Introduction

The accounts payable cycle is a vital component of a company's financial operations, encompassing the management and recording of liabilities. From receiving invoices to executing payments, this systematic process requires meticulous attention to detail and compliance with financial standards. In this article, we will explore the key steps in the accounts payable process, the importance of invoice receipt and verification, efficient data entry and coding practices, the significance of approval and authorization, the evolving landscape of payment processing, the various payment methods and options available, the role of reconciliation and reporting in maintaining financial health, tools and software for managing accounts payable, best practices for optimizing the accounts payable cycle, common challenges and solutions in accounts payable, and resources for further reading.

By understanding and implementing these concepts, businesses can enhance their financial stability, streamline operations, and build strong vendor relationships.

What is the Accounts Payable Cycle?

The accounts payable cycle is a pivotal element in a business's financial operations, playing a meticulous role in managing and recording liabilities. This systematic process begins when invoices are received from vendors and suppliers; it then progresses through a series of critical stages including verification, approval, and culminates in the execution of payments. Efficient handling of this cycle is not merely about paying bills; it's about safeguarding the financial health and compliance of a company.

With each invoice, an accounts payable clerk is entrusted with the responsibility of ensuring accurate and timely processing, which is vital for maintaining robust expense management and reporting. This attention to detail extends beyond the numbers to encompass financial compliance and the management of vendor relationships. Keeping a keen eye on financial transactions, these clerks contribute significantly to small businesses by upholding financial stability and integrity.

Through their expertise, accounts payable clerks navigate the intricate requirements of financial operations, embodying the strategic vigilance necessary to fortify a business's financial framework. They are key players in ensuring that the company not only meets its obligations but also maintains a harmonious rapport with its suppliers, reinforcing trust and reliability in the business ecosystem.

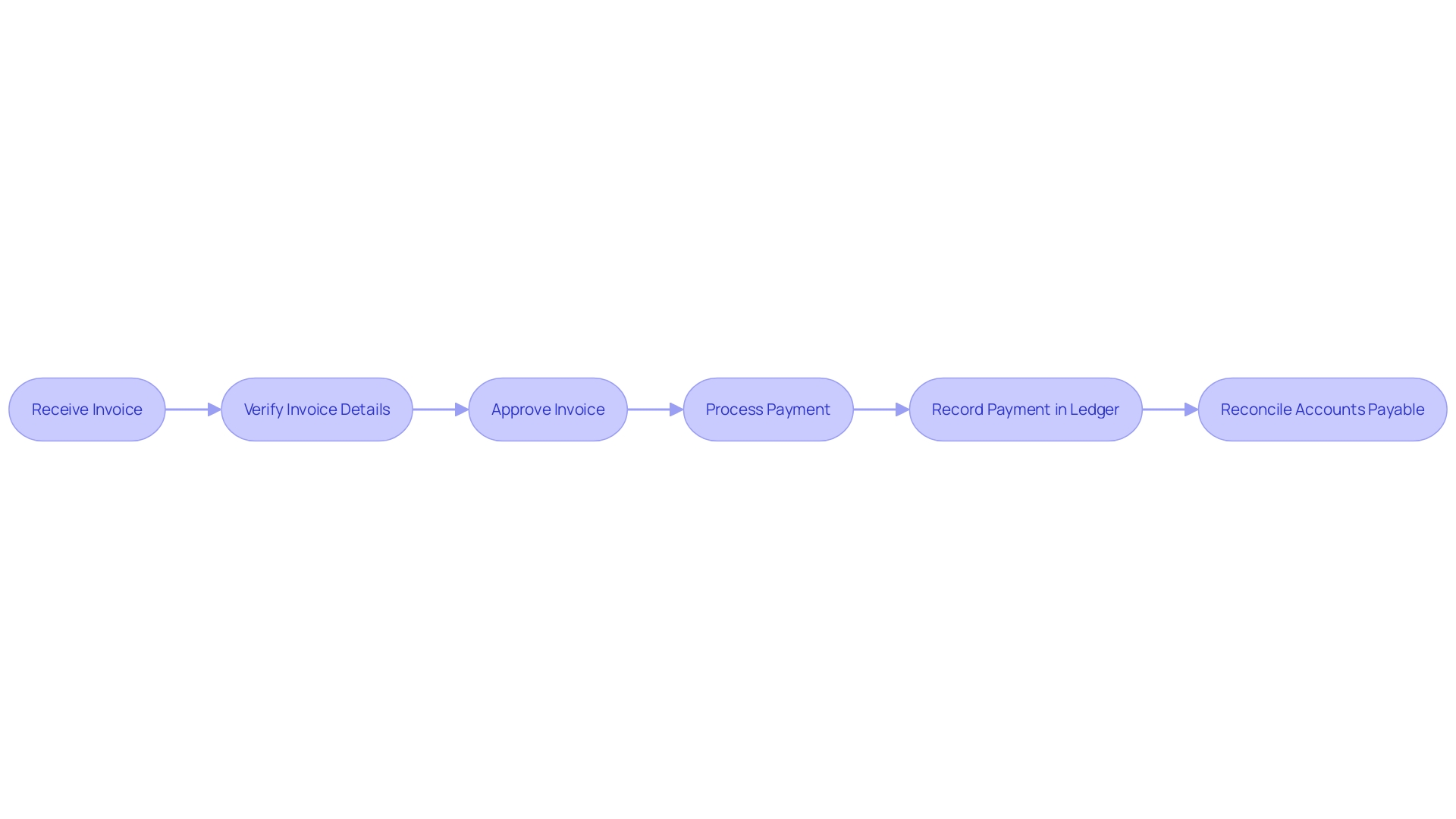

Key Steps in the Accounts Payable Process

Understanding the accounts payable cycle is fundamental to managing business finances effectively. This cycle encapsulates the entire process from when a purchase is made to the final payment of the bill. It's more than just paying off what you owe; it's about streamlining operations, capturing early payment discounts, avoiding late fees, and maintaining robust vendor relationships.

