Overview

This article delves into the critical distinctions between stakeholder and shareholder theories in corporate management, emphasizing their ethical implications and practical applications.

- Stakeholder theory advocates for the consideration of all affected parties' interests, fostering corporate social responsibility and long-term sustainability.

- In contrast, shareholder theory prioritizes profit maximization, which can lead to negative externalities and short-termism.

- This trend is increasingly evident in contemporary corporate management practices and consumer preferences.

Moreover, understanding these theories is essential for navigating the complexities of modern business environments.

- Stakeholder theory not only enhances a company's reputation but also aligns with evolving consumer expectations, driving sustainable growth.

- Conversely, the relentless focus on shareholder value can undermine long-term viability, as companies may neglect broader societal responsibilities.

Consequently, businesses must reassess their priorities to balance profit with purpose.

- By integrating stakeholder perspectives into their strategies, organizations can achieve a competitive edge while contributing positively to society.

- This shift is not merely a trend; it is a necessity for enduring success in today's market landscape.

Introduction

The ongoing debate surrounding stakeholder and shareholder theories holds profound implications for corporate management ethics.

As businesses navigate an increasingly complex landscape, understanding the balance between profit maximization and social responsibility becomes paramount.

This article delves into the core principles of both theories, exploring their ethical ramifications and practical applications in today’s corporate environment.

Are companies genuinely prioritizing the interests of all stakeholders, or do they remain tethered to the traditional focus on shareholder returns?

