Introduction

In the realm of financial analysis, the accounts payable turnover ratio emerges as a crucial metric, reflecting a firm's adeptness in clearing its accounts payable. This article will explain what the accounts payable turnover ratio is, why it is important, how to calculate it, and how to interpret the ratio. Additionally, it will explore the factors influencing the ratio, strategies to improve it, and common mistakes and drawbacks to avoid.

By understanding and leveraging this financial metric, CFOs and finance professionals can make informed decisions and drive operational efficiency in managing cash flow and supplier engagements.

In the realm of financial analysis, the accounts payable turnover ratio emerges as a crucial metric, reflecting a firm's adeptness in clearing its accounts payable. This ratio measures the frequency within a stipulated timeframe—commonly annual—during which an entity settles its payable accounts. The effective management of this aspect is telling of a company's strategic financial health, relating directly to cash flow management and the balancing act between liquid funds and outstanding debts.

It's essential to discern the distinction between cash flow and profits, whereby cash flow depicts the liquidity aspect necessary for the day-to-day functioning of a business, and profit is the residual earnings post settling all dues. A meticulous reevaluation of spending, aligning with an organization's goals, is foundational to enhancing this ratio. Additionally, understanding and applying financial ratios create a transparent benchmarking system, indispensable for gauging a company's fiscal well-being when pitted against its contemporaries.

