Introduction

In the world of finance, the consequences of making poor decisions can be dire and far-reaching. From immediate financial setbacks to long-term damage, the effects of bad financial choices can impact every aspect of one's life. This article delves into the immediate and long-term repercussions of such decisions and offers practical strategies to avoid them.

Whether it's accumulating debt, damaging credit scores, or causing financial stress and anxiety, the risks are significant. However, with careful budgeting, seeking professional advice, and avoiding impulsive purchases, individuals can safeguard their financial well-being and pave the way to a more secure future. So let's explore these strategies and empower ourselves to make wise financial choices.

II. Immediate Consequences of Bad Financial Decisions

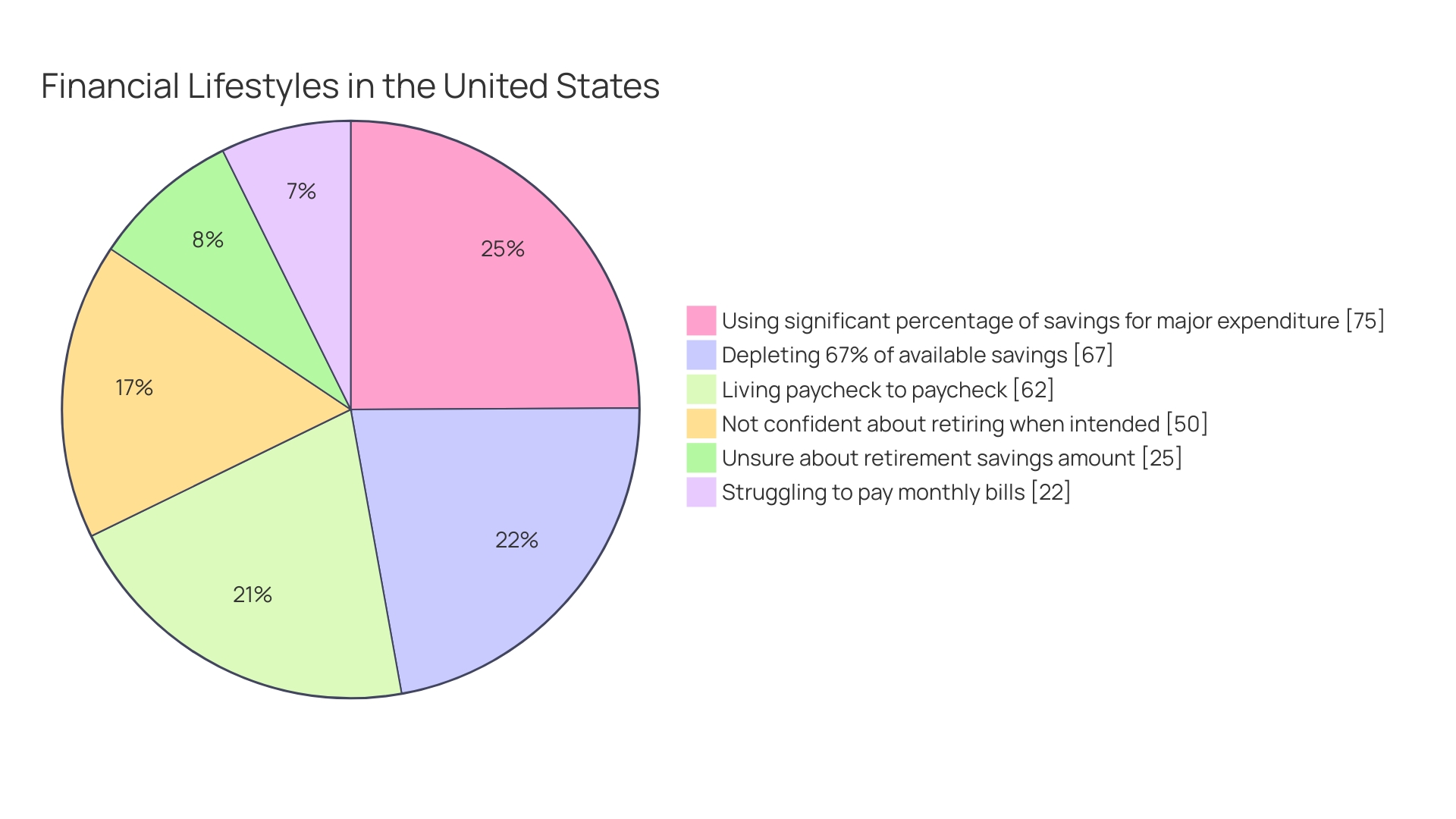

Financial missteps can have swift and severe repercussions, undermining one's financial health almost immediately. To illustrate more clearly, consider the landscape of mortgage rates — currently peaking at 7.5%, the highest since the year 2000, which spells out a dire situation for homebuying and market liquidity. Coupled with statistics showing that a majority of Americans (51%) could deplete their savings within a month without income, the consequences of poor financial choices are starkly evident.

One must entertain a serious approach towards budget management to counter such shocks. Financial analyst Alina Fisch recommends a thorough analysis of necessary expenses like housing, groceries, and transport as a foundation for resiliency. In parallel, unforeseen circumstances might lure individuals to prematurely access retirement funds; however, this is typically a costly stratagem.

Instead, exploring non-retirement assets, social programs, or loans should be preliminary considerations.

Indeed, investment fees, although often 'out of sight', cumulatively can erode a substantial part of one's pension fund. The SEC paints a clear picture: over 20 years, a mere 0.75% increase in annual fees on a $100,000 investment can lead to a $30,000 deficit in returns.

From these cases, one learns to recognize and counter biases in financial decisions, an aspect emphasized in the field of behavioral economics. Anchoring to past asset performance or seeking confirmatory information can derail effective financial strategies. A comprehensive, analytical approach, coupled with astute awareness of market health as iterated by experts like Dave Ramsey, fortifies against such pitfalls leading to more sound financial decisions.

A. Debt Accumulation

Debt can be a double-edged sword, serving as either a stepping-stone towards wealth or the anchor that sinks your financial stability. Recognizing the distinction between 'good debt'—that which enhances your net worth or has future value—and 'bad debt'—that which you spend on depreciating items, is crucial for maintaining financial health. Irresponsible credit card usage, for example, can contradict your wealth accumulation by imposing high interest rates that exceed those of personal loans or fixed-rate loans when not paid in full monthly.

