Overview

The article focuses on the key insights from Adriaanse regarding turnaround management and bankruptcy, emphasizing the importance of financial assessments, strong leadership, stakeholder engagement, and technology integration for successful recovery. It supports this by outlining specific strategies, such as conducting comprehensive financial analyses, fostering transparent communication with stakeholders, and leveraging technology for operational efficiency, all of which are crucial for navigating the complexities of financial distress and achieving long-term growth.

Introduction

In the landscape of corporate recovery, turnaround management emerges as a critical discipline that can determine the fate of struggling organizations. As businesses grapple with financial distress and operational challenges, understanding the key factors that drive successful turnaround strategies becomes paramount.

From conducting thorough financial assessments to fostering strong leadership and engaging stakeholders, each element plays a vital role in navigating the complexities of recovery.

This article delves into the essential techniques and approaches that can empower organizations to not only survive but thrive in the face of adversity, ensuring a sustainable path forward amidst an ever-evolving market landscape.

Key Factors for Successful Turnaround Management

Successful adriaanse turnaround management and bankruptcy download hinges on several pivotal factors. Firstly, conducting a comprehensive financial assessment is vital as it allows entities to pinpoint cash flow challenges and uncover potential cost-saving opportunities. Richard Bryan, with extensive experience in a century-old family business, emphasized the importance of a fact-based understanding of a company’s weaknesses, stating, ‘It is important that you get a fact-based understanding of the weaknesses of the company and the root causes of these.’

Secondly, strong leadership is essential; effective interim management can adeptly guide the organization through challenging phases.

Engaging stakeholders is also crucial, as their involvement fosters trust and collaboration—key ingredients for implementing necessary changes. A clear and actionable recovery plan must delineate specific steps and timelines to navigate the transition process seamlessly. Furthermore, adopting a holistic approach that addresses financial, operational, and customer-centric factors is critical for turnaround success.

Ongoing performance evaluation and the ability to adjust approaches are essential, considering the swift changes in market dynamics. Utilizing real-time analytics and operationalizing lessons learned enhances this process, as case studies demonstrate the benefits of integrating existing planning tools with newer technologies, such as drone inspections and digital plant modeling, which significantly improve task tracking and milestone management, thereby bolstering overall efficiency.

To master the Cash Conversion Cycle, organizations should adopt approaches such as:

- Optimizing inventory turnover

- Streamlining accounts receivable processes

- Negotiating favorable payment terms with suppliers

By implementing insights gained from past initiatives related to adriaanse turnaround management and bankruptcy download, companies can enhance their approaches, ensuring that they are well-prepared to address upcoming challenges.

Navigating the Challenges of Bankruptcy and Financial Distress

Navigating the complexities of bankruptcy, as detailed in the adriaanse turnaround management and bankruptcy download, requires confronting numerous challenges, such as managing creditor relationships, preserving cash flow, and ensuring operational viability. With personal bankruptcy filings surging to 405,132 by the end of October 2024, it's crucial for enterprises to adopt effective strategies related to adriaanse turnaround management and bankruptcy download during this tumultuous time. A comprehensive financial assessment is essential; it identifies opportunities to preserve cash and reduce liabilities, ultimately uncovering value and mitigating risks.

Our comprehensive bankruptcy and restructuring advisory services provide expert support in navigating these challenges. One key approach is to prioritize open communication with creditors. Transparent discussions can facilitate negotiated terms that provide much-needed relief.

Furthermore, businesses must focus on cash preservation by implementing rigorous budgeting and cost-cutting measures—identifying non-essential expenditures can free up valuable resources for critical functions. Leveraging technology not only streamlines operations but also enhances efficiency through real-time analytics, allowing for swift decision-making throughout the turnaround process. Experts suggest that bankruptcy filings could reach nearly 450,000 in 2025, which underscores the importance of adriaanse turnaround management and bankruptcy download for a proactive stance.

In light of these challenges, entities should consider alternatives to bankruptcy, such as debt settlement and consolidation, which may pave viable paths to financial recovery. Notably, a case study reveals that from 1991 to 2018, bankruptcy filings among individuals aged 65 and older increased threefold, highlighting the growing financial vulnerability in this demographic. As Foohey points out, 'There was a drastic drop at the time of the pandemic that continued for several years, which is now returning to pre-pandemic levels.'

