Overview

Stakeholder management and engagement are paramount for financial leaders, as they significantly enhance decision-making and foster collaboration, especially during challenging times. Effective strategies, such as consistent communication and real-time analytics, are emphasized as vital tools that can markedly improve project outcomes and stakeholder satisfaction. Ultimately, these practices lead to superior organizational performance. Financial leaders must recognize the importance of these strategies and implement them to navigate complexities effectively.

Introduction

In the intricate world of project management, the ability to effectively engage and manage stakeholders has emerged as a pivotal factor influencing success. As organizations navigate the complexities of diverse interests and rapidly changing environments, financial leaders must prioritize stakeholder engagement to foster collaboration and trust.

In 2025, the stakes are higher than ever, with research indicating that organizations excelling in stakeholder engagement are significantly more likely to deliver projects on time and within budget.

This article delves into the nuances of stakeholder management, exploring essential strategies and technologies that empower CFOs to build robust relationships and drive project outcomes. By understanding the principles of effective engagement and the challenges that lie ahead, financial leaders can enhance immediate project success and ensure long-term organizational sustainability.

Understanding Stakeholder Management and Engagement

This management approach represents a systematic method that encompasses recognizing, evaluating, and managing relationships with interested parties. It delineates the distinctions between stakeholder management and engagement to ensure the success of initiatives. This process is crucial, as it directly influences scope, schedule, budget, and quality. Conversely, stakeholder management and engagement prioritize nurturing connections and actively involving contributors in decision-making processes.

This differentiation is particularly significant for financial leaders, as effective stakeholder management and engagement can substantially enhance outcomes and elevate satisfaction levels. By 2025, the impact of stakeholder management and engagement on success rates will be more pronounced than ever. Organizations that prioritize these practices are likely to experience improved performance in their initiatives. Studies indicate that:

- 64% of high-maturity management processes deliver tasks on time

- 67% do so within budget

This underscores the necessity for CFOs to navigate complex interest landscapes, especially during financial crises when interests may diverge from organizational objectives.

Moreover, a commitment to continuous business performance monitoring through real-time analytics, facilitated by our client dashboard, is essential for fostering strong relationships with involved parties. This dashboard offers real-time business analytics that empower CFOs to consistently assess their business health. Organizations that adeptly manage relationships with interested parties during economic downturns can mitigate risks and promote collaboration, resulting in more robust outcomes.

Understanding the nuances of stakeholder management and engagement not only supports short-term success but also cultivates long-term organizational viability.

Effective strategies for stakeholder management and engagement in initiative oversight include:

- Consistent communication

- Clarity in decision-making

- Integration of participant feedback into planning

Current trends indicate a shift towards Agile methodologies, which emphasize flexibility and responsiveness to participant needs, thereby enhancing stakeholder management and engagement, as well as collaboration and outcomes. Furthermore, adopting technology-enabled solutions, such as portfolio oversight tools, can streamline decision-making processes and provide real-time analytics that inform efforts in stakeholder management and engagement.

As the landscape of participant oversight evolves in 2025, it is imperative for CFOs to remain informed about the latest trends and statistics. With 91% of project management professionals reporting challenges related to managing interested parties, ongoing investment in training becomes essential. Notably, 83% of high-performance organizations (i.e., 'Champions') make continuous investments in project management training. By implementing lessons learned from turnaround processes and leveraging analytics, including a pragmatic approach to data testing, CFOs can enhance their relationships with interested parties and secure a competitive advantage in an increasingly complex environment.

The Importance of Stakeholder Engagement for Financial Leaders

For financial leaders, the significance of stakeholder management versus engagement with interested parties is paramount, particularly in the context of turnaround and restructuring efforts. Effectively engaging involved parties in stakeholder management not only enhances decision-making but also incorporates a variety of perspectives and insights that are crucial during challenging times. As organizations encounter rising financial pressures in 2025, understanding the concerns of involved parties becomes essential for creating strategies that align with both organizational objectives and expectations.

