Introduction

Undertaking financial due diligence is a critical step in assessing a company's viability and stability before committing to a transaction. This investigative process involves a comprehensive analysis of financial statements, assets, debts, cash flow, and projections, providing a clear view of a company's fiscal health. It also examines legal and regulatory risks, ensuring compliance with tax laws and evaluating potential legal liabilities.

Financial due diligence goes beyond surface-level assessments, diving deep into operational, market, and asset reviews, as well as risk assessment. This meticulous approach is crucial for potential buyers or investors to make well-informed decisions, safeguarding their interests and capitalizing on opportunities with a clear understanding of associated risks and rewards. In this article, we will explore the importance of financial due diligence, the types of due diligence, the process involved, key steps, critical documents to review, analyzing financial statements, understanding financial projections and tax compliance, the role of financial due diligence in M&A transactions, successful case studies, challenges, and best practices.

By delving into these topics, we aim to equip CFOs with practical advice and solutions to navigate the financial due diligence landscape confidently.

Understanding Financial Due Diligence

Undertaking financial due diligence is an investigative process, integral to assessing a company's viability and stability before committing to a transaction. It offers a comprehensive analysis of financial statements, assets, debts, cash flow, and projections, providing a clear view of a company's fiscal health. Legal and regulatory risks, especially in heavily-regulated industries, are also scrutinized, ensuring compliance with tax laws and evaluating potential legal liabilities, such as partnerships and licensing agreements.

A case in point is SmartRent, a smart-home company that experienced overvaluation due to its unprofitable hardware-centric business model with low gross margins, revealing the importance of due diligence in uncovering overestimations in value. Similarly, examining the project structure of a business entity, such as determining whether code is original or a fork, contributes to understanding the inherent value and originality of the company's offerings.

In the rapidly evolving financial world, new software now detects money laundering activities more effectively. This is pertinent to due diligence as it highlights the need for advanced analytical tools to identify financial discrepancies that could indicate risks such as fraudulent activities. As noted by Dr. Huiping Chen and colleagues, conventional detection methods relying on rule-based or machine-learning frameworks may fall short, emphasizing the necessity for thorough due diligence processes that leverage cutting-edge technology.

Furthermore, accurate business valuation is critical, as undervaluation or overestimation could detrimentally affect transaction outcomes. Professional appraisers or valuation experts can provide invaluable insights into a business's market value, considering financial health, asset valuation, customer base, and industry dynamics.

Financial due diligence is not merely a cursory glance but a deep dive into operational, market, and asset reviews, as well as risk assessment—crucial for understanding a company's revenue streams, profitability, debt levels, financial liabilities, and overall market position. This meticulous approach is essential for potential buyers or investors to make well-informed decisions, safeguarding their interests and capitalizing on opportunities with a clear understanding of associated risks and rewards.

Types of Due Diligence and Their Importance

Financial due diligence serves as a critical component in evaluating the viability and financial health of a target company. At the core of this process is a thorough examination of financial records, encompassing the assessment of financial statements, scrutiny of tax compliance, analysis of cash flows, evaluation of debt obligations, and review of financial projections. This exhaustive analysis is not only about confirming the accuracy of reported figures but also about understanding the financial dynamics at play.

For instance, delving into the financial statements allows us to trace the double-entry accounting system back to its roots, seeking any discrepancies that might signal financial mismanagement. By reviewing cash flows and debt levels, we gain insights into the company's ability to sustain operations and fulfill obligations. Moreover, assessing financial projections offers a glimpse into the company's potential trajectory, aligning with the concept of Dividend Potential, which indicates a company's capability to distribute profits to shareholders.

Financial due diligence transcends mere number crunching; it's an investigative odyssey that reveals the essence of a company's financial integrity and future prospects. A case in point involves SmartRent, a smart-home company whose financial turbulence underpinned its overvaluation, highlighting the importance of due diligence in revealing underlying financial instabilities. Additionally, recent news about a bank's interim financial report showcases the complexities of financial decision-making, where changes in business models and reclassification of assets impact the financial landscape, underscoring the gravity of due diligence in navigating such intricacies.

In essence, financial due diligence is a fundamental exercise in risk assessment, ensuring that stakeholders are well-informed and prepared to make strategic decisions.

