Introduction

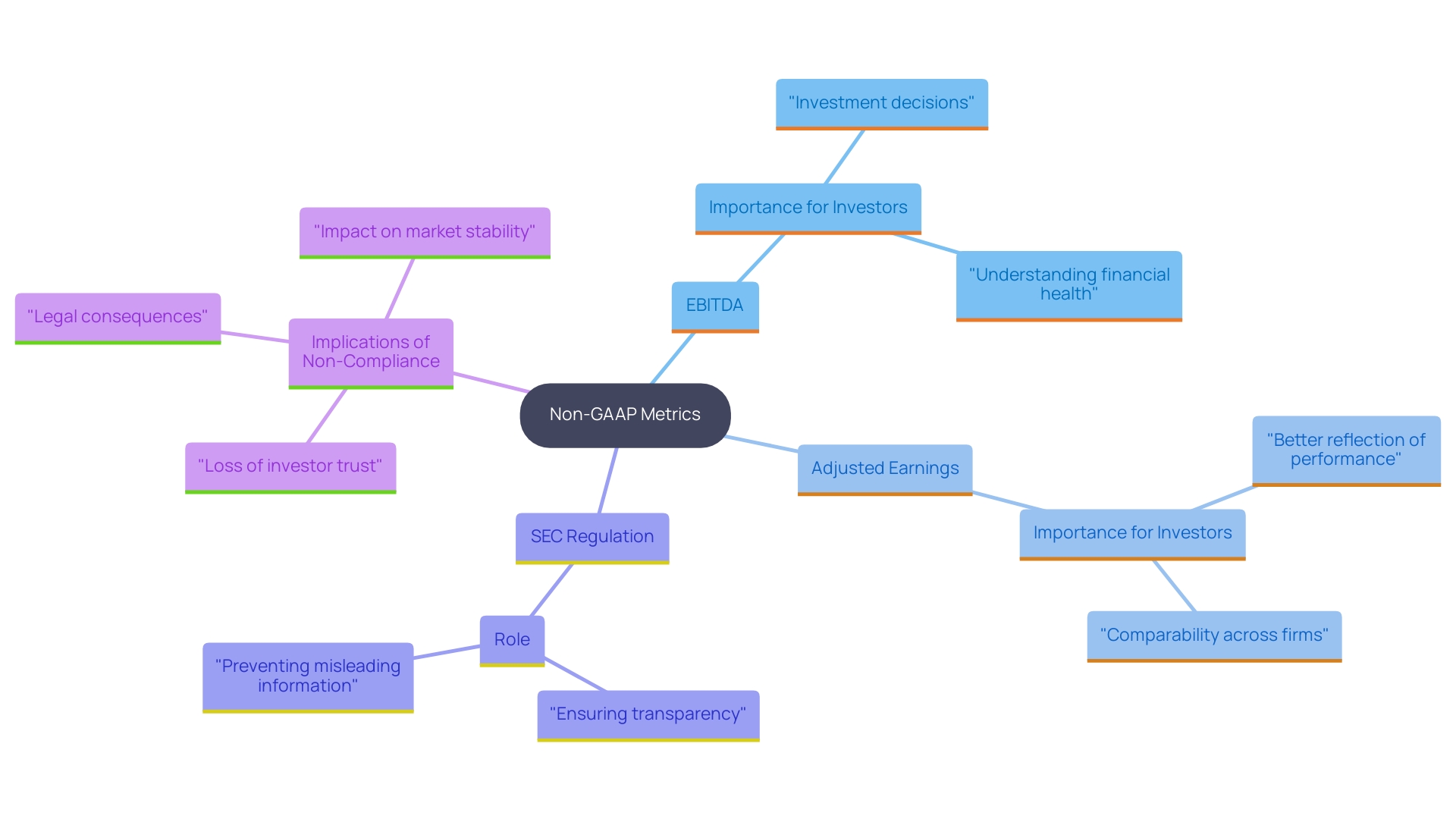

In the dynamic landscape of financial reporting, the distinction between GAAP and non-GAAP measures has become increasingly significant for organizations aiming to present a transparent view of their operational performance. Non-GAAP metrics, such as EBITDA and adjusted earnings, offer valuable insights by excluding non-operational costs, thus illuminating a company’s core profitability and efficiency. As more businesses adopt these measures, understanding the nuances and regulatory requirements surrounding them is essential for CFOs who seek to enhance investor confidence and make informed strategic decisions.

