Introduction

In the realm of cost accounting, the meticulous work of Accounts Payable Processing plays a crucial role. This process involves handling a company's invoices and expenses with precision, ensuring accurate recording and examination of each financial transaction. The integration of artificial intelligence is reshaping the efficiency of accounting operations, including accounts payable processing.

Timely and precise accounts payable management is essential for robust vendor relationships, superior cash flow management, and accurate financial reporting. Streamlined accounts payable processes and automation technologies can significantly enhance efficiency, reduce errors and fraud risks, and unlock favorable pricing and discounts. Through this article, we will explore the benefits and steps of efficient accounts payable processing as well as the transformative power of automation in this domain.

Embracing innovative solutions and staying ahead of technological advancements is crucial for organizations to maintain their fiscal health and competitive edge.

What is Accounts Payable Processing?

Deep within the realm of cost accounting, the meticulous work of Accounts Payable Processing stands as a cornerstone task. This intricate process necessitates the careful handling of a company's invoices and expenses, ensuring that each financial transaction is not only recorded but also examined with precision. These initial steps entail the meticulous verification of invoices received from vendors against existing purchase agreements.

With the accuracy of each invoice confirmed, the information is systematically integrated into the company's financial system, setting the stage for subsequent settlement of these obligations.

The essence of this operation aligns with the practice of accrual-basis accounting, where financial activities are recorded upon occurrence, irrespective of the actual exchange of cash. This technique underscores the fundamental principle of recording revenues upon invoicing and expenses upon their incurring—allowing for financial transparency during the entirety of a transaction's lifecycle.

In essence, the meticulous process of Accounts Payable Processing is reminiscent of a 'prix fixe' menu, where each stage of the process is finely curated, much like a chef meticulously prepares a meal, ensuring a consistent and satisfying end product. It's an echo of the dedication found in restaurant kitchens, where attention to detail and process excellence stand paramount.

Consider the innovative approach employed by TigerBeetle, which processes batches of transactions, allowing for the expedient handling of financial activities as a unified transaction. This method parallels the functionality needed in accounts payable processing, where efficiency and reliability are key.

Recent figures indicate economic factors such as inflation and interest rates heavily influence the accounting sector. Their impact on profitability cannot be overstated, as firms battle rising operation costs, now more than ever. In this light, the accuracy and efficiency of accounts payable processing are pivotal, ensuring financial clarity and resilience amidst a volatile economy.

Furthermore, the integration of artificial intelligence into accounting practices marks a significant stride towards higher audit quality. Although studies have yet to show a statistically significant direct impact on audit quality from AI, it's undeniable that the incorporation of such technology is reshaping the efficiency and efficacy of accounting operations, including accounts payable processing.

Embracing the concept of accrual accounting, businesses manifest greater intentionality in managing transactions and setting the groundwork for a vibrant financial future, much like individuals using zero-based budgeting techniques for personal finance. By ensuring that every dollar is accounted for and every expense justified, organizations, much like savvy budgets, can pave the way towards sustained financial health.

Benefits of Efficient Accounts Payable Processing

Timely and precise accounts payable management ensures robust vendor relationships and can unlock favorable pricing, discounts, and better payment terms. Such meticulous processing aids in superior cash flow management, allowing for strategic funding distribution and keeping late payment penalties at bay. It underpins financial reporting accuracy, enabling a clear analysis of expenses which facilitates better decision-making.

Automated accounts payable processes, apart from improving operational efficiency, also significantly reduce the error and fraud risk inherent in manual tasks.

Consider the transformative shift at the Somerset Academies of Texas, where disparate software systems for various operational aspects were seamlessly integrated for enhanced efficiency. Similarly, the Ford Foundation's digital engagement upgrades illustrate the value of evolving systems to meet output demands.

As social commerce reshapes consumer experiences, and as businesses adopt digital payments, the integration of Straight Through Processing (STP) systems exemplifies the arduous transition from paper checks to electronic mediums, enhancing payment workflows and eliminating manual bottlenecks.

