Introduction

FTI Consulting, AlixPartners, Boston Consulting Group (BCG), Alvarez & Marsal, and Deloitte are among the top restructuring consulting firms that provide essential guidance and support to businesses facing financial challenges. These firms offer a wide range of services, including financial restructuring, operational enhancement, and strategic development. Their expertise and experience enable them to craft tailored solutions that address the unique needs of each client.

In a time of escalating financial pressures, healthcare organizations, in particular, have turned to these consultancies for vital fiscal improvement and navigational aid through economic hurdles. With their deep industry knowledge and strategic approach, these firms have been instrumental in providing insights and strategies to address the intricate dynamics of today's market. By leveraging their expertise, businesses can navigate financial turbulence and emerge stronger and more competitive.

FTI Consulting

FTI Consulting stands at the forefront as a global advisory firm, celebrated for its exceptional . The firm boasts a seasoned cadre of professionals adept at steering businesses through tumultuous , propelling them toward lasting growth. Their profound understanding of industry nuances, coupled with a strategic methodology, positions them as the for companies in quest of sophisticated . Amidst a backdrop of escalating financial pressures — a confluence of the pandemic, inflation, and workforce shortages — healthcare organizations, in particular, find themselves grappling with constricted revenues and mounting expenses. Such challenging times have seen a marked turn toward these consultancies for vital fiscal improvement and navigational aid through economic hurdles. FTI Consulting, in its capacity, has been instrumental in providing insights and strategies tailored to address the intricate dynamics of today's market.

AlixPartners

AlixPartners stands out as a beacon of expertise in the intricate domain of . This firm is lauded for steering companies through multifaceted by providing a spectrum of services, from to performance enhancement and comprehensive risk management. As a testament to their efficacy, Arab National Bank, with its historical focus on pensioners and retirees, successfully pivoted to a modern banking paradigm with an ambitious digital transformation. AlixPartners' commitment to delivering tangible results has cemented their reputation as a go-to advisor for , mirroring the transformative success stories of industry leaders like Strategic Solution Partners in the hospitality sector, and Pacific Steel's groundbreaking shift to reference-based pricing in healthcare management. AlixPartners' prowess is further underscored by their global presence and the trust placed in them by an array of prestigious clients, including corporate boards, law firms, and investment banks. Their proven track record in driving business success is a clarion call to companies seeking to navigate the complexities of today's financial landscapes.

Boston Consulting Group (BCG)