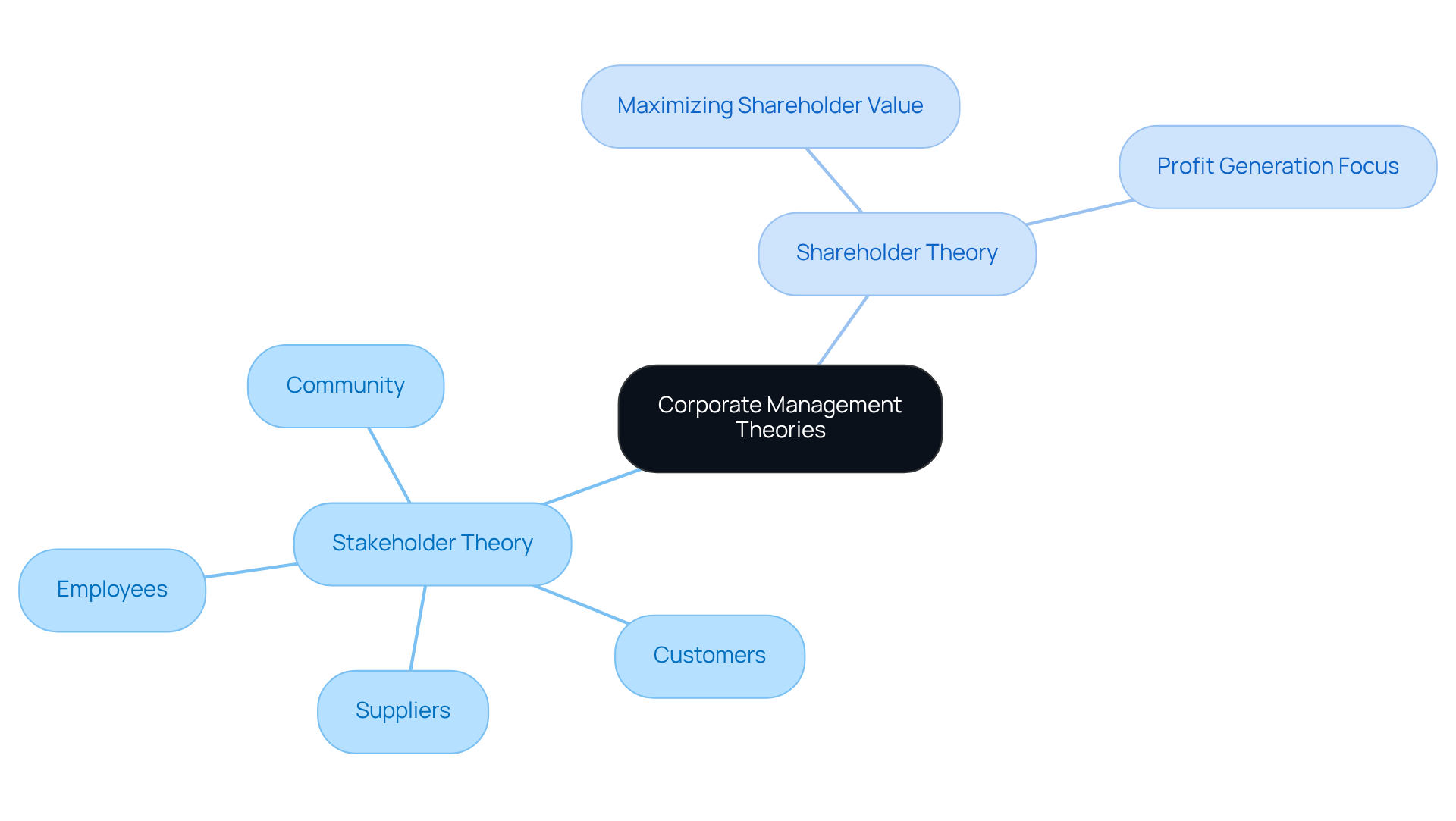

Define Stakeholder and Shareholder Theories

According to the stakeholder vs shareholder theory of the ethics of corporate management, a corporation must consider the interests of all parties affected by its actions, including:

- Employees

- Customers

- Suppliers

- The community

This approach underscores the importance of corporate social responsibility and the ethical obligation to generate value for a wider audience. In contrast, the stakeholder vs shareholder theory of the ethics of corporate management, which is often associated with Milton Friedman, posits that an organization's primary duty is to maximize shareholder value, focusing on financial returns for those who own shares. This viewpoint prioritizes profit generation above all else, frequently leading to a more limited understanding of corporate success.

