Introduction

Asset-Based Lending (ABL) is a powerful financing avenue that allows businesses to unlock capital tied up in their assets. By leveraging assets such as accounts receivable, inventory, equipment, and real property, companies can access essential working capital to support operational funding, growth initiatives, or a restructuring process. Unlike traditional lending, ABL emphasizes the intrinsic value of collateral rather than credit scores, making it beneficial for organizations with substantial physical or financial assets.

The dynamic landscape of financial assets, including the rise of tokenized assets, is reshaping the ABL domain, offering businesses new opportunities to leverage their assets in innovative ways. In this article, we will explore the types of assets used as collateral, how asset-based lending works, the loan-to-value ratio (LTV), key factors influencing asset-based loan rates, and the benefits and risks of asset-based lending. We will also discuss the financial health of your business, industry and market conditions, lender requirements and policies, preparing for an asset-based loan application, financial documentation needed, understanding loan terms and conditions, asset inventories and legal documents, fees and interest rates, default conditions and consequences, and more.

Whether you're a CFO seeking practical advice or solutions, this article will provide you with valuable insights into the world of asset-based lending.

What is Asset-Based Lending?

Asset-Based Lending (ABL) stands out as a robust financing avenue, particularly useful for businesses that need to unlock capital tied up in their assets. This type of lending provides companies with the opportunity to leverage a variety of assets, including accounts receivable, inventory, equipment, and real property, to gain access to essential working capital. This capital infusion can be instrumental in supporting endeavors such as operational funding, growth initiatives, or a restructuring process.

Notably, ABL doesn't hinge solely on credit scores; instead, it emphasizes the intrinsic value of the collateral. This aspect of ABL is especially beneficial for organizations that may not meet traditional lending criteria but possess substantial physical or financial assets. For instance, a climbing gym aiming to support community development was able to secure funding for facility expansion, despite the financial challenges posed by the pandemic.

This demonstrates how ABL can serve as a lifeline to businesses in diverse sectors, including those with a social impact focus.

Furthermore, the dynamic landscape of financial assets, including the rise of tokenized assets such as treasury bonds and real estate, is reshaping the ABL domain. With more institutions expressing interest in real-world asset (RWA) products, ABL is poised to grow in importance, offering businesses new opportunities to leverage their assets in innovative ways.

In the context of small business financing, ABL emerges as a compelling option that can accommodate various lending needs. Whether seeking to launch a startup or expand an established enterprise, ABL offers a pathway to secure funding by utilizing owned assets as collateral. This can result in potentially favorable lending terms and even access to credit for business owners with less-than-perfect credit histories.

The strategic use of collateral not only mitigates lender risk but also unlocks new possibilities for businesses to achieve their financial objectives.

