Introduction

In the dynamic world of business, restructuring is often a necessity rather than a choice, especially for organizations grappling with financial challenges. Restructuring support teams emerge as vital allies in this transformative journey, equipped with the expertise to navigate complex financial landscapes and implement strategic changes.

By conducting comprehensive assessments, optimizing operations, and facilitating effective change management, these teams empower businesses to not only survive but thrive amidst adversity.

This article delves into the critical role these teams play, the strategies they employ, and the metrics that define their success, providing actionable insights for organizations aiming to emerge stronger from their restructuring efforts.

The Role of Restructuring Support Teams in Business Transformation

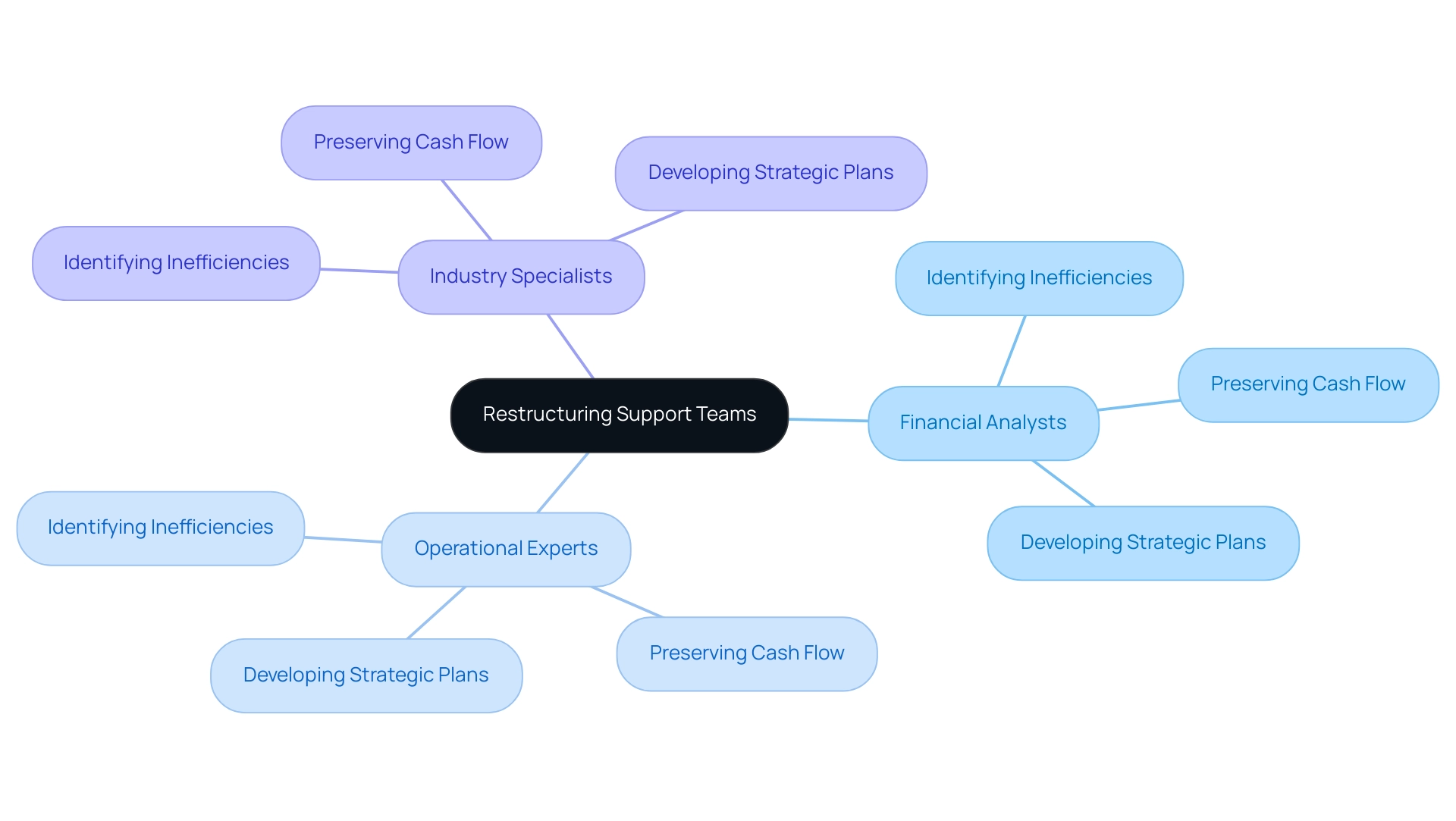

Reorganizing support groups is essential for organizations facing difficulties, highlighting the importance of restructuring support teams. Composed of financial analysts, operational experts, and industry specialists, these groups collaborate to conduct thorough financial assessments, which are crucial for cash preservation and liability reduction. Their primary objectives include:

