Introduction

At the heart of a firm's fiscal operations resides the corporate controller, an influential figure responsible for directing accounting and financial undertakings. As an architect of financial statements, their role extends beyond reporting past and present financial performance to strategic decision-making.

With a keen understanding of the financial narrative, the corporate controller curates monthly financial reports that ensure accuracy and compliance, setting the foundation for the organization's financial health. In this article, we will explore the key responsibilities of a corporate controller, including financial management and reporting, budgeting and cost control, financial analysis and planning, leadership and team management, and compliance and risk management. By delving into these areas, we aim to provide practical advice and solutions to CFOs, empowering them to navigate the intricate waters of corporate governance and strategically influence their company's financial destiny.

Key Responsibilities of a Corporate Controller

At the heart of a firm's fiscal operations resides the corporate controller, whose role is pivotal in directing the course of accounting and financial undertakings. Tasked with upholding the precision and trustworthiness of fiscal records, they are the architects of financial statements that not only report past and current financial performance but also pave the way for strategic decision-making.

A keen understanding of the financial narrative of an LLC, or any company, rests on the shoulders of the corporate controller. Regularly, they curate monthly financial reports, each one a crystalline reflection of the company's economic health, ensuring complete accuracy, essential for compliance and informed corporate planning.

The omnipresent eyes of a controller survey the company's financial landscape, addressing legal compliances and bolstering the strategic financial framework. Ensuring meticulous record-keeping, akin to a bookkeeper’s responsibility, they lay a strong foundation for continued financial health, making sure every transaction aligns with the company’s larger goals and statutory obligations. In essence, the controller acts as a financial guardian, ensuring that the organization navigates through the intricate waters of corporate governance with expertise, ultimately influencing its financial destiny.

Financial Management and Reporting

At the helm of ensuring transparent and precise financial representation stands the corporate controller, a linchpin in the meticulous process of financial management and reporting. This pivotal role not only encompasses the generation of financial statements—statements of profit or loss, statements of financial position, and statements of cash flows—but also guarantees adherence to the ever-evolving financial standards as mandated by regulatory bodies. With new amendments brought forth by experts such as Andreas Barckow, these professionals are adapting to standards which demand accuracy and uniformity in financial reporting.

The introduction of explicit requirements for presenting operating profit and management-defined performance measures, as outlined in the updated guidelines replacing IAS 1, marks a significant shift toward enhanced transparency for investors. Controllers are the stewards of financial integrity within Limited Liability Companies (Llcs) and beyond, supplying stakeholders with monthly financial snapshots that influence strategic direction and compliance. As controllers navigate the diverse methodologies of calculating operating profits—as evidenced by an IASB study where over 60 companies utilized no less than nine different calculations—their acumen becomes ever more critical in forging financial trust and clarity.

Budgeting and Cost Control

In the face of rapid digital transformation, corporate controllers are tasked with more than just traditional budgeting and cost control; they must foster a cost-aware culture across all departments. As per the insights shared by the Boston Consulting Group, inefficiencies such as data scientists dedicating substantial time to tasks that detract from innovation demonstrate the importance of cost-optimization strategies. Controllers work closely with all organizational levels – from departmental heads to executives – to embed cost considerations as a critical, non-functional requirement within the product development cycle.

