Introduction

Cash flow from investing activities is a critical metric for analyzing a company's growth trajectory and financial resilience. This section of the financial statement provides transparency into a firm's strategic investment patterns, shedding light on the movement of funds used for investments in assets and securities. By meticulously tracking this cash flow, a company can gauge the effectiveness of its investment strategy and ensure alignment with long-term financial sustainability.

Understanding the nuances of cash flow from investing activities goes beyond numbers; it involves reading the story behind a company's investment decisions and their long-term financial implications. In this article, we will delve into the components, calculation, interpretation, and importance of cash flow from investing activities, providing practical insights and solutions for CFOs seeking to optimize their financial strategies.

What is Cash Flow from Investing Activities?

The cash flow from investing activities section on a company's financial statement shines a light on the movement of funds used for investments in assets and securities, providing a transparent view of a firm's strategic investment patterns. It's an essential metric for analyzing the growth trajectory and financial resilience of a business. By meticulously tracking this cash flow, a firm can gauge the effectiveness of its investment strategy and ensure alignment with long-term financial sustainability. For instance, a significant outflow might indicate hefty investments in capital expenditures (CAPEX), a sign of future growth. Conversely, substantial inflows suggest the liquidation of assets, which could either signal a strategic shift or a need to bolster liquidity. Understanding these nuances is critical for maintaining a robust balance sheet and ensuring that the company's investments are driving value maximization. This deep dive into cash flow from investing activities is not merely about numbers; it's about reading the story behind a company's investment decisions and their long-term financial implications.

