Overview

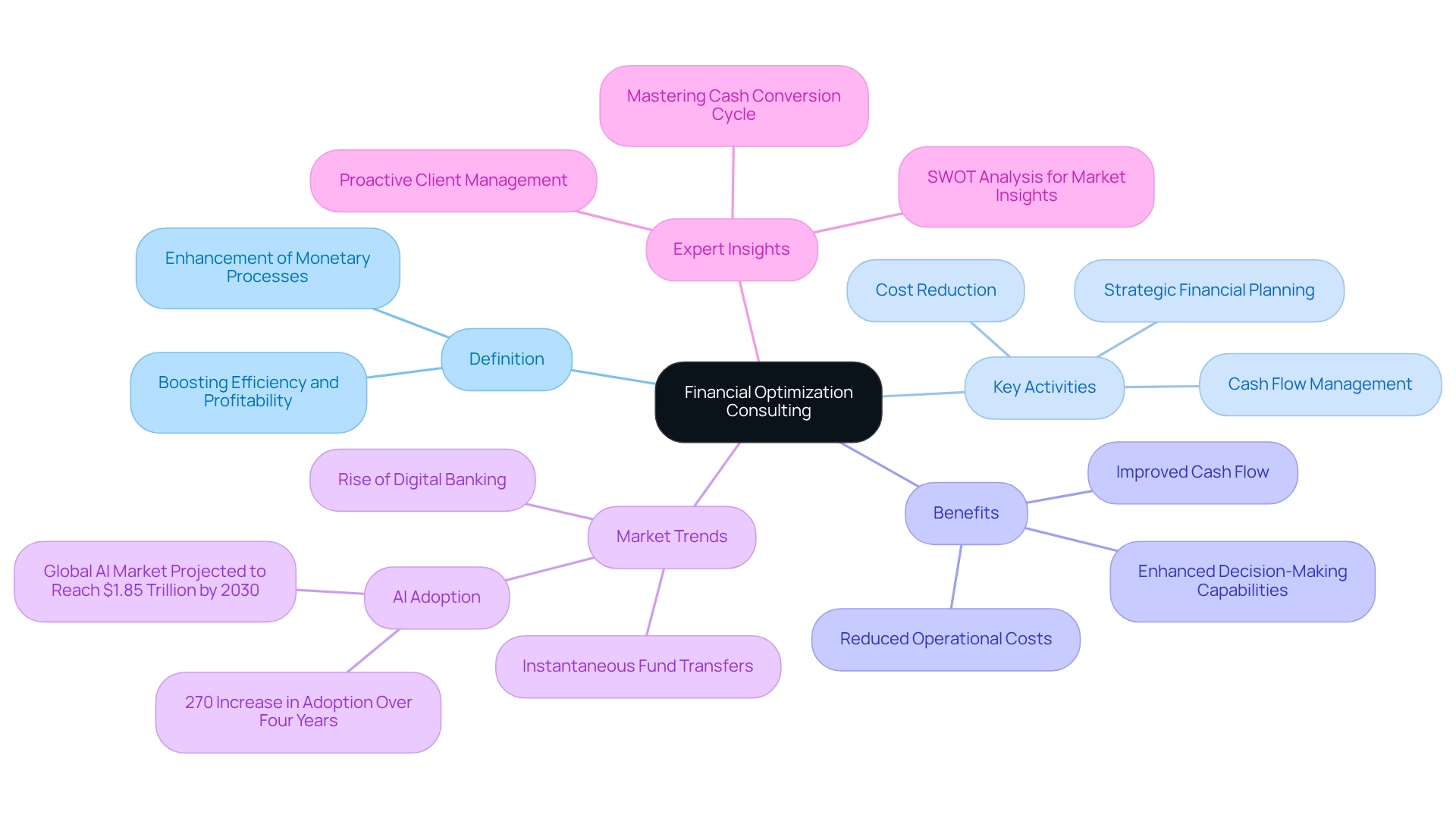

Financial optimization consulting is essential for enhancing a corporation's financial processes and strategies, ultimately leading to improved efficiency, profitability, and overall performance. This is achieved through activities such as:

- Cost reduction

- Cash flow management

Moreover, consultants leverage data analysis and industry best practices to identify inefficiencies. Consequently, organizations can achieve sustainable growth and effectively navigate economic uncertainties in a rapidly evolving market.

Introduction

In an increasingly complex financial landscape, businesses are turning to financial optimization consulting as a vital strategy for enhancing performance and ensuring sustainable growth. This consulting service transcends mere number-crunching; it entails a comprehensive analysis of financial processes to identify inefficiencies and streamline operations. As organizations grapple with rapid technological advancements and changing market dynamics, the demand for agile financial solutions has never been more critical. From improving cash flow to reducing operational costs, the benefits of effective financial optimization are unmistakable. This article delves into the evolution, key components, and transformative impact of financial optimization consulting, illustrating how it empowers businesses to navigate uncertainties and seize growth opportunities in a competitive environment.

