Introduction

In the competitive landscape of modern business, turnaround management emerges as a vital strategy for organizations facing financial distress or operational inefficiencies. This comprehensive approach goes beyond simple cost-cutting; it involves a multifaceted transformation aimed at revitalizing a company’s profitability and stability.

CFOs play a crucial role in this process, as they must not only assess the current state of their organization but also implement innovative solutions that leverage technology and engage employees. By understanding the critical indicators that signal the need for a turnaround and following a structured approach to management, businesses can navigate challenges effectively and emerge stronger.

This article delves into the essential stages of turnaround management, key success factors, and real-world case studies, providing actionable insights that empower CFOs to lead their organizations toward recovery and sustained growth.

Understanding Turnaround Management: Definition and Importance

The describes a tactical process aimed at revitalizing a struggling entity through the implementation of comprehensive changes designed to restore profitability and operational stability. For CFOs, recognizing that recovery oversight goes beyond simple expense reduction is crucial; it involves a that entails:

- Reorganizing operations

- Enhancing cash flow

- Redefining the organization's strategic direction

Embracing innovative technologies like AI and machine learning can revolutionize these efforts, and operational efficiency.

To assist your transformation initiatives, consider our comprehensive guide on Revolutionizing Operations With AI & Machine Learning, now available at a promotional price of $399. Maintaining employee morale during these changes is crucial, as statistics show that engaged than those who don’t feel engaged. The emphasizes the importance of recovery strategies, highlighting their capacity to into thriving organizations, ultimately safeguarding employment and creating value for stakeholders.

In today's swiftly changing business environment, especially with the growth of , organizations must adjust their response plans to utilize new technologies that enable improved contract oversight and adherence. With over half of businesses adopting cloud-only solutions for contract handling and 71% of legal teams operating in a hybrid model, the integration of advanced contract systems has become crucial in navigating international regulations. This further illustrates the effect of strategic alterations in [turnaround management definition](https://contractsafe.com/blog/contract-management-statistics) on business profitability, making mastery of the cash conversion cycle a crucial approach for improving overall business performance.

Discover our approaches to excel in the cash conversion cycle and enhance your company's performance today.

The Stages of Turnaround Management: A Step-by-Step Guide

- Assessment: Begin with a meticulous analysis of your entity’s financial health, operational efficiency, and market position. This essential step includes recognizing the root causes of underperformance, which is crucial in developing an effective recovery plan. Current statistics reveal that 55% of employees lack access to , and notably, 66% of employees in the hospitality industry cannot locate an AED. These statistics reflect a broader issue of preparedness that organizations must address. Understanding these gaps is vital for developing a robust response. As Obaid Noman states, 'An accurate assessment is the cornerstone of any successful recovery strategy.' Furthermore, testing hypotheses during this phase can uncover underlying issues and inform the direction of the recovery effort.

- Planning: Develop a comprehensive recovery plan that outlines specific objectives, timelines, and resource allocations. A well-structured plan serves as a roadmap that guides the organization through the challenges ahead, ensuring streamlined decision-making. Engaging key stakeholders is essential to build consensus and commitment in this phase. This phase should also include the identification of key performance indicators (KPIs) to measure success.

- Implementation: Execute the recovery plan with precision. This phase may involve significant changes to operations, management, and planning, supported by real-time analytics tools such as dashboards and performance tracking software to monitor progress. Engaging key stakeholders is crucial to ensure buy-in and facilitate smooth transitions. Keeping the team aligned and motivated will enhance the likelihood of success.

- Monitoring: Continuously monitor the implementation process using key performance indicators (KPIs) to gauge progress. Real-time business analytics offer valuable insights, enabling prompt modifications to approaches, ensuring the organization stays aligned to reach its recovery objectives. For example, a study highlighted the use of outlier events across 496 laboratories to monitor , providing valuable insights into , which can inform the monitoring stage of turnaround management definition.

- Sustainability: After realizing improvements, focus on sustaining these changes through ongoing evaluation and adaptation of strategies. This step is crucial to preventing future crises and ensuring that the entity is resilient in the face of challenges. As noted by industry experts, the sustainability of recovery efforts hinges on a commitment to throughout the process. This commitment not only fosters strong, lasting relationships but also ensures that the entity is better prepared for future challenges.

Critical Success Factors in Turnaround Management

Effective management of change hinges on several critical factors that directly influence the likelihood of success. Robust leadership is essential; research shows that 90% of entities in the 'woe zone' lacked effective agile leadership, highlighting the need for of institutional distress.