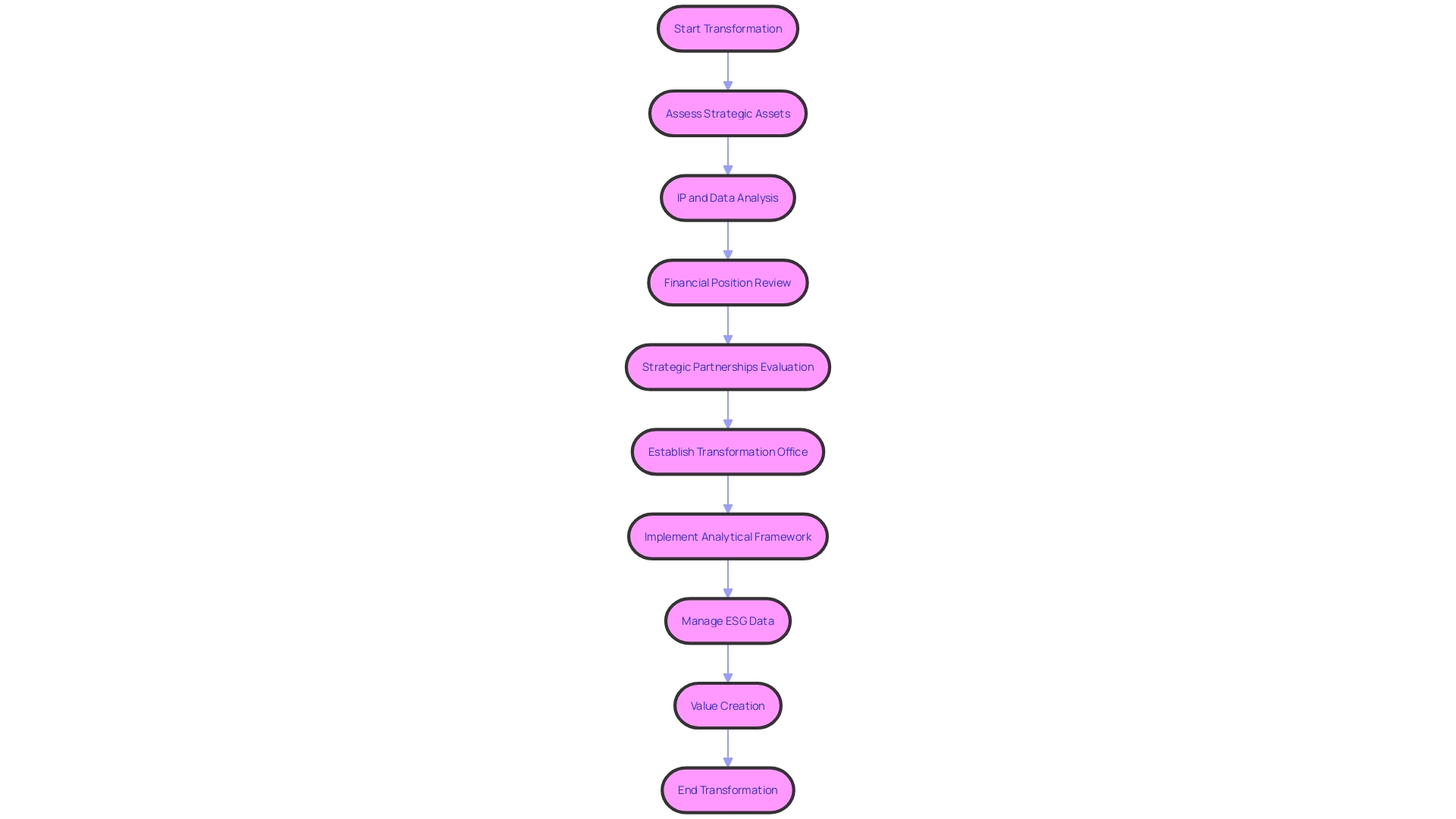

Boston Consulting Group (BCG) stands out in the management consulting landscape, particularly for companies navigating complex restructuring and . By leveraging a suite of strategic assets—such as intellectual property, a robust financial position with healthy cash flow, and strategic partnerships—BCG crafts bespoke strategies that enable businesses to flourish even in dynamic market conditions. Their approach is grounded in a deep comprehension of market forces, paired with a rigorous analytical framework akin to the IDC MarketScape vendor assessment model, which evaluates ICT suppliers using both qualitative and quantitative data to produce a comprehensive market success overview.

BCG's commitment to transformative change is not just about advisory; it's about ensuring executional certainty. This is echoed in their methodology, which emphasizes establishing a that improves by up to 50%, according to their data. Such a TO fosters transparency and accountability, vital for businesses aiming to swiftly deliver value while undergoing transformation.

Furthermore, with ESG factors becoming crucial in operations and investment decisions, BCG's expertise extends to helping organizations manage ESG data effectively—addressing the scattered and inconsistently classified nature of such data, thereby reducing related costs and risks. The firm's strategic foresight and comprehensive solutions make it a preferred partner for entities seeking to align their financial objectives with emerging global trends.

