Overview

The article outlines seven key cost reduction strategies that banks should implement, focusing on optimizing expenses related to personnel, operations, compliance, and technology. It emphasizes the importance of leveraging automation, streamlining processes, and engaging stakeholders to enhance efficiency while maintaining customer satisfaction, supported by case studies and industry insights that highlight successful implementations and the necessity for continuous improvement.

Introduction

In the competitive landscape of banking, understanding and managing costs effectively is paramount for financial success. As institutions navigate a complex array of cost drivers—including personnel expenses, operational overhead, and regulatory compliance—they must adopt strategic initiatives to enhance efficiency and profitability.

With the challenges posed by a lower interest rate environment and evolving customer expectations, banks are compelled to scrutinize their expenditures and implement targeted cost reduction strategies. This article delves into practical approaches that financial leaders can adopt, including:

- Leveraging automation and technology

- Optimizing processes

- Outsourcing non-core functions

- Engaging stakeholders in cost-saving initiatives

By prioritizing these strategies, banks can not only achieve significant savings but also maintain a strong focus on customer experience and operational excellence.

Understanding Cost Drivers in Banking

In the banking sector, a nuanced comprehension of expense drivers is essential for effective financial management. Key factors to examine include:

- Personnel expenses

- Operational expenditures

- Regulatory compliance expenses

- Technology investments

A comprehensive financial evaluation allows institutions to identify the areas that most significantly affect their overall expenditures.

Significantly, staffing expenses generally represent a considerable portion of a financial institution's budget, frequently approaching 60%. This reality necessitates a critical evaluation of staffing levels and compensation structures. Furthermore, operational costs—particularly those associated with branch maintenance and IT infrastructure—warrant close scrutiny to identify potential inefficiencies.

As financial institutions prepare for the challenges of a lower interest rate environment and modest economic growth in 2025, understanding these expense drivers will enable management teams to implement cost reduction strategies in the banking sector effectively. For example, Standard Chartered has allocated US$1.5 billion for its 'Fit for Growth' program, demonstrating proactive expenditure management strategies. Moreover, the case study titled 'Preparing for Macroeconomic Challenges' highlights the necessity for financial institutions to adjust by concentrating on:

- Cost reduction strategies in the banking sector

- Increasing noninterest revenue

- Updating technology

- Managing expenses efficiently

Furthermore, a recent study by Adyen discovered that 55% of respondents will abandon a purchase if they cannot pay with their preferred method, emphasizing the significance of operational expenses and user experience in the current environment.

Leveraging Automation and Technology for Cost Efficiency

The adoption of automation technologies, including robotic process automation (RPA) and artificial intelligence (AI), presents banks with significant opportunities for implementing cost reduction strategies in the banking sector. These technologies streamline repetitive tasks such as data entry and compliance checks, allowing staff to concentrate on higher-value activities that drive business growth. For example, AI-driven chatbots efficiently manage customer inquiries, significantly decreasing the reliance on large customer service teams.

Moreover, adopting cloud computing solutions can support cost reduction strategies in the banking sector by resulting in lower IT infrastructure expenses while concurrently improving scalability and flexibility. According to the case study 'Benefits of Finance Automation,' organizations that embrace finance automation experience:

- Faster processing times

- Reduced errors

- Improved compliance

Typically realizing a return on investment within 6 to 12 months, accompanied by notable improvements in operational efficiency and data quality. This is especially pertinent as 99% of companies are preparing for stricter disclosure requirements, highlighting the necessity for financial institutions to adopt these technologies.

As Mamta Bagde, a Technical Lead and Solution Architect specializing in RPA, aptly states, 'Automation is transforming the financial sector in profound ways.' By prioritizing these technological advancements, financial institutions can enhance their operational efficiency and adopt cost reduction strategies in the banking sector to attain significant savings in a competitive landscape.

