Overview

The article underscores the critical role of effective stakeholder management courses for CFOs, asserting that such training provides them with vital skills to navigate intricate stakeholder relationships and align financial strategies with organizational objectives. Evidence supports this assertion, indicating that organizations with robust stakeholder engagement are significantly more likely to successfully complete projects, mitigate risks, and achieve long-term sustainability. This highlights the strategic necessity of these courses in enhancing decision-making and fostering collaboration.

Introduction

In an increasingly interconnected business world, the ability to manage stakeholder relationships has emerged as a critical competency for financial leaders. Effective stakeholder management not only fosters trust and transparency but also aligns diverse interests with organizational goals, paving the way for sustainable growth. Yet, many CFOs grapple with the complexities of these relationships.

How can they enhance communication, mitigate risks, and drive financial success while navigating the expectations of various parties? This article delves into the essential components of an effective stakeholder management course tailored for CFOs, highlighting the strategic advantages that come from mastering this vital skill set.

Define Stakeholder Management: Core Concepts and Importance

The management of interested parties is pivotal in today's business landscape. It encompasses the systematic identification, analysis, planning, and execution of actions designed to engage and manage relationships with stakeholders. Stakeholders include individuals or groups who have a vested interest in or are impacted by a company's operations—this includes employees, customers, investors, suppliers, and the community.

Effective management of these parties is essential for organizations, as it fosters trust, enhances communication, and aligns stakeholder expectations with business objectives. By comprehending the needs and concerns of interested parties, organizations can mitigate risks, improve decision-making, and promote sustainable growth.

Moreover, organizations that prioritize stakeholder management are more likely to achieve long-term success. This proactive approach not only strengthens relationships but also creates an environment conducive to collaboration and innovation. Therefore, it is imperative for businesses to develop strategies that engage stakeholders effectively, and can help address their diverse interests.

In conclusion, of interested parties is not merely a best practice; it is a fundamental component of a successful business strategy. Companies must take decisive action to understand and respond to stakeholder needs, ensuring that they remain aligned with their overarching goals.

Components of an Effective Stakeholder Management Course

encompasses several critical components designed to empower CFOs in navigating complex stakeholder landscapes:

- Party Identification: Techniques for recognizing all relevant parties, understanding their interests, and evaluating their influence on projects. Research suggests that organizations prioritizing participant engagement are 30% more likely to succeed with new initiatives.

- Participant Analysis: Techniques for assessing participant power, interest, and potential influence on decisions. Utilizing tools like the Power-Interest Grid can help categorize involved parties based on their influence and interest, ensuring that engagement strategies are appropriately tailored.

- Communication Strategies: Best practices for developing clear and effective communication plans customized for various interest groups. Effective communication is vital, as 55% of organizations lack access to real-time KPIs, which can hinder timely decision-making.

- Engagement Techniques: Strategies for building relationships and involving parties through collaboration and feedback. Involving interested parties early can result in clearer plans and improved focus on critical issues, significantly enhancing project outcomes.

- Conflict Resolution: Skills for managing and resolving disputes that may occur among involved parties. A proactive approach to conflict resolution can mitigate potential controversies and foster a collaborative environment.

- Monitoring and Evaluation: Tools for assessing the effectiveness of and making necessary adjustments. Ongoing assessment is vital, as organizations incorporating input from interested parties into their processes experience a 30% greater adoption rate of new products.

These elements provide financial executives with the expertise and abilities required to efficiently handle relationships with interested parties, which can be developed through an effective stakeholder management course, ultimately leading to improved project results and organizational achievement.

Why Stakeholder Management Matters for CFOs: Addressing Financial Challenges

For , participating in an effective stakeholder management course is crucial for the efficient management of interested parties while navigating various economic challenges. Stakeholders, including investors, creditors, and regulatory bodies, significantly influence monetary strategies and outcomes. By actively managing these relationships, CFOs can:

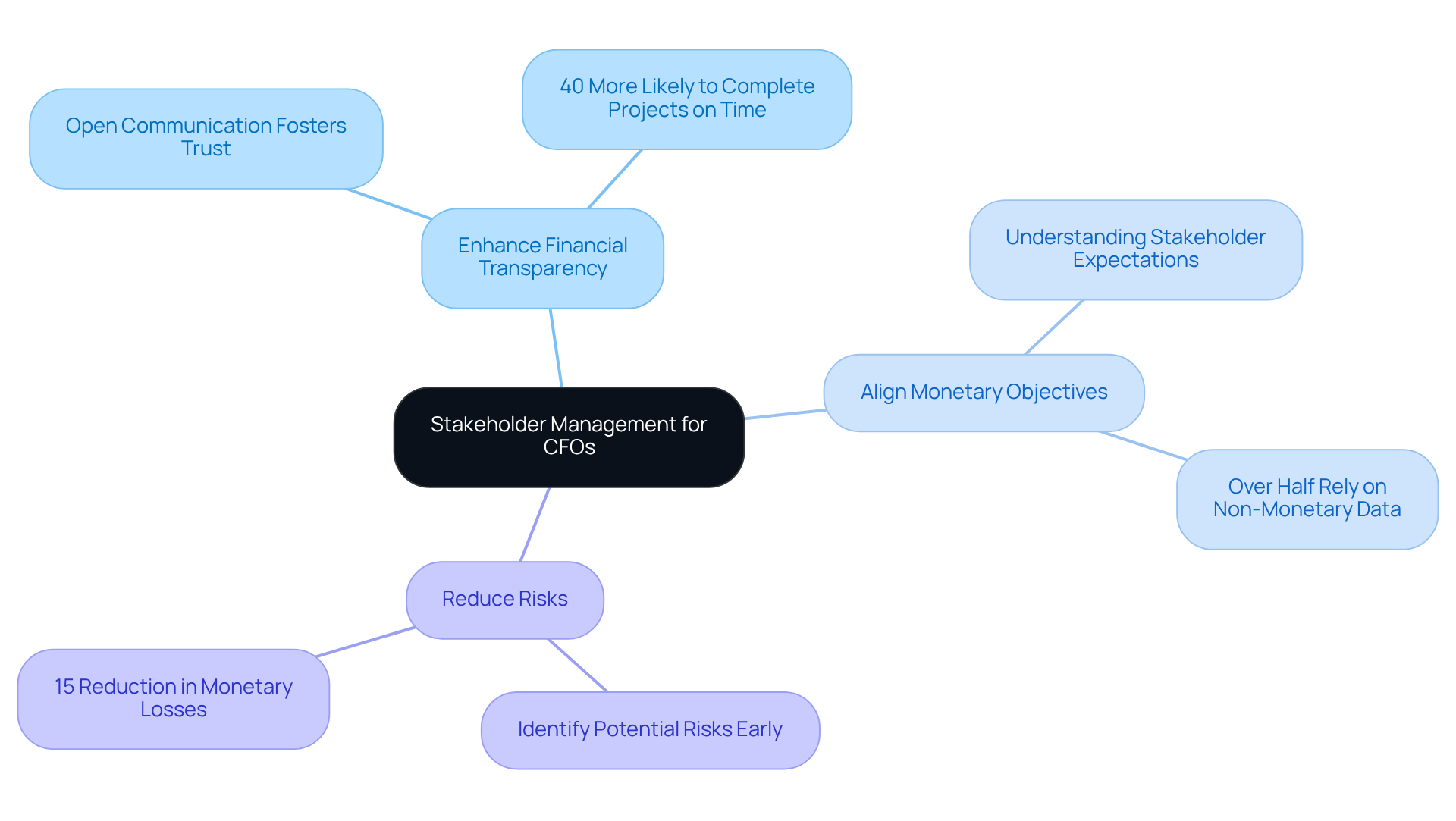

- Enhance Financial Transparency: Open communication with stakeholders fosters trust and reduces uncertainty, which is vital during financial crises. A study indicates that firms with robust participant involvement are 40% more likely to complete projects on time and within budget, underscoring the importance of transparency in monetary transactions.

- Align Monetary Objectives: Understanding the expectations of interested parties enables chief financial officers to align economic plans with broader organizational goals, ensuring that all involved work towards shared objectives. This alignment is essential as over half of chief financial officers increasingly rely on non-monetary data for decision-making, highlighting the importance of an effective stakeholder management course in integrated economic planning. By recognizing fundamental business challenges and collaborating to develop solutions, chief financial officers can ensure that monetary plans are robust and adaptable to the needs of interested parties by participating in an effective stakeholder management course.

- Reduce Risks: Actively engaging with involved parties helps identify potential risks early, allowing financial leaders to devise effective mitigation strategies. In banking, for instance, strong participant involvement can reduce monetary losses by 15%, illustrating the tangible benefits of risk management through collaboration. By leveraging real-time analytics, financial executives can continuously assess business health and adjust strategies as necessary.