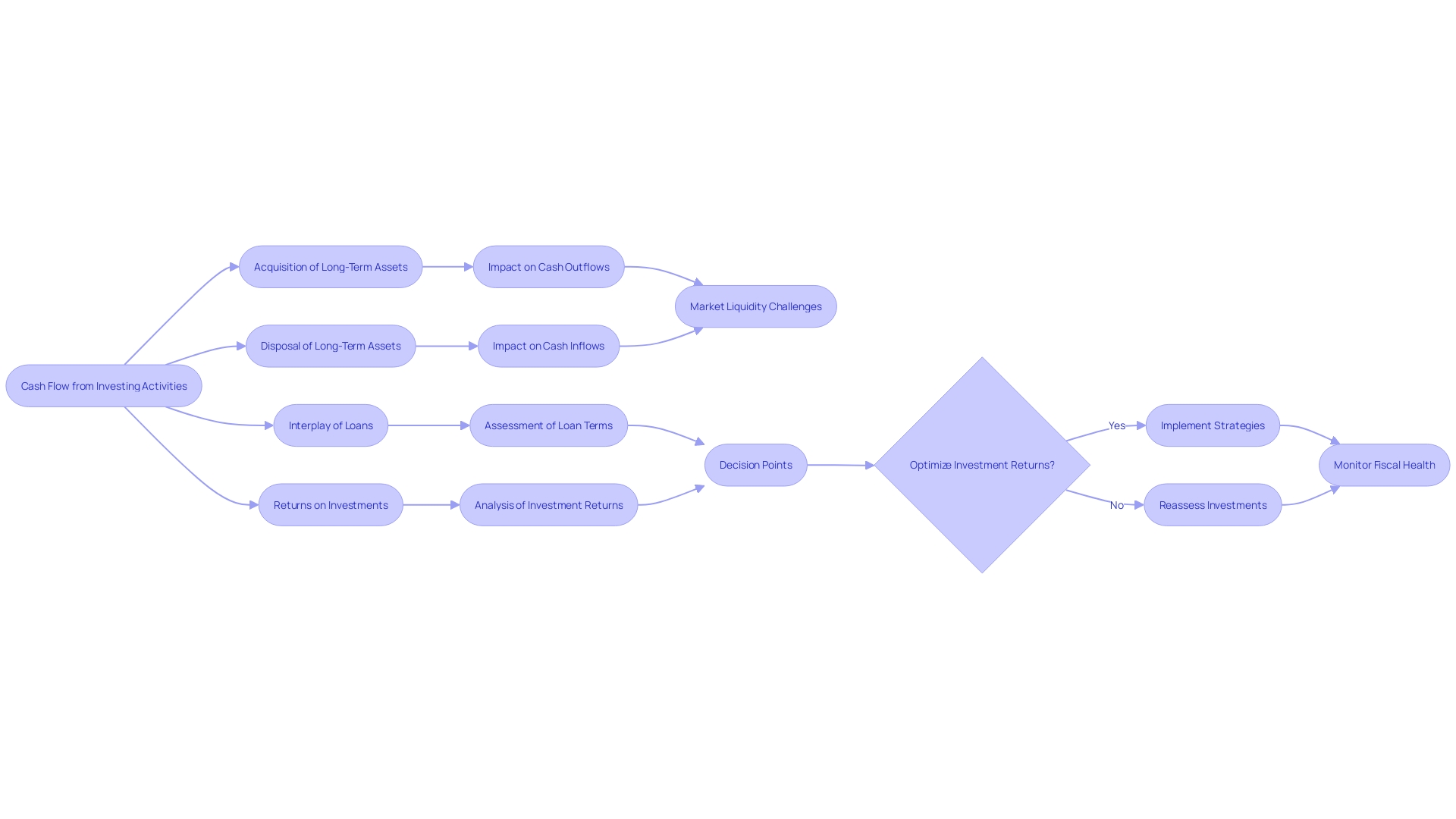

Components of Cash Flow from Investing Activities

Delving into the intricacies of cash flow from investing activities reveals a nuanced financial landscape that CFOs must navigate to assess their company's fiscal health and investment prowess. These activities include the acquisition and disposal of long-term assets and the interplay of loans and returns on investments. For instance, a sale of a company asset generates cash inflows, bolstering the investment segment of the cash flow statement. Conversely, purchasing new equipment or investing in another company results in cash outflows, which require careful scrutiny to ensure alignment with the company's strategic growth objectives.

Moreover, cash flow from investing captures the movement of funds in the form of loans extended and the subsequent collection of principal amounts. A keen understanding of these elements can provide CFOs with insights into how their investment decisions influence overall cash flow. For example, Monday.com's trajectory to becoming free cash flow positive as growth decelerated is a testament to efficient growth strategies. Such efficiency ensures a sturdy cash runway and enhances shareholder value, demonstrating the significance of prudent investment decisions.

The narrative of cash flow from investing is further enriched by external factors, such as market liquidity challenges. As seen in the crypto market's supply overhang and liquidity issues, the potential for forced selling and liquidation can exert considerable pressure on a company's financial position. This underscores the need for CFOs to maintain a vigilant eye on both internal and external factors affecting investment-related cash flows.

By dissecting these components, CFOs can craft a more robust financial strategy that supports sustainable growth, optimizes investment returns, and mitigates risks associated with cash flow volatility.

