Introduction

Understanding amortization is essential in the realm of cost accounting, especially when it comes to intangible assets that don't physically exist but have a clear value for a business. This article will delve into the concept of amortization, its various types, methods of calculation, and its importance in accounting.

We will explore how amortization impacts financial health, strategic decision-making, and the transparency of financial statements. Additionally, we will discuss the differences between amortization and depreciation, the significance of amortization schedules, and the amortization of loans and intangible assets. Whether you are a CFO or a business owner, this article will provide practical advice and solutions to help you navigate the complexities of amortization and optimize your financial management.

Understanding amortization is essential in the realm of cost accounting, especially when it comes to intangible assets that don't physically exist but have a clear value for a business. This includes assets like patents and trademarks, which are pivotal in many industries, including construction. Distinguishing between what should be expensed immediately and what should be capitalized and amortized over time can have a significant impact on a company's financial health.

For instance, expenses directly affect the income statement, showcasing the costs incurred over a period, while capitalized assets like patents appear on the balance sheet, reflecting the company's financial status at a specific point in time. The decision to amortize an asset is not just a matter of compliance but a strategic choice that can influence a company's reported earnings and tax liabilities. For example, a construction business owner like Jane must decide whether to immediately expense the cost of a new software or to spread it out over its useful life.

With reported revenues of $7.6 billion in 2022 by companies like First American Financial Corporation, the stakes are high, and such decisions must be made with precision. The concept of materiality plays a crucial role here; it determines the significance of an expense in the grand scheme of financial statements, affecting everything from investor perception to credit terms. It's about striking the right balance between short-term financial reporting and long-term fiscal responsibility.

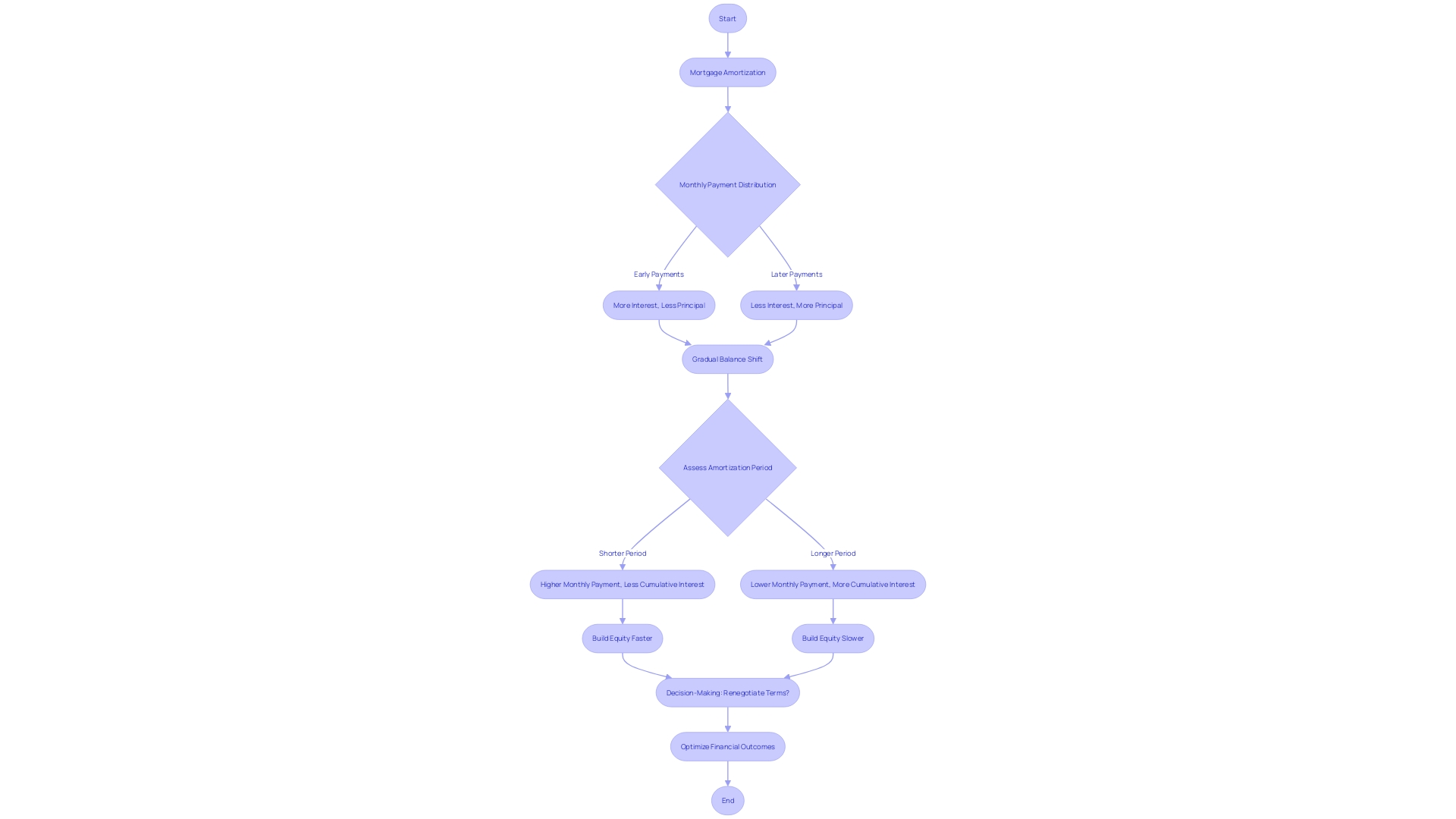

Amortization is a critical financial concept, particularly when dealing with mortgage loans. It refers to the schedule of payments a borrower makes to clear a loan over time.

These payments are split between the principal, the original sum borrowed, and interest, the cost charged by the lender. A key aspect of amortization is the loan term length; a longer amortization period translates to lower monthly payments, as the repayment is spread out over more time.

However, this comes with a caveat: a lengthier loan term means paying more in interest overall. Additionally, with longer mortgages, interest payments are concentrated at the start, delaying significant reductions in the principal and the accumulation of home equity. When selecting a loan, it's essential to weigh the benefits of lower monthly payments against the total interest cost and the impact on equity growth.