Examine Ethical Implications in Corporate Management

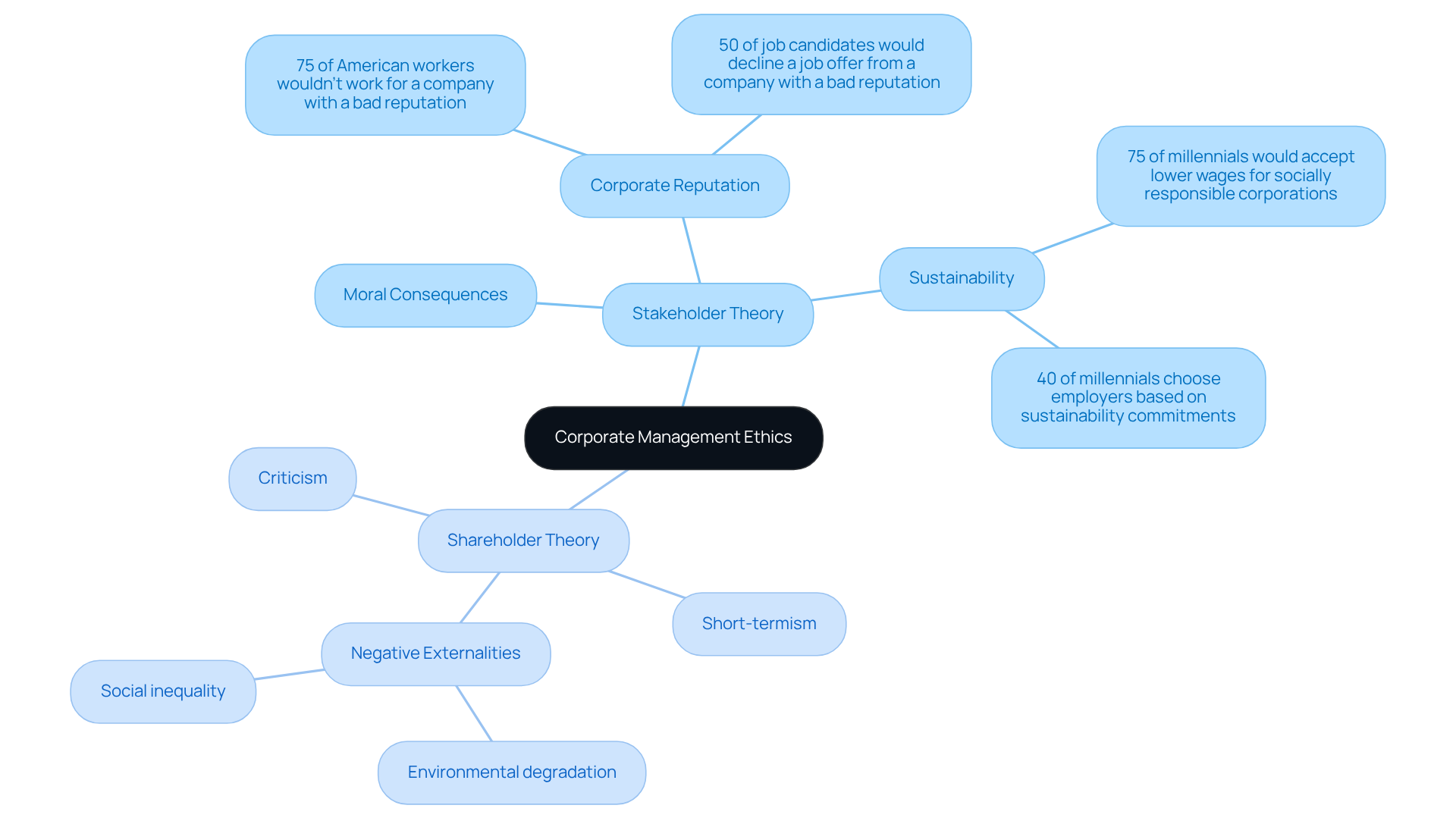

The moral consequences of stakeholder principles are significant. They urge companies to consider the interests of all parties involved, promoting fairness and social accountability. This inclusive approach not only enhances corporate reputation but also contributes to long-term sustainability.

In contrast, shareholder theory has faced criticism for fostering a culture of short-termism, where immediate financial gains are prioritized over moral considerations. This often results in negative externalities, such as environmental degradation and social inequality.

The current moral discussion examines the stakeholder vs shareholder theory of the ethics of corporate management, questioning whether companies should focus solely on profit maximization or adopt a broader perspective that considers societal effects. Notably, almost 90% of C-suite leaders recognize a transition towards stakeholder capitalism, indicating an increasing awareness of the responsibilities corporations have towards their stakeholders.

Furthermore, data show that 75% of millennials would agree to lower salaries to work for socially responsible organizations, underscoring the significance of moral practices in attracting and retaining talent. Additionally, 75% of American workers wouldn’t work for a company with a bad brand reputation, highlighting the critical role of corporate ethics in recruitment.

As Warren Buffet wisely observed, it takes 20 years to establish a reputation and only 5 minutes to destroy it, emphasizing the long-term consequences of moral conduct in corporate management.

As the landscape of corporate management evolves, the stakeholder vs shareholder theory of the ethics of corporate management will increasingly influence business strategies and societal expectations.

