Overview

Interim CFO services in Los Angeles are crucial for businesses facing transitions, providing experienced financial leadership to stabilize operations and implement effective strategies during critical periods. The article highlights their benefits, including cost-effectiveness, immediate impact, and expertise in crisis management, which empower organizations to navigate challenges and focus on long-term growth while ensuring compliance and risk management.

Introduction

In the ever-evolving landscape of business, particularly in bustling markets like Los Angeles, the need for agile financial leadership has never been more critical. Interim CFO services have emerged as a strategic solution for organizations facing transitions, whether due to unexpected leadership changes, restructuring efforts, or the pursuit of enhanced financial oversight.

These seasoned professionals bring a wealth of experience to the table, enabling companies to stabilize their financial health and implement effective turnaround strategies without the long-term commitment of a full-time hire. By leveraging their expertise, businesses can navigate immediate challenges while laying the groundwork for sustainable growth.

This article delves into the key benefits of hiring an interim CFO, offers guidance on selecting the right candidate, and highlights best practices for maximizing the impact of this vital role during periods of change.

What Are Interim CFO Services and Why They Matter for Los Angeles Businesses

Interim CFO services Los Angeles are a vital asset for organizations navigating periods of transition, especially in dynamic markets. These seasoned professionals enter organizations temporarily to address urgent challenges arising from unexpected departures of permanent CFOs, company restructuring, or the need for enhanced oversight. By employing a hands-on approach, an interim CFO stabilizes finances, implements effective turnaround strategies, and ensures compliance with regulations, allowing businesses to focus on growth and sustainability.

Our services include:

- Comprehensive monetary assessments

- Bankruptcy case management

- Operational efficiency improvements

With over 100 years of combined experience in turnaround and restructuring consulting, our team is skilled at conducting thorough monetary reviews that emphasize cash preservation, efficiency, and risk mitigation. In fact, nearly 23% of project resources in the industrial goods and services sector have recently been directed towards temporary leadership efforts, reflecting the growing reliance on short-term specialists.

The fractional CFO model further illustrates the power of interim leadership, allowing organizations to pay only for the services they require, thus enhancing flexibility and efficiency during fluctuating workloads. A fractional CFO collaborates closely with portfolio companies to establish strong economic systems, drive strategic planning, and offer transparency for management and investors. They operationalize real-time analytics through a client dashboard that monitors business performance, allowing for timely decision-making and adjustments.

As trusted partners, they translate financial insights into actionable recommendations that foster profitability and growth. In today's competitive landscape, the growing demand for interim CFO services in Los Angeles plays a crucial role in enhancing performance and adapting to evolving market conditions, with the U.S. accounting service market projected to expand significantly, underscoring the increasing importance of these services.