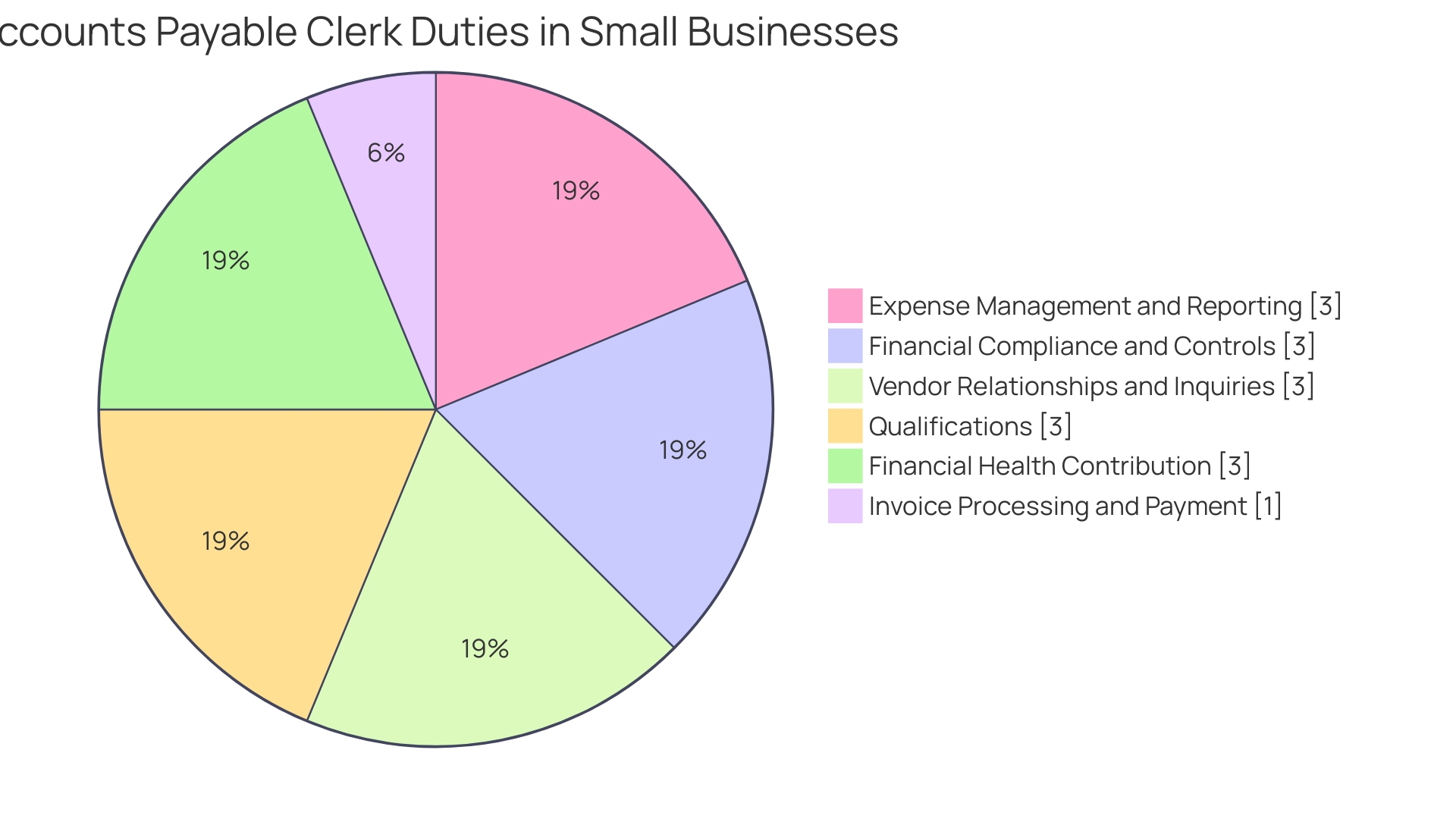

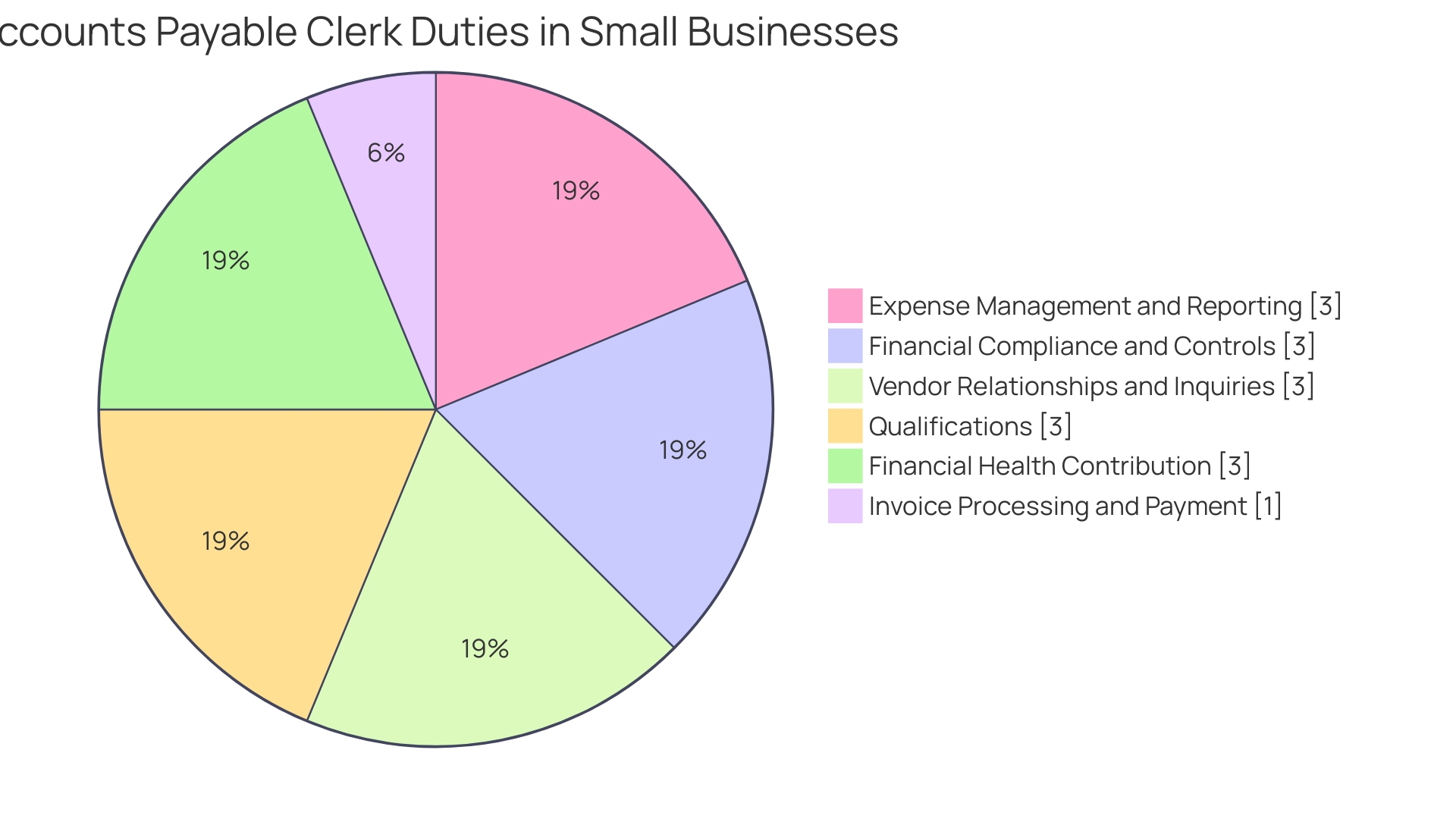

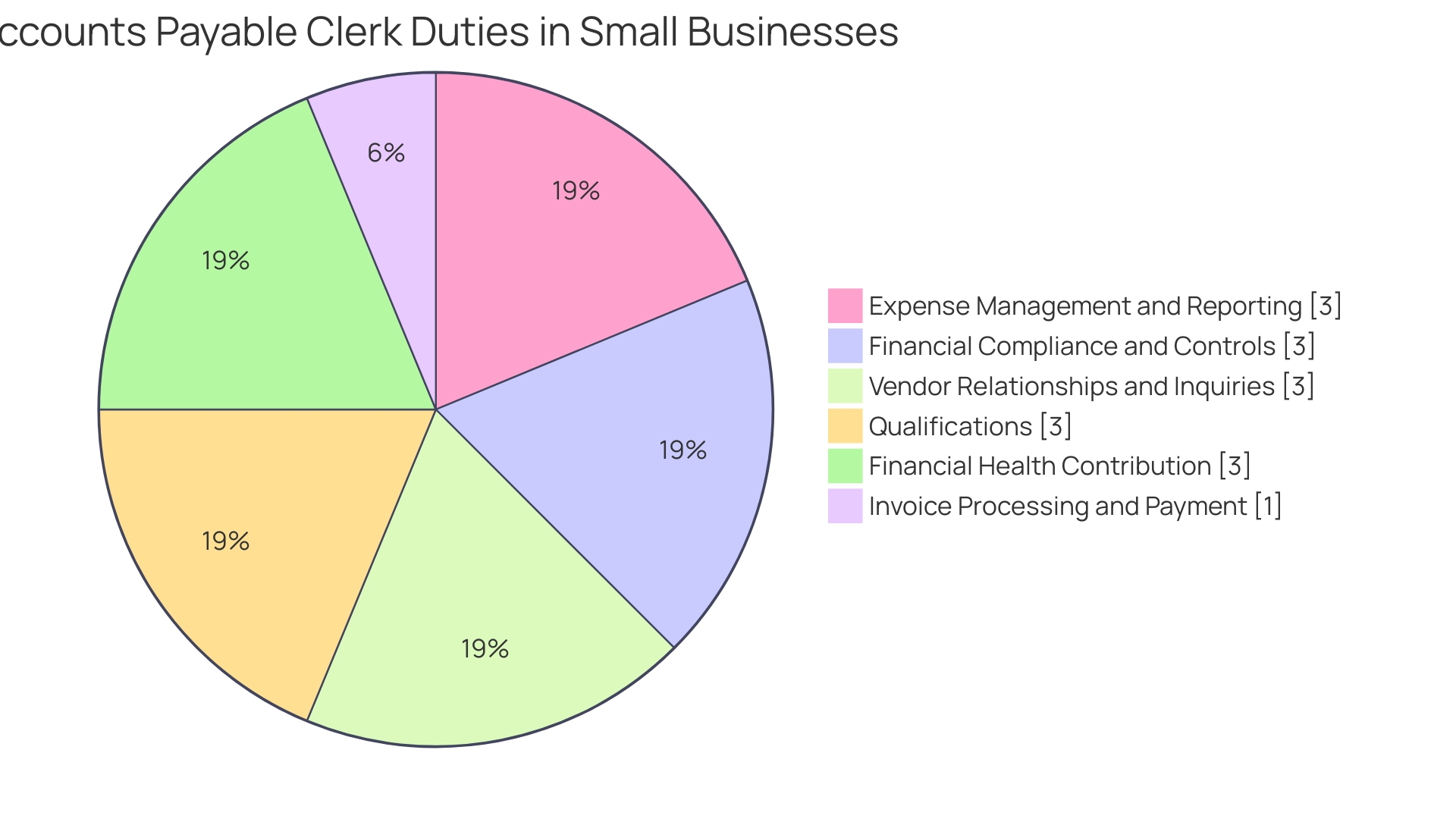

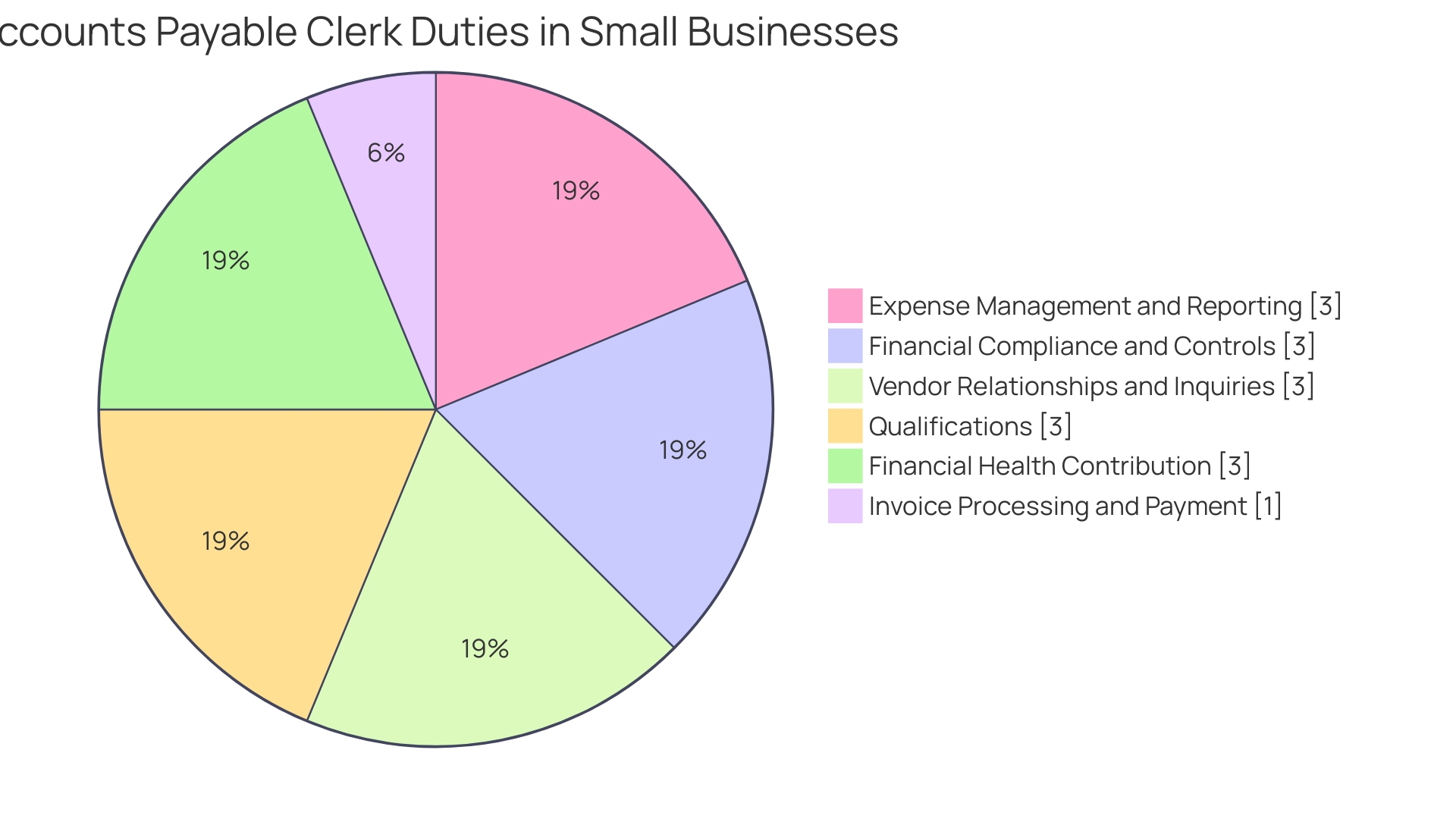

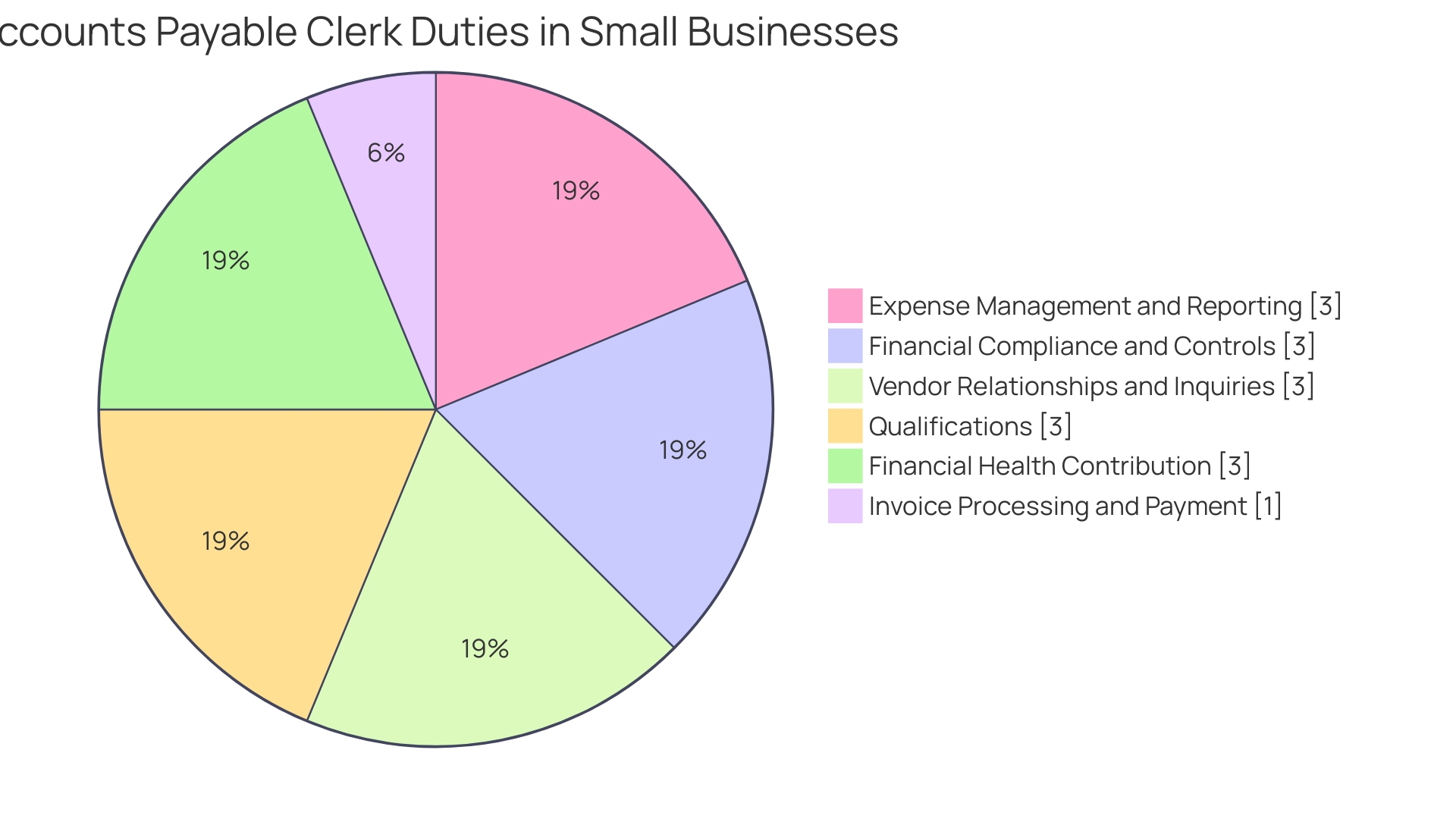

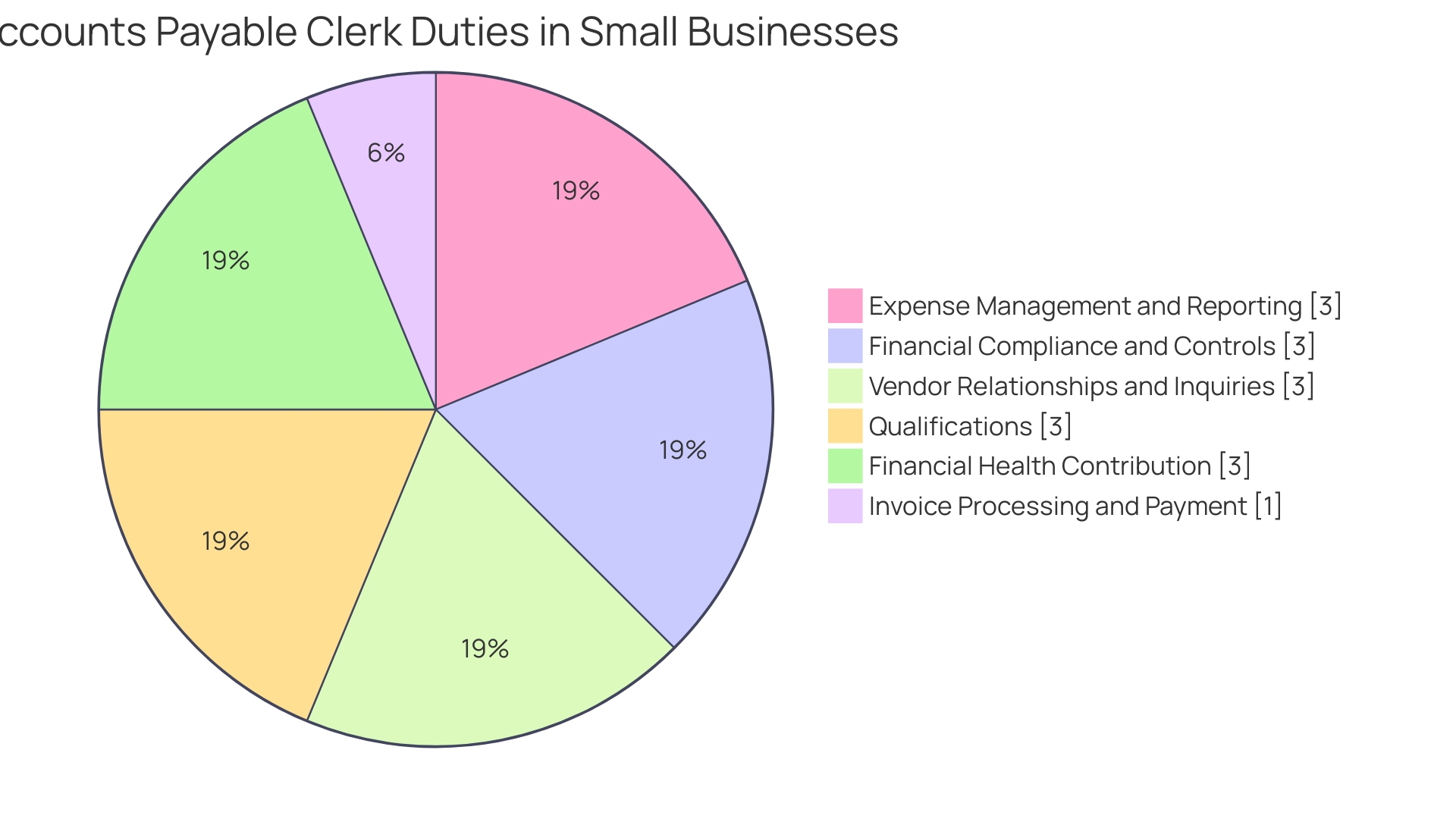

The accounts payable turnover ratio serves as a quantifiable gauge to inform pivotal business decisions and financial practices. Furthermore, in the context of small businesses, the role of an accounts payable clerk becomes pivotal. Their responsibilities—ranging from managing expense reports to maintaining vendor relations and adhering to financial compliance—are vital components in weaving the financial fabric that upholds a small business's financial health.