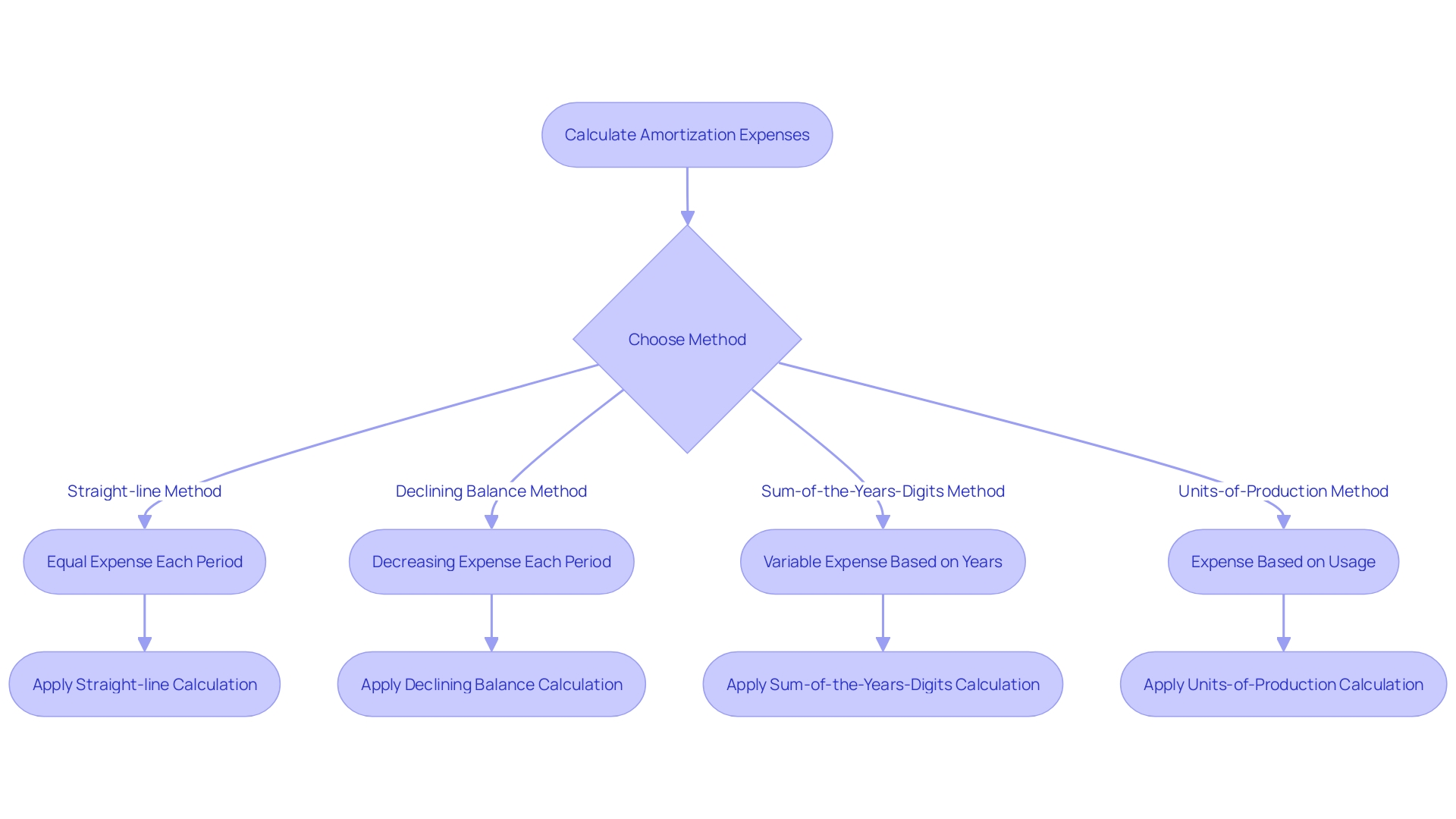

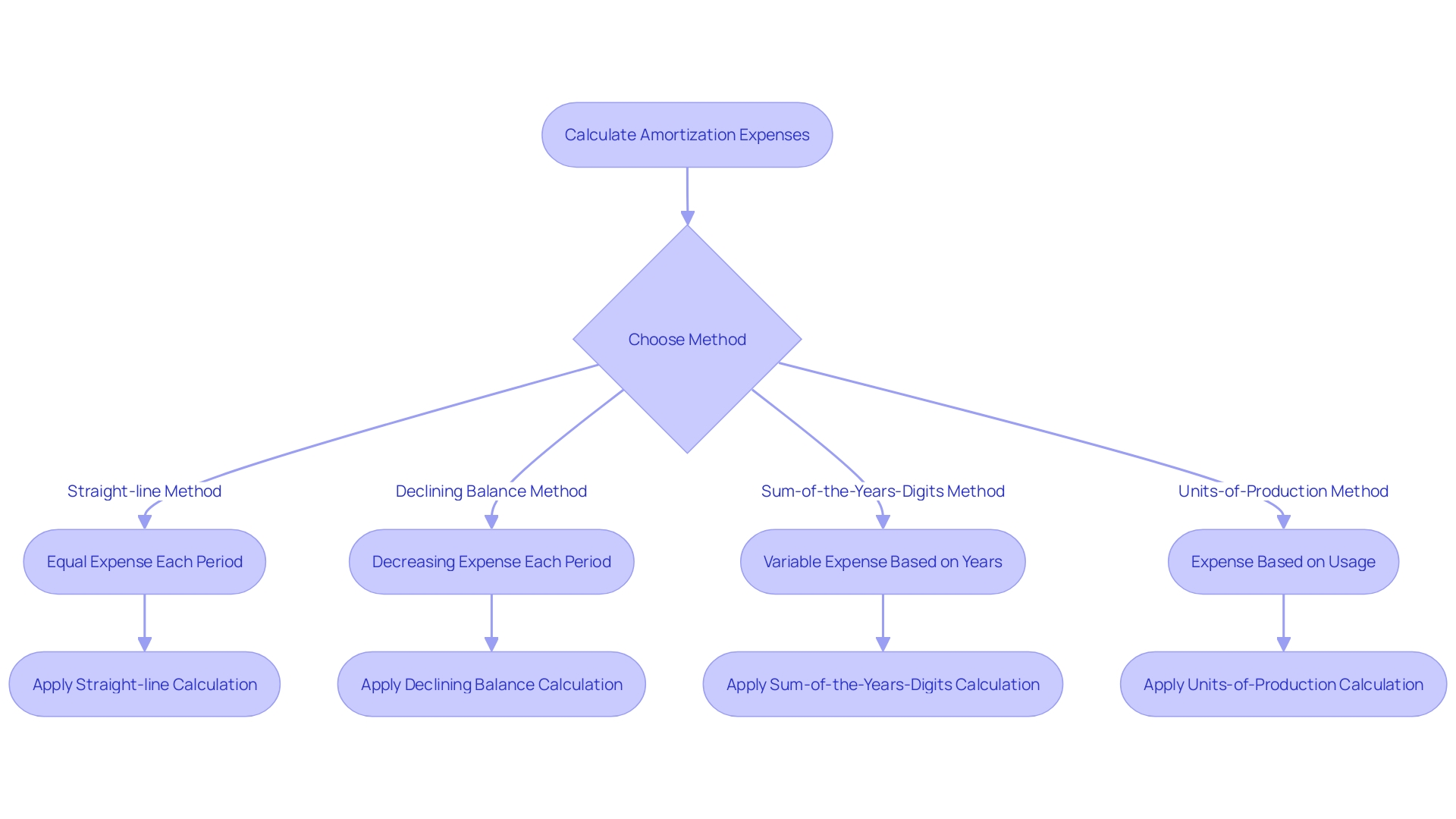

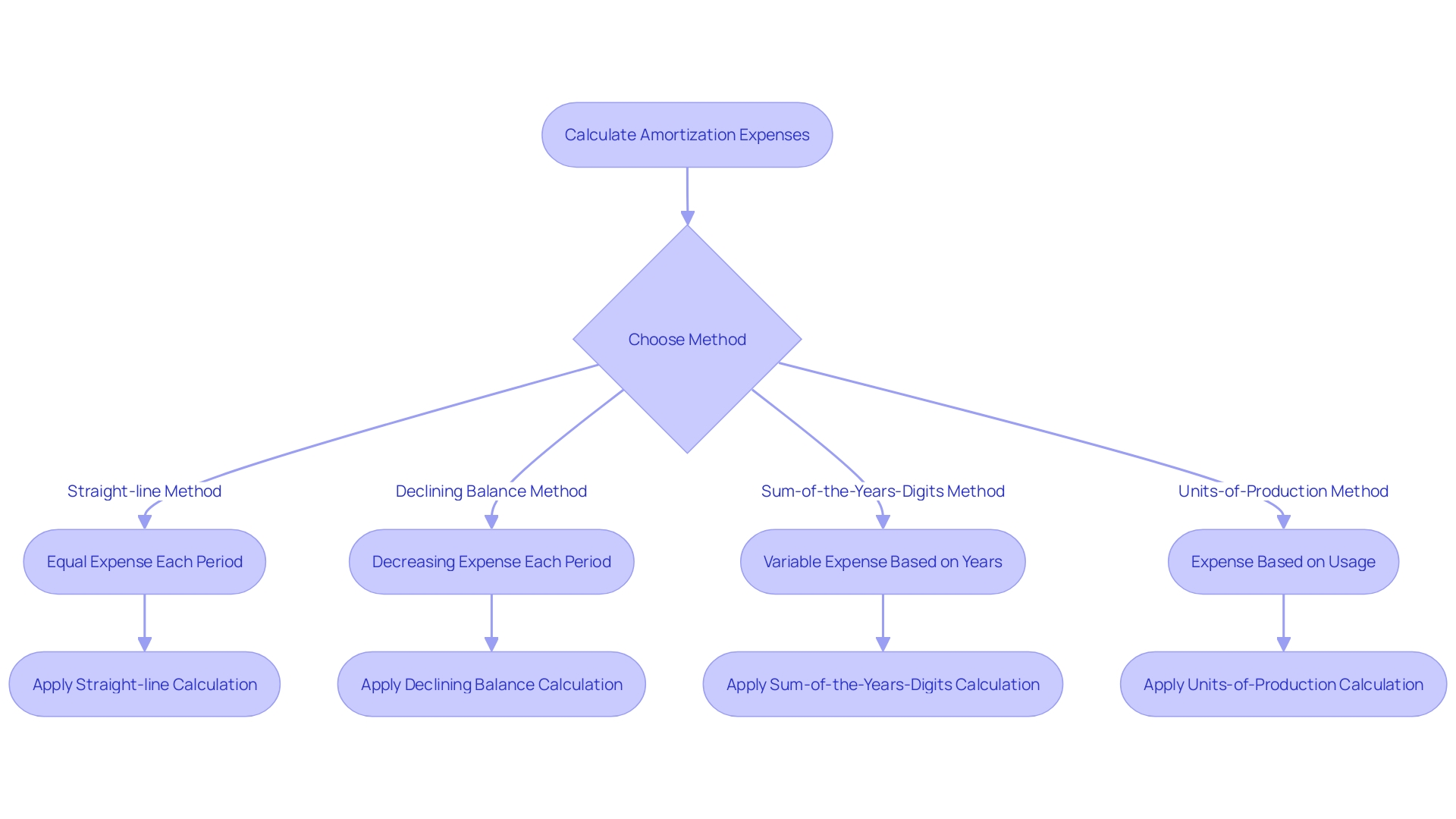

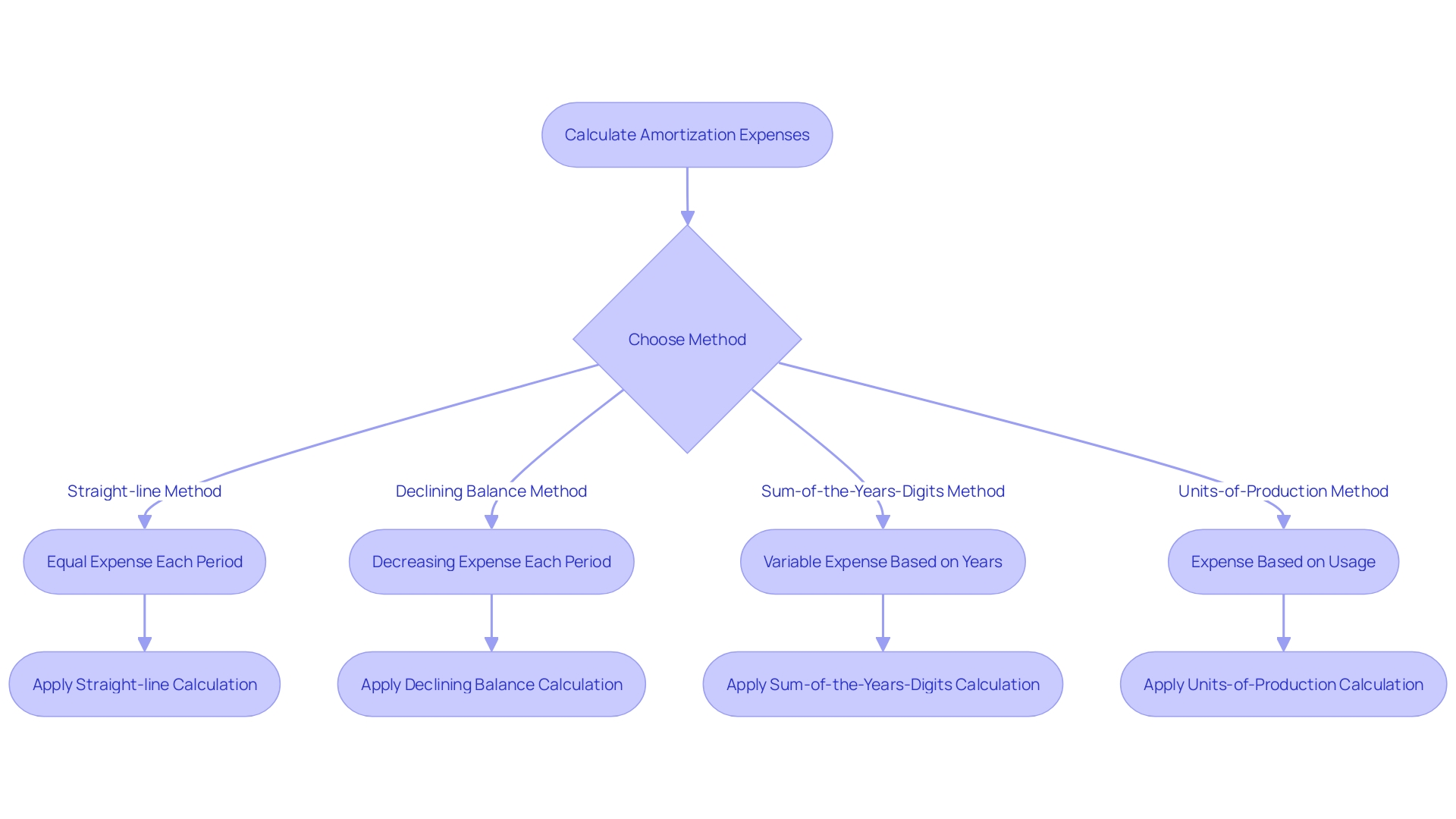

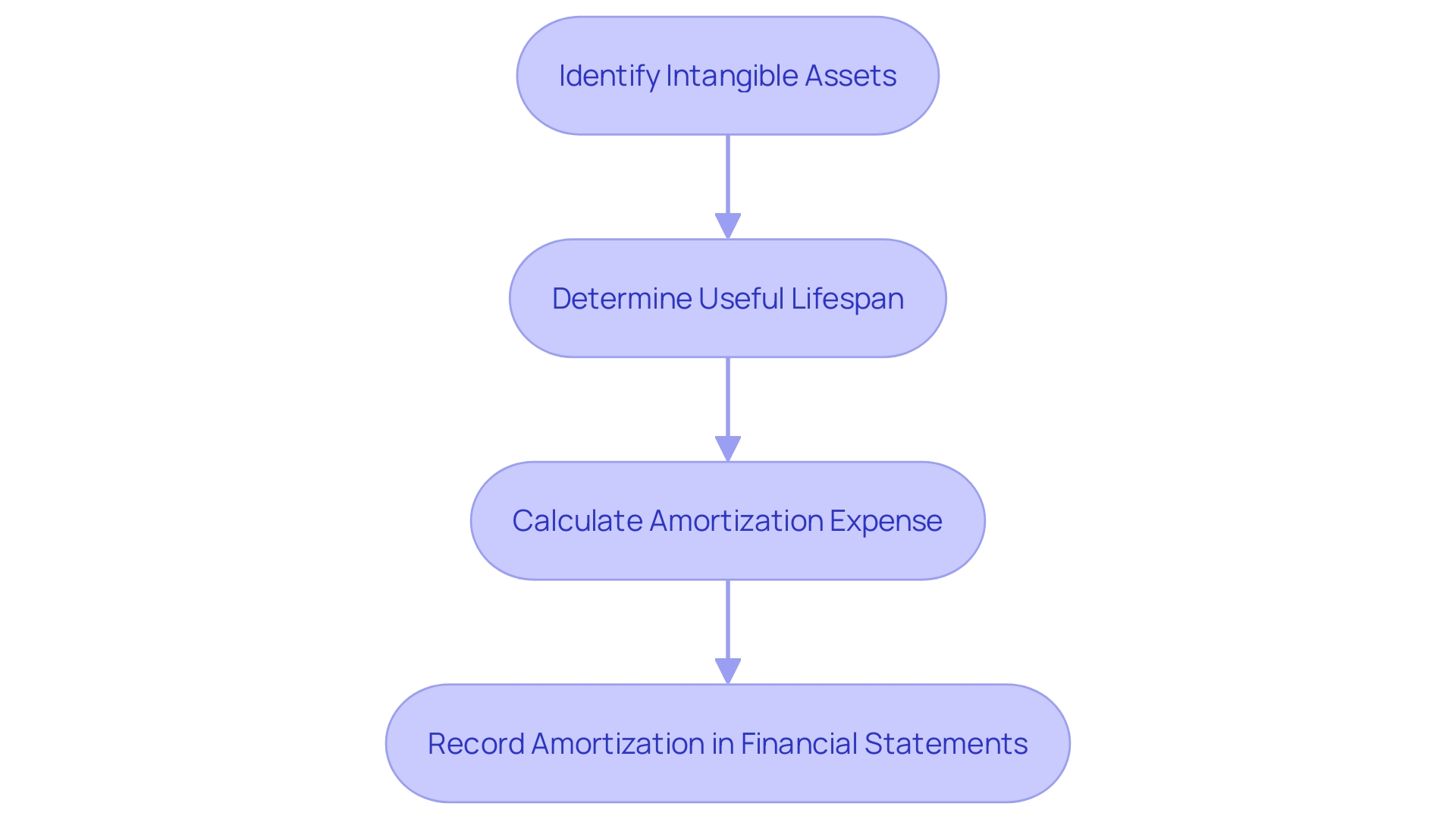

Amortization expenses play a critical role in accurately reflecting the cost of intangible assets over their useful lives. The Straight-line Method, a favored approach, spreads the expense uniformly across the lifespan of the asset.

This method is akin to the steady work of building a skyscraper, ensuring a solid structure by laying one floor at a time. Alternatively, the Declining Balance Method mirrors the upfront intensive labor in construction, front-loading the expenses to reflect the asset's higher utility in the early stages.

For a more nuanced approach, the Sum-of-the-Years-Digits Method also front-loads expenses but tapers them off as the asset ages, similar to how a construction project might require intense initial capital but less over time. Lastly, the Units-of-Production Method aligns expenses with the asset's actual usage or output, much like tracking the materials used in construction to allocate costs based on actual consumption. Each of these methods ensures that the financial health of a business, as displayed on the balance sheet, remains robust and transparent, reflecting the true value of assets and the costs associated with them.