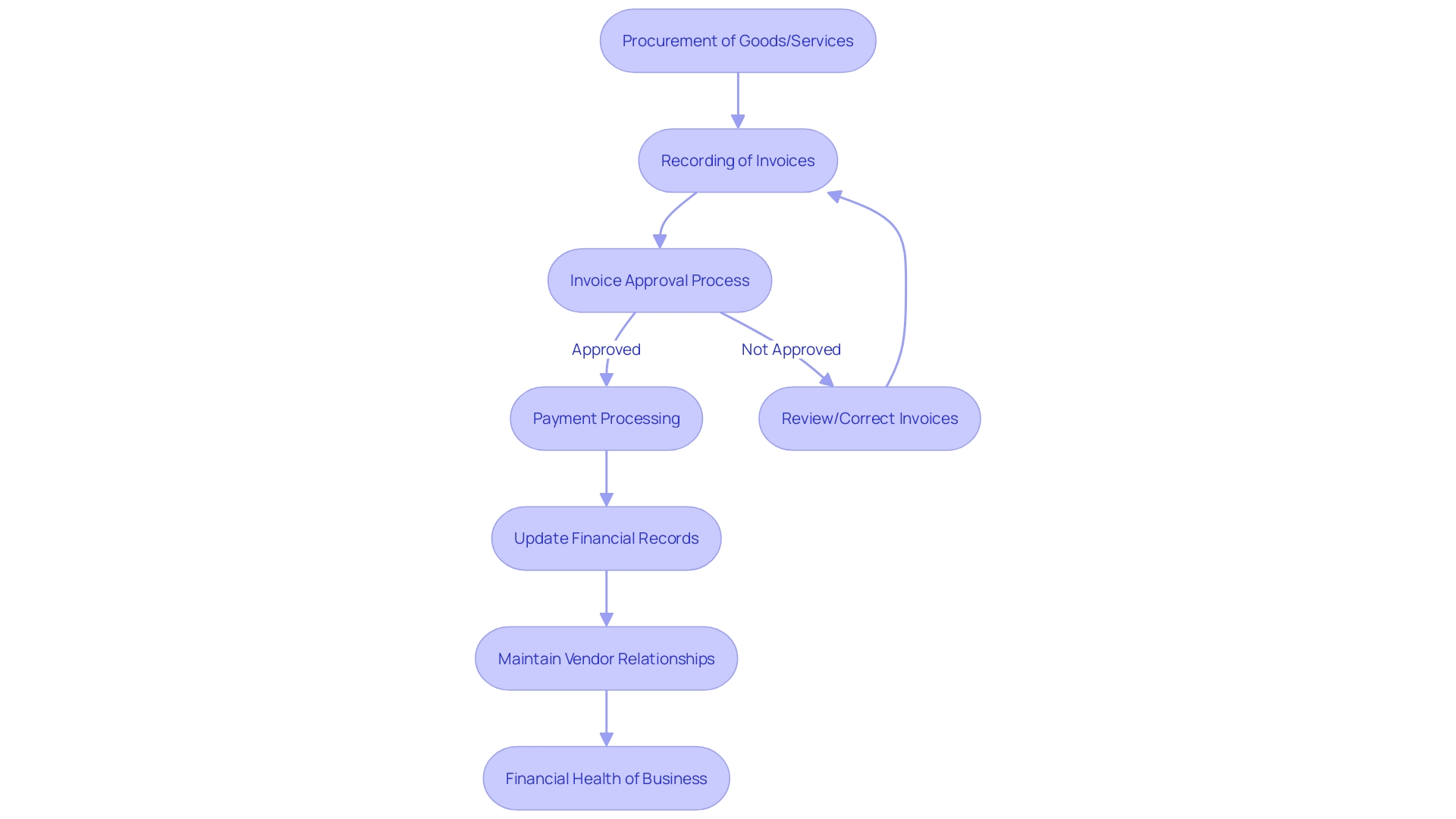

The accounts payable cycle begins with the procurement of goods or services and continues through to the recording of the liability in the books. Once an invoice is received, it undergoes verification for accuracy, and the details are entered into the accounting system. This meticulous recording ensures that expenditures are tracked, and financial statements remain accurate, which is imperative for internal analysis and compliance with regulatory standards.

After recording the invoice, the next step is the approval process. Depending on a company's internal controls, this might involve multiple levels of authorization to ensure the expenditure aligns with the company's budget and policies. A well-structured approval workflow can prevent unauthorized purchases and help maintain fiscal discipline.

Payment processing is the final stage. Here, the accounts payable department schedules payments based on due dates and available discounts. Timely payments foster trust and can lead to better terms with suppliers.

However, late payments can damage vendor relationships and lead to additional costs. Therefore, an efficient accounts payable cycle contributes significantly to the overall financial health of a business.

In a nutshell, the accounts payable cycle is critical for maintaining accurate financial records, managing cash flows, and building strong vendor relations — all of which are key to the sustainability and growth of any enterprise.

