Overview

The top seven benefits of interim CFO services for companies include immediate access to financial expertise, cost-effective leadership, flexible engagement models, strategic insights, enhanced operational efficiency, effective crisis management, and long-term value creation. The article supports this by detailing how interim CFOs provide essential financial guidance during critical transitions, optimize costs without long-term commitments, and implement strategic frameworks that lead to improved financial health and stability for organizations.

Introduction

In a rapidly evolving business landscape, organizations often find themselves in need of immediate financial guidance amidst uncertainty and change. Interim CFOs have emerged as vital assets, offering not only expert financial oversight but also strategic insights that can steer companies through turbulent times. Their ability to quickly assess financial health, implement effective strategies, and optimize operations positions them as key players in enhancing organizational resilience.

As businesses face challenges ranging from mergers to economic shifts, the flexible engagement models provided by interim CFOs allow for tailored financial leadership that meets specific needs. By leveraging their expertise, companies can navigate complexities, improve cash flow, and ultimately lay the groundwork for sustainable growth.

This article delves into the multifaceted roles of interim CFOs, highlighting their impact on financial stability and long-term success.

Immediate Access to Financial Expertise

Organizations can swiftly utilize interim CFO services for companies to confront pressing monetary challenges, as these services provide essential expertise. Their extensive knowledge enables companies to promptly evaluate their economic standing, pinpoint urgent issues, and deploy effective strategies to stabilize operations. This immediate access to seasoned economic expertise is especially vital for businesses navigating significant transformations, such as mergers, acquisitions, or restructuring efforts, where responsive decision-making can determine the trajectory of success.

As Christina Ross, CFO and CEO of Cube, aptly puts it,

Get out of the data entry weeds and into the strategy.

This sentiment resonates with the 58% of financial executives who are now dedicating more time to technology investment and implementation compared to just a year ago. Moreover, recent recruitment patterns indicate that as 64% of chief financial officers emphasize cost efficiency—the greatest attention in ten years—there is an increasing dependence on interim CFO services for companies to provide prompt expertise during crucial transitions.

With a pragmatic approach to data, temporary financial officers test every hypothesis to maximize return on invested capital, while continually monitoring progress through real-time analytics via a client dashboard that diagnoses business health. Significantly, the job market dynamics suggest that 24% of finance professionals intend to change positions within a year, emphasizing the evolving landscape and underscoring the necessity for interim CFO services for companies, who can step in, operationalize lessons learned, and cultivate robust lasting relationships to stabilize monetary operations during times of uncertainty.

Cost-Effective Financial Leadership

Engaging interim CFO services for companies presents a strategic opportunity to significantly reduce the burdens associated with full-time executive salaries and benefits. Companies can utilize interim CFO services for companies on a temporary basis, gaining access to exceptional leadership in finance without the substantial overhead of a permanent hire. This flexibility not only enables businesses to maintain tighter control over their budgets but also ensures they receive the necessary economic insights and guidance vital for streamlined decision-making and real-time analytics.

As Scott Orn, Chief Operating Officer, points out, earlier stage companies often face costs ranging from $250,000 to $400,000 for a full-time CFO, along with equity stakes of 0.6% to 1.25%. Moreover, recruitment fees for hiring a full-time CFO can range from 20% to 30% of the CFO's first-year salary, further emphasizing the cost burden of a permanent hire. In contrast, investing in interim CFO services for companies can yield significant savings, as they provide valuable support and insights without the long-term monetary commitment.

Moreover, by recognizing fundamental business problems and working together to develop practical strategies, temporary financial executives can improve performance tracking and investment returns efficiently. A crucial aspect of this process is the 'Test & Measure' approach, where every hypothesis is tested to ensure maximum return on invested capital. The incorporation of advanced monetary software and tools may impact costs; for example, financial executives employing cutting-edge technology might impose higher fees to account for these expenses.

This trend, emphasized in case studies, highlights the cost advantages of interim CFO services for companies, particularly as organizations aim to navigate the increasingly intricate economic landscape of 2024. By viewing interim CFO services for companies as an investment rather than a cost, businesses can better appreciate the strategic advantages these services offer, including mastering the cash conversion cycle through effective planning and measurement. Specific strategies for mastering the cash conversion cycle include:

- Optimizing inventory management

- Improving receivables collection processes

Additionally, the pricing for these services often starts at $99.00, providing an accessible option for companies looking to improve their economic performance.

Flexible Engagement Models

Interim CFO services for companies provide various engagement models, including part-time and project-based setups, enabling organizations to choose the level of leadership that aligns with their immediate needs. These professionals not only collaborate with current staff but also may enlist experts for specific projects, ensuring a comprehensive approach to management. This adaptability enables companies to leverage interim CFO services to adjust their financial oversight as circumstances change, particularly during transitions such as rapid growth, mergers, or financial restructuring.