By effectively managing these challenges and exploring all available options, organizations position themselves not only for a successful exit from bankruptcy but also to lay the groundwork for future growth, particularly with the principles of adriaanse turnaround management and bankruptcy download. For a thorough financial evaluation that can assist your company in navigating these complexities, contact us today.

The Role of Leadership in Turnaround Success

Leadership is a cornerstone of successful adriaanse turnaround management and bankruptcy download, requiring a blend of decisiveness, resilience, and the ability to inspire and motivate teams, especially under pressure. Research shows that 80% of employees believe effective leadership can significantly reduce workplace stress, underscoring the impact of strong leaders in challenging times. To enhance decision-making cycles, our team supports accelerated processes that allow decisive action, preserving organizational integrity during crises.

Leaders must cultivate a culture of transparency, actively encouraging open communication and soliciting feedback from employees across all levels. This approach not only enhances trust but also fosters a shared commitment to the company's goals.

Moreover, adaptability is essential; leaders should be prepared to pivot strategies in response to evolving circumstances and real-time data analytics. In light of the challenges highlighted by the rise of remote and hybrid work environments, where 63% of leadership professionals recognize a high impact on leadership effectiveness, being adaptable becomes even more critical. As Thomas Griffin notes, '63% of leadership professionals believe remote and hybrid work has had a high to very high impact on leadership effectiveness.'

Hybrid leaders often express dissatisfaction with their roles, reflecting the complexities of leading effectively in varied work settings. Interestingly, remote workers tend to trust senior leaders more than their in-office counterparts, which adds another layer to the leadership dynamic in these environments.

Regular assessments of both internal and external environments are vital for informed decision-making. Our commitment to operationalizing lessons learned through the recovery process builds strong, lasting relationships, facilitating continuous business performance monitoring through our client dashboard, which provides real-time business analytics.

Additionally, we adopt a pragmatic approach to data by testing hypotheses to ensure maximum return on invested capital. By embodying key leadership qualities—decisiveness, transparency, adaptability, and an inspiring presence—along with investing in education to promote a culture of learning, leaders can successfully navigate the intricate landscape of management reform, ultimately utilizing adriaanse turnaround management and bankruptcy download to drive their organizations toward sustainable growth.

Financial Assessment Techniques for Turnaround Management

Effective financial assessment techniques are indispensable for pinpointing areas ripe for improvement during a recovery, especially in the context of adriaanse turnaround management and bankruptcy download. Commence with a detailed cash flow analysis that meticulously tracks inflows and outflows, revealing potential liquidity challenges that could jeopardize operations. As emphasized by Tim Stobierski, understanding how these metrics impact organizational planning is a vital financial accounting skill for all managers to cultivate.

This is particularly relevant considering the stakes involved, as illustrated by General Motors' bankruptcy, which underscored the importance of robust financial assessments in adriaanse turnaround management and bankruptcy download strategies. Following the cash flow analysis, conduct a profitability analysis for each product line or service to identify underperforming segments that may necessitate restructuring or even discontinuation. A thorough examination of both fixed and variable costs can also unveil significant opportunities for cost reduction.

Moreover, leveraging real-time analytics and streamlined decision-making processes can enhance operational efficiencies and facilitate continuous business performance monitoring. By benchmarking against industry standards, organizations can gain valuable insights that highlight areas requiring immediate attention. The incorporation of advanced planning tools and technologies, as highlighted in expert advice from Peter Griscom, David Bates, and Chase Hudson, has demonstrated improvement in work process efficiency and KPI comparability, further enhancing the recovery process.

Furthermore, the federal government's reaction to the subprime mortgage crisis of 2007/2008, which included recovery approaches, offers essential context for the financial environment in which these recovery methods are being executed. By utilizing these financial evaluation methods and consulting the Business Valuation Report, organizations can create a strong basis for their recovery initiatives, which aligns with adriaanse turnaround management and bankruptcy download, ultimately improving their likelihood of success.