These observations amalgamate into a compelling case for IT solutions that augment transaction processing efficiently, as emphasized by OpenText and the Association for Financial Professionals. The emphasis on innovation and efficient accounts payable practices forms a critical cornerstone for an organization's sustained fiscal health and compliance posture.

Steps in the Accounts Payable Process

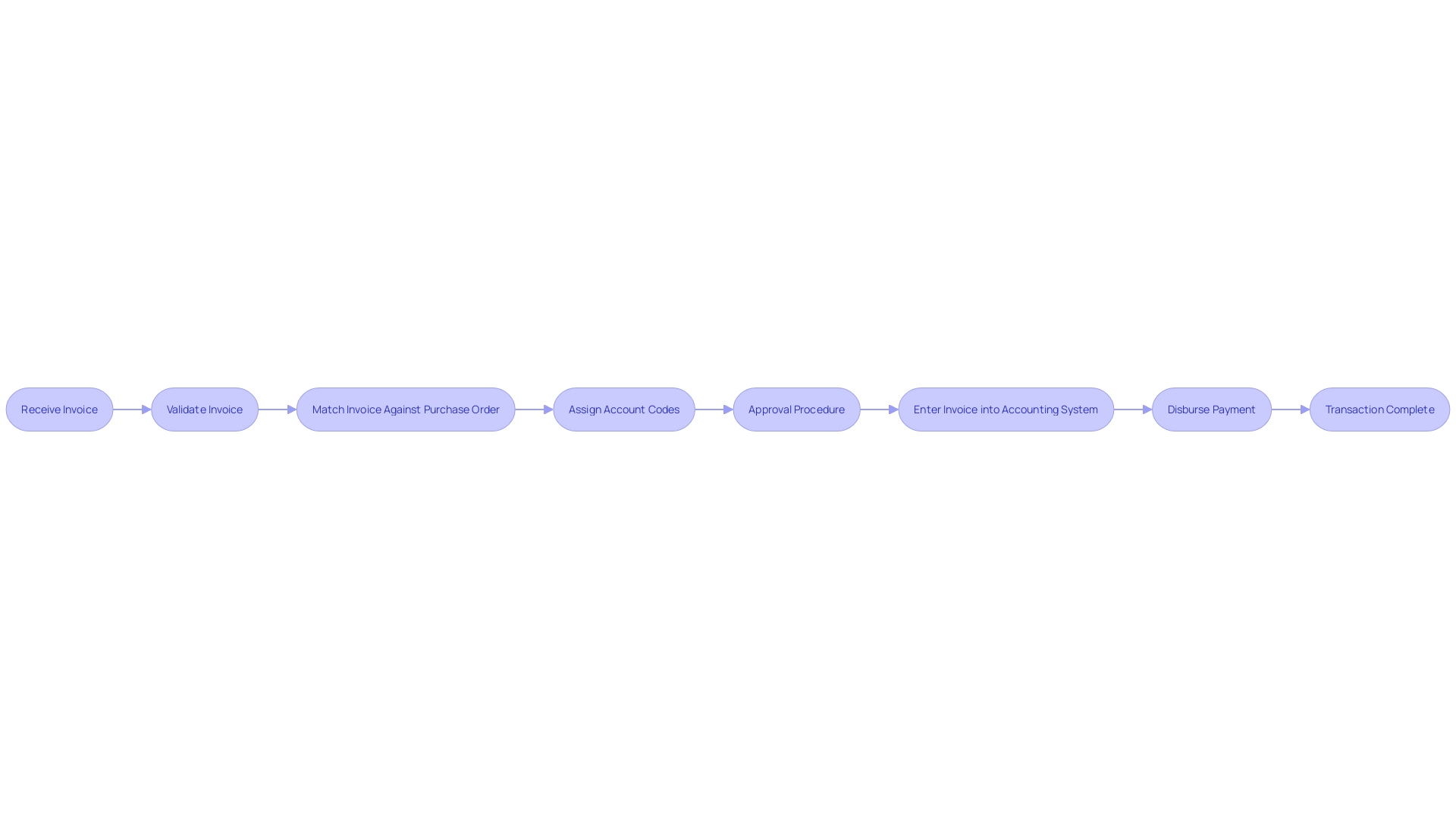

At the heart of a streamlined financial operation lies a meticulous accounts payable process, which, when executed effectively, ensures the integrity and efficiency of financial transactions. An accounts payable clerk plays an instrumental role in small businesses by managing the end-to-end invoice handling and payment cycle. It begins with the accurate receipt and validation of invoices, which are carefully matched against pertinent purchase agreements or contracts, confirming that the charges reflected are for approved expenditures.