- Identifying inefficiencies

- Preserving cash flow

- Developing strategic plans that align with both short and long-term goals

By offering interim management services, restructuring support teams provide hands-on executive leadership during crises, ensuring stability and effective crisis resolution. Through the implementation of the Rapid-30 process, they are equipped to quickly identify underlying business issues and initiate transformational change. Ultimately, their expertise enables organizations to manage crises effectively, stabilize economic positions, and emerge stronger by saving money, streamlining operations, and increasing revenues through decisive action and collaborative strategies.

Strategies for Effective Restructuring: Navigating Financial Challenges

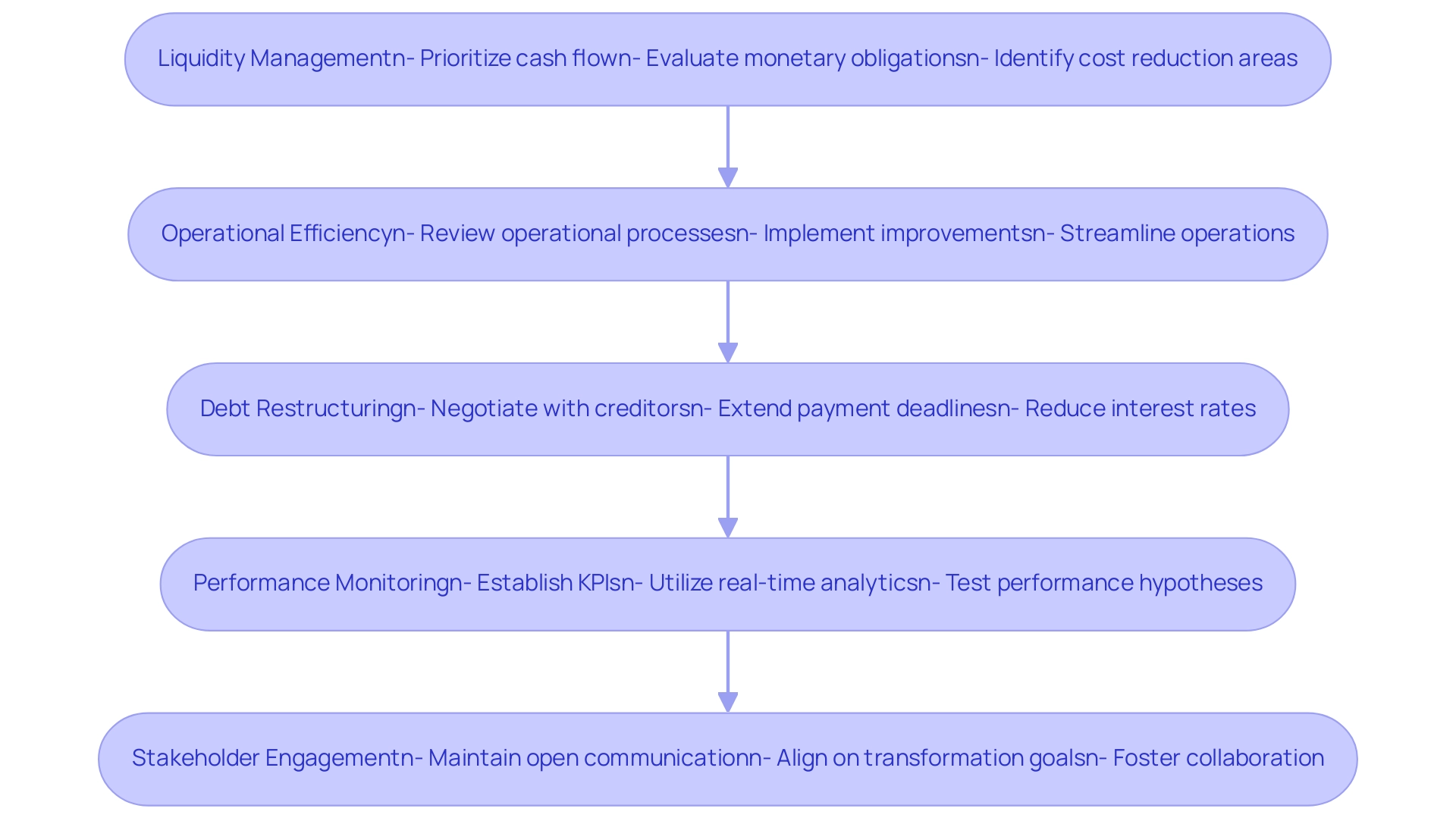

To effectively navigate economic challenges, restructuring support teams can implement several key strategies:

- Liquidity Management: Prioritize cash flow by evaluating current monetary obligations and identifying areas for cost reduction. This may include renegotiating payment terms with suppliers or reducing discretionary spending.

- Operational Efficiency: Conduct a thorough review of operational processes to identify inefficiencies. Implement process improvements or technology solutions that streamline operations, reduce overhead costs, and operationalize lessons learned from previous experiences.

- Debt Restructuring: Engage with creditors to negotiate more favorable terms, such as extending payment deadlines or reducing interest rates. This can provide immediate relief and allow companies to stabilize their finances while fostering strong relationships through transparent communication.

- Performance Monitoring: Establish key performance indicators (KPIs) to track financial health and operational performance. Utilizing real-time analytics through a client dashboard enables timely adjustments to strategies as needed, ensuring continuous monitoring of organizational health. Additionally, testing hypotheses related to performance can help deliver maximum return on invested capital.

- Stakeholder Engagement: Maintain open communication with stakeholders, including employees, investors, and creditors, to ensure alignment on transformation goals and foster a collaborative environment for change. This relationship-building is crucial for implementing the lessons learned during the turnaround process.

By employing these strategies, support teams can guide organizations through economic challenges, leveraging streamlined decision-making and real-time insights to establish the foundation for restructuring support teams and sustainable growth.