A clear vision is equally vital. Establishing a compelling future direction not only aligns the team's efforts but also inspires collective action. Leaders must communicate this vision consistently to ensure all stakeholders are pulling in the same direction.

in fostering a supportive environment for change. Engaging key stakeholders—including employees, creditors, and suppliers—fosters a sense of ownership and dedication to the recovery efforts. Expert views indicate that is vital for establishing trust and promoting collaboration throughout the organization, improving the likelihood of a successful change.

during a recovery. and concentrating on are crucial to ensure that resources are allocated effectively and risks are mitigated. The application of real-time analytics, such as those provided through client dashboards, can deliver valuable insights into financial performance, enhancing operational efficiency and laying the groundwork for future growth.

For example, one client mentioned, 'The insights from the dashboard enabled us to make informed decisions swiftly, which was crucial during our recovery.'

Finally, adaptability is a hallmark of the turnaround management definition that signifies successful outcomes. Leaders must be prepared to pivot and adjust strategies based on real-time feedback and shifting market conditions. This flexibility is vital for sustained success, allowing organizations to respond proactively to challenges.

As demonstrated in the who have utilized the SMB team's 'Rapid30' plan, the ability to operationalize lessons learned significantly enhances business performance and customer focus. One satisfied client remarked, "Thanks to the SMB team and their Rapid plan, we not only survived but thrived, focusing on what we do best: serving our customers." Quality indicators, such as those reflecting overall process quality, can serve as crucial benchmarks for evaluating progress, enabling informed decision-making that drives success.

Recognizing the Need for Turnaround Management: Key Indicators

Identifying when a change is necessary is crucial for maintaining business health, which aligns with the . Here are five key indicators that signal the need for immediate action:

-

: A consistent drop in sales or revenue is often the initial indication that a change is required.

Recent reports reveal alarming trends, with significant portions of businesses grappling with revenue declines that can jeopardize their future. The Congressional Budget Office projects that 6.2 million will become uninsured, underscoring the economic pressures that can lead to declining revenues across various sectors. Testing every hypothesis around revenue streams can provide insights into potential recovery strategies.

-

Increased Debt Levels: Rising liabilities coupled with stagnant or declining asset growth serve as a critical warning signal. This imbalance can threaten operational stability and , particularly in industries facing economic downturns. Quick decision-making processes are essential here to prevent further deterioration.

-

: Chronic cash flow problems can severely threaten a business's viability. CFOs must monitor cash flow closely, as persistent deficits may require immediate intervention to avoid insolvency. Utilizing real-time analytics through our client dashboard can aid in diagnosing cash flow health and implementing timely corrective measures.

-

: High turnover rates often reflect deeper organizational issues that demand urgent attention. Retaining top talent is essential; thus, understanding the underlying causes of turnover can provide insights into necessary changes within the company. Operationalizing lessons learned from turnover data can help build stronger workplace relationships and enhance retention strategies.

-

Customer Complaints: An uptick in may indicate operational inefficiencies or product-related shortcomings that need addressing. As Shreya Roy aptly notes,

We owe our sincere appreciation to all of the researchers who developed indicators and conducted data analyses for this scorecard,

emphasizing the necessity for thorough assessment of customer feedback to guide improvement plans. Case studies like the initiative on 'Eliminating Racial Inequities in Maternal Health' demonstrate how adopting policies that focus on health equity can result in substantial enhancements, highlighting the significance of strategic management in tackling systemic challenges.

In summary, identifying these indicators promptly can enable CFOs to apply effective [turnaround management definition](https://commonwealthfund.org/publications/scorecard/2023/jun/2023-scorecard-state-health-system-performance) approaches, leveraging streamlined decision-making and real-time analytics via our client dashboard to protect the organization’s future.

