Introduction

Forensic accounting is a critical discipline in the financial world, combining accounting, auditing, and investigative skills to uncover financial misdeeds. With the growing complexity of financial fraud schemes, forensic accountants play a vital role in detecting and scrutinizing suspicious transactions, uncovering hidden assets, and compiling evidence for legal proceedings. In this article, we will explore the fundamentals of forensic accounting, the use of financial analysis methods, the integration of data forensics and digital analysis techniques, the application of interview and interrogation techniques, common financial irregularities uncovered, notable case studies, the benefits of forensic accounting in corporate settings, and best practices for conducting forensic accounting investigations.

Join us as we delve into the world of forensic accounting and discover its significance in combatting financial fraud.

The Role of Forensic Accounting in Uncovering Financial Irregularities

Forensic accounting is an imperative discipline in the financial world, combining accounting, auditing, and investigative skills to expose financial misdeeds. These experts delve into financial records to detect and scrutinize suspicious transactions, uncover hidden assets, and compile evidence for legal proceedings. The significance of their role is highlighted by the growing complexity of financial statement fraud schemes. Fraudsters with extensive knowledge of company operations craft intricate schemes camouflaged within legitimate financial reporting, often overwhelming traditional analysis methods due to the sheer volume and complexity of data involved.

The fundamentals of forensic accounting are rooted in the double-entry accounting system, a method so precise that it can pinpoint financial discrepancies just as fingerprints can solve crimes. Understanding the accounting equation (Assets = Equity + Liabilities) is crucial, as changes in balance sheet items can signal fraudulent activity. Furthermore, the interrelated nature of the income statement, balance sheet, and cash flow statement can provide additional clues.

Real-world cases exemplify the necessity for forensic scrutiny, such as when the Ontario Securities Commission (OSC) identified capitalization issues in Royal Bank of Canada's (RBC) internally developed software. While no evidence of malicious intent was found, the case underscores the importance of vigilance in financial reporting. Similarly, auditors may sometimes miss complex fraud schemes, emphasizing the need for forensic accountants who are equipped to unravel sophisticated deceptions.

The 'Report to the Nations' underscores the importance of effective anti-fraud controls, noting that most occupational frauds stem from inadequate internal controls. Technological advances and data analytics are playing an increasingly vital role in detecting fraudulent activities. An understanding of the typical fraudster's profile, including their organizational position and methods of concealment, is also invaluable in fraud prevention and detection.

Financial Analysis Methods in Forensic Accounting

Forensic accounting plays a crucial role in identifying financial fraud, which has become increasingly sophisticated over time. By employing a combination of financial analysis methodologies such as ratio analysis, trend analysis, cash flow analysis, and variance analysis, forensic accountants dissect financial statements, bank records, and transactional data to spot inconsistencies and red flags.

The modern landscape of financial statement fraud involves elaborate schemes designed by individuals who possess deep knowledge of their company's operations and internal controls. This knowledge allows them to conceal fraudulent activity within the standard financial reporting mechanisms. Moreover, the sheer volume and intricacy of financial data today—with complex transactions, multiple subsidiaries, and diverse accounting treatments—present significant challenges and can overwhelm traditional analytical methods.

To combat these challenges, data analytics has become a cornerstone of informed decision-making in finance. Financial professionals now depend on sophisticated data analytics to turn vast amounts of complex data into actionable insights. For instance, in risk management, data analytics is instrumental in assessing and mitigating risks by analyzing historical and real-time market data. It also provides customer insights that are crucial for the financial industry.

The significance of data analytics is underscored by a survey by S&P Global, which revealed that 25% of respondents claimed nearly all of their decisions are data-driven, while 44% stated that most are. These statistics highlight the growing reliance on data analytics tools for evidence-based decision-making, which can help reduce the likelihood of biased judgments.

Dr. Weber, a professor and program director with expertise in forensic accounting and financial misconduct, exemplifies the profound impact that advanced data analytics and forensic accounting expertise can have on addressing financial crimes. His work, particularly with students in the fraud experiential program, demonstrates the real-world application of these skills in tackling financial and high-tech crimes, even in the most rural and challenging environments.

In summary, the role of forensic accountants is more critical than ever, as they utilize advanced analytical tools to uncover and combat the increasingly complex and hidden nature of financial fraud. The integration of data analytics into their investigative processes not only aids in detecting irregularities but also enhances the overall decision-making capabilities within the financial sector.

Data Forensics and Digital Analysis Techniques

The digitalization of financial transactions has necessitated the evolution of forensic accounting into a discipline deeply intertwined with data forensics and digital analysis. These modern-day sleuths delve into the electronic abyss to examine emails, computer files, and digital documents. They are not merely looking for numbers that don't add up; they're tracing the digital footprints and metadata that can reveal the origins of fraud.