Identifying Key Metrics for Restructuring Success

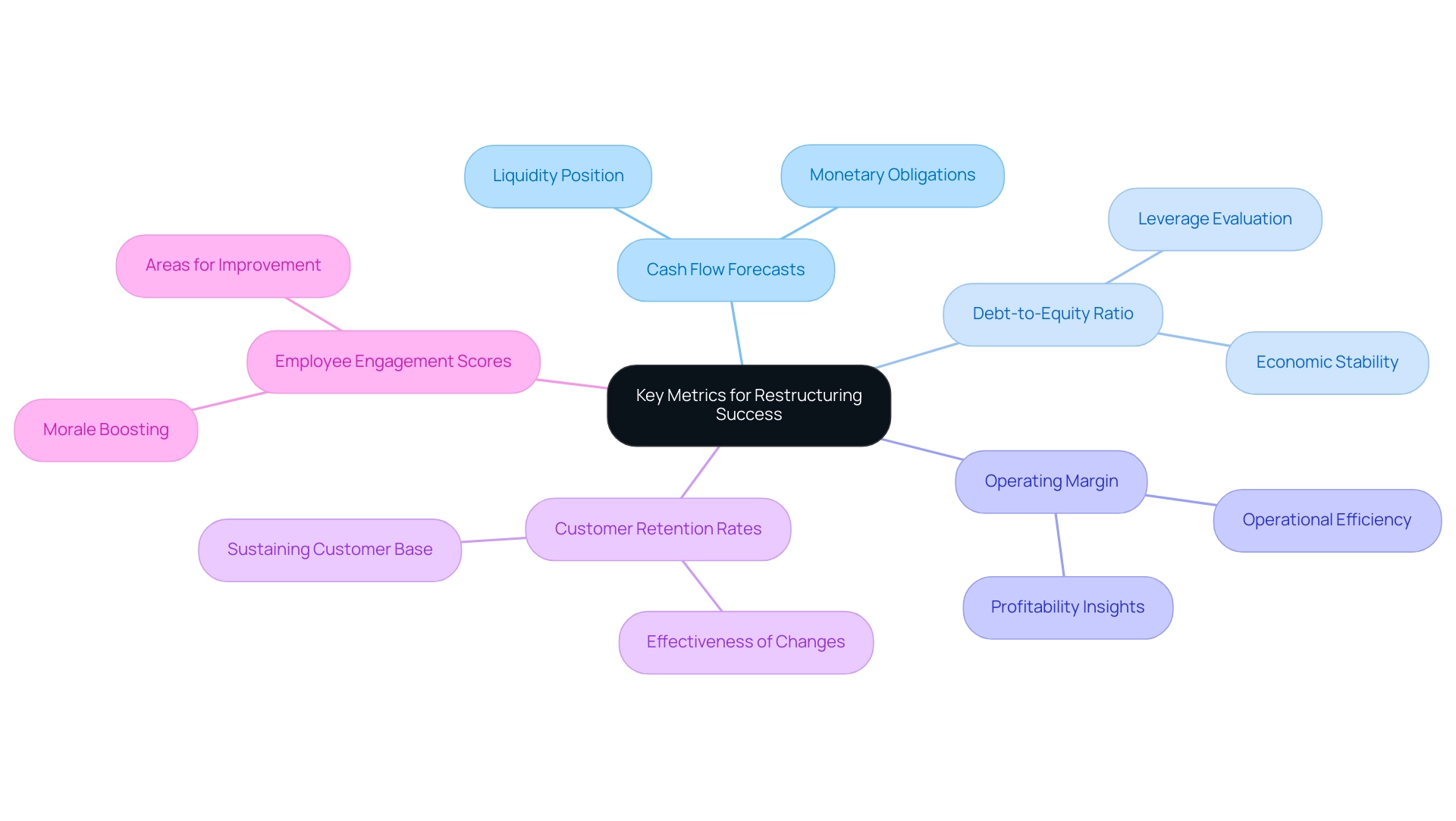

To gauge the success of restructuring initiatives, business leaders should focus on the following key metrics while leveraging real-time analytics to enhance decision-making and performance monitoring:

- Identify & Plan: Maintaining precise cash flow forecasts is essential for understanding the organization's liquidity position and ensuring that it can meet monetary obligations.

Decide & Execute: The Debt-to-Equity Ratio helps evaluate the company's leverage and economic stability. A declining ratio may indicate improved financial health as debt is reduced, signaling effective turnaround strategies. - Operating Margin: Monitoring the operating margin provides insights into the company's operational efficiency. An increasing margin suggests enhanced profitability and cost management, aligning with strategic organizational improvement goals.

- Customer Retention Rates: Monitoring customer retention rates can reveal the effectiveness of operational changes and the company's capability to sustain its customer base during transitions. Real-time analytics can help adjust strategies swiftly based on these metrics.

- Employee Engagement Scores: Engaged employees are crucial during times of change. Regularly measuring employee engagement can help identify areas for improvement and boost morale, reinforcing the importance of operationalizing lessons learned throughout the turnaround process.

By focusing on these metrics and utilizing real-time business analytics through our client dashboard, teams can ensure that their efforts are yielding positive results and make necessary adjustments promptly.