By enrolling in an effective stakeholder management course, executives can learn to reconcile the interests of diverse parties and formulate strategies that foster long-term sustainability and profitability. Companies that effectively engage with interested parties are 30% more likely to succeed with new products, emphasizing the significance of managing these relationships in driving innovation and growth. Streamlined decision-making processes further enhance the capacity to operationalize lessons learned during turnaround efforts.

In summary, the effective stakeholder management course highlights that managing interests transcends being merely a soft skill; it is a strategic necessity for chief financial officers maneuvering through the complexities of the economic landscape in 2025. As Owen Ryan, co-CEO of BlackLine, asserts, "Companies that truly connect with interested parties are 50% more likely to achieve their major objectives," further emphasizing the critical nature of managing these relationships.

Benefits of Effective Stakeholder Management Training for Financial Leaders

Investing in effective stakeholder management training offers numerous benefits for financial leaders, including:

- Improved Decision-Making: Training equips CFOs with the skills to analyze stakeholder needs and make informed decisions that consider diverse perspectives. Our method facilitates a shortened decision-making cycle, enabling financial leaders to take decisive action that maintains business health.

- Improved Communication Skills: Chief Financial Officers learn to convey financial information clearly and convincingly, nurturing better connections with interested parties. Effective participant engagement can enhance customer satisfaction, illustrating the significance of clear communication.

- Enhanced Participation: Training assists CFOs in formulating approaches to involve interested parties actively, resulting in greater levels of trust and teamwork. Organizations that interact efficiently with interested parties can experience an increase in profits, demonstrating the concrete advantages of successful engagement plans.

- Conflict Management: Financial leaders gain tools to navigate and resolve conflicts, ensuring smoother operations and project success. Effective engagement with relevant parties can decrease project delivery time, emphasizing the significance of strong conflict resolution abilities.

- Strategic Alignment: Training allows financial leaders to align the interests of involved parties with organizational objectives, fostering cohesive strategies that benefit everyone. Our client dashboard offers real-time business analytics to consistently track performance, ensuring that organizations align better with the expectations of interested parties, leading to enhanced financial results.

Overall, an empowers CFOs to become more strategic leaders, capable of navigating complex stakeholder dynamics and driving organizational success.

Conclusion

Effective stakeholder management stands as a crucial skill for CFOs navigating the complexities of modern business. By understanding and engaging with various stakeholders, financial leaders can foster trust, enhance communication, and align diverse interests with organizational goals. This strategic approach not only mitigates risks but also drives sustainable growth and innovation, making it essential for CFOs to invest in their stakeholder management capabilities.

The article outlines several key components of an effective stakeholder management course:

- Techniques for party identification

- Participant analysis

- Communication strategies

- Engagement techniques

- Conflict resolution

- Monitoring and evaluation

Each of these elements equips CFOs with the necessary skills to manage relationships effectively, ultimately leading to improved decision-making, financial transparency, and project success. By mastering these concepts, financial leaders can ensure that their organizations remain resilient and adaptable in an ever-changing economic landscape.

In conclusion, the significance of stakeholder management cannot be overstated for CFOs aiming to achieve organizational objectives. As the business environment continues to evolve, embracing effective stakeholder management training is not merely beneficial but imperative. By prioritizing these relationships, financial leaders can enhance their strategic impact, drive innovation, and secure long-term success for their organizations. Engaging with stakeholders effectively will pave the way for a more collaborative and prosperous future in business.

Frequently Asked Questions

What is stakeholder management?

Stakeholder management is the systematic identification, analysis, planning, and execution of actions designed to engage and manage relationships with individuals or groups who have a vested interest in or are impacted by a company's operations.

Who are considered stakeholders?

Stakeholders include employees, customers, investors, suppliers, and the community, all of whom have a vested interest in a company's operations.

Why is stakeholder management important for organizations?

Effective stakeholder management fosters trust, enhances communication, aligns stakeholder expectations with business objectives, mitigates risks, improves decision-making, and promotes sustainable growth.

How does prioritizing stakeholder management contribute to a company's success?

Organizations that prioritize stakeholder management are more likely to achieve long-term success by strengthening relationships and creating an environment conducive to collaboration and innovation.

What should businesses do to engage stakeholders effectively?

Businesses must develop strategies that effectively engage stakeholders, understanding and responding to their diverse interests to ensure alignment with overarching goals.

Is stakeholder management considered a best practice?

Yes, stakeholder management is not merely a best practice; it is a fundamental component of a successful business strategy that requires decisive action to understand and respond to stakeholder needs.