Consolidating these debts into a single loan has been suggested to mitigate the impact of disparate, high-interest debts, with structured term payments paving the way toward financial recovery.

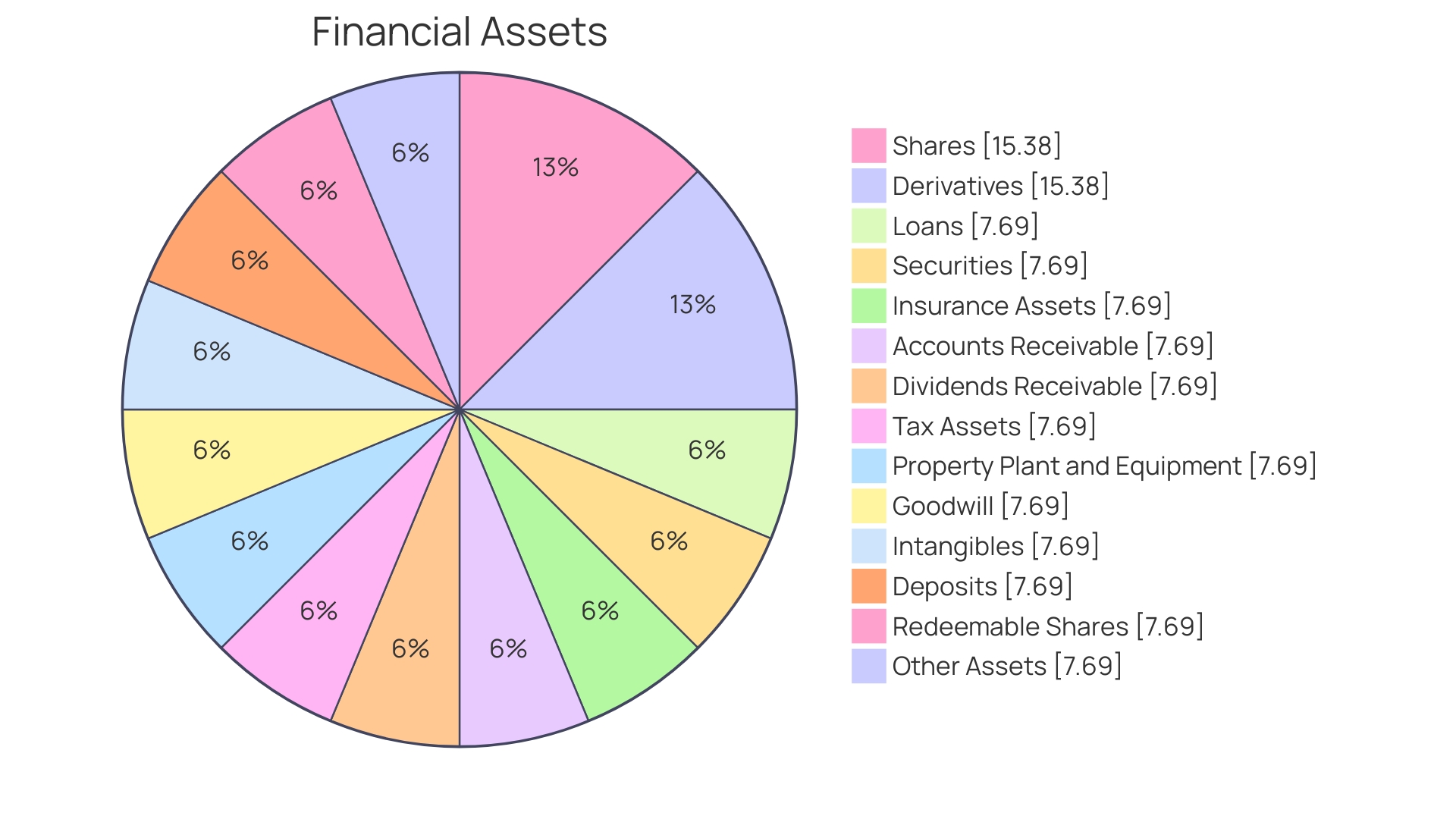

In contrast, not all investments demand immediate gains. It's sensible to spend on appreciable assets, like investing in an S&P 500 index fund—a low-cost option to diversify investments while incurring less risk than buying individual stocks. Such strategic investments are akin to 'good debts,' potentially increasing in value over time.

The mindset towards investing shouldn't focus solely on immediacy but rather on long-term wealth accumulation. As proclaimed by investment gurus, embracing the principles of disciplined investments by starting with manageable, risk-adjusted vehicles like index funds establishes the foundation for a more resilient financial profile.

While juggling financial obligations may seem daunting, the effective use of debt can indeed play a constructive role. Borrowing to invest in an income-producing asset, exemplified by property with prospects of rental income, typifies the sort of financial maneuvers that can grow wealth. As the average American household grapples with approximately $7,951 in credit card debt, the need for an actionable plan to tackle debt while opportunistically engaging in investing principles is integral.

Focusing on reducing liabilities while consciously investing in assets underscores the balance required for achieving financial wellness.

