Introduction

In an era marked by rapid economic shifts and increasing scrutiny, corporate restructuring has emerged as a vital strategy for organizations seeking to navigate financial challenges and operational inefficiencies. As companies grapple with declining revenues, rising debt, and evolving market conditions, the role of restructuring consultants becomes indispensable. These experts provide tailored solutions that not only address immediate concerns but also lay the groundwork for sustainable growth.

With the corporate restructuring consulting market poised for significant expansion in 2024, understanding the intricacies of this field is essential for leaders aiming to steer their organizations toward resilience and profitability. This article delves into the core services offered by restructuring consultants, the triggers that necessitate such interventions, and the strategic methodologies that underpin successful transformations.

By equipping CFOs with actionable insights, organizations can effectively position themselves to thrive amidst uncertainty.

Defining Corporate Restructuring Consulting: An Overview

Corporate restructuring consulting services are a critical offering designed to provide strategic guidance for organizations facing financial challenges and operational inefficiencies. This corporate restructuring consulting services approach aims to realign a company's structure, operations, and finances, fostering long-term sustainability and profitability. In 2024, the corporate restructuring consulting services market is expected to experience substantial growth, driven by an increasing number of distressed companies seeking expert assistance.

For instance, WeWork's valuation recently dropped to US$ 9 billion due to investor concerns, exemplifying the financial challenges that distressed companies face. Many of these firms will initially pursue rate cuts or favorable economic shifts before contemplating adjustment alternatives. Financial evaluations play a pivotal role in this operation, as they help identify underlying issues and inform tailored strategies.

A thorough restructuring procedure usually entails:

- Operational streamlining

- Innovative model implementation that align with both market demands and internal capabilities

Key to this is the client engagement approach, which begins with a thorough business review to align stakeholders and understand the situation beyond just the numbers. This is complemented by real-time analytics and quick decision-making to test hypotheses and operationalize lessons learned.

Additionally, specific strategies for mastering the cash conversion cycle, such as optimizing inventory management and improving receivables collection, are integral to enhancing financial performance. Moreover, effective communication is essential. As Sarah Brown, a project coordinator, emphasizes, handling client requests that shift project timelines requires:

- Setting clear processes

- Communicating impacts

- Balancing flexibility with firmness

This expert insight emphasizes the importance of structured communication in navigating the complexities of corporate reorganization.

Furthermore, the present environment is shaped by increased federal examination of antitrust matters, complicating mergers and acquisitions and impacting reorganization options for larger entities. As companies encounter fierce competition and difficulties in attracting top talent, providing effective solutions for reorganization becomes crucial. The complexities encountered by corporate reorganization firms, such as meeting client expectations under strict timelines and the need for tailored solutions, further underscore the importance of corporate restructuring consulting services.

Successful case studies demonstrate how targeted strategies, including mastering the cash conversion cycle, can improve financial performance, highlighting the importance of corporate restructuring consulting services in today's dynamic market. Through collaborative planning, our consulting team works closely with clients to identify weaknesses and reinvest in strengths, ensuring a tailored approach to each unique situation.

Key Services Offered by Corporate Restructuring Consultants

Corporate reorganization advisors offer a range of essential services aimed at navigating complex financial landscapes and fostering sustainable recovery. Key offerings include:

-

Financial Assessment: Conducting comprehensive evaluations of a company's financial health to pinpoint weaknesses and opportunities for enhancement. This step is crucial, especially as the healthcare sector grapples with anticipated challenges in 2024, where improved reimbursement rates or reduced interest rates will be vital for stability.

Comprehensive financial evaluations are vital for cash preservation and liability reduction, ensuring that enterprises can endure economic uncertainties.

-

Operational Streamlining: Identifying and suggesting methods and systems that enhance operational efficiency, reduce costs, and uncover hidden value, thereby increasing overall organizational effectiveness. This emphasis on operational efficiency is essential for small to medium enterprises striving to strengthen their competitive advantage.