Implementing Change Management in Restructuring Efforts

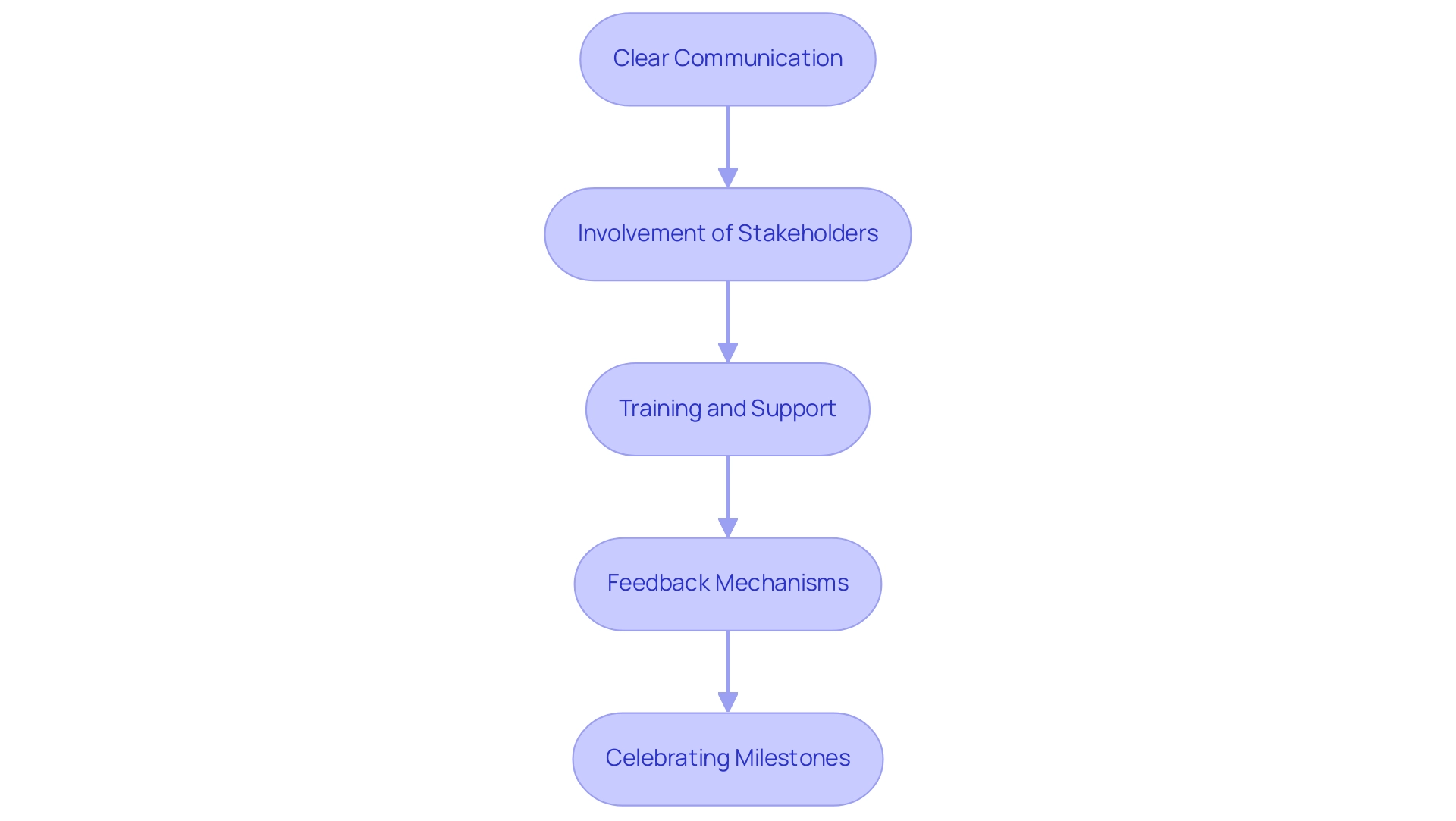

Successful reorganization requires effective change management strategies to ensure that employees are engaged and supportive of the transformation process. Here are key strategies for managing change:

- Clear Communication: Establish transparent communication channels to keep employees informed about the organizational changes, objectives, and expected outcomes.

This helps build trust and reduces uncertainty. - Involvement of Stakeholders: Involve key stakeholders in the planning and execution phases of the reorganization.

This encourages ownership and fosters a sense of collaboration. - Training and Support: Provide training and resources to help employees adapt to new processes and systems.

Offering support during the transition can alleviate anxiety and boost confidence. - Feedback Mechanisms: Implement feedback systems to gather input from employees throughout the reorganization process.

Actively seeking their opinions can lead to valuable insights and enhance engagement. - Celebrating Milestones: Acknowledge and celebrate accomplishments throughout the transformation journey.

Recognizing progress can enhance morale and inspire employees to stay dedicated to the transformation.

By incorporating these change management strategies, organizations can create a supportive environment for restructuring support teams that promotes successful adaptation and encourages long-term growth.