B. Credit Score Damage

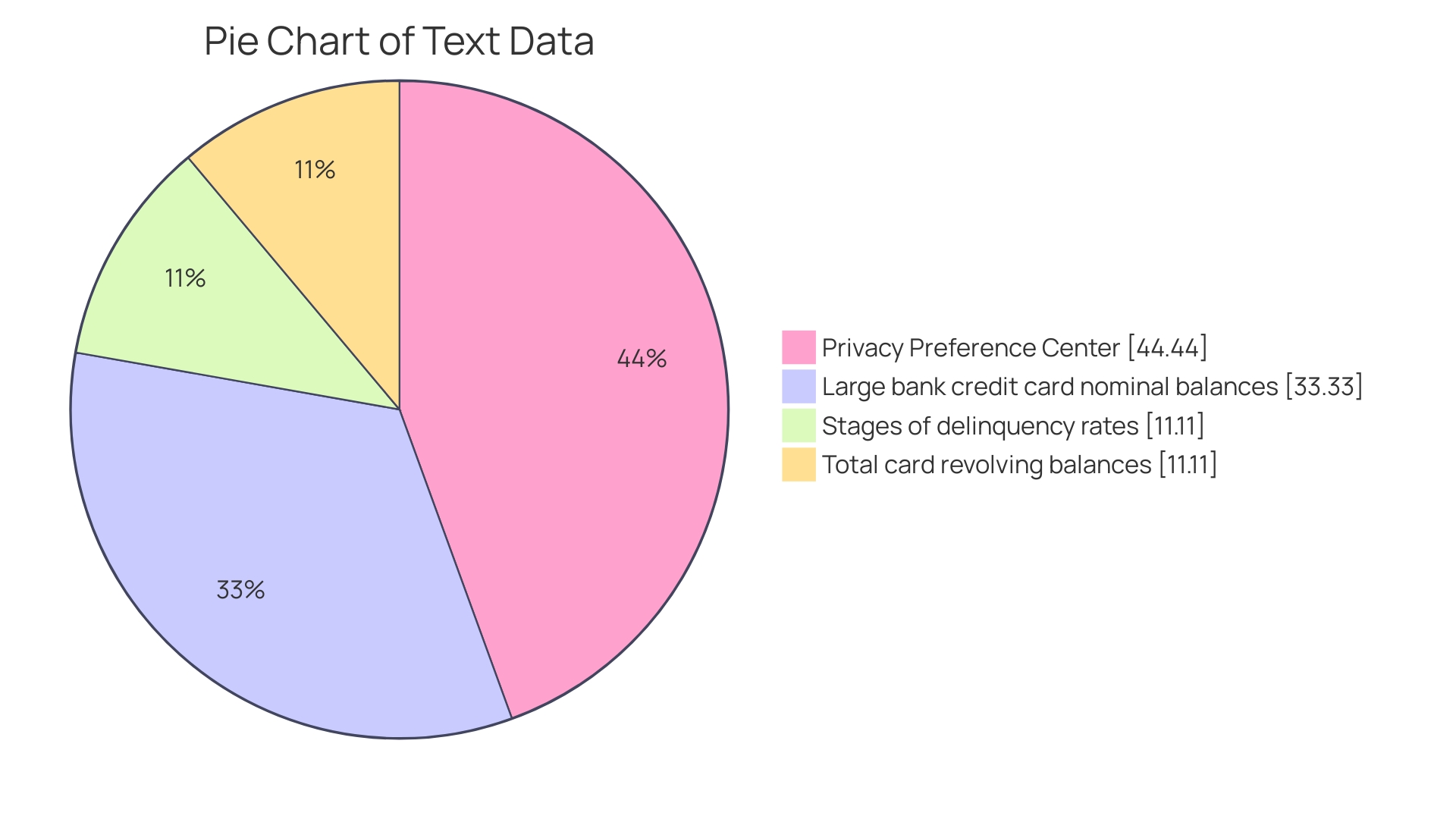

Financial missteps like missed payments, maxing out credit cards, or loan defaults can have steep repercussions on your credit score. This numerical gauge of your creditworthiness plays a critical role in determining your access to future loans, credit cards, and favorable interest rates. When lenders evaluate your credit score, they're assessing your likelihood of repaying borrowed funds.

The ripple effects extend to your day-to-day life, influencing the interest rates you'll incur on a mortgage or car loan, your eligibility for renting certain properties, and even your car insurance premiums. For instance, according to FICO, which accounts for a substantial share of credit score assessments, 35% of your score is derived from your payment history alone. Neglecting financial obligations can lead to a sharp decline in your credit score, sometimes by as much as 100 to 200 points.

The impact of severe financial actions like bankruptcy is even more pronounced; you might see your score plummet by up to 240 points, depending upon your starting score, and this blemish remains on your credit report for seven to ten years. In contrast, a single missed payment may affect your score for a maximum of seven years. With interest rates climbing following Federal Reserve adjustments—reaching 5.33% in September 2022, per the New York Fed— and the direct correlation between credit scores and interest expenses, it has never been more crucial to maintain a robust credit profile.

A high credit score, which ranges from 300 to 850 across popular scoring models like FICO and VantageScore, can translate into significant interest savings over the lifetime of financial products.