-

Interim Management: Providing leadership during transitional stages, which is vital for sustaining stability and guiding the organization through changes. This role can be crucial as companies encounter a rise in bankruptcies, with a 68% increase noted in 2023, underscoring the urgent need for effective management during challenging times.

-

Bankruptcy Case Management: Offering specialized support and guidance through the bankruptcy phase, ensuring adherence to legal requirements and assisting enterprises in navigating their options effectively.

-

Stakeholder Engagement: Promoting strong communication and collaboration among various stakeholders to align goals and expectations, ensuring that all parties are dedicated to the reorganization plan. This engagement is crucial for streamlined decision-making and implementing lessons learned, and it directly supports the client engagement process by reinforcing stakeholder alignment.

-

Strategic Planning: Crafting actionable plans that detail the steps necessary for recovery and growth, essential in a climate where mergers and acquisitions are increasingly scrutinized due to antitrust concerns, complicating reorganization efforts. Comprehensive corporate restructuring consulting services are tailored to meet the distinct needs of each enterprise, ensuring a holistic approach to financial recovery and risk mitigation.

-

Change Management: Implementing effective strategies to manage organizational change, enabling smooth transitions and minimizing disruption. This is particularly important as businesses must adapt to evolving market conditions and operational challenges.

-

Real-time Analytics: Utilizing advanced analytics to monitor performance and inform decision-making, allowing businesses to respond swiftly to changing circumstances and operational challenges.

These tailored services effectively address the unique needs of each business, ensuring a strategic focus on cash preservation, efficiency, and risk mitigation. As the market landscape evolves, the emphasis on these key services becomes increasingly significant, especially in light of the latest developments in financial evaluations for reorganization.

