Introduction

Cash basis accounting, with its focus on simplicity and immediacy, provides a clear and straightforward approach to financial transaction recording. Unlike accrual accounting, which recognizes revenue and expenses when they are earned or incurred, cash basis accounting only marks revenue and expenses when cash actually changes hands. This method offers small businesses and startups a transparent view of liquidity, vital for assessing financial health.

However, managing cash flow can be cumbersome without automated tools, leading to inefficiencies in tracking expenses and generating reliable forecasts. As businesses recognize the benefits of investing in software solutions, they adapt their accounting practices to the changing landscape of the digital economy. In this article, we will explore the key concepts, benefits, limitations, and compliance considerations of cash basis accounting.

We will also delve into practical examples and case studies, such as the journey of Monday.com, to illustrate the importance of efficient growth, profitability metrics, and the distinction between cash basis accounting and accrual basis accounting. Additionally, we will examine the impact of cash basis accounting on tax reporting and the transition to Generally Accepted Accounting Principles (GAAP) compliance. By understanding the nuances of cash basis accounting, businesses can make informed decisions, manage cash flow effectively, and drive profitability.

Key Concepts of Cash Basis Accounting

Cash basis accounting, at its core, is about simplicity and immediacy in financial transaction recording. It concerns itself solely with the cash flowing in and out of a business, marking revenue and expenses only at the point that cash actually changes hands. This approach starkly contrasts with accrual accounting, where revenue and expenses are recorded when they are earned or incurred, regardless of when the money is actually received or paid.

To illustrate, consider a scenario involving a local grocery store purchasing mangos from a distributor. Under cash basis accounting, the store's books reflect the cost of the mangos only when the store pays the distributor, not when the order is placed or delivered. Similarly, the store records sales revenue only when customers pay at the register, not when they select their groceries.