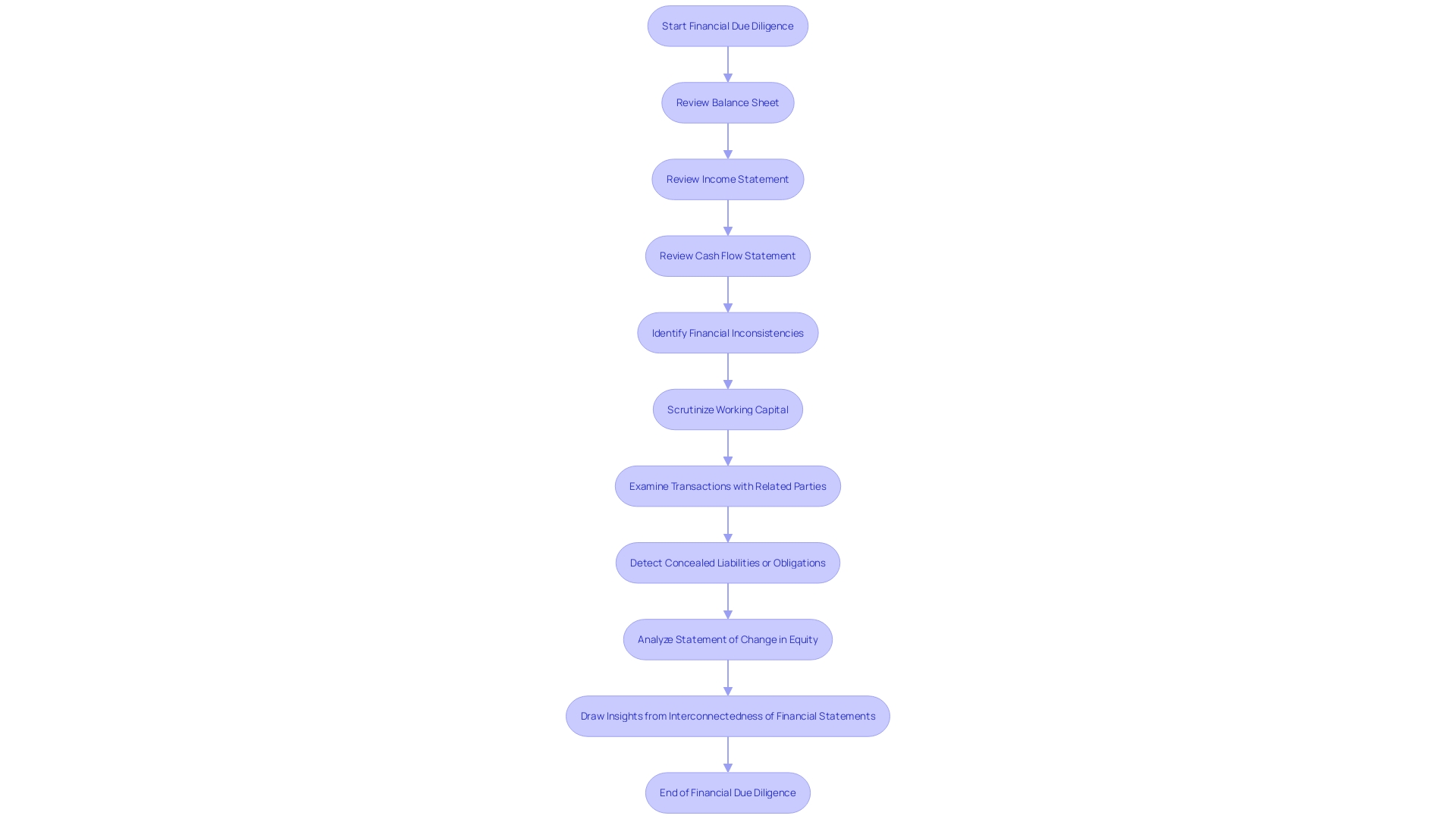

The Financial Due Diligence Process

Conducting a thorough financial due diligence involves a meticulous examination of a company's financial ecosystem. This critical analysis includes delving into financial statements, tax returns, bank statements, and contracts, along with other essential records that paint a picture of the company's financial health. Financial analysts play a pivotal role in this process, assessing a company's profitability, liquidity, and solvency by analyzing balance sheets, income statements, and cash flow statements.

Beyond the numbers, interviews with key personnel and discussions with external stakeholders offer valuable insights into the historical performance and future prospects of the target company.

