Overview

Interim CFO services in Houston offer small businesses immediate access to financial expertise, cost-effective leadership solutions, and essential stability during transitions. This enables organizations to effectively navigate economic challenges. These services grant businesses the opportunity to leverage experienced financial leadership on a flexible basis, ensuring robust oversight and strategic direction while significantly reducing the costs associated with full-time executives. By utilizing interim CFO services, companies can maintain a competitive edge in a fluctuating market.

Introduction

In the ever-evolving landscape of business, the role of interim CFOs has emerged as a vital solution for organizations facing financial turbulence. These seasoned professionals bring immediate expertise to the table, adeptly addressing pressing financial challenges while ensuring continuity during periods of transition.

Whether navigating leadership changes, mergers, or critical financial projects, interim CFOs offer tailored strategies that not only stabilize operations but also drive growth. As companies increasingly recognize the benefits of flexible financial leadership, the demand for interim CFOs continues to rise, revealing a transformative approach to managing financial health in a dynamic market.

Through their unique ability to blend real-time analytics with strategic oversight, interim CFOs are not just filling gaps; they are paving the way for sustainable success.

Immediate Financial Expertise from Interim CFOs

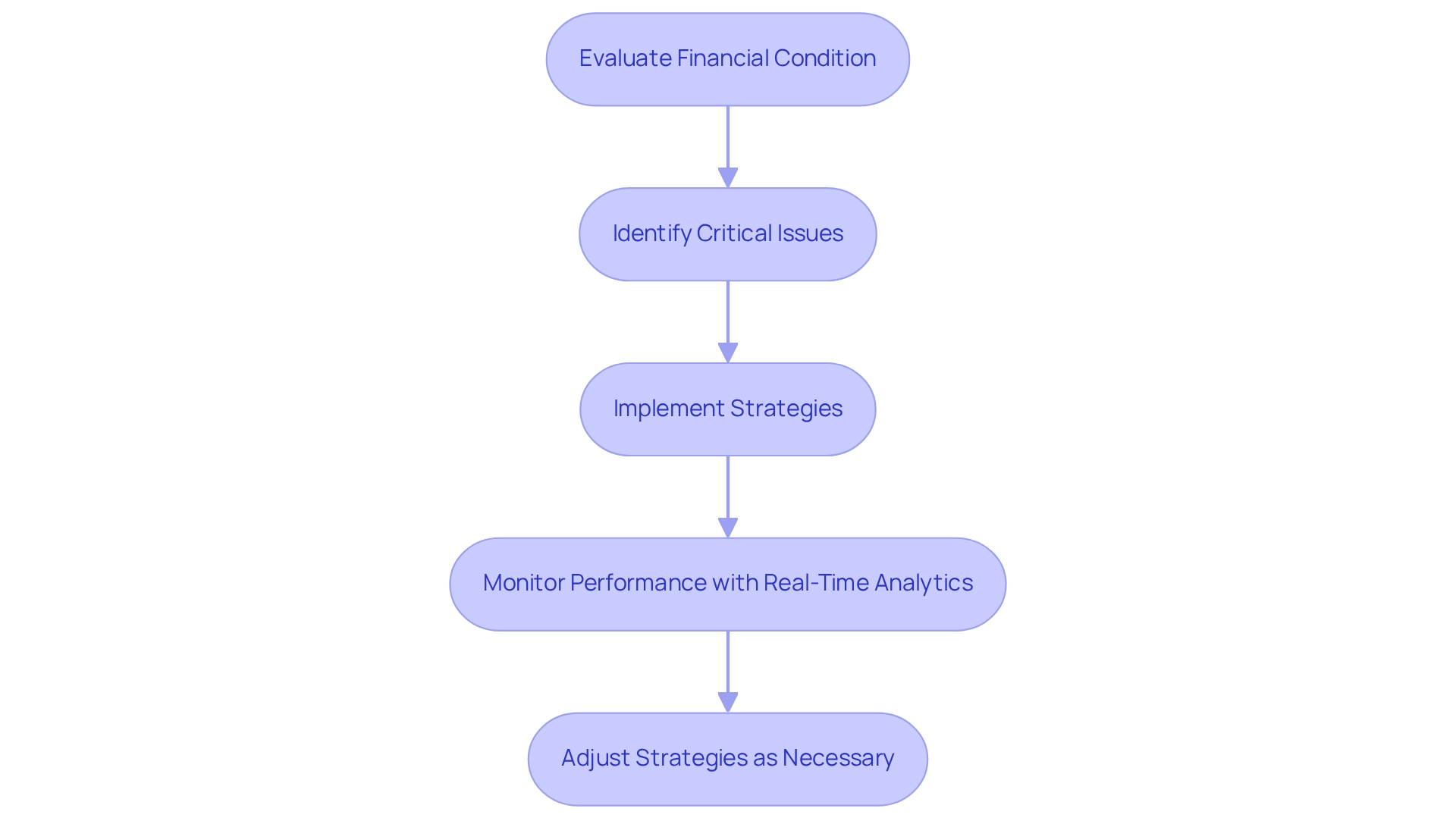

Interim CFO services in Houston provide invaluable expertise in finances, empowering organizations to address immediate monetary challenges with precision. They conduct swift evaluations of a company's financial condition, pinpointing critical issues that demand attention. This capability is particularly vital during transitions, such as leadership changes or financial crises, where interim CFO services in Houston facilitate rapid decision-making. By leveraging real-time analytics through a client dashboard, temporary financial officers can consistently monitor business performance, ensuring that strategies are adjusted according to the latest data.