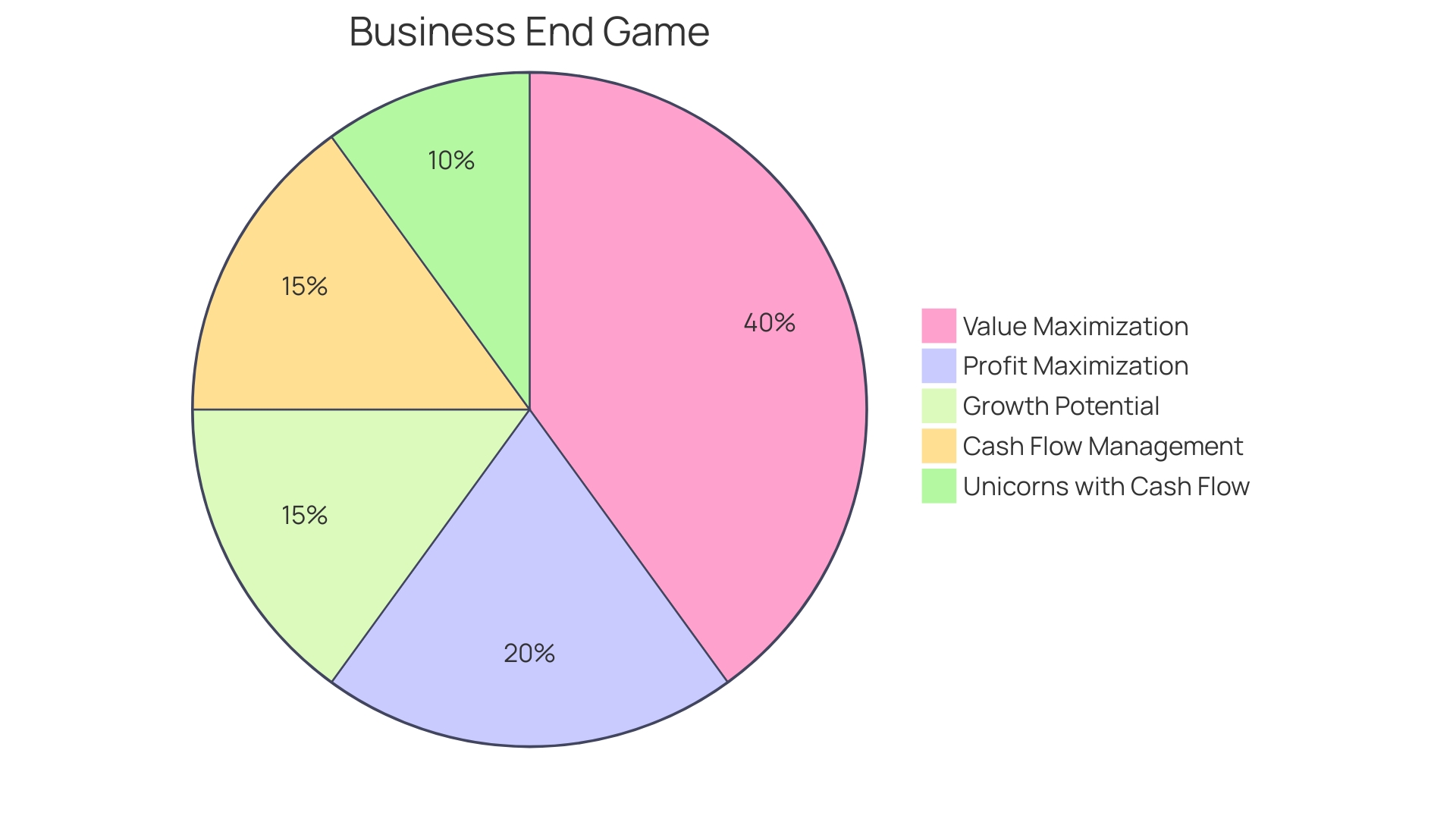

This method's clarity is particularly beneficial for small businesses and startups where cash flow is a critical indicator of financial health. It provides an unobstructed view of liquidity, which is vital for entities like Monday.com, a software company that swiftly became free cash flow positive. By focusing on efficient growth and the nuances of cash flow, rather than revenue alone, Monday.com has been able to enhance its shareholder value and investment capacity, demonstrating the value of prudent financial strategies.

The importance of free cash flow—a measure of financial performance that shows how much money a company has at its disposal after covering capital expenditures—cannot be overstated. It's a testament to a company's ability to sustain growth, innovate, and return value to shareholders.

However, it's worth noting that managing cash flow can be cumbersome if relying on manual processes. A significant portion of small and medium businesses still use spreadsheets, paper records, and manual calculations, which can lead to inefficiencies and inaccuracies. These methods can impede the ability to track expenses, revenue, and generate reliable forecasts, which are essential for informed decision-making and strategic planning.

With the advent of financial technology, businesses are increasingly recognizing the benefits of investing in software solutions to enhance productivity, manage data more effectively, and create operational efficiencies. As the digital economy evolves, consumer behavior also shifts, with a notable preference for credit cards over cash, highlighting the need for businesses to adapt their accounting practices to the changing landscape.