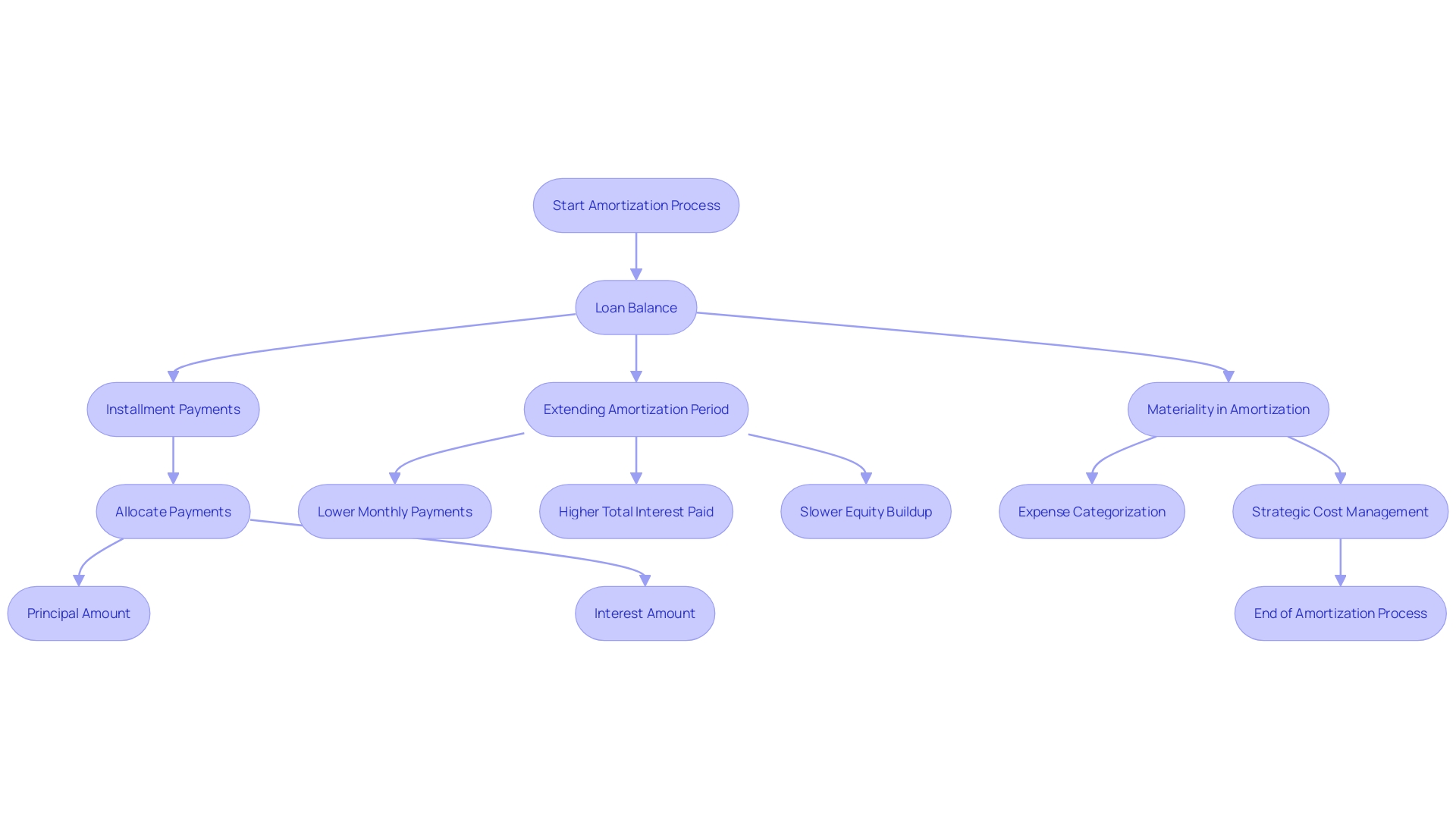

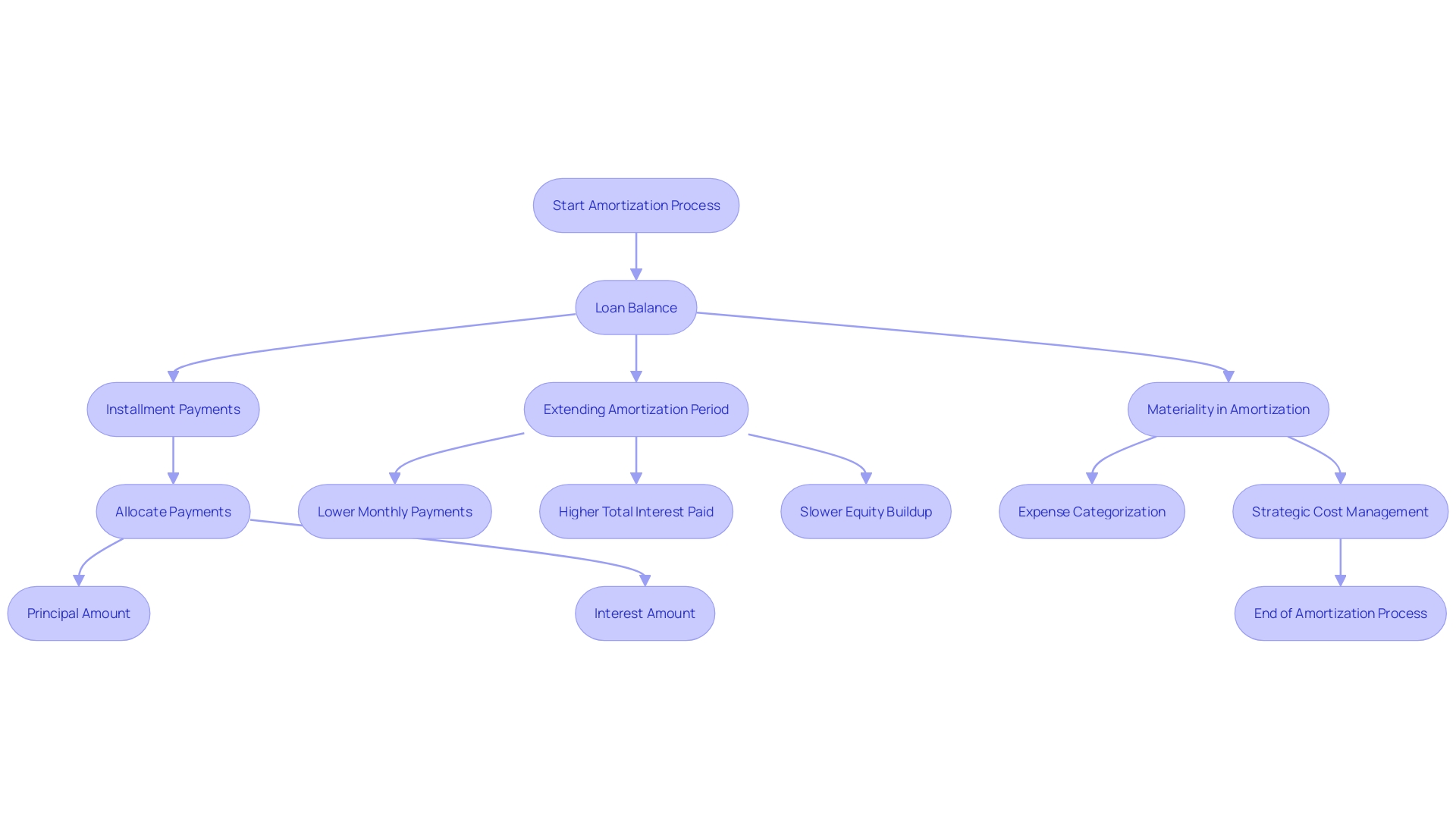

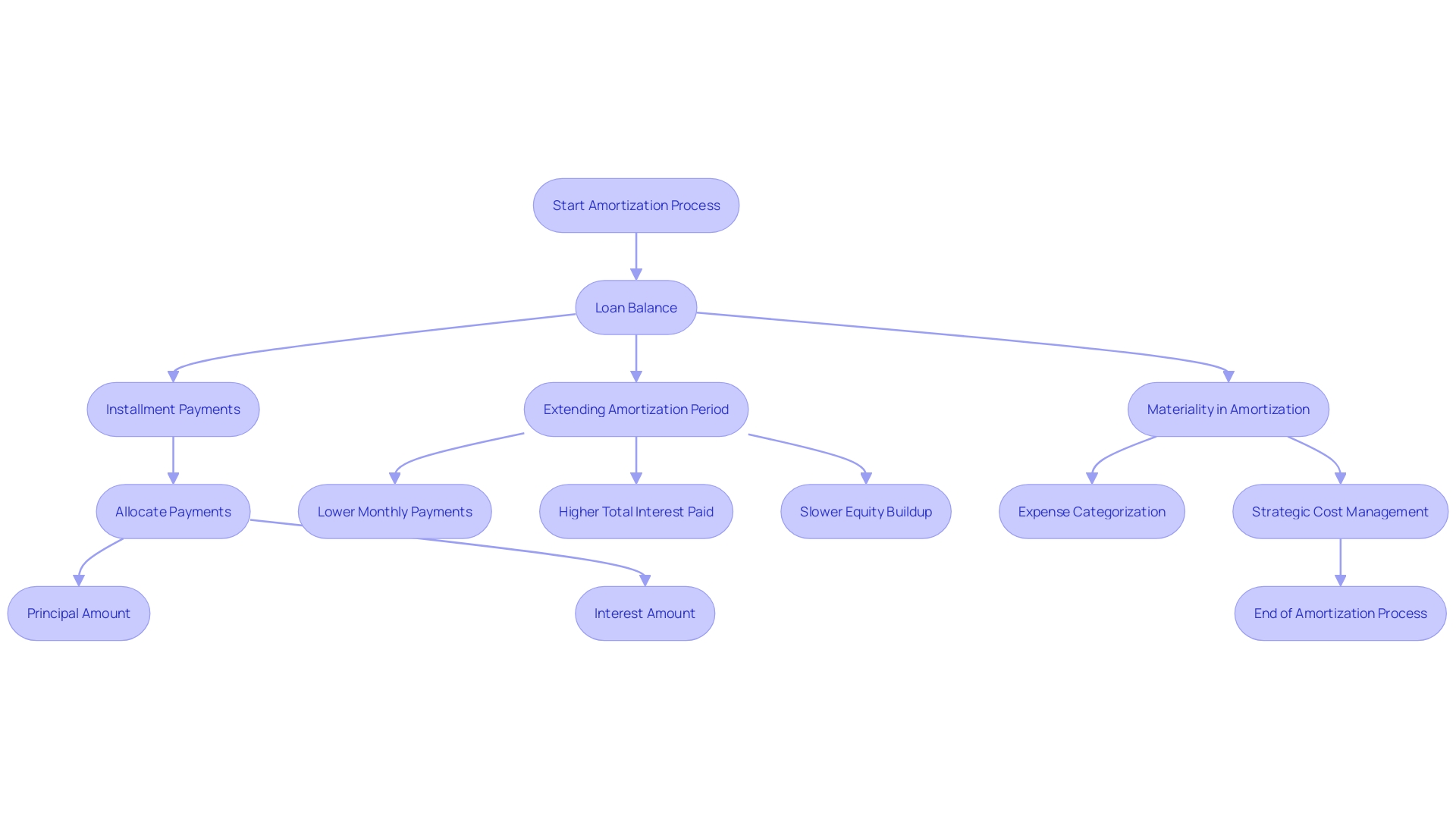

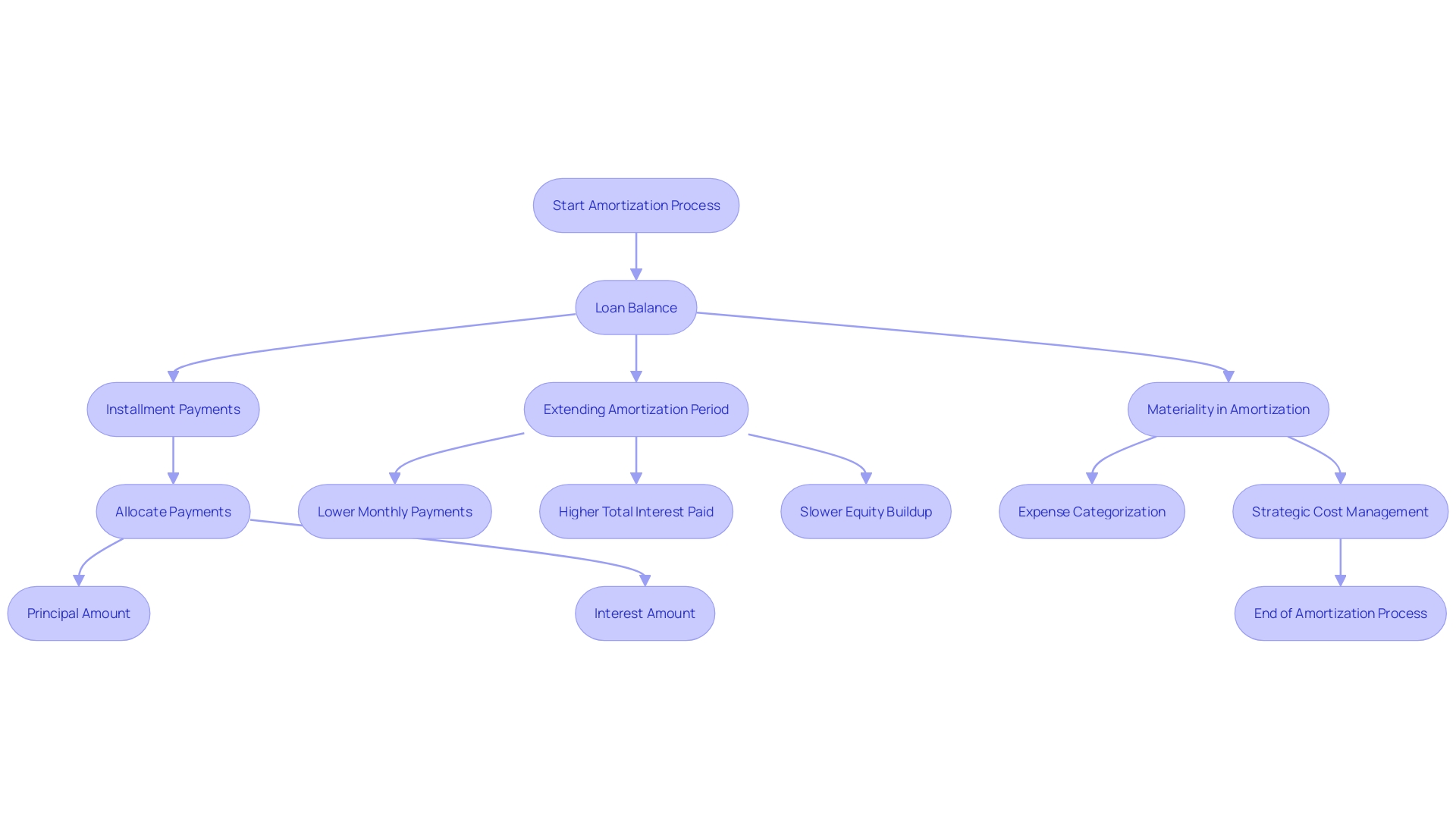

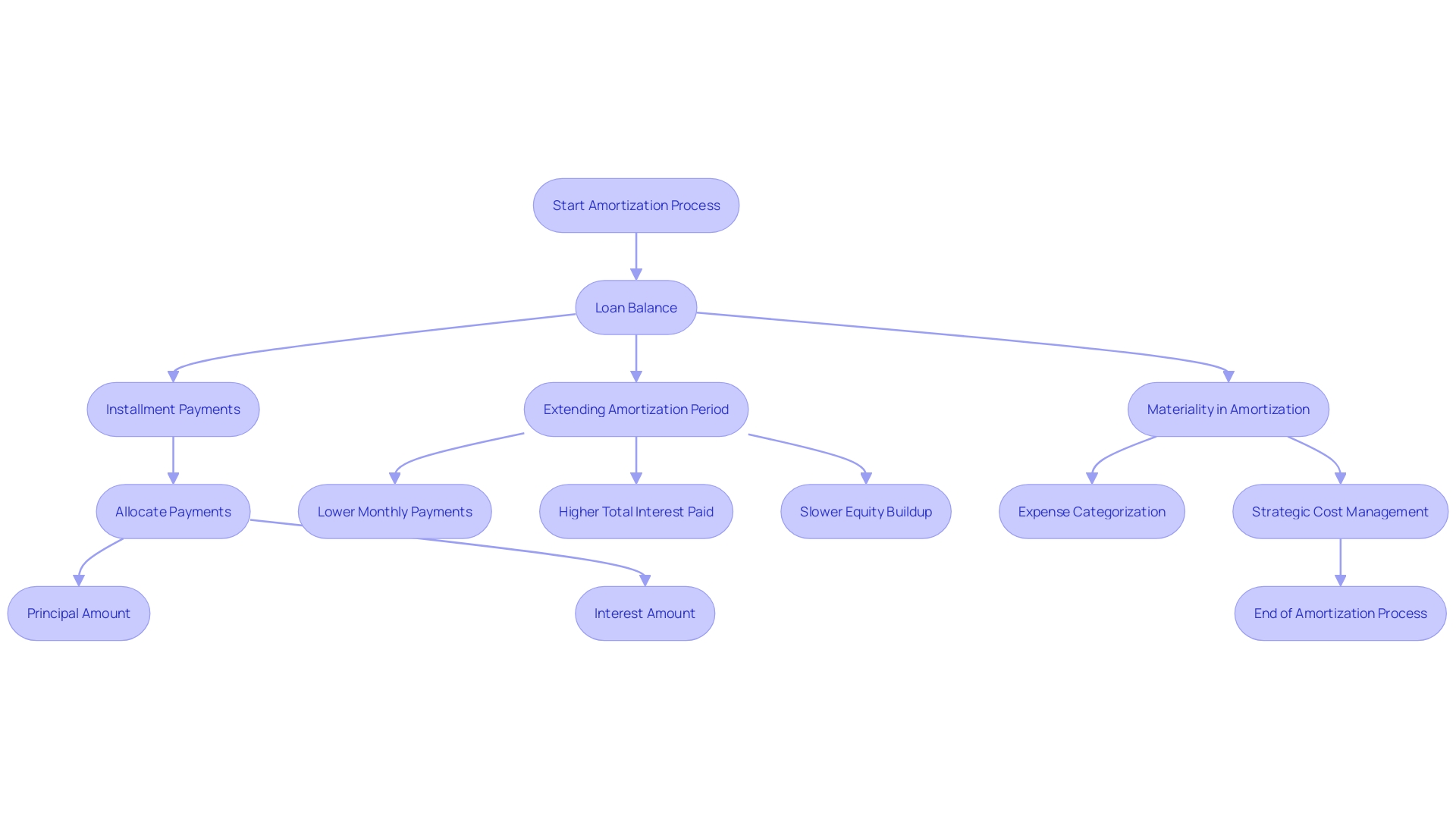

Understanding amortization is pivotal for managing a company's financial health, particularly when it comes to mortgage amortization. This process involves the gradual reduction of a loan balance through installment payments, which are allocated between the principal amount and the interest cost. A crucial aspect to consider is the loan's amortization period; extending it results in lower monthly payments, as the repayment is spread over a longer duration.

However, this also means paying more in total interest and slower equity buildup in your property. The concept of materiality plays a significant role in amortization. It's about discerning the significance of an expense in the broader context of financial statements.

As one industry expert puts it, materiality is the line between categorizing an expense with a short or long life, and between a low or high price. Efficiently managing financial records requires a strategic approach to categorize expenses either directly to the profit and loss statement or initially to the balance sheet. To optimize costs, fostering a cost-aware culture within your organization is essential.

This means integrating cost considerations into the product development cycle as a non-functional requirement and making cost management a collective responsibility. A non-functional requirement, often associated with a system's availability, performance, and reliability, should include cost to ensure comprehensive success measurement in a system's performance, especially in SaaS environments. This strategic approach to cost embeds financial prudence into every aspect of organizational operations.

The nuances of asset allocation are crucial in the financial landscape. Amortization and depreciation are two fundamental concepts that deal with spreading the cost of assets over their useful life.

Amortization pertains to intangible assets, like software development costs, which, as per IRS's Notice 2023-63, now require most expenses to be amortized, impacting 'bootstrap' software developers significantly. Depreciation, meanwhile, addresses tangible assets such as buildings and machinery.

The recent IRS clarification has made it imperative for businesses, especially startups with limited capital, to adjust their financial strategies. These startups often don't survive beyond five years, and the ability to expense their software development costs in the year they are incurred is essential for their financial management.

In the context of the broader financial discipline of accounting, understanding the difference between bookkeeping and accounting is key. Bookkeepers meticulously record the financial minutiae, while accountants analyze, interpret, and report on financial transactions to provide strategic advice.

This distinction is exemplified in the construction industry, where expenses must be correctly categorized as either immediate or balance sheet items. A balance sheet reflects a company's financial health at a specific time, highlighting assets, liabilities, and equity, whereas expenses are recorded on the income statement and represent costs incurred during a particular period. The significance of an expense item, or its materiality, can dictate whether it is expensed immediately or capitalized and amortized over time. This decision is critical for managing a company's financial records efficiently. With the ongoing expansion in industries like healthcare and semiconductors, understanding these financial concepts is more important than ever for ensuring accurate reporting and sound financial strategy.