Optimizing Processes for Enhanced Cost Savings

To attain significant savings and improve operational efficiency, financial institutions must adopt cost reduction strategies in the banking sector by performing a thorough examination of their workflows, identifying bottlenecks and redundancies. Implementing Lean Six Sigma methodologies serves as a powerful strategy for cost reduction strategies in the banking sector by streamlining operations. For example, by streamlining the loan approval procedure and decreasing the number of necessary approvals, financial institutions can utilize cost reduction strategies in the banking sector to accelerate delivery and greatly reduce operational expenses.

As Jason Wilk, CEO and Founder of Dave, states, 'We’re witnessing impressive outcomes from our proprietary AI-driven underwriting model,' underscoring the importance of innovation in optimizing banking processes. Furthermore, it is crucial for financial institutions to routinely evaluate their offerings, identifying and eliminating underperforming products that deplete valuable resources. Continuous business performance monitoring, backed by real-time analytics, enables CFOs to make informed decisions and strengthen client relationships.

Assessing and quantifying the effectiveness of these strategies is crucial; for instance, financial institutions can apply A/B testing for new offerings to gauge their influence on customer satisfaction and operational efficiency. The case study titled 'Wealth Management Market Opportunities' illustrates that despite leading financial institutions holding only a 32% market share in wealth management, they face competitive challenges and regulatory pressures for fee transparency, complicating their ability to justify high fees. By committing to continuous enhancement, leveraging strategic planning, and regularly testing their initiatives, banks can adopt cost reduction strategies in the banking sector, unlocking significant cost savings while also elevating the quality of their offerings and driving better outcomes for their clients.

Additionally, mobile banking advantages such as convenient access, mobile wallets, peer-to-peer payment options, and predictive budgeting tools illustrate how Lean Six Sigma can improve delivery in this rapidly evolving sector. As emphasized in recent discussions, the focus on Lean Six Sigma in the financial sector is becoming increasingly essential, especially as industry professionals acknowledge the need for cohesive automation platforms—an approach favored by 94% of business professionals for their financial operations.

Outsourcing and Remote Work: Strategies for Cost Reduction

Delegating non-essential tasks, such as IT assistance, human resources, and compliance, provides a strategic option for financial institutions to greatly lessen overhead expenses while concentrating on their primary strengths. By collaborating with specialized providers, financial institutions can attain higher quality offerings along with lowered costs, gaining advantages from our thorough financial review process. Our turnaround and restructuring services encompass thorough evaluations of operational efficiency and cash flow management, guaranteeing that financial institutions not only reduce expenses but also maintain essential resources.

For instance, data shows that companies leveraging outsourcing can experience up to a 25% faster time-to-market, which is critical in the competitive banking sector. Furthermore, the move towards remote work is transforming operational expense frameworks; financial institutions can reduce their physical presence and associated expenditures by allowing employees to work from home, promoting satisfaction and retention while realizing significant savings. Recent findings indicate that 57% of U.S. businesses are currently utilizing freelancers, a trend reflected in the banking industry, where outsourcing is increasingly becoming the norm.

Notably, a case study on small businesses reveals that 37% outsource at least part of their processes, with 52% planning to do so soon, showcasing the growing acceptance of outsourcing as a means to enhance efficiency. Additionally, with India becoming the largest market for outsourcing and expected expansion in BPO positions due to reduced local labor expenses, financial institutions can strategically utilize this global environment for their operational requirements. The rise in nearshore outsourcing by 38% further illustrates a shift towards more accessible and cost-effective solutions.

Such cost reduction strategies in the banking sector are essential for financial institutions aiming to enhance efficiency without sacrificing quality, aligning perfectly with our commitment to transparency and collaboration in delivering expert advice.

Balancing Cost Reduction with Customer Experience

In the pursuit of cost reduction strategies in the banking sector, banks must exercise caution to ensure that client experience does not suffer. For example, decreasing support staff can greatly lengthen wait times and result in discontent, undermining trust with clients. Research indicates that only around 50% of companies presently meet social media response time standards, highlighting the importance of prompt interactions as part of cost reduction strategies in the banking sector.

