Introduction

Amortization is a crucial concept in accounting that enables businesses to spread the cost of an intangible asset or a loan over a specified timeframe. This systematic expense allocation helps reduce the asset's book value or pay off a loan in manageable installments. Understanding amortization is imperative for businesses as it ensures accurate representation of asset values in financial statements and aids in managing loan repayments efficiently.

With recent amendments to Section 174 of the US tax law, which disallow immediate expensing of software development costs, the importance of analyzing financial activities has become even more critical. Prioritizing expenditures and understanding the intricacies of amortization are proactive steps in financial management, especially in light of potential legislative changes. In this dynamic economic landscape, where legislation and market conditions fluctuate, the role of amortization in financial strategy cannot be overstated.

It is not just a matter of compliance but a strategic tool that can influence a company's financial stability and long-term success.

What is Amortization?

Amortization is a crucial concept in accounting that enables a business to spread the cost of an intangible asset or a loan over a specified timeframe. This systematic expense allocation helps in reducing the asset's book value or paying off a loan in manageable installments. It's imperative for businesses to comprehend amortization, as it ensures that financial statements accurately represent the company's asset values and aids in managing loan repayments efficiently.

For instance, take the case of a software company that must now navigate the complexities introduced by amendments to Section 174 of the US tax law. This change disallows immediate expensing of software development costs, including labor. Previously, companies like 'Acme Corp.'—a hypothetical SaaS business with $1,000,000 in annual revenue—could deduct these costs in the year they were incurred.

The shift to capitalizing these expenses and amortizing them over several years is a significant departure from global norms and has led to unexpected tax liabilities for many.

This unexpected tax burden underscores the importance of a thorough analysis of all financial activities, as advised by industry experts. Prioritizing expenditures in alignment with strategic objectives while eliminating or deferring non-essential costs is a proactive step in financial management. Moreover, understanding the intricacies of amortization becomes even more critical in light of potential legislative changes, such as the 'Tax Relief for American Families and Workers Act of 2024,' which may impact the deductibility of business interest expenses and other financial practices.

To ensure a balanced approach, businesses must recognize the material significance of each expense in their financial statements. The decision of whether to charge an expense directly to the profit and loss statement or to capitalize it on the balance sheet is a strategic one that affects the company's reported financial health.

In conclusion, as we navigate a dynamic economic landscape where legislation and market conditions fluctuate, the role of amortization in financial strategy cannot be overstated. It is not just a matter of compliance, but a strategic tool that can influence a company's financial stability and long-term success.

Types of Amortization

Amortization is a vital concept in financial management, serving as a strategy to allocate the cost of an asset over its useful life. Understanding the intricacies of amortization can have significant implications for a company's income statement and overall financial health.

Intangible assets such as patents, copyrights, trademarks, and goodwill are pivotal to businesses, especially in today's knowledge economy. For instance, brands hold immense value, and their strength is often gauged by metrics such as marketing investment and stakeholder equity. When acquired, the costs of these assets are not expensed immediately.

Instead, they are amortized, ensuring the expense aligns with the benefits accrued over time. This method reflects the gradual consumption of the asset's economic value, offering a clearer financial picture. One striking example of brand valuation is Kraft Heinz's significant asset write-down, which raised questions about the enduring power of 'Big Food' trademarks.

On the other side of the amortization spectrum are loan repayments. Businesses frequently finance operations or expansions through loans, leading to regular payments composed of principal and interest. These repayments are structured so that over the loan's term, the balance decreases, a process known as loan amortization.

This systematic approach to debt reduction helps businesses manage cash flow and forecast future financial obligations. For instance, the European Investment Bank (EIB) and Almi are known to support businesses with such financial structures, enabling sustainable growth and development.

In practice, amortization affects a company's financial statements by consistently spreading costs, which can impact reported earnings and tax liabilities. It's crucial for businesses to manage these expenses judiciously, as they play a significant role in the organization's financial trajectory, akin to an individual's economic lifecycle that transitions from consumption to savings accumulation.

As companies navigate their financial journey, understanding and properly accounting for amortization expenses is essential for accurate financial reporting and strategic decision-making. It's a testament to the adage that in business, as in life, it's not just what you earn but also how you allocate your resources that determines your success.