C. Financial Stress and Anxiety

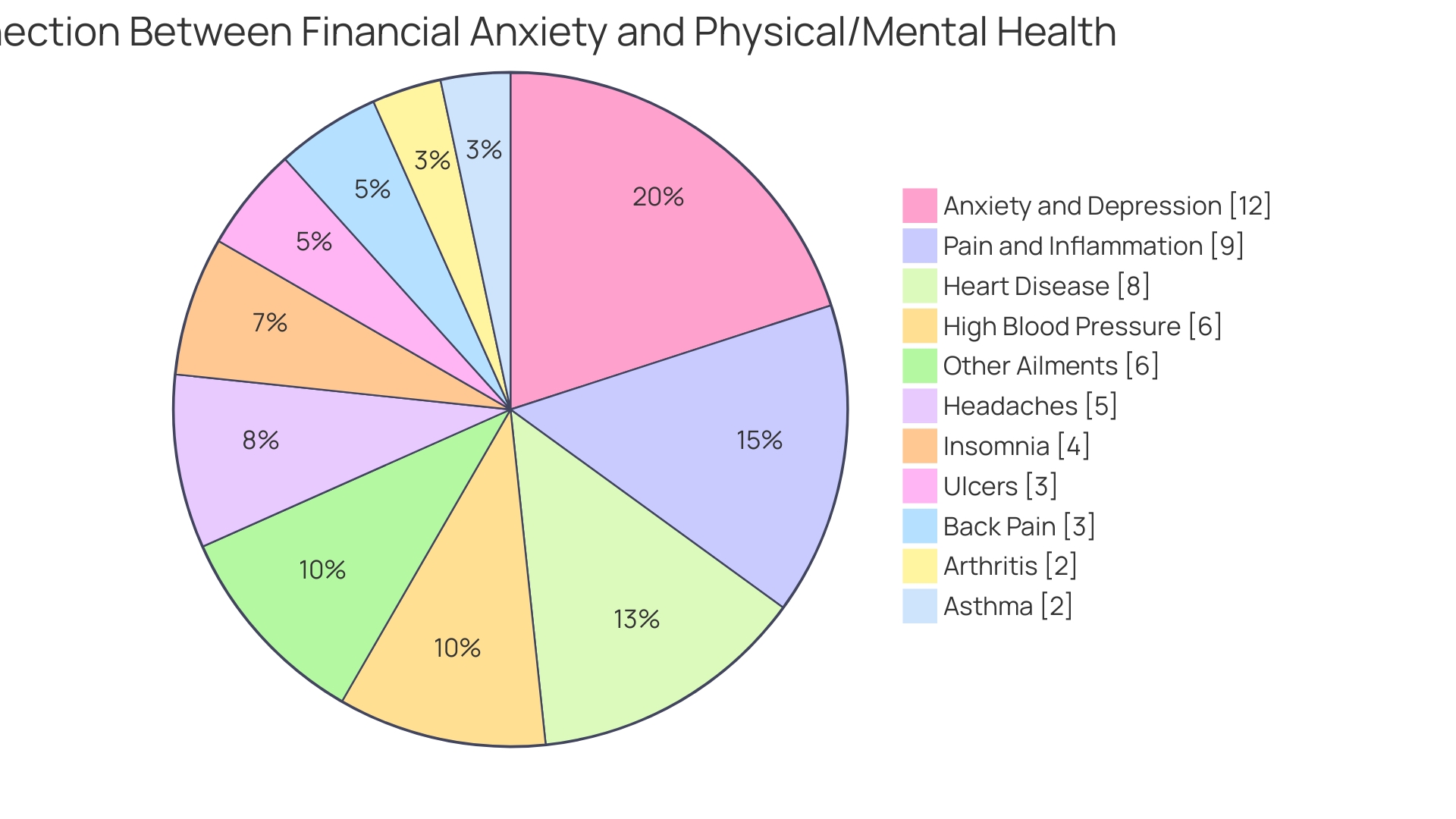

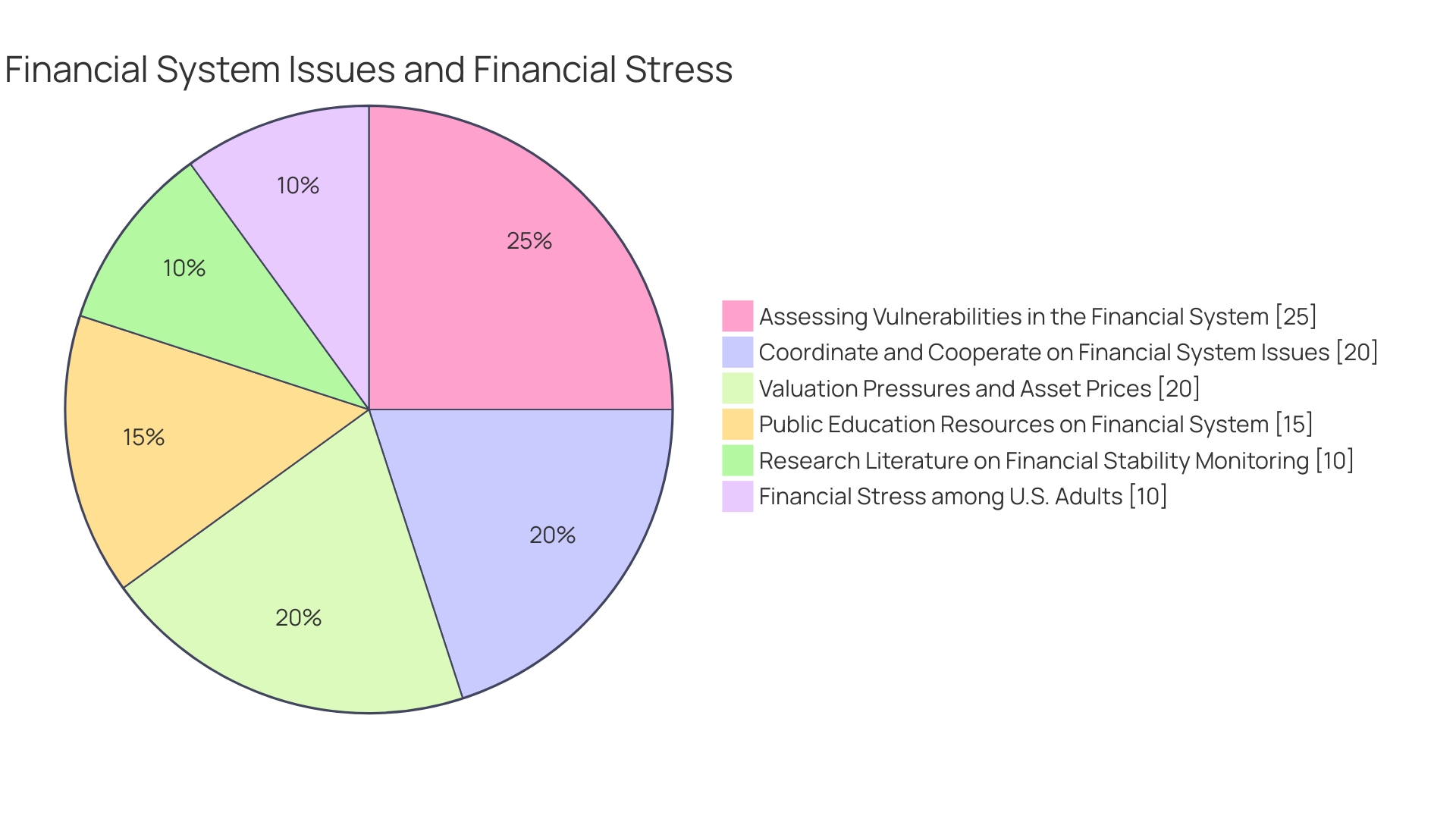

Mounting financial stress can generate significant mental and emotional strain, revealing itself through various physical and psychological symptoms. The connection between financial uncertainty and mental health issues is exhaustively documented, drawing a straight line from economic worries to conditions such as anxiety, depression, sleep disruption, and a cascade of stress-induced physical ailments.

Recent data indicates that over half of the population grapples with stress, anxiety, or depression tied to their financial situation. A staggering 52.8% have lost sleep due to monetary concerns, while 42.5% acknowledge that financial strain has damaged relationships with romantic partners. Moreover, 41.4% battle with feelings of guilt or hopelessness stemming from their financial standing, and 32% report recurrent headaches triggered by fiscal stress.

Additionally, financial unease can upend personal life plans and delay critical milestones. Findings suggest that roughly 54% of unmarried individuals admit that such stress diminishes their likelihood of marriage, and nearly one-quarter concede it deters them from having children.