One such case emerged from Buenos Aires, where a malicious application known as PDF AI: Add-On was installed on a device, later exploiting Android's Accessibility features to access sensitive user data. Similarly, the BBC's 'Rip Off Britain' highlighted the need for forensic accountants to stay ahead of increasingly sophisticated fraud schemes, as fraudsters leverage in-depth knowledge of company operations to conceal their tracks.

The challenges are formidable. Financial statement fraud schemes are growing in sophistication, often well-hidden within legitimate business processes. With the rise of big data, the overwhelming volume and complexity of financial transactions call for advanced tools and methodologies. Traditional analysis methods falter against the sheer scale of modern financial data, which encompasses complex transactions and multiple subsidiaries.

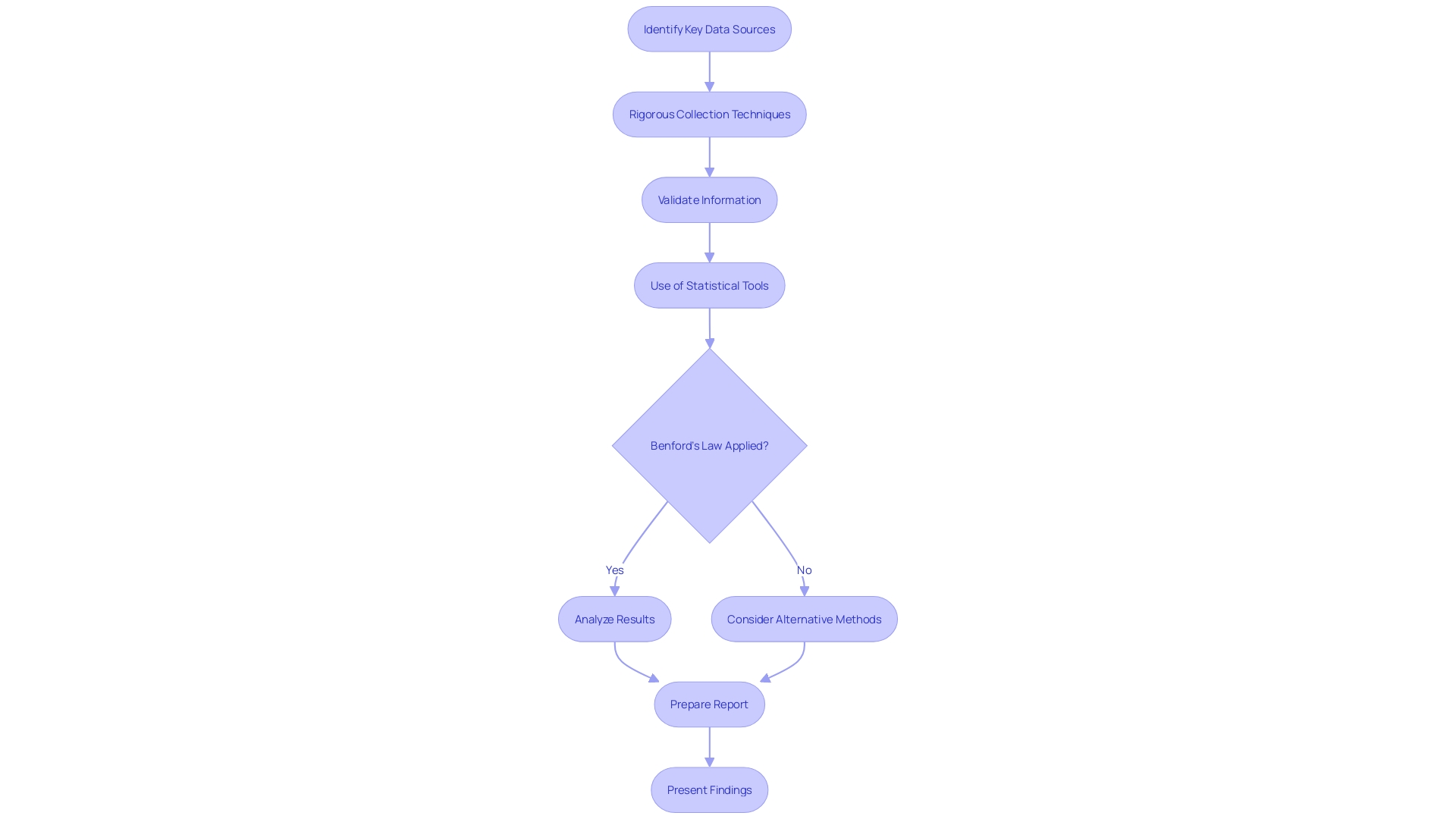

To address this, forensic accountants have adopted a structured approach to their investigations. Starting with identifying key sources of data, they employ rigorous collection techniques to gather and validate information. This meticulous process is crucial, as even a character as astute as Sherlock Holmes recognized the paramount importance of 'data, data, data,' a sentiment echoed in the financial world.

