Introduction

Mastering the art of cash flow forecasting is crucial for the long-term success of any business. A 13-Week Cash Flow Forecast allows businesses to visualize the flow of cash in and out of their operations on a quarterly basis, providing the agility needed to preempt financial pitfalls. This tool aids businesses in strategizing resource allocation, identifying potential surpluses, and preventing shortages that could throttle operations.

Especially in an ever-evolving financial landscape, timely insights into cash movements furnish companies with the foresight to make proactive, informed decisions.

What is a 13-Week Cash Flow Forecast?

Mastering the art of cash flow forecasting is crucial for the long-term success of any business. A 13-Week Cash Flow Forecast allows businesses to visualize the flow of cash in and out of their operations on a quarterly basis, providing the agility needed to preempt financial pitfalls. This tool aids businesses in strategizing resource allocation, identifying potential surpluses, and preventing shortages that could throttle operations.

Especially in an ever-evolving financial landscape, timely insights into cash movements furnish companies with the foresight to make proactive, informed decisions.

Statistics showcase the tangible benefits of effective cash management: businesses that streamline their cash flow processes report a 44% boost in profitability, a 43% increase in productivity, and a 42% reduction in costs. These metrics underscore the significance of integrating robust financial tools within business practices. Citizens Financial Group, for example, emphasizes personalized customer-centric solutions, acknowledging that a refined approach to financial management can fortify a company’s competitive edge.

As Mark Valentino of Citizens asserts, optimizing financial performance through superior tools enables business operators to focus on what they love—running their businesses.

Citizens' investment in financial technology reflects a broader trend where successful enterprises leverage digital advancements to refine their cash flow management. Utilizing AI and machine learning for real-time data analysis transforms traditional, time-consuming forecasting methods, allowing businesses to swiftly adjust to market demands.

Cash flow is the bedrock of any business venture. It is not just about maintaining a balance but about understanding the intricacies of financial inflow and outflow patterns. A 13-Week Cash Flow Forecasting tool stands as a testament to modern financial acumen, offering a panoramic view of the company’s fiscal health, ensuring ventures stay afloat and thrive in today's challenging economic seas.

Why is a 13-Week Cash Flow Forecast Important?