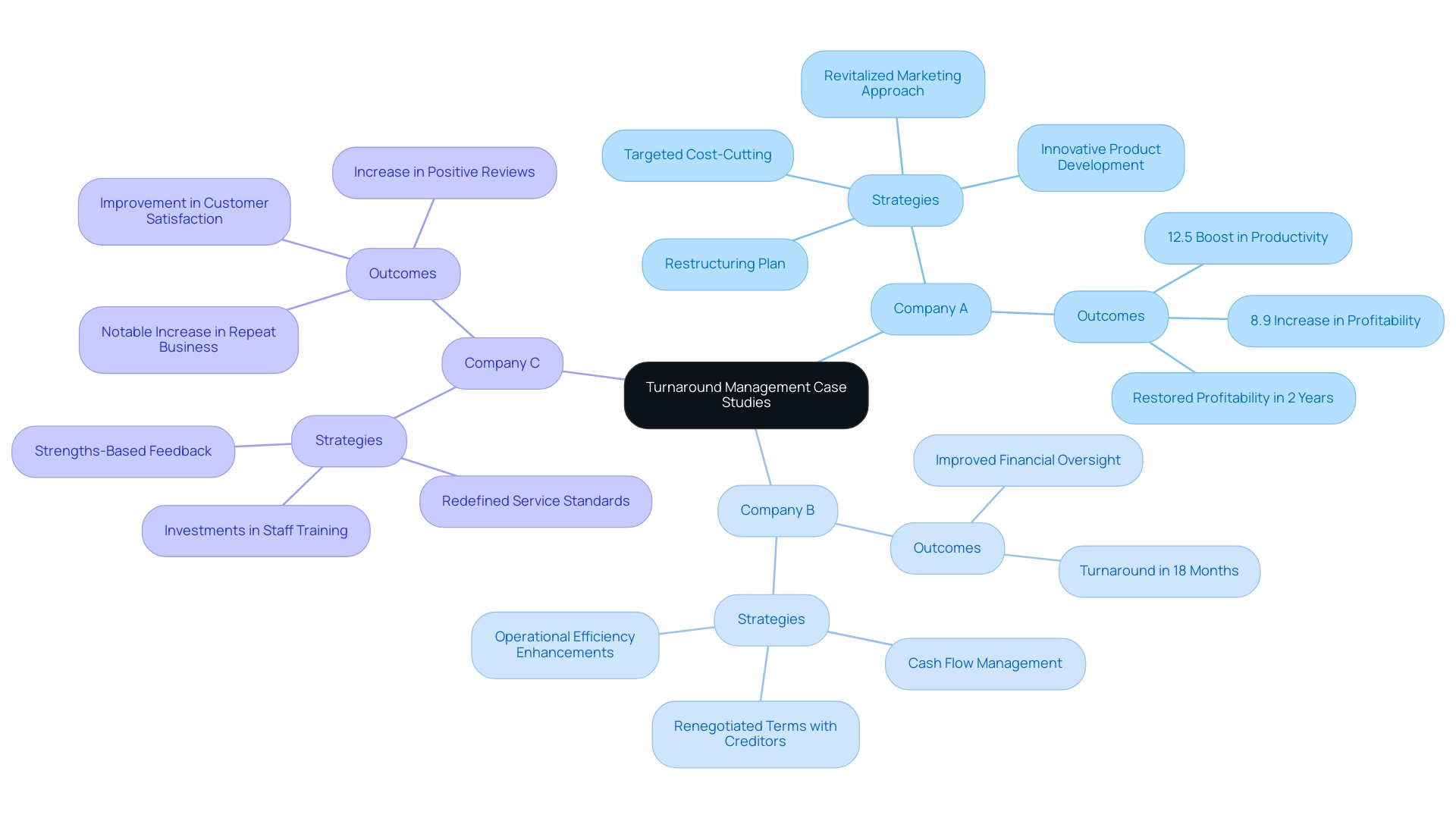

Case Studies in Turnaround Management: Learning from Real-World Examples

- Case Study: Company A - In response to a significant decline in sales driven by heightened market competition, Company A executed a robust restructuring plan that encompassed targeted cost-cutting measures, a revitalized marketing approach, and innovative product development. This multifaceted initiative not only enabled the company to reclaim lost market share but also restored profitability within a two-year timeframe. Engaging employees through consistent performance feedback and during this period contributed to an 8.9% increase in profitability and a 12.5% boost in productivity. The company's focus on operationalizing lessons learned reinforced the importance of streamlined decision-making. Notably, they recognized that workers who receive are eight times more engaged, a crucial factor in the successful turnaround. Additionally, the company tested every hypothesis related to its strategies, ensuring that decisions were data-driven and effective.

- Case Study: Company B - Confronted with severe liquidity challenges, Company B undertook stringent cash flow management practices and successfully renegotiated terms with creditors. These financial maneuvers, alongside significant enhancements to operational efficiency driven by through their client dashboard, exemplify the definition, culminating in a remarkable turnaround within just 18 months. This case illustrates the critical role that disciplined financial oversight and quick decision-making play in the [turnaround management definition](https://blog.smbdistress.com/turnaround-management-software-key-features-and-comparisons-for-cf-os) during crises. The dashboard offered insights that enabled prompt modifications to approaches based on performance metrics.

