Introduction

Navigating the intricate world of financial risks is a critical endeavor for organizations seeking stability and growth in today's volatile market. Financial risk management consulting emerges as a vital ally, equipping businesses with tailored strategies to identify vulnerabilities and implement robust defenses against potential threats. As market dynamics shift and new challenges arise, the importance of effective risk management cannot be overstated.

Consulting firms specializing in this area offer not only expertise but also innovative solutions that empower companies to enhance their financial health and resilience. With the financial risk management consulting market projected to grow significantly, organizations must prioritize these services to safeguard their interests and foster sustainable success. This article delves into the essential frameworks, common risks, and actionable steps necessary for implementing a successful financial risk management program, ensuring that businesses remain agile and prepared for whatever lies ahead.

Introduction to Financial Risk Management Consulting

Financial threat management consulting is crucial for organizations looking to navigate the complexities of potential financial challenges. These uncertainties can arise from multiple sources, such as:

- Market volatility

- Credit exposure

- Liquidity constraints

- [[[Operational failures

Howard Marks](https://novelinvestor.com/quote-category/risk-management)](https://novelinvestor.com/quote-category/risk-management)](https://novelinvestor.com/quote-category/risk-management) highlights the significance of this process, stating,

The point is to consider control of potential losses, avoidance of loss, at least as important as return.

Consulting companies focusing on economic uncertainty control provide tailored solutions that enable small and medium enterprises to:

- Identify weaknesses

- Develop strong uncertainty handling strategies

- Implement efficient policies

For example, a recent case study showed that a mid-sized manufacturing company enhanced its economic condition by 30% after adopting a framework for addressing uncertainties provided by a consulting firm.

Moreover, the monetary management consulting sector is anticipated to expand by 15% in 2024, emphasizing the rising significance of these services. Recent trends indicate a shift towards integrating technology in assessment processes, allowing organizations to predict and mitigate challenges more effectively.

By collaborating with these experts, organizations not only enhance their understanding of economic health but also equip themselves to make informed decisions that protect their interests and foster sustainable success. In a setting where the economic landscape is constantly changing, investing in evaluation of uncertainties is not just wise; it is crucial for long-term sustainability.

Key Frameworks and Policies in Financial Risk Management

Numerous essential structures and guidelines constitute the foundation of efficient monetary management. These include:

-

Threat Evaluation Structure: This involves identifying potential dangers and assessing their impact on the organization’s financial stability. It encompasses both qualitative and quantitative analyses to assess exposure.

Risk Management Policies: Establishing clear policies is essential for guiding decision-making processes. These policies should outline procedures for risk identification, reporting, and mitigation strategies.

-

Compliance and Regulatory Frameworks: Businesses must adhere to fiscal regulations and reporting standards. Understanding these frameworks ensures that organizations remain compliant while effectively managing risks.

-

Crisis Management Strategies: Creating contingency plans that detail actions to be taken during economic distress is essential. This ensures that organizations can respond quickly and effectively to mitigate impacts.

-

Ongoing Monitoring and Evaluation Process: Frequently assessing management policies and frameworks assists organizations in adjusting to evolving market circumstances and emerging threats.

By applying these frameworks and policies, companies can establish a strong asset management system that not only safeguards their resources but also prepares them for sustainable growth.

Common Financial Risks Faced by Businesses

Businesses often face various financial challenges that can significantly affect their performance, particularly in managing the cash conversion cycle. To effectively master the cash conversion cycle, it is essential to implement the following 20 strategies that enhance business performance while reducing uncertainties. These dangers include:

- Market Risk: This involves the potential for financial loss due to changes in market prices, stemming from fluctuations in stock prices, interest rates, and commodity prices. Strategies such as diversifying investments can help manage this risk.

- Credit Risk: This threat arises when a borrower fails to meet their contractual obligations. To minimize exposure, businesses must assess the creditworthiness of clients and partners, utilizing credit scoring models and regular reviews.

- Liquidity Threat: This involves the possibility of failing to meet short-term monetary obligations, often due to an imbalance between liquid assets and liabilities. Maintaining a liquidity buffer and regularly forecasting cash flow can mitigate this risk.

- Operational Hazard: Encompassing threats arising from internal processes, systems, and individuals, failures in operational procedures can lead to significant monetary losses. Implementing robust process controls and employee training programs can reduce operational risks.

- Reputational Risk: Negative public perception can lead to monetary losses. Organizations must handle their brand and customer connections thoughtfully to reduce this threat, using approaches like proactive communication and reputation oversight.

By comprehending these typical monetary challenges and applying the 20 strategies detailed in our extensive guide, enterprises can customize their risk handling techniques efficiently, thereby improving their cash conversion cycle and overall operational performance. For more insights, consider exploring our guide priced at $99.00.

Implementing a Financial Risk Management Program

To implement an effective monetary management program, businesses should follow these steps:

- Conduct a Comprehensive Threat Evaluation: A detailed monetary review is essential to identify potential hazards specific to your organization while assessing the likelihood and impact of each hazard. This assessment can uncover opportunities to preserve cash and reduce liabilities, enabling a focused approach to economic efficiency.