Define Financial Optimization Consulting

involves a thorough examination and enhancement of a corporation's monetary processes and strategies to boost efficiency, profitability, and overall performance. This service encompasses various activities, including , cash flow management, and . By leveraging data analysis and industry best practices, consultants identify inefficiencies and optimize operations, ensuring that financial strategies align with long-term business objectives.

In 2025, the significance of economic enhancement advisory is underscored by the increasing demand for adaptable monetary solutions in a rapidly evolving market landscape. Companies are recognizing that effective monetary management is vital for sustainable growth, particularly as the services market continues to expand, driven by the .

The key benefits of include , reduced operational costs, and . A comprehensive can help identify opportunities to conserve cash and reduce liabilities, which is essential for small to medium enterprises facing today's challenges. For instance, small businesses that have implemented process improvements, such as optimizing budgeting procedures or automating invoicing, have reported substantial gains in efficiency and profitability. As the integration of AI in finance accelerates, with projections indicating a 270% increase in adoption over four years, the role of consultants in enhancing financial practices becomes increasingly critical in guiding companies through these transformative changes. This trend is exemplified in the case study titled "The Future of Finance is AI," which highlights how AI technologies are reshaping monetary strategies and operations.

Expert insights emphasize the importance of addressing client challenges proactively, as timely intervention can prevent minor issues from escalating into significant setbacks. Michael Zipursky asserts that by fostering a culture of openness and proactive problem-solving, consultants enhance organizations' capacity to navigate challenges and seize opportunities for growth. Additionally, employing tools such as SWOT analysis can provide valuable insights into the , further refining the effectiveness of financial enhancement strategies. Furthermore, mastering the through targeted strategies can significantly improve business performance, ensuring that companies remain competitive and financially sound.

Explore the Evolution and Importance of Financial Optimization Consulting

has undergone a remarkable transformation in recent decades, driven by technological advancements, evolving regulatory frameworks, and the complexities of global markets. Initially centered on fundamental accounting and budgeting practices, this discipline has expanded to encompass sophisticated monetary modeling, predictive analytics, and . According to the Market Research Services Global Market Report 2025, is projected to experience significant growth, propelled by an increasing demand for and responsible investment guidance that integrates environmental, social, and governance considerations.

The emergence of digital tools and data analytics has revolutionized the methodologies employed by consultants, enabling them to provide more precise and actionable insights. Our team at Transform Your Small/ Medium Organization focuses on identifying underlying issues and collaboratively devising strategies to address weaknesses, empowering enterprises to reinvest in their core strengths. Euan Cameron, PwC’s UK AI Leader, notes that 'AI could add huge value to the management advisory sector, which traditionally was conservative and human-driven.' This underscores the critical role of technology in enhancing the efficiency of .

In today’s dynamic environment, companies increasingly recognize fiscal advisory services as an integral component of their strategic framework, equipping them to navigate economic uncertainties and seize growth opportunities. This evolution underscores the necessity for organizations to engage with advisors who can deliver tailored solutions through to address their unique challenges and objectives. Furthermore, our pragmatic approach to data testing and measurement ensures the highest return on invested capital, illustrating the practical applications of in achieving sustainable growth.

Identify Key Components and Strategies in Financial Optimization Consulting

Key components of encompass several strategic areas that drive efficiency and profitability.

- Cost Reduction: Identifying and eliminating unnecessary expenses is crucial for enhancing profit margins. Strategies may include renegotiating contracts, streamlining operations, and adopting more efficient processes. Businesses that effectively implement these strategies can significantly reduce operational costs. For instance, studies indicate that organizations integrating regulatory compliance into their processes can spend 41% less on compliance activities, a practice beneficial for as well.

- : Ensuring adequate liquidity to meet obligations while maximizing the use of available funds is paramount. This includes optimizing accounts receivable and payable processes, which can lead to improved cash flow and operational stability.

- : Creating accurate monetary models based on historical data and market trends allows businesses to anticipate future performance. This foresight assists in making informed choices concerning investments and resource distribution, ultimately improving economic resilience.

- Performance Metrics and KPIs: Establishing is essential for assessing economic health and . Metrics such as are critical for evaluating client relationships. Consistent tracking of these indicators enables companies to make prompt modifications to their strategies, ensuring alignment with their monetary objectives. As noted by industry experts, tracking the right metrics and KPIs is not just a best practice; it is essential for making informed decisions and fostering growth with clarity and confidence.

- : and formulating strategies to mitigate them is vital for long-term stability. Effective risk management guarantees that companies can navigate uncertainties and sustain resilience in fluctuating markets, and can help organizations significantly improve their economic performance and attain sustainable growth. Our team will identify underlying organizational issues and work collaboratively to create a plan to mitigate weaknesses, allowing the entity to reinvest in key strengths. For instance, organizations that excel in operational efficiency systematically identify, measure, and optimize their capabilities, leading to measurable returns on technology investments. This method is pertinent not only for monetary organizations but also for small to medium enterprises aiming to enhance their operational efficiency.