Understanding the pervasive impacts of financial distress is only the starting point. Strategies to mitigate this stress involve practical measures like thorough assessments of one's finances to craft a precise action plan, deliberate saving initiatives, and tools to expedite debt repayment. By adopting measures such as routine saving—easily facilitated by the best savings accounts with advanced setup capabilities for automatic transfers—and seeking out debt payoff applications, individuals can gain a tangible sense of progress and control.

Evidently, the trauma of financial turbulence is not to be underestimated, as it touches every facet of an individual's life, from mental and physical health to the most intimate personal relationships and future aspirations. Developing robust financial strategies to navigate this terrain is paramount for long-term well-being.

III. Long-Term Consequences of Bad Financial Decisions

Long-term negative impacts on one's financial health can stem from seemingly trivial decisions made without proper foresight or understanding. For example, a medical student making the seemingly benign choice to prioritize love over financial education may experience unforeseen consequences. As enticing as young romance is, aligning it with financial literacy can be a challenging but essential balance to strike.

Similarly, the allure of early retirement under the FIRE movement can mislead individuals into overlooking essential considerations like the compounding effect of time on savings and investments. Another critical factor often underestimated is the influence of fees on investment growth. For instance, even a 1% annual fee can substantially deplete investment returns, such as in the SEC's example where an investor could retain approximately $30,000 more over two decades by opting for a 0.25% fee instead of a 1% fee.

Furthermore, traditional savings accounts, like those offered by large institutions, might not provide competitive returns in today's high-rate environment. This underscores the importance of diligently researching and choosing financial services that align with one's long-term financial goals.

Lastly, in an era of social media and instant communication, the risk of being swayed by the latest investment hype, such as the GameStop bubble influenced by voices with questionable expertise on platforms like TikTok and Instagram, can lead to a disconnection from fundamental investment practices. Therefore, it's imperative to maintain a cautious approach and perform individual analysis rather than blindly follow popular sentiment. Succumbing to loss aversion—a behavioral tendency to prefer avoiding losses over acquiring equivalent gains—can have particularly detrimental long-term financial outcomes.

By keeping these long-term consequences in mind and approaching financial decisions with prudence and informed judgment, investors can better navigate their financial landscape and safeguard their economic well-being.

A. Financial Instability

Staying afloat in today's economic tides means more than just keeping your head above water—it necessitates a firm understanding of personal finance, especially as we've seen from the tempests like the Great Financial Crisis. The crisis of 2007 resurfaced the uncomfortable truth that without a solid financial literacy foundation—an aspect only 24% of Millennials know—individuals are often ill-equipped to navigate towards secure financial horizons. Jenny's experience as a Senior Business Development Director during that time underlines the critical role of informed investment strategies.

The assertion from a report on European OECD countries reinforces this perspective, highlighting how income instability disproportionately impacts those without a financial cushion.

Moreover, the allure of early retirement, fueled by movements such as the Financial Independence, Retire Early (FIRE) concept, could lead to premature depletion of savings without careful planning. The sobering reality is that savings in some major banks like Chase yield returns that are lagging in today's high-rate environment—potentially costing account holders over $400 yearly. The ramifications of inattention to investment fees became starkly clear; over a 20-year period, an investor could lose approximately $30,000 just by paying 1% in fees compared to a more favorable rate of 0.25%.