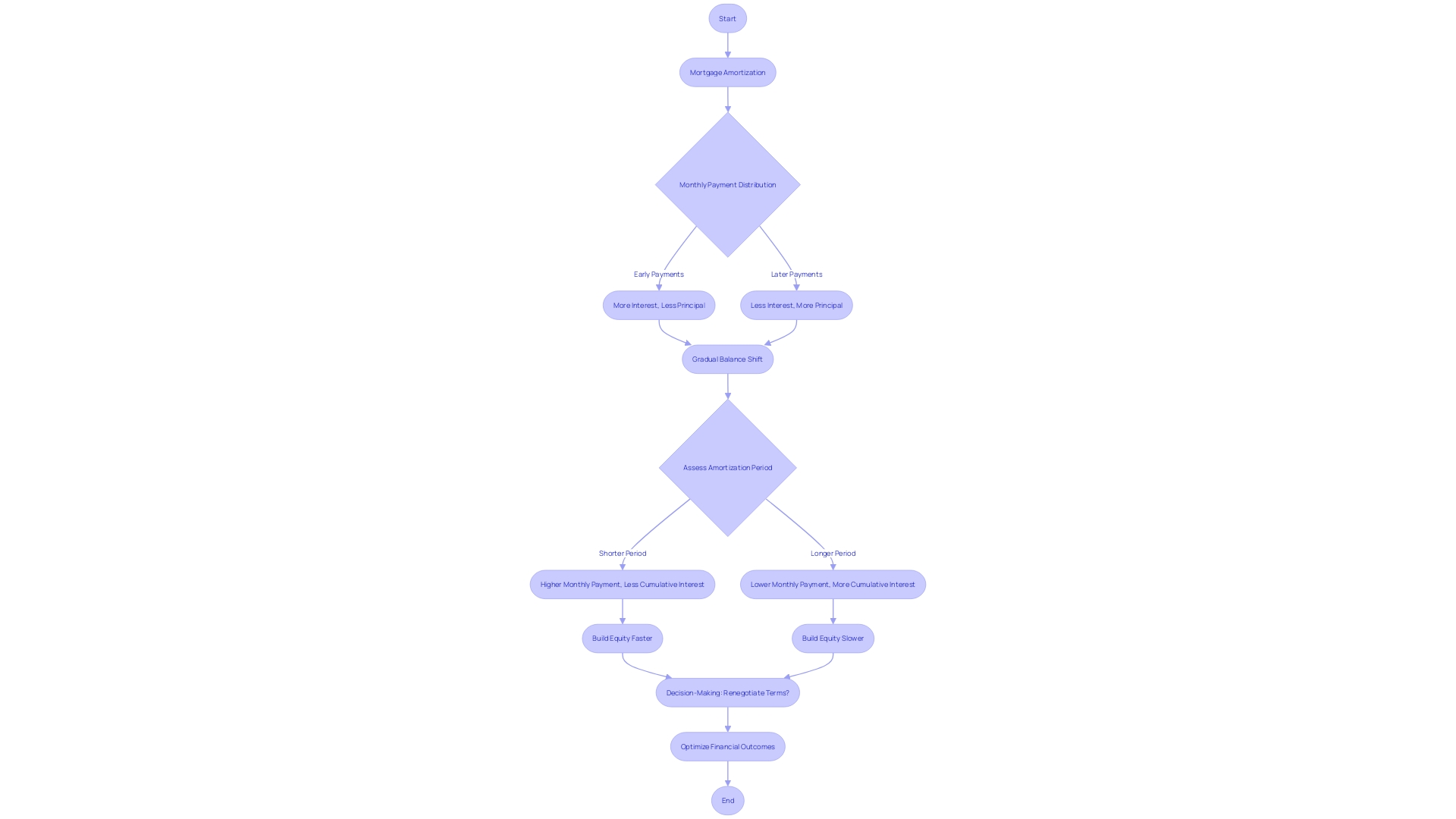

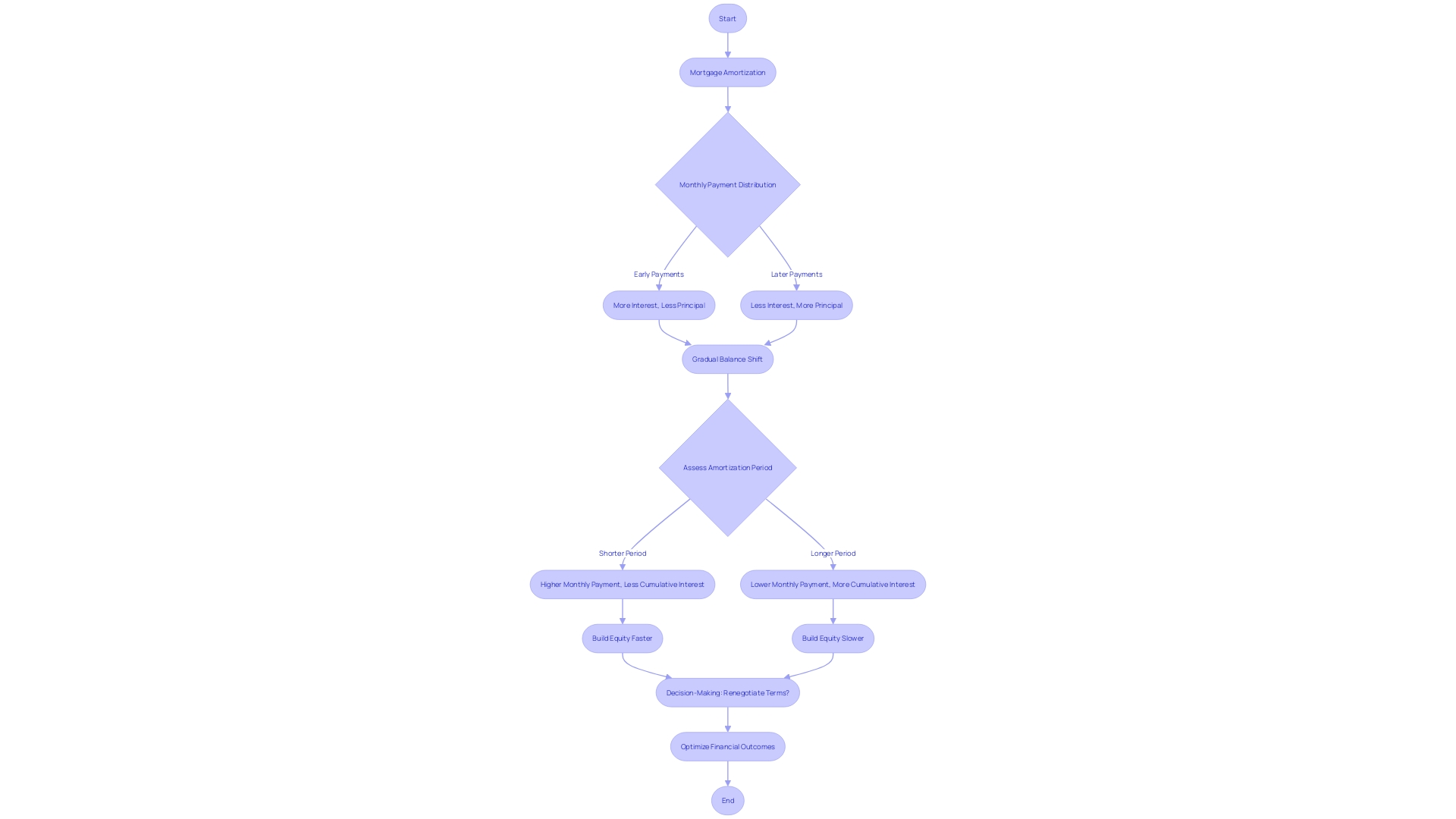

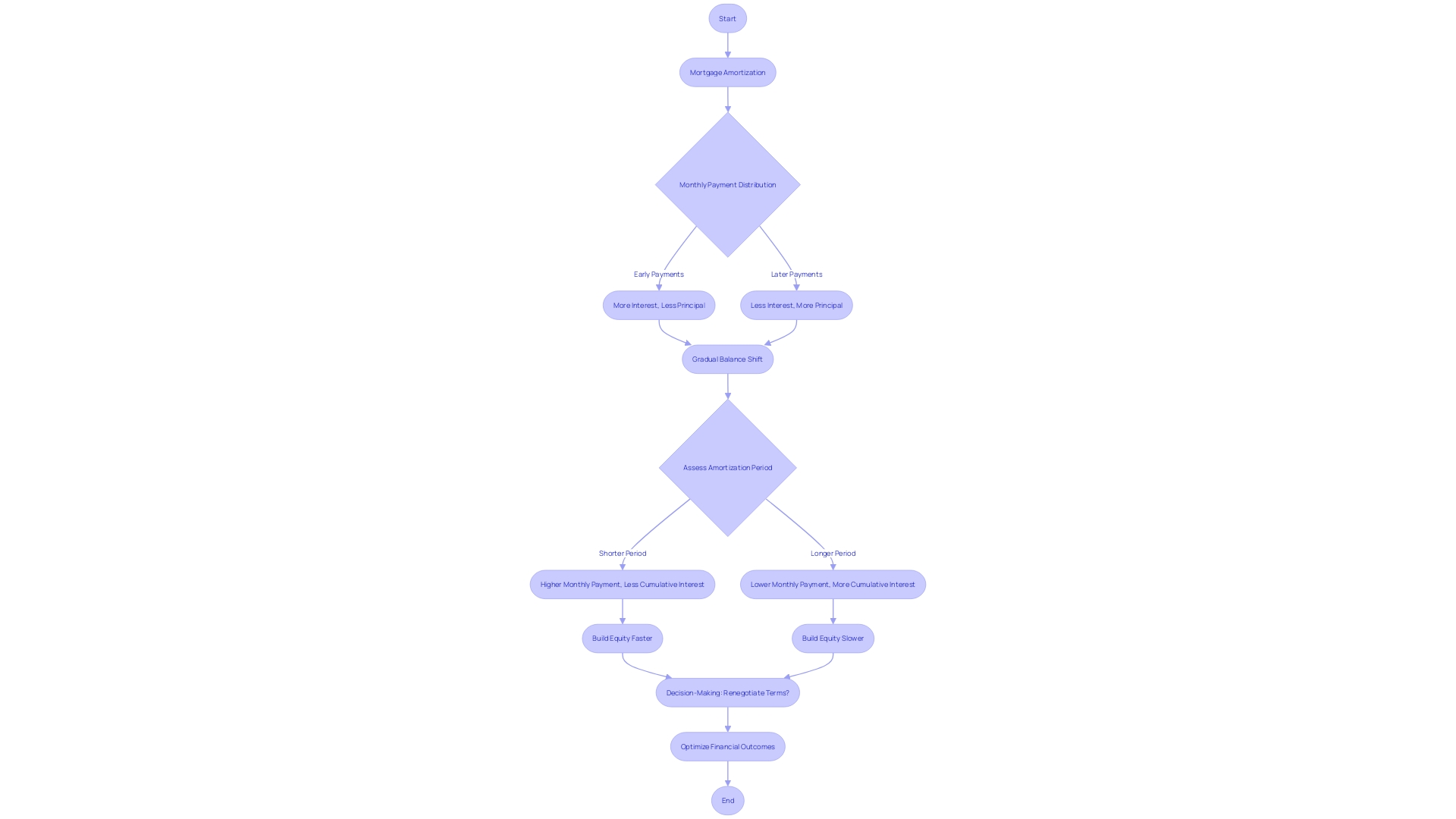

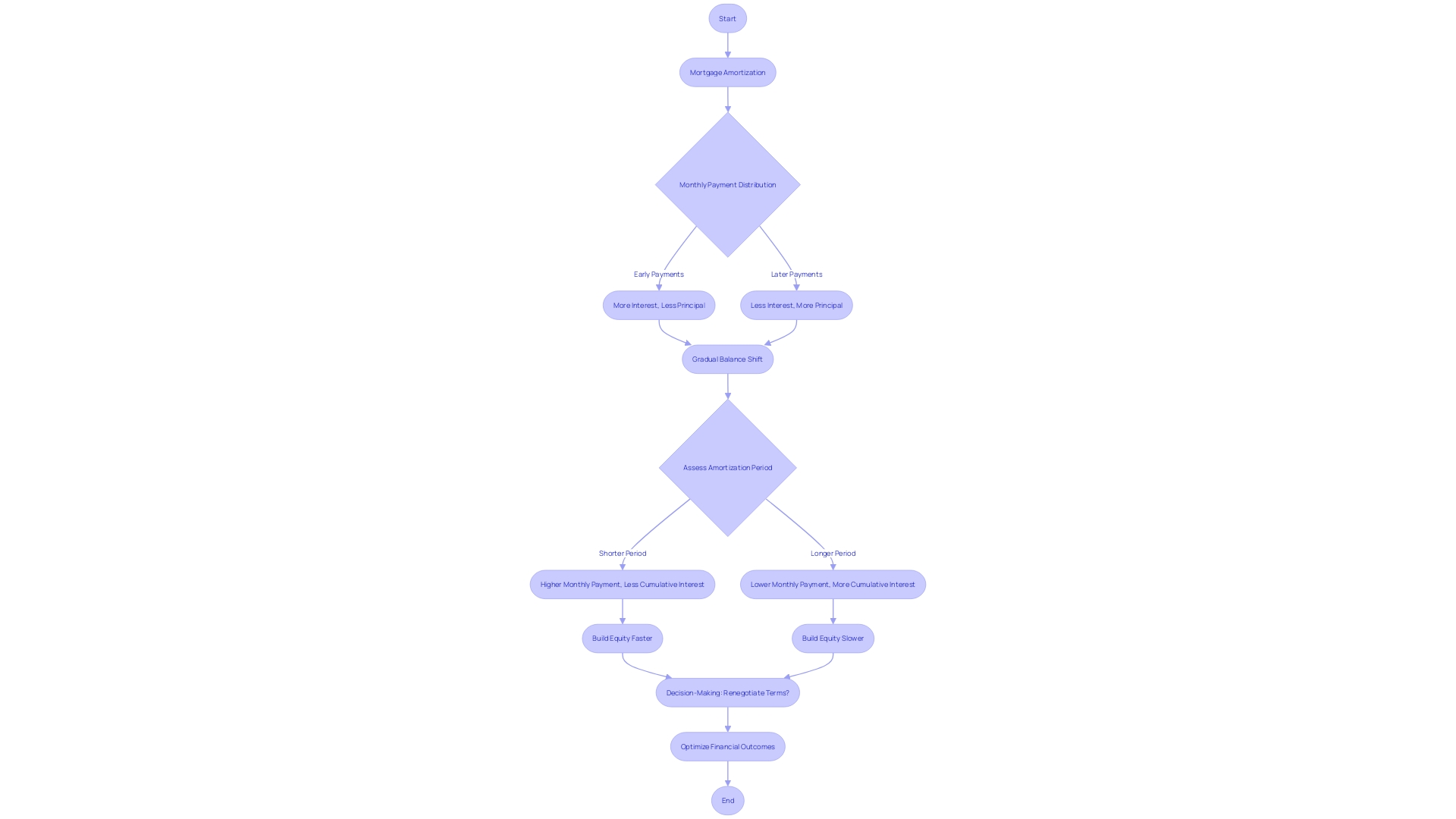

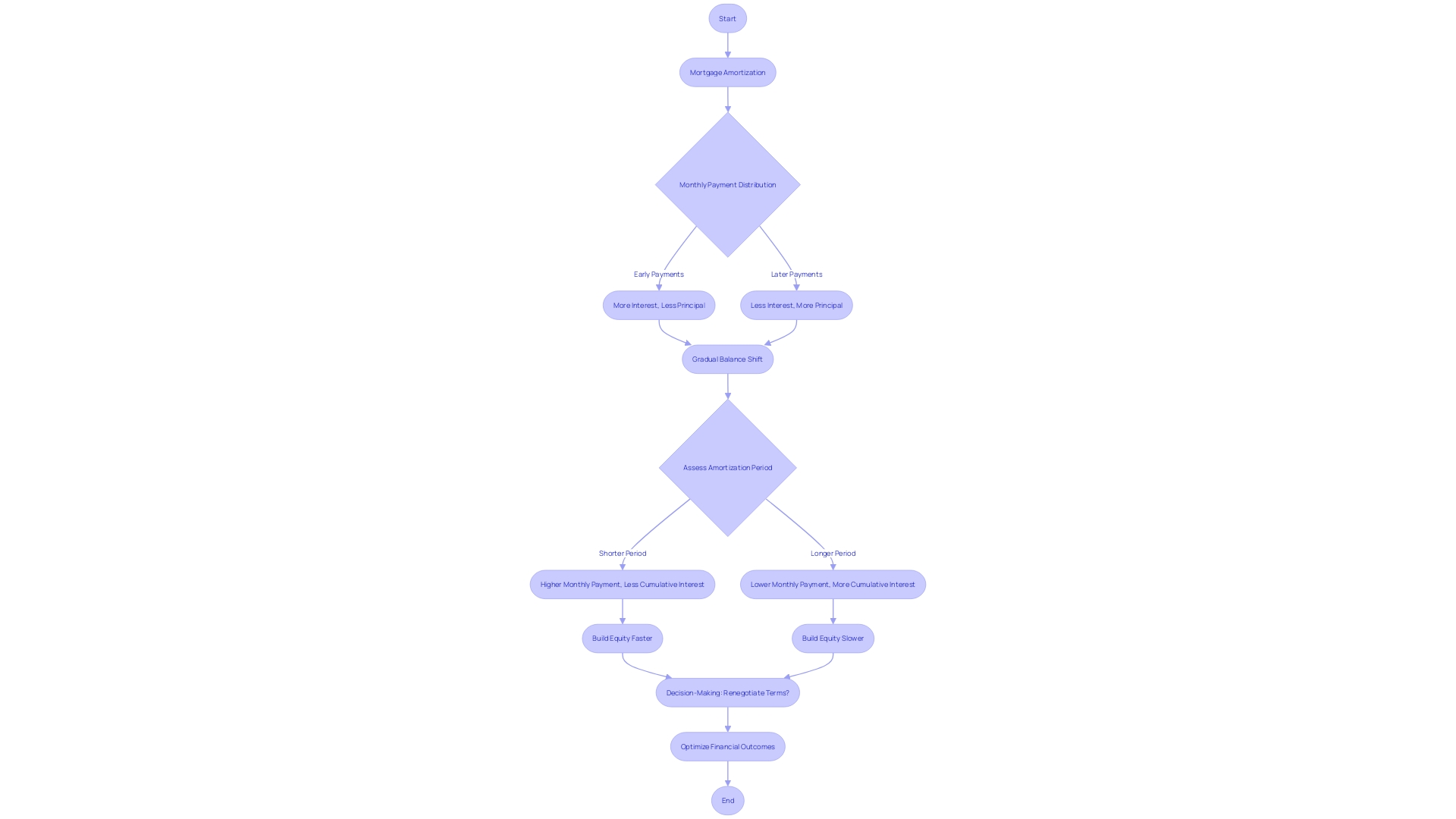

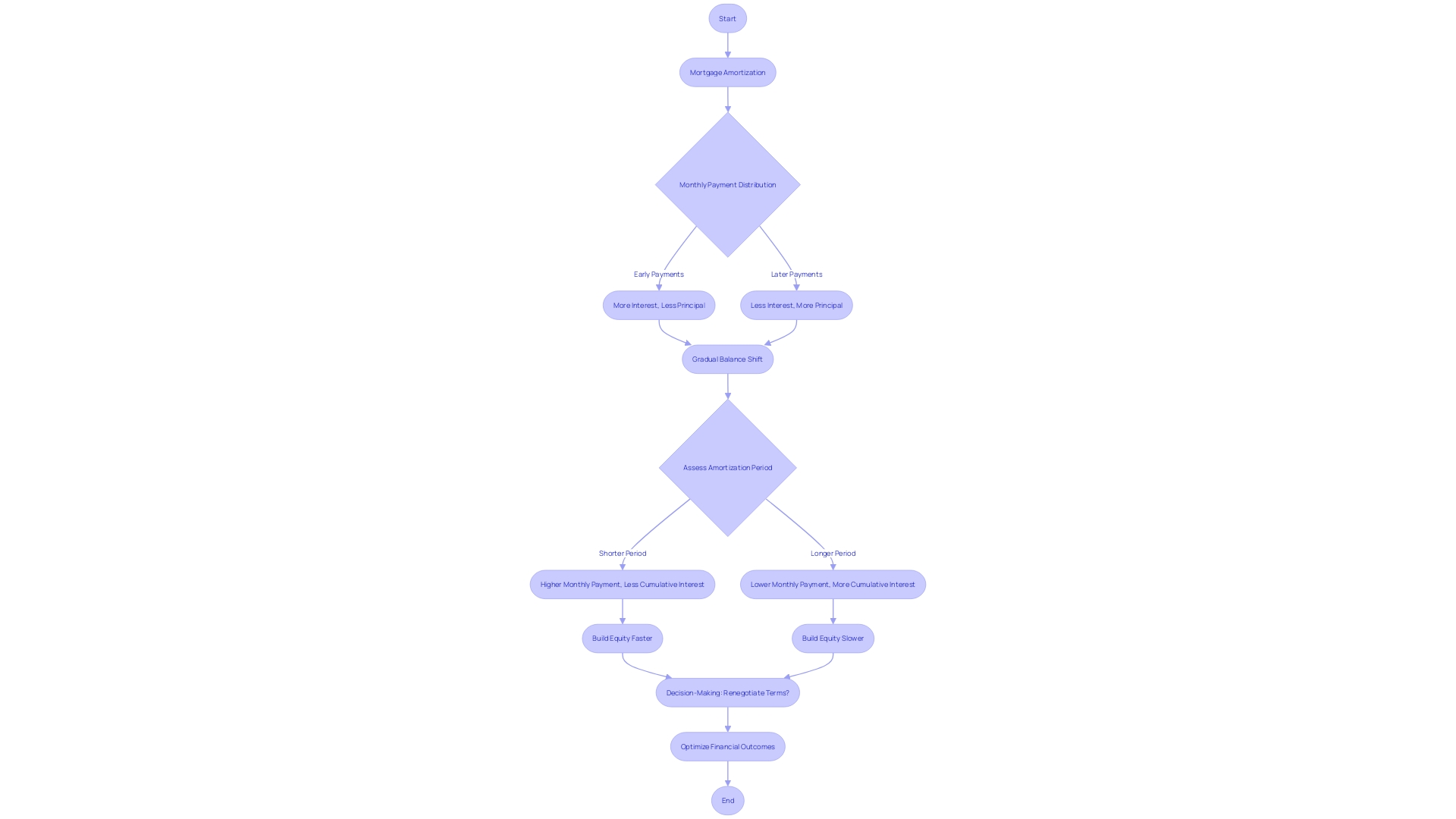

An amortization schedule is a financial tool that provides a comprehensive view of how loan payments are allocated over time. When you secure a mortgage to purchase a home, this schedule becomes a roadmap for your repayment journey, delineating the distribution of your payments towards the loan principal and interest.

Initially, a larger portion of each payment is directed towards interest, reflecting the lender's charge for borrowing funds. However, as time progresses, this balance shifts, with a growing fraction of your installments reducing the principal amount.

This dynamic is particularly evident in long-term loans, which can extend up to 30 years, offering lower monthly payments due to the extended repayment window. Nonetheless, an extended amortization period also translates into higher cumulative interest payments, underscoring the importance of considering the total cost of borrowing. WeWork's recent financial disclosures highlight the significance of understanding such schedules, as they navigate through restructuring their debt. As a CFO, grasping the nuances of these schedules is crucial, as they not only influence cash flow management but also play a pivotal role in strategic decision-making, especially when evaluating options like renegotiating leases to optimize financial outcomes.