Examine the Impact of Financial Optimization Consulting on Business Success

The impact of monetary enhancement consulting on corporate success is both significant and multifaceted. Organizations that engage in these services often experience:

- : By identifying and optimizing resource allocation, companies can significantly enhance their profit margins. For instance, a retail client that adopted achieved a remarkable 20% increase in profitability within just one year. Moreover, small enterprises adopting energy-efficient enhancements can decrease utility expenses by as much as 30%, highlighting another path for savings that aligns with economic optimization initiatives.

- : Implementing efficient promotes improved liquidity, allowing enterprises to invest in growth opportunities without financial pressure. A restaurant chain that refined its cash flow management reported a striking 30% reduction in operational costs, illustrating the direct benefits of consulting services.

- : Our team facilitates during the turnaround process, enabling companies to take decisive action to maintain their operations. Precise empower organizations to make informed strategic choices that align with their long-term goals. This proactive approach not only mitigates risks but also positions companies to capitalize on emerging market opportunities, ensuring they remain agile in a dynamic environment. The case study titled "Best Practices for Financial Forecasting in 2025" underscores how effective forecasting enables firms to anticipate market changes and allocate resources effectively.

- : Focusing on resource optimization enables companies to achieve sustainable growth, enhancing their competitive advantage. Organizations that prioritize economic well-being are better prepared to navigate economic declines and sector disturbances. For example, Sprout Social improved its economic analysis by integrating new metrics with Vena's assistance, illustrating how companies actively refine their fiscal strategies through advisory services. Additionally, we consistently monitor the success of our strategies via our client dashboard, which offers real-time analytics to continually assess organizational health.

Overall, serves as a catalyst for organizational transformation, enabling entities to thrive in an increasingly complex financial landscape. By leveraging data-driven approaches, businesses can refine customer retention strategies and marketing initiatives, ultimately driving profitability and long-term success.

Conclusion

The significance of financial optimization consulting in today’s dynamic business environment cannot be overstated. As organizations face mounting pressures from technological advancements and evolving market conditions, the need for tailored financial strategies has become paramount. This consulting approach not only enhances financial processes but also empowers businesses to identify inefficiencies, reduce operational costs, and improve cash flow.

Moreover, the evolution of financial optimization consulting reflects its growing importance, shifting from traditional accounting practices to more sophisticated strategies that incorporate data analytics and predictive modeling. By leveraging these advanced techniques, businesses can make informed decisions that promote sustainable growth and resilience against market fluctuations. Key components such as cost reduction, cash flow management, and risk mitigation play vital roles in enhancing overall business performance.

Ultimately, the transformative impact of financial optimization consulting extends beyond mere financial metrics. It fosters a culture of proactive problem-solving and strategic foresight, enabling organizations to navigate uncertainties with confidence. As businesses continue to embrace this consulting service, they position themselves not only for immediate gains but also for long-term success in an increasingly competitive landscape. Embracing financial optimization is not just a strategy; it is a crucial step towards achieving sustainable growth and operational excellence.

Frequently Asked Questions

What is financial optimization consulting?

Financial optimization consulting involves a thorough examination and enhancement of a corporation's monetary processes and strategies to boost efficiency, profitability, and overall performance.

What activities are included in financial optimization consulting?

This service encompasses activities such as cost reduction, cash flow management, and strategic financial planning.

How do consultants improve financial strategies?

Consultants leverage data analysis and industry best practices to identify inefficiencies and optimize operations, ensuring that financial strategies align with long-term business objectives.

Why is financial optimization consulting important in 2025?

The significance of economic enhancement advisory is increasing due to the demand for adaptable monetary solutions in a rapidly evolving market landscape, particularly as effective monetary management is vital for sustainable growth.

What are the key benefits of financial optimization consulting?

Key benefits include improved cash flow, reduced operational costs, and enhanced decision-making capabilities.

How can small to medium enterprises benefit from financial optimization consulting?

A comprehensive financial evaluation can help identify opportunities to conserve cash and reduce liabilities, which is essential for small to medium enterprises facing today’s challenges.

What are some examples of process improvements that can enhance efficiency?

Examples include optimizing budgeting procedures and automating invoicing, which have led to substantial gains in efficiency and profitability for small businesses.

How is AI impacting financial optimization consulting?

The integration of AI in finance is accelerating, with projections indicating a 270% increase in adoption over four years, making consultants critical in guiding companies through these transformative changes.

What role do expert insights play in financial optimization consulting?

Expert insights emphasize the importance of addressing client challenges proactively, preventing minor issues from escalating into significant setbacks.

What tools can enhance the effectiveness of financial enhancement strategies?

Tools such as SWOT analysis can provide valuable insights into the financial services market's strengths and weaknesses, refining the effectiveness of financial strategies.

How can mastering the cash conversion cycle improve business performance?

Targeted strategies to master the cash conversion cycle can significantly improve business performance, ensuring that companies remain competitive and financially sound.