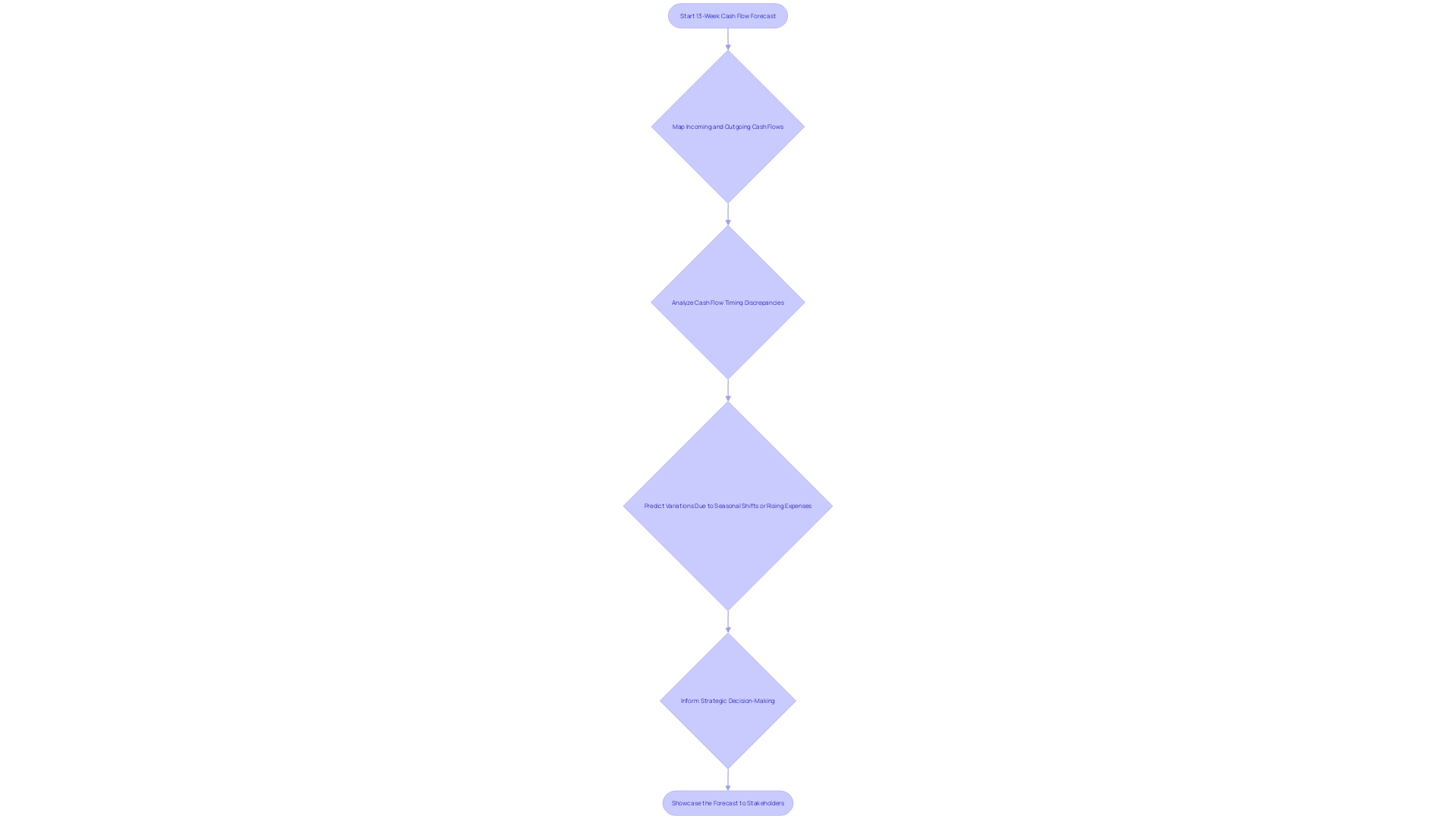

Understanding and forecasting cash movement is pivotal for sustaining an enterprise; hence, the implementation of a 13-Week Cash Flow Forecast is an indispensable tool. It enables businesses to:

- Precisely gauge short-term liquidity requirements by mapping incoming and outgoing cash flows, thereby pinpointing any discrepancies in cash inflow and outflow timings. This ensures businesses can strategize over their immediate cash needs and sidestep potential liquidity pitfalls.

- Predict cash flow variances, including anticipated fluctuations due to seasonal shifts or rising expenses, granting businesses the foresight to adjust operational strategies proactively.

- Inform strategic decision-making, offering a crystalline comprehension of cash standings that allows for prudent judgment with respect to investments, acquisitions, or financial obligations— ensuring resource allocation and spending take center stage.

- Communicate with stakeholders convincingly about financial bearings, showcasing a robust cash flow forecast to creditors, investors, or lenders which underscores the company's capability to honor its financial commitments.

For illustration, Citizens Financial Group, Inc., with its sizeable assets, and extensive consumer and commercial banking services, can serve as an archetype for excellent financial management using robust forecasting techniques. Furthermore, practical examples, such as the hotel company that optimized its advertising strategies with foundational digital tools like Google Analytics, highlight the imperative nature of having robust financial strategies.

To master cash flow management is to govern the vitality of your business, as cash flow is indubitably the lifeblood of any venture. It allows for covering expenses, strategic investments, and growth over time. Thus, staying informed about the dynamic patterns of money within your business is key to maintaining equilibrium and avoiding catastrophic cash shortages that could otherwise stall operations and growth.

Key Components of a 13-Week Cash Flow Forecast

When constructing a 13-Week Cash Flow Forecast, it's crucial to amalgamate several pivotal elements for nuanced and exhaustive financial projections. Cash on Hand marks the beginning, identifying the immediate cash balance as the forecast kicks off. The lifeblood of the projection is the Cash Inflows—the anticipated cash entering the system through sales, collections, and external funding.

Equally significant are the Cash Outflows, which encapsulate all projected disbursements, such as operational expenses and debt servicing.

Crafting the forecast necessitates a methodical approach, synthesizing data from prior performance, current trends, and future projections to estimate weekly cash movements. Once operational, this financial tool demands diligent supervision, contrasting actual cash flow against projected figures, making necessary course corrections to counter unforeseen financial shifts.

Consider the case of Citizens Financial Group, with $220.4 billion in assets, adept at offering customer-centric solutions, indicating the importance of understanding financial nuances, such as the distinction between cash flow management and profit maximization. Similarly, an example in the hospitality sector demonstrated the salience of foundational strategies in revenue management, reinforcing the premise that meticulous planning is the cornerstone of fiscal stability.

These precedents underscore the primacy of proficient cash flow forecasting—a meticulous process where precision and adaptability converge to maintain financial health and steer growth trajectories within the dynamic tapestry of business finance.

