Introduction

Actual vs Budget Analysis is a crucial tool for financial management, allowing businesses to evaluate their financial performance against predefined expectations. This analysis involves a meticulous examination of financial figures, comparing actual revenue, expenses, and profit margins with the anticipated budget. By doing so, organizations can uncover variances and make informed decisions.

In this article, we will explore the components of Actual vs Budget Analysis, its importance, types of budget variances, how to calculate budget variance, budget variance analysis reports, and the benefits of conducting this analysis. We will also address common challenges and provide solutions to help businesses optimize their financial planning and growth strategies. So let's dive in and discover how Actual vs Budget Analysis can guide entities towards financial optimization and strategic growth.

What is Actual vs Budget Analysis?

Actual vs Budget Analysis is a cornerstone of money management, offering a lens through which businesses can evaluate their money performance against predefined expectations. This analysis involves a meticulous examination of the company's figures, encompassing revenue, expenses, and profit margins, juxtaposed with the projected financial plan. By doing so, organizations uncover variances, both favorable and adverse, which in turn illuminates the underlying causes and catalyzes informed decision-making.

For instance, in real estate, the process dives deep into not only the property's purchase price but extends to a thorough assessment of all ancillary costs associated with the investment, highlighting the potential profit margin upon project completion. Similarly, when planning an expense budget for project proposals—for instance, pitching a service delivery—the approach meticulously categorizes costs, providing a clear picture of the project's economic footprint.

In the realm of education, school districts allocate resources through allotments for various operational needs and projects for the subsequent academic year. The budgeting process in this context is twofold, addressing both the tangible value of district property and the equitable distribution of funds.

Furthermore, ongoing patterns in business examination emphasize the relevance of such monetary examination. Data from the Global State of Business Analysis Report, utilizing a sample of more than 4,400 professionals in 165 countries, clarifies the changing demographics and advancing practices in the field, strengthening the strategic use of business investigation in navigating industry challenges.

The investment community also echoes the importance of detailed analysis, with investment frameworks such as 'Size, Risk, Go' still prevailing. Here, the focus is on comprehending market dynamics, risk tolerance, and the potential for substantial opportunities. Notably, in the burgeoning field of AI, investors are keen on startups that harness AI to address specific industry challenges, as evidenced by investments in data infrastructure and AI applications across various sectors.

Hence, Actual vs Budget Analysis is not just a static comparison but a dynamic tool that offers strategic insights across different industries, guiding entities towards economic optimization and strategic growth.

