Introduction

Financial audits play a crucial role in ensuring the accuracy and reliability of a company's financial information. As fraud schemes become increasingly complex, independent auditors meticulously examine financial statements to validate compliance with regulatory norms and accounting standards. These audits provide actionable insights for stakeholders, reinforcing confidence in the company's financial standing.

However, preparing for an audit requires a clear understanding of financial reporting needs and timelines. The expertise of auditors is invaluable in navigating the complexities of financial reporting and maintaining the integrity of financial information. With the demand for trustworthy financial data on the rise, accurate audits are more important than ever.

This article explores the types of financial audits, the audit process, key components of a financial audit report, the benefits of financial audits, common challenges, best practices, and the role of technology in financial audits. By understanding the significance of financial audits and implementing best practices, companies can ensure transparency, foster trust, and adapt to business disruptions effectively.

What is a Financial Audit?

Financial audits are more than just a procedural check; they are a vital process for ensuring the veracity and reliability of a company's financial information. Independent auditors delve into the financial statements with the precision of a surgeon, scrutinizing every aspect to validate their compliance with regulatory norms and accounting standards, such as GAAP. This meticulous examination is essential as it equips stakeholders with actionable insights, reinforcing their confidence in the company's financial standing.

The significance of these audits is underscored by the increasing complexity of financial schemes designed to conceal fraudulent activities. Despite rigorous internal controls, the ingenuity and depth of understanding that fraudsters possess allow them to bury deceptions deep within the financial statements. This, combined with the sheer volume of financial data and its intricacies, presents a formidable challenge in fraud detection.

Advanced analytical tools are now crucial to pierce through this veil, as traditional methods are easily overwhelmed.

Preparing for an audit is a process that demands a clear understanding of one's financial reporting needs and the establishment of precise timelines. Whether the financial statements adhere to GAAP or other accounting frameworks, it is imperative to align them with the governing documents of the entity. A clean set of books, reflective of the latest costs and supported by robust accounting software, lays the groundwork for accuracy in financial reporting, as emphasized by Omar Choucair of Trintech.

Furthermore, the expertise of auditors is an invaluable resource, providing the depth and breadth of knowledge necessary to navigate the complexities of financial reporting. Their role is foundational to maintaining the integrity of financial reporting, ensuring adherence to regulations, and protecting investor interests. With the intensification of regulatory oversight and a scarcity of qualified professionals, the demand for precise and trustworthy financial information has never been greater.

The urgency for accurate audits is echoed by recent research indicating that nearly 40% of CFOs lack complete trust in their organization's financial data. This skepticism hampers strategic decision-making, especially in a climate fraught with external challenges such as potential global financial crises, cybersecurity threats, and emerging disruptive technologies. In such a landscape, real-time access to and analysis of financial data becomes a critical asset for companies to navigate and adapt to business disruptions.