Types of Assets Used as Collateral

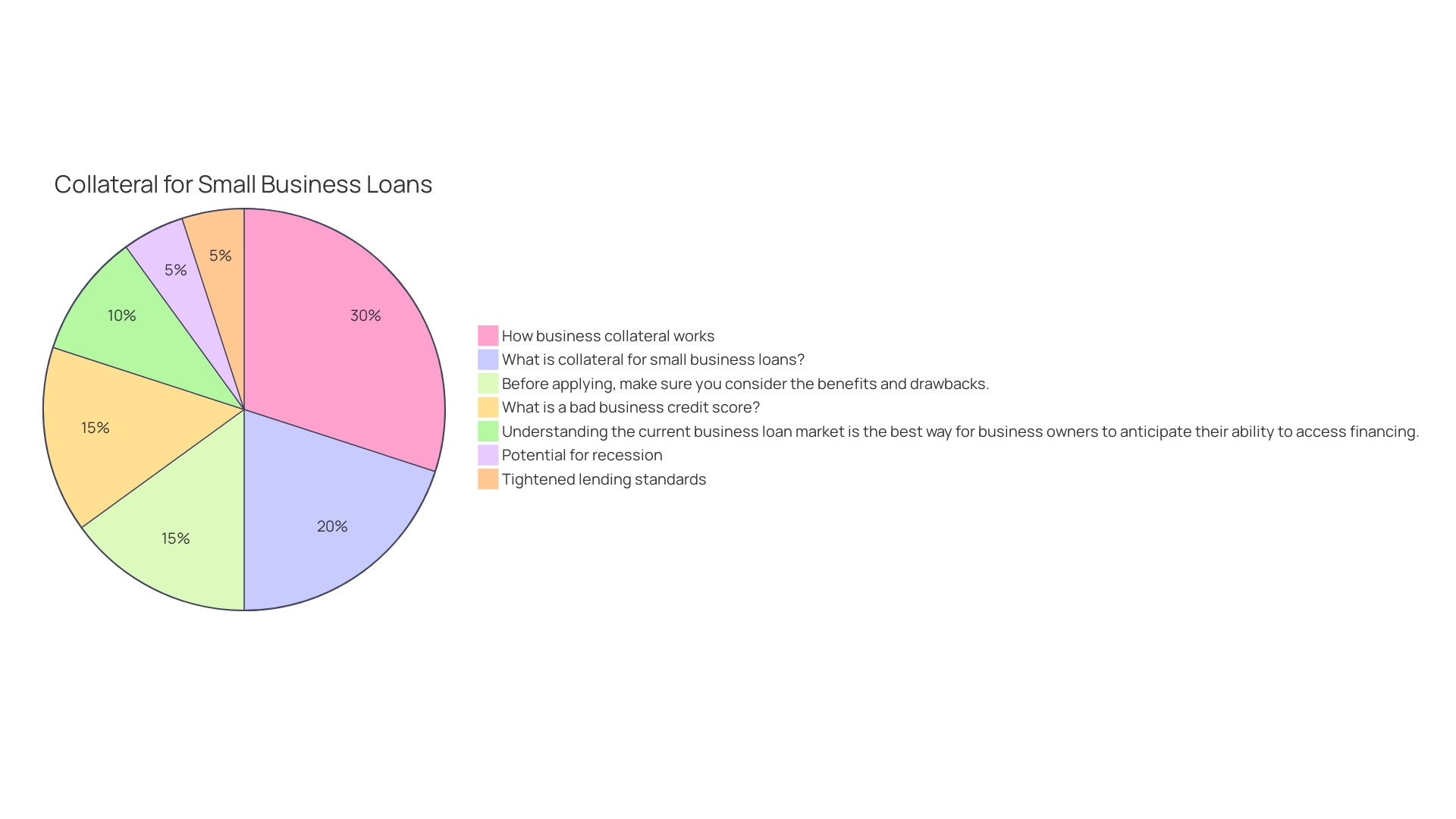

Asset-based lending (ABL) is a significant financing strategy for businesses, allowing them to leverage various assets to secure necessary funding. Beyond the commonly used accounts receivable, which involve leveraging unpaid invoices, ABL can encompass various other assets. Inventory, whether it's finished products ready for sale or raw materials for production, is frequently used as collateral.

Additionally, tangible fixed assets like equipment and machinery, or even owned real estate, can be instrumental in securing a loan. The range of accepted collateral types often hinges on both the lender's policy and the specific sector the business operates in.

For instance, within industries such as manufacturing or construction, where equipment and machinery are integral, these physical assets are typically viable for collateral. On the other hand, businesses in the retail sector might find it more appropriate to use inventory as their collateral base.

It's important to understand that when a business pledges an asset as collateral, they are entering into an agreement that may involve a lien on that asset. This legal claim ensures the lender can take possession of the collateral if the loan defaults, providing a safety net and potentially more favorable loan terms for the borrower. Lenders generally seek collateral that covers the full amount of the loan to mitigate their risk.

The Secured Finance Network, with its extensive network of over 1,000 members globally, underscores the significance of secured lending in bolstering business operations. Understanding the intricacies of secured loans and the types of collateral that can be utilized is crucial for any business seeking to navigate financial challenges successfully.

How Asset-Based Lending Works

Asset-based lending hinges on the valuation of collateral assets to secure a loan. The lender assesses the asset's value to determine the loan-to-value ratio (LTV), a crucial percentage that dictates the amount of the loan relative to the asset's appraised worth. This LTV fluctuates based on the asset category, its marketability, and associated risk levels.

Flexible loan terms enable customization to fit the borrower's needs, including the loan duration and interest rates, ensuring that the financial arrangement aligns with their unique circumstances. Unlike traditional loans that might react to market changes, certain asset-based lending agreements are designed to protect borrowers from asset price volatility, avoiding automatic liquidation if the agreed payments are met on time. This financial instrument has proven its worth in various scenarios, such as enabling The Ledge Climbing Gym & Charity in Scotland to secure funding and create impactful community programs.

As the financial landscape evolves with the tokenization of assets like treasury bonds and real estate, asset-based lending remains a focal point for institutions and innovators alike, poised for growth in the coming years.

Loan-to-Value Ratio (LTV) and Its Impact

Understanding the loan-to-value ratio (LTV) is fundamental when navigating the subtleties of asset-based lending. This metric illustrates what proportion of an asset's assessed worth a lender is willing to finance. When lenders present a high LTV, it signals a robust belief in the asset's stability and may lead to a more substantial loan offer.

Nonetheless, embracing a high LTV also entails embracing higher risk. This delicate balance demands that borrowers meticulously substantiate the value of their collateral. Companies like L&T Finance, with a significant retail portfolio, and platforms that offer one-to-one backed web3 lending solutions, exemplify the importance of maintaining a credible LTV to ensure liquidity and operational efficiency.

The recent shift in the financial landscape, where the net asset value (NAV) finance market has burgeoned, further underscores the necessity for astute asset evaluation. The NAV finance space has expanded, providing non-dilutive capital that bolsters liquidity and portfolio management, as fund managers express a responsibility to optimize investors' capital.

Moreover, the enormity of today's opportunistic credit universe, which has experienced a fourfold growth since the financial crisis, presents a fertile ground for credit investors. With the market standing at approximately $13 trillion, the implications of LTV calculations have never been more profound.

In conclusion, a well-structured LTV can be a harbinger of financial prudence, allowing borrowers to negotiate better terms while offering lenders a safeguard against potential losses.

