Overview

This article presents a systematic approach for CFOs to conduct supplier financial risk assessments, underscoring the critical need to evaluate vendors' economic health through seven essential steps. These steps encompass:

- Identifying critical suppliers

- Defining risk criteria

- Gathering pertinent data

- Assessing risk via questionnaires

- Calculating risk levels

- Developing effective mitigation strategies

- Continuously monitoring supplier risks

This comprehensive process aims to bolster supply chain resilience and operational stability.

Introduction

In an increasingly complex business landscape, the financial health of suppliers has emerged as a critical focus for CFOs aiming to bolster organizational resilience. As supply chains face unprecedented disruptions, understanding and assessing supplier financial risks is essential.

By employing structured methodologies to evaluate supplier stability—ranging from credit scores to payment histories—CFOs can proactively identify potential vulnerabilities that threaten operational continuity.

Moreover, as the urgency for robust risk management practices intensifies, especially in light of rising cybersecurity concerns, organizations must refine their approach to supplier assessments to safeguard against financial losses and maintain a competitive edge.

This article delves into effective strategies for evaluating supplier financial risk, highlighting the importance of continuous monitoring and data-driven decision-making in fostering strong, resilient partnerships.

Understand Supplier Financial Risk Assessment

is essential for chief financial officers aiming to enhance . This systematic approach utilizes a to evaluate the of vendors by analyzing critical indicators such as credit scores, payment histories, and debt levels. By identifying potential challenges, CFOs can ensure that vendors meet their obligations, thereby safeguarding the supply chain and maintaining .

In 2025, as companies place greater emphasis on oversight for , performing a supplier financial risk assessment to understand the economic challenges associated with vendors becomes increasingly vital. Notably, only 14% of procurement and 13% of supplier management professionals report utilizing continuous monitoring tools, highlighting a significant gap in current practices.

Furthermore, 70% of participants indicate that Information Security (InfoSec) is more involved in third-party threat management than ever, underscoring the growing importance of monetary evaluation. By incorporating strategies to master the , financial leaders can make informed decisions that mitigate disruptions and , ultimately fostering a more resilient supply chain.

Organizations are adopting additional measures to oversee third-party breaches, and the challenges in —where 62% of respondents report having an understaffed cybersecurity team—emphasize the necessity for to enhance overall organizational resilience.

