Overview

The primary focus of this article is to elucidate the concept of financial turnaround value and its critical importance for business success. Financial turnaround value is essential for companies aiming to recover from periods of underperformance. It encompasses improved cash flow, revenue growth, and operational efficiency, all of which collectively bolster stakeholder confidence and ensure long-term sustainability.

Moreover, understanding and leveraging financial turnaround value can significantly enhance a company's market position. As businesses face increasing competition and economic challenges, the ability to adapt and thrive becomes paramount. This article provides insights into how organizations can implement strategies to achieve financial turnaround value effectively.

Consequently, it is imperative for business leaders to prioritize this concept in their strategic planning. By doing so, they can foster a resilient business model that not only addresses immediate financial concerns but also paves the way for future growth and stability.

In conclusion, embracing the principles of financial turnaround value is not just beneficial; it is essential for any organization seeking sustained success in today's dynamic market landscape.

Introduction

In the intricate realm of business, the notion of financial turnaround value stands as a beacon of hope for organizations facing underperformance. This vital metric not only quantifies the restoration of a company's financial health but also acts as a crucial indicator of resilience and adaptability amid adversity.

By examining the strategic initiatives that drive operational efficiency, revenue growth, and stakeholder engagement, companies can unlock pathways to sustainable recovery and future success.

Real-world examples from industry leaders such as Apple and Starbucks illustrate the transformative potential of effective turnaround strategies, underscoring the critical importance of timely actions and innovative approaches in navigating financial crises.

As businesses endeavor to regain their footing, grasping and leveraging financial turnaround value becomes essential for securing a competitive advantage and fostering long-term stability.

Define Financial Turnaround Value

The financial turnaround value represents the quantifiable enhancement in a company's economic condition following a period of underperformance. This value, known as the financial turnaround value, is generally assessed through critical financial metrics such as revenue growth, profit margins, cash flow stability, and overall market valuation. A successful financial turnaround value is marked by strategic initiatives that boost operational efficiency, lower costs, and optimize resource allocation, thereby paving the way for sustainable recovery and growth.

As Carter and Schwab articulate, "Turnaround strategies are a set of consequential, directive, short- and long-term decisions and actions targeted at the reversal of a perceived crisis." A pertinent example is General Motors, which illustrates the impact of effective intervention during a crisis; after facing bankruptcy due to the subprime mortgage crisis, GM's recovery was supported by federal bailout funds, enabling it to resume operations and improve its economic standing. This case underscores the critical importance of prompt and decisive actions in enhancing the financial turnaround value.

Furthermore, executing strategic expansions, as highlighted by Enviro-Serv's leadership, is essential for maximizing returns. Leveraging expert advice and employing AI/ML techniques can further refine the recovery process, particularly in mastering the cash conversion cycle, which is vital for optimizing organizational performance.

The Valuation Report, priced at $3,500.00, provides essential insights into the financial turnaround value, helping companies understand their market position and recovery prospects. Ultimately, the concept transcends mere recovery; it involves strategically positioning the company for future success in an increasingly competitive landscape. The transformation process initiates with stability and extends to seizing new growth opportunities, reinforcing financial foundations, and enhancing workflows.

Explain the Importance of Financial Turnaround Value for Businesses

The financial turnaround value is essential for rebuilding stakeholder confidence and ensuring business continuity. A well-defined recovery strategy not only attracts investment but also retains customers and motivates employees. A positive recovery value acts as a strong market indicator, showcasing the organization’s resilience and ability to navigate challenges, thereby enhancing its reputation and competitive edge. For small to medium enterprises, particularly those facing difficulties, understanding and achieving financial turnaround value can be the decisive factor between survival and closure. This financial turnaround value serves as a benchmark for evaluating the success of recovery strategies and operational adjustments.

Statistics reveal that in 2022:

- Nearly 48% of small enterprises leveraged mobile applications to connect with customers, underscoring the growing importance of technology in enhancing operational efficiency and customer interaction.

- 43% of cyberattacks targeted small enterprises—60% of which cease operations within six months—demonstrating a robust financial turnaround value becomes even more crucial for their recuperation and sustainability.