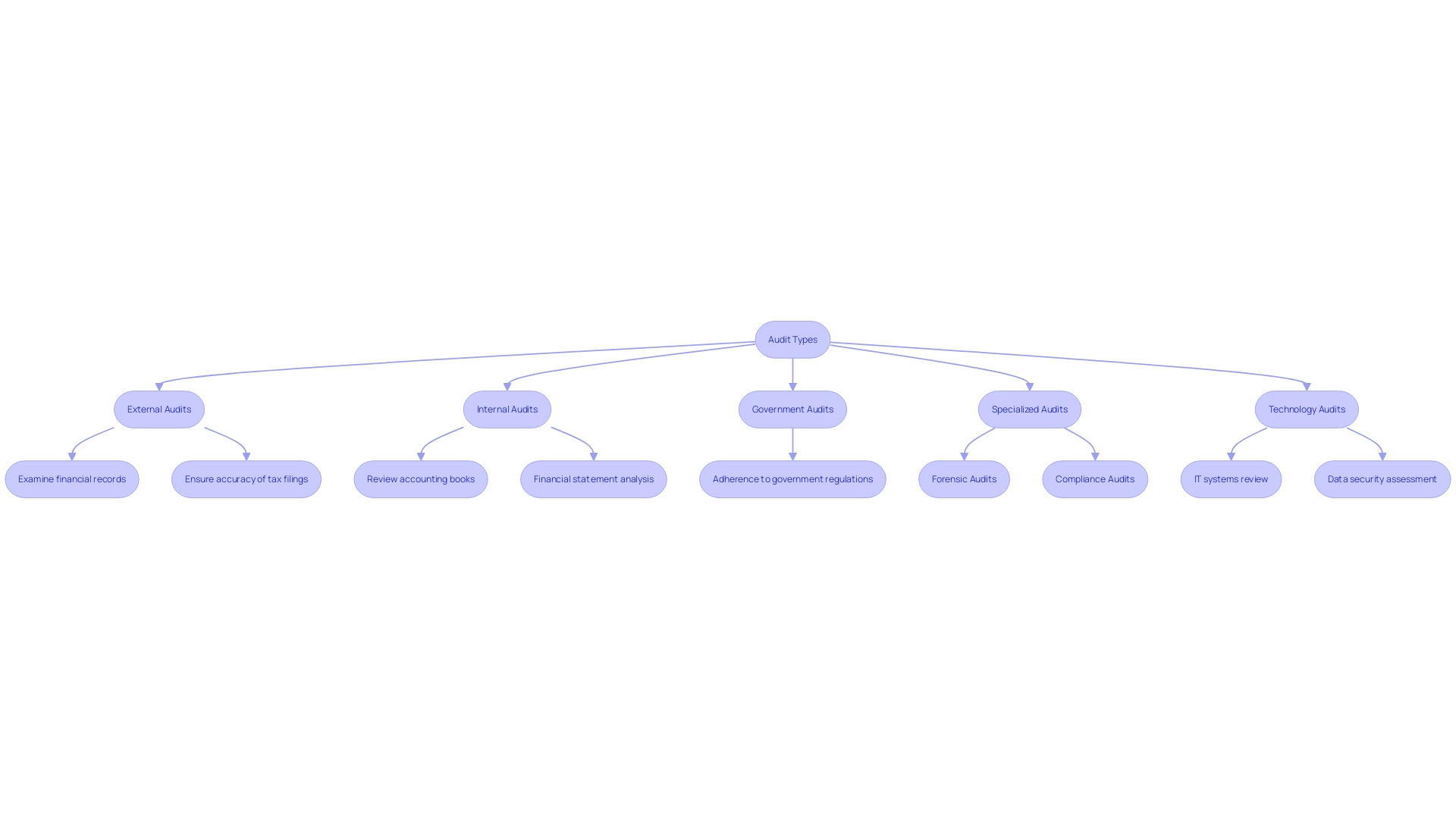

Types of Financial Audits

Financial audits are diverse and cater to different aspects of an organization's operations and compliance. While external audits are performed by independent auditors who validate the accuracy of financial statements, internal audits, conducted by an organization's own team, scrutinize the effectiveness of internal controls and risk management. Government audits, on the other hand, are specific to public entities and examine adherence to laws and regulations.

Specialized audits like forensic audits delve deep to detect fraud and financial misconduct through meticulous financial record examinations and interviews. Similarly, compliance audits specifically focus on whether an organization meets legal and regulatory obligations.

