Introduction

In the face of evolving market dynamics and increasing financial pressures, organizations are turning to operational restructuring consulting services as a lifeline for revitalization. This strategic approach not only enhances operational efficiency but also positions companies to navigate complex challenges with agility. By conducting thorough analyses and implementing targeted changes, organizations can streamline processes, reduce costs, and ultimately boost productivity.

As the healthcare sector grapples with the aftermath of the pandemic and rising interest rates, the urgency for effective restructuring has never been more pronounced. This article delves into the essential components of operational restructuring, the pivotal roles played by consultants, and the strategies that empower organizations to thrive amidst adversity. With a focus on practical solutions and measurable outcomes, it aims to equip leaders with the insights needed to drive meaningful change and ensure long-term success.

Defining Operational Restructuring Consulting Services

Operational restructuring consulting services are crucial for improving a company's efficiency and financial performance. This critical strategy begins with a thorough analysis of current operations, identifying underlying business issues and creating actionable plans for improvement. By executing targeted changes, organizations can streamline processes, reduce costs, and ultimately increase productivity.

For instance, many rural healthcare providers encounter significant operational challenges, often operating in sparsely populated markets with a high percentage of residents relying on Medicaid or Medicare. As one industry leader noted, 'They often come with high fees, higher interest rates, more restrictive covenants and more reporting requirements,' underscoring the financial pressures that necessitate a reevaluation of business models to adapt to a changing care and payer landscape. The case study titled 'Healthcare Sector Pressures' highlights how healthcare providers are navigating a challenging recovery from COVID-19, facing high interest rates and regulatory demands.

Projections indicate that unless reimbursement rates improve or interest rates decrease, 2024 will be an especially challenging year for healthcare providers, many of whom are at risk of default and reorganization. Given the evolving economic environment, we expect an increase in bankruptcy filings in 2024 due to compressed margins, emphasizing the urgent need for effective operational restructuring consulting services. Our comprehensive services include bankruptcy case management, which plays a crucial role in stabilizing financial positions.

Consultants deliver tailored strategies that tackle the unique challenges organizations face, empowering them to emerge more agile and competitive. The key advantages of efficiency improvements include better resource allocation, enhanced service delivery, and increased profitability, establishing a solid foundation for long-term success.

Roles and Responsibilities of Operational Restructuring Consultants

Restructuring advisors play a crucial role in navigating the complexities of a company’s functional and economic landscape by offering operational restructuring consulting services, particularly in difficult markets where many residents depend on Medicaid or Medicare. Rural providers often face significant hurdles in sparsely populated areas, highlighting the necessity for expert guidance. The key roles of these consultants encompass:

- Financial Analysis: Conducting thorough evaluations of financial statements to pinpoint weaknesses and identify strategic opportunities for improvement, crucial for mastering the cash conversion cycle. Specific strategies may include optimizing inventory management and accelerating receivables collection.

- Process Optimization: Redesigning workflows to enhance operational efficiency and minimize waste, utilizing real-time analytics for informed decision-making.

- Change Management: Steering organizations through transitions by effectively managing stakeholder expectations and fostering open communication, thus operationalizing lessons learned during the turnaround process.

- Performance Metrics: Establishing robust key performance indicators (KPIs) to track progress and measure success throughout the transformation journey, reinforcing strengths while addressing weaknesses.

- Interim Management: Providing temporary leadership in critical areas to ensure operational continuity during the transition phase. As noted by a Certified Investment Banking Professional, 'You can be the best DCF LBO model, but if you don't know how to read a borrowing base or associated loan documents, you will be in trouble.' This insight highlights the crucial importance of monetary assessment in reorganization efforts.

Moreover, trust is crucial in effective dealmaking, as shown in the case study titled 'Why Trust is a Key Trait of Successful Dealmaking,' which illustrates how perceptions of leadership can be affected during organizational changes. Our comprehensive business review and strategic planning process are designed to address these issues effectively. Upcoming virtual bootcamps for case interviews and modeling can provide valuable resources for CFOs eager to enhance their skills.

By fulfilling these responsibilities, consultants drive transformation and ensure long-term viability, particularly through operational restructuring consulting services, as companies prepare for growth amidst complex distressed situations. For more information on our services and pricing, please visit our website.

