Overview

The article focuses on the essential requirements and strategies for conducting financial viability risk assessments, which are critical for organizations, particularly small to medium-sized businesses, to maintain economic sustainability and navigate financial challenges. It emphasizes the importance of comprehensive data collection, stakeholder engagement, and proactive risk management, supported by evidence that effective assessments can enhance decision-making and ensure organizational resilience in a volatile market.

Introduction

Navigating the complexities of financial viability is crucial for organizations striving to maintain operational integrity and ensure long-term success. Financial viability risk assessments serve as a vital tool for CFOs, offering a systematic approach to evaluate an organization's ability to sustain itself amidst fluctuating market conditions.

By rigorously analyzing cash flow, revenue streams, and potential vulnerabilities, these assessments not only highlight areas for improvement but also uncover opportunities for growth. As businesses face increasing pressures from economic uncertainties, understanding the intricacies of financial viability becomes paramount.

This article delves into the essential components of effective assessments, the role of financial viability in supplier management, and best practices to avoid common pitfalls, equipping leaders with the insights needed to foster resilience and drive strategic decision-making in an ever-evolving landscape.

Introduction to Financial Viability Risk Assessments

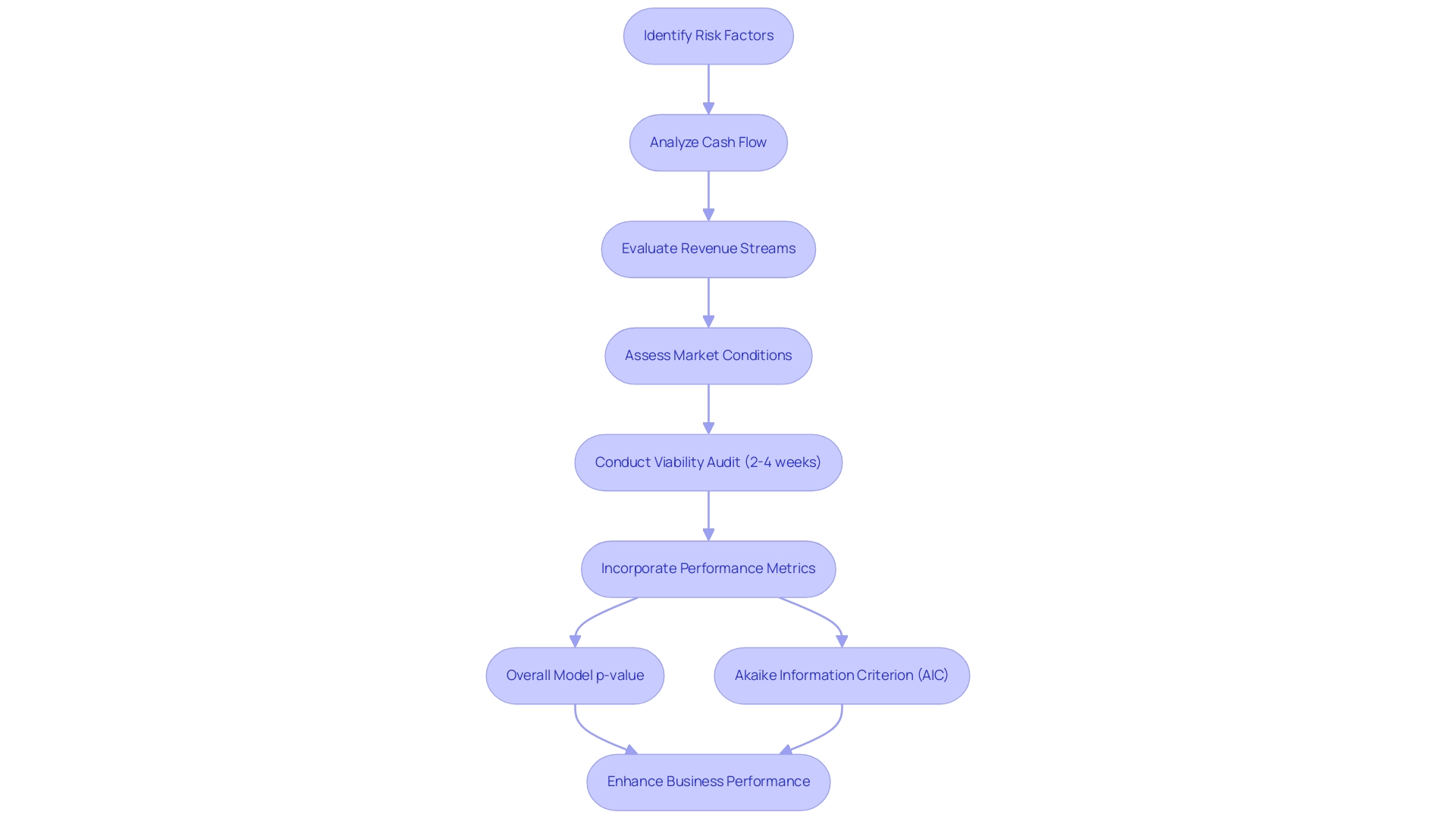

Economic sustainability risk evaluations are systematic analyses essential for identifying a company’s capacity to maintain operations and fulfill commitments, particularly for small to medium businesses facing the financial viability risk assessment requirements during economic difficulties. These evaluations are indispensable as they rigorously analyze cash flow, revenue streams, and prevailing market conditions, helping organizations identify vulnerabilities while uncovering opportunities for enhancement, in line with financial viability risk assessment requirements. Research has indicated that employing a comprehensive model that includes various predictor categories greatly enhances predictive accuracy for business failure, a crucial insight for CFOs seeking to navigate potential pitfalls.