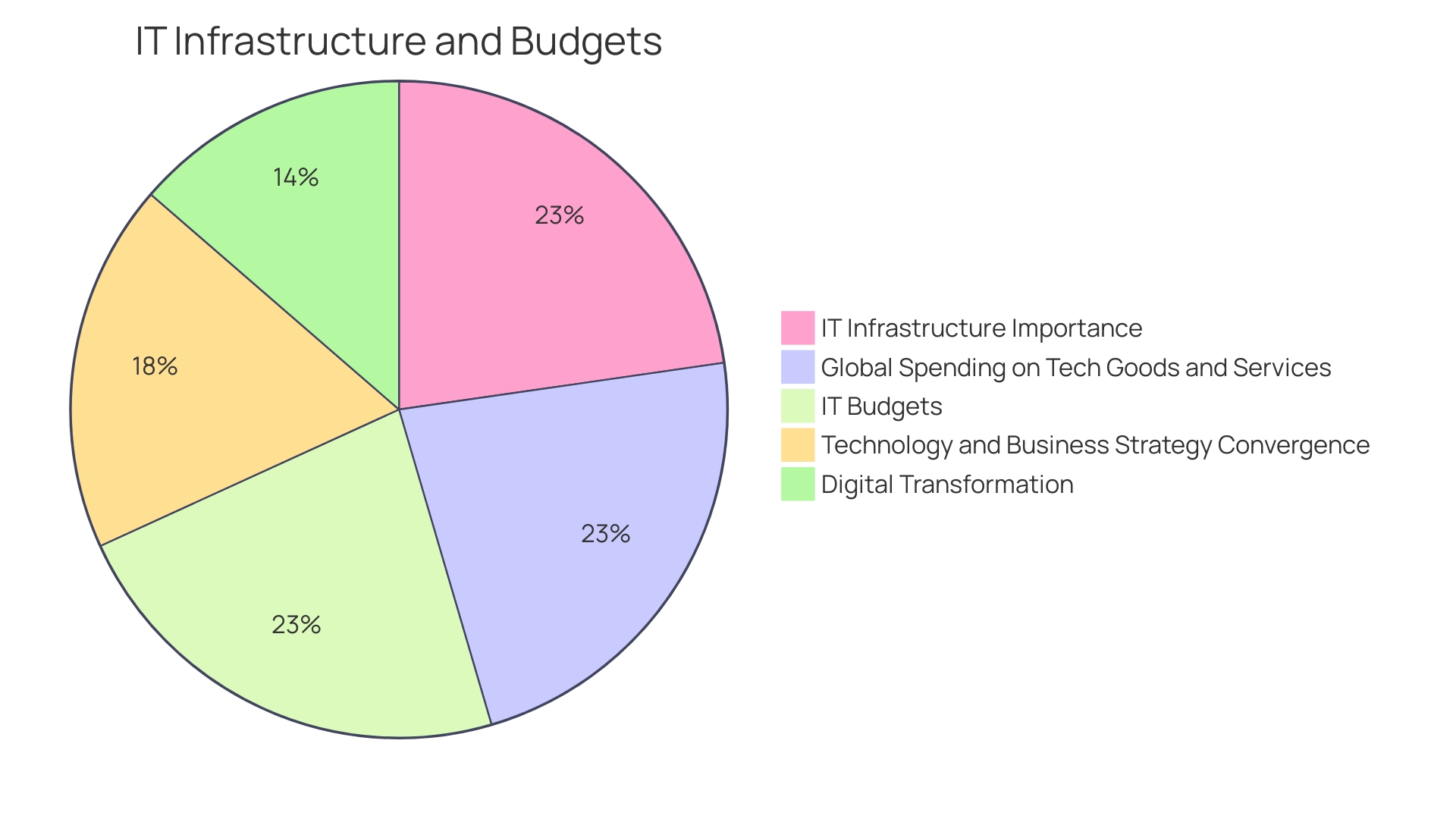

This collaborative approach ensures that costs are everyone's responsibility, thereby enhancing the organization's strategic alignment and cost-effectiveness. Moreover, real-world statistics underscore the pivotal role of IT infrastructure in organizational success, highlighting that global technologic investments have catapulted to a trillion-dollar industry. This financial landscape mandates vigilant management of technology-related expenses.

By proactively monitoring spending against projections, corporate controllers create immense value – avoiding the perils of isolated 'shadow IT' systems and enabling congruence between operations and overarching financial goals. As noted by industry thought leaders, eschewing obsolete yearly budgeting practices in favor of a dynamic, performance-based model can lead to tangible results, such as a 30% savings over three years. Corporate controllers must also pay heed to prevalent cost management anti-patterns to overcome potential organizational friction and amplify efficiency and profitability.

Financial Analysis and Planning

Corporate controllers, as financial stewards of an organization, wield extensive analytical prowess to steer business towards prosperity. Diving deep into the ocean of financial data, they single out trends and dissect patterns, drawing a rich tapestry of insights. Their recommendations, forged in the crucible of their analysis, become the cornerstone for bolstering financial performance.