Key Factors Influencing Asset-Based Loan Rates

Asset-based loan rates are not static; they fluctuate based on a variety of factors. A borrower's credit history, the quality and valuation of the collateral, the specific industry of the business, and prevailing macroeconomic conditions all play a role. Typically, asset-based loans carry higher interest rates compared to conventional loans due to the heightened risk profile.

However, the actual rates are subject to change, influenced by borrower-specific details and the lender's own policies.

Recent trends, as indicated by the Senior Loan Officer Opinion Survey on Bank Lending Practices, suggest a tightening of standards and a reduction in demand for commercial and industrial loans, reflecting a cautious lending environment. This could potentially affect the terms of asset-based loans, pushing interest rates higher as lenders compensate for increased risk.

Moreover, in a climate where the Federal Reserve has raised benchmark rates to manage inflation, the cost of borrowing naturally escalates. This has a direct impact on the rates of various loan types, including asset-based lending. Home equity loans, for instance, have seen average interest rates climb to 8.91 percent as of January 17, 2024.

It is also important to note that while borrowers may feel the pinch of higher rates, such financial conditions create an advantageous scenario for savers.

As these lending dynamics evolve, it is crucial for businesses to stay informed and to seek out the most favorable terms possible. In the face of a potentially forthcoming 'mild recession' as predicted by financial experts, strategies for financial management and loan acquisition must be carefully considered.

Collateral Value and Liquidity

Asset-based lending hinges on the quality and liquidity of collateral assets. The evaluation of these assets is a critical step, determining both the loan amount and the borrower's repayment capacity. Assets such as accounts receivable are often preferred for their high liquidity and ease of conversion into cash.

Conversely, less liquid assets, such as real estate, pose challenges due to their longer conversion times, which can influence loan conditions. The digitization of promissory notes, as seen in Latin America with the adoption of blockchain technology by companies like Mifiel, exemplifies the innovation in handling such financial assets. This shift towards digital solutions enhances the verification, accessibility, and scalability of promissory notes, making them more suited for the modern economy and more attractive as collateral.

With the increasing scrutiny from regulatory bodies like the SEC, the choice of blockchain platforms that avoid regulatory risks, such as the Liquid Network, has become paramount. This is particularly relevant in the context of asset-based lending, where the robustness and legal standing of collateral assets are of utmost importance.

Financial Health of Your Business

Asset-based lending hinges critically on the financial robustness of a business. Lenders meticulously analyze financial documents such as balance sheets, income statements, and cash flow statements to gauge a company's revenue generation capacity and its potential to service debt obligations. A robust financial standing, characterized by consistent cash flows and profitability, significantly enhances the probability of securing a loan with advantageous terms.

This meticulous vetting process ensures that only businesses with sound financial practices and stability receive the funding they need, safeguarding the interests of both lenders and borrowers in the long run.

Loan Amount and Term

Asset-based lending hinges upon the value of collateral—assets like inventory, equipment, or receivables that a business pledges to secure a loan. The loan amount is not arbitrary but typically represents a calculated percentage of the appraised collateral value, ensuring lenders can recover their funds in case of default. Moreover, asset-based loans offer customizable terms, empowering businesses to tailor the duration and interest rates to their unique financial landscapes, thus providing a safety net against market volatility and asset price fluctuations.

For instance, innovative platforms now allow borrowers to set their own terms or select from a variety of existing offers, ensuring zero price-based liquidation as long as the loan is repaid within its term. This flexibility is crucial for entities like The Ledge Climbing Gym & Charity, which, despite being located in an economically challenged area, secured funding through asset-based lending to develop their facilities and run community support programs.

Creditworthiness remains a cornerstone of financial transactions, and understanding the nuances of APR—Annual Percentage Rate—is critical. APR encapsulates the yearly interest rate paid on a loan, providing a transparent metric for borrowers to gauge the cost of borrowing over the term of a loan.

In the world of finance, the delicate balance between assets, liabilities, and equity defines a company’s financial health. Assets boost a company's value, liabilities represent obligations to creditors, and equity is the residual interest belonging to the owners. Asset-based lending taps into this equation by allowing businesses to leverage their assets for growth while maintaining this balance.

The dynamic nature of asset-based lending, supported by real-time data and market analysis, becomes evident when examining household wealth metrics. These statistics reflect the reality that net worth, a measure of assets minus debts, can influence a household's ability to engage in asset-based financing. By understanding the interplay of these financial factors, businesses can make strategic decisions to enhance their financial capabilities and resilience.

Industry and Market Conditions

Asset-based lending is not a one-size-fits-all solution; it deeply depends on the industry context and the current market conditions. Lenders often develop a niche expertise, favoring certain industries over others, which can lead to significant variations in the terms and availability of loans. Economic trends and the overall performance of an industry can heavily sway a lender's risk assessment, thus influencing the rates and terms they're willing to offer.

For instance, during economic downturns, lenders may tighten their criteria, whereas in a growing economy, more favorable terms could be available. It's crucial for businesses to understand these dynamics and seek financial partners with the right expertise to navigate the complexities of secured financing.