Supporting their efforts, statistical tools such as Benford's Law serve as a litmus test for the integrity of numerical data. Deviations from Benford's expected distribution can signal red flags for auditors, indicating possible fraud or manipulation. This law has become a cornerstone in the detection of financial irregularities, helping forensic accountants to not only expose fraud but also to enhance data integrity in an age where artificial intelligence plays a growing role.

In the end, the forensic accountant's role is ever-evolving, reflecting the complex interplay between technology, data, and the ingenuity of fraudsters. It is a field that demands continuous learning and adaptability, as the guardians of financial data integrity tirelessly work to shine a light on the truth hidden within the digits.

Interview and Interrogation Techniques in Investigations

Forensic accountants play a vital role in deciphering financial puzzles, especially when it comes to legal disputes and investigations of fraudulent activities. These financial detectives employ a series of meticulous techniques to scrutinize financial statements and transactions, searching for any signs of anomalies or misconduct. Their expertise is not limited to mere number-crunching; they conduct thorough interviews, drawing upon their extensive knowledge of accounting, law, and investigative tactics.

During interviews and interrogations, forensic accountants leverage their skills to extract crucial information from individuals closely associated with the case, including employees, clients, and business partners. These conversations are instrumental in revealing concealed details, understanding the motives for fraudulent behavior, and pinpointing the individuals involved in financial discrepancies. This process is akin to piecing together a complex puzzle, where each bit of information helps form a clearer picture of the financial irregularities at hand.

Armed with domestic and international experience, licensed forensic investigators delve into the digital realm, identifying and preserving data that might be pivotal in upholding a company's reputation and complying with regulatory standards. In today's data-centric world, such meticulous data analysis not only aids in legal proceedings but also contributes to commercial success and societal benefits.

To illustrate the profound impact of forensic accounting, consider the work of Dr. Weber, a respected figure in the field. His academic and professional contributions as a forensic accountant, Certified Fraud Examiner, and legal expert have significantly advanced the understanding of financial misconduct. Dr. Weber's initiatives, including experiential programs for students tackling financial crimes, have received substantial funding, demonstrating the value placed on combating financial exploitation and high-tech crime.

Furthermore, the interconnectivity of financial statements is essential for forensic accountants. The foundational double-entry accounting system, which maintains that Assets = Equity + Liabilities, provides clues to unravel financial crimes, similar to how fingerprints solve murder cases. Any alteration on one side of the balance sheet necessitates a corresponding change on the other, offering leads to investigators.