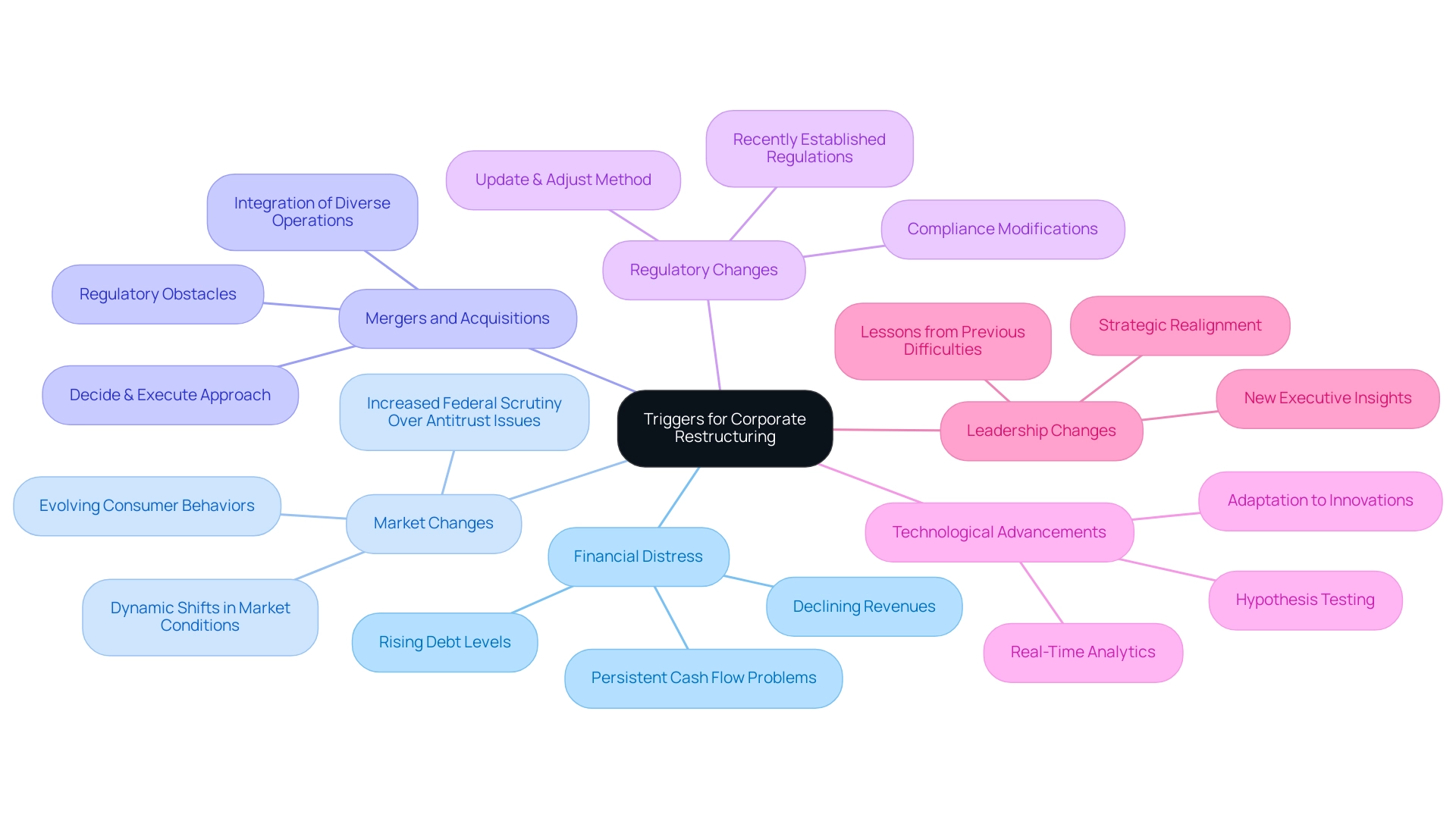

Identifying the Triggers for Corporate Restructuring

Corporate reorganization is often initiated by a range of critical triggers that can significantly impact a company's operational health and strategic direction. Understanding these triggers is essential for CFOs looking to navigate financial challenges effectively:

- Financial Distress: Indicators such as declining revenues, rising debt levels, or persistent cash flow problems frequently signal an urgent need for restructuring. According to Amy Quackenboss, Executive Director of the American Bankruptcy Institute,

While [pandemic relief efforts](https://debt.org/bankruptcy/statistics) have largely expired, the safe haven of bankruptcy is continually available for financially distressed businesses and consumers, emphasizing the significance of recognizing these financial signs early. - Market Changes: Dynamic shifts in market conditions or evolving consumer behaviors can adversely affect sales and profitability, necessitating a reevaluation of business approaches. Furthermore, increased federal scrutiny over antitrust issues has complicated mergers and acquisitions, making it crucial for companies to reassess their operational strategies in light of these challenges.

- Mergers and Acquisitions: Following mergers, companies often face the challenge of integrating diverse operations and cultures. This integration can be further complicated by regulatory obstacles, prompting the need for reorganizing to simplify workflows and enhance synergy. Applying the 'Decide & Execute' approach can aid this integration by allowing swift, informed choices during the transition.

- Regulatory Changes: Recently established regulations may necessitate organizations to modify their operations significantly, prompting a reorganization process to ensure compliance and operational efficiency. The 'Update & Adjust' method is crucial here, enabling companies to modify their strategies in real-time as regulations change.

- Technological Advancements: As industries progress, companies that do not adapt to technological innovations risk becoming outdated, emphasizing the necessity for a strong overhaul strategy. Testing hypotheses and leveraging real-time analytics can guide effective decisions in this domain.

- Leadership Changes: The arrival of new executives often brings fresh insights and perspectives, which can lead to a strategic realignment of the company's objectives and operations. The implementation of lessons gained from previous difficulties becomes essential in shaping future strategies.

By proactively identifying these triggers and employing a practical approach that includes testing hypotheses and utilizing real-time commercial analytics, CFOs can engage corporate restructuring consulting services to address their unique challenges. Recent trends indicate that sectors such as healthcare and manufacturing have undergone significant transformation activities. For instance, Merck has adapted to regulatory challenges by implementing a robust compliance framework, Cisco has responded to market changes through flexible business approaches, and Illumina and Kimberly Clark have successfully executed significant operational overhauls to align with shifting market conditions.