Implementing Technology for Enhanced Turnaround Strategies

Incorporating technology into recovery plans is essential for improving operational efficiency and informed decision-making. Financial management software, for instance, provides real-time insights into cash flow and budgeting, empowering CFOs to make data-driven decisions essential for recovery. The methodologies outlined in 'Mastering the Cash Conversion Cycle: 20 Strategies for Enhancing Business Performance'—priced at $99.00—highlight the necessity of streamlined decision-making and continuous performance monitoring through processes like 'Decide & Execute' and 'Update & Adjust'.

Additionally, customer relationship management (CRM) systems become pivotal in understanding customer preferences, allowing for targeted marketing initiatives that enhance brand loyalty. With intelligent systems projected to drive 70% of customer interactions, as recent trends indicate, embracing these digital tools is imperative. Furthermore, the increasing emphasis on environmental sustainability is encouraging organizations to align their turnaround strategies with broader societal goals.

Data analytics not only identifies trends and inefficiencies but also facilitates proactive adjustments that bolster performance. As noted by Iva Krasteva, a content creator expert and agile practitioner, embracing generative AI is becoming vital for businesses striving to remain competitive and innovative in a rapidly evolving landscape. By leveraging such technologies, entities can streamline operations and concentrate on strategic initiatives, leading to recovery and sustainable growth.

Significantly, entities that prioritize cultural transformation achieve results five times more remarkable than their peers.

Engaging Stakeholders During the Turnaround Process

Effective stakeholder engagement is crucial during a change, fostering support and aligning objectives across the organization. Begin by pinpointing essential stakeholders, including employees, creditors, suppliers, and customers. Communicate updates on the turnaround strategy regularly, inviting feedback to cultivate a sense of ownership.

Transparency is imperative; sharing both hurdles and achievements enhances trust and strengthens relationships. As recent statistics show, the percentage of directors receiving less support has risen from 22% to 30%, indicating a growing demand for clarity in decision-making. As emphasized by a pleased client, 'Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years.'

This underscores the effectiveness of having meaningful data on shifts in stakeholder sentiment, allowing you to measure the success of initiatives and ensure your investments are directed in the right places. The 'Rapid30' plan not only provides a structured approach to identifying and addressing key issues but also facilitates a shortened decision-making cycle, enabling your team to take decisive action swiftly. Furthermore, the continuous monitoring processes through real-time analytics allow for ongoing assessment of business health, ensuring that adjustments can be made proactively.

Consider establishing advisory groups that incorporate diverse stakeholder representatives. This inclusive method not only offers valuable insights but also strengthens dedication to the recovery plan. For instance, the case study titled 'Engagement ROI: Quantifying the Value of Stakeholder Involvement' illustrates how measuring engagement can improve plans, manage risks, and maintain support for programs.

Involving stakeholders actively fosters a collaborative atmosphere, crucial for managing the complexities of recovery strategies, particularly in adherence to regulations such as the Companies Act 2006 and the Insolvency Act 1986. As organizations execute these plans, they can better manage risks and maintain robust support for their initiatives, ultimately leading to a successful recovery.