Alvarez & Marsal

Alvarez & Marsal stands out in the realm of professional services, offering a robust suite of . This firm harnesses the of over 500 consultants stationed in 16 offices worldwide, bringing a wealth of knowledge to the table. Their approach is deeply analytical, targeting the core issues that challenge . By leveraging their global presence and extensive experience, they craft , ensuring that businesses not only recover from financial adversity but also thrive moving forward. Alvarez & Marsal's dedication to operational and financial improvement is evident through their strategic focus on tangible results, which has earned them a reputation for excellence in driving meaningful change for their clients.

Deloitte

Deloitte, a formidable name in the consulting industry, is adeptly navigating the complexities of today's dynamic business environment. With an acute focus on , they leverage a blend of deep industry insight and a vast pool of expert professionals dedicated to steering businesses through financial turbulence. Their steadfast commitment to innovation is exemplified by their strategic use of artificial intelligence. By evaluating staff skills with AI, Deloitte crafts adaptive plans to reallocate talent from less active sectors to burgeoning areas of demand, exemplifying their proactive approach to .

The firm's forward-thinking stance is further highlighted by their recent report showcasing a significant uptick in , a testament to their effectiveness in delivering operational enhancements and cost efficiencies. Deloitte's ability to drive change and bolster efficiency is not only seen in their internal operations but also in the strategic outcomes they deliver for clients, with an emphasis on revenue augmentation and cost reduction.

As the consulting landscape faces the dual challenge of integrating alternative data into investment processes and addressing the recent trend of workforce adjustments, Deloitte's innovative solutions and collaborative ethos position them as a premier choice for organizations in pursuit of robust . Their adeptness at fostering a culture of change, necessary for embracing alternative data, is indicative of their holistic approach to solving complex financial challenges within the intricacies of today's market.

Industry Specialization and Expertise

Leading restructuring possess a deep understanding of the distinctive hurdles present across various industries, from retail to technology. Their sector-specific knowledge equips them to devise bespoke strategies that address the particular challenges each industry faces. For example, in the healthcare sector, consulting firms have adapted their approach in response to financial strains exacerbated by the COVID-19 pandemic, inflation, and staffing shortages. A recent KLAS report highlights a 56% increase in , indicating a focus on operational evaluations to boost revenue and cut costs. This underscores a trend where more than half of the clients achieved enhanced efficiency and performance, leading to increased net revenue and reduced expenditure. These improvements are vital for healthcare organizations navigating decreased revenues and increased costs.

Furthermore, the consulting landscape is adapting to interconnected industry demands. As companies venture across traditional industry boundaries in search of new opportunities, consulting firms are gearing up to offer relevant expertise. This cross-industry fluency is crucial for businesses like automotive enterprises converging with consumer goods, or consumer products companies branching into retail.

Global consulting entities like Virtusa Corporation leverage their digital engineering proficiency to address strategic challenges, emphasizing the importance of executing ideas promptly for impactful results. Similarly, 's broad global presence and balanced mix of consulting and outsourcing services help businesses transition operations seamlessly, tackling attrition and enhancing efficiency.

These consulting firms exemplify the trend of offering specialized services alongside broader strategic advice, such as labor force optimization and contract negotiation, to ensure tailored solutions that meet the evolving needs of diverse sectors. The aggregation of deep technical expertise, operational know-how, and comprehensive business insight is shaping the way consulting firms deliver long-lasting results in a dynamic business environment.

