Introduction

Rolling forecasts have become a vital tool in financial planning, providing businesses with the adaptability they need to thrive in a rapidly changing market. Unlike traditional annual budgets, rolling forecasts offer a continuous and up-to-date framework for adjusting financial projections based on evolving market conditions and internal dynamics. By integrating real-time data and leveraging advanced technologies like AI and machine learning, businesses can make informed decisions and stay ahead in a competitive landscape.

In this article, we will explore the definition and benefits of rolling forecasts, how they work, and the key differences between rolling forecasts and traditional budgets. Get ready to discover how rolling forecasts can empower your financial planning and drive your organization towards success.

Definition of Rolling Forecast

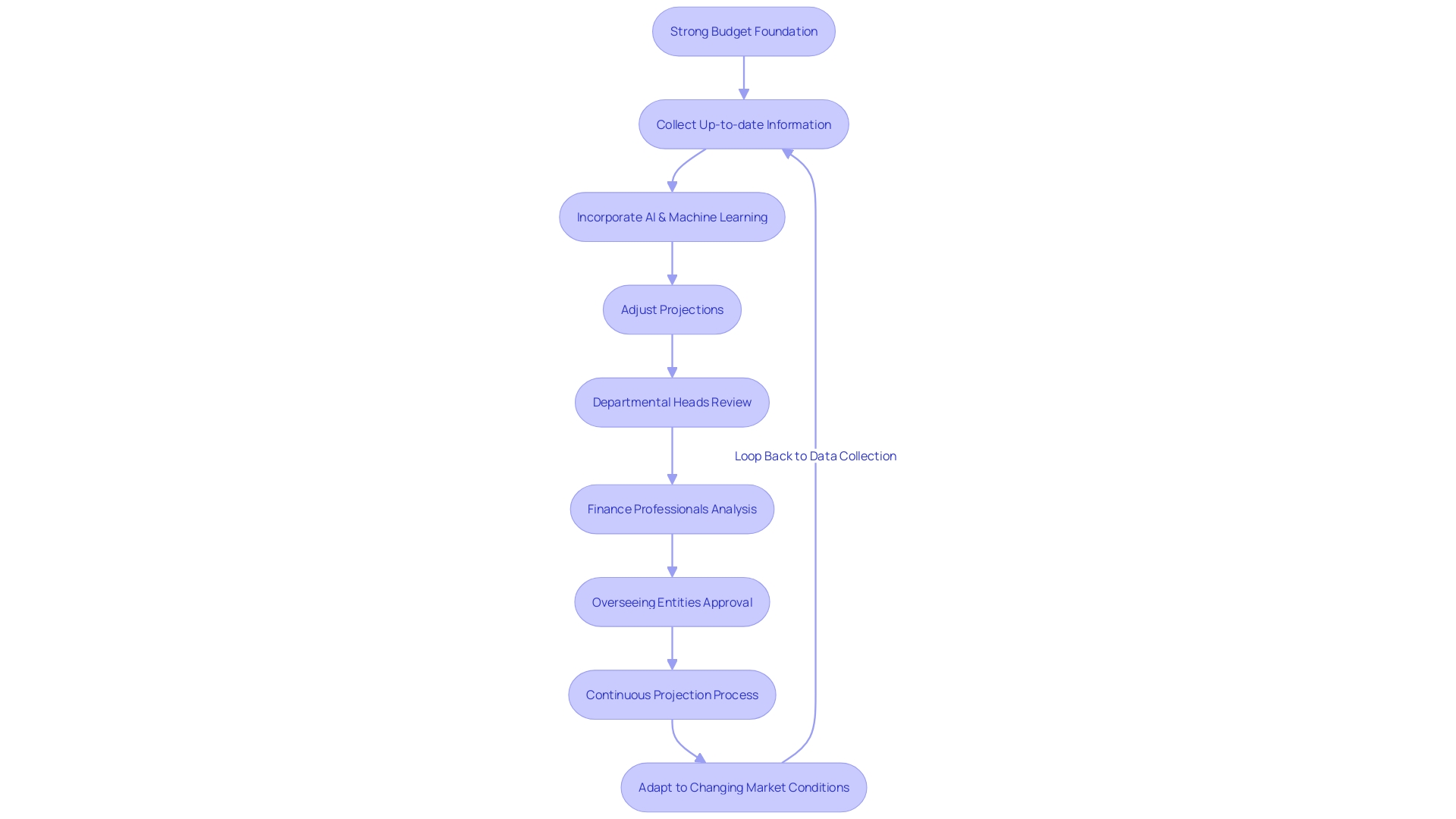

An ongoing projection represents the pinnacle of adaptability in planning, providing a continuous, up-to-the-minute structure for businesses to modify their estimations in accordance with changing market conditions and internal dynamics. This approach markedly transcends the rigid confines of traditional annual budgets, offering a proactive and progressive perspective on financial performance. An essential continuous projection process starts with a strong budget, acting as a fundamental starting point from which modifications are made. It is meticulously constructed by departmental heads, synthesized by finance professionals, and sanctioned by the overseeing entities. The development of a continuous prediction, although appearing simple, requires a thorough comprehension of the complexities involved.