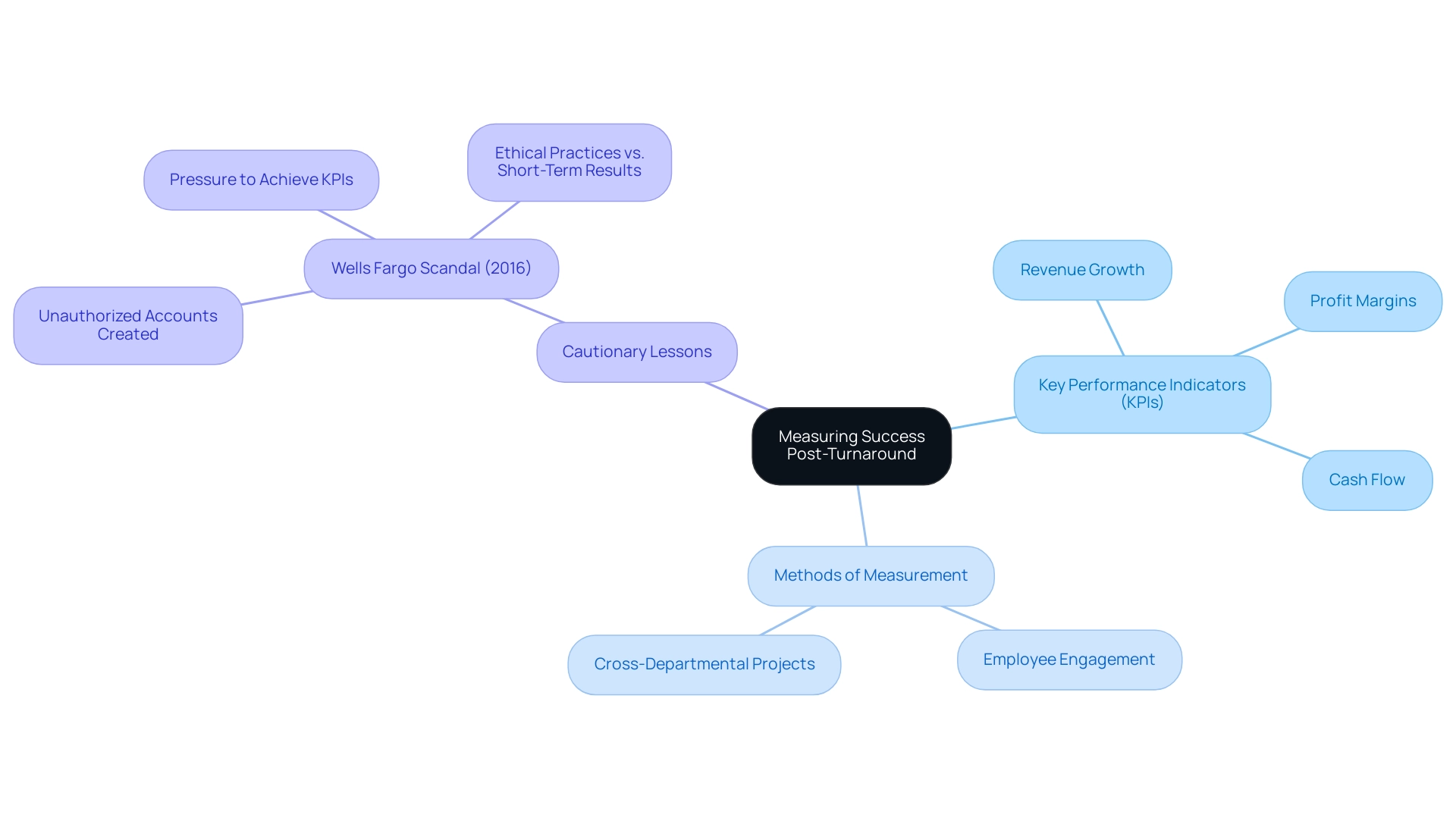

Measuring Success Post-Turnaround

Post-turnaround success measurement is vital for fostering long-term viability and growth. Chief Financial Officers should focus on key performance indicators (KPIs) such as:

- Revenue growth

- Profit margins

- Cash flow

These KPIs should be updated regularly—often on a monthly or quarterly basis—to gauge the effectiveness of implemented turnaround strategies. Our commitment to streamlined decision-making accelerates this process, allowing CFOs to take decisive actions based on real-time analytics provided through our client dashboard, which continually monitors business health and diagnostics.

Additionally, we emphasize the importance of testing hypotheses to deliver maximum return on invested capital, ensuring that every decision is backed by data-driven insights. Soufiane Erraji, IT Senior Manager at Procter & Gamble, suggests that measuring collaboration within a company can be achieved through methods such as:

- Tracking employee engagement

- Cross-departmental projects

These methods are critical post-turnaround. Metrics related to customer satisfaction are crucial; they not only reflect how well the entity meets market demands but also help identify areas for improvement.

For instance, if a company generates $100,000 in annual revenue from 100 clients, the revenue per client (RPC) amounts to $1,000, highlighting the significance of focusing on client relationships post-recovery. Regularly reviewing these KPIs empowers entities to make timely adjustments, ensuring alignment with sustainable growth objectives. Furthermore, our commitment to operationalizing lessons learned enhances relationships and supports continuous performance monitoring.