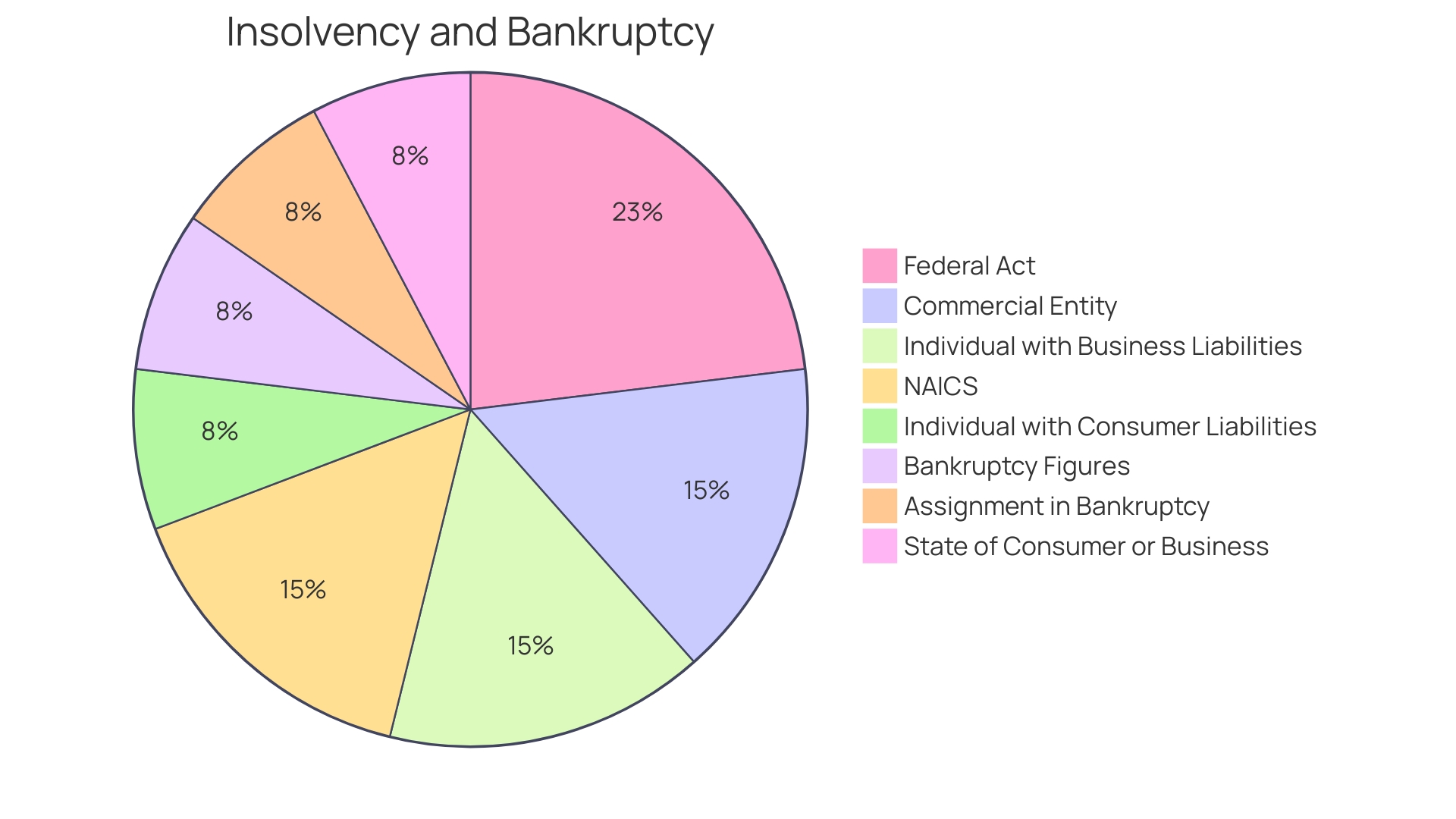

Debtor vs. Creditor Side Work

As the financial landscape continues to evolve, driven by macroeconomic factors such as pandemics, inflation, and labor shortages, the role of becomes increasingly critical. These firms are adept at navigating the complex terrain of financial distress, offering robust solutions to both debtors and creditors. For debtors, they step in with comprehensive , expert negotiations with creditors, and the implementation of cost-reduction measures that are essential for . Creditors, on the other hand, benefit from their astute financial analysis, thorough due diligence, and strategic debt restructuring advice to safeguard their investments.