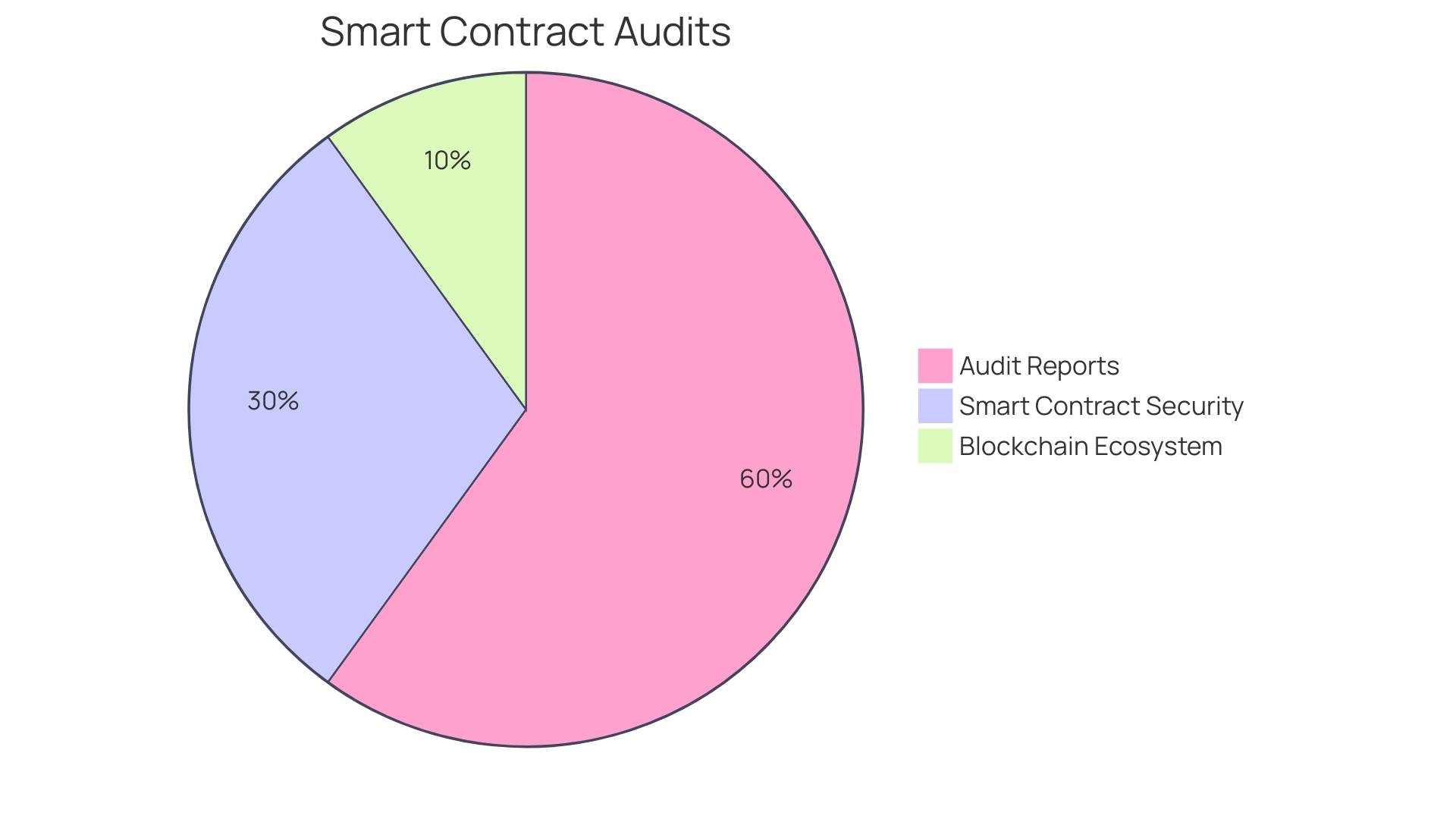

In the dynamic field of technology and cryptocurrency, audits take on a specialized role. They extend beyond traditional financial scrutiny to encompass the examination of technological infrastructures, such as blockchain and smart contracts. Accessing these audits can be as straightforward as searching the project's website or other online platforms that offer audit reports for technology projects.