Bill Fay, with over 30 years of experience in financial writing, emphasizes the significance of grasping these dynamics in the context of effective corporate reorganization.

Strategies and Methodologies in Corporate Restructuring

In the dynamic landscape of corporate reorganization, consultants provide corporate restructuring consulting services that leverage a range of strategies and methodologies tailored to the specific needs of each organization. Given that companies should plan for the next 18 months to have the runway needed to address potential problems, key approaches include:

- SWOT Analysis: This critical tool evaluates strengths, weaknesses, opportunities, and threats, enabling CFOs to make informed decisions that align with both financial viability and strategic goals.

- Lean Management: By focusing on maximizing value while reducing waste, this approach frequently results in substantial operational efficiencies, an essential element in improving overall performance during organizational changes.

- Scenario Planning: Creating multiple future scenarios equips organizations to anticipate potential challenges and seize opportunities, ensuring preparedness in an uncertain environment.

- Stakeholder Analysis: Engaging key stakeholders is vital for securing alignment and support throughout the organizational change process, which can significantly impact success rates.

- Financial Modeling: Developing detailed projections allows CFOs to assess the financial implications of various restructuring options, aiding in the identification of the most beneficial paths forward.

To complement these methodologies, a robust approach to testing hypotheses is essential. This involves continually monitoring success through real-time analytics via client dashboards, allowing for swift adjustments and informed decision-making that can preserve business health. Moreover, implementing lessons gained from previous experiences nurtures strong connections and improves the overall efficiency of turnaround approaches, ultimately maximizing return on invested capital.

Significantly, increased federal examination of antitrust matters has obstructed M&A initiatives among larger hospitals and provider networks, complicating alternative solutions. As emphasized in the case study titled 'Impact of ESG on Restructuring Approaches,' the growing significance of ESG factors is transforming restructuring methods, with companies prioritizing financial viability alongside ESG initiatives to fulfill stakeholder expectations. James Poston aptly noted,

This flexibility enables midmarket businesses to support their ESG goals as they work to restore financial stability and grow.

As companies increasingly prioritize ESG factors, incorporating these approaches can facilitate a smoother transition while enhancing overall resilience.

The Role of Change Management in Successful Restructuring

Change management is a cornerstone of successful corporate restructuring, encompassing several key components that drive effective organizational transformation:

- Communication Plans: Crafting transparent communication strategies is vital to keep all stakeholders informed and engaged throughout the restructuring. Notably, implementing open-source communication can significantly enhance understanding; as stated by the CEB Corporate Leadership Council, 54% of the workforce comprehends the change compared to only 20% under traditional top-down approaches.

- Training and Support: Equipping employees with the necessary resources and training is essential for fostering adaptation to new methods and protocols. This initiative not only smooths the transition but also empowers employees to take ownership of their roles in the restructuring.

- Feedback Mechanisms: Establishing robust channels for employee feedback is crucial to gauge sentiment and address concerns in real time. This dynamic approach can lead to improved adoption rates and project timelines, as feedback directly informs necessary adjustments. Real-time analytics, delivered through our client dashboard, enable continual monitoring of feedback and overall business health during the turnaround process.

- Cultural Alignment: Aligning organizational culture with the new strategic direction is critical post-restructuring. A culture that welcomes change cultivates a more open atmosphere for transformation initiatives, ultimately enhancing involvement and dedication.

- Monitoring and Evaluation: Ongoing evaluation of the transformation effort is crucial, especially in crisis scenarios where time is vital. Frequent reviews of long-term projects lead to higher success rates compared to infrequent reviews of smaller projects, allowing organizations to identify opportunities for improvement and make timely adjustments. Our dedication to implementing the lessons learned through the turnaround initiative ensures that these evaluations not only guide immediate actions but also enhance enduring relationships with stakeholders.

- Testing Hypotheses: As part of our strategy, we rigorously test hypotheses throughout the transformation effort to ensure that decisions are data-driven and aligned with maximizing return on invested capital. This method enables us to validate approaches before full implementation, minimizing risks and enhancing outcomes.