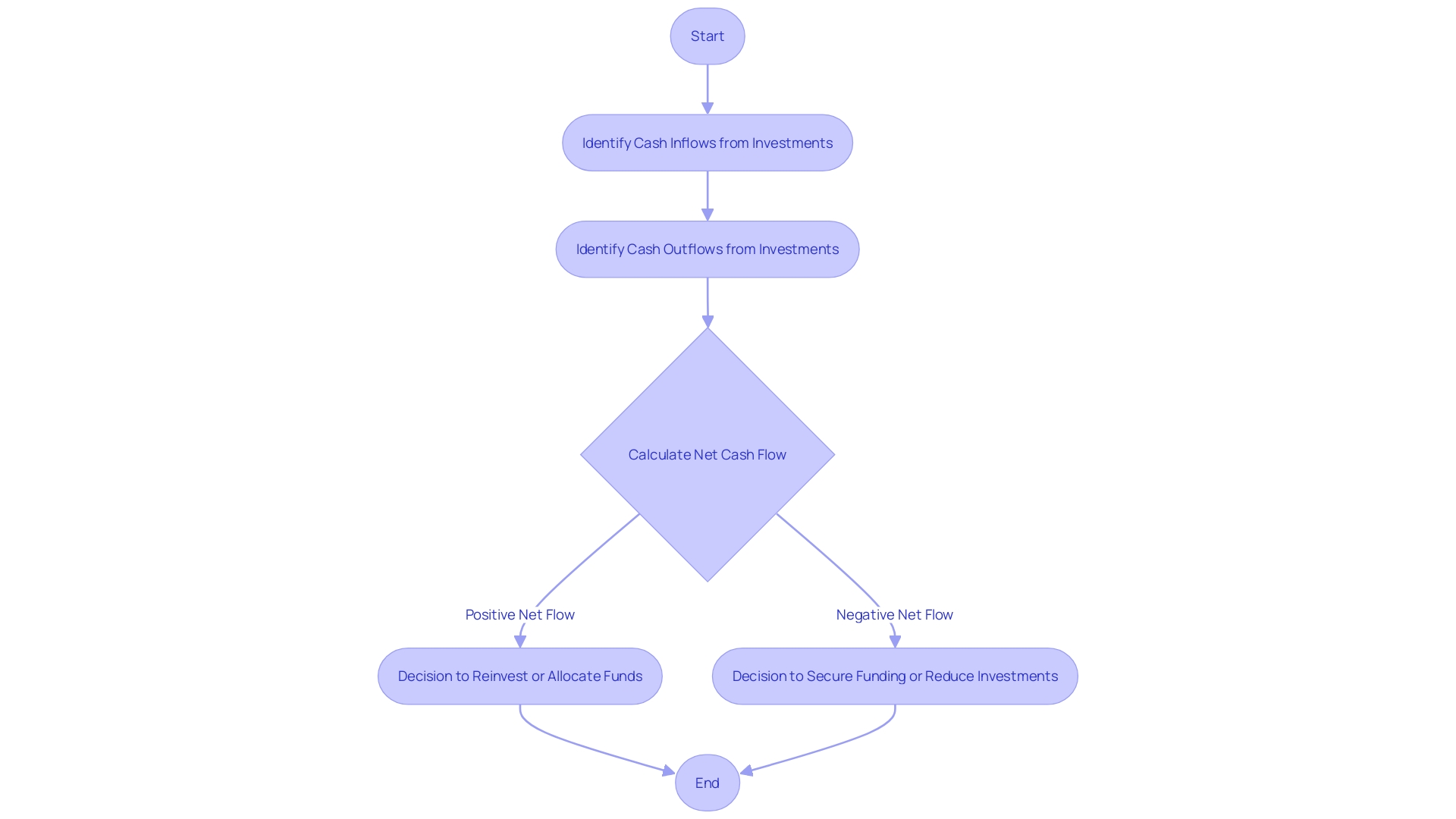

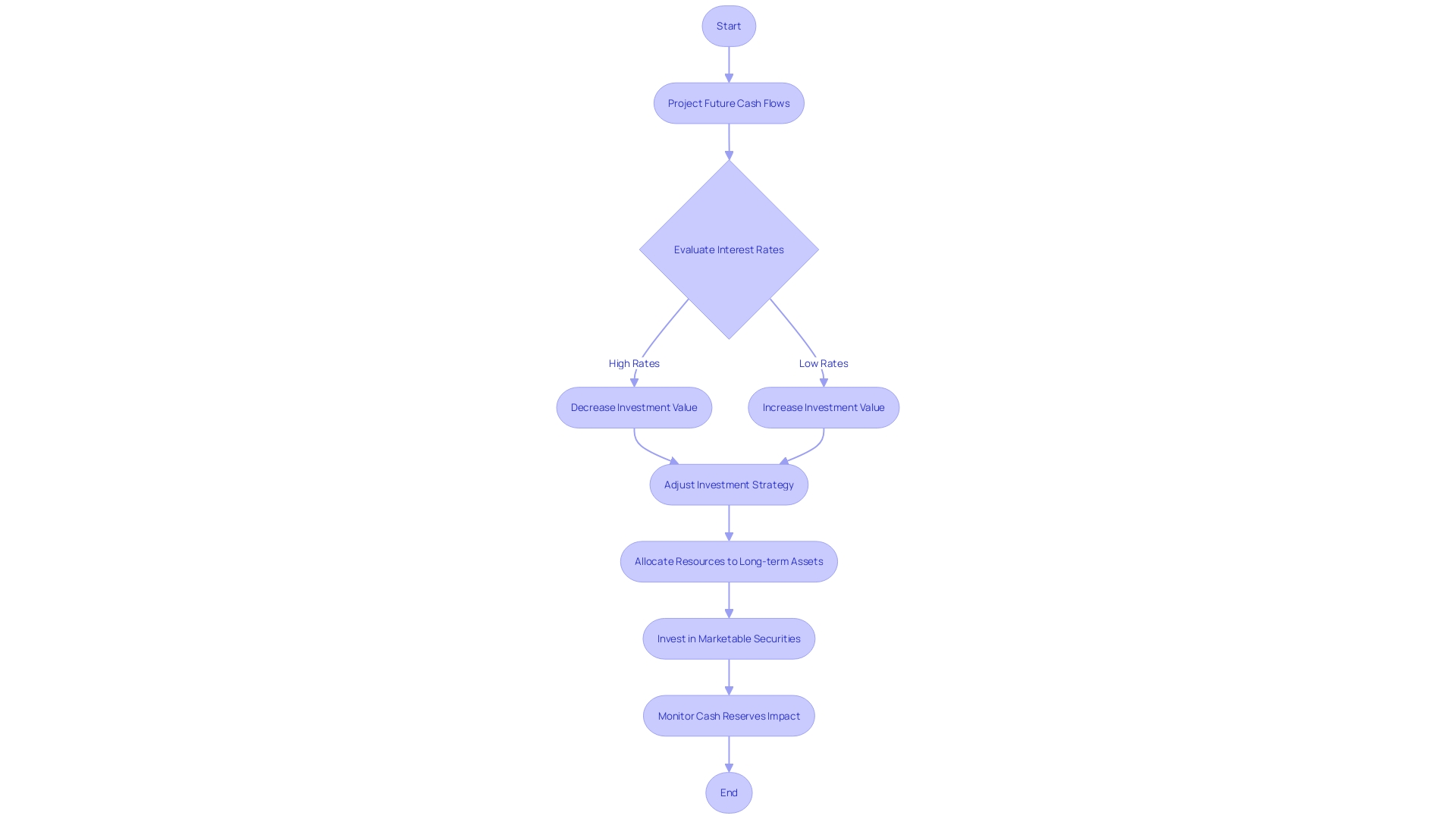

Calculating Cash Flow from Investing Activities

To ascertain the net cash flow from investing activities, one must delve into the financial statements to track the ebb and flow of cash related to such activities. This process is more than just a simple arithmetic exercise; it's about piecing together a narrative of the company's investment endeavors. By carefully examining the inflows from sales of assets or returns from investments and contrasting them with the outflows for capital expenditures (CAPEX) or acquisitions, a comprehensive picture of investment performance emerges.

Let's consider Jeans X, a hypothetical company. If Jeans X sells off a piece of machinery for a cash inflow and invests in new technology, causing a cash outflow, the net cash flow from investing is calculated by deducting the investment from the sale proceeds. But it's not just about the numbers; it's about understanding the strategic moves behind these figures. These cash flows reflect the company's decisions to divest or invest in long-term assets which are pivotal for growth.

Free Cash Flow (FCF) is a vital metric that represents the cash a company can generate after accounting for the cash outflows to support operations and maintain its capital assets. It's the purest form of profitability and is often seen as an indicator of a company's ability to expand, innovate, and return value to shareholders. For instance, the FCF of Jeans X could signify its potential to invest in new ventures or pay dividends.

Analysts and CFOs alike closely scrutinize these figures, understanding that a positive net cash flow from investing activities often suggests a firm is effectively selling off assets for a profit. Conversely, a negative net cash flow might indicate significant investments which, if strategically sound, could bode well for future returns.

In the broader financial landscape, these insights are crucial. News like Industrial Alliance's restructuring or the UK's nuclear power expansion reflects shifting investment strategies, while the performance of companies such as those highlighted in recent stock market reports serves as a testament to the impact of cash flow management on corporate growth and investor confidence.

The art of analyzing cash flow from investing activities lies not just in the calculation but in interpreting the strategic implications these movements have on a company's financial health and future prospects.

Interpreting Cash Flow from Investing Activities

Interpreting the cash flow from investing activities is pivotal for comprehending a company's investment dynamics and their repercussions on liquidity. When a company reports positive cash flow from these activities, it's indicative of successful capital returns or asset disposals surpassing its investments. Such a scenario signals a robust financial trajectory. Conversely, a negative cash flow in this area points to a heavier investment volume compared to the proceeds from asset sales or returns, warranting a critical evaluation of investment strategies and their influence on the company's fiscal health.

For instance, Monday.com exemplifies a scenario where efficient growth and strategic investments hastened its transition to positive free cash flow, enhancing its cash reserves and shareholder value. Similarly, Flow Traders' emphasis on risk minimization over high-stakes profit maximization illustrates the significance of prudent investment and cash flow management for long-term stability.