Navigating corporate fiscal health necessitates a mastery of financial metrics, with the accounts payable turnover ratio standing as a critical barometer. This ratio illuminates the frequency with which a firm settles its invoices over a specific period, thus revealing the proficiency with which a company administers both cash flow and supplier engagements. When we delve into a company like Monday.com, we witness an exemplar of proficient growth coupled with rapid attainment of positive cash flow, emphasizing the importance of leveraging such financial metrics for operational efficiency.

With a heightened accounts payable turnover ratio, a firm displays its capacity to promptly fulfill supplier obligations, fostering robust supplier alliances and potentially securing advantageous payment terms. Conversely, a subdued ratio may signal underlying financial distress or inefficiencies in the payable mechanisms. Accounting, as underscored in recent narratives, is not just a mere administrative task; it's a strategic compass that guides business decisions.

Moreover, it plays a pivotal role in the strategic objectivity of entities such as the UK tax department, which affects millions and serves as a linchpin for public service financing. Understanding these financial nuances is vital for measuring a firm's sustainability and can profoundly impact the strategic prioritization of expenses within the organization.

Understanding the velocity at which a business pays off its suppliers can be illuminated by the accounts payable turnover ratio. This measurement, vital for any company, particularly those with an e-commerce flavor, contrasts the cost of goods sold against the average accounts payable. A robust ratio indicates a speedier payment cadence, suggesting an agile approach to supplier management.

For the calculation, start by pinpointing the average accounts payable; this figure is the midpoint between the account's value at the onset and conclusion of the evaluation period. Pair this with the annual cost of goods sold. The formula that binds them into meaningful data is simple: divide the COGS by the average accounts payable.

Hence, the lower the quotient, the slower a company reimburses its suppliers, which could imply a need to reassess cash flow priorities, negotiate better payment terms, or optimize cost management strategies.

In precise terms, the accounts payable turnover ratio \= Cost of Goods Sold (COGS) / [(Beginning Accounts Payable + Ending Accounts Payable) / 2]. This calculation assists e-commerce business owners in evaluating their financial performance, scrutinizing their operational efficacy, and honing in on their supply chain management. By aligning their accounting processes with this focused financial analysis, businesses can enhance strategies to maximize value and sustain growth while tending meticulously to profitability.

Understanding the accounts payable turnover ratio goes beyond just recognizing whether a company is settling its bills promptly. It reflects the company's operational efficiency and cash management strategies. Monday.com exemplifies the significance of this ratio through their impressively efficient growth and ability to generate positive cash flow swiftly, even as growth decelerates.

They teach us that not all revenue is equal—investors now look beyond top-line growth, considering the gross margins and the company's capability to sustain free cash flow.

Observing a higher accounts payable turnover ratio can be a hallmark of operational prowess, a testament to a company's agility in managing cash flow and contributions to shareholder value. Conversely, a lower ratio could reveal cash flow constraints or strategic payment extensions to suppliers that may help conserve cash on hand. It's not merely about paying quickly but aligning payments with operational cash flows and investment strategies.

In assessing the turnover ratio, especially against industry benchmarks, it becomes evident that efficient cash management touches different aspects, from managing receivables and production costs to handling labor and interest expenses effectively.

Remember that the true north for any company, as shown by Monday.com's experience, is in its enduring capacity to enhance shareholder wealth by perpetuating a positive cash flow. This reflects a far more infallible metric of financial health than mere revenue figures, a mindset that lead to the post-2021 shift where investors started scrutinizing under the veneer of revenue, looking for the sustainability of cash flows and sound cost strategies.

The accounts payable turnover ratio is not an isolated metric but is impacted by various components, each a cog in the financial machine of a business. Payment terms agreed upon with suppliers can shift this ratio significantly; extended payment periods may result in a lower turnover ratio, allowing businesses more time to manage funds. The turnover ratio also mirrors industry-specific factors, like production cycles.

Industries with lengthier cycles and steeper supplier costs may lead to a lower ratio, contrasting industries that enjoy quicker cycles and reduced supplier expenses. In managing vendor relationships, an accounts payable clerk plays an important role in small business by ensuring that invoices are processed accurately and promptly, which is crucial to maintaining healthy cash flow and financial compliance. This diligence in managing expenses and nurturing supplier rapport contributes to the overall financial vitality of the company.

It's through education, guidance, and the adept use of digital services that the accounts payable department upholds fiscal responsibility and supports the strategic goal of right tax collection and financial support dissemination, thus fostering a stable environment for operational growth and compliance.

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

What is the Accounts Payable Turnover Ratio?

In the realm of financial analysis, the accounts payable turnover ratio emerges as a crucial metric, reflecting a firm's adeptness in clearing its accounts payable. This ratio measures the frequency within a stipulated timeframe—commonly annual—during which an entity settles its payable accounts. The effective management of this aspect is telling of a company's strategic financial health, relating directly to cash flow management and the balancing act between liquid funds and outstanding debts.

It's essential to discern the distinction between cash flow and profits, whereby cash flow depicts the liquidity aspect necessary for the day-to-day functioning of a business, and profit is the residual earnings post settling all dues. A meticulous reevaluation of spending, aligning with an organization's goals, is foundational to enhancing this ratio. Additionally, understanding and applying financial ratios create a transparent benchmarking system, indispensable for gauging a company's fiscal well-being when pitted against its contemporaries.

The accounts payable turnover ratio serves as a quantifiable gauge to inform pivotal business decisions and financial practices. Furthermore, in the context of small businesses, the role of an accounts payable clerk becomes pivotal. Their responsibilities—ranging from managing expense reports to maintaining vendor relations and adhering to financial compliance—are vital components in weaving the financial fabric that upholds a small business's financial health.

Navigating corporate fiscal health necessitates a mastery of financial metrics, with the accounts payable turnover ratio standing as a critical barometer. This ratio illuminates the frequency with which a firm settles its invoices over a specific period, thus revealing the proficiency with which a company administers both cash flow and supplier engagements. When we delve into a company like Monday.com, we witness an exemplar of proficient growth coupled with rapid attainment of positive cash flow, emphasizing the importance of leveraging such financial metrics for operational efficiency.

With a heightened accounts payable turnover ratio, a firm displays its capacity to promptly fulfill supplier obligations, fostering robust supplier alliances and potentially securing advantageous payment terms. Conversely, a subdued ratio may signal underlying financial distress or inefficiencies in the payable mechanisms. Accounting, as underscored in recent narratives, is not just a mere administrative task; it's a strategic compass that guides business decisions.