To foster trust and collaboration—essential elements for navigating crises and achieving sustainable growth—stakeholder management is vital. Stakeholders, including employees, customers, investors, and regulators, must be actively involved. The comprehensive turnaround consulting services provided by Transform Your Small/Medium Business underscore the need for financial assessment, interim management, and bankruptcy case management to streamline operations. Statistics indicate that participants with high value but lower voice require better connections, while those with lower voice and value can be developed through involvement in significant projects. This dual approach ensures that everyone involved feels valued and heard, which is particularly important in financial decision-making.

Moreover, 39% of social media users desire prompt replies, underscoring the necessity for financial leaders to adopt effective interaction strategies. Digital platforms have emerged as influential instruments for improving participant involvement, enabling direct and interactive communication. A case study titled 'Digital Platforms for Enhanced Interaction' illustrated how a company utilized these platforms to enhance participant involvement during a financial crisis, resulting in quicker responses and more informed decision-making.

By implementing lessons learned through the turnaround process, including the management of bankruptcy cases, financial leaders can build strong, lasting relationships that enhance involvement from interested parties.

Financial leaders who prioritize stakeholder management from interested parties are better equipped to manage risks and seize opportunities, ultimately leading to improved outcomes in both the short and long term. By fostering an environment of trust and collaboration, they can navigate the complexities of financial distress more effectively, ensuring that their organizations not only survive but thrive.