Amidst shifting economic landscapes, such as the recent contraction in total assets for US banks, companies must be agile and informed to maintain a competitive edge in securing financing. The rise or fall of loan and lease rates, as discussed by financial analysts, underscores the importance of staying current with market trends to optimize financing strategies. Additionally, the insights from entities like the Secured Finance Network, with over a thousand members globally, provide valuable data and knowledge that can inform better decision-making in asset-based lending.

It's also essential to consider the wisdom of financial theory when engaging in asset-based lending. As historical figures like Adam Smith have indicated, the value of assets is tied to the market rate of interest. With this understanding, CFOs can better anticipate the implications of changing interest rates on the value of their collateral and the cost of borrowing.

In essence, a comprehensive approach that incorporates industry expertise, market awareness, and financial acumen is crucial for businesses to secure the most advantageous asset-based loans.

Lender Requirements and Policies

Asset-based lending (ABL) is a nuanced field with many lenders catering to different needs. For example, while some may have a niche focus on particular industries or asset classes, others offer a broader set of criteria that may be more suitable for diverse business models. The Secured Finance Network, a vital hub connecting secured financing professionals, underscores the importance of understanding the unique requirements and policies of each potential lender.

Their expansive network is a testament to the variety of options available to businesses seeking asset-based loans.

The recent Senior Loan Officer Opinion Survey on Bank Lending Practices highlighted a trend of tightening standards and reduced demand for commercial loans, making it even more critical for businesses to thoroughly research potential lenders. Considering the evolving landscape, as seen in the case of California's utilities and their efforts to mitigate wildfire risks, it's clear that adaptability and due diligence are key in securing appropriate financing.

When approaching asset-based lending, Stilt's experience is instructive; registering across multiple states and navigating comprehensive audits showcases the complexity of obtaining the right type of license. Similarly, updates by financial institutions to their lending requirements, as in the case of attorney opinion of title letters, demonstrate the dynamic nature of ABL criteria.

Navigating the ABL landscape requires a meticulous approach, taking into account factors such as the lender's industry expertise, asset preference, and risk assessment strategies. By aligning with a lender whose profile complements the business's needs and strategic direction, companies can ensure a more successful asset-based lending process.

Benefits and Risks of Asset-Based Lending

Asset-based lending can be a powerful tool for businesses seeking additional capital, offering swift access to funds by leveraging the value of assets. This approach provides a flexible funding structure, which can be pivotal for companies in times of financial strain or undergoing restructuring efforts.

For instance, businesses like The Ledge Climbing Gym in Inverness have utilized asset-based loans to transform their operations and serve community needs. Despite being located in an area facing economic challenges, The Ledge successfully used funding to develop facilities that not only offer recreational activities but also drive social impact programs.

Moreover, asset-based lending terms are often customizable, allowing businesses to negotiate loan amounts, durations, and interest rates, as well as avoid the pitfalls of price-based liquidation—provided the loan is repaid within the agreed period.

However, it's crucial to recognize the potential downsides, such as heightened interest rates compared to traditional loans. Collateral is at risk if the business defaults, and the requirement for continual collateral monitoring can be administratively burdensome.

Businesses need to weigh these considerations meticulously. According to financial data, the terms and conditions of such loans are constantly evolving, with interest rates subject to change, influencing the decision-making process.

Ultimately, while asset-based lending can offer better rates and more lenient repayment terms, especially for those with less-than-ideal credit, it demands a clear-eyed assessment of the business's financial landscape to ensure it is the most suitable option for growth or survival.

Pros of Asset-Based Lending

Asset-based lending (ABL) stands out as a financial lifeline, offering swift capital infusion when traditional loan timelines don't align with the immediate needs of businesses. It shines in its ability to mold to a company's unique circumstances through bespoke loan structures. A prime example of this flexibility was evident when The Ledge Climbing Gym in Inverness leveraged its assets to finance a community-supportive climbing wall amidst the challenges of COVID-19.

In the ever-changing landscape of small business financing, ABL allows companies to utilize their assets, from inventory to receivables, as collateral to secure necessary funds. This method can provide more favorable rates and terms, especially when compared to unsecured loans that rely heavily on credit scores and revenue history.

The strategic advantage of ABL is further exemplified by organizations like Corsham Gymnastics Academy, which, even during the peak of the pandemic, managed to secure expansion funds through targeted and professional approaches to asset-based finance.

As the European financial market experiences a paradigm shift, with simultaneous contractions in loan supply and demand, ABL offers a vital alternative for SMEs facing barriers due to rising interest rates and stringent lending criteria. The agility of ABL could very well bridge the widening funding gap for SMEs that find traditional loans less attainable.

In summary, asset-based lending not only provides businesses with rapid access to capital but also tailors the lending experience to each company's specific needs, leveraging their assets to unlock growth opportunities and navigate through financial turbulence.

Cons of Asset-Based Lending

Asset-based lending, while a practical financing option for businesses, does come with certain considerations. The nature of these loans often results in higher interest rates due to the elevated risk lenders undertake. For example, secured loans are typically accompanied by substantial borrowing limits, but they inherently carry the risk of higher rates to offset potential losses.

