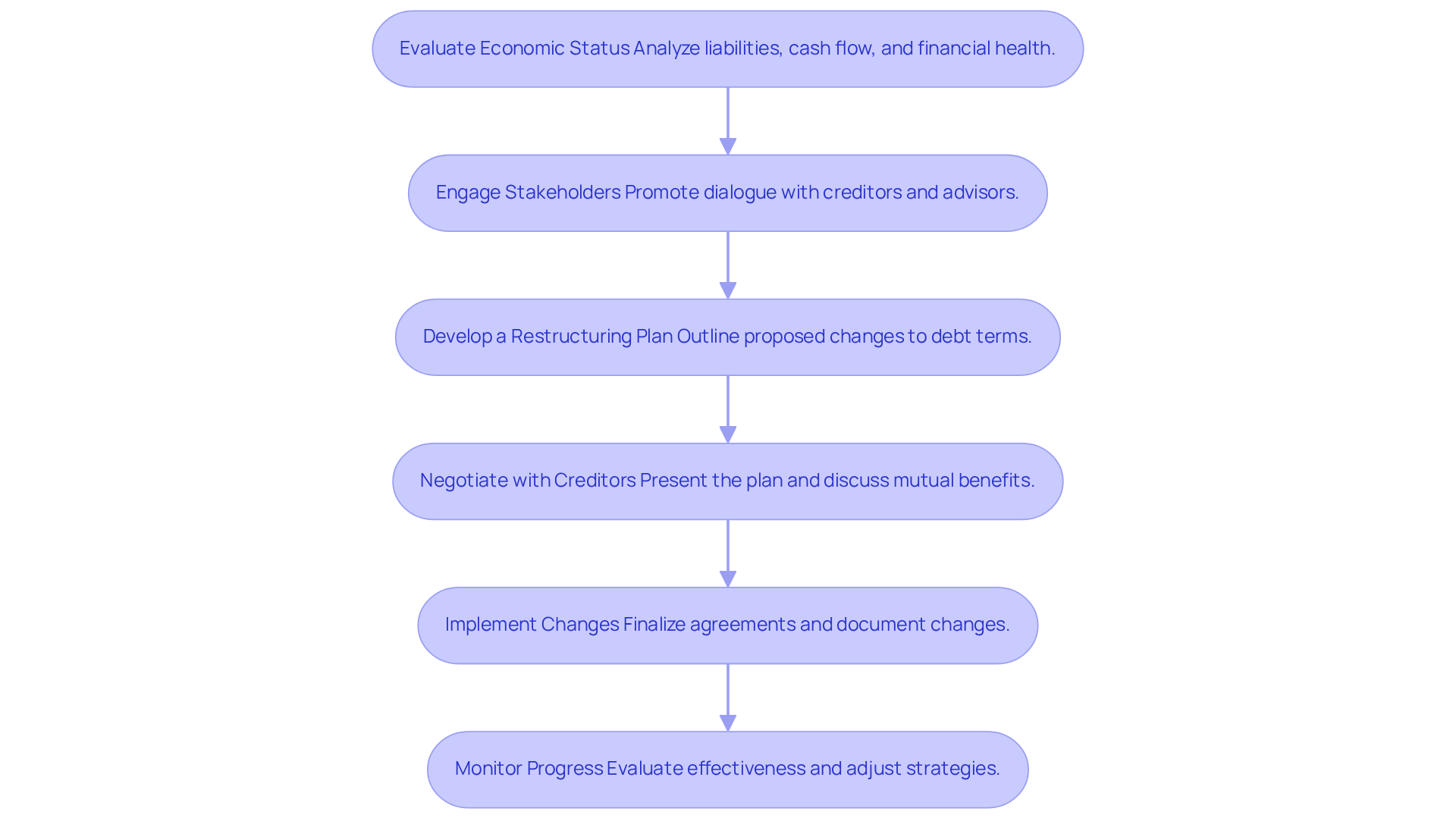

Follow the Step-by-Step Debt Restructuring Process

-

Evaluate Economic Status: Begin with a thorough analysis of your existing liabilities, cash flow, and overall monetary well-being. In 2025, nearly 40% of small enterprises hold over $100,000 in liabilities, highlighting the necessity to recognize and prioritize the most burdensome financial obligations to restructure business debt.