Key Principles of Effective Stakeholder Engagement

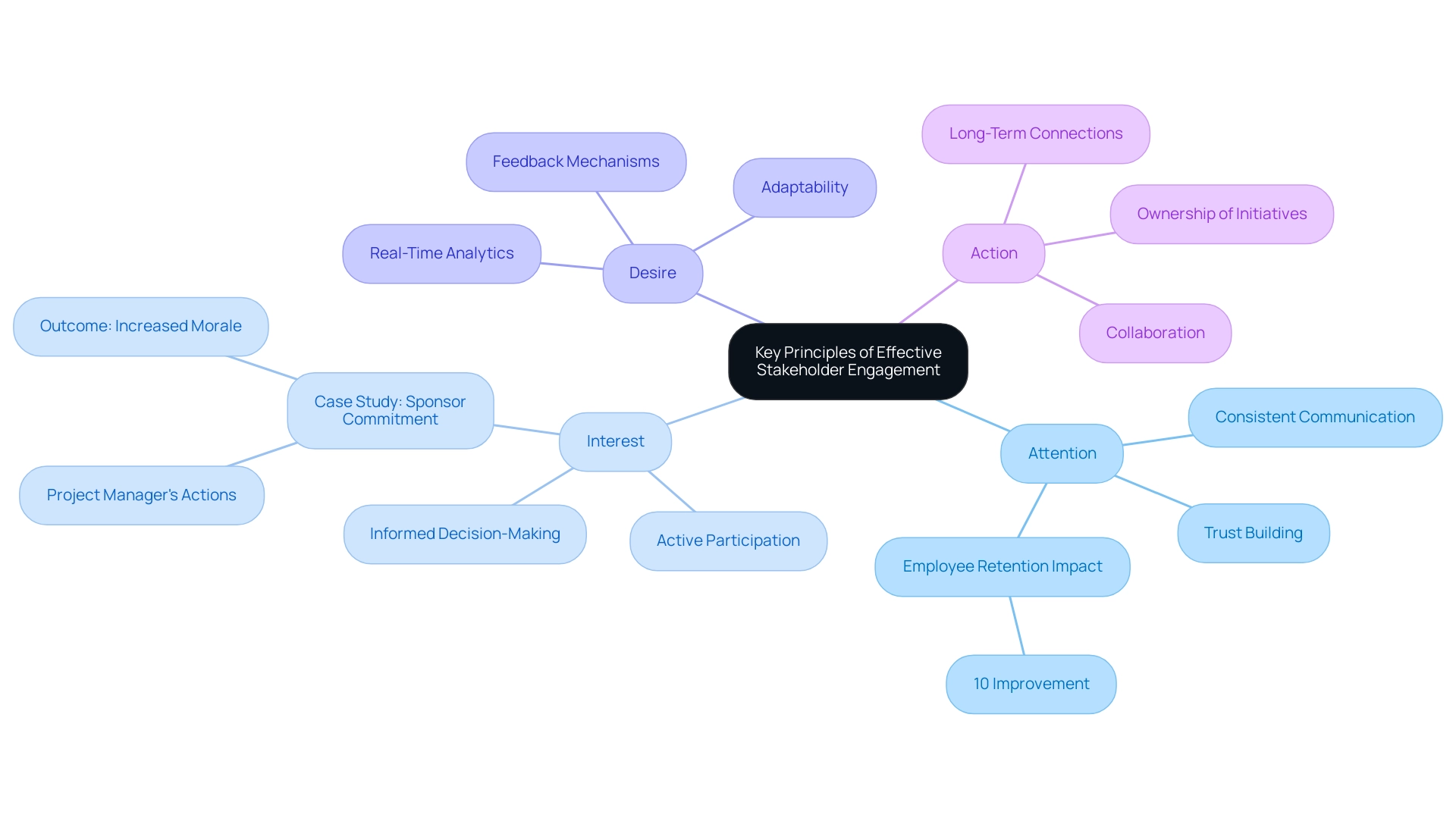

Effective engagement with interested parties hinges on several foundational principles that can significantly influence outcomes:

- Attention: Consistent and transparent communication is essential for building trust in the context of stakeholder management versus engagement among involved parties. Regular updates and open dialogues foster a sense of security and involvement. Significantly, effective communication can result in a 10% enhancement in employee retention, especially in technology sectors, highlighting the tangible advantages of prioritizing relationships with interested parties.

- Interest: Involvement is crucial; actively engaging participants in decision-making processes ensures their perspectives are valued and considered. This not only enhances stakeholder management versus engagement but also results in more informed decisions. Our client engagement process begins with a comprehensive business review, allowing our team to identify underlying issues and collaborate on strategies that reinforce strengths. For instance, a manager in a distribution firm recognized that the sponsor's absence of visible commitment was affecting team morale. By encouraging the sponsor to take a more active role—participating in testing and debugging—the project manager revitalized the project team and illustrated the concept of stakeholder management versus engagement, reinforcing the project's significance within the organization. Additionally, this process supports a shortened decision-making cycle, enabling swift actions to preserve business integrity.

- Desire: Feedback is vital; establishing robust mechanisms for stakeholder management versus engagement empowers participants to voice their concerns and suggestions. This two-way communication is crucial for effective stakeholder management versus engagement, as it helps identify potential issues early and adapt strategies accordingly. Our client dashboard offers real-time business analytics, allowing us to consistently track the success of our plans, ensuring that feedback from involved parties is not only heard but acted upon. Adaptability is key; the comparison of stakeholder management versus engagement shows that strategies must be flexible to respond to the evolving needs of involved parties. As circumstances change, so too should the approaches to maintain relevance and effectiveness, allowing for a streamlined decision-making cycle that supports timely actions during business turnarounds.

- Action: Collaboration plays a crucial role in stakeholder management versus engagement by fostering a cooperative environment that encourages participants to take ownership of initiatives. This shared commitment can lead to increased motivation and better project outcomes. Our commitment to implementing insights gained from the turnaround process enhances these connections, guaranteeing they are not merely transactional but lasting.

In 2025, the significance of communication in the context of stakeholder management versus engagement cannot be overstated. Metrics such as communication quality, task completion rates, and participant satisfaction are critical for assessing the return on investment in involvement strategies. Additionally, 39% of social media users desire prompt replies, emphasizing the necessity for rapid strategies for all parties involved.