In the banking sector, for example, the transformation towards a digital customer experience has increased the importance of software quality and compliance with stringent regulatory requirements. Banks like M&T, with its formidable 165-year history, have recognized the necessity to establish clean code standards for software development to maintain high security and performance levels. This is reflective of the broader due diligence process, which encompasses not just financial audits but also a deep dive into legal and regulatory risks, tax law compliance, and a comprehensive evaluation of IT infrastructure to identify and address any potential risks.

The due diligence process is also informed by the latest industry movements, such as the restructuring of capital markets divisions seen at organizations like Industrial Alliance, signaling strategic shifts and potential impacts on financial health. Ultimately, due diligence is an expansive investigation ensuring that all aspects of a company's operations are scrutinized for risks and opportunities, guiding investment decisions with precision and foresight.

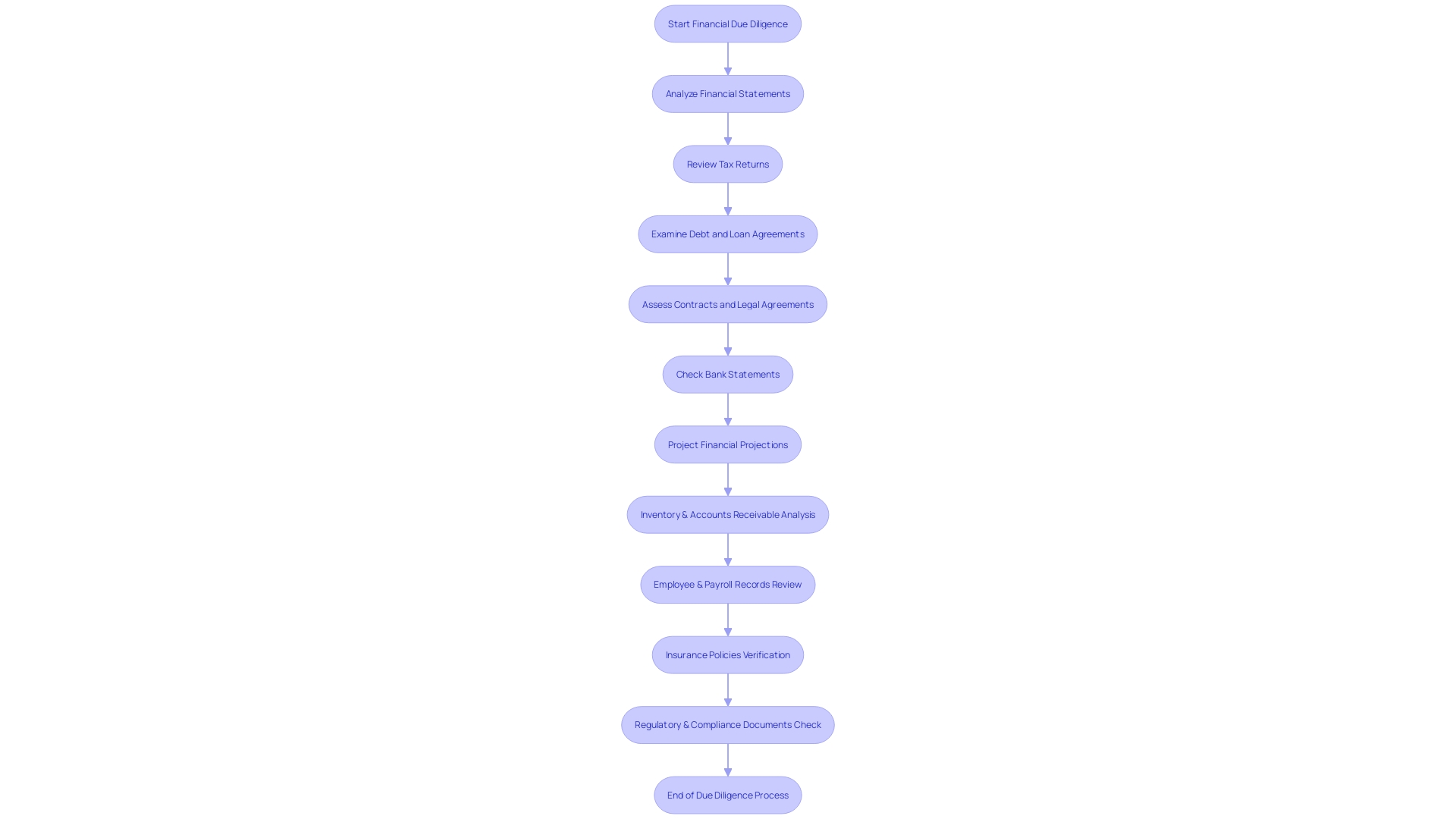

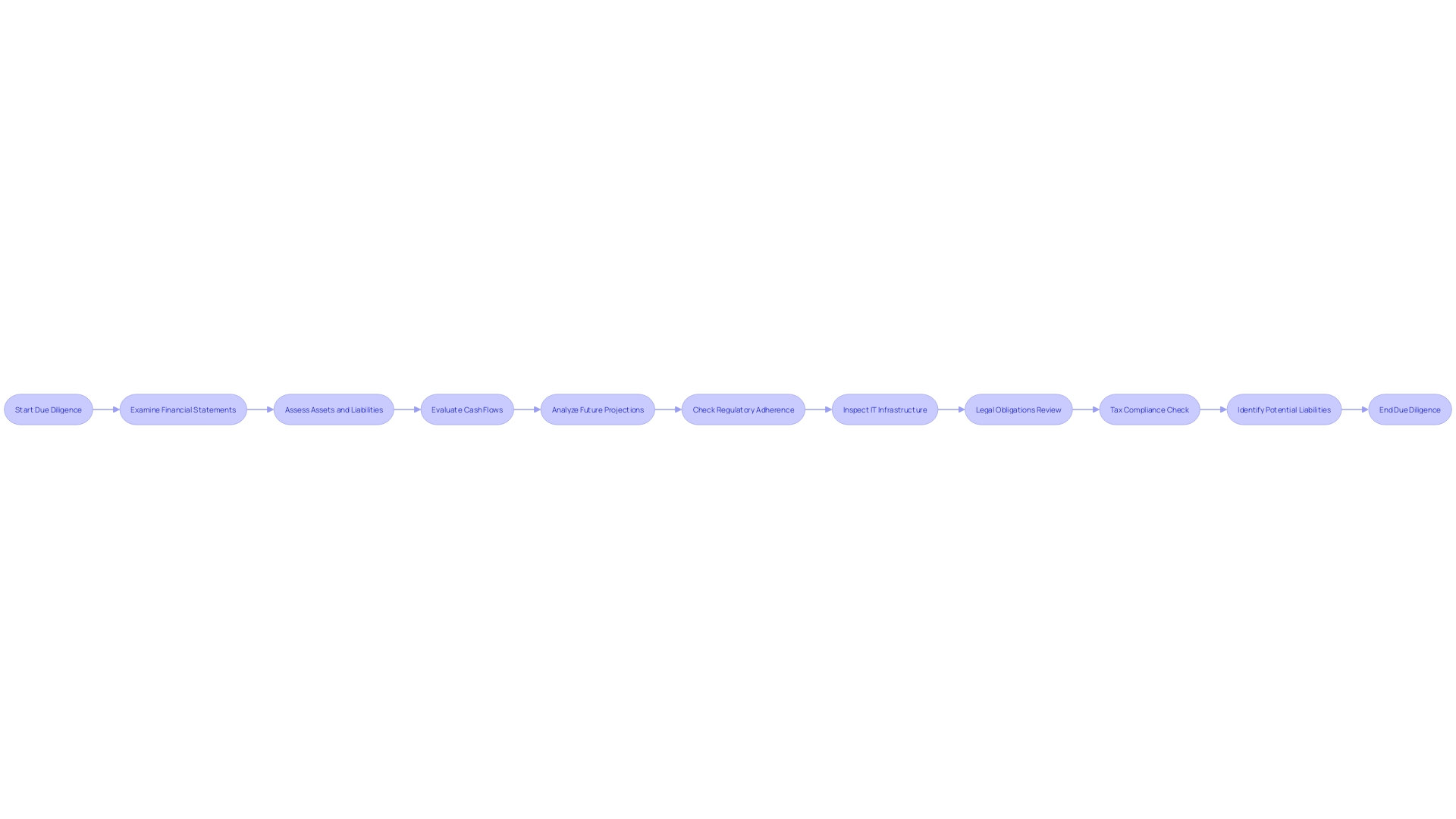

Key Steps in Conducting Financial Due Diligence

- Initiating the financial due diligence process starts with defining clear objectives. The goals should encompass a thorough examination of specific financial areas and an assessment of potential risks that could affect the transaction. 2. The information gathering phase is a meticulous process, involving the collection of all pertinent financial documents and records from the target company to ensure a complete evaluation. 