Understanding the main components of a cash flow statement—operating activities, investing activities, and financing activities—provides CFOs with a holistic view of cash movements and financial health. Operating activities detail cash inflows from sales and outflows from expenses, while investing activities reveal the financial impact of asset acquisitions and disposals. Complementing these, financing activities cover transactions related to debt, equity, and dividends.

Free cash flow, a critical metric representing the cash generated post operational expenses and capital expenditures, is a key indicator of a company's financial flexibility. Companies aim for a growing free cash flow, as it offers insight into potential for investment, expansion, and shareholder returns. A common CFO oversight is neglecting a comprehensive review of all financial statements, which can lead to misguided cash flow management and investment decisions, as highlighted by Dr. Sharon H. Porter.

Lastly, the movement of financial markets and the role of corporate giants therein, such as Apple and Alphabet, demonstrate the intricate relationship between investment activities and market conditions. With these behemoths managing extensive portfolios, the impact of fluctuating interest rates on their bond-heavy investments underscores the importance of astute cash flow analysis in an uncertain economic climate.

Positive vs. Negative Cash Flow from Investing Activities

Understanding the nuances of cash flow from investing activities is pivotal for effective financial management. This involves recognizing when a company is experiencing an influx of cash through investment gains, which can be strategically utilized for repaying debts, distributing dividends, or reinvesting to foster business growth. Conversely, a negative cash flow signifies an outflow, typically directed towards asset acquisition or investment endeavors, which could potentially reduce the cash reserves necessary for other business activities.

Cash flow analysis is not merely about tracking numbers; it's about interpreting the story behind those numbers. For instance, a company that consistently demonstrates positive free cash flow is an indicator of financial health and the ability to grow at a compelling rate. Free cash flow, calculated by subtracting capital expenditures from operating cash flow, is a metric of paramount importance in finance. It reflects the actual amount of cash a business generates after covering all its expenses, including investments in assets to maintain or expand operations.

To paint a clearer picture, consider the case of 'Jeans X,' a company whose operating cash flow and capital expenditures data provide the necessary inputs to compute its free cash flow. This example underscores the importance of understanding each component that contributes to the overall financial standing of a business.

Moreover, cash flow trends offer invaluable insights that drive strategic investment decisions and resource allocation. By meticulously analyzing financial statements—beyond the cash flow statement to include income and balance sheet reports—leaders can avoid common pitfalls, such as neglecting to consider the full financial health of their company.

The significance of cash management cannot be overstated, as it is often described as the lifeblood of a business, essential for ensuring smooth operations and long-term viability. In a dynamic business environment where opportunities and risks abound, maintaining a vigilant eye on cash flow can equip CFOs with the foresight necessary to protect and enhance the value of the business.

Importance for Stakeholders and Financial Health

Cash flows from investing activities are a crucial aspect of a company's financial landscape, offering insights into investment strategies and their consequent effect on the organization's cash reserves. These cash flows reflect how a company allocates resources to long-term asset investments, which may include marketable securities such as corporate bonds and U.S. Treasuries. With large corporations like Apple and Alphabet becoming significant players in financial markets, the composition and management of their investment portfolios have become even more critical. The careful analysis of such investments is imperative, especially in a fluctuating interest rate environment where the value of bonds inversely correlates with interest rates.

Stakeholders must closely examine cash flows from investing to evaluate the effectiveness of a company's investment decisions and its proficiency in generating returns. For instance, the data sourcing practices within an investment firm can provide competitive advantages, highlighting the importance of a meticulous investment strategy that extends beyond the immediate financial gains to encompass the entire process of data procurement and utilization.

In the current economic context, where adjustments to interest rates are employed to mitigate inflation, understanding the implications of these changes on investment values is essential. The anticipation of interest rate cuts necessitates a strategic approach to investment decisions, underscoring the need for companies to manage their investment portfolios with foresight and agility.

Ultimately, mastering cash flow from investing activities equips CFOs with the necessary tools to identify risks, evaluate liquidity, and devise strategies that sustain and propel growth. As financial stewards, they must navigate the complex interplay of investments and cash flow to ensure the long-term solvency and prosperity of their organizations. In doing so, they not only safeguard the company's financial health but also secure its competitive edge in a dynamic market landscape.