The shifting dynamics in the healthcare sector, due to the financial strains introduced by the COVID-19 pandemic and other challenges, underscore the importance of such consulting services. Reports from industry watchdogs like KLAS have highlighted the significant contributions of consulting firms in aiding healthcare organizations during these trying times. With financial pressures mounting, these organizations have turned to consultants for their expertise in and steering through fiscal hurdles.

The expertise of restructuring consultants is further exemplified by the trend of 'lender-on-lender' activity and the increasing complexity of financial restructuring cases, as noted by industry experts. While the overall economy has shown resilience, the restructuring sector has witnessed an uneven year, marked by high-profile cases like the SVB filing and a rise in court cases as a result of interest rate hikes. This underscores the nuanced and critical role that these firms play in the financial ecosystem.

Additionally, the rise in personal and student loan debt, which totals approximately $1.77 trillion, has brought financial stability into sharp focus. With medical debt contributing to a significant number of bankruptcies, the expertise of restructuring consultants is instrumental in providing strategies to manage and alleviate these financial burdens.

In summary, [restructuring consulting firms](https://blog.smbdistress.com/top-10-business-transformation-consulting-firms-you-should-know) offer invaluable services to both sides of the financial spectrum. Their strategic interventions and tailored solutions are not only pivotal for organizations looking to overcome financial challenges but also for creditors aiming to maximize their recoveries in a tumultuous economic climate.

Services Offered by Top Restructuring Firms

Premier restructuring consulting firms play a pivotal role in guiding businesses through . These entities specialize in a spectrum of services encompassing , , operational enhancement, and strategic development. Their expertise is not limited to remedial actions for financial distress but extends to proactive strategies for sustainable growth. By integrating practices like zero-based budgeting, these consultants instill a culture of prudent expenditure paired with innovation.

Leveraging analytics and agile methodologies, these firms ensure customer-centric solutions that resonate with market demands. They facilitate collaborative environments, much like Satyendra Kumar's , which harmonizes diverse organizational functions towards common goals, including rigorous security standards and efficient data management.

Recent restructuring announcements, like DocuSign's operational efficiency plan, underscore the importance of strategic workforce adjustments and investment in growth-centric initiatives. Similarly, the resilience of companies such as Pros, which has pivoted towards revenue growth despite historical losses, demonstrates the potential for recovery with the right guidance.

In the landscape of debt relief, it's important to recognize the spectrum of options available, from settlement to management, each with its implications for the organization's financial health. The collective wisdom of the industry, as shared by Virtusa Corporation, highlights the imperative of an 'Engineering First' mindset, ensuring that every proposed strategy is feasible and impactful.

Furthermore, industry statistics reveal a broader truth: businesses must prioritize value maximization over mere profit generation. This paradigm shift is crucial in a market where traditional metrics of success are rapidly evolving. Firms that adapt to prioritize long-term value creation, while maintaining operational efficiency and fostering innovation, are those that will thrive.

In conclusion, restructuring consulting firms are invaluable allies for companies seeking not just to weather financial storms but to emerge stronger and more competitive. Their holistic approaches to financial and operational restructuring are tailored to help businesses realign with their core objectives and achieve lasting success in an ever-changing economic landscape.

Turnaround and Restructuring Process

provide crucial support to companies facing , assisting them through a transformative process that aims to restore financial health and operational efficiency. This journey often begins with a comprehensive financial assessment, followed by the development of a . The implementation phase is where the most critical changes occur, with continuous monitoring to ensure progress and success. These firms draw on deep industry expertise and experience in operations strategy, leveraging innovative approaches such as generative AI solutions and an Engineering First approach, as seen in companies like Virtusa Corporation.

Firms specializing in operations strategy and transformation dig deep to identify the root causes of complex problems. Their approach is evidenced by the recent restructuring of Rite Aid Corporation, which, under a court-supervised process, reached an agreement in principle with senior secured noteholders to significantly reduce debt and increase financial flexibility. This kind of restructuring is pivotal for companies to continue serving customers effectively and to .