Typically, conducting a viability audit spans two to four weeks, offering CFOs a clear timeline to gain a thorough understanding of their economic health. Furthermore, incorporating performance metrics such as the overall model p-value and the Akaike information criterion (AIC) for regression model comparisons can deepen the technical rigor of these evaluations and enhance decision-making. Furthermore, mastering the cash conversion cycle through strategic management of receivables, payables, and inventory can significantly improve liquidity and operational efficiency.

Expert opinions affirm the importance of these evaluations; for instance, Hessels et al. note that mental health issues can adversely impact entrepreneurial performance across social, physical, and cognitive domains, underlining the need for a solid economic foundation to support business resilience. Moreover, case studies showcasing the impact of network ties on firm resilience reveal that strong relationships with customers and suppliers, particularly in family firms, can significantly enhance survival rates during economic downturns. This strengthens the notion that financial viability risk assessment requirements are not simply compliance instruments but are crucial to strategic planning and resource distribution.

By emphasizing economic sustainability and utilizing real-time analytics, entities can proactively handle risks, enhance their cash conversion cycles, and prepare themselves for long-term success. Additionally, adopting a test and measure approach allows for continuous monitoring of performance metrics, ensuring that entities can adapt their strategies based on real-time data insights. The comprehensive guide to mastering the cash conversion cycle is available for $99.00, providing valuable strategies for enhancing business performance.