Statistics reveal that nearly a quarter (23%) of project resources in the industrial goods and services sector are allocated for temporary leadership efforts, underscoring the growing reliance on these professionals. Furthermore, 38% of chief financial officers assert that avoiding complacency, arrogance, and bureaucracy is essential for success, highlighting the proactive mindset that temporary finance leaders must adopt during economic turmoil. Utilizing their extensive experience, temporary chief financial executives assist companies in formulating robust economic strategies that align with organizational objectives, fostering stability and growth even in challenging conditions.

Case studies indicate that chief financial officers who prioritize risk management significantly enhance their organizations' stability and success, ensuring accurate reporting and compliance with regulations. For instance, the finance department plays a crucial role in shaping company culture by managing monetary flows and aligning with corporate goals, which is essential during transitions. In times of crisis, organizations can depend on interim CFO services in Houston to swiftly assess financial stability and implement transformative changes that lead to improved economic outcomes. Moreover, by applying insights from past experiences and evaluating hypotheses, temporary financial leaders can achieve better results and enhance overall organizational performance.

Cost-Effective Leadership Solutions

Hiring interim CFO services in Houston presents a cost-effective solution for small enterprises seeking expert fiscal guidance without the hefty expense associated with a full-time executive. Typically engaged on a flexible basis, temporary financial officers allow companies to pay solely for the services they require, resulting in significant cost reductions. This arrangement enables businesses to avoid the burdens of full-time salaries, benefits, and long-term commitments, which can often exceed $100,000 annually. Such economic flexibility empowers companies to allocate resources more effectively, redirecting savings towards growth initiatives.

Moreover, temporary CFOs excel at identifying cost-saving opportunities within the organization, thereby enhancing overall economic efficiency. With 43% of small enterprises recognizing operational cost management as a significant hurdle, the expertise of a temporary CFO can be pivotal in navigating these complexities. They employ a pragmatic approach to data, rigorously testing every hypothesis to ensure maximum return on invested capital—an essential strategy for small enterprises aiming to optimize their economic performance. Furthermore, temporary financial officers are committed to applying lessons learned throughout the engagement, ensuring that insights gained are seamlessly integrated into organizational processes.