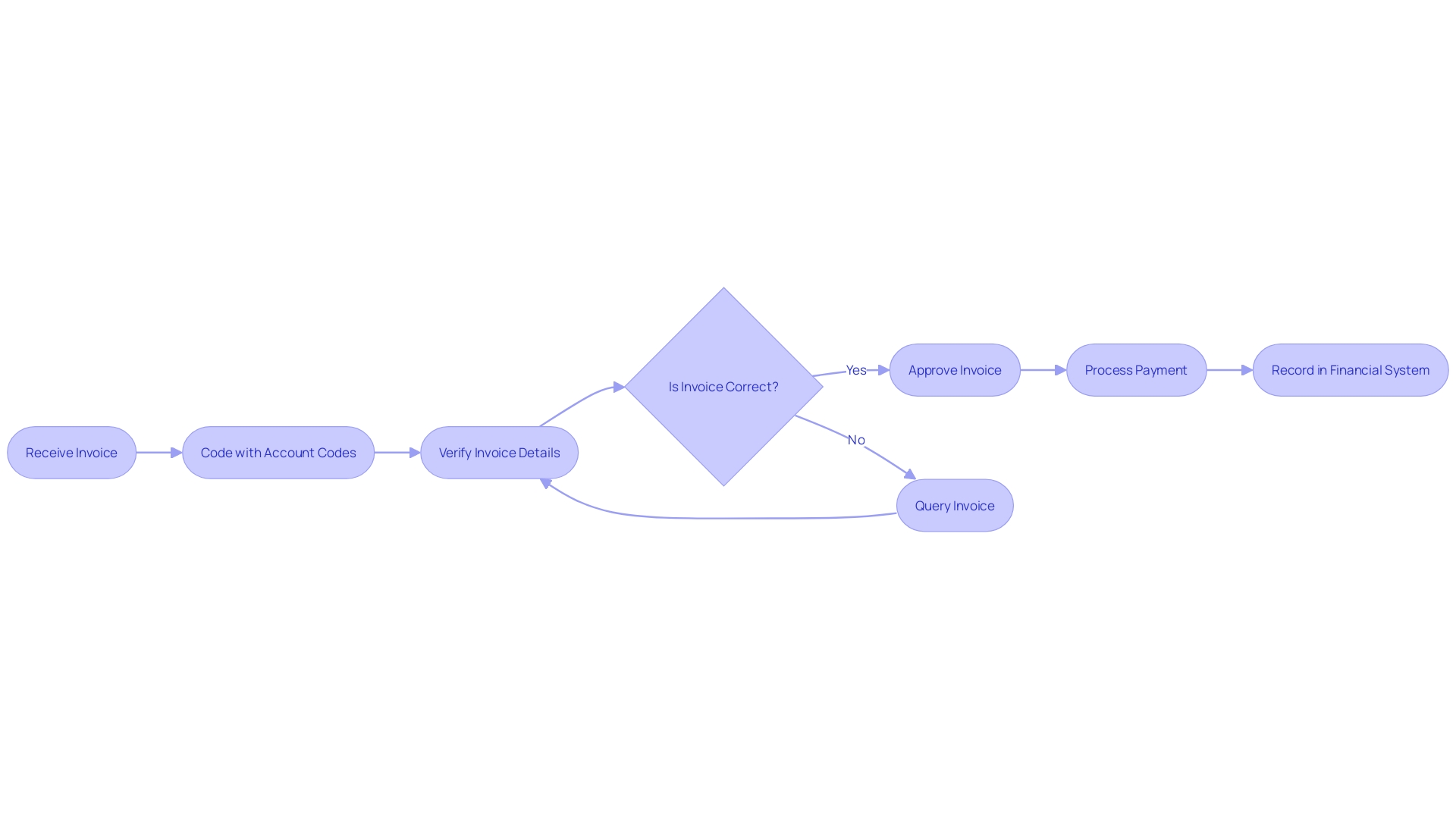

Invoice Receipt and Verification

The process of scrutinizing vendor invoices for precision is more than just a clerical task; it's an integral part of maintaining a company's financial integrity. Invoices are not merely requests for payment; they are detailed records that itemize the provision of goods or services, stating the amount due and the payment deadline. By thoroughly checking each invoice against the delivered goods or services, businesses can avoid discrepancies that might later complicate financial statements or lead to disputes.

This meticulous validation ensures every transaction is transparent and accounted for, reflecting accurate financial data—a cornerstone of solid business practices. Moreover, with the evolution of digital solutions, this process is increasingly streamlined, reducing the manual burden on accounting teams and enabling more timely financial reporting.

Data Entry and Coding

Efficiently processing invoices is crucial for maintaining accurate financial records. Each invoice must be carefully coded with the correct account codes, ensuring that every financial transaction reflects the true nature of the expense. This meticulous approach to data entry is not just about keeping the books in order; it's a critical step in painting an accurate picture of a company's financial health.

Think of it as translating the complex financial story of a business into a language that all stakeholders can understand. With the right software, this process can be streamlined, allowing for real-time tracking and analysis, and ultimately, more informed decision-making.

The importance of such precision in financial data entry cannot be overstated. Small businesses in particular have felt the strain of outdated accounting systems that fail to capture the nuances of modern transactions. Innovative solutions, like those developed by Digits, address these challenges head-on by working closely with accountants to create tools that are both powerful and user-friendly.

The goal is to bridge the gap between the rich data available to product-engineering teams and the often outdated financial reports that executives rely on.

Moreover, the evolving financial standards, such as the recent proposals by the Financial Accounting Standards Board, emphasize the need to adapt to the changing landscape of software capitalization and expense reporting. As these rules are set to affect virtually every company, the way we enter, track, and analyze software costs is being revolutionized. Data entry clerks are at the forefront of this transformation, ensuring that every dollar spent on software is accounted for accurately and transparently.

The role of data entry in cost accounting is similarly crucial. By properly categorizing expenses and understanding the flow of funds, businesses can see not just the depletion of cash but the assets they gain, like the acquisition of a laptop from the reduction of bank funds. It's a tangible illustration of how effective data entry isn't just about record-keeping; it's about storytelling and ensuring that every financial narrative is complete, from the granular details of a credit card statement to the broader strokes of a cash-flow statement.