3. The financial analysis is a deep dive into the company's financial statements, tax compliance, and cash flow. This scrutiny reveals any discrepancies or warning signs that might pose future problems. 4. Risk assessment is about gauging the potential impact of identified risks on the investment and aligning them with the investor's risk tolerance. Strategies are then formulated to mitigate these risks effectively. 5. The final step is the preparation of a detailed report, which consolidates the findings and recommendations, providing a clear roadmap for the involved parties to follow post-due diligence.

Critical Documents and Information to Review

Financial due diligence is an essential investigative step during mergers, acquisitions, or any strategic financial planning to ensure that all financial aspects of a target company are transparent and thoroughly understood. This process involves an in-depth review of a multitude of documents and data to uncover any underlying financial risks or opportunities, which can significantly impact investment decisions.

- Financial Statements: It is crucial to analyze the balance sheet, income statement, and cash flow statement to evaluate the company's financial health and performance. These documents provide insights into profitability, liquidity, and cash flow management.

- Tax Returns and Compliance: A review of the company's tax history, including returns, audits, and compliance records, ensures that the company adheres to tax laws and regulations, avoiding potential legal complications.

- Debt and Loan Agreements: Understanding the company's existing financial obligations through its debt and loan agreements can shed light on its financial stability and repayment capacity.

- Contracts and Legal Agreements: Scrutinizing all contracts and legal agreements, including partnerships and licensing deals, helps identify any legal liabilities or benefits that may affect the company's valuation.

- Bank Statements and Records: A thorough examination of bank statements and financial transactions confirms the accuracy of reported financial data and reveals the company's cash handling practices.

- Financial Projections and Forecasts: Assessing financial projections and forecasts, using historical data and financial modeling, is vital for predicting the company's future financial performance and potential growth.

- Inventory and Accounts Receivable: The state of inventory and accounts receivable information can indicate the efficiency of the company's operations and its ability to convert assets into cash.

- Employee and Payroll Records: These records are reviewed to understand the company's labor costs, benefits liabilities, and any potential issues regarding employment.

- Insurance Policies: Evaluating the company’s insurance coverage helps determine if it is adequately protected against risks, which can affect financial stability.

- Regulatory and Compliance Documents: For heavily-regulated industries, it's important to assess the company's compliance with all relevant regulations to prevent future legal challenges or fines.

By meticulously reviewing these areas, financial due diligence provides a comprehensive and nuanced view of the potential risks and rewards associated with major financial decisions. This strategic process empowers businesses to make informed choices that align with their long-term financial goals and operational needs.

