Introduction

Financial analysis is a crucial tool for CFOs and business leaders to understand and manage the financial health of their organizations. It provides actionable insights into expenses, profitability, liquidity, and solvency metrics, empowering decision-makers to identify improvement opportunities and make strategic moves for financial stability. In this article, we will explore the importance of financial analysis, different types of analysis techniques, and how they can be used for decision-making.

We will also delve into best practices, common tools, and techniques in financial analysis, highlighting the role of data analytics in today's data-saturated financial landscape. By the end of this article, you will have a comprehensive understanding of the power of financial analysis and its ability to drive informed, strategic business decisions in a complex economic environment.

Importance of Financial Analysis

is an essential tool for businesses to understand and manage their . With a focus on analyzing, recording, and tracking all costs related to production and distribution, it provides actionable insights into expenses, aiding in . A critical element of this accounting practice is the , which delves into profitability, liquidity, efficiency, and solvency metrics, empowering CFOs and business leaders to pinpoint improvement opportunities and make strategic moves for financial stability.

In the intricate world of cost accounting, there are several systems adept at catering to the diverse needs of industries. For instance, standard cost accounting evaluates costs based on typical operating conditions, seeking variances between standard and actual costs to identify inefficiencies. This approach is widespread across various sectors, including those with complex departmental structures like steel manufacturing.

Understanding direct costs is another essential aspect. These costs, such as materials and labor directly associated with production, are often variable and fluctuate with production levels. They are meticulously traced and included in the Cost of Goods Sold (COGS) on financial statements, providing a transparent view of the expenses directly tied to revenue-generating activities.

The role of in this process cannot be overstated. They meticulously scrutinize financial data and market trends to provide businesses with the insights necessary to navigate financial challenges. By analyzing balance sheets, income statements, and cash flow statements, they provide a comprehensive assessment of a company's financial position.

Their forecasting capabilities, using historical data and financial modeling, are crucial for predicting sales, expenses, and earnings, ultimately guiding investment decisions.

Recognizing the importance of consistent and transparent , recent IASB (International Accounting Standards Board) studies underscore the variability in operating profit reporting. With over 60 out of 100 companies employing different calculation methods, there is a clear need for standardized practices to improve financial performance reporting.