This article delves into the critical role of non-GAAP financial measures, the importance of key performance indicators, and the regulatory landscape that governs their use, equipping financial leaders with the knowledge necessary to navigate this complex terrain effectively.

Understanding Non-GAAP Financial Measures

Non-GAAP metrics are essential instruments that modify standard Generally Accepted Accounting Principles (GAAP) figures to offer a more customized and clear view of a company's operational performance. These methods, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and adjusted earnings, are designed to exclude specific expenses, offering a nuanced perspective on profitability.

For instance, EBITDA is frequently used in reporting to strip away non-operational costs, thereby highlighting core operational efficiency. This approach can reveal trends and performance metrics that GAAP figures might obscure, providing a clearer path to enhancing cash flow and profitability. Such actions are essential for investors, as they provide deeper insights into an organization's economic status and trajectory, facilitating more informed decision-making.

In 2024, about 65% of public companies indicated employing some type of alternative accounting metric, highlighting its increasing significance in financial analysis. Additionally, our Comprehensive Business Valuation Service provides detailed insights for business owners and investors seeking to understand their business's worth accurately, which is crucial for strategic planning.

The SEC frequently examines the application of alternative accounting metrics to ensure adherence to disclosure standards and to avoid excessive emphasis on GAAP standards. Recent guidelines emphasize the importance of clear labeling and avoiding titles that could confuse these metrics with GAAP standards. Companies such as Netflix and Amazon have effectively employed alternative metrics, such as free cash flow and adjusted EBITDA, to convey their performance more transparently.

Those receiving SEC feedback typically improve their disclosures or modify their alternative accounting metrics accordingly, reflecting an ongoing conversation aimed at maintaining clarity and dependability in reporting. With the increasing use of non-GAAP fiscal measures in 2024, it is crucial for CFOs to stay updated on best practices and regulatory expectations. Comprehending and accurately utilizing these metrics can greatly influence investor perceptions and choices, emphasizing the necessity of precision and clarity in communications.

Furthermore, mastering strategies from resources like our whitepaper, 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance,' can empower CFOs to optimize their organization's financial health. Non-compliance with SEC guidelines can lead to reputational damage and potential penalties, making it imperative for CFOs to ensure their reporting practices align with regulatory expectations.

