Introduction

Financial auditors play a crucial role in ensuring the accuracy and transparency of financial records. In this article, we will explore the responsibilities and types of financial audits that auditors perform.

We will also delve into common challenges faced by auditors and discuss best practices for conducting effective audits. With a focus on the evolving landscape of technology and regulation, we will examine how auditors can maintain independence, navigate complex regulatory environments, and leverage tools such as data analytics and audit management software. Whether you are a financial auditor looking to enhance your skills or a CFO seeking insights into the auditing process, this article will provide valuable information and practical advice to help you navigate the world of financial auditing with confidence and precision.

Financial auditors serve as stewards of fiscal integrity, delving into financial records and transactions to verify their accuracy and conformity to established guidelines. They are the sentinels who ensure that financial statements paint a true picture of an organization's financial well-being.

By scrutinizing balance sheets, income statements, and cash flow statements, auditors not only gauge a company's profitability and liquidity but also safeguard its solvency. Their impartial assessments are vital to maintaining transparency and fostering trust among stakeholders.

Moreover, their role extends to forecasting, where they apply historical data and analytical tools to predict future financial outcomes. In the complex ecosystem of blockchain and cryptocurrency, for instance, the term 'audit' is often misconstrued. Auditors stretch beyond the boundaries of traditional financial oversight, applying a comprehensive suite of verification tools to meet the unique demands of these emerging technologies. The functionality and originality of code, for example, are scrutinized to unveil the inner workings and potential of financial mechanisms within this space, such as those found in options-based markets.

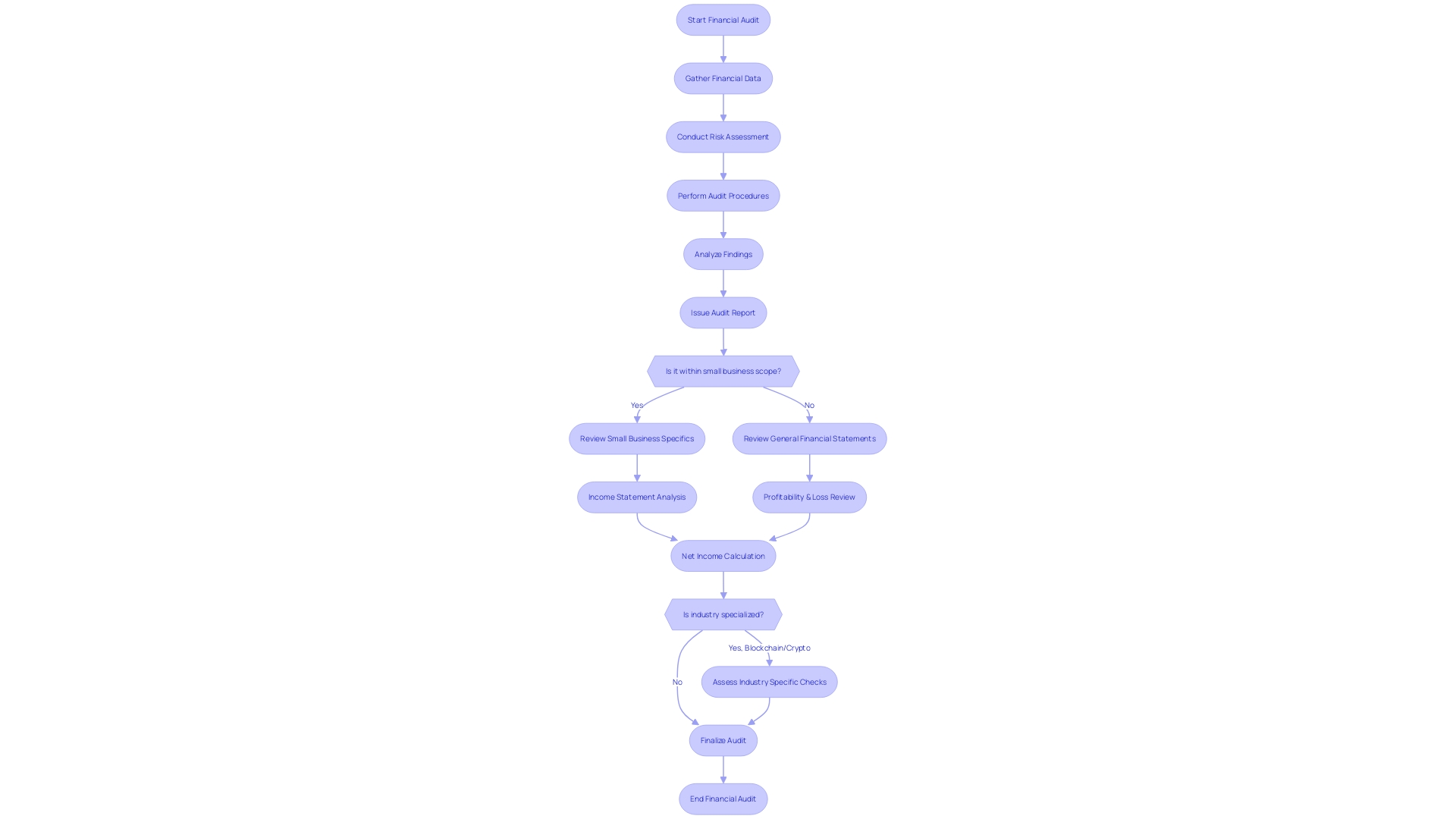

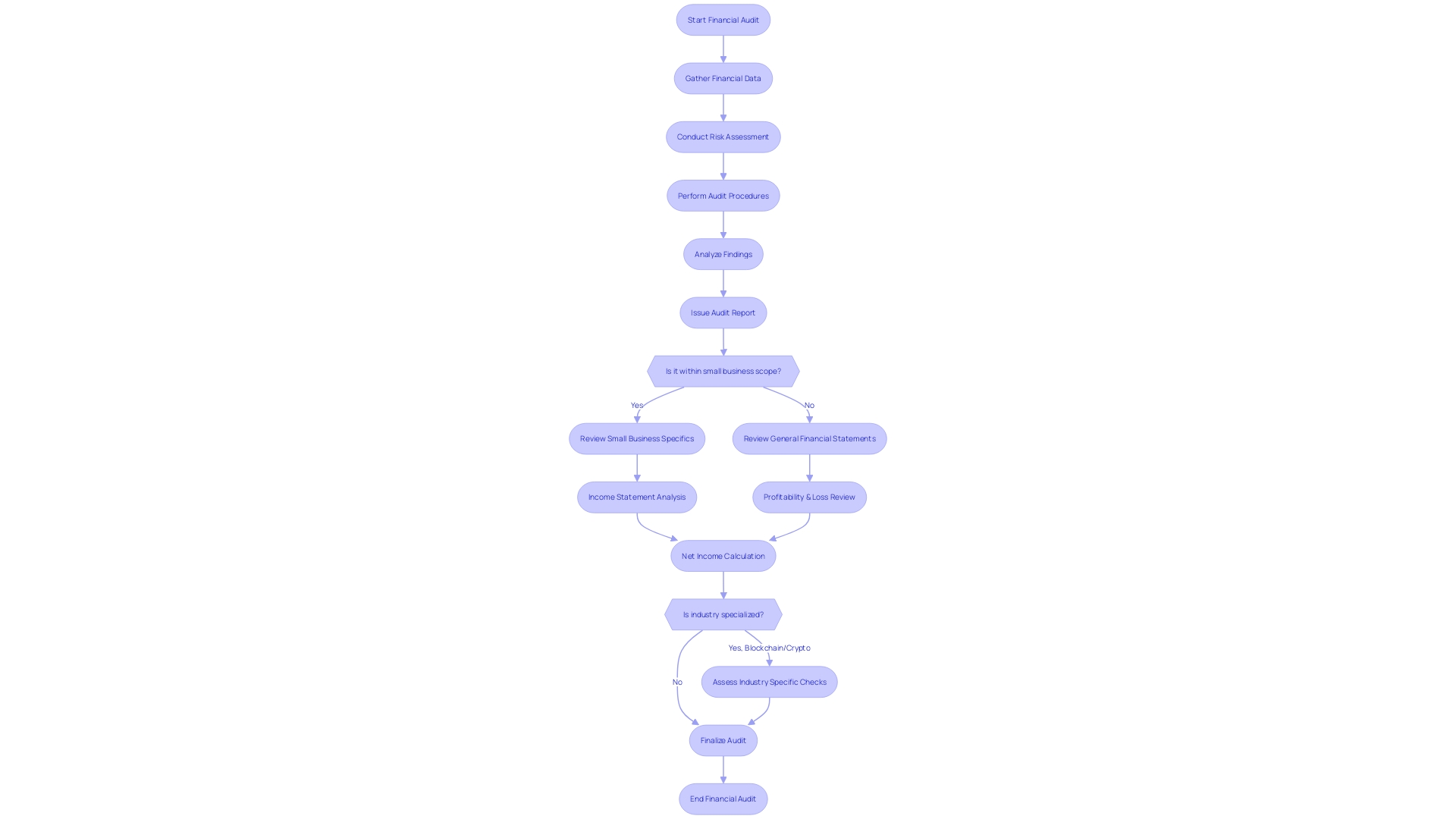

An examination of an organization's financial statements ensures both accuracy and adherence to accounting standards and regulations. Such an audit engenders trust between a business and its stakeholders, while also being a pivot toward transparency.

This rings especially true within sectors like healthcare and semiconductor industries, which are both undergoing significant changes and advancements. Similarly, for small businesses, the evaluation of tax filings and financial documents is crucial to verify that records are kept effectively, complying with regulatory requirements such as IRS mandates on foreign accounts.

Auditing practices are central to Information Security (InfoSec) and Cybersecurity, where the focus expands beyond just financial scrutiny to encompass technology and data integrity. The advent of technology and crypto-assets introduces novel auditing dynamics, where examining a blockchain or smart contract's underlying tech becomes paramount. Seeking out the audits of a project is often straightforward, as many are accessible on the project's own website or through resources like coinmarketcap, which neatly displays them among other project metrics. In essence, audits span a range of objectives and scopes, tailored to specific organizational needs, from assessing internal policies' effectiveness to evaluating a crypto project's technical foundations.

Independent or external audits, delivered by a licensed CPA not affiliated with the entity under review, offer a crucial objective evaluation of financial statements, aiming to affirm their adherence to established accounting norms. Required mandatorily for publicly listed entities, such audits are a guardrail to investor confidence and market integrity. However, it's essential to recognize that their scope is strictly financial and does not extend to verifying the operational efficacy or compliance of business models, especially in nuanced fields like blockchain and crypto assets, where risks are multifarious and regulatory frames are still evolving.

A report by Consensys Diligence iterates the absence of warranties or representations on aspects like code robustness, business models, and legal compliance in emerging technologies. Meanwhile, industry professionals caution against loose application of the audit term, specifically within the blockchain and cryptocurrency sphere. They highlight a dire need for nuanced verification instruments and precise language to depict various assessments that diverge substantially from traditional financial statement audits.

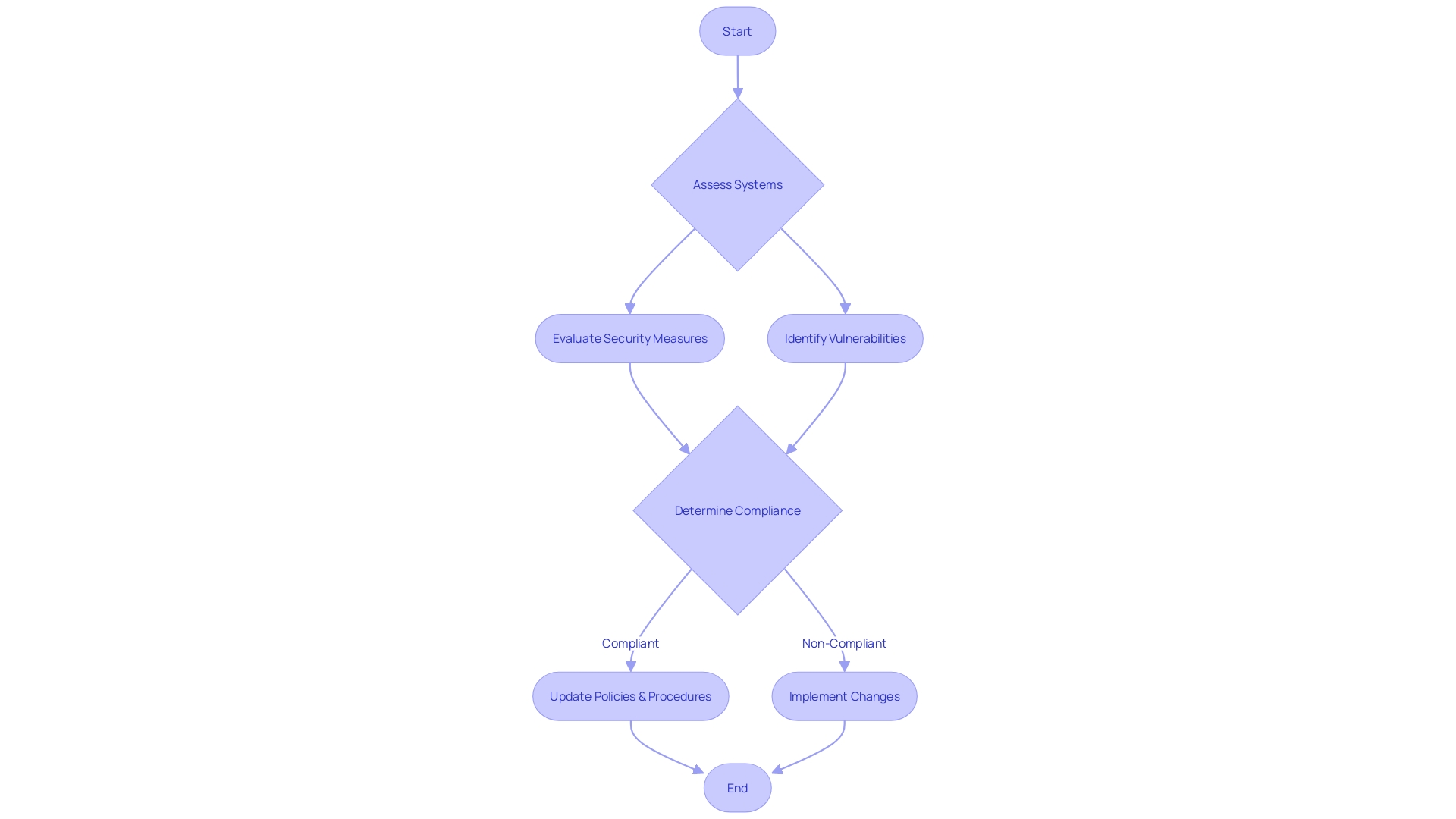

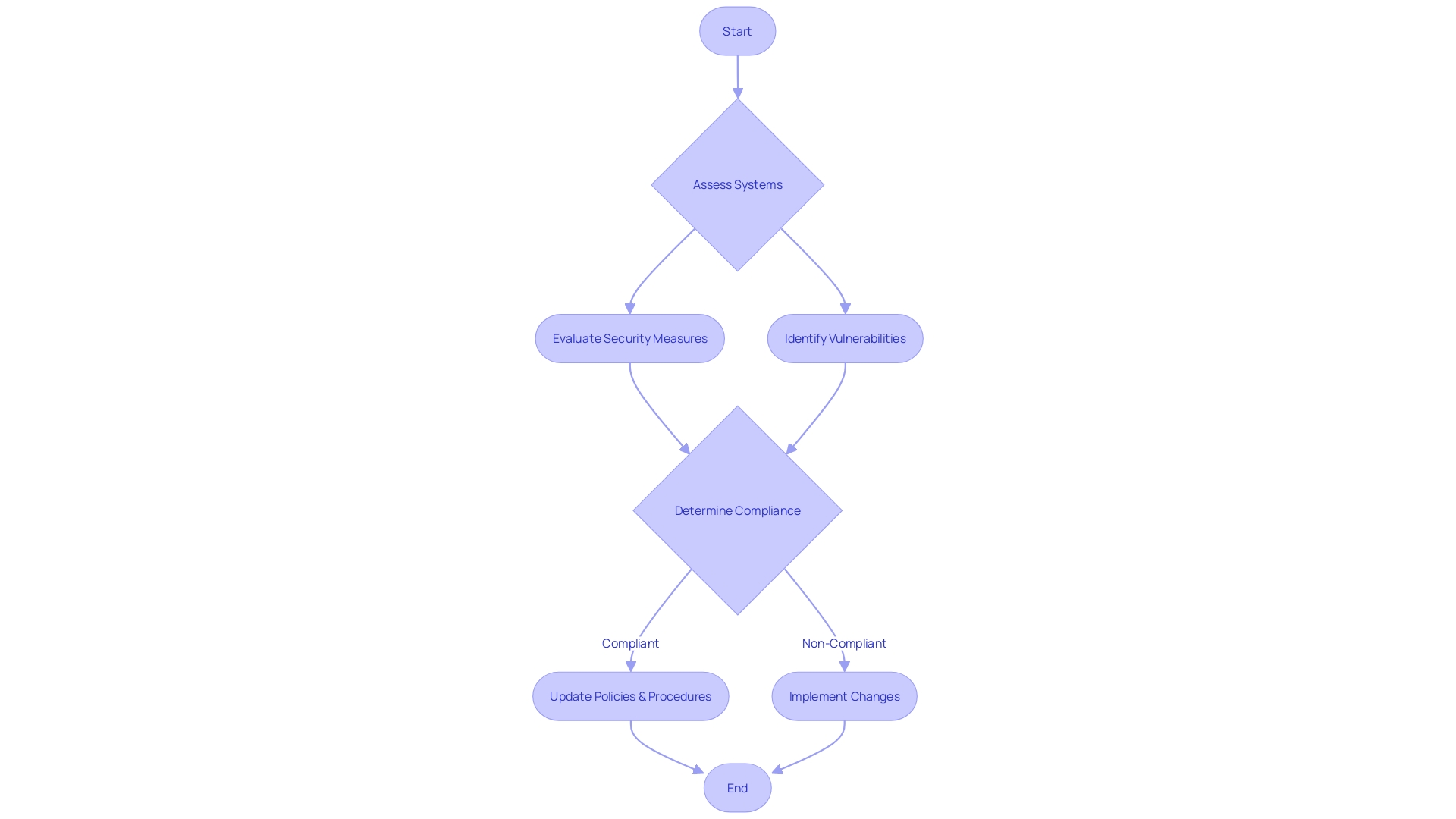

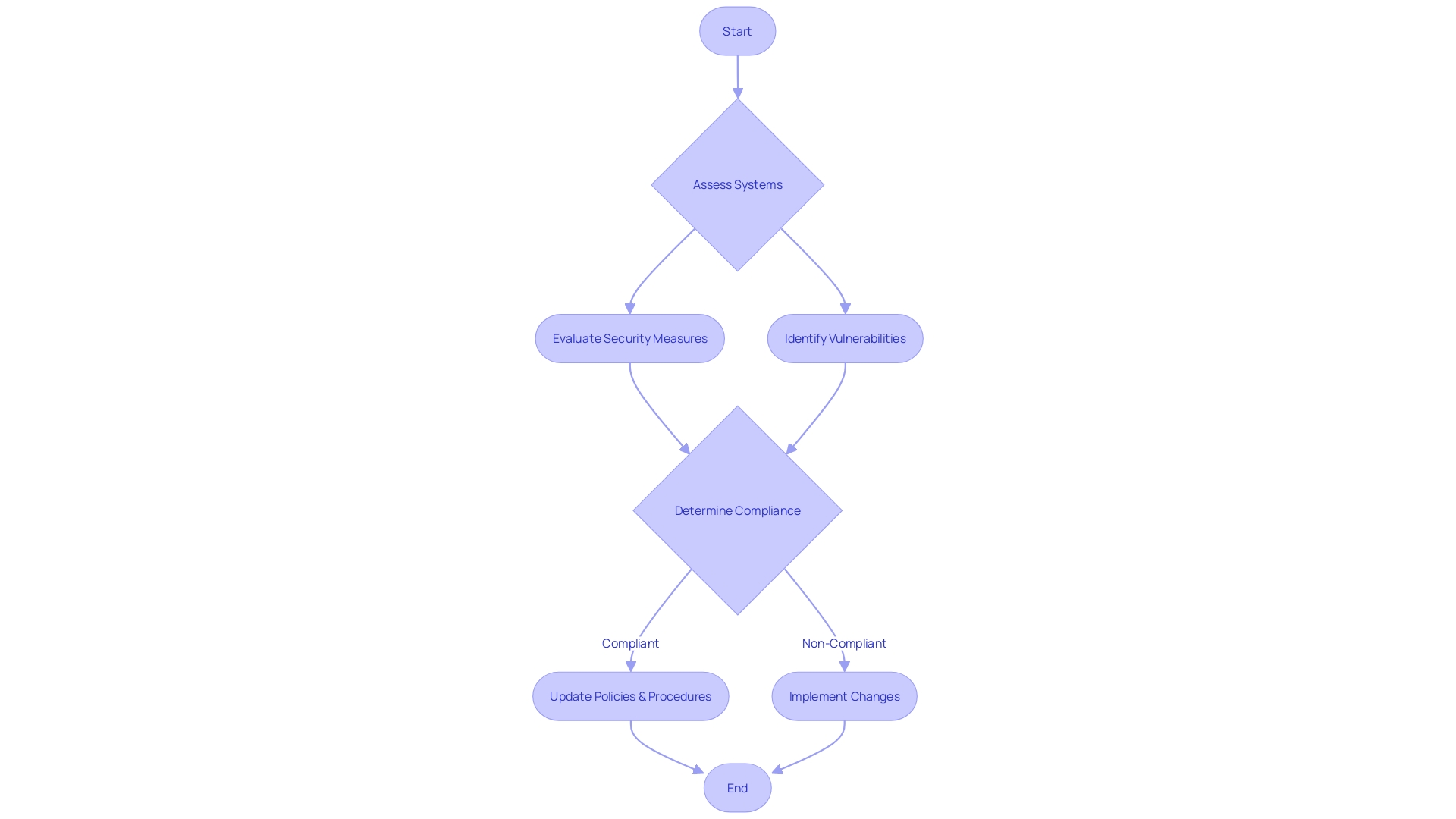

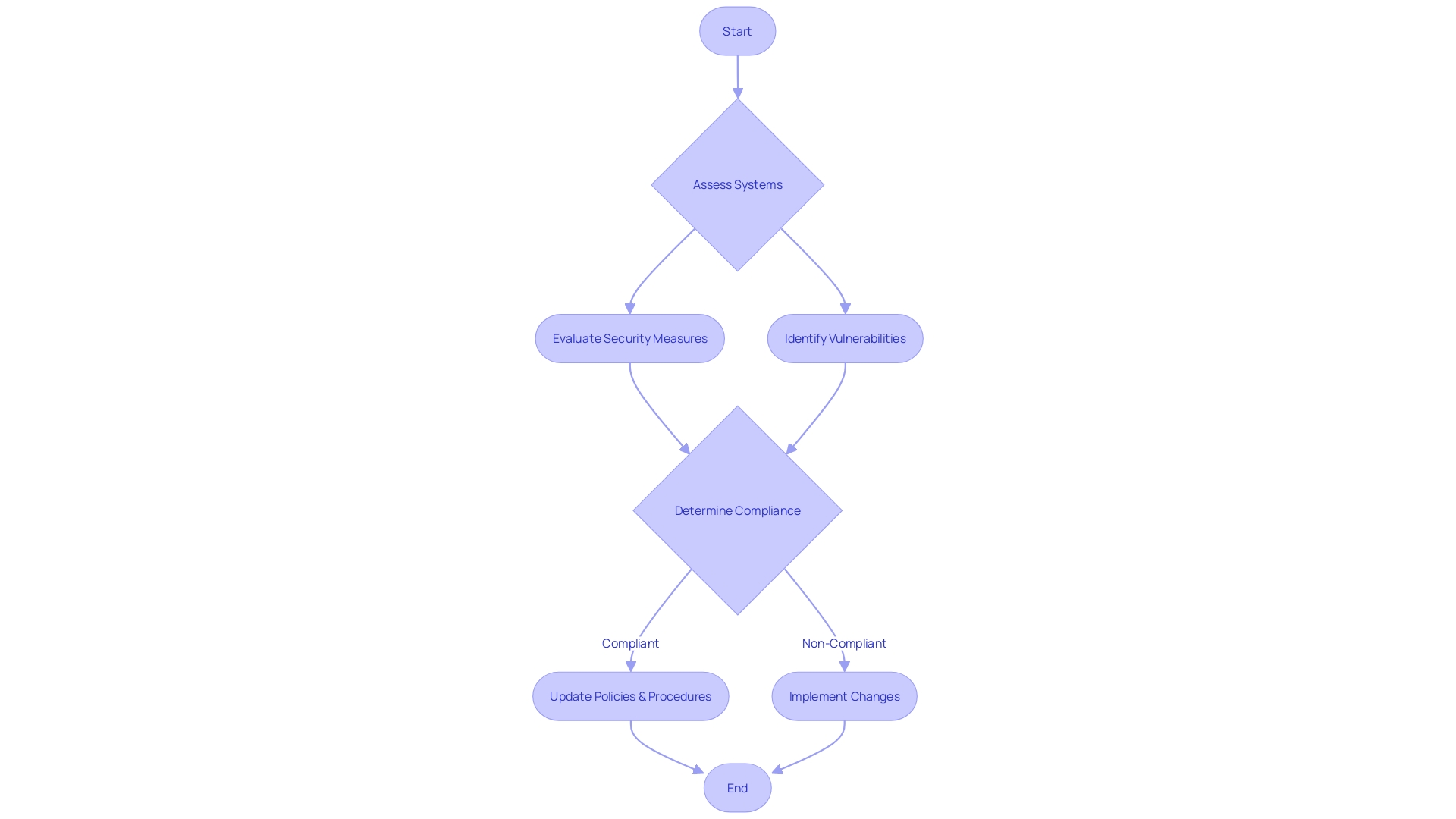

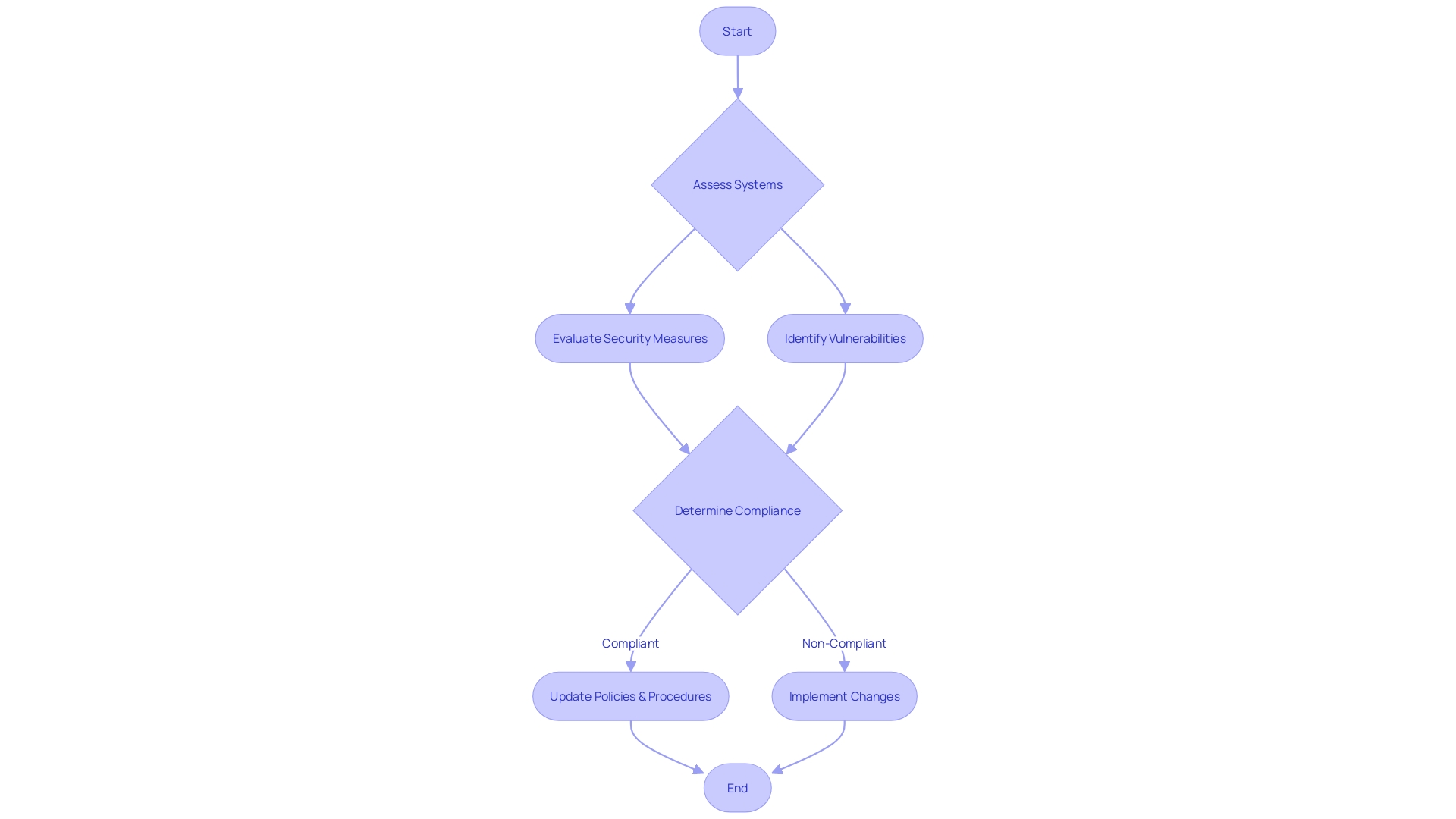

In the realm of Information Security (InfoSec) or Cybersecurity, internal audits serve as a crucial instrument in fortifying an organization's defense mechanisms. Conducted meticulously by a company's own audit team, they scrutinize information systems, processes, and controls to evaluate the robustness of security measures and uncover any potential vulnerabilities.

Such audits are not only pivotal for maintaining the integrity, confidentiality, and availability of sensitive data but also for ensuring adherence to internal standards and regulatory demands. The strategic execution of internal audits provides insightful revelations into operational effectiveness.

These assessments highlight the need for potent internal compliance controls, as mandated by the Foreign Corrupt Practices Act (FCPA), and determine their efficacy in situational practice. “This will help you determine whether adequate internal compliance controls are present in your company.

From there, you can move on to see if they are working in practice,” underscores the significance of these controls in establishing a best practices compliance program. Furthermore, internal audits offer a comprehensive purview of the organization's procedural landscape. The implementation of the International Professional Practices Framework (IPPF) reaffirms their essential role. “We started off by calling it the relook of the standards, but in fact, it became much more than just a relook,” reflects the aim to be dynamic and responsive to various business sectors and stakeholders' needs. As internal auditing's primary objective is to aid and add value, conducting thorough audits is indispensable for appreciating the business context, managing risks, enhancing stakeholder relationships, and achieving corporate objectives.

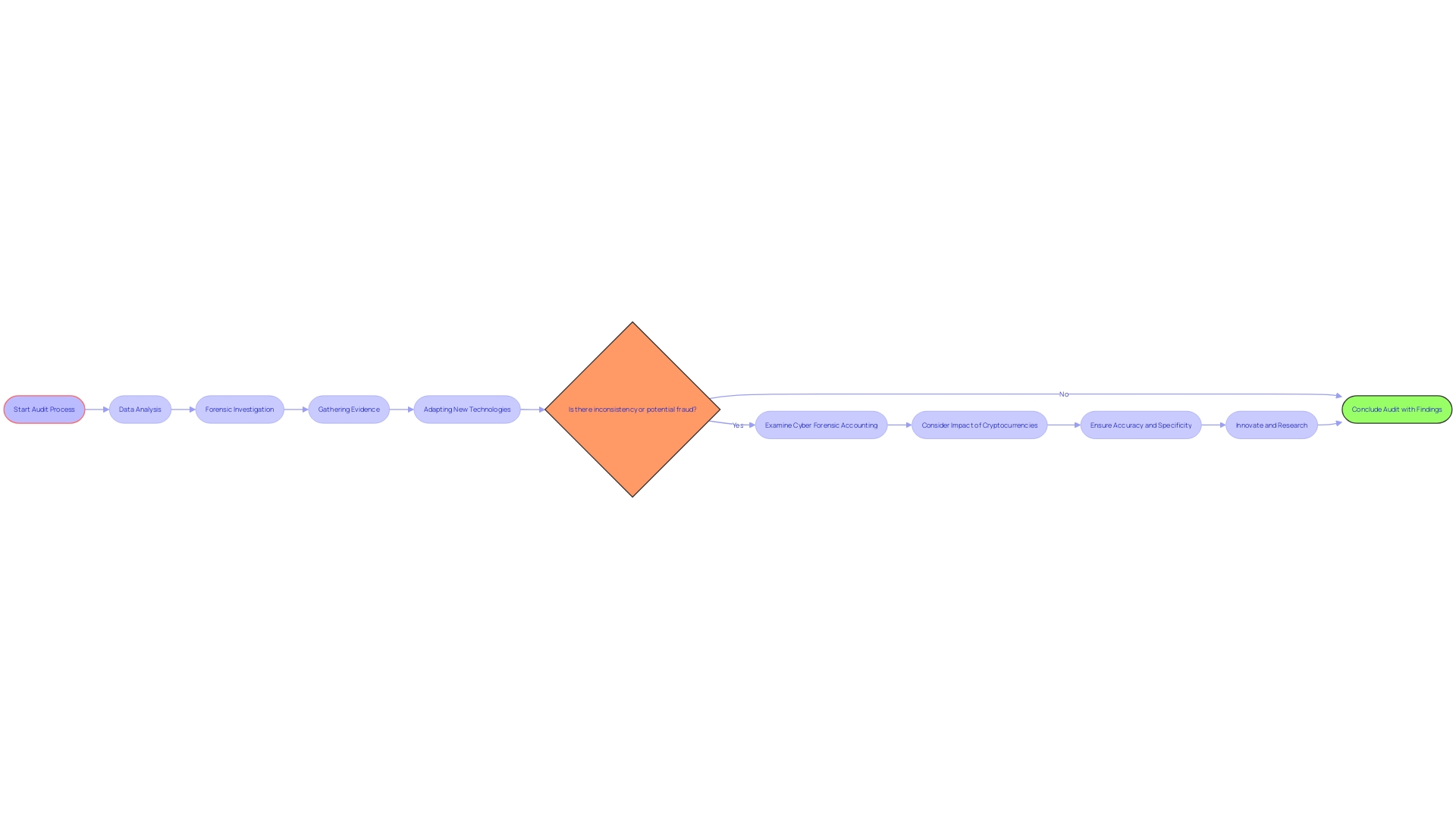

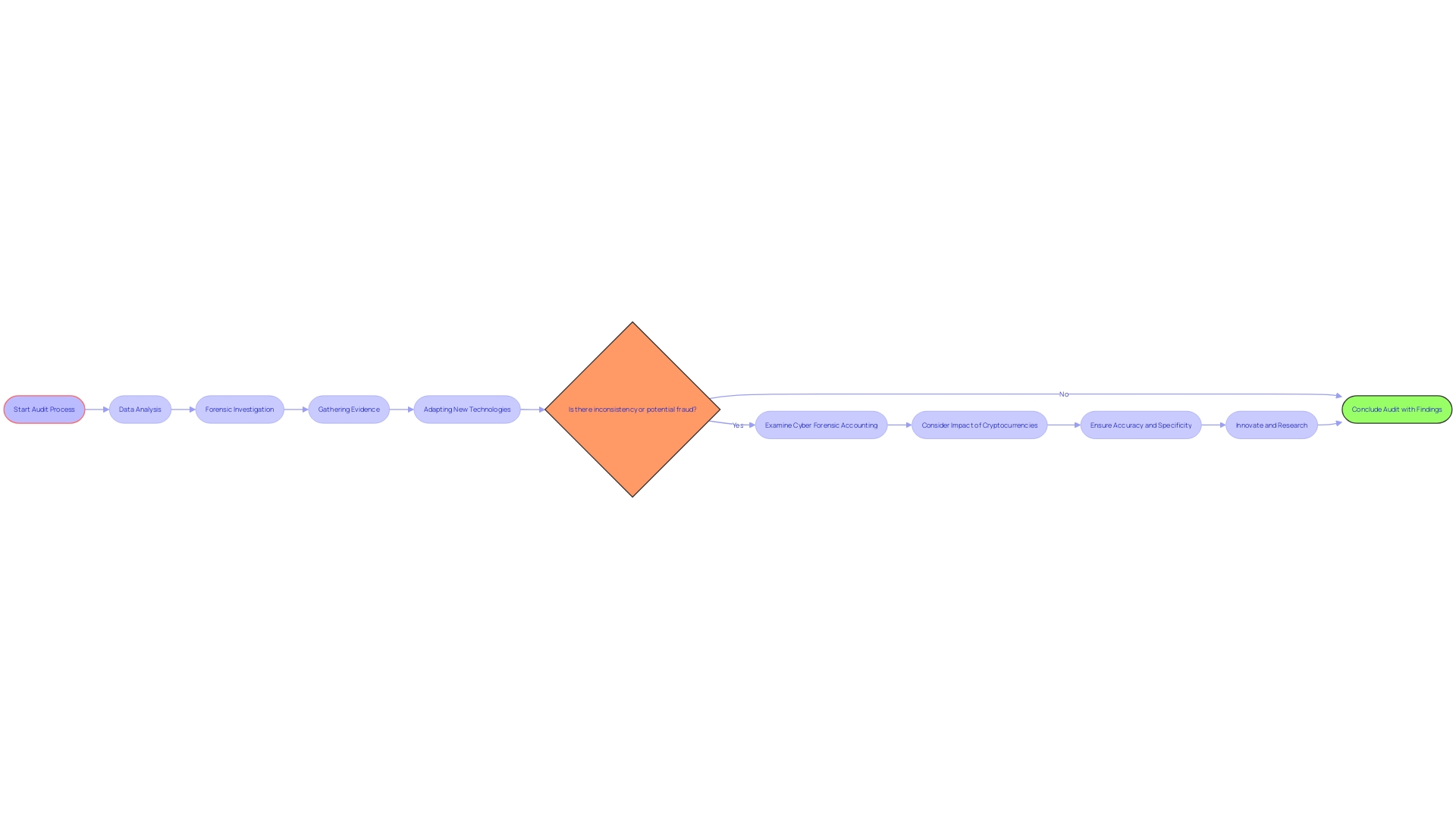

Forensic audits delve into the financial labyrinth of an organization, shedding light on any misconduct or malpractices that could undermine its integrity. The auditors utilize their prowess in forensic accounting—an amalgamation of accounting, auditing, and investigative skills—to dissect financial information for evidence usable in legal confrontations.

With the seismic shifts brought about by data analytics, cyber forensic accounting, and the growing tentacles of cryptocurrencies, the field of forensic accounting is experiencing a transformative era. These advancements make the meticulous pursuit of financial veracity not just possible but also imperative.

The methodologies and tools used are advancing in sophistication, tackling the complexities of crimes such as embezzlement and other financial discrepancies that can tarnish an organization's reputation. Illuminated by Hanzo van Beusekom's remarks on the inextricable link between an auditor's integrity and their function of instilling trust, we see the detrimental impact of widespread examination fraud in the industry—fraud that erodes the bedrock of credibility that auditors are sworn to uphold. As dissected in the 35th Annual Report on the protection of the EU’s financial interests, the role of Member States and Commission oversight in managing and protecting over 85% of EU expenditure underscores the critical nature of the ongoing battle against fraud affecting the EU budget. Recognizing the inherent challenges of this dynamic domain, it becomes clear that continuous research and innovation are vital for equipping practitioners with the necessary tools to combat financial fraud effectively, thus guarding against the ever-evolving risks presented by emerging technologies.

Financial auditors are indispensable to an organization, charged with scrutinizing the myriad details that uphold its financial integrity. Their eagle-eyed analysis of financial documents, such as balance sheets, income statements, and cash flow statements, is critical for assessing a company's fiscal health. They pursue this task with a keen understanding that potent market trends and economic conditions can significantly influence profitability, liquidity, and solvency.

Armed with statistical tools and financial modeling techniques, auditors forecast potential futures, shaping strategies that ensure the organization is not just agile in the face of immediate market demands but also long-term industry shifts. Their influence extends to evaluating investment opportunities, helping companies ponder the merits of investing in high-potential assets versus the security of established ones. The role of the financial auditor is further underscored by the rising complexities in sectors like healthcare and semiconductors, where the demands for quality and technological innovation are precipitating rapid transformation.

Here, auditors ensure that as organizations strive to capitalize on these opportunities, their financial decisions rest on solid and ethical grounds. Fulfilling their fiduciary duties with unyielding loyalty and care, financial auditors become the key to maintaining a company's reputation for integrity. Their work ensures that all financial transactions are not merely recorded but also serve as a reliable compass for the company's financial journey, adhering to the highest standards of legal and ethical compliance.