- Case Study: Company C - A hospitality business grappling with dwindling customer satisfaction addressed its challenges by redefining service standards and making substantial investments in staff training. This renewed focus on elevating the customer experience led to a marked improvement in positive reviews and a notable increase in repeat business. Such strategic emphasis on employee development is crucial, especially considering that 74% of U.K. workers find ineffective. By shifting focus toward strengths-based feedback, as highlighted by the statistic that teams receiving this type of feedback are 8.9% more profitable and 12.5% more productive, companies can operationalize their insights and harness the full potential of their workforce. Furthermore, the use of [real-time analytics](https://keboola.com/blog/5-stats-that-show-how-data-driven-organizations-outperform-their-competition) allowed the company to continuously monitor and adjust its strategies, ensuring alignment with customer expectations.

Conclusion

Turnaround management stands as a critical strategy for CFOs navigating the turbulent waters of financial distress and operational inefficiencies. This article has illuminated the multifaceted nature of successful turnarounds, emphasizing that they require more than mere cost-cutting; they demand a comprehensive approach involving:

- Assessment

- Planning

- Implementation

- Monitoring

- Sustainability

By understanding the stages of this process, CFOs can create a solid roadmap to revitalize their organizations.

The importance of recognizing key indicators of distress cannot be overstated. Declining revenues, increased debt, negative cash flow, high employee turnover, and rising customer complaints are all signs that immediate action is imperative. Addressing these issues proactively allows organizations to pivot quickly and implement effective turnaround strategies that not only restore stability but also set the stage for future growth.

Real-world case studies further demonstrate the power of strategic turnaround management. Companies that have embraced:

- Strong leadership

- Clear vision

- Stakeholder engagement

- Financial prudence

- Adaptability

have not only survived but thrived. These examples serve as compelling proof that with the right strategies in place, organizations can transform challenges into opportunities, ensuring long-term profitability and resilience in an ever-evolving business landscape.

Ultimately, the path to successful turnaround management is paved with informed decision-making and a commitment to continuous improvement. By embracing these principles, CFOs can lead their organizations toward recovery, fostering a culture of engagement and innovation that will sustain them for years to come. Now is the time to take decisive action and harness the potential of turnaround management to safeguard the future of the organization.

Frequently Asked Questions

What is turnaround management?

Turnaround management is a tactical process aimed at revitalizing a struggling entity through comprehensive changes designed to restore profitability and operational stability.

What are the key components of a successful turnaround management strategy?

Key components include reorganizing operations, enhancing cash flow, and redefining the organization's strategic direction.

How can technology assist in turnaround management?

Embracing innovative technologies like AI and machine learning can enhance decision-making and operational efficiency during the turnaround process.

Why is maintaining employee morale important during a turnaround?

Maintaining employee morale is crucial because engaged employees are 87% less likely to leave their jobs, which is vital for the success of recovery strategies.

What indicators suggest that a change is necessary in a business?

Key indicators include declining revenue, increased debt levels, negative cash flow, high employee turnover, and rising customer complaints.

What are the steps involved in the turnaround management process?

The steps include: 1. Assessment: Analyzing financial health and operational efficiency. 2. Planning: Developing a comprehensive recovery plan. 3. Implementation: Executing the recovery plan with precision. 4. Monitoring: Continuously tracking progress using KPIs. 5. Sustainability: Focusing on sustaining improvements through ongoing evaluation.

What role does leadership play in turnaround management?

Effective leadership is essential for navigating complexities during distress, establishing a clear vision, and engaging stakeholders to foster a supportive environment for change.

How can real-time analytics contribute to turnaround management?

Real-time analytics can provide valuable insights into financial performance, enabling informed decision-making and enhancing operational efficiency.

What is the significance of stakeholder engagement in the turnaround process?

Engaging key stakeholders fosters a sense of ownership and dedication to recovery efforts, which is vital for establishing trust and promoting collaboration throughout the organization.

Can you provide examples of successful turnaround management?

Examples include: 1. Company A, which reclaimed market share and restored profitability through restructuring and employee engagement. 2. Company B, which overcame liquidity challenges through cash flow management and operational efficiency enhancements. 3. Company C, a hospitality business that improved customer satisfaction by redefining service standards and investing in staff training.