The Importance of Key Performance Indicators (KPIs) in Financial Analysis

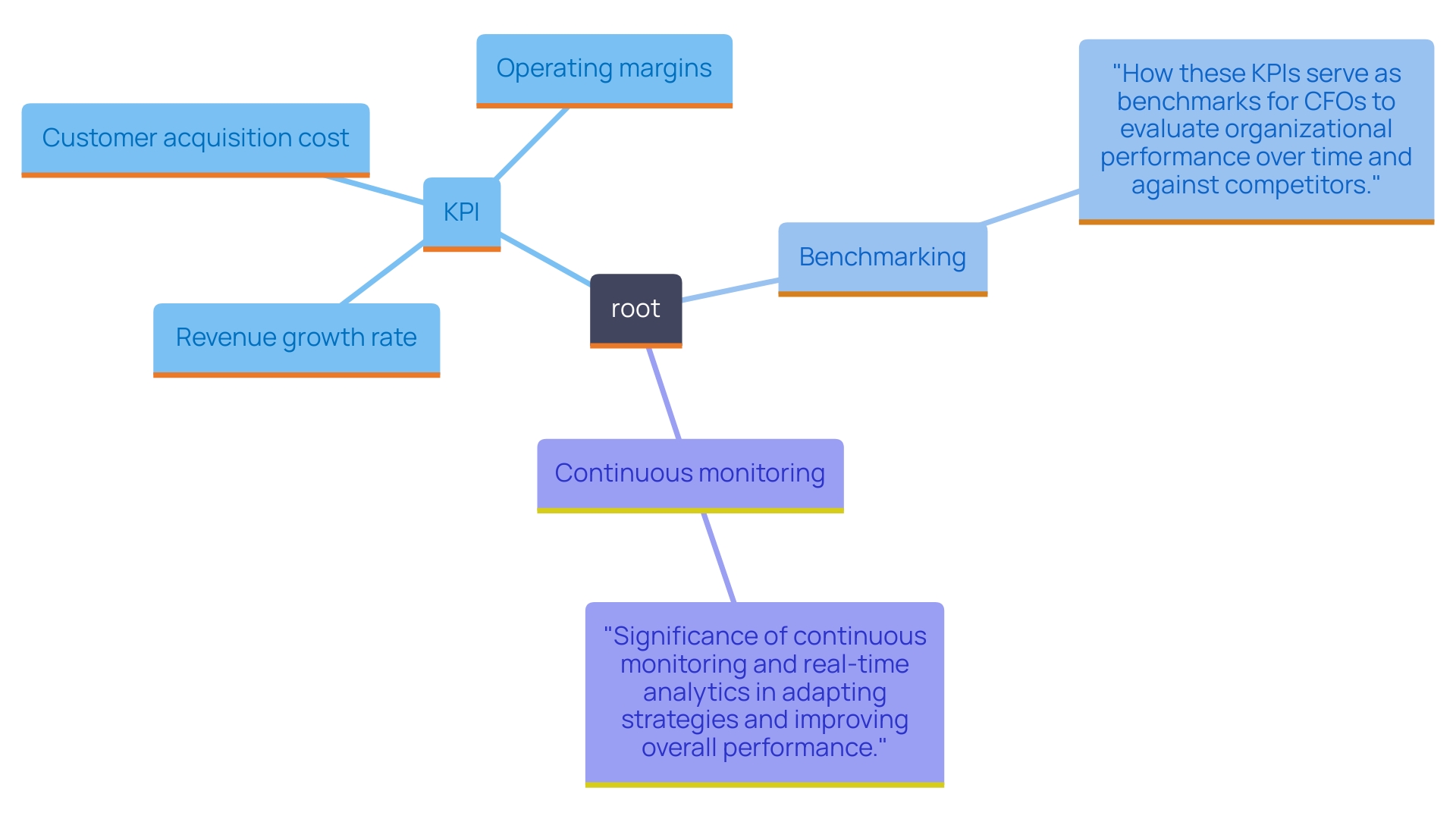

Key Performance Indicators (KPIs) are quantifiable metrics that assess an organization's success in reaching its goals. Common examples of KPIs include:

- Revenue growth rate

- Customer acquisition cost

- Operating margins

For Chief Financial Officers (CFOs), these KPIs serve as essential benchmarks to gauge the organization's performance over time and in comparison to competitors. By concentrating on these indicators, CFOs can effectively assess the success of management strategies and operational efficiencies, facilitating informed investment decisions.

Additionally, a continuous monitoring approach, bolstered by real-time analytics, enables businesses to swiftly adapt to changing conditions, operationalize lessons learned, and enhance overall performance. This proactive strategy is crucial for mastering the Cash Conversion Cycle, ultimately leading to optimal business outcomes.