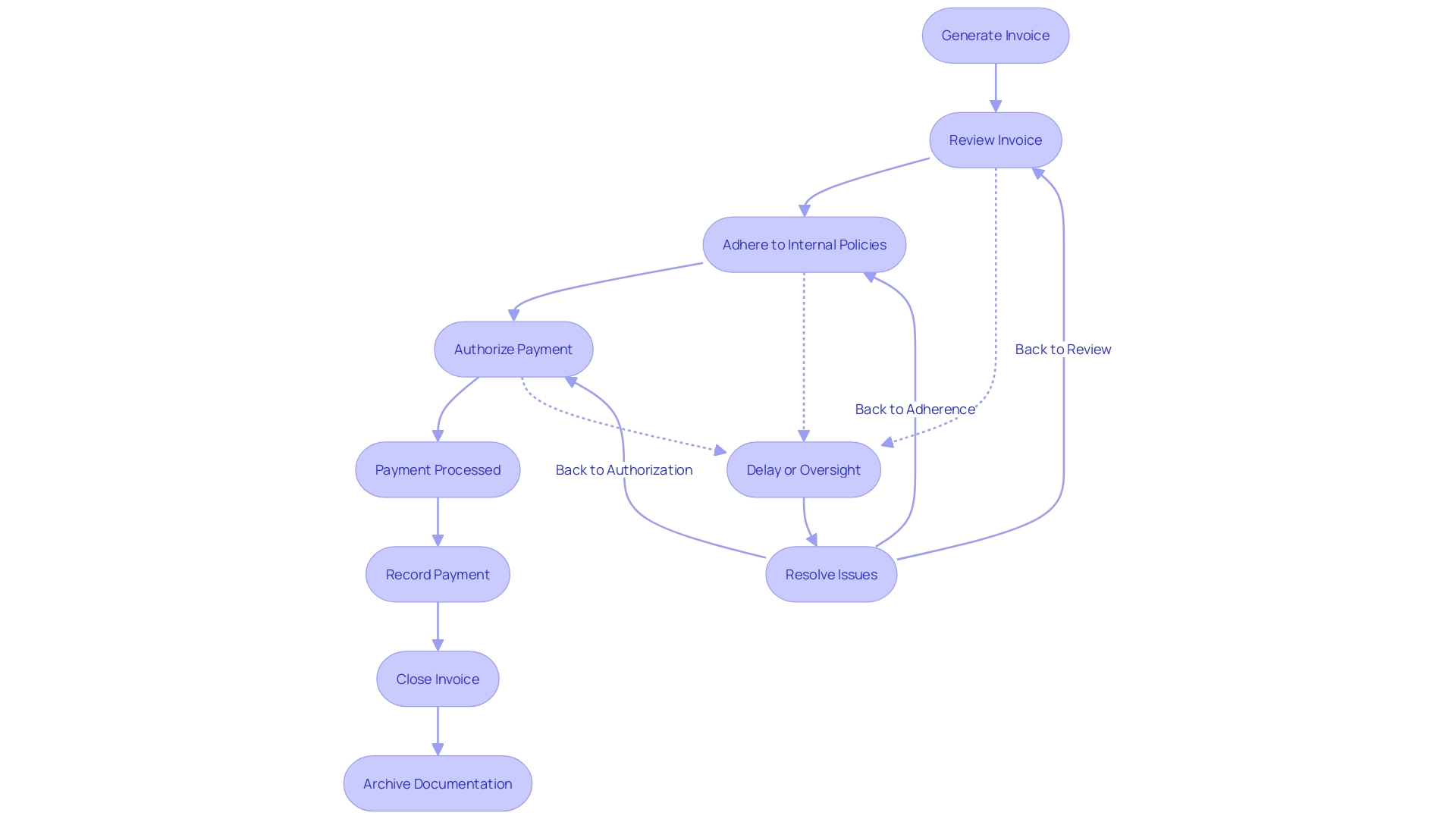

Approval and Authorization

In the intricate dance of financial management, invoices play a pivotal role, akin to the precise steps of a well-rehearsed ballet. Once an invoice is generated, it must gracefully navigate the approval process, a rigorous review conducted by authorized personnel. This review is not merely a formality but a critical examination to ensure alignment with the company's established financial governance.

The authorization of an invoice is contingent upon its adherence to internal policies, akin to a chef's adherence to a prix fixe menu, ensuring every dish meets the exacting standards of culinary excellence and consistency.

Within this process, the attention to detail is paramount, as even minor oversights can lead to delays in payment, much like a misplaced order in a bustling restaurant can lead to dissatisfaction. As such, clarity and precision in invoicing are essential, with explicit requirements such as correct billing office information and adherence to the Prompt Payment Act's stipulations. Similarly, in line with the recent proposal from the Financial Accounting Standards Board, there's a movement towards greater transparency and standardization in reporting software costs, reflecting the evolving landscape of financial practices.

This meticulous scrutiny and authorization process is not only about compliance but also about safeguarding the company's financial health. The act of balancing an invoice on the books, deciding whether to capitalize or expense costs, echoes the broader principles of cost accounting—where every financial decision is a deliberate step towards achieving fiscal harmony and operational efficiency.