- Develop Management Policies: Create clear policies that outline how uncertainties will be handled, including procedures for reporting and responding to issues, ensuring efficiency and accountability in operations.

- Engage Stakeholders: Involve key stakeholders, including leadership and department heads, in the assessment process to ensure comprehensive coverage and buy-in, vital for achieving financial efficiency and uncovering hidden value.

- Establish Monitoring and Reporting Mechanisms: Set up systems for ongoing observation of threats and regular reporting to leadership. This facilitates timely decision-making and allows for adjustments in strategy as needed.

- Train Employees: Provide training for employees on safety management policies and procedures. Ensuring that everyone understands their role in reducing threats is crucial for maintaining financial stability.

- Review and Update the Program Regularly: Financial uncertainties and business environments evolve over time. Consistently assessing and refreshing your threat oversight program is essential for its ongoing effectiveness.

- Consider Interim Executive Leadership: In times of crisis, engaging transformational leaders can provide the necessary expertise to navigate economic challenges. These leaders can take on essential administrative positions, such as CEO or Chief Restructuring Officer, and direct your organization through effective turnaround strategies.

By adhering to these steps and incorporating temporary executive leadership during difficult situations, enterprises can establish a strong basis for handling economic challenges, ultimately resulting in enhanced stability and growth.

The Role of Technology in Financial Risk Management

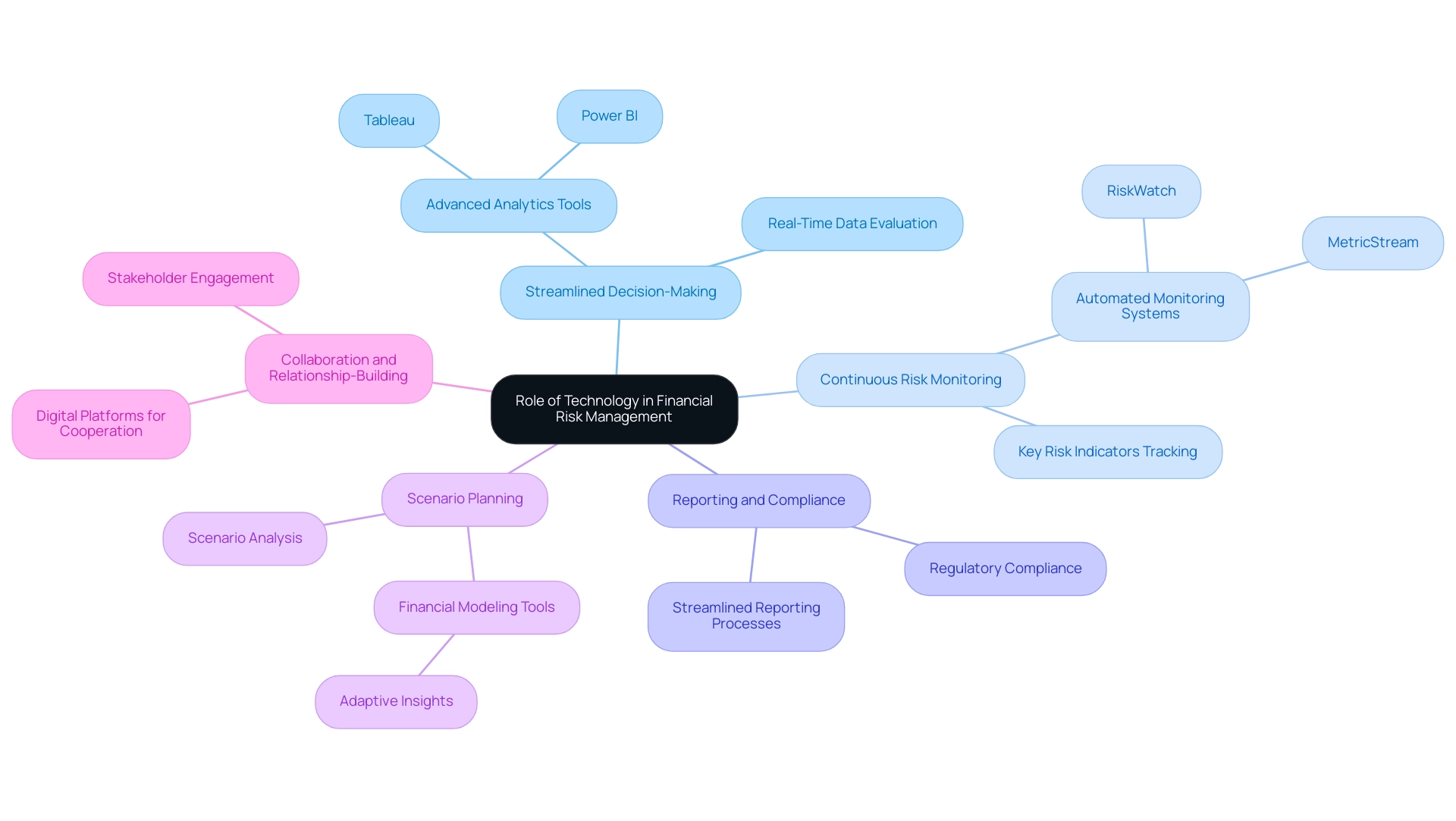

Technology plays a vital role in enhancing financial management by providing tools and systems that facilitate:

- Streamlined Decision-Making: Our team supports a shortened decision-making cycle throughout the turnaround process, allowing organizations to take decisive action to preserve their business. Advanced analytics and data visualization tools, like Tableau and Power BI, assist in evaluating uncertainties more accurately and making informed decisions based on real-time data.