- Social media advertising spending by US small enterprises was projected to approach just under $63 billion in 2022, illustrating how these entities are adapting to market demands and harnessing technology to bolster their economic standing.

Expert insights highlight that effective recovery strategies not only improve financial metrics but also foster loyalty through enhanced customer feedback loops. As one satisfied client of the SMB team noted, "Within 100 days of meeting the SMB team, my company was in a better position financially and strategically than it had been in years." This testimonial illustrates the transformative impact of the SMB team's 'Rapid30' plan, which emphasizes efficient decision-making, real-time analytics, and the application of lessons learned for organizational recovery and performance monitoring. By prioritizing financial turnaround value, companies can significantly enhance their performance and secure a stable future. Moreover, the adaptability of small enterprises compared to larger corporations, along with the optimism of their owners regarding the future, further exemplifies the resilience required in crisis situations. By effectively communicating their financial turnaround value, companies can regain stakeholder trust and pave the way for sustainable growth.

Identify Key Characteristics of Financial Turnaround Value

Key characteristics of financial turnaround value encompass several critical elements that signal recovery and pave the way for sustainable growth:

- Improved Cash Flow: A notable increase in cash flow is a strong indicator of enhanced liquidity and operational efficiency. Organizations that effectively manage financial recoveries often report a substantial financial turnaround value in cash flow, which is crucial for fulfilling obligations and investing in growth initiatives.

- Revenue Growth: A steady increase in sales indicates market recovery and successful customer retention approaches. Companies that adopt strong recovery plans can witness significant revenue growth, as shown by the expansion MRR rate of 6.67%, underscoring the potential for enhanced earnings after tactical adjustments.

- Cost Reduction: Effective turnaround strategies frequently involve a thorough analysis of expenses, leading to the identification and elimination of unnecessary costs. This process not only enhances profit margins but also ensures that resources are allocated more efficiently, contributing to overall financial health.

- Operational Efficiency: Streamlined processes and optimized resource allocation are vital for creating a more agile and responsive business model. Companies that focus on operational efficiency can adapt more quickly to market changes, thereby improving their competitive position. The dedication to implementing lessons learned during the recovery process further enhances this agility.

- Stakeholder Engagement: Clear communication with stakeholders is essential during a recovery. Involving stakeholders builds trust and teamwork, which are crucial for implementing changes and gaining support for new approaches.

- User Retention Approaches: Long-term methods and immediate successes for app user retention are essential during financial recoveries. As noted by Emilia Korczynska, Head of Marketing, "Userpilot can help you do all these," emphasizing the importance of maintaining customer engagement to support recovery efforts.

- Testing Hypotheses: A pragmatic approach to data is essential, where testing every hypothesis can deliver maximum return on invested capital in both the short and long term. This method ensures that strategies are based on solid evidence, enhancing the likelihood of successful outcomes.

These characteristics not only signify recovery but also establish a foundation for long-term success by showcasing the financial turnaround value, as demonstrated by case studies of companies like TransMedics, which, despite existing risks, are positioned for growth through innovative product offerings. Furthermore, companies such as CR3 Partners, LLC emphasize the significance of working together with management teams during changes or crises, reinforcing the necessity for strategic alliances in recovery management. By concentrating on these essential areas, businesses can improve their value and attain sustainable growth, backed by real-time analytics that consistently assess business health.