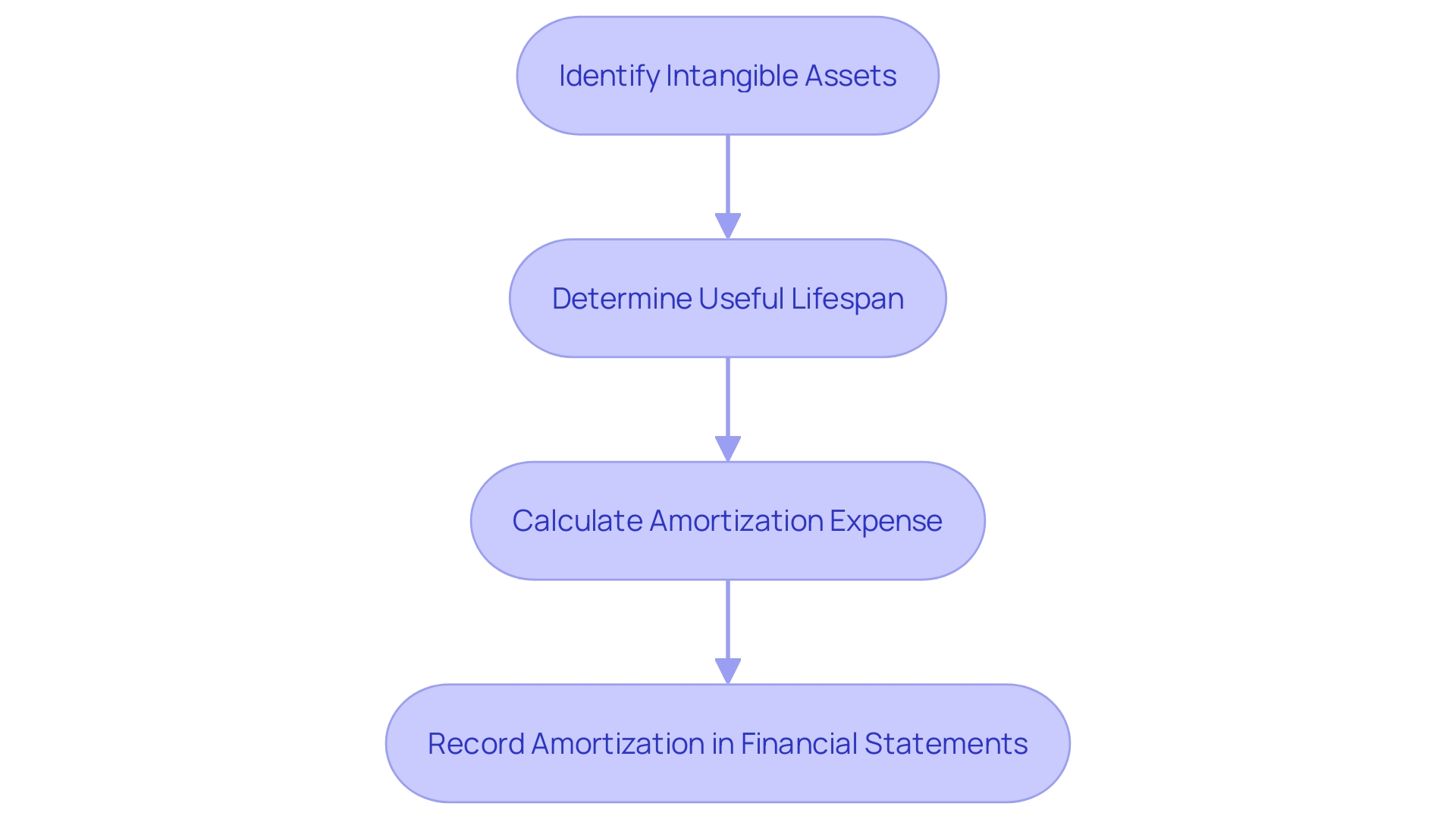

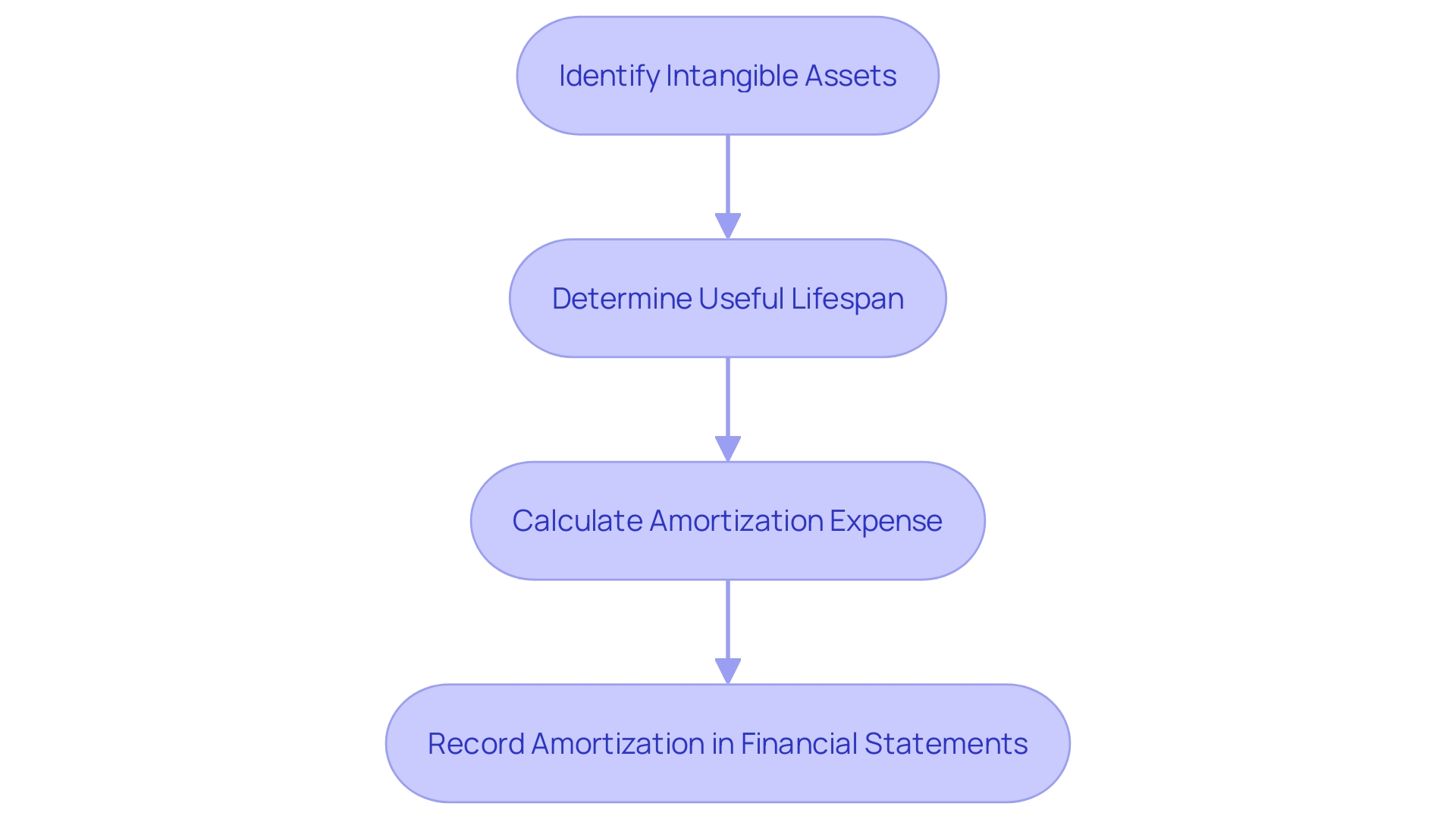

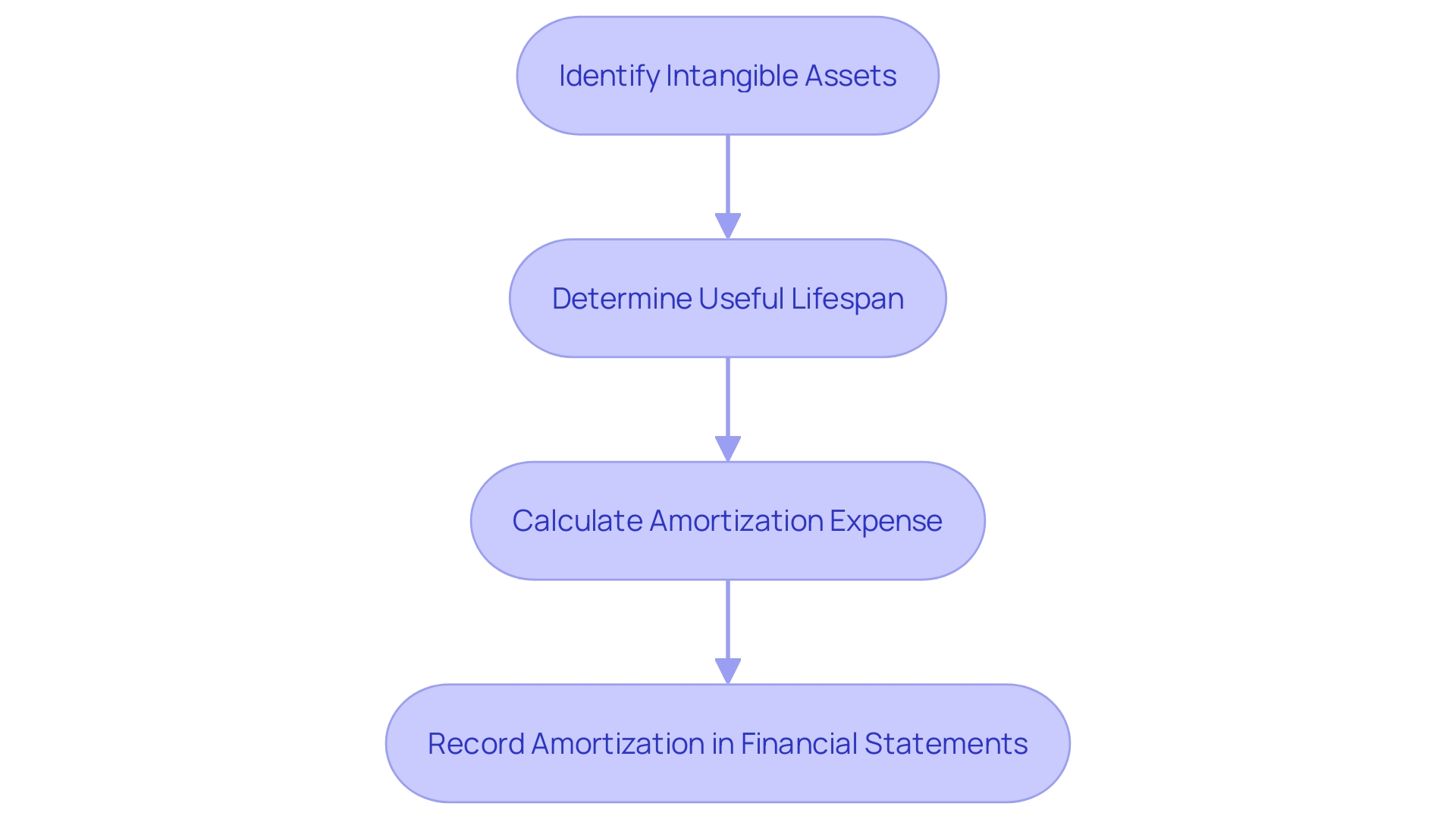

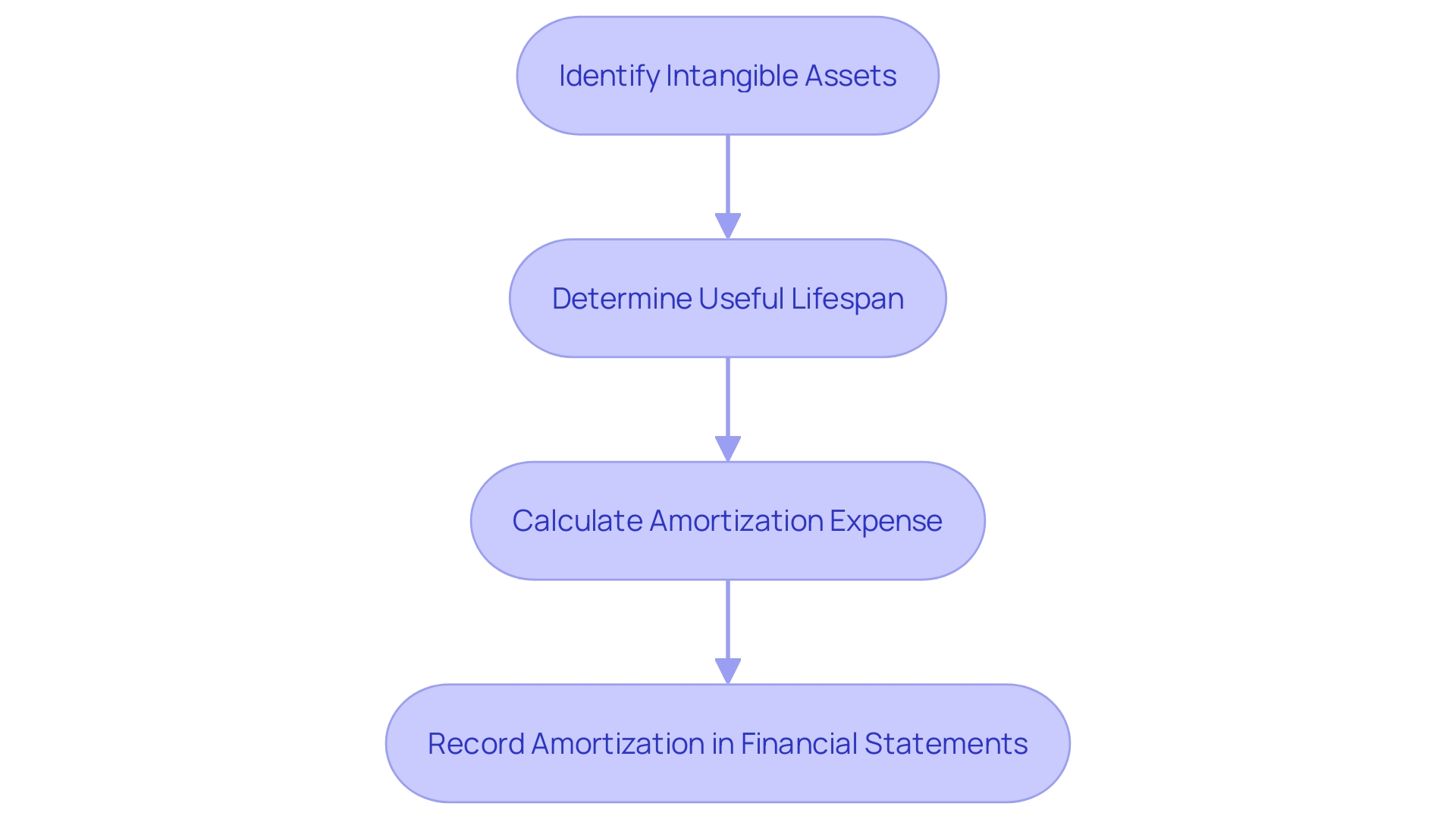

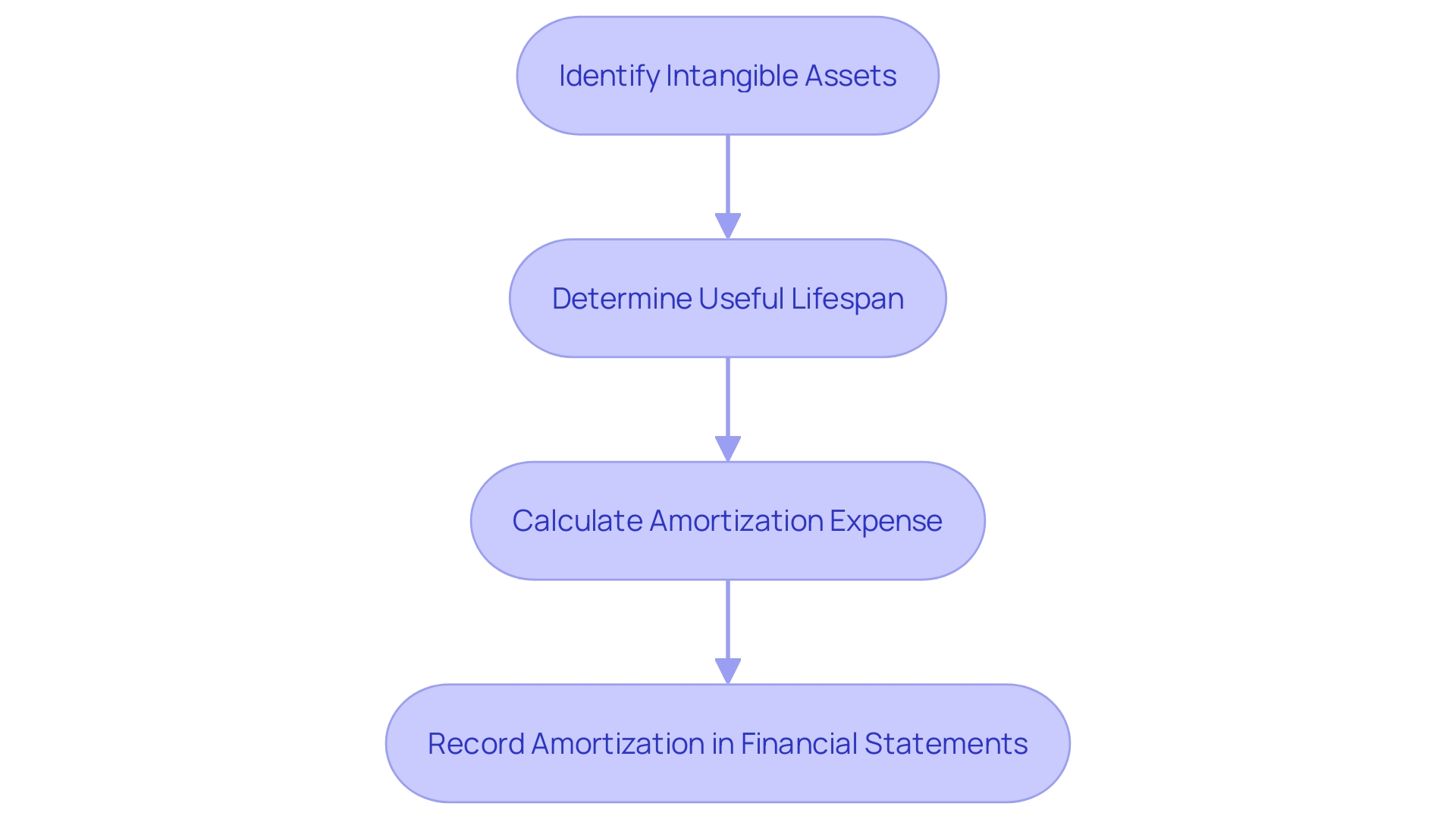

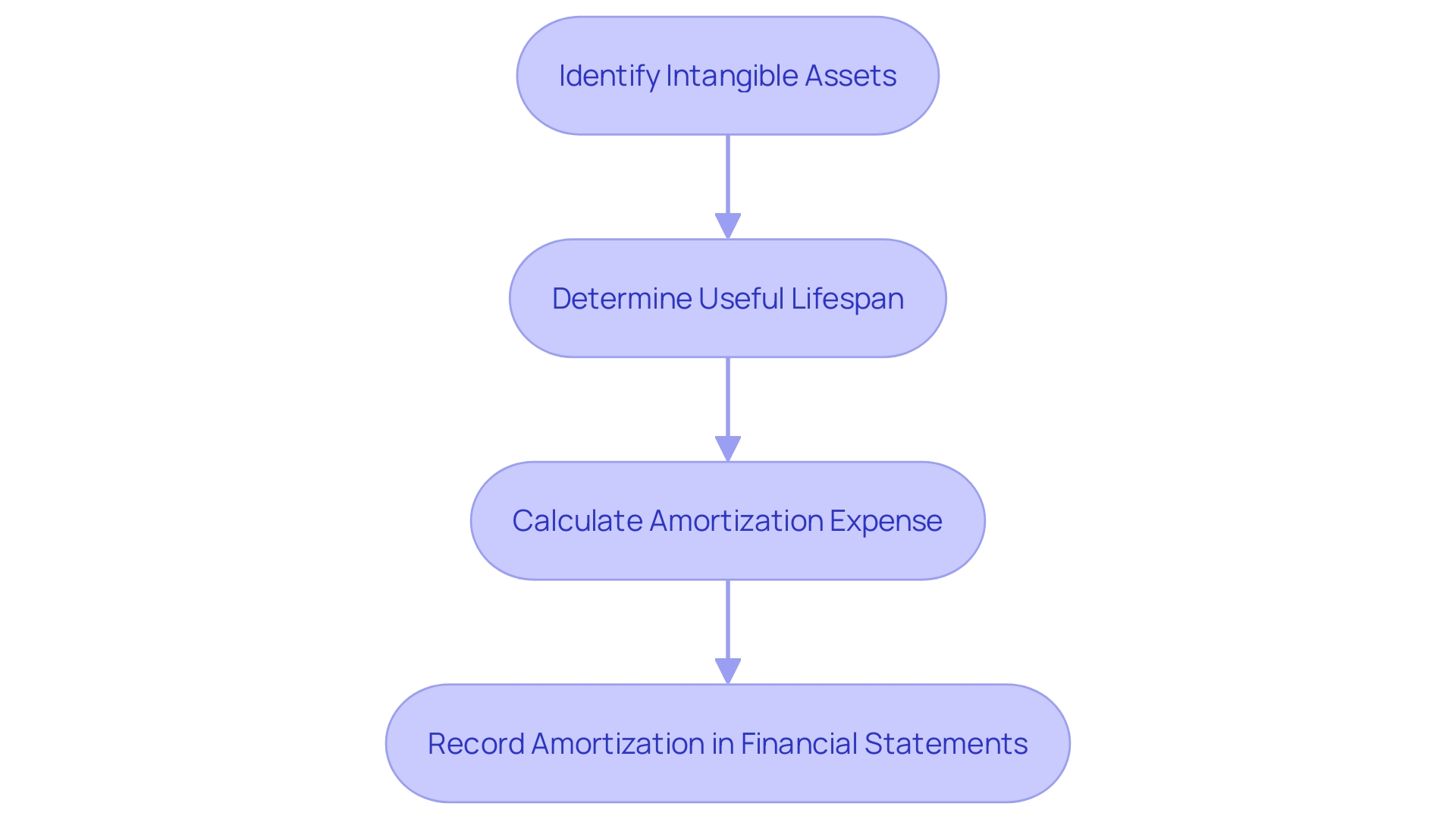

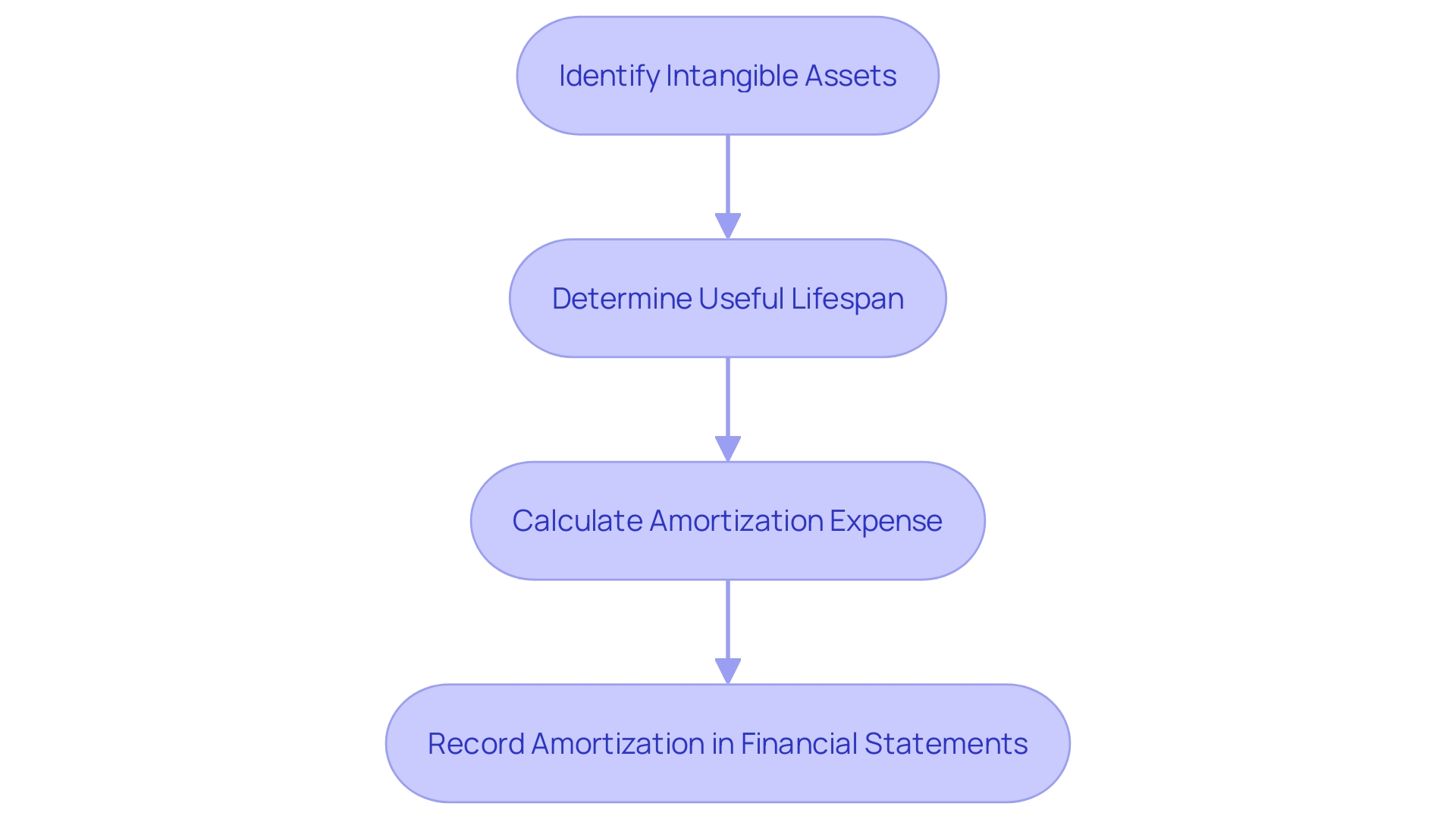

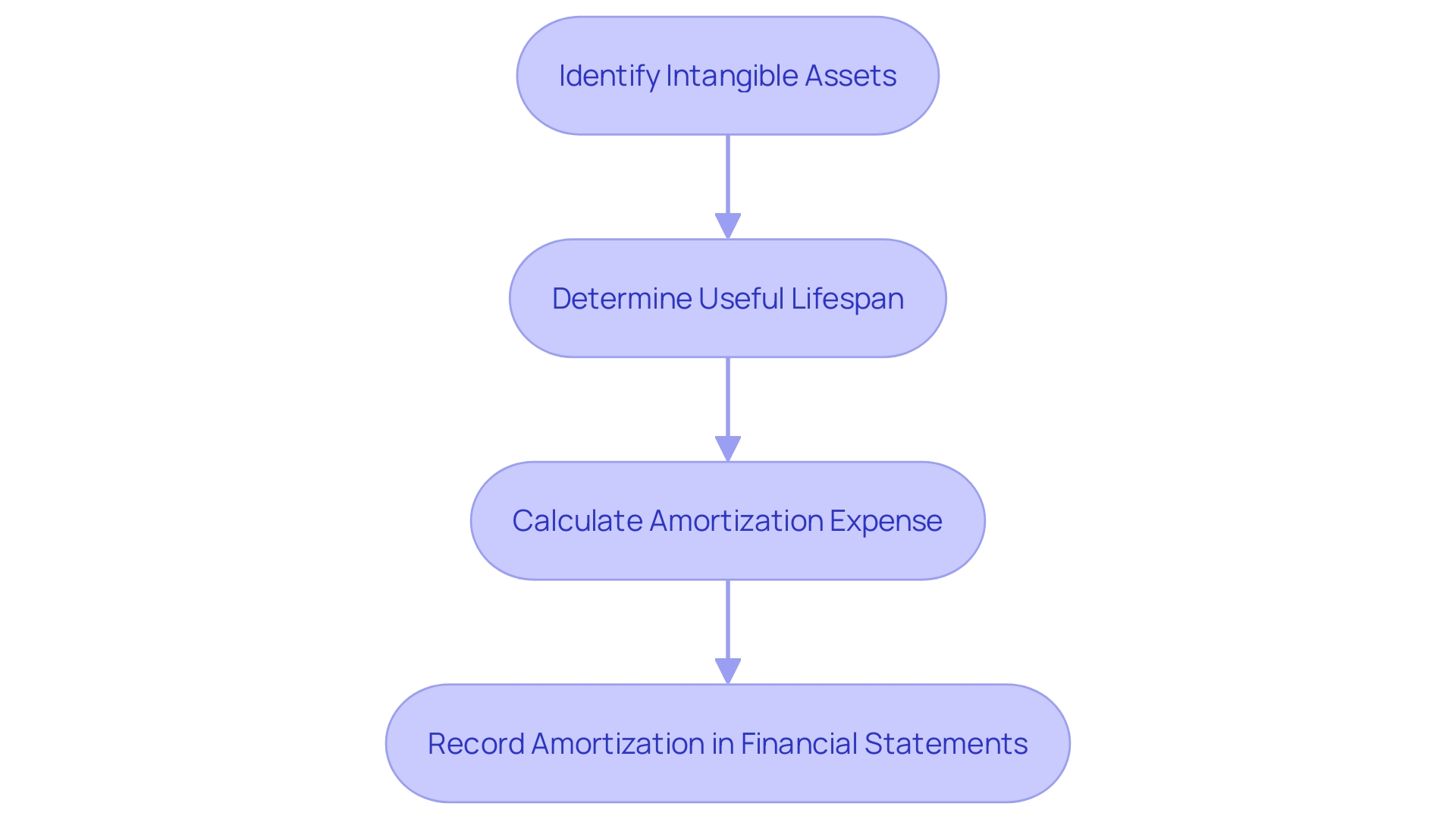

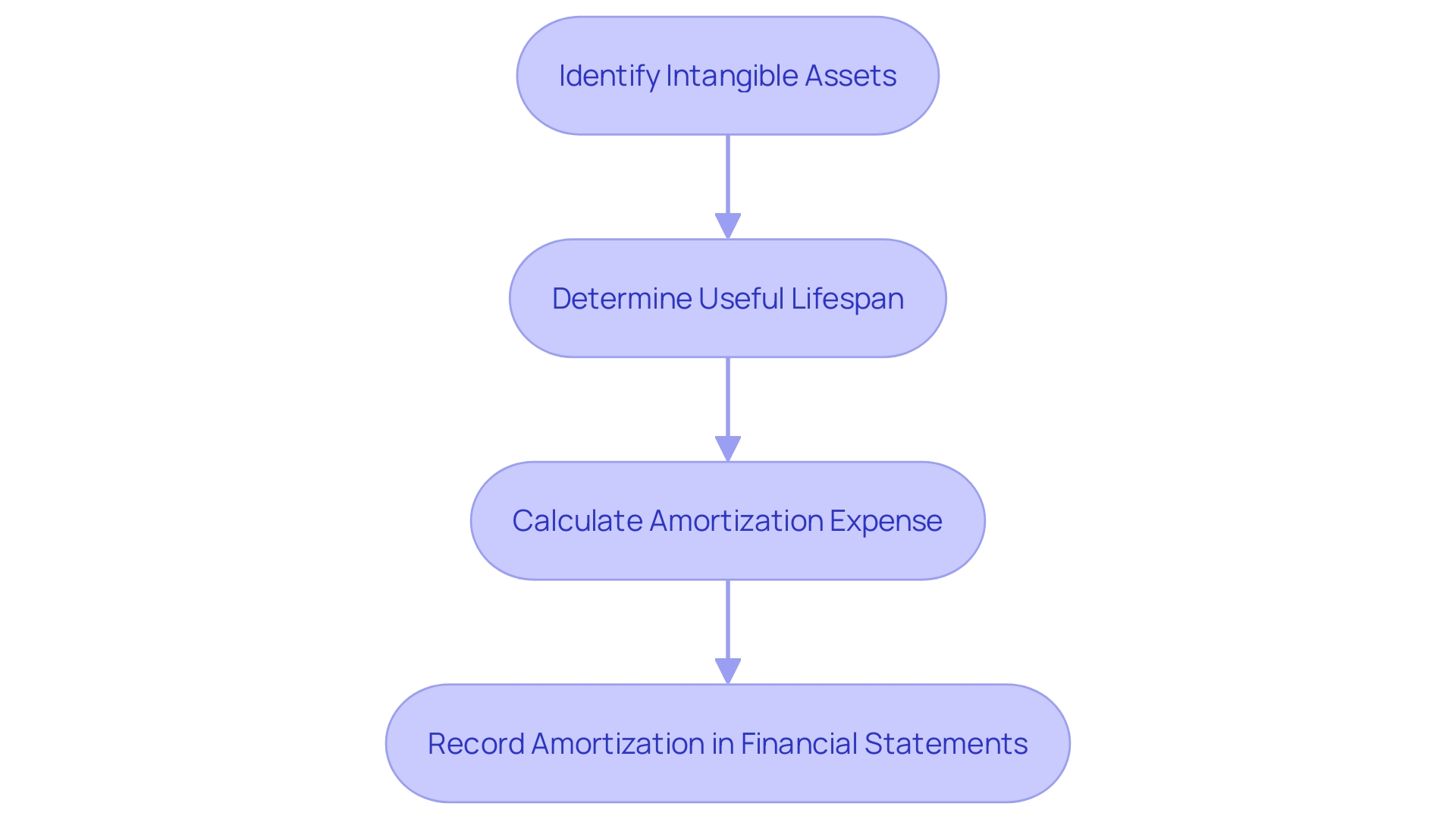

In the realm of financial reporting, the treatment of intangible assets such as patents, copyrights, and trademarks holds significant weight. Amortization of these intangibles is not merely a procedural entry; it represents the systematic recognition of the assets' diminishing economic benefits over time.

The intrinsic value of these assets is deeply rooted in their ability to generate future cash flows or reduce investment risks. For instance, a strong brand name may command higher cash flows, while robust management or regulatory connections might mitigate risks.

These factors need to be meticulously reflected in the amortization schedules, enhancing the precision of financial statements. The recent overhaul of IFRS 18 underscores the importance of clarity in financial disclosures, mandating new subtotals and presentation requirements in the profit or loss statement. This paradigm shift aligns with the dynamic nature of entities like Birkenstock, which, despite its age, continues to evolve and contribute materially to financial outcomes. Therefore, the amortization of intangible assets is not just an accounting practice but a strategic tool that aids in the transparent communication of an entity's sustained value to investors and stakeholders alike.

In the financial world, amortization plays a crucial role, particularly in the realm of loan management. When discussing loans, each payment by the borrower is meticulously crafted to chip away at the principal amount while also covering the interest charges.

This structured approach ensures that the loan balance is methodically reduced over the stipulated period until it is completely settled. For instance, in mortgage amortization, the borrower's installment payments are split between the principal—the initial amount borrowed—and the interest—the lender's charge for the loan.

Opting for a longer amortization period might seem beneficial due to the lower monthly outlay, but it's also true that it results in higher total interest costs over the life of the loan. Moreover, with interest payments front loaded in such arrangements, it takes longer to make a significant impact on the principal and to accumulate equity in the property. This is a key consideration when weighing loan options, particularly in the current European SME financing landscape where rising interest rates have heightened the barriers to accessing funds, especially for SMEs with limited capital and higher risk profiles.

Understanding amortization is fundamental to mastering cost accounting and ensuring the integrity of financial reporting. It allows for the systematic allocation of the cost of intangible assets across their useful lifespan, capturing the essence of their depreciating value.

This process is not merely about adherence to accounting principles but is a strategic tool that guides the interpretation of financial data, enabling informed decision-making. As businesses navigate complex industries, like construction or healthcare, where the distinction between balance sheet items and immediate expenses is pivotal, amortization becomes a critical component.

It clarifies the financial narrative by introducing rigor to the profit and loss statement, distinguishing between long-lived assets and short-term expenditures. When a company like First American Financial Corporation, with a revenue of $7.6 billion in 2022, approaches its financial reporting, it recognizes the importance of such practices for providing transparency and enhancing investor decision-making. With the adoption of new standards requiring more detailed profit subtotals, the role of amortization in presenting a true and fair view of a company's financial health becomes even more pronounced. It's not just about tracking numbers; it's about crafting a financial story that resonates with clarity and materiality, whether it's for a small construction business or a global healthcare provider.

Amortization serves as a critical financial concept that enables businesses and individuals to systematically allocate costs over a specific period. For instance, when a company secures a patent for an innovative product, the cost associated with acquiring the patent is not expensed all at once; rather, it is amortized throughout the patient's estimated useful life.

This approach reflects the gradual consumption of the patient's value over time. Similarly, the purchase price of a trademark - the symbol of a brand's identity - is spread across its useful life, allowing a business to gradually absorb the cost.

In the context of mortgages, amortization is the process by which a borrower repays a loan balance through installment payments over a predetermined term. These payments are split between the principal amount and the interest charged by the lender.

Opting for a more extended amortization period can lower monthly payments since the repayment is distributed over a more extended period. However, this can result in higher total interest costs over the loan's life and slower equity accumulation in the property, as initial payments are predominantly interest-heavy.

Additionally, social network analysis (SNA) has been used to illustrate complex systems, including the dynamics of amortization schedules. By visualizing the interactions between the components of a loan, such as principal and interest payments over time, SNA can provide valuable insights into the financial structure and implications of different amortization strategies. Moreover, unstructured data from sources like patent applications can yield insights into emerging technologies and trends. Patent analysis, which includes tracking the life cycle of patents, has become a strategic tool in forecasting technological advancements. This analysis can partially automate the process of understanding the financial implications of patents, thereby aiding strategic planning and technology management.

In conclusion, understanding amortization is crucial in cost accounting for managing intangible assets. It impacts financial health, tax liabilities, and strategic decision-making. Different methods like the Straight-line Method, Declining Balance Method, Sum-of-the-Years-Digits Method, and Units-of-Production Method ensure accurate reflection of asset costs over their useful lives.

Amortization schedules play a significant role in loan management and cash flow. It's important to consider the total interest cost and equity growth when selecting a loan term. Categorizing expenses correctly is critical for accurate financial reporting.

Amortization differs from depreciation as it applies to intangible assets while depreciation pertains to tangible assets. Understanding the distinction is key in financial management. The amortization of intangible assets is not just an accounting practice but also a strategic tool that communicates value to stakeholders.