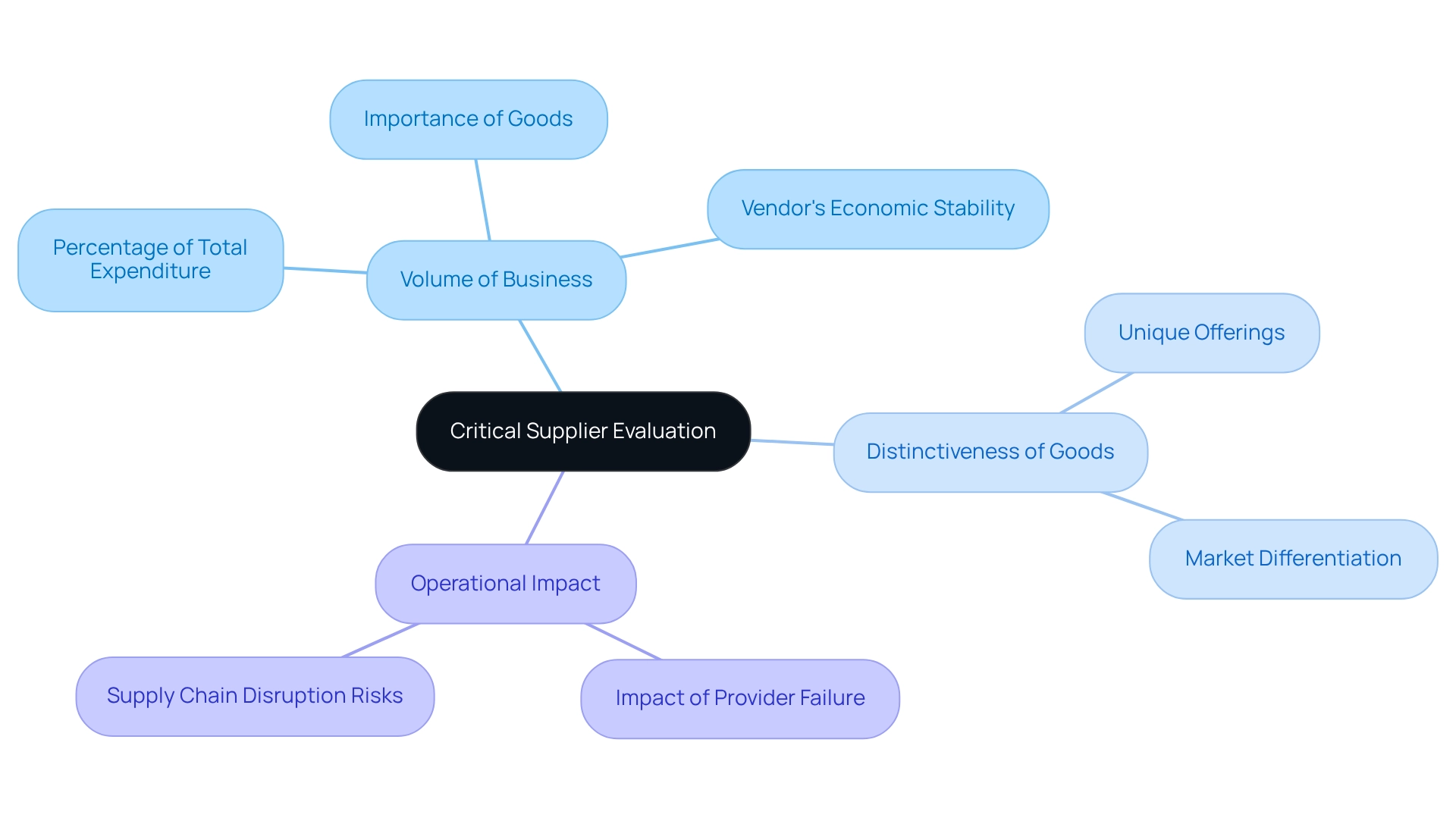

Identify Critical Suppliers

To effectively identify essential vendors, CFOs must evaluate their partners using a set of key criteria. These criteria include:

- The volume of business performed

- The distinctiveness of the goods or services offered

- The potential in the event of a provider failure

Introducing a scoring system can significantly enhance this assessment; vendors can be evaluated on a scale from low to high criticality. For instance, a straightforward scoring system could allocate points based on factors such as:

- The percentage of total expenditure

- The importance of the goods or services

- The vendor's

This structured approach not only prioritizes vendors that require more thorough economic evaluations but also ensures of the most significant connections through real-time analytics provided by our client dashboard.

Notably, 60% of providers report that key clients impose excessive administrative burdens, as reflected in the '' case study, where 53% of providers indicated they would offer more information and enhance communication if buyers were easier to collaborate with. This underscores the urgent need for improved collaboration.

Furthermore, can lead to substantial economic strains, as noted by Meghan (Lockwood) Rexer: 'Supply chain disruptions aren't merely an inconvenience; they're a huge economic burden.'

By and conducting a supplier , finance leaders can enhance communication and , ultimately mitigating monetary threats associated with supply chain disruptions. Future discussions will also connect to the cybersecurity Confidentiality, Integrity, and Availability (CIA) Triad, underscoring its relevance in the evaluation process.