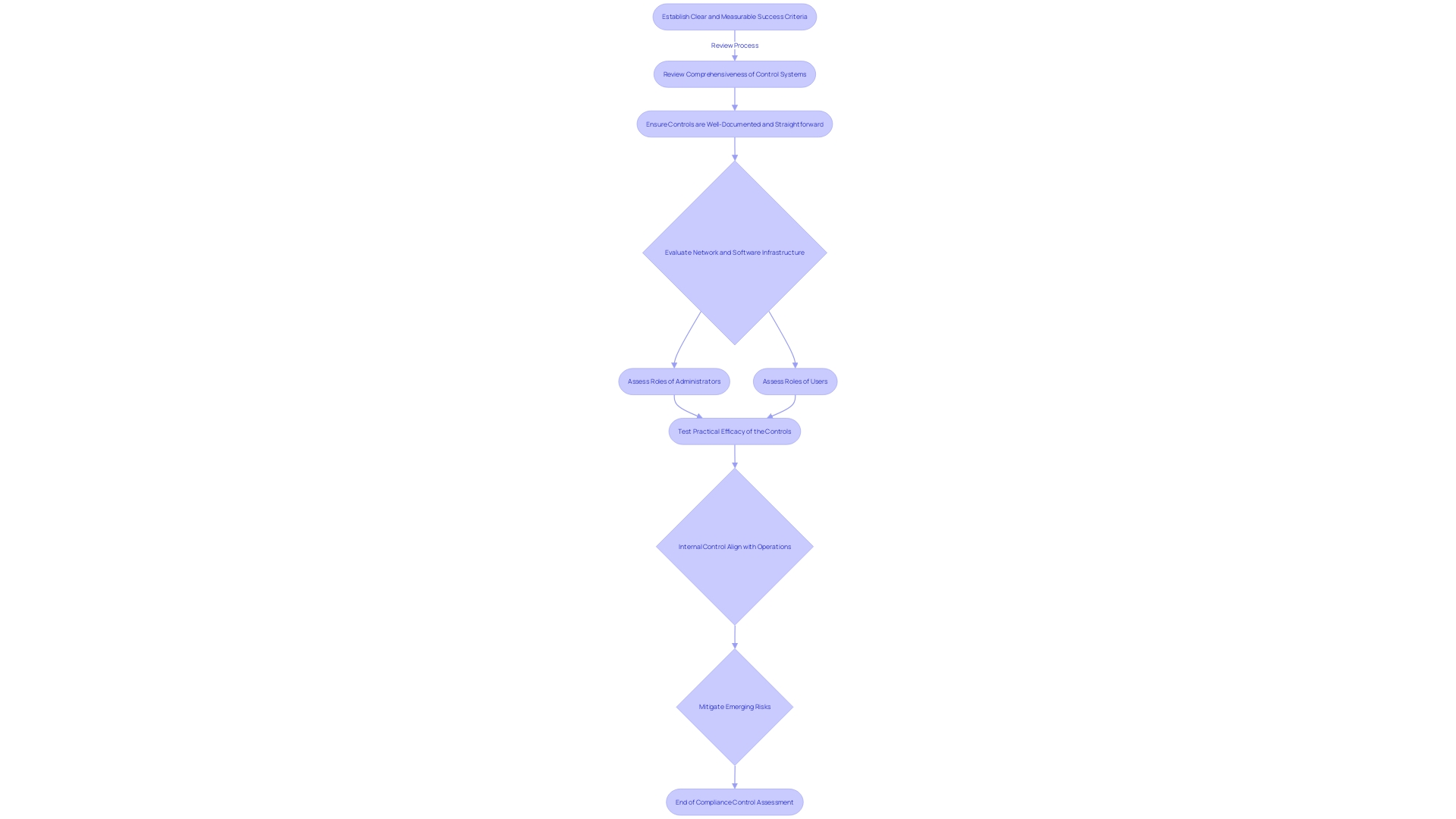

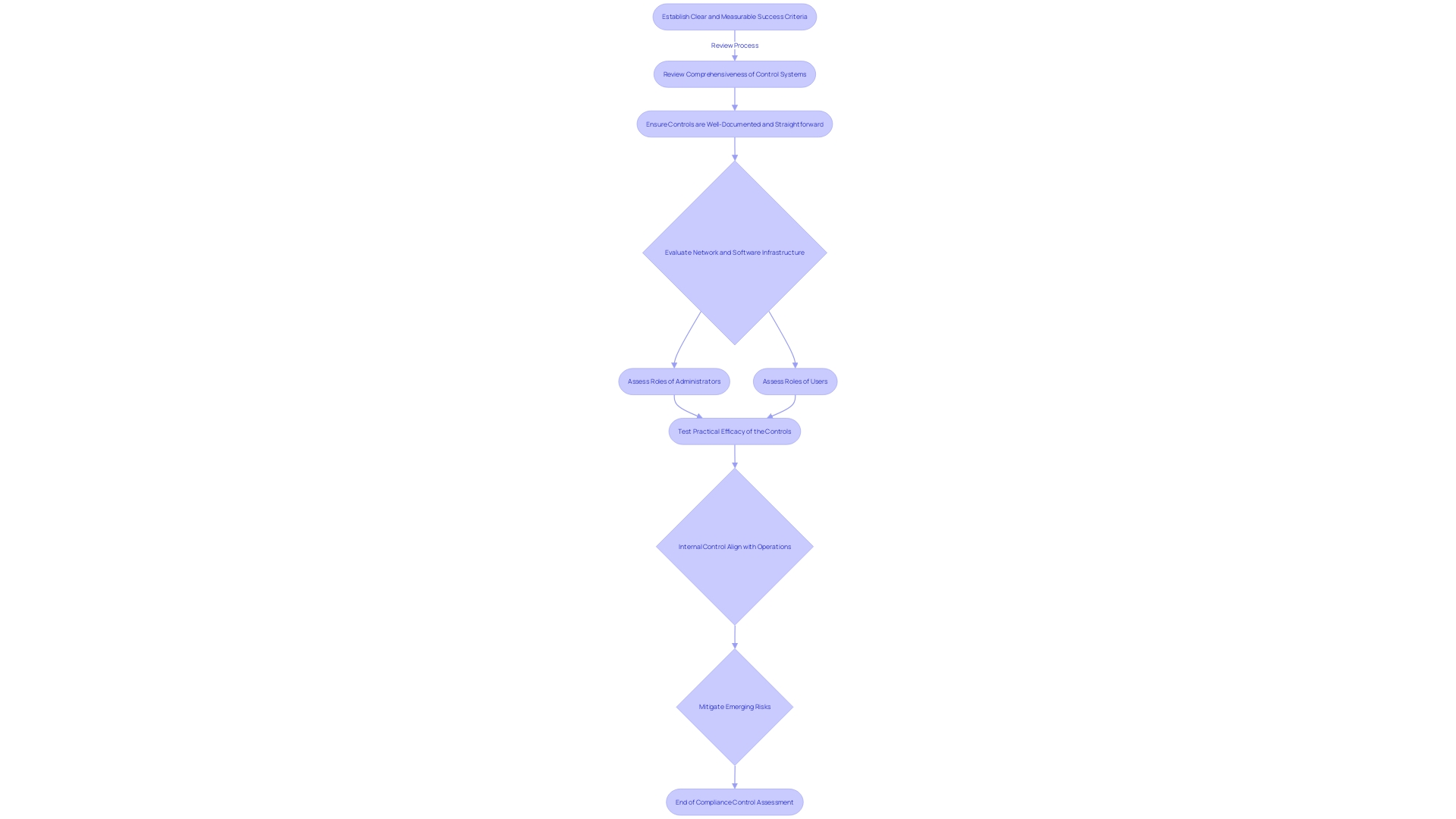

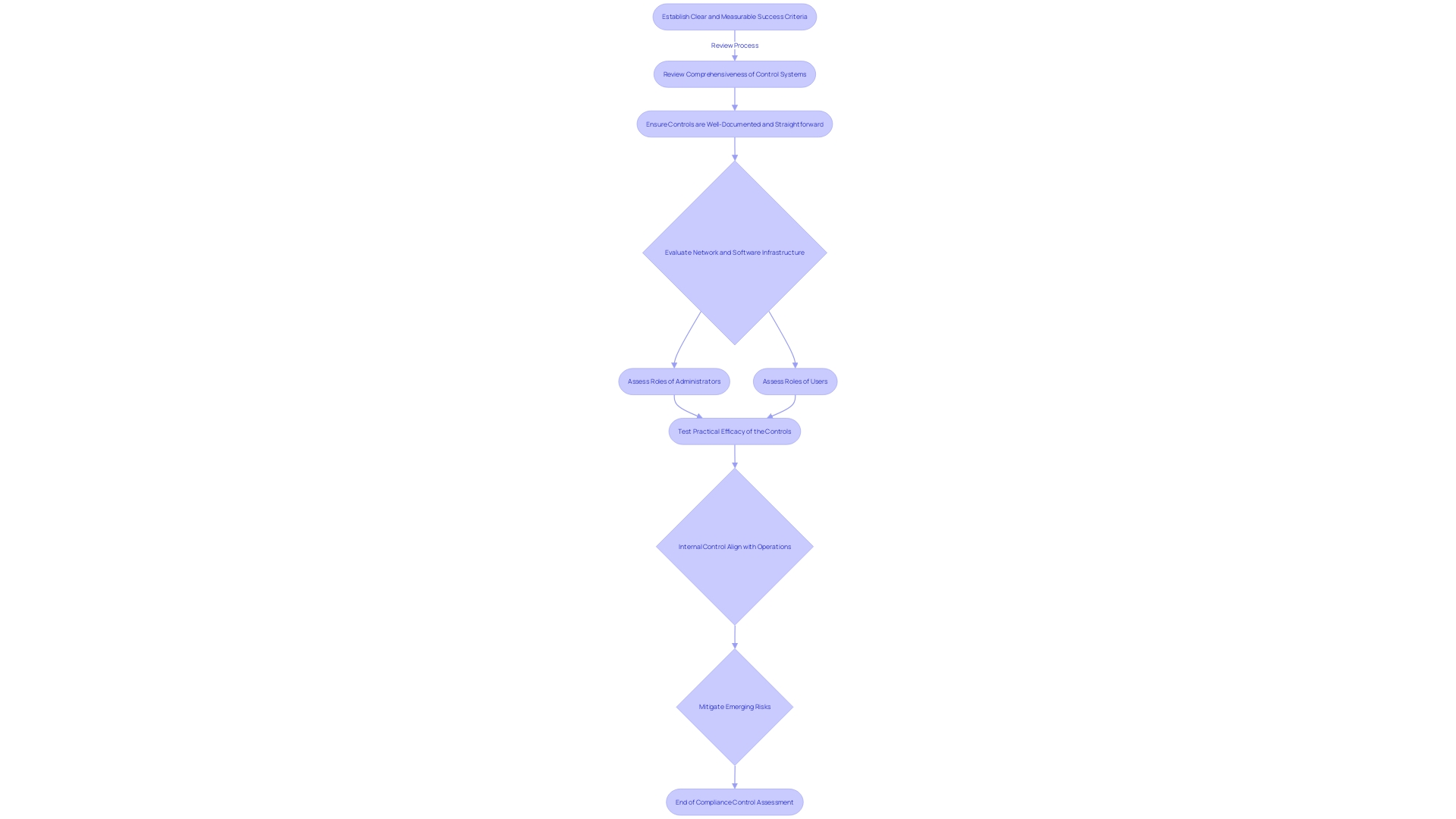

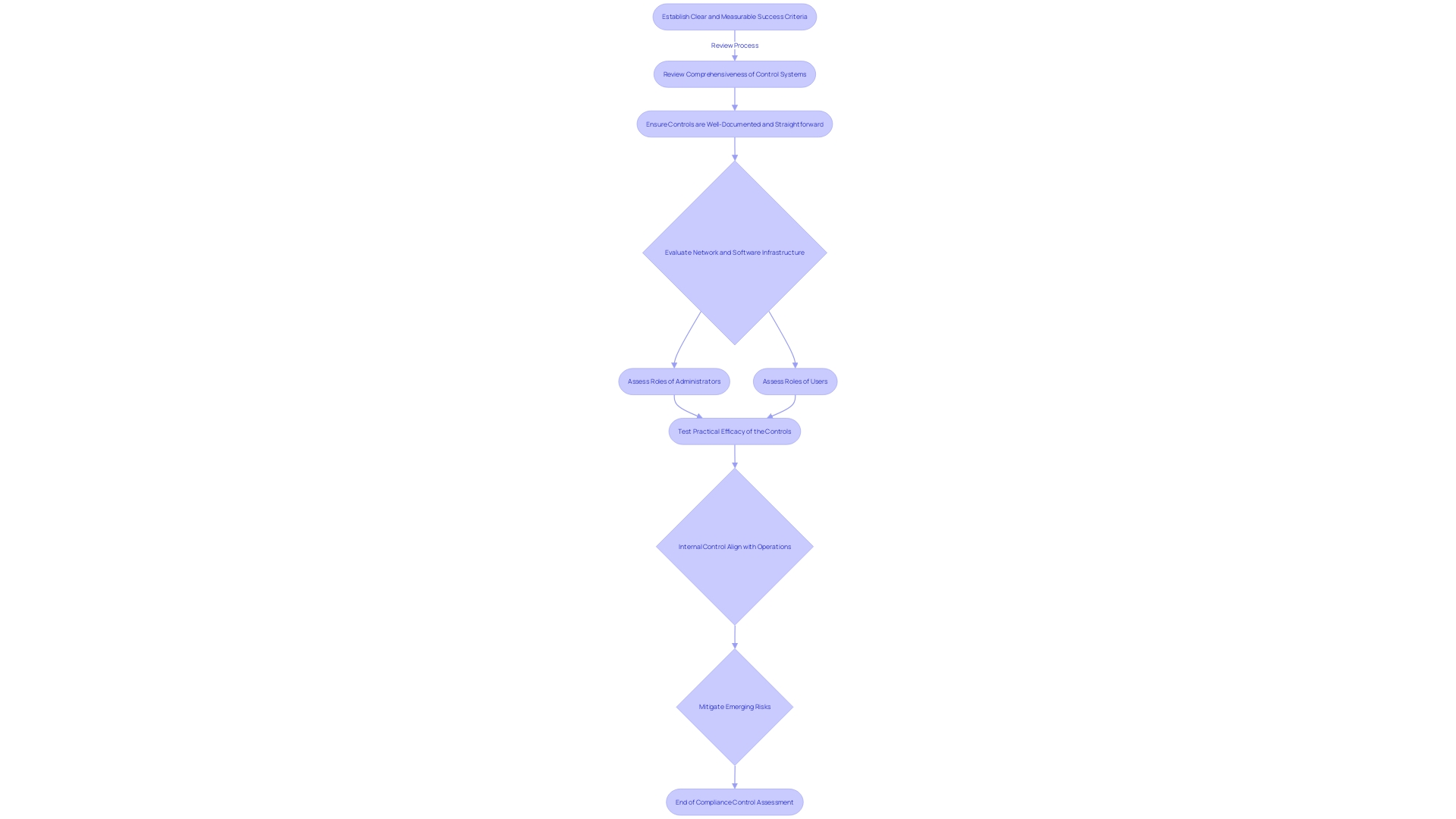

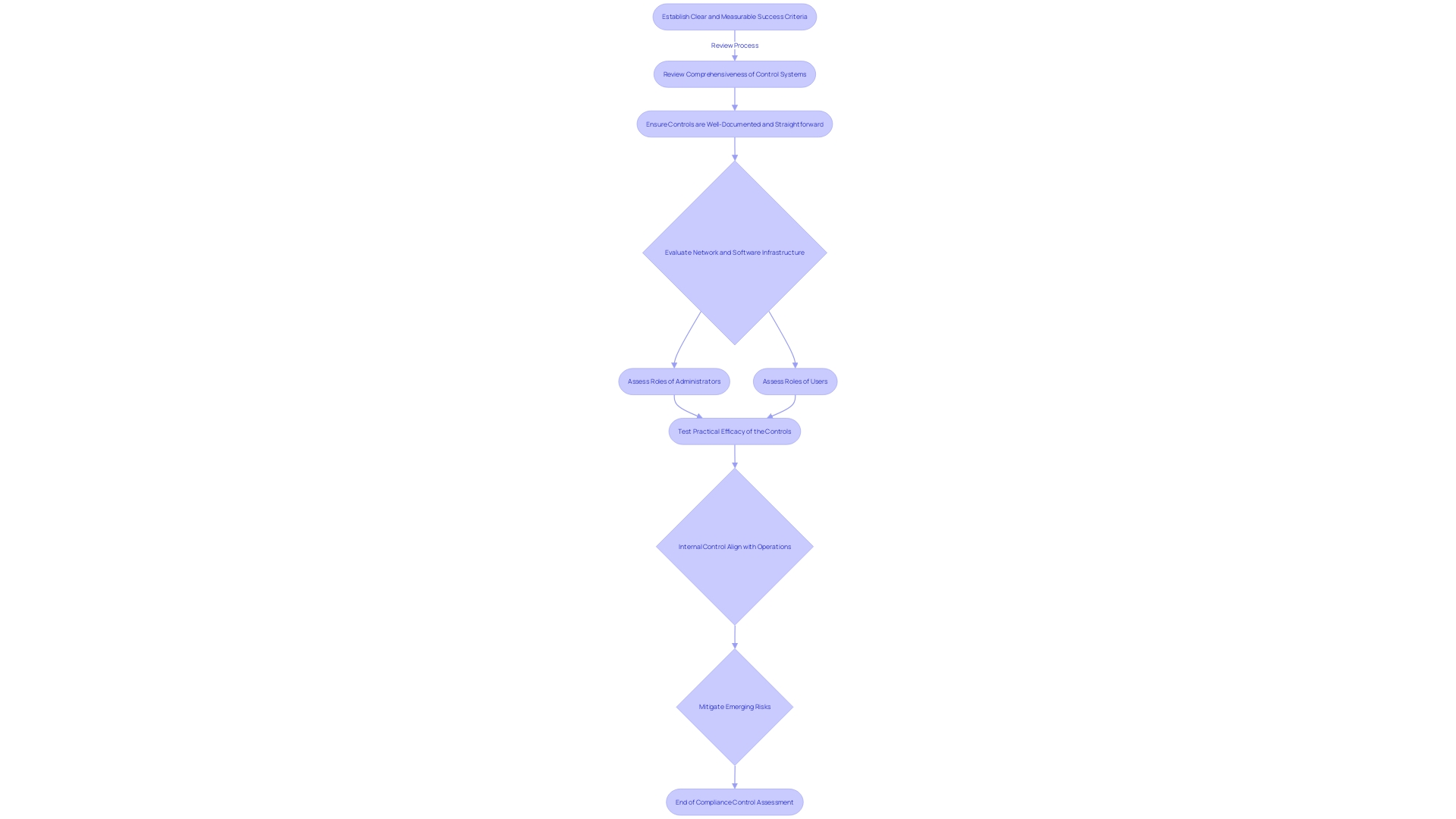

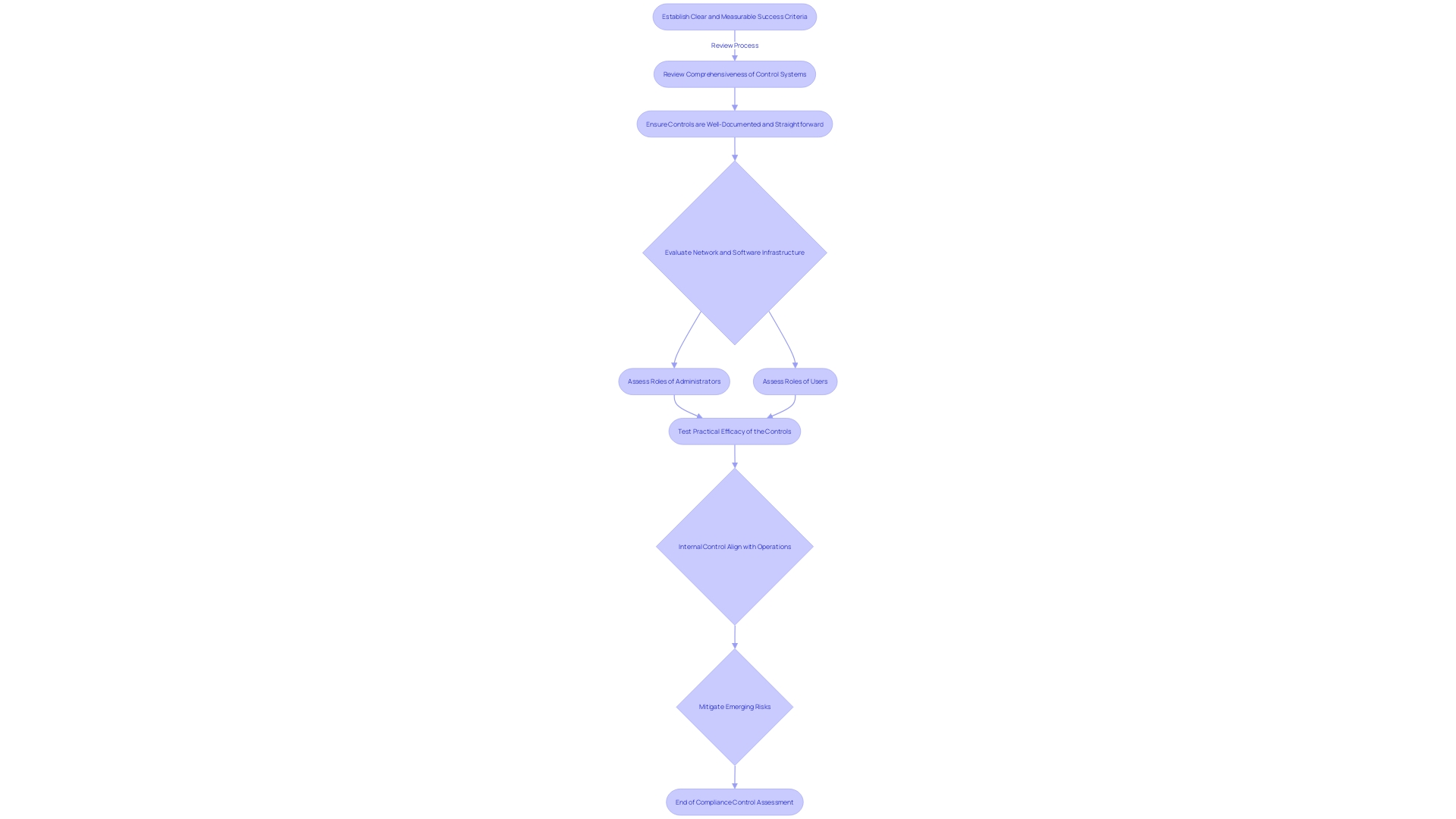

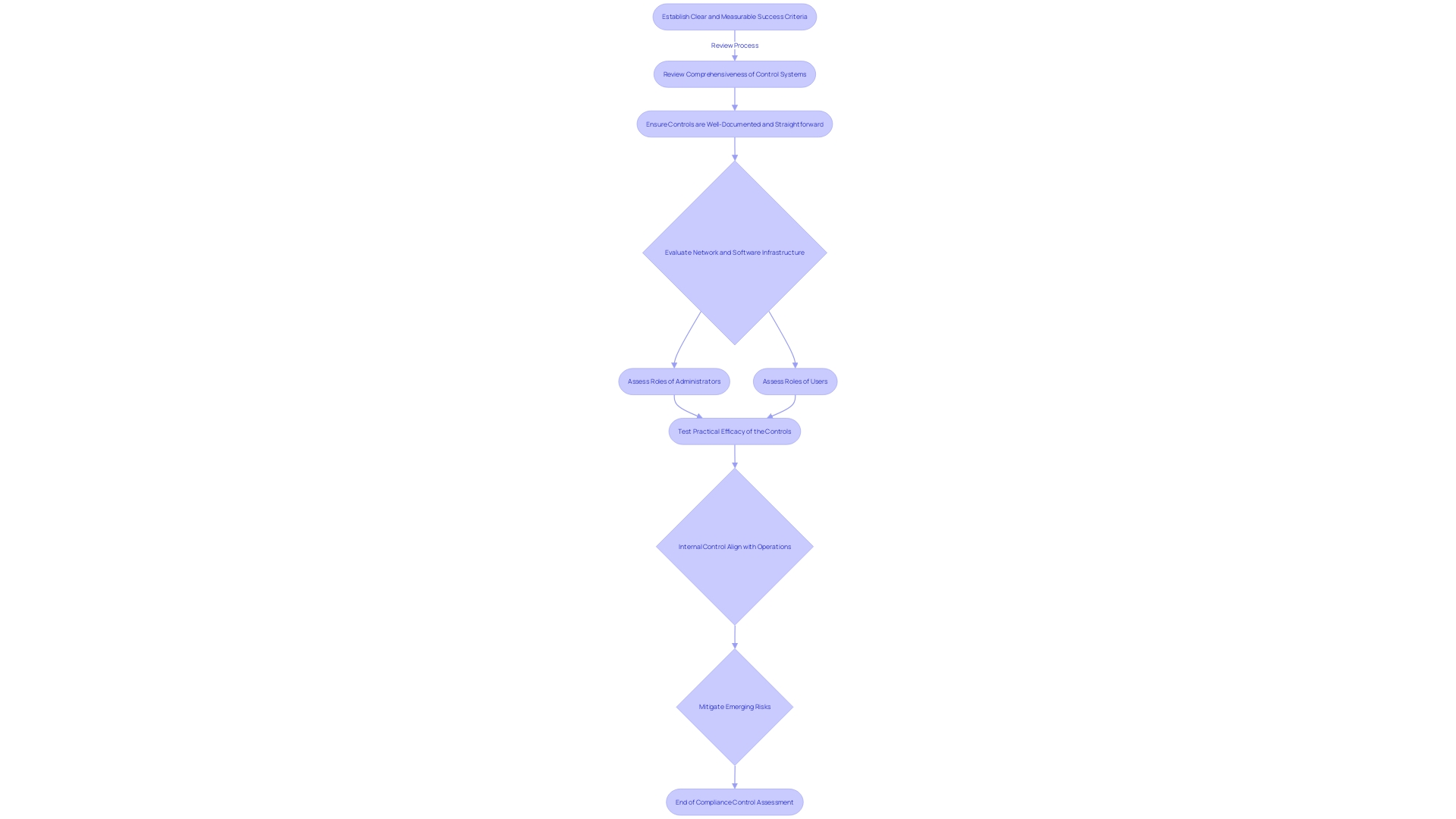

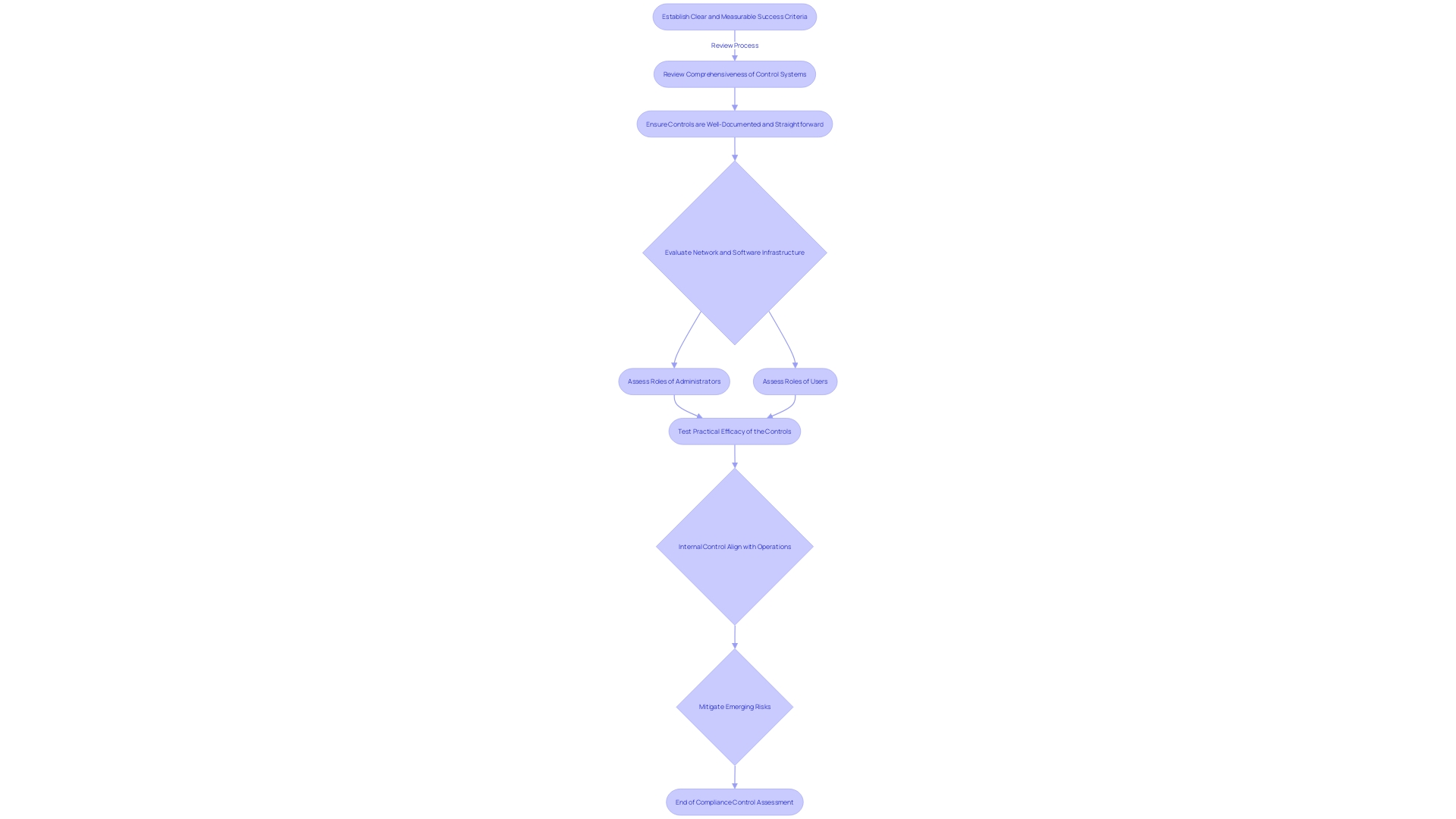

To ascertain if robust internal compliance controls are in place within an organization, one must start with a clear, manageable, and measurable set of success criteria, as underscored in the field of financial auditing. Establishing these benchmarks allows a company to thoroughly review whether their internal control systems are comprehensive, eschewing convoluted processes for straightforward and clearly documented targets.

Indeed, under the FCPA, effective internal controls aren't merely advisable but a requirement, especially as they form the backbone of any best practices compliance program. In evaluating these controls, it's critical to examine performance across various elements of the enterprise, recognizing that the network, encompassing both the software infrastructure and the administrators and users, plays a significant role in the operational execution of controls.

Much like architecture on uncertain foundations, if an organization's financial controls are not robust and reliable, the stability of the entire operation is compromised, inviting risks ranging from fraud to inaccurate financial reporting. To successfully navigate this complex landscape, an organization must engage in rigorous internal evaluations, which, akin to AI system assessments done by companies like Anthropic, become essential tools in improving the safety, truthfulness, and fairness of the systems in place. Such evaluations delve into the intricacies of controls, testing not just for presence but for practical efficacy – the alignment of protocols with ongoing operations and emerging risks.

Financial auditors are critical in assessing the fidelity of a company's financial statements. Delving into the balance sheets and income statements, they examine all underlying documents to verify the precision and entirety of the financial data.

By scrutinizing transaction details, account tallies, and declaration sufficiency, they ensure that all financial communications align impeccably with the prevailing accounting standards and laws. In a rapidly evolving economic landscape, with recent proposals from the Financial Accounting Standards Board to modernize the reporting of software costs, the role of auditors becomes even more pivotal.

These proposed changes will demand meticulous attention to the cash-flow statements, as the new guidelines aim to streamline how companies categorize software expenditures. This evolution in accounting practice reflects the necessity for companies to clarify cash movements tied to technological investments, a change much overdue from rules established in the late 20th century. As auditors consider these updates, they are holding the beacon for financial integrity, ensuring stakeholders can reliably understand a company's fiscal position and investment decisions in an age where virtually every company's operations are underpinned by software solutions.

As guardians of an organization's fiscal fortitude, financial auditors meticulously dissect the fabric of an enterprise's financial practices. Their eagle-eyed scrutiny reveals not only potential hazards and compliance gaps but also outlines opportunities to fortify financial health. By employing their expertise, auditors dissect income statements and balance sheets, artfully translating the raw data into digestible financial ratios.

These potent analytical tools bestow clarity, transforming percentages into benchmarks that square a business up against the industry vanguard. Financial ratios prove to be a salient beacon for decision-makers across the business landscape—accountants, procurement specialists, valuers, and consultants. They pinpoint fiscal anomalies while providing an X-ray of a company's monetary wellbeing.

Furthermore, the amalgamation of this extensive know-how guides pivotal business decisions, refining strategies and illuminating the pathways for risk assessment and credit analysis. The importance of precise terminology in financial evaluation should not be understated, as a miscellany of verification methodologies extend beyond the bounds of traditional audit procedures, particularly in burgeoning domains like blockchain and crypto. Here, auditors employ a lexicon that is razor-sharp in its specificity, ensuring that the financial oversight mechanisms are congruent with the progressive and ever-evolving financial landscape, as reflected by the dynamic shifts in industries such as healthcare and semiconductors.

Financial audits are key to a company's fiscal well-being, offering a panoramic view of the company's finances, much like a detailed inspection of a protocol's project structure in a blockchain environment. Auditors verify whether a company's financial practices are original or merely a modification of another entity's methods, similar to distinguishing original code from forked code in software development. With the dynamic growth observed in the healthcare and semiconductor industries, efficient financial scrutiny becomes paramount, as businesses invest in their accounting practices to achieve sustained success.

A scrupulous audit can disclose the inner workings of cash flow statements, revealing whether a company optimally leverages operations for cash generation or if it's unduly dependent on external financing. This examination goes beyond mere numbers; it delves into the intricacies of a company's equity changes over time, offering a narrative of shareholder value that's shaped by profits, losses, and dividend distributions. As urged by experts from professional services firms, it's crucial for the blockchain and crypto sectors, and indeed all industries, to adopt a comprehensive suite of verification tools and precise language to articulate their financial checks and balances, beyond the traditional financial statement audit.

Financial audits serve a critical role in reinforcing corporate integrity by meticulously evaluating a company's financial records. More than a mere formality, these assessments provide stakeholders—which include parties like investors, creditors, and regulatory bodies—with the confidence that the financial data they rely upon is both trustworthy and meticulously vetted.

This trust is indispensable, especially in a landscape where terminology is often used loosely. A profound understanding that audits are much more than a routine check, but a cornerstone in the financial ecosystem, is essential for informed decision-making and strategic planning. As the financial terrain evolves with innovations like blockchain and cryptocurrencies, the scope of verification and the precision of language used to describe various evaluative processes must also adapt to ensure clarity and meet the nuanced demands of these emerging sectors.

Without a doubt, financial audits act as the cornerstone of robust corporate governance and oversight. By taking a deep dive into an organization's financial ecosystem, auditors unravel complexities and shine a light on areas where the armor of internal controls may be chinked.

The consequential recommendations forge a sturdier bulwark against fraud and inaccuracies in financial reporting. From the blossoming health care sector to the semiconductor industry's exponential growth, underscored by chips' surging demand and breakthrough technologies, the role of audits is ever more pivotal.

These sectors rely on the clear-eyed scrutiny of auditors to navigate the tides of rapid transformation and technological innovation. Edith Baranauskaitė of STATICUS presses upon financial leaders the imperative to impart the essence of finance to their non-financial counterparts.

To elevate their financial acumen, teams must grasp not just the 'how' but also the 'why' of financial protocols. It is a deliberate process, one that demands financial information be distilled into a vernacular that resonates across the board. According to experts from EY, a historical titan in auditing, the term 'audit' is often bandied about liberally, drifting from its anchored meaning. The advent of blockchain and cryptocurrency introduces a galaxy of verification needs where calling for precision in language is not just insightful—it's crucial. These sectors don't just need audits in the classical sense; they need a spectrum of verification tools to support their burgeoning ecosystems.