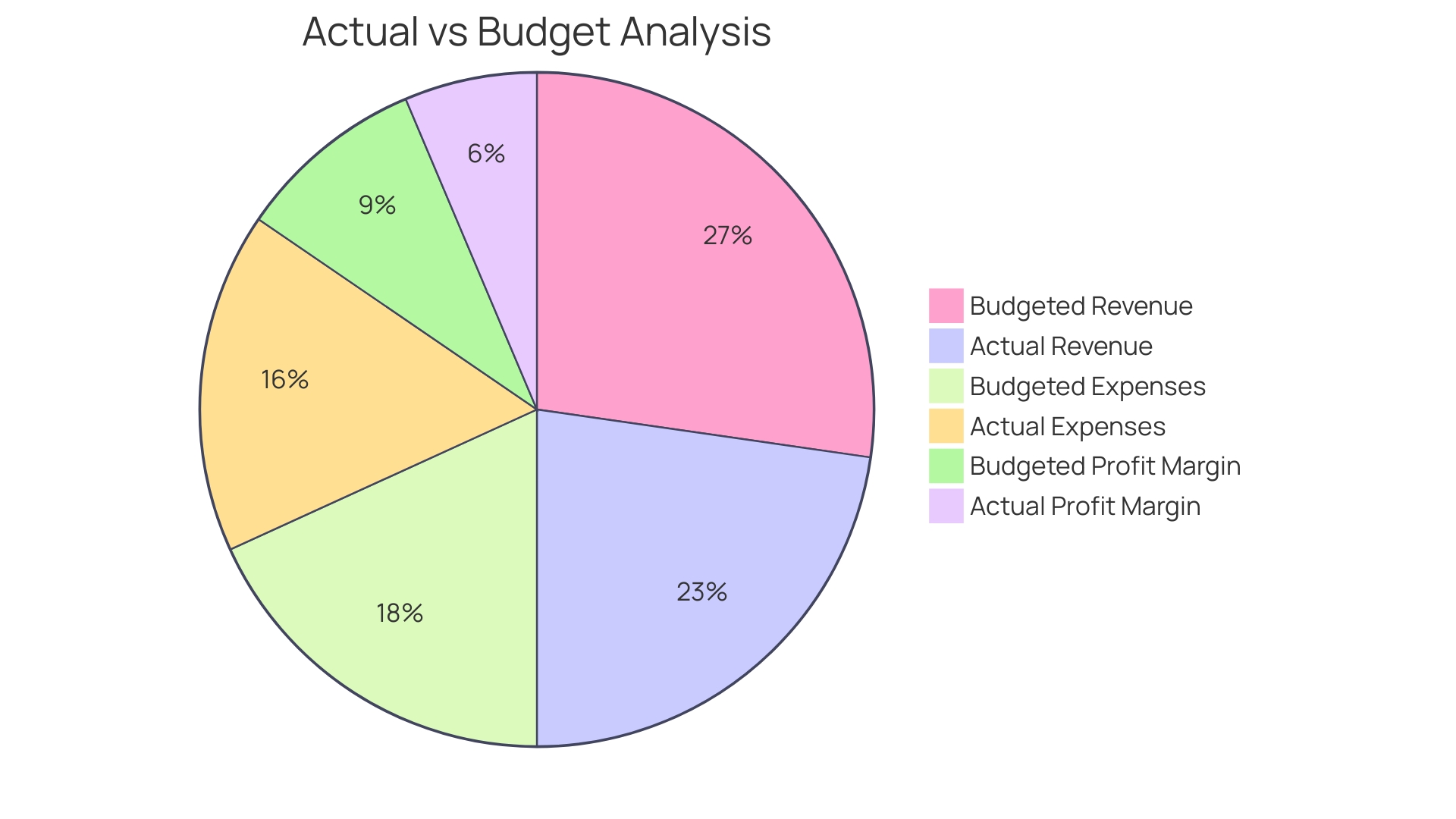

Components of Actual vs Budget Analysis

A comprehensive Actual vs Budget Analysis is a multifaceted process, crucial for guiding any business toward stability and growth. Here's how to dissect and understand your company's financial activities effectively:

-

Revenue Analysis: Begin by scrutinizing actual revenue against budgeted figures. This analysis is not simply about determining if sales targets are on track but also understanding market shifts that impact revenue streams. For instance, evolving socio-cultural, economic, and technological landscapes necessitate adaptable sales strategies, like optimizing sales channels before penetrating deeper into the customer base.

-

Expense Analysis: Next, dive into the expenses, comparing actual spend against the budget. This will shine a light on potential inefficiencies or opportunities for cost-saving measures. Consider how strategic investments, like those aimed at enhancing customer experience, might initially reflect as increased expenses but can translate into long-term profitability through heightened customer satisfaction and loyalty.

-

Profitability Analysis: Assessing actual profitability vis-à-vis budgeted targets gives a clear picture of the organization's financial health. This step goes beyond mere numbers; it is about evaluating whether the resources allocated across various departments and initiatives are yielding the expected return on investment.

-

Variance Analysis: Finally, variance analysis uncovers the 'why' behind discrepancies in actual and budgeted figures. Mike Tyson's adage, "Everyone has a plan until they get punched in the mouth," reflects the dynamic nature of business - budgets are plans that may need recalibration when faced with unexpected market realities.

Utilize tools like analytical reports to dissect these components systematically. Such reports are not just a collection of data but a strategic roadmap that identifies trends, patterns, and relationships, empowering you to make data-driven decisions.

In the evolving business landscape, with insights from the Global State of Business Analysis Report, it's evident that professionals are adapting to a dynamic age range and that industries are shifting towards data-driven decision-making strategies. These trends are shaping the way we approach Actual vs Budget Analysis, ensuring that monetary strategies are not just compliant with regulations but also aligned with long-term organizational goals, balancing the operational needs of today with the aspirations of tomorrow.

Why is Actual vs Budget Analysis Important?

Conducting a precise Actual vs Budget Analysis is a cornerstone of sturdy money management, enabling businesses to gauge their fiscal health and pinpoint areas ripe for enhancement. At its core, this analysis serves multiple critical functions:

-

Performance Evaluation: By comparing actual outcomes to predetermined targets, companies can discern variances and address concerns promptly.

-

Informed Decision-Making: Insights from Actual vs Budget Analysis underpin strategic choices about resource distribution, cost management, and avenues for revenue growth.

-

Continual evaluation of actual versus budgeted figures guides the refinement of future budgets, bolstering their accuracy and reliability.

-

This process ensures departments and individuals are responsible for their results, spotlighting the need for enhanced support or training where necessary.

In a dynamic market influenced by socio-cultural, economic, and technological factors, organizations must adeptly navigate and capitalize on these changes. Integrating strategic growth paths like optimizing sales and penetrating customer bases can significantly impact data teams and their approach to financial analysis. In addition, comprehending consumer demographics and market demand is essential for creating financial plans that align with organizational goals and consumer expectations.