The evolving audit standards propose enhanced obligations for auditors to proactively identify laws and regulations that could materially affect financial statements. This includes a more rigorous evaluation of non compliance and its potential effects, necessitating auditors to possess or acquire specialized skills to effectively carry out their duties.

Understanding the types of audits and their specific functions is crucial for stakeholders, including investors who may be drawn to smaller, high-return projects. Awareness and transparency through audits are essential, especially for new investors, to mitigate risks associated with early-stage ventures.

Overall, an audit serves as a foundational element in ensuring transparency, fostering trust, and maintaining the integrity of financial and operational information within an organization.

The Financial Audit Process

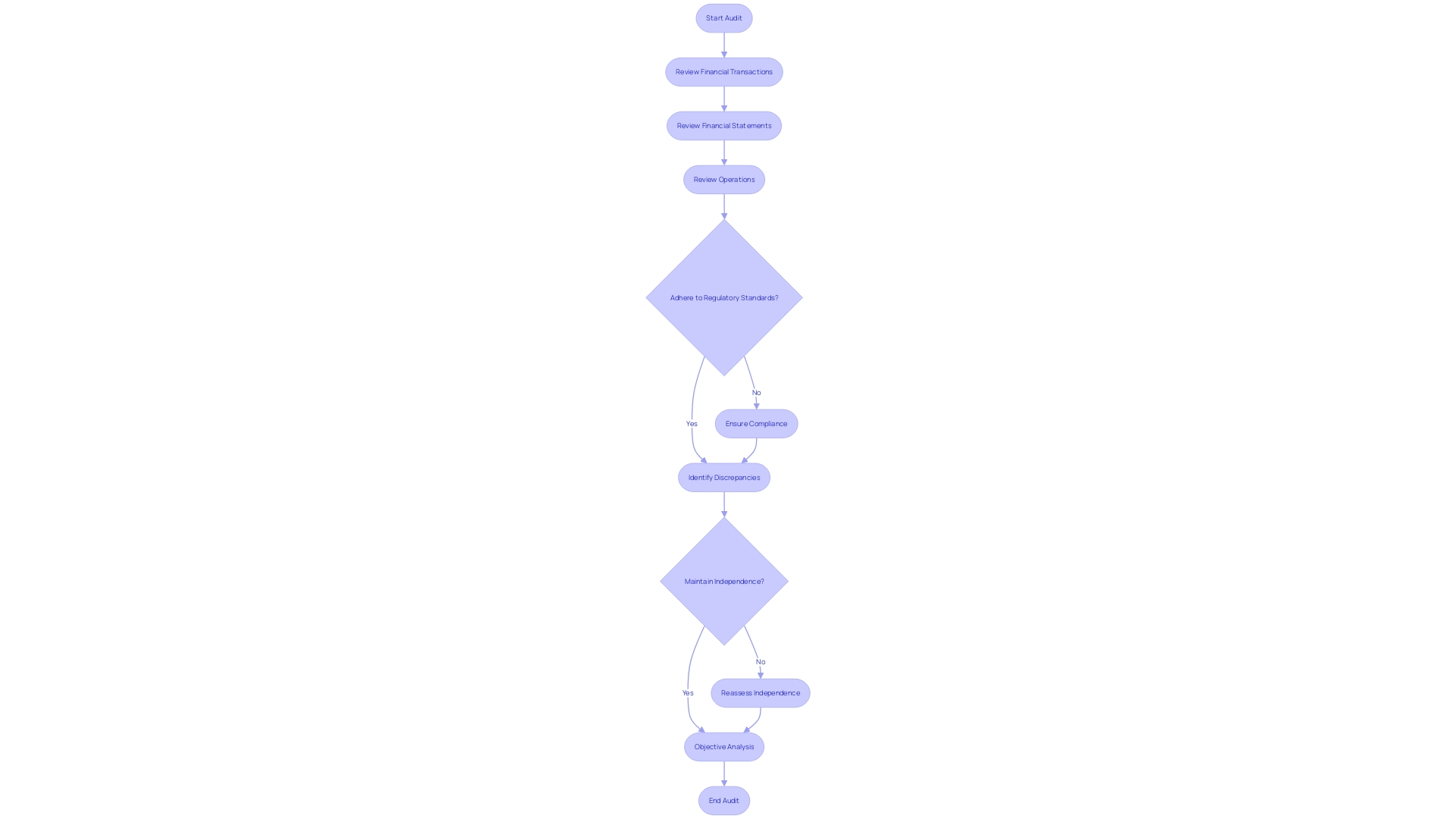

The meticulous journey of a financial audit unfolds across various critical stages, ensuring a comprehensive assessment of an organization's monetary records. It commences with Planning and Preparation, where auditors immerse themselves in the company's operations to pinpoint potential risks and craft a tailored audit strategy. A robust evaluation of the internal control systems is conducted, setting the stage for the audit's extent.

Transitioning to the Risk Assessment stage, auditors unearth the risks that could lead to significant misstatements within the financial statements. This phase is pivotal as it informs the degree of audit testing necessary.

In the Fieldwork and Data Collection phase, auditors gather a plethora of information through financial records, corroborative documents, and discussions with key staff. To ascertain the financial data's accuracy, auditors engage in substantive testing procedures.

Audit Testing and Evaluation follows, where auditors employ a mix of analytical and substantive tests to examine the company's internal controls and unearth any material inaccuracies. They scrutinize accounting estimates and the financial statements' overall portrayal.

The journey culminates in the Reporting and Findings phase, where auditors compile a report encapsulating their discoveries and viewpoints. This document evaluates the financial statements, flags issues, and proposes enhancements. It then becomes a crucial resource for management, stakeholders, and regulatory agencies.