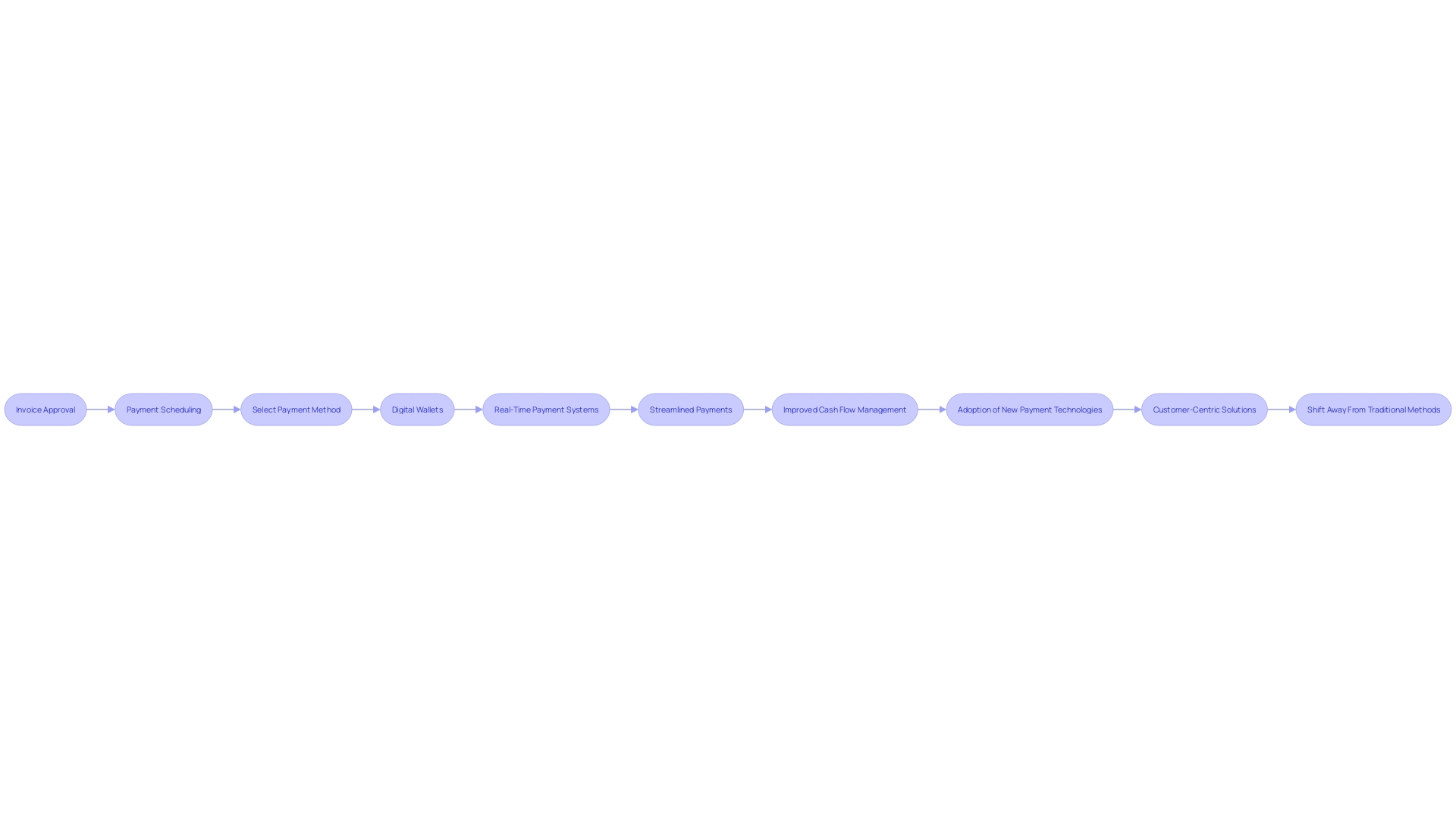

Payment Processing

As financial technologies evolve, the payment processing landscape is continuously advancing, offering more efficient and secure methods for handling transactions. Once an invoice receives approval, it's critical to navigate this dynamic environment by meticulously planning payment schedules and selecting the most suitable payment method.

Digital wallets and real-time payment systems, for instance, are at the forefront of this transformation, streamlining the way payments are conducted, from the moment they are initiated to the instant they are received. Such technologies not only enhance the user experience but also significantly improve cash flow management by facilitating instant transfers.

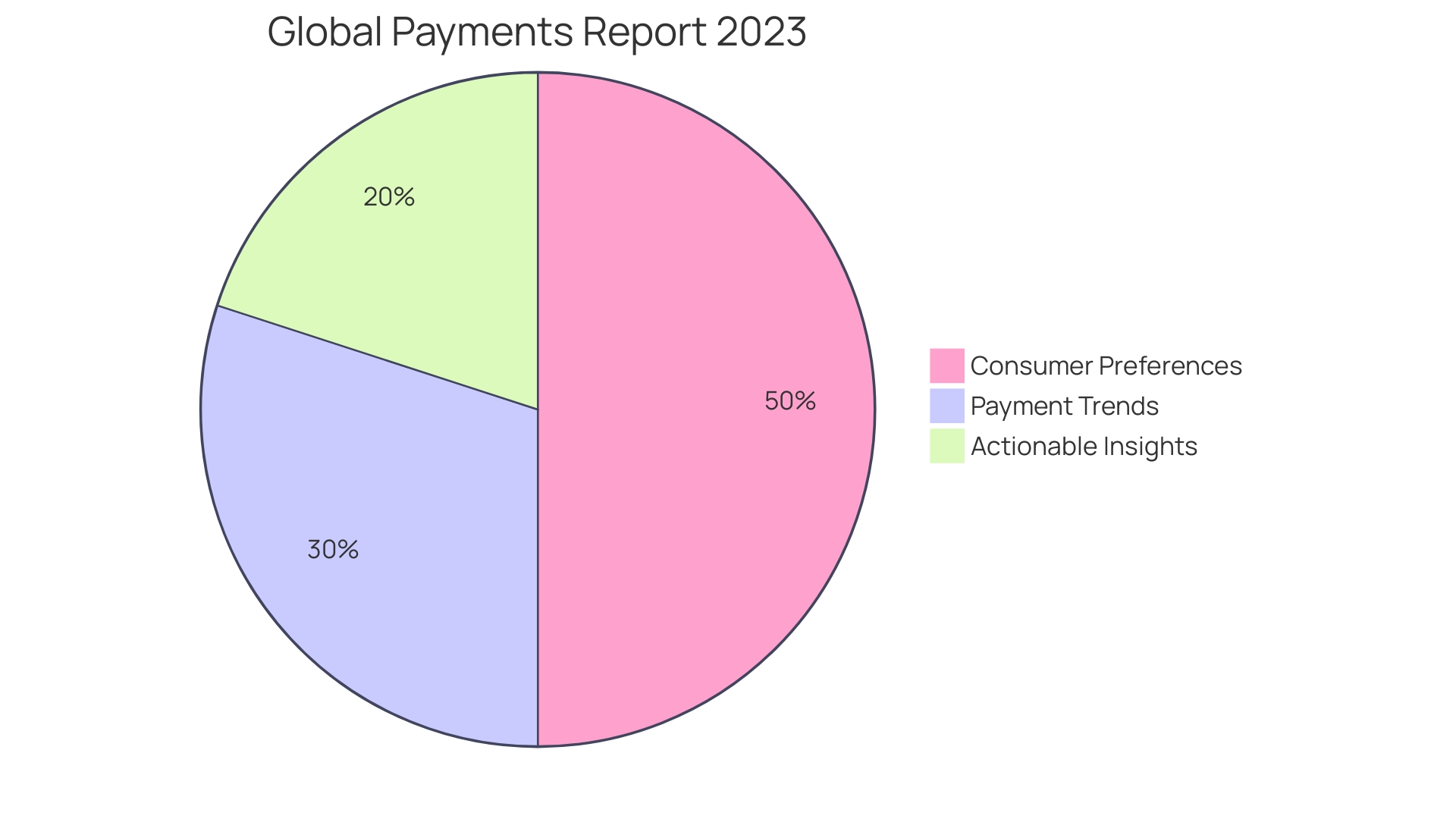

Leveraging these innovative solutions is becoming increasingly vital. The Global Payments Report 2023 underscores the rapid pace at which new payment technologies are being adopted, highlighting that understanding consumer preferences at the checkout is essential for business growth and entry into new markets.