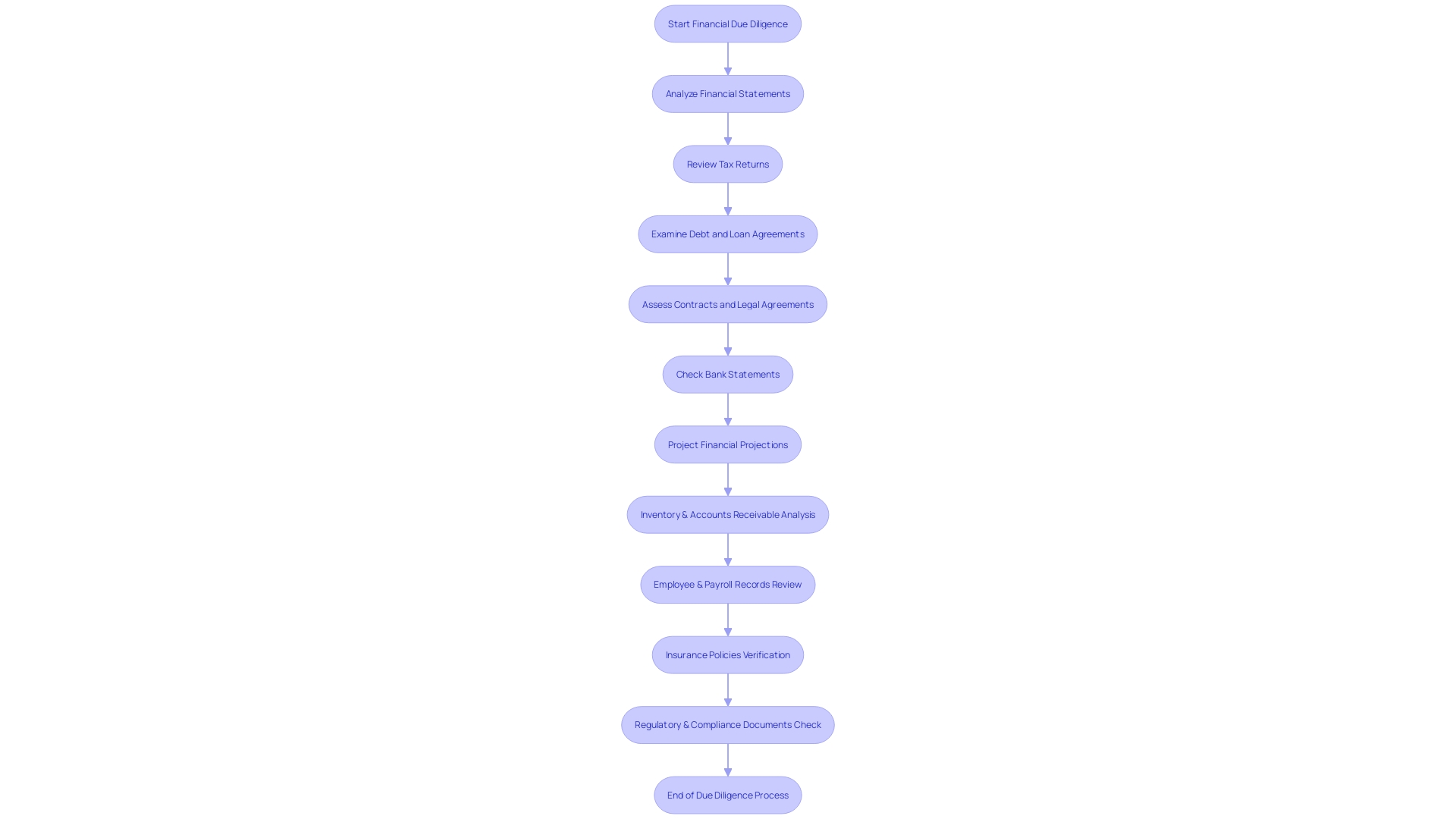

Analyzing Financial Statements and Identifying Red Flags

When conducting financial due diligence, the dissection of financial statements is more than a mere review; it's a meticulous audit of the company's financial health. By parsing through the balance sheet, income statement, and cash flow statement, one can gauge the company's liquidity, profitability, and overall financial robustness. It's crucial to recognize and scrutinize any financial inconsistencies that might raise eyebrows, including:

- Disparities in the ways revenue or expenses are recognized

- Unjustified shifts in crucial financial indicators

- Notable alterations in working capital

- Transactions with related parties that seem excessive or atypical

- Concealed liabilities or obligations that are contingent

Drawing on the wisdom of Luca Pacioli's double-entry accounting system, a financial analyst can detect the financial fingerprints that may point to discrepancies. Just as the accounting equation asserts that Assets = Equity + Liabilities, any variation on one side of the balance sheet must be mirrored on the other, providing insights into the financial narrative. Moreover, the holistic interconnection among the income statement, balance sheet, and cash flow statement offers a complete financial picture, uncovering any red flags.

The expertise of forensic accountants like Tan, who co-authored 'Asian Financial Statement Analysis,' can be instrumental in this process. The book serves as a seminal guide, emphasizing the significance of vigilance when investing, especially in complex regions like Asia.

Furthermore, contemporary news underscores the importance of financial due diligence. For instance, a disclosure in MarketWise's 2022 annual report filed with the SEC flagged a significant issue that might have deterred further investigation.

In essence, a detailed and forensic approach to analyzing financial statements empowers potential buyers or investors to make well-informed decisions, poised to negotiate from a position of strength and insight.