The effectiveness of such restructuring efforts can be measured through financial performance analysis, operational efficiency reviews, and marketing and customer engagement evaluations. For example, assessing how well a company managed significant disruptions can provide insights into the resilience of its supply chain processes. Moreover, financial analysis helps in reflecting on whether financial targets were met and in understanding key financial elements such as revenue growth and profit margins.

As the number of company insolvencies hit the highest number since 1993, with 25,158 cases registered in 2023, the role of these consulting firms becomes increasingly important. They not only advise on navigating the insolvency process but also on strategies to avoid it altogether, ensuring companies remain competitive and financially viable in an ever-changing business landscape.

Benefits of Working with Restructuring Consultants

Engaging with a top-tier restructuring consultant can significantly enhance a company's ability to address and overcome . These experts offer objective insights that are critical when an organization faces or seeks to optimize its operations. Their skill in crafting bespoke solutions that are tailored to the unique needs of a business is invaluable. By drawing on extensive experience and a strategic approach, these consultants facilitate the development and execution of robust strategies designed to steer companies back to profitability and sustainable growth.

For instance, the transformation of the Ford Foundation's digital engagement strategy underscores the impact of expert consultation. The foundation transitioned from a rigid content management system, optimized for minimal content production, to a dynamic platform that could handle the surge in content creation. This shift was paramount to their mission of advocating for social change.

In the hospitality sector, a prominent hotel leveraged strategic advice to revitalize its restaurant business. By understanding its market and using location to its advantage, the hotel experienced a remarkable uptick in food and beverage sales, validating the consultant's comprehensive approach to problem-solving.

The current trend of highly skilled professionals, including those in technology sectors, choosing contracting over traditional employment, as highlighted in Eurostat data, reflects the evolving landscape of work. This shift towards contracting emphasizes the value that can bring to an organization, especially when internal resources may be limited or require augmentation with specific expertise.

Moreover, a recent KLAS report on financial improvement consulting revealed that engagements focused on are on the rise, with over half of the clients reporting enhanced efficiency and performance. This indicates that consultants are successfully guiding businesses through complex financial landscapes to achieve tangible results, such as increased net revenue and cost reductions.

In summary, restructuring consultants serve as pivotal agents of change, equipped with the tools and insights necessary to navigate financial complexities and drive organizational success. As the business world continues to evolve, the role of these consultants becomes increasingly critical in ensuring that companies not only survive but thrive in challenging environments.

Career Paths and Exit Opportunities in Restructuring Consulting

Venturing into the realm of equips professionals with an arsenal of skills and opens a gateway to a plethora of career pathways. As consultants traverse through assignments with different companies across a spectrum of industries, they hone their prowess in , strategic foresight, and optimizing operations. The stature and versatility gained in this field not only elevate one's professional profile but also carve out opportunities to ascend into leadership positions within client organizations, venture into the dynamic world of private equity, or transition to other consulting powerhouses.

In the world of consultancy, firms like Booz Allen Hamilton stand out for their comprehensive approach to nurturing leaders. Known for propelling many to the CEO chair, the firm offers a crucible for developing a broad understanding of complex, high-stakes environments and fostering leadership alongside technical acumen. Similarly, the Big Four accounting firms have expanded their horizons beyond auditing, riding the wave of consulting to drive a significant portion of their global revenues. This diversification has not only reshaped their service offerings but has also become a fertile ground for consultants to grow and evolve.

On the global stage, companies like Virtusa Corporation are redefining the consulting landscape with their 'Engineering First' approach, blending innovative digital solutions with traditional consultancy. Meanwhile, industry giants McKinsey, BCG, and Bain—revered as the MBB—continue to be the gold standard in management consulting, offering a springboard for consultants to leap into a variety of strategic roles post-consultancy.