To illustrate, PayPal's journey from its inception in Palo Alto to managing over 1 million transactions a day is a testament to the importance of scalable infrastructure in payment processing. Similarly, Stripe's integration into existing systems demonstrates the significance of customer-centric payment solutions that revolve around providing the best possible experience.

These advancements signal a departure from traditional methods like cash and checks, as noted in recent news, paving the way for a future where transactions are not only faster and more convenient but also integrated with enhanced security measures. As we embrace these changes, it's clear that the way we process payments is fundamentally shifting, calling for an agile approach to keep pace with the evolving demands of the finance sector.

Payment Methods and Options

With the proliferation of digital technology, the landscape of payment methods has evolved dramatically. Checks, once a mainstay of business transactions, are being overshadowed by more modern alternatives. Electronic Funds Transfers (EFT) streamline the transaction process by directly managing the movement of funds between accounts, thus reducing the time and potential errors associated with manual processing.

Additionally, credit cards have solidified their position as a vital tool in the financial toolkit, offering convenience and security. These cards not only facilitate immediate purchases but also provide fraud protection and the ability to manage cash flow effectively.

The integration of systems like Stripe underscores a shift towards unification in payment processing. Stripe's comprehensive approach, which encompasses payment proposals, captures, refunds, reconciliation, and fraud analysis, caters to a customer-centric model. This unification is a reflection of the demand for seamless payment experiences, where customers' billing and tax information are efficiently managed for subscriptions and one-off transactions.

Moreover, the payment ecosystem is expanding to include a variety of cashless options, highlighted by the growth of debit cards, cash transfer apps, and virtual wallets. These methods are increasingly being preferred over traditional cash transactions, as noted by Lael Brainard, the former Vice Chair of the Board of Governors of the Federal Reserve System. This trend is part of a broader shift toward an infrastructure that supports the diverse financial tools required in today's economy.

As the Global Payments Report 2023 indicates, understanding these trends is crucial for businesses aiming to stay competitive and cater to consumer preferences across different markets.

In this dynamic environment, compliance becomes a critical consideration for businesses navigating the complexities of payment systems, as stated by Ivan Noskov, a lead partnership specialist at UTIP Technologies Ltd. Ensuring that payment platforms meet the requirements of acquiring banks and regulators is an essential part of maintaining smooth cash flow and providing clients with a comfortable experience. This attention to compliance and customer satisfaction is integral to the adoption and success of any payment method in the current financial landscape.

Reconciliation and Reporting

To maintain financial health and operational efficiency, businesses must ensure that their accounting practices are not only accurate but also reflective of their financial activities. Within the realm of accounting, the reconciliation of accounts payable with bank statements stands as a crucial task. By generating comprehensive reports, businesses can keep a meticulous track of their financial transactions, ensuring that every outgoing payment is accounted for and correctly reflected in the financial records.

This process is vital for small businesses, where the margin for error is slim and the consequences of discrepancies can be significant.

The software used in accounting has often been criticized for its lack of agility and real-time data processing. However, advancements in accounting technology, as highlighted by the experiences of companies like Digits, have brought to light the potential for software to revolutionize the way financial data is tracked and analyzed. Digits, for instance, emerged from a need for more immediate and insightful financial reporting, contrasting the traditional delayed and static financial documents.

A case in point is the insight from accountants who have worked with Digits, revealing the tedious and manual nature of their work and highlighting the importance of having detailed transactional data. Financial transactions on a credit card statement, for example, provide a mere snapshot of the date and amount owed, with critical details pertinent to accountants often missing. By reconciling accounts payable with bank statements and embracing innovative accounting solutions, businesses can avoid the pitfalls of outdated systems and gain a clearer, real-time picture of their financial standings.

In the world of accounting, where precision and detail are paramount, the distinction between bookkeeping and accounting becomes apparent. While bookkeeping lays the groundwork with systematic recording and organizing of a company's financial activities, accounting takes a step further by analyzing, interpreting, and reporting on the company's financial health. This deeper dive into the numbers is what enables businesses to strategize and make informed financial decisions.

The challenges faced by accountants in maintaining accurate records underscore the need for a seamless transition from traditional methods to more sophisticated, software-driven approaches. This transition not only simplifies the reconciliation process but also provides a platform for continuous financial oversight, a necessity in the dynamic environment of small business accounting.