-

Engage Stakeholders: Promote open dialogue with key stakeholders, including creditors, board members, and advisors. Transparency is essential for building trust and facilitating effective negotiations.

-

Develop a Restructuring Plan: Formulate a detailed plan that outlines the proposed changes to debt terms. This plan should articulate clear objectives, timelines, and the rationale behind the reorganization, ensuring alignment with the company's financial goals, particularly in how to restructure business debt.

-

Negotiate with Creditors: Present your reform plan to creditors, emphasizing the mutual benefits of the proposed changes. Be prepared to discuss conditions that are both advantageous and practical, considering the current economic environment where small enterprises face limited access to credit.

-

Implement Changes: Once agreements are finalized, implement the new terms promptly. Ensure that all changes are thoroughly documented and communicated to all relevant parties to maintain clarity and accountability.

-

Monitor Progress: After restructuring, closely observe monetary performance to evaluate the effectiveness of the changes. Adjust strategies as needed to ensure continuous economic well-being, particularly in light of the rising expenses and unpredictable cash flow challenges that many small enterprises are currently encountering.

Explore Common Debt Restructuring Strategies

-

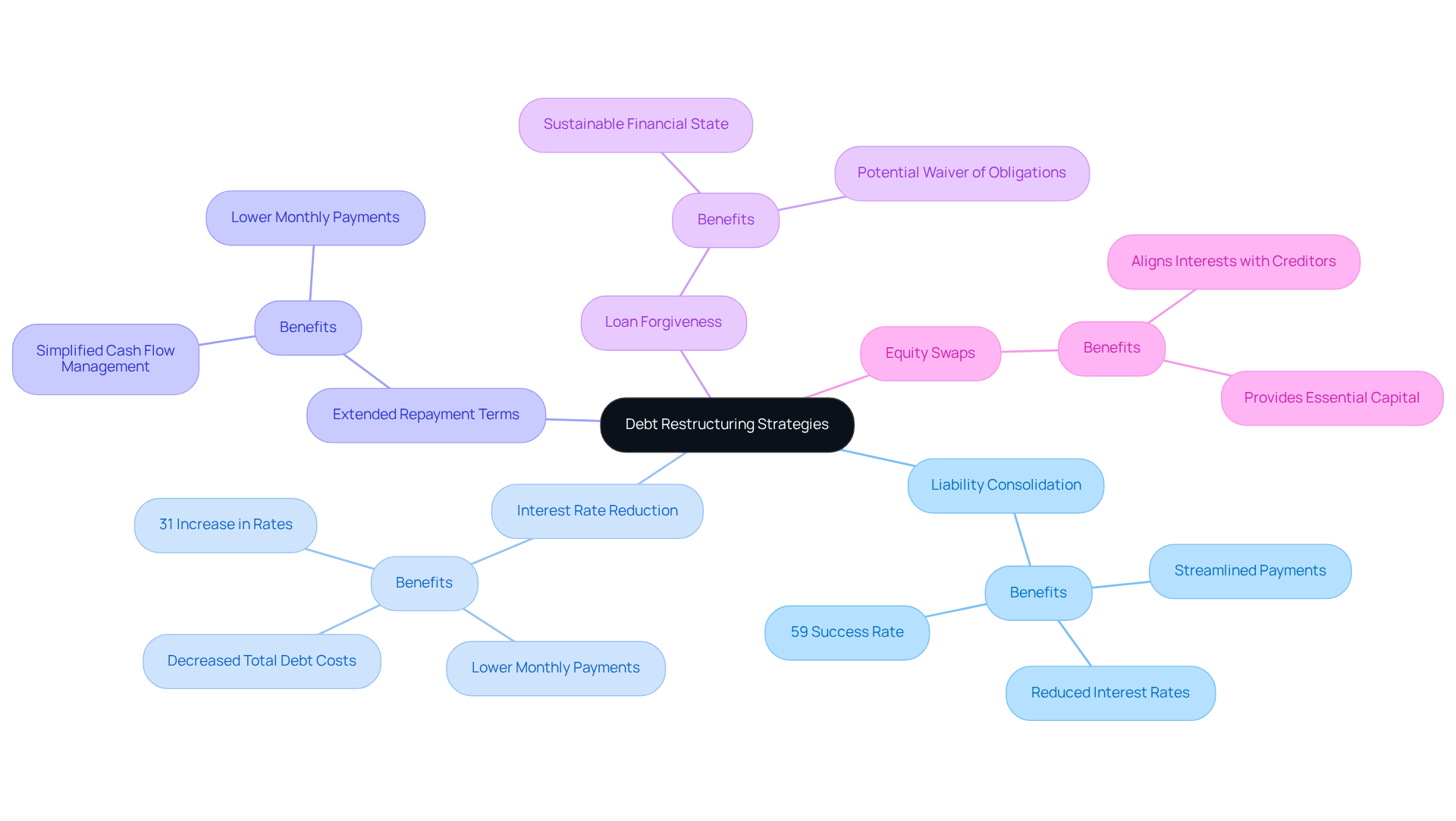

Liability Consolidation: This approach entails merging various obligations into one loan with a reduced interest rate, which can help to restructure business debt, streamline payments, and potentially lower total expenses. For small enterprises, the ability to restructure business debt can result in considerable monetary relief, as evidenced by the statistic that 59% of respondents successfully merged all their current liabilities using a consolidation loan. By leveraging real-time analytics and utilizing client dashboards, CFOs can monitor the impact of this consolidation on cash flow and overall economic health, testing hypotheses about its effectiveness.

-

