Overview

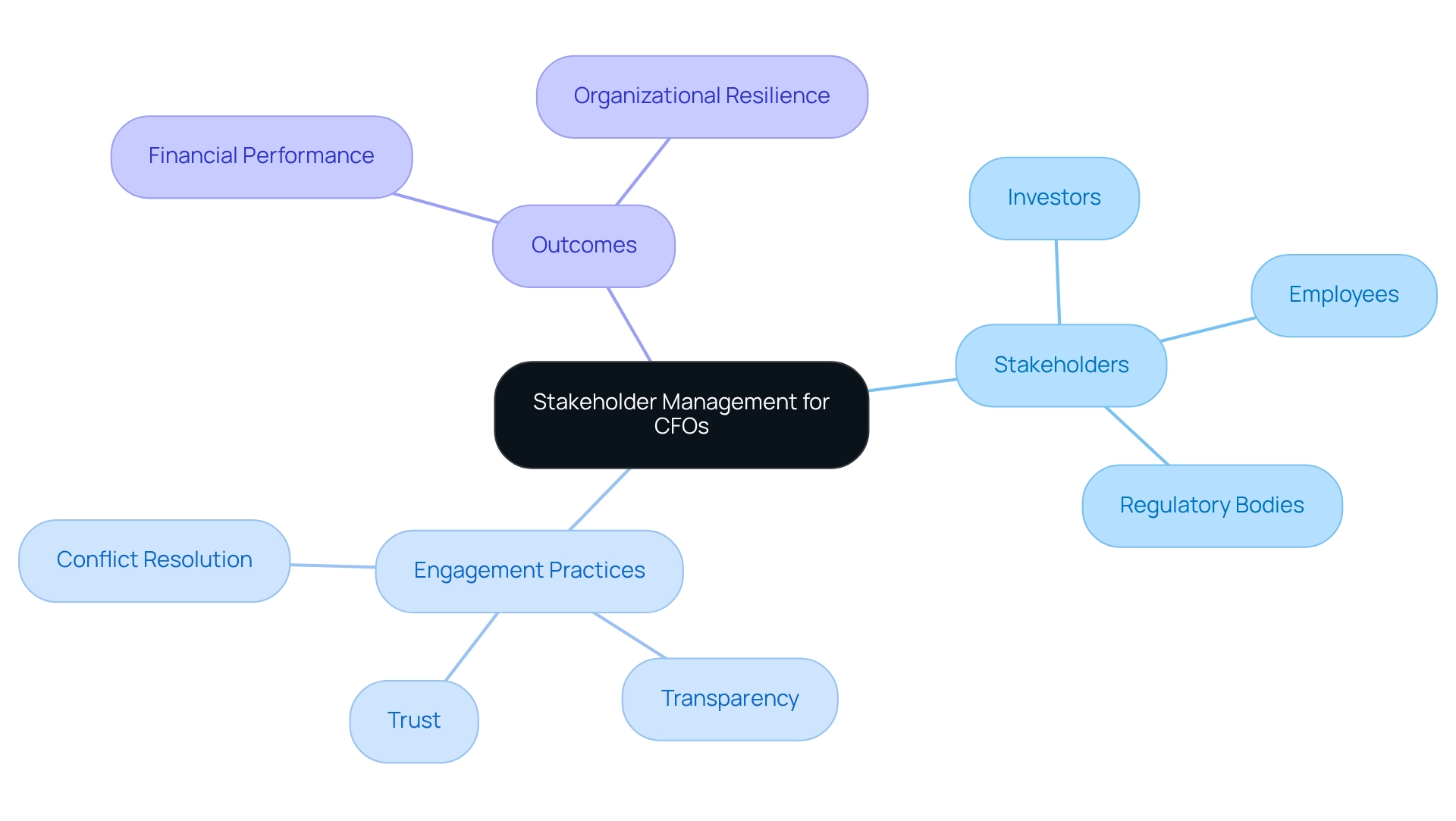

The Stakeholder Management Training Course in Cardiff is specifically designed to equip CFOs with essential skills for effectively identifying and engaging stakeholders. This capability is crucial for aligning financial strategies with organizational goals. Moreover, mastering these skills fosters trust and transparency, enhances decision-making, and ultimately leads to improved financial performance, particularly during periods of volatility.

Introduction

In the ever-evolving corporate landscape, the ability to effectively manage stakeholders has emerged as a pivotal skill for financial leaders. A Stakeholder Management Training Course empowers CFOs to hone their expertise in identifying, analyzing, and engaging with various stakeholders—from investors to regulatory bodies. By mastering communication strategies and conflict resolution techniques, these financial executives can align their strategies with the diverse interests of their organizations.

As the significance of stakeholder engagement continues to grow, understanding its historical evolution and key components becomes essential for fostering trust, transparency, and ultimately, organizational resilience in times of uncertainty.

This article delves into the critical aspects of stakeholder management training and its profound impact on financial performance and sustainable growth.