By following these principles and concentrating on recognizing underlying business challenges, financial leaders can foster stronger relationships with interested parties, highlighting the importance of stakeholder management versus engagement and ultimately enhancing organizational outcomes.

Developing a Stakeholder Engagement Plan: A Step-by-Step Guide

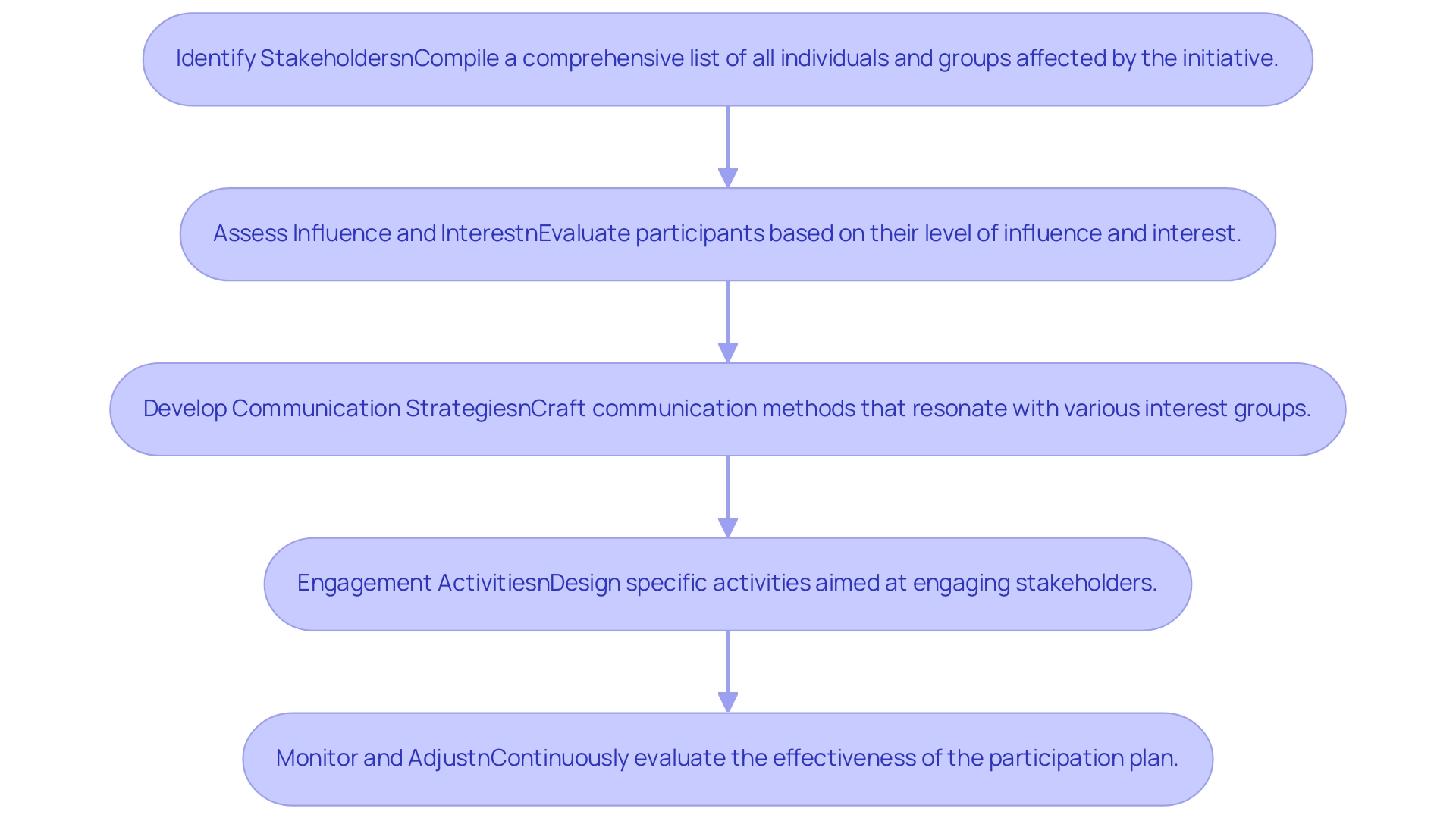

Creating a stakeholder engagement plan is essential for ensuring project success and involves several critical steps:

- Identify Stakeholders: Begin by compiling a comprehensive list of all individuals and groups who are affected by or have an interest in the initiative. This includes internal team members, external partners, and any other relevant parties. Grasping the influence and interest of these parties can streamline decision-making processes.