Step-by-Step Guide to Creating a 13-Week Cash Flow Forecast

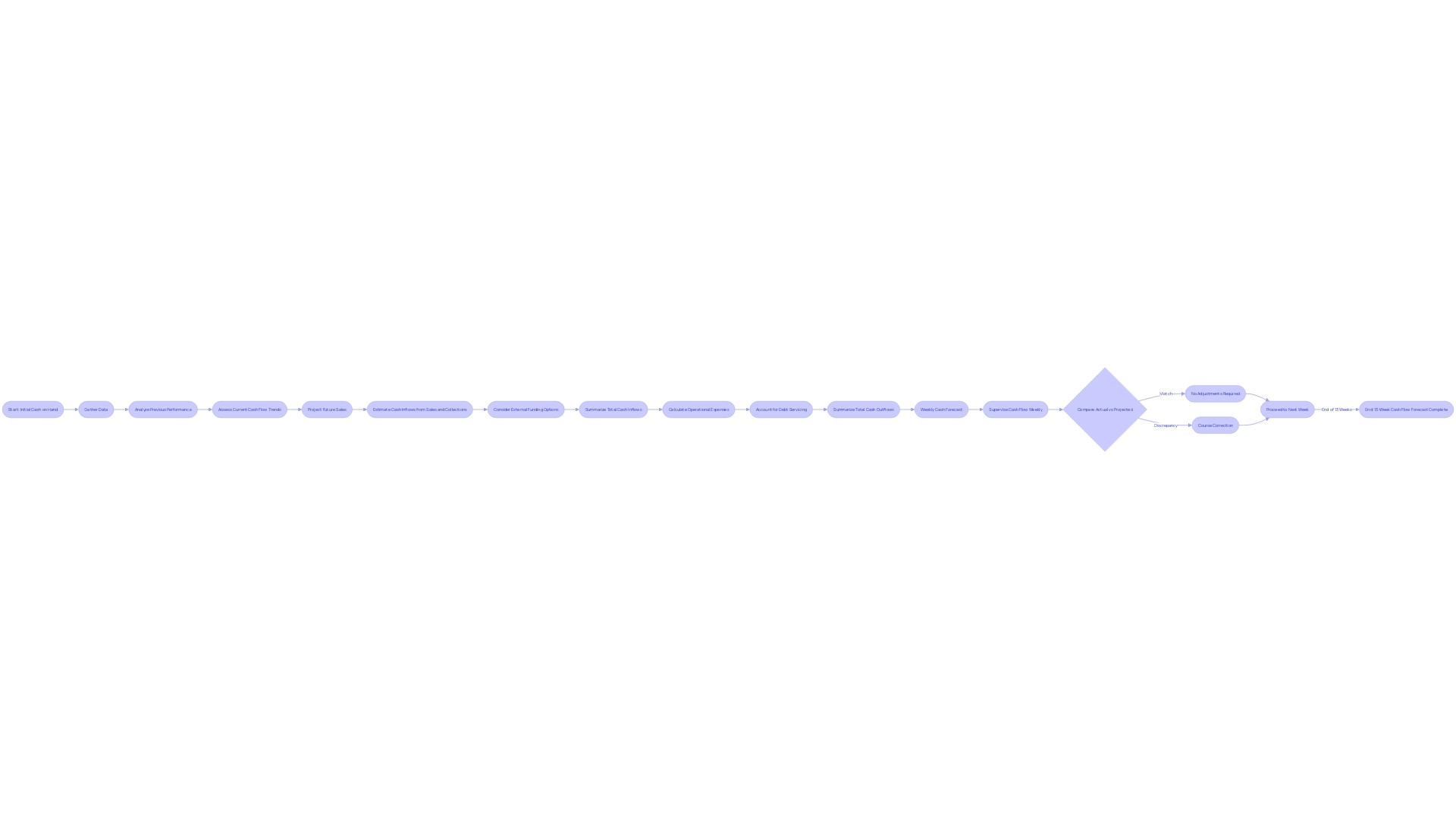

To establish a 13-week cash flow forecast, follow this comprehensive guide for precision and efficacy:

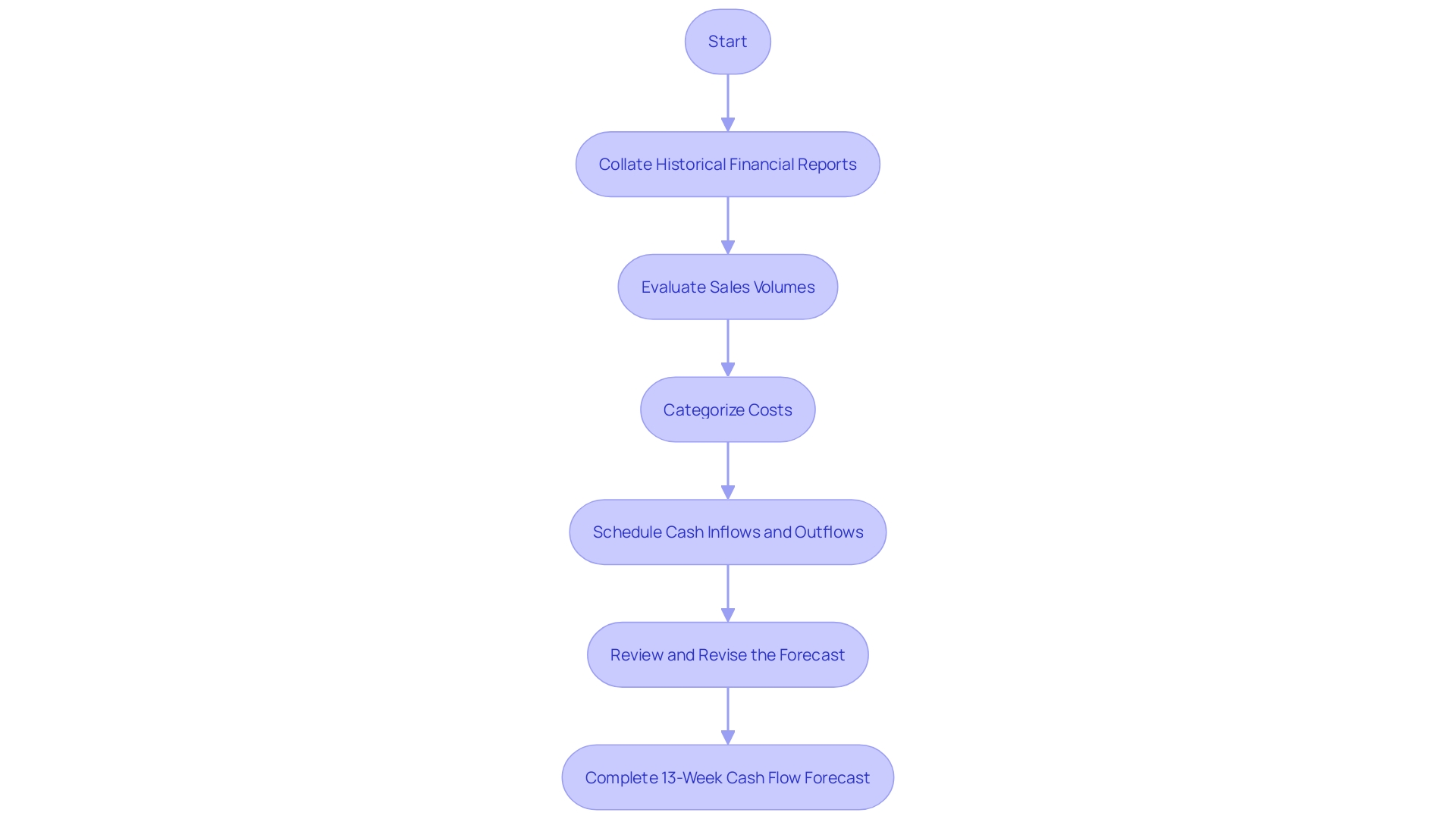

- Collate and assess historical financial reports, exploring balance sheets, income statements, and statements of cash flows to discern cash flow patterns and tendencies.

- Partner with the sales team to evaluate anticipated sales volumes and pricing strategies, which are pivotal to predicting cash inflows.

- Categorize both fixed and variable costs that the business consistently faces—such as payroll, utilities, inventory outlays, and rent—based on their occurrence and regularity.

- Schedule anticipated cash inflows and outflows in line with sales estimates and expenditure timelines, taking into account fluctuations due to seasonal trends.

- For each week, determine anticipated cash reserves, commencing with the opening balance and adjusting for each period’s expected cash movements.

- Thoroughly review the forecast to validate its soundness. Collaborate with finance personnel and department leaders to refine the forecast with their insights.

- Continuously supervise and revise the forecast to account for any new developments affecting sales estimates, costs, or other factors that may influence cash flow.

By diligently abiding by this process, CFOs can ensure a robust cash flow management system, safeguarding their businesses against potential liquidity challenges and facilitating informed decision-making.

Conclusion

In conclusion, mastering cash flow forecasting through a 13-Week Cash Flow Forecast is vital for long-term success. It offers agility, aids in resource allocation, and prevents shortages. Timely insights enable proactive, informed decisions.

Effective cash management boosts profitability, productivity, and reduces costs. Advanced tools like AI and machine learning streamline cash flow processes for real-time adjustments.

A 13-Week Cash Flow Forecast gauges liquidity, predicts variances, informs decision-making, and communicates with stakeholders. Robust forecasting optimizes financial management and bolsters competitiveness.

Key components include cash on hand, inflows, and outflows. Methodical construction and diligent supervision counter unforeseen shifts, supporting financial health and growth.

Creating a forecast entails evaluating reports, sales volumes, costs, scheduling, and continuous revision. This ensures a robust system for CFOs, safeguarding against challenges and facilitating informed decisions.

Mastering cash flow forecasting is essential for financial health and growth in today's business landscape.

Start optimizing your cash flow and ensure long-term success for your business today!