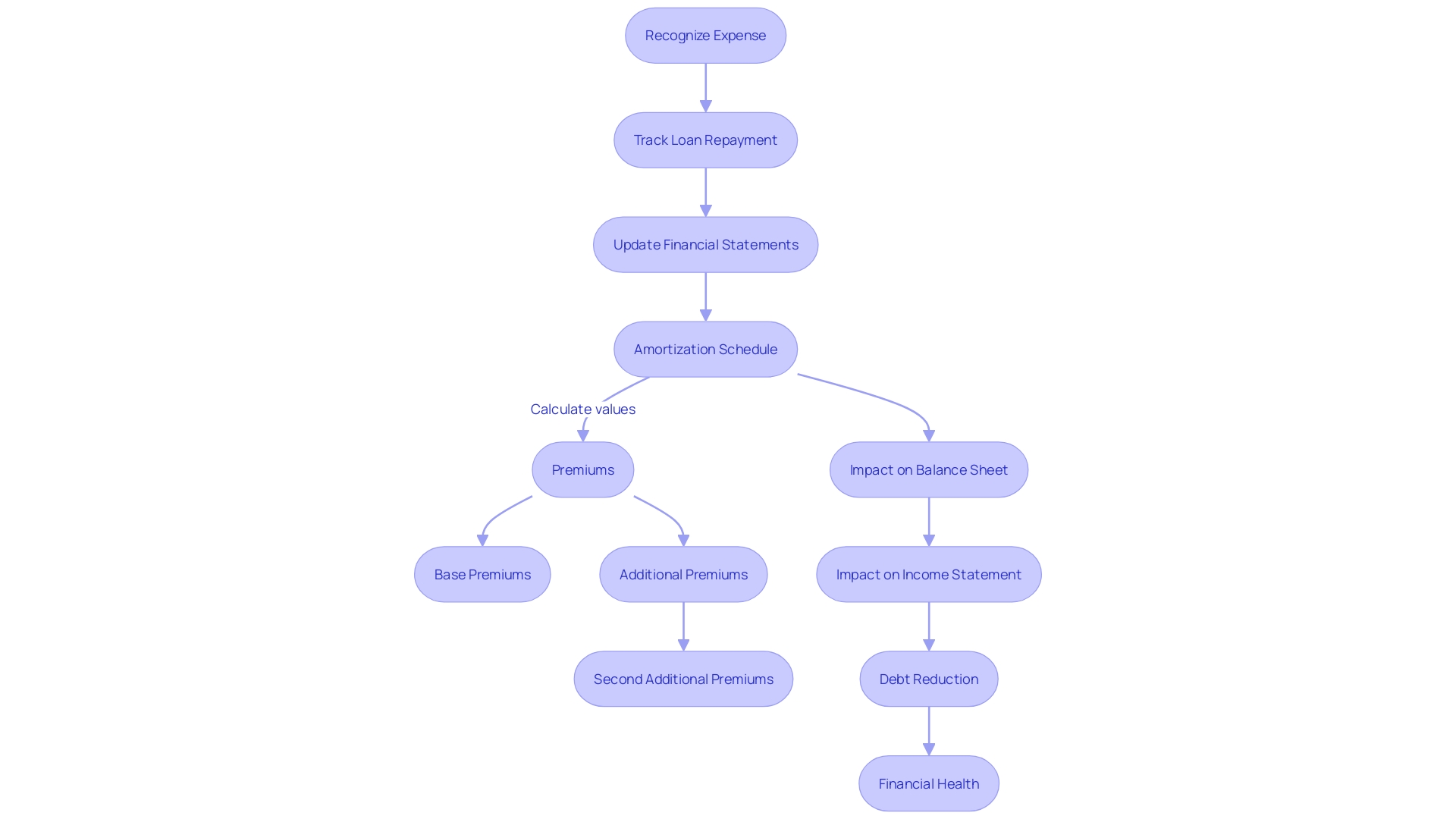

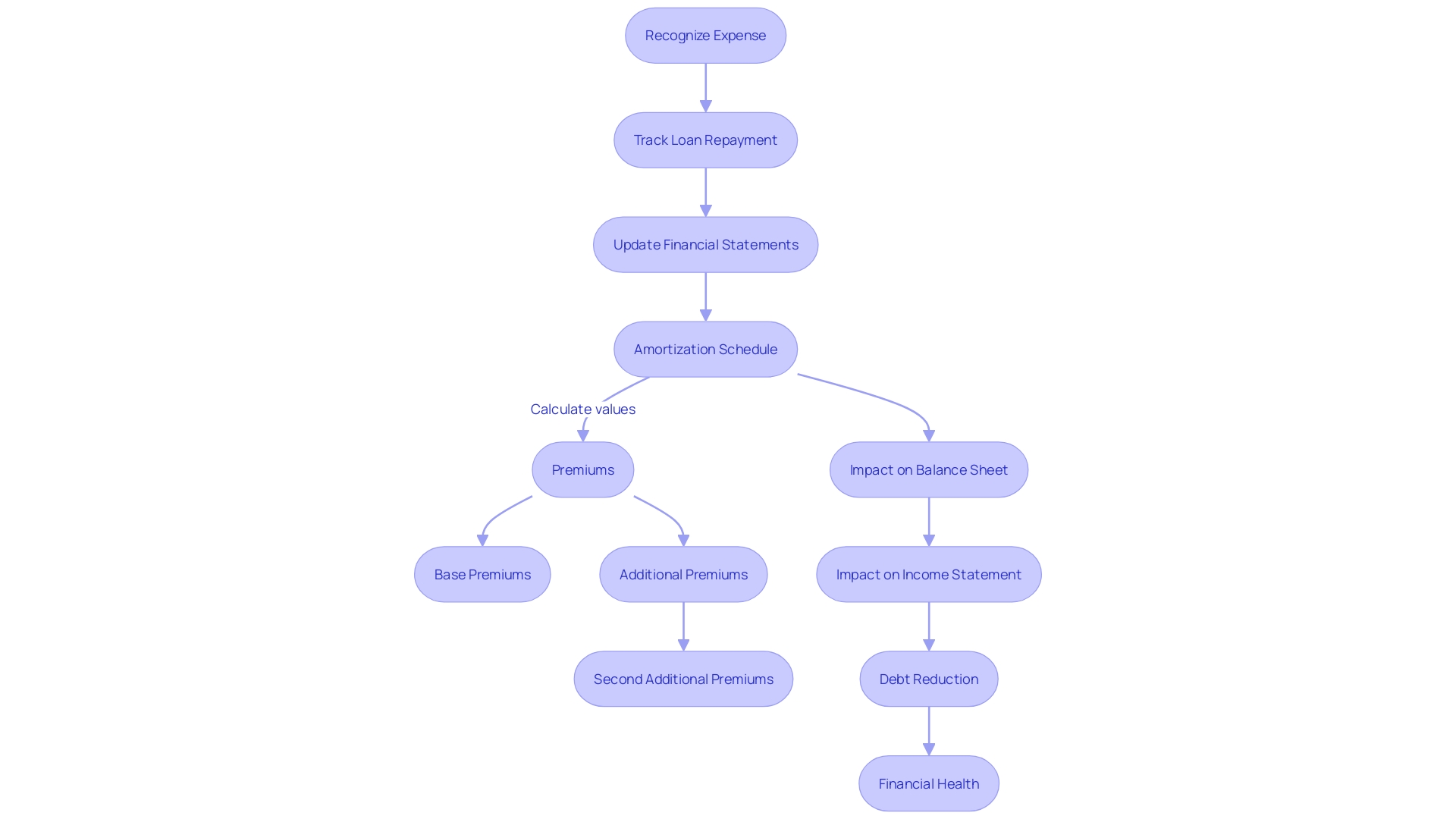

Creating an Amortization Schedule

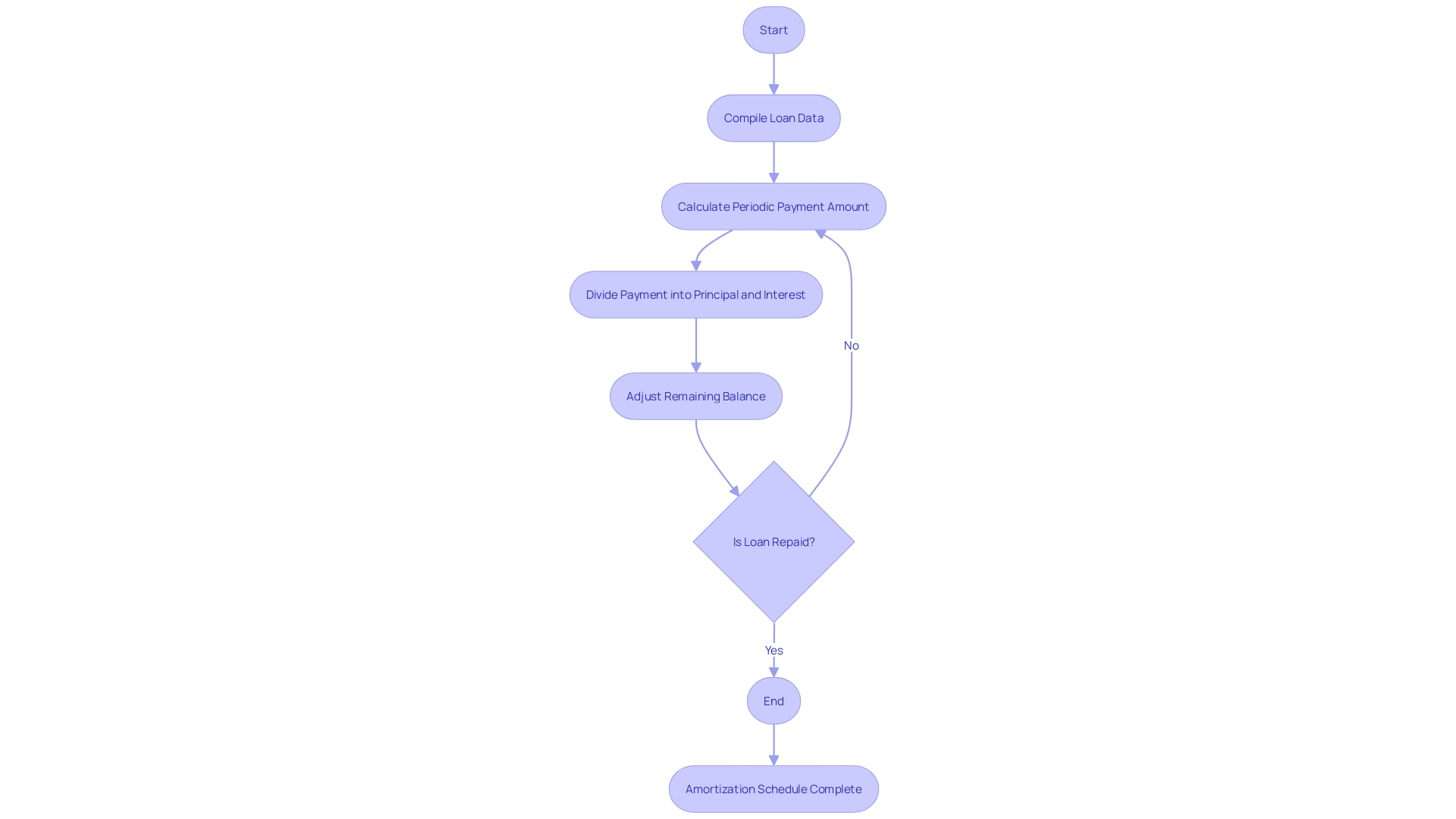

Creating an amortization schedule is a strategic move for managing the financial trajectory of long-term assets or loans. This schedule serves as a comprehensive ledger, detailing each payment and its specific application toward the principal and interest. To craft an effective amortization schedule, begin by compiling the vital data: the amount of the loan or the cost of the asset, the interest rate, the term of the loan, or the projected lifespan and salvage value of the asset.

Next, calculate the periodic payment amount using either manual formulas or online calculators tailored for these financial determinations. Subsequently, divide each payment into its principal and interest portions, adhering to the established amortization formula. With each payment cycle, the remaining balance is adjusted by deducting the principal paid from the outstanding balance, thus yielding the updated amount due.

This iterative process continues until the loan is completely repaid or the asset is fully depreciated, offering clear visibility into the financial journey of the asset or loan within the broader spectrum of your business's financial statements.

Amortizing expenses can substantially influence a company's financial reporting and tax obligations. Whether an expense is immediately taken to the profit and loss statement or first recorded on the balance sheet can have material consequences. This is particularly relevant in industries where the cost of assets can vary significantly, necessitating judicious financial strategies to optimize tax positions and comply with accounting standards.