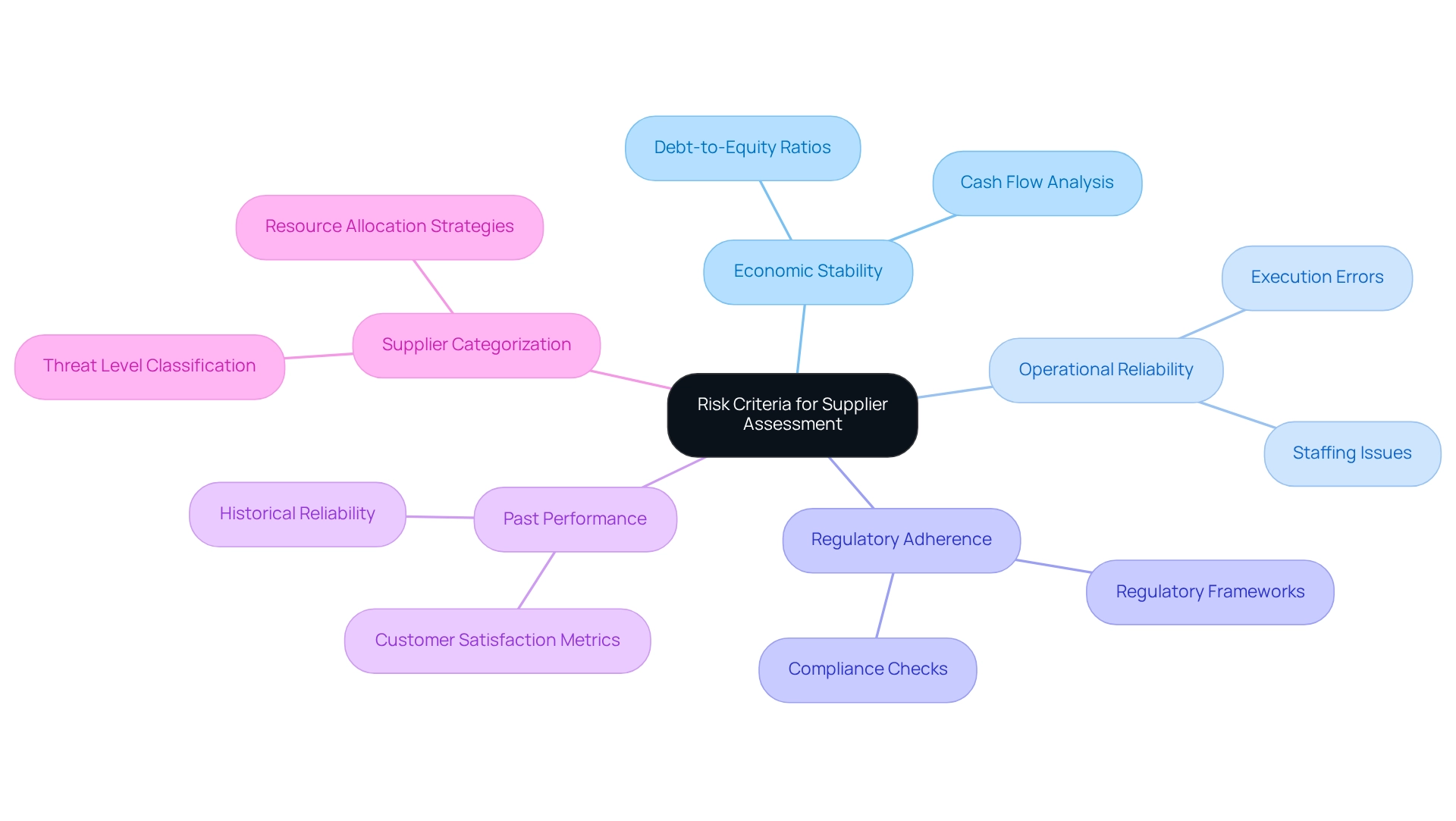

Define Risk Criteria

Establishing criteria for is essential for effective , encompassing factors such as , , regulatory adherence, and past performance. CFOs are encouraged to develop a that assigns weights to each criterion, reflecting its importance to the organization. For example, financial stability may be prioritized over operational reliability for suppliers of critical components. This structured approach not only facilitates a detailed understanding of supplier challenges but also aids in .

Notably, 29% of organizations categorize suppliers by threat level, implementing distinct assessments and measures accordingly. This classification is crucial as it allows organizations to allocate resources efficiently and mitigate potential risks before they escalate. A case study on mitigating operational challenges from vendors demonstrates that by , organizations can significantly improve supply chain reliability and enhance customer satisfaction.

As Ernest Breitschwerdt, Head of Credit Product Specialists at S&P Global Market Intelligence, asserts, "It is hard to predict the future, but we have recently released the Economic & Country Risk projection overlay as part of ." This underscores the necessity of structured assessments in navigating uncertainties.

To further enhance , CFOs should integrate strategies for optimizing the cash conversion cycle into their assessment criteria. This includes metrics such as inventory turnover rates and accounts receivable days, which can provide valuable insights into vendor reliability and economic health. A proactive approach to establishing criteria is vital for maintaining economic stability and ensuring long-term success in vendor management.

To effectively implement these established criteria, financial leaders should consider specific metrics for evaluating economic stability, such as debt-to-equity ratios and , and incorporate a supplier financial risk assessment while formulating a clear action plan for ongoing vendor assessments.