Significantly, the position of temporary financial officers has gained traction, with a reported 116% year-over-year growth in such roles across various sectors, especially within private equity portfolio companies and in the life sciences and technology industries. Additionally, the hiring process for a temporary CFO involves:

- Calibration and scoping

- Candidate engagement

- Evaluations

- Selections

- Onboarding

This process is crucial for aligning the right expertise with organizational needs. By utilizing a 'Test & Measure' approach, interim CFOs can experiment with different monetary strategies and assess their effectiveness, leading to informed adjustments.

Furthermore, they continuously 'Update & Adjust' their tactics based on real-time analytics from client dashboards, ensuring that the strategies remain relevant and effective. As Adam Zaki, a reporter, highlights, this trend underscores the increasing reliance on flexible engagement models in today’s dynamic business landscape. Moreover, CFO job advertisements have experienced a 238% increase in AI references, while compensation has decreased, indicating the evolving nature of leadership roles in finance.

By leveraging interim CFO services for companies, organizations can efficiently navigate fluctuating demands while maintaining high standards of fiscal governance.

Strategic Financial Insights and Guidance

Interim financial leaders serve as more than just financial overseers; they are essential strategic partners capable of delivering profound insights into market dynamics, financial forecasting, and effective risk management. Mastering the cash conversion cycle is pivotal, and our 20 strategies, including optimizing accounts receivable and inventory management, can significantly enhance business performance by improving cash flow and enabling reinvestment in strengths. In a time when organizations struggle with economic unpredictability and swift technological progress, the need for agile budgeting has become essential—36% of financial executives emphasize this necessity for flexibility.

Furthermore, over half of financial executives are now investing more time in technology and performance management, reflecting a shift towards sustainable growth, as highlighted in PwC’s Pulse Survey. While only 31% of chief financial officers view achieving measurable value from tech adoption as a significant challenge, this indicates a growing recognition of the importance of technology in enhancing economic performance through continuous monitoring and real-time analytics. With their expertise in interpreting intricate economic data, interim CFO services for companies enable the development of actionable strategies that align with long-term objectives.

They implement methodologies such as:

- Scenario planning

- Performance benchmarking

These methodologies not only enhance financial forecasting accuracy but also position organizations to adeptly navigate challenges, fostering sustainable growth. As Dean Hobbs, principal and US chief operating officer for the Finance & Performance practice at Deloitte Consulting LLP, asserts, 'The urgency for financial leaders is to look beyond the basics and reimagine entire business processes with AI.' Such insights reflect the evolving role of interim financial leaders, who are increasingly recognized for their capacity to facilitate strategic decision-making and operationalizing turnaround lessons in a rapidly changing environment.

Enhanced Operational Efficiency

Interim chief financial officers play a vital role in improving operational efficiency by first getting acquainted with the organization's economic operations and creating a customized strategy after evaluating the situation. They pinpoint inefficiencies within existing financial processes and execute best practices that align with the organization's needs. By utilizing a pragmatic approach, temporary financial executives test hypotheses to ensure maximum return on invested capital, streamlining key functions such as budgeting, forecasting, and reporting to not only enhance efficiency but also align with strategic objectives.

The integration of real-time business analytics through client dashboards allows for continuous performance monitoring, enabling CFOs to make informed decisions swiftly throughout the turnaround process. This adaptability in interim CFO services for companies enables organizations to adjust their fiscal oversight based on the intricacy and length of their turnaround, promoting a more responsive and effective method of managing finances. Such adaptability is particularly crucial during periods of economic uncertainty, where strong leadership, effective governance, and cultural transformation are paramount.

For example, a recent case study named 'The Crucial Role of Temporary Chief Financial Officers in Monetary Uncertainty' demonstrated how temporary chief financial officers became part of teams to stabilize budgets, perform comprehensive audits, and establish the foundation for both short-term recovery and long-term development. As Talent, a Managing Director, noted, 'I’ve always been so impressed by your network, deep firsthand understanding of what ‘great’ looks like for PE and your ability to run down trusted back channels from trusted sponsors and that all came to bear here in such a meaningful way.' By streamlining monetary processes and implementing lessons learned, companies can benefit from interim CFO services for companies that not only save time and resources but also enable organizations to focus on essential operations and strategic initiatives, ultimately converting challenges into opportunities and boosting overall resilience.

In this context, the 'Decide & Execute' approach ensures decisive actions are taken, while the 'Update & Adjust' philosophy supports ongoing improvements based on real-time analytics.