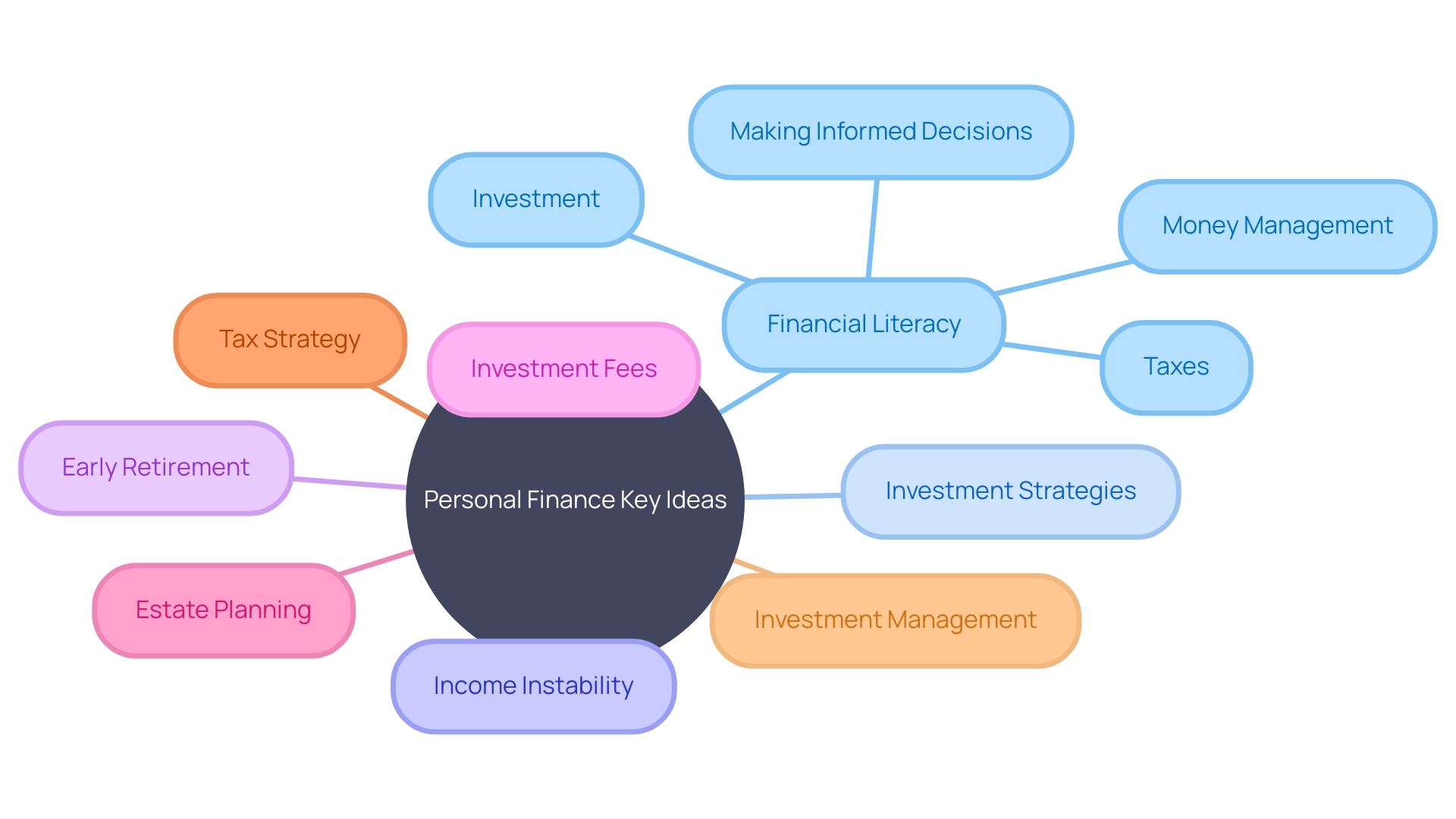

Prominent finance experts, including author and radio host Dave Ramsey, stress the importance of having an in-depth grasp of personal finance, often deviating from specific advice to underscore the significance of a cohesive financial plan encompassing estate planning, tax strategy, and investment management. Yet, even with a structured approach, the discipline required by passive investors demonstrates a common pitfall. It's prevalent for individuals to capitulate to the volatility of market sentiments, diverging from their annual portfolio review, thus eroding the structural integrity of their long-term financial objectives.

In the face of such potential perils, maintaining a disciplined and informed approach to personal finance is the keystone to constructing a robust economic edifice—one that can withstand the pressure of immediate concerns while supporting the weight of future aspirations.

B. Missed Investment Opportunities

When it comes to financial decisions and investment strategies, the significance of due diligence cannot be overstated. Randall Atkins, a former Wall Street banker, serves as a striking example: He purchased a Wyoming coal mine for $2 million without initially realizing the full potential of the assets. This impulsive decision surprisingly led to the discovery of a $37 billion cache of rare earth elements (Rees), underscoring the monumental returns that can arise from informed actions.

Similarly, Kristoffer Koch's investment in 5,000 Bitcoin tokens for merely $22—based on what many might have deemed a risky venture—paid off spectacularly as the cryptocurrency's value soared, serving as a reminder of how unanticipated gains are still possible with the right investment choices.

However, not all investments yield such fortuitous results. Financial missteps, like not conducting thorough market analysis, disregarding expert advice, or flouting basic economic indicators, can prevent individuals from capitalizing on profitable opportunities. Understanding leading and lagging economic indicators is crucial for predicting future market trends and recovery signals, respectively.

This knowledge, combined with an awareness of one's biases and a cohesive business strategy, fosters better investment decisions and risk management, reducing chances of undesirable outcomes. Ultimately, judicious decision-making, grounded in a comprehensive understanding of financial markets and investments, is pivotal for accumulating wealth and fostering long-term financial stability.

C. Impact on Retirement Savings

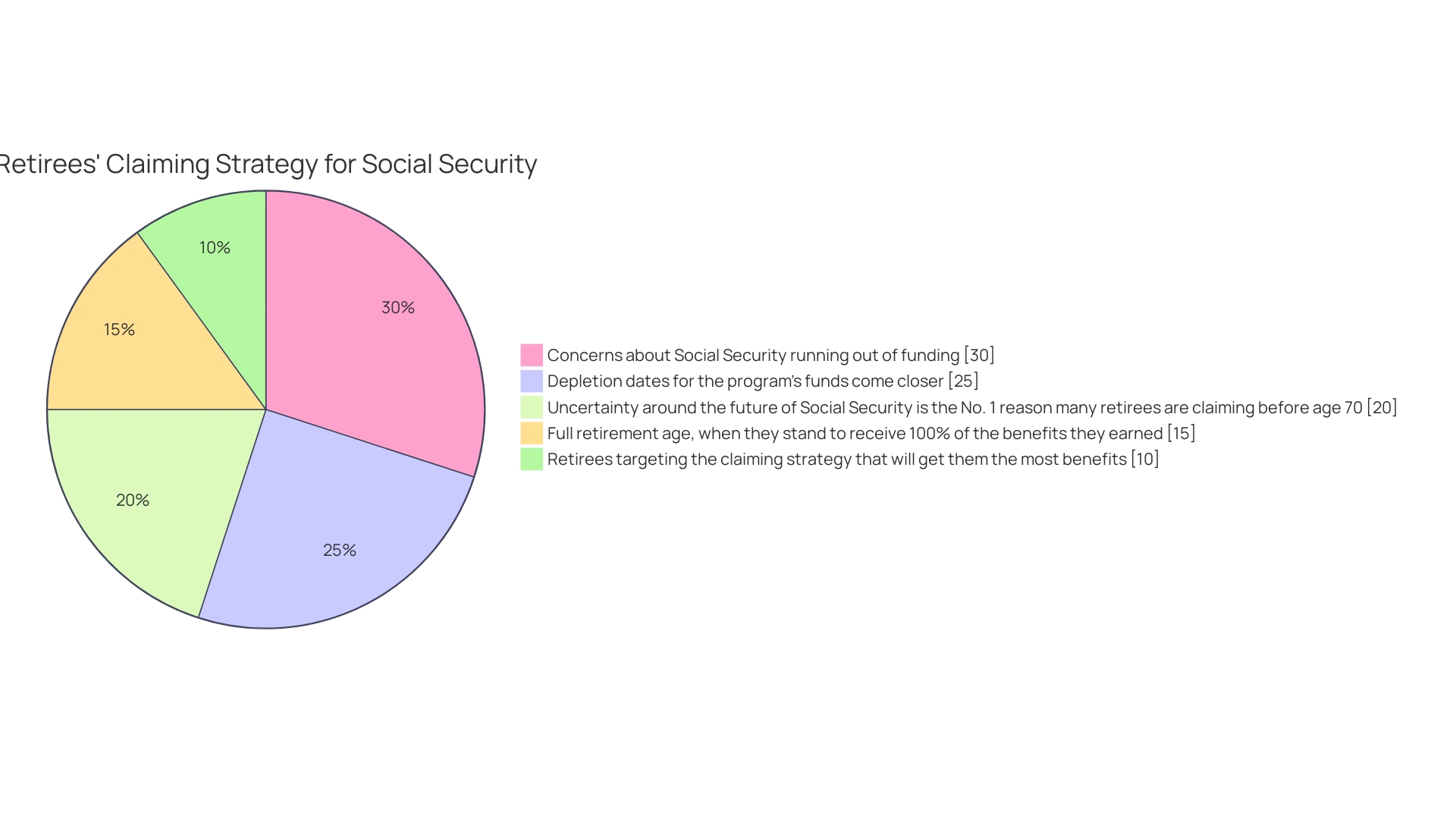

As financial stewards considering the journey toward retirement, embracing a vigorous savings strategy and cautioning against early withdrawal is crucial. Reports indicate an alarming trend: Americans from all earnings brackets are likely to encounter a shortfall in retirement, even with Social Security accounted for. Acknowledging the appeal of movements like Financial Independence, Retire Early (FIRE), the allure of early retirement could invite critical financial jeopardy.