It ensures accurate financial disclosures and aligns with evolving standards. Overall, understanding amortization is fundamental in cost accounting for accurate reporting, informed decision-making, transparency, and optimization of financial management. Incorporating practical advice on amortization can enhance your financial management skills and drive fiscal responsibility.

What is Amortization Expense?

Understanding amortization is essential in the realm of cost accounting, especially when it comes to intangible assets that don't physically exist but have a clear value for a business. This includes assets like patents and trademarks, which are pivotal in many industries, including construction. Distinguishing between what should be expensed immediately and what should be capitalized and amortized over time can have a significant impact on a company's financial health.

For instance, expenses directly affect the income statement, showcasing the costs incurred over a period, while capitalized assets like patents appear on the balance sheet, reflecting the company's financial status at a specific point in time. The decision to amortize an asset is not just a matter of compliance but a strategic choice that can influence a company's reported earnings and tax liabilities. For example, a construction business owner like Jane must decide whether to immediately expense the cost of a new software or to spread it out over its useful life.

With reported revenues of $7.6 billion in 2022 by companies like First American Financial Corporation, the stakes are high, and such decisions must be made with precision. The concept of materiality plays a crucial role here; it determines the significance of an expense in the grand scheme of financial statements, affecting everything from investor perception to credit terms. It's about striking the right balance between short-term financial reporting and long-term fiscal responsibility.

Amortization is a critical financial concept, particularly when dealing with mortgage loans. It refers to the schedule of payments a borrower makes to clear a loan over time.

These payments are split between the principal, the original sum borrowed, and interest, the cost charged by the lender. A key aspect of amortization is the loan term length; a longer amortization period translates to lower monthly payments, as the repayment is spread out over more time.

However, this comes with a caveat: a lengthier loan term means paying more in interest overall. Additionally, with longer mortgages, interest payments are concentrated at the start, delaying significant reductions in the principal and the accumulation of home equity. When selecting a loan, it's essential to weigh the benefits of lower monthly payments against the total interest cost and the impact on equity growth.

Amortization expenses play a critical role in accurately reflecting the cost of intangible assets over their useful lives. The Straight-line Method, a favored approach, spreads the expense uniformly across the lifespan of the asset.

This method is akin to the steady work of building a skyscraper, ensuring a solid structure by laying one floor at a time. Alternatively, the Declining Balance Method mirrors the upfront intensive labor in construction, front-loading the expenses to reflect the asset's higher utility in the early stages.

For a more nuanced approach, the Sum-of-the-Years-Digits Method also front-loads expenses but tapers them off as the asset ages, similar to how a construction project might require intense initial capital but less over time. Lastly, the Units-of-Production Method aligns expenses with the asset's actual usage or output, much like tracking the materials used in construction to allocate costs based on actual consumption. Each of these methods ensures that the financial health of a business, as displayed on the balance sheet, remains robust and transparent, reflecting the true value of assets and the costs associated with them.

Understanding amortization is pivotal for managing a company's financial health, particularly when it comes to mortgage amortization. This process involves the gradual reduction of a loan balance through installment payments, which are allocated between the principal amount and the interest cost. A crucial aspect to consider is the loan's amortization period; extending it results in lower monthly payments, as the repayment is spread over a longer duration.

However, this also means paying more in total interest and slower equity buildup in your property. The concept of materiality plays a significant role in amortization. It's about discerning the significance of an expense in the broader context of financial statements.

As one industry expert puts it, materiality is the line between categorizing an expense with a short or long life, and between a low or high price. Efficiently managing financial records requires a strategic approach to categorize expenses either directly to the profit and loss statement or initially to the balance sheet. To optimize costs, fostering a cost-aware culture within your organization is essential.

This means integrating cost considerations into the product development cycle as a non-functional requirement and making cost management a collective responsibility. A non-functional requirement, often associated with a system's availability, performance, and reliability, should include cost to ensure comprehensive success measurement in a system's performance, especially in SaaS environments. This strategic approach to cost embeds financial prudence into every aspect of organizational operations.

The nuances of asset allocation are crucial in the financial landscape. Amortization and depreciation are two fundamental concepts that deal with spreading the cost of assets over their useful life.

Amortization pertains to intangible assets, like software development costs, which, as per IRS's Notice 2023-63, now require most expenses to be amortized, impacting 'bootstrap' software developers significantly. Depreciation, meanwhile, addresses tangible assets such as buildings and machinery.

The recent IRS clarification has made it imperative for businesses, especially startups with limited capital, to adjust their financial strategies. These startups often don't survive beyond five years, and the ability to expense their software development costs in the year they are incurred is essential for their financial management.

In the context of the broader financial discipline of accounting, understanding the difference between bookkeeping and accounting is key. Bookkeepers meticulously record the financial minutiae, while accountants analyze, interpret, and report on financial transactions to provide strategic advice.

This distinction is exemplified in the construction industry, where expenses must be correctly categorized as either immediate or balance sheet items. A balance sheet reflects a company's financial health at a specific time, highlighting assets, liabilities, and equity, whereas expenses are recorded on the income statement and represent costs incurred during a particular period. The significance of an expense item, or its materiality, can dictate whether it is expensed immediately or capitalized and amortized over time. This decision is critical for managing a company's financial records efficiently. With the ongoing expansion in industries like healthcare and semiconductors, understanding these financial concepts is more important than ever for ensuring accurate reporting and sound financial strategy.

