Introduction

In today's challenging economic landscape, financial restructuring has become a crucial endeavor for companies across various industries. This article explores the multifaceted nature of restructuring and highlights real-world examples of successful turnarounds. From the consulting industry's response to macroeconomic pressures to the agile transformation of banks and healthcare organizations, we delve into the essential steps and decisions taken during the restructuring process.

By examining the importance of strategic planning, transparency, and agility, we uncover the keys to overcoming financial distress and paving the way for a stable and prosperous future.

Background and Context

The landscape of financial restructuring is a testament to the resilience and strategic acumen required to navigate through challenging economic times. A striking example of such tenacity is evident in the consulting industry's response to the macroeconomic pressures of recent years. Amidst a climate where clients are deferring long-term investments, leading consultancies like Accenture, Ernst & Young, and PricewaterhouseCoopers have had to make difficult decisions, including significant job cuts, reflecting the tough realities of an uncertain market.

When it comes to restructuring, the process is intricate and multifaceted. A pertinent case is that of Pacific Steel, a steel-recycling company with about 900 employees, which faced a daunting financial decision about a decade ago. The company's self-insured status meant high medical bill payouts.

They sought clarity on healthcare costs, which had become untenable. The move to a smaller administrator offered them the transparency they needed, revealing they were paying substantially more than Medicare rates. With the expertise of USI Insurance Services, Pacific Steel adopted a reference-based pricing strategy, aligning their payments more closely with Medicare rates, a transformative step for their financial health.

Meanwhile, companies like Pros Holdings Inc. have experienced the volatility of financial distress firsthand. Founded in 1985, Pros faced significant challenges following its transition to cloud computing, compounded by the pandemic's impact on its airline clients. Despite consistent revenue growth post-pandemic, the elusive return to profitability led to exploring strategic options, including a potential sale, underscoring the critical nature of agile and responsive financial strategies during times of distress.

In the banking sector, TBC Bank's mission to simplify life through digital innovation underscores the importance of agility and customer-centricity in the face of organizational complexity. Their agile transformation showcases a commitment to growth and digital business transformation. Similarly, healthcare organizations, as reported by KLAS, are seeking consulting expertise to navigate financial pressure fueled by the pandemic, inflation, and staffing shortages.

These studies highlight the essential role of consulting firms in providing strategic guidance during financially challenging times.

On the flip side, Haleon's emergence from GSK's demerger illustrates the complexities entailed in large-scale transformations, emphasizing the need for careful planning and management to avoid system downtime and lost sales, critical factors in ensuring financial stability during restructuring.

In the broader scope, the journey from consultant to CEO often involves gaining a comprehensive understanding of company operations and industry dynamics. At firms like Booz Allen Hamilton, this leadership development is integral to the ethos, fostering a culture where one can impact a broad spectrum of clients across diverse global industries.

Furthermore, the data on corporate bankruptcies underscores the vulnerability of consumer discretionary and industrial sectors to financial distress, especially in a rising rate environment. U.S. corporate interest costs have seen a 22% annual increase, underscoring the urgency for companies to take proactive measures in managing their financial health, whether through cost-cutting, debt restructuring, or, in dire circumstances, considering bankruptcy.

Each of these vignettes provides a glimpse into the crucial steps and decisions taken by organizations across various industries during restructuring processes, highlighting the importance of strategic planning, transparency, and agility in overcoming financial distress and paving the way for a stable and prosperous future.

Case Study Overview

In a dynamic business environment, it's not uncommon for companies to face the need for a strategic overhaul. A case in point is a restructuring consulting case where a blend of technical innovation and market analysis paved the way for a successful turnaround. The company leveraged a robust technical stack comprising Django, Tailwind, and HTMX to enhance user experience.

Simultaneously, a meticulous SEO strategy was employed, starting from scratch with competitor traffic analyses to pinpoint high-impact pages and keywords. This was coupled with a content refresh and a strategic roadmap for new content targeting specific search intentions, which was continually optimized through testing and CTA enhancements.