Instead, banks should prioritize enhancing operational efficiency through technology. Digital solutions such as online banking platforms and mobile applications have demonstrated effectiveness in enhancing interactions, enabling better delivery without compromising quality. Additionally, integrating client feedback during the cost reduction strategies in the banking sector is essential, as it provides invaluable insights that inform strategic choices.

Exceeding financial institutions uphold an efficiency ratio below 50%, establishing a standard for achievement in balancing expense reduction and client service. Research indicates that 89% of clients express satisfaction with generative AI virtual assistants, highlighting the potential of these modern tools to enhance user engagement while driving down costs. The financial sector also encounters rising competition from unconventional financial entities, which aim at the largest profit pools, making it crucial for traditional institutions to uphold a strong focus on client experience alongside cost-saving efforts.

By doing so, financial institutions can not only uphold their competitive edge but also cultivate enduring customer loyalty amidst escalating competition.

Implementing Continuous Improvement Programs

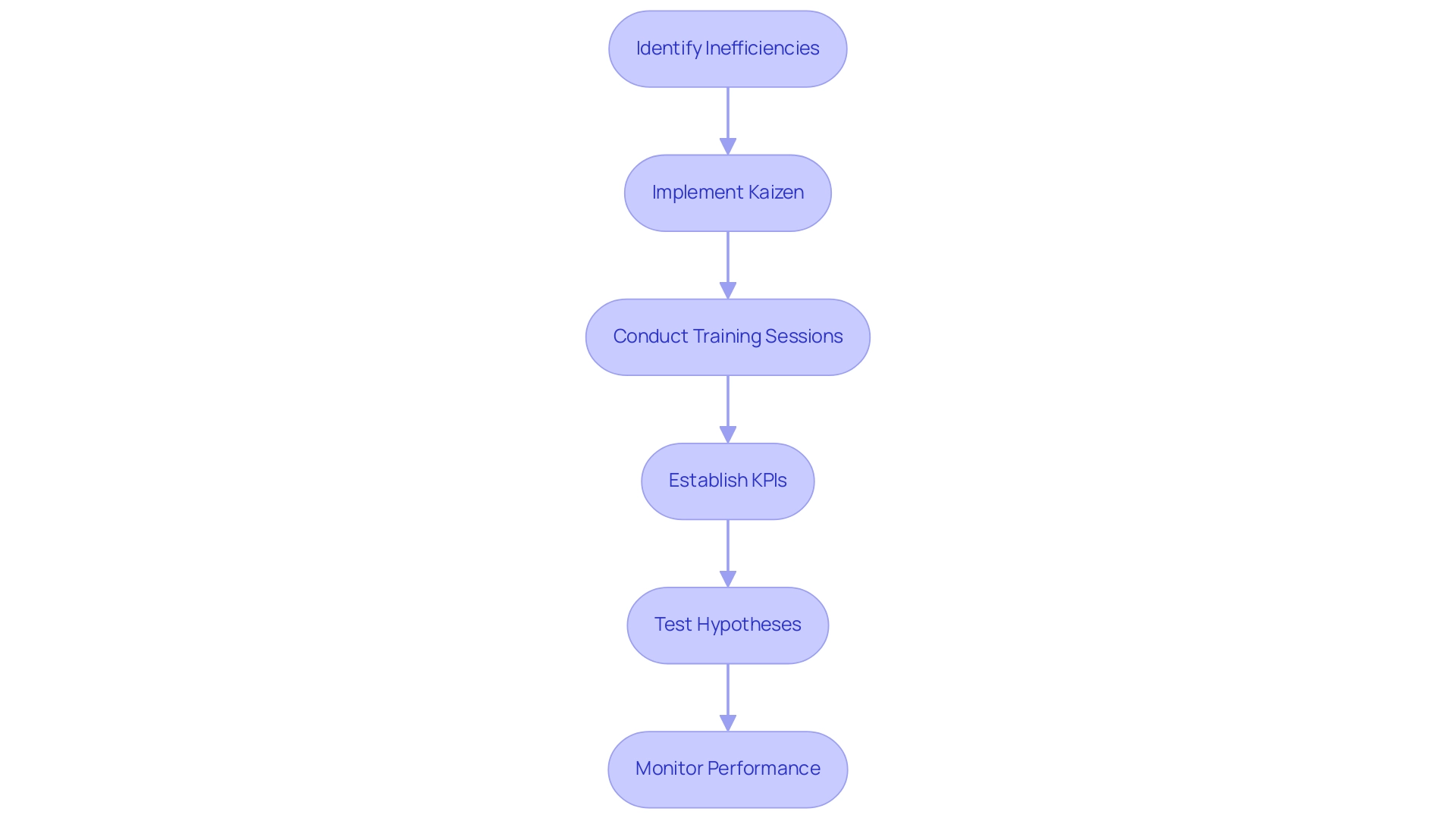

To attain ongoing savings, financial institutions must implement extensive enhancement initiatives that enable staff to identify chances for increased efficiency. By implementing methodologies such as Kaizen, organizations can foster a culture of continuous improvement where small, incremental changes lead to substantial gains over time. This approach is complemented by real-time analytics, enabling streamlined decision-making and agile response to operational challenges.

Regular training sessions and workshops are essential to equip staff with the skills needed to identify inefficiencies and propose actionable solutions. Establishing key performance indicators (KPIs) is crucial; these metrics allow financial institutions to monitor ongoing performance, measure the effectiveness of their improvement initiatives, and make informed adjustments as needed. Additionally, testing hypotheses is vital for delivering maximum return on invested capital, ensuring that strategies are effective and aligned with business goals.