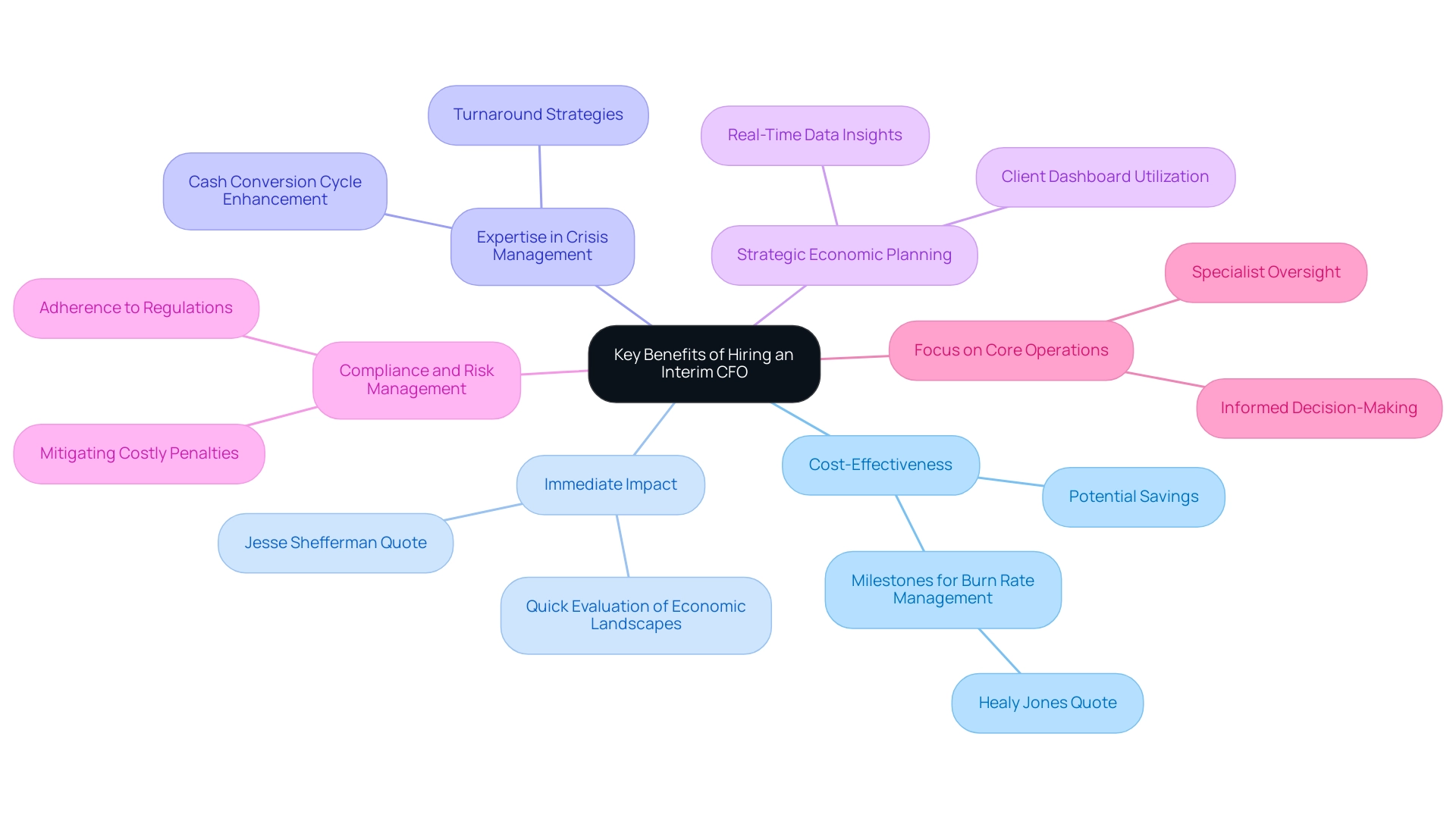

Key Benefits of Hiring an Interim CFO for Your Business

- Cost-Effectiveness: Utilizing interim CFO services Los Angeles offers significant savings compared to a full-time hire. Companies can access high-level monetary expertise without the burden of a long-term salary and benefits package, potentially saving over 60%. Healy Jones, VP of FP&A at Kruze Consulting, emphasizes the importance of using milestones to manage a startup's burn rate, which can aid in maximizing these savings. This adaptability is especially advantageous for startups and expanding enterprises that need professional interim CFO services Los Angeles without the economic burden of a long-term obligation.

- Immediate Impact: Interim CFOs are seasoned professionals adept at quickly evaluating economic landscapes and implementing essential changes. Their capability to stabilize a company's finances with interim CFO services Los Angeles ensures that organizations can regain momentum without the delays typically associated with permanent hires. Jesse Shefferman, CEO, notes, "The Kruze team helped us grow from a 2-person startup to a NASDAQ listed public company in 2 years. We wouldn’t have gotten public without Kruze’s support."

- Expertise in Crisis Management: Specialized in turnaround strategies, many businesses benefit from interim CFO services Los Angeles to excel in guiding them through economic turmoil or restructuring phases. Their extensive experience equips them to navigate complex economic challenges effectively, making them invaluable assets during critical times. Through rigorous testing of hypotheses, they ensure that strategies are tailored to enhance the cash conversion cycle and overall performance.

- Strategic Economic Planning: Interim CFO services Los Angeles enhance strategy by leveraging real-time data to provide actionable insights. This capability allows organizations to make informed decisions that not only address immediate needs but also align with long-term growth objectives, ensuring they remain competitive in a dynamic market. The use of real-time analytics, supported by a client dashboard, facilitates a more streamlined decision-making process, empowering organizations to act swiftly and effectively.

- Compliance and Risk Management: Interim CFOs play a crucial role in ensuring adherence to monetary regulations and reporting standards. By utilizing interim CFO services Los Angeles, they can mitigate the risk of costly penalties and enhance the overall economic health of the organization, fostering a culture of accountability and transparency.

- Focus on Core Operations: By utilizing interim CFO services in Los Angeles, company leaders can shift their focus to core operations, assured that monetary leadership is overseen by a specialist. This arrangement allows for the uninterrupted pursuit of strategic initiatives, facilitating smoother operational flow and enhanced productivity. Moreover, comprehending the factors that affect outsourced CFO expenses can assist companies in making educated choices when choosing a temporary CFO that meets their budgeting requirements.