Key Strategies in Operational Restructuring

Successful structural reorganization requires a multifaceted approach grounded in several key strategies:

- Comprehensive Financial Assessment: This involves detailed evaluations to uncover cash flow challenges and pinpoint potential cost-saving opportunities, ensuring that decisions are based on solid financial data. Recent contributions indicate that coordinating performance measurement with external partners has been crucial, with five significant inputs emphasizing this aspect.

- Stakeholder Engagement: Actively involving key stakeholders from the outset cultivates essential buy-in and support, which is crucial for driving the necessary changes.

- Lean Methodology: By embracing lean principles, organizations can effectively eliminate waste, thus enhancing operational efficiency and promoting a culture of continuous improvement. As noted by Lance Rubin, a leading expert on data-driven decision-making, human data and analytics are essential for organizational decisions, as they provide a comprehensive understanding of the company's people, culture, and capabilities.

- Technology Integration: Leveraging cutting-edge technology solutions facilitates streamlined processes and superior data management, enabling CFOs to make informed decisions swiftly.

- Testing and Measuring: Implementing a rigorous testing and measuring approach is vital for validating reorganization strategies, ensuring that every hypothesis is assessed to deliver maximum return on invested capital.

- Continuous Monitoring: Establishing a robust feedback mechanism, supported by real-time analytics through a client dashboard, allows for the ongoing assessment of implemented changes, ensuring adjustments can be made as required. This commitment to operationalizing lessons learned builds strong, lasting relationships with stakeholders.

These tactics enable entities to address intricate transformation projects with greater assurance and lucidity, ultimately aligning resources with fundamental strengths by leveraging operational restructuring consulting services. For instance, the case study titled 'Streamlining Operations for Efficiency' illustrates how outsourcing non-core activities can lead to significant cost reductions, allowing firms to focus on their primary strengths. Additionally, referencing key metrics in production and delivery, such as Procure to Pay and Order to Cash, is vital for margin analysis and operational analytics, making the strategies even more relevant for CFOs.