This dedication to nurturing a culture of ongoing enhancement not only strengthens cost reduction strategies in the banking sector but also ensures they adapt to the changing requirements of the industry. Recent insights indicate that 35% of firms are prioritizing product improvement, underscoring the importance of systematic approaches to enhance operational efficiency. As one team member noted, 'We learned from this project that relatively simple processes can get very complicated when there are many hand-offs.

Rapid Action gave us a way to challenge the status quo and implement creative solutions while maintaining necessary controls.' This perspective highlights the complexities financial institutions face in operationalizing turnaround lessons. Moreover, case studies on managing variation in complex manufacturing processes reveal that integrating methodologies like Variation Risk Management (VRM) with Six Sigma can significantly enhance management practices.

By applying these insights collaboratively, financial institutions can effectively leverage continuous improvement to boost banking efficiency well into 2024 and beyond.

Engaging Stakeholders in Cost Reduction Initiatives

Successful expense reduction efforts depend on the active involvement of all stakeholders—senior management, employees, and clients alike. Our team supports a shortened decision-making cycle throughout the turnaround process, allowing your organization to take decisive action to preserve business continuity. Importantly, we begin by identifying underlying business issues collaboratively, ensuring that all perspectives are considered in the planning process.

Banks that clearly communicate the rationale behind their cost-cutting measures not only foster transparency but also encourage innovative input from their employees. This collaborative approach leads to creative solutions that may not surface in a more rigid environment. For instance, a software company recently achieved a remarkable Net Promoter Score of +70, reflecting high stakeholder satisfaction—testifying to the impact of inclusive strategies.

Furthermore, involving customers in discussions about potential changes enables banks to gauge public sentiment and refine their strategies accordingly. By leveraging real-time business analytics through our client dashboard, organizations can continually diagnose business health and reinforce positive employee behaviors essential for the successful adoption of new practices, particularly during the 'Neutral Zone' phase of William Bridges' Transition Model. Tailoring engagement strategies to meet the unique needs of different stakeholder segments maximizes their value, ensuring that cost reduction strategies in the banking sector are well-received and effectively executed.