The is in the throes of transformation, with digital technologies and AI reimagining traditional practices. As noted in the Global State of Business Analysis Report, a deep understanding of the industry's current state is crucial for steering through these changes. The report, with insights from over 4,400 professionals across 165 countries, uncovers trends that are sculpting the field of business analysis and shaping the future of consultancy.

In this evolving ecosystem, consultants are not only expected to deliver concrete solutions to well-defined problems but also to navigate the amorphous challenges of a volatile market. This dual capability to manage risk and harness uncertainty can propel consultants to the forefront of strategic decision-making, as they become indispensable in guiding firms through the complexities of modern business landscapes.

Choosing the Right Restructuring Consulting Firm

Selecting the appropriate is a pivotal decision for companies aiming to rectify their . It involves a multifaceted approach that scrutinizes the firm's acumen, specialization within certain industries, a history of successful engagements, and compatibility with the company's ethos. The goal is to partner with an advisor who can offer strategic guidance during financial upheavals.

Virtusa Corporation exemplifies a company that has woven into the fabric of their services, showcasing their 'Engineering First' philosophy. They emphasize the ability to execute ideas from their inception, which is a critical competency for a consulting firm. Their proven generative AI solution, Virtusa Helio, and a commitment to internal execution ensure impactful outcomes for their clients.

The contemporary consulting landscape, as highlighted by a recent report, shows a significant rise in engagements focused on , which have surged by 56% from previous years. This reflects a growing demand for operational evaluations aimed at augmenting revenue and curbing expenses. Consulting firms are increasingly tasked with offering specialized services like labor optimization and strategic risk management.

A profound understanding of the business environment is essential for consultants, as evidenced by an approach that began with an in-depth SEO analysis of competitors, leading to content refinement and strategic roadmap development for new content creation. This meticulous strategy resulted in a notable uplift in sales and positive customer feedback within the first week.

Moreover, insights from industry experts suggest a pragmatic approach to financial management, advocating for a comprehensive review of expenditures aligned with long-term objectives rather than immediate cost reductions. This underscores the importance of a holistic view of the company's finances when engaging with a consulting firm.

Businesses must navigate through a dynamic market where, according to analyst Bryan Solis, over half of the companies recognize competition and growth opportunities as catalysts for change. In an environment where continuous adaptation is necessary for survival, consulting firms provide valuable insights and strategies to harness technological advancements for organizational evolution.

In conclusion, the journey to finding a restructuring consulting partner demands diligence and an understanding of the firm's ability to deliver tangible results. Firms like Virtusa exemplify the blend of expertise and execution prowess required to steer companies towards financial resilience and operational excellence. The consulting industry's current focus on financial improvement and efficiency parallels the strategic needs of businesses striving to remain competitive and profitable.

Conclusion

Restructuring consulting firms are invaluable partners for businesses facing financial challenges. With their deep industry knowledge and strategic approach, these firms offer tailored solutions, including financial restructuring, operational enhancement, and strategic development, to address the unique needs of each client. They play a crucial role in helping businesses navigate the complexities of today's market and emerge stronger and more competitive.

In the healthcare sector, these firms adapt their approach to assist organizations in overcoming financial strains caused by the COVID-19 pandemic, inflation, and staffing shortages. By focusing on operational evaluations to boost revenue and reduce costs, they enhance efficiency and performance for healthcare organizations. This sector-specific expertise demonstrates the specialized knowledge these firms bring to different industries.

Restructuring consulting firms provide essential support to both debtors and creditors. They offer comprehensive turnaround strategies, expert negotiations with creditors, and cost-reduction measures for debtors, while providing financial analysis, due diligence, and strategic debt restructuring advice for creditors. Their expertise is crucial in helping organizations manage financial strains and debt in a dynamic financial landscape.

These firms offer a range of services, including cash flow optimization, debt realignment, operational enhancement, and strategic development. By integrating practices like zero-based budgeting and leveraging analytics and agile methodologies, they deliver customer-centric solutions that align with market demands. They empower businesses to prioritize value maximization, operational efficiency, and innovation, enabling them to thrive in today's evolving market.