The possibility of asset forfeiture is also a real concern. Lenders are entitled to seize collateral in the event of a default, which could mean the liquidation of critical business assets. This was highlighted in a narrative where collateral acts as a security net for lenders, granting them the right to recoup losses through asset claims.

This mechanism provides lenders with a layer of protection, ensuring they are not left without recourse if a borrower fails to repay.

Furthermore, the administrative aspect of asset-based financing can be burdensome. Businesses must consistently monitor and report on their collateral assets, adding to their operational workload. The stringent need for regular updates and a clear lien agreement on the assets used as collateral serves as a reminder of the lender's rights and the business's obligations.

These factors are underscored by recent trends in lending practices, as reported in the April and July 2024 Senior Loan Officer Opinion Surveys on Bank Lending Practices. The surveys indicated a tightening of standards and a dip in demand for both commercial and industrial loans and commercial real estate loans, reflecting a cautious approach in the lending environment.

Businesses considering asset-based loans must weigh these factors carefully, especially in the current financial climate where lending standards are strict, and the potential for economic downturn looms. Hence, while asset-based lending can provide necessary funds, it is crucial for businesses to understand and prepare for the attached commitments and risks.

Preparing for an Asset-Based Loan Application

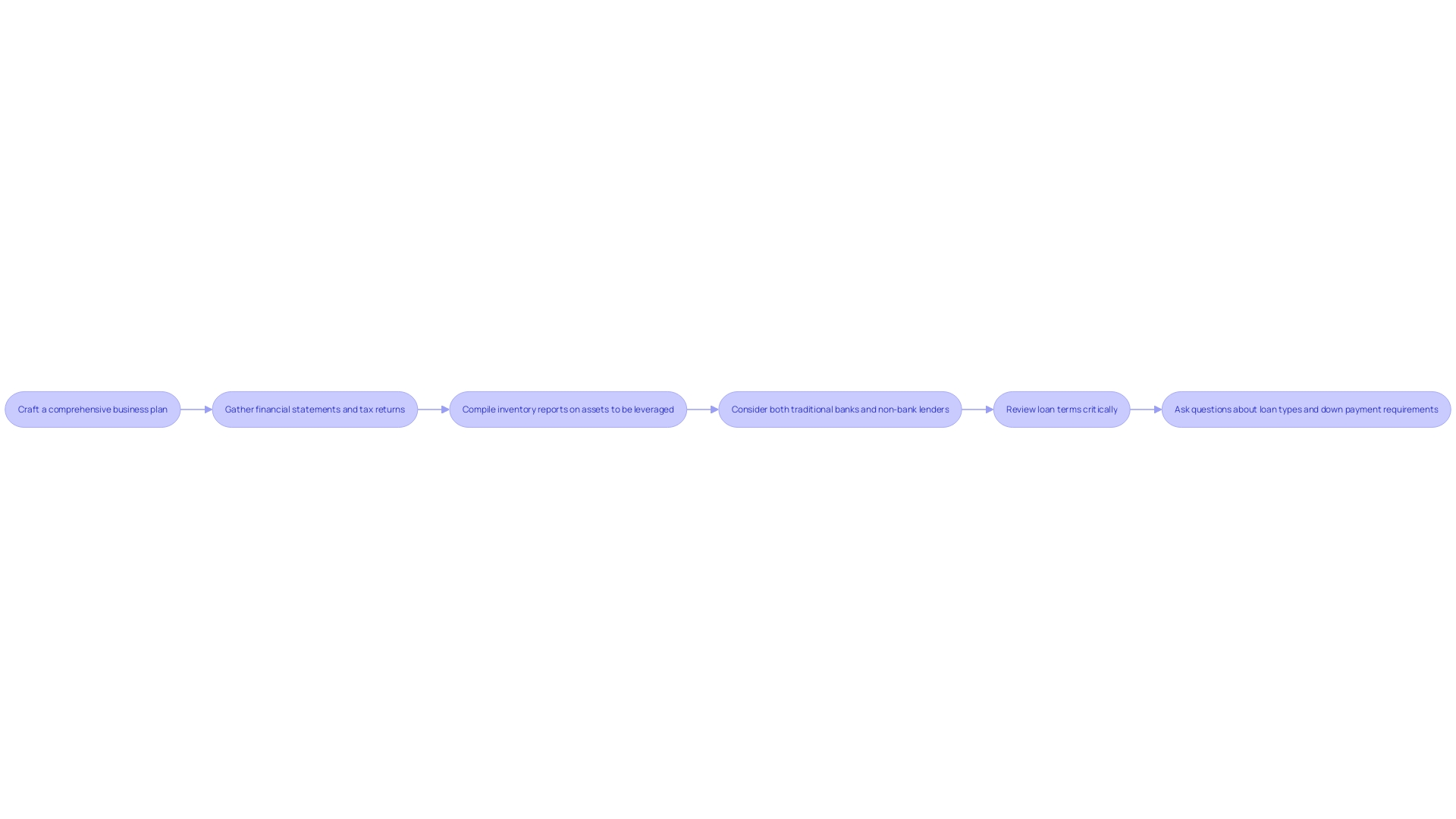

To enhance the prospects of securing an asset-based loan amidst a fluctuating economic landscape, meticulous preparation is key. Start by crafting a comprehensive business plan that articulates your company's mission, outlines its operations, and details the products or services offered. This plan should include an incisive market analysis, a robust marketing and sales strategy, and forward-looking financial projections.