Investing in your organization is akin to investing in its future success. Judicious spending decisions should consider potential returns on investment (ROI) and the broader impact on organizational growth. For instance, a well-designed financial plan can serve as a guide for necessary investments, ensuring resources are allocated effectively to support optimal functioning.

It's vital to note that skimping on necessary resources can hinder an organization's ability to thrive. When seeking funding, it's important to aim for what will enable the organization to flourish, not merely survive. Actual vs Budget Analysis is not just a fiscal exercise; it's a strategic tool that, when used correctly, can lead to sustained business success and a superior customer experience.

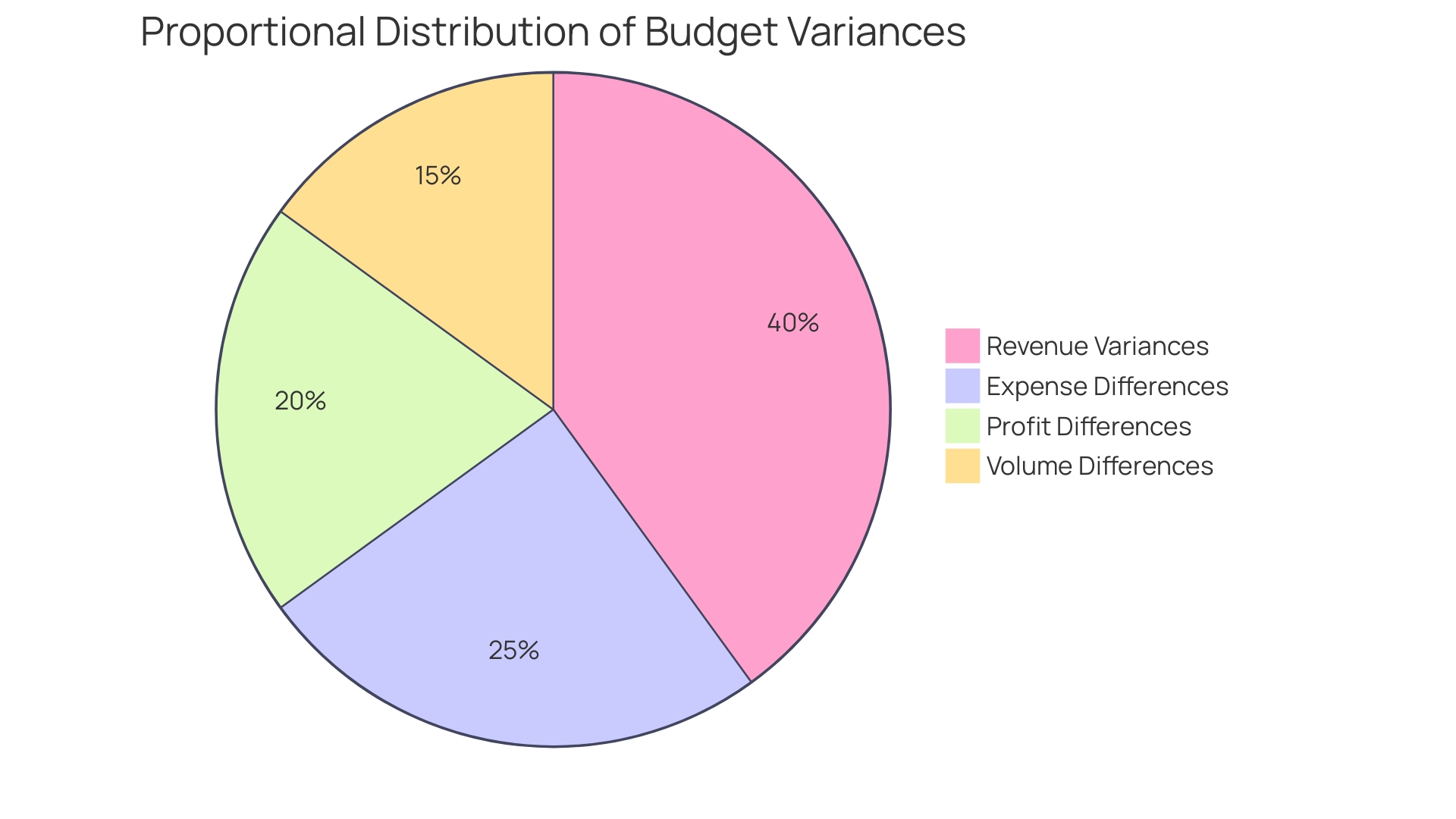

Types of Budget Variances

The skill of excelling in budget analysis and reporting includes comprehending the subtleties of different budget deviations that can either build or destroy the fiscal well-being of an organization. These variances are critical indicators of performance against the financial plan, and they can be categorized into the following:

-

Revenue Variances: When the actual revenue deviates from what was projected, it raises either a flag of opportunity if positive, indicating that revenue has surpassed expectations, or a signal for investigation if negative, showing that revenue has fallen short. The causes behind these differences can be multifaceted, ranging from market dynamics to operational efficiencies.