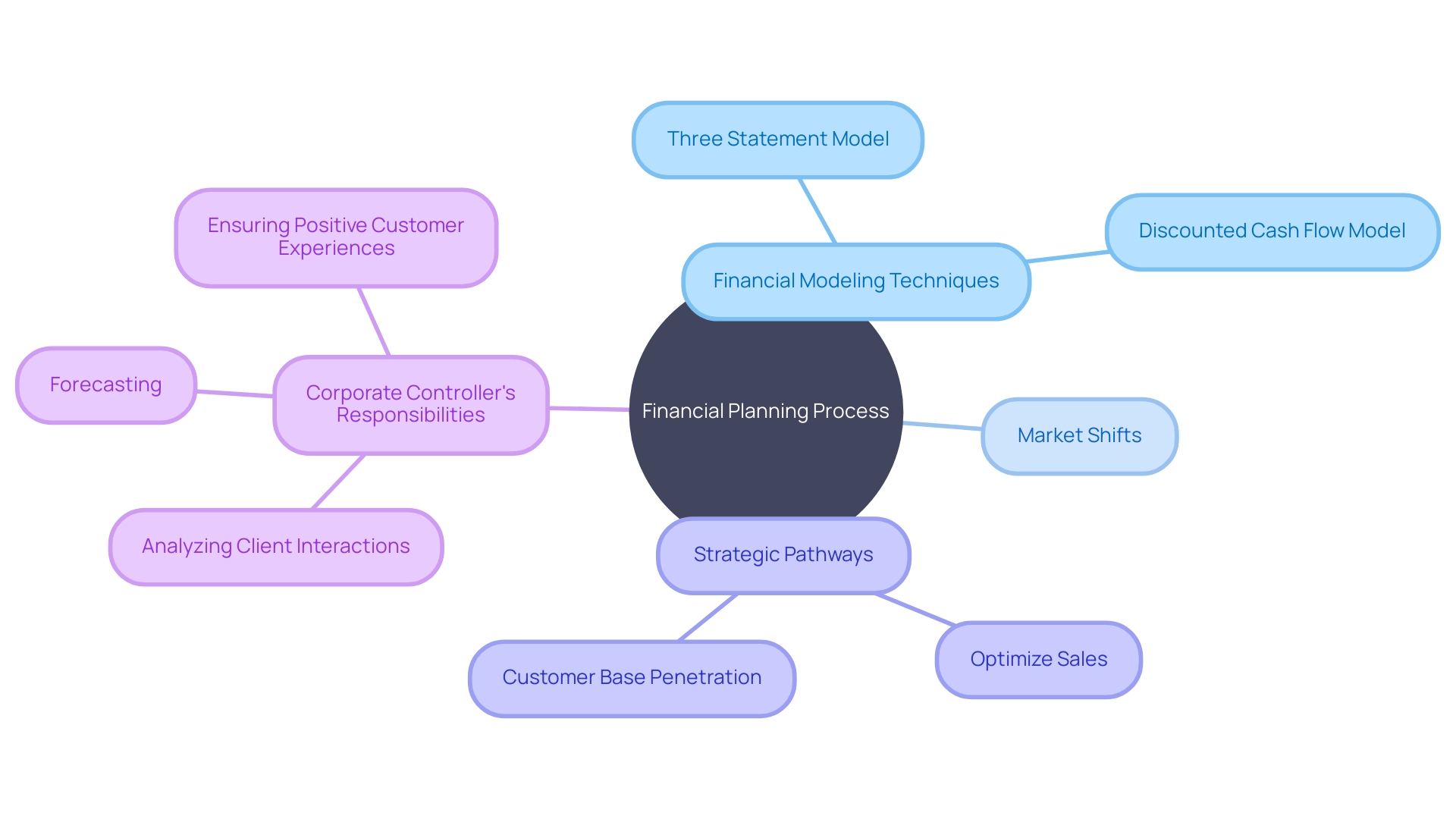

Through robust financial modeling—embracing both the simplicity of the Three Statement Model and the depth of the Discounted Cash Flow Model—they orchestrate a dynamic and ever-evolving financial planning process. With a vigilant eye on market shifts, including socio-cultural, economic, and technological factors, corporate controllers harness these changes, aligning strategic pathways such as 'Optimize Sales' and 'Customer Base Penetration'. This alignment is paramount, not just to thrive, but to perpetuate the success garnered over years.

Furthermore, their role extends to prophesying the financial future through shrewd forecasting. For instance, analyzing client interactions with products and services can significantly impact the path to growth, particularly with regard to customer experience. Corporate controllers play an indispensable role in ensuring that customers' engagements with the company translate into positive experiences and ultimately, healthy financial outcomes.

Supported by insights from over 4,400 professionals in the Global State of Business Analysis Report, the field's evolution and the strategies for a data-driven transformation are clear. As the report elucidates, understanding current industry states is vital for navigating challenges effectively—a principle corporate controllers live by. With not just technical skills but also personal traits and a solid educational grounding, financial analysts within the corporate controller's team transform data into forecasts and strategies that secure a company's financial health and strategic edge.