An amortization schedule is a financial tool that provides a comprehensive view of how loan payments are allocated over time. When you secure a mortgage to purchase a home, this schedule becomes a roadmap for your repayment journey, delineating the distribution of your payments towards the loan principal and interest.

Initially, a larger portion of each payment is directed towards interest, reflecting the lender's charge for borrowing funds. However, as time progresses, this balance shifts, with a growing fraction of your installments reducing the principal amount.

This dynamic is particularly evident in long-term loans, which can extend up to 30 years, offering lower monthly payments due to the extended repayment window. Nonetheless, an extended amortization period also translates into higher cumulative interest payments, underscoring the importance of considering the total cost of borrowing. WeWork's recent financial disclosures highlight the significance of understanding such schedules, as they navigate through restructuring their debt. As a CFO, grasping the nuances of these schedules is crucial, as they not only influence cash flow management but also play a pivotal role in strategic decision-making, especially when evaluating options like renegotiating leases to optimize financial outcomes.

In the realm of financial reporting, the treatment of intangible assets such as patents, copyrights, and trademarks holds significant weight. Amortization of these intangibles is not merely a procedural entry; it represents the systematic recognition of the assets' diminishing economic benefits over time.

The intrinsic value of these assets is deeply rooted in their ability to generate future cash flows or reduce investment risks. For instance, a strong brand name may command higher cash flows, while robust management or regulatory connections might mitigate risks.

These factors need to be meticulously reflected in the amortization schedules, enhancing the precision of financial statements. The recent overhaul of IFRS 18 underscores the importance of clarity in financial disclosures, mandating new subtotals and presentation requirements in the profit or loss statement. This paradigm shift aligns with the dynamic nature of entities like Birkenstock, which, despite its age, continues to evolve and contribute materially to financial outcomes. Therefore, the amortization of intangible assets is not just an accounting practice but a strategic tool that aids in the transparent communication of an entity's sustained value to investors and stakeholders alike.

In the financial world, amortization plays a crucial role, particularly in the realm of loan management. When discussing loans, each payment by the borrower is meticulously crafted to chip away at the principal amount while also covering the interest charges.

This structured approach ensures that the loan balance is methodically reduced over the stipulated period until it is completely settled. For instance, in mortgage amortization, the borrower's installment payments are split between the principal—the initial amount borrowed—and the interest—the lender's charge for the loan.

Opting for a longer amortization period might seem beneficial due to the lower monthly outlay, but it's also true that it results in higher total interest costs over the life of the loan. Moreover, with interest payments front loaded in such arrangements, it takes longer to make a significant impact on the principal and to accumulate equity in the property. This is a key consideration when weighing loan options, particularly in the current European SME financing landscape where rising interest rates have heightened the barriers to accessing funds, especially for SMEs with limited capital and higher risk profiles.

Understanding amortization is fundamental to mastering cost accounting and ensuring the integrity of financial reporting. It allows for the systematic allocation of the cost of intangible assets across their useful lifespan, capturing the essence of their depreciating value.

This process is not merely about adherence to accounting principles but is a strategic tool that guides the interpretation of financial data, enabling informed decision-making. As businesses navigate complex industries, like construction or healthcare, where the distinction between balance sheet items and immediate expenses is pivotal, amortization becomes a critical component.

It clarifies the financial narrative by introducing rigor to the profit and loss statement, distinguishing between long-lived assets and short-term expenditures. When a company like First American Financial Corporation, with a revenue of $7.6 billion in 2022, approaches its financial reporting, it recognizes the importance of such practices for providing transparency and enhancing investor decision-making. With the adoption of new standards requiring more detailed profit subtotals, the role of amortization in presenting a true and fair view of a company's financial health becomes even more pronounced. It's not just about tracking numbers; it's about crafting a financial story that resonates with clarity and materiality, whether it's for a small construction business or a global healthcare provider.

Amortization serves as a critical financial concept that enables businesses and individuals to systematically allocate costs over a specific period. For instance, when a company secures a patent for an innovative product, the cost associated with acquiring the patent is not expensed all at once; rather, it is amortized throughout the patient's estimated useful life.

This approach reflects the gradual consumption of the patient's value over time. Similarly, the purchase price of a trademark - the symbol of a brand's identity - is spread across its useful life, allowing a business to gradually absorb the cost.

In the context of mortgages, amortization is the process by which a borrower repays a loan balance through installment payments over a predetermined term. These payments are split between the principal amount and the interest charged by the lender.

Opting for a more extended amortization period can lower monthly payments since the repayment is distributed over a more extended period. However, this can result in higher total interest costs over the loan's life and slower equity accumulation in the property, as initial payments are predominantly interest-heavy.

Additionally, social network analysis (SNA) has been used to illustrate complex systems, including the dynamics of amortization schedules. By visualizing the interactions between the components of a loan, such as principal and interest payments over time, SNA can provide valuable insights into the financial structure and implications of different amortization strategies. Moreover, unstructured data from sources like patent applications can yield insights into emerging technologies and trends. Patent analysis, which includes tracking the life cycle of patents, has become a strategic tool in forecasting technological advancements. This analysis can partially automate the process of understanding the financial implications of patents, thereby aiding strategic planning and technology management.

In conclusion, understanding amortization is crucial in cost accounting for managing intangible assets. It impacts financial health, tax liabilities, and strategic decision-making. Different methods like the Straight-line Method, Declining Balance Method, Sum-of-the-Years-Digits Method, and Units-of-Production Method ensure accurate reflection of asset costs over their useful lives.

Amortization schedules play a significant role in loan management and cash flow. It's important to consider the total interest cost and equity growth when selecting a loan term. Categorizing expenses correctly is critical for accurate financial reporting.

Amortization differs from depreciation as it applies to intangible assets while depreciation pertains to tangible assets. Understanding the distinction is key in financial management. The amortization of intangible assets is not just an accounting practice but also a strategic tool that communicates value to stakeholders.

It ensures accurate financial disclosures and aligns with evolving standards. Overall, understanding amortization is fundamental in cost accounting for accurate reporting, informed decision-making, transparency, and optimization of financial management. Incorporating practical advice on amortization can enhance your financial management skills and drive fiscal responsibility.

Types of Amortization

Amortization is a critical financial concept, particularly when dealing with mortgage loans. It refers to the schedule of payments a borrower makes to clear a loan over time.

These payments are split between the principal, the original sum borrowed, and interest, the cost charged by the lender. A key aspect of amortization is the loan term length; a longer amortization period translates to lower monthly payments, as the repayment is spread out over more time.

However, this comes with a caveat: a lengthier loan term means paying more in interest overall. Additionally, with longer mortgages, interest payments are concentrated at the start, delaying significant reductions in the principal and the accumulation of home equity. When selecting a loan, it's essential to weigh the benefits of lower monthly payments against the total interest cost and the impact on equity growth.

Amortization expenses play a critical role in accurately reflecting the cost of intangible assets over their useful lives. The Straight-line Method, a favored approach, spreads the expense uniformly across the lifespan of the asset.

This method is akin to the steady work of building a skyscraper, ensuring a solid structure by laying one floor at a time. Alternatively, the Declining Balance Method mirrors the upfront intensive labor in construction, front-loading the expenses to reflect the asset's higher utility in the early stages.

For a more nuanced approach, the Sum-of-the-Years-Digits Method also front-loads expenses but tapers them off as the asset ages, similar to how a construction project might require intense initial capital but less over time. Lastly, the Units-of-Production Method aligns expenses with the asset's actual usage or output, much like tracking the materials used in construction to allocate costs based on actual consumption. Each of these methods ensures that the financial health of a business, as displayed on the balance sheet, remains robust and transparent, reflecting the true value of assets and the costs associated with them.

Understanding amortization is pivotal for managing a company's financial health, particularly when it comes to mortgage amortization. This process involves the gradual reduction of a loan balance through installment payments, which are allocated between the principal amount and the interest cost. A crucial aspect to consider is the loan's amortization period; extending it results in lower monthly payments, as the repayment is spread over a longer duration.

However, this also means paying more in total interest and slower equity buildup in your property. The concept of materiality plays a significant role in amortization. It's about discerning the significance of an expense in the broader context of financial statements.

As one industry expert puts it, materiality is the line between categorizing an expense with a short or long life, and between a low or high price. Efficiently managing financial records requires a strategic approach to categorize expenses either directly to the profit and loss statement or initially to the balance sheet. To optimize costs, fostering a cost-aware culture within your organization is essential.

This means integrating cost considerations into the product development cycle as a non-functional requirement and making cost management a collective responsibility. A non-functional requirement, often associated with a system's availability, performance, and reliability, should include cost to ensure comprehensive success measurement in a system's performance, especially in SaaS environments. This strategic approach to cost embeds financial prudence into every aspect of organizational operations.

The nuances of asset allocation are crucial in the financial landscape. Amortization and depreciation are two fundamental concepts that deal with spreading the cost of assets over their useful life.

Amortization pertains to intangible assets, like software development costs, which, as per IRS's Notice 2023-63, now require most expenses to be amortized, impacting 'bootstrap' software developers significantly. Depreciation, meanwhile, addresses tangible assets such as buildings and machinery.

The recent IRS clarification has made it imperative for businesses, especially startups with limited capital, to adjust their financial strategies. These startups often don't survive beyond five years, and the ability to expense their software development costs in the year they are incurred is essential for their financial management.

In the context of the broader financial discipline of accounting, understanding the difference between bookkeeping and accounting is key. Bookkeepers meticulously record the financial minutiae, while accountants analyze, interpret, and report on financial transactions to provide strategic advice.

This distinction is exemplified in the construction industry, where expenses must be correctly categorized as either immediate or balance sheet items. A balance sheet reflects a company's financial health at a specific time, highlighting assets, liabilities, and equity, whereas expenses are recorded on the income statement and represent costs incurred during a particular period. The significance of an expense item, or its materiality, can dictate whether it is expensed immediately or capitalized and amortized over time. This decision is critical for managing a company's financial records efficiently. With the ongoing expansion in industries like healthcare and semiconductors, understanding these financial concepts is more important than ever for ensuring accurate reporting and sound financial strategy.

An amortization schedule is a financial tool that provides a comprehensive view of how loan payments are allocated over time. When you secure a mortgage to purchase a home, this schedule becomes a roadmap for your repayment journey, delineating the distribution of your payments towards the loan principal and interest.

Initially, a larger portion of each payment is directed towards interest, reflecting the lender's charge for borrowing funds. However, as time progresses, this balance shifts, with a growing fraction of your installments reducing the principal amount.

This dynamic is particularly evident in long-term loans, which can extend up to 30 years, offering lower monthly payments due to the extended repayment window. Nonetheless, an extended amortization period also translates into higher cumulative interest payments, underscoring the importance of considering the total cost of borrowing. WeWork's recent financial disclosures highlight the significance of understanding such schedules, as they navigate through restructuring their debt. As a CFO, grasping the nuances of these schedules is crucial, as they not only influence cash flow management but also play a pivotal role in strategic decision-making, especially when evaluating options like renegotiating leases to optimize financial outcomes.

In the realm of financial reporting, the treatment of intangible assets such as patents, copyrights, and trademarks holds significant weight. Amortization of these intangibles is not merely a procedural entry; it represents the systematic recognition of the assets' diminishing economic benefits over time.

The intrinsic value of these assets is deeply rooted in their ability to generate future cash flows or reduce investment risks. For instance, a strong brand name may command higher cash flows, while robust management or regulatory connections might mitigate risks.

These factors need to be meticulously reflected in the amortization schedules, enhancing the precision of financial statements. The recent overhaul of IFRS 18 underscores the importance of clarity in financial disclosures, mandating new subtotals and presentation requirements in the profit or loss statement. This paradigm shift aligns with the dynamic nature of entities like Birkenstock, which, despite its age, continues to evolve and contribute materially to financial outcomes. Therefore, the amortization of intangible assets is not just an accounting practice but a strategic tool that aids in the transparent communication of an entity's sustained value to investors and stakeholders alike.

In the financial world, amortization plays a crucial role, particularly in the realm of loan management. When discussing loans, each payment by the borrower is meticulously crafted to chip away at the principal amount while also covering the interest charges.

This structured approach ensures that the loan balance is methodically reduced over the stipulated period until it is completely settled. For instance, in mortgage amortization, the borrower's installment payments are split between the principal—the initial amount borrowed—and the interest—the lender's charge for the loan.

Opting for a longer amortization period might seem beneficial due to the lower monthly outlay, but it's also true that it results in higher total interest costs over the life of the loan. Moreover, with interest payments front loaded in such arrangements, it takes longer to make a significant impact on the principal and to accumulate equity in the property. This is a key consideration when weighing loan options, particularly in the current European SME financing landscape where rising interest rates have heightened the barriers to accessing funds, especially for SMEs with limited capital and higher risk profiles.

Understanding amortization is fundamental to mastering cost accounting and ensuring the integrity of financial reporting. It allows for the systematic allocation of the cost of intangible assets across their useful lifespan, capturing the essence of their depreciating value.

This process is not merely about adherence to accounting principles but is a strategic tool that guides the interpretation of financial data, enabling informed decision-making. As businesses navigate complex industries, like construction or healthcare, where the distinction between balance sheet items and immediate expenses is pivotal, amortization becomes a critical component.

It clarifies the financial narrative by introducing rigor to the profit and loss statement, distinguishing between long-lived assets and short-term expenditures. When a company like First American Financial Corporation, with a revenue of $7.6 billion in 2022, approaches its financial reporting, it recognizes the importance of such practices for providing transparency and enhancing investor decision-making. With the adoption of new standards requiring more detailed profit subtotals, the role of amortization in presenting a true and fair view of a company's financial health becomes even more pronounced. It's not just about tracking numbers; it's about crafting a financial story that resonates with clarity and materiality, whether it's for a small construction business or a global healthcare provider.

Amortization serves as a critical financial concept that enables businesses and individuals to systematically allocate costs over a specific period. For instance, when a company secures a patent for an innovative product, the cost associated with acquiring the patent is not expensed all at once; rather, it is amortized throughout the patient's estimated useful life.

This approach reflects the gradual consumption of the patient's value over time. Similarly, the purchase price of a trademark - the symbol of a brand's identity - is spread across its useful life, allowing a business to gradually absorb the cost.

In the context of mortgages, amortization is the process by which a borrower repays a loan balance through installment payments over a predetermined term. These payments are split between the principal amount and the interest charged by the lender.

Opting for a more extended amortization period can lower monthly payments since the repayment is distributed over a more extended period. However, this can result in higher total interest costs over the loan's life and slower equity accumulation in the property, as initial payments are predominantly interest-heavy.

Additionally, social network analysis (SNA) has been used to illustrate complex systems, including the dynamics of amortization schedules. By visualizing the interactions between the components of a loan, such as principal and interest payments over time, SNA can provide valuable insights into the financial structure and implications of different amortization strategies. Moreover, unstructured data from sources like patent applications can yield insights into emerging technologies and trends. Patent analysis, which includes tracking the life cycle of patents, has become a strategic tool in forecasting technological advancements. This analysis can partially automate the process of understanding the financial implications of patents, thereby aiding strategic planning and technology management.

In conclusion, understanding amortization is crucial in cost accounting for managing intangible assets. It impacts financial health, tax liabilities, and strategic decision-making. Different methods like the Straight-line Method, Declining Balance Method, Sum-of-the-Years-Digits Method, and Units-of-Production Method ensure accurate reflection of asset costs over their useful lives.

Amortization schedules play a significant role in loan management and cash flow. It's important to consider the total interest cost and equity growth when selecting a loan term. Categorizing expenses correctly is critical for accurate financial reporting.

Amortization differs from depreciation as it applies to intangible assets while depreciation pertains to tangible assets. Understanding the distinction is key in financial management. The amortization of intangible assets is not just an accounting practice but also a strategic tool that communicates value to stakeholders.

It ensures accurate financial disclosures and aligns with evolving standards. Overall, understanding amortization is fundamental in cost accounting for accurate reporting, informed decision-making, transparency, and optimization of financial management. Incorporating practical advice on amortization can enhance your financial management skills and drive fiscal responsibility.

Amortization Methods

Amortization expenses play a critical role in accurately reflecting the cost of intangible assets over their useful lives. The Straight-line Method, a favored approach, spreads the expense uniformly across the lifespan of the asset.

This method is akin to the steady work of building a skyscraper, ensuring a solid structure by laying one floor at a time. Alternatively, the Declining Balance Method mirrors the upfront intensive labor in construction, front-loading the expenses to reflect the asset's higher utility in the early stages.

For a more nuanced approach, the Sum-of-the-Years-Digits Method also front-loads expenses but tapers them off as the asset ages, similar to how a construction project might require intense initial capital but less over time. Lastly, the Units-of-Production Method aligns expenses with the asset's actual usage or output, much like tracking the materials used in construction to allocate costs based on actual consumption. Each of these methods ensures that the financial health of a business, as displayed on the balance sheet, remains robust and transparent, reflecting the true value of assets and the costs associated with them.

Understanding amortization is pivotal for managing a company's financial health, particularly when it comes to mortgage amortization. This process involves the gradual reduction of a loan balance through installment payments, which are allocated between the principal amount and the interest cost. A crucial aspect to consider is the loan's amortization period; extending it results in lower monthly payments, as the repayment is spread over a longer duration.

However, this also means paying more in total interest and slower equity buildup in your property. The concept of materiality plays a significant role in amortization. It's about discerning the significance of an expense in the broader context of financial statements.

As one industry expert puts it, materiality is the line between categorizing an expense with a short or long life, and between a low or high price. Efficiently managing financial records requires a strategic approach to categorize expenses either directly to the profit and loss statement or initially to the balance sheet. To optimize costs, fostering a cost-aware culture within your organization is essential.

This means integrating cost considerations into the product development cycle as a non-functional requirement and making cost management a collective responsibility. A non-functional requirement, often associated with a system's availability, performance, and reliability, should include cost to ensure comprehensive success measurement in a system's performance, especially in SaaS environments. This strategic approach to cost embeds financial prudence into every aspect of organizational operations.

The nuances of asset allocation are crucial in the financial landscape. Amortization and depreciation are two fundamental concepts that deal with spreading the cost of assets over their useful life.

Amortization pertains to intangible assets, like software development costs, which, as per IRS's Notice 2023-63, now require most expenses to be amortized, impacting 'bootstrap' software developers significantly. Depreciation, meanwhile, addresses tangible assets such as buildings and machinery.

The recent IRS clarification has made it imperative for businesses, especially startups with limited capital, to adjust their financial strategies. These startups often don't survive beyond five years, and the ability to expense their software development costs in the year they are incurred is essential for their financial management.

In the context of the broader financial discipline of accounting, understanding the difference between bookkeeping and accounting is key. Bookkeepers meticulously record the financial minutiae, while accountants analyze, interpret, and report on financial transactions to provide strategic advice.

This distinction is exemplified in the construction industry, where expenses must be correctly categorized as either immediate or balance sheet items. A balance sheet reflects a company's financial health at a specific time, highlighting assets, liabilities, and equity, whereas expenses are recorded on the income statement and represent costs incurred during a particular period. The significance of an expense item, or its materiality, can dictate whether it is expensed immediately or capitalized and amortized over time. This decision is critical for managing a company's financial records efficiently. With the ongoing expansion in industries like healthcare and semiconductors, understanding these financial concepts is more important than ever for ensuring accurate reporting and sound financial strategy.