- Assess Influence and Interest: Evaluate participants based on their level of influence and interest in the project. This evaluation aids in prioritizing participation efforts and customizing strategies accordingly, enabling more definitive actions in response to input from interested parties.

- Develop Communication Strategies: Craft communication methods that resonate with various interest groups. Consider their preferences and the most effective channels for delivering information, whether through emails, reports, or face-to-face meetings. Real-time analytics can inform these strategies by highlighting which methods produce the best interaction results.

- Engagement Activities: Design specific activities aimed at engaging stakeholders. This could include organizing meetings, conducting surveys, or facilitating workshops to gather feedback and foster collaboration. By continuously monitoring participation outcomes through analytics, you can adjust these activities to enhance effectiveness.

- Monitor and Adjust: Implement a system for continuously evaluating the effectiveness of the participation plan. Utilizing real-time business analytics, regularly assess input from interested parties and results of interactions, and make necessary adjustments to enhance the plan's effectiveness. This streamlined decision-making approach allows your team to take decisive actions that preserve your business during turnaround processes.

This organized method not only guarantees that participant needs are met but also greatly improves the chances of success. In fact, statistics show that 91% of experts in program oversight encounter difficulties associated with stakeholder management vs engagement, highlighting the importance of a clearly defined strategy. As Rich Rinaldi, a specialist in overseeing projects, observes, 'A Master of Project Oversight degree provides professionals with the knowledge, skills, and credentials to endure and succeed in a swiftly evolving, intricate environment.'

By defining clear metrics and success criteria, CFOs can evaluate the effectiveness of their involvement strategies, aligning them with business objectives.

Moreover, comprehending the financial consequences of efficient management is essential; the typical manager in Europe earns approximately $95,000 each year, emphasizing the worth of proficient individuals in handling participant dynamics. The popularity of Scrum in Agile frameworks, with 71% of US firms adopting Agile and 61% concentrating mainly on Scrum, demonstrates an effective methodology that highlights participant involvement. By following these steps and leveraging continuous performance monitoring, CFOs can effectively navigate the dynamics of involved parties and drive successful project outcomes.

Challenges in Stakeholder Management and Engagement

Navigating the terrain of stakeholder management versus engagement presents a myriad of challenges for financial leaders, particularly in terms of strategic business enhancement. Key issues include:

- Diverse Interests: Stakeholders often possess conflicting priorities, complicating efforts to achieve consensus and satisfaction across the board. This diversity can lead to friction, particularly when financial decisions are at stake, highlighting the need for streamlined decision-making.

- Communication Barriers: Effective communication is crucial; however, miscommunication can lead to misunderstandings that distance involved parties. In 2025, overcoming these barriers is essential, as 74% of leaders report involving employees in change strategies, yet only 42% of employees feel included. This disconnect underscores the importance of real-time analytics and operationalizing turnaround lessons to enhance dialogue. Furthermore, 98% of companies adopting OKRs report improved transparency and alignment, indicating that structured frameworks can foster better communication.

- Resource Constraints: Limited resources can significantly hinder participation initiatives. Financial leaders must strategically allocate resources to ensure that efforts in stakeholder management versus engagement are both effective and sustainable, enabling continuous business performance monitoring.