Leadership and Team Management

The corporate controller plays a pivotal role, not just in safeguarding financial integrity but in uplifting the finance and accounting team. This influential leader ensures team members are well-equipped with the necessary tools, knowledge, and developmental opportunities to excel in their duties. Similar to how Nets, a venerable payment solutions provider, revolutionized their data presentation to spur independent user exploration, a controller creates avenues for innovation within their team.

They foster an environment rich in collaboration, where accountability and collective professional advancement are core to the team's dynamism. A corporate controller's assiduous management is underscored by the understanding that a company thrives on the collective prowess of its people, as eloquently put by a leading CEO, "It's the people... The primary job of each manager is to help people be more effective in their job and to grow and develop."

Such leadership is critical in weathering market changes and maintaining the equipoise between risk management and technological advancements, necessitating operational adherence to established policies. This empathic and structured approach to team management echoes the recommendations of 'The Global State of Business Analysis Report,' which emphasizes that navigating the business landscape demands a comprehensive grasp of industry states and evolution. As finance professionals shape the pulse of a company's fiscal health, so does the corporate controller invigorate the finance and accounting team, ensuring its alignment with the company's strategic vision and the broader business environment.

Compliance and Risk Management

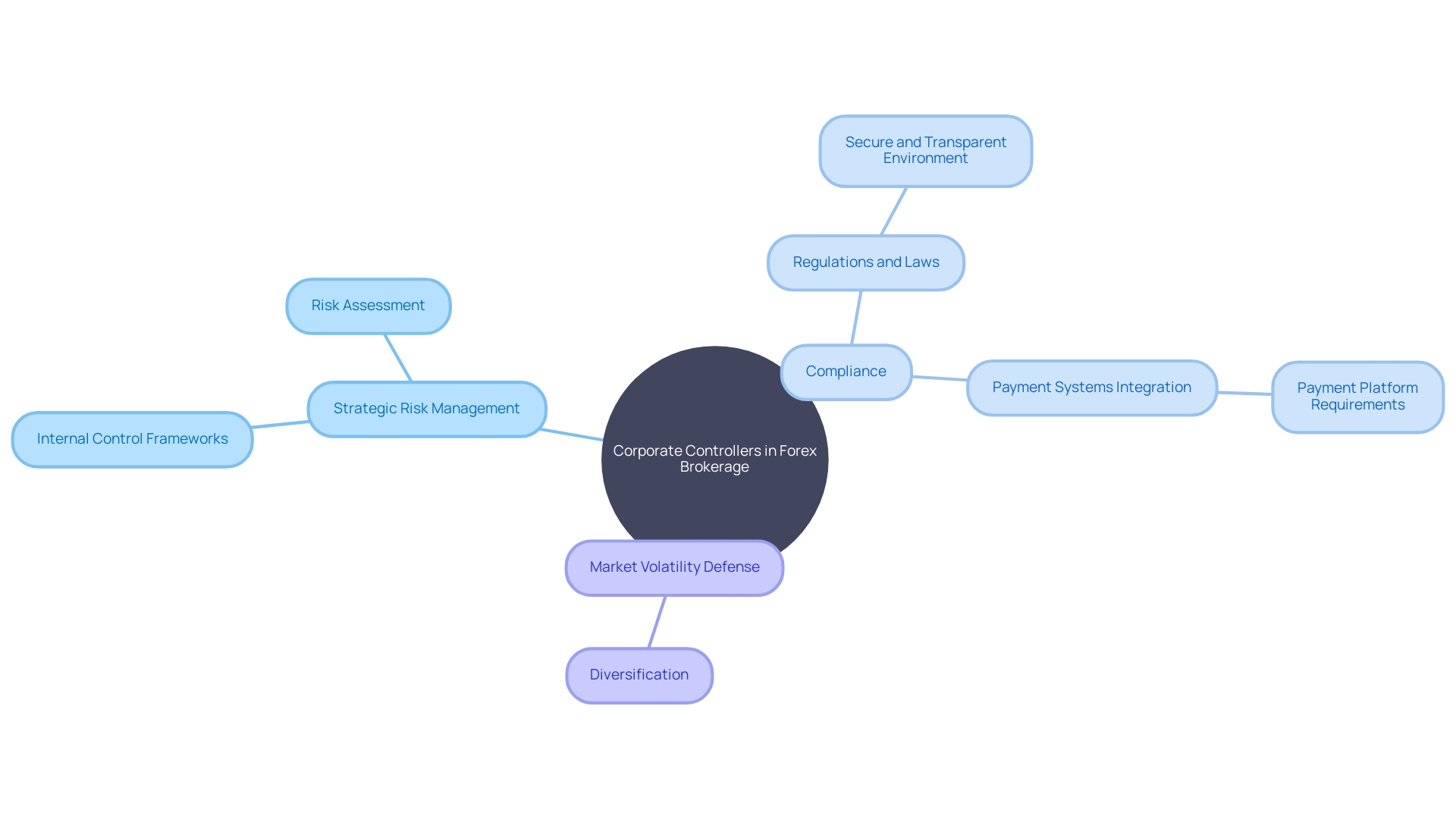

Corporate controllers orchestrate the delicate balance of adhering to ever-evolving financial regulations while managing embedded risks in the financial landscape. Their role is multifaceted—they construct robust internal control frameworks that serve as a bulwark against misuse of assets and financial discrepancies.

In an industry as dynamic as forex brokerage, complying with regulatory benchmarks is not just best practice; it's a cornerstone of operational longevity and market credibility. Controllers deftly integrate suitable payment systems, a necessary pivot for sustaining trader transactions, thereby fueling business prosperity.

As articulated by Ivan Noskov, a lead partnership specialist, compliance transcends mere rule-following—it's an intricate dance of preparation and understanding the stringent demands of payment platforms, acquiring banks, and regulatory authorities. Digital communication complicates compliance landscapes, with laws bifurcating into surveillance and digital communication; these dictate internal policy adherence and regulate content dissemination across proliferating media channels.

From a strategic viewpoint, controllers engage in meticulous risk assessment, as highlighted by industry experts. They remain vigilant, monitoring market flux, geopolitical shifts, and the potential reverberations on financial health. The subsequent strategy is a pastiche of acceptance, mitigation, or transfer of risks. Moreover, diversification stands as a testament to sagacious risk management, where investment spread across asset classes—whether equities or commodities—construes a resilient defense against market volatility and ensures a fortified pathway to organizational resilience and expansion.