Moreover, it plays a pivotal role in the strategic objectivity of entities such as the UK tax department, which affects millions and serves as a linchpin for public service financing. Understanding these financial nuances is vital for measuring a firm's sustainability and can profoundly impact the strategic prioritization of expenses within the organization.

Understanding the velocity at which a business pays off its suppliers can be illuminated by the accounts payable turnover ratio. This measurement, vital for any company, particularly those with an e-commerce flavor, contrasts the cost of goods sold against the average accounts payable. A robust ratio indicates a speedier payment cadence, suggesting an agile approach to supplier management.

For the calculation, start by pinpointing the average accounts payable; this figure is the midpoint between the account's value at the onset and conclusion of the evaluation period. Pair this with the annual cost of goods sold. The formula that binds them into meaningful data is simple: divide the COGS by the average accounts payable.

Hence, the lower the quotient, the slower a company reimburses its suppliers, which could imply a need to reassess cash flow priorities, negotiate better payment terms, or optimize cost management strategies.

In precise terms, the accounts payable turnover ratio \= Cost of Goods Sold (COGS) / [(Beginning Accounts Payable + Ending Accounts Payable) / 2]. This calculation assists e-commerce business owners in evaluating their financial performance, scrutinizing their operational efficacy, and honing in on their supply chain management. By aligning their accounting processes with this focused financial analysis, businesses can enhance strategies to maximize value and sustain growth while tending meticulously to profitability.

Understanding the accounts payable turnover ratio goes beyond just recognizing whether a company is settling its bills promptly. It reflects the company's operational efficiency and cash management strategies. Monday.com exemplifies the significance of this ratio through their impressively efficient growth and ability to generate positive cash flow swiftly, even as growth decelerates.

They teach us that not all revenue is equal—investors now look beyond top-line growth, considering the gross margins and the company's capability to sustain free cash flow.

Observing a higher accounts payable turnover ratio can be a hallmark of operational prowess, a testament to a company's agility in managing cash flow and contributions to shareholder value. Conversely, a lower ratio could reveal cash flow constraints or strategic payment extensions to suppliers that may help conserve cash on hand. It's not merely about paying quickly but aligning payments with operational cash flows and investment strategies.

In assessing the turnover ratio, especially against industry benchmarks, it becomes evident that efficient cash management touches different aspects, from managing receivables and production costs to handling labor and interest expenses effectively.

Remember that the true north for any company, as shown by Monday.com's experience, is in its enduring capacity to enhance shareholder wealth by perpetuating a positive cash flow. This reflects a far more infallible metric of financial health than mere revenue figures, a mindset that lead to the post-2021 shift where investors started scrutinizing under the veneer of revenue, looking for the sustainability of cash flows and sound cost strategies.

The accounts payable turnover ratio is not an isolated metric but is impacted by various components, each a cog in the financial machine of a business. Payment terms agreed upon with suppliers can shift this ratio significantly; extended payment periods may result in a lower turnover ratio, allowing businesses more time to manage funds. The turnover ratio also mirrors industry-specific factors, like production cycles.

Industries with lengthier cycles and steeper supplier costs may lead to a lower ratio, contrasting industries that enjoy quicker cycles and reduced supplier expenses. In managing vendor relationships, an accounts payable clerk plays an important role in small business by ensuring that invoices are processed accurately and promptly, which is crucial to maintaining healthy cash flow and financial compliance. This diligence in managing expenses and nurturing supplier rapport contributes to the overall financial vitality of the company.

It's through education, guidance, and the adept use of digital services that the accounts payable department upholds fiscal responsibility and supports the strategic goal of right tax collection and financial support dissemination, thus fostering a stable environment for operational growth and compliance.

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

Why is the Accounts Payable Turnover Ratio Important?

Navigating corporate fiscal health necessitates a mastery of financial metrics, with the accounts payable turnover ratio standing as a critical barometer. This ratio illuminates the frequency with which a firm settles its invoices over a specific period, thus revealing the proficiency with which a company administers both cash flow and supplier engagements. When we delve into a company like Monday.com, we witness an exemplar of proficient growth coupled with rapid attainment of positive cash flow, emphasizing the importance of leveraging such financial metrics for operational efficiency.

With a heightened accounts payable turnover ratio, a firm displays its capacity to promptly fulfill supplier obligations, fostering robust supplier alliances and potentially securing advantageous payment terms. Conversely, a subdued ratio may signal underlying financial distress or inefficiencies in the payable mechanisms. Accounting, as underscored in recent narratives, is not just a mere administrative task; it's a strategic compass that guides business decisions.

Moreover, it plays a pivotal role in the strategic objectivity of entities such as the UK tax department, which affects millions and serves as a linchpin for public service financing. Understanding these financial nuances is vital for measuring a firm's sustainability and can profoundly impact the strategic prioritization of expenses within the organization.

Understanding the velocity at which a business pays off its suppliers can be illuminated by the accounts payable turnover ratio. This measurement, vital for any company, particularly those with an e-commerce flavor, contrasts the cost of goods sold against the average accounts payable. A robust ratio indicates a speedier payment cadence, suggesting an agile approach to supplier management.

For the calculation, start by pinpointing the average accounts payable; this figure is the midpoint between the account's value at the onset and conclusion of the evaluation period. Pair this with the annual cost of goods sold. The formula that binds them into meaningful data is simple: divide the COGS by the average accounts payable.

Hence, the lower the quotient, the slower a company reimburses its suppliers, which could imply a need to reassess cash flow priorities, negotiate better payment terms, or optimize cost management strategies.

In precise terms, the accounts payable turnover ratio \= Cost of Goods Sold (COGS) / [(Beginning Accounts Payable + Ending Accounts Payable) / 2]. This calculation assists e-commerce business owners in evaluating their financial performance, scrutinizing their operational efficacy, and honing in on their supply chain management. By aligning their accounting processes with this focused financial analysis, businesses can enhance strategies to maximize value and sustain growth while tending meticulously to profitability.

Understanding the accounts payable turnover ratio goes beyond just recognizing whether a company is settling its bills promptly. It reflects the company's operational efficiency and cash management strategies. Monday.com exemplifies the significance of this ratio through their impressively efficient growth and ability to generate positive cash flow swiftly, even as growth decelerates.