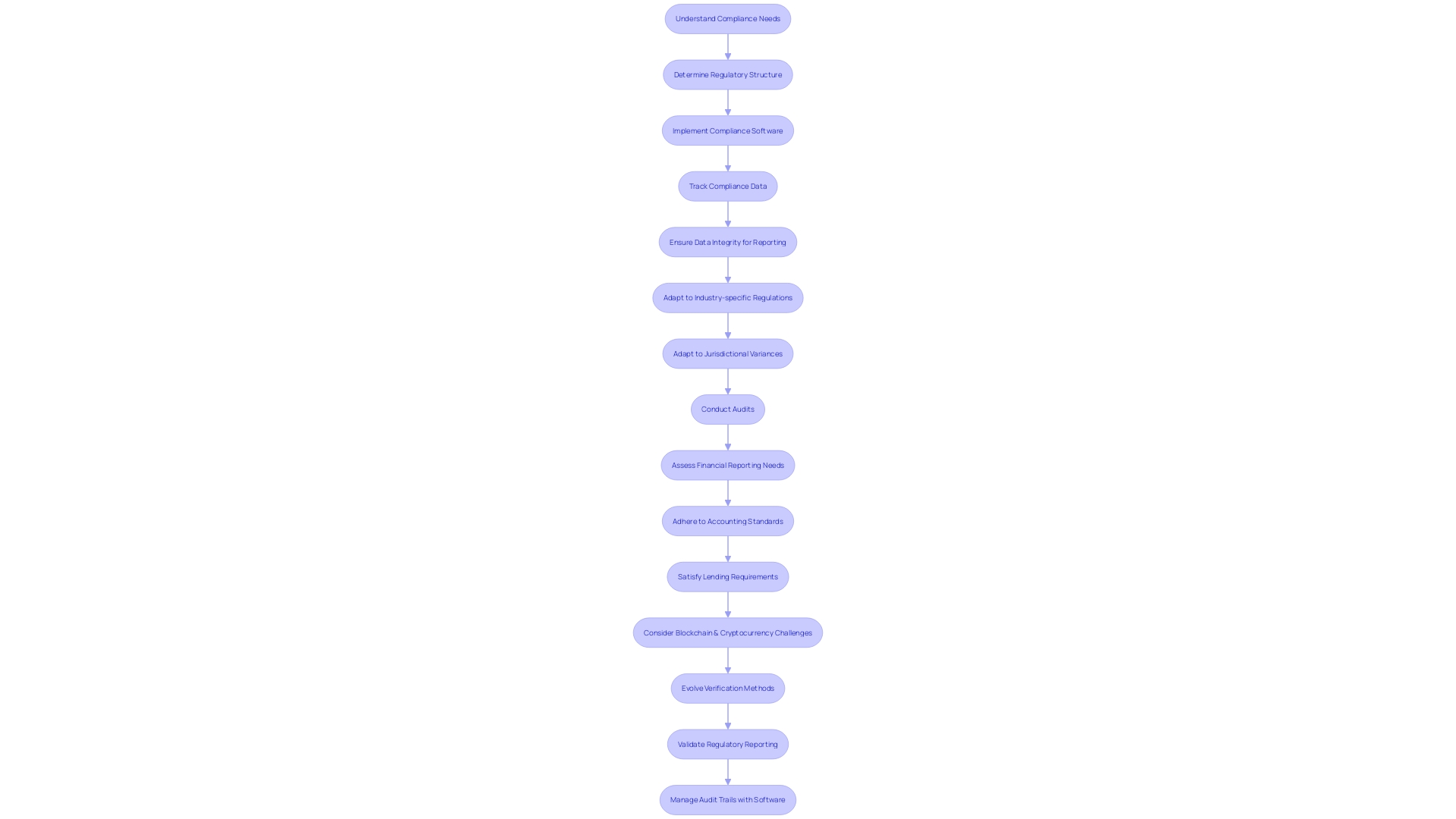

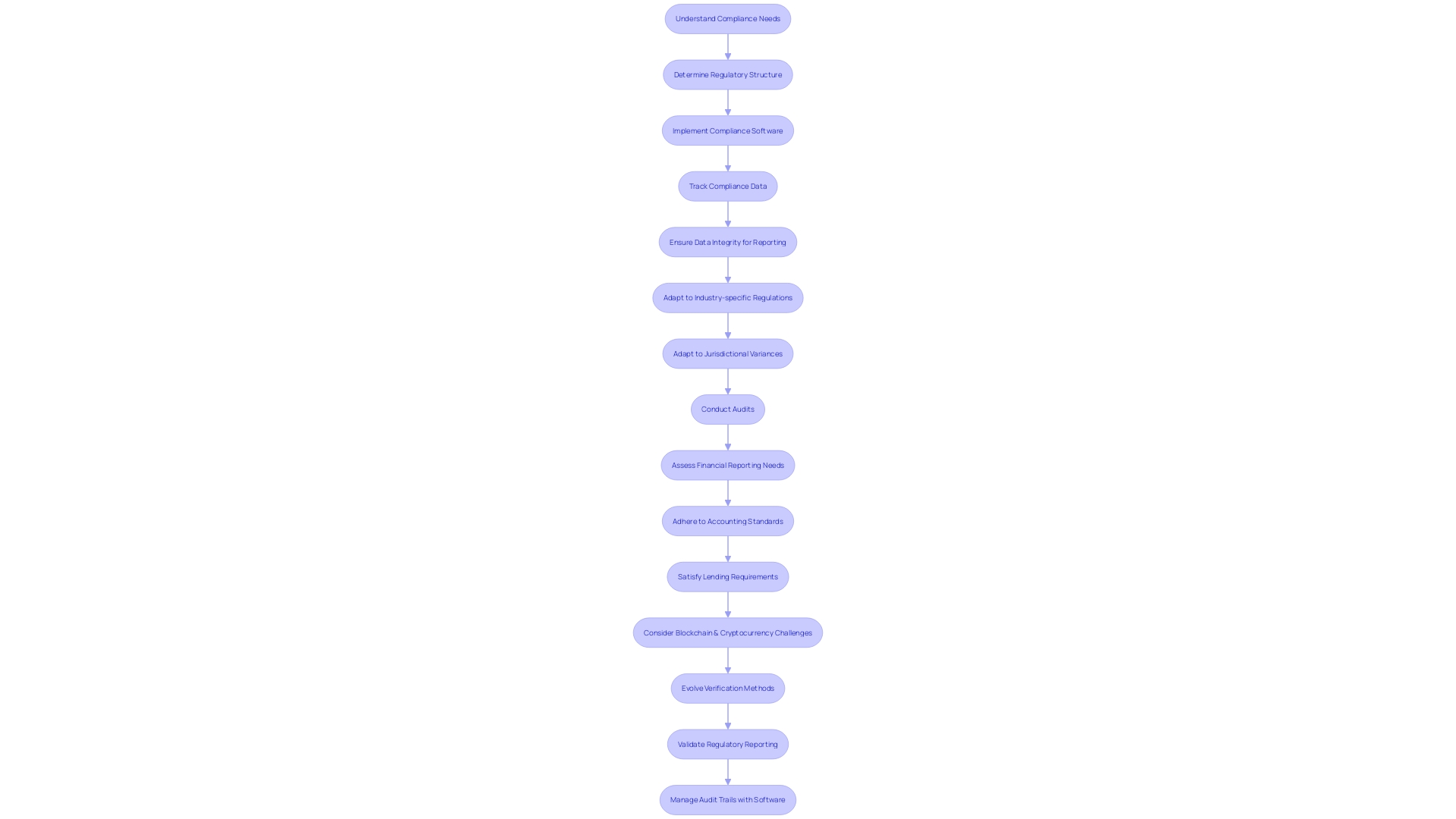

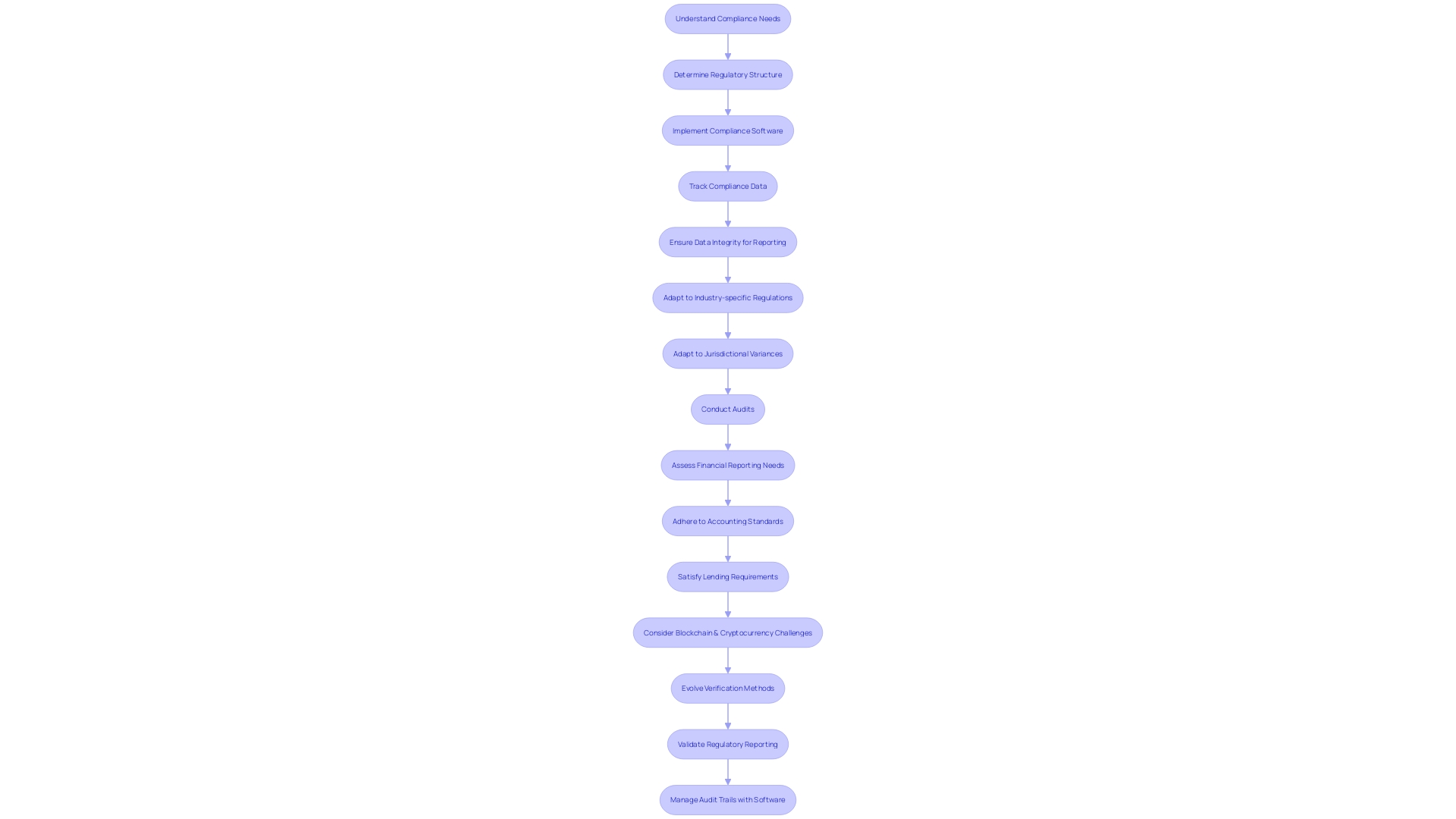

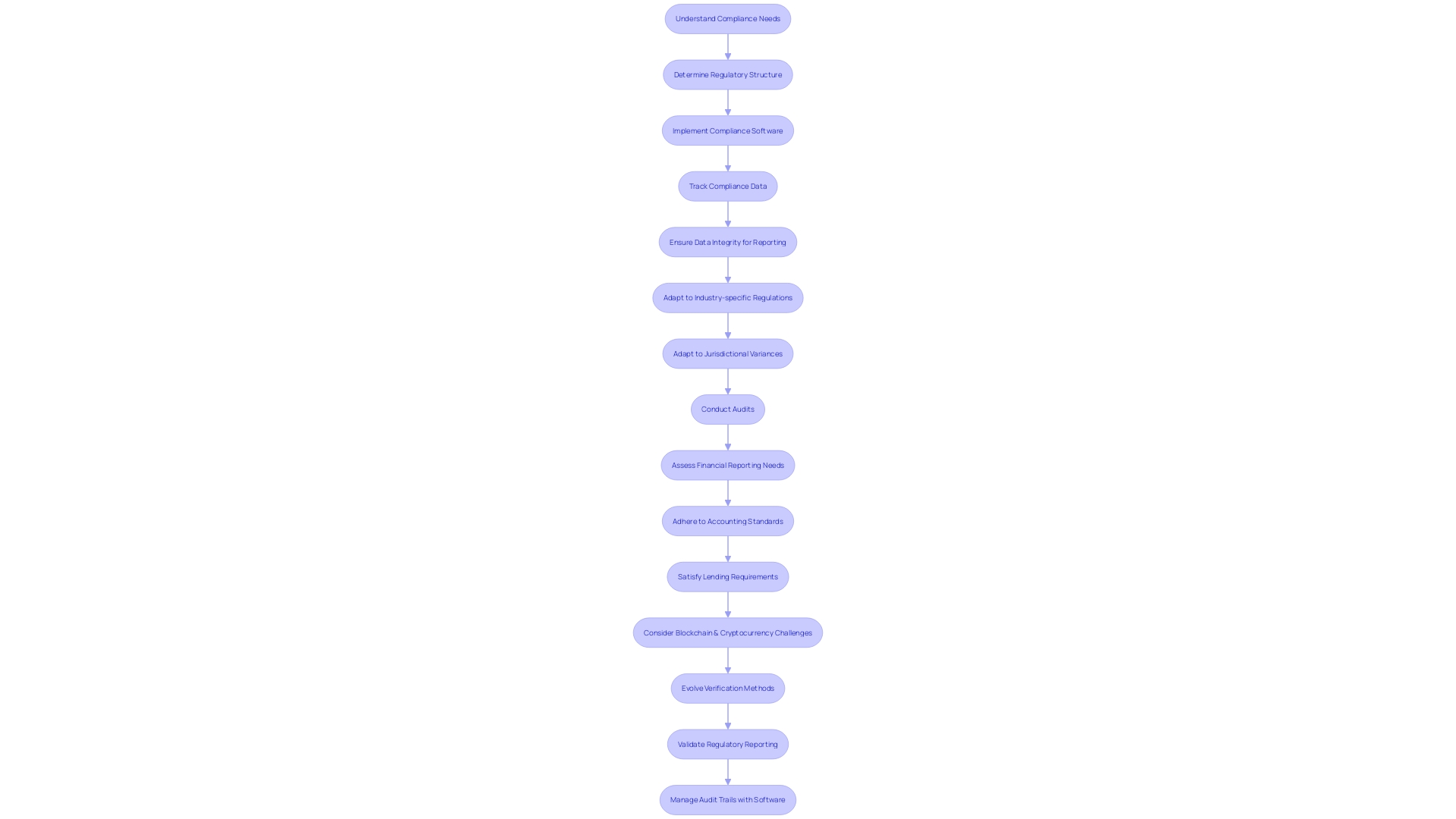

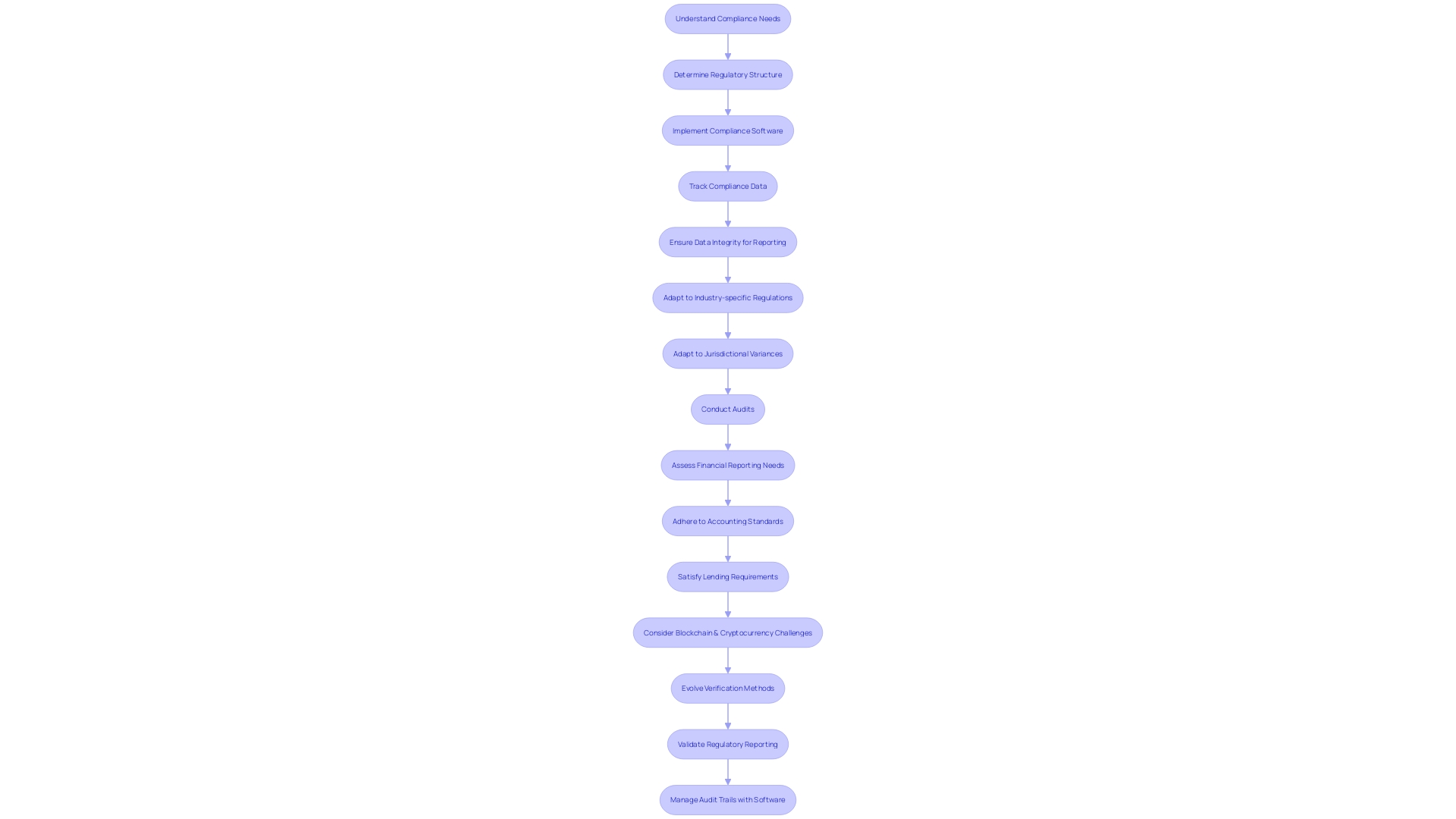

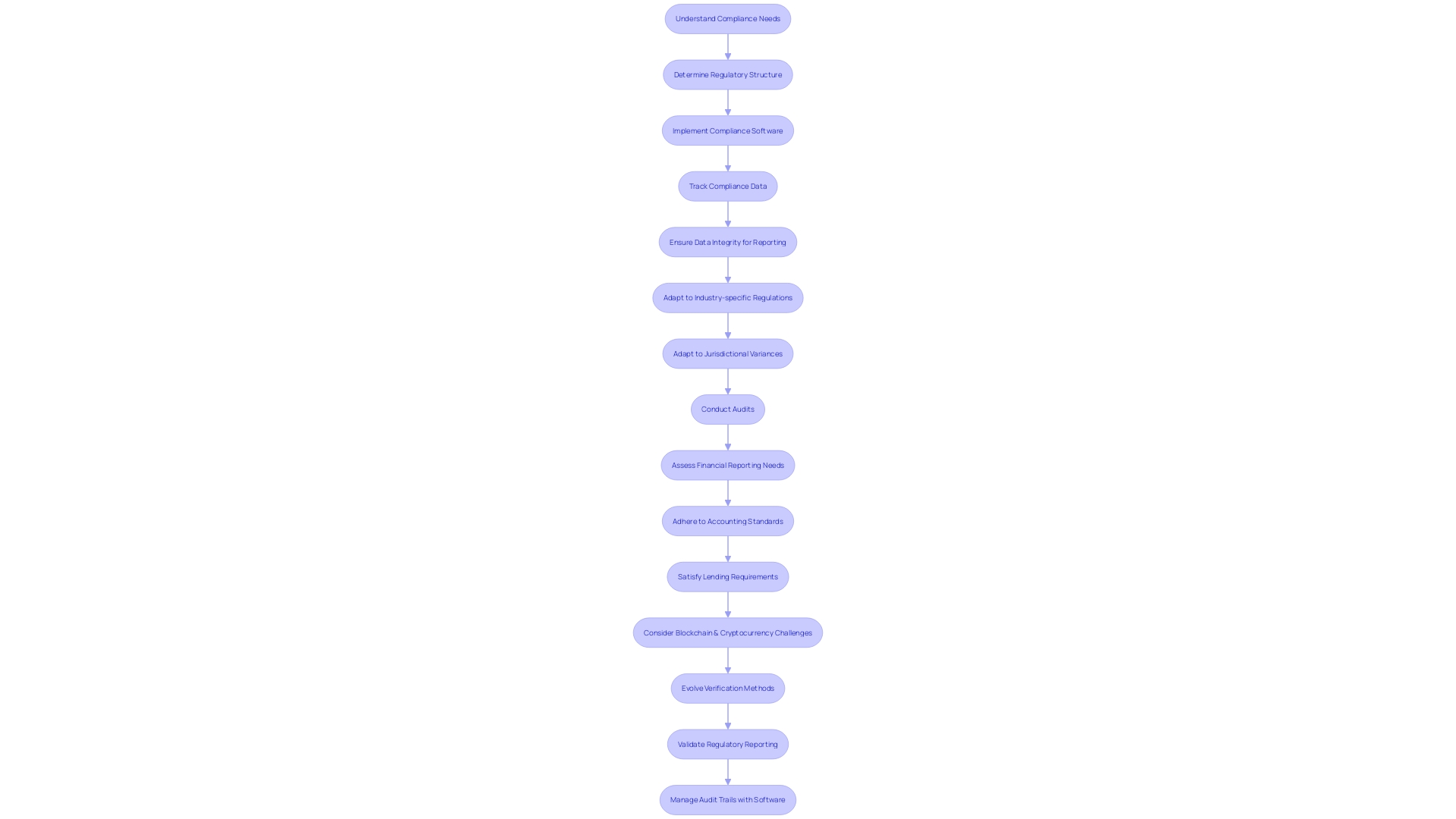

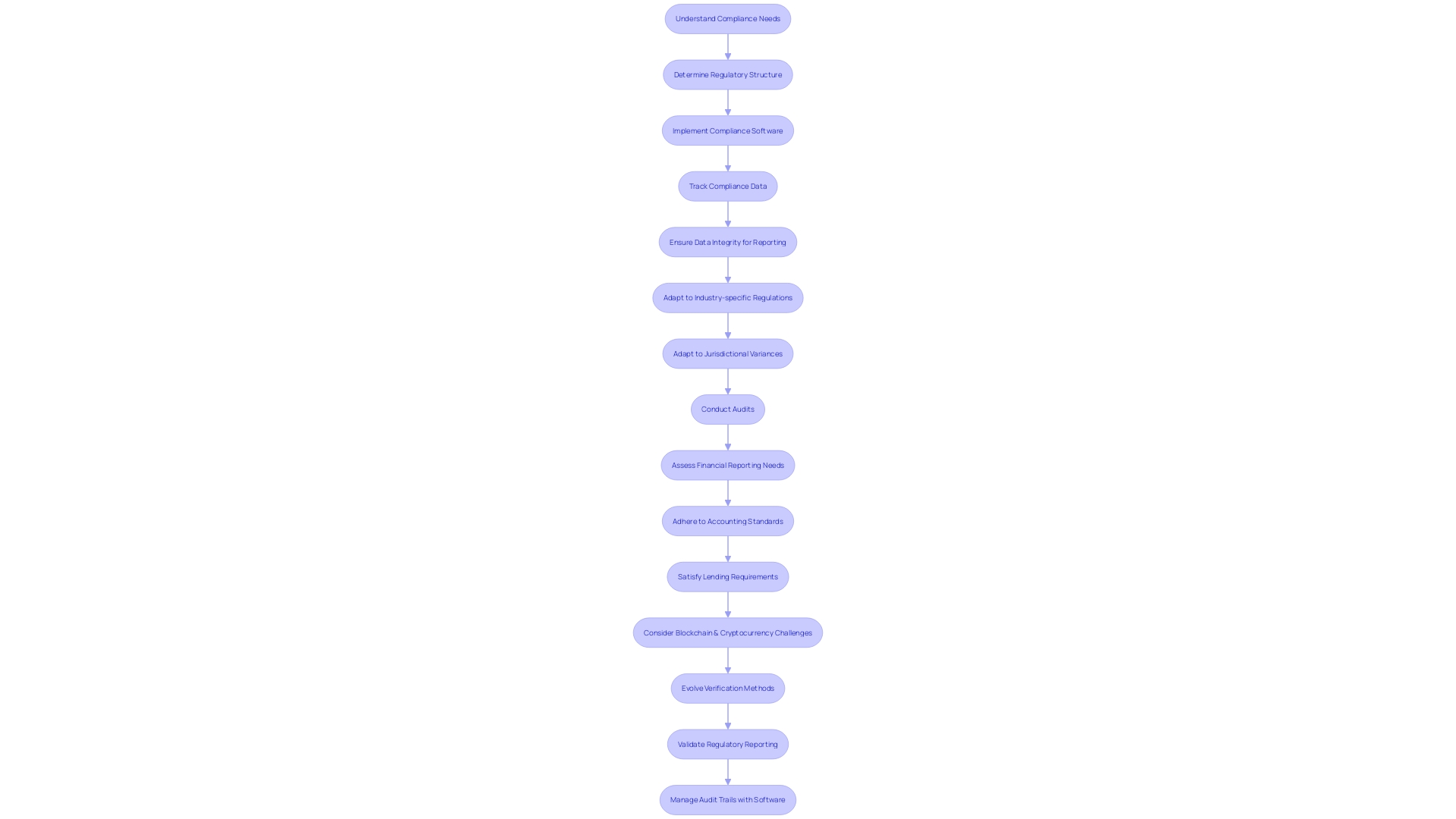

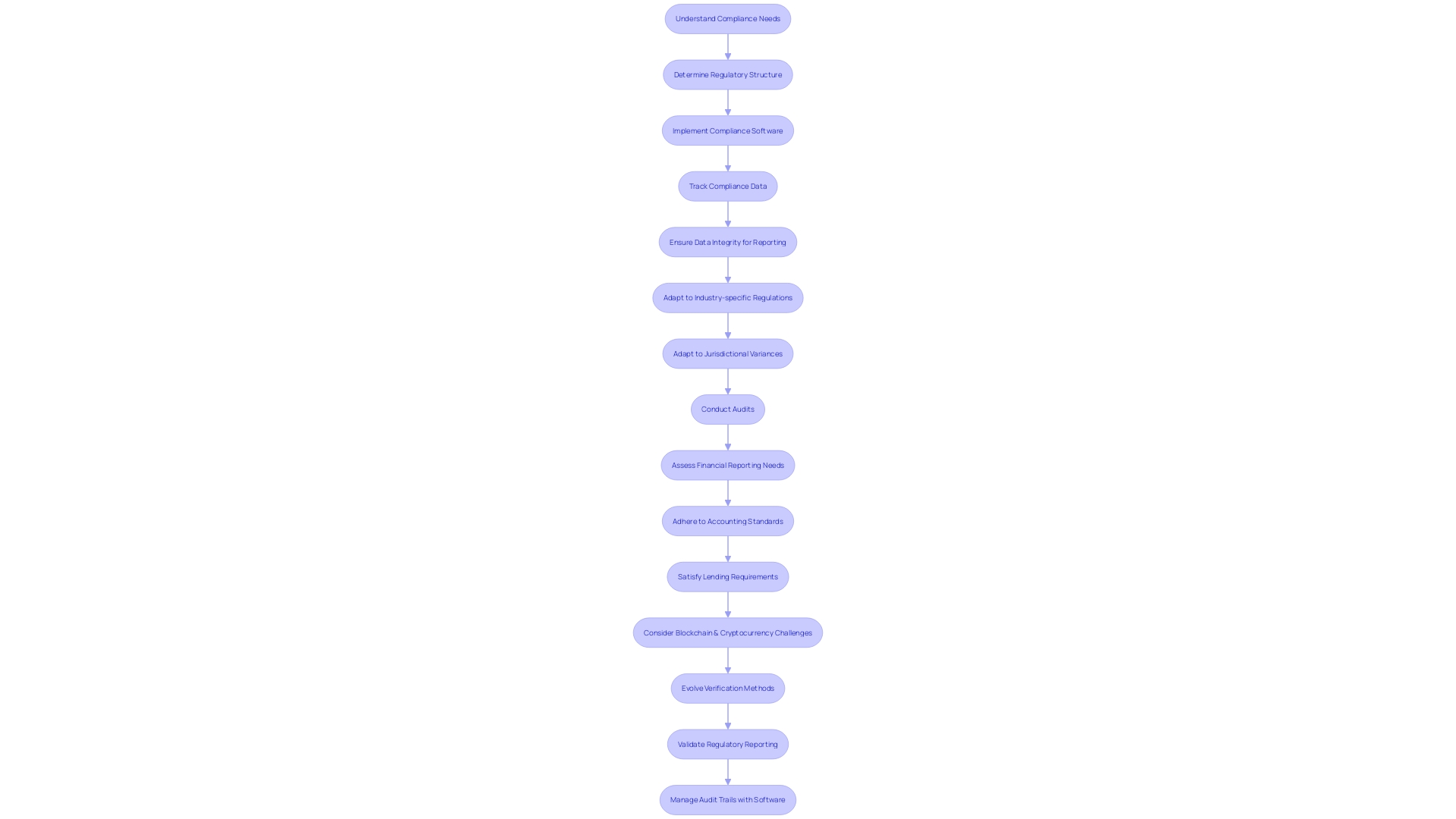

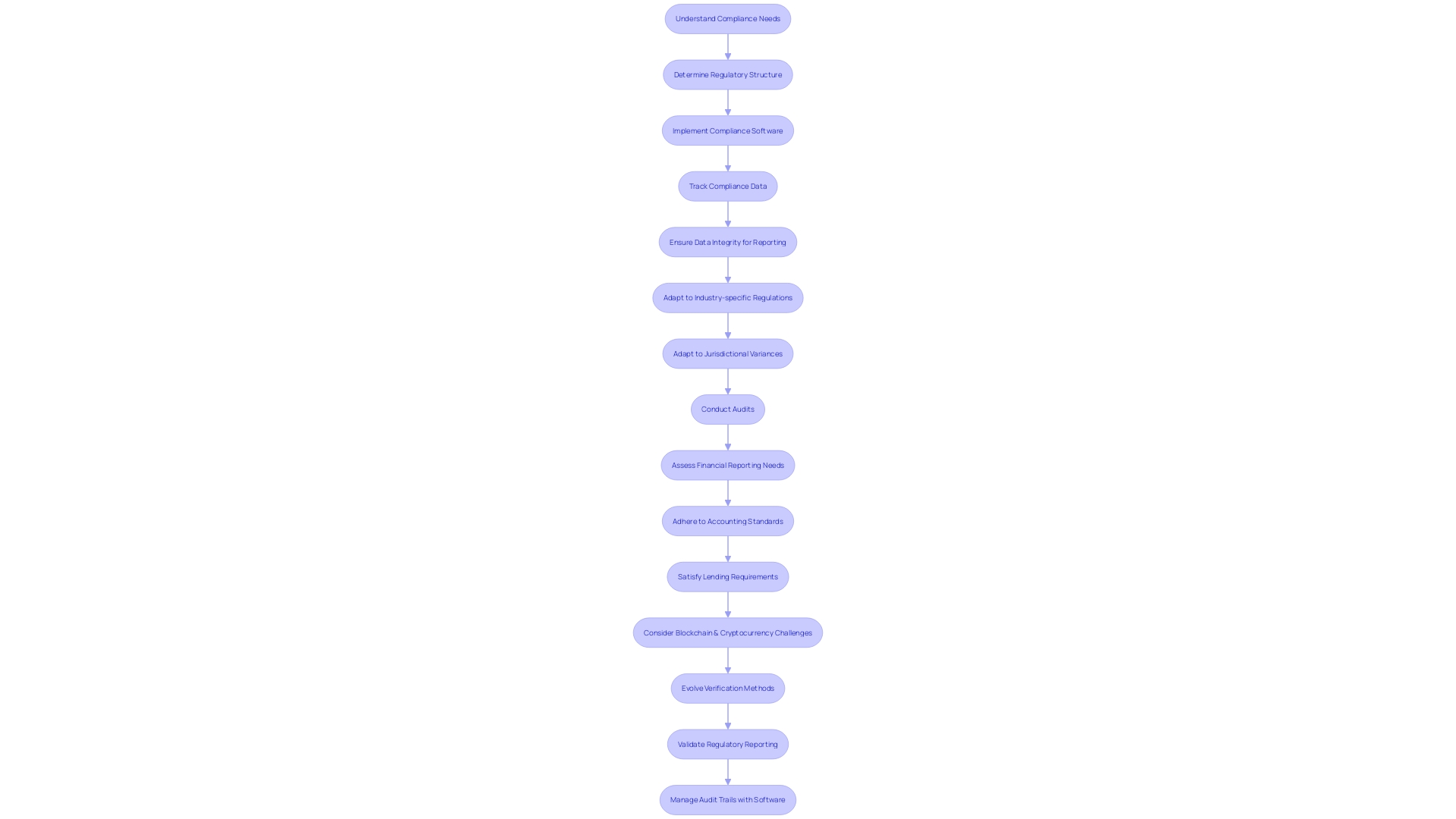

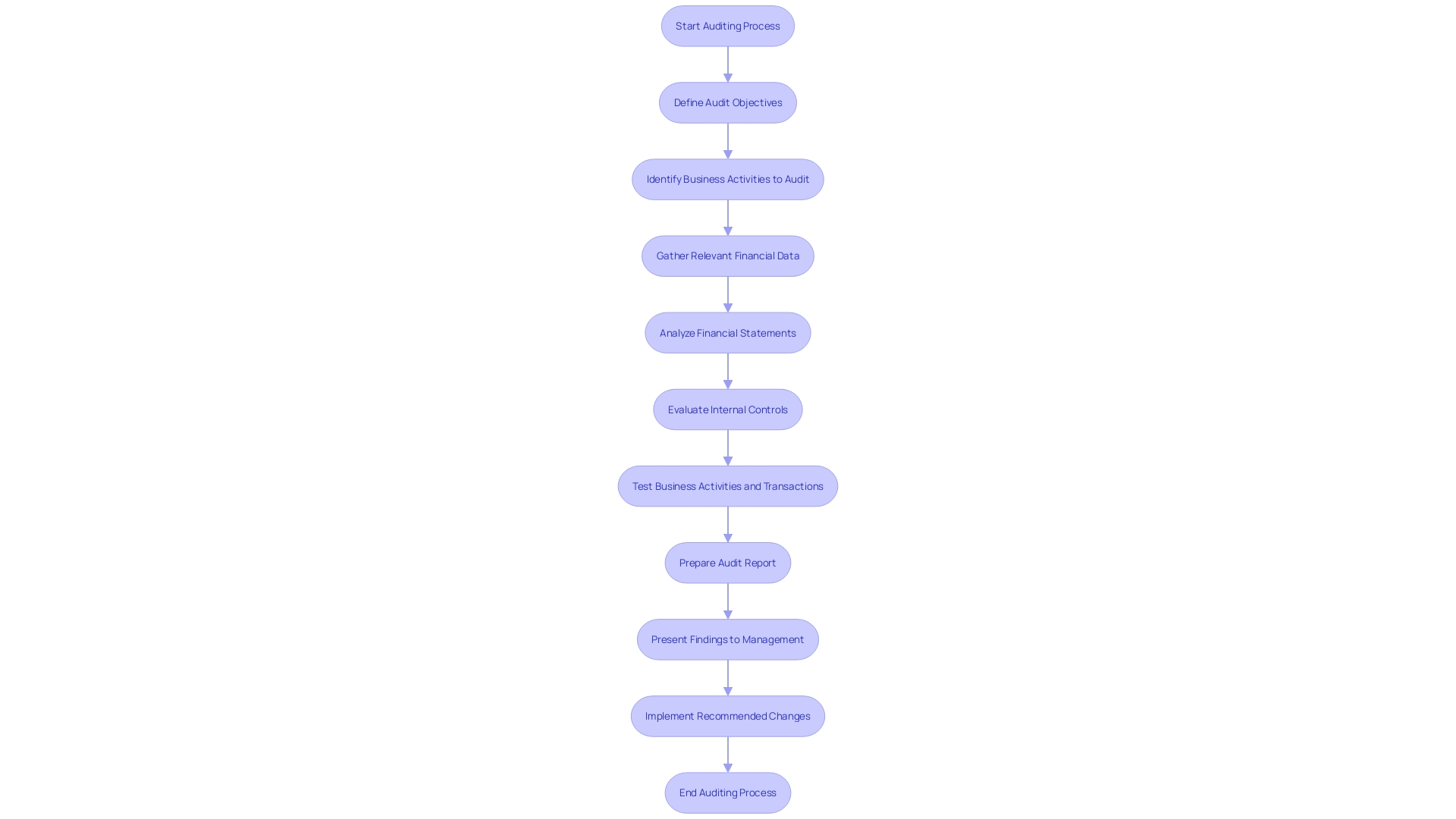

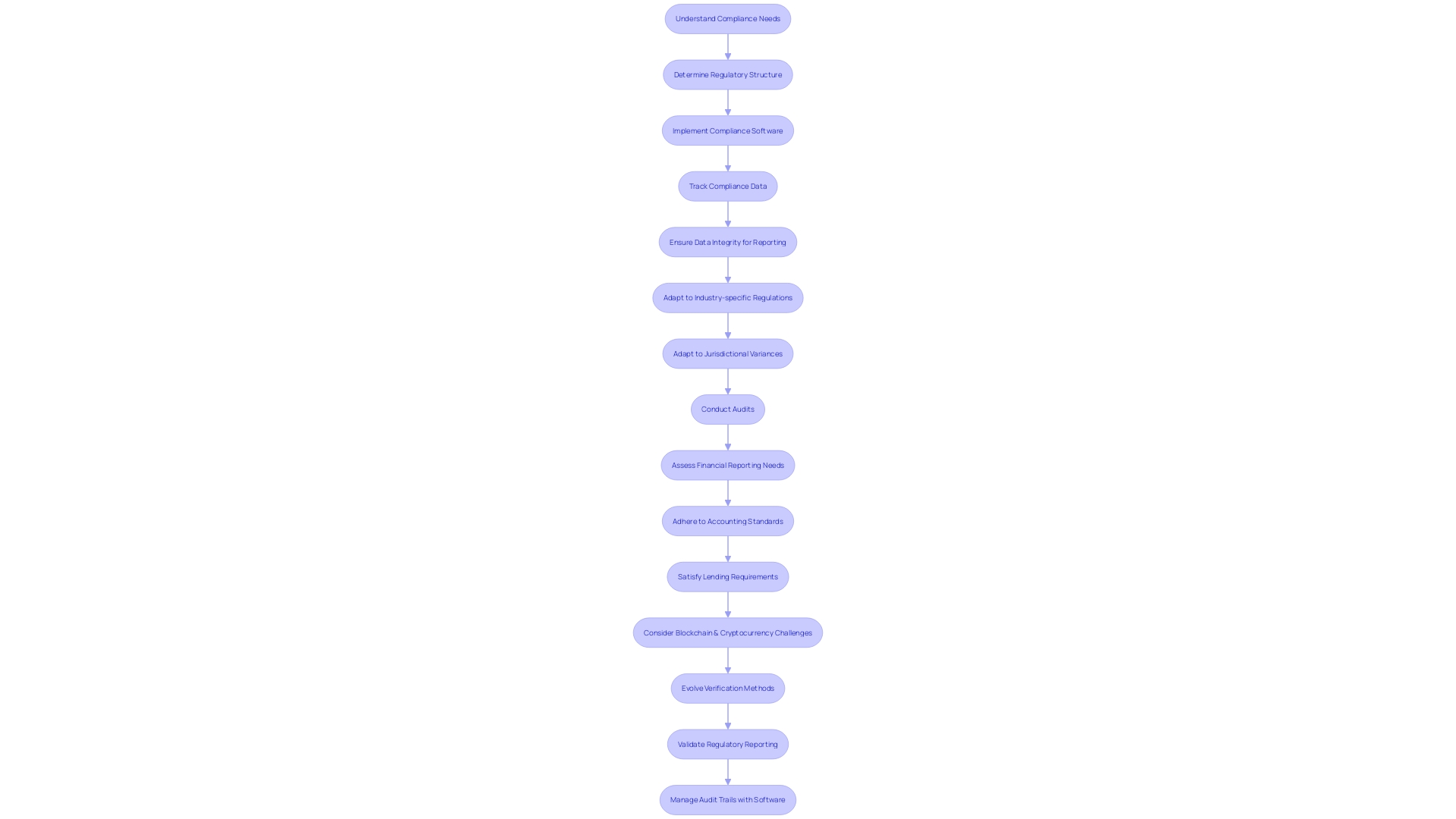

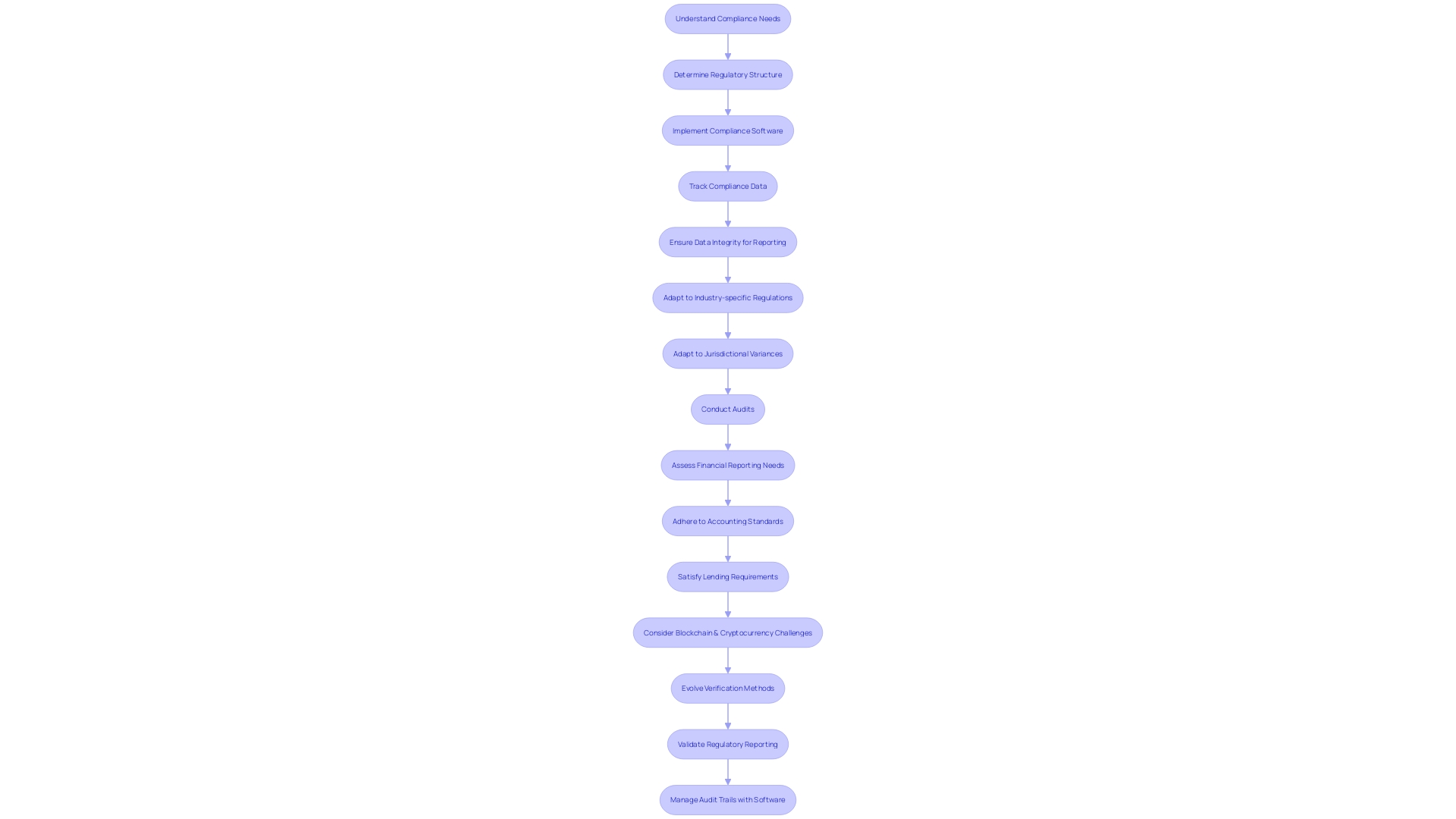

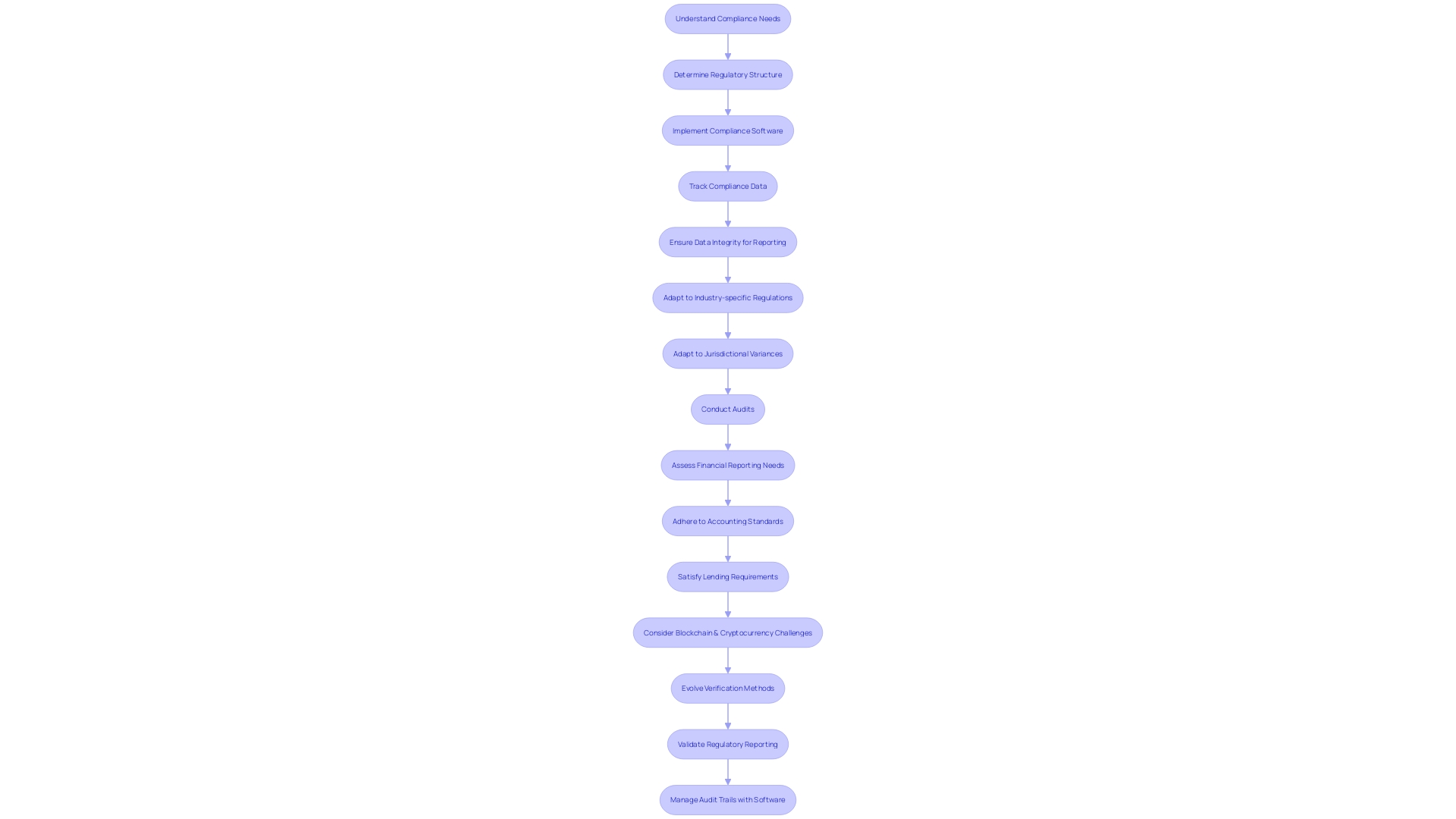

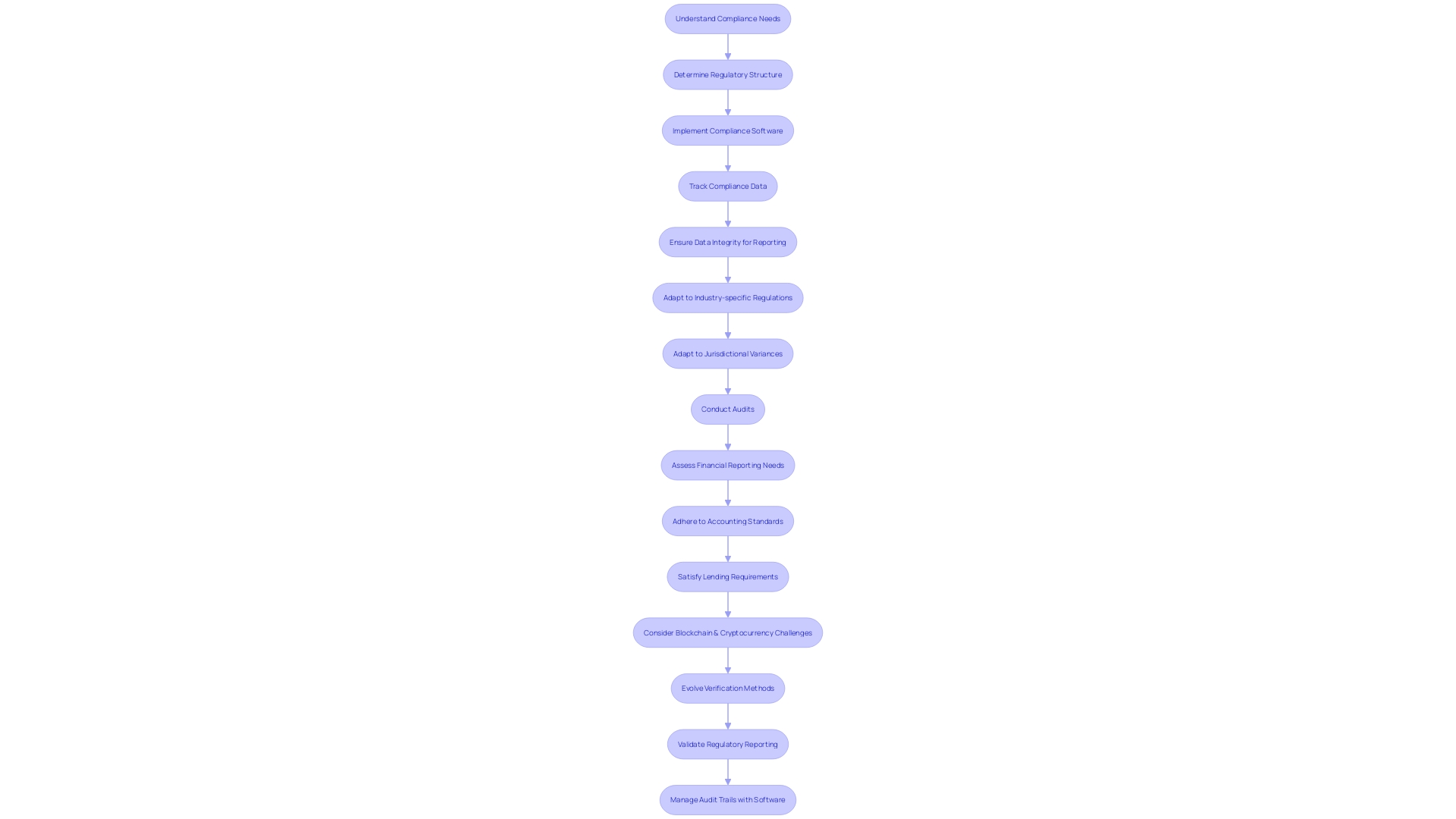

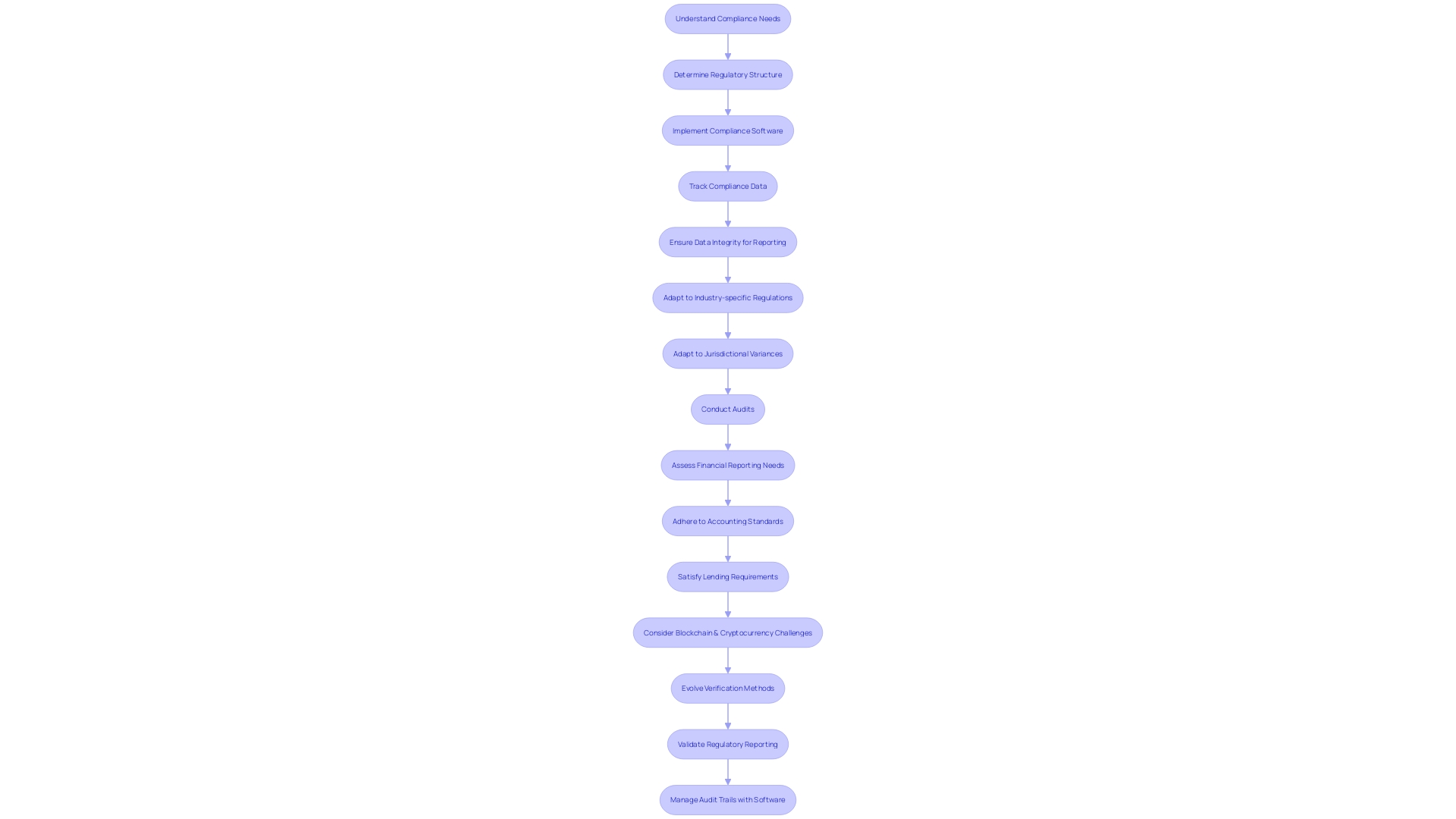

In the intricate web of regulations that govern the financial sector, audits serve as an indispensable tool for maintaining integrity and accountability. The landscape of financial compliance is vast, governed by a plethora of laws that focus on surveillance and supervision—veil-lifting measures like monitoring, retention of records, and comprehensive audit trails of digital communications that encompass mobile, text, social media, and more.

These audits do more than just tick boxes; they dissect company adherence to the strict and often sophisticated frameworks established by myriad supervisory agencies, from local to national levels, across various districts and industries. Delving into the specifics of a financial audit reveals its true complexity.

Before the first auditor steps through the door, entities must critically assess their financial reporting needs, considering deadlines and the accounting principles they must follow—commonly GAAP or income tax basis of accounting. This understanding is critical for ensuring that when the auditors scrutinize the financial statements, every transaction adheres to the defined accounting standards and satisfies lending requirements as stipulated in governing documents.

Beyond the meticulous nature of traditional financial audits, the burgeoning sectors of blockchain and cryptocurrency introduce yet another layer of complexity. They demand a broad spectrum of verification methods which stretch the very notion of what constitutes an audit.

As underscored by thought leaders in professional services, while financial statement audits remain foundational, the language describing verification in the crypto sphere must evolve. Financial audits are a cornerstone in upholding market stability and shielding the public from risks like fraud and money laundering. Compliance is not a mere formality; it is a dynamic framework that evolves with emerging technologies. As regulations constantly shift, companies are turning to sophisticated software solutions to navigate and manage compliance obligations with greater precision, such as tracking audit trails and validating regulatory reporting. Although the concept of finance may be universally understood, the intricate details of regulatory compliance are unique to each jurisdiction and industry, underscoring the need for tailored and robust audit processes.