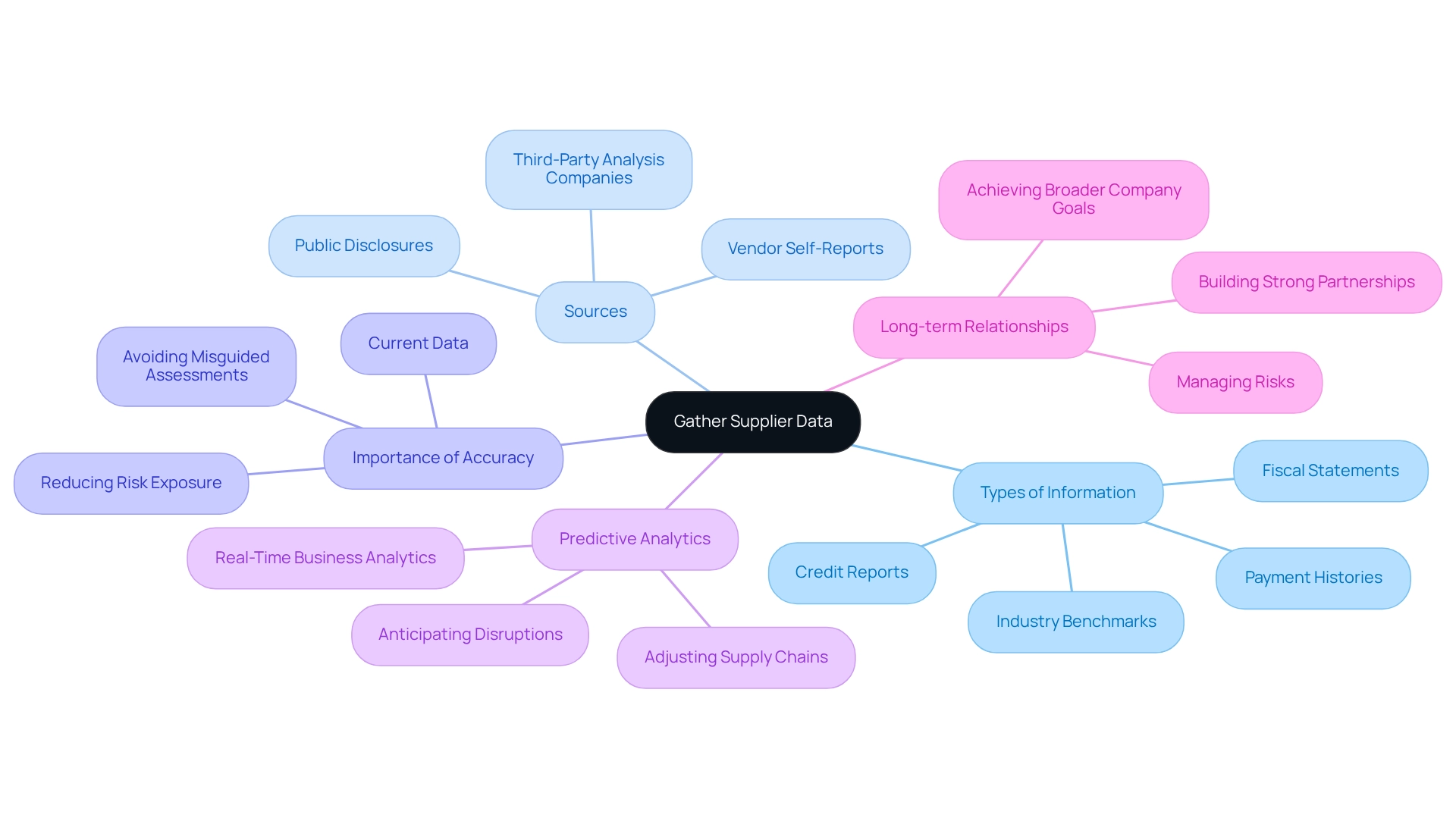

Gather Supplier Data

Collecting provider information is a critical phase in monetary assessment, as it is essential for conducting a , which necessitates the gathering of fiscal statements, credit reports, payment histories, and pertinent industry benchmarks. for this information, including third-party analysis companies, vendor self-reports, and public disclosures. Ensuring the data is current and accurate is paramount; outdated or incorrect information can lead to misguided assessments and . Moreover, creating a uniform data collection procedure not only simplifies this endeavor but also .

In 2025, optimal methods for highlight the significance of , which can assist companies in swiftly foreseeing interruptions and adjusting their supply chains. Our team supports a shortened decision-making cycle throughout the turnaround process, enabling CFOs to take decisive action based on real-time business analytics. Routine business evaluations with providers should encompass , as these dialogues are vital for promoting clarity and cooperation, ultimately improving management strategies. The Hackett Group indicates a 10.6% rise in global procurement requirements, emphasizing a productivity gap of 7.4% and an effectiveness gap of 7.8%. This underscores the urgency of efficient vendor economic data collection in today's environment. Businesses are increasingly recognizing that establishing enduring connections with vendors is crucial for managing uncertainties effectively, as illustrated by case studies showcasing the benefits of robust partnerships over short-term cost reductions; therefore, a supplier financial risk assessment is essential, as precise economic data about vendors directly influences uncertainty evaluation and decision-making for chief financial officers. By implementing and utilizing expert insights, organizations can build and avoid costly surprises, ultimately driving .