-

Keeping a close watch on expense differences aids in upholding financial discipline, as these differences point out discrepancies between actual and budgeted expenditures. Positive differences here indicate potential cost savings, perhaps through strategic sourcing or operational frugality, while negative differences could signal the need to review spending practices or unexpected costs.

-

Profit Differences: The ultimate result for any organization is its profitability, and distinctions here are a testament to how well the company is converting revenues into profits. Positive profit differences can be a consequence of higher revenue or lower expenses than planned, while negative differences may require a strategic pivot to get back on track.

-

These differences are a measure of operational efficiency and market demand, comparing the actual quantity of goods or services sold against the budgeted figures. Positive volume differences can be credited to a robust market presence and sales strategies, while negative differences could suggest a requirement for market research and business development initiatives.

Each of these differences doesn't just represent numbers but stories of where and how an organization's financial strategies are materializing. For example, grants for small enterprises, such as those accessible in the beauty sector, can greatly impact revenue and profit differences, enabling growth or creativity beyond the initial budget. Likewise, in educational environments, the notion of fairness in budgeting guarantees that resources are distributed to promote equal opportunities and outcomes, impacting expenditure and volume differences.

The secret to harnessing these insights lies in a comprehensive and well-organized financial strategy that takes into account all potential expenses and expected impacts, ensuring that leaders can identify the cause of differences and make informed decisions. Using a comprehensive financial template can serve as a guidepost for this endeavor, providing clarity on where investments are yielding returns and where recalibration might be necessary.

To sum up, comprehending the complex specifics behind each differentiation kind empowers leaders in the field of finance to guide their organizations toward continuous expansion and stability, emphasized by knowledgeable budgetary choices and strategic management of finances.