Compare Practical Applications in Business Contexts

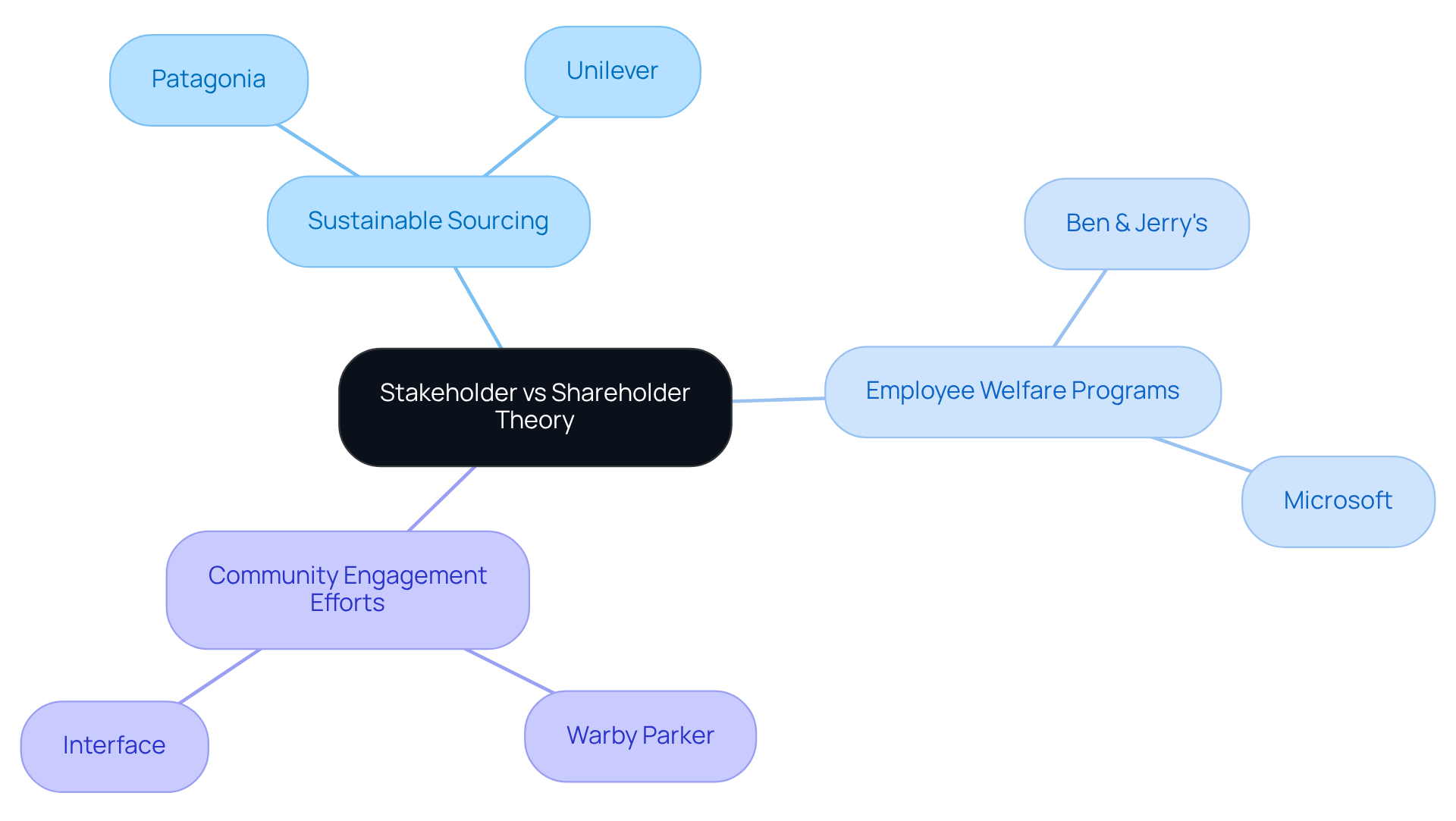

In practice, interest group concepts are frequently utilized in organizations that focus on the stakeholder vs shareholder theory of the ethics of corporate management, including initiatives like:

- Sustainable sourcing

- Employee welfare programs

- Community engagement efforts

For instance, organizations like Patagonia and Ben & Jerry's actively integrate the stakeholder vs shareholder theory of the ethics of corporate management into their business frameworks, which results in robust brand loyalty and favorable public perception.

Moreover, the stakeholder vs shareholder theory of the ethics of corporate management illustrates how the shareholder perspective is prevalent in publicly traded companies, where management decisions are heavily influenced by stock performance and shareholder expectations. This can lead to practices such as cost-cutting measures that prioritize short-term profits, as seen in many traditional corporations during economic downturns.

Analyze Advantages and Disadvantages of Each Theory

The stakeholder vs shareholder theory of the ethics of corporate management presents several advantages that cannot be overlooked:

- It cultivates a positive corporate image.

- It enhances employee engagement.

- It promotes long-term sustainability.