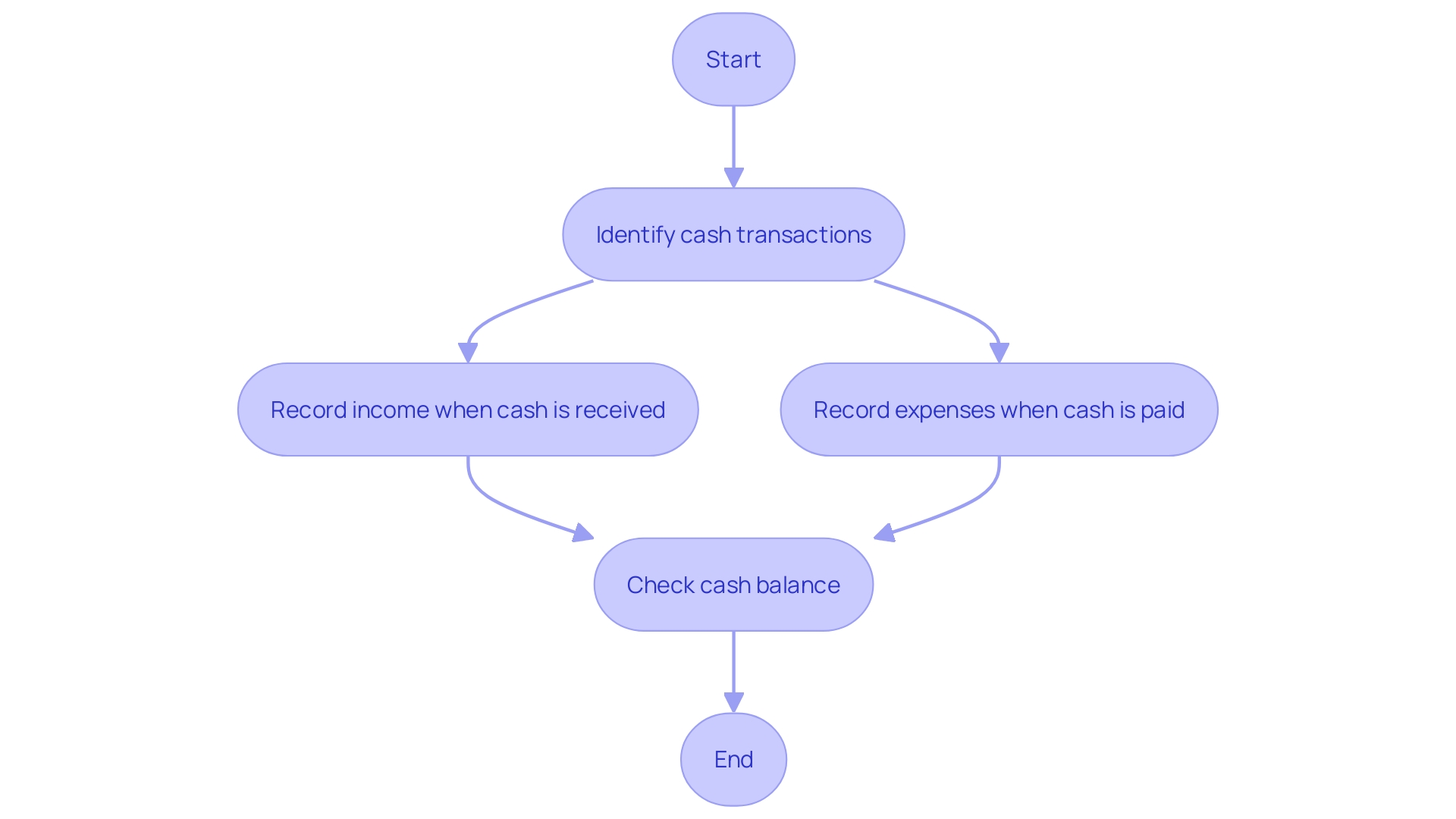

How Cash Basis Accounting Works

Cash basis accounting is a straightforward approach to financial management. It only records transactions when cash actually changes hands, making it simpler to track and understand, especially for smaller businesses. For instance, if a local grocery chain orders mangos and pays for them, the expense is recorded at that moment, not when the mangos are received or used.

This method's simplicity can be seen in the case of Monday.com, which efficiently used its cash to enhance growth, swiftly achieving positive free cash flow.

In contrast, understanding profitability becomes more complex. Not all revenue is equal; factors like gross margins play a critical role. During high-growth periods, such as in 2021, investors may overlook these details, but ultimately, a company's value is tied to its ability to generate free cash flow for shareholders.

By concentrating on gross margins, businesses like Monday.com can fine-tune their operational efficiency.

For example, a company's accounting practices can significantly impact how it's perceived financially. When Monday.com reported strong free cash flow, it underscored the importance of effective cash management and the potential for shareholder value increase. The company's ability to grow efficiently, as highlighted by its Rule of 40 Score, demonstrates the power of combining profitability with growth.

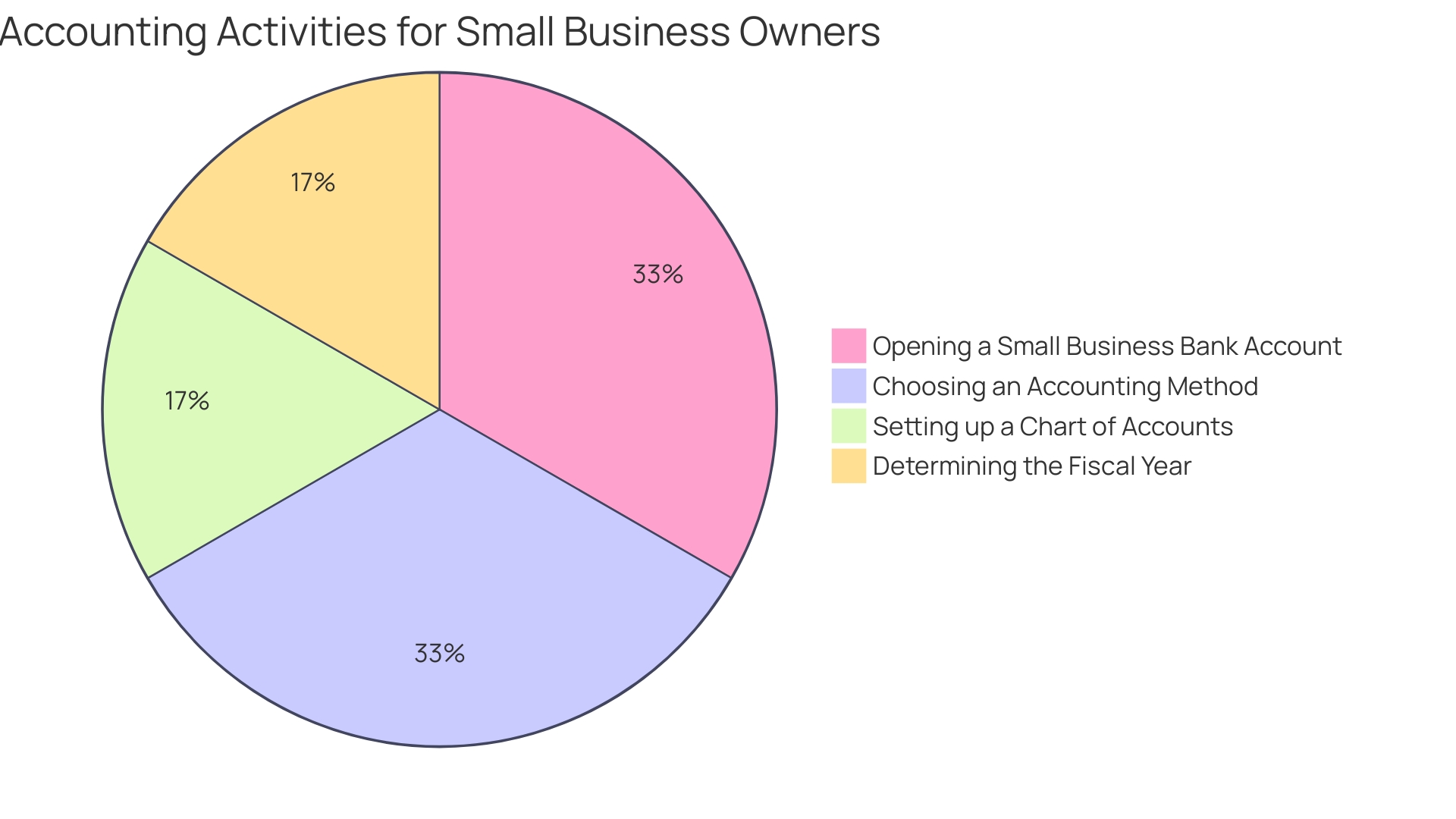

Moreover, the distinction between bookkeeping and accounting is crucial. Bookkeeping involves the meticulous recording of transactions, laying the groundwork for accountants to analyze, interpret, and report on a company's financial health and transactions. This clarity is essential when communicating with CPAs or making strategic decisions.