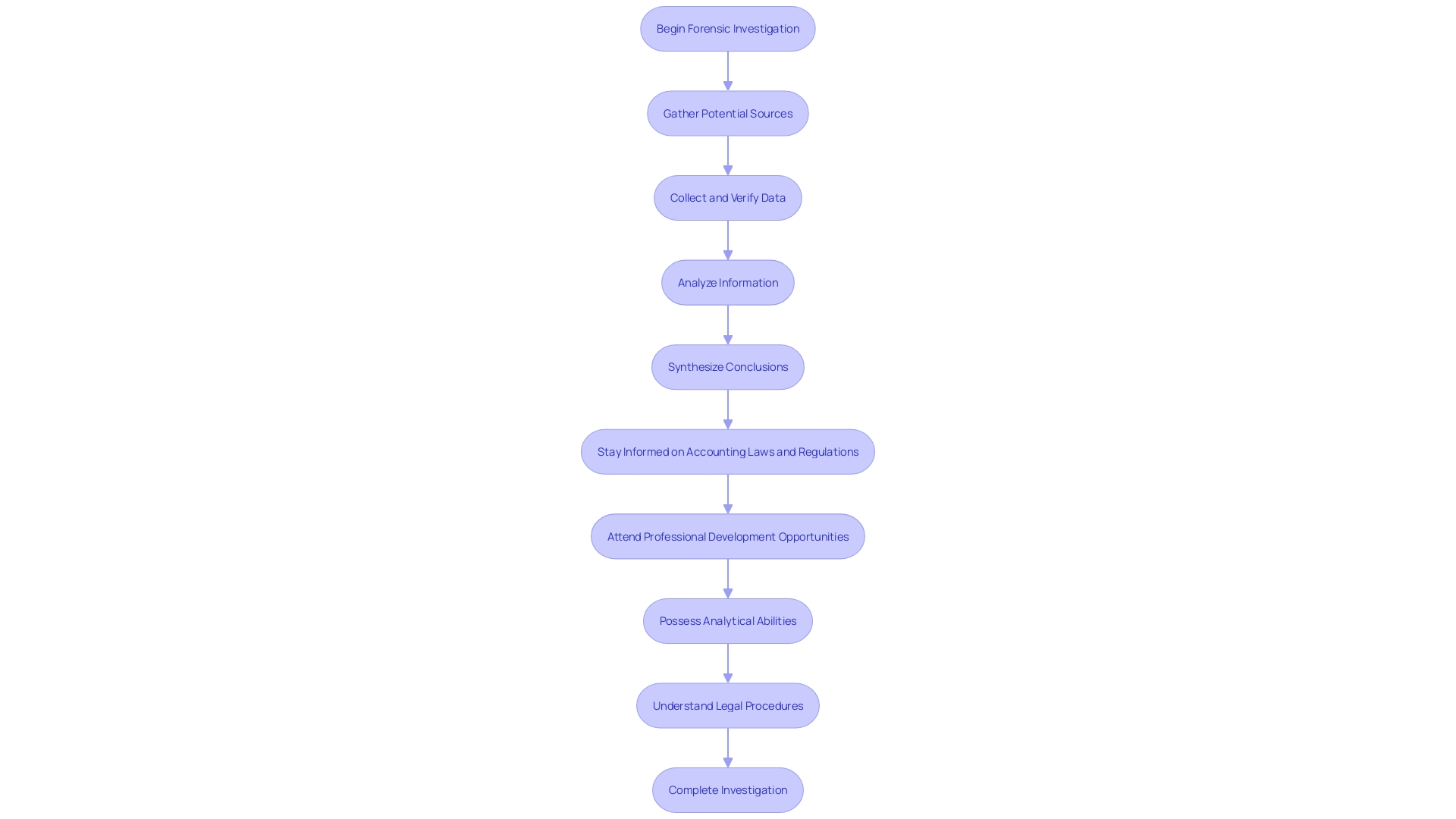

The steps involved in a forensic investigation are sequential and methodical. Starting with gathering a list of potential sources, forensic experts then collect and verify data, ultimately analyzing the information to synthesize conclusions. Their ability to stay informed on the latest accounting laws and regulations is critical, often achieved through professional development opportunities such as attending conferences and webinars.

The skills required for forensic accounting extend beyond traditional accounting knowledge. An adept forensic accountant must possess sharp analytical abilities, a keen eye for detail, and a solid understanding of legal procedures. These competencies enable them to navigate the intricacies of financial investigations and legal challenges effectively.

In a landscape where financial crimes and wrongful convictions continue to be a concern, the role of forensic accountants is increasingly important. Their analytical prowess is a cornerstone in the fight against money laundering and fraud, as evidenced by the success of organizations like Verafin, which provides cloud-based anti-fraud solutions to the financial industry. With over 3,000 cases of wrongful convictions on record in the United States, the work of forensic accountants and the accuracy of forensic science remain crucial in ensuring justice and integrity in financial matters.

Common Financial Irregularities Uncovered by Forensic Accountants

Forensic accounting, a field akin to the use of fingerprints in solving a murder, is essential for unraveling financial crimes within the modern business landscape. Rooted in the double-entry accounting system established in the 15th century by Luca Pacioli, forensic accountants use this framework to detect discrepancies and trace the origins of financial misconduct. The fundamental accounting equation, Assets = Equity + Liabilities, guides their analysis; any alteration on one side of the balance sheet inevitably signals a corresponding change on the other, providing vital clues for investigation.

Fraudulent activities such as financial statement fraud, asset misappropriation, and tax evasion are meticulously dissected by these financial detectives. Advanced software tools have notably enhanced their capabilities, as evidenced by a novel algorithm that is three times more effective than previous methods. This software rapidly identifies suspicious transaction patterns, even in complex scenarios such as smurfing, where large sums are divided and dispersed.

The insights of forensic accountants extend beyond immediate problem-solving; they offer a retrospective view on the effectiveness of anti-fraud controls. Data from the 2024 Report to the Nations reveals that over half of occupational frauds transpire from inadequate or overridden internal controls. Furthermore, the evolving landscape of fraud, magnified by economic instability, prompts forensic accountants to stay vigilant and adapt to emerging fraudulent schemes, ensuring that businesses can better arm themselves against the potential for financial harm.