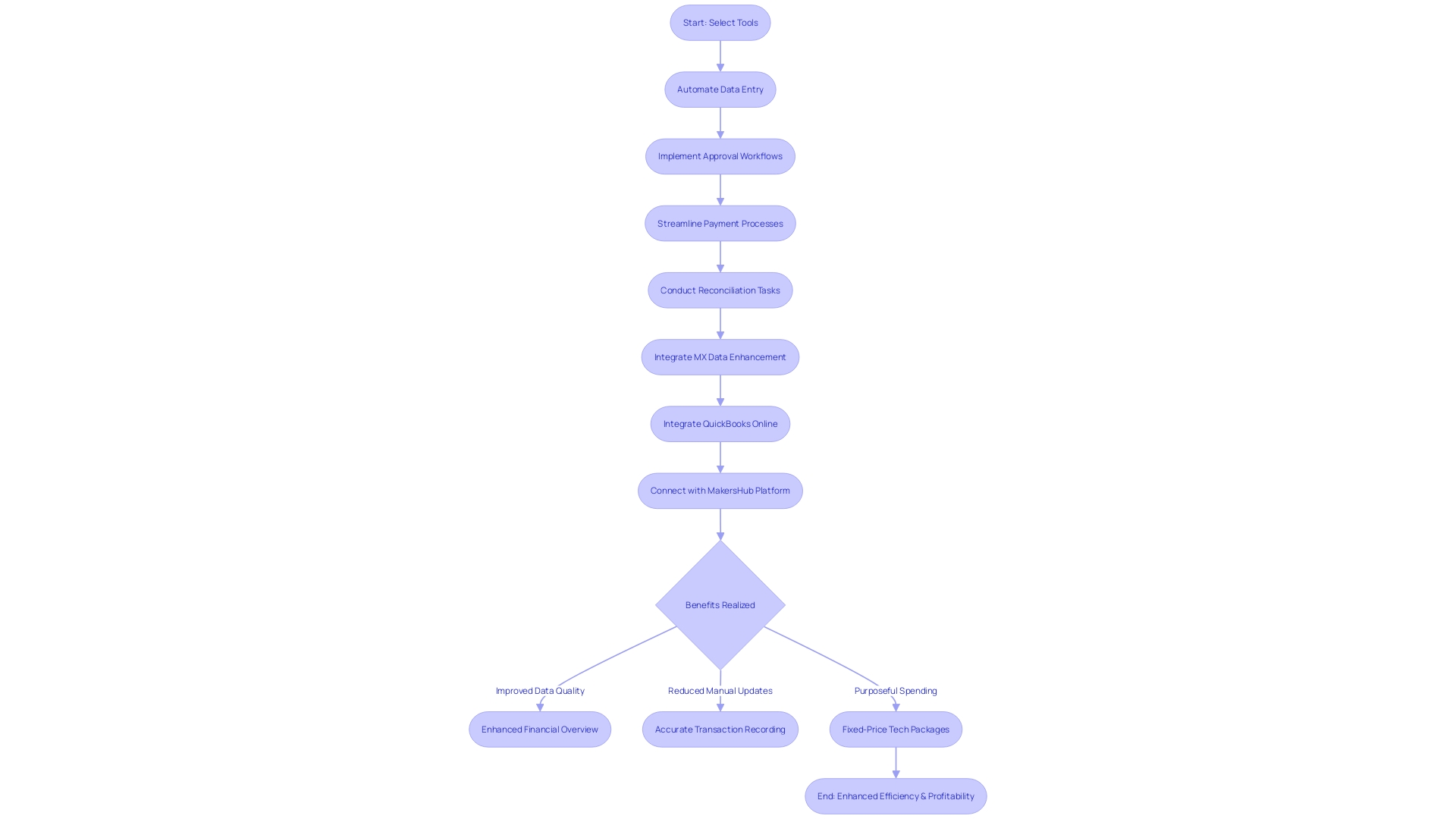

Tools and Software for Managing Accounts Payable

Selecting the right tools to enhance the accounts payable process can be a game-changer for businesses aiming to automate and streamline financial operations. Sophisticated software solutions are designed to handle the intricacies of accounts payable by taking over tasks such as data entry, managing approval workflows, executing payment processes, and simplifying reconciliation tasks.

For instance, MX Data Enhancement services elevate the quality of financial data, which is fundamental in making informed decisions and optimizing money experiences. Such enhancements are crucial when dealing with a variety of financial accounts spread across different institutions, ensuring a comprehensive and clear financial overview.

Moreover, QuickBooks Online, with its robust two-way integration with platforms like MakersHub, serves as a single source of truth. It automates the creation of vendors and items, thereby reducing the need to update information across multiple systems. QuickBooks Online's general ledger is at the core of its functionality, enabling the seamless recording of transactions through the double-entry bookkeeping system, which is vital for accuracy and adherence to accounting standards.

The benefits of these tools are not just theoretical. Case studies, like that of YNAB, which employs a zero-based budgeting system, demonstrate the practical advantages of purposeful spending and intentional financial management. Similarly, firms employing fixed-price technology packages find they can significantly boost efficiency while providing a curated set of services.

Ultimately, in an economic environment where inflation and interest rates pose significant challenges, leveraging technology to automate accounts payable not only enhances efficiency but can also contribute to the resilience and continued profitability of businesses.

Best Practices for Optimizing the Accounts Payable Cycle

Optimizing the accounts payable cycle is crucial for enhancing efficiency and achieving cost savings. Incorporating best practices such as reevaluating all expenditures and aligning them with strategic company goals can lead to more prudent financial management. Rather than indiscriminately cutting costs, a detailed examination of all budget aspects is essential, allowing for informed decisions on prioritizing spending that supports the organization's long-term objectives.

Case studies in various industries, from hospitality to healthcare, underscore the benefits of such optimization. For instance, a firm in the technology sector adopted a 'prix fixe' approach, offering a fixed price for a curated selection of services, which parallels the fixed menu concept in restaurants. This strategy not only streamlined their offerings but also enhanced their clients' operational efficiency.

Similarly, health systems, grappling with staffing challenges and the need for timely data, have turned to automation technologies to circumvent manual reporting and expedite processes. A physician organization, in particular, leveraged automation to consolidate weekly management reports that previously required extensive manual effort by several business analysts, thereby freeing up valuable resources.

Moreover, statistics from the Association for Financial Professionals indicate that 46% of organizations are transitioning from paper checks to electronic payments to support Straight Through Processing (STP), aimed at speeding up the remittance and settlement process. By integrating STP with digital Enterprise Resource Planning (ERP) systems, businesses can achieve a seamless payment workflow, reducing errors and enhancing efficiency.

In light of these insights, accounts payable clerks in small businesses play a pivotal role in managing expenses, ensuring financial compliance, and maintaining vendor relationships. Their contributions are vital to the financial health of the business, emphasizing the importance of their responsibilities in processing financial transactions accurately and promptly.

Common Challenges and Solutions in Accounts Payable

Navigating the complex terrain of accounts payable is crucial for maintaining streamlined financial operations and ensuring the stability of an organization's cash flow. A meticulous approach to managing accounts payable not only tightens financial controls but also enhances relationships with vendors. Successful strategies involve a keen eye for detail and a comprehensive understanding of financial intricacies.