Building strong relationships based on these lessons is essential for future success. The Wells Fargo scandal of 2016 serves as a cautionary tale, illustrating the dangers of prioritizing short-term KPI results over ethical practices and employee well-being. By conducting periodic reviews of the turnaround process and operationalizing insights gained, organizations can glean valuable lessons and best practices that will inform future initiatives, ultimately enhancing their turnaround effectiveness.

Conclusion

Successful turnaround management is anchored in a series of critical strategies that empower organizations to navigate adversity effectively. Conducting thorough financial assessments is the first step, enabling companies to identify cash flow challenges and uncover areas for cost savings. Strong leadership and stakeholder engagement are equally important, fostering trust and collaboration while guiding the organization through turbulent times. A clear recovery plan, along with continuous performance monitoring and adaptability, ensures that businesses can respond swiftly to changing market dynamics.

As businesses face escalating challenges, including rising bankruptcy filings, proactive strategies become imperative. Open communication with creditors and a focus on cash preservation can make a significant difference in maintaining operational viability. Exploring alternatives to bankruptcy, such as debt settlement, can provide viable pathways to recovery. The evolving landscape of remote and hybrid work environments also necessitates adaptable leadership that prioritizes transparency and promotes a culture of continuous learning.

Integrating technology into turnaround strategies enhances operational efficiency and supports informed decision-making. Utilizing financial management software and real-time analytics allows organizations to streamline operations and make data-driven choices that are crucial for recovery. Engaging stakeholders throughout the turnaround process fosters a collaborative environment, ensuring alignment and commitment to the recovery plan.

Ultimately, measuring success post-turnaround is vital for sustainable growth. By focusing on key performance indicators and regularly reviewing progress, organizations can make informed adjustments to their strategies. Operationalizing lessons learned from the turnaround process not only strengthens relationships but also prepares businesses for future challenges. With the right strategies in place, organizations can successfully navigate their recovery journey and emerge stronger in a competitive marketplace.

Frequently Asked Questions

What are the key factors for successful turnaround management?

Successful turnaround management hinges on conducting a comprehensive financial assessment, strong leadership, engaging stakeholders, creating a clear recovery plan, adopting a holistic approach, and ongoing performance evaluation.

Why is a comprehensive financial assessment important?

A comprehensive financial assessment is vital as it helps identify cash flow challenges, uncover potential cost-saving opportunities, and provides a fact-based understanding of a company's weaknesses and root causes.

What role does leadership play in turnaround management?

Strong leadership is essential as effective interim management can guide the organization through challenging phases during the turnaround process.

How can stakeholder engagement benefit a turnaround strategy?

Engaging stakeholders fosters trust and collaboration, which are key ingredients for implementing necessary changes during a turnaround.

What should a recovery plan include?

A clear and actionable recovery plan should delineate specific steps and timelines to navigate the transition process seamlessly.

What approach is recommended for addressing turnaround challenges?

A holistic approach that addresses financial, operational, and customer-centric factors is critical for successful turnaround management.

How can organizations evaluate their performance during a turnaround?

Ongoing performance evaluation and the ability to adjust approaches based on market dynamics are essential, utilizing real-time analytics and lessons learned from past initiatives.

What strategies can help master the Cash Conversion Cycle?

Strategies include optimizing inventory turnover, streamlining accounts receivable processes, and negotiating favorable payment terms with suppliers.

What challenges do businesses face during bankruptcy?

Businesses face challenges such as managing creditor relationships, preserving cash flow, and ensuring operational viability during bankruptcy.

What is a key approach to managing creditor relationships during bankruptcy?

Prioritizing open communication with creditors can facilitate negotiated terms that provide much-needed relief.

How can businesses preserve cash during bankruptcy?

Businesses can preserve cash by implementing rigorous budgeting and cost-cutting measures, identifying non-essential expenditures to free up resources.

What alternatives to bankruptcy should organizations consider?

Organizations should consider alternatives such as debt settlement and consolidation, which may provide viable paths to financial recovery.

What trend has been observed in bankruptcy filings among older individuals?

Bankruptcy filings among individuals aged 65 and older increased threefold from 1991 to 2018, highlighting growing financial vulnerability in this demographic.

What is the importance of adopting effective turnaround strategies?

Adopting effective turnaround strategies positions organizations not only for a successful exit from bankruptcy but also lays the groundwork for future growth.