- Continuous Risk Monitoring: Automated monitoring systems, like RiskWatch and MetricStream, track key risk indicators, providing alerts and insights that enable proactive risk management. We continually monitor the success of our plans through our client dashboard, which offers real-time analytics to diagnose your organization's health.

- Reporting and Compliance: Technology solutions can streamline reporting processes, ensuring compliance with regulatory requirements while reducing the burden on staff.

- Scenario Planning: Financial modeling and simulation tools, such as Adaptive Insights, enable organizations to conduct scenario analysis, helping them understand potential impacts and develop effective response strategies.

- Collaboration and Relationship-Building: Digital platforms improve cooperation among stakeholders, ensuring that threat oversight efforts are coordinated and effective. We are dedicated to building robust, enduring connections by putting into practice the insights gained during the turnaround process.

By adopting technology in economic oversight, companies can enhance their resilience and adaptability in a constantly evolving economic environment.

Conclusion: The Path Forward in Financial Risk Management

In summary, financial uncertainty consulting offers essential assistance for companies in maneuvering through the intricacies of financial challenges. By employing a strategic approach that incorporates streamlined decision-making, including the 'Decide & Execute' phase, and real-time analytics, organizations can not only identify underlying issues but also plan effective solutions and measure the returns on their investments.

Utilizing a client dashboard to continually monitor performance through advanced analytics allows businesses to build strong, lasting relationships that enhance operational resilience. In a rapidly evolving landscape, adopting proactive risk management strategies will be essential for ensuring long-term success and adaptability against unforeseen challenges.

Conclusion

Navigating the complexities of financial risks is imperative for organizations striving for stability and growth. The insights provided throughout this article underscore the necessity of financial risk management consulting as a vital partner in this endeavor. By implementing tailored frameworks and policies, businesses can effectively identify and mitigate potential vulnerabilities, ensuring they remain resilient against market fluctuations and operational challenges.

Understanding the common financial risks—such as market, credit, liquidity, operational, and reputational risks—equips organizations with the knowledge needed to enhance their cash conversion cycles and overall performance. The actionable steps outlined for implementing a financial risk management program emphasize the importance of comprehensive risk assessments, stakeholder engagement, and continuous monitoring, all of which contribute to a robust risk management system.

Moreover, leveraging technology has become increasingly crucial in this landscape. By embracing advanced analytics and automated monitoring systems, organizations can streamline decision-making and enhance their ability to respond to emerging threats. As the financial risk management consulting market continues to grow, prioritizing these strategies will not only safeguard interests but also foster sustainable success in an ever-evolving environment.

Taking decisive action now will position businesses to thrive amid uncertainties, ensuring their long-term viability and growth.

Frequently Asked Questions

What is the purpose of financial threat management consulting?

Financial threat management consulting helps organizations navigate potential financial challenges arising from market volatility, credit exposure, liquidity constraints, and operational failures.

What are the key benefits of consulting companies focused on economic uncertainty control?

These consulting companies provide tailored solutions that enable small and medium enterprises to identify weaknesses, develop strong uncertainty handling strategies, and implement efficient policies.

Can you give an example of the impact of financial consulting on a business?

A mid-sized manufacturing company improved its economic condition by 30% after adopting a framework for addressing uncertainties provided by a consulting firm.

What is the projected growth for the monetary management consulting sector in 2024?

The monetary management consulting sector is anticipated to expand by 15% in 2024, highlighting the increasing significance of these services.

What essential structures and guidelines are foundational for efficient monetary management?

Key structures include a risk evaluation framework, compliance and regulatory frameworks, crisis management strategies, and an ongoing monitoring and evaluation process.

What are some common financial challenges businesses face?

Common challenges include market risk, credit risk, liquidity threat, operational hazard, and reputational risk.

What steps should businesses take to implement an effective monetary management program?

Steps include conducting a comprehensive threat evaluation, developing management policies, engaging stakeholders, establishing monitoring mechanisms, training employees, reviewing the program regularly, and considering interim executive leadership during crises.

How does technology enhance financial management?

Technology improves financial management by streamlining decision-making, enabling continuous risk monitoring, simplifying reporting and compliance, facilitating scenario planning, and enhancing collaboration among stakeholders.

What is the significance of ongoing monitoring in financial threat management?

Ongoing monitoring allows organizations to adjust their strategies in response to evolving market circumstances and emerging threats, ensuring continued effectiveness in managing financial risks.

How can organizations ensure long-term sustainability in financial management?

By investing in the evaluation of uncertainties and adopting proactive risk management strategies, organizations can enhance their resilience and adaptability in a constantly changing economic environment.