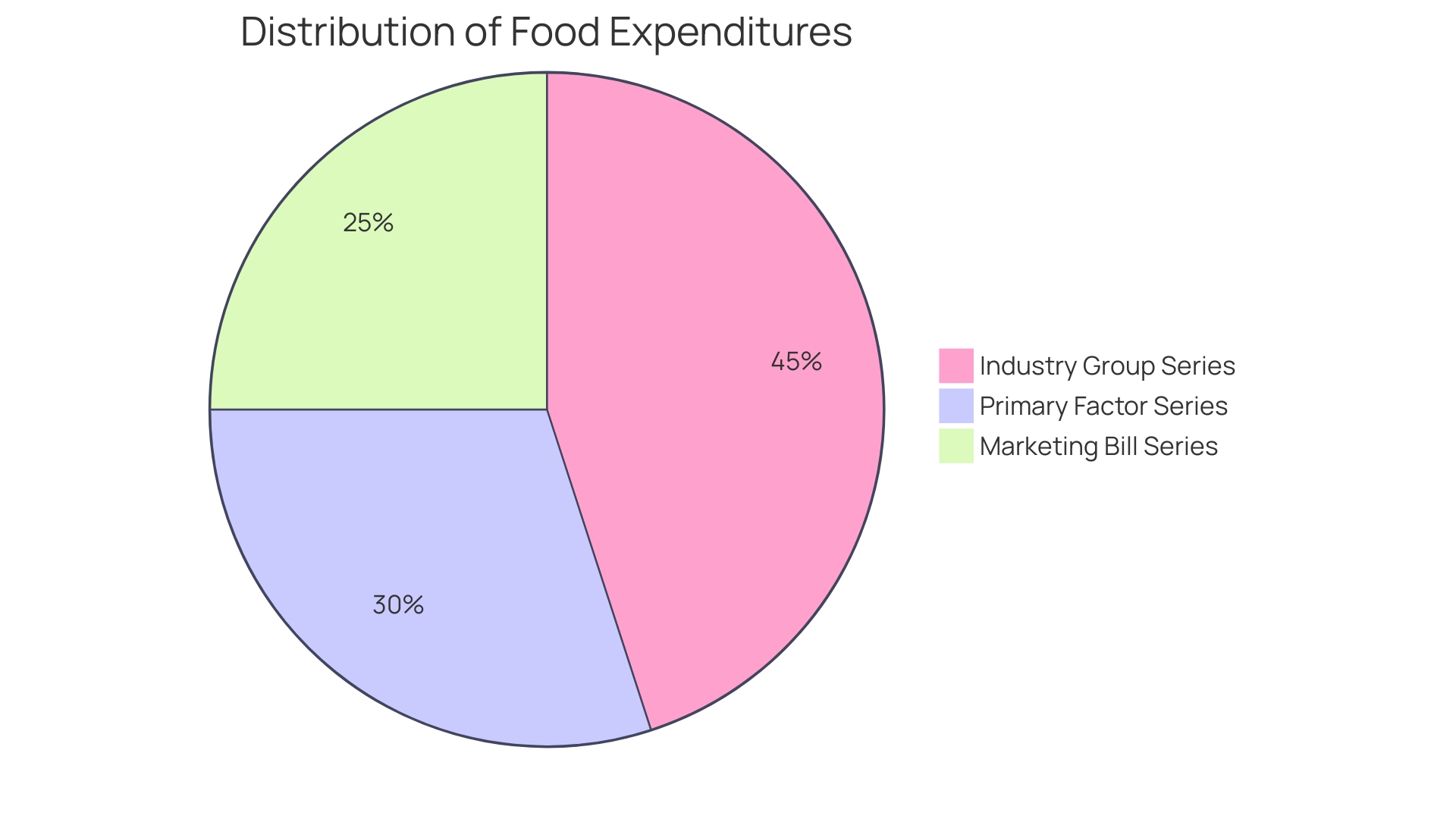

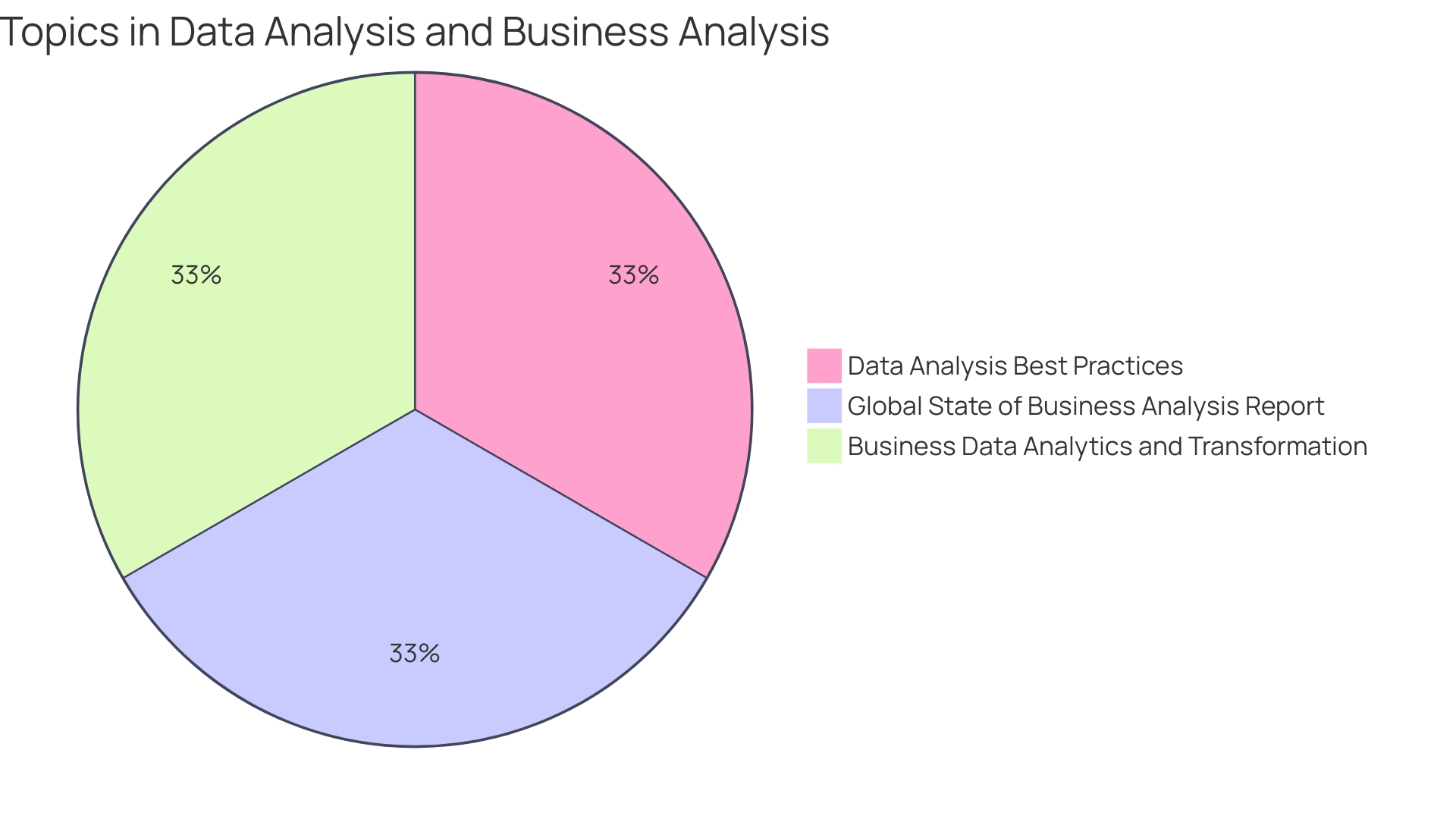

Finally, the evolving landscape of , as highlighted in the Global State of Business Analysis Report, reflects the importance of data-driven decision-making. With the industry seeing a shift towards professionals aged 36 to 45, it's evident that experienced individuals are shaping the field, navigating through the complexities of modern financial operations.