Gather your financial statements, tax returns, and aging reports for accounts receivable. Compile inventory reports and other pertinent data concerning the assets you plan to leverage.

In light of the recent tightening of bank lending standards and the heightened probability of an economic downturn, it's prudent to consider both traditional banks and non-bank lenders, the latter now offering increasingly competitive rates. With the Senior Loan Officer Opinion Survey indicating a constriction of credit standards and a dip in demand for commercial and industrial loans, your preparedness will set you apart. It's also essential to review loan terms critically, as advised by financial experts.

Questions to ask potential lenders might include the type of loan best suited to your needs and the minimum down payment requirements, ensuring you make an informed investment in your business's future.

Financial Documentation Needed

Securing an asset-based loan demands meticulous preparation and the submission of a comprehensive package of financial documents. The lender's assessment will revolve heavily around your balance sheet, income statement, and cash flow statements, which provide a snapshot of your company's financial health. Tax returns offer a historical perspective of earnings and compliance, while accounts receivable aging reports shed light on the liquidity and collectability of your receivables.

Inventory reports are critical as they detail the assets that may serve as collateral for the loan. It's essential to remember that an accurate appraisal or valuation of the collateral assets can significantly influence the terms of the loan. Moreover, lenders might request additional financial records that are unique to your business operations or industry to gain a deeper understanding of the risks involved.

To streamline the application process, it's advisable to work closely with your lender to identify precisely which documents are needed, as the requirements may vary with the loan size and the lender's internal procedures. A common bottleneck in the loan approval process is the lack of required documents, to ensure that you fill out the application thoroughly and provide all necessary documentation to avoid delays.

Furthermore, it's good practice to monitor your credit using free services to anticipate what lenders might see and prepare explanations for any potential issues. This proactive approach can minimize additional underwriting queries and accelerate the approval process.

Given the current lending climate, as reported in the October 2023 Senior Loan Officer Opinion Survey, banks have tightened standards for commercial loans and reported weaker demand. This trend underscores the importance of presenting a robust and complete application to improve the chances of securing a loan under these stricter conditions.

Asset Inventories and Legal Documents

When securing a business loan, it's essential to present a meticulously detailed asset inventory to your lender. This should encompass not just a comprehensive list of assets pledged as collateral but also their specific descriptions, quantities, conditions, and precise locations. Equally important is the organization of corresponding legal documentation such as titles, ownership certificates, and any applicable liens.

Such preparation demonstrates the credibility of your business's financial standing and can significantly influence the lender's decision-making process.

Collateral is the cornerstone of securing a loan, especially for small businesses where it serves as a critical safety net for lenders. It's an asset—a guarantee—that if the loan isn't repaid, the lender has something of value to fall back on. This security can be particularly beneficial for businesses facing credit challenges, as it can facilitate loan approval and potentially result in more favorable loan terms.

In light of the volatile financial landscape where industries such as real estate and construction have experienced significant revenue downturns and cash flow constraints, it's imperative to have an exhaustive asset inventory. Such meticulous documentation can shield a business during challenging economic climates, safeguard against legal disputes over asset misrepresentation, and enhance the efficiency of insurance claims, as evidenced by the expedited claims process for a retail store following fire damage.

Understanding the composition of your assets, which include liquid assets like cash and accounts receivable, as well as long-term investments, is fundamental to your company's valuation. The equilibrium between assets, liabilities, and equity is pivotal, and it's crucial to calculate the total assets accurately. This could involve appraising intangible assets such as brand strength, which can be a significant contributor to a company's value and appeal to lenders.