Leveraging Technology in Restructuring Initiatives

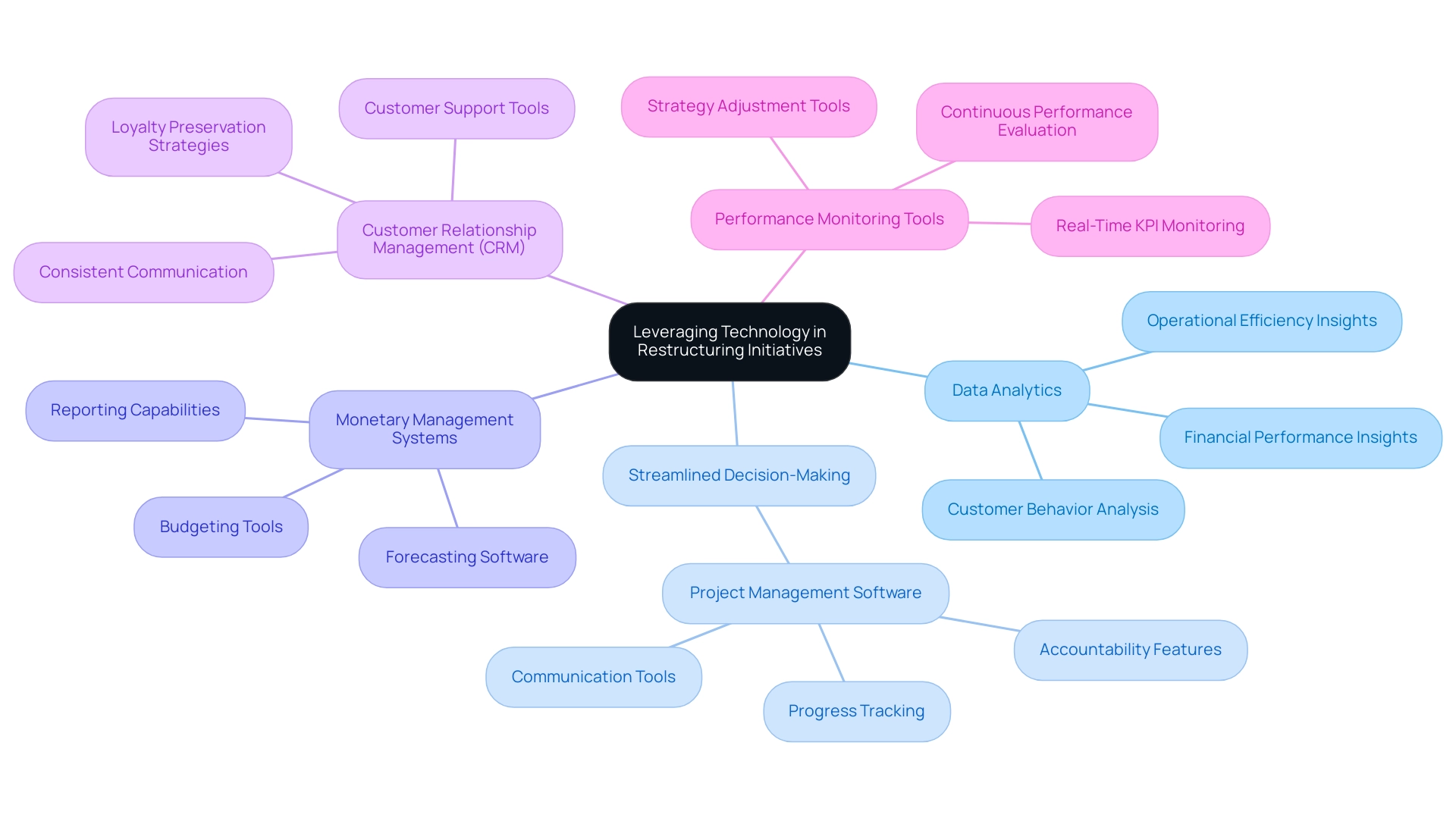

Incorporating technology into the efforts of restructuring support teams can greatly enhance efficiency and effectiveness. Here are some ways to leverage technology:

-

Data Analytics: Utilize data analytics tools to gain insights into financial performance, customer behavior, and operational efficiency.

This data-driven approach enables informed decision-making and identifies areas for improvement, crucial for developing a business valuation report. -

Streamlined Decision-Making: Our group, guided by experts Peter Griscom M.S., David Bates CFP, CPA, and Chase Hudson, MBA, Lean Six Sigma Black Belt, supports a shortened decision-making cycle throughout the turnaround process, allowing your staff to take decisive actions, which is enhanced through technology integration.