A well-maintained amortization schedule not only enhances transparency and accuracy in financial management but also fortifies the company's compliance framework. Additionally, such meticulous financial tracking is instrumental for businesses in articulating clear, numerical communication with CPAs and other financial stakeholders, ensuring precision in financial reporting.

In the ever-evolving landscape of business operations, adhering to a robust expense policy and maintaining an effective amortization schedule is crucial. This systematic approach to financial management can result in more strategic decision-making and ultimately bolster the financial health and competitive edge of a business.

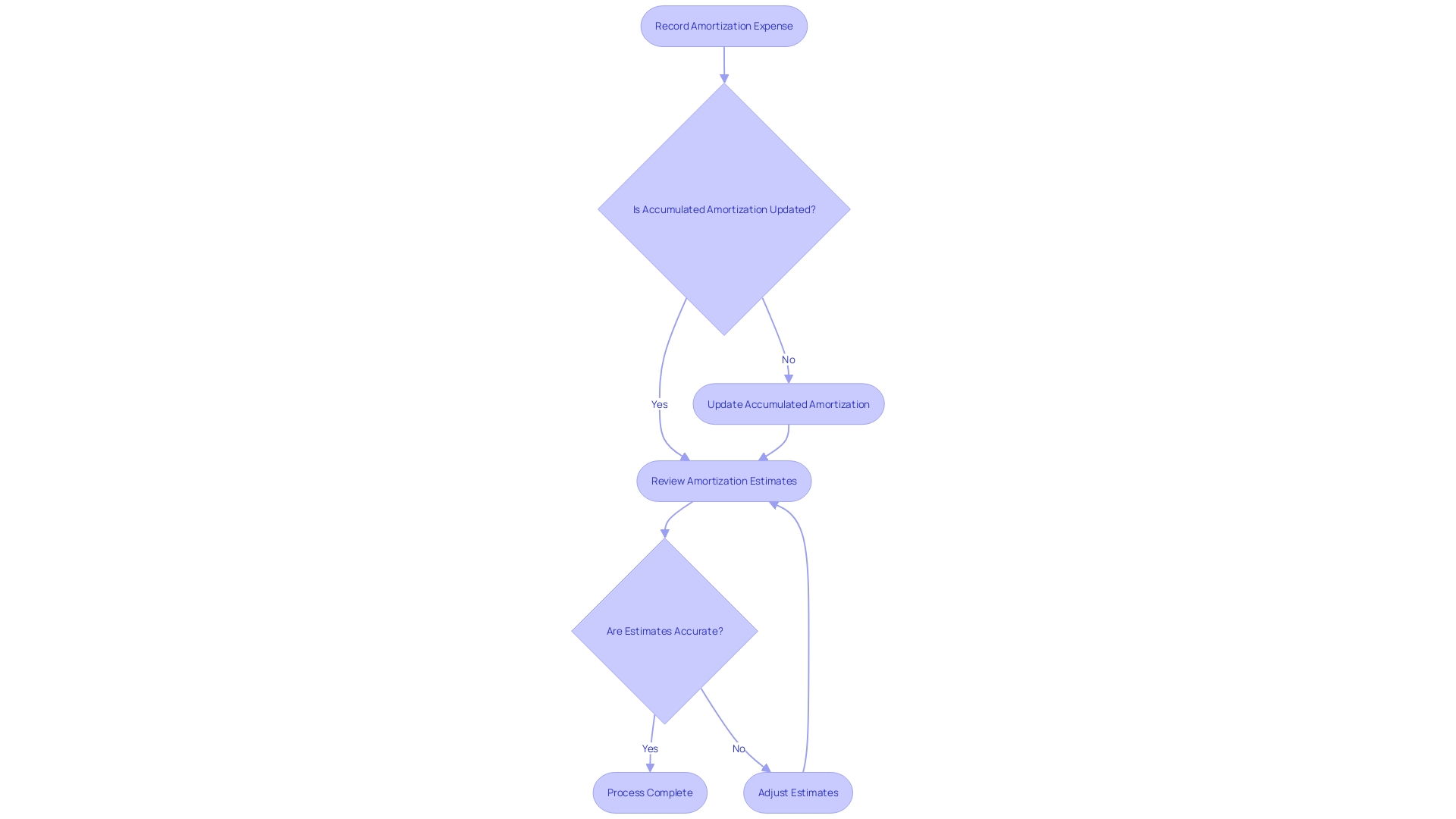

Accounting for Amortization

To ensure that financial statements accurately represent a company's fiscal health, it's essential to meticulously account for amortization expenses. This process involves several critical steps:

-

Recording Amortization Expenses: For each accounting period, it's necessary to document the amortization expense on the income statement. This reflects the proportion of the asset's value that has been utilized during the period and affects the effective tax rate. As businesses are increasingly scrutinized for how deductions and credits affect their reported tax rates, accurate expense recording is more vital than ever.

-

Updating Accumulated Amortization: The balance sheet should feature an "accumulated amortization" account that aggregates the total recognized amortization expense over the asset's lifespan. This account is a testament to the asset's diminishing value and aids in presenting a transparent picture to stakeholders and investors.

-

Reviewing and Adjusting Estimates: Regularly re-evaluating the estimated useful life of assets is crucial. Any adjustments to the amortization period may be necessary due to changes in economic conditions or how the assets are utilized, which could subsequently influence the amortization expense.

For software companies, particularly those that are bootstrapped, the importance of these steps is heightened. Recent changes in Section 174 of the US tax law have made it so that R&D costs, including software development, must be amortized. This increases the complexity of managing a lean operation, making careful accounting even more significant.

In the broader context of asset management, the introduction of new rules by the Financial Accounting Standards Board regarding cryptocurrency accounting and disclosure is indicative of the evolving nature of asset classification and the importance of recognized expense management. The transition to Fair Value Accounting for assets like Bitcoin will likely impact how organizations report their financial condition and manage their intangible assets.

By adhering to these practices, companies can maintain compliance with financial reporting standards and present a true representation of their financial standing, which is essential for making informed business decisions.

Amortization vs. Depreciation

Amortization and depreciation serve a similar purpose in the accounting world, yet they apply to distinct asset classes. Amortization is reserved for intangible assets, such as patents or software, whereas depreciation is concerned with tangible assets, namely buildings, equipment, and vehicles. The essence of both processes is to distribute the cost of an asset over its expected useful life, a reflection of its diminishing value or functionality over time.

To illustrate, consider a company car on a 36-month lease: the vehicle's value decreases or depreciates as it's used, akin to how a loan diminishes as payments are made against the principal. Similarly, in real estate investment, an investor can take advantage of bonus depreciation to deduct a substantial part of a property's cost in the first year, reducing taxable income while not depleting cash flow. WeWork's financial restructuring, which includes renegotiating leases, also highlights the importance of managing amortization and depreciation, as they greatly affect a company’s financial agility.

Understanding these concepts is crucial for accurate financial reporting and strategic planning, as they ensure the balance between assets, liabilities, and equity, and affect cash flow, tax deductions, and the overall financial health of a business.

Tax Implications of Amortization

Amortization expenses, while often considered a straightforward deduction, can carry nuanced tax implications depending on the jurisdiction. A poignant example is the shift in U.S. tax law, specifically Section 174, which upended the financial strategies of many software companies. This modification, initially unforeseen by many, disallowed immediate expensing of research and development costs, including software development labor, mandating these costs be capitalized and amortized over time.

The implications were profound, particularly for bootstrapped businesses, which faced the brunt of the financial impact due to their reliance on continual innovation and development. Software development activities, as clarified by the IRS, range from planning and design to coding and testing. This broad definition means a significant portion of a tech company's operations could be subject to the new rules.

The sudden onset of these changes, compounded by a lack of timely advisement from accountants, led to unexpectedly high tax bills for many businesses. The IRS's detailed guidelines underscore the importance of diligent tax planning and understanding the full scope of activities considered as R&D under the new law. In light of these complexities, consulting with a tax professional is not just advisable but essential to navigate the intricate landscape of amortization and its tax consequences effectively.

Examples and Practical Applications

Amortization is a fundamental financial concept that affects both tangible and intangible assets. Understanding it is crucial for any business to manage its financial health effectively. Let's take a closer look through practical examples:

-

Consider a company, XYZ, that has invested $100,000 in acquiring a patent. The patient's life expectancy is 10 years. Using the straight-line method of amortization, XYZ would recognize an annual amortization expense of $10,000. This means that every year, the company's income statement will reflect $10,000 less in profits due to this non-cash expense, impacting the net income and providing a clearer picture of the company's financial position.