As we transition from traditional to more dynamic business environments, the importance of proper accounting methods remains paramount. Firms must navigate through various financial landscapes, and the decision between cash and accrual accounting methods can have significant implications on how their financial story is told and understood.

Recording Revenue and Expenses in Cash Basis Accounting

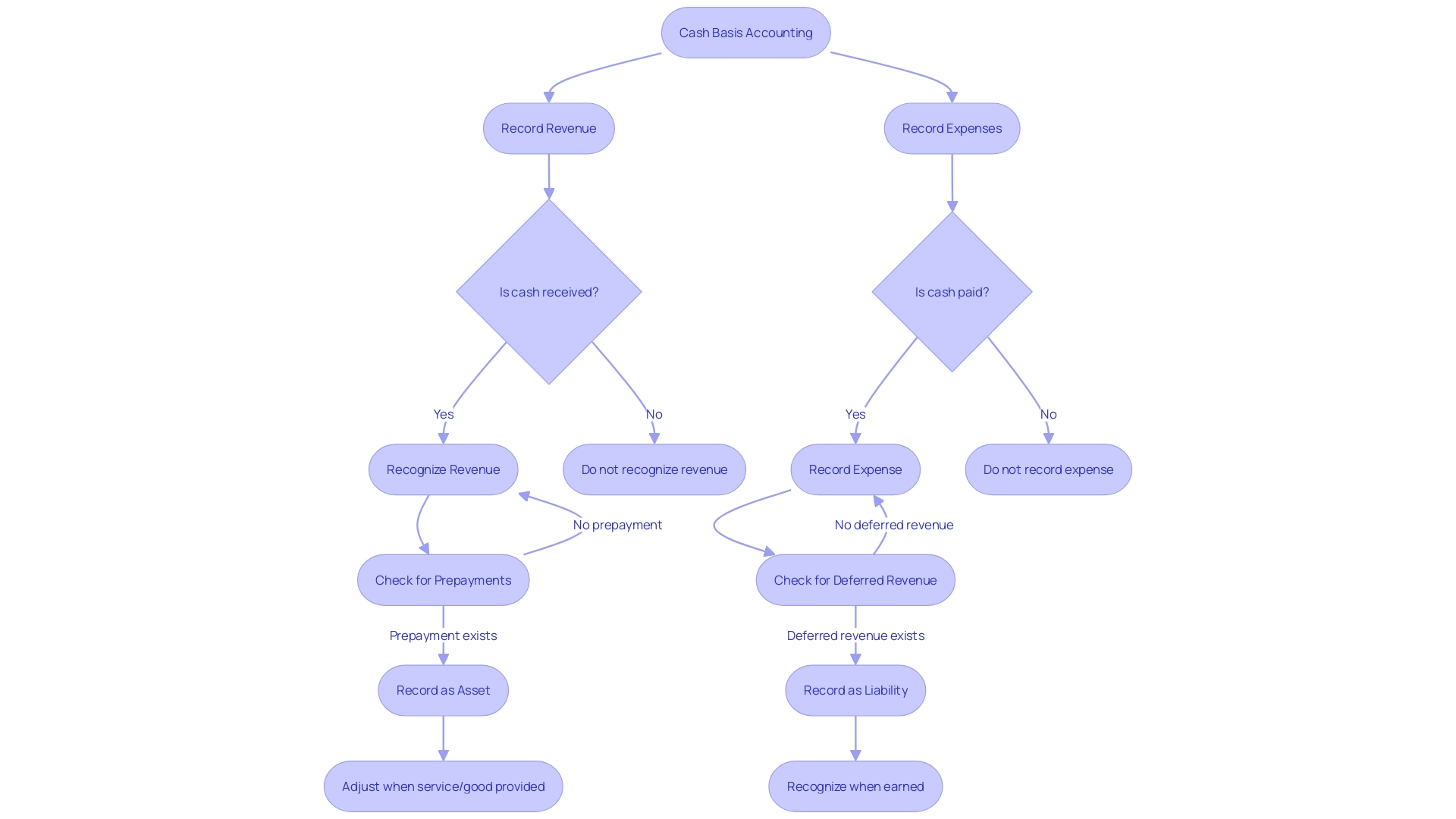

In the realm of cash basis accounting, the act of recording revenue and expenses is a pivotal element. Revenue is acknowledged when cash is physically received, aligning income recognition with actual cash flow. Conversely, expenses are recorded only when cash is disbursed, providing a straightforward view of financial outlays.

This method also addresses the treatment of prepayments and deferred revenue, critical for maintaining accurate financial records.