The consulting industry itself, while having experienced a boom during the pandemic, is now seeing a shift. Major consultancies like Accenture, Ernst & Young, and PricewaterhouseCoopers have been compelled to restructure, cutting jobs and reevaluating investments amid a fluctuating macroeconomic climate. These industry adjustments mirror the broader challenges and necessary adaptability within the consulting field.

Real-world examples underscore the effectiveness of these strategies. Rite Aid's agreement with its senior secured noteholders to significantly reduce debt and increase financial flexibility—achieved through a court-supervised Chapter 11 process—highlights the importance of a clearly structured financial restructuring plan. Similarly, WeWork's emergence from Chapter 11, after a comprehensive restructuring of its lease portfolio and debt reduction, underscores the potential for renewed growth and profitability when strategic restructuring is successfully implemented.

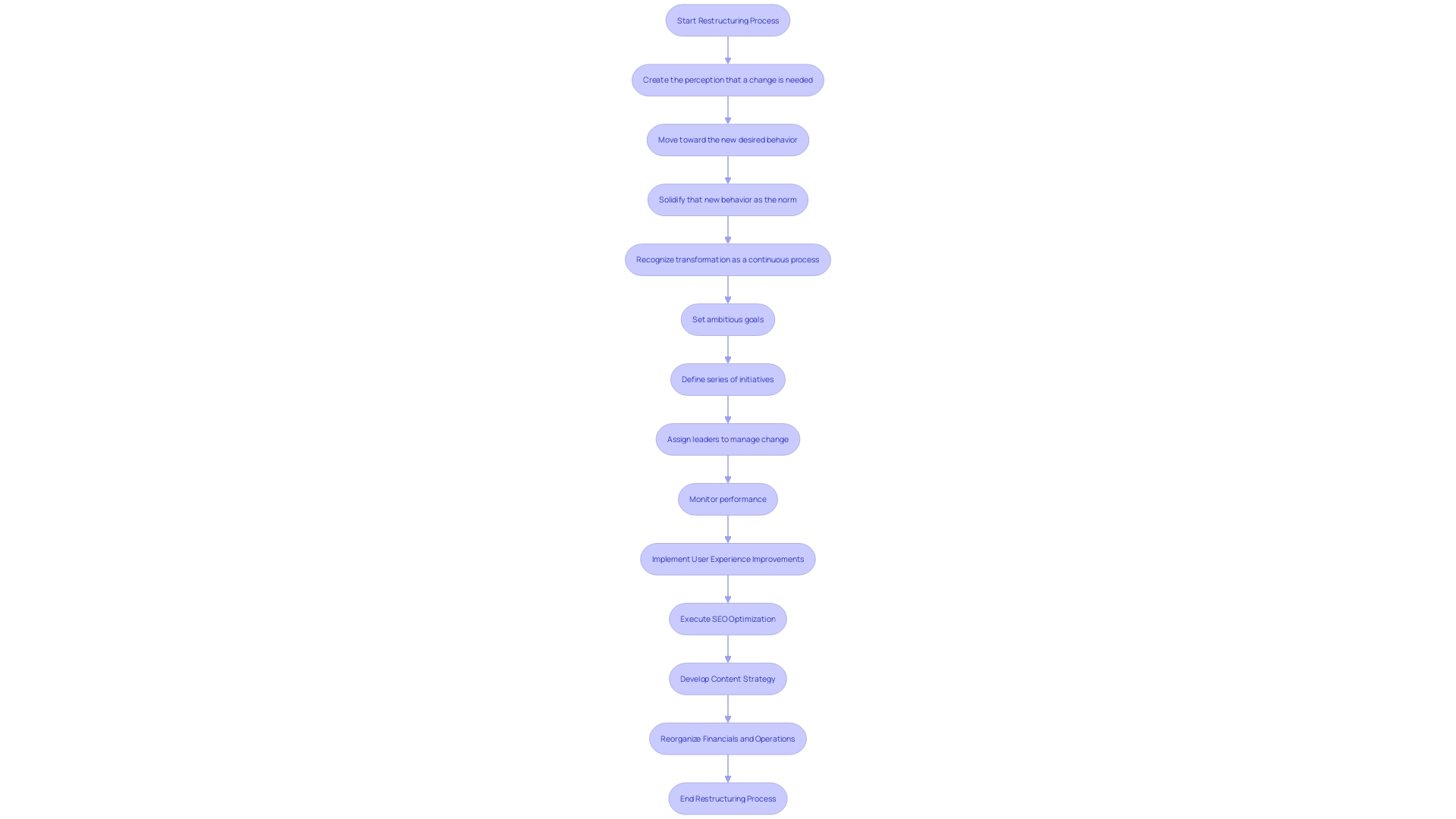

The lessons drawn from these cases are clear: a successful restructuring process is multi-faceted, requiring a combination of technical savvy, market insight, and strategic financial planning. It's a testament to the power of a holistic approach to restructuring, integrating user experience improvements, SEO optimization, and content strategy with financial and operational reorganization for transformative results.