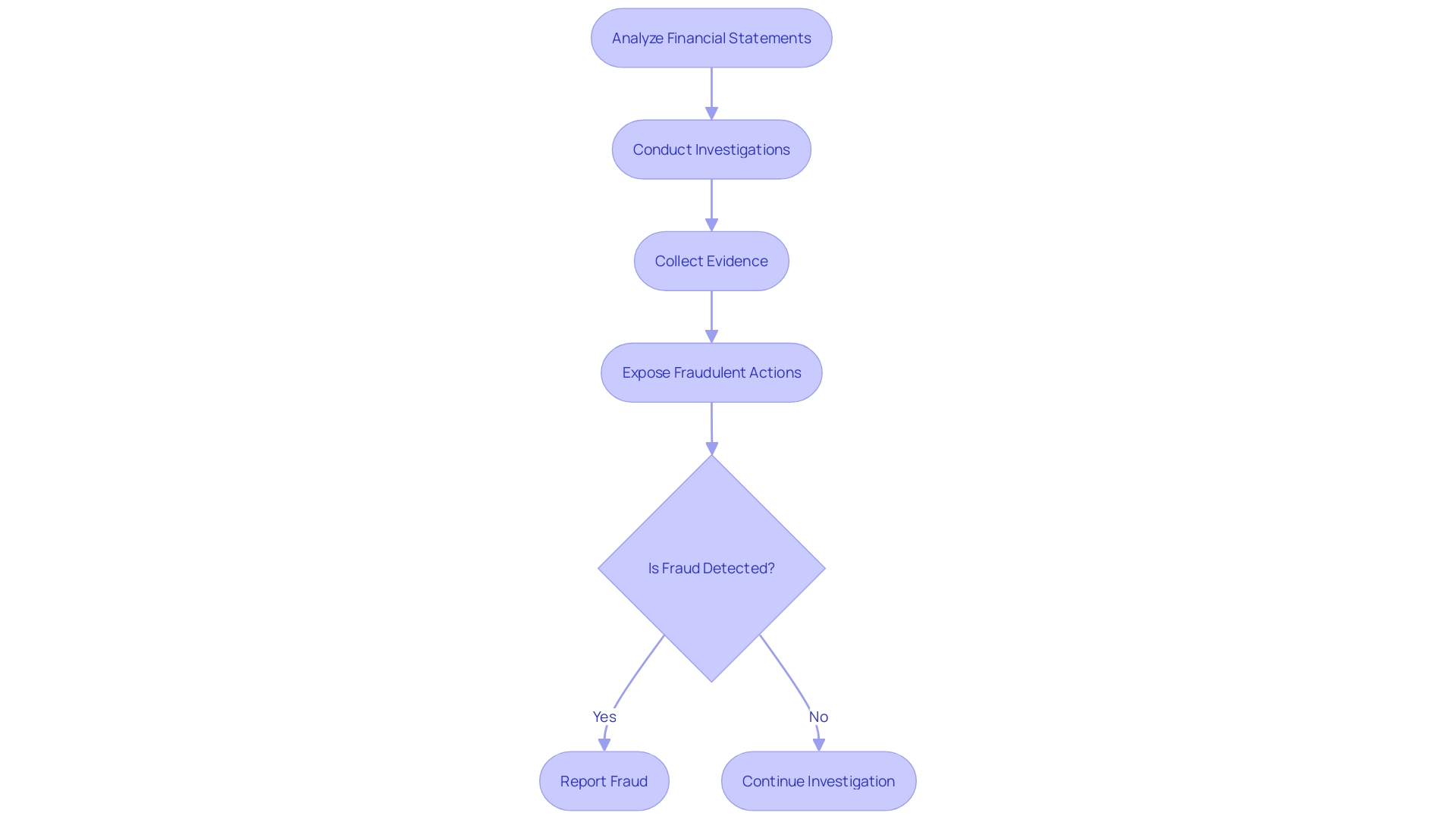

Case Study: Notable Examples of Forensic Accounting in Action

Forensic accounting has proven pivotal in revealing financial fraud and ensuring accountability. The Enron scandal, for instance, is a testament to the vital role forensic accountants play in dissecting financial statements and exposing fraudulent actions by top executives. Similarly, the Panama Papers leak, which involved a detailed examination of massive data sets, uncovered concealed wealth and tax evasion schemes. These instances underscore the continuous need for vigilance within regulatory frameworks to counteract the evolving tactics of financial malfeasance. Recent advancements, such as innovative software that detects money laundering more efficiently by analyzing complex transaction networks, demonstrate the growing importance of technology and data analytics in the fight against financial crime. This technology has been shown to be three times more effective than traditional methods, which often rely on rule-based or machine learning systems that may miss sophisticated laundering techniques like smurfing. The ongoing cat-and-mouse dynamic between perpetrators and watchdogs highlights the importance of staying ahead through continuous innovation in surveillance and detection methods. The repercussions of market manipulation are extensive, eroding investor confidence, unsettling markets, and potentially triggering economic downturns, thereby affecting not just the financial sector but the broader economy and public trust.