The power of rolling predictions lies in their capability to incorporate up-to-date information, thereby refining decision-making processes with accuracy. In a time when unexpected circumstances like economic changes or unique incidents can disturb market dynamics, the capacity to quickly adjust predictions is priceless. This agility is evident in various sectors, including hospitality, where detailed monthly budgets are adjusted to reflect actual performance, leading to strategic economic redirections and the achievement of economic targets. In the same way, the paper and board industry highlights the importance of dependable predictions in sustaining continuous operations, where equipment effectiveness and minimized downtime are crucial.

Recent advancements, like the European Central Bank's approaching interest rate reduction, emphasize the need for organizations to maintain an up-to-date financial pulse. Such economic indicators impact prediction models, requiring an estimate that is responsive to external economic conditions. With AI and machine learning revolutionizing forecasting by providing accurate, real-time data analysis, organizations are increasingly leveraging these technologies to stay ahead in a competitive landscape.

As companies navigate through the intricacies of monetary planning, rolling projections arise as essential tools. They offer a clear pathway to not just anticipate but also shape financial outcomes, underlining the strategic advantage of adopting advanced forecasting methods that align with current and future market realities.

How Rolling Forecasts Work

Rolling projections offer a flexible method for financial planning and prediction, customized for adaptability in the contemporary corporate setting. In contrast to fixed yearly budgets, ongoing predictions are consistently revised, usually on a monthly or quarterly schedule, to include the most recent information and understanding. This method enables businesses to adapt their financial strategies responsively, keeping pace with the rapid changes in market conditions and internal performance metrics.

The core of a continuous projection is its cyclical nature; as time progresses and new information becomes available, the projection horizon extends, maintaining a constant outlook period. For example, a 12-month continuous prediction reviewed monthly will remove the oldest month and include projections for a new month at the end of the cycle. This creates a continuously changing projection that closely aligns with short-term operational needs while still supporting long-term strategic goals.

To demonstrate the importance of continuous projections, think about the hospitality sector. Here, a carefully constructed 12-month budget by department managers, consolidated by leadership, and approved by stakeholders serves as the foundation. This budget is not a one-time activity but a starting point for the continuous projection, which evolves as conditions change throughout the year, revealing insights that can lead to pivotal financial decisions.

Retailers also gain substantial advantages from ongoing projections. In an industry where competition is intense and consumer demands fluctuate, leveraging data for accurate forecasting is crucial. Advanced tools employing machine learning and predictive analytics can transform past sales data and customer interactions into actionable insights. This allows retailers to not only predict popular stock items but also to anticipate seasonal trends and align resources effectively, thus minimizing waste and maximizing profitability.

As we embrace the digital age, the traditional methods of forecasting, often slow and error-prone, are being outstripped by AI-powered forecasting techniques. These advanced algorithms consider a broader range of data points and provide real-time predictive insights, which are essential for maintaining a competitive edge.

The significance of continuous predictions is additionally emphasized by the principles of trend analysis. A moving average, an essential statistical technique, can be utilized to forecast future trends in the industry by concentrating on recent data points and regularly updating them. This approach doesn't necessitate complex mathematics but instead a tactical utilization of metrics to predict future performance.

In conclusion, rolling predictions represent a tactical resource, providing a complete perspective of an organization's monetary path. They empower enterprises to pivot with precision in response to evolving market dynamics, ensuring that budgetary planning remains both robust and flexible.

Benefits of Rolling Forecasts

Continuous predictions have revolutionized the manner in which businesses anticipate and respond to market dynamics. They are not just a budgeting tool but a strategic asset that, when used effectively, can significantly enhance an organization's financial performance. Here's why:

-

Flexibility in an Unpredictable Market: Rolling projections serve as an agility enhancer, enabling companies to pivot swiftly in response to market shifts. This dynamism is particularly vital in today's volatile commercial environment, where the ability to reallocate resources and adjust strategies at a moment's notice can be a game-changer.