Interest Rate Reduction: Negotiating lower interest rates can significantly decrease monthly payments and total debt costs, providing immediate financial relief. In the current lending environment, where personal loan interest rates have surged by 31% over the past year, securing lower rates is more crucial than ever. An efficient decision-making process can enable faster negotiations, allowing companies to capitalize on favorable terms while experimenting with various negotiation strategies.

-

Extended Repayment Terms: Lengthening the repayment period can reduce monthly payments, simplifying cash flow management while still meeting obligations. This method is particularly advantageous for small enterprises facing tight cash flow circumstances. Continuous monitoring through client dashboards allows CFOs to assess the effectiveness of this strategy in real-time, adjusting as necessary.

-

Loan Forgiveness: In certain situations, creditors may agree to waive a portion of the obligation, especially if they believe it is in their best interest to recover some funds rather than risk total loss. Such negotiations can lead to a more sustainable financial state for the company. Testing various negotiation strategies can yield insights into the most effective approaches for securing forgiveness.

-

Equity Swaps: This entails converting liabilities into equity, enabling creditors to become stakeholders in the company, which can align interests and provide the organization with essential capital. This innovative reorganization option fosters a collaborative relationship with creditors. Operationalizing lessons learned from previous negotiations can enhance the success rate of equity swaps.

Statistics indicate that companies that utilize strategies to restructure business debt can experience substantial advantages. For instance, businesses that consolidate their financial obligations often report an average credit score improvement of approximately 18 points shortly after the procedure, further enhancing their borrowing capacity. Moreover, numerous CFOs recognize that efficient liability management not only alleviates short-term monetary pressures but also positions the organization for sustained growth and stability. As one financial consultant observed, 'Debt consolidation can be a lifeline for companies, enabling them to regain control over their finances and focus on growth.' Additionally, the success story of Michelle V., who reduced her obligations by 23%, exemplifies the tangible benefits of these strategies.