Challenges and Risks in Operational Restructuring

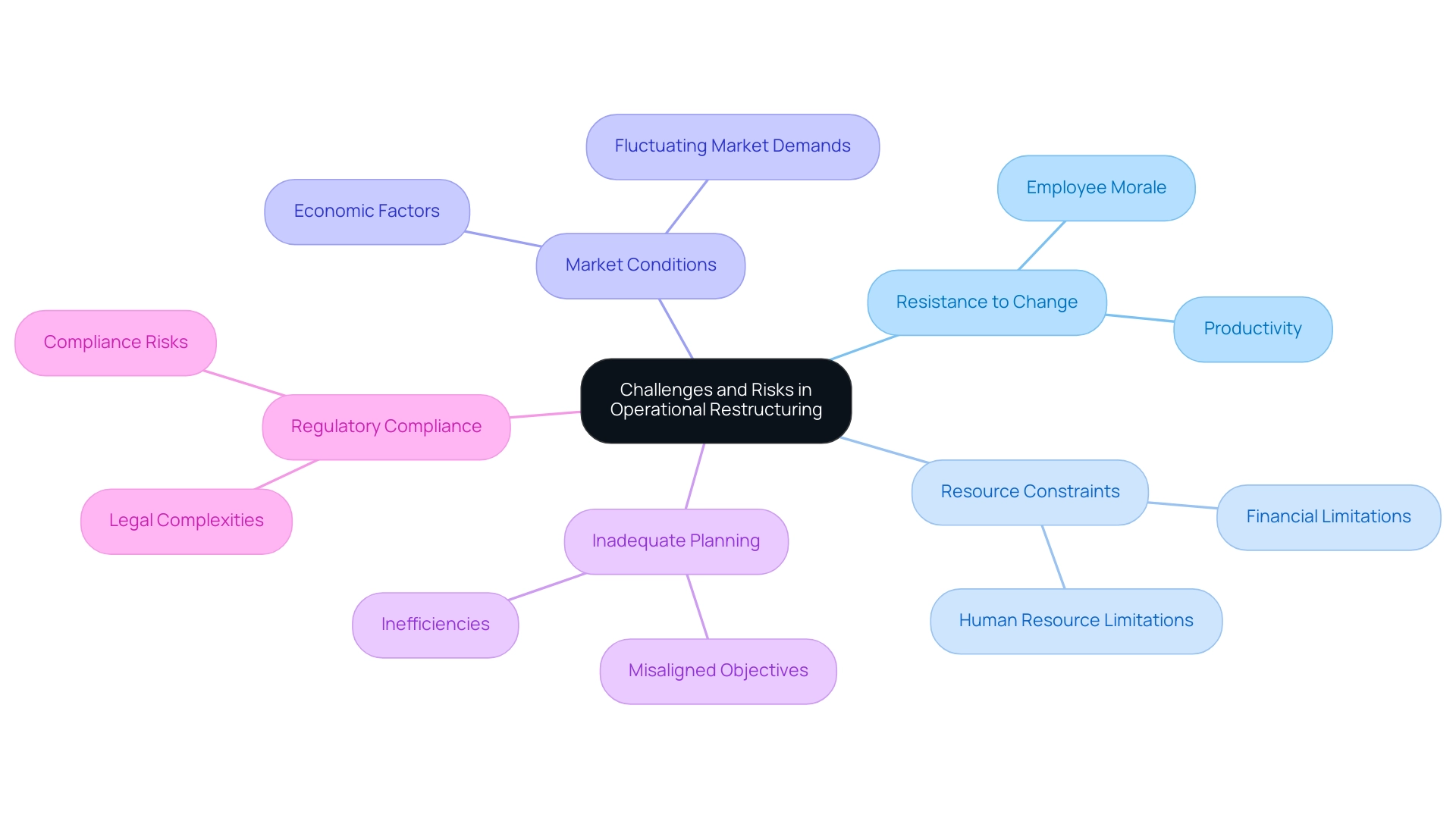

Operational restructuring consulting services present a range of challenges and risks that organizations must navigate effectively. Key issues include:

- Resistance to Change: Employees often resist new processes or leadership transitions, which can lead to decreased morale and productivity.

- Resource Constraints: Organizations may face limited financial or human resources, hindering the successful execution of reorganization initiatives.

- Market Conditions: External economic factors, including fluctuating market demands, can significantly impact the effectiveness of reorganization efforts.

- Inadequate Planning: A lack of a comprehensive strategic plan can result in misaligned objectives, inefficiencies, and wasted resources.

- Regulatory Compliance: Navigating the complexities of legal and compliance issues during the reorganization process poses substantial risks.

The urgency for effective planning is underscored by Reorg's report of a staggering 68% increase in bankruptcies compared to the previous year, highlighting the critical need for companies to strategically plan for the next 18 months to create the necessary runway for addressing potential challenges.

Corporate restructuring, supported by operational restructuring consulting services, serves as a vital tool for navigating these monetary challenges and improving operational efficiency. By leveraging real-time analytics and continuous performance monitoring, organizations can collaboratively identify underlying business issues, plan solutions, and measure investment returns effectively.

The situation of Sasol demonstrates this point; confronted with significant economic challenges due to high debt levels and volatile oil prices, Sasol executed strategic asset divestitures and debt reduction.

These actions not only stabilized its financial position but also tackled specific challenges such as resistance to change and insufficient planning, ultimately enhancing its long-term sustainability and providing valuable insights into effective strategies for overcoming difficulties in organizational transformation. Testing and measuring the outcomes of these strategies ensures that organizations can maximize their return on invested capital.

Measuring Success in Operational Restructuring

Evaluating success in operational adjustment requires a focused approach on several key metrics that provide a comprehensive view of performance and areas for improvement. Here are the essential metrics to consider:

-

Financial Performance:

It is crucial to monitor changes in revenue, net profit margin—which represents how much money the company made after subtracting all costs compared to revenue—and cash flow following restructuring efforts.

These indicators reveal the financial health of the entity and its ability to sustain profitability over time, particularly in the context of mastering the cash conversion cycle. Furthermore, integrating the 20 strategies for optimal business performance can enhance this analysis.

-

Operational Efficiency:

Organizations should evaluate enhancements in process cycle times, productivity rates, and cost reductions. Improved operational efficiency directly correlates with better resource allocation and waste reduction. This is further enhanced by leveraging real-time analytics to drive streamlined decision-making.

Specific methodologies, such as predictive analytics and dashboard reporting, can operationalize these insights effectively. However, it is essential to avoid data overload, which can obscure meaningful insights.