Understanding Financial Projections and Tax Compliance

Financial due diligence is not just about assessing current performance; it's also integral to forecasting a target company's growth trajectory. This forward-looking aspect draws heavily on financial projections, which are meticulously analyzed for plausibility. Analysts scrutinize projections to discern the validity of underlying assumptions and the feasibility of achieving financial objectives.

This analytical process is vital to investors who rely on it to gauge potential returns.

Tax compliance is equally pivotal in due diligence. It's about more than just ticking boxes; it involves a deep dive into the company's adherence to tax obligations—scrutinizing past transactions and ensuring there are no hidden liabilities. Case studies, such as the intricate tax scenarios encountered by De Grandpré Chait when dealing with cryptocurrency cases, underscore the importance of specialized tools like Chainalysis for comprehensive analysis.

The law firm's experience illustrates that staying on top of complex tax matters is crucial in avoiding legal and financial pitfalls.

The landscape of tax compliance is continually evolving. Marketplaces, including Etsy, have had to overhaul their systems to manage tax collection and remittance on a global scale, emphasizing the complexity and dynamic nature of tax regulations. Even in the fast-paced world of cryptocurrencies, tax obligations can arise from various activities, with the IRS clearly categorizing digital assets as capital assets.

In this regard, financial analysts play a vital role. Their expertise in dissecting financial statements and utilizing financial models, such as the Three Statement Model or Discounted Cash Flow Model, equips businesses with the insight to navigate financial due diligence successfully. With organizations increasingly relying on data-driven decision-making, as evidenced by the S&P Global survey, the role of financial analytics tools becomes indispensable in facilitating informed, evidence-based choices.

However, the financial analytics market faces its own challenges. The dual concerns of data security and a shortage of skilled professionals pose significant hurdles. As data increasingly moves to the cloud, safeguarding sensitive financial information becomes paramount, and the talent gap, highlighted by the shortage of data science professionals, underscores the need for expertise in translating complex data into strategic actions.

In conclusion, financial due diligence is a multifaceted process, with financial projections and tax compliance at its core. It requires a combination of analytical acumen, specialized tools, and an understanding of the regulatory landscape to ensure that investors and buyers can make decisions with confidence and clarity.

The Role of Financial Due Diligence in M&A Transactions

Financial due diligence is the cornerstone of successful mergers and acquisitions (M&A), serving as a comprehensive assessment of the target company's financial health and operational risks. By meticulously examining financial statements, assets, liabilities, cash flows, and future projections, acquiring entities can gauge the true value of their investments. Beyond numbers, it involves scrutinizing the company's adherence to environmental regulations, IT infrastructure, legal obligations, tax compliance, and potential liabilities tied to partnerships or licensing agreements.

This multi-faceted investigation is essential in today's unpredictable M&A landscape, highlighted by the volatile activity captured in BCGâs M&A Sentiment Index. As dealmakers navigate an environment where strategic decisions are influenced by global and regional sentiments, financial due diligence becomes the lens through which risks are identified and strategies are tailored.

Understanding the intricate dynamics of a deal is pivotal. Insights into the perspective and experiences of the other party can dramatically influence negotiation outcomes. Whether it involves resolving complexities with joint ventures or aligning with key stakeholders' interests, the goal is to foster a partnership that ensures a seamless integration and the long-term success of the transaction.

Recent trends indicate a cautious approach to deal-making, with a discerning eye on valuations. As BCG analysts note, the M&A market has faced significant headwinds, leading to a more selective pursuit of opportunities. This strategic prudence underscores the importance of due diligence, ensuring that each deal is not only financially sound but also strategically aligned with the broader market trajectory.

Case Study: Successful Financial Due Diligence in Action

When Company XYZ embarked on a recent acquisition, they meticulously scrutinized the financial health of the target firm. This encompassed a deep dive into the financial statements, ensuring tax compliance, and evaluating financial forecasts. In the midst of this scrutiny, they unearthed discrepancies in revenue recognition practices and looming litigation risks.

These insights were critical; Company XYZ leveraged them to recalibrate the purchase price, instituting indemnification safeguards within the acquisition contract, and formulating strategies to mitigate identified risks. Their diligence not only paved the way for a smoother transaction but also fortified their position against financial vulnerabilities that could have emerged post-acquisition.