Define Stakeholder Management Training Course

The Stakeholder Management Training Course Cardiff equips individuals with essential skills for effectively identifying, analyzing, and engaging interested parties. The curriculum encompasses critical areas such as participant identification, needs assessment, communication strategies, and conflict resolution techniques. By enhancing the ability to build and maintain productive relationships, this training is vital for organizational success.

For financial leaders, mastering these skills is particularly crucial, as it enables them to navigate intricate participant dynamics, ensuring that financial decisions align with broader organizational goals. This alignment fosters a culture of accountability and transparency, increasingly important in today’s corporate governance landscape.

Moreover, the course underscores the significance of efficient decision-making procedures and the implementation of a client dashboard that offers real-time business analytics. This empowers financial leaders to take decisive actions that sustain business health during turnaround situations.

Contextualize Importance for CFOs

For chief financial officers, stakeholder management transcends a mere task; it embodies a crucial responsibility that profoundly influences financial performance and organizational resilience. Effective engagement with stakeholders—encompassing investors, employees, and regulatory bodies—enables financial leaders to align financial strategies with diverse interests. By cultivating robust relationships, CFOs can nurture trust and transparency, which are essential during periods of financial volatility. A systematic approach to managing interested parties not only enhances a CFO's capacity to navigate crises but also facilitates proactive communication and conflict resolution.

Statistics reveal that organizations with strong participant engagement practices are more adept at transforming challenges into opportunities, ultimately leading to enhanced financial outcomes. Moreover, case studies, including those employing Social Return on Investment (SROI) frameworks, illustrate how considering all participants' perspectives can yield substantial social and economic value. This underscores the importance of thorough participant oversight in fostering sustainable growth.

Trace Origins and Development

The concept of managing interested parties emerged in the 1960s, with the term 'interested party' first introduced by the Stanford Research Institute. However, it was R. Edward Freeman's seminal 1984 work that formalized the theory of interested parties, underscoring the necessity of considering all entities impacted by corporate actions. Since then, the theory has undergone significant evolution, particularly after 2002, transitioning from a narrow focus on shareholder value to a more comprehensive perspective that recognizes the interconnectedness of various stakeholders.

As articulated by Couillard et al., interested parties are defined as entities or individuals who are or will be affected by, or have a direct or indirect impact on, a project. This paradigm shift reflects an enhanced understanding of corporate responsibility and the imperative for organizations to actively engage with their constituents.

The significance of interest group oversight has been documented across numerous fields, as illustrated by the case study 'Industry Sector Representation in Interest Group Literature,' which examined how interest group theory has expanded beyond traditional sectors such as construction and IT.

Presently, the stakeholder management training course Cardiff is recognized as a crucial component of strategic planning and operational success, essential for achieving long-term sustainability in an increasingly complex business environment. The research group, which includes experts such as Paul Littau, Nirmala Jyothi Jujagiri, and Gerald Adlbrecht, emphasizes the importance of a stakeholder management training course Cardiff for effective management practices in navigating these challenges.