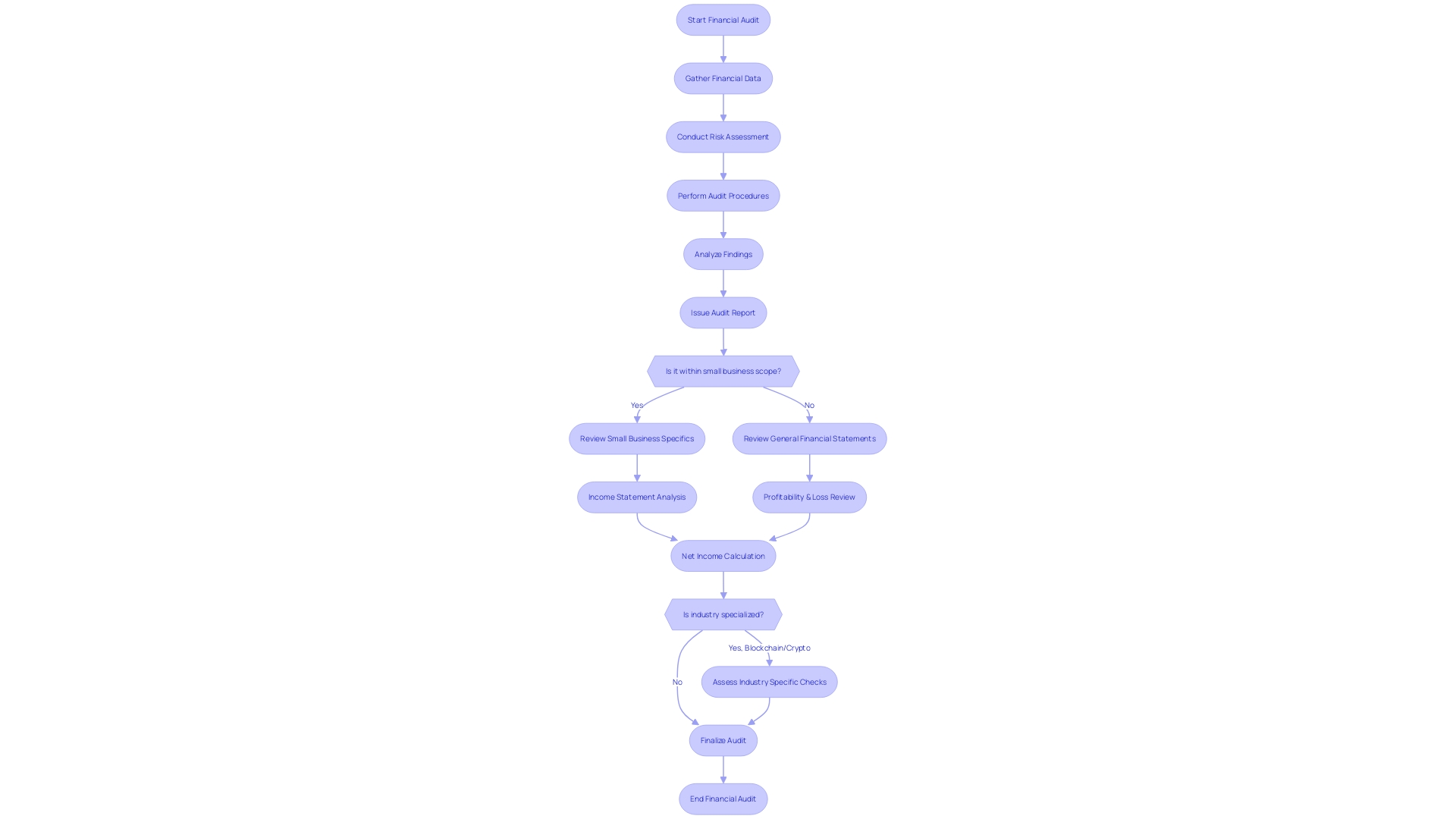

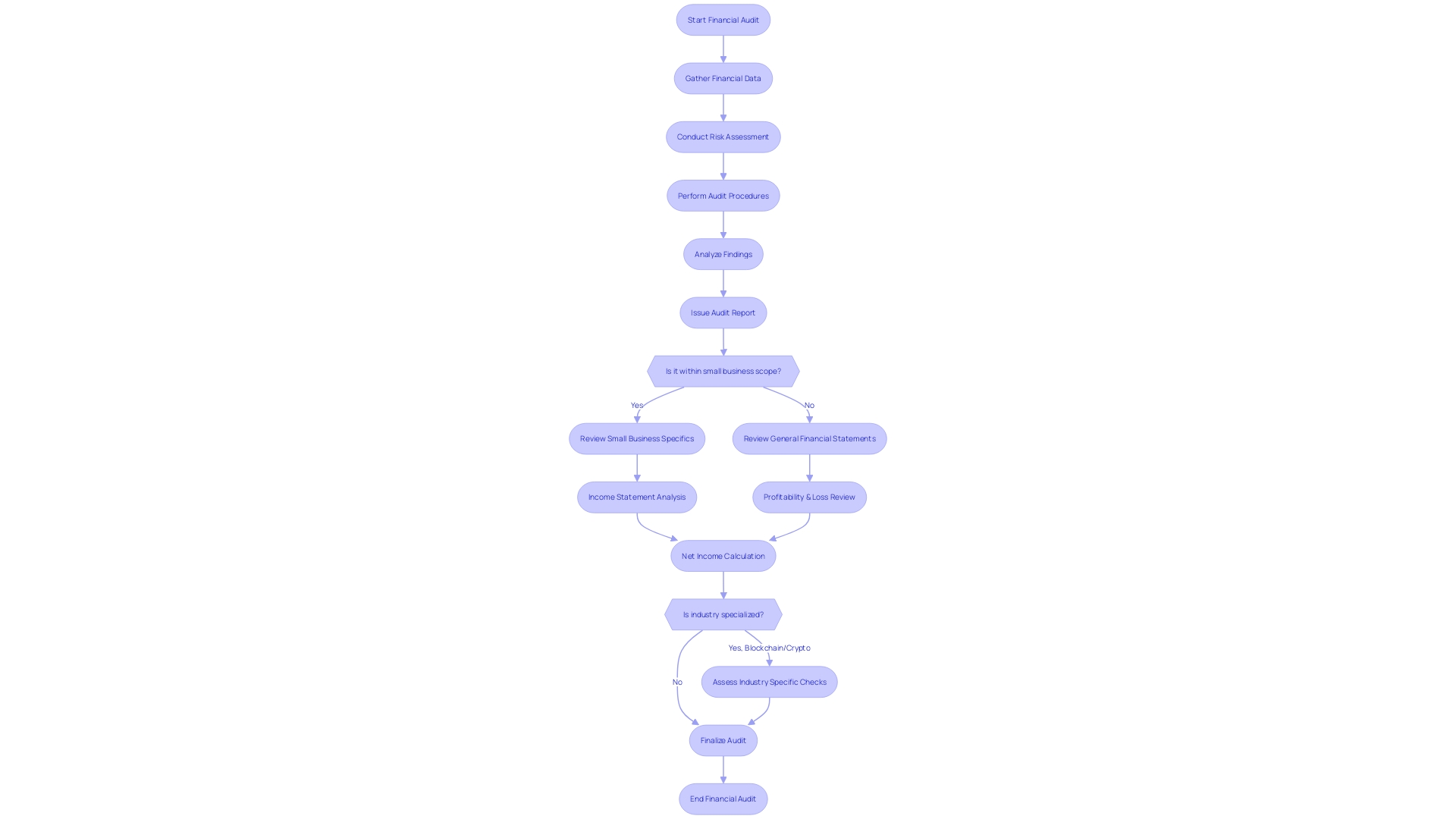

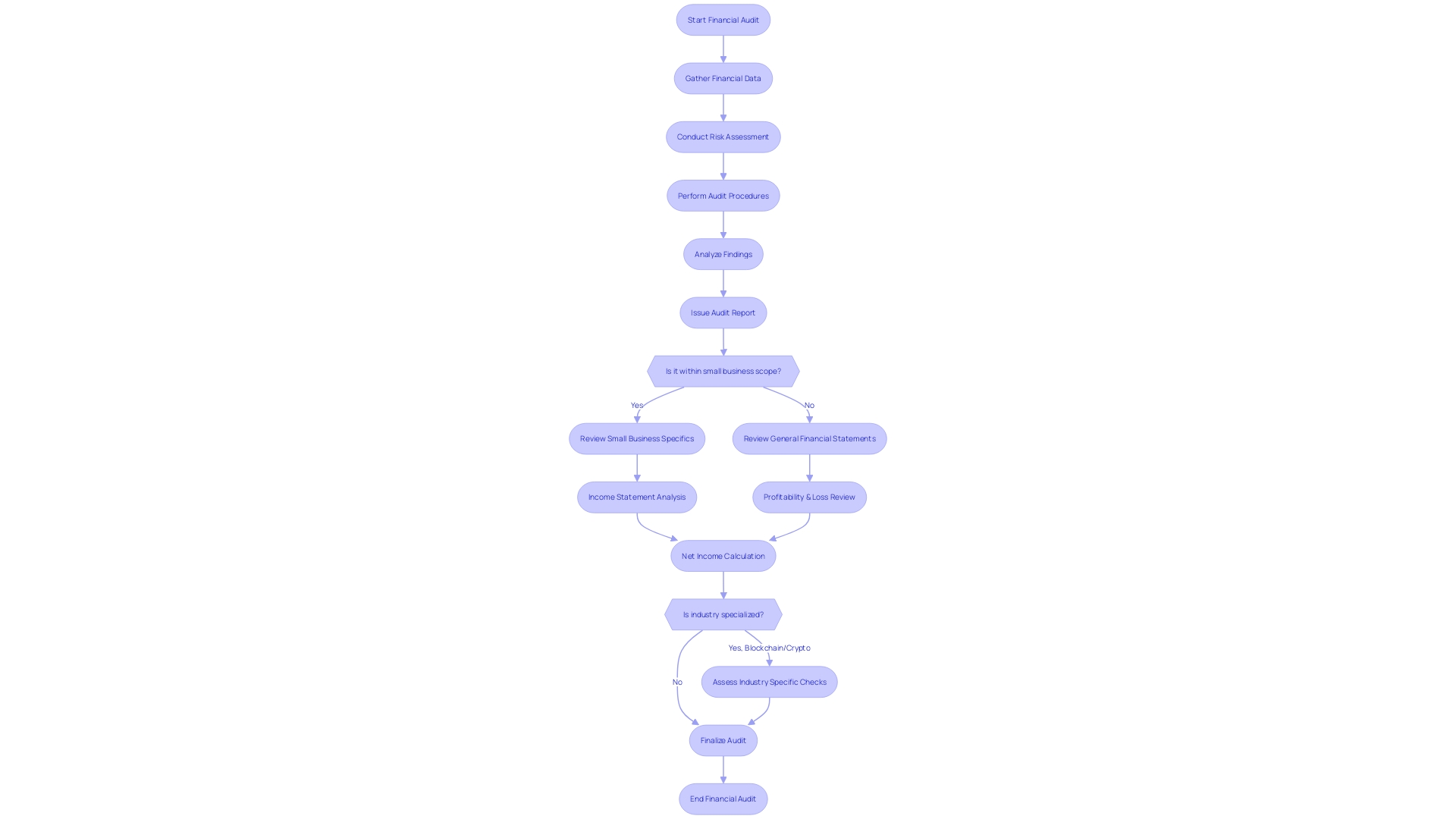

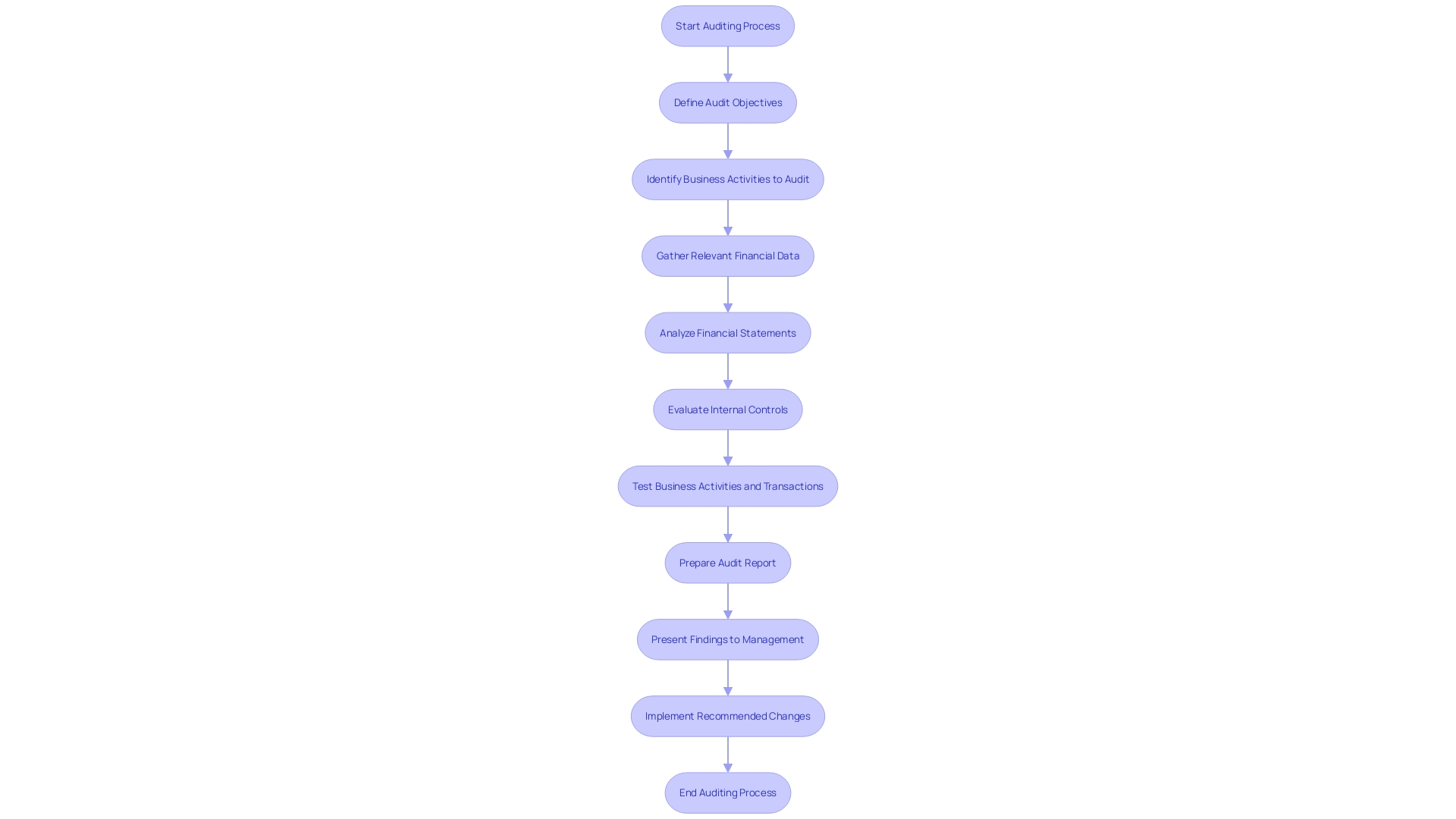

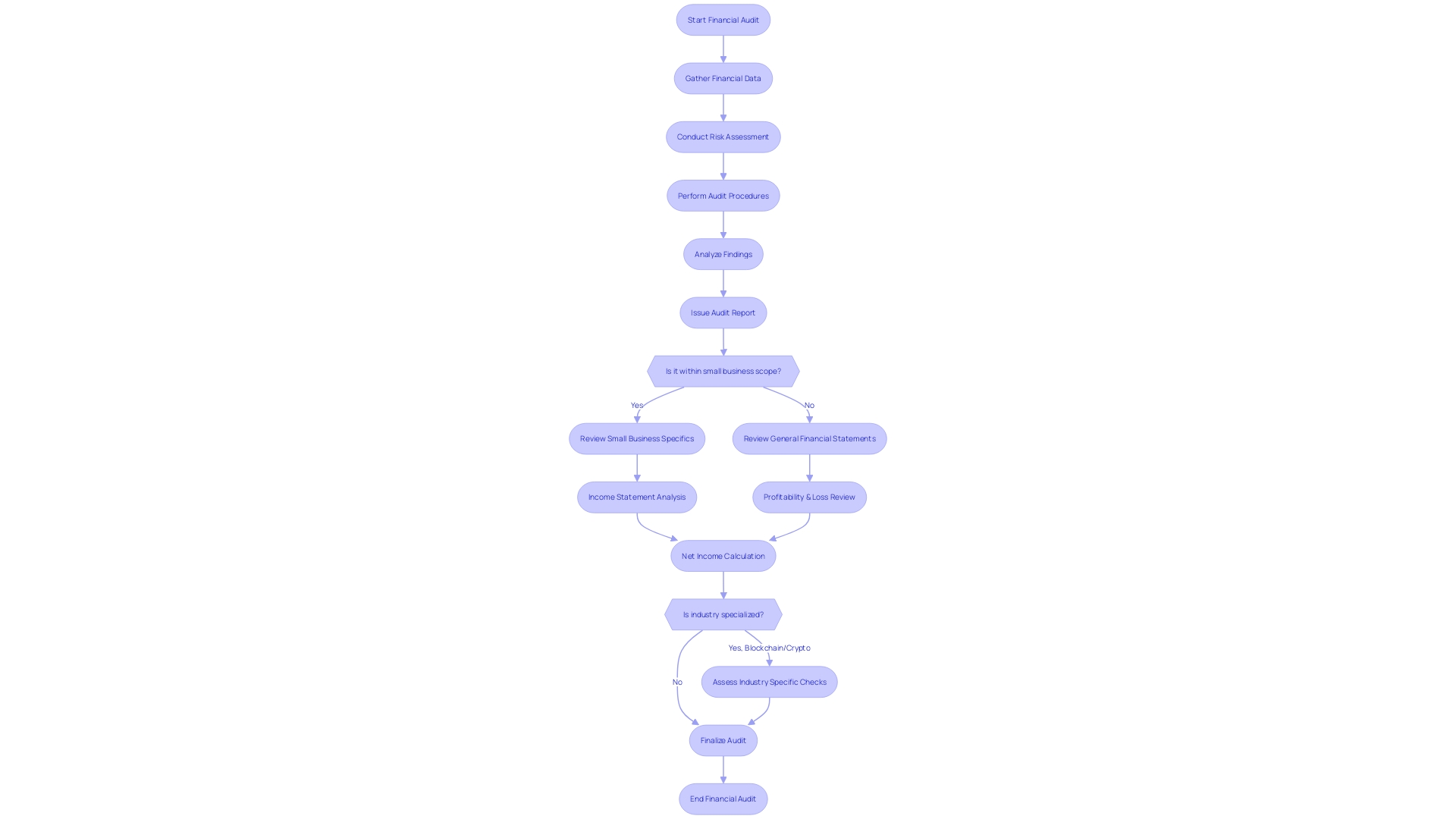

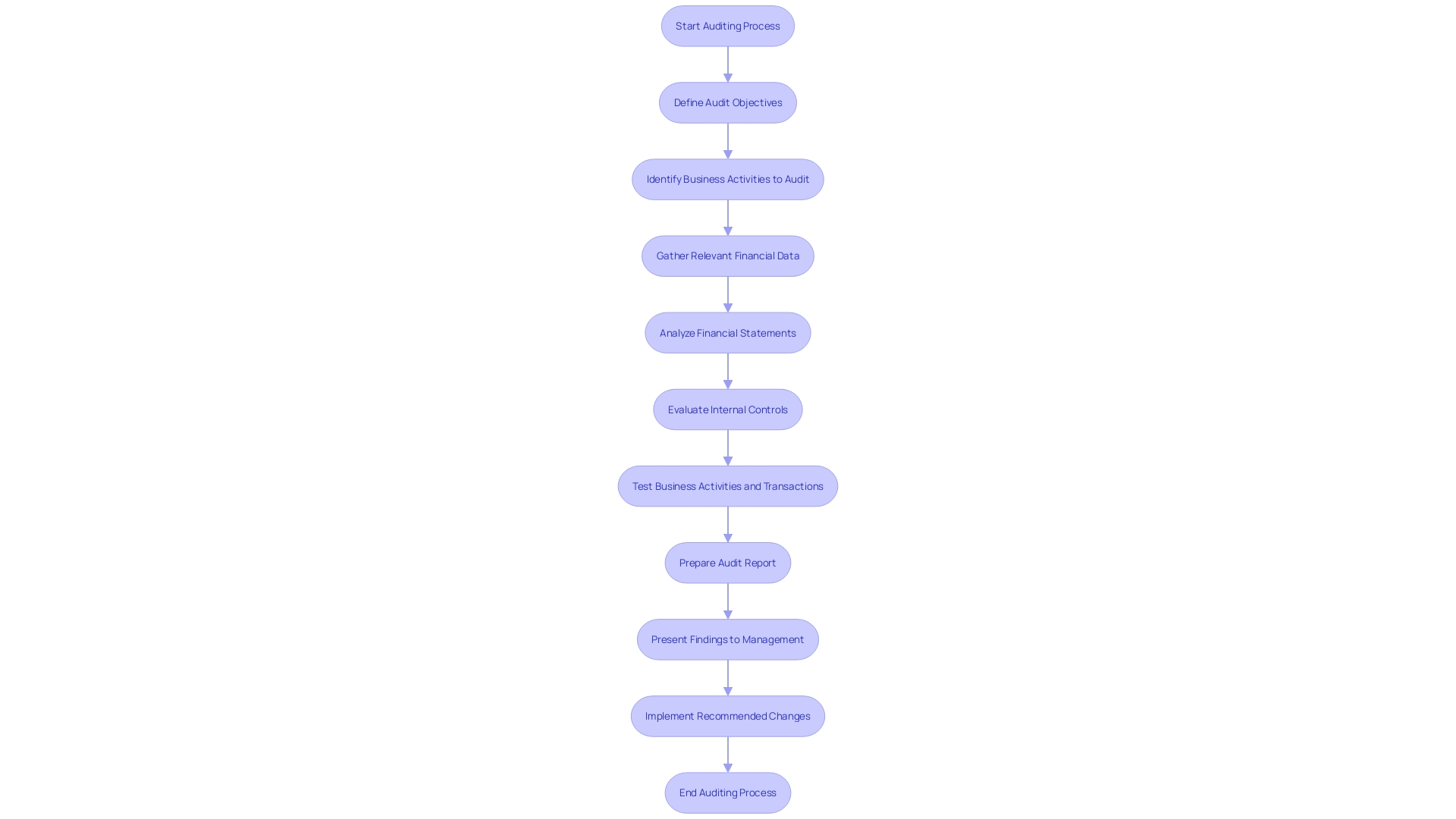

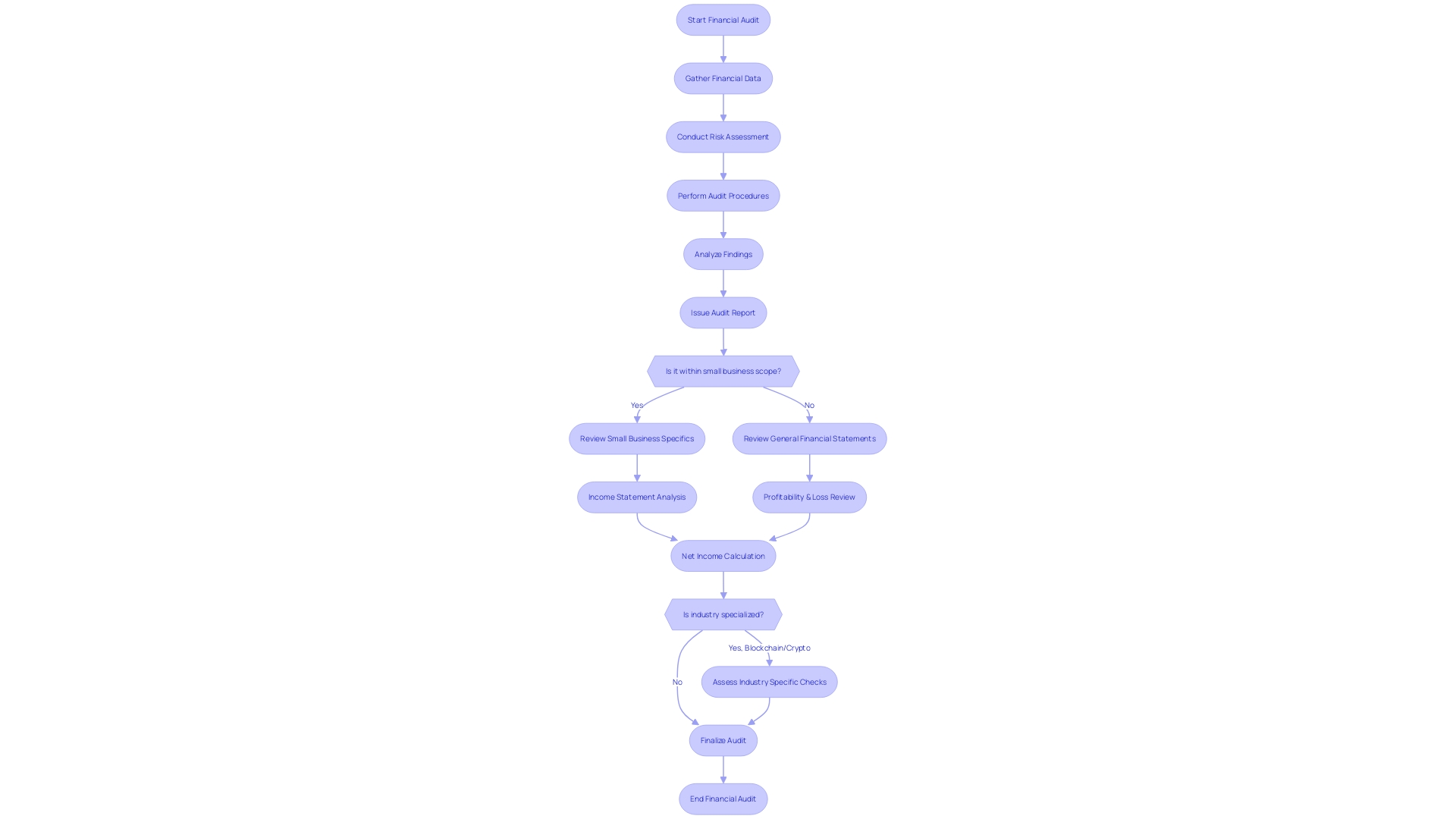

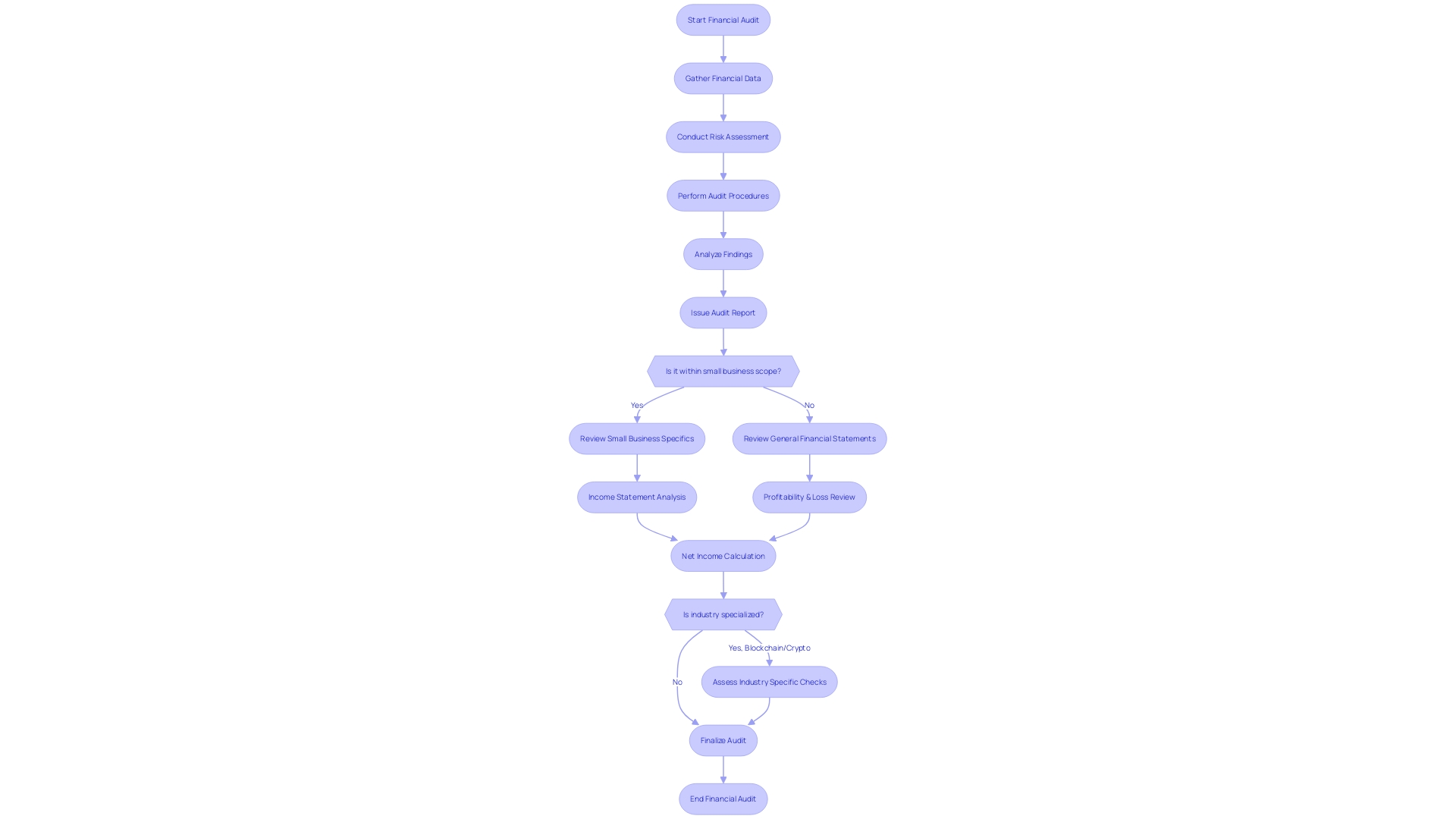

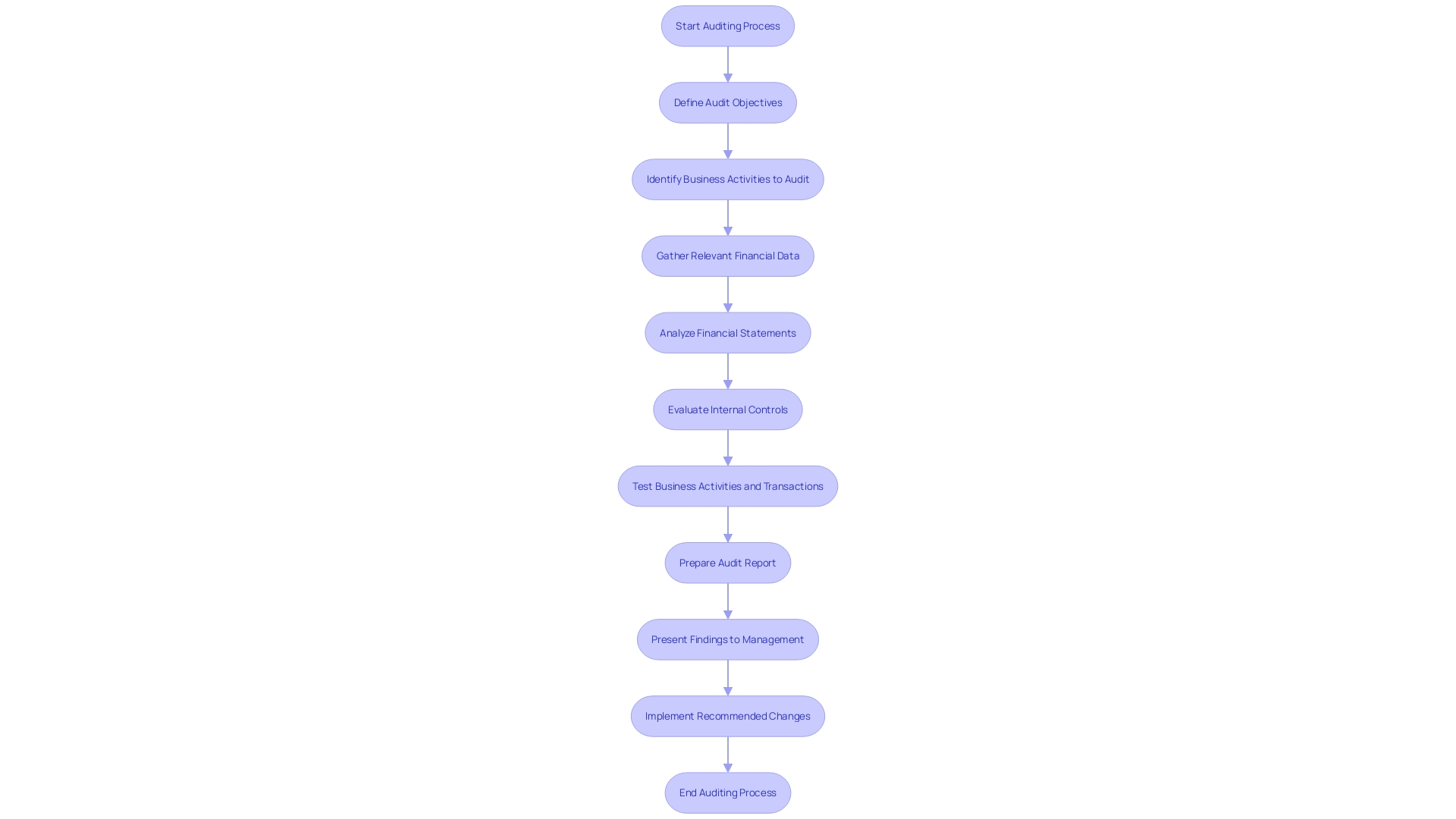

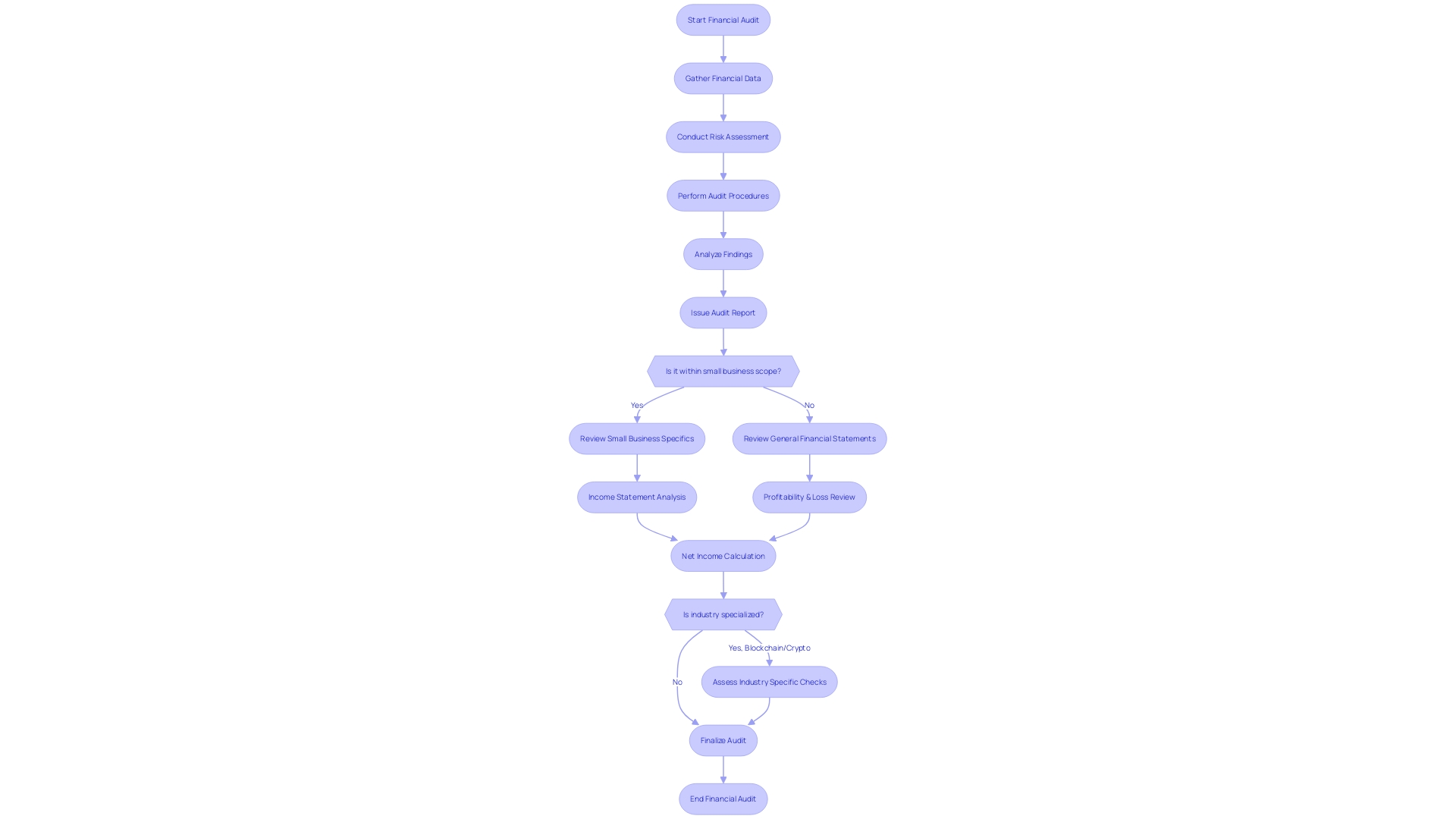

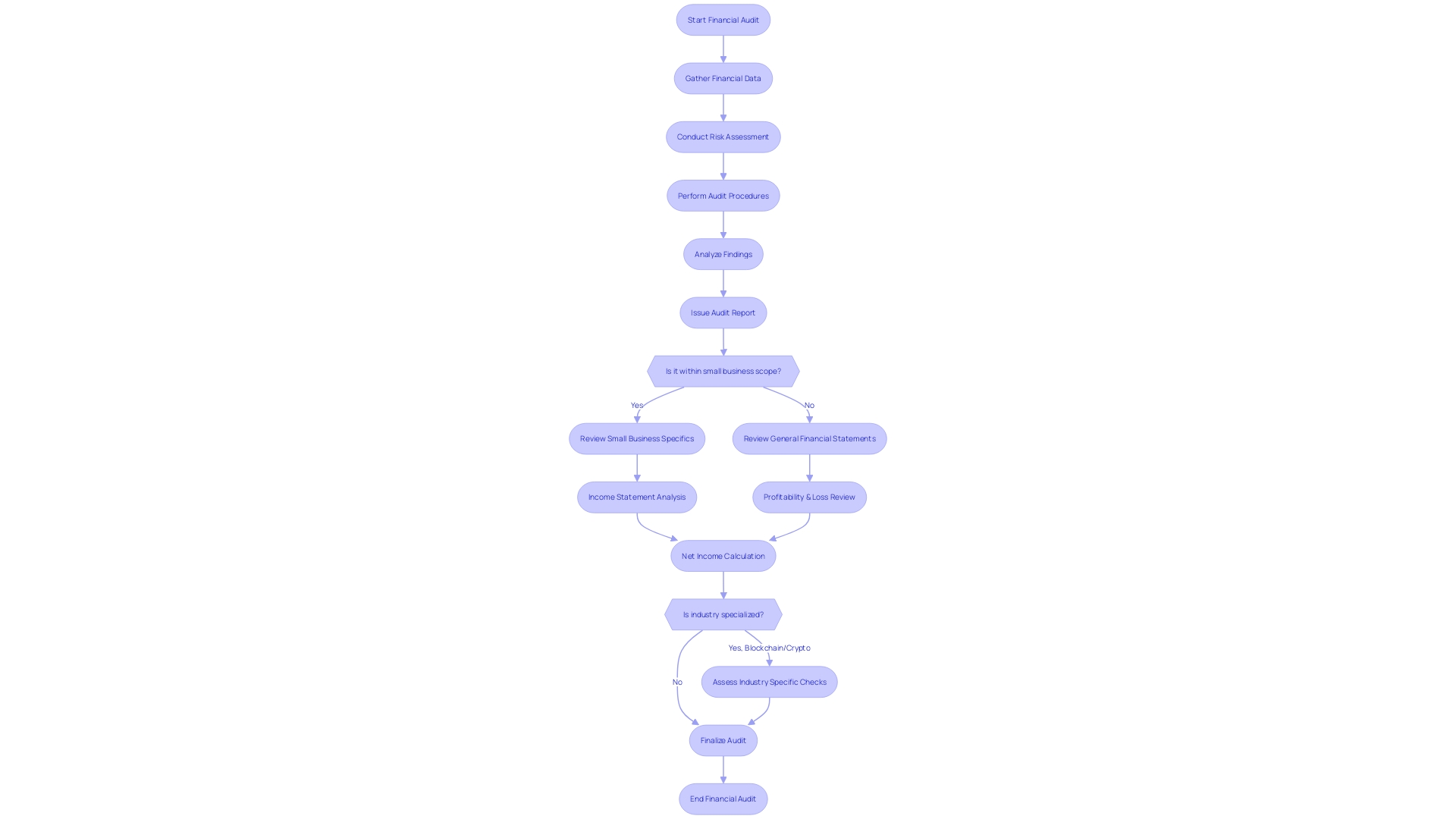

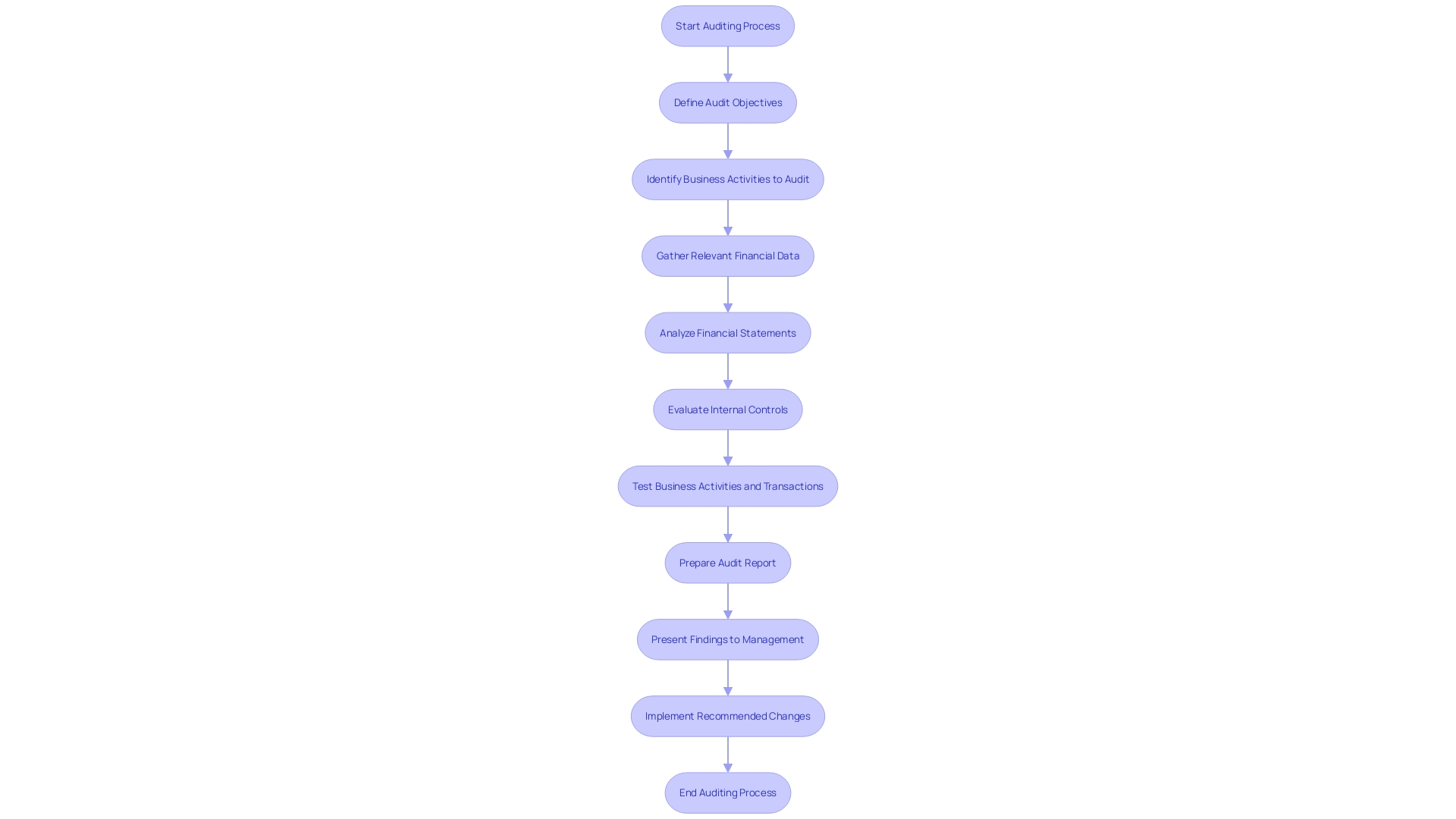

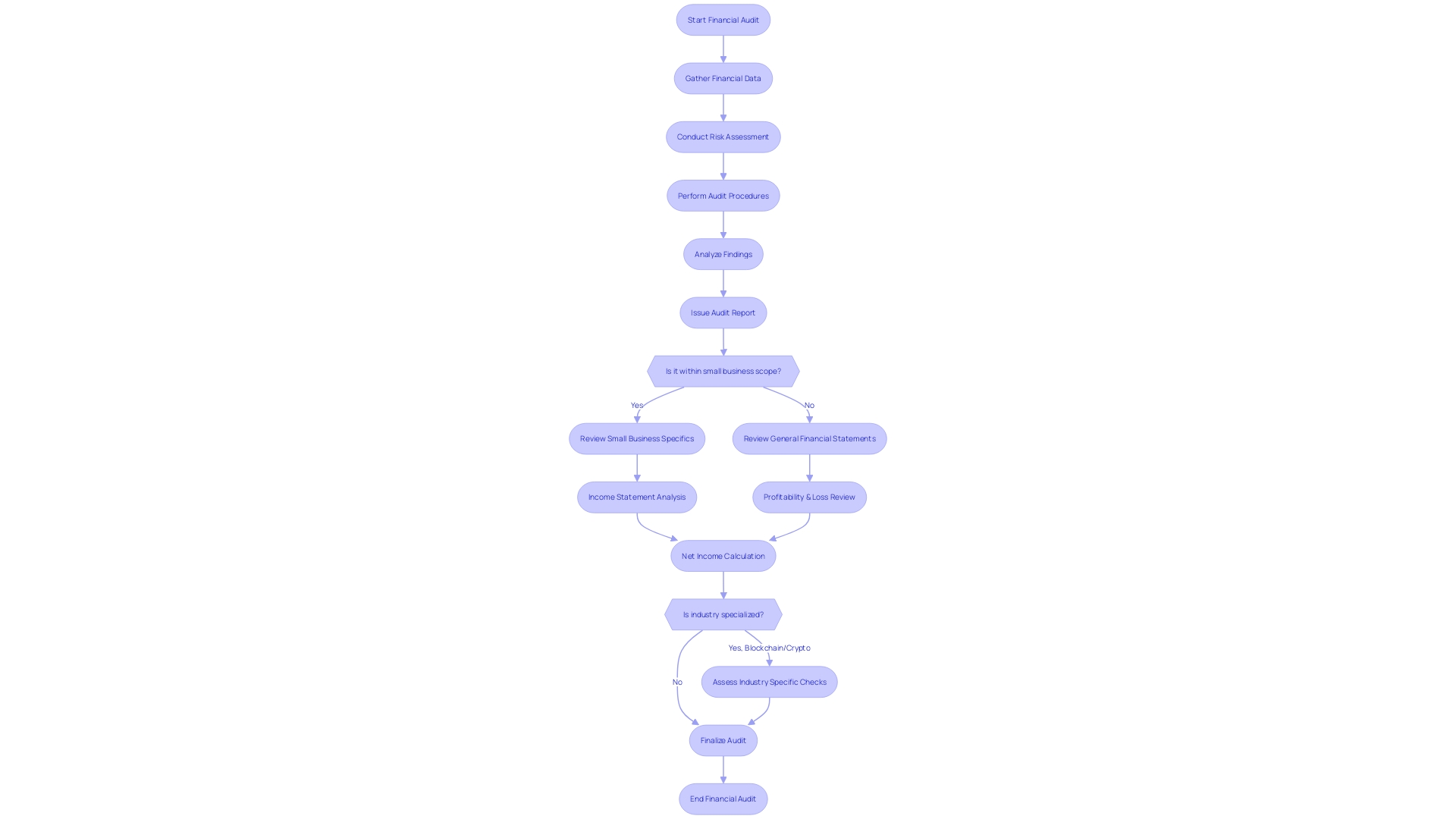

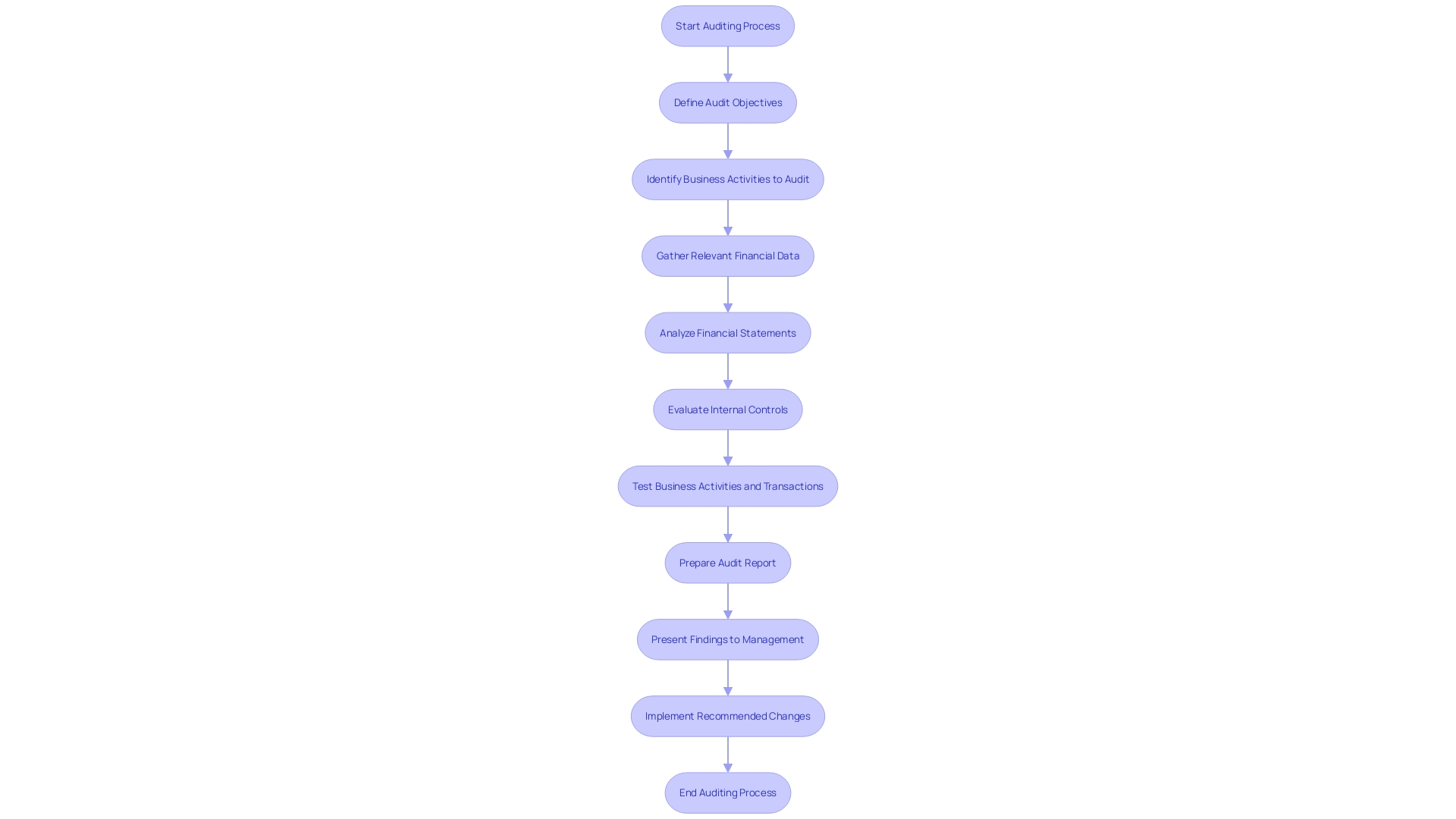

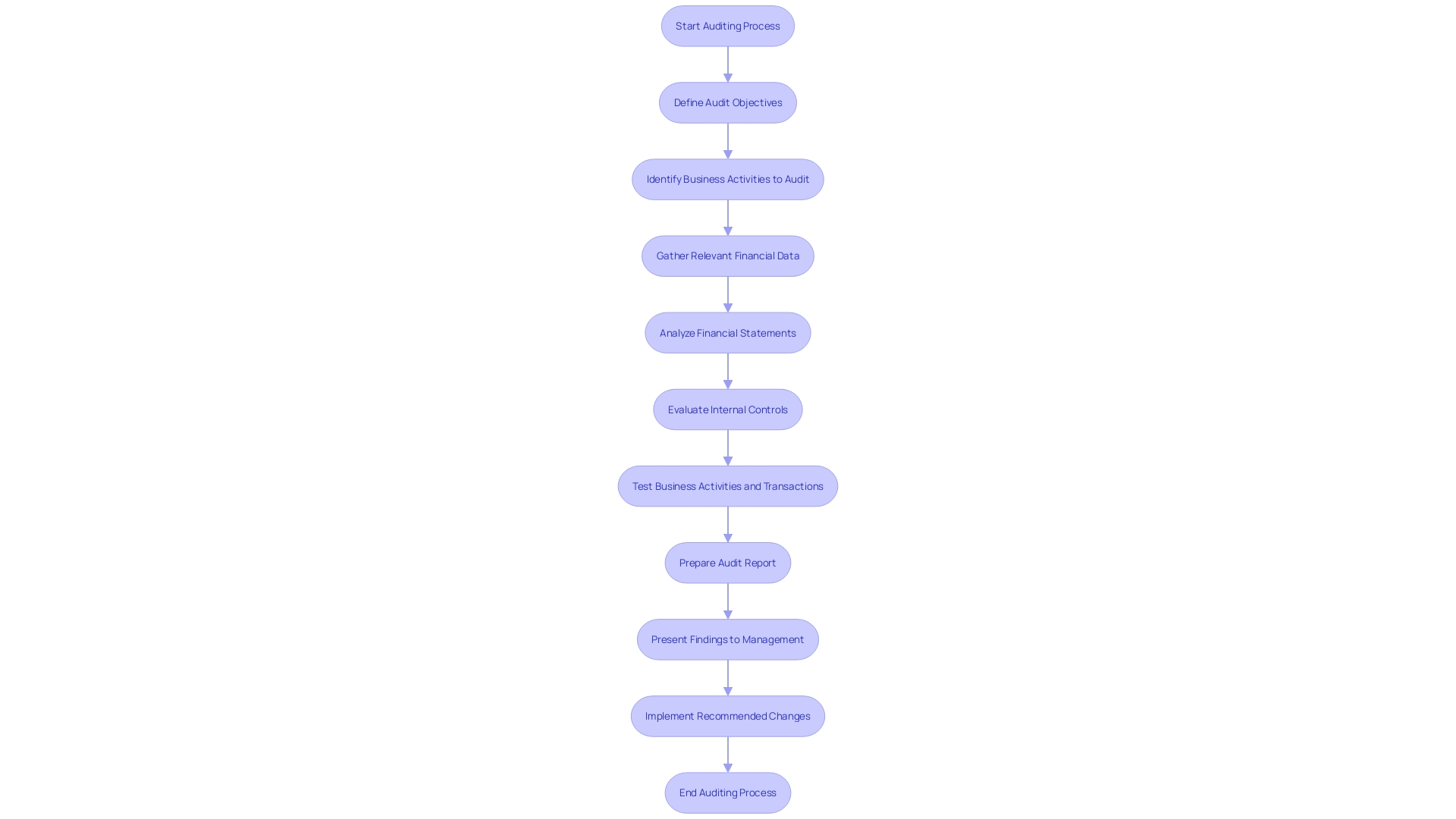

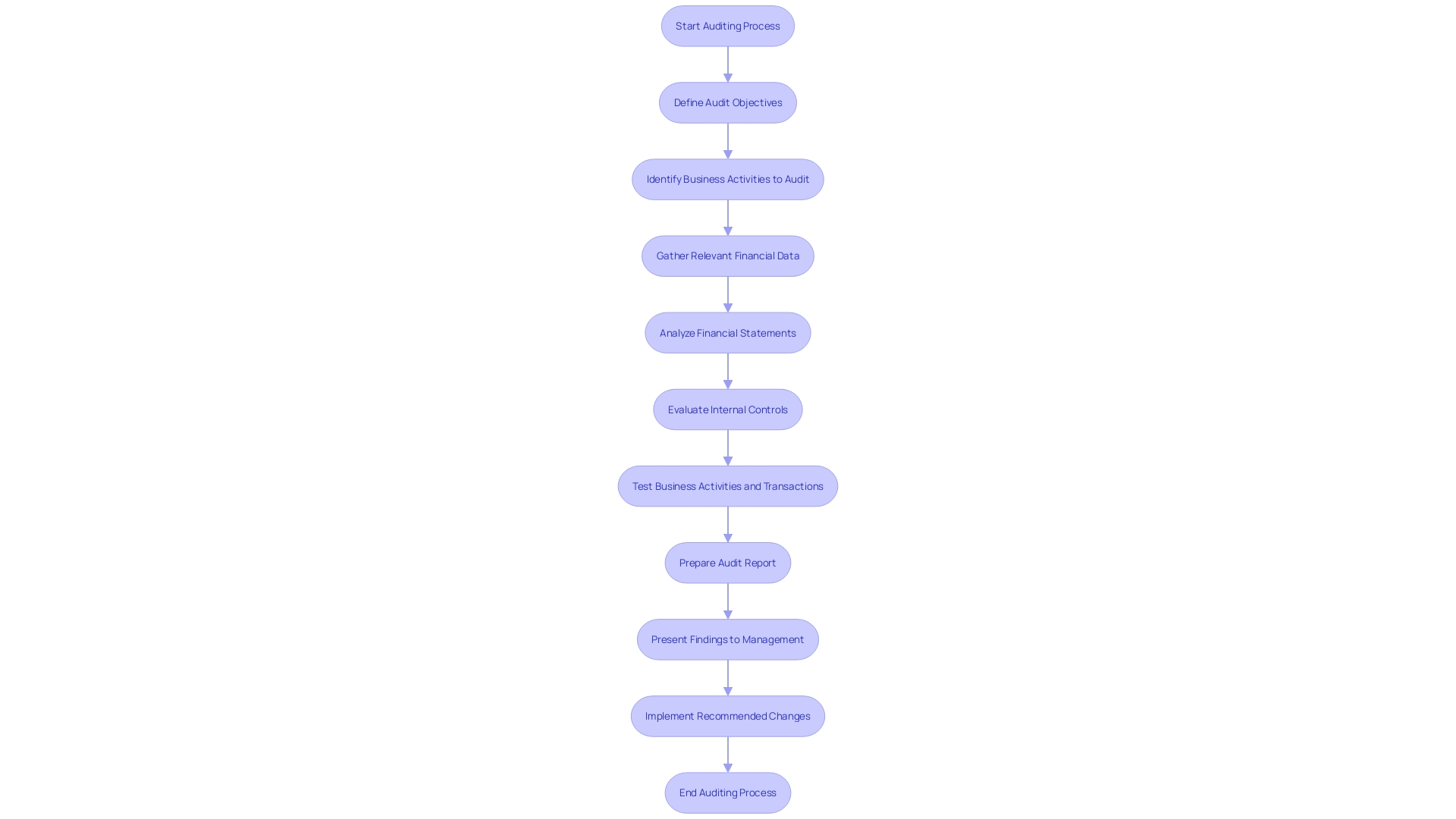

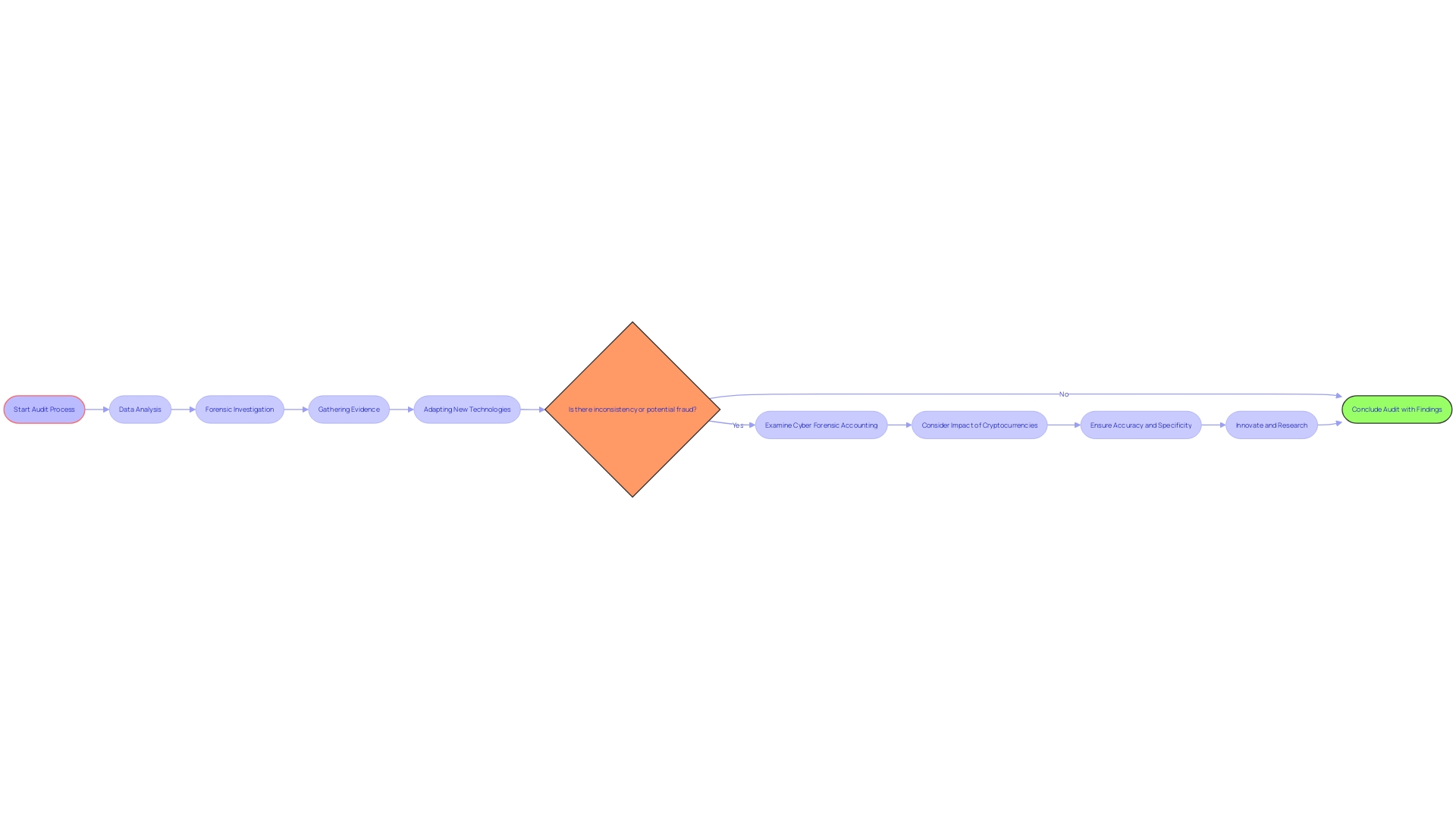

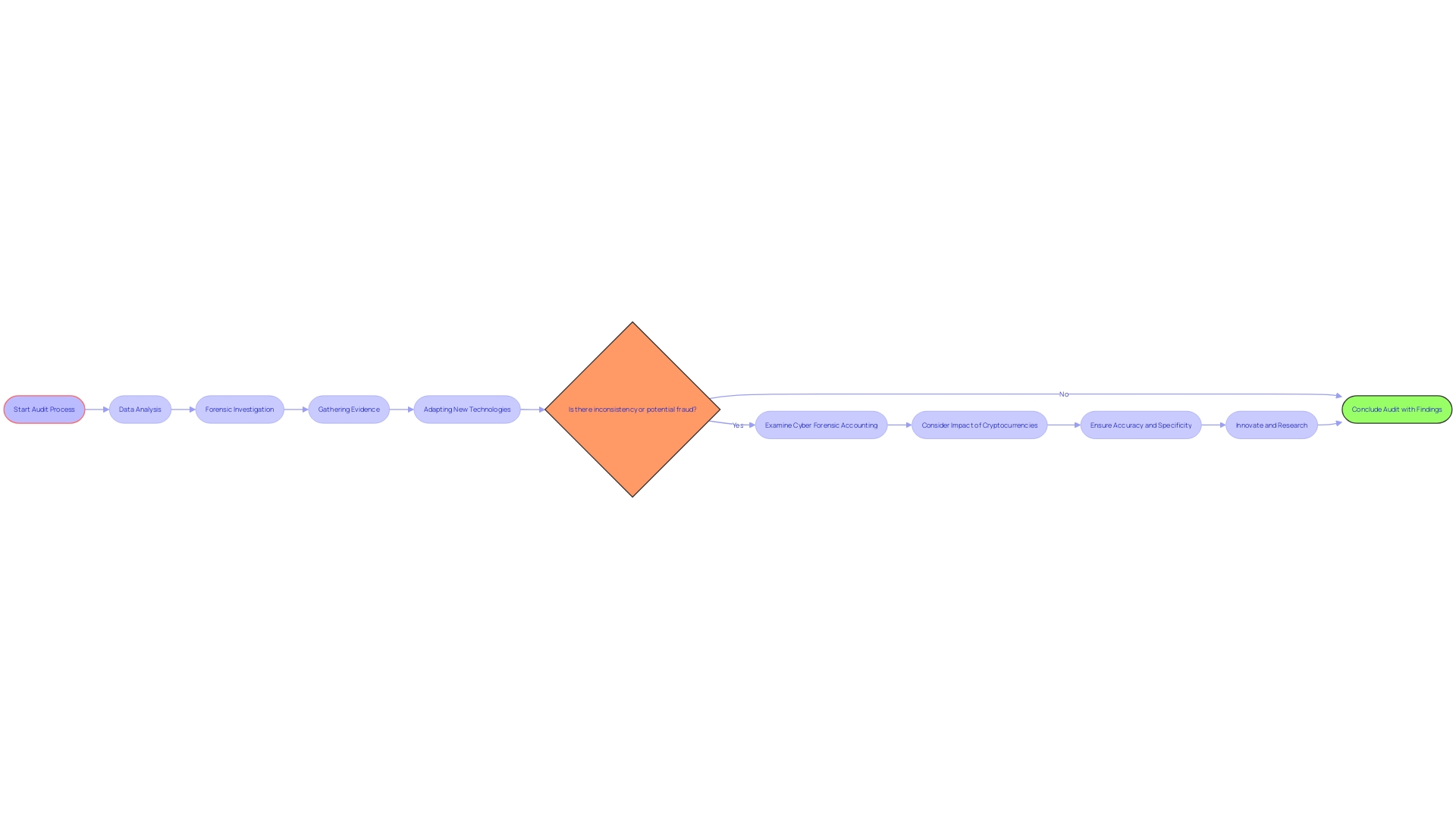

A financial audit is more than ticking off a checklist; it's an intricate assessment ensuring the reliability and accuracy of an organization's financial statements. Here's how you embark on this meticulous process:

Initially, dive into the project's structure.

Start by understanding its core, determining its uniqueness, and whether it's an original creation or a modified version of a pre-existing model. In the case of an options-based market, for instance, examining the highest-level functions accessed by users will give insights into the internal workings of the system.

Financial analysts play a pivotal role in this stage, harnessing their expertise in diving deep into financial data. They evaluate profitability and forecast future performance by analyzing balance sheets, income statements, and cash flow statements.

Their scrutiny powers the audit's focus on liquidity and solvency, underpinning its thoroughness. When examining a small business, the audit puts its tax filings and financial records under the microscope, ensuring their veracity.

It becomes indispensable to survey not just the ledgers but also to report specifics, such as foreign bank accounts. These audits aren't arbitrary; they're conducted with a purpose, often triggered by discrepancies or regulatory mandates. To grasp the complete context, remember the words of an industry expert from a prestigious firm like EY, who points out the necessity for precise terminology in audit-related discourse, especially within the realms of blockchain and cryptocurrency. In these innovative sectors, the demand extends beyond traditional financial audits, necessitating a broad spectrum of verification tools tailored for the digital age. In sum, a financial audit is a rigorous exploration of an entity's financial fidelity, informed by the expertise of financial analysts and equipped with the resolve to uphold accuracy and transparency in the financial ecosystem.