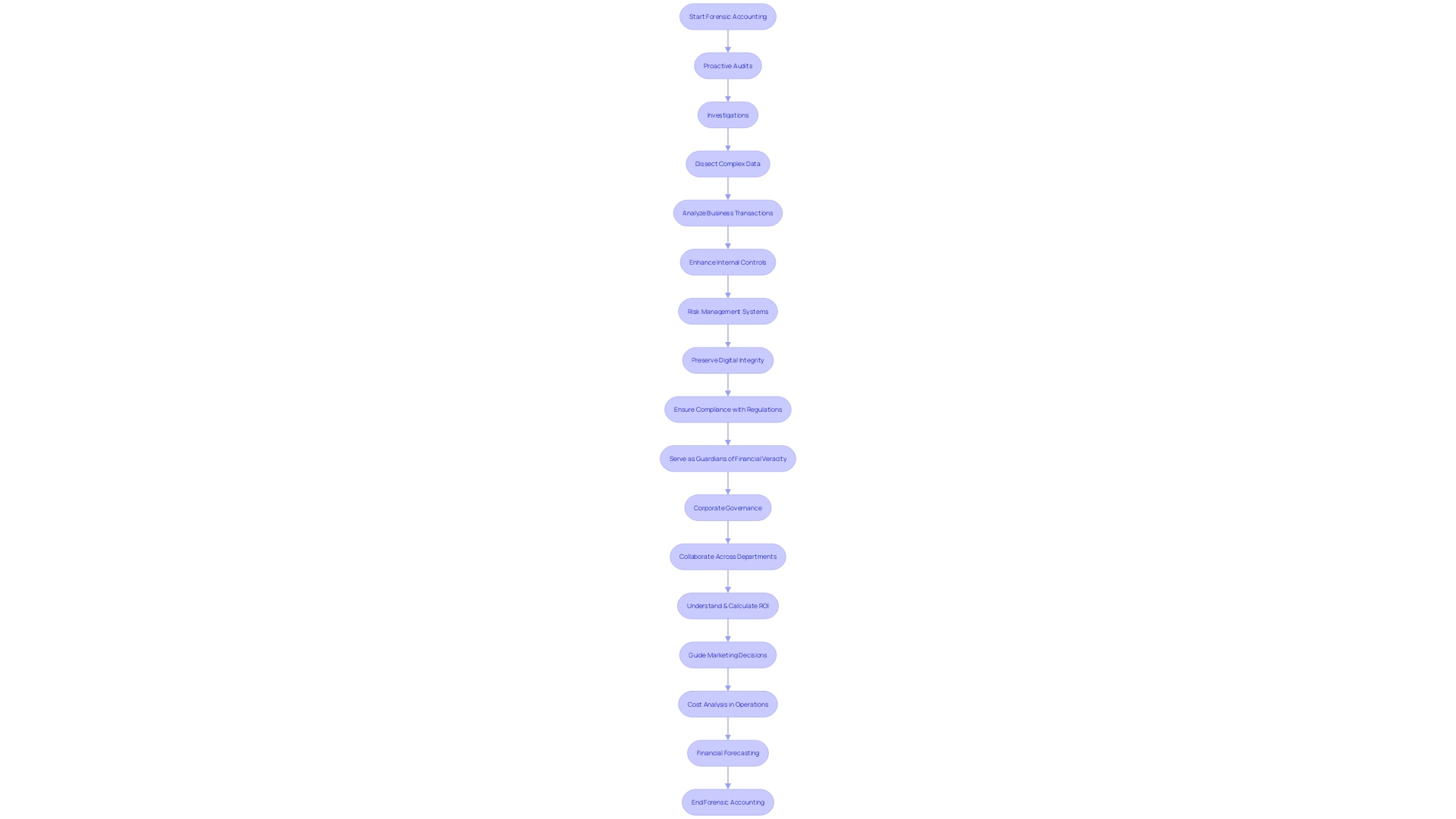

Benefits of Forensic Accounting in Corporate Settings

In the realm of financial vigilance, forensic accounting stands as a sentinel against the tide of fraud and financial deception. The expertise of forensic accountants is not limited to post-mishap investigations; their proactive audits are instrumental in unearthing potential financial misdeeds, nipping them in the bud before they burgeon into catastrophic losses. These financial sleuths are adept at dissecting complex data, employing advanced tools to analyze the intricate web of modern business transactions that traditional methods may overlook. Their analytical prowess is particularly critical given the increasing sophistication of financial statement fraud schemes, which are often masterminded by individuals with intimate knowledge of company operations and internal controls.