Types of Financial Analysis

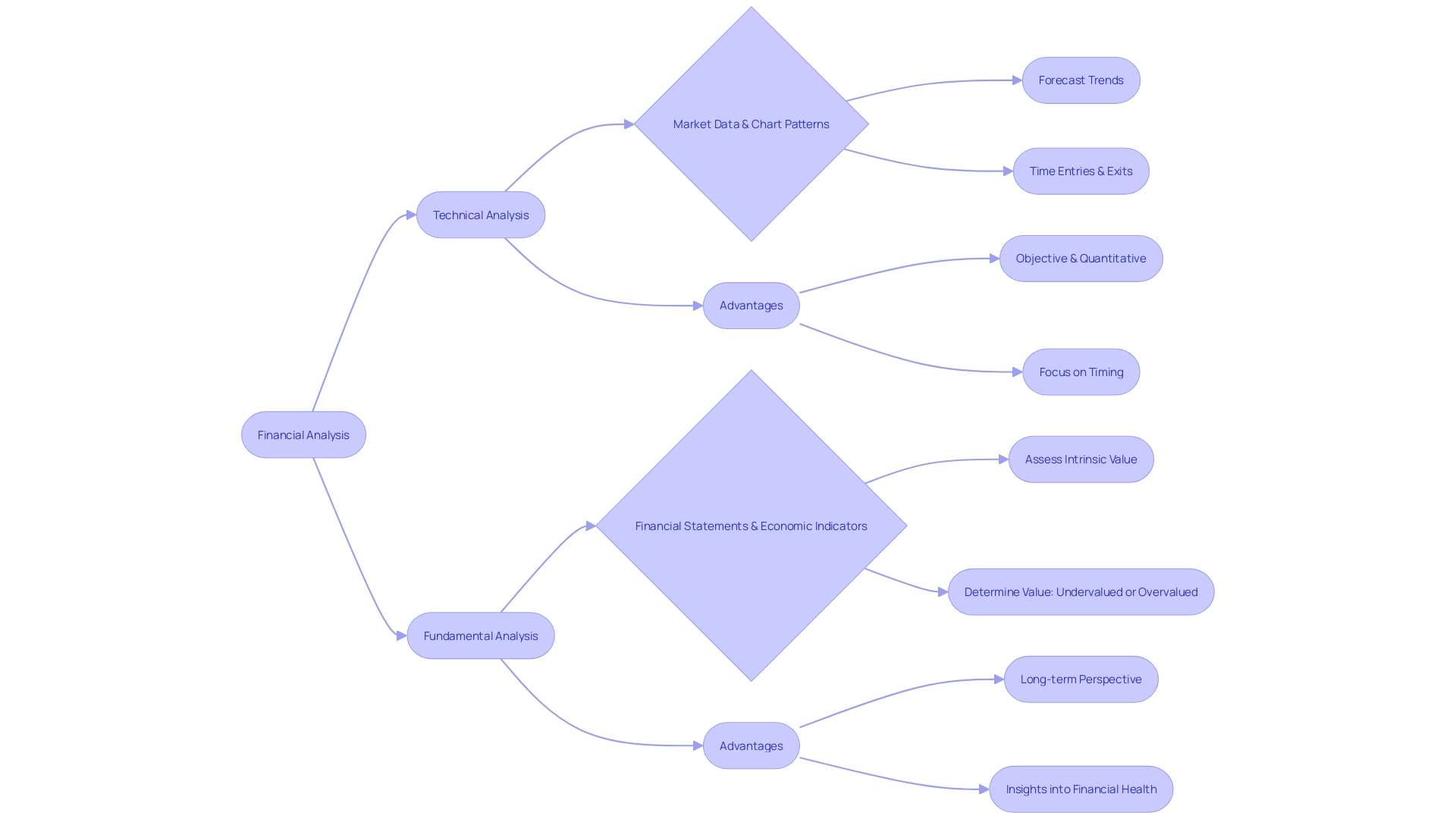

is a cornerstone of , involving a variety of techniques to understand and . Among the most prevalent methods are technical and fundamental analysis. Technical analysis is rooted in the belief that , such as past stock prices, can forecast future trends.

It's an objective, quantitative approach that reduces emotional bias by focusing on chart patterns and price movements to time market entries and exits. Over 1.8 million professionals leverage technical analysis as a powerful tool not just for trading, but also to complement fundamental strategies, pinpointing optimal entry points after deciding to invest based on asset value.

On the flip side, fundamental analysis delves deep into , economic indicators, and other external data to assess the intrinsic value of securities. It is particularly oriented towards , providing a comprehensive view of a company's financial wellbeing and growth potential. This method has evolved from its inception over 25 years ago, where it primarily focused on accounting information to determine investment worth.

Notably, Benjamin Graham pioneered this approach, laying the groundwork for value investing and influencing countless investors, including Warren Buffett.

However, both techniques have their limitations. Fundamental analysis has historically been criticized for lacking rigorous economic analysis, though 'modern finance' has since addressed some of these gaps. Meanwhile, technical analysis, despite its widespread usage, is sometimes seen as too reliant on market patterns that may not always predict future outcomes accurately.

As financial markets continue to evolve, practitioners and academics alike seek innovative ways to enhance these traditional methods, such as incorporating macroeconomic data and social media trends into their analyses.

Fundamental Analysis

serves as a compass for CFOs, guiding them through the meticulous analysis of a company's financial documents, including balance sheets, income statements, and cash flow statements. This granular scrutiny is pivotal in determining a company's fiscal well-being, profitability, and potential for expansion. Beyond internal financial assessments, cost accounting extends its reach to encompass a broader view of industry dynamics, , and the competitive landscape, all of which are instrumental in crafting strategic .

Over the past quarter-century, the landscape of investment analysis has evolved considerably. Where fundamental analysis, with its emphasis on accounting information, once reigned supreme as the cornerstone of security valuation, its methodologies have since been critiqued for lacking robust economic theoretical underpinnings. The advent of modern finance has shifted the focus towards relative pricing models and an understanding of financial asset price interrelations under no-arbitrage conditions.