The audit process is not just a series of steps but a dynamic exploration into the company's financial ethos, ensuring integrity and transparency in its financial reporting. Recent proposals to fortify auditor duties further underscore the critical nature of this process, enhancing the auditor's proactive identification of applicable laws and regulations, and clarifying the requirements for evaluating and communicating potential noncompliance.

Key Components of a Financial Audit Report

A critical document for any business, the financial audit report, dissects the company's financial health through multiple lenses. The Auditor's Opinion serves as a testament to the accuracy of financial statements, ranging from an unqualified nod of approval to a disclaimer of uncertainty when the auditor lacks enough evidence for a definitive statement.

Management's Responsibility underscores the crucial role leaders play in financial reporting, from ensuring every figure is accurate to maintaining a robust system of internal controls. This segment is pivotal, as Omar Choucair of Trintech highlights the necessity of 'clean books' and the implementation of bespoke accounting software for reliable financial statements.

The Audit Scope delineates the boundaries within which the audit was conducted, detailing the time frame and financial documents scrutinized, while candidly acknowledging any constraints faced by auditors.

Key Audit Findings reveal the auditor's most significant discoveries, spotlighting areas for concern, compliance slip-ups, or control system flaws. These findings are not just a report card but a mirror reflecting the organization's operational effectiveness.

Lastly, the Recommendations provide a roadmap for rectifying shortcomings identified within the audit, offering guidance for bolstering financial reporting and compliance. With the S&P 500 companies' audit fees soaring to an average of $10,776,916 in FY2022, as reported by Ideagen Audit Analytics, these suggestions become even more valuable for firms seeking to optimize their financial strategies and maintain investor confidence amidst increasing regulatory oversight and a competitive audit professional landscape.

Benefits of Financial Audits

Conducting financial audits is more than a mere compliance exercise; it's an integral component for enhancing the fiscal health and operational efficiency of an organization. Here are the multifaceted advantages of regular financial audits:

-

Stakeholders, including investors and creditors, gain a comprehensive and transparent view of a company's financial status through audits. This openness fortifies trust and facilitates informed decision-making, similar to how platforms like AdvisorCheck are fostering financial trust through transparency.