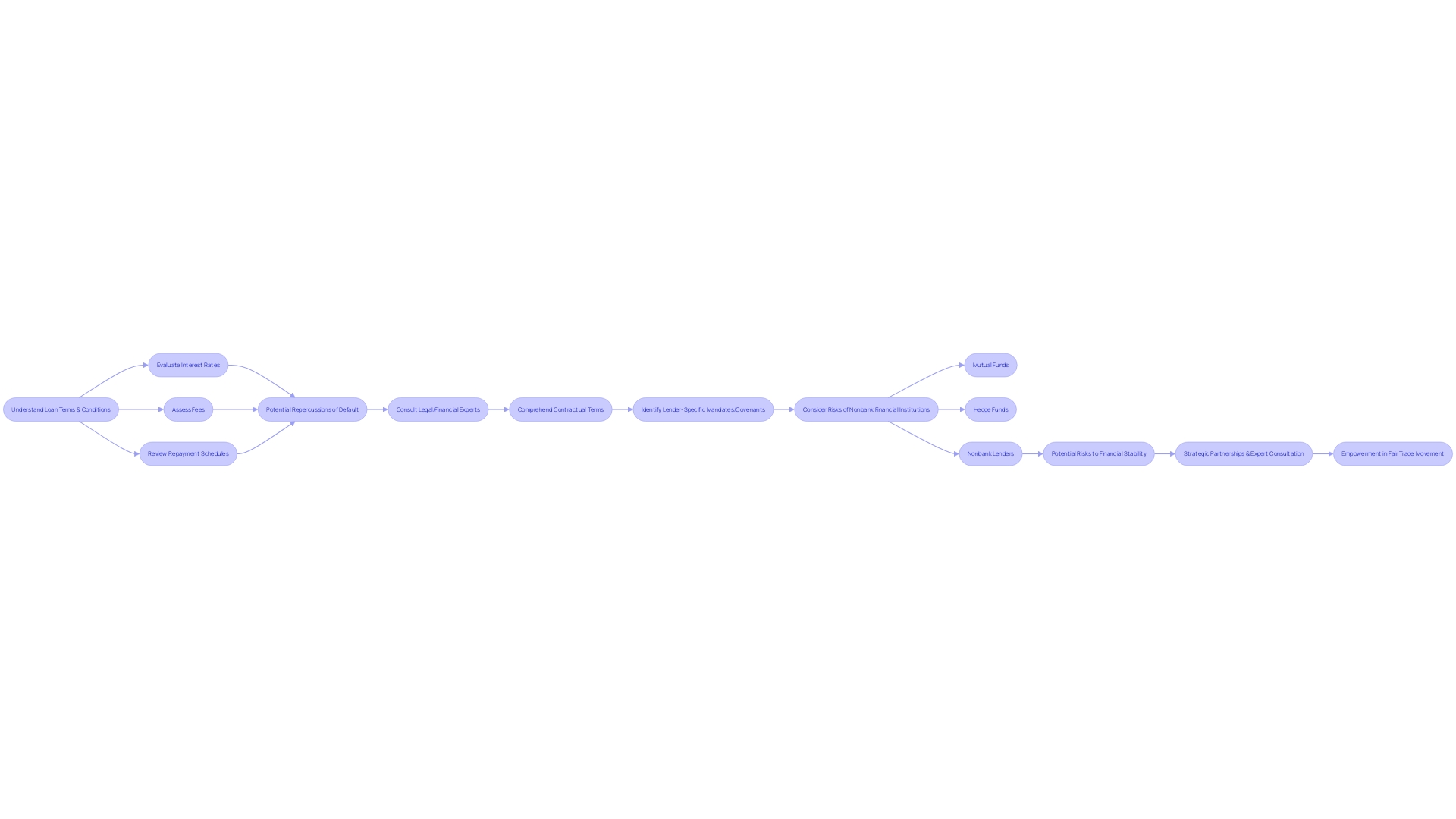

Understanding Loan Terms and Conditions

As you prepare to enter into an asset-based lending agreement, it's essential to grasp the nuances of the loan terms and conditions you're committing to. Delve into the details of interest rates, fees, and repayment schedules with diligence. Be mindful of the repercussions of default, as well as any lender-specific mandates or covenants that could shape your financial obligations.

The complex landscape of nonbank financial institutions is characterized by the Financial Stability Board's definition which highlights the significance of understanding the diverse entities involved in this space, including mutual funds, hedge funds, and nonbank lenders, all of which may pose potential risks to financial stability through activities such as maturity or liquidity transformation. Given the intricate nature of these financial arrangements, consulting with legal or financial experts is a prudent step to ensure a comprehensive comprehension of the contractual terms. This level of preparation can aid in safeguarding your business's future, much like Equal Exchange's strategic partnerships have empowered farmers and consumers in the fair trade movement, ensuring sustainability and growth for both parties.

Borrowing Base and Covenants

Asset-based lending hinges on the valuation of collateral through a 'borrowing base,' which essentially caps the amount a borrower can obtain, typically tied to assets like inventory or accounts receivable. Lenders secure these loans further with covenants—rules the borrower must adhere to. These can involve maintaining certain financial ratios, adhering to reporting obligations, or limiting new debt incurrence.

For instance, Almi's financial solutions—extending loans and venture capital—emphasize the importance of such covenants by offering business development support to small and medium-sized companies. Meanwhile, The Ledge Climbing Gym's journey to establish a community-supporting climbing facility showcases the practical application of securing funds while adhering to specific lending conditions. The gym navigated financial challenges, including the COVID-19 pandemic setbacks, to finally secure a tenancy and launch impactful 'Vertical Living' programs.

In the digital realm, web3 lending platforms introduce a contemporary twist to asset-based lending by backing loans with digital assets, thereby enabling cross-border lending in areas with limited credit access. Investors enjoy flexible investment terms and the ability to liquidate their positions without lock-up periods, which underscores the evolving nature of loan covenants in the context of modern financial technology.

Such innovations reflect the cryptocurrency industry's drive, as evidenced by Coinbase's mission to modernize a century-old financial system with crypto, enhancing economic freedom. The Gearbox protocol similarly innovates in the DeFi space by providing users with 'Credit Accounts' for enhanced capital utilization, illustrating the value of flexible but regulated credit mechanisms to maintain financial stability.