The process continues with assigning granular account codes to each invoice — a critical step for unerring financial tracking and cost allocation. Such precision in coding supports robust expense management and plays into broader strategies for sustainable financial health.

Subsequent to coding, the invoice goes through a thorough approval procedure, wherein authorized individuals scrutinize the details before giving the green light for payment. This gatekeeping not only controls outflows but also ensures adherence to financial compliance and regulatory norms, reflecting an effective guard against fiscal irregularities, a concern exemplified by the conscientious actions of companies like SAP adhering to financial settlements to rectify past discrepancies.

Once the approval is secured, the invoice is meticulously entered into the accounting system, scheduled for payment within the agreed terms. The final act of disbursing payment solidifies the trust between the business and its vendors, while an accounts payable clerk’s dexterity in handling vendor queries and maintaining harmonious relationships further reinforces this bond.

For a small business, the qualifications and readiness of an accounts payable clerk are not trivial; they directly influence the timeliness, accuracy, and reliability of the entire accounts payable function. This isn't just administrative work; it's a crucial contribution to managing cash flow, forecasting financial outcomes, and preserving the overall financial health of the enterprise.

Automation in Accounts Payable

Harnessing automation transforms the accounts payable (AP) landscape, considerably boosting processing efficiency for businesses. Advanced technology furnishes tools such as electronic invoice submission and optical character recognition that seamlessly convert text from images into editable data. Sophisticated software can now handle automated invoice matching as well as approval workflows.

Such innovations eradicate the need for laborious manual entry, curtail the possibility of human error, and expedite the AP cycle significantly. Moreover, the added benefit of automation lies in its capacity to heighten visibility and offer real-time analytics, aiding in more informed decision-making. As a case in point, a large healthcare provider tackled the challenge of time-consuming manual report generation – a task that occupied three business analysts full-time – by embracing automation to streamline their reporting process.

Similarly, Delivery Hero experienced a notable decrease in account recovery time, from an average of 35 minutes per incident down to virtually no time, alleviating the burden on both their IT department and their extensive workforce. Hiscox, too, efficiently cut down their client email response times by 28% by adopting an automated system. Current trends reveal a rapid adoption of such automation, with the global market for AP automation projected to soar to $5.3 billion by 2028, growing annually at 11.3%.

This uptick in adoption is largely driven by artificial intelligence and machine learning, underscoring the need for companies to keep abreast of technological advancements to avoid outdated practices that could hinder their competitive edge.

Conclusion

In conclusion, efficient accounts payable processing, combined with the integration of automation technologies, is crucial for maintaining financial transparency, robust vendor relationships, and accurate financial reporting. By streamlining processes and leveraging technology, organizations can unlock numerous benefits.

Efficient accounts payable management ensures robust vendor relationships, unlocks favorable pricing and discounts, and aids in superior cash flow management. Automation significantly reduces the risk of errors and fraud, enhancing operational efficiency.

The steps in the accounts payable process, from invoice receipt and validation to approval procedures, ensure financial compliance and reliability. The qualifications and readiness of accounts payable clerks directly influence timeliness, accuracy, and reliability.

Automation technologies, such as electronic invoice submission and optical character recognition, eliminate manual tasks and human errors. These technologies also enhance visibility and provide real-time analytics for informed decision-making.

Rapid adoption of automation, driven by AI and machine learning, highlights the importance for organizations to stay ahead technologically to maintain their competitive edge.

In summary, embracing efficient accounts payable processing and leveraging automation technologies are essential for organizations to maintain financial health and competitiveness. Timely and precise accounts payable management enhances vendor relationships, cash flow management, and financial reporting accuracy. Organizations must embrace automation and stay informed about technological advancements for long-term success.