Nonetheless, the enduring question of how market participants can ascertain the right price to pay for a stock persists, with accounting information still playing a vital role.

In the realm of technical analysis, over 1.8 million professionals harness tools to forecast the likely future price movements of securities based on market data. This methodology operates on the premise that market participants' collective activities—encompassing all buying and selling actions—accurately integrate all pertinent information about a security, continuously establishing its fair market value. Notably, while technical traders primarily leverage this approach, it is also employed by fundamental analysts to identify optimal entry price levels after deciding to engage with the market.

The pursuit of understanding and predicting market trends underpins technical analysis, offering an objective and quantitative framework that endeavors to reduce the influence of human emotions on investment decisions. By focusing on patterns that historically tend to recur, technical analysis provides clear indicators for optimal timing in trading.

Conversely, fundamental analysis delves into the intrinsic value of an asset, such as a stock, by meticulously evaluating , economic indicators, and prevailing market conditions. This approach strives to discern whether an asset is undervalued or overvalued, offering a long-term perspective that sheds light on a company’s , prospects for growth, and its competitive stance.

Navigating the complexities of market analysis, CFOs face the critical task of integrating these disparate analytical methods to inform their . The synthesis of fundamental and technical analysis can equip them with a comprehensive toolkit to make judicious investment decisions that align with the company's long-term financial objectives and operational realities.

Technical Analysis

stands as a cornerstone in market forecasting, through the examination of historical price and volume data. It is a discipline deeply embedded in the trading world, aiding investors and CFOs in discerning market patterns, trends, along with critical support and resistance thresholds. The method revolves around the principle that , dictated by supply and demand dynamics, are reflective of all pertinent information, hence predicting future price movements based on past market behavior.

Armed with a plethora of technical indicators, which are essentially mathematical calculations, traders can extract patterns and trends from the market labyrinth. These indicators fall into categories such as trend, momentum, volume, volatility, and breadth indicators. The art lies in selecting a congruent indicator that resonates with one's and the prevailing market climate.

It's crucial to understand that no solitary indicator can encapsulate the market's complete narrative.

A testament to technical analysis's versatility is its applicability across a wide array of securities, whether it be stocks, futures, commodities, fixed-income instruments, currencies, and beyond. The principles are universally applicable and are especially prevalent in commodities and forex markets, where traders often focus on short-term price trends.

The relevance of technical analysis is further highlighted by the fact that over 1.8 million professionals harness its principles to . The underlying theory posits that market participants collectively and continually establish a security's fair market value, encapsulating all relevant information. This collective market behavior, therefore, serves as a formidable indicator of future price action, a belief held not just by technical traders but also employed by fundamental traders to identify optimal entry points after deciding to invest in a market.

In the realm of finance, the adage 'The trend is your friend' echoes with enduring truth. Formidable market trends have historically paved the way for exceptional stock market victories. The ability to ride these trends is not just a matter of chance but a strategic approach augmented through technical analysis, which meticulously tracks the pulse of the market and its potential trajectories.

Other Types of Financial Analysis

To optimize , organizations utilize a suite of beyond the basics of fundamental and technical analysis. These methods dissect various facets of a company's finances to inform better decision-making. For instance, vertical analysis and horizontal analysis offer insights into financial statements over time and relative to other line items, respectively.

and help determine how well a company can meet short-term obligations and how efficiently it's generating profits.

is crucial for understanding the movement of funds within an organization, an essential aspect for maintaining liquidity and operational efficacy. Efficiency ratios, meanwhile, gauge how well a company uses its assets and manages liabilities, providing a clear picture of operational performance.

measures the profitability of investments, guiding future investment decisions and risk assessments. determines a company's worth, which is vital for mergers, acquisitions, and raising capital. Scenario and sensitivity analysis explore potential future events and how they might impact the company, helping in strategic planning and risk management.

Lastly, variance analysis compares actual performance to budgeted figures, highlighting areas of over or underperformance for further investigation.

Each method is a cog in the mechanism of comprehensive financial analysis, offering a different perspective on the company's financial health and guiding strategic decisions in an ever-changing economic landscape.