- Resistance to Change: Stakeholders may show reluctance to proposed changes, complicating the involvement process. Successful organizations in 2025 will effectively navigate the balance between stakeholder management versus engagement, allowing employee freedom to innovate while adhering to structured guidelines that align with overarching change plans. This balance is crucial for fostering an environment conducive to participation and performance monitoring.

- Measuring Participation: Quantifying the effectiveness of participation initiatives remains a challenge. With 91% of project management professionals reporting difficulties in project management, establishing clear metrics for success is vital for financial leaders. Implementing methodologies like Six Sigma can provide a structured approach to improve operational efficiency and participant engagement, ensuring that investment returns are maximized.

To address these challenges, CFOs should adopt proactive strategies that include:

- Fostering open communication channels

- Utilizing technology to streamline engagement processes

- Implementing frameworks like the Six Sigma methodology to enhance operational efficiency

Additionally, they should collaboratively identify underlying issues with involved parties and create plans that not only address weaknesses but also reinvest in key strengths. By doing so, they can effectively navigate the complexities of stakeholder management versus engagement and drive successful outcomes in their organizations.

Leveraging Technology for Enhanced Stakeholder Engagement

In the rapidly evolving digital landscape of 2025, technology plays a crucial role in transforming participant engagement and streamlining decision-making processes. Advanced tools such as customer relationship management (CRM) systems, management software, and sophisticated communication platforms are essential for fostering meaningful interactions with interested parties while supporting a shortened decision-making cycle. These technologies empower financial leaders to meticulously track interactions and gather valuable feedback, all while leveraging real-time business analytics through a client dashboard that continually diagnoses organizational health and performance.

Moreover, digital solutions facilitate the personalization of communication, enabling CFOs to deliver relevant information tailored to the unique needs of each individual. This targeted approach not only enhances comprehension but also significantly boosts retention of information; studies from PwC indicate that visuals can improve retention by up to 70%. By effectively utilizing technology, CFOs can foster stronger connections and operationalize turnaround lessons, transforming interested parties into advocates for their projects—an essential factor when considering stakeholder management versus engagement to ensure project success and sustained growth.

The influence of CRM systems on stakeholder management versus engagement with interested parties is particularly noteworthy in 2025, as organizations increasingly recognize the necessity of developing customized interaction strategies for different segments. The case study titled 'Critical Participant Segments: Tailoring Interaction Strategies' illustrates this necessity, emphasizing that by categorizing participants based on their voice and value, businesses can create targeted strategies that maximize contributions and involvement. This strategic alignment is crucial in navigating the blurred lines between public and private sectors in technology development, ultimately enhancing civil society's role in shaping these processes.

As financial leaders adopt these technological advancements and emphasize real-time analytics from their client dashboards, they are better equipped for stakeholder management versus engagement, ultimately driving both immediate results and long-term success. Leaders are encouraged to prioritize stakeholder management versus engagement to build trust and alignment with involved parties, transforming them into project advocates to ensure project success and sustained growth.