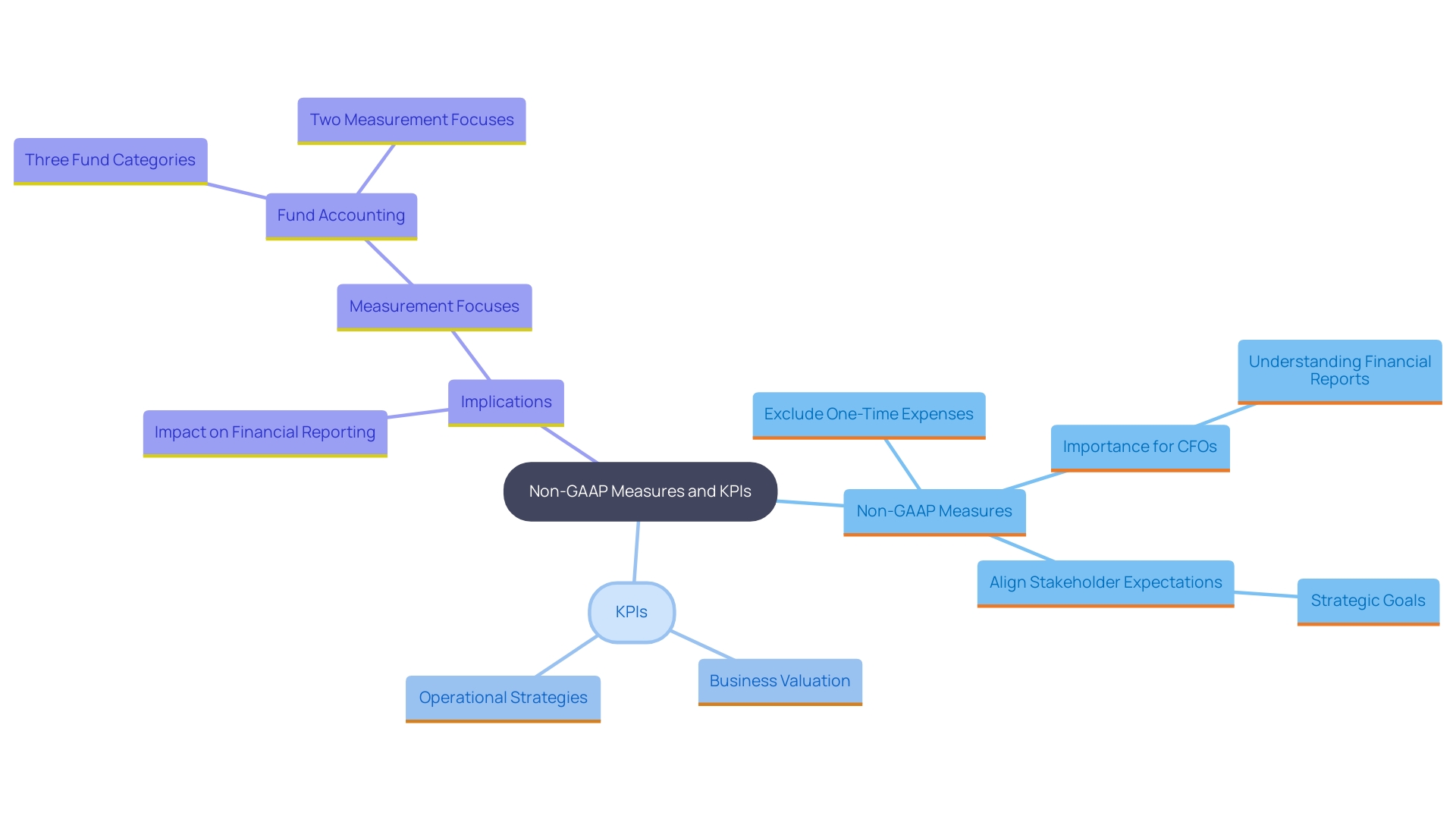

Why Companies Use Non-GAAP Measures and KPIs

Companies often utilize non-GAAP measures and KPIs to present a more comprehensive view of their economic performance. Management may choose to highlight these figures to exclude one-time expenses, such as restructuring costs or asset write-downs, which they believe do not reflect ongoing operations. By doing so, they aim to provide a clearer picture of profitability and operational efficiency, critical insights when considering our Comprehensive Business Valuation Service.

This service offers detailed analyses of business worth, informing strategic decisions for owners and investors alike. Additionally, these metrics help align stakeholder expectations with the company’s strategic goals, enhancing investor confidence and engagement.

Understanding the motivations behind these disclosures, alongside mastering the Cash Conversion Cycle through our whitepaper, 'Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance,' is essential for CFOs. This knowledge enables them to interpret monetary reports critically and optimize cash flow and profitability effectively.