How to Choose the Right Interim CFO for Your Business

-

Assess Your Needs: Begin by pinpointing the specific challenges your organization is facing. Whether it’s cash flow management, compliance issues, or the formulation of a comprehensive strategy, having a clear understanding of your needs will aid in the selection of interim CFO services Los Angeles that possess the requisite expertise.

Look for Relevant Experience: Prioritize candidates with a proven track record in your specific industry. Their familiarity with industry-specific challenges can lead to more efficient and effective solutions, ensuring a quicker turnaround on critical issues.

-

Evaluate Communication Skills: A successful temporary CFO must possess the ability to convey complex monetary concepts in an accessible manner. Assess candidates for their aptitude in explaining financial strategies clearly, as effective communication is vital for aligning with stakeholders.

-

Check References and Success Stories: Solicit references from previous clients to evaluate the CFO's performance. Success stories that illustrate their impact can provide invaluable insight into their capabilities and effectiveness in previous roles.

-

Consider Cultural Fit: Given the close collaboration required between the temporary CFO and your team, it’s crucial to choose an individual who aligns well with your company culture and values. This alignment fosters a more productive working relationship and enhances overall team morale.

-

Discuss Expectations and Goals: Engage in an open dialogue regarding your expectations for the temporary CFO. Clearly articulating goals and timelines from the outset can foster alignment and ensure a commitment to achieving your business objectives. Ruth Singleton noted that in nonprofits and government entities, 37% of search efforts targeted temporary leadership fulfilling essential finance duties; thus, clarity in expectations is fundamental to successful placements.

Be Aware of Retained Search Firm Limitations: While retained search firms can provide access to a wider pool of candidates, they come with higher costs and a longer hiring process due to thorough vetting. Weigh these cons against the urgency of your needs when considering your options.

-

Explore Customized Solutions: Consider engaging with interim CFO services Los Angeles, like those offered by BluWave, which are designed to meet specific organizational needs. Their expertise in testing hypotheses and delivering maximum returns on invested capital can help streamline the selection process, ensuring you find the right fit for your temporary leadership requirements.

Emphasize Strategic Alignment: A temporary CFO should not only oversee budgets but also align monetary plans with the company’s long-term objectives. A strategic perspective is essential; candidates should be ready to foresee future market trends and combine financial planning with wider organizational strategies while utilizing real-time analytics to monitor performance and modify strategies as required. Additionally, they should apply hypothesis testing to refine their approaches and ensure that decisions are data-driven.

Common Challenges Faced by Businesses During Transition

- Resistance to Change: The transition period often sees employees resisting the changes introduced by an interim CFO, particularly if they are accustomed to established processes. To effectively navigate this resistance, clear and consistent communication from leadership is essential. Engaging employees in the change process fosters a sense of ownership and reduces uncertainty. Given that there is a 70% failure rate of organizational change, addressing these resistance and communication issues is critical to success.

- Lack of Clear Vision: A well-defined vision is crucial during any transition. Without it, organizations may find themselves struggling to make progress or align efforts effectively. Interim CFO services in Los Angeles must establish clear goals and strategic frameworks to guide their teams, ensuring that every member understands the direction and purpose of the transition. As Jayne Ruff, Occupational Psychologist & Managing Director at ChangingPoint, states, 'Our programs are designed to deliver meaningful, measurable impact, aligning both your team and business goals for optimal success.'

- Inadequate Data: Interim CFOs depend heavily on accurate and comprehensive financial data to make informed decisions. However, organizations frequently encounter challenges in gathering and organizing this data during transitions. Therefore, establishing robust data collection and analysis processes is vital to empower those utilizing interim CFO services Los Angeles to respond effectively and strategically. Utilizing real-time business analytics allows for continuous monitoring of performance, enabling timely adjustments to strategies as needed.

- Short-term Focus: While immediate financial stabilization is often a priority during transitions, it is crucial not to lose sight of long-term objectives. Interim CFOs should adeptly balance short-term tactics, such as cost-cutting measures, with sustainable growth strategies that align with the organization’s overarching vision and goals. This balanced approach can significantly enhance the overall turnaround strategy while operationalizing lessons learned for future success.