They teach us that not all revenue is equal—investors now look beyond top-line growth, considering the gross margins and the company's capability to sustain free cash flow.

Observing a higher accounts payable turnover ratio can be a hallmark of operational prowess, a testament to a company's agility in managing cash flow and contributions to shareholder value. Conversely, a lower ratio could reveal cash flow constraints or strategic payment extensions to suppliers that may help conserve cash on hand. It's not merely about paying quickly but aligning payments with operational cash flows and investment strategies.

In assessing the turnover ratio, especially against industry benchmarks, it becomes evident that efficient cash management touches different aspects, from managing receivables and production costs to handling labor and interest expenses effectively.

Remember that the true north for any company, as shown by Monday.com's experience, is in its enduring capacity to enhance shareholder wealth by perpetuating a positive cash flow. This reflects a far more infallible metric of financial health than mere revenue figures, a mindset that lead to the post-2021 shift where investors started scrutinizing under the veneer of revenue, looking for the sustainability of cash flows and sound cost strategies.

The accounts payable turnover ratio is not an isolated metric but is impacted by various components, each a cog in the financial machine of a business. Payment terms agreed upon with suppliers can shift this ratio significantly; extended payment periods may result in a lower turnover ratio, allowing businesses more time to manage funds. The turnover ratio also mirrors industry-specific factors, like production cycles.

Industries with lengthier cycles and steeper supplier costs may lead to a lower ratio, contrasting industries that enjoy quicker cycles and reduced supplier expenses. In managing vendor relationships, an accounts payable clerk plays an important role in small business by ensuring that invoices are processed accurately and promptly, which is crucial to maintaining healthy cash flow and financial compliance. This diligence in managing expenses and nurturing supplier rapport contributes to the overall financial vitality of the company.

It's through education, guidance, and the adept use of digital services that the accounts payable department upholds fiscal responsibility and supports the strategic goal of right tax collection and financial support dissemination, thus fostering a stable environment for operational growth and compliance.

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

How to Calculate the Accounts Payable Turnover Ratio

Understanding the velocity at which a business pays off its suppliers can be illuminated by the accounts payable turnover ratio. This measurement, vital for any company, particularly those with an e-commerce flavor, contrasts the cost of goods sold against the average accounts payable. A robust ratio indicates a speedier payment cadence, suggesting an agile approach to supplier management.

For the calculation, start by pinpointing the average accounts payable; this figure is the midpoint between the account's value at the onset and conclusion of the evaluation period. Pair this with the annual cost of goods sold. The formula that binds them into meaningful data is simple: divide the COGS by the average accounts payable.

Hence, the lower the quotient, the slower a company reimburses its suppliers, which could imply a need to reassess cash flow priorities, negotiate better payment terms, or optimize cost management strategies.

In precise terms, the accounts payable turnover ratio \= Cost of Goods Sold (COGS) / [(Beginning Accounts Payable + Ending Accounts Payable) / 2]. This calculation assists e-commerce business owners in evaluating their financial performance, scrutinizing their operational efficacy, and honing in on their supply chain management. By aligning their accounting processes with this focused financial analysis, businesses can enhance strategies to maximize value and sustain growth while tending meticulously to profitability.

Understanding the accounts payable turnover ratio goes beyond just recognizing whether a company is settling its bills promptly. It reflects the company's operational efficiency and cash management strategies. Monday.com exemplifies the significance of this ratio through their impressively efficient growth and ability to generate positive cash flow swiftly, even as growth decelerates.

They teach us that not all revenue is equal—investors now look beyond top-line growth, considering the gross margins and the company's capability to sustain free cash flow.

Observing a higher accounts payable turnover ratio can be a hallmark of operational prowess, a testament to a company's agility in managing cash flow and contributions to shareholder value. Conversely, a lower ratio could reveal cash flow constraints or strategic payment extensions to suppliers that may help conserve cash on hand. It's not merely about paying quickly but aligning payments with operational cash flows and investment strategies.

In assessing the turnover ratio, especially against industry benchmarks, it becomes evident that efficient cash management touches different aspects, from managing receivables and production costs to handling labor and interest expenses effectively.

Remember that the true north for any company, as shown by Monday.com's experience, is in its enduring capacity to enhance shareholder wealth by perpetuating a positive cash flow. This reflects a far more infallible metric of financial health than mere revenue figures, a mindset that lead to the post-2021 shift where investors started scrutinizing under the veneer of revenue, looking for the sustainability of cash flows and sound cost strategies.

The accounts payable turnover ratio is not an isolated metric but is impacted by various components, each a cog in the financial machine of a business. Payment terms agreed upon with suppliers can shift this ratio significantly; extended payment periods may result in a lower turnover ratio, allowing businesses more time to manage funds. The turnover ratio also mirrors industry-specific factors, like production cycles.

Industries with lengthier cycles and steeper supplier costs may lead to a lower ratio, contrasting industries that enjoy quicker cycles and reduced supplier expenses. In managing vendor relationships, an accounts payable clerk plays an important role in small business by ensuring that invoices are processed accurately and promptly, which is crucial to maintaining healthy cash flow and financial compliance. This diligence in managing expenses and nurturing supplier rapport contributes to the overall financial vitality of the company.

It's through education, guidance, and the adept use of digital services that the accounts payable department upholds fiscal responsibility and supports the strategic goal of right tax collection and financial support dissemination, thus fostering a stable environment for operational growth and compliance.

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

Interpreting the Accounts Payable Turnover Ratio

Understanding the accounts payable turnover ratio goes beyond just recognizing whether a company is settling its bills promptly. It reflects the company's operational efficiency and cash management strategies. Monday.com exemplifies the significance of this ratio through their impressively efficient growth and ability to generate positive cash flow swiftly, even as growth decelerates.

They teach us that not all revenue is equal—investors now look beyond top-line growth, considering the gross margins and the company's capability to sustain free cash flow.

Observing a higher accounts payable turnover ratio can be a hallmark of operational prowess, a testament to a company's agility in managing cash flow and contributions to shareholder value. Conversely, a lower ratio could reveal cash flow constraints or strategic payment extensions to suppliers that may help conserve cash on hand. It's not merely about paying quickly but aligning payments with operational cash flows and investment strategies.

In assessing the turnover ratio, especially against industry benchmarks, it becomes evident that efficient cash management touches different aspects, from managing receivables and production costs to handling labor and interest expenses effectively.

