Introduction

Independent investigations play a crucial role in maintaining corporate compliance and integrity, providing objective assessments of internal practices and ensuring adherence to legal and regulatory standards. Utilizing third-party investigation firms helps companies avoid conflicts of interest and gain unbiased insights into potential breaches, thus upholding their reputation and fostering trust among stakeholders. This article delves into the importance of independent investigations, the key objectives and challenges of corporate compliance investigations, and best practices for engaging investigation firms.

By exploring these elements, organizations can strengthen their compliance frameworks, manage risks effectively, and maintain operational integrity.

The Importance of Independent Investigations

Self-sufficient inquiries are crucial in upholding by offering an impartial evaluation of internal practices. This ensures that organizations adhere to . Involving external inquiry firms assists organizations in steering clear of conflicts of interest and obtaining impartial perspectives on possible regulatory violations, thereby among stakeholders.

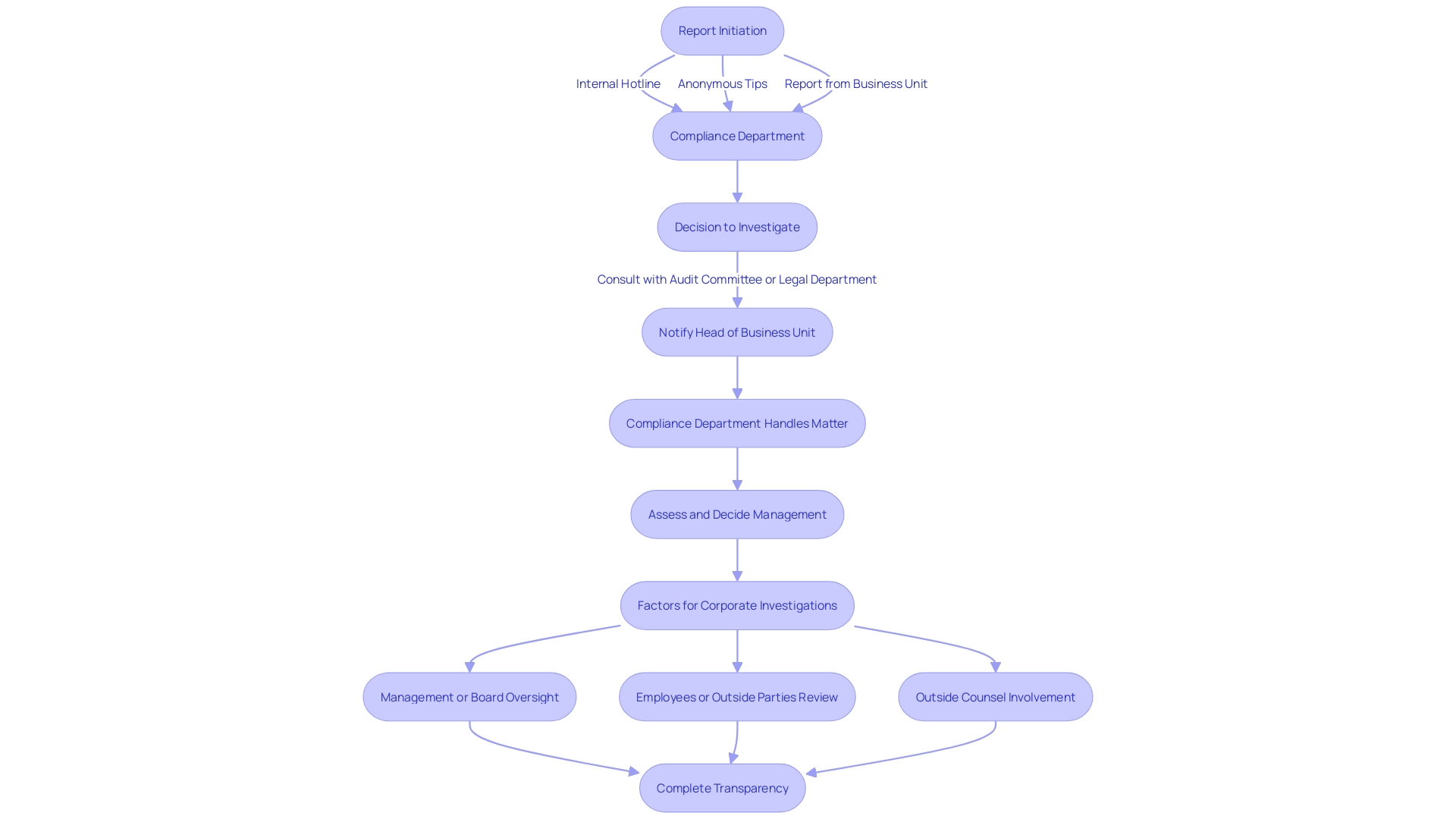

A well-documented procedure for handling complaints or allegations, such as bribery or corruption, is essential. This could involve using internal company hotlines, anonymous tips, or direct reports from business units. Decisions on whether to investigate should be made in consultation with groups like the Audit Committee or the Legal Department, ensuring transparency on the rights and obligations of all parties involved.