Measuring Success: Evaluating Stakeholder Engagement Outcomes

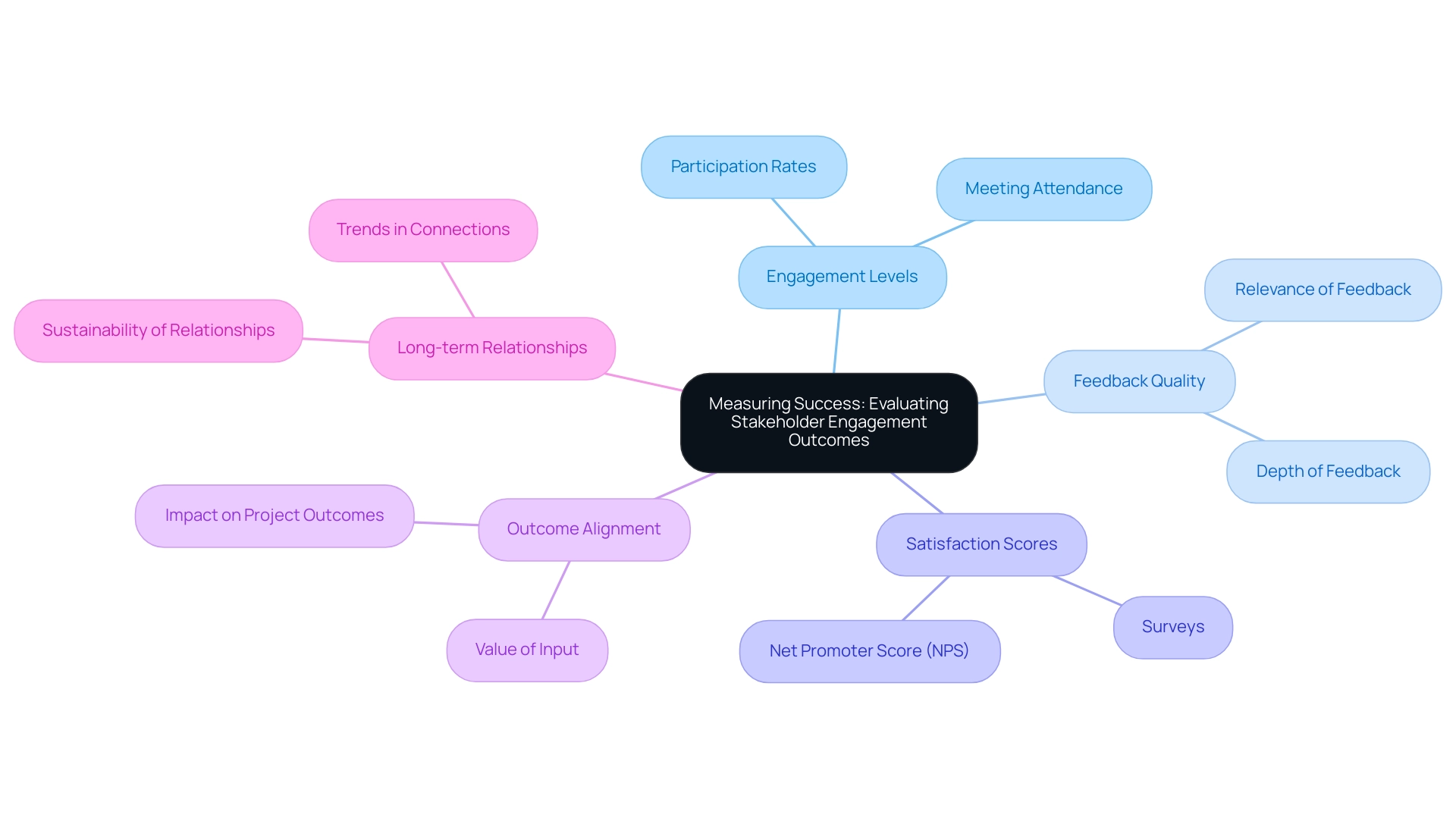

Measuring the success of stakeholder engagement necessitates a multifaceted approach, emphasizing several critical metrics:

- Engagement Levels: Monitor participation rates in meetings, events, and other interactions to assess the involvement of interested parties.

- Feedback Quality: Evaluate the relevance and depth of feedback obtained from involved parties, ensuring alignment with organizational goals.

- Satisfaction Scores: Implement surveys to gauge participant satisfaction with engagement initiatives, providing quantitative data to inform strategies. Notably, the Net Promoter Score (NPS) can be calculated by subtracting the percentage of detractors from the percentage of promoters, offering a clear measure of satisfaction among interested parties.

- Outcome Alignment: Analyze whether contributions from involved parties have positively impacted project outcomes, demonstrating the value of their input.

- Long-term Relationships: Monitor the sustainability of partner relationships over time, identifying trends that indicate the strength of these connections.