Premature retirement truncates the timeline for savings to proliferate through the power of compound interest.

With the current economic climate — where traditional pensions are less prevalent and living costs incessantly climb — financial vulnerability is not a stranger to many, including unionized autoworkers and even medical professionals who face the temptation of extravagant spending following years of ascetic living through education and training. A consistent observation is that without widespread access to automated retirement savings programs, which are shown to aid in postponing Social Security claims and thereby increase benefits, the problem of insufficient retirement savings looms large over the collective.

These insights command attention to tackle head-on the financial challenges impeding a secure retirement, with a call to action for an intertwined effort amongst employers, policy makers, and financial advisors to furnish the essential resources. All the while, it is imperative for individuals to fortify their savings — considering factors such as age, desired retirement age, and income levels —, and resist the impulse to deplete this reservoir prematurely. The need for an adaptive and proactive approach to retirement planning has never been more pronounced, in an era where longevity extends and the stability of future financial support systems remains uncertain.

IV. Strategies to Avoid Bad Financial Decisions

To make savvy financial decisions and circumvent the repercussions of poor judgment, one can apply a set of proven strategies. Abby Sussman, a distinguished professor from the University of Chicago Booth School of Business and President of the Society for Judgment and Decision Making, highlights the importance of understanding non-discretionary expenditures—such as housing, groceries, and transportation—as a foundational step. By managing essential costs, individuals can create space to enhance their skills, network effectively, and design a robust savings and investment strategy.

Addressing mental and emotional health is equally vital, as financial stress can exert considerable impact beyond monetary loss. In scenarios of significant life changes, such as divorce, expert Chris Chen from Insight Financial Strategists advises prompt financial disentanglement to regain control and pursue financial independence.

Moreover, precise financial guidance is crucial. Dave Ramsey, a respected author and radio host, encapsulates this sentiment, advising a swift comprehension of challenges and strategic action to resolve specific financial concerns. Aligning with Ramsey's ethos, the key to navigating complex financial waters is a balance of vigilance and informed action.

Economic indicators play an instrumental role, providing insights into market conditions and enabling individuals to anticipate changes. Understanding leading, lagging indicators, and recognizing the nuances of the economy can fortify decision-making in unpredictable markets.

In light of current events, attempting to time the market or hastily exiting it can be counterproductive strategies that breed uncertainty. The pandemic-induced market volatility in 2020 serves as a precedent; while the urge to shift to cash was strong for many, it proved to be an oversimplified reaction to fear, rather than a strategic move. As such, adopting holistic financial well-being involves arranging life priorities rightly, where money is handled shrewdly within the broader context of one's life endeavors.

Data shows the profound effect finances have on Americans, where 65% state that financial matters are their primary source of stress, and over half could deplete their financial reserves within a month of income loss. This underscores not only the urgency for prudent financial judgment but also the opportunity for improved financial literacy and resilience.

A. Budgeting and Financial Planning

Devising a meticulous budget is vital to avert financial pitfalls - it is more than a mere ledger of income and expenses. It encapsulates the essence of one's financial aims and the strategy to attain them through conscientious spending. It's the narrative of a project or personal fiscal plan distilled into figures, reflecting both aspirations and pragmatic constraints.

An illustrative case is Priyanka's story from Bangalore, who harnessed the power of prudent spending to transition toward her entrepreneurial aspirations. Her fiscal sagacity, ingrained since childhood, manifests in her discerning outlay decisions, demonstrating that a strategic budget can lead to profound personal and professional empowerment. Understanding the purpose behind each cost item, whether it's a sculptor accounting for materials and labor or an individual forecasting monthly utility bills, transforms a budget from a static chart into a dynamic roadmap for financial management.

In recent times, the pandemic has highlighted the futility of forecasting financial markets, urging a focused, controlled approach to budgeting. By concentrating on immediate, adjustable aspects of finance, individuals work towards enhancing their economic standing one month at a time, one category at a time. Automating savings, a technique increasingly recommended, synergizes well with this method, enabling proactive accumulation of wealth alongside budget adherence.

Key financial strategies reinforce this practice - setting clear, time-bound financial goals across the short, medium, and long term, routinely reassessing one's fiscal trajectory to ensure alignment with objectives, and evaluating net worth to guide financial decision-making. A budget is, therefore, not just a tool but a reflection of fiscal ambition and prudence, steering individuals towards their financial summit.