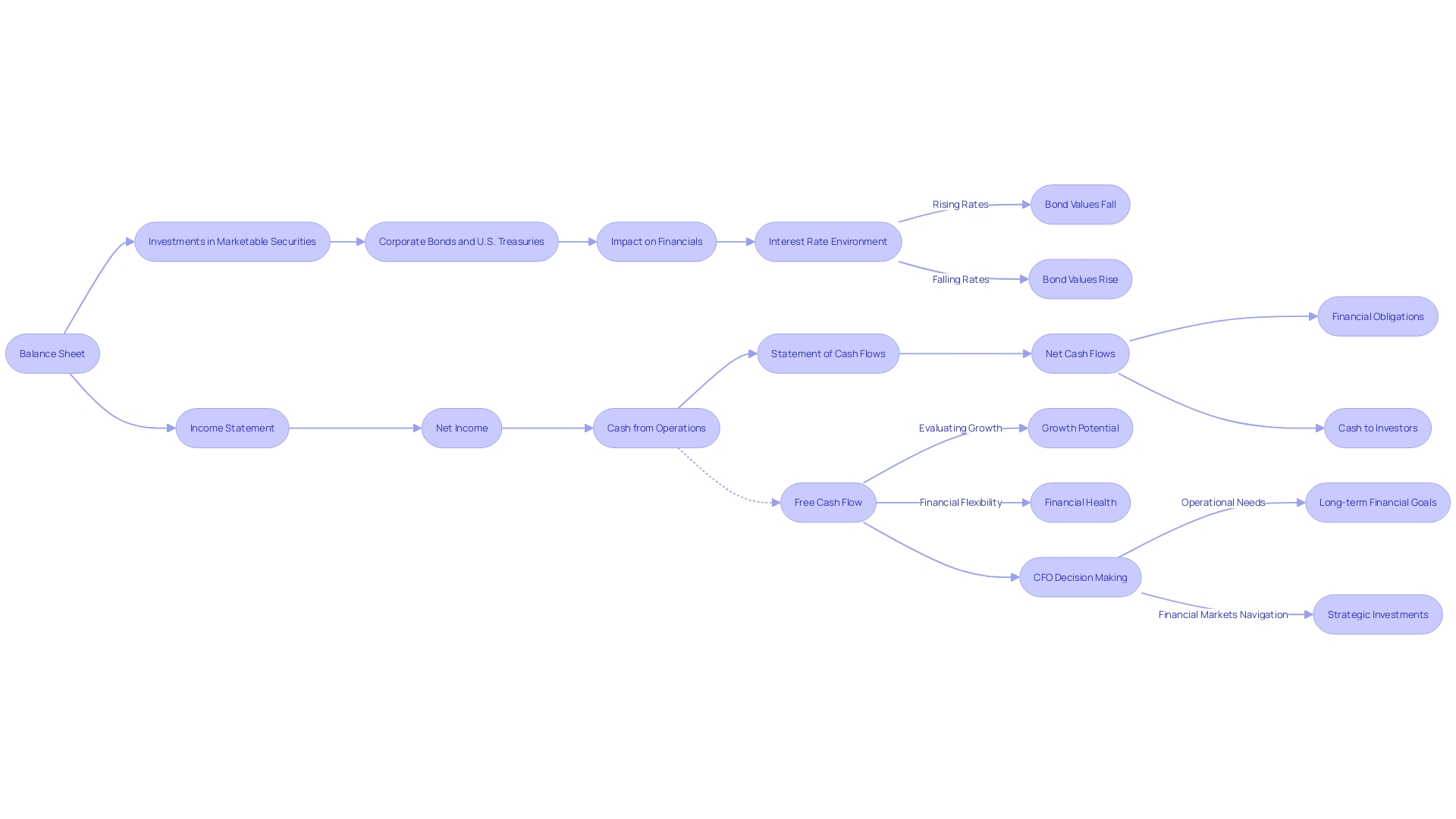

Connection to Other Financial Statements

Cash flows from investing activities provide a vital link in understanding a company's financial health, connecting the balance sheet and income statement in a way that frames a firm's cash position and investment results. For instance, large corporations like Apple and Alphabet have evolved into major participants in the financial markets, holding extensive portfolios of marketable securities such as corporate bonds and U.S. Treasuries. These investments, which are detailed in the cash flow from investing activities, have substantial implications for a company's financials, especially in uncertain interest rate environments where bond values can fluctuate significantly.

The statement of cash flows, as a crucial component of financial statements, must be treated with the same meticulous care as other financial documents. It offers invaluable insights into a company's ability to generate future net cash flows, satisfy financial obligations, and return cash to investors. Moreover, the statement sheds light on the necessity for external financing and reveals the impact of both cash and noncash investing and financing transactions on a company's financial position.