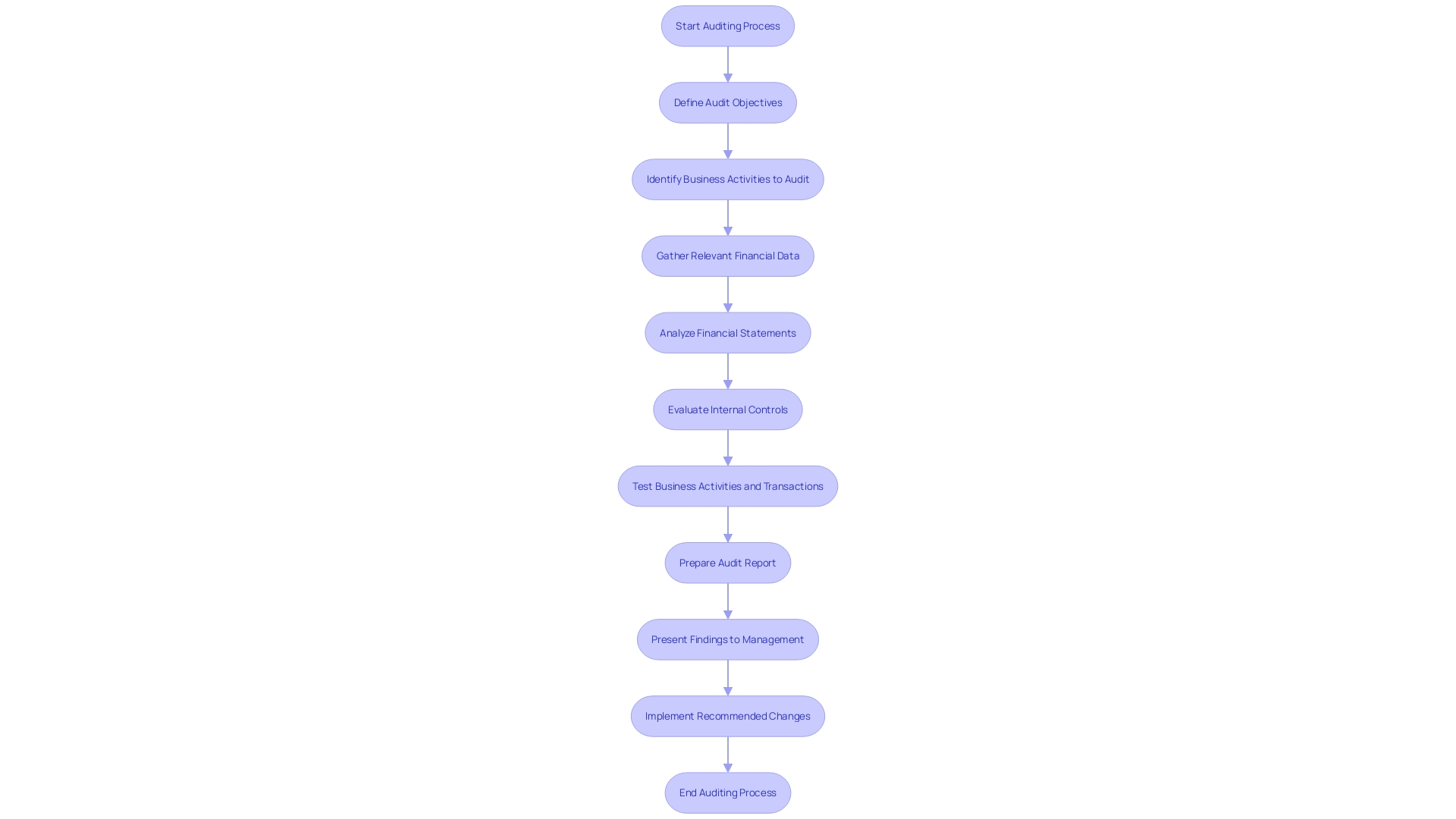

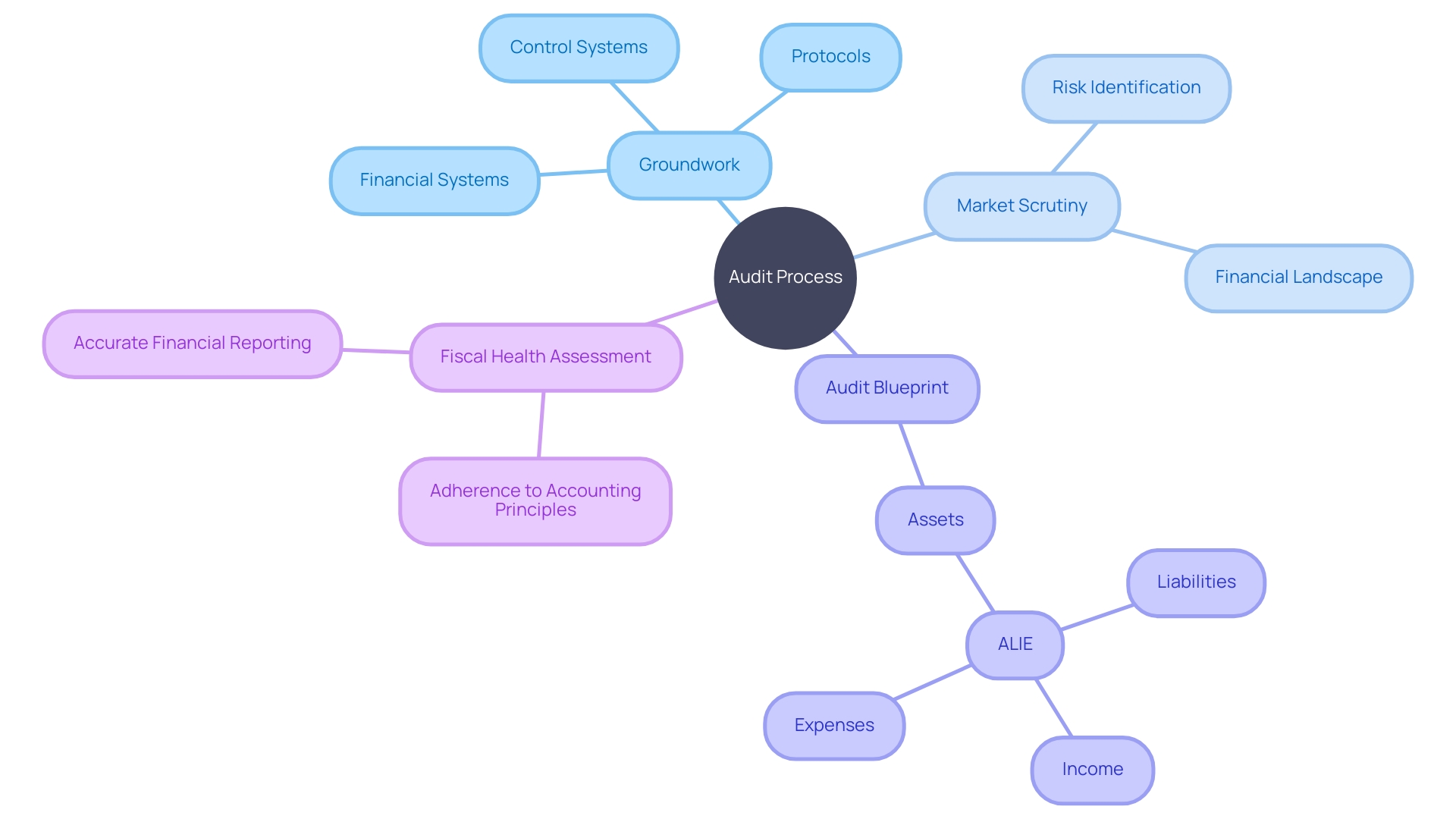

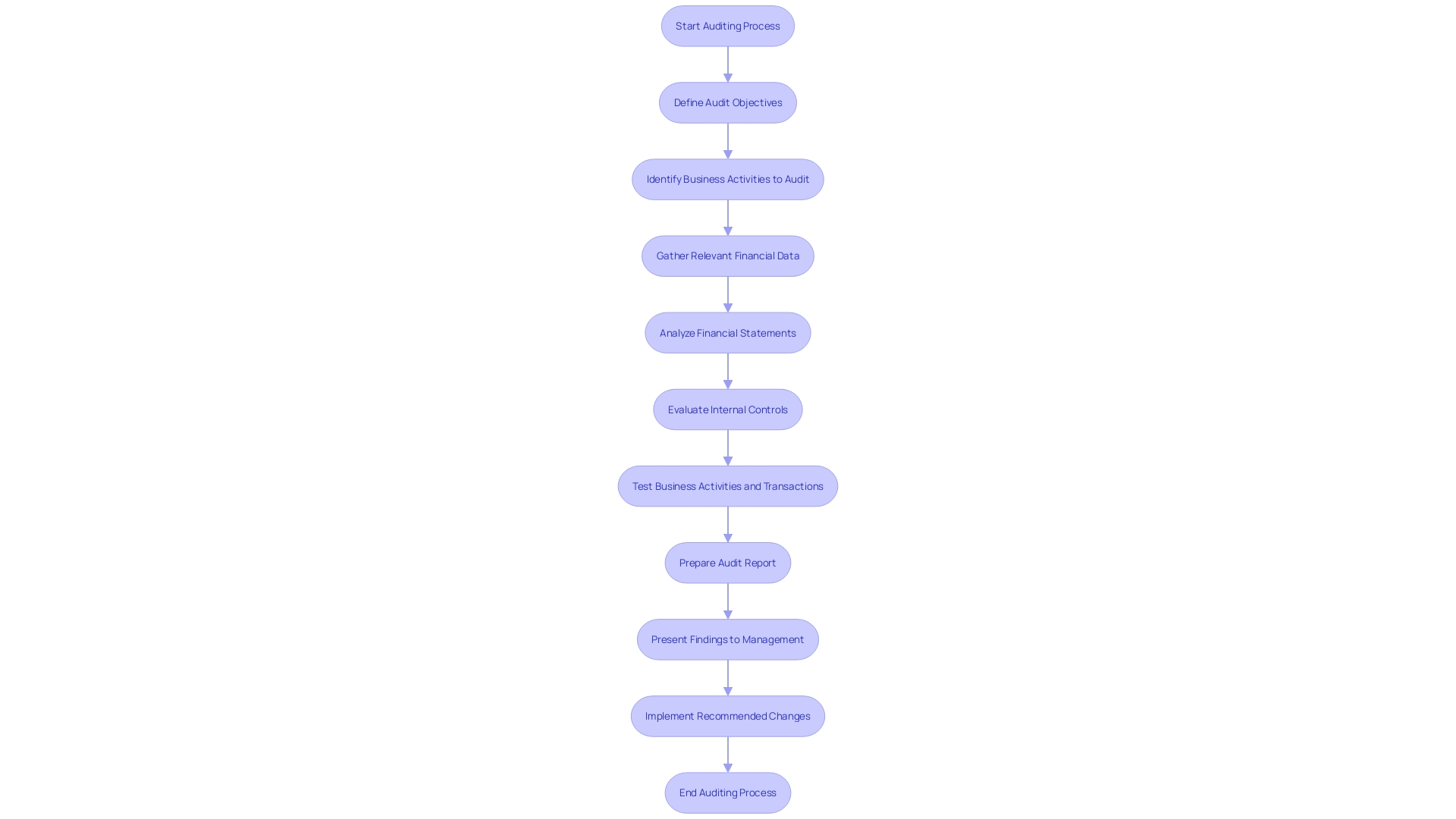

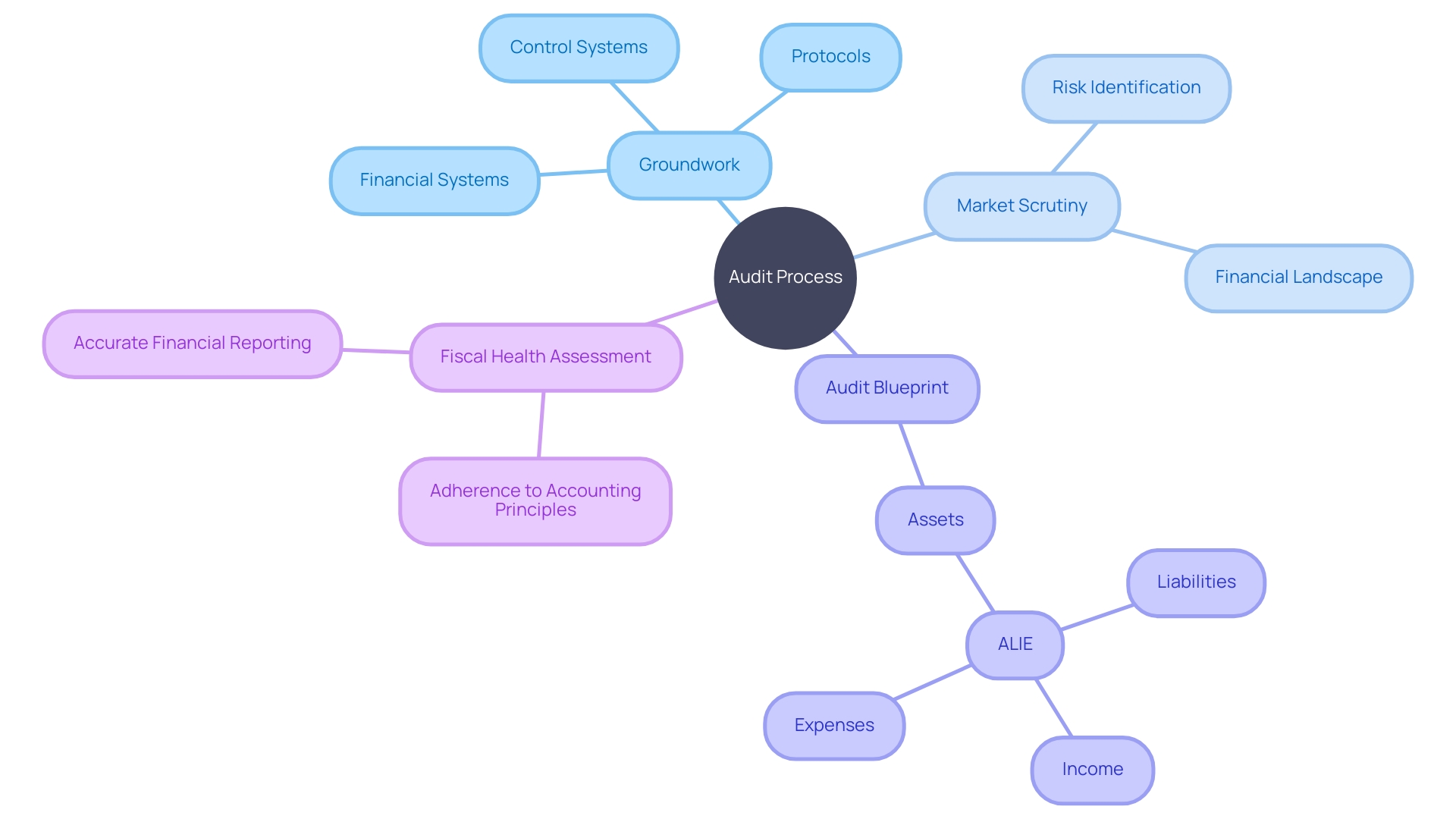

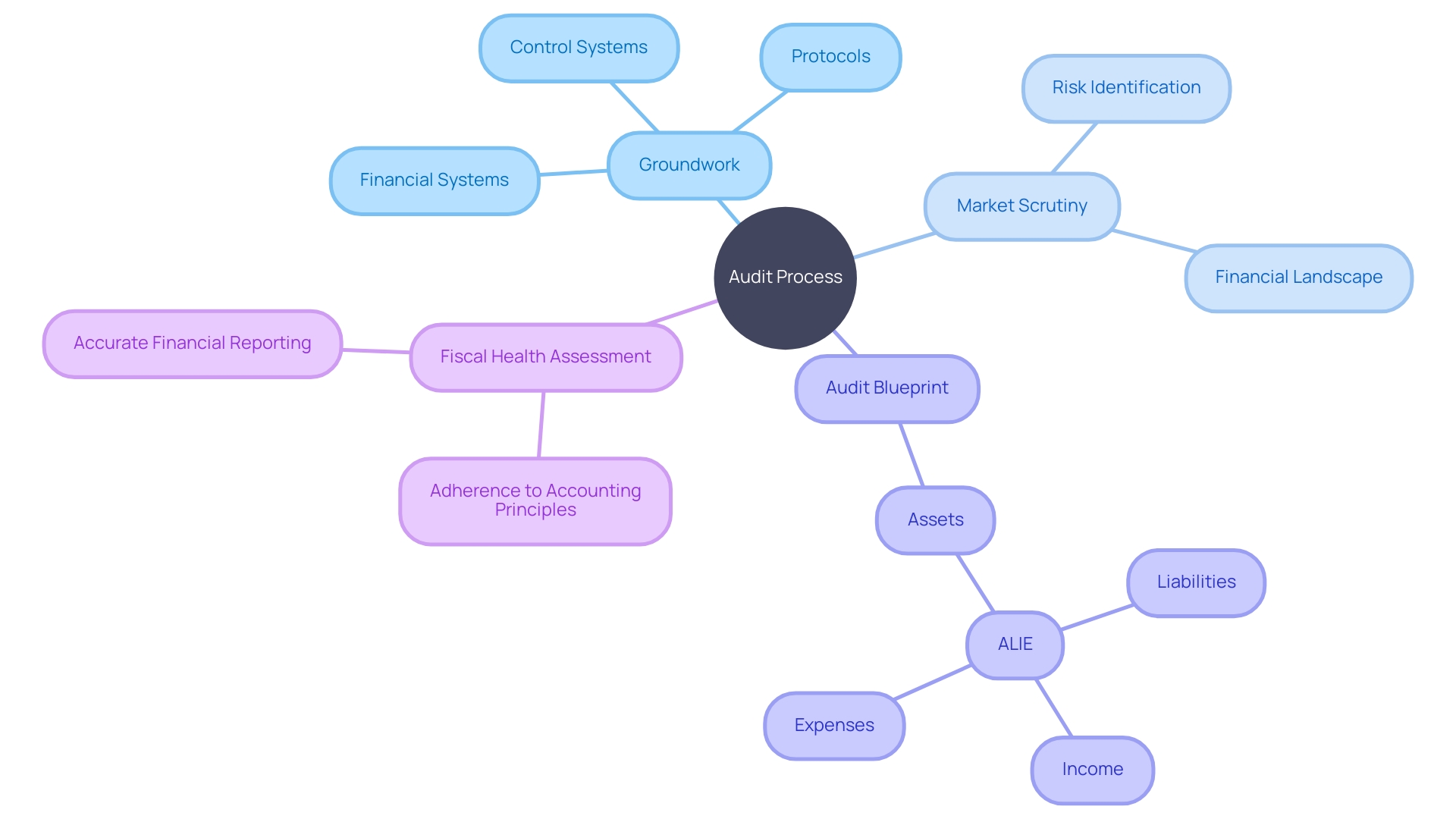

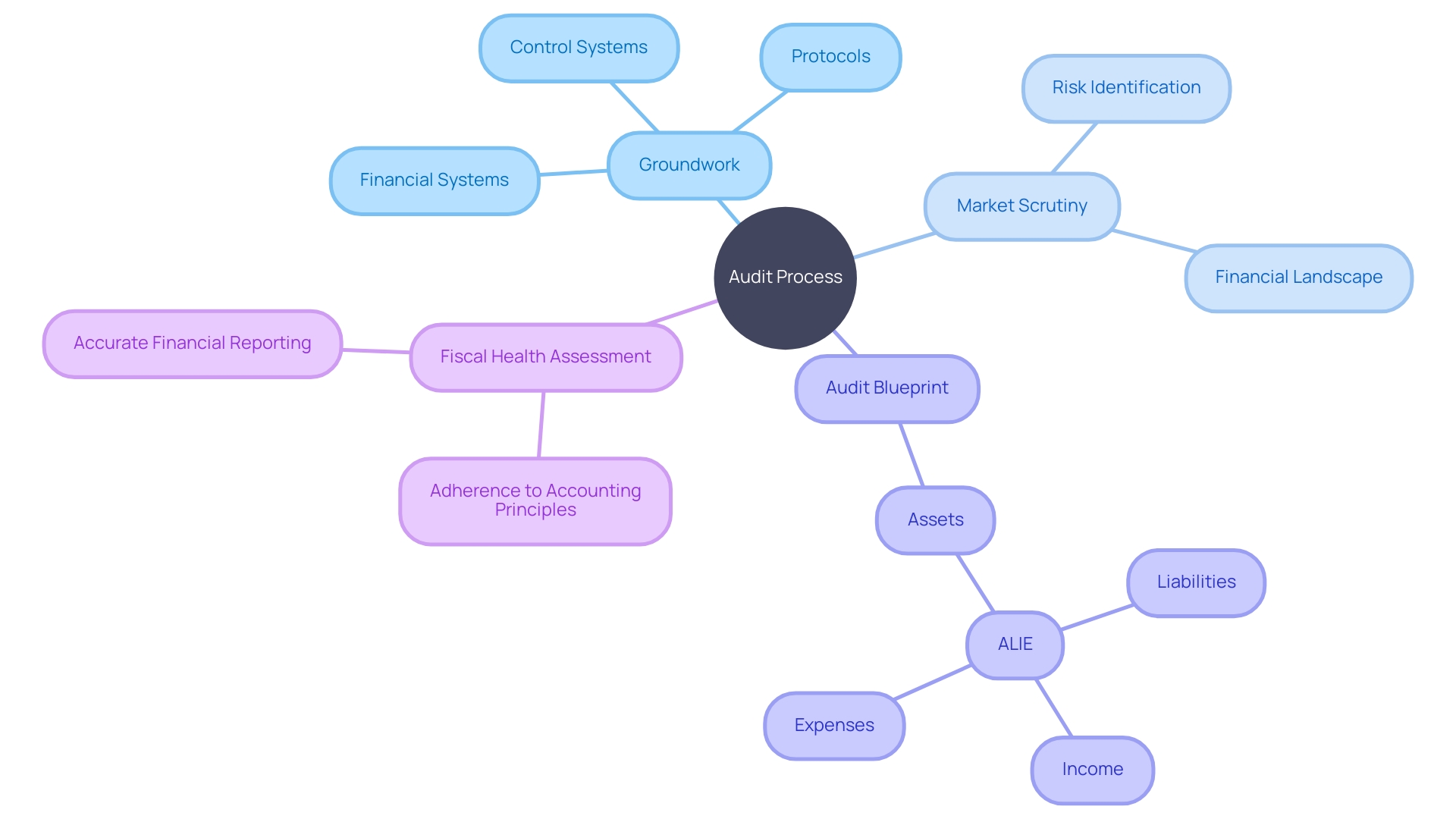

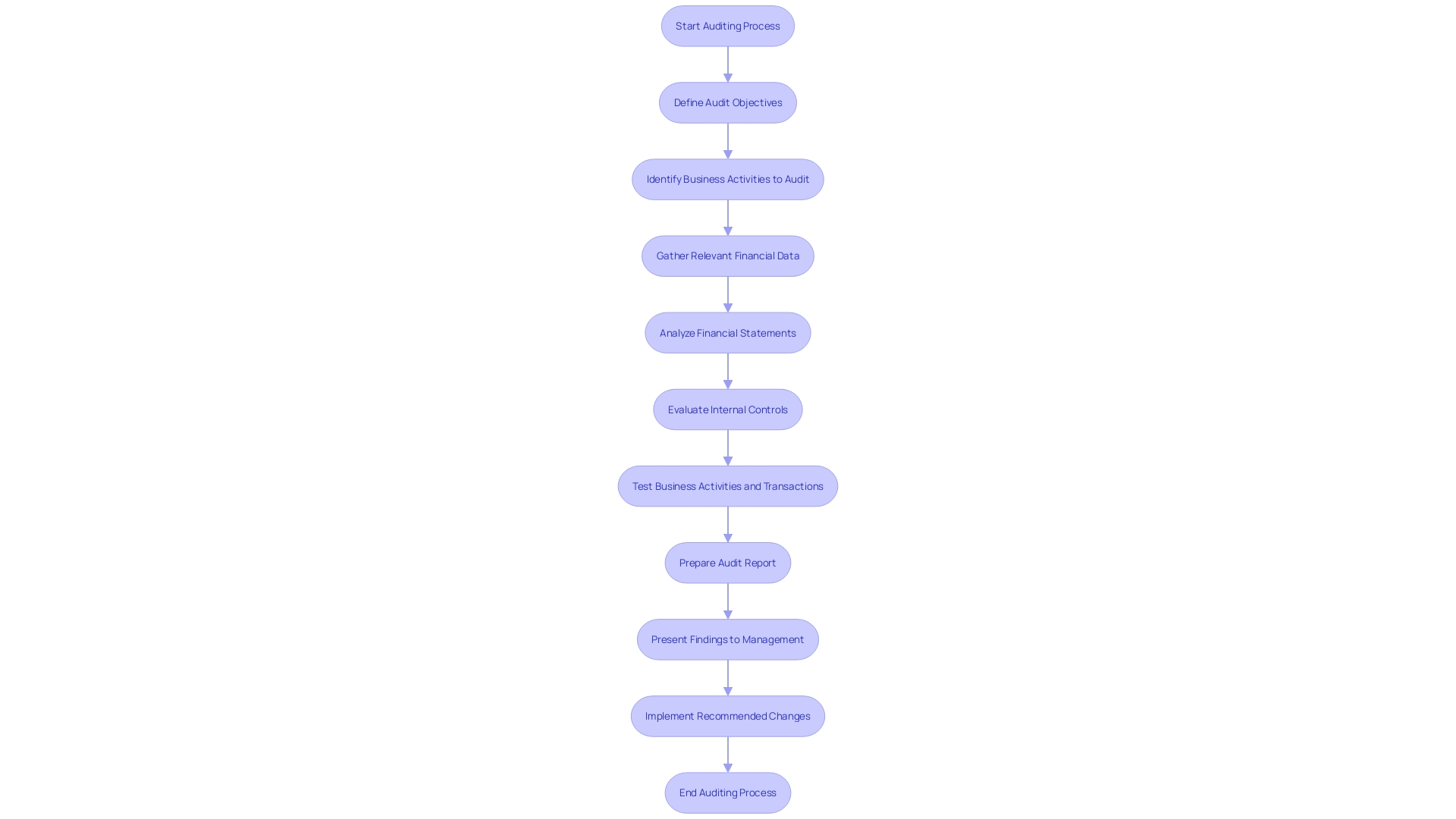

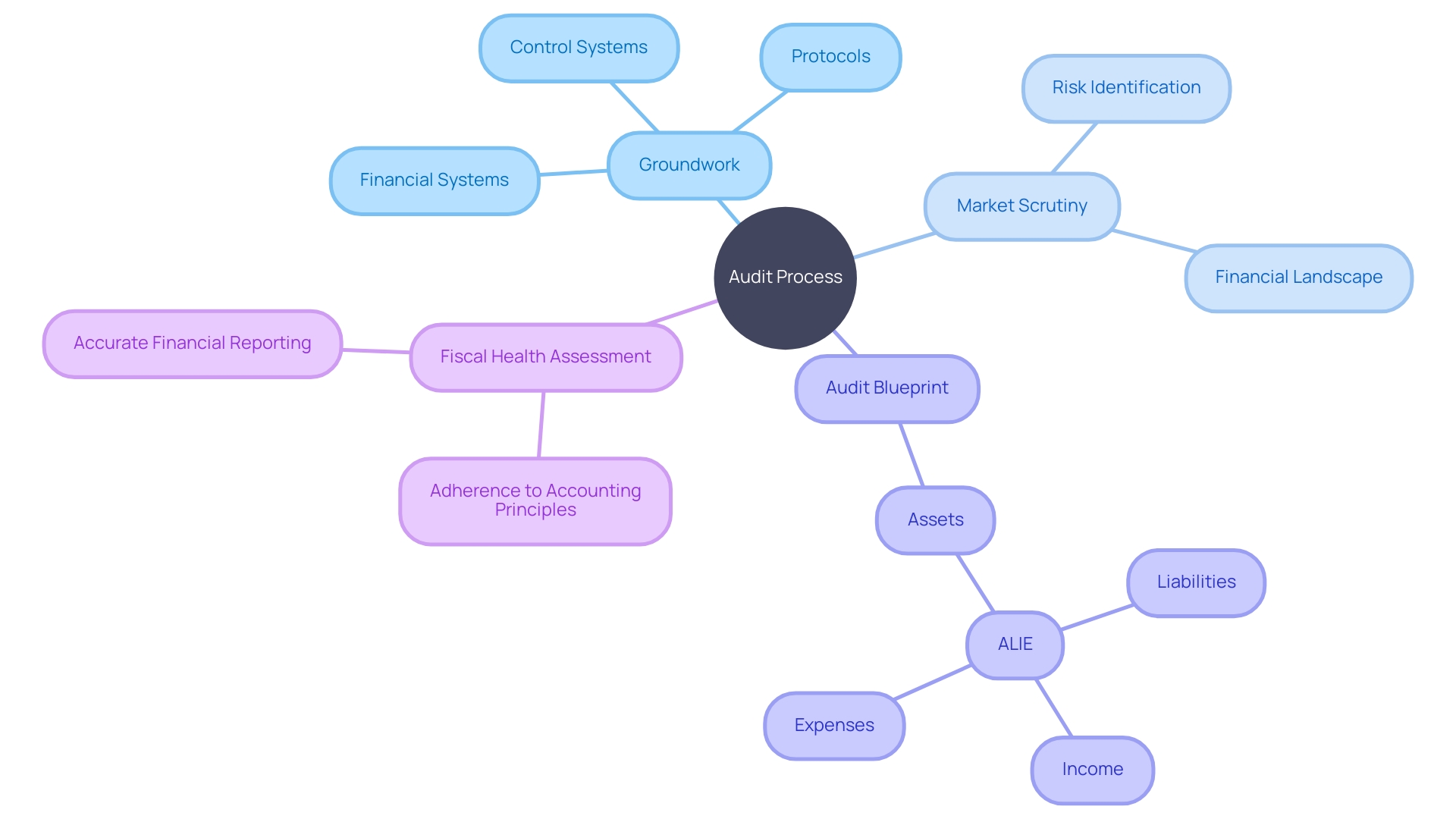

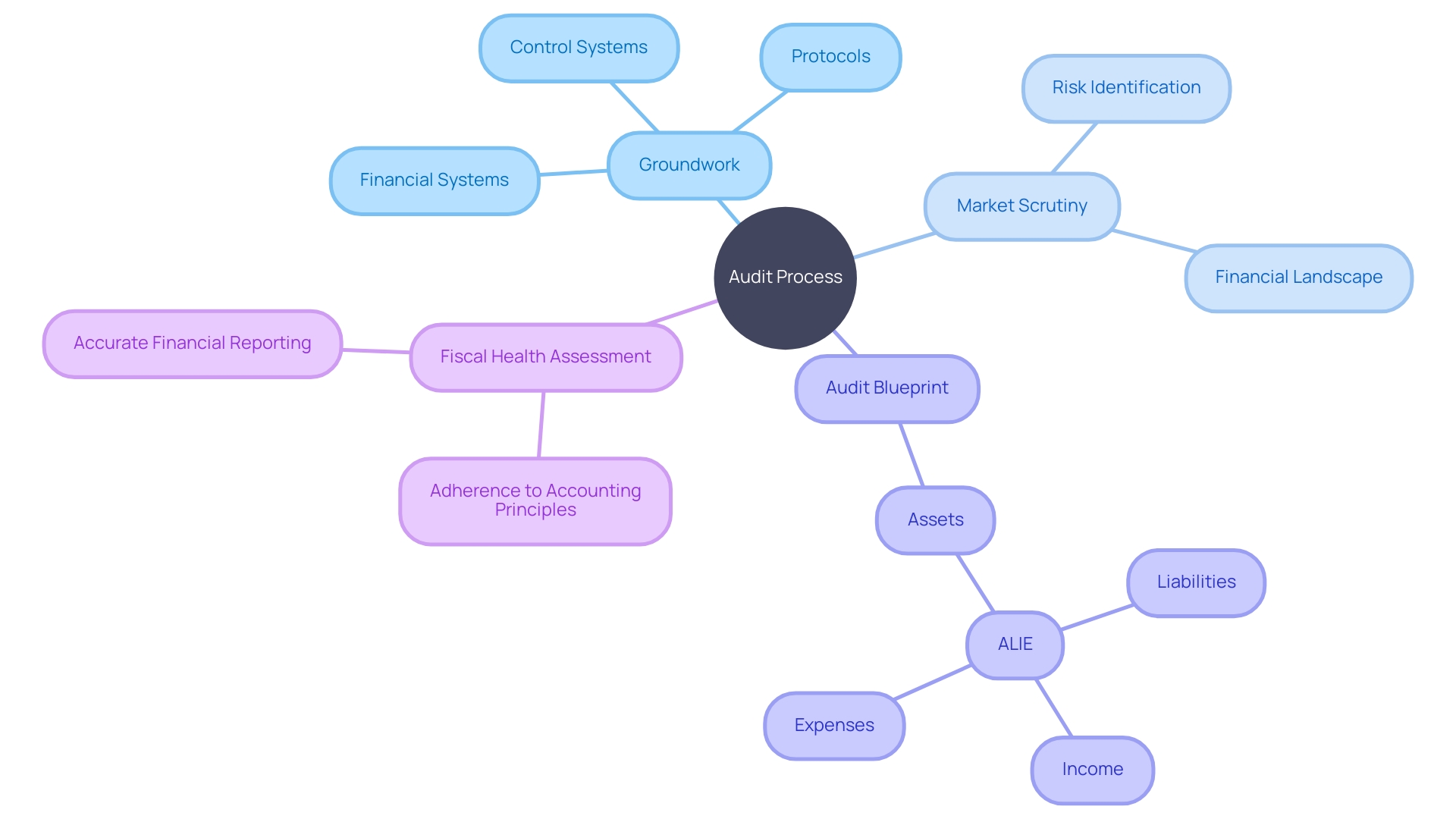

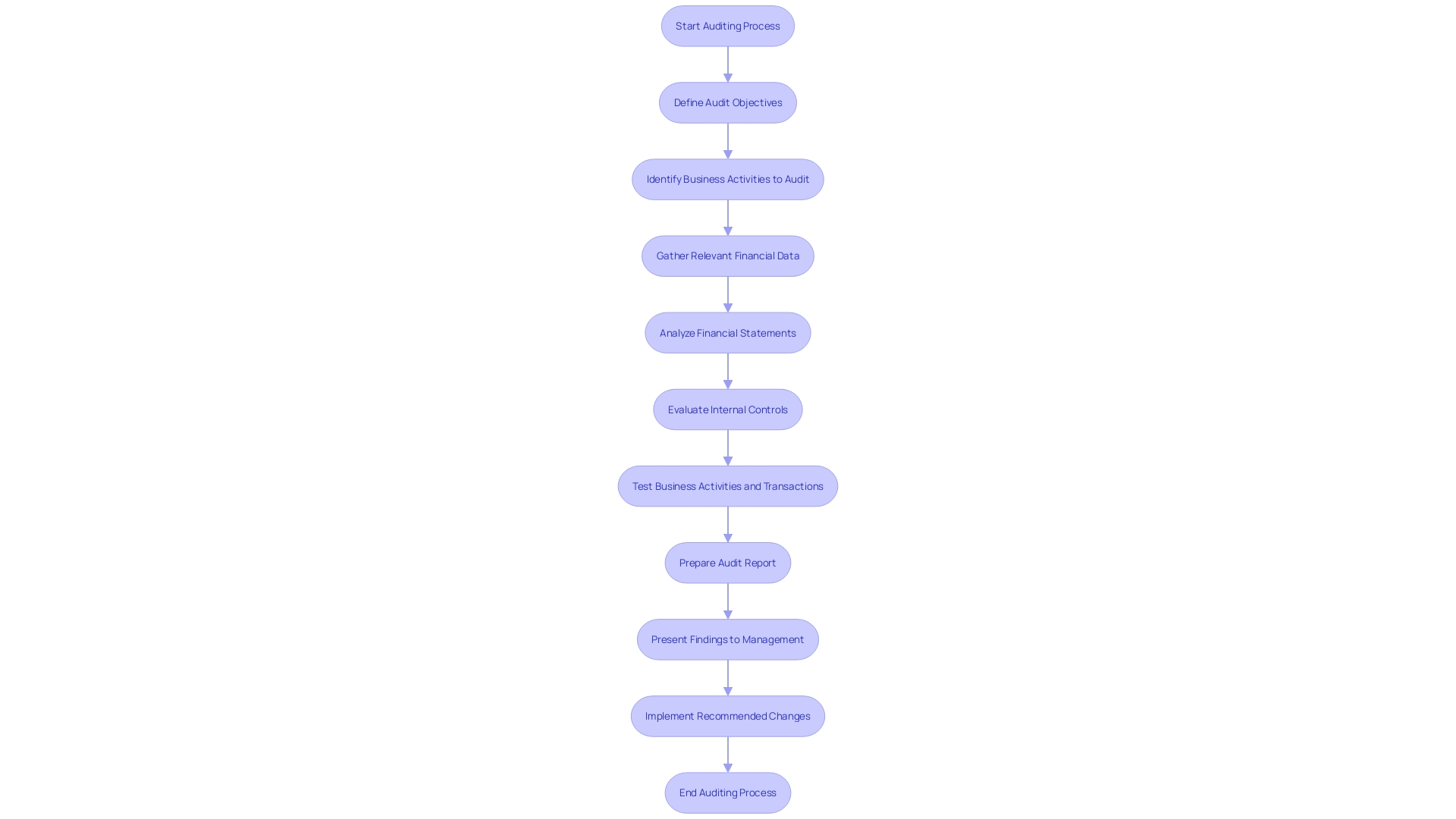

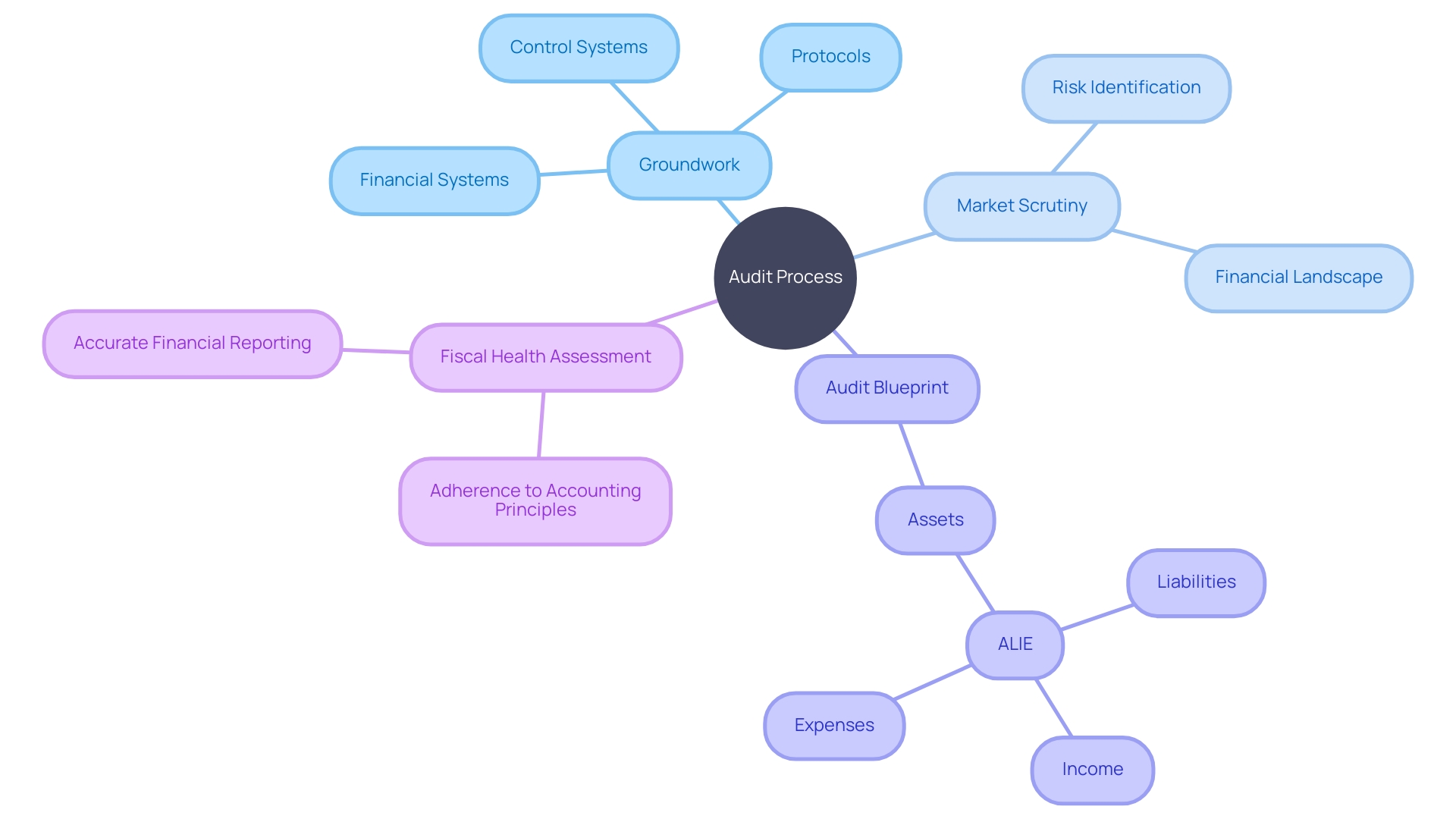

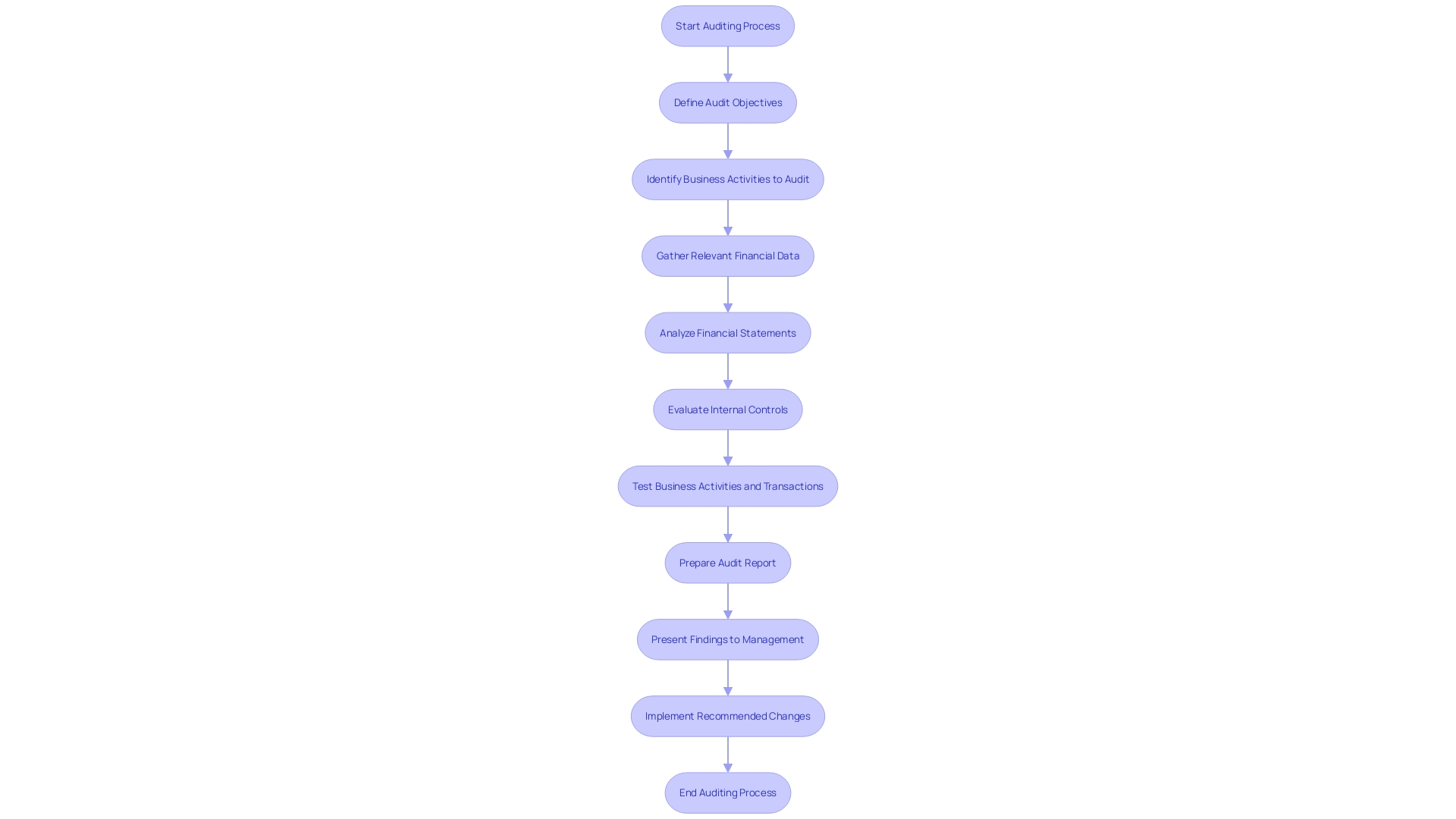

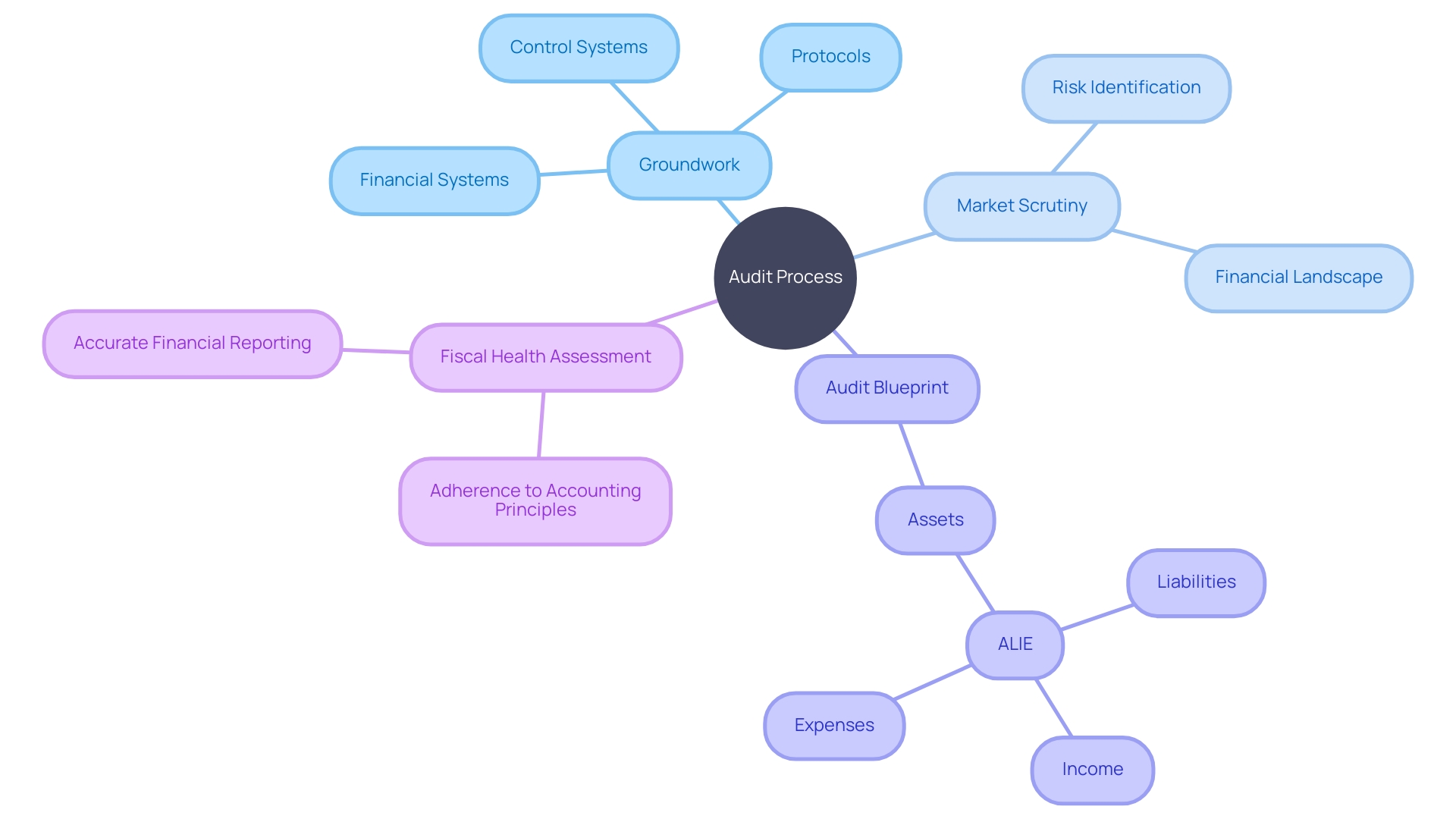

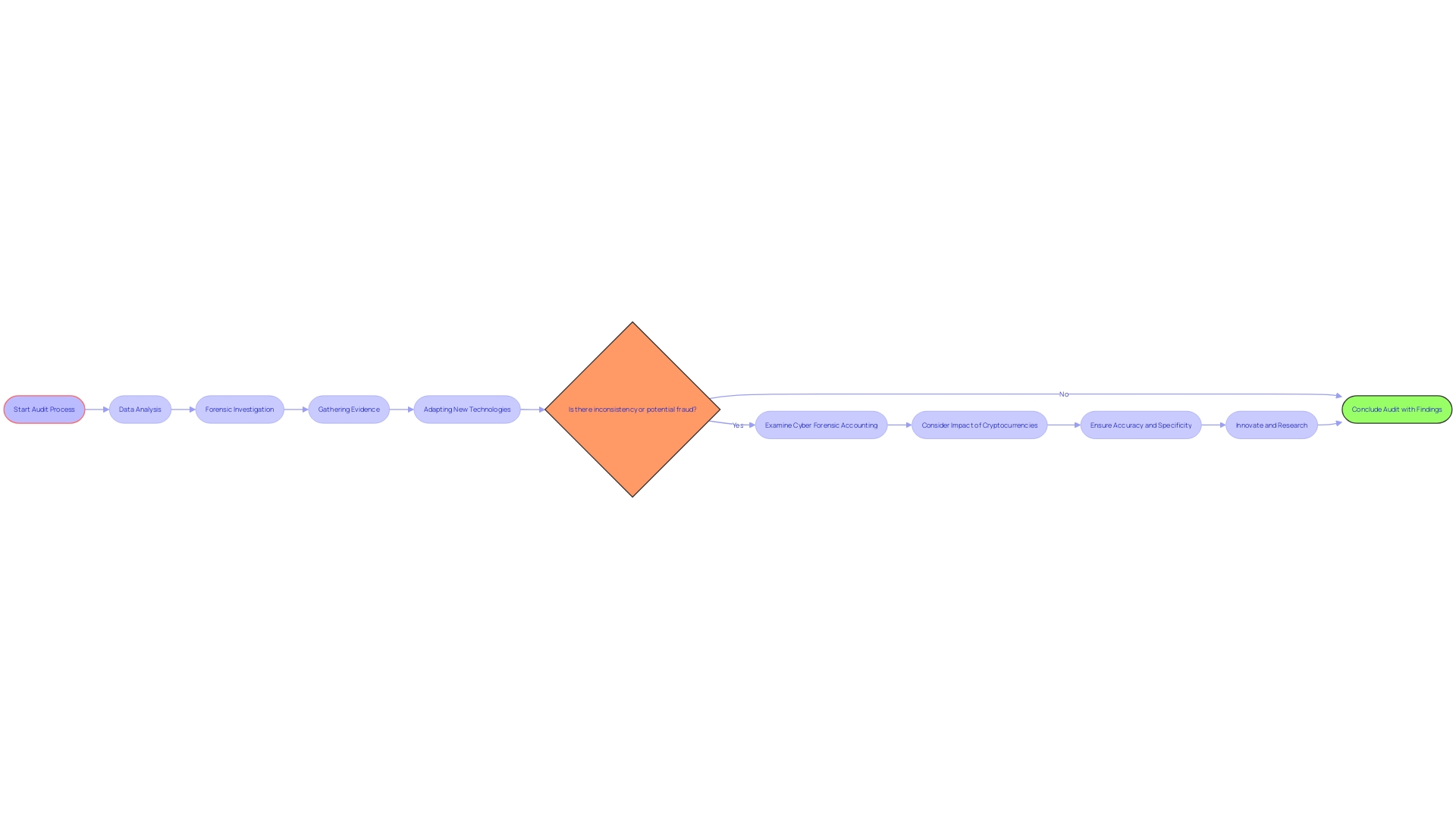