This strategic approach aligns with the experience of many companies who consider mergers and acquisitions (M&A) as a key growth strategy. Unlike simple capital raising, M&A is complex, requiring a thorough understanding of the target company and how it complements the acquiring firm's long-term objectives. It's imperative for companies to assess how an acquisition aligns with their strategic vision, the desired outcomes, and the resources they are willing to allocate.

For instance, Capital One's acquisition of a global payments network emphasized the importance of scale and strategic investment in remaining competitive. Similarly, thorough due diligence helped them to understand the exact nature of the business they were acquiring, which is crucial for any company considering an M&A.

When executing financial due diligence, it's essential to review key performance indicators (KPIs), user profitability, seasonality effects, and customer risk. The objective is to obtain a holistic view of the company's operational health and sustainability. This process not only influences the transaction terms but also ensures that the acquisition is a strategic fit and has the potential for synergy.

In the contemporary business landscape, where unicorns—start-ups valued over $1 billion—are becoming more common, it's increasingly important to identify those that are financially independent and operationally robust. Bain's research indicates that it's a rarity to find unicorns that don't rely on continuous venture capital injections, highlighting the significance of due diligence in ensuring the financial viability of an acquisition.

Ultimately, a well-executed financial due diligence process, as demonstrated by Company XYZ, is instrumental for any company to make informed decisions, safeguard investments, and drive successful M&A outcomes.

Challenges and Best Practices in Financial Due Diligence

Navigating the intricacies of financial due diligence requires a vigilant approach, particularly when faced with challenges such as restricted access to critical data, pressing deadlines, and multifaceted monetary frameworks. To enhance the precision and speed of this process, consider implementing the following methodologies:

- Employ the expertise of seasoned financial advisors or consultants to navigate through the intricate financial landscape.

- Define the aims and boundaries of due diligence with clarity to ensure a targeted approach.

- Employ a systematic methodology for the collection and examination of pertinent information.

- Conduct in-depth discussions with essential personnel to gain valuable insights.

- Engage in meticulous financial scrutiny and verification of data to unearth any discrepancies.

- Anticipate potential risks and formulate strategies to mitigate these risks effectively.

- Maintain clear and consistent communication with all entities engaged in the transaction.

By embracing these strategies, businesses can bolster the impact and efficiency of their financial due diligence endeavors, thereby mitigating risks and enhancing decision-making capabilities.

Conclusion

Financial due diligence is a critical step in assessing a company's viability and stability before committing to a transaction. It involves a comprehensive analysis of financial statements, assets, debts, cash flow, and projections, ensuring that potential buyers or investors have a clear understanding of associated risks and rewards. This meticulous approach is crucial for making well-informed decisions and safeguarding interests.

Thorough financial due diligence evaluates the financial health of a target company by examining financial records, tax compliance, cash flows, and debt obligations. It provides stakeholders with valuable insights and prepares them to make strategic decisions considering all potential risks.

Conducting financial due diligence requires a meticulous examination of a company's financial ecosystem, including financial statements, tax returns, bank statements, and contracts. It involves interviews with key personnel and discussions with external stakeholders to gain valuable insights. This systematic approach ensures a comprehensive evaluation of the target company, guiding investment decisions with precision.

Analyzing financial statements is a vital part of financial due diligence, identifying any financial inconsistencies and potential red flags. This detailed and forensic approach empowers potential buyers or investors to negotiate from a position of strength and insight.

Financial due diligence also involves forecasting a target company's growth trajectory and ensuring tax compliance. Financial projections are meticulously analyzed for plausibility, and tax obligations are scrutinized to avoid hidden liabilities. Financial analysts play a vital role in dissecting financial statements and utilizing financial models, providing businesses with the insight needed to navigate financial due diligence successfully.

In M&A transactions, financial due diligence serves as a comprehensive assessment of the target company's financial health and operational risks. It ensures that risks are identified, strategies are tailored, and the acquisition is financially sound and strategically aligned.

Successful financial due diligence requires a vigilant approach, employing seasoned financial advisors, defining clear objectives, utilizing a systematic methodology, conducting in-depth discussions, and maintaining clear communication. By following these best practices, businesses can navigate the financial due diligence landscape confidently.

In conclusion, financial due diligence is a multifaceted process that empowers businesses to make well-informed decisions, safeguard investments, and drive successful outcomes. By conducting comprehensive analyses, scrutinizing critical documents, and employing best practices, businesses can navigate the financial due diligence landscape with confidence and clarity.