Understanding the distinction between net income, free cash flow, and cash generation is essential. For example, SoFi's GAAP net income for 4Q23 was $48M, but due to non-cash expenses like stock-based compensation, this figure does not directly equate to an increase in cash. It's crucial to grasp that free cash flow represents the actual cash a company generates after all expenses, a metric that is vital for evaluating a company's growth potential and financial flexibility. For example, determining a company's free cash flow involves deducting capital expenditures (CAPEX) from its operating cash flow, providing a clear view of the cash available for strategic initiatives or shareholder returns.

Therefore, by dissecting the cash flow statement and understanding the nuances of investing activities, CFOs can make more informed decisions, aligning short-term operational needs with long-term financial goals and ensuring the company navigates financial markets effectively.

Examples and Case Studies

The intricate dance of cash flows from investing activities is a pivotal aspect of a company's financial narrative, revealing the strategic decisions made by management. Real-world examples and case studies serve as an invaluable resource for CFOs to distill practical insights. Consider the approach of Flow Traders, a market maker that thrives on minimizing risks and profiting from market volatility by offering a balanced bid-ask spread. This model accentuates the importance of liquidity and the ability to adapt to market swings, crucial for cash flow management.

Moreover, the strategy adopted by companies like Shell, which focuses on 'Powering Progress' by balancing shareholder distributions with strategic investments, underscores the significance of aligning investment decisions with shareholder interests. It highlights the ramifications of these decisions on cash flow and long-term shareholder value, especially in regards to savings and pension funds that millions rely on.

Analyzing these examples, it becomes apparent that effective investment decisions are not just about immediate gains but also about ensuring financial stability and future growth. As noted in a recent statement highlighting cash flow reporting's importance, the statement of cash flows should be as rigorously audited as other financial statements due to its role in evaluating a company's future net cash flows, financial obligations, and capacity for returning cash to investors. This level of scrutiny is evidenced by cash flow statements often leading to financial restatements when not properly managed.

CFOs can glean from these insights that a strategic, well-analyzed approach to investing can lead to robust cash flows, which in turn, supports operational needs and long-term financial goals. Such an approach not only aligns with the operational philosophy of maintaining a healthy liquidity profile but also adheres to the rigorous standards expected by stakeholders.