-

Audits are instrumental in pinpointing deficiencies in internal controls. By addressing these vulnerabilities, organizations can bolster their defense against fraud and ensure the precision of financial statements, mirroring the high-quality and reliable data provided by solutions like Chainalysis to its legal firm clients.

-

Adherence to financial regulations and accounting standards is non-negotiable for maintaining corporate reputation and avoiding punitive actions. Audits confirm compliance, akin to the meticulous financial review necessary for small business audits as outlined by accounting experts.

-

The accuracy of financial reports is paramount, as nearly 40% of CFOs report skepticism about their data's reliability, according to BlackLine, Inc. Audits validate financial data, providing the necessary confidence for stakeholders to base their strategic decisions.

-

Finally, audits often reveal opportunities for enhancing financial management, risk management, and internal controls. Recommendations from auditors can lead to operational improvements, just as the fixed-price technology and services provided by specialized accounting firms have revolutionized efficiency for their clients.

Common Challenges and Best Practices

Circumventing the pitfalls of financial audits necessitates a meticulous approach. The evolving landscape of regulations requires continuous vigilance to maintain compliance. For instance, a project's structure might reveal essential details akin to determining if a codebase is original or a modified fork.

This insight is analogous to identifying and adhering to relevant laws and regulations that could materially impact financial statements.

Furthermore, the constraints of resources pose a significant challenge, particularly for smaller entities. The IRS scrutinizes small business audits with precision, evaluating tax filings and financial records to ensure accuracy. Organizations must, therefore, allocate skilled auditors, time, and budget efficiently.

A proactive strategy is to comprehend financial reporting requirements thoroughly, set a timeline, and understand the basis of accounting principles required for financial statements.

Data integrity is the cornerstone of an effective audit. The integrity of financial data, often compromised by insufficient internal controls or overridden controls, can be safeguarded by implementing strong internal controls, such as segregation of duties and regular risk assessments. Technologies like Snowflake can be harnessed to ingest necessary data, while designing and executing queries to visualize and analyze this data is crucial.

Adopting a compliance management system is not merely a recommendation—it is a necessity to stay abreast of regulations and accounting standards, a sentiment echoed by recent proposals to enhance auditor obligations. These proposals mandate auditors to proactively identify applicable laws and evaluate the consequences of noncompliance.

Utilizing technology is no longer optional. With more than half of occupational frauds occurring due to the absence or override of internal controls, leveraging technology and data analytics is becoming increasingly prevalent in detecting fraudulent activities. Organizations should also consider continuous audit readiness by maintaining accurate, real-time financial records, conducting internal audits, and addressing issues promptly.

In conclusion, as Omar Choucair of Trintech articulates, ensuring financial statements are accurate starts with the basics of financial reporting. It is imperative to have clean books reflecting the latest costs and to analyze these with management teams. This reinforces investor trust in financial statements and confirms the company's effective controls and compliance with reporting standards.

With a legacy of insight and vigilance, entities must remain steadfast in their commitment to unveiling the complexities of fraud and enhancing their defensive measures.

The Role of Technology in Financial Audits

The integration of advanced technology is revolutionizing the realm of financial audits, offering a plethora of enhancements across the board. Here are some pivotal ways these technological solutions are contributing to more robust and incisive auditing practices:

-

Data Analytics: Harnessing the power of data analytics tools, auditors can now sift through substantial financial data sets with unparalleled speed. This capacity to rapidly unearth patterns, anomalies, and potential risks vastly outperforms conventional manual techniques.

-

Audit Management Software: Centralizing the audit workflow through sophisticated audit management software enhances coordination among team members and grants instantaneous oversight of audit progression, refining everything from the planning stages to reporting.

-

Artificial Intelligence (AI) and Machine Learning (ML): By automating routine tasks like data extraction and validation, AI and ML technologies liberate auditors to dedicate their expertise to more strategic endeavors such as nuanced data interpretation and thorough risk evaluation.