Provide Examples of Successful Financial Turnarounds

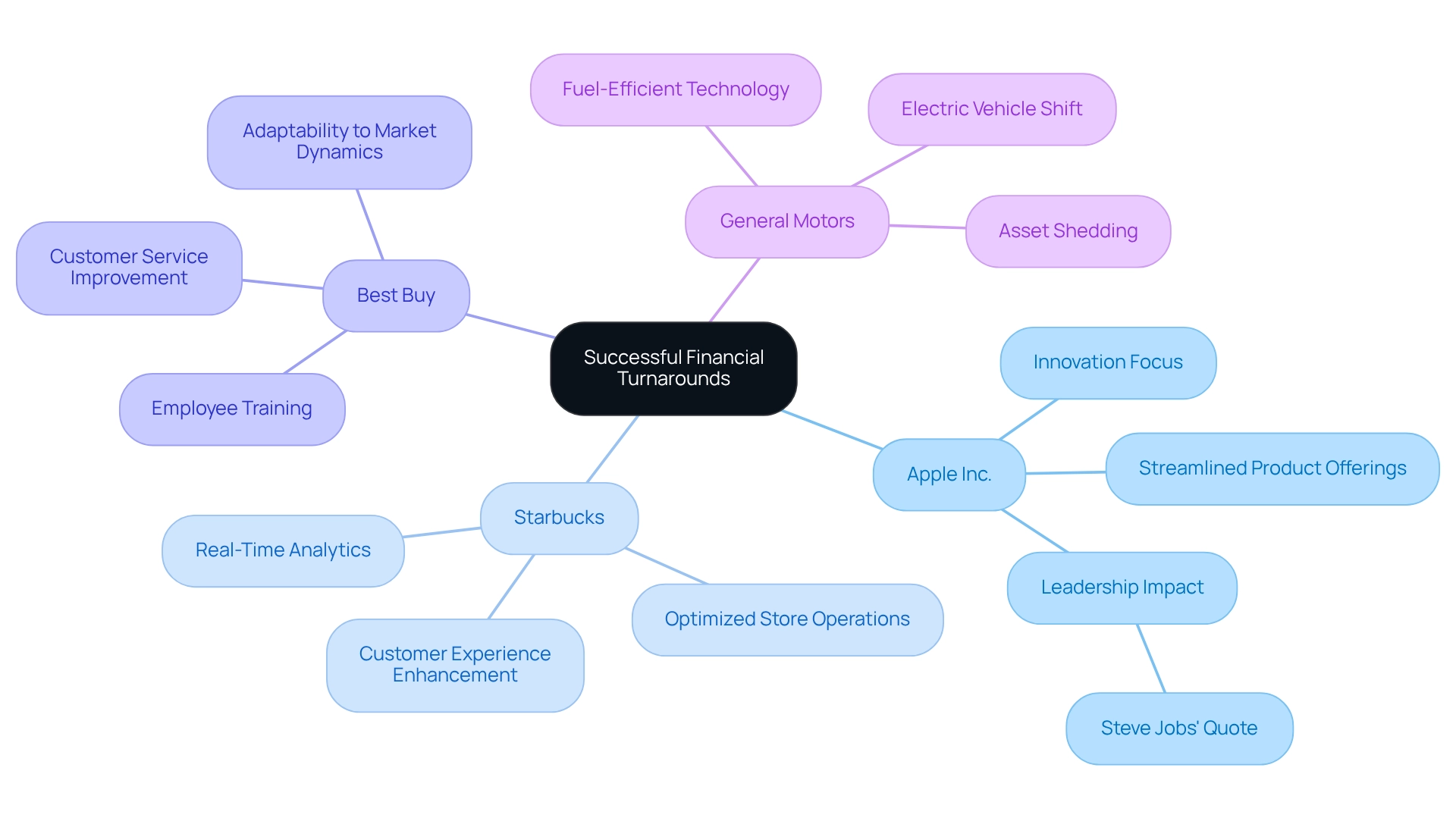

Several notable examples of successful financial turnaround value underscore the effectiveness of strategic innovation and operational optimization, particularly through streamlined decision-making and real-time analytics.

- Apple Inc.: In the late 1990s, Apple faced significant economic challenges. Under Steve Jobs's leadership, the company shifted its focus toward innovation and streamlined its product offerings. Jobs famously stated, "Innovation distinguishes between a leader and a follower," highlighting the importance of strategic decisions in fostering economic recovery. This pivot not only revitalized the brand but also set the stage for unprecedented growth, transforming Apple into one of the most valuable companies in the world.

- Starbucks: After experiencing a decline in sales, Starbucks launched a comprehensive turnaround plan that focused on enhancing the customer experience through improved service and optimized store operations. By consistently tracking performance and adapting strategies based on real-time analytics, the company achieved a notable rebound in sales and strengthened brand loyalty. This showcases the effectiveness of customer-focused approaches in navigating economic recovery, particularly in response to challenges posed by COVID-19.