- Project Management Software: Implement project management tools to streamline communication and collaboration among team members.

These platforms facilitate tracking progress and ensuring accountability, helping operationalize the lessons learned during the turnaround process.

- Project Management Software: Implement project management tools to streamline communication and collaboration among team members.

-

Monetary Management Systems: Adopting advanced monetary management software can enhance budgeting, forecasting, and reporting capabilities.

This permits more precise financial evaluations during reorganization and is crucial for efficient performance monitoring. -

Customer Relationship Management (CRM): A robust CRM system can help maintain customer relationships during organizational changes by ensuring consistent communication and support, ultimately preserving customer loyalty.

-

Performance Monitoring Tools: Implement tools that allow for real-time monitoring of key performance indicators.

This enables quick adjustments in strategies based on performance metrics, ensuring continuous business performance monitoring and fostering strong relationships through effective operationalization of turnaround lessons.

Business Valuation Report: Our comprehensive Business Valuation Report is available for $3,500.00, providing expert guidance essential for navigating your restructuring support teams.

By effectively leveraging technology, organizations can not only streamline their restructuring support teams but also position themselves for sustained success in a competitive landscape.

Conclusion

Restructuring support teams are indispensable in guiding organizations through financial challenges and transformative changes. By conducting thorough assessments, these teams identify inefficiencies, optimize operations, and implement strategic plans that align with both immediate and long-term goals. Their expertise in liquidity management, operational efficiency, and debt restructuring ensures that businesses can navigate crises effectively, stabilize their financial positions, and ultimately emerge stronger.

The strategies employed by these teams, such as establishing key performance indicators and fostering stakeholder engagement, lay the groundwork for sustainable growth. By focusing on metrics like cash flow projections, operating margins, and employee engagement scores, organizations can assess their restructuring efforts' success and make timely adjustments as needed. This data-driven approach, combined with effective change management strategies, creates an environment where employees feel supported and motivated throughout the transformation process.

Incorporating technology further enhances the effectiveness of restructuring initiatives, enabling real-time decision-making and streamlined communication. By leveraging data analytics, project management tools, and advanced financial management systems, organizations can not only improve their operational efficiency but also ensure they are well-equipped to face future challenges.

In conclusion, the collaborative efforts of restructuring support teams are critical for businesses aiming to thrive amidst adversity. By embracing a comprehensive approach that encompasses strategic planning, performance monitoring, and technological integration, organizations can navigate the complexities of restructuring with confidence and resilience, paving the way for a successful and sustainable future.

Frequently Asked Questions

What is the purpose of restructuring support teams in organizations?

Restructuring support teams are essential for organizations facing difficulties as they help identify inefficiencies, preserve cash flow, and develop strategic plans that align with both short and long-term goals.

Who composes the restructuring support teams?

The teams are composed of financial analysts, operational experts, and industry specialists who collaborate to conduct thorough financial assessments.

What are the primary objectives of restructuring support teams?

The primary objectives include identifying inefficiencies, preserving cash flow, and developing strategic plans that align with both short and long-term goals.

How do restructuring support teams assist during crises?

They provide interim management services and hands-on executive leadership to ensure stability and effective crisis resolution, utilizing the Rapid-30 process to identify underlying business issues quickly.

What key strategies can restructuring support teams implement to navigate economic challenges?

Key strategies include liquidity management, operational efficiency, debt restructuring, performance monitoring, and stakeholder engagement.

How can organizations manage liquidity effectively?

Organizations can manage liquidity by evaluating current monetary obligations, identifying areas for cost reduction, and renegotiating payment terms with suppliers.

What metrics should business leaders focus on to gauge the success of restructuring initiatives?

Key metrics include cash flow forecasts, Debt-to-Equity Ratio, operating margin, customer retention rates, and employee engagement scores.

What change management strategies are important for successful reorganization?

Important strategies include clear communication, involvement of stakeholders, training and support, feedback mechanisms, and celebrating milestones.

How can technology enhance the efforts of restructuring support teams?

Technology can enhance efficiency through data analytics, streamlined decision-making, monetary management systems, customer relationship management (CRM), and performance monitoring tools.

What is the cost of the comprehensive Business Valuation Report mentioned in the article?

The Business Valuation Report is available for $3,500.00.