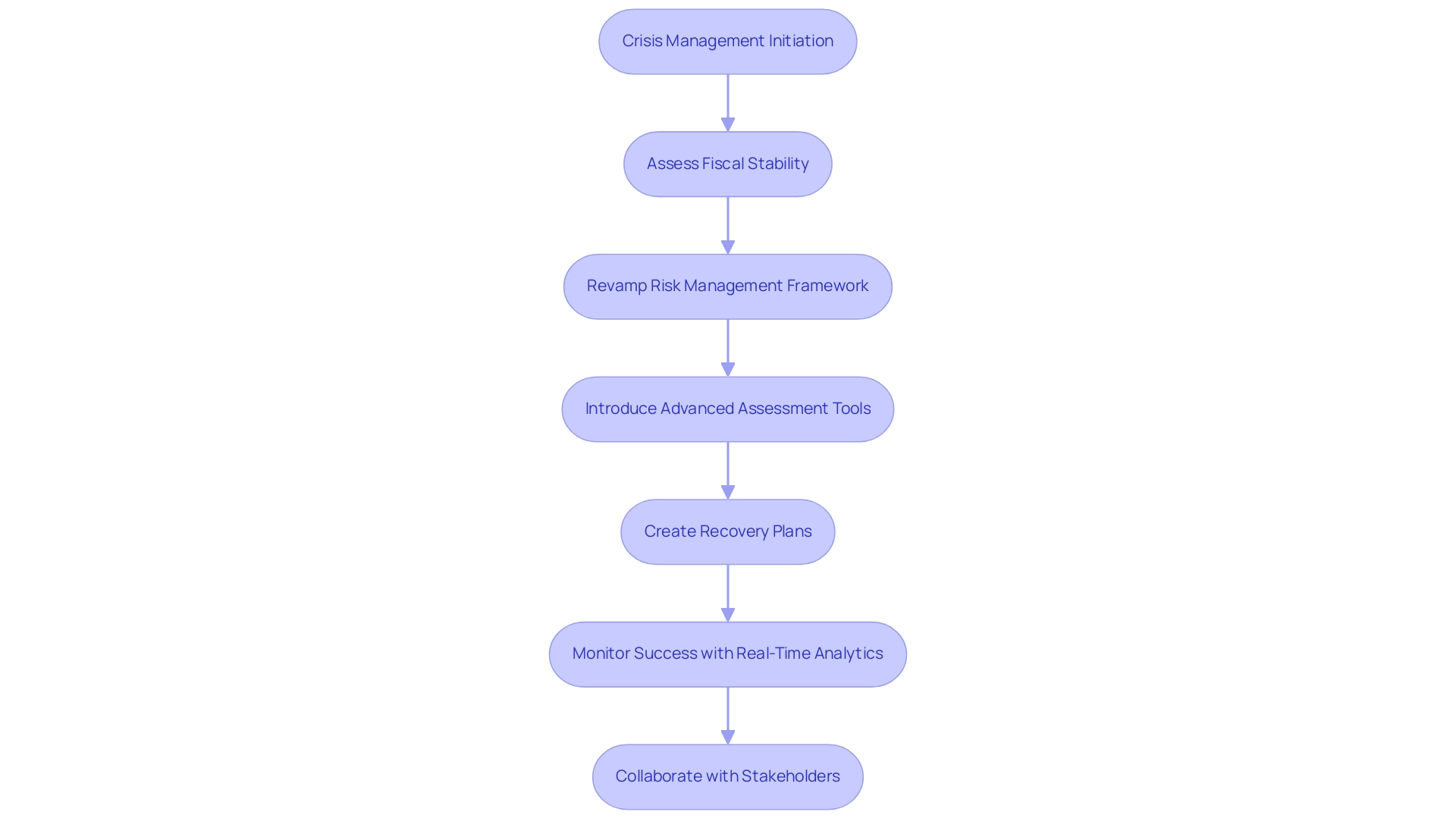

Effective Crisis Management

During times of economic hardship, temporary chief financial officers are crucial participants in crisis management, armed with the resources to quickly assess an organization's fiscal stability. They apply a pragmatic approach to data, testing every hypothesis to identify areas that require immediate attention. By revamping the risk management framework and introducing advanced assessment tools, temporary financial leaders create actionable recovery plans that not only stabilize cash flow but also strategically reduce liabilities and protect essential resources.

Their commitment to operationalizing the lessons learned through the turnaround process is crucial. According to industry experts, 'The chief financial officer should not believe that all is on their shoulders and make judgments without consulting anybody.' This collaborative method promotes swift decision-making, enabling temporary financial officers to execute targeted strategies that assist companies in regaining their stability.

Additionally, they continually monitor the success of these strategies through real-time analytics, utilizing client dashboards that provide comprehensive insights into business performance and health. Their leadership during turbulent times not only aids in overcoming immediate challenges but also positions organizations for long-term growth. By cultivating strong connections with stakeholders, temporary financial executives ensure that insights from the turnaround process are effectively implemented for future stability.