Moreover, there are legal and voluntary disclosure requirements that companies must consider. For example, public companies might need to file an 8-K with the SEC if an investigation is significant enough to influence shareholder decisions. Companies must meet stringent timelines, such as filing within four business days of discovering the allegations. Insurance policies may also necessitate immediate notification of potential wrongdoing.

The increase of private assessments, especially social adherence evaluations, emphasizes their significance in reducing public relations challenges. These audits, forming an $80 billion global industry, aim to address concerns like labor practices and legal risks. However, recurring problems such as missed child labor instances highlight the need for thorough and effective auditing processes.

In summary, strong autonomous inquiries and clear guidelines for managing adherence issues are essential for upholding corporate integrity and trust. They not only help in adhering to legal standards but also in managing reputation and stakeholder confidence.

Key Objectives of Corporate Compliance Investigations

'Corporate adherence inquiries serve several key objectives: identifying legal and regulatory breaches, evaluating the effectiveness of adherence programs, and mitigating risks linked to non-adherence.'. These inquiries are essential for revealing wrongdoing, directing corrective measures, and making certain that entities create in accordance with industry norms and regulatory obligations.

Effective adherence programs are essential for and incentivizing organizations to report misconduct. Companies must ensure that employees who suspect misconduct know how to without fear of retaliation. This includes demonstrating a clear commitment to and anti-retaliation policies. Investigations must also evaluate whether personnel have adequate access to relevant data and resources to perform their duties effectively.

For instance, the updated ECCP includes questions about access to data sources for compliance officers and the technology available for regulatory and risk oversight. By utilizing data analysis and breaking down data barriers, entities can enhance efficiency and effectiveness in adhering to regulations. 'Furthermore, companies should learn from their own past misconduct and other organizations' issues to continuously update and enhance their regulatory programs.'.

The significance of well-resourced and empowered regulatory functions cannot be overstated. Sufficient compensation, promotion, and protection for those involved in regulatory investigations are essential for maintaining a strong adherence culture. As emphasized by recent news, like Boeing's decision to admit guilt to a felony charge, the stakes are significant, and the necessity for strict adherence to practices is more urgent than ever. By investing in comprehensive adherence programs, organizations can not only prevent and deter corporate crime but also foster a culture of integrity and accountability.

Challenges and Considerations in Conducting Effective Investigations

Conducting effective entails navigating several challenges, including and within complex legal landscapes. One critical aspect is ensuring that inquiries are thorough yet efficient. Investigations must be tailored to the specific allegations and unique circumstances of the organization, as inefficient processes can lead to increased costs and the risk of informational leaks.

Establishing clear protocols from the outset is essential. The board and counsel should provide clear directions and organized plans, approaching the inquiry in phases with set deadlines. This organized method aids in preserving concentration and guarantees prompt resolution of main concerns.

Moreover, maintaining open lines of communication is crucial to managing potential pushback from internal stakeholders and minimizing disruptions to business operations. Clarity and truthfulness are throughout the inquiry process, as misrepresentation or delays can harm the company's reputation and generate extra legal risks.

In some cases, external expertise is necessary. For instance, cybersecurity specialists may be required to address data breaches, while forensic accountants could be essential for analyzing financial misconduct. Making certain that these experts are thoroughly incorporated into the inquiry process can enhance the trustworthiness of the results and reassure stakeholders of the company’s dedication to tackling concerns responsibly.

Recent developments indicate that many companies are now integrating adherence to regulatory standards into their performance evaluations and compensation structures. This change not only fosters ethical behavior but also encourages the reporting of possible regulatory concerns, establishing a positive model within the marketplace.

In the end, effective compliance inquiries depend on a blend of meticulous preparation, efficient implementation, and clear communication, guaranteeing that the entity can tackle challenges efficiently while preserving its operational integrity.

, emphasizing the importance of preparation, implementation, and communication. This flowchart outlines the critical steps in conducting effective corporate compliance assessments, emphasizing the importance of preparation, implementation, and communication.](https://tely.blob.core.windows.net/telyai/this-flowchart-outlines-the-critical-steps-in-conducting-effective-corporate-compliance-assessments-emphasizing-the-importance-of-preparation-implementation-and-communication.jpg)

Best Practices for Engaging Investigations Firms

To ensure the effectiveness of , entities must adopt a series of . First, clearly define the scope of the inquiry to avoid any ambiguity and ensure all aspects of the issue are covered comprehensively. Establishing open communication channels between the organization and the investigative firm is crucial for . It's essential to choose a firm with knowledge and experience pertinent to the specific inquiry at hand, as inadequate expertise or insufficient resources can undermine the credibility of the process.