For instance, the case of Monday.com illustrates the significance of efficient growth and becoming free cash flow positive, particularly when expansion rates decelerate. An emphasis on gross margins and an acute awareness of cash flow management has enabled Monday.com to invest more effectively, extend its cash runway, and enhance shareholder value. Such a focus on profitability metrics is crucial for software companies aiming to optimize their growth efficiency.

A recent IASB study highlighted the diversity in operating profit reporting among companies, with over 60 companies using at least nine different calculation methods. This underscores the importance of having clear, consistent guidelines for financial reporting. For CFOs and accountants, precise terminology and consistent categorization of financial transactions are instrumental, as reflected by an expert's emphasis on the precision of naming financial accounts.

To further illustrate the practical application of cash basis accounting, consider a software startup with a single-member LLC. Here, clear differentiation between 'Owner's' accounts and 'Member' or 'Shareholder' accounts is imperative for accurate financial reporting.

Lastly, understanding the distinction between bookkeeping and accounting is vital. While bookkeeping involves the meticulous recording and management of financial transactions, accounting synthesizes this data to create a comprehensive picture of a company's financial health. This distinction is exemplified by the different ways in which revenue recognition can be applied, such as the matching principle for nonprofit organizations or immediate recognition upon sale for small businesses.

In summary, mastering the intricacies of cash basis accounting, from revenue recognition to the handling of prepayments and deferred revenue, equips companies with the clarity needed to make informed decisions, manage cash flow effectively, and ultimately drive profitability.

Financial Statements in Cash Basis Accounting

Grasping the nuances of cash basis accounting is crucial for businesses, particularly when it comes to the differences from accrual basis accounting. The cash basis method records transactions only when cash is exchanged, significantly affecting how financial statements are presented. For instance, a cash basis income statement will reflect income only when it's received, and expenses only when they are paid.

This contrasts with accrual accounting, which recognizes income and expenses when they are earned or incurred, regardless of when the cash transaction happens.

To dive deeper, the cash basis balance sheet may not show liabilities or receivables that an accrual basis balance sheet would, since these amounts have not yet been settled in cash. Moreover, the cash flow statement under cash basis accounting becomes a pivotal tool, as it provides a transparent view of cash movements, aiding in assessing a company's ability to generate positive net cash flows, fulfill financial obligations, and potentially return cash to investors.

Notably, a study has shown that 42% of SMEs still rely on manual processes for cash flow management, which can introduce errors and inefficiencies. In contrast, adopting automated tools can significantly improve productivity and data management. It's also been observed that nearly 30% of businesses lack adequate cash reserves for unexpected challenges, underscoring the importance of accurate cash flow statements for strategic decision-making.

Moreover, recent findings reveal that 40% of small businesses have suffered from inconsistent cash flow, and a large portion have had to sacrifice salaries and business opportunities as a result. This highlights the critical nature of effective cash flow management to the sustainability of a business. In light of these insights, it's clear that the quality of cash flow reporting cannot be overstated, and businesses must ensure that their financial statements, including those prepared on a cash basis, are as rigorous and attentive as those prepared under other accounting methods.

Pros of Cash Basis Accounting

Cash basis accounting, with its straightforward approach, can be exceptionally beneficial for small to medium-sized businesses. It simplifies financial transactions by recording them only when cash changes hands, making it easier to manage and understand cash flow. This method eliminates the need to track receivables and payables meticulously, reducing the burden of financial tracking and associated costs.

Small businesses, like John Dee Warwick, experienced significant growth and complexity in operations, which could have been streamlined with simpler accounting practices like the cash basis method. This method is especially advantageous during phases of rapid expansion or when dealing with variable production outputs, as in John Dee's case with meat processing.

A strong case for adopting cash basis accounting can be made when considering the challenges of managing intricate product flows and ensuring timely order fulfillment, as seen in the meat processing industry. The cash basis method promotes better visibility and control over cash movements, which is crucial for businesses experiencing growth or those with intricate operational flows.

Moreover, the rising compliance costs and economic uncertainties facing small businesses underscore the importance of adopting straightforward financial management practices. Inflation concerns and regulatory challenges, as reported in recent news, are compelling reasons for businesses to opt for accounting methods that reduce complexity and cost.

In light of these considerations, cash basis accounting stands out as a suitable choice for businesses seeking to streamline their financial operations, ensure compliance with ease, and navigate the complexities of growth and market demands with greater agility.

Cons of Cash Basis Accounting

Cash basis accounting, while straightforward, presents challenges in presenting a comprehensive view of a company's financial health. It records transactions only when cash changes hands, offering a limited perspective that can obscure true profitability and liquidity. For instance, a large sale made on credit won't appear on the books until payment is received, potentially delaying strategic decisions.

This method also fails to account for future obligations, which can lead to a distorted understanding of long-term financial performance. Moreover, the use of cash basis accounting can complicate comparisons with firms using accrual accounting, where revenues and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged. As investors heavily rely on the statement of cash flows alongside other financial statements to assess a company's potential to generate cash and meet obligations, the lack of clarity in cash basis accounting statements could hinder informed decision-making.