Key Requirements and Strategies for Effective Assessments

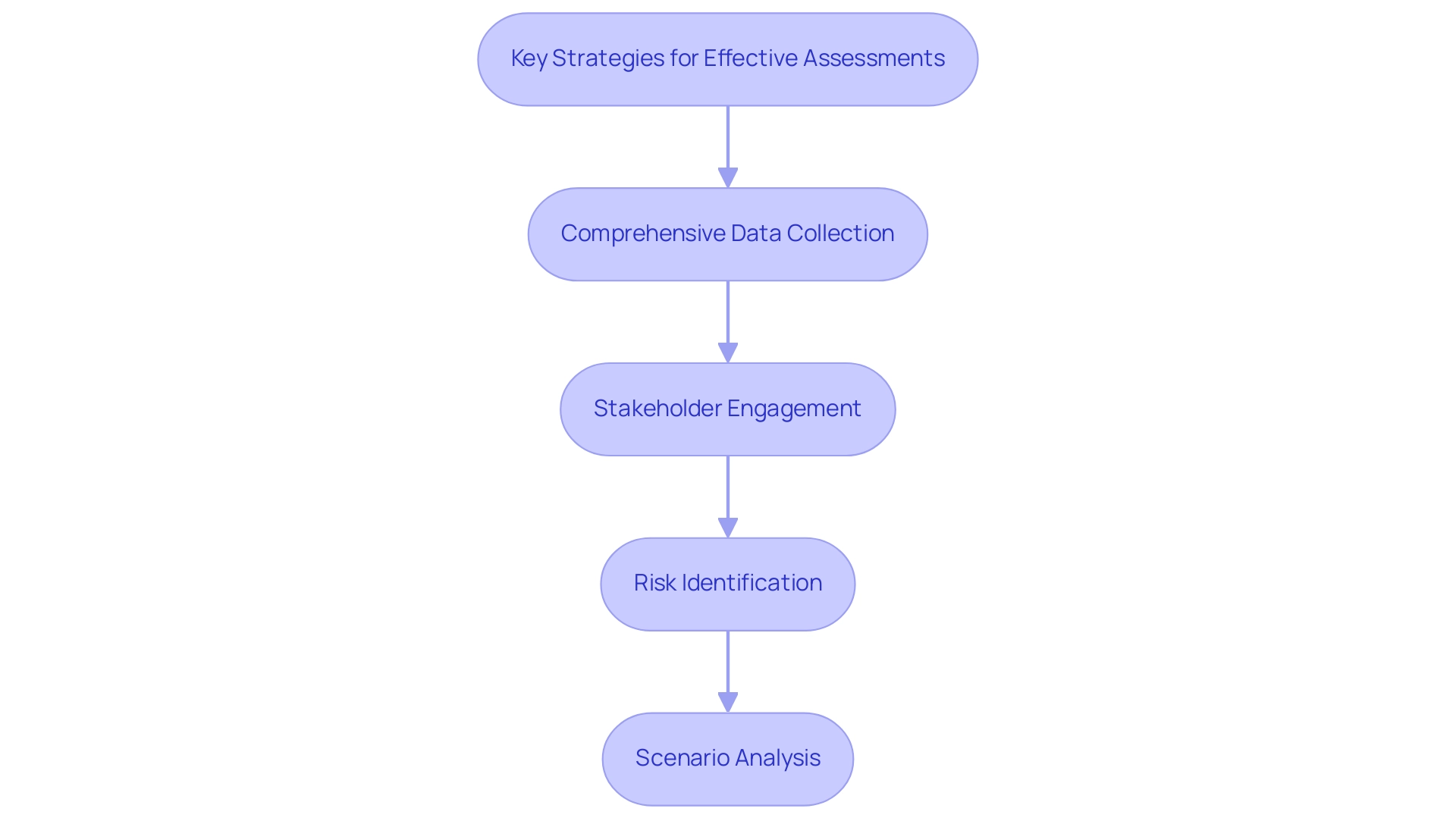

To carry out effective evaluations, entities must prioritize the financial viability risk assessment requirements.

- Comprehensive Data Collection: It is essential to gather accurate fiscal statements, cash flow projections, and detailed market analysis reports. This data serves as the foundation for informed decision-making.

- Stakeholder Engagement: Engaging key stakeholders—including CFOs, operational managers, and procurement professionals—enables organizations to leverage diverse insights and perspectives. This collaboration is critical for understanding the full scope of monetary risks.

- Risk Identification: Organizations should systematically identify potential economic risks, such as market volatility, credit risks, and operational inefficiencies. Recognizing these threats early allows for proactive management strategies.

- Scenario Analysis: Implementing scenario planning is essential for evaluating how different variables may affect economic viability. By modeling various outcomes, organizations can better prepare for uncertainty.

Additionally, it is important to consider liquidity, solvency, efficiency, and profitability as part of a complete view of a company's stability. For instance, profit margins below 5% are regarded as low, while those above 10% are viewed as healthy, providing a clear benchmark for evaluating economic health. Liquidity ratios, including the current and quick ratios, provide insights into a tenderer's short-term monetary strength, where higher ratios indicate better economic health essential for managing cash flow in procurement scenarios.

By adopting these strategies, businesses can significantly enhance the accuracy and relevance of their economic assessments to meet the financial viability risk assessment requirements, ensuring they remain competitive in a rapidly changing market. As Rod Linsley aptly states,

While such action may increase the pressure on a supplier's sustainability, just remember: it’s not personal, it’s business.