Working together during the inquiry process is another key factor. Supplying the necessary resources and support to the investigative firm promotes a thorough and efficient inquiry. This collaboration is particularly essential when addressing ESG () matters, where inquiries often involve potential victims and communities profoundly impacted by the incident.

Organizations should also be mindful of the political and societal consequences of their inquiries. For example, mishandling an inquiry related to human rights abuses or environmental disasters can lead to legal and financial risks, as well as damage relationships with stakeholders. Transparency commitments, such as publishing findings, can help ensure accountability and maintain stakeholder trust.

Ultimately, utilizing technology and knowledge in the inquiry process can significantly improve the efficiency of examinations. The integration of AI and digital evidence management systems can help investigators manage the growing volume of digital evidence, ensuring its integrity and chain of custody. By adopting these [best practices](https://blog.smbdistress.com/10-essential-stakeholder-management-interview-answers-for-cf-os), organizations can conduct more effective, rigorous, and timely investigations, ultimately protecting their interests and maintaining compliance with regulations.

Conclusion

Independent investigations are essential for upholding corporate compliance and integrity, allowing organizations to objectively assess internal practices and adhere to legal standards. Engaging third-party investigation firms not only mitigates conflicts of interest but also provides unbiased insights into potential compliance breaches. Establishing clear protocols for handling complaints and allegations is crucial, as it ensures transparency and promotes trust among stakeholders, ultimately preserving the company’s reputation.

The objectives of corporate compliance investigations extend beyond merely identifying violations; they also involve evaluating the effectiveness of compliance programs and mitigating risks. A strong compliance culture, supported by adequate resources and protection for whistleblowers, plays a vital role in preventing corporate misconduct. Organizations that invest in comprehensive compliance frameworks not only deter corporate crime but also foster an environment of integrity and accountability.

However, conducting effective investigations presents challenges, including the management of sensitive information and maintaining confidentiality. A structured approach, with clear protocols and open communication, is necessary to navigate these complexities. Involving external experts when needed can enhance the credibility of findings and demonstrate a commitment to responsible issue resolution.

Finally, adopting best practices when engaging investigation firms is vital for the success of the investigative process. Clearly defining the scope of the investigation, ensuring collaboration, and leveraging technology can lead to more effective and timely outcomes. By prioritizing these elements, organizations can safeguard their interests, maintain compliance, and reinforce stakeholder trust.

Frequently Asked Questions

What is the purpose of self-sufficient inquiries in a corporate context?

Self-sufficient inquiries are essential for upholding corporate adherence and integrity. They provide an impartial evaluation of internal practices to ensure organizations comply with legal and regulatory standards, thus maintaining their reputation and promoting trust among stakeholders.

Why should organizations involve external inquiry firms?

Involving external inquiry firms helps organizations avoid conflicts of interest and obtain unbiased perspectives on potential regulatory violations. This can enhance the integrity of the inquiry process and support the organization's reputation.

How should complaints or allegations of misconduct be handled?

A well-documented procedure is crucial, which may include internal hotlines, anonymous tips, or direct reports. Decisions on whether to investigate should involve consultation with the Audit Committee or Legal Department to ensure transparency.

What legal requirements must companies consider during an investigation?

Companies, particularly public ones, may need to file disclosures such as an 8-K with the SEC if an investigation could significantly influence shareholder decisions. There are strict timelines for reporting, typically within four business days of discovering allegations.

What are the challenges in conducting corporate compliance assessments?

Challenges include managing sensitive information, maintaining confidentiality, and ensuring thorough yet efficient inquiries. Clear protocols and organized plans are necessary to address these challenges effectively.

Why is effective communication important during compliance inquiries?

Open lines of communication help manage potential pushback from internal stakeholders and prevent disruptions to business operations. Clarity and honesty are critical to maintaining the company's reputation throughout the inquiry process.

When might external expertise be necessary in investigations?

External expertise, such as cybersecurity specialists or forensic accountants, may be needed to address specific issues like data breaches or financial misconduct, enhancing the credibility and thoroughness of the inquiry.

How are compliance and regulatory standards integrated into corporate culture?

Many companies now incorporate adherence to regulatory standards into performance evaluations and compensation structures, fostering ethical behavior and encouraging reporting of potential regulatory concerns.

What best practices should entities adopt for effective forensic and investigative consulting services?

Best practices include clearly defining the inquiry's scope, maintaining open communication with the investigative firm, and ensuring the chosen firm has the relevant expertise. Collaboration and support during the inquiry are also crucial for effectiveness.

How can technology improve the efficiency of compliance inquiries?

Utilizing technology, such as AI and digital evidence management systems, can enhance the efficiency of investigations by helping manage the increasing volume of digital evidence while ensuring its integrity and proper chain of custody.

Why is transparency important in the inquiry process?

Transparency, such as publishing findings, is vital for accountability and maintaining stakeholder trust. Mishandling inquiries, especially regarding sensitive issues like human rights or environmental concerns, can lead to significant legal and reputational risks.