Identify Key Characteristics and Components

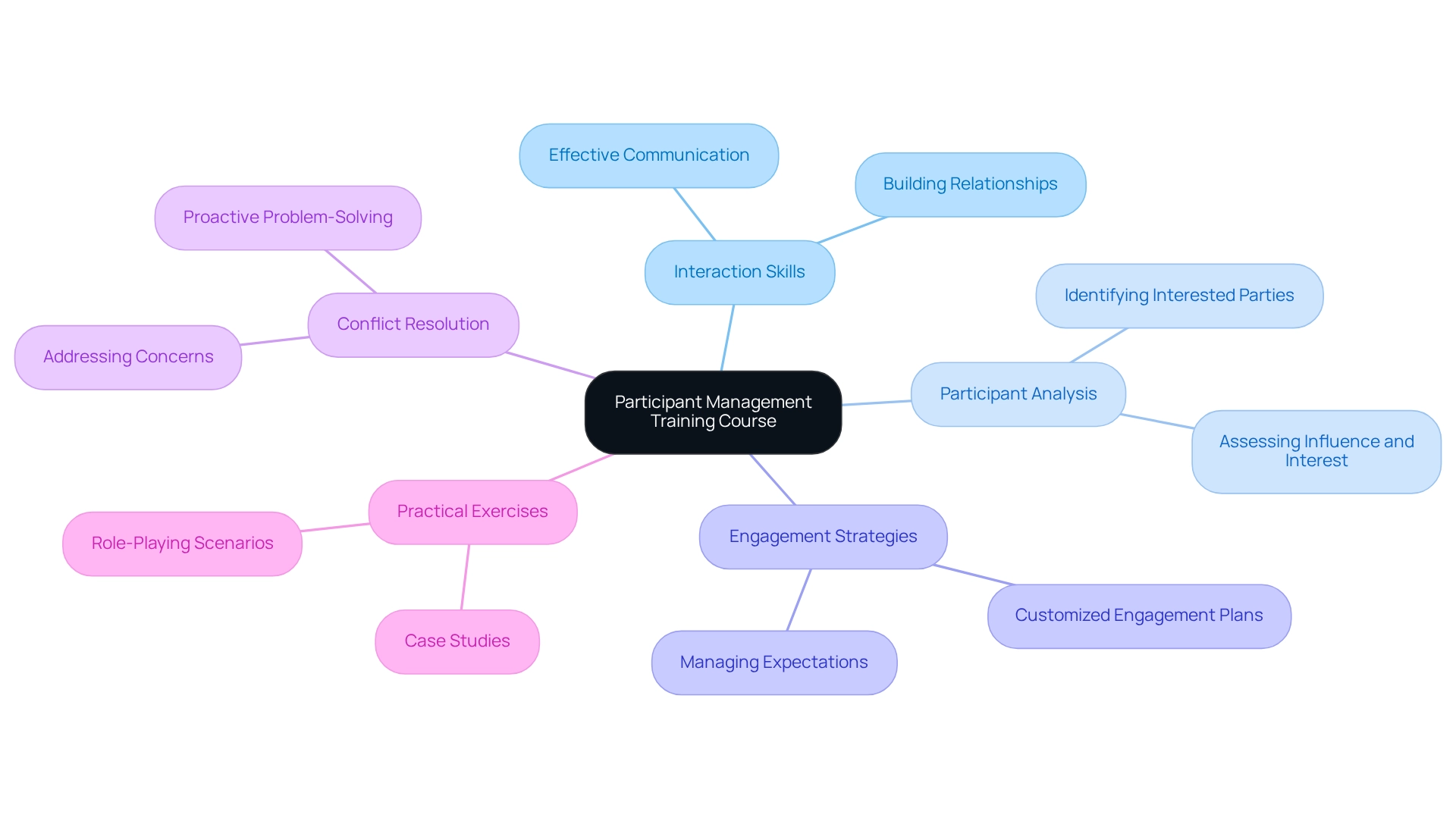

Key features of a Participant Management Training Course include a strong focus on interaction skills, participant analysis, and engagement strategies. Participants are trained to recognize interested parties based on their influence and interest, enabling them to create customized engagement plans that effectively manage expectations. The curriculum encompasses conflict resolution methods, empowering financial leaders to proactively address the concerns of interested parties.

Practical exercises, case studies, and role-playing scenarios are integral to the training, reinforcing learning and ensuring participants can apply these skills in real-world contexts. This approach not only enhances communication capabilities but also fosters collaborative relationships, which are crucial for driving organizational success.

Involving employees, pleasing customers, and gaining investor trust are essential elements of successful management of all parties involved, underscoring the importance of these training programs for CFOs seeking to navigate intricate business environments. Moreover, statistics suggest that proactive problem-solving and enhanced relationships with involved parties significantly reduce conflict resolution expenses, rendering this training essential for long-term organizational well-being.

As Simon Mainwaring wisely expressed, companies must acknowledge that shareholders should also view themselves as participants in the welfare of society. Furthermore, insights from the case study titled 'Stakeholder Influence on Project Dynamics' reveal that proactive engagement aids in identifying and alleviating emerging challenges, thereby enhancing overall project effectiveness. This comprehensive approach to the stakeholder management training course Cardiff not only prepares CFOs to meet current challenges but also encourages innovative thinking in measuring stakeholder engagement.

Conclusion

The significance of stakeholder management training for CFOs is paramount. By equipping financial leaders with the essential tools and skills to identify, analyze, and engage with stakeholders, organizations can foster a culture of accountability and transparency. This training encompasses critical components such as:

- Communication strategies

- Conflict resolution

- Stakeholder analysis

These are vital for navigating the complexities of modern corporate environments.

Understanding the evolution of stakeholder theory underscores the increasing recognition of the interconnectedness among various entities involved in corporate governance. Effective stakeholder engagement transcends mere financial performance; it emerges as a strategic imperative that bolsters organizational resilience, especially during uncertain times. The capability to cultivate robust relationships with stakeholders—from investors to regulatory bodies—enables CFOs to align their financial strategies with broader organizational objectives, ultimately transforming challenges into opportunities for sustainable growth.

In conclusion, investing in stakeholder management training is indispensable for CFOs striving to excel in an increasingly complex business landscape. By prioritizing effective engagement and communication, financial leaders can significantly enhance their organizations' outcomes while contributing to long-term sustainability. As the corporate world continues to evolve, the mastery of stakeholder management will only become more critical, reinforcing the necessity for continuous learning and adaptation in this vital area.

Frequently Asked Questions

What skills does the Stakeholder Management Training Course in Cardiff teach?

The course teaches essential skills for identifying, analyzing, and engaging interested parties, including participant identification, needs assessment, communication strategies, and conflict resolution techniques.

Why is this training important for financial leaders?

For financial leaders, mastering these skills is crucial for navigating participant dynamics and ensuring that financial decisions align with broader organizational goals, fostering a culture of accountability and transparency.

How does the course contribute to decision-making in organizations?

The course emphasizes efficient decision-making procedures and the implementation of a client dashboard that provides real-time business analytics, enabling financial leaders to make decisive actions that sustain business health during turnaround situations.

What is the overall goal of the Stakeholder Management Training Course?

The overall goal of the course is to enhance the ability to build and maintain productive relationships, which is vital for organizational success.