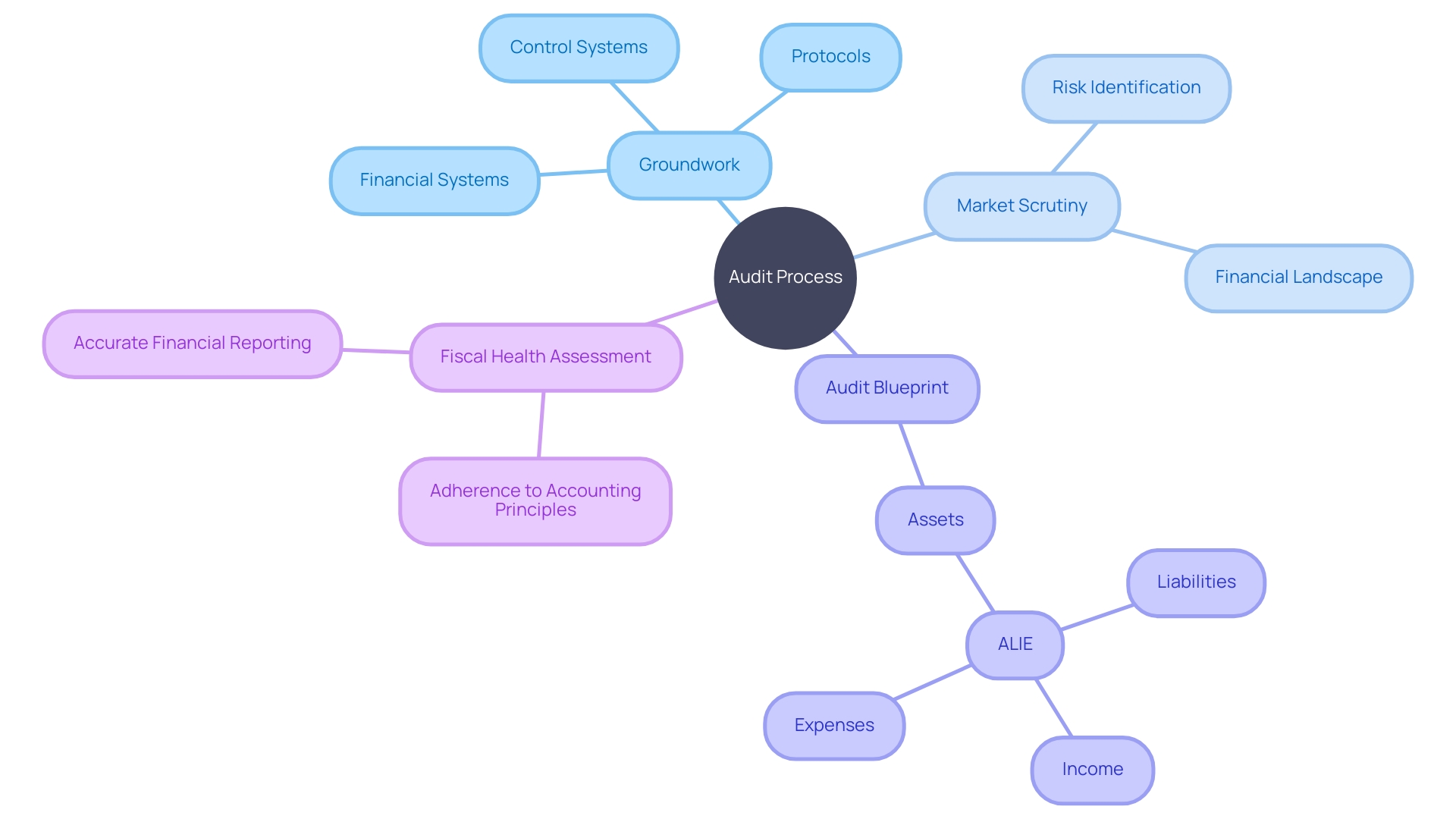

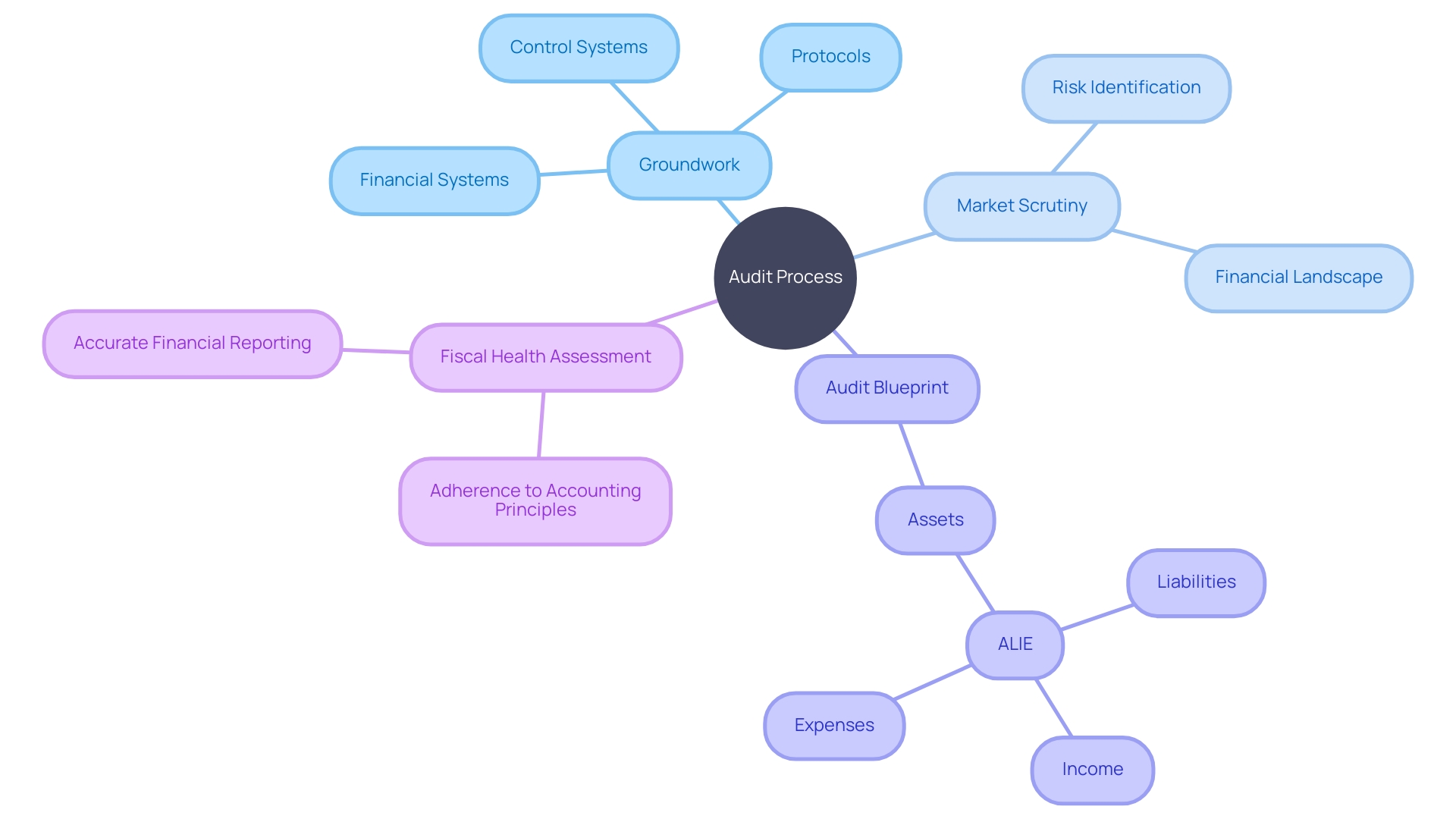

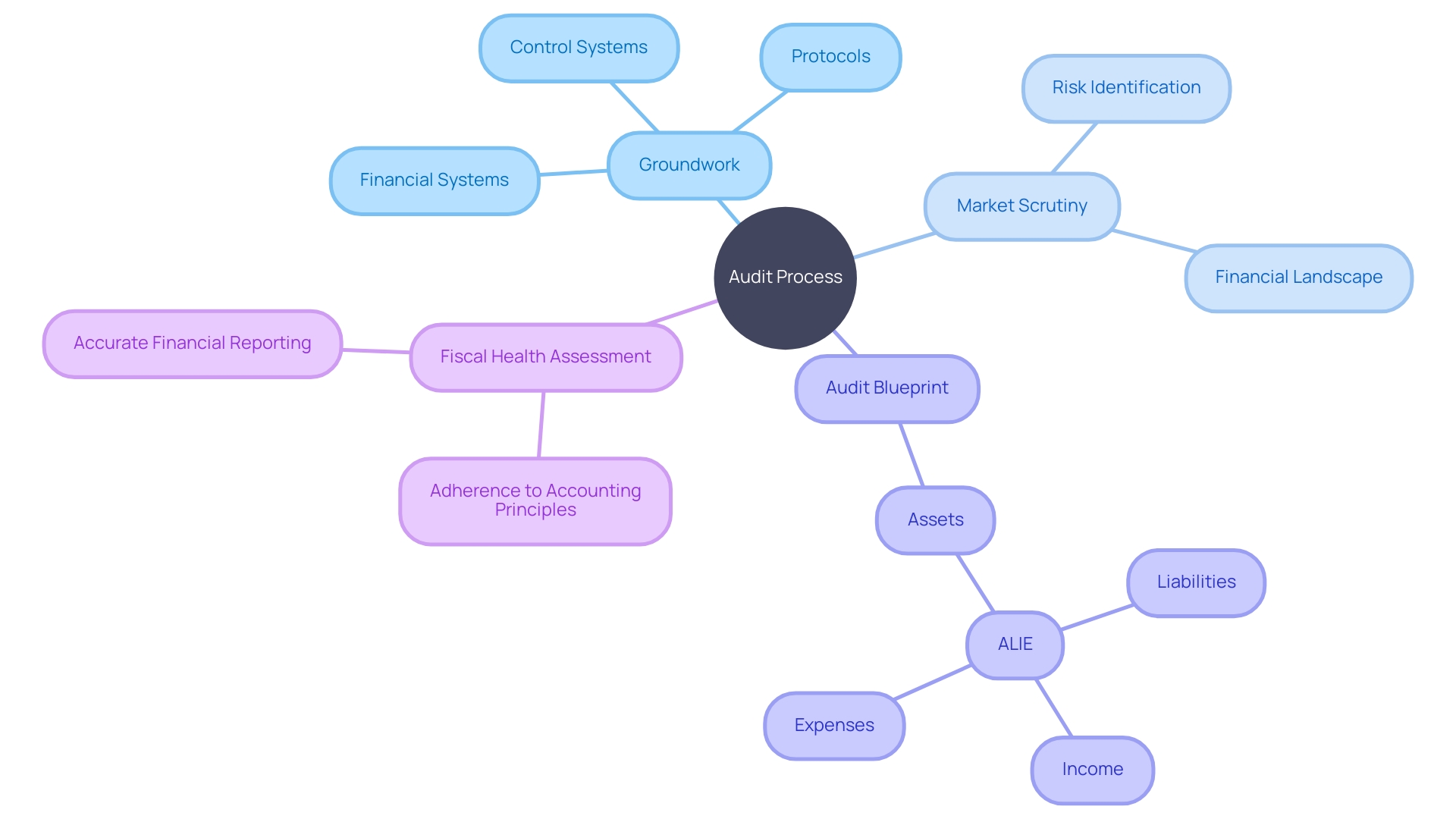

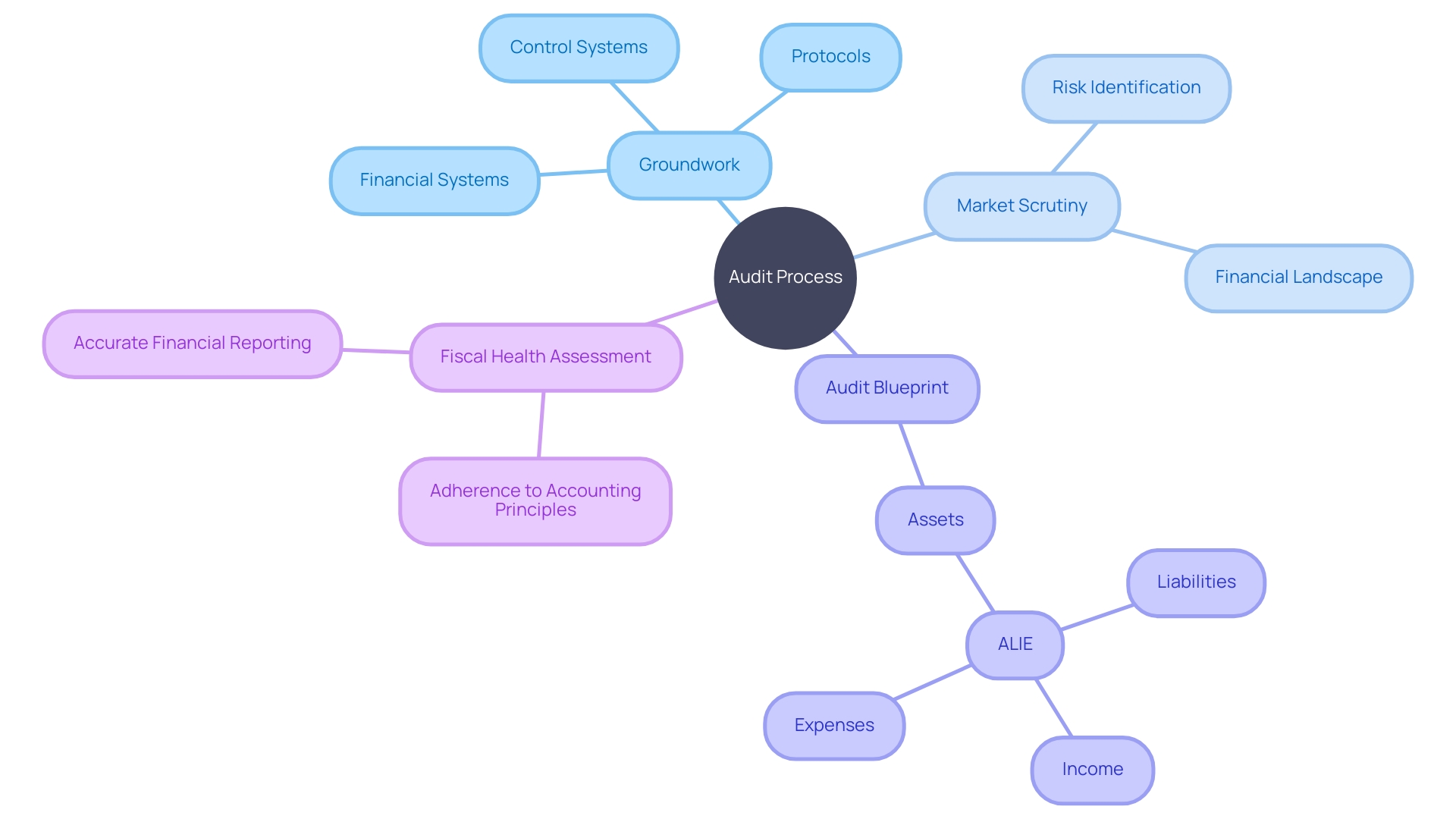

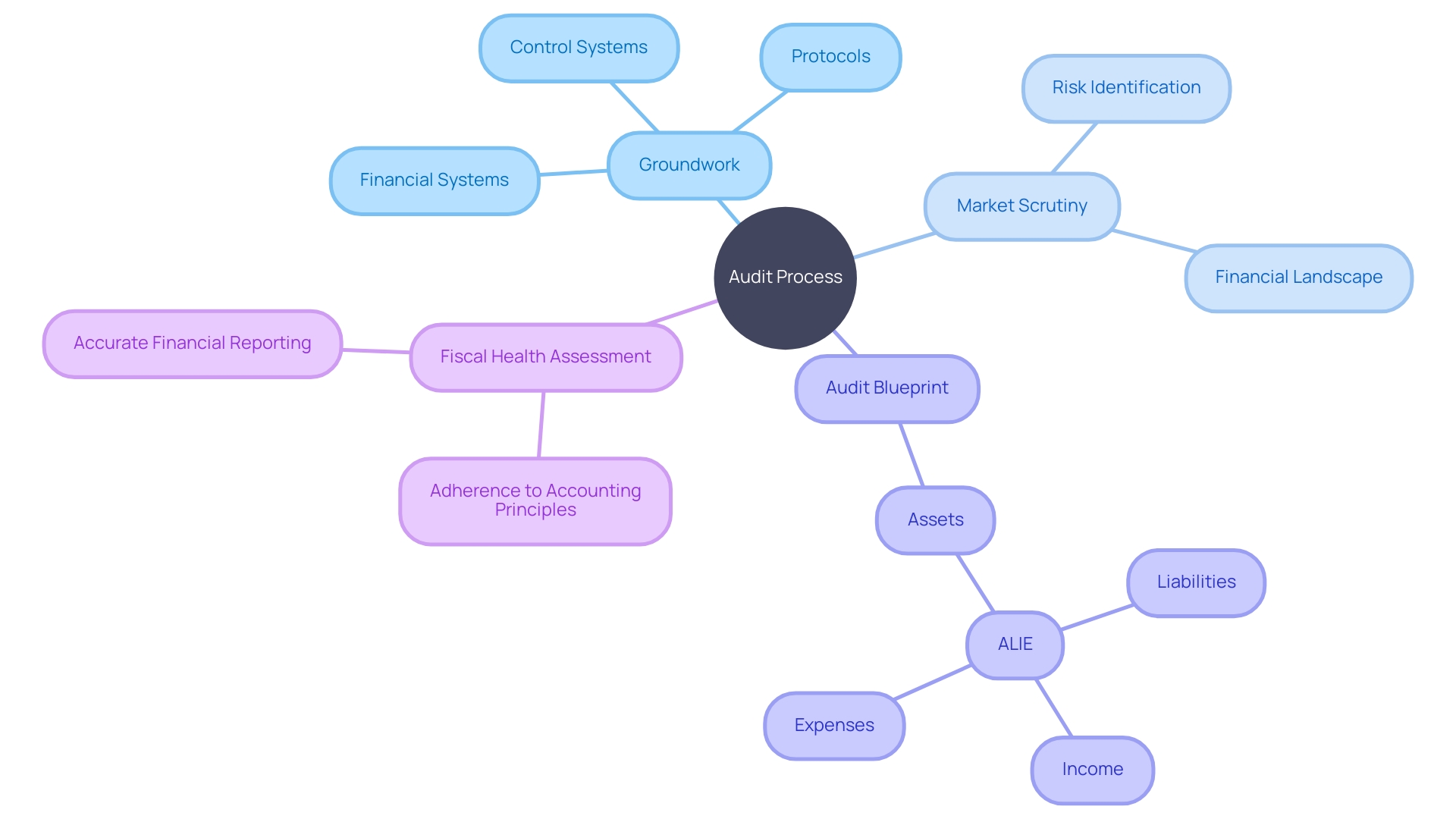

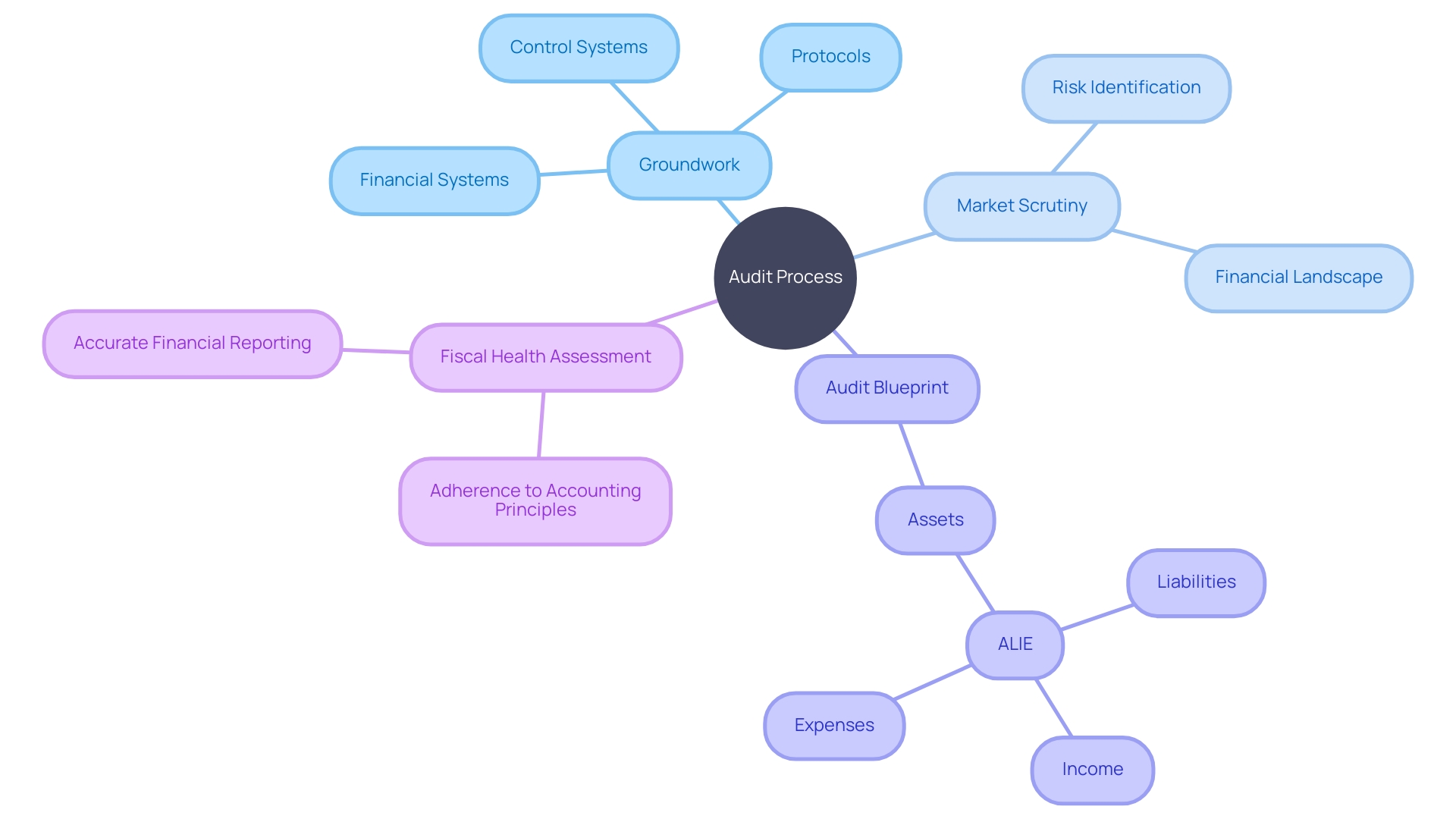

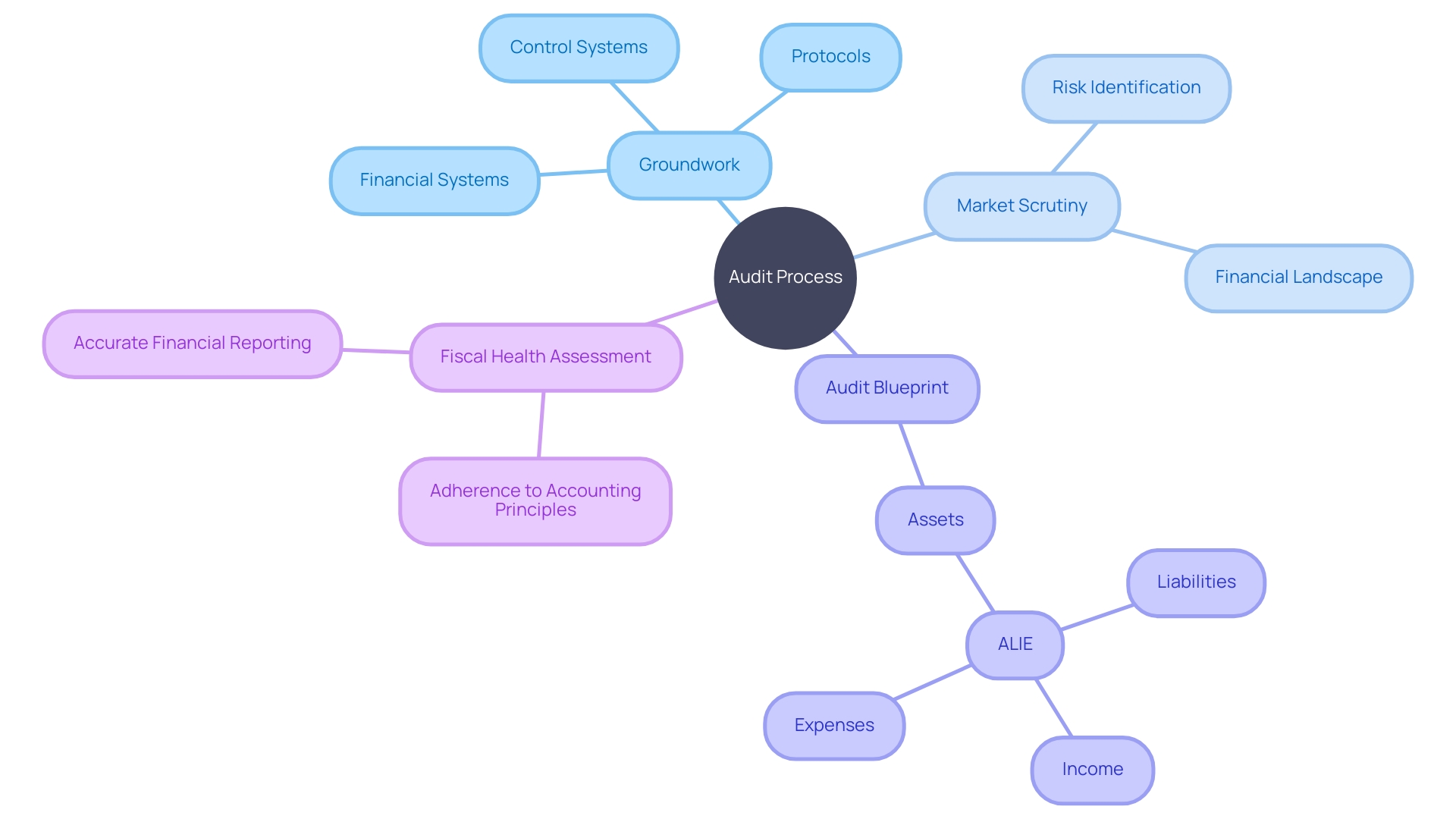

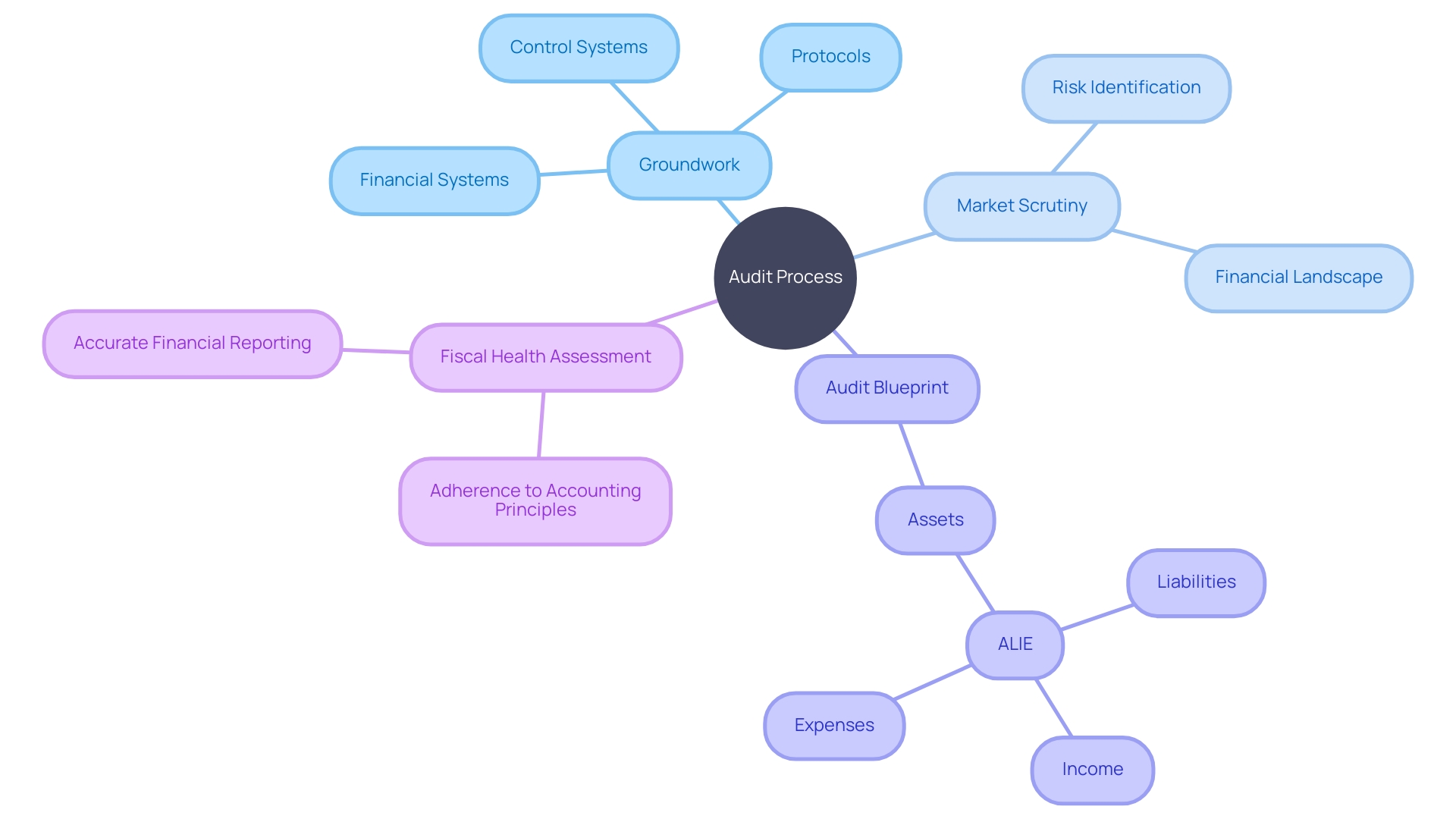

At the outset of the auditing journey, an intensive stage of groundwork and market scrutiny is initiated. During this period, auditors diligently compile a body of knowledge pertaining to the entity's fiscal mechanisms, protocols, and control systems.