This mindset is essential for CFOs navigating the complexities of risk management.

The Role of Financial Viability in Supplier Management

Financial viability risk assessment requirements are essential in supplier management, serving as a safeguard to ensure suppliers can fulfill their contractual obligations. To effectively assess the economic health of suppliers, organizations should utilize key metrics such as:

- Liquidity ratios

- Profitability margins

- Credit ratings

For instance, the calculation of supply expense per CMI adjusted discharge—totaling $500,000 divided by 96,000 adjusted discharges—reveals a significant cost of $5.21, underscoring the economic implications of supplier efficiency and aiding budget analysts in estimating labor costs and assessing supply chain efficiency.

Daniel Barnes, a leader in procurement and contract management, emphasizes that manual and [automated vendor finance checks](https://gatekeeperhq.com/blog/how-to-assess-a-vendors-financial-stability-during-the-due-diligence-process) are not a substitute for due diligence. This proactive stance not only helps mitigate risks associated with supplier insolvency, which can disrupt operations and compromise service delivery, but also emphasizes the financial viability risk assessment requirements that necessitate regularly reviewing service level agreements and maintaining comprehensive documentation. A case study titled 'Due Diligence in Vendor Assessment' highlights the necessity of thorough evaluations, including the review of statements and credit ratings, ensuring that vendors are dependable partners.

Additionally, best practices for evaluating supplier economic health include:

- Assuming potential monetary strain

- Maintaining updated documentation

By emphasizing the importance of economic sustainability in supplier selection and management, businesses can enhance their operational resilience and ensure a strong supply chain, ultimately navigating the complexities of supply chain dynamics with confidence.

Implications of Financial Viability for Business Sustainability

The financial viability risk assessment requirements are a cornerstone of business sustainability, fundamentally influencing an organization’s capacity to invest in growth and innovation. Based on recent discoveries, non-reporters have a total debt to equity ratio of 103.62, whereas reporters exhibit a notably greater ratio of 204.6, highlighting the essential nature of monetary evaluations. Companies that routinely assess their economic health can proactively identify potential barriers to sustainability by addressing the financial viability risk assessment requirements related to cash flow challenges and escalating costs.

This ongoing scrutiny enables businesses to pivot their strategies in response to evolving market dynamics. By incorporating financial viability risk assessment requirements within their sustainability frameworks, organizations not only enhance their agility but also prepare themselves to effectively tackle future challenges. As Gómez-Bezares et al.

Note, the absence of a universal definition of CSR highlights the conceptual challenges surrounding economic sustainability, which further emphasizes the need for a structured approach. Zahra (2005) also explores entrepreneurial risk-taking in family businesses, demonstrating the relationship between economic viability and risk management. This organized method is crucial for aligning investment strategies with corporate governance, as highlighted in the thorough literature review on sustainability, which underscores the financial viability risk assessment requirements to ensure coherence in current measures.

Ultimately, prioritizing economic health is not just a reactive measure; it is a strategic initiative that drives long-term value and enhances overall organizational resilience.

Best Practices and Common Pitfalls in Financial Viability Assessments

To enhance economic viability evaluations, organizations should apply the following best practices:

- Regular Reviews: Perform evaluations at consistent intervals to adjust to changing economic circumstances and ensure relevance.

- Stakeholder Involvement: Involve cross-functional teams to capture diverse perspectives, leading to a more comprehensive understanding of financial health.

- Documentation and Reporting: Maintain meticulous documentation of findings and decisions, which is crucial for fostering transparency and accountability.

On the other hand, organizations must steer clear of common pitfalls that can undermine their assessments:

- Neglecting External Factors: Ignoring market trends and external economic conditions can result in misleading evaluations.

- Over-reliance on Historical Data: Solely focusing on past performance may obscure emerging risks that could affect future sustainability.

For instance, recent trends in liquidity, including liquidity ratios such as the current and quick ratios, have highlighted the importance of evaluating a tenderer's short-term economic strength. Higher liquidity ratios signal better cash flow management, reinforcing the need for thorough evaluations.