B. Seeking Professional Advice

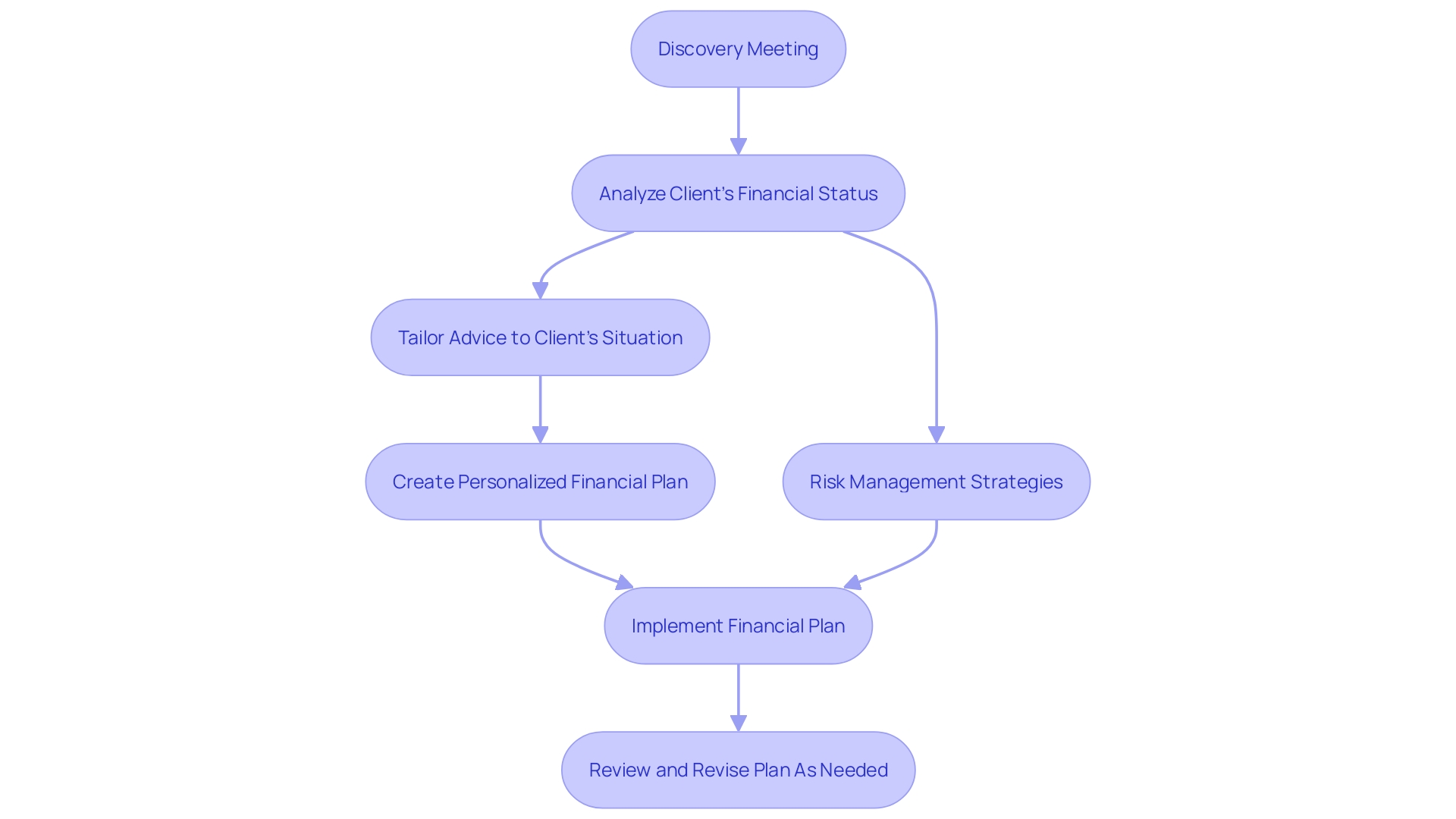

Professional financial consultations play an essential role in shaping one's financial future, especially amidst the complexities of today's economic landscape. Tailoring financial advice to an individual's situation, a consultant can transform daunting monetary challenges into structured, manageable tasks. For those already financially adept, seeking a secondary analysis of their financial trajectory can further refine their plan.

From discerning the optimal course for investment to establishing a robust financial plan inclusive of future projections, professional advice is more than just number-crunching; it’s about crafting a strategy to meet both long-term objectives, like retirement, and immediate financial goals. A discovery meeting can kick-start this process, where thorough exploration of your financial status aids in creating an effective, personalized plan.

The crux of financial planning is not just to create a roadmap for wealth accumulation but also for prudent risk management. Acknowledging market uncertainties, devising strategies with your risk tolerance central to the investment approach becomes paramount.

Moreover, as the digital age ushers in an era where over 4.59 billion individuals interact through social platforms, the line between genuine financial advice and 'salesy' pitches often blurs. It's vital to interrogate the intentions behind financial advice, distinguishing between those aimed at enriching your fiscal health and others swayed by commissions. This discernment ensures that the financial strategy devised is one authentically aligned with your interests.

C. Avoiding Impulse Purchases

Mastering your spending habits requires thoughtful reflection on every potential purchase. Modern economics underscores the significance of opportunity cost, an often-overlooked concept that illustrates the benefits we forfeit when making one choice over another. When faced with the decision to spend or save, one must recognize that the actual cost goes beyond the price tag; it includes what's sacrificed, whether it be investment gains or other financial opportunities.

Realizing this can serve as a robust deterrent against impulsive buying behavior, which tends to derail even the best-laid financial plans.

A practical approach to improving spending decisions is crafting a comprehensive budget. Statistics reveal that a vast majority of young adults, specifically 60% of those aged between 25 and 34 in the US, have savings of $1000 or under, highlighting the need for rigorous budgeting. By delineating expenses and assigning your income into categories—50% for essentials, 30% for discretionary items, and 20% for savings—you create a clear picture of your financial standing.

This structured outlook facilitates managing your funds more effectively and curbs the propensity for spur-of-the-moment purchases.

Awareness is also pivotal in this context. Recognizing the characteristics of impulse buying—from the sudden urge to own a product to the immediate satisfaction it promises—helps you pause and consider the real impact of these purchases. The collective wisdom from Kiplinger Advisor Collective's financial leaders suggests introspecting before every significant buy, inquiring into the necessity of the purchase, how it aligns with your financial objectives, and confronting the broader question: 'At what cost?'

Asking oneself this can illuminate the trade-offs involved in any given financial decision, thus promoting wiser spending patterns.

Finally, routine reviews of where your money is going, as indicated by categorized spending reports from bank statements, and the automation of savings can substantially support your mission to spend less and save more. Implementing such measures can steadily lead to a healthier financial state, even in the face of economic pressures such as inflation. These intentional steps join hands in safeguarding your financial wellbeing and guiding you towards a more secure financial horizon.

Conclusion

In conclusion, making poor financial decisions can have immediate and long-term consequences that can significantly impact our financial well-being. Immediate consequences, such as accumulating debt, can lead to financial instability and hinder wealth accumulation. Similarly, damaged credit scores can limit access to loans and favorable interest rates.

Additionally, the stress and anxiety caused by financial instability can have negative effects on mental and physical health.

When it comes to avoiding bad financial decisions, there are practical strategies that individuals can implement. Budgeting and financial planning are crucial to managing expenses and setting financial goals. Seeking professional advice can provide valuable insights and tailored recommendations for a solid financial plan.

Furthermore, avoiding impulsive purchases and understanding the concept of opportunity cost can help us make informed spending decisions.

To safeguard our financial future, it is important to remain vigilant, seek reliable advice, and continuously educate ourselves about personal finance. By implementing these strategies and taking a proactive approach to our financial well-being, we can navigate the complex financial landscape and build a secure future. So let's prioritize our financial health and make wise choices to achieve long-term financial stability.