Using Financial Analysis for Decision-Making

For Chief Financial Officers, acts as a compass guiding corporate strategy and operational efficiency. It's the meticulous scrutiny of , market trends, and economic indicators that illuminates the of a business. This multifaceted tool enables CFOs to assess the profitability, liquidity, and solvency of their organizations, informing decisions on new ventures, pricing, and investment opportunities.

Financial analysis is not merely about parsing numbers; it's a strategic exercise in forecasting and planning. A financial analyst dives deep into balance sheets, income statements, and cash flow statements, using historical data and financial modeling to project future . This foresight is crucial for proactive decision-making, especially when navigating uncertainties akin to California's wildfire risks, where the cost and success of risk mitigation strategies are continually assessed.

Moreover, the role of in financial analysis cannot be overstated. As observed in the Global State of Business Analysis Report, professionals who adeptly interpret data sets stand at the vanguard of their field. They transform raw data into actionable insights, which is a competitive differentiator in today's data-saturated financial landscape.

, too, is a critical component of financial analysis. Analysts evaluate assets to discern their potential returns against associated risks. In a rapidly evolving industry where machine learning, AI, and blockchain are changing the game, the ability to offer timely, data-backed investment counsel can significantly impact an organization's profitability and growth.

Ultimately, the power of financial analysis lies in its capacity to turn data into insights that drive informed, . It is a dynamic discipline that combines the precision of data analysis with the strategic foresight of financial planning, ensuring that organizations not only survive but thrive in a complex economic environment.

Best Practices in Financial Analysis

is the cornerstone of growth and stability in the banking sector. With the evolving digital landscape and stringent regulatory requirements, it's imperative to adopt a to . High-quality financial analysis hinges on the use of up-to-date and accurate financial data.