Furthermore, entities should eliminate tenderers with significant economic risk if those risks cannot be managed effectively, as this is essential for preserving overall fiscal health. Furthermore, a downward trend over time in the debt-to-equity (D/E) ratio is a good indicator that a company is on increasingly solid economic ground. By adhering to these best practices and avoiding typical mistakes, organizations can significantly enhance their financial viability risk assessment requirements, leading to improved decision-making and outcomes.

Conclusion

Understanding and implementing financial viability risk assessments is essential for organizations aiming to achieve long-term sustainability and operational integrity. These assessments provide a comprehensive framework for evaluating cash flow, revenue streams, and market conditions, allowing CFOs to identify vulnerabilities and seize opportunities for growth. By focusing on key requirements such as:

- Data collection

- Stakeholder engagement

- Risk identification

organizations can enhance their decision-making processes and better navigate financial uncertainties.

In supplier management, financial viability assessments play a critical role in ensuring that suppliers can meet their commitments, ultimately safeguarding the supply chain. By utilizing key financial metrics and conducting thorough evaluations, organizations can mitigate risks associated with supplier insolvency and strengthen their operational resilience. Prioritizing financial health in supplier selection not only fosters dependable partnerships but also enhances overall strategic positioning.

Moreover, embedding financial viability assessments within the broader context of business sustainability empowers organizations to proactively address potential challenges. Regular reviews, stakeholder involvement, and meticulous documentation are vital best practices that can significantly improve the accuracy and relevance of these assessments. By avoiding common pitfalls and embracing a structured approach, organizations can drive long-term value and adaptability in an ever-evolving marketplace.

Ultimately, the commitment to understanding and improving financial viability is not merely a compliance exercise; it is a strategic initiative that lays the foundation for resilience, innovation, and sustained success. Organizations equipped with these insights are better positioned to thrive in complex environments and capitalize on growth opportunities, ensuring they remain competitive and agile in the face of change.

Frequently Asked Questions

What are economic sustainability risk evaluations?

Economic sustainability risk evaluations are systematic analyses that identify a company's capacity to maintain operations and fulfill commitments, particularly essential for small to medium businesses facing financial viability risk assessment requirements during economic difficulties.

Why are these evaluations important for businesses?

They rigorously analyze cash flow, revenue streams, and market conditions, helping organizations identify vulnerabilities and uncover opportunities for enhancement, which is crucial for maintaining financial viability.

How long does it typically take to conduct a viability audit?

Conducting a viability audit usually spans two to four weeks, providing CFOs with a clear timeline to understand their economic health.

What performance metrics can enhance the technical rigor of these evaluations?

Incorporating metrics such as the overall model p-value and the Akaike information criterion (AIC) for regression model comparisons can deepen the technical rigor of evaluations and enhance decision-making.

What is the cash conversion cycle, and why is it important?

The cash conversion cycle involves the strategic management of receivables, payables, and inventory. Mastering it can significantly improve liquidity and operational efficiency.

How do mental health issues relate to entrepreneurial performance?

Research indicates that mental health issues can adversely impact entrepreneurial performance across social, physical, and cognitive domains, emphasizing the need for a solid economic foundation to support business resilience.

What role do network ties play in firm resilience?

Strong relationships with customers and suppliers, particularly in family firms, can significantly enhance survival rates during economic downturns, highlighting the importance of financial viability risk assessments in strategic planning.

How can businesses proactively handle risks and prepare for long-term success?

By emphasizing economic sustainability and utilizing real-time analytics, entities can manage risks and adapt strategies based on real-time data insights.

What are the key steps for carrying out effective evaluations?

Key steps include comprehensive data collection, stakeholder engagement, risk identification, and scenario analysis to evaluate how different variables may affect economic viability.

What financial indicators should businesses consider for a complete view of stability?

Businesses should consider liquidity, solvency, efficiency, and profitability, with specific benchmarks like profit margins and liquidity ratios to assess economic health.

How can businesses enhance the accuracy of their economic assessments?

By adopting comprehensive strategies that meet financial viability risk assessment requirements, businesses can ensure they remain competitive in a rapidly changing market.