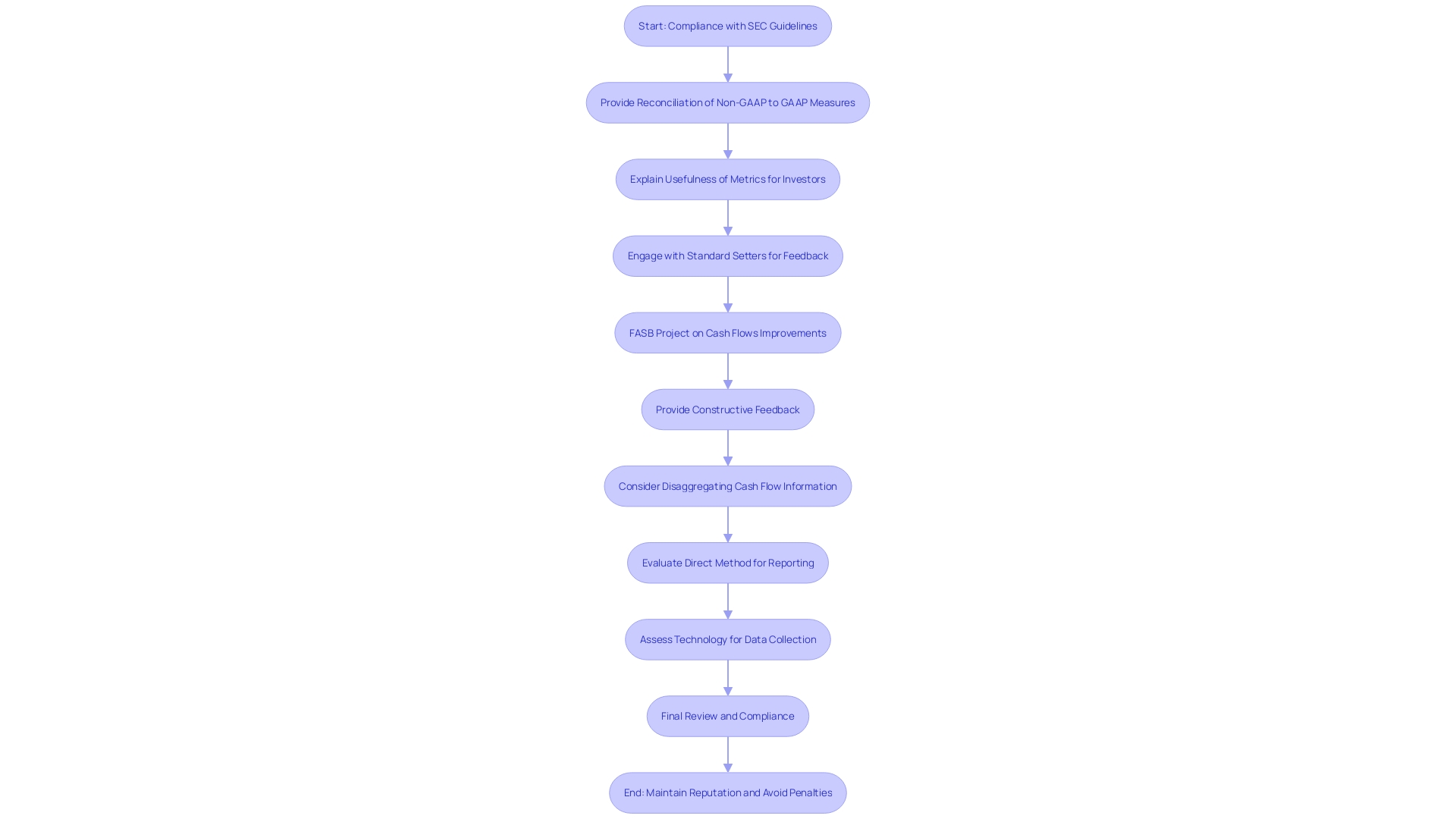

Regulatory Requirements for Non-GAAP Disclosures

Regulatory authorities, like the Securities and Exchange Commission (SEC), have set forth guidelines for the presentation of alternative accounting metrics to ensure that they are not deceptive. Companies must provide:

- A reconciliation of non-GAAP measures to the most directly comparable GAAP measures

- An explanation of why these measures are useful for investors

These requirements are designed to enhance the transparency of monetary reporting while ensuring that investors can make comparisons with GAAP figures. Failure to follow these regulations can lead to significant penalties and harm to an organization's reputation, emphasizing the importance of compliance for both management and investors.