Case studies demonstrate how temporary chief financial officers have effectively guided companies through recessions, often leading to enhanced economic stability and a more robust operational structure moving forward. With over 4 million satisfied learners served by DigitalDefynd, the demand for interim CFO services is evident, emphasizing their critical role in navigating economic crisis.

Long-Term Value and Growth Potential

Interim financial officers often step in during critical moments, yet their influence reaches well beyond immediate challenges. By establishing robust monetary practices and strategic initiatives, they play a pivotal role in enhancing a company's long-term economic health. With an annual salary of £60K in the UK, their expertise can lead to improved profitability, optimized cash flow management, and a reinforced competitive stance in the market.

As noted by a part-time CFO from Coin Masters, fractional CFOs support a company, and their expense line item is one of the first things to look at. This focus on cost management is crucial in driving sustainable financial practices. Furthermore, our team supports a shortened decision-making cycle throughout the turnaround process, enabling decisive actions that preserve your organization through the 'Decide & Execute' framework.

We continually monitor the success of our plans through a client dashboard that provides real-time business analytics, allowing for continuous diagnosis of your business health, embodying the 'Update & Adjust' feature. Studies have indicated that companies with robust corporate governance, when led by temporary financial officers, encounter reduced earnings manipulation and an increased probability of attaining long-term profitability. The case study titled 'Consequences of Temporary Chief Financial Officer Appointments' illustrates that while temporary financial leaders can lead to higher income-increasing earnings management in firms lacking strong governance, those with robust governance do not exhibit significant earnings management.

Thus, the frameworks and insights offered through interim CFO services for companies not only address urgent needs but also lay the groundwork for sustained success and growth in the business landscape. Their collaboration with other C-suite members ensures alignment of financial strategies with the company's growth plans and R&D goals, further operationalizing turnaround lessons and mastering the cash conversion cycle.

Conclusion

Interim CFOs have proven to be invaluable assets for organizations navigating the complexities of today’s business environment. Their immediate access to financial expertise allows companies to swiftly address pressing challenges, ensuring that critical decisions are informed by data-driven insights. By providing strategic oversight during transitions such as mergers or restructuring, interim CFOs help stabilize operations and set the stage for future success.

The cost-effective nature of engaging interim CFOs cannot be overstated. Businesses can gain high-level financial leadership without the long-term financial commitments associated with permanent hires. This flexibility not only optimizes budget management but also enhances operational efficiency, allowing organizations to focus resources on core activities and strategic initiatives. The ability to hire interim CFOs on a part-time or project basis empowers companies to adapt their financial leadership to evolving needs.

Moreover, the strategic insights and guidance offered by interim CFOs facilitate agile decision-making and risk management, which are essential in an era marked by economic uncertainty and rapid technological advancement. Their expertise in areas such as cash flow management and financial forecasting positions companies to not only weather immediate challenges but also to thrive in the long run.

In conclusion, interim CFOs are more than just temporary financial overseers; they are key partners in fostering resilience and driving sustainable growth. By leveraging their skills, organizations can enhance operational efficiency, implement effective crisis management strategies, and establish a robust foundation for long-term value creation. As the demand for flexible and strategic financial leadership continues to rise, the role of interim CFOs will undoubtedly remain central to the success of businesses navigating the complexities of the modern financial landscape.

Frequently Asked Questions

What are interim CFO services and why are they important for companies?

Interim CFO services provide companies with essential financial expertise to address pressing monetary challenges. They enable businesses to quickly assess their economic standing, identify urgent issues, and implement effective strategies, particularly during significant transformations like mergers, acquisitions, or restructuring.

How do interim CFO services help in decision-making during critical transitions?

Interim CFO services offer immediate access to seasoned financial expertise, which is crucial for responsive decision-making. This can significantly influence the success of businesses navigating major changes.

What trend is observed among financial executives regarding technology investment?

A growing trend shows that 58% of financial executives are dedicating more time to technology investment and implementation compared to the previous year, reflecting an increased focus on leveraging technology for financial management.

What are the cost benefits of using interim CFO services compared to hiring a full-time CFO?

Engaging interim CFO services allows companies to significantly reduce costs associated with full-time executive salaries and benefits, which can range from $250,000 to $400,000 annually. Additionally, recruitment fees for full-time CFOs can be 20% to 30% of the first-year salary, making interim services a more economical option.

How do interim CFOs contribute to improving financial performance?

Interim CFOs work collaboratively with companies to identify fundamental business problems and develop practical strategies. They utilize a 'Test & Measure' approach to ensure maximum return on invested capital and improve performance tracking efficiently.

What strategies do interim CFO services recommend for mastering the cash conversion cycle?

Key strategies include optimizing inventory management and improving receivables collection processes, which are essential for enhancing cash flow and economic performance.

What is the starting pricing for interim CFO services?

The pricing for interim CFO services often starts at $99.00, making it an accessible option for companies looking to improve their financial performance without a long-term monetary commitment.