Essential Steps in Restructuring Consulting

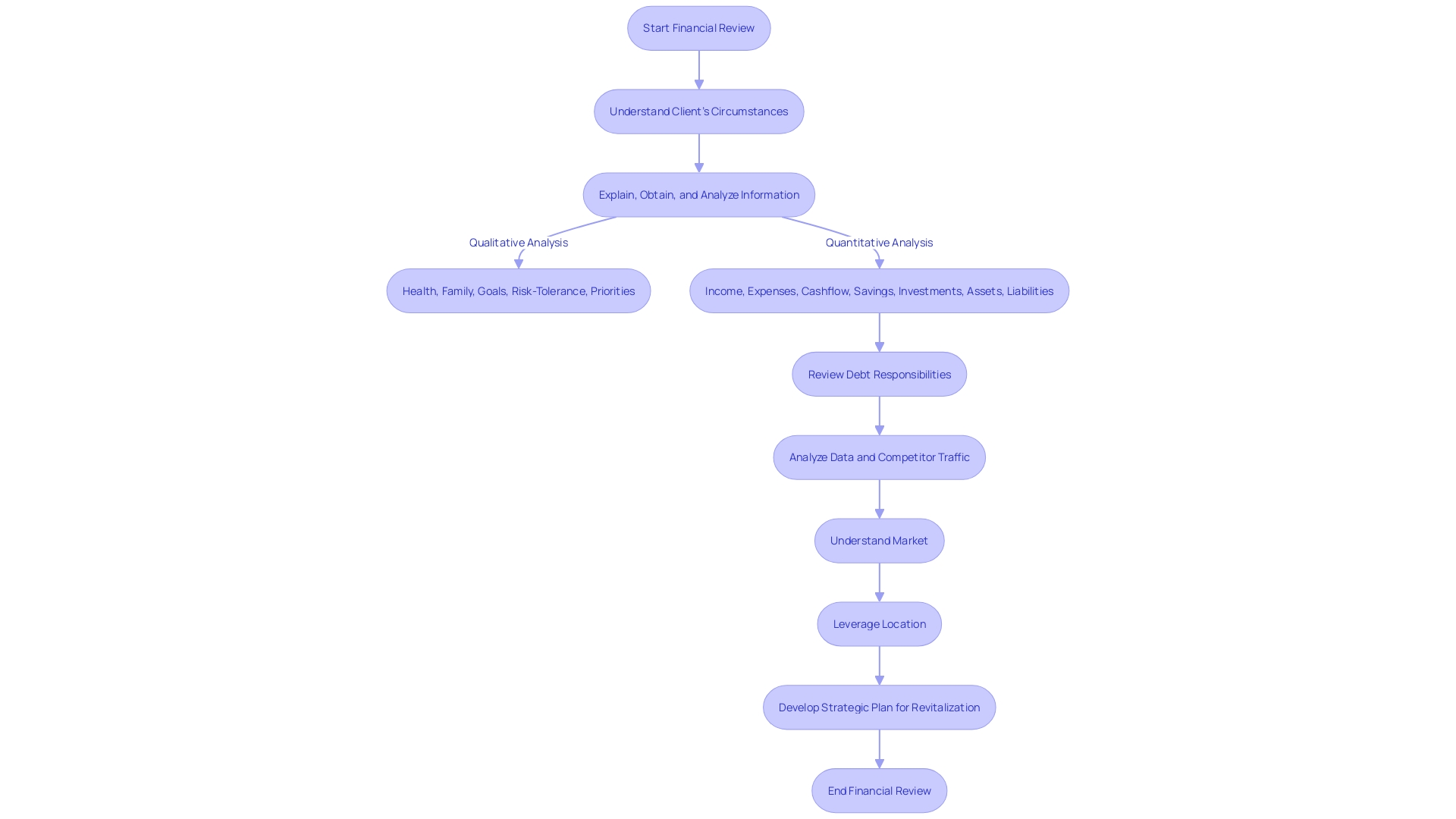

The cornerstone of any effective restructuring strategy is a meticulous financial review. This crucial initial phase entails a deep-dive into the company's financial health, scrutinizing assets, liabilities, and cash flows, alongside a thorough review of debt responsibilities. It's a process akin to putting the company's finances under a microscope to map out a detailed landscape of its fiscal position.

This level of analysis is vital to pinpoint potential areas that need shoring up and to carve out a strategic plan aimed at revitalization. It's the kind of groundwork that sets the stage for a successful turnaround, much like the approach used in a recent case where a comprehensive digital and content strategy, built on a robust technical stack and informed by a granular analysis of competitor traffic, led to a significant uplift in sales for a client. Similarly, when a branded hotel in a prime location faced stagnant sales, an incisive strategy focusing on market understanding and location leveraging was put into place, resulting in immediate positive feedback and increased revenue.

These scenarios underscore the importance of informed strategies in steering troubled businesses back on course. Moreover, as exemplified by WeWork’s recent emergence from Chapter 11, a calculated and collaborative approach to restructuring, with a focus on operational efficiency and sustainable growth, can pave the way for a business to not only survive but thrive post-restructuring. This is borne out by statistical methods such as time series analysis, which is integral to understanding the structure of a company's financials over time and making informed decisions based on that data.