Thus, it is crucial for companies to weigh the simplicity of cash basis accounting against its limitations in accurately reflecting the business's financial standing.

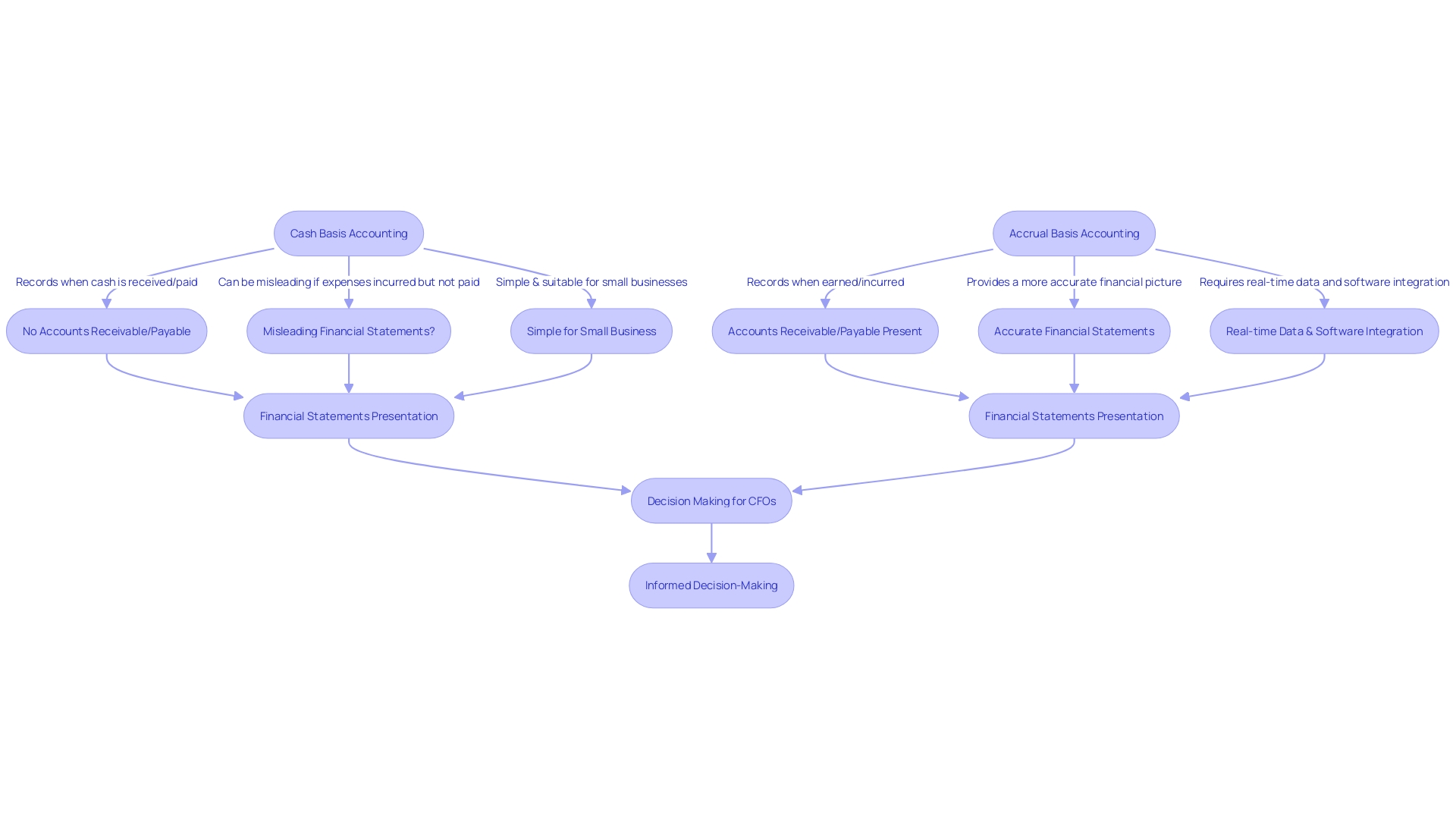

Comparison with Accrual Basis Accounting

Grasping the essence of cash basis accounting necessitates examining it alongside its counterpart: accrual basis accounting. A stark contrast lies in the timing of when revenue and expenses are recognized. Under cash basis accounting, transactions are recorded only when cash changes hands, which can paint a different picture of a business's financial health than accrual accounting, where revenue and expenses are recorded when they are earned or incurred, regardless of when the cash transaction occurs.

For instance, in accrual accounting, accounts receivable and accounts payable are acknowledged, which are absent in cash basis accounting. This variation significantly affects the presentation of financial statements. While cash basis may seem straightforward, especially for small businesses or single-member Llcs, it may not always reflect the true financial position of a company.

Consider a scenario where a business incurs expenses but delays payment: under cash basis, these expenses wouldn't appear on the books until the payment is made, potentially misleading stakeholders about the company's actual liabilities.

Moreover, the delay in financial reporting that many experience—waiting weeks for a monthly statement—is a hindrance that modern accounting software aims to eliminate. Real-time data, which is commonly seen on the engineering side of businesses, is becoming more prevalent in finance, offering up-to-date insights into a company's performance. The convergence of bookkeeping and accounting processes through software not only streamlines operations but also empowers CFOs with immediate access to critical financial statements such as cash flow statements, balance sheets, and income statements—key tools in making informed business decisions.