Remember that the true north for any company, as shown by Monday.com's experience, is in its enduring capacity to enhance shareholder wealth by perpetuating a positive cash flow. This reflects a far more infallible metric of financial health than mere revenue figures, a mindset that lead to the post-2021 shift where investors started scrutinizing under the veneer of revenue, looking for the sustainability of cash flows and sound cost strategies.

The accounts payable turnover ratio is not an isolated metric but is impacted by various components, each a cog in the financial machine of a business. Payment terms agreed upon with suppliers can shift this ratio significantly; extended payment periods may result in a lower turnover ratio, allowing businesses more time to manage funds. The turnover ratio also mirrors industry-specific factors, like production cycles.

Industries with lengthier cycles and steeper supplier costs may lead to a lower ratio, contrasting industries that enjoy quicker cycles and reduced supplier expenses. In managing vendor relationships, an accounts payable clerk plays an important role in small business by ensuring that invoices are processed accurately and promptly, which is crucial to maintaining healthy cash flow and financial compliance. This diligence in managing expenses and nurturing supplier rapport contributes to the overall financial vitality of the company.

It's through education, guidance, and the adept use of digital services that the accounts payable department upholds fiscal responsibility and supports the strategic goal of right tax collection and financial support dissemination, thus fostering a stable environment for operational growth and compliance.

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

Factors Influencing the Accounts Payable Turnover Ratio

The accounts payable turnover ratio is not an isolated metric but is impacted by various components, each a cog in the financial machine of a business. Payment terms agreed upon with suppliers can shift this ratio significantly; extended payment periods may result in a lower turnover ratio, allowing businesses more time to manage funds. The turnover ratio also mirrors industry-specific factors, like production cycles.

Industries with lengthier cycles and steeper supplier costs may lead to a lower ratio, contrasting industries that enjoy quicker cycles and reduced supplier expenses. In managing vendor relationships, an accounts payable clerk plays an important role in small business by ensuring that invoices are processed accurately and promptly, which is crucial to maintaining healthy cash flow and financial compliance. This diligence in managing expenses and nurturing supplier rapport contributes to the overall financial vitality of the company.

It's through education, guidance, and the adept use of digital services that the accounts payable department upholds fiscal responsibility and supports the strategic goal of right tax collection and financial support dissemination, thus fostering a stable environment for operational growth and compliance.

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

Strategies to Improve the Accounts Payable Turnover Ratio

To fortify a company's financial health, refining the accounts payable turnover ratio is paramount. This metric is a reflection of how swiftly a business settles its invoices and, thus, a barometer of sound cash flow management and robust supplier alliances. Enhancing this ratio involves several critical strategies, each aimed at maximizing operational efficiency.

Strategic negotiation for optimal payment terms with vendors forms the bedrock of improved turnover. Cultivating this approach aligns the company's payment cycles with its cash flow patterns, ensuring liquidity is maintained without impairing relationships with suppliers. Additionally, by streamlining the accounts payable cycle, businesses eradicate bottlenecks, carving a path for smoother financial operations.

Embracing technology through electronic invoicing and payment solutions marks a company's commitment to efficiency, curbing delays, and reducing the margin for error inherent in manual processes. Vigilant cash flow management, underpinned by a deep understanding of operating costs—from payroll to inventory—and a commitment to keeping operating expenses and the cost of goods sold at a sustainable ratio to revenue, becomes a linchpin for fiscal stability.

Moreover, nurturing supplier relationships through effective communication and management is not merely about fostering goodwill but also unlocks financial advantages. Early payment discounts, as a case in point, are incentives that can significantly lower costs over time. Lastly, empowering accounts payable clerks with the requisite skills to manage expense reporting and vendor queries ensures adherence to financial compliance, thereby cementing the overall financial fortitude of the business.

In essence, by reevaluating expenditures and giving due attention to business efficiencies, from cost management to customer satisfaction, a company adeptly solidifies its financial platform. As iconic management consultant Peter Drucker asserted, 'What gets measured gets managed.' By harnessing the power of Key Performance Indicators (KPIs), businesses can gain critical insights into their financial and operational health and drive sustainable growth.

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

Common Mistakes and Drawbacks

Delving into the intricacies of cost accounting, particularly in understanding the accounts payable turnover ratio, requires a meticulous approach. To circumvent typical pitfalls, one must ensure that data is not only accurate but whole. Incompleteness or erroneous data could significantly skew the ratio, impairing the ability to make sound financial judgments.

It's crucial to contextualize the ratio against the backdrop of industry standards, allowing for a relative assessment of payment efficiency. Factors such as seasonal variations, which can distort the ratio by their episodic nature, should not be ignored. Moreover, while the ratio is a useful indicator of liquidity, it should not be isolated from the broader financial narrative of a business.

It's essential to integrate it with other metrics for a holistic overview of financial health. Additionally, fostering robust supplier relationships and understanding payment terms are key. These not only affect the ratio but also reflect a company's standing and leverage with its vendors.

Managing these relationships well can lead to more favorable payment terms, thus impacting the ratio positively. By addressing these aspects thoughtfully, one can leverage the accounts payable turnover ratio as a valuable tool in the strategic financial analysis and planning required in today's high-velocity commercial ecosystems.

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.

Conclusion

To summarize, the accounts payable turnover ratio is a vital metric for financial analysis, reflecting a company's effectiveness in managing its accounts payable. It provides valuable insights into operational efficiency, cash management, and supplier relationships.

Businesses can improve this ratio by implementing strategies such as negotiating optimal payment terms, streamlining the accounts payable cycle, embracing technology for efficiency, and nurturing supplier relationships. It is crucial to empower accounts payable clerks and ensure compliance with financial regulations.

Avoid common mistakes like inaccurate data, failing to contextualize the ratio against industry standards, and isolating it from other financial metrics. Understanding the impact of supplier relationships and payment terms is essential.

By measuring and managing the accounts payable turnover ratio, CFOs and finance professionals can make informed decisions and drive sustainable growth. It serves as a valuable tool for strategic financial analysis in today's dynamic business environment.

In conclusion, leveraging the accounts payable turnover ratio enhances a company's financial platform. By prioritizing efficient accounts payable management and utilizing this metric effectively, businesses can strengthen their financial health and navigate the path to long-term success.