- Communication Gaps: Miscommunication among the temporary CFO, management, and staff can lead to confusion and inefficiencies, undermining the change process. To mitigate this risk, establishing clear lines of communication is vital. Regular updates, open forums for discussion, and feedback mechanisms help ensure that everyone is on the same page and can contribute to a successful transition. The case study on 'Organisational Relevance and Change Alignment' illustrates the importance of aligning organizational changes with strategic goals, thereby providing a practical example of overcoming challenges during transitions.

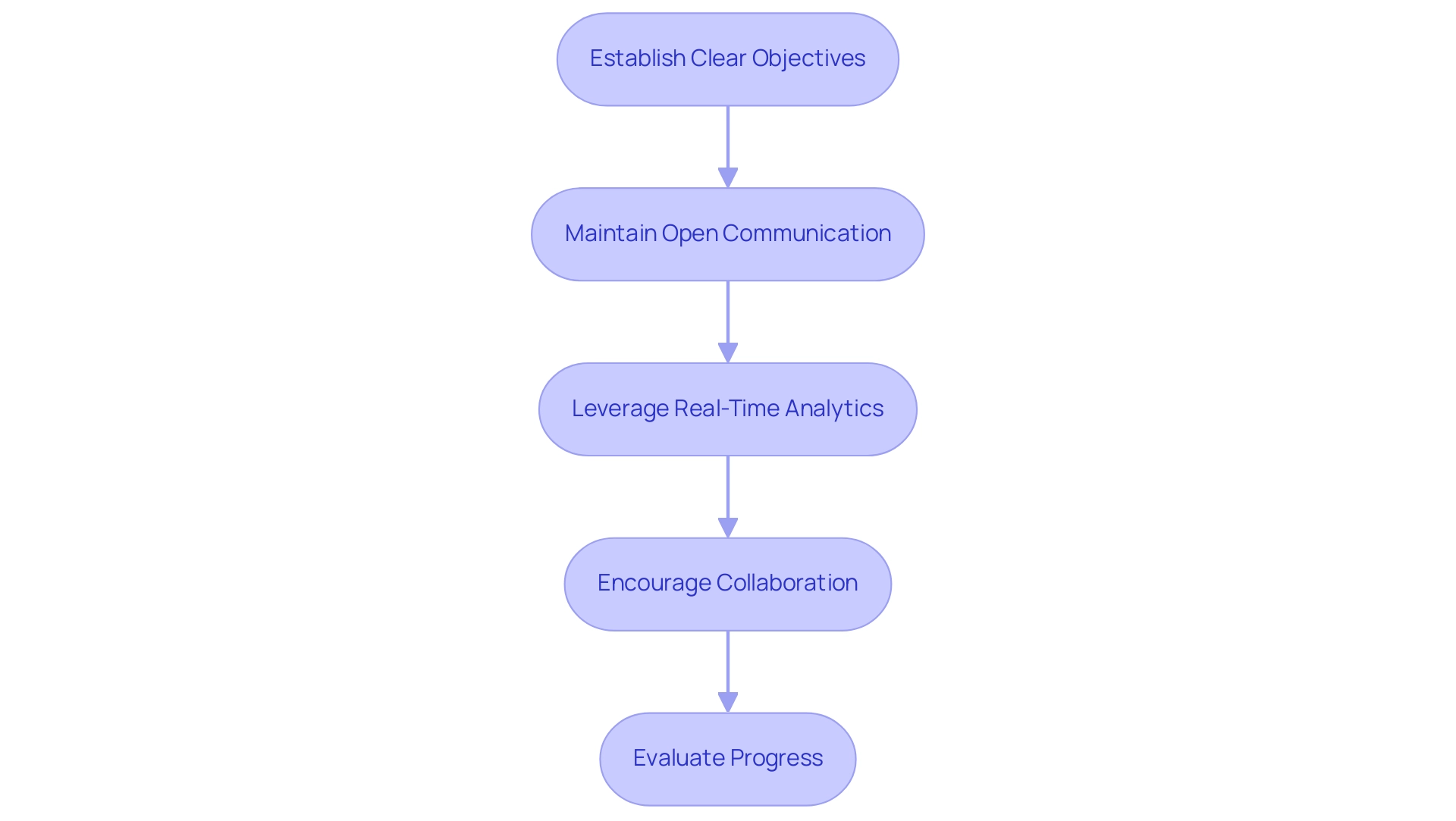

Best Practices for Working with an Interim CFO

- Establish Clear Objectives: Begin your collaboration with the temporary CFO by setting explicit goals and benchmarks for success. This alignment is crucial for ensuring that both parties are working towards shared outcomes, thereby enhancing the overall effectiveness of the engagement.