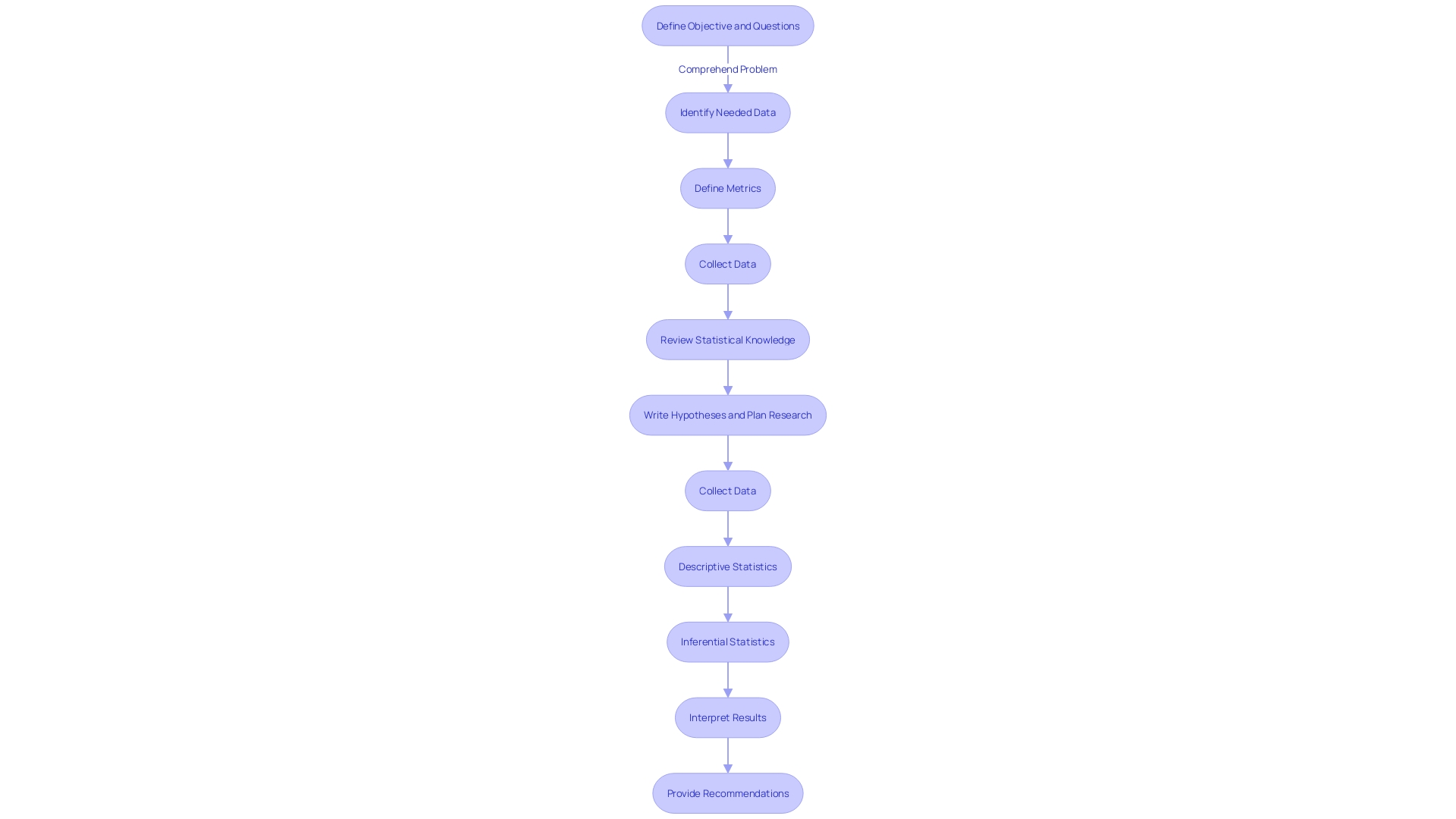

Calculating Budget Variance

Comprehending real versus planned analysis is vital for fiscal management. When we discuss budget differences, it is the assessment of how actual results vary from the budgeted amounts. The essence of this comparison is distilled into a straightforward formula: Budget Variance = (Actual Amount - Budgeted Amount) / Budgeted Amount. Expressed as a percentage, this variance demonstrates the degree to which performance deviates from the plan.

In practice, this formula isn't just about crunching numbers; it's an insightful gauge of monetary health and strategic execution. For instance, in the realm of charity organizations, despite good intentions, there's a spectrum of financial efficiency and effectiveness. This difference can indicate how well resources are being utilized towards the intended mission, reflecting the underlying complexity of choices and their associated costs.

Likewise, the expectation surrounding government budgets, such as the interim Budget of February 1, 2024, highlights the importance of variance examination. Stakeholders closely monitor these fiscal plans for deviations that could signal changing priorities or economic shifts. The same applies to businesses, where a well-structured budget, complemented by actual-versus-budget analysis, is vital. It's the canvas on which strategies are painted, outlining the anticipated cash flow and expenditures, and serving as a benchmark for performance.

In a landscape where IT investments and business monetary data are crucial, understanding the dynamic between actual figures and budgeted projections enables organizations to navigate the complexities of economic decision-making. Using this knowledge, CFOs can enhance their investment in growth, evaluate the return on investment for various spending decisions, and adapt strategies to ensure they stay aligned with long-term objectives.

Budget Variance Analysis Reports

A successful variance analysis report serves as a comprehensive tool, revealing the performance of an organization by comparing actual outcomes with expected projections. This report encompasses:

-

This section provides a comparison of actual results versus the predetermined plan, highlighting important indicators such as revenues, expenditures, and profit margins. It is a critical step in understanding where the organization stands in terms of its monetary objectives.

-

Variance Analysis: A meticulous examination of discrepancies follows, delving into the factors that contribute to divergences from the budget. This analysis intends to reveal the underlying reasons and the possible consequences these differences have on the business's economic well-being and operational effectiveness.

-

Recommendations: The report concludes with actionable insights and strategic recommendations designed to rectify any negative variances. This future-oriented guidance is crucial in improving upcoming fiscal projections and strengthening the overall planning process.

Real-world case studies, such as the intense scrutiny faced by AI labs or the fiscal strategies employed by governments during election years, exemplify the gravity of astute money management. Recent news, such as the Welsh Government's draft budget constraints, further underscores the necessity for diligent budget management. By comparing against industry standards and evaluating investment returns, organizations can navigate their economic landscape with greater precision and foresight.