Importance of a Corporate Controller in an Organization

A corporate controller is a pivotal figure within a business, particularly in the realms of financial oversight and strategic fiscal management. Charged with steering the accounting department, this role encapsulates the generation of meticulous monthly financial statements, ensuring that the business's economic reports accurately reflect its condition. This rigor in maintaining financial health is not just internally beneficial; it's a cornerstone for strategizing future financial pathways and complying with overarching regulatory standards.

Beyond simply tracking dollars and cents, controllers delve deep into nuanced financial reports. Their eyes keenly fixed on the balance sheets, income statements, and cash flow, they wield their financial acumen to distill complex data into actionable insights. These insights lay the groundwork for sound decision-making that aligns with the entity’s broad objectives.

Controllers are the sentinels of compliance and governance, identifying and staving off risks before they exacerbate. The strategic stewardship of a controller extends to include the identification of beneficial owners—those wielding substantial control or significant stakes in the company. Their grasp of the fiscal landscape informs their reports, which are not just compilations of historical data but narrations of the company's financial saga, emphasizing factual accuracy and exhaustive analysis.

The role's essence is aptly summarized by insights from top business publications that extol the value of information and training. These nourish the bedrock of any company—its people—enabling them to thrive in an environment that exudes nurturance, respect, and trust, as highlighted in quotable wisdom from industry observers. Controllers, therefore, are not merely guardians of the balance sheet but architects of an environment where great people and great strategies coalesce to ensure the organization's flourishing financial future.

Conclusion

In conclusion, the role of a corporate controller is pivotal in directing the financial operations of a firm. They are responsible for ensuring the accuracy and trustworthiness of financial records, curating monthly financial reports that reflect the company's economic health.

The corporate controller plays a crucial role in financial management and reporting, ensuring adherence to financial standards and providing transparent financial representation to stakeholders. They are also tasked with budgeting and cost control, fostering a cost-aware culture across all departments and managing technology-related expenses.

Additionally, corporate controllers bring extensive analytical prowess to the table, diving deep into financial data to identify trends and provide insights for financial planning. They also play a crucial role in leadership and team management, fostering collaboration and professional development within the finance and accounting team. Lastly, corporate controllers are responsible for compliance and risk management, constructing internal control frameworks and mitigating risks in the financial landscape. Overall, they are instrumental in shaping the financial destiny of an organization and ensuring its long-term success.