In 2025, organizations are increasingly utilizing management platforms, such as Simply Stakeholders, to simplify the tracking and reporting of these interaction metrics. These platforms support a streamlined decision-making cycle that allows businesses to take decisive actions based on real-time analytics. By effectively measuring engagement metrics, organizations can make informed decisions that directly contribute to turnaround efforts.

A recent case study titled "Measure Engagement With a Reporting Tool" highlighted the effectiveness of a reporting tool featuring custom dashboards and mapping capabilities, enabling continuous monitoring of business performance and the operationalization of turnaround lessons. As Milad Malek from Project Management states, "Start applying these strategies today to foster stronger relationships and achieve unparalleled project outcomes." By systematically assessing these outcomes, financial leaders can refine their engagement strategies, ultimately enhancing organizational success and fostering stronger stakeholder relationships through informed decisions and ongoing analytics, especially when considering stakeholder management versus engagement.

Conclusion

In the intricate realm of project management, effective stakeholder engagement stands as a cornerstone of success. Financial leaders, particularly CFOs, must prioritize the cultivation of robust relationships with stakeholders to enhance project outcomes. By grasping the nuances of stakeholder management, organizations can adeptly navigate diverse interests and foster collaboration—an imperative especially in times of financial uncertainty.

The strategies outlined—regular communication, active involvement, and the integration of technology—are vital for building trust and ensuring that stakeholder voices resonate. As organizations grapple with increasing pressures in 2025, the significance of these engagement principles is paramount. By emphasizing transparency and adaptability, CFOs can respond adeptly to the evolving needs of stakeholders, ultimately resulting in improved decision-making and project performance.

Moreover, the incorporation of real-time analytics and digital platforms enables a more personalized approach to stakeholder engagement. This advancement not only enhances the quality of interactions but also empowers financial leaders to make informed decisions that align with both organizational objectives and stakeholder expectations. By continuously measuring engagement outcomes, organizations can refine their strategies, ensuring they remain relevant and effective.

In conclusion, the journey toward successful stakeholder engagement is an ongoing endeavor that demands commitment and strategic foresight. By operationalizing lessons learned and leveraging technology, financial leaders can transform stakeholders into advocates, paving the way for sustainable growth and project success. As the landscape continues to evolve, prioritizing stakeholder engagement will emerge as the key differentiator for organizations striving to thrive in an increasingly complex environment.

Frequently Asked Questions

What is the primary focus of stakeholder management and engagement?

The primary focus is on recognizing, evaluating, and managing relationships with interested parties to ensure the success of initiatives, influencing scope, schedule, budget, and quality.

How do stakeholder management and engagement differ?

Stakeholder management emphasizes nurturing connections, while engagement actively involves contributors in decision-making processes.

Why is stakeholder management important for financial leaders?

Effective stakeholder management and engagement can significantly enhance outcomes and satisfaction levels, especially during financial crises when interests may diverge.

What impact is expected from stakeholder management and engagement by 2025?

The impact on success rates will be more pronounced, with organizations prioritizing these practices likely to experience improved performance in their initiatives.

What statistics support the benefits of high-maturity management processes?

Studies indicate that 64% of high-maturity management processes deliver tasks on time, and 67% do so within budget.

How can organizations mitigate risks during economic downturns?

By managing relationships with interested parties effectively, organizations can promote collaboration and achieve more robust outcomes.

What strategies are effective for stakeholder management and engagement?

Effective strategies include consistent communication, clarity in decision-making, and integrating participant feedback into planning.

What trends are influencing stakeholder management and engagement?

There is a shift towards Agile methodologies that emphasize flexibility and responsiveness to participant needs, enhancing collaboration and outcomes.

Why is ongoing investment in project management training essential?

With 91% of project management professionals reporting challenges in managing interested parties, continuous investment in training helps organizations navigate these complexities.

How can financial leaders enhance their relationships with interested parties?

By implementing lessons learned from turnaround processes, leveraging analytics, and fostering an environment of trust and collaboration, financial leaders can improve outcomes and manage risks effectively.