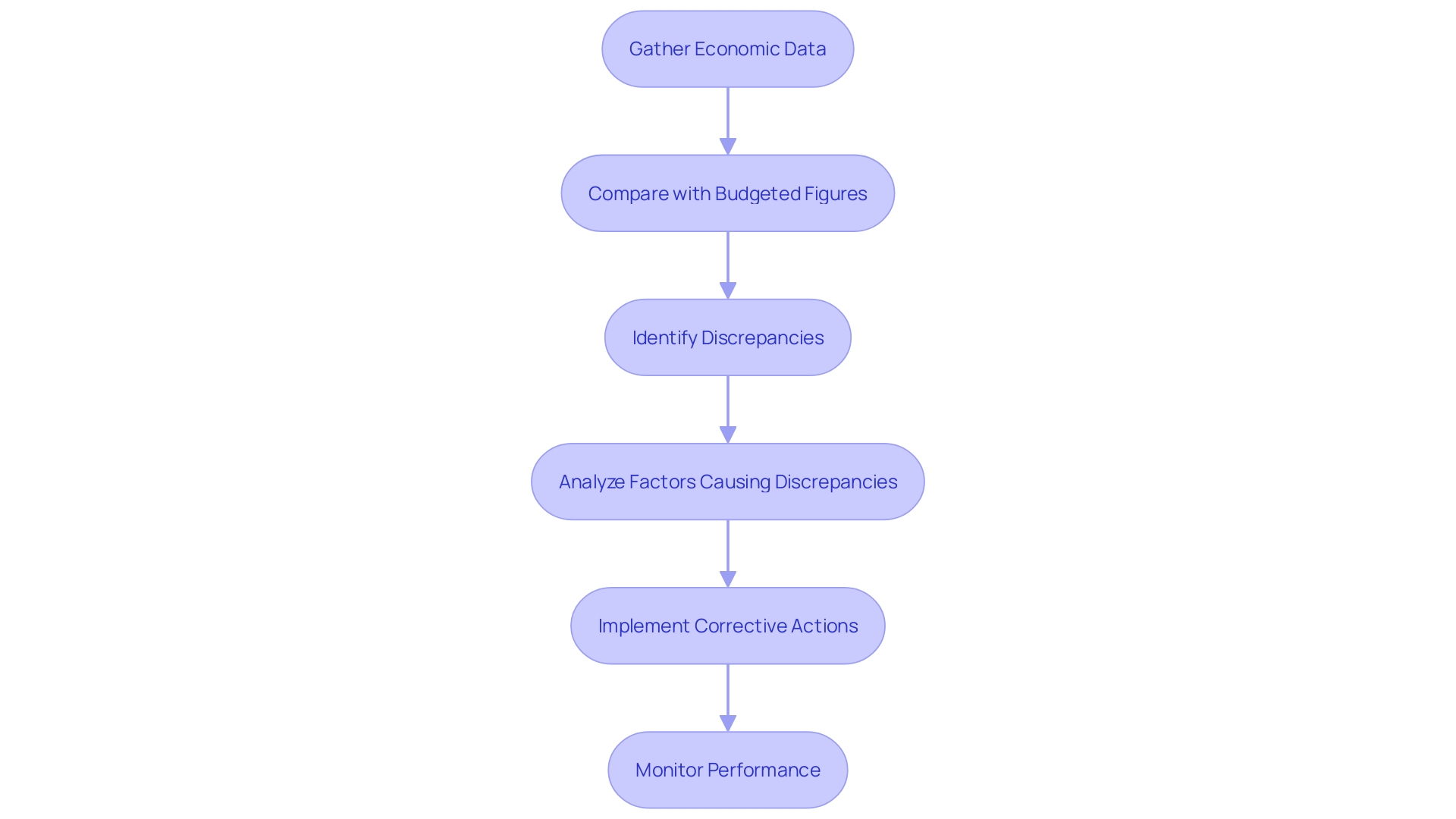

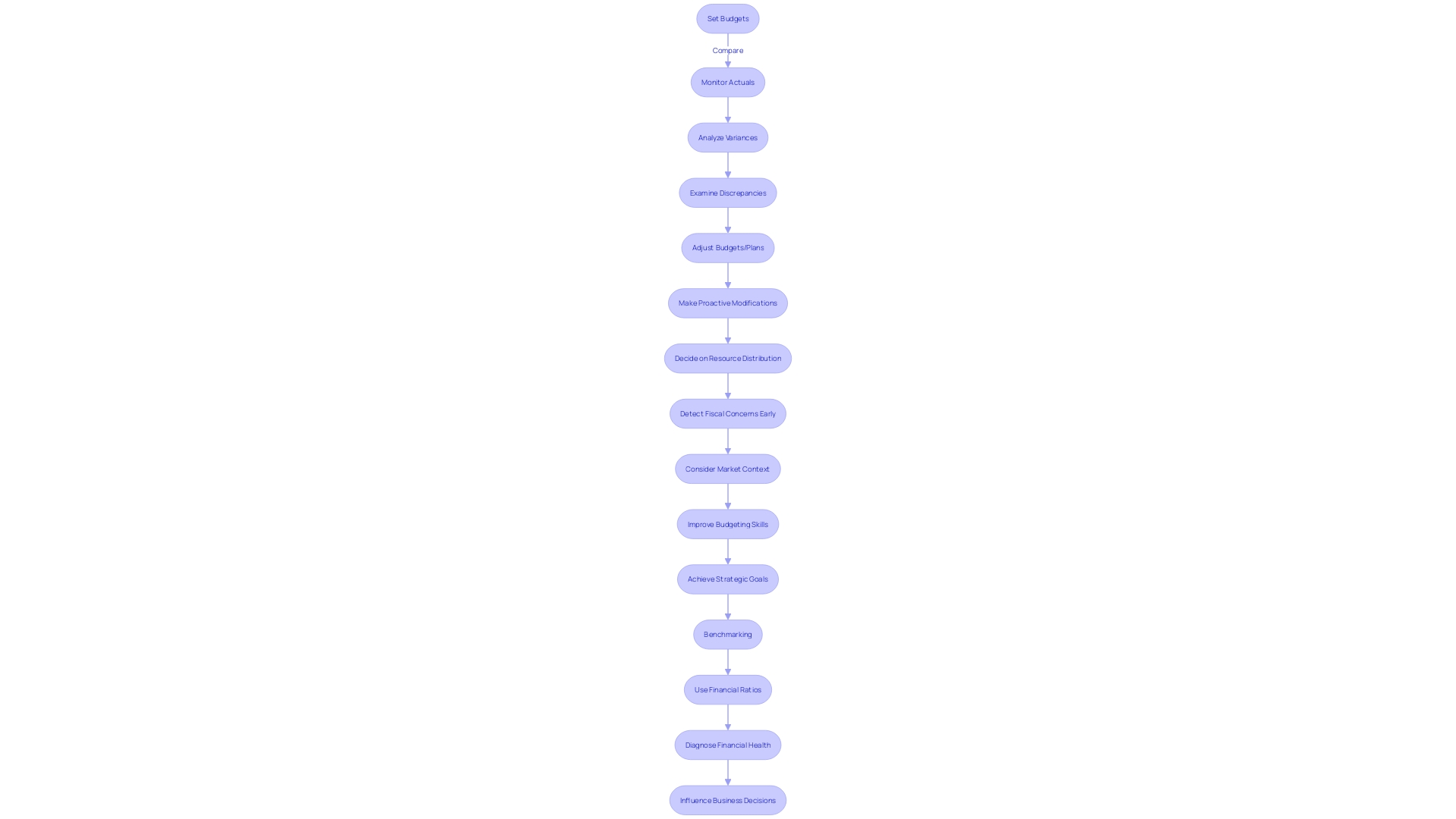

How to Conduct Actual vs Budget Analysis

To effectively navigate the complexities of Actual vs Budget Analysis, a multi-step approach is essential. Begin by gathering the real economic data for the time frame in question, making sure you have a complete perspective of revenue, expenses, and profitability. Once the data is in hand, it's time to set it against your budgeted figures to unearth any discrepancies. Examine these discrepancies carefully to uncover the factors that may consist of changing market conditions, variable costs, or dynamics of sales performance.

Using this assessment, develop and implement strategic corrective actions to address the discrepancies and enhance future outcomes. Lastly, keep a watchful eye on performance, consistently measuring it against the budget to confirm that the implemented actions are achieving the desired effect.

Accurate assessment and reporting are the cornerstone of stability and growth. In a survey of over 4,400 professionals from 165 countries, the importance of staying current with industry trends and understanding the market was emphasized. Utilizing this knowledge can streamline operations and enhance the accuracy of your projections.

To gain a practical view, think about how companies incorporate market research to reduce risks and understand consumer demographics, which can greatly influence financial planning and deviation assessment. Moreover, contemplating the utilization of business data analytics can unveil how organizations evolve into data-driven entities, an approach that can be employed to acquire a competitive advantage.

In the rapidly advancing field of AI, where investment decisions are crucial, the 'Size, Risk, Go' framework remains pertinent. It emphasizes the significance of evaluating market size and risks when making monetary decisions, a principle that can be applied to budget analysis to guarantee strong planning and performance.

Benefits of Actual vs Budget Analysis

The practice of Actual vs Budget Analysis is a critical instrument in a company's toolbox, serving multiple functions that extend beyond mere number crunching. It enables a thorough evaluation of health, identifying both the strong areas and those requiring attention. This evaluation acts as a guiding light for resource distribution decisions, ensuring that every dollar is put to its best use in fostering growth and controlling costs. By examining discrepancies between projected and actual figures, businesses can sharpen their budgeting skills, making subsequent financial plans more accurate and reliable.

Moreover, Actual vs Budget Analysis serves as an early detection system, flagging potential fiscal concerns before they escalate. It entrusts individuals and departments with fiscal responsibility, promoting a culture where performance is closely monitored, and continuous enhancement is sought. These benefits are amplified when the examination is coupled with a thorough understanding of the changing market context including socio-cultural, economic, and technological shifts.