The Auditor's Role in Non-GAAP Financial Reporting

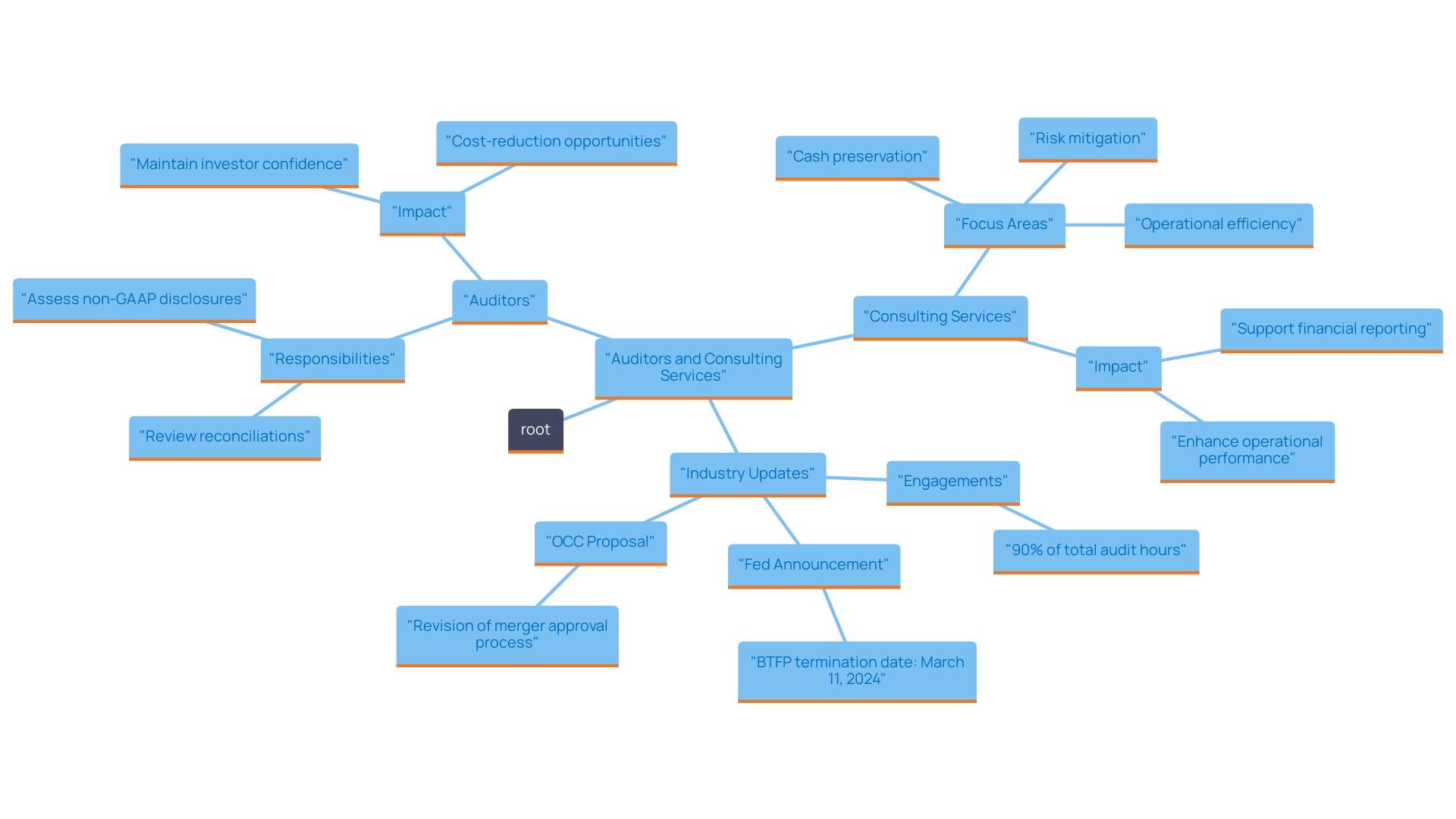

Auditors play an essential role in ensuring the integrity of alternative reporting by verifying adherence to established guidelines and confirming that disclosed metrics align with the organization’s overall economic condition. Their responsibilities encompass:

- Reviewing reconciliations of non-GAAP to GAAP measures

- Assessing whether non-GAAP disclosures fairly represent the company's performance

This oversight is crucial for maintaining investor confidence, as it guarantees the credibility of the monetary information provided.

In conjunction with this, expert turnaround consulting services provide comprehensive assessments that prioritize:

- Cash preservation

- Operational efficiency

- Risk mitigation

By swiftly evaluating a company's monetary operations, we can uncover hidden value and identify cost-reduction opportunities. For instance, a recent engagement revealed that a mid-sized firm could save 15% in operational costs by optimizing its cash flow management practices.

Comprehending the auditor's role allows investors and CFOs to better assess the reliability of the statements they rely on for investment decisions. Moreover, the importance of swift and effective financial consulting cannot be overstated, as it is essential for navigating potential crises and ensuring long-term business survival.

Conclusion

Non-GAAP financial measures and key performance indicators (KPIs) have emerged as indispensable tools for organizations seeking to enhance transparency in their financial reporting. By providing a clearer picture of operational performance, non-GAAP metrics like EBITDA and adjusted earnings allow CFOs to present a more accurate reflection of a company's core profitability. As the prevalence of these measures grows—evidenced by the 65% adoption rate among public companies in 2024—understanding their nuances and the regulatory landscape surrounding them is crucial for financial leaders.

The importance of KPIs cannot be overstated, as they serve as benchmarks that enable CFOs to assess performance effectively. By focusing on these quantifiable measures, organizations can make informed decisions that drive strategic planning and operational efficiency. Furthermore, compliance with SEC guidelines ensures that non-GAAP disclosures remain transparent and reliable, safeguarding investor confidence and enhancing the credibility of financial communications.

Ultimately, the effective use of non-GAAP measures and KPIs not only facilitates a more accurate representation of a company’s financial health but also aligns stakeholder expectations with corporate objectives. For CFOs, mastering these financial strategies is essential for optimizing cash flow, enhancing profitability, and navigating the complexities of the financial landscape. Embracing these practices will empower organizations to communicate their performance more effectively, ultimately fostering stronger investor relationships and driving long-term success.