They meticulously dissect the financial landscape to pinpoint areas susceptible to risk, meticulously crafting the boundaries of the audit's purview. The resultant stratagem is an expansive audit blueprint designed to navigate and scrutinize the intricate details of the entity's financial narratives.

It is here that the auditor's adroit understanding of Assets, Liabilities, Income, and Expenses (ALIE)—the core pillars of fiscal assessment—comes into play, ensuring a holistic appraisal of the organization's fiscal health. This preparedness not only sets the tone for an effective audit but also becomes an indispensable resource for reporting to stakeholders. The meticulously devised plan establishes the imperative deadliness and accounting frameworks necessary to align with generally accepted accounting principles (GAAP) or other comprehensive accounting bases, offering clarity and precision in financial reporting.

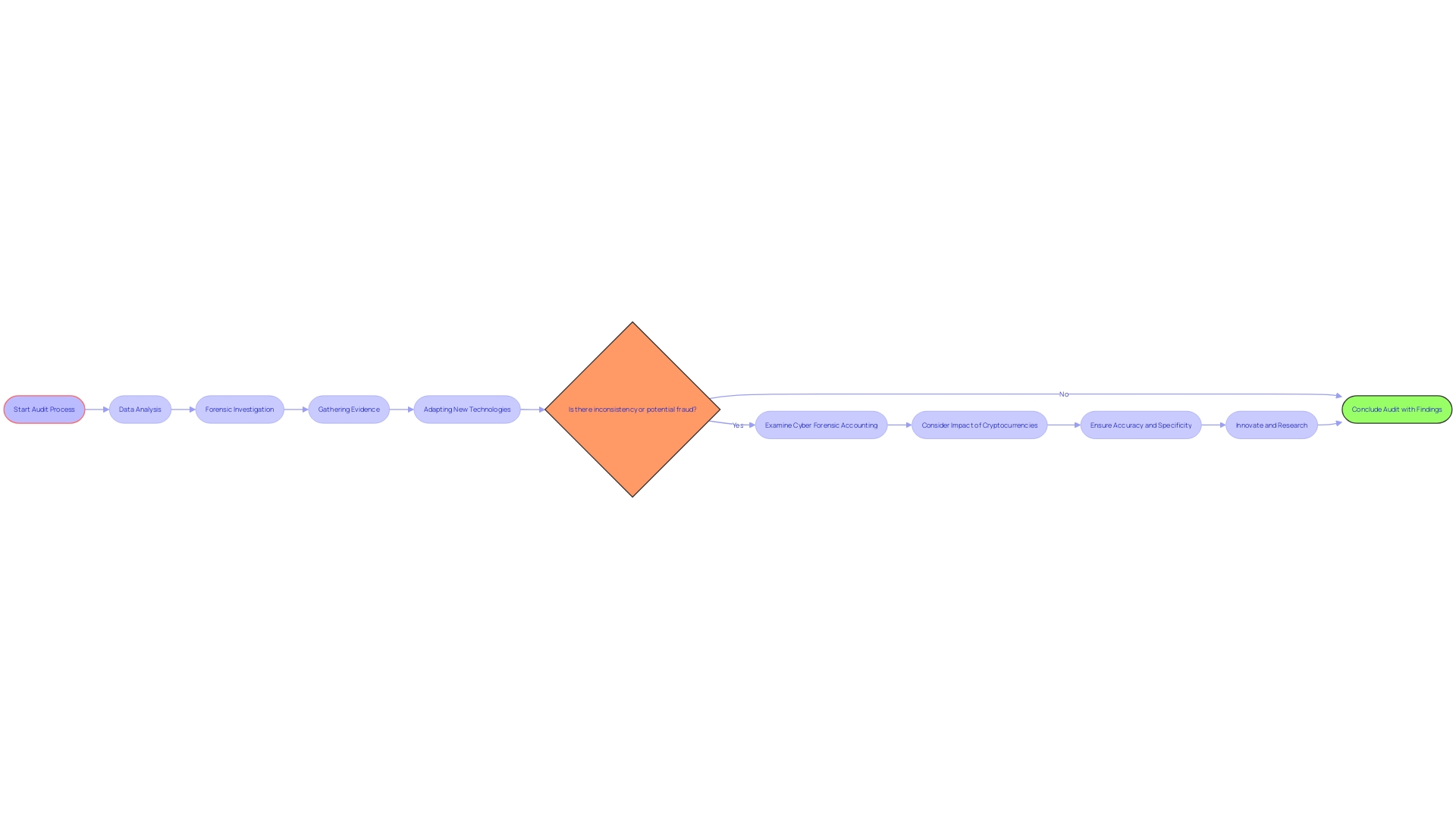

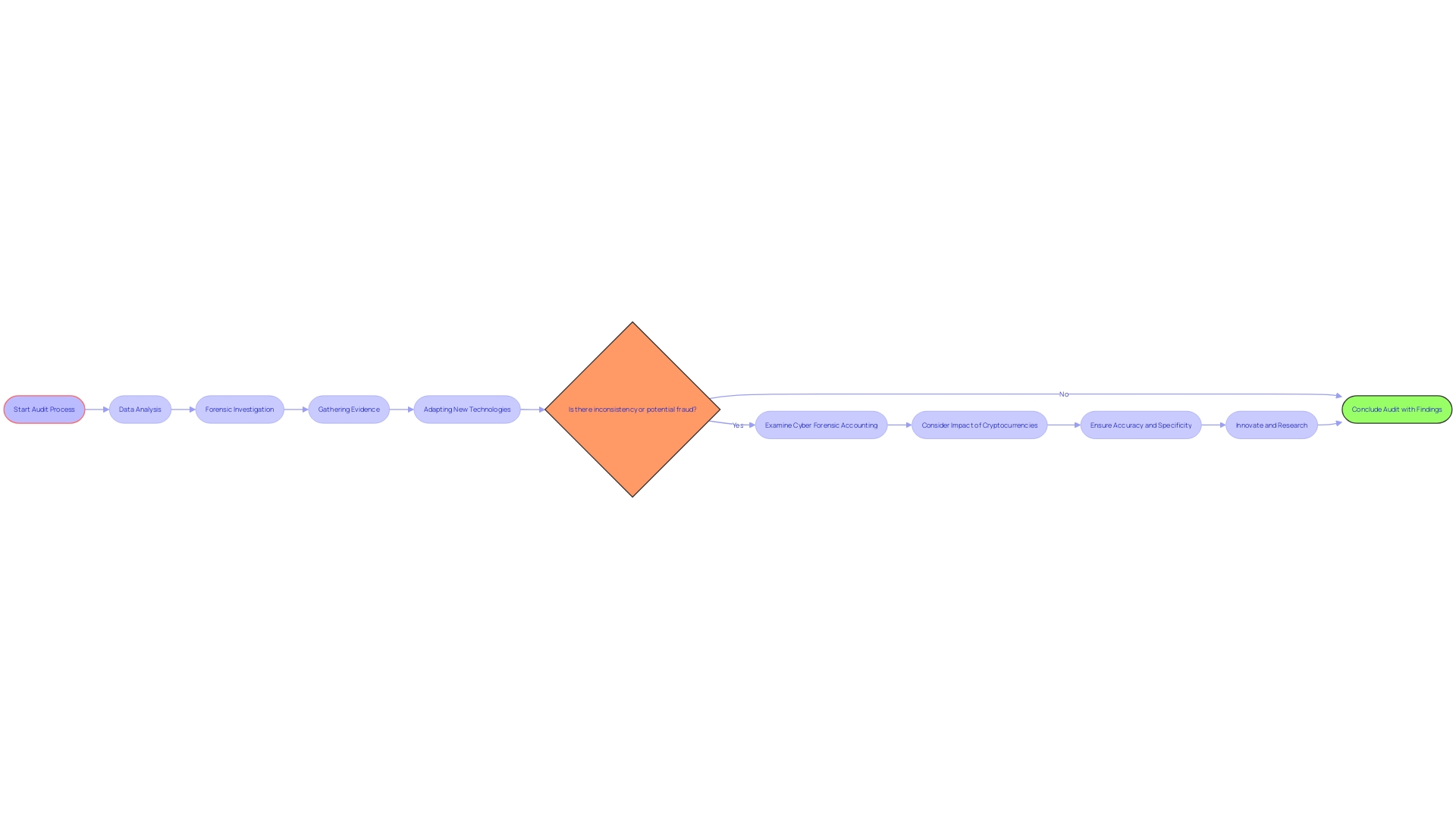

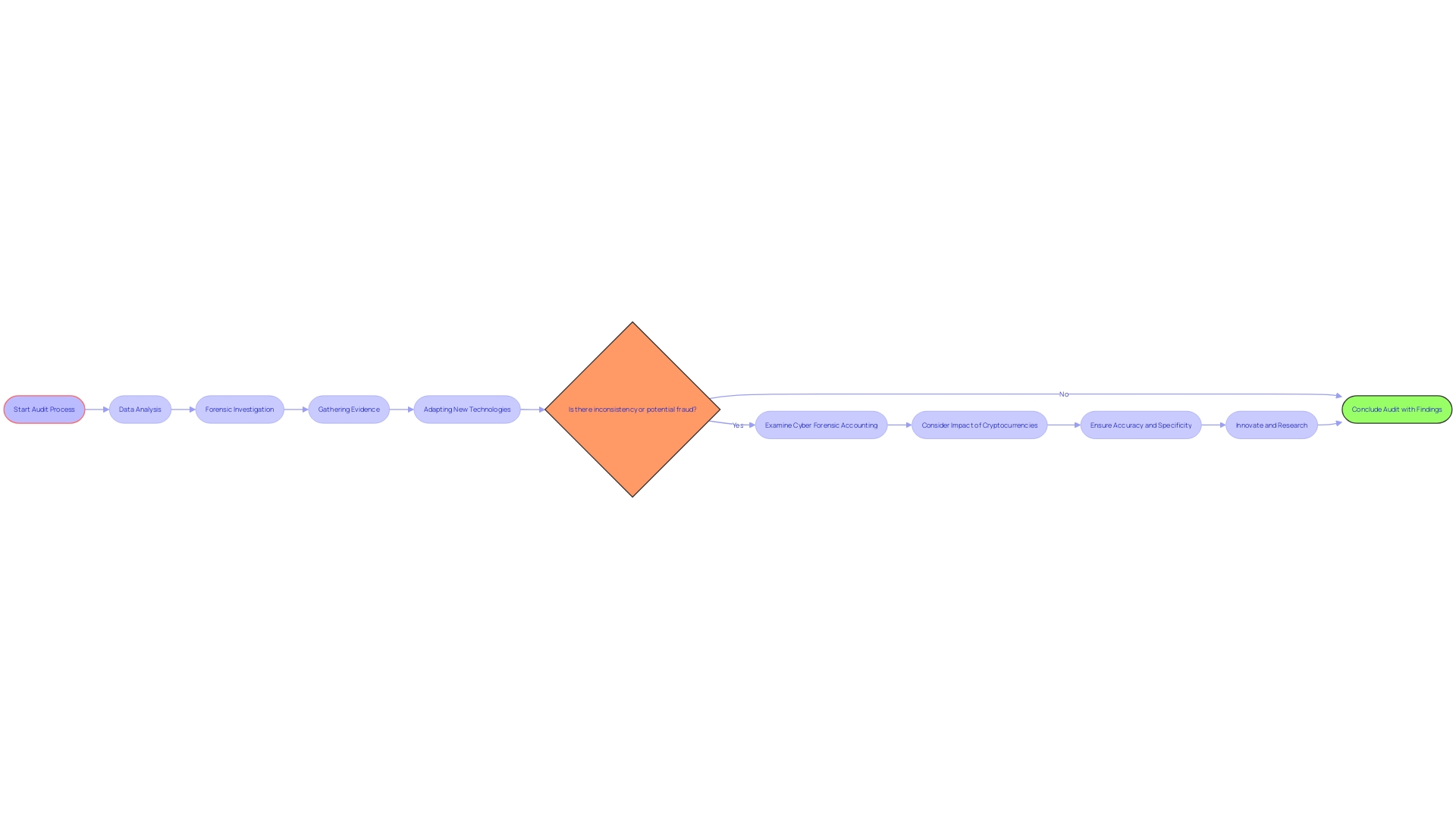

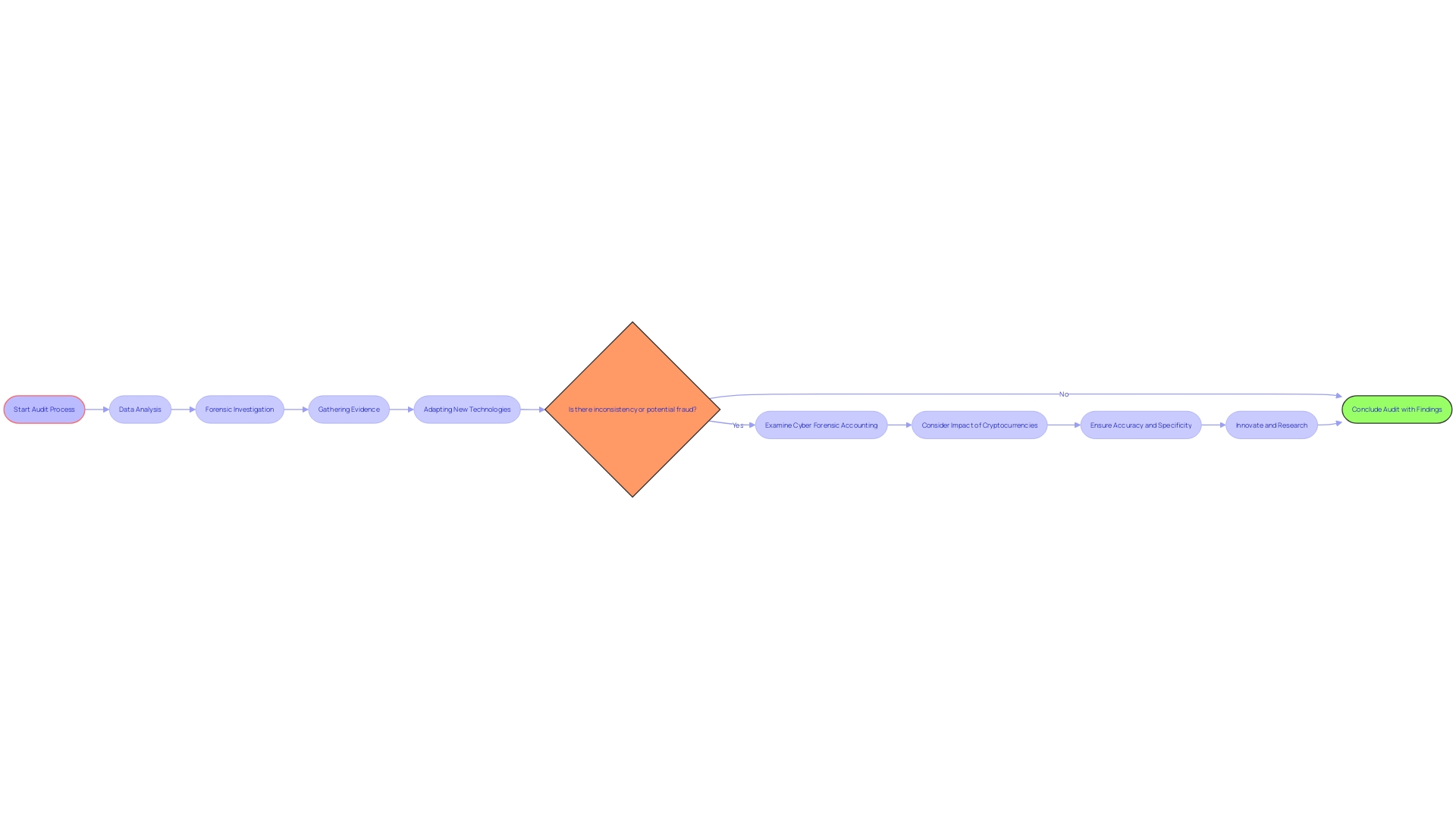

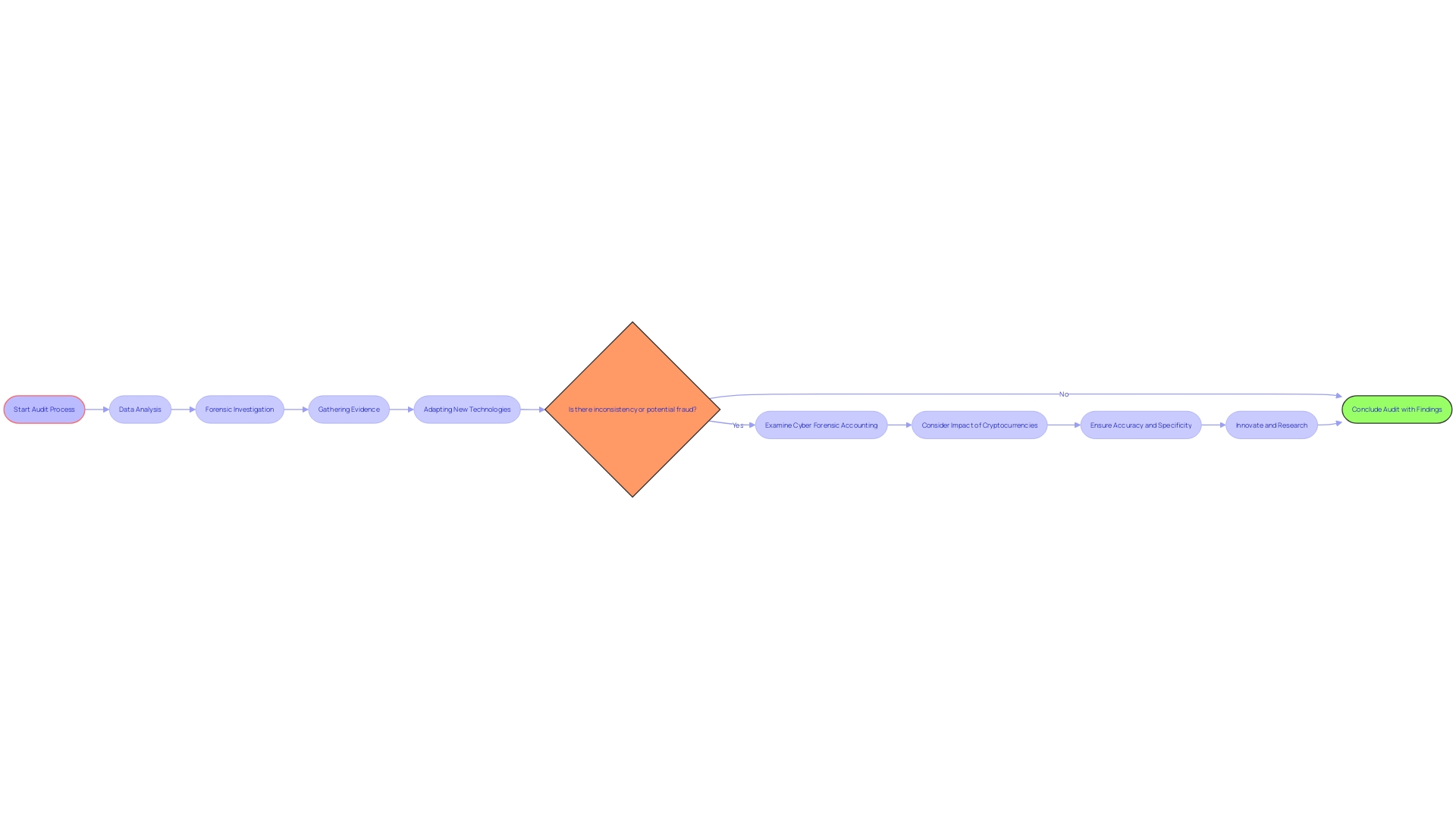

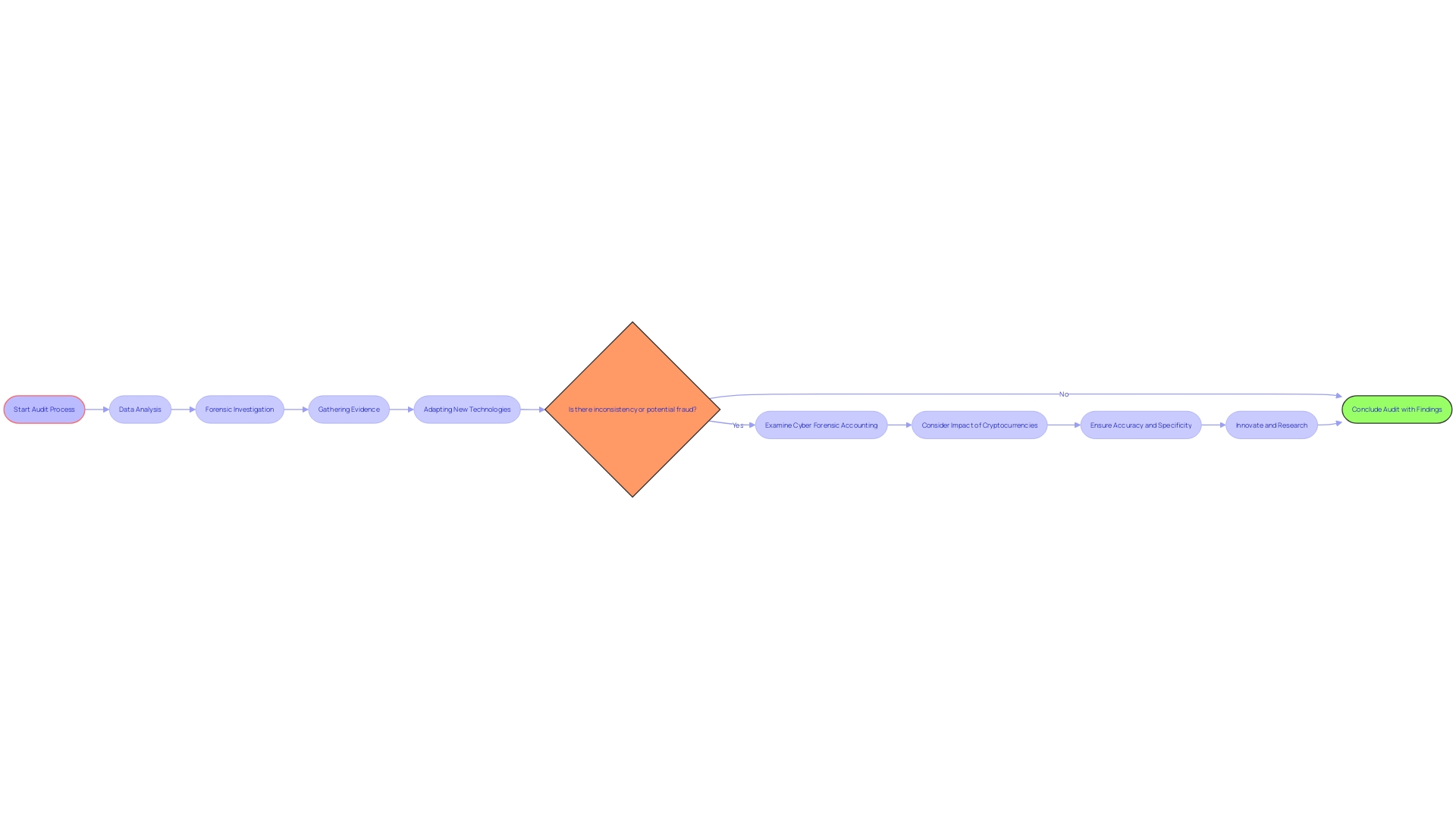

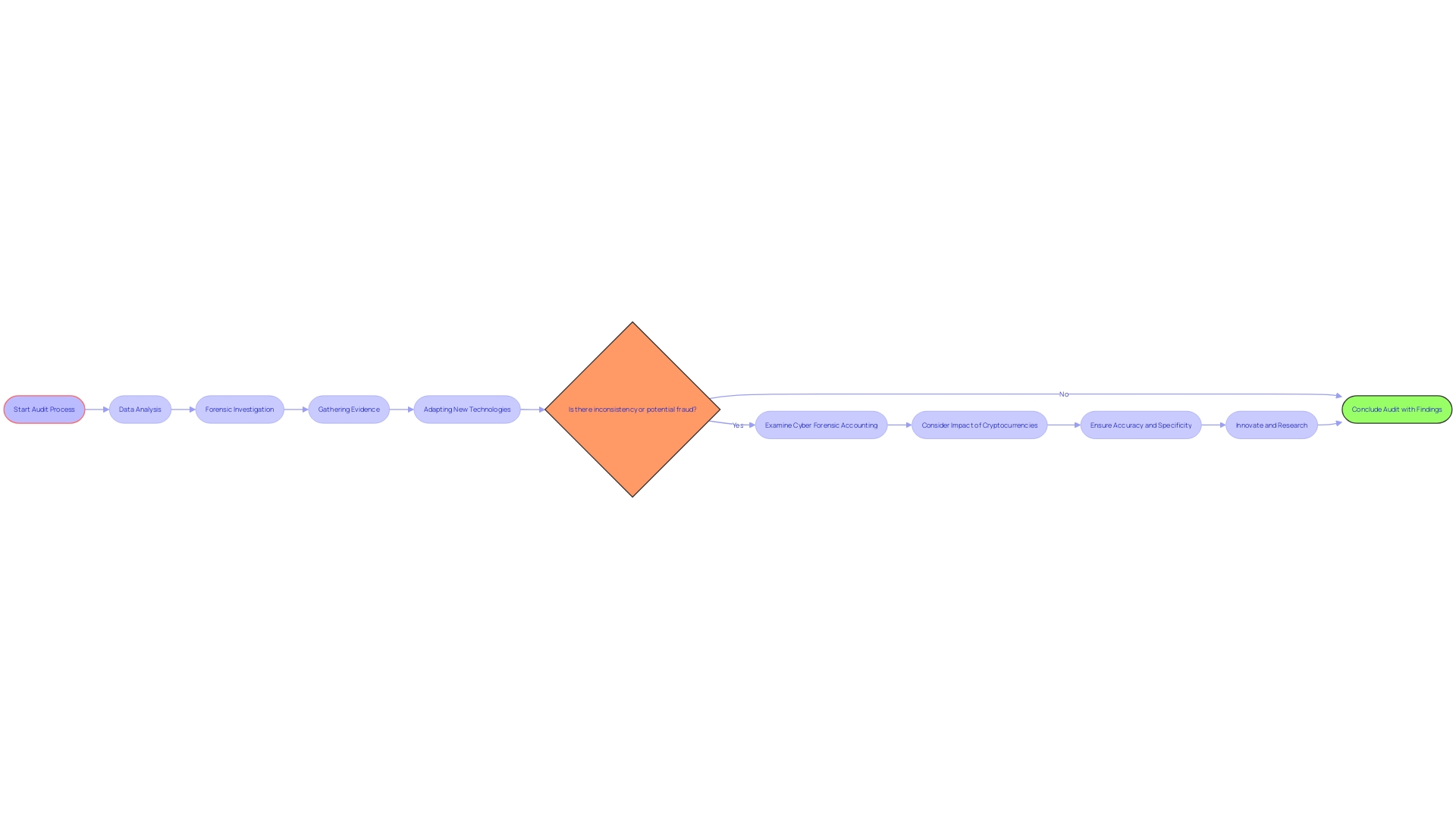

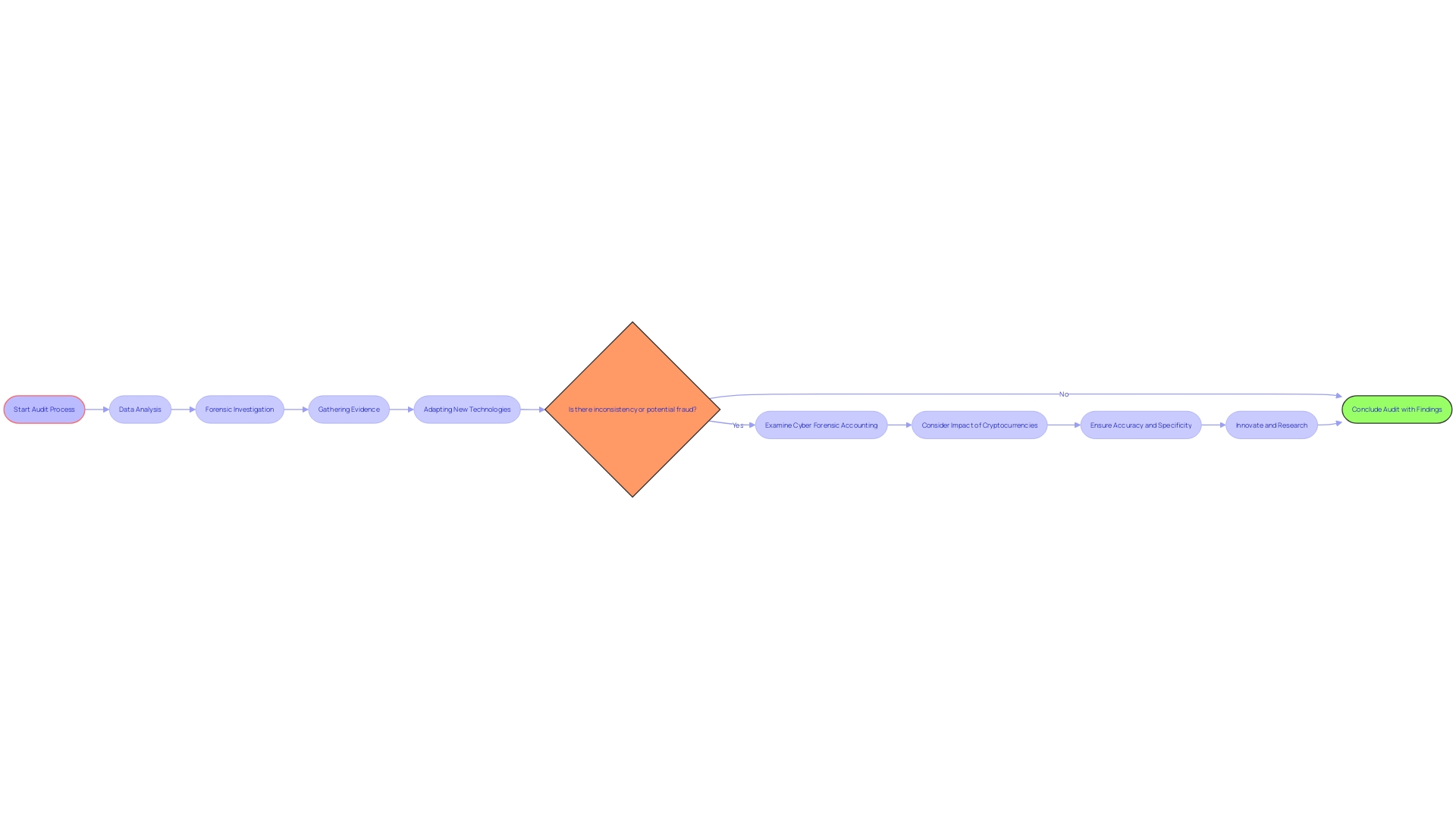

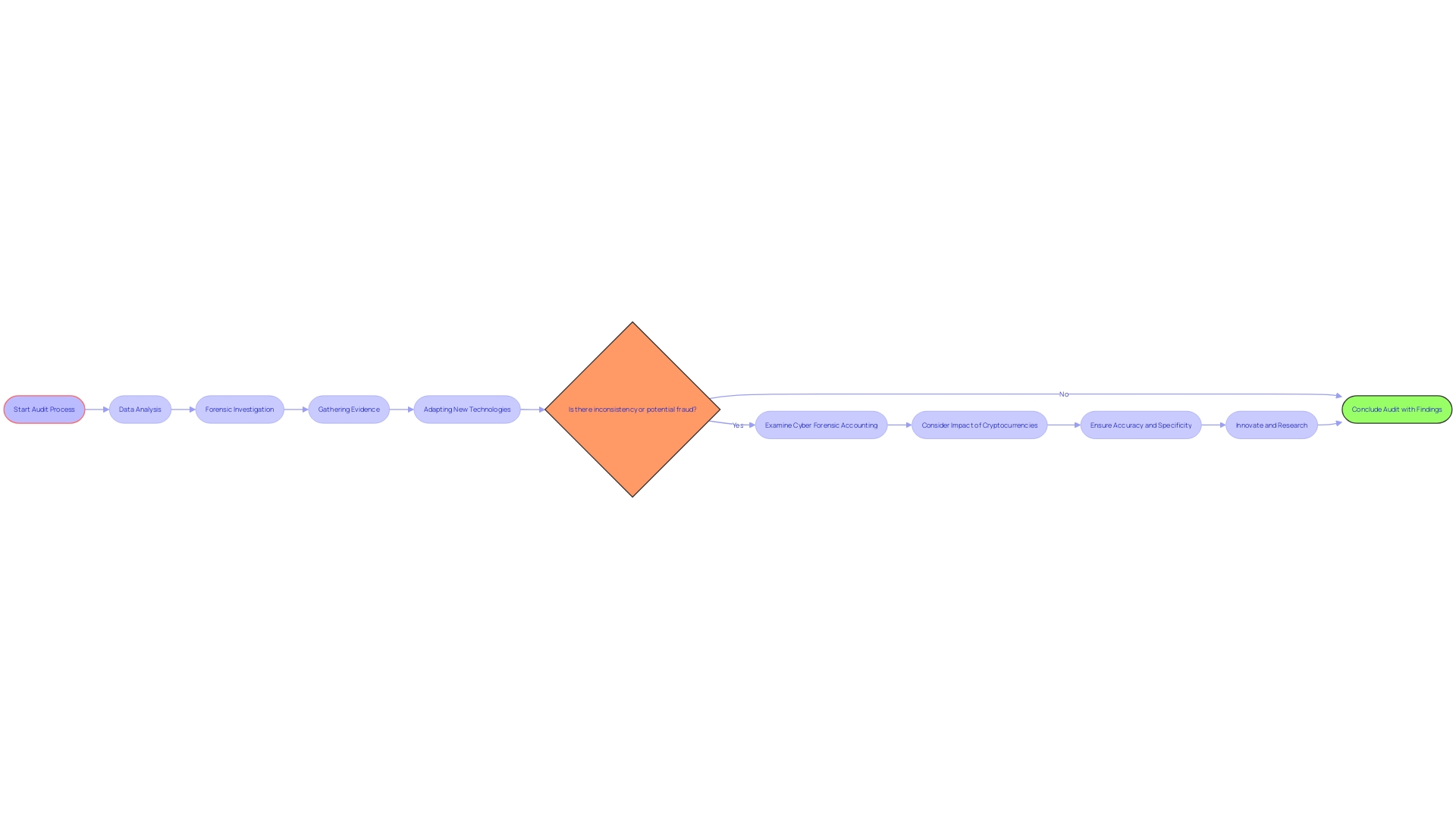

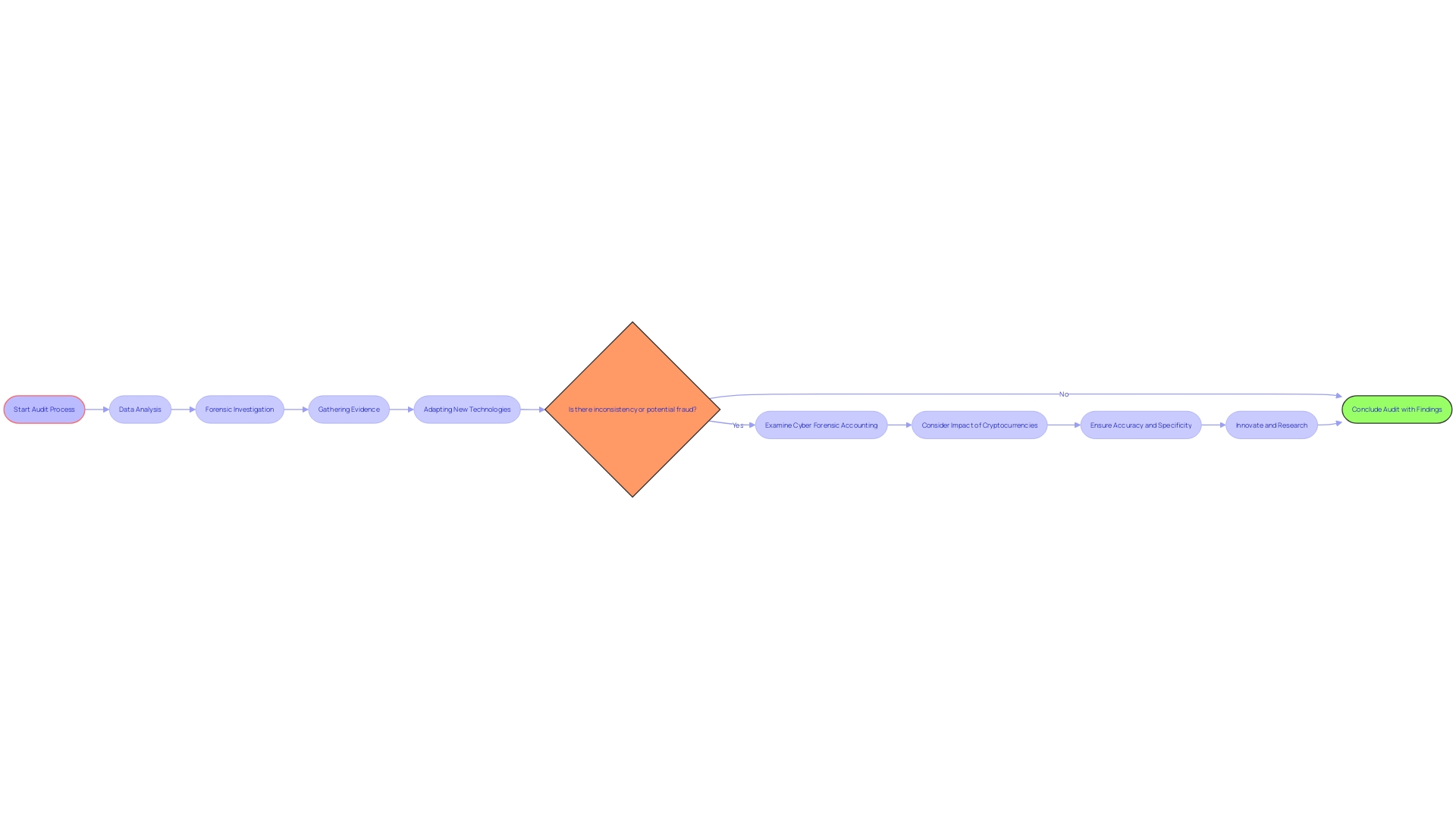

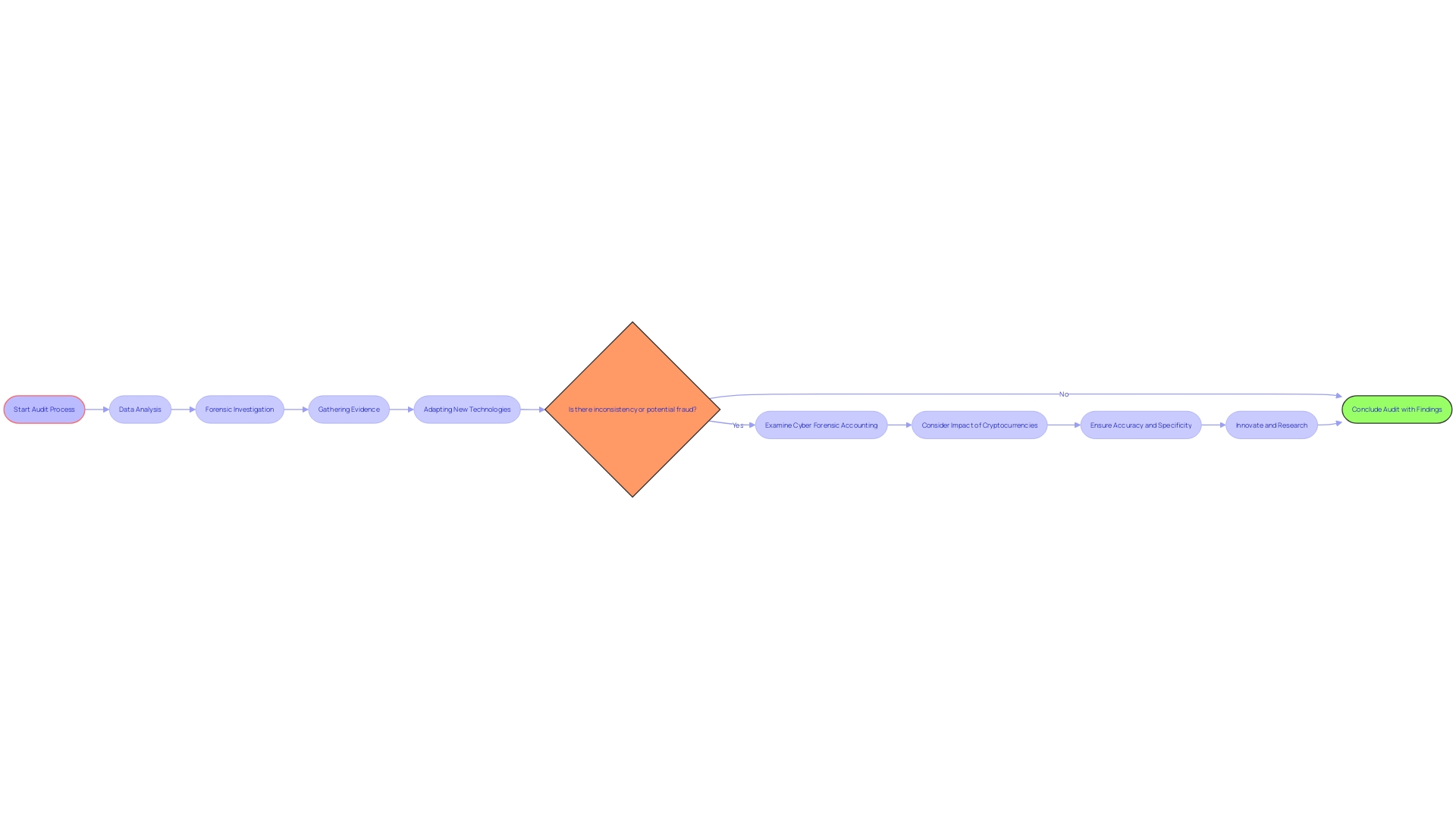

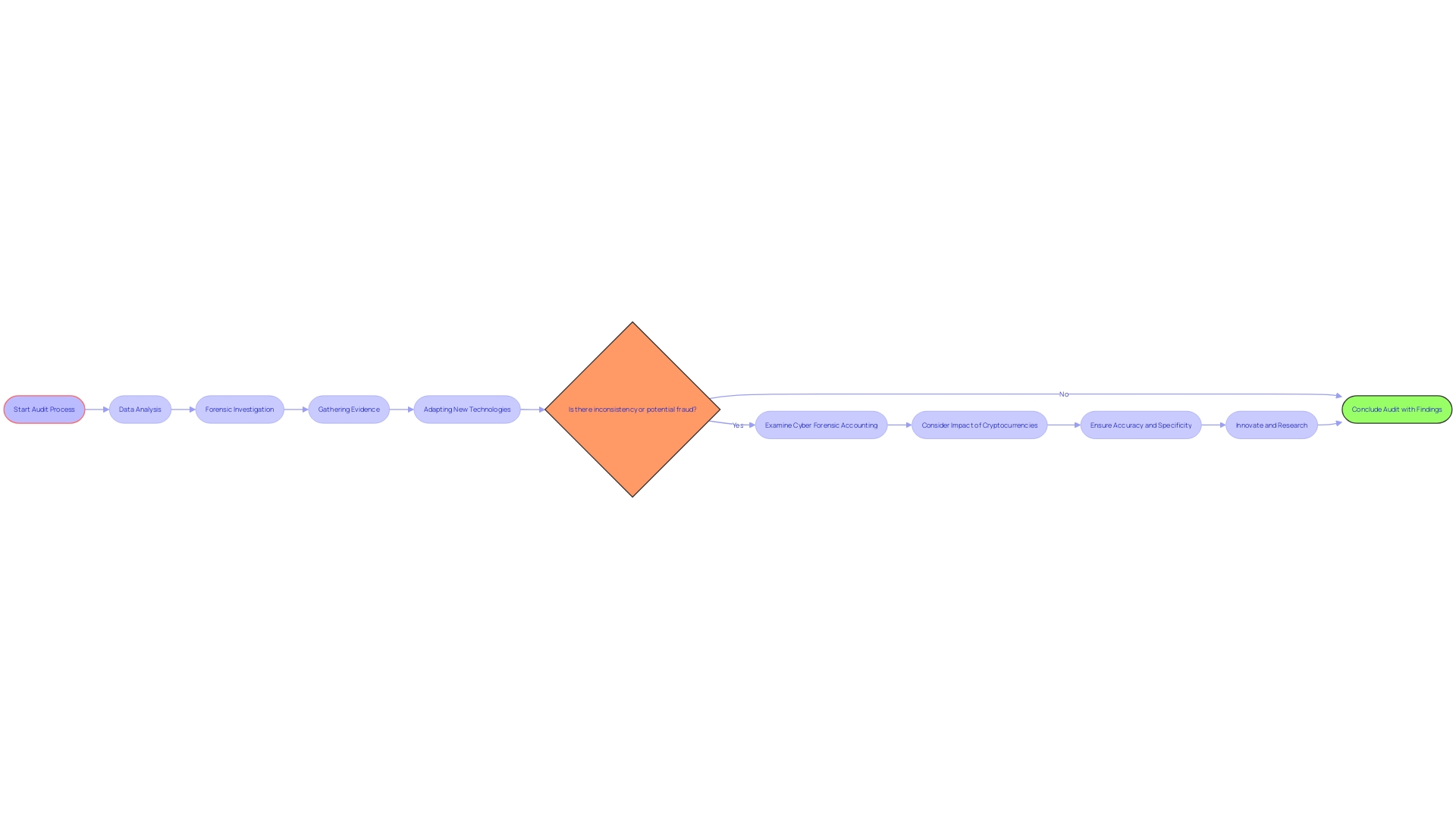

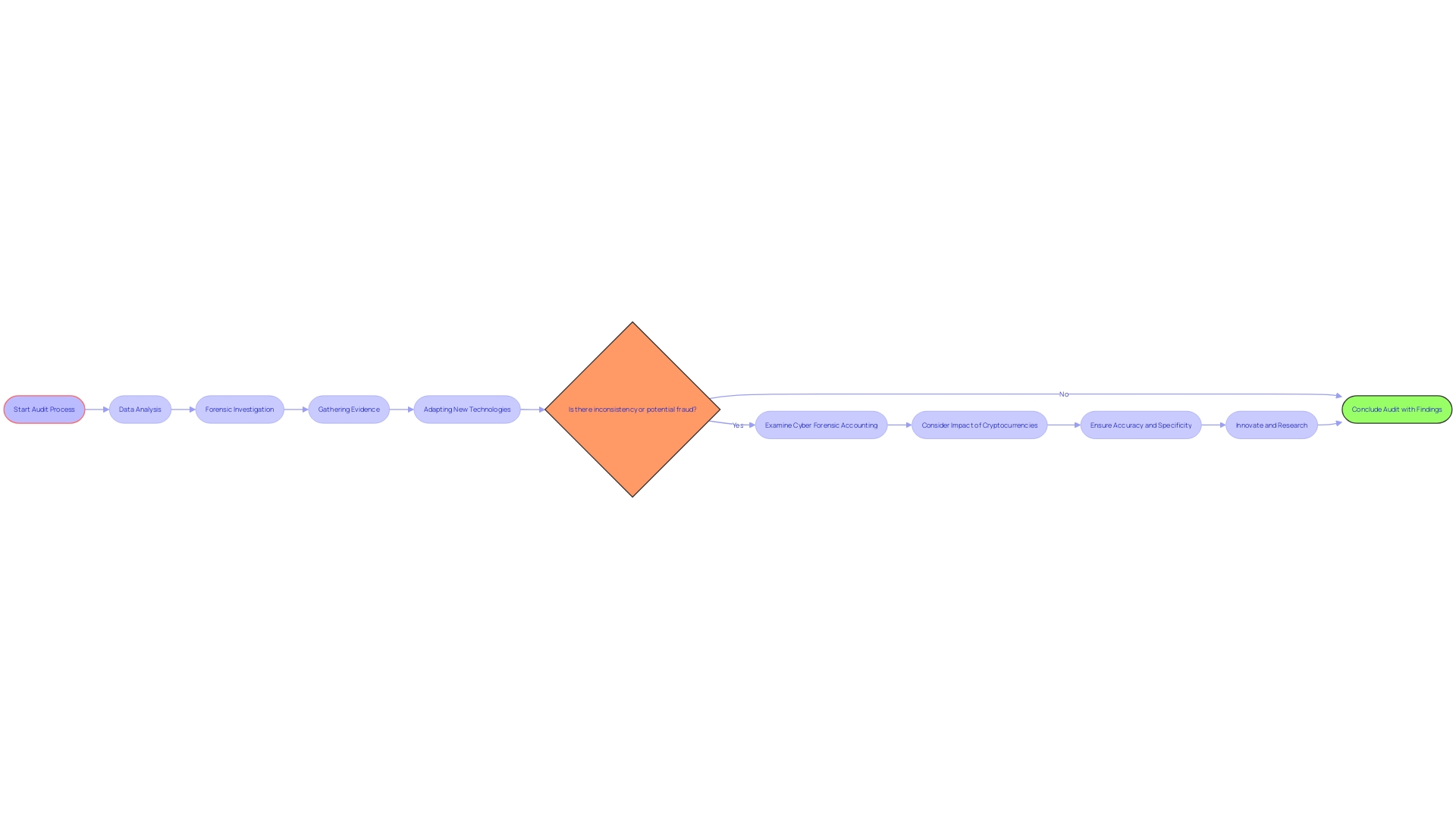

In the forensic accounting landscape, practitioners apply meticulous scrutiny to financial documents during the fieldwork phase. This rigorous examination serves to confirm the veracity of the financial statements presented. Auditors systematically evaluate all transactions and company records, leaving no stone unturned as they test for accuracy and consistency.