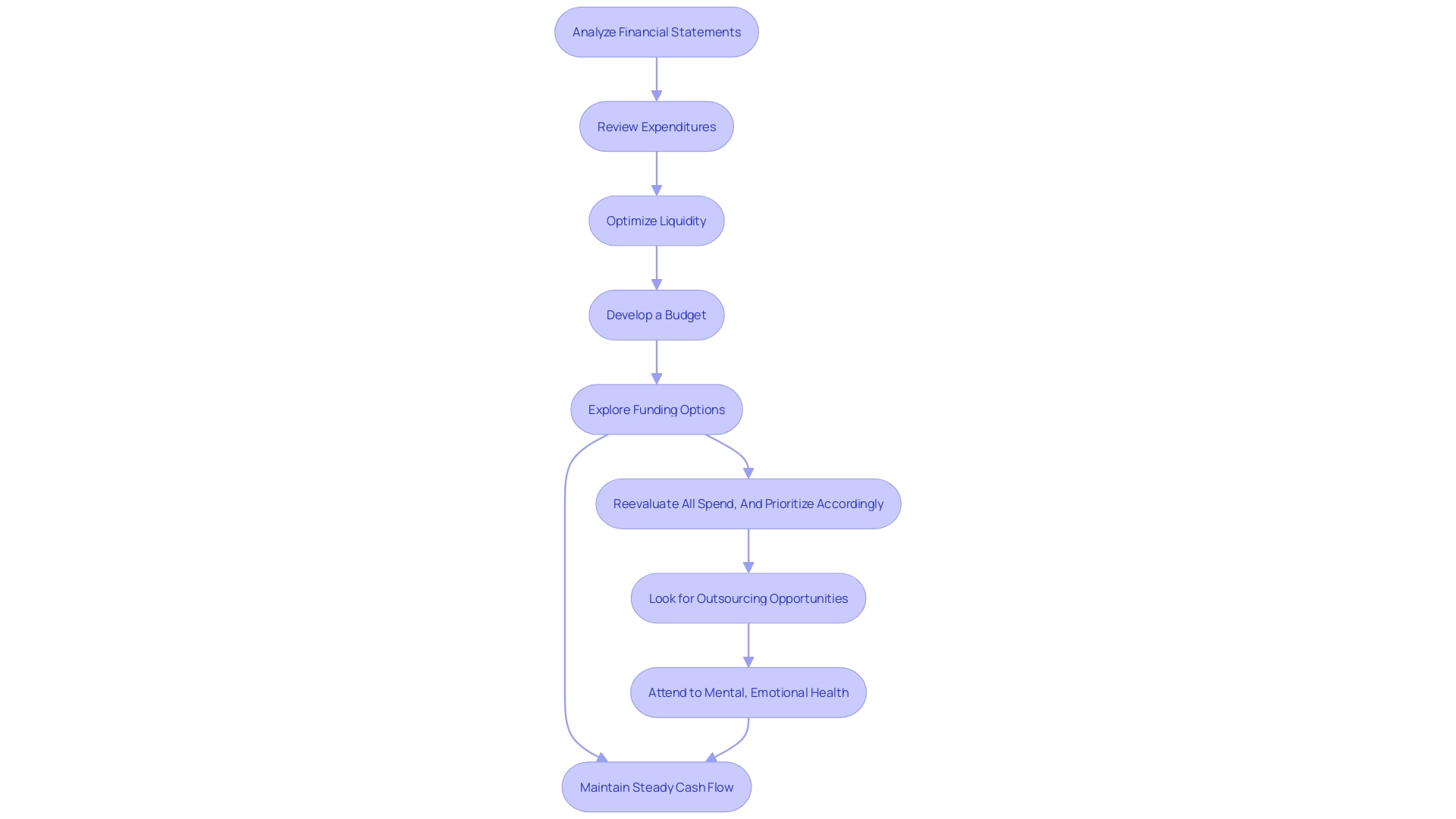

Best Practices for Analyzing Cash Flow from Investing Activities

CFOs seeking to fine-tune their approach to cash flows from investing activities can draw inspiration from innovative financial strategies like those of Revolut. This FinTech company, created by visionaries Storonsky and Yatsenko, revolutionized the banking sector by offering currency exchange without hidden fees, demonstrating the importance of transparency and efficiency in financial operations. Similarly, CFOs must prioritize meticulous due diligence and performance monitoring of investments. Diversifying the investment portfolio is not merely a risk management tactic; it's a strategic move akin to the multifaceted services offered by companies like Starbucks, which personalize experiences to boost satisfaction and revenue. Strategic alignment of investments with broader corporate goals ensures that financial maneuvers support sustainable growth, mirroring the success seen in companies that invest in customer-centric strategies. Furthermore, the timing of investment activities is crucial, as is clear communication with stakeholders about the strategy and its impact on cash flow. By embodying these principles, CFOs can strengthen the financial foundation of their organizations, ensuring robust cash flow management that is both responsive to immediate operational needs and firmly rooted in long-term strategic planning.

Conclusion

Cash flow from investing activities is a critical metric for analyzing a company's growth trajectory and financial resilience. It provides transparency into a firm's strategic investment patterns and helps gauge the effectiveness of its investment strategy. Understanding the nuances of cash flow from investing activities involves reading the story behind a company's investment decisions and their long-term financial implications.

Calculating and interpreting cash flow from investing activities is pivotal for comprehending a company's investment dynamics and their impact on liquidity. Positive cash flow indicates successful capital returns or asset disposals, while negative cash flow suggests heavier investments. Mastering cash flow from investing activities equips CFOs with the necessary tools to identify risks, evaluate liquidity, and devise strategies for sustainable growth.

Cash flows from investing activities connect the balance sheet and income statement, providing insights into a company's cash position and investment results. Understanding the distinction between net income, free cash flow, and cash generation is essential for evaluating a company's financial health and flexibility.

Real-world examples and case studies offer practical insights into effective investment decisions. Best practices for analyzing cash flow from investing activities include due diligence, diversifying the investment portfolio, and aligning investments with corporate goals.

In conclusion, understanding cash flow from investing activities is crucial for CFOs seeking to optimize financial strategies. By analyzing components, calculating cash flow, and interpreting implications, CFOs can make informed decisions that support sustainable growth and mitigate risks associated with cash flow volatility.