Forensic accountants serve as the architects of fortified internal controls and risk management systems. They champion the harmonization and alignment of protocols to mitigate insider risks, which, as stated in the 2023 Ponemon Cost of Insider Risks Report, are frequently the result of negligence or manipulation. By enhancing communication and education within the workforce, forensic accountants empower organizations to pre-emptively address deviations from established processes.

In an era where data reigns supreme, forensic accountants are the custodians of digital integrity. Their ability to identify, preserve, and analyze data extends beyond the balance sheet, addressing complex challenges across multiple jurisdictions and ensuring compliance with regulatory mandates. As elucidated by Luca Pacioli, the progenitor of double-entry accounting, the meticulous examination of financial statements can reveal the fingerprints of financial malfeasance.

The value of forensic accounting is further exemplified by its deterrent effect. The mere presence of these experts signifies an organization's unwavering commitment to transparency and rectitude, sending an unequivocal message that fraudulence will find no quarter within its walls. Thus, forensic accountants are not just guardians of financial veracity but also the standard-bearers of corporate governance, steering enterprises toward a path of unassailable ethical conduct.

Best Practices for Conducting Forensic Accounting Investigations

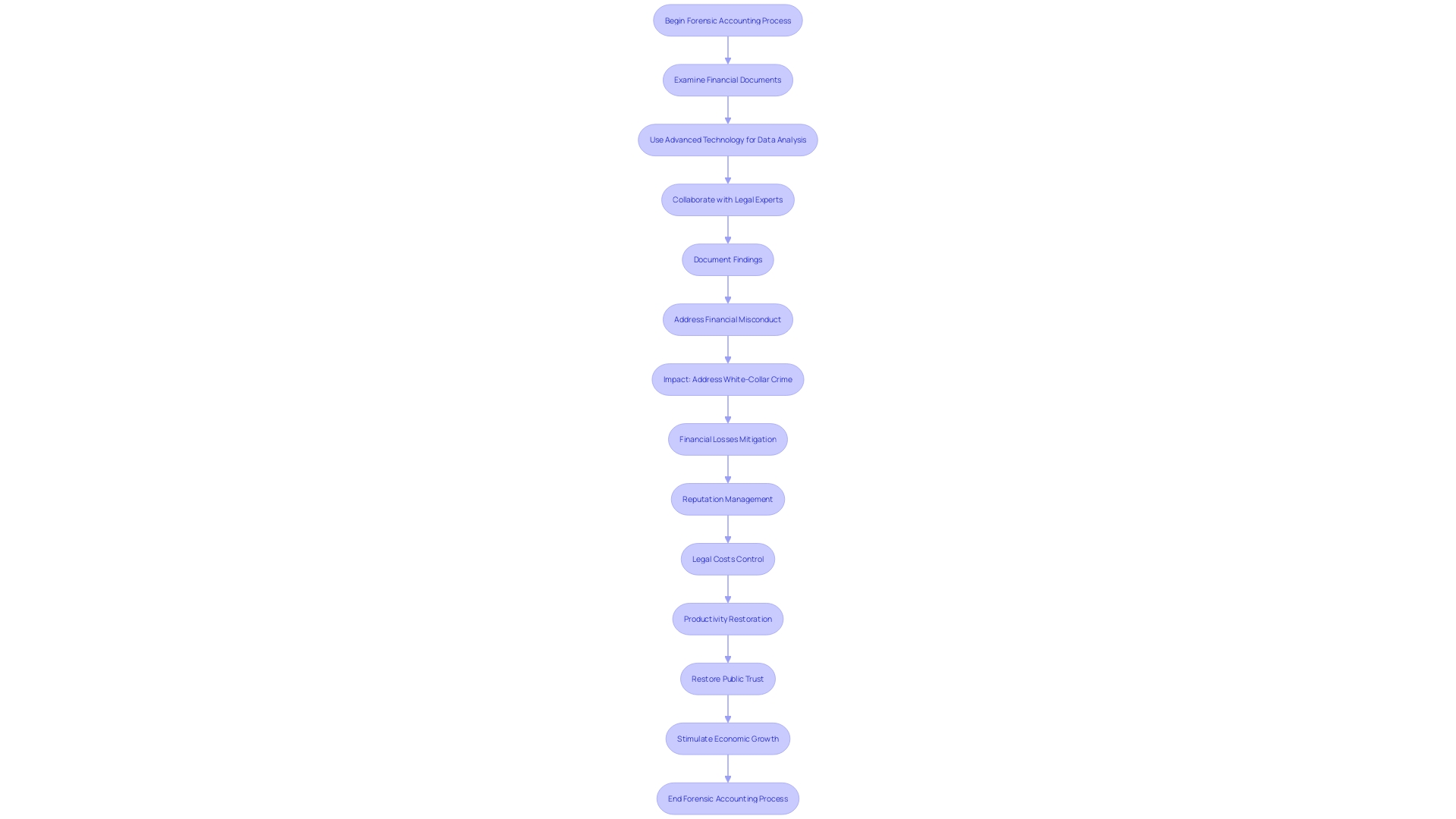

Forensic accounting is an indispensable tool in unraveling financial discrepancies and investigating malfeasance. This meticulous process demands adherence to certain best practices to guarantee the fidelity of its outcomes. Objectivity and independence stand at the forefront, ensuring that all investigations are free from bias and vested interests. A methodical examination of financial documents underpins the investigative process, as it uncovers the intricate details necessary for an accurate analysis.

Advanced technology and software have become the linchpin in sifting through complex data, enabling forensic accountants to detect patterns and anomalies indicative of fraudulent activities. Collaboration with legal experts ensures that investigations are not only thorough but also legally sound, paving the way for successful prosecutions.

Furthermore, the documentation of findings plays a critical role, demanding clarity and precision to effectively communicate the nuances of the case. This rigorous approach to documentation ensures that evidence can withstand legal scrutiny and aids in presenting a cogent narrative in legal proceedings.

These best practices are not just theoretical; they're exemplified by professionals like Dr. Weber, whose work in forensic accounting and fraud examination has been instrumental in addressing financial misconduct. His efforts, along with the contributions of his students in combating elder financial exploitation and high-tech crime, underscore the real-world impact of meticulous forensic accounting.