-

Employee Engagement:

Assessing employee satisfaction through surveys and feedback mechanisms is vital, as engaged employees drive productivity and innovation. Ongoing observation of these aspects can aid in relationship-building within the company, aligning with collaborative planning to tackle underlying business issues.

-

Customer Satisfaction:

Tracking customer retention and satisfaction scores assists in assessing market reaction to modifications made during the organizational change. Positive customer feedback can indicate successful adaptation to new processes.

-

Achievement of KPIs:

Establishing and regularly tracking key performance indicators allows entities to ensure that strategic goals are being met. As Peter Drucker once noted,

OKRs originated with the concept of management by objectives, created by Peter Drucker in the 1950s,

highlighting the foundational importance of measurable goals. However, KPI selections should be carefully considered to avoid unintended negative consequences.

By integrating these metrics into their operational restructuring consulting services, organizations can effectively assess their progress and make informed adjustments to strategies as necessary, ultimately paving the way for sustained financial performance improvements through strategic planning and ongoing performance monitoring.

Conclusion

In a rapidly changing economic landscape, operational restructuring consulting services emerge as a vital strategy for organizations seeking to enhance efficiency and financial performance. By conducting comprehensive analyses and implementing targeted changes, these services help businesses streamline processes, reduce costs, and ultimately drive productivity. The unique challenges faced by sectors such as healthcare, particularly in the aftermath of the pandemic, underscore the urgency for effective restructuring to navigate financial pressures and evolving market conditions.

Consultants play a pivotal role in this transformation, offering expertise in:

- Financial analysis

- Process optimization

- Change management

Their focus on stakeholder engagement, performance metrics, and technology integration ensures that organizations can adapt to challenges while fostering a culture of continuous improvement. By employing proven strategies and methodologies, organizations can mitigate risks associated with restructuring, such as:

- Resistance to change

- Resource constraints

while maintaining compliance with regulatory demands.

Measuring success through key performance indicators not only provides insight into financial and operational health but also highlights areas for ongoing improvement. By prioritizing employee and customer satisfaction alongside financial metrics, organizations can create a holistic approach to restructuring that supports long-term viability and growth.

As the pressures of the current market environment intensify, the case for operational restructuring becomes increasingly clear. Organizations that embrace these strategies can position themselves not just to survive but to thrive, turning challenges into opportunities for lasting change and success. Now is the time for leaders to take decisive action and leverage restructuring consulting services to secure a competitive edge in their respective industries.

Frequently Asked Questions

What are operational restructuring consulting services?

Operational restructuring consulting services are designed to improve a company's efficiency and financial performance by analyzing current operations, identifying underlying issues, and creating actionable plans for improvement.

How do operational restructuring consulting services benefit organizations?

These services help organizations streamline processes, reduce costs, and increase productivity, ultimately leading to better resource allocation, enhanced service delivery, and increased profitability.

What challenges do rural healthcare providers face that necessitate restructuring consulting?

Rural healthcare providers often operate in sparsely populated markets with high percentages of residents relying on Medicaid or Medicare, leading to financial pressures such as high fees, interest rates, and restrictive covenants.

What are the key components of operational restructuring consulting?

Key components include financial analysis, process optimization, change management, performance metrics establishment, and interim management to ensure operational continuity during transitions.

How do consultants conduct financial analysis?

Consultants evaluate financial statements to identify weaknesses and strategic opportunities for improvement, focusing on mastering the cash conversion cycle and optimizing inventory management and receivables collection.

What role does change management play in operational restructuring?

Change management involves steering organizations through transitions by managing stakeholder expectations and fostering open communication, which helps operationalize lessons learned during the turnaround process.

Why are performance metrics important in restructuring?

Establishing robust key performance indicators (KPIs) is crucial for tracking progress and measuring success throughout the transformation journey, reinforcing strengths while addressing weaknesses.

What is the significance of interim management in restructuring consulting?

Interim management provides temporary leadership in critical areas to ensure operational continuity during the transition phase, which is essential for maintaining stability.

What are the expected economic challenges for healthcare providers in 2024?

Projections indicate that unless reimbursement rates improve or interest rates decrease, 2024 will pose significant challenges for healthcare providers, many of whom are at risk of default and reorganization.

How can organizations prepare for growth amidst complex distressed situations?

By engaging in operational restructuring consulting services, organizations can drive transformation and ensure long-term viability, preparing them for growth despite challenging market conditions.