In the face of such challenges, it is clear that a well-conceived and expertly executed financial assessment is the linchpin of any successful business recovery plan.

Conclusion

In conclusion, the landscape of financial restructuring requires resilience and strategic acumen to navigate challenging economic times. Real-world examples from the consulting industry, healthcare organizations, and the banking sector highlight the importance of strategic planning, transparency, and agility in overcoming financial distress.

The success stories of companies like Pacific Steel, Pros Holdings Inc., TBC Bank, and Haleon demonstrate the transformative power of strategic decisions during the restructuring process. From adopting reference-based pricing strategies to embracing agile transformations, these organizations have paved the way for stability and growth.

The case studies of Rite Aid and WeWork emphasize the importance of a structured financial restructuring plan. By reducing debt, increasing financial flexibility, and implementing comprehensive restructuring measures, these companies have positioned themselves for renewed growth and profitability.

The essential steps in restructuring consulting start with a meticulous financial review. This deep-dive analysis provides a detailed understanding of a company's fiscal position and identifies areas for improvement. Informed strategies, supported by technical expertise and market insights, can lead to significant uplift in sales and revenue.

Overall, a well-conceived and expertly executed financial assessment is the linchpin of any successful business recovery plan. By embracing strategic planning, transparency, and agility, companies can overcome financial distress and pave the way for a stable and prosperous future.