- Shortened Decision-Making Cycle: Our team supports a shortened decision-making cycle during the turnaround process, allowing your organization to take decisive action swiftly. This approach is vital in maintaining momentum and addressing challenges as they arise.

By prioritizing these elements of change management within corporate restructuring consulting services, organizations can cultivate greater employee buy-in, reduce resistance, and ensure a smoother transition, leading to more successful restructuring outcomes. For example, the adoption of an open-source approach can enhance the probability of success by up to 24% and decrease change implementation time by one-third. This strategy not only enhances employee engagement and ownership but also demonstrates the tangible benefits of effective change management, as illustrated by the case study on open-source strategy for change implementation.

Conclusion

Navigating the complexities of corporate restructuring is essential for organizations facing financial and operational challenges. As highlighted, the services offered by restructuring consultants—ranging from financial assessments to strategic planning—are designed to address the unique needs of each business. By leveraging methodologies such as SWOT analysis and scenario planning, CFOs can make informed decisions that align with their strategic objectives while ensuring operational efficiency.

Recognizing the triggers for restructuring, such as financial distress or market changes, allows leaders to proactively engage with consultants who can provide the necessary support. The emphasis on change management further reinforces the importance of effective communication, training, and cultural alignment throughout the restructuring process. By fostering an environment that embraces change, organizations can enhance their resilience and adaptability in an ever-evolving market landscape.

In conclusion, corporate restructuring consulting is not just a response to crisis; it is a strategic pathway to sustainable growth. By understanding the intricacies of this field and implementing tailored solutions, CFOs can position their organizations for success amidst uncertainty. The proactive engagement of restructuring consultants equips companies with the tools needed to navigate challenges, optimize performance, and ultimately thrive in a competitive environment. Now is the time for leaders to embrace these strategies and ensure their organizations are well-prepared for the future.

Frequently Asked Questions

What are corporate restructuring consulting services?

Corporate restructuring consulting services provide strategic guidance to organizations facing financial challenges and operational inefficiencies, aiming to realign their structure, operations, and finances for long-term sustainability and profitability.

Why is the corporate restructuring consulting services market expected to grow in 2024?

The market is anticipated to grow due to an increasing number of distressed companies seeking expert assistance to navigate their financial challenges.

What is an example of a distressed company mentioned in the article?

WeWork is mentioned as an example, with its valuation recently dropping to US$ 9 billion due to investor concerns.

What are some key components of a thorough restructuring procedure?

Key components include operational streamlining and the implementation of innovative models that align with market demands and internal capabilities.

How does client engagement play a role in corporate restructuring?

Client engagement starts with a thorough business review to align stakeholders and understand the situation beyond just financial numbers, supported by real-time analytics and quick decision-making.

What strategies are important for improving financial performance during restructuring?

Strategies include mastering the cash conversion cycle, optimizing inventory management, and improving receivables collection.

What role does communication play in corporate reorganization?

Effective communication is crucial for handling client requests, setting clear processes, communicating impacts, and balancing flexibility with firmness.

What challenges do corporate reorganization firms face?

Firms face challenges such as meeting client expectations under strict timelines, the need for tailored solutions, and increased federal examination of antitrust matters affecting mergers and acquisitions.

What services do corporate reorganization advisors offer?

Services include financial assessment, operational streamlining, interim management, bankruptcy case management, stakeholder engagement, strategic planning, change management, and real-time analytics.

Why are comprehensive financial evaluations important in corporate restructuring?

They help identify weaknesses and opportunities for enhancement, ensuring cash preservation and liability reduction, which is vital for enduring economic uncertainties.

What is the significance of interim management during restructuring?

Interim management provides leadership during transitional stages, ensuring stability and guiding organizations through changes, especially during times of increasing bankruptcies.

How does strategic planning support corporate restructuring efforts?

Strategic planning involves crafting actionable plans for recovery and growth, essential in a climate of increased scrutiny on mergers and acquisitions due to antitrust concerns.