-

Blockchain Technology: As a bulwark for the security and immutability of financial data, blockchain technology is a formidable ally in the fight against fraud, simultaneously ensuring data integrity and simplifying the audit trail.

-

Cloud Computing: The agility of cloud-based audit solutions permits auditors to access pertinent data and collaborate effectively regardless of their physical location, thereby enhancing operational efficiency.

The progressive embedding of these technologies into financial audit systems is set to elevate their efficacy continuously, allowing auditors to deliver deeper insights and heightened value to entities across the spectrum.

Further Reading and Resources

To uphold the integrity of financial reporting and ensure compliance with regulatory requirements, it's crucial for organizations to engage in thorough financial audits. These audits are not just a formality; they are a critical defense mechanism protecting investor interests and supporting the capital markets. The landscape of financial auditing is evolving, driven by heightened scrutiny from regulatory bodies such as the Public Company Accounting Oversight Board and the Securities and Exchange Commission.

This intensification, coupled with a shortage of seasoned audit professionals, has sparked a greater demand for high-quality financial information.

To navigate these challenges and enhance audit quality, organizations must stay informed of the latest standards and practices. A shift from quality control to quality management, as noted in the 2024 Yellow Book's major revisions, underscores the need for a risk-based approach in managing engagement quality. This evolution in standards is a response to the audit community's concerns about audit quality, scalability, and the necessity for a system that is adaptable to audit organizations of varying sizes and complexities.

Furthermore, recent news highlights the significance of maintaining robust compliance practices. The sizable settlement by SAP to resolve bribery charges underscores the severe consequences of non-compliance. Similarly, global events such as Russia's actions in Ukraine have prompted a reevaluation of financial crime, sanctions, and compliance, emphasizing the need for continuous education and adherence to international standards.

Organizations seeking to bolster their financial audit strategies can benefit from a variety of expert resources:

- The American Institute of Certified Public Accountants (AICPA) offers a comprehensive collection of materials focused on audit and assurance, guiding businesses through the complexities of financial audits.

- The International Auditing and Assurance Standards Board (IAASB) provides a global perspective, promoting high-quality auditing practices worldwide.

- The U.S. Securities and Exchange Commission (SEC) serves as a repository of information on financial reporting and auditing, ensuring businesses meet the stringent requirements set forth by regulatory authorities.

By leveraging these resources, companies can ensure that their audits are not only compliant but also insightful, providing actionable intelligence that drives value and supports long-term financial stability.

Conclusion

Financial audits are vital for ensuring accurate and reliable financial information. Auditors meticulously examine statements, providing insights that reinforce stakeholder confidence. Understanding reporting needs and timelines, along with the expertise of auditors, navigates complexities and meets the demand for trustworthy financial data.

Various audit types serve specific purposes, evaluating operations, compliance, and technology. The audit process includes planning, risk assessment, fieldwork, testing, and reporting, offering valuable insights to management, stakeholders, and regulators.

Key components of audit reports include the auditor's opinion, management's responsibility, audit scope, findings, and recommendations. These components provide a comprehensive view, confirm compliance, validate data, and identify areas for improvement.

Financial audits bring benefits such as transparency, internal control assessment, compliance confirmation, data validation, and opportunities for financial and risk management enhancements.

Challenges include evolving regulations, resource allocation, data integrity, compliance management, and leveraging technology for fraud detection and process optimization.

Technology plays a transformative role, with advancements in data analytics, audit software, AI, ML, blockchain, and cloud computing enhancing effectiveness.

Further reading and resources from institutions like AICPA, IAASB, and SEC help enhance audit quality and stay informed.

By understanding financial audits and implementing best practices, companies ensure transparency, trust, and effective adaptation to disruptions. Upholding integrity and compliance protects investor interests and supports the capital markets.