Evaluate Risks and Benefits of Debt Restructuring

Evaluate Risks and Benefits of Debt Restructuring

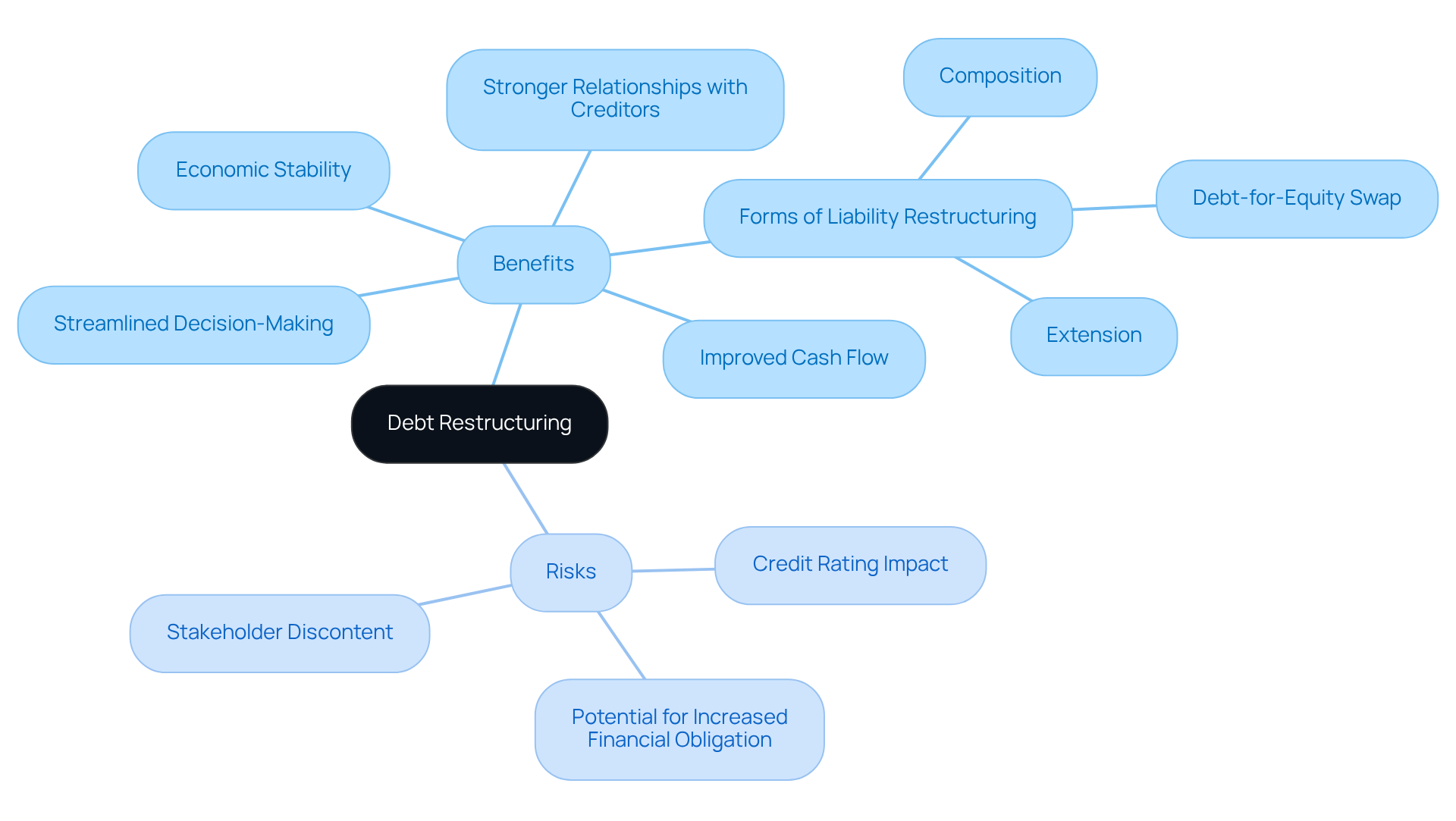

Benefits:

- Improved Cash Flow: Debt restructuring can significantly lower monthly payments, allowing businesses to allocate cash towards essential operational needs. This enhanced liquidity is crucial for maintaining day-to-day operations and investing in growth opportunities.

- Economic Stability: By taking steps to restructure business debt and renegotiate loan terms, companies can regain control over their monetary situation, reducing the likelihood of bankruptcy. This proactive method aids in stabilizing the company and promotes a more sustainable economic environment.

- Stronger Relationships with Creditors: Successfully negotiating new terms can enhance goodwill with creditors, paving the way for more favorable dealings in the future. A collaborative approach can lead to better support from creditors during challenging times.