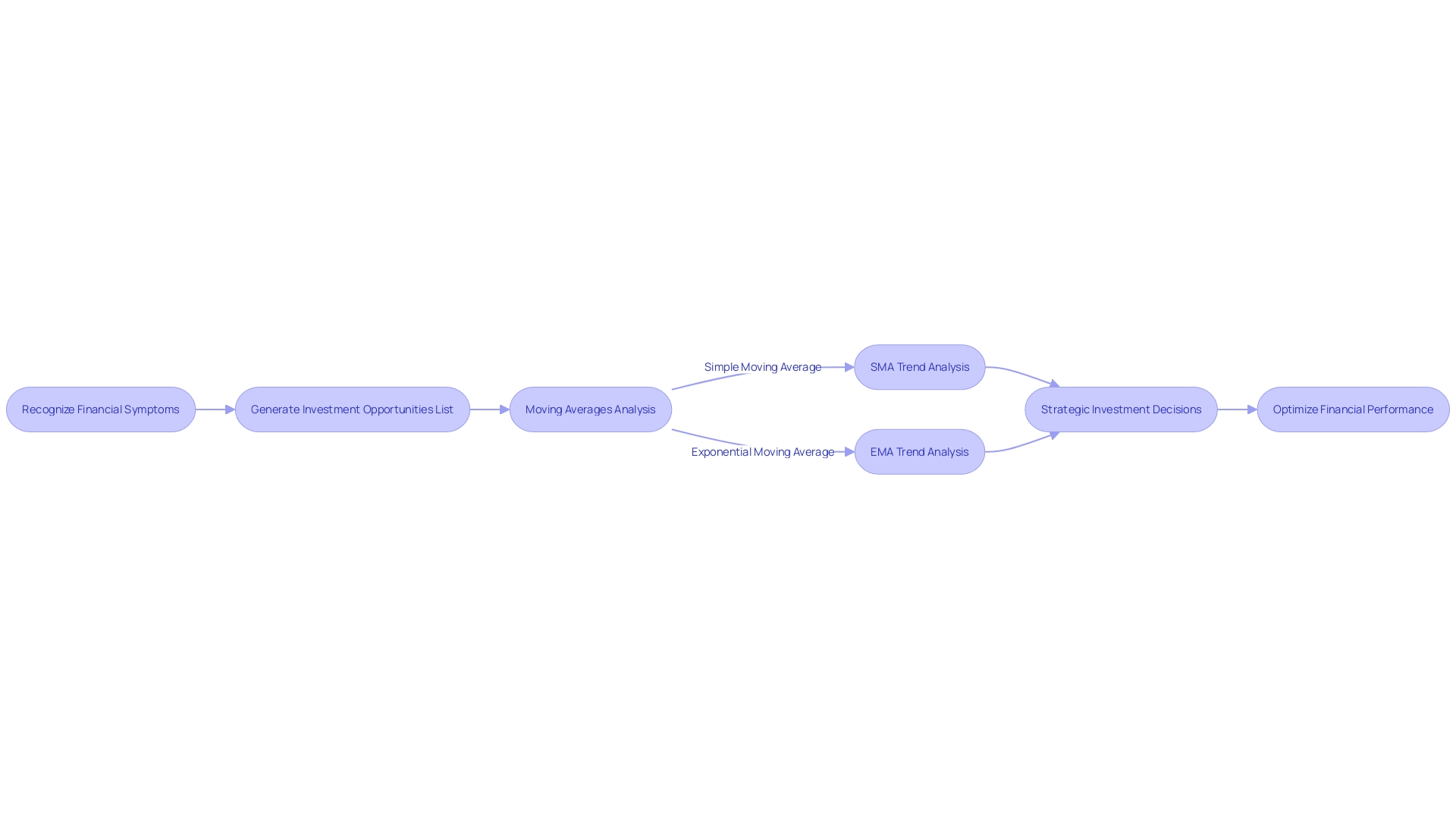

Sophisticated techniques are needed to answer critical questions, such as the fluctuations in stock prices over time, the relevance of moving averages, and the correlation between daily returns of different stocks.

For instance, M&T Bank, with its rich history and innovative leadership, has set a precedent in establishing Clean Code standards to maintain the performance and security of their digital platforms. This initiative underscores the importance of adhering to .

Analytical reports offer invaluable insights by revealing trends and relationships within financial data. This empowers organizations to make that are crucial for . Financial analysts play a pivotal role in this process, as they scrutinize financial statements and market trends to provide a comprehensive view of a company's financial health.

Ensuring reproducibility and data integrity is also paramount. This can be achieved through systematic methodologies and tools that guide analysts through the data analysis process. Preprocessing, for example, is a critical step that enhances data quality, eliminating the 'Garbage in, garbage out' dilemma.

The goal is to craft a structured approach that minimizes errors and maximizes the reliability of the analysis.

Incorporating these best practices into financial analysis not only enhances credibility but also provides a sturdy foundation for making informed decisions, ultimately leading to a company's .

Common Tools and Techniques in Financial Analysis

The landscape of is vast and dynamic, encompassing a variety of tools and methodologies that delve into the of a company. Among them, provides a quick and powerful means of evaluating a company's , liquidity, profitability, and solvency through the lens of their financial statements. Trend analysis, on the other hand, offers insights into a company's performance over time, revealing underlying patterns and guiding future projections.

In the realm of , analysts construct comprehensive representations of a company's financial situation, often using historical data to simulate future outcomes under different scenarios. This practice is bolstered by sensitivity analysis, which tests the robustness of a model by varying key assumptions and observing the impact on outcomes. Break-even analysis complements these techniques by pinpointing the level of sales necessary to cover the costs, thus informing and operational adjustments.

Yet the true power of financial analysis today lies in the seamless integration with cutting-edge , where Exploratory Data Analysis (EDA) plays a pivotal role. By systematically sifting through datasets, EDA uncovers patterns and generates hypotheses, often visualized to make complex data more accessible and actionable. As reflected in the recent advancements in software tools, which can identify suspicious financial activity more effectively by analyzing complex transaction networks, the integration of sophisticated algorithms has become essential for financial analysts.

This innovative approach to analysis is not just about gathering data; it's about transforming it into actionable insights, which is the cornerstone of informed decision-making. By leveraging the full spectrum of analytical tools, including the latest in data mining and graph-based transaction analysis, financial professionals can anticipate and navigate through the intricacies of the financial world with precision and agility. Armed with this knowledge, financial analysts become indispensable in steering companies towards sustainable growth and resilience against potential financial crisis.