In summary, understanding the nuances between cash basis and accrual accounting is pivotal for CFOs. It ensures accurate financial oversight and supports strategic planning by providing a comprehensive view of the company's financial activities.

Impact on Tax Reporting

Understanding the implications of cash basis accounting on tax reporting is vital for financial management. Under this system, income and deductions are reported in the tax period when payment is received or made, rather than when the obligation arises. This offers simplicity and immediacy in recognizing transactions, but also carries certain limitations and requirements for compliance with tax authorities.

For instance, with the recent IRS guidance on activities qualifying as software development under Section 174, companies face a new layer of complexity. The capitalization and amortization of development costs can significantly affect cash flow—particularly in weighing domestic versus international hiring decisions. This underscores the importance of strategic tax planning under cash basis accounting.

Furthermore, the new standard for quantifying deductions and credits in financial statements will compel both public and private companies to adopt more transparent tax rate reconciliation practices. Public entities, for example, will have to provide a detailed rate reconciliation table, elucidating the factors affecting their effective tax rate against the statutory rate. This move towards greater consistency is designed to enhance investor understanding of an organization's tax position.

Consequently, CFOs must be cognizant of the dynamic regulatory landscape and the pivotal role of cash flow reporting in investors' assessments of financial health. The ability to generate positive net cash flows, fulfill financial commitments, and maintain liquidity is closely tied to the accounting methodologies employed. Cash basis accounting, with its focus on actual cash transactions, can influence the perceived profitability and operational efficiency of a business.