-

Using the most up-to-date information, rolling predictions cut through the clutter to offer clarity on economic well-being. This accuracy allows enterprises to navigate away from potential pitfalls and towards opportunities, supported by data-driven insights.

-

By providing insight into future economic trends, these predictions empower management to anticipate and address potential challenges proactively. This proactive approach can be instrumental in navigating through uncertainty and maintaining a competitive edge.

-

The inherent flexibility of ongoing predictions means they can be recalibrated as new information comes to light, ensuring alignment with current business objectives. This adaptability is crucial for staying relevant and on course in a landscape that's constantly evolving.

In real-world scenarios, an ongoing prediction starts with a strong budgetary basis, usually a comprehensive one-year strategy created by departmental managers and consolidated by fiscal management. Despite sounding straightforward, crafting this budget is a complex endeavor that forms the backbone of the forecasting process.

Additionally, as seen from the perspective of Holiday Extras, a prominent European travel extras provider, continuous predictions are essential for businesses operating in various markets and languages. They help tackle the challenges of scale and data fluency, enabling even non-technical teams to make data-driven decisions, thus democratizing the power of financial insight across an organization.

In a world where data privacy and consumer rights are paramount, the efficacy of forecasting tools such as AI is even more pronounced. AI-based forecasting outstrips traditional methods by providing real-time insights and predictions, leveraging vast amounts of data from various digital interactions and consumer behaviors.

The appeal of continuous projections lies in their ease and availability. As experts assert, you don't need complex algorithms to start reaping the benefits. A moving average - a fundamental statistical concept - can be your first step towards predictive analysis, providing you with a twelve-month perspective on sales trends to guide your decision-making.

To sum up, rolling forecasts are not just about achieving accuracy; they're about creating real value and impact. They enable businesses to act with foresight, ensuring strategies are not only responsive but also proactive and aligned with long-term objectives. This is the core of strategic fiscal management, and it's how you make your numbers work for you.

Key Differences Between Rolling Forecasts and Traditional Budgets

Continuous projections represent a notable deviation from the unchanging characteristics of conventional yearly budgets. They are dynamic, adapting to new data, and span a shorter, more actionable timeline. This method not only embraces the inherent flexibility required in today's fast-paced organizational setting but also takes advantage of real-time data to provide a more precise outlook. With the flexibility to adjust predictions as fresh data arises, they promote a culture of ongoing planning, enabling companies to adapt rapidly in reaction to market changes.

The practicality of rolling forecasts is underscored by the necessity to periodically review and adjust economic plans. They mirror the reality that while a budget sets the initial course, the journey often requires recalibrations to stay on target. The integration of real-time data and analytics propels this process, offering insights that are critical for informed decision-making. It's a strategic tool that gains momentum and precision as the fiscal year progresses, much like a compelling narrative that builds towards an impactful conclusion.

Furthermore, case studies demonstrate that companies, like John Lewis, utilize their fiscal prediction to foresee improved half-year outcomes and direct their operational strategies. This emphasizes the significance of a flexible planning approach that can manage the fluctuations of economic cycles.

In this evolving financial landscape, where traditional budgeting methods fall short, rolling forecasts present a robust solution. By emphasizing adaptability and continuous oversight, they equip businesses to navigate the uncertainties of the market and steer towards sustained profitability and growth.

Conclusion

In conclusion, rolling forecasts have become essential tools in financial planning, offering businesses the adaptability they need in a rapidly changing market. Unlike traditional budgets, rolling forecasts provide a continuous and up-to-date framework for adjusting financial projections based on evolving market conditions and internal dynamics. By integrating real-time data and advanced technologies like AI and machine learning, businesses can make informed decisions and stay ahead in a competitive landscape.

Rolling forecasts offer agility in an unpredictable market, allowing companies to pivot swiftly in response to market shifts. They provide real-time accuracy, cutting through the noise to provide clarity on financial health. Rolling forecasts enable proactive decision-making by offering insights into future financial trends.

Additionally, they are adaptable for continuous relevance, ensuring alignment with current business objectives.

The practicality of rolling forecasts is underscored by the necessity to periodically review and adjust financial plans. They mirror the reality that while a budget sets the initial course, the journey often requires recalibrations to stay on target. Rolling forecasts equip businesses to navigate the uncertainties of the market and steer towards sustained profitability and growth.

In summary, rolling forecasts empower businesses to anticipate and shape financial outcomes, providing a clear pathway to success in a rapidly changing market. By leveraging real-time data and advanced technologies, businesses can make informed decisions and stay ahead of the competition. Adopting rolling forecasts as a strategic asset ensures that financial planning remains robust and flexible, enabling businesses to thrive in an unpredictable business environment.