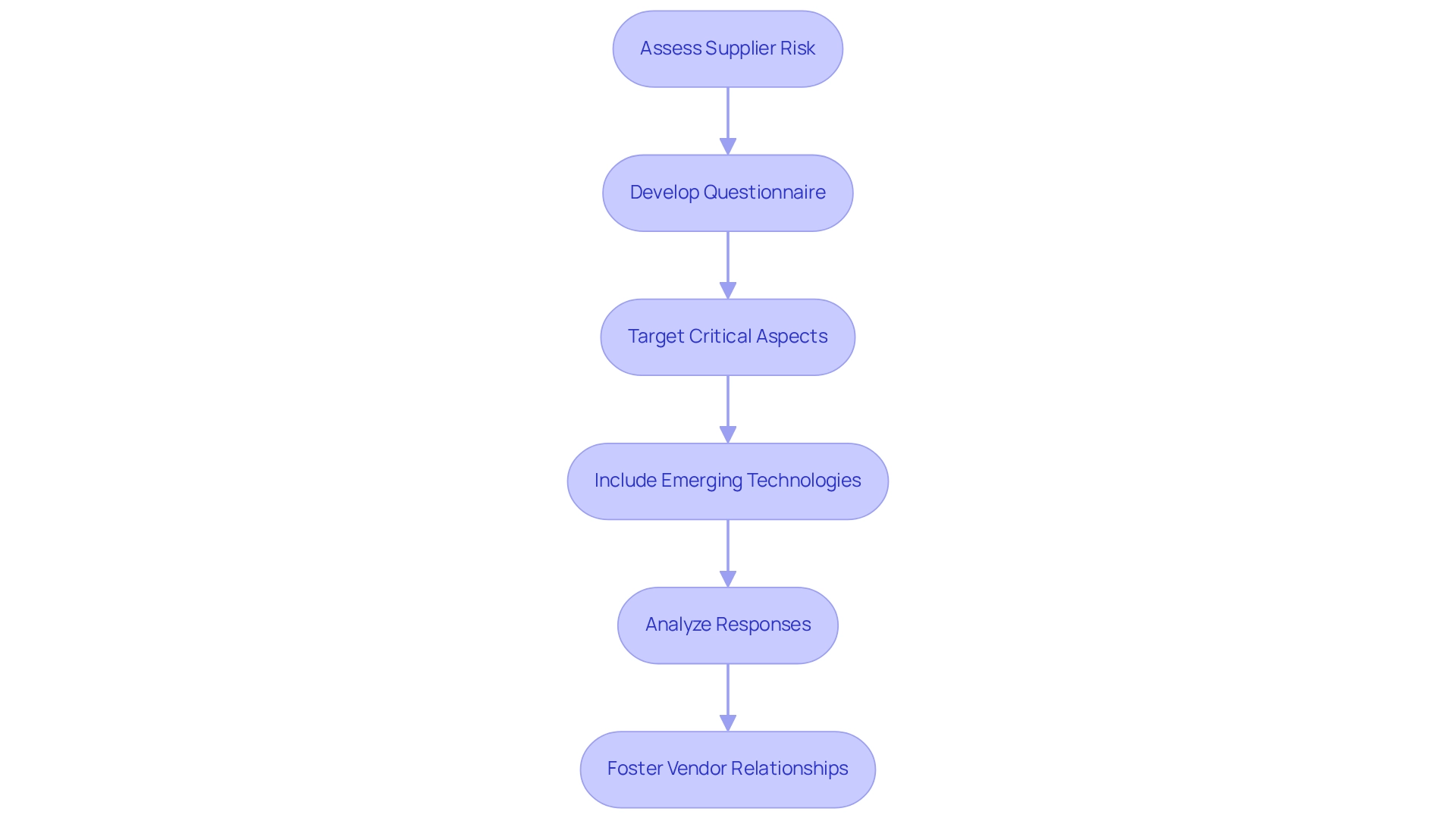

Assess Supplier Risk Using a Questionnaire

In today’s rapidly evolving business landscape, assessing vendor uncertainty is imperative for maintaining and economic stability. CFOs can effectively evaluate through a by developing a comprehensive questionnaire that addresses critical aspects of vendor operations, such as , , and . This questionnaire should feature targeted questions designed to elicit detailed responses, offering insights into potential challenges.

For instance, inquiries regarding the provider's , disaster recovery plans, and adherence to industry standards can uncover vulnerabilities that may pose risks to the organization, making a supplier financial risk assessment essential. As we approach 2025, it is crucial to include questions that reflect the shifting landscape of provider compliance and operational capabilities. This involves assessing the provider's investment in , as 20% of supply chain management respondents indicate that such investments are vital for sustaining a resilient supply chain. Additionally, including questions about the provider's data handling practices, particularly in relation to third-party agreements, can enhance the evaluation of potential issues.

Experts emphasize that clearly defined contracts regarding information processing and retention periods are crucial for effective data management, underscoring the significance of the questionnaire in this context.

Analyzing the responses from these questionnaires will illuminate areas of concern that require further investigation or immediate action. A case study from a Navex survey reveals that 72% of companies believe that conducting a supplier financial risk assessment as part of a robust third-party due diligence program significantly mitigates legal, financial, and reputational risks. This finding underscores the importance of thorough and ongoing oversight as essential components of effective vendor management, which is directly supported by insights gleaned from the questionnaires and the supplier financial risk assessment.