The process extends beyond mere validation; auditors judiciously analyze the operational effectiveness of the internal controls in place. Moreover, they are trained to unearth any financial inconsistencies, spot potential fraudulent activities, and document these findings, all while maintaining an eye for ethical considerations. Engaging with the intricacies of forensic accounting opens up avenues for understanding complex financial ecosystems.

Experts in the field are sounding the alarm on the increasing influence of data analytics, cyber forensic accounting, and the disruptive impact of crypto-currencies. As these emerging technologies shape the financial arena, auditors and accountants navigate these tides by leaning on their specialized skills which are vital for legal proceedings. The profession's commitment to innovation and research is unwavering, aiming to fortify financial systems against fraud in an environment brimming with technological advancements.

The key to a successful audit lies in establishing clear expectations upfront, familiarizing oneself with the requisite financial reporting deadlines, and determining the accounting principles that govern the statements in question. Armed with such insights, entities can steer a well-informed course through their initial property-level audits, ensuring precision in their financial narrative. With the expanding role of audit processes and technological adaptations, it's paramount that industry professionals keep pace with these changes, upholding the highest professional standards to safeguard the integrity of financial reporting.

As auditors conclude their meticulous examination of a project's inner workings, from its architecture to the deeper intricacies of its originality and user-function interactions, they prepare a comprehensive audit report. This pivotal document transcends a mere summary; it serves as a critical diagnostic tool reflecting the 2024 Yellow Book's evolution towards a quality management system that is intricately scalable and proactive. The report weaves together a tapestry of thorough observations, ranging from structural assessments—distinguishing original code from forked counterparts—to evaluative insights into the topmost functions summoned by users.

In line with the revision's risk-oriented strategy, the report meticulously catalogs the audited entity’s strengths and divulges any weaknesses or areas susceptible to improvement. This methodical evaluation is driven by a rigor akin to conducting a Materiality Assessment, whereby the report hones in on the most significant aspects tailored to the entity's domain, such as data security for technology firms or supply chain efficacy for healthcare providers. Through this, it echoes the industry's shift in focus; highlighting essentials like audit quality, stakeholder considerations, and embracement of a scalable and nuanced quality management infrastructure.

The audit report emerges not just as a record but as a roadmap, equipped with targeted recommendations designed to elevate the entity's operational quality and adherence to proven standards. It encapsulates the collective wisdom distilled from both quantitative and qualitative research methodologies, reinforcing the importance of multifaceted analysis in the pursuit of excellence and compliance. Central to its creation is a symphony of stakeholder collaboration, a shared commitment to quality that is vividly endorsed by authoritative voices in the field—an ethos of unity in enhancing the standards that underpin our financial and technological landscapes.

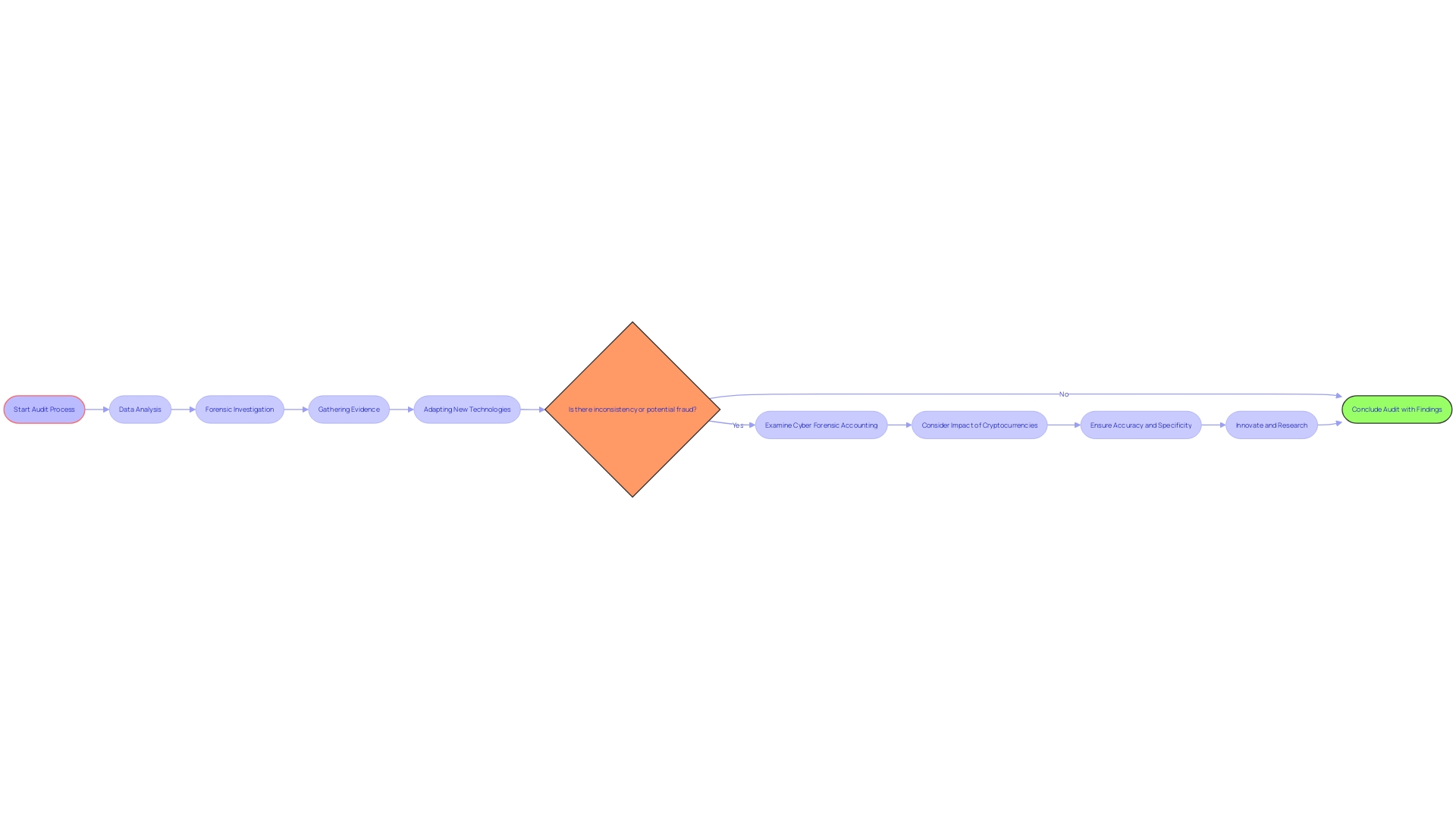

Financial auditors today leverage sophisticated data analytics to discover inconsistencies and anomalies. The use of data-driven methods goes beyond traditional number-crunching, adding a layer of scientific precision to identify potential fraud.

Forensic accounting comes into play here, where specialized training allows for the meticulous investigation and documentation of financial fraud. The expertise of forensic accountants is increasingly important in legal settings as they gather evidence capable of swaying court outcomes.

On a broader scale, the auditing field witnessed the intersection of cyber forensic accounting and the impact of cryptocurrencies. These emerging domains present both opportunities and challenges, requiring continuous innovation to adapt to the new technologies. Recent trends in healthcare and semiconductor industries underscore the growing need for such adaptable auditing strategies due to their rapid evolution and technological advancements. Ultimately, the audit process today extends much further than financial statement verification, making accuracy and specificity in language used to describe various auditing activities imperative for clarity and efficiency.

Statistical sampling techniques in financial auditing are not merely about drawing random conclusions from a subset of transactions. Today's auditors are integrating data analytics, cyber forensic accounting, and knowledge of modern-day phenomena like cryptocurrencies to enhance the precision of their investigations.

Simple Random Sampling (SRS) is foundational to this process—by selecting samples impartially, auditors ensure that their assessment mirrors the overall financial situation, avoiding biases as much as possible. Each selected transaction is an invitation to scrutinize the financial ecosystem's complexity.

For example, when analyzing an options-based market, auditors must evaluate if the code underpinning the transactions is original or simply a modified fork. Such inspections ascertain whether the financial representations are indeed reliable and could withstand legal scrutiny.

Forensic accountants, with their keen investigative skills, often lead these endeavors, meticulously peeling back layers to detect and document irregularities that might otherwise remain in the shadows. Considering this, it's the auditor's responsibility not only to understand the current technologies but also to stay ahead. Developing trends like the continuous growth seen in the healthcare and semiconductor industries demand that we remain vigilant in our sampling strategies, always ensuring they can adapt to the dynamically changing financial environments. As such, auditors are not just number-crunchers but guardians of financial clarity and legally-binding precision.

The digital revolution has significantly sharpened the tools in financial auditing, particularly through the integration of data analytics. By leveraging the vast ocean of available financial information, auditors unlock the capability to unearth patterns, recognize inconsistencies, and preemptively pinpoint areas steeped in risk.

These analytical technologies are not just a matter of convenience; they serve as a beacon for discerning the subtle indicators of financial fraud, misstatement, and discrepancies that manual processes may overlook. The transformative power of data analytics lies in its ability to convert raw data into actionable insights.

In adopting these technologies, auditors can sift through large volumes of data to detect irregularities – whether it be in a complex network of transactions or emerging financial products such as cryptocurrencies. The application of AI and machine learning in bookkeeping, for instance, significantly truncates the processing time for financial transactions, which once took days or weeks.

Auditors equipped with these advanced tools are not just participants in the financial realm but pioneers of an evolving frontier where efficiency and foresight set the groundwork for sound financial judgment and enterprise success. Forensic accounting, lit by the same technological torch, deploys these instruments within the legal sphere, applying keen investigative skills to deliver compelling financial evidence for court proceedings. The ascendancy of technology in areas like cyber forensic accounting showcases the necessity for continuous research and innovation to adapt to the challenges presented by an ever-changing technological landscape, fortifying the financial sector against sophisticated schemes of fraudulence. Data analytics doesn’t just represent a gear change in how financial analytics are recommended; it is the foundation upon which the financial industry can craft robust defenses against the tides of fiscal malfeasance.

In the realm of accounting, audit management software has become an indispensable tool for auditors. Its powerful functionality encompasses an array of features designed to facilitate the entire auditing process, from inception to conclusion.

A critical advantage of such software is its ability to bring together various audit-related activities onto a single, centralized platform, empowering auditors to plan, execute, and report on audits with heightened efficiency and collaboration. The core feature that stands behind any robust audit management program is the general ledger system, which utilizes the time-honored double-entry bookkeeping method to ensure every financial transaction is meticulously recorded.

This not only guarantees precision but also upholds stringent accounting principles. Automated tracking of debits and credits aids in maintaining accuracy and fostering regulatory compliance.

Furthermore, the software addresses vital facets of financial management, such as managing accounts receivable and payable, which are essential for preserving robust cash flow dynamics. The emergence of such advanced audit solutions marks a stark departure from the days of toiling with manual spreadsheets and bookkeeping. These contemporary tools have reshaped the accounting landscape, presenting a comprehensive suite of features engineered to streamline and automate diverse accounting tasks, including expense tracking, invoice generation, payroll administration, and the synthesis of financial reports. With this guide in hand, businesses can unearth the profound impact that proficient audit management software can exert on their financial operations, steering them towards precision, compliance, and overall financial health.

In the dynamic sphere of financial auditing, adhering to certain best practices not only elevates the quality of an auditor's work but also significantly contributes to an organization's integrity and accountability. Forensic accounting, a specialized field characterized by the application of detailed accounting, auditing, and investigative skills to analyze financial information, provides a robust framework for these practices. A key focus for auditors is the comprehensive understanding of the operational structure of the project they are reviewing, such as determining whether a code is original or modified from an existing fork, and identifying top functions invoked by users.

By integrating data analytics, auditors can delve deeper into financial patterns, enhancing their capacity to identify irregularities and potential fraud. Moreover, cyber forensic accounting has surged in relevance with the increasing complexity of financial ecosystems, especially with cryptocurrency integration into the mainstream market. This discipline examines digital footprints and cryptological sequences to unravel sophisticated financial crimes.

Although these emerging technologies bring along transformative benefits, such as streamlined processes, enhanced accuracy, and elevated fraud detection capabilities, they also introduce ethical dilemmas and constraints, requiring forensic accountants to be diligent and adaptive. Furthermore, recent industry news indicates a mounting demand in sectors such as healthcare and semiconductors, which significantly impacts financial auditing through elevated industry-specific requirements and the necessity for advanced technical knowledge. To fulfill their role effectively in light of these developments, financial auditors must not only maintain a vigilant eye for detail but also continuously engage in research and embrace innovation, ensuring they are equipped to navigate and contribute to the rapidly evolving landscape of financial auditing.

Amid the rapid transformations in various industries, it's critical for financial auditors to remain conversant with the evolving sphere of accounting standards and regulatory requirements. The unsettled economic climate, marked by the residual effects of a global pandemic, ongoing geopolitical unrest, and the relentless advance of technology such as artificial intelligence, casts a particularly stark light on the accounting and finance sectors.

These sectors are grappling with the after effects of remote work transitions and significant shifts in workplace dynamics, which are intricately linked to the challenges that auditors face today. Furthermore, the introduction of the International Professional Practices Framework (IPPF) Evolution heralds a new era of flexibility designed to meet the nuanced demands of practitioners across diverse business sectors.

This comprehensive re-evaluation of audit standards underscores the necessity for auditors to be adaptive and responsive to the needs of their stakeholders, from organizational boards to the clientele of their services. In an environment where professional judgment plays a pivotal role in audit outcomes, staying informed is not merely an option—it is an indispensable facet of an auditor's competence. According to the International Standards of Auditing 200, professional judgment is the result of applying relevant training, knowledge, and ethical standards to make informed decisions during an audit engagement. Therefore, continuous learning and professional development are not just beneficial but essential for an auditor's ability to deliver precise and current insights, keeping pace with an industry that is evolving with unprecedented speed.

As the nature of auditing evolves, particularly with changes in the 2024 Yellow Book, financial auditors face a heightened responsibility to uphold quality management over mere quality control. This paradigm shift implicates a more nuanced, risk-based approach to quality, requiring auditors to adapt and scale their practices according to the variable size and complexity of their organizations.

To safeguard audit integrity, it's not just a matter of independence and objectivity; auditors must be equipped with the relevant training, knowledge, and experience to make appropriate decisions in diverse scenarios. The International Standards of Auditing 200 (ISA 200) elucidates professional judgment as the application of such skills within the dimensions of auditing, accounting, and ethical standards.

Embracing this modern methodology means recognizing that the term 'audit' may carry different connotations and requirements across various fields, such as blockchain and crypto, which demand more than traditional models. Hence, auditors and other stakeholders need to clearly distinguish between traditional financial audits and the broader spectrum of verification tools necessary for emerging industries. With this clarity, auditors are not just number crunchers; they become pivotal figures in advancing financial insight and transparency, tracking and reporting transactions to shed light on company values. Amidst this transformative landscape, audit organization leaders are tasked with proactively curating engagement quality, ensuring that systems are both robust and malleable enough to uphold the standards, regardless of organizational scale.

Financial auditors today navigate an intricately regulated landscape, tasked with not only dissecting complex data but also delivering their insights in a manner that withstands the challenge of diversely digitized platforms. With a smorgasbord of communication tools - from the ubiquity of mobile phones and social media to the formality of video conferencing - auditors must tailor their content for varying channels, ensuring compliance with a raft of laws that govern everything from surveillance and supervision policies to content retention and internal auditing protocols.

These regulatory norms enforce oversight not just at a national level but extend to district, state, and even industry-specific agencies, reflecting the multifaceted nature of financial communications. In view of such exhaustive requirements, articulating audit results becomes a high-stakes endeavor, wherein the clarity of messaging is paramount. Auditors delve into a project's anatomy, evaluating its unique aspects, such as authenticity of the code or modifications in forked versions, to provide a cohesive narrative that not only aligns with regulatory standards but also equips management and stakeholders with actionable insights amid the seismic shifts of sectors like healthcare and semiconductors.

Accurate financial auditing is paramount for maintaining transparency and accountability within organizations. Auditors conduct examinations to ensure that all financial transactions are recorded diligently and reported authentically.

However, the auditing process is fraught with challenges. For instance, when reviewing the code of an options-based market, an auditor must determine if the code is a unique creation or a modified version of an existing program.

This distinction is critical in understanding the intricacies of the project and uncovering any potential anomalies. Recent developments have shown the potential for software defects to complicate the auditing process further.

For example, the Serious Fraud Office (SFO) discovered flaws in software used for evidence disclosure, emphasizing the need for robust tools in financial examination. Understanding and implementing compliance is another significant hurdle for auditors.

Compliance acts as a safeguard against fraudulent activity and ensures adherence to financial regulations—essential for stability in the markets. Compliance data tracking is imperative, yet cumbersome.

It requires meticulous record-keeping of all company operations to assist in validating regulatory reporting. Moreover, with the evolving regulatory landscape, auditors are leaning towards advanced software solutions to manage compliance data.

This approach helps in maintaining comprehensive records, including calculations, data transfers, and maintaining an audit trail. It's imperative to note that regulatory compliance standards can vary across different industries and jurisdictions, introducing another layer of complexity for auditors. The struggle of untrained individuals thrust into the world of financial scrutiny further illustrates the challenges in the sector. One instance of an inexperienced duty manager asked to assess a department's profitability underlines the importance of professional expertise in auditing. Anti-fraud controls, or lack thereof, frequently lead to instances of occupational fraud. The necessity for ongoing research, data analytics, and forensic accounting practices in surmounting these obstacles cannot be understated. The role of forensic accountants, equipped to detect and investigate financial misconduct, is becoming ever more crucial in the digital age, where the realm of cryptocurrencies introduces new avenues for financial fraud. Ultimately, the key is continuous vigilance and the innovative application of emerging technologies in the field of financial auditing.

The ever-evolving regulatory landscape poses challenges for financial auditors. Keeping up with changing regulations and interpreting their impact on financial statements can be demanding.

Addressing the multi-faceted challenges auditors face when scrutinizing the financial data's integrity is paramount. These experts delve into ensuring data quality across multiple dimensions, ensuring consistency, accuracy, reliability, and completeness.

Hindered by data silos, stemming from departmental divides or disparate systems, auditors frequently battle to uphold the data's health. Recognizing this, the push for a structured data quality framework has gained traction, encapsulating processes, standards, rules, and tools to secure dependable data.

An integral part of such frameworks involves data profiling, which scrutinizes the data's content, structure, and associations to expose irregularities or outliers. Substantiating data’s integrity in forensic accounting, where precision is crucial for legal proceedings, means grappling with an IT ecosystem's pivotal foundation.

With the increase of data analytics, cyber forensic techniques, and emerging phenomena like cryptocurrencies, practitioners are tasked with navigating advancements while curating evidence fit for court. Forensic accountants, armed with specific skills, are at the frontline, detecting and documenting financial discrepancies.

Their role is to piece together a bulletproof narrative, with data quality as the linchpin of credible evidence. Statistics indicate that the mean time to resolve data incidents (MTTR) and the mean time to production (MTTP) for new data products are critical metrics in data management. Enhancing data quality can significantly reduce MTTP, essential in an era where data science demands speed. A data quality framework not only mitigates risks but also serves as an innovative safeguard against financial fraud, propelling the field forward into new territories of technological potential. As stressed by financial leaders, the imperative is a 'data-dependent' stance, leveraging robust, high-quality data to guide economic and business decisions. This commitment to excellence in data management serves as the bedrock to navigate the ever-changing financial landscape effectively.

In the fast-paced world of financial analysis, professionals grapple with the demand for meticulous data analysis and shrewd forecasting amidst stringent timelines. The precision required to dissect balance sheets and project future financial performance must be balanced against the capacity to provide timely investment advice. Just as the healthcare and semiconductor industries continually adjust to technology advances and regulation updates, financial analysts must adapt to the progressive transformation within the accounting sphere.

Equipped with statistical tools and financial modeling, analysts strive to predict metrics, including sales and revenue, to guide informed decision-making. Moreover, they hold the responsibility to decipher the potential risks and returns of investment opportunities, demonstrating the breadth and depth of knowledge necessary to navigate the intricate financial landscape. Illustrating this challenge, consider the analogy of an astronaut preparing for a mission: they manage limited resources such as oxygen and fuel to ensure mission success.

Similarly, time is a vital yet finite resource for financial auditors who must execute their duties within precise boundaries. Additionally, the poignant predicament of a young manager abruptly thrust into the accounting role without prior training emphasizes the importance of being adaptable and efficient in manipulating and understanding financial intricacies. Thus, professionals in this field are continually reminded of the need to optimize the use of their resources—time, knowledge, and analytical skills—to foster insightful and strategic financial planning.

In conclusion, financial auditors play a vital role in ensuring the accuracy, transparency, and integrity of financial records. They navigate complex regulatory environments and use their expertise to conduct effective audits.

The types of financial audits they perform range from traditional financial statement audits to specialized audits like forensic audits. Financial auditors are responsible for verifying the precision and entirety of financial data, assessing an organization's fiscal health, forecasting future financial outcomes, and identifying risks and weaknesses.

They also contribute to enhanced financial transparency, improved governance and control, and compliance with regulations. To conduct successful financial audits, auditors must stay up to date with changing accounting standards and regulatory requirements.

They leverage tools and techniques such as data analytics, sampling methods, and audit management software to enhance the accuracy and efficiency of their work. Effective communication is crucial in delivering audit results with clarity and precision, particularly in the age of diverse digitized platforms.

Financial auditors face challenges such as the complex regulatory environment, data integrity and availability, and the need to balance time and resources. However, by continuously updating their knowledge, maintaining independence and objectivity, and embracing best practices, auditors can overcome these challenges and contribute to the integrity and accountability of organizations. In this evolving landscape of financial auditing, auditors must adapt to emerging technologies and industry-specific requirements. They must remain vigilant, continuously learning, and embracing innovation to meet the demands of a rapidly changing financial ecosystem. Overall, financial auditors are indispensable in navigating the world of financial auditing with confidence and precision, ensuring the accuracy and transparency of financial records.

What Is a Financial Auditor?

Financial auditors serve as stewards of fiscal integrity, delving into financial records and transactions to verify their accuracy and conformity to established guidelines. They are the sentinels who ensure that financial statements paint a true picture of an organization's financial well-being.

By scrutinizing balance sheets, income statements, and cash flow statements, auditors not only gauge a company's profitability and liquidity but also safeguard its solvency. Their impartial assessments are vital to maintaining transparency and fostering trust among stakeholders.

Moreover, their role extends to forecasting, where they apply historical data and analytical tools to predict future financial outcomes. In the complex ecosystem of blockchain and cryptocurrency, for instance, the term 'audit' is often misconstrued. Auditors stretch beyond the boundaries of traditional financial oversight, applying a comprehensive suite of verification tools to meet the unique demands of these emerging technologies. The functionality and originality of code, for example, are scrutinized to unveil the inner workings and potential of financial mechanisms within this space, such as those found in options-based markets.

An examination of an organization's financial statements ensures both accuracy and adherence to accounting standards and regulations. Such an audit engenders trust between a business and its stakeholders, while also being a pivot toward transparency.

This rings especially true within sectors like healthcare and semiconductor industries, which are both undergoing significant changes and advancements. Similarly, for small businesses, the evaluation of tax filings and financial documents is crucial to verify that records are kept effectively, complying with regulatory requirements such as IRS mandates on foreign accounts.

Auditing practices are central to Information Security (InfoSec) and Cybersecurity, where the focus expands beyond just financial scrutiny to encompass technology and data integrity. The advent of technology and crypto-assets introduces novel auditing dynamics, where examining a blockchain or smart contract's underlying tech becomes paramount. Seeking out the audits of a project is often straightforward, as many are accessible on the project's own website or through resources like coinmarketcap, which neatly displays them among other project metrics. In essence, audits span a range of objectives and scopes, tailored to specific organizational needs, from assessing internal policies' effectiveness to evaluating a crypto project's technical foundations.

Independent or external audits, delivered by a licensed CPA not affiliated with the entity under review, offer a crucial objective evaluation of financial statements, aiming to affirm their adherence to established accounting norms. Required mandatorily for publicly listed entities, such audits are a guardrail to investor confidence and market integrity. However, it's essential to recognize that their scope is strictly financial and does not extend to verifying the operational efficacy or compliance of business models, especially in nuanced fields like blockchain and crypto assets, where risks are multifarious and regulatory frames are still evolving.

A report by Consensys Diligence iterates the absence of warranties or representations on aspects like code robustness, business models, and legal compliance in emerging technologies. Meanwhile, industry professionals caution against loose application of the audit term, specifically within the blockchain and cryptocurrency sphere. They highlight a dire need for nuanced verification instruments and precise language to depict various assessments that diverge substantially from traditional financial statement audits.

In the realm of Information Security (InfoSec) or Cybersecurity, internal audits serve as a crucial instrument in fortifying an organization's defense mechanisms. Conducted meticulously by a company's own audit team, they scrutinize information systems, processes, and controls to evaluate the robustness of security measures and uncover any potential vulnerabilities.

Such audits are not only pivotal for maintaining the integrity, confidentiality, and availability of sensitive data but also for ensuring adherence to internal standards and regulatory demands. The strategic execution of internal audits provides insightful revelations into operational effectiveness.

These assessments highlight the need for potent internal compliance controls, as mandated by the Foreign Corrupt Practices Act (FCPA), and determine their efficacy in situational practice. “This will help you determine whether adequate internal compliance controls are present in your company.

From there, you can move on to see if they are working in practice,” underscores the significance of these controls in establishing a best practices compliance program. Furthermore, internal audits offer a comprehensive purview of the organization's procedural landscape. The implementation of the International Professional Practices Framework (IPPF) reaffirms their essential role. “We started off by calling it the relook of the standards, but in fact, it became much more than just a relook,” reflects the aim to be dynamic and responsive to various business sectors and stakeholders' needs. As internal auditing's primary objective is to aid and add value, conducting thorough audits is indispensable for appreciating the business context, managing risks, enhancing stakeholder relationships, and achieving corporate objectives.

Forensic audits delve into the financial labyrinth of an organization, shedding light on any misconduct or malpractices that could undermine its integrity. The auditors utilize their prowess in forensic accounting—an amalgamation of accounting, auditing, and investigative skills—to dissect financial information for evidence usable in legal confrontations.

With the seismic shifts brought about by data analytics, cyber forensic accounting, and the growing tentacles of cryptocurrencies, the field of forensic accounting is experiencing a transformative era. These advancements make the meticulous pursuit of financial veracity not just possible but also imperative.

The methodologies and tools used are advancing in sophistication, tackling the complexities of crimes such as embezzlement and other financial discrepancies that can tarnish an organization's reputation. Illuminated by Hanzo van Beusekom's remarks on the inextricable link between an auditor's integrity and their function of instilling trust, we see the detrimental impact of widespread examination fraud in the industry—fraud that erodes the bedrock of credibility that auditors are sworn to uphold. As dissected in the 35th Annual Report on the protection of the EU’s financial interests, the role of Member States and Commission oversight in managing and protecting over 85% of EU expenditure underscores the critical nature of the ongoing battle against fraud affecting the EU budget. Recognizing the inherent challenges of this dynamic domain, it becomes clear that continuous research and innovation are vital for equipping practitioners with the necessary tools to combat financial fraud effectively, thus guarding against the ever-evolving risks presented by emerging technologies.

Financial auditors are indispensable to an organization, charged with scrutinizing the myriad details that uphold its financial integrity. Their eagle-eyed analysis of financial documents, such as balance sheets, income statements, and cash flow statements, is critical for assessing a company's fiscal health. They pursue this task with a keen understanding that potent market trends and economic conditions can significantly influence profitability, liquidity, and solvency.

Armed with statistical tools and financial modeling techniques, auditors forecast potential futures, shaping strategies that ensure the organization is not just agile in the face of immediate market demands but also long-term industry shifts. Their influence extends to evaluating investment opportunities, helping companies ponder the merits of investing in high-potential assets versus the security of established ones. The role of the financial auditor is further underscored by the rising complexities in sectors like healthcare and semiconductors, where the demands for quality and technological innovation are precipitating rapid transformation.

Here, auditors ensure that as organizations strive to capitalize on these opportunities, their financial decisions rest on solid and ethical grounds. Fulfilling their fiduciary duties with unyielding loyalty and care, financial auditors become the key to maintaining a company's reputation for integrity. Their work ensures that all financial transactions are not merely recorded but also serve as a reliable compass for the company's financial journey, adhering to the highest standards of legal and ethical compliance.

To ascertain if robust internal compliance controls are in place within an organization, one must start with a clear, manageable, and measurable set of success criteria, as underscored in the field of financial auditing. Establishing these benchmarks allows a company to thoroughly review whether their internal control systems are comprehensive, eschewing convoluted processes for straightforward and clearly documented targets.

Indeed, under the FCPA, effective internal controls aren't merely advisable but a requirement, especially as they form the backbone of any best practices compliance program. In evaluating these controls, it's critical to examine performance across various elements of the enterprise, recognizing that the network, encompassing both the software infrastructure and the administrators and users, plays a significant role in the operational execution of controls.

Much like architecture on uncertain foundations, if an organization's financial controls are not robust and reliable, the stability of the entire operation is compromised, inviting risks ranging from fraud to inaccurate financial reporting. To successfully navigate this complex landscape, an organization must engage in rigorous internal evaluations, which, akin to AI system assessments done by companies like Anthropic, become essential tools in improving the safety, truthfulness, and fairness of the systems in place. Such evaluations delve into the intricacies of controls, testing not just for presence but for practical efficacy – the alignment of protocols with ongoing operations and emerging risks.

Financial auditors are critical in assessing the fidelity of a company's financial statements. Delving into the balance sheets and income statements, they examine all underlying documents to verify the precision and entirety of the financial data.

By scrutinizing transaction details, account tallies, and declaration sufficiency, they ensure that all financial communications align impeccably with the prevailing accounting standards and laws. In a rapidly evolving economic landscape, with recent proposals from the Financial Accounting Standards Board to modernize the reporting of software costs, the role of auditors becomes even more pivotal.

These proposed changes will demand meticulous attention to the cash-flow statements, as the new guidelines aim to streamline how companies categorize software expenditures. This evolution in accounting practice reflects the necessity for companies to clarify cash movements tied to technological investments, a change much overdue from rules established in the late 20th century. As auditors consider these updates, they are holding the beacon for financial integrity, ensuring stakeholders can reliably understand a company's fiscal position and investment decisions in an age where virtually every company's operations are underpinned by software solutions.

As guardians of an organization's fiscal fortitude, financial auditors meticulously dissect the fabric of an enterprise's financial practices. Their eagle-eyed scrutiny reveals not only potential hazards and compliance gaps but also outlines opportunities to fortify financial health. By employing their expertise, auditors dissect income statements and balance sheets, artfully translating the raw data into digestible financial ratios.

These potent analytical tools bestow clarity, transforming percentages into benchmarks that square a business up against the industry vanguard. Financial ratios prove to be a salient beacon for decision-makers across the business landscape—accountants, procurement specialists, valuers, and consultants. They pinpoint fiscal anomalies while providing an X-ray of a company's monetary wellbeing.

Furthermore, the amalgamation of this extensive know-how guides pivotal business decisions, refining strategies and illuminating the pathways for risk assessment and credit analysis. The importance of precise terminology in financial evaluation should not be understated, as a miscellany of verification methodologies extend beyond the bounds of traditional audit procedures, particularly in burgeoning domains like blockchain and crypto. Here, auditors employ a lexicon that is razor-sharp in its specificity, ensuring that the financial oversight mechanisms are congruent with the progressive and ever-evolving financial landscape, as reflected by the dynamic shifts in industries such as healthcare and semiconductors.

Financial audits are key to a company's fiscal well-being, offering a panoramic view of the company's finances, much like a detailed inspection of a protocol's project structure in a blockchain environment. Auditors verify whether a company's financial practices are original or merely a modification of another entity's methods, similar to distinguishing original code from forked code in software development. With the dynamic growth observed in the healthcare and semiconductor industries, efficient financial scrutiny becomes paramount, as businesses invest in their accounting practices to achieve sustained success.

A scrupulous audit can disclose the inner workings of cash flow statements, revealing whether a company optimally leverages operations for cash generation or if it's unduly dependent on external financing. This examination goes beyond mere numbers; it delves into the intricacies of a company's equity changes over time, offering a narrative of shareholder value that's shaped by profits, losses, and dividend distributions. As urged by experts from professional services firms, it's crucial for the blockchain and crypto sectors, and indeed all industries, to adopt a comprehensive suite of verification tools and precise language to articulate their financial checks and balances, beyond the traditional financial statement audit.

Financial audits serve a critical role in reinforcing corporate integrity by meticulously evaluating a company's financial records. More than a mere formality, these assessments provide stakeholders—which include parties like investors, creditors, and regulatory bodies—with the confidence that the financial data they rely upon is both trustworthy and meticulously vetted.

This trust is indispensable, especially in a landscape where terminology is often used loosely. A profound understanding that audits are much more than a routine check, but a cornerstone in the financial ecosystem, is essential for informed decision-making and strategic planning. As the financial terrain evolves with innovations like blockchain and cryptocurrencies, the scope of verification and the precision of language used to describe various evaluative processes must also adapt to ensure clarity and meet the nuanced demands of these emerging sectors.

Without a doubt, financial audits act as the cornerstone of robust corporate governance and oversight. By taking a deep dive into an organization's financial ecosystem, auditors unravel complexities and shine a light on areas where the armor of internal controls may be chinked.

The consequential recommendations forge a sturdier bulwark against fraud and inaccuracies in financial reporting. From the blossoming health care sector to the semiconductor industry's exponential growth, underscored by chips' surging demand and breakthrough technologies, the role of audits is ever more pivotal.

These sectors rely on the clear-eyed scrutiny of auditors to navigate the tides of rapid transformation and technological innovation. Edith Baranauskaitė of STATICUS presses upon financial leaders the imperative to impart the essence of finance to their non-financial counterparts.

To elevate their financial acumen, teams must grasp not just the 'how' but also the 'why' of financial protocols. It is a deliberate process, one that demands financial information be distilled into a vernacular that resonates across the board. According to experts from EY, a historical titan in auditing, the term 'audit' is often bandied about liberally, drifting from its anchored meaning. The advent of blockchain and cryptocurrency introduces a galaxy of verification needs where calling for precision in language is not just insightful—it's crucial. These sectors don't just need audits in the classical sense; they need a spectrum of verification tools to support their burgeoning ecosystems.

In the intricate web of regulations that govern the financial sector, audits serve as an indispensable tool for maintaining integrity and accountability. The landscape of financial compliance is vast, governed by a plethora of laws that focus on surveillance and supervision—veil-lifting measures like monitoring, retention of records, and comprehensive audit trails of digital communications that encompass mobile, text, social media, and more.

These audits do more than just tick boxes; they dissect company adherence to the strict and often sophisticated frameworks established by myriad supervisory agencies, from local to national levels, across various districts and industries. Delving into the specifics of a financial audit reveals its true complexity.

Before the first auditor steps through the door, entities must critically assess their financial reporting needs, considering deadlines and the accounting principles they must follow—commonly GAAP or income tax basis of accounting. This understanding is critical for ensuring that when the auditors scrutinize the financial statements, every transaction adheres to the defined accounting standards and satisfies lending requirements as stipulated in governing documents.

Beyond the meticulous nature of traditional financial audits, the burgeoning sectors of blockchain and cryptocurrency introduce yet another layer of complexity. They demand a broad spectrum of verification methods which stretch the very notion of what constitutes an audit.

As underscored by thought leaders in professional services, while financial statement audits remain foundational, the language describing verification in the crypto sphere must evolve. Financial audits are a cornerstone in upholding market stability and shielding the public from risks like fraud and money laundering. Compliance is not a mere formality; it is a dynamic framework that evolves with emerging technologies. As regulations constantly shift, companies are turning to sophisticated software solutions to navigate and manage compliance obligations with greater precision, such as tracking audit trails and validating regulatory reporting. Although the concept of finance may be universally understood, the intricate details of regulatory compliance are unique to each jurisdiction and industry, underscoring the need for tailored and robust audit processes.

A financial audit is more than ticking off a checklist; it's an intricate assessment ensuring the reliability and accuracy of an organization's financial statements. Here's how you embark on this meticulous process:

Initially, dive into the project's structure.

Start by understanding its core, determining its uniqueness, and whether it's an original creation or a modified version of a pre-existing model. In the case of an options-based market, for instance, examining the highest-level functions accessed by users will give insights into the internal workings of the system.

Financial analysts play a pivotal role in this stage, harnessing their expertise in diving deep into financial data. They evaluate profitability and forecast future performance by analyzing balance sheets, income statements, and cash flow statements.

Their scrutiny powers the audit's focus on liquidity and solvency, underpinning its thoroughness. When examining a small business, the audit puts its tax filings and financial records under the microscope, ensuring their veracity.

It becomes indispensable to survey not just the ledgers but also to report specifics, such as foreign bank accounts. These audits aren't arbitrary; they're conducted with a purpose, often triggered by discrepancies or regulatory mandates. To grasp the complete context, remember the words of an industry expert from a prestigious firm like EY, who points out the necessity for precise terminology in audit-related discourse, especially within the realms of blockchain and cryptocurrency. In these innovative sectors, the demand extends beyond traditional financial audits, necessitating a broad spectrum of verification tools tailored for the digital age. In sum, a financial audit is a rigorous exploration of an entity's financial fidelity, informed by the expertise of financial analysts and equipped with the resolve to uphold accuracy and transparency in the financial ecosystem.

At the outset of the auditing journey, an intensive stage of groundwork and market scrutiny is initiated. During this period, auditors diligently compile a body of knowledge pertaining to the entity's fiscal mechanisms, protocols, and control systems.

They meticulously dissect the financial landscape to pinpoint areas susceptible to risk, meticulously crafting the boundaries of the audit's purview. The resultant stratagem is an expansive audit blueprint designed to navigate and scrutinize the intricate details of the entity's financial narratives.

It is here that the auditor's adroit understanding of Assets, Liabilities, Income, and Expenses (ALIE)—the core pillars of fiscal assessment—comes into play, ensuring a holistic appraisal of the organization's fiscal health. This preparedness not only sets the tone for an effective audit but also becomes an indispensable resource for reporting to stakeholders. The meticulously devised plan establishes the imperative deadliness and accounting frameworks necessary to align with generally accepted accounting principles (GAAP) or other comprehensive accounting bases, offering clarity and precision in financial reporting.

In the forensic accounting landscape, practitioners apply meticulous scrutiny to financial documents during the fieldwork phase. This rigorous examination serves to confirm the veracity of the financial statements presented. Auditors systematically evaluate all transactions and company records, leaving no stone unturned as they test for accuracy and consistency.

The process extends beyond mere validation; auditors judiciously analyze the operational effectiveness of the internal controls in place. Moreover, they are trained to unearth any financial inconsistencies, spot potential fraudulent activities, and document these findings, all while maintaining an eye for ethical considerations. Engaging with the intricacies of forensic accounting opens up avenues for understanding complex financial ecosystems.

Experts in the field are sounding the alarm on the increasing influence of data analytics, cyber forensic accounting, and the disruptive impact of crypto-currencies. As these emerging technologies shape the financial arena, auditors and accountants navigate these tides by leaning on their specialized skills which are vital for legal proceedings. The profession's commitment to innovation and research is unwavering, aiming to fortify financial systems against fraud in an environment brimming with technological advancements.

The key to a successful audit lies in establishing clear expectations upfront, familiarizing oneself with the requisite financial reporting deadlines, and determining the accounting principles that govern the statements in question. Armed with such insights, entities can steer a well-informed course through their initial property-level audits, ensuring precision in their financial narrative. With the expanding role of audit processes and technological adaptations, it's paramount that industry professionals keep pace with these changes, upholding the highest professional standards to safeguard the integrity of financial reporting.

As auditors conclude their meticulous examination of a project's inner workings, from its architecture to the deeper intricacies of its originality and user-function interactions, they prepare a comprehensive audit report. This pivotal document transcends a mere summary; it serves as a critical diagnostic tool reflecting the 2024 Yellow Book's evolution towards a quality management system that is intricately scalable and proactive. The report weaves together a tapestry of thorough observations, ranging from structural assessments—distinguishing original code from forked counterparts—to evaluative insights into the topmost functions summoned by users.

In line with the revision's risk-oriented strategy, the report meticulously catalogs the audited entity’s strengths and divulges any weaknesses or areas susceptible to improvement. This methodical evaluation is driven by a rigor akin to conducting a Materiality Assessment, whereby the report hones in on the most significant aspects tailored to the entity's domain, such as data security for technology firms or supply chain efficacy for healthcare providers. Through this, it echoes the industry's shift in focus; highlighting essentials like audit quality, stakeholder considerations, and embracement of a scalable and nuanced quality management infrastructure.

The audit report emerges not just as a record but as a roadmap, equipped with targeted recommendations designed to elevate the entity's operational quality and adherence to proven standards. It encapsulates the collective wisdom distilled from both quantitative and qualitative research methodologies, reinforcing the importance of multifaceted analysis in the pursuit of excellence and compliance. Central to its creation is a symphony of stakeholder collaboration, a shared commitment to quality that is vividly endorsed by authoritative voices in the field—an ethos of unity in enhancing the standards that underpin our financial and technological landscapes.

Financial auditors today leverage sophisticated data analytics to discover inconsistencies and anomalies. The use of data-driven methods goes beyond traditional number-crunching, adding a layer of scientific precision to identify potential fraud.

Forensic accounting comes into play here, where specialized training allows for the meticulous investigation and documentation of financial fraud. The expertise of forensic accountants is increasingly important in legal settings as they gather evidence capable of swaying court outcomes.

On a broader scale, the auditing field witnessed the intersection of cyber forensic accounting and the impact of cryptocurrencies. These emerging domains present both opportunities and challenges, requiring continuous innovation to adapt to the new technologies. Recent trends in healthcare and semiconductor industries underscore the growing need for such adaptable auditing strategies due to their rapid evolution and technological advancements. Ultimately, the audit process today extends much further than financial statement verification, making accuracy and specificity in language used to describe various auditing activities imperative for clarity and efficiency.

Statistical sampling techniques in financial auditing are not merely about drawing random conclusions from a subset of transactions. Today's auditors are integrating data analytics, cyber forensic accounting, and knowledge of modern-day phenomena like cryptocurrencies to enhance the precision of their investigations.

Simple Random Sampling (SRS) is foundational to this process—by selecting samples impartially, auditors ensure that their assessment mirrors the overall financial situation, avoiding biases as much as possible. Each selected transaction is an invitation to scrutinize the financial ecosystem's complexity.

For example, when analyzing an options-based market, auditors must evaluate if the code underpinning the transactions is original or simply a modified fork. Such inspections ascertain whether the financial representations are indeed reliable and could withstand legal scrutiny.

Forensic accountants, with their keen investigative skills, often lead these endeavors, meticulously peeling back layers to detect and document irregularities that might otherwise remain in the shadows. Considering this, it's the auditor's responsibility not only to understand the current technologies but also to stay ahead. Developing trends like the continuous growth seen in the healthcare and semiconductor industries demand that we remain vigilant in our sampling strategies, always ensuring they can adapt to the dynamically changing financial environments. As such, auditors are not just number-crunchers but guardians of financial clarity and legally-binding precision.