- Best Buy: Confronted with intense competition from online retailers, Best Buy recognized the urgent need for transformation. By investing in employee training and enhancing customer service, the company successfully reversed its economic decline. This situation emphasizes the significance of adaptability and responsiveness to market dynamics, alongside a commitment to implementing lessons learned to achieve a successful recovery.

- General Motors: In response to evolving market demands, General Motors undertook a strategic shift toward fuel-efficient and electric vehicle technology. This transformation not only enabled the company to shed underperforming assets but also positioned it favorably for future growth in a rapidly changing automotive landscape.

These examples illustrate that with the right strategies and unwavering dedication, organizations can effectively navigate financial challenges and achieve a significant financial turnaround value. The integration of innovative approaches, streamlined decision-making, and responsiveness to market conditions are pivotal factors in these successful turnarounds. Furthermore, the importance of testing hypotheses to maximize return on invested capital and the 'Decide & Execute' framework are crucial in supporting the turnaround process. Utilizing client dashboards for real-time business analytics to monitor success also plays a significant role.

Conclusion

The journey toward financial turnaround value is characterized by strategic decisions and actions that lay the groundwork for recovery and growth. This concept embodies the quantifiable improvements in a company's financial health following a period of underperformance, driven by key metrics such as cash flow, revenue growth, and operational efficiency. Successful turnarounds, exemplified by industry giants like Apple, Starbucks, and General Motors, underscore the necessity of timely interventions and innovative strategies that not only restore financial stability but also enhance market positioning.

Understanding the significance of financial turnaround value is crucial for businesses, particularly those confronting crises. It serves as a vital benchmark for evaluating recovery strategies, instilling confidence among stakeholders, and fostering a culture of resilience and adaptability. As small to medium-sized enterprises increasingly leverage technology and customer engagement strategies, the path to achieving a solid turnaround value becomes clearer, offering a lifeline for survival and growth in competitive landscapes.

Ultimately, the characteristics that define financial turnaround value—improved cash flow, revenue growth, cost reduction, and stakeholder engagement—are essential for establishing a robust foundation for long-term success. By focusing on these elements and learning from successful case studies, companies can not only navigate financial challenges but also position themselves for sustainable growth, ensuring they emerge stronger and more competitive in the face of adversity. Embracing the journey of transformation with a clear understanding of financial turnaround value is key to thriving in an ever-evolving business environment.

Frequently Asked Questions

What is financial turnaround value?

Financial turnaround value represents the quantifiable enhancement in a company's economic condition following a period of underperformance, assessed through financial metrics like revenue growth, profit margins, cash flow stability, and overall market valuation.

What are the key components that indicate a successful financial turnaround?

A successful financial turnaround is marked by strategic initiatives that boost operational efficiency, lower costs, and optimize resource allocation, leading to sustainable recovery and growth.

How do turnaround strategies function according to Carter and Schwab?

Turnaround strategies consist of consequential, directive, short- and long-term decisions and actions aimed at reversing a perceived crisis.

Can you provide an example of a company that successfully executed a financial turnaround?

General Motors is an example, as it faced bankruptcy due to the subprime mortgage crisis but recovered with federal bailout funds, allowing it to resume operations and improve its economic standing.

What role does strategic expansion play in maximizing financial turnaround value?

Strategic expansions are essential for maximizing returns, as highlighted by Enviro-Serv's leadership, which emphasizes the importance of growth initiatives during recovery.

How can companies refine their recovery process?

Companies can refine their recovery process by leveraging expert advice and employing AI/ML techniques, particularly in mastering the cash conversion cycle to optimize organizational performance.

What is the purpose of the Valuation Report, and how much does it cost?

The Valuation Report, priced at $3,500.00, provides essential insights into the financial turnaround value, helping companies understand their market position and recovery prospects.

What does the financial turnaround process involve beyond recovery?

The financial turnaround process goes beyond mere recovery; it involves strategically positioning the company for future success, initiating with stability and extending to new growth opportunities, reinforcing financial foundations, and enhancing workflows.