Real-world examples underscore the impact of temporary financial officer services. Companies that have opted for part-time chief financial officers report not only direct cost reductions—often highlighted in case studies comparing savings to full-time salaries—but also improved economic performance and strategic guidance. This leadership approach allows small enterprises to access top-tier talent without the constraints of a full-time commitment, rendering it an attractive solution in today's dynamic market. Additionally, the flexibility in engagement duration and scope offered by fractional financial officers enables businesses to tailor services to meet specific needs without long-term obligations. Average contract rates for interim CFO services in Houston typically range from $150 to $300 per hour, providing further context for the financial expectations associated with these services.

Stability During Financial Transitions

Interim chief executives play a pivotal role in sustaining stability during economic transitions, such as mergers, acquisitions, and executive turnover. Their presence guarantees that monetary operations continue seamlessly, effectively mitigating risks linked to leadership changes. By delivering steady oversight and strategic direction, temporary chief financial officers empower organizations to adhere to their budgetary objectives, thereby averting disruptions that could adversely affect performance.

For instance, companies that implemented liquidity strategies with the guidance of temporary financial officers reported an average improvement in financial stability within six months, showcasing the tangible benefits of their expertise. Moreover, during mergers and acquisitions, temporary chief financial officers are essential in managing cash flow and negotiating with stakeholders, which is crucial for maintaining operational continuity. Their proactive approach not only stabilizes organizations but also bolsters stakeholder confidence during uncertain times.

Furthermore, acting financial executives are committed to applying lessons learned throughout the turnaround process, fostering strong relationships and continuous improvement. They advocate for an efficient decision-making process, enabling companies to make swift choices, while their focus on ongoing performance evaluation through real-time analytics ensures that economic health is consistently monitored.

Overall, the strategic involvement of temporary chief officers allows companies to navigate transitions with confidence, ensuring that all monetary processes remain robust and effective. To effectively leverage interim CFO services in Houston during transitions, executives should prioritize clear communication with stakeholders and establish defined economic objectives to guide the interim officer's initiatives.

Tailored Solutions for Specific Financial Projects

Interim chief financial officers deliver tailored solutions for critical monetary projects, including IPO preparations, debt restructuring, and the implementation of new accounting systems. Their expertise allows them to adapt strategies to meet the unique needs of small to medium enterprises, ensuring these organizations receive the most relevant and effective assistance. By concentrating on specific initiatives, temporary chief financial executives significantly enhance economic performance, enabling organizations to achieve their strategic goals with increased efficiency.

Notably, in the nonprofit and government sectors, 37 percent of leadership searches have focused on interim positions fulfilling traditional finance responsibilities. This highlights the growing reliance on these experts across various domains, including small to medium enterprises. Furthermore, industry leaders underscore the importance of customized monetary solutions as the landscape of economic data evolves, necessitating chief financial officers to adeptly manage information flow throughout their organizations to prevent data gaps.

Mark Partin, Chief Financial Officer of BlackLine, stresses that valuable data is now dispersed throughout the organization, making it essential for financial leaders to stay informed about information flow. This flexibility and focus on specific projects position temporary chief financial officers as indispensable resources in navigating complex monetary environments. By mastering the cash conversion cycle and leveraging real-time analytics, financial leaders can continuously monitor business performance and operationalize turnaround lessons.

For chief financial officers aiming to utilize temporary CFO services, focusing on particular projects such as debt restructuring or IPO preparations can lead to substantial improvements in economic outcomes and long-term growth.

Bridging Gaps Between CFO Hires

Interim CFO services in Houston play a crucial role in bridging the gaps that arise between the departure of a permanent financial officer and the hiring of a new one. Typically engaged for durations ranging from 3 to 12 months, these experts provide prompt leadership and continuity, ensuring that monetary operations remain stable during this transitional phase. By overseeing daily monetary operations and strategic initiatives, organizations can leverage interim CFO services in Houston to prevent disruptions that may stem from changes in leadership. Their expertise allows organizations to take the necessary time to find the right permanent CFO without jeopardizing monetary stability.