By employing well-structured questionnaires, CFOs can not only assess vendor challenges but also foster strong and secure vendor relationships, ultimately enhancing the organization’s overall financial health and operational efficiency.

Calculate Risk Levels

Determining hazard levels requires the allocation of numerical figures to responses collected from vendor questionnaires and other relevant data sources. A can be established, wherein lower scores signify greater danger and higher scores indicate lesser danger. By aggregating these scores across various criteria, an overall threat level for each vendor. This facilitates clear comparisons between providers, empowering organizations to conduct a to identify those that present the most significant challenges.

Moreover, understanding —how swiftly a threat can materialize—further informs these evaluations. This method not only streamlines but also by providing a clear visual representation of . As Megha Thakkar notes, adaptability and scalability are essential factors when selecting an evaluation approach.

Furthermore, illustrate the effectiveness of scoring systems in enhancing vendor relationships and operational efficiency.

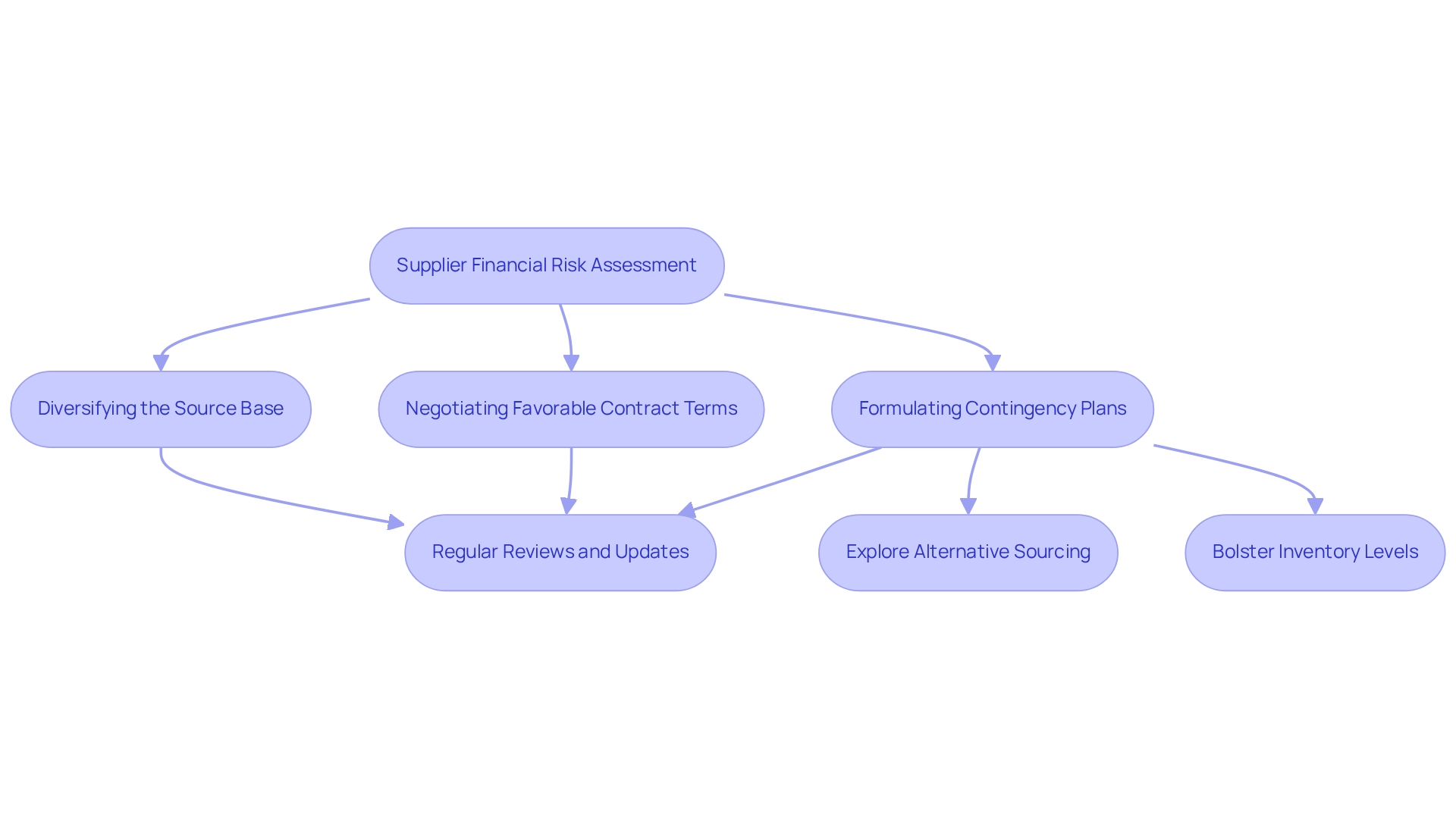

Develop Risk Mitigation Strategies

After conducting a , CFOs must develop customized risk for each vendor, reflecting their unique risk profiles. :

- Diversifying the source base

- Negotiating favorable contract terms

- Formulating contingency plans for essential providers

For instance, if a vendor is classified as high-risk due to the supplier financial risk assessment highlighting their , the organization could explore alternative sourcing options or bolster inventory levels to mitigate potential disruptions. Regular reviews and updates of these strategies are crucial for conducting a in order to remain responsive to evolving circumstances.