As financial crime continues to evolve, particularly in the digital realm, forensic accountants must remain vigilant and adaptable. The expectation is for cybercrime costs to soar dramatically, highlighting the growing need for forensic accountancy skills in navigating this challenging landscape.

In essence, the integrity and credibility of forensic accounting are bolstered by these best practices, which are vital in ensuring successful outcomes and upholding the rule of law in financial investigations.

Conclusion

Forensic accounting is a critical discipline in the financial world, combining accounting, auditing, and investigative skills to uncover financial misdeeds. With the growing complexity of financial fraud schemes, forensic accountants play a vital role in detecting and scrutinizing suspicious transactions, uncovering hidden assets, and compiling evidence for legal proceedings.

Fundamental to forensic accounting is the double-entry accounting system, which allows for precise identification of financial discrepancies. Real-world case studies highlight the importance of vigilance in financial reporting and the need for specialized skills to unravel complex fraud schemes.

Financial analysis methods, such as ratio analysis, trend analysis, cash flow analysis, and variance analysis, are crucial tools in forensic accounting. The integration of data analytics enhances the detection of irregularities and improves decision-making capabilities within the financial sector.

The digitalization of financial transactions has led to the evolution of forensic accounting into a discipline intertwined with data forensics and digital analysis. Statistical tools, such as Benford's Law, aid in the detection of financial irregularities by assessing the integrity of data.

Interview and interrogation techniques are vital in forensic accounting investigations. Forensic accountants extract crucial information from individuals associated with the case, revealing concealed details and understanding motives behind fraudulent behavior.

Forensic accountants uncover common financial irregularities, including financial statement fraud, asset misappropriation, and tax evasion. Advanced software tools enhance their capabilities in detecting suspicious transaction patterns and analyzing complex scenarios.

In corporate settings, forensic accounting serves as a sentinel against fraud and financial deception. Forensic accountants conduct post-mishap investigations and proactively audit potential financial misdeeds, bolstering internal controls and risk management systems.

Adherence to best practices is essential in conducting forensic accounting investigations, ensuring objectivity, independence, and a methodical examination of financial documents. Collaboration with legal experts and meticulous documentation of findings strengthen the credibility and integrity of forensic accounting outcomes.

In conclusion, forensic accounting plays a critical role in uncovering financial misdeeds and combatting financial fraud. Utilizing advanced analytical tools, integrating data analytics, and adhering to best practices, forensic accountants provide practical solutions to uncover financial irregularities and ensure accountability.