Engaging with a top-tier restructuring consultant significantly enhances a company's ability to overcome financial challenges. These experts provide objective insights, craft bespoke solutions, and facilitate the execution of robust strategies for profitability and sustainable growth. Their impact is evident in success stories across industries, such as digital engagement transformations and operational revitalizations in the hospitality sector.

Restructuring consulting opens up diverse career pathways, offering professionals opportunities to develop skills in financial analysis, strategic foresight, and operational optimization. These skills can lead to leadership positions within client organizations, transitions to private equity, or roles in other consulting powerhouses. As the consulting industry evolves with digital technologies and AI, the ability to navigate uncertainty and manage risk becomes increasingly important for consultants.

Selecting the right restructuring consulting firm is a crucial decision for companies seeking financial rectification. Factors to consider include the firm's expertise, industry specialization, successful engagements, and compatibility with the company's ethos. Partnering with a trusted advisor who provides strategic guidance during financial challenges is essential for achieving tangible results.

It is vital to find a firm that combines expertise with execution prowess to steer companies toward financial resilience and operational excellence.

In conclusion, restructuring consulting firms offer essential guidance and support to businesses facing financial challenges. Through their expertise, industry knowledge, and tailored solutions, they help businesses navigate financial turbulence and emerge stronger and more competitive. Partnering with these firms enables companies to overcome financial hurdles, optimize operations, and achieve lasting success in today's dynamic business environment.

Frequently Asked Questions

What is FTI Consulting known for?

FTI Consulting is renowned for its exceptional restructuring and turnaround services, helping businesses navigate difficult financial situations and achieve lasting growth.

How did AlixPartners help the Arab National Bank?

AlixPartners assisted Arab National Bank in transitioning to a modern banking paradigm through an ambitious digital transformation.

What unique service does the Boston Consulting Group (BCG) offer to assist in business transformations?

BCG offers the establishment of a Transformation Office (TO) that aids in enhancing value creation by up to 50%, fostering transparency and accountability during transformation.

What areas does Alvarez & Marsal specialize in?

Alvarez & Marsal specializes in turnaround and restructuring consulting services focused on operational and financial improvement.

How does Deloitte use artificial intelligence in its restructuring and turnaround consulting?

Deloitte uses artificial intelligence to evaluate staff skills, allowing them to adaptively plan and reallocate talent to meet demand in different sectors.

What is a recent trend in the healthcare sector that consulting firms are addressing?

Consulting firms are focusing on financial performance improvement engagements due to financial strains exacerbated by the COVID-19 pandemic, inflation, and staffing shortages.

What is the difference between debtor and creditor side work in restructuring consulting?

Debtors receive help with turnaround strategies and cost-reduction measures, while creditors benefit from financial analysis and strategic debt restructuring advice to protect their investments.

What services do top restructuring firms offer?

Top restructuring firms offer services including cash flow optimization, debt realignment, operational enhancement, and strategic development, often incorporating zero-based budgeting and analytics.

What is the main goal in the turnaround and restructuring process provided by consulting firms?

The goal is to restore financial health and operational efficiency, which involves a comprehensive financial assessment and the development and implementation of a strategic turnaround plan.

What are the benefits of working with restructuring consultants?

Restructuring consultants provide objective insights, tailor solutions to unique business needs, and facilitate the development and execution of strategies that lead to profitability and sustainable growth.

What career paths are available in restructuring consulting?

Professionals in restructuring consulting can move into leadership positions within client organizations, enter the private equity world, or transition to other consulting roles.

How should a company choose the right restructuring consulting firm?

A company should consider the consulting firm's expertise, industry specialization, successful engagement history, and compatibility with the company's culture. The firm should be able to offer strategic guidance during financial challenges and execute ideas effectively.