An amortization schedule is a financial tool that provides a comprehensive view of how loan payments are allocated over time. When you secure a mortgage to purchase a home, this schedule becomes a roadmap for your repayment journey, delineating the distribution of your payments towards the loan principal and interest.

Initially, a larger portion of each payment is directed towards interest, reflecting the lender's charge for borrowing funds. However, as time progresses, this balance shifts, with a growing fraction of your installments reducing the principal amount.

This dynamic is particularly evident in long-term loans, which can extend up to 30 years, offering lower monthly payments due to the extended repayment window. Nonetheless, an extended amortization period also translates into higher cumulative interest payments, underscoring the importance of considering the total cost of borrowing. WeWork's recent financial disclosures highlight the significance of understanding such schedules, as they navigate through restructuring their debt. As a CFO, grasping the nuances of these schedules is crucial, as they not only influence cash flow management but also play a pivotal role in strategic decision-making, especially when evaluating options like renegotiating leases to optimize financial outcomes.

In the realm of financial reporting, the treatment of intangible assets such as patents, copyrights, and trademarks holds significant weight. Amortization of these intangibles is not merely a procedural entry; it represents the systematic recognition of the assets' diminishing economic benefits over time.

The intrinsic value of these assets is deeply rooted in their ability to generate future cash flows or reduce investment risks. For instance, a strong brand name may command higher cash flows, while robust management or regulatory connections might mitigate risks.

These factors need to be meticulously reflected in the amortization schedules, enhancing the precision of financial statements. The recent overhaul of IFRS 18 underscores the importance of clarity in financial disclosures, mandating new subtotals and presentation requirements in the profit or loss statement. This paradigm shift aligns with the dynamic nature of entities like Birkenstock, which, despite its age, continues to evolve and contribute materially to financial outcomes. Therefore, the amortization of intangible assets is not just an accounting practice but a strategic tool that aids in the transparent communication of an entity's sustained value to investors and stakeholders alike.

In the financial world, amortization plays a crucial role, particularly in the realm of loan management. When discussing loans, each payment by the borrower is meticulously crafted to chip away at the principal amount while also covering the interest charges.

This structured approach ensures that the loan balance is methodically reduced over the stipulated period until it is completely settled. For instance, in mortgage amortization, the borrower's installment payments are split between the principal—the initial amount borrowed—and the interest—the lender's charge for the loan.

Opting for a longer amortization period might seem beneficial due to the lower monthly outlay, but it's also true that it results in higher total interest costs over the life of the loan. Moreover, with interest payments front loaded in such arrangements, it takes longer to make a significant impact on the principal and to accumulate equity in the property. This is a key consideration when weighing loan options, particularly in the current European SME financing landscape where rising interest rates have heightened the barriers to accessing funds, especially for SMEs with limited capital and higher risk profiles.

Understanding amortization is fundamental to mastering cost accounting and ensuring the integrity of financial reporting. It allows for the systematic allocation of the cost of intangible assets across their useful lifespan, capturing the essence of their depreciating value.

This process is not merely about adherence to accounting principles but is a strategic tool that guides the interpretation of financial data, enabling informed decision-making. As businesses navigate complex industries, like construction or healthcare, where the distinction between balance sheet items and immediate expenses is pivotal, amortization becomes a critical component.

It clarifies the financial narrative by introducing rigor to the profit and loss statement, distinguishing between long-lived assets and short-term expenditures. When a company like First American Financial Corporation, with a revenue of $7.6 billion in 2022, approaches its financial reporting, it recognizes the importance of such practices for providing transparency and enhancing investor decision-making. With the adoption of new standards requiring more detailed profit subtotals, the role of amortization in presenting a true and fair view of a company's financial health becomes even more pronounced. It's not just about tracking numbers; it's about crafting a financial story that resonates with clarity and materiality, whether it's for a small construction business or a global healthcare provider.

Amortization serves as a critical financial concept that enables businesses and individuals to systematically allocate costs over a specific period. For instance, when a company secures a patent for an innovative product, the cost associated with acquiring the patent is not expensed all at once; rather, it is amortized throughout the patient's estimated useful life.

This approach reflects the gradual consumption of the patient's value over time. Similarly, the purchase price of a trademark - the symbol of a brand's identity - is spread across its useful life, allowing a business to gradually absorb the cost.

In the context of mortgages, amortization is the process by which a borrower repays a loan balance through installment payments over a predetermined term. These payments are split between the principal amount and the interest charged by the lender.

Opting for a more extended amortization period can lower monthly payments since the repayment is distributed over a more extended period. However, this can result in higher total interest costs over the loan's life and slower equity accumulation in the property, as initial payments are predominantly interest-heavy.

Additionally, social network analysis (SNA) has been used to illustrate complex systems, including the dynamics of amortization schedules. By visualizing the interactions between the components of a loan, such as principal and interest payments over time, SNA can provide valuable insights into the financial structure and implications of different amortization strategies. Moreover, unstructured data from sources like patent applications can yield insights into emerging technologies and trends. Patent analysis, which includes tracking the life cycle of patents, has become a strategic tool in forecasting technological advancements. This analysis can partially automate the process of understanding the financial implications of patents, thereby aiding strategic planning and technology management.

In conclusion, understanding amortization is crucial in cost accounting for managing intangible assets. It impacts financial health, tax liabilities, and strategic decision-making. Different methods like the Straight-line Method, Declining Balance Method, Sum-of-the-Years-Digits Method, and Units-of-Production Method ensure accurate reflection of asset costs over their useful lives.

Amortization schedules play a significant role in loan management and cash flow. It's important to consider the total interest cost and equity growth when selecting a loan term. Categorizing expenses correctly is critical for accurate financial reporting.

Amortization differs from depreciation as it applies to intangible assets while depreciation pertains to tangible assets. Understanding the distinction is key in financial management. The amortization of intangible assets is not just an accounting practice but also a strategic tool that communicates value to stakeholders.

It ensures accurate financial disclosures and aligns with evolving standards. Overall, understanding amortization is fundamental in cost accounting for accurate reporting, informed decision-making, transparency, and optimization of financial management. Incorporating practical advice on amortization can enhance your financial management skills and drive fiscal responsibility.

How to Calculate Amortization

Understanding amortization is pivotal for managing a company's financial health, particularly when it comes to mortgage amortization. This process involves the gradual reduction of a loan balance through installment payments, which are allocated between the principal amount and the interest cost. A crucial aspect to consider is the loan's amortization period; extending it results in lower monthly payments, as the repayment is spread over a longer duration.

However, this also means paying more in total interest and slower equity buildup in your property. The concept of materiality plays a significant role in amortization. It's about discerning the significance of an expense in the broader context of financial statements.

As one industry expert puts it, materiality is the line between categorizing an expense with a short or long life, and between a low or high price. Efficiently managing financial records requires a strategic approach to categorize expenses either directly to the profit and loss statement or initially to the balance sheet. To optimize costs, fostering a cost-aware culture within your organization is essential.

This means integrating cost considerations into the product development cycle as a non-functional requirement and making cost management a collective responsibility. A non-functional requirement, often associated with a system's availability, performance, and reliability, should include cost to ensure comprehensive success measurement in a system's performance, especially in SaaS environments. This strategic approach to cost embeds financial prudence into every aspect of organizational operations.

The nuances of asset allocation are crucial in the financial landscape. Amortization and depreciation are two fundamental concepts that deal with spreading the cost of assets over their useful life.

Amortization pertains to intangible assets, like software development costs, which, as per IRS's Notice 2023-63, now require most expenses to be amortized, impacting 'bootstrap' software developers significantly. Depreciation, meanwhile, addresses tangible assets such as buildings and machinery.

The recent IRS clarification has made it imperative for businesses, especially startups with limited capital, to adjust their financial strategies. These startups often don't survive beyond five years, and the ability to expense their software development costs in the year they are incurred is essential for their financial management.

In the context of the broader financial discipline of accounting, understanding the difference between bookkeeping and accounting is key. Bookkeepers meticulously record the financial minutiae, while accountants analyze, interpret, and report on financial transactions to provide strategic advice.

This distinction is exemplified in the construction industry, where expenses must be correctly categorized as either immediate or balance sheet items. A balance sheet reflects a company's financial health at a specific time, highlighting assets, liabilities, and equity, whereas expenses are recorded on the income statement and represent costs incurred during a particular period. The significance of an expense item, or its materiality, can dictate whether it is expensed immediately or capitalized and amortized over time. This decision is critical for managing a company's financial records efficiently. With the ongoing expansion in industries like healthcare and semiconductors, understanding these financial concepts is more important than ever for ensuring accurate reporting and sound financial strategy.

An amortization schedule is a financial tool that provides a comprehensive view of how loan payments are allocated over time. When you secure a mortgage to purchase a home, this schedule becomes a roadmap for your repayment journey, delineating the distribution of your payments towards the loan principal and interest.

Initially, a larger portion of each payment is directed towards interest, reflecting the lender's charge for borrowing funds. However, as time progresses, this balance shifts, with a growing fraction of your installments reducing the principal amount.

This dynamic is particularly evident in long-term loans, which can extend up to 30 years, offering lower monthly payments due to the extended repayment window. Nonetheless, an extended amortization period also translates into higher cumulative interest payments, underscoring the importance of considering the total cost of borrowing. WeWork's recent financial disclosures highlight the significance of understanding such schedules, as they navigate through restructuring their debt. As a CFO, grasping the nuances of these schedules is crucial, as they not only influence cash flow management but also play a pivotal role in strategic decision-making, especially when evaluating options like renegotiating leases to optimize financial outcomes.

In the realm of financial reporting, the treatment of intangible assets such as patents, copyrights, and trademarks holds significant weight. Amortization of these intangibles is not merely a procedural entry; it represents the systematic recognition of the assets' diminishing economic benefits over time.

The intrinsic value of these assets is deeply rooted in their ability to generate future cash flows or reduce investment risks. For instance, a strong brand name may command higher cash flows, while robust management or regulatory connections might mitigate risks.

These factors need to be meticulously reflected in the amortization schedules, enhancing the precision of financial statements. The recent overhaul of IFRS 18 underscores the importance of clarity in financial disclosures, mandating new subtotals and presentation requirements in the profit or loss statement. This paradigm shift aligns with the dynamic nature of entities like Birkenstock, which, despite its age, continues to evolve and contribute materially to financial outcomes. Therefore, the amortization of intangible assets is not just an accounting practice but a strategic tool that aids in the transparent communication of an entity's sustained value to investors and stakeholders alike.

In the financial world, amortization plays a crucial role, particularly in the realm of loan management. When discussing loans, each payment by the borrower is meticulously crafted to chip away at the principal amount while also covering the interest charges.

This structured approach ensures that the loan balance is methodically reduced over the stipulated period until it is completely settled. For instance, in mortgage amortization, the borrower's installment payments are split between the principal—the initial amount borrowed—and the interest—the lender's charge for the loan.

Opting for a longer amortization period might seem beneficial due to the lower monthly outlay, but it's also true that it results in higher total interest costs over the life of the loan. Moreover, with interest payments front loaded in such arrangements, it takes longer to make a significant impact on the principal and to accumulate equity in the property. This is a key consideration when weighing loan options, particularly in the current European SME financing landscape where rising interest rates have heightened the barriers to accessing funds, especially for SMEs with limited capital and higher risk profiles.

Understanding amortization is fundamental to mastering cost accounting and ensuring the integrity of financial reporting. It allows for the systematic allocation of the cost of intangible assets across their useful lifespan, capturing the essence of their depreciating value.

This process is not merely about adherence to accounting principles but is a strategic tool that guides the interpretation of financial data, enabling informed decision-making. As businesses navigate complex industries, like construction or healthcare, where the distinction between balance sheet items and immediate expenses is pivotal, amortization becomes a critical component.

It clarifies the financial narrative by introducing rigor to the profit and loss statement, distinguishing between long-lived assets and short-term expenditures. When a company like First American Financial Corporation, with a revenue of $7.6 billion in 2022, approaches its financial reporting, it recognizes the importance of such practices for providing transparency and enhancing investor decision-making. With the adoption of new standards requiring more detailed profit subtotals, the role of amortization in presenting a true and fair view of a company's financial health becomes even more pronounced. It's not just about tracking numbers; it's about crafting a financial story that resonates with clarity and materiality, whether it's for a small construction business or a global healthcare provider.

Amortization serves as a critical financial concept that enables businesses and individuals to systematically allocate costs over a specific period. For instance, when a company secures a patent for an innovative product, the cost associated with acquiring the patent is not expensed all at once; rather, it is amortized throughout the patient's estimated useful life.

This approach reflects the gradual consumption of the patient's value over time. Similarly, the purchase price of a trademark - the symbol of a brand's identity - is spread across its useful life, allowing a business to gradually absorb the cost.

In the context of mortgages, amortization is the process by which a borrower repays a loan balance through installment payments over a predetermined term. These payments are split between the principal amount and the interest charged by the lender.

Opting for a more extended amortization period can lower monthly payments since the repayment is distributed over a more extended period. However, this can result in higher total interest costs over the loan's life and slower equity accumulation in the property, as initial payments are predominantly interest-heavy.

Additionally, social network analysis (SNA) has been used to illustrate complex systems, including the dynamics of amortization schedules. By visualizing the interactions between the components of a loan, such as principal and interest payments over time, SNA can provide valuable insights into the financial structure and implications of different amortization strategies. Moreover, unstructured data from sources like patent applications can yield insights into emerging technologies and trends. Patent analysis, which includes tracking the life cycle of patents, has become a strategic tool in forecasting technological advancements. This analysis can partially automate the process of understanding the financial implications of patents, thereby aiding strategic planning and technology management.

In conclusion, understanding amortization is crucial in cost accounting for managing intangible assets. It impacts financial health, tax liabilities, and strategic decision-making. Different methods like the Straight-line Method, Declining Balance Method, Sum-of-the-Years-Digits Method, and Units-of-Production Method ensure accurate reflection of asset costs over their useful lives.

Amortization schedules play a significant role in loan management and cash flow. It's important to consider the total interest cost and equity growth when selecting a loan term. Categorizing expenses correctly is critical for accurate financial reporting.

Amortization differs from depreciation as it applies to intangible assets while depreciation pertains to tangible assets. Understanding the distinction is key in financial management. The amortization of intangible assets is not just an accounting practice but also a strategic tool that communicates value to stakeholders.

It ensures accurate financial disclosures and aligns with evolving standards. Overall, understanding amortization is fundamental in cost accounting for accurate reporting, informed decision-making, transparency, and optimization of financial management. Incorporating practical advice on amortization can enhance your financial management skills and drive fiscal responsibility.

Amortization vs. Depreciation

The nuances of asset allocation are crucial in the financial landscape. Amortization and depreciation are two fundamental concepts that deal with spreading the cost of assets over their useful life.

Amortization pertains to intangible assets, like software development costs, which, as per IRS's Notice 2023-63, now require most expenses to be amortized, impacting 'bootstrap' software developers significantly. Depreciation, meanwhile, addresses tangible assets such as buildings and machinery.

The recent IRS clarification has made it imperative for businesses, especially startups with limited capital, to adjust their financial strategies. These startups often don't survive beyond five years, and the ability to expense their software development costs in the year they are incurred is essential for their financial management.

In the context of the broader financial discipline of accounting, understanding the difference between bookkeeping and accounting is key. Bookkeepers meticulously record the financial minutiae, while accountants analyze, interpret, and report on financial transactions to provide strategic advice.

This distinction is exemplified in the construction industry, where expenses must be correctly categorized as either immediate or balance sheet items. A balance sheet reflects a company's financial health at a specific time, highlighting assets, liabilities, and equity, whereas expenses are recorded on the income statement and represent costs incurred during a particular period. The significance of an expense item, or its materiality, can dictate whether it is expensed immediately or capitalized and amortized over time. This decision is critical for managing a company's financial records efficiently. With the ongoing expansion in industries like healthcare and semiconductors, understanding these financial concepts is more important than ever for ensuring accurate reporting and sound financial strategy.

An amortization schedule is a financial tool that provides a comprehensive view of how loan payments are allocated over time. When you secure a mortgage to purchase a home, this schedule becomes a roadmap for your repayment journey, delineating the distribution of your payments towards the loan principal and interest.

Initially, a larger portion of each payment is directed towards interest, reflecting the lender's charge for borrowing funds. However, as time progresses, this balance shifts, with a growing fraction of your installments reducing the principal amount.

This dynamic is particularly evident in long-term loans, which can extend up to 30 years, offering lower monthly payments due to the extended repayment window. Nonetheless, an extended amortization period also translates into higher cumulative interest payments, underscoring the importance of considering the total cost of borrowing. WeWork's recent financial disclosures highlight the significance of understanding such schedules, as they navigate through restructuring their debt. As a CFO, grasping the nuances of these schedules is crucial, as they not only influence cash flow management but also play a pivotal role in strategic decision-making, especially when evaluating options like renegotiating leases to optimize financial outcomes.

In the realm of financial reporting, the treatment of intangible assets such as patents, copyrights, and trademarks holds significant weight. Amortization of these intangibles is not merely a procedural entry; it represents the systematic recognition of the assets' diminishing economic benefits over time.

The intrinsic value of these assets is deeply rooted in their ability to generate future cash flows or reduce investment risks. For instance, a strong brand name may command higher cash flows, while robust management or regulatory connections might mitigate risks.

These factors need to be meticulously reflected in the amortization schedules, enhancing the precision of financial statements. The recent overhaul of IFRS 18 underscores the importance of clarity in financial disclosures, mandating new subtotals and presentation requirements in the profit or loss statement. This paradigm shift aligns with the dynamic nature of entities like Birkenstock, which, despite its age, continues to evolve and contribute materially to financial outcomes. Therefore, the amortization of intangible assets is not just an accounting practice but a strategic tool that aids in the transparent communication of an entity's sustained value to investors and stakeholders alike.

In the financial world, amortization plays a crucial role, particularly in the realm of loan management. When discussing loans, each payment by the borrower is meticulously crafted to chip away at the principal amount while also covering the interest charges.

This structured approach ensures that the loan balance is methodically reduced over the stipulated period until it is completely settled. For instance, in mortgage amortization, the borrower's installment payments are split between the principal—the initial amount borrowed—and the interest—the lender's charge for the loan.

Opting for a longer amortization period might seem beneficial due to the lower monthly outlay, but it's also true that it results in higher total interest costs over the life of the loan. Moreover, with interest payments front loaded in such arrangements, it takes longer to make a significant impact on the principal and to accumulate equity in the property. This is a key consideration when weighing loan options, particularly in the current European SME financing landscape where rising interest rates have heightened the barriers to accessing funds, especially for SMEs with limited capital and higher risk profiles.

Understanding amortization is fundamental to mastering cost accounting and ensuring the integrity of financial reporting. It allows for the systematic allocation of the cost of intangible assets across their useful lifespan, capturing the essence of their depreciating value.

This process is not merely about adherence to accounting principles but is a strategic tool that guides the interpretation of financial data, enabling informed decision-making. As businesses navigate complex industries, like construction or healthcare, where the distinction between balance sheet items and immediate expenses is pivotal, amortization becomes a critical component.