This includes an 'Update & Adjust' approach, where we continually monitor performance and adjust plans based on real-time data. Key metrics, such as communication quality, task completion rates, stakeholder satisfaction, and goal alignment, are critical in measuring engagement ROI. As highlighted, 'Good stakeholder engagement brings financial gains,' underscoring the financial benefits of effective stakeholder involvement.

The case study titled 'Critical Stakeholder Segments: Tailoring Engagement Strategies' illustrates how organizations can maximize stakeholder value by implementing specific engagement strategies tailored to each group's unique contributions and needs.

Conclusion

By implementing the outlined strategies, banks can effectively navigate the complexities of cost management while enhancing their operational efficiency. Understanding cost drivers is the foundation for informed decision-making, enabling institutions to identify key areas for improvement—from personnel expenses to technology investments. Embracing automation and optimizing processes not only streamline workflows but also free up valuable resources, allowing teams to focus on strategic initiatives that drive growth.

Outsourcing non-core functions and leveraging remote work arrangements present additional avenues for cost reduction, enabling banks to maintain quality service while reducing overhead. However, it is crucial to balance these efforts with an unwavering commitment to customer experience. The integration of technology and continuous improvement programs ensures that banks remain agile in responding to evolving customer expectations and market dynamics.

Engaging all stakeholders in the cost reduction process fosters a collaborative environment where innovative solutions can thrive. By prioritizing transparency and communication, banks can cultivate trust and loyalty among employees and customers alike. As the financial landscape continues to evolve, the proactive management of costs combined with a steadfast focus on customer satisfaction will be key to achieving sustained success and competitive advantage. The time for action is now; the strategies discussed will equip banks to thrive in an increasingly challenging environment.

Frequently Asked Questions

Why is understanding expense drivers important for financial management in banking?

A nuanced comprehension of expense drivers is essential for effective financial management as it allows institutions to identify areas that significantly affect their overall expenditures, such as personnel expenses, operational expenditures, regulatory compliance expenses, and technology investments.

What percentage of a financial institution's budget typically goes towards staffing expenses?

Staffing expenses generally represent a considerable portion of a financial institution's budget, frequently approaching 60%.

What are some key areas financial institutions should scrutinize to manage costs effectively?

Financial institutions should critically evaluate staffing levels and compensation structures, as well as operational costs related to branch maintenance and IT infrastructure to identify potential inefficiencies.

How are financial institutions preparing for economic challenges in 2025?

Financial institutions are preparing for challenges in a lower interest rate environment and modest economic growth by understanding expense drivers and implementing cost reduction strategies.

What proactive expenditure management strategy has Standard Chartered implemented?

Standard Chartered has allocated US$1.5 billion for its 'Fit for Growth' program, demonstrating its commitment to proactive expenditure management strategies.

What are some strategies highlighted in the case study 'Preparing for Macroeconomic Challenges'?

The strategies include focusing on cost reduction, increasing noninterest revenue, updating technology, and managing expenses efficiently.

How does user experience impact operational expenses in banking?

A study by Adyen found that 55% of respondents would abandon a purchase if they cannot pay with their preferred method, highlighting the importance of user experience in managing operational expenses.

What role do automation technologies play in cost reduction for banks?

Automation technologies like robotic process automation (RPA) and artificial intelligence (AI) streamline repetitive tasks, allowing staff to focus on higher-value activities and reducing reliance on large customer service teams.

How does cloud computing contribute to cost reduction strategies in banking?

Cloud computing solutions lower IT infrastructure expenses while improving scalability and flexibility, supporting overall cost reduction strategies.

What benefits do organizations experience by adopting finance automation?

Organizations that embrace finance automation typically see faster processing times, reduced errors, improved compliance, and a return on investment within 6 to 12 months, along with notable improvements in operational efficiency and data quality.

What is the significance of adopting automation technologies in the financial sector?

Automation is transforming the financial sector by enhancing operational efficiency and helping institutions implement cost reduction strategies to achieve significant savings in a competitive landscape.