Conclusion

Financial analysis is a crucial tool for CFOs and business leaders, providing actionable insights into expenses, profitability, liquidity, and solvency. By integrating techniques such as technical and fundamental analysis, CFOs can make informed investment decisions aligned with long-term objectives. Other sophisticated methods, including vertical and horizontal analysis, liquidity analysis, and valuation analysis, offer valuable perspectives on a company's financial health.

Data analytics plays a crucial role in transforming raw data into actionable insights, driving informed, strategic decisions. Adhering to best practices, such as using accurate data and ensuring reproducibility, enhances the credibility and reliability of the analysis.

Common tools like ratio analysis, trend analysis, and financial modeling provide CFOs with the means to evaluate operational efficiency, assess performance over time, and simulate future outcomes. The integration of cutting-edge data analytics, such as Exploratory Data Analysis (EDA) and sophisticated algorithms, further enhances the power of financial analysis in today's data-saturated financial landscape.

In conclusion, financial analysis empowers CFOs to make practical, action-oriented decisions for long-term financial stability and growth. By leveraging various analysis techniques, adhering to best practices, and incorporating data analytics, CFOs can navigate the complexities of the financial landscape with confidence. With financial analysis as their compass, CFOs can drive informed, strategic business decisions that ensure the success of their organizations.

Frequently Asked Questions

What is the purpose of cost accounting?

Cost accounting is used by businesses to understand and manage their financial health. It focuses on analyzing, recording, and tracking all costs related to production and distribution to provide insights into expenses, which aid in pricing and profitability decisions.

Why is financial analysis critical in cost accounting?

Financial analysis is critical because it examines metrics such as profitability, liquidity, efficiency, and solvency. This allows CFOs and business leaders to identify opportunities for improvement and make strategic decisions for financial stability.

What are the different systems within cost accounting?

Cost accounting includes systems like standard cost accounting, which evaluates costs based on typical operating conditions and seeks variances to identify inefficiencies.

What are direct costs and how are they handled in financial statements?

Direct costs, such as materials and labor directly associated with production, are variable and fluctuate with production levels. They are traced and included in the Cost of Goods Sold (COGS) on financial statements.

What is the role of financial analysts in cost accounting?

Financial analysts scrutinize financial data and market trends to provide insights that help businesses navigate financial challenges. They analyze financial documents like balance sheets and income statements to assess a company's financial position.

How does IASB view financial reporting practices?

Recent IASB studies indicate a need for standardized practices in operating profit reporting due to variability in calculation methods used by different companies.

What is technical analysis?

Technical analysis is a method that uses historical market data to forecast future market trends. It focuses on chart patterns and price movements to inform market entry and exit strategies.

What is fundamental analysis?

Fundamental analysis assesses the intrinsic value of securities by examining financial statements, economic indicators, and other external data. It is oriented towards long-term value assessment.

What are some limitations of fundamental and technical analysis?

Fundamental analysis has been criticized for not incorporating rigorous economic analysis, while technical analysis may rely too heavily on patterns that may not always predict future outcomes accurately.

How do financial analysts use technical analysis?

Financial analysts use technical analysis to identify market patterns and trends. This helps them determine the timing for trading and informs investment decisions.

What other types of financial analysis do organizations use?

Organizations use various analytical techniques such as vertical and horizontal analysis, liquidity and profitability analysis, cash flow analysis, efficiency ratios, rate of return analysis, valuation analysis, scenario and sensitivity analysis, and variance analysis to inform decision-making.

Why is financial analysis important for decision-making?

Financial analysis guides corporate strategy and operational efficiency by assessing profitability, liquidity, and solvency. It informs decisions on new ventures, pricing, and investment opportunities through forecasting and planning.

What are the best practices in financial analysis?

Best practices include using up-to-date and accurate financial data, adhering to Clean Code standards, ensuring reproducibility and data integrity, preprocessing data to enhance quality, and minimizing errors for reliable analysis.

What common tools and techniques are used in financial analysis?

Common tools include ratio analysis, trend analysis, financial modeling, sensitivity analysis, break-even analysis, and exploratory data analysis (EDA). These are used to evaluate a company's performance and inform strategic decisions.