Notably, 63% of executives consider their organization's effective; however, many acknowledge that their procedures related to supplier financial risk assessment are underdeveloped, signaling a significant opportunity for enhancement in . Furthermore, 35% of compliance executives identify adherence and regulatory challenges as their primary concern, highlighting the necessity for a and effective mitigation strategies.

As Marijn Overvest, Founder of Procurement Tactics, asserts, "I have a deep passion for procurement, and I’ve upskilled over 200 procurement teams from all over the world." By implementing comprehensive threat mitigation strategies, organizations can enhance their resilience and ensure sustainable operations.

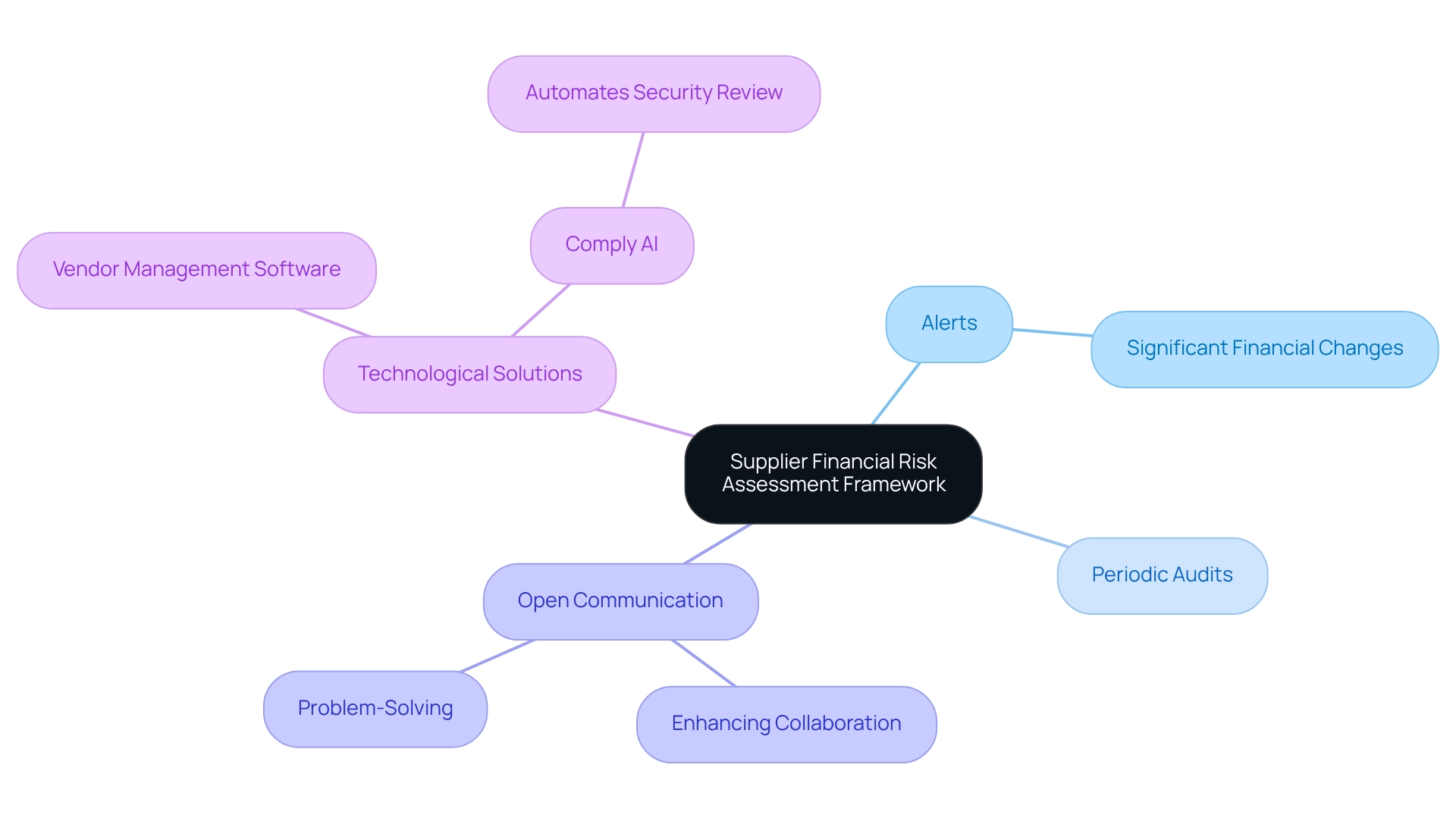

Monitor Supplier Risk Continuously

To efficiently oversee vendor concerns, CFOs must establish a supplier framework that includes frequent evaluations of . This framework should incorporate:

- Alerts for significant changes in a vendor's financial status

- Periodic audits

- The fostering of open communication channels with vendors to support the supplier financial risk assessment

In 2025, the utilization of technological solutions, such as , becomes essential; these tools enhance the monitoring process and provide real-time insights into performance. Notably, 47% of European firms report managing vendors across up to 49 nations, compared to just 22% of North American firms, underscoring the complexity of vendor relationships and the necessity for . Furthermore, 35% of compliance executives identify adherence and regulatory challenges as their primary concern, emphasizing the importance of .

By remaining vigilant to vendor challenges and employing , organizations can proactively address potential disruptions, ensuring a more resilient supply chain. For example, a case study on optimized supply chains demonstrates that maintaining with vendors enhances collaboration and problem-solving, ultimately leading to improved logistics, reduced costs, and enhanced product quality.

This proactive strategy for supplier uncertainty management, supported by an expedited decision-making process and the use of a client dashboard for real-time business analytics, is crucial for . Moving forward, CFOs should consider integrating specific technology solutions, such as Comply AI, which automates the security review process by extracting key answers from vendor documents, further strengthening and operationalizing turnaround lessons.

Conclusion

Understanding and managing supplier financial risks is essential for maintaining organizational resilience in today’s complex business environment. By employing structured methodologies—such as assessing credit scores, payment histories, and operational stability—CFOs can proactively identify vulnerabilities within their supply chains. This approach not only safeguards against potential disruptions but also enhances overall operational continuity.

Identifying critical suppliers through a systematic evaluation process allows organizations to prioritize their assessments effectively. By defining clear risk criteria and gathering accurate supplier data, CFOs can develop robust risk mitigation strategies tailored to the unique profiles of each supplier. Moreover, continuous monitoring further strengthens this framework, ensuring that organizations remain agile and responsive to emerging risks.

Ultimately, the integration of data-driven decision-making and the use of advanced technologies will empower CFOs to foster resilient partnerships with suppliers. By prioritizing financial risk assessments, organizations can protect their supply chains from potential threats while driving sustainable growth in an increasingly competitive landscape. Taking these proactive steps will ensure that businesses are better equipped to navigate uncertainties and maintain a competitive edge.

Frequently Asked Questions

Why is vendor monetary evaluation important for chief financial officers (CFOs)?

Vendor monetary evaluation is essential for CFOs as it helps enhance business performance by assessing the economic health and stability of vendors, ensuring they meet their obligations and safeguarding the supply chain.

What does a supplier financial risk assessment involve?

A supplier financial risk assessment involves analyzing critical indicators such as credit scores, payment histories, and debt levels to evaluate the economic health and stability of vendors.

What is the significance of performing supplier financial risk assessments in 2025?

In 2025, performing supplier financial risk assessments becomes increasingly vital as companies focus more on oversight for third-party violations and understanding the economic challenges associated with vendors.

What percentage of procurement and supplier management professionals utilize continuous monitoring tools?

Only 14% of procurement and 13% of supplier management professionals report utilizing continuous monitoring tools, indicating a significant gap in current practices.

How involved is Information Security (InfoSec) in third-party threat management?

Seventy percent of participants indicate that InfoSec is more involved in third-party threat management than ever, highlighting the growing importance of monetary evaluation.

What criteria should CFOs use to evaluate essential vendors?

CFOs should evaluate essential vendors based on the volume of business performed, the distinctiveness of goods or services offered, and the potential operational impact in the event of a provider failure.

How can a scoring system improve vendor assessment?

A scoring system can enhance vendor assessment by allowing evaluation on a scale from low to high criticality, based on factors such as total expenditure percentage, importance of goods or services, and the vendor's economic stability.

What challenges do providers face in their relationships with key clients?

Sixty percent of providers report that key clients impose excessive administrative burdens, which affects collaboration and communication.

What impact do supply chain disruptions have on the economy?

Supply chain disruptions can lead to substantial economic strains, as they are considered a significant economic burden rather than just an inconvenience.

How can refining vendor evaluations help finance leaders?

By refining vendor evaluations and conducting supplier financial risk assessments, finance leaders can enhance communication, foster stronger partnerships, and mitigate monetary threats associated with supply chain disruptions.