Companies that adopt this approach frequently enjoy increased customer loyalty and encounter less regulatory scrutiny. Engaged employees contribute to a more effective business, further solidifying the argument for involving various interested parties. However, the challenge lies in balancing the diverse interests of the stakeholder vs shareholder theory of the ethics of corporate management, which complicates decision-making processes. For instance, organizations may grapple with prioritizing conflicting demands from employees, customers, suppliers, and the community, which can lead to operational hurdles such as decreased worker morale and diminished consumer loyalty.

In contrast, the stakeholder vs shareholder theory of the ethics of corporate management provides a clear focus on profitability, driving financial performance and attracting investment. This emphasis on profit maximization can yield immediate financial benefits, as evidenced by firms that prioritize shareholder returns. Enhanced performance typically leads to increased investment and a robust customer base, underscoring the financial advantages of this approach. Nevertheless, the drawbacks are significant. This narrow focus often neglects ethical considerations outlined in the stakeholder vs shareholder theory of the ethics of corporate management and can harm relationships with other stakeholders, resulting in reputational damage and jeopardizing long-term sustainability. Critics argue that the stakeholder vs shareholder theory of the ethics of corporate management highlights how this limited perspective can create a disconnect between the organization and its broader community, ultimately compromising operational reliability and market position.

Moreover, statistics reveal that businesses strictly adhering to shareholder principles may face intensified scrutiny from consumers who increasingly favor brands demonstrating corporate social responsibility. North American consumers are progressively supporting brands that exhibit corporate social responsibility and sound hiring practices, emphasizing the risks associated with neglecting the interests of involved parties. This shift in consumer sentiment indicates that businesses failing to engage with their broader ecosystem may find themselves at a competitive disadvantage in an evolving market landscape. As Edward Freeman aptly states, "A company is only successful when it delivers value to its stakeholders," reinforcing the pivotal role of stakeholder theory in achieving long-term success.

Conclusion

The debate between stakeholder and shareholder theories underscores the evolving landscape of corporate management ethics. Stakeholder theory champions a holistic approach, emphasizing the necessity of considering the interests of all parties impacted by corporate actions. This viewpoint aligns with the increasing acknowledgment of corporate social responsibility, indicating that businesses should prioritize the welfare of employees, customers, suppliers, and the community alongside profit generation.

Key insights from the article illustrate that while stakeholder theory promotes long-term sustainability and a positive corporate image, shareholder theory frequently results in short-term financial gains at the cost of ethical considerations. The growing awareness among corporate leaders regarding the importance of stakeholder capitalism signifies a notable shift in business strategies, as demonstrated by consumer preferences for socially responsible brands. Furthermore, statistics reveal that many employees favor working for ethically sound organizations, further emphasizing the relevance of stakeholder principles in today’s corporate environment.

Ultimately, the implications of these theories extend beyond mere financial performance. Organizations are urged to adopt a stakeholder-centric approach to excel in a competitive market, where ethical practices and corporate responsibility are not merely appreciated but anticipated. As the realm of corporate management continues to transform, prioritizing the interests of all stakeholders will not only bolster reputation but also contribute to sustainable business success. Embracing this broader perspective is crucial for companies striving to navigate future challenges while upholding a robust ethical foundation.

Frequently Asked Questions

What is the stakeholder theory in corporate management?

The stakeholder theory posits that a corporation must consider the interests of all parties affected by its actions, including employees, customers, suppliers, and the community. It emphasizes corporate social responsibility and the ethical obligation to generate value for a wider audience.

What is the shareholder theory in corporate management?

The shareholder theory, often associated with Milton Friedman, asserts that an organization's primary duty is to maximize shareholder value, focusing on financial returns for those who own shares. This viewpoint prioritizes profit generation above all else.

How do stakeholder and shareholder theories differ?

Stakeholder theory emphasizes the importance of considering the interests of all parties impacted by corporate actions, while shareholder theory focuses solely on maximizing financial returns for shareholders, often at the expense of other stakeholders.

What is the ethical implication of the stakeholder theory?

The ethical implication of stakeholder theory is the responsibility of corporations to act in a way that benefits a broader audience beyond just shareholders, reflecting a commitment to corporate social responsibility.

Why is the shareholder theory often criticized?

The shareholder theory is often criticized for leading to a limited understanding of corporate success, as it prioritizes profit generation above all else, potentially neglecting the interests of other stakeholders.