By implementing strategies like value creation planning plus (VCP+) or zero-based budgeting (ZBB), and initiating the budgeting process in advance, it is possible to optimize the evaluation, enabling proactive modifications. Such strategies have been echoed by industry leaders who emphasize the importance of market research and consumer understanding from the outset. By asking questions about market demand and size, businesses can align their budgeting and analysis with customer needs and market potential.

Furthermore, case studies demonstrate that when companies prioritize enhancing customer experience, they can anticipate observing a direct effect on their monetary results. As a business leader, understanding the relationship between investment choices, expected ROI, and resource allocation is vital. This is underscored by Gilt Edged's experience, where using tools to monitor and focus efforts led to tangible targets in carbon footprint reduction, showcasing the power of informed decision-making in achieving strategic goals.

Common Challenges and Solutions

Companies involved in Actual vs Budget Analysis frequently face a variety of obstacles that can impede their planning and growth strategies. Dealing with these challenges is vital for maintaining stability and achieving long-term operational success.

Inaccurate Budget Forecasts can disrupt planning, leading to misguided strategies. To lessen this, businesses should improve the budgeting process by incorporating vital insights from key stakeholders, conducting thorough market research, and ensuring the budget stays flexible through regular evaluations and modifications, as shown by the City of Thunder Bay's utilization of a grant to create a strategic communication plan for its asset management, which emphasized the importance of continuous updates and stakeholder involvement.

Data Unavailability is another barrier that can hinder effective examination of finances. Organizations should implement a strong data management infrastructure to ensure prompt access to accurate data. The Global State of Business Analysis Report underscores the transformative impact of data analytics on industry, emphasizing the necessity of accessible and reliable data for informed decision-making.

Limited Analytical Depth can lead to superficial insights that fail to inform strategic decisions. Investing in advanced tools and software that offer comprehensive insights and facilitate automated processes can overcome this challenge. For instance, the integration of Business Analysis Professionals, as indicated by IIBA's Global Research, can drive an organization's transition to a data-centric model, enhancing analytical capabilities.

Resistance to Organizational Change often arises when implementing new processes like Actual vs Budget Analysis. Clear communication of the benefits and providing adequate training and support can ease the transition. Learning from the City of Thunder Bay's experience in engaging staff and citizens can guide businesses in effectively managing change and retaining knowledge despite staff turnover.

Poor communication of evaluation outcomes can make even the most precise monetary assessments worthless. Establishing well-defined communication channels and regular reporting protocols is vital to ensure that insights are shared effectively across all relevant departments. Drawing from the City of Thunder Bay's example, where a comprehensive communication plan played a crucial role in informing and engaging stakeholders, organizations can see the value in making communication a cornerstone of analysis processes.

By addressing these challenges with strategic solutions, businesses can strengthen their Actual vs Budget Analysis efforts, resulting in enhanced financial planning, increased operational efficiency, and better alignment with long-term financial objectives.

Conclusion

In conclusion, Actual vs Budget Analysis is a crucial tool for financial management. It involves comparing actual revenue, expenses, and profit margins with the anticipated budget to uncover variances and make informed decisions. By conducting a thorough analysis, organizations can evaluate their financial performance, identify areas for improvement, and guide strategic decision-making.

The components of Actual vs Budget Analysis, including revenue analysis, expense analysis, profitability analysis, and variance analysis, provide a comprehensive understanding of the organization's financial activities. Utilizing tools like analytical reports can further enhance the analysis process by identifying trends and patterns.

Actual vs Budget Analysis is important because it enables performance evaluation, informed decision-making, budget refinement, and accountability. It allows organizations to navigate market changes, optimize sales strategies, and align budgets with organizational goals and consumer expectations.

There are different types of budget variances, such as revenue variances, expense variances, profit variances, and volume variances. Each variance type tells a story about the organization's financial strategies and can inform future decision-making.

Calculating budget variance involves comparing actual results with budgeted amounts, providing insights into financial health and strategic execution. Understanding the dynamic between actual figures and budgeted projections enables organizations to navigate financial decision-making and align strategies with long-term objectives.

Budget variance analysis reports provide a comprehensive evaluation of actual outcomes compared to budgeted expectations. They offer insights into discrepancies, root causes, and strategic recommendations. By benchmarking against industry standards and evaluating investment returns, organizations can navigate their financial landscape with greater precision.

Despite challenges like inaccurate forecasts, data unavailability, limited analytical depth, resistance to change, and ineffective communication, organizations can overcome these obstacles with strategic solutions. By addressing these challenges, businesses can strengthen their Actual vs Budget Analysis efforts and improve financial planning and alignment with long-term objectives.

In summary, Actual vs Budget Analysis is a critical tool for financial optimization and strategic growth. By conducting a thorough analysis and addressing common challenges, organizations can evaluate their financial performance, uncover variances, and make informed decisions to achieve long-term success.