Nonbank financial institutions, including mutual funds, hedge funds, and nonbank lenders—often termed 'shadow banks'—highlight the significance of covenants and borrowing bases. They play pivotal roles in the financial system, potentially introducing risks through activities like leverage or liquidity transformation, as noted by financial authorities.

In sum, asset-based lending is a critical tool for managing cash flow and funding growth while requiring careful compliance with lender-imposed covenants to ensure the balance between accessing necessary capital and maintaining financial stability.

Fees and Interest Rates

Asset-based lending often entails a mixture of various fees beyond the interest charged on the borrowed amount. Typically, these charges include origination fees, which cover the cost of processing the loan; appraisal fees for asset valuation; underwriting fees, which are paid for the service of evaluating the financial risk of the loan; and monitoring fees, which are ongoing costs for overseeing the status of the loan and the assets. The interest rates on these loans can either be fixed, offering stability over the loan term, or variable, fluctuating with market conditions.

It is critical to conduct a meticulous analysis of both the interest rates and the fees to ascertain the total cost of securing an asset-based loan. In doing so, one must consider the size and growth prospects of their account, as fees can become more manageable with a larger balance or less significant when compared to the benefits of investment growth. When reviewing an investment advisory agreement, which outlines the fees and services associated with the loan, ensure that you understand each component.

Remember, this is a binding legal document, and it is essential to thoroughly review it prior to agreeing to the terms, even if it's presented as a standard online 'I agree' checkbox.

Default Conditions and Consequences

Grasping the intricacies of default conditions is essential for steering clear of complications when dealing with asset-based lending. Defaulting occurs when borrowers fail to fulfill their obligations, such as missing scheduled payments or violating loan covenants. These covenants can impose restrictions on the borrower’s financial operations, like setting a cap on the permissible debt-to-earnings ratio.

When defaults transpire, the repercussions can be severe, encompassing additional charges or the collateral being repossessed and liquidated.

For instance, during the surge of subprime auto bonds following the pandemic, companies like Santander Consumer USA extended loans at high-interest rates to individuals with weaker credit profiles, leading to difficulties in repayment. A borrower’s inability to keep up with the steep payments can result in the lender taking action to recover the loan by seizing the asset, as was the case with the Silers, who struggled with their payments despite having a substantial income.

The repercussions of default can also impact the broader economy. With the growth of private credit and leveraged loans, regulatory scrutiny has intensified, and financial institutions face the challenge of managing a potential increase in loan failures. The Consumer Financial Protection Bureau's legal actions against certain lenders underscore the seriousness of these defaults.

Defaults not only affect the borrowers but also investors, as the recovery rate—the amount recouped by bondholders in the event of a default—is often significantly less than the bond's face value. Moody’s reports that the average recovery rate for senior unsecured bonds is around 39%, indicating the high risk involved in such lending practices.

With banks reporting a tightening of standards and a drop in demand for both commercial and industrial loans and commercial real estate loans, the landscape of asset-based lending is shifting, necessitating a careful approach to avoid the damaging effects of default.

Conclusion

Asset-Based Lending (ABL) is a robust financing avenue that allows businesses to unlock capital tied up in their assets. By leveraging assets such as accounts receivable, inventory, equipment, and real property, companies can access essential working capital to support operational funding, growth initiatives, or restructuring processes. ABL emphasizes the intrinsic value of collateral rather than credit scores, making it beneficial for organizations with substantial physical or financial assets.

ABL offers businesses new opportunities to leverage their assets in innovative ways, including the rise of tokenized assets. It encompasses various types of assets used as collateral, such as accounts receivable, inventory, equipment, and real estate. Understanding the collateral's value is crucial, as it determines the loan-to-value ratio (LTV) and influences the loan amount and terms.

Asset-based loan rates fluctuate based on factors such as a borrower's credit history, collateral quality and valuation, industry, and market conditions. Recent trends indicate a tightening of lending standards and a reduction in demand for commercial and industrial loans, which may affect the terms of asset-based loans. However, businesses can stay informed and seek out the most favorable terms possible by understanding market trends and the implications of changing interest rates.

Asset-based lending offers numerous benefits, including swift access to funds, flexible funding structures, and the ability to tailor loan terms to meet unique financial landscapes. It can be instrumental in supporting businesses during times of financial strain or restructuring efforts. However, it's important to weigh the potential risks, such as higher interest rates and the possibility of asset forfeiture in the event of default.

Preparing for an asset-based loan application involves crafting a comprehensive business plan, gathering financial documents, and researching potential lenders. Businesses should present a meticulously detailed asset inventory and corresponding legal documentation to demonstrate the credibility of their financial standing. Understanding loan terms and conditions, including fees and interest rates, is essential for making informed decisions and avoiding complications.

Awareness of default conditions and consequences is crucial to navigate asset-based lending successfully and avoid damaging effects.

Overall, asset-based lending is a powerful tool for businesses seeking additional capital. It offers flexibility, customization, and the potential to unlock growth opportunities. However, careful consideration of the associated risks and thorough preparation are necessary to ensure that asset-based lending aligns with a business's financial objectives and long-term stability.