- Forms of Liability Restructuring: Common forms include Extension, where creditors extend repayment periods; Composition, which involves negotiating to pay back less than owed; and Liability-for-Equity Swap, allowing creditors to exchange obligations for equity in the company. Understanding these forms can help CFOs choose the best strategy for their situation.

- Streamlined Decision-Making: Utilizing real-time analytics can support a shortened decision-making cycle during the reorganization process, enabling CFOs to take decisive actions that restructure business debt and preserve the business's financial health.

Risks:

- Credit Rating Impact: Engaging in debt restructuring may adversely affect a company's credit rating. This decline can result in higher borrowing costs or difficulties in securing future financing, which can hinder growth and operational flexibility.

- Potential for Increased Financial Obligation: If restructuring is not managed prudently, it may lead to a cycle of increased financial responsibility. Unsustainable new terms can worsen economic difficulties rather than relieve them, making it crucial to ensure that any changes are feasible long-term solutions.

- Stakeholder Discontent: Changes in debt terms may not be universally accepted by all stakeholders, potentially leading to conflicts or dissatisfaction. Transparent communication and engagement with stakeholders are vital to mitigate these risks and maintain trust.

By carefully weighing these factors, including the forms of restructuring available and insights from experts like Joshua Harris, CFOs can make informed strategic decisions that align with their organization's financial health and long-term objectives.

Conclusion

Restructuring business debt transcends a mere financial adjustment; it represents a strategic maneuver capable of significantly enhancing a company's economic stability. By grasping the fundamentals of debt restructuring, engaging stakeholders, and employing effective negotiation strategies, CFOs can adeptly navigate the complexities of financial obligations. This proactive approach is indispensable for organizations grappling with cash flow challenges, empowering them to regain control and strategically position themselves for future growth.

Key strategies include:

- Liability consolidation

- Interest rate reduction

- Extended repayment terms

These strategies emerge as effective means of alleviating financial pressures. Each step in the restructuring process, from evaluating economic status to monitoring progress, plays a crucial role in ensuring successful outcomes. Moreover, recognizing the benefits—such as improved cash flow and stronger creditor relationships—while remaining vigilant of potential risks can empower CFOs to make informed decisions that align with their company’s long-term objectives.

Ultimately, the capability to restructure business debt effectively can serve as a lifeline for many organizations, enabling them not only to survive but also to thrive in a competitive landscape. It is imperative for CFOs to embrace these strategies, maintain vigilance regarding potential risks, and foster transparent communication with stakeholders. By doing so, they can transform their financial landscape and pave the way for sustainable success.

Frequently Asked Questions

What is debt restructuring?

Debt restructuring is a strategic process aimed at reorganizing business debt by renegotiating current obligations to enhance a company's economic stability, particularly for organizations facing cash flow challenges.

Why is understanding the difference between secured and unsecured debt important?

The distinction between secured and unsecured debt significantly influences negotiation strategies and potential outcomes during the debt restructuring process.

What role do creditors play in debt restructuring?

Creditors play a pivotal role in the restructuring process, and fostering open communication with them can lead to negotiations that may result in altered interest rates, extended repayment schedules, or reductions in principal amounts.

What approach should CFOs take for effective debt restructuring?

CFOs should adopt a 'Decide & Execute' approach for swift decision-making during the turnaround process, along with leveraging real-time analytics via client dashboards for continuous performance monitoring.

How can CFOs ensure informed decisions during the restructuring process?

By aligning with the 'Update & Adjust' strategy, CFOs can ensure that decisions are informed and responsive to evolving circumstances throughout the restructuring process.

What strategies should be established post-reorganization?

A follow-up strategy should be established to manage expenses and encourage prudent savings, which will help bolster economic stability after the reorganization.

What risks should CFOs be aware of during the debt restructuring process?

CFOs must remain vigilant regarding potential risks such as creditor reluctance to negotiate and the short-term adverse effects on credit scores that may arise during the restructuring process.

How can insights from the reorganization process benefit companies?

The insights gained during the reorganization can prepare companies for transformative success and enhance their overall economic well-being.