-

Now, imagine Business ABC that has taken out a $500,000 loan at a 5% annual interest rate, repayable over 5 years. An amortization schedule is critical here as it breaks down each payment into interest and principal components, showing a decrease in the loan balance over the loan's life. This schedule helps ABC manage cash flow, which is especially important in times when companies across various industries, like real estate and construction, are facing cash flow problems and longer receivable collection periods, as recent financial analyses have revealed.

These examples highlight how amortization schedules not only aid in tracking the reduction of debt over time but also provide insights into managing operational needs and long-term financial goals. Such detailed financial planning is essential, particularly in a challenging economic environment where interest rates are rising, and companies are navigating tighter borrowing constraints.

In light of these complexities, companies are increasingly leveraging data platforms and analytical tools. For instance, technologies like the Check Data Platform enable organizations to perform comprehensive analyses, ranging from marketing campaign effectiveness to fraud detection, which in turn can drive strategic decisions and feature improvements.

In conclusion, the practical application of amortization, whether it's spreading out the cost of an intangible asset or managing loan repayments, is a testament to its importance in financial strategy and operations. As companies face evolving economic conditions, the ability to understand and apply these financial principles becomes even more critical in steering a company towards financial stability and growth.

Common Mistakes and Considerations

Amortization expenses play a crucial role in financial reporting and tax planning for businesses. To manage them effectively, companies must diligently update their amortization schedules. This is to accommodate changes in payment terms, interest rates, or the valuation of assets.

A precise allocation of payments between the principal and interest is equally important to ensure that loan balances or asset values are correctly reflected in the books.

Errors in estimating the useful life of assets can lead to inaccurate amortization expenses. Regular reviews and adjustments to these estimates are necessary to align with any changes affecting asset utilization or value. Moreover, compliance with accounting standards is non-negotiable.

Adhering to these regulations guarantees transparency and accuracy in financial reporting.

Tax strategies, such as leveraging Section 179 deductions for immediate expensing of qualifying purchases, can provide significant tax relief. However, the IRS's recent clarification on software development expensing requires most related expenses to be amortized, presenting challenges for software developers who rely heavily on these deductions for financial viability. Furthermore, with the Tax Cuts and Jobs Act limiting the deductibility of business interest expense, businesses, especially in real estate, must navigate these constraints wisely to optimize their tax positions.

In the ever-evolving landscape of financial management, it's imperative to stay informed and adapt to new regulations and standards. For instance, the proposed 'Tax Relief for American Families and Workers Act of 2024' may bring changes that could affect current tax strategies. Keeping abreast of these developments and understanding their implications on amortization and depreciation will enable businesses to maintain robust financial health and strategically manage their tax liabilities.

Conclusion

In conclusion, amortization plays a crucial role in accounting and financial management for businesses. It allows for the spreading of costs over time, ensuring accurate representation of asset values and efficient loan repayments. Understanding and prioritizing amortization are proactive steps in financial strategy, especially in the face of potential legislative changes.

Amortization serves as a strategic tool for allocating the cost of assets, both tangible and intangible, over their useful life. Proper management of these expenses impacts a company's financial health and income statement.

Creating an effective amortization schedule is essential for managing long-term assets or loans. It provides a comprehensive record of each payment, ensuring transparency and accuracy in financial management.

Accurate accounting for amortization expenses is vital for financial reporting. It involves recording expenses, updating accumulated amortization, and reviewing estimates to align with changes in asset utilization or value. Consulting with tax professionals is crucial, considering recent tax law amendments and their impact on software development expenses.

Practical examples demonstrate the significance of amortization in financial strategy and operations. It aids in tracking debt reduction, managing operational needs, and achieving long-term financial goals.

To manage amortization effectively, companies should update schedules, ensure proper allocation of payments, and stay informed about accounting standards and regulations. By doing so, businesses can maintain financial health and strategically manage tax liabilities.

In summary, amortization is a critical tool for businesses to manage costs, accurately report financial information, and navigate changing economic conditions. Understanding and implementing amortization principles are essential for long-term financial stability and success.