Moreover, alongside preserving operational integrity, temporary financial officers employ efficient decision-making procedures and real-time analytics via a client dashboard to consistently assess performance. This approach enables them to test hypotheses and make informed decisions that drive maximum return on invested capital, particularly during critical restructuring or financial downturns. As highlighted in the case study titled 'Temporary Financial Leadership During Transitions,' the use of interim CFO services in Houston has proven invaluable in preserving cash flow and positioning businesses for sustainable growth as they navigate challenging times. Furthermore, their commitment to operationalizing lessons learned reinforces their significance in the hiring process, providing the necessary time to find the right full-time CFO.

Conclusion

The role of interim CFOs has become increasingly indispensable in today's business environment, particularly during times of financial uncertainty and transition. Their immediate financial expertise allows organizations to address urgent challenges effectively, utilizing real-time analytics to monitor performance and adjust strategies as needed. This proactive approach not only stabilizes operations but also fosters growth, demonstrating the significant impact interim CFOs can have on a company's financial health.

Moreover, engaging interim CFOs presents a cost-effective solution for businesses, especially small enterprises that require top-tier financial leadership without the burden of full-time salaries. This flexibility enables organizations to allocate resources more strategically, redirecting savings towards essential growth initiatives. Real-world examples highlight how interim CFOs enhance operational efficiency and financial performance, making them an attractive option in a dynamic market.

As organizations navigate complex transitions such as mergers or executive turnover, interim CFOs play a crucial role in preserving stability and ensuring that financial processes remain uninterrupted. Their tailored solutions for specific financial projects further illustrate their capacity to adapt to the unique needs of each company, guiding them through critical initiatives like IPO preparations or debt restructuring.

In summary, interim CFOs are not merely temporary solutions; they are vital partners in driving sustainable success. By bridging gaps during leadership changes and providing expert guidance, they empower companies to thrive in challenging environments and lay the groundwork for long-term growth. As the demand for flexible financial leadership continues to rise, the value of interim CFOs in shaping the future of organizations becomes increasingly clear.

Frequently Asked Questions

What are interim CFO services in Houston?

Interim CFO services in Houston provide expert financial guidance to organizations, helping them address immediate monetary challenges through swift evaluations of their financial condition and critical issue identification.

Why are interim CFO services important during transitions?

They are vital during transitions, such as leadership changes or financial crises, as they facilitate rapid decision-making and help organizations navigate through challenging situations effectively.

How do interim CFOs utilize data in their role?

Interim CFOs leverage real-time analytics through a client dashboard to consistently monitor business performance, ensuring that strategies are adjusted based on the latest data.

What is the significance of temporary leadership in the industrial goods and services sector?

Statistics show that nearly 23% of project resources in this sector are allocated for temporary leadership efforts, indicating a growing reliance on these professionals for financial guidance.

What mindset do temporary finance leaders need to adopt?

Temporary finance leaders must adopt a proactive mindset to avoid complacency, arrogance, and bureaucracy, which is essential for success during economic turmoil.

How do interim CFOs contribute to economic strategies?

They assist companies in formulating robust economic strategies that align with organizational objectives, fostering stability and growth even in challenging conditions.

What role does risk management play for CFOs?

Chief financial officers who prioritize risk management significantly enhance their organizations' stability and success, ensuring accurate reporting and compliance with regulations.

How do interim CFO services support organizations in crisis?

They swiftly assess financial stability and implement transformative changes that lead to improved economic outcomes during times of crisis.

What are the financial benefits of hiring interim CFO services for small enterprises?

Hiring interim CFO services is cost-effective as it allows small enterprises to pay only for the services they require, avoiding the costs associated with full-time salaries and benefits.

What is the average cost of interim CFO services in Houston?

Average contract rates for interim CFO services in Houston typically range from $150 to $300 per hour.

How do temporary CFOs enhance economic efficiency?

They excel at identifying cost-saving opportunities within the organization, which can significantly enhance overall economic efficiency.

What flexibility do interim CFOs offer to businesses?

Temporary CFOs provide flexibility in engagement duration and scope, allowing businesses to tailor services to meet specific needs without long-term commitments.