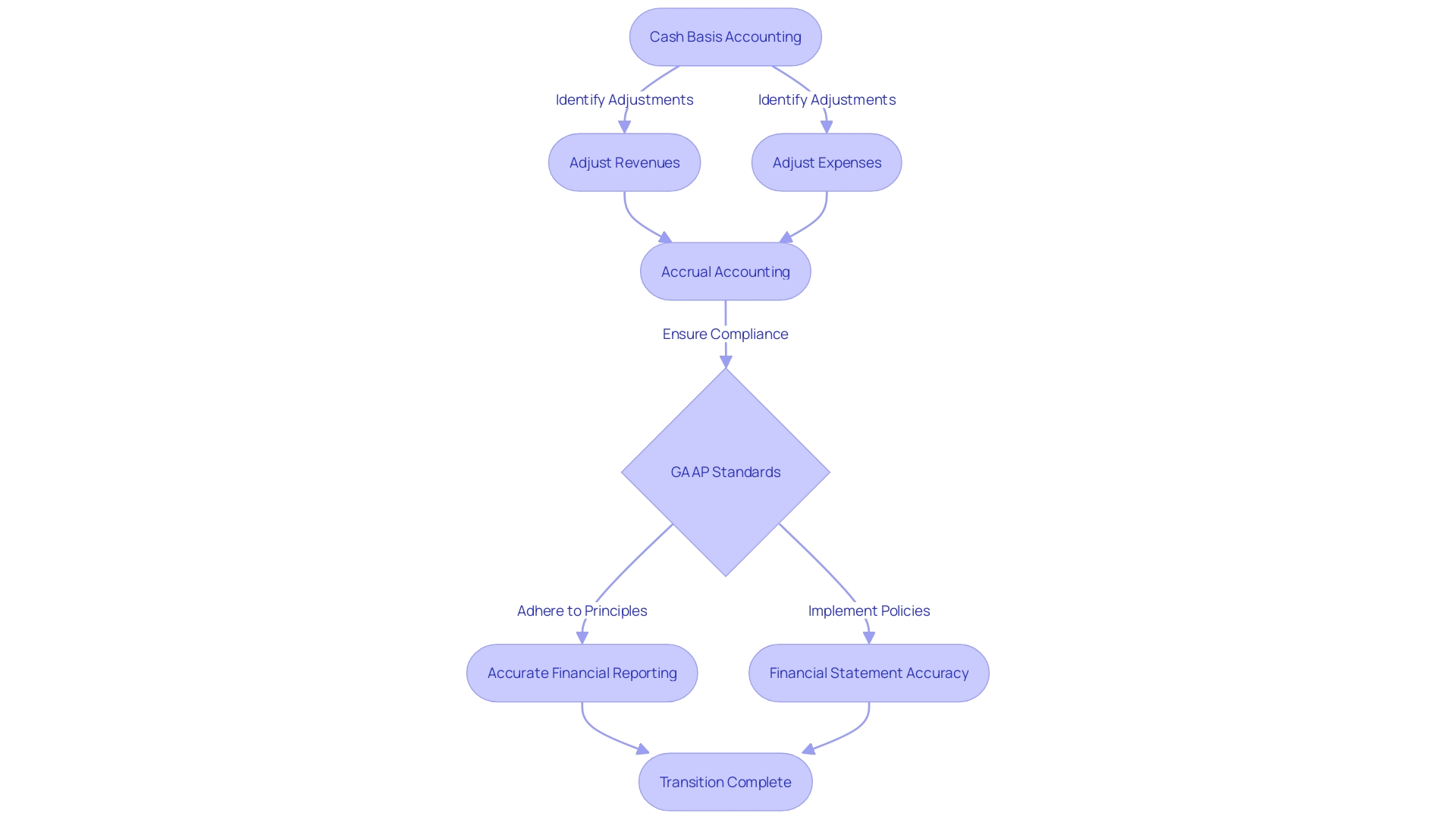

Limitations and Compliance with GAAP

Cash basis accounting, a method recording transactions when cash is exchanged, can pose challenges for businesses adhering to Generally Accepted Accounting Principles (GAAP). This method's simplicity is overshadowed by its limitations in reflecting a company's financial health accurately, as it doesn't account for revenue and expenses when they are incurred. For CFOs, understanding these limitations is crucial for ensuring financial statements provide a true representation of a company's financial position.

A critical aspect of GAAP compliance is the accurate reporting of income and expenses. Cash basis accounting records income when payment is received and expenses when paid. However, GAAP requires the use of accrual basis accounting, where transactions are recorded when they are earned or incurred, not just when cash is exchanged.

This distinction is vital for the preparation of financial statements that accurately reflect a company's obligations and resources over time.

Transitioning from cash basis to accrual accounting may necessitate adjustments. For instance, a business might need to recognize revenue that has been earned but not yet received, or account for expenses that have been incurred but not yet paid. These adjustments ensure that financial statements are in line with GAAP standards, providing a more comprehensive view of the company's financial activities.

The need to switch to accrual basis accounting becomes more pronounced as a business grows and seeks to present a more complete financial picture to investors, lenders, and regulatory bodies. It's essential for CFOs to recognize when this transition is necessary, as compliance with GAAP not only enhances the credibility of financial statements but also aligns with legal and regulatory requirements.

In practice, many small businesses in the United States face challenges with accounting software that fails to adequately support the nuances of accrual accounting. These systems often do not capture the detailed information accountants need, leading to manual and tedious processes. Recent developments by companies like Digits, however, suggest that software advancements are on the horizon, aiming to resolve these inefficiencies and improve the financial reporting landscape.

These improvements in accounting software are expected to facilitate the preparation of GAAP-compliant financial statements. As the IRS continues to define and clarify activities considered as software development, including enhancements that significantly improve functionality or efficiency, the evolution of accounting software will likely play a pivotal role in helping businesses transition from cash basis to accrual accounting and maintain compliance with GAAP standards.

Examples and Case Studies

Exploring the intricacies of cash basis accounting through the lens of real-world applications, we can turn to the case of Monday.com. This company's journey to becoming free cash flow positive as their growth decelerated is a testament to the efficiency of their operational model. It underscores a critical question that echoes through the software industry: how to amplify growth with efficiency.

With a focus on efficiency, companies like Monday.com are able to redirect more resources into investment opportunities, elongating their cash runway and boosting shareholder value.

Gross margins play a pivotal role in this scenario. They are not all created equally and are a significant factor in a company's valuation, especially when investor attention shifts from mere revenue to the more telling indicators of financial health during fluctuating market conditions. Monday.com's experience during the high tide of 2021 illustrates this point, where investors placed a premium on revenue, often overlooking gross margins and other costs.

Moreover, the release of IFRS 18 by the International Accounting Standards Board on 9 April 2024 has ushered in a new era of financial reporting. This standard aims to enhance the clarity of financial statements, mandating the presentation of specific subtotals for increased comparability and enforcing categorization of income and expenses into distinct classes. Such changes are crucial for CFOs to comprehend, as they directly affect financial disclosures and the assessment of a company's financial standing.

An exemplary instance of cash basis accounting can be seen in a hypothetical situation where a local grocery store chain orders mangos from a distributor. The essence of cash basis accounting is captured in this transaction: the store records the expense when it pays for the mangos, and the distributor records the income upon receiving the payment. This method prioritizes the actual movement of cash over the timing of the delivery of goods or services.

Understanding the operational mechanics of cash basis accounting is more than an academic exercise. It is a practical necessity that allows CFOs to navigate various financial landscapes, from the management of everyday transactions to the strategic interpretation of new accounting standards. By examining cases like Monday.com and staying abreast of developments like IFRS 18, CFOs can apply these insights to enhance their company's financial resilience and foresight.

Conclusion

Cash basis accounting provides small businesses and startups with a transparent view of liquidity, but manual cash flow management can be cumbersome. Investing in software solutions enhances productivity and profitability. While cash basis accounting simplifies financial transactions, it offers a limited perspective and hinders comparisons with accrual accounting.

Understanding the implications of cash basis accounting on tax reporting is crucial. Transitioning to accrual accounting may be necessary for a comprehensive financial picture. The journey of Monday.com highlights the importance of efficiency in driving growth and shareholder value.

Comprehending new accounting standards, like IFRS 18, is crucial for accurate financial reporting. By understanding the nuances of cash basis accounting, businesses can make informed decisions, manage cash flow effectively, and drive profitability. Investing in software solutions, staying compliant with tax regulations, and transitioning to accrual accounting when necessary are crucial for financial success in the digital economy.