- Maintain Open Communication: Effective communication is key in managing temporary CFO relationships. Setting up weekly check-ins allows for regular updates on progress and challenges, facilitating timely adjustments to strategies as necessary. This practice not only fosters transparency but also builds trust.

- Leverage Real-Time Analytics: Provide your temporary CFO with access to a client dashboard that offers real-time operational analytics. This tool is essential for continually diagnosing your business health and monitoring performance, enabling informed decision-making and rapid adjustments throughout the turnaround process.

- Encourage Collaboration: Foster an environment where interim CFO services Los Angeles can work closely with internal teams. This collaboration is essential for sharing insights and creating a cohesive approach to resource management. Engaging various stakeholders can lead to innovative solutions and improved financial outcomes.

- Evaluate Progress: Regularly review the acting CFO’s contributions against the established objectives. This ongoing evaluation allows for constructive feedback and necessary adjustments, ensuring that goals are consistently met. Celebrating successes and addressing challenges promptly can further enhance the effectiveness of this partnership. The role of interim CFO services Los Angeles is vital in preserving the business by ensuring that decisions are made swiftly and effectively, particularly during critical turnaround phases.

Conclusion

Engaging an interim CFO can serve as a transformative strategy for businesses navigating periods of transition, particularly in dynamic markets like Los Angeles. The advantages are clear:

- Cost-effectiveness

- Immediate impact

- Specialized crisis management

- Strategic financial planning

- Compliance assurance

- Ability to refocus on core operations

By leveraging the expertise of seasoned professionals, organizations can stabilize their financial health and implement effective turnaround strategies without the long-term commitment of a permanent hire.

Selecting the right interim CFO is crucial for maximizing these benefits. By assessing specific needs, prioritizing relevant experience, and evaluating communication skills, businesses can ensure they find a candidate who not only fits the technical requirements but also aligns with their culture and goals. Establishing clear objectives and maintaining open communication throughout the engagement further enhances the effectiveness of this vital partnership.

As the business landscape continues to evolve, the role of interim CFOs will only grow in importance. By embracing this flexible leadership model, companies can navigate immediate challenges while laying the foundation for sustainable growth. With the right interim CFO, organizations are not just equipped to survive transitions—they are poised to thrive. This strategic approach to financial leadership positions businesses for future success, ensuring they remain competitive and resilient in ever-changing markets.

Frequently Asked Questions

What are interim CFO services in Los Angeles?

Interim CFO services in Los Angeles involve experienced professionals temporarily entering organizations to address urgent financial challenges, stabilize finances, implement turnaround strategies, and ensure regulatory compliance during periods of transition.

What specific services do interim CFOs provide?

Interim CFOs offer services such as comprehensive monetary assessments, bankruptcy case management, and operational efficiency improvements.

What is the experience level of the team providing interim CFO services?

The team has over 100 years of combined experience in turnaround and restructuring consulting, focusing on cash preservation, efficiency, and risk mitigation.

Why are organizations increasingly relying on interim CFOs?

Organizations are relying on interim CFOs due to the need for immediate expertise during transitions, the ability to manage costs effectively, and the growing complexity of financial landscapes in dynamic markets.

How does the fractional CFO model work?

The fractional CFO model allows organizations to pay only for the services they need, enhancing flexibility and efficiency during fluctuating workloads while collaborating closely with portfolio companies.

What benefits do interim CFO services provide in terms of cost?

Interim CFO services can save companies over 60% compared to hiring a full-time CFO, making them a cost-effective solution for accessing high-level monetary expertise without long-term commitments.

How quickly can interim CFOs make an impact on an organization?

Interim CFOs can quickly evaluate economic landscapes and implement essential changes, helping organizations regain momentum without the delays often associated with permanent hires.

What role do interim CFOs play in crisis management?

Interim CFOs specialize in turnaround strategies and are equipped to navigate complex economic challenges, making them invaluable during economic turmoil or restructuring phases.

How do interim CFOs enhance strategic economic planning?

They leverage real-time data to provide actionable insights that align with both immediate needs and long-term growth objectives, facilitating informed decision-making.

What is the importance of compliance and risk management in interim CFO services?

Interim CFOs ensure adherence to monetary regulations and reporting standards, helping to mitigate the risk of costly penalties and fostering a culture of accountability within the organization.

How do interim CFO services allow company leaders to focus on core operations?

By overseeing monetary leadership, interim CFOs enable company leaders to concentrate on strategic initiatives and enhance productivity without financial distractions.