For instance, precise naming conventions in accounts are paramount, as exemplified by a software-based startup's approach to structuring single-member LLC accounts. Duplication of these accounts for each member, with appropriate terminology adjustments (e.g., 'Owner' to 'Member' or 'Shareholder'), facilitates clear communication with CPAs.

Moreover, adopting a zero-based budgeting system, akin to the method employed by YNAB, can revolutionize expense management. By assigning each dollar a specific role, businesses can foster intentional spending, proactive savings, and generous contributions. The challenge lies in consolidating financial information from various institutions to gain a complete financial picture.

To bolster financial health, accounts payable clerks play a pivotal role. Their duties encompass the precise processing of transactions, which contributes to effective expense management and compliance with financial regulations. The qualifications for this role extend beyond basic financial skills to encompass a deep understanding of reporting, strategic planning, and risk management.

In the face of economic pressures, automation proves to be a formidable ally. Hershey's experience serves as a testament to the transformative power of automating the accounts receivable process. Despite struggles with sales and supply chain inefficiencies, Hershey's resurgence was fueled by the adoption of automation solutions and online channels, leading to improved cash flow and market position.

Small business owners resonate with this need for financial agility, as evidenced by a study revealing that 85% of them prioritize cash flow, with nearly half impacted by inflation. The pursuit of financial resilience is relentless, with some owners sacrificing their paychecks and struggling to pay bills. This underscores the importance of a strategic approach to accounts payable, which can mitigate the impacts of inflation and unpredictable supply chains.

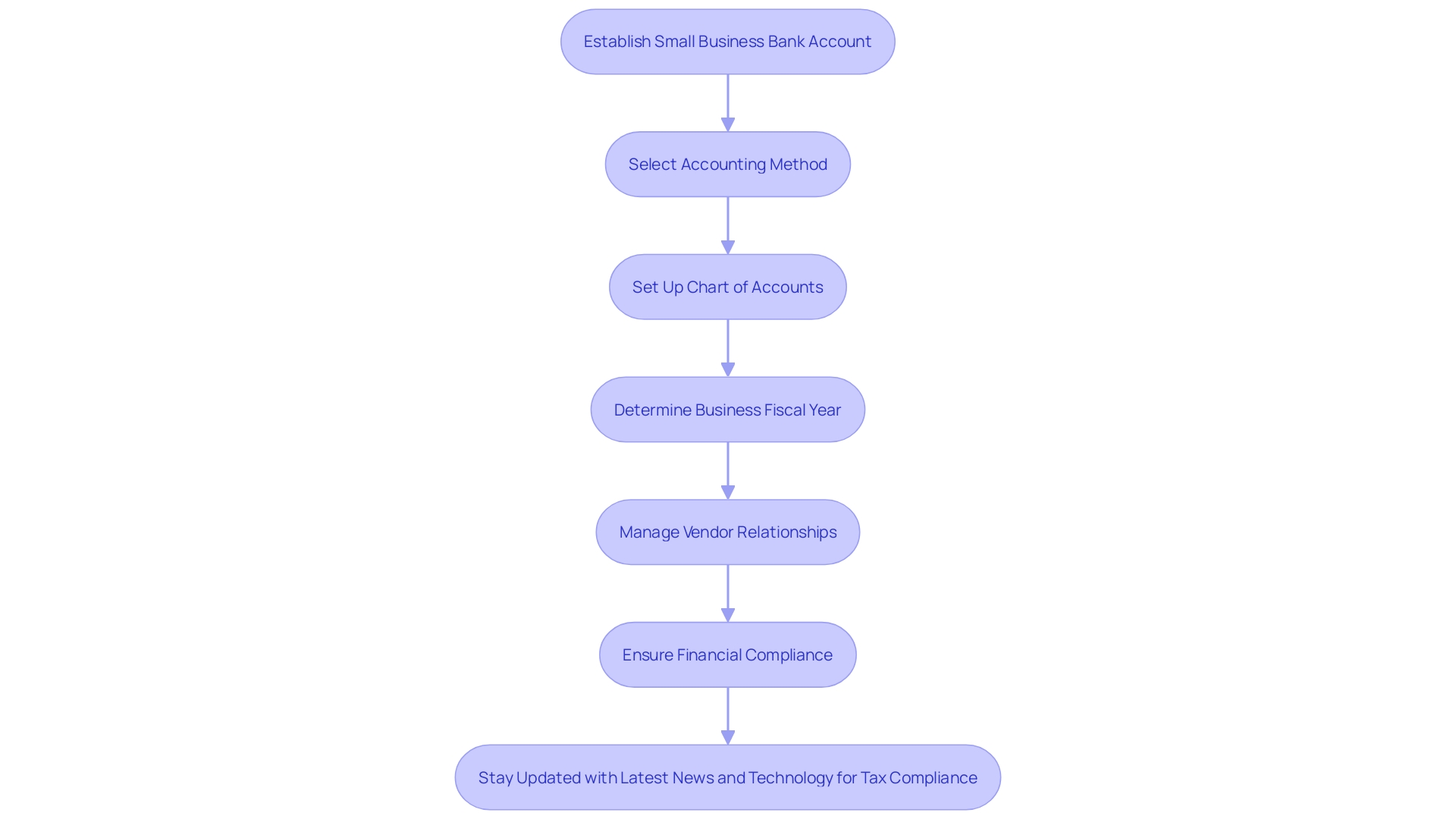

References and Further Reading

When considering resources for accounts payable knowledge enhancement, it's crucial to have a structured approach. Starting with a solid foundation in accounting practices is essential for any small business owner, which involves a series of foundational activities. First, you need to establish a small business bank account to separate your business and personal finances.

This separation is particularly beneficial when tax-filing time arrives, allowing you to accurately claim eligible business expenses.

To set up this account, you'll generally require specific documentation like an Employer Identification Number (EIN) or a Social Security number if you're a sole proprietor. In some cases, a business license might also be necessary. Once your bank account is operational, you can move on to selecting an accounting method (cash or accrual), setting up a chart of accounts, and determining your business's fiscal year.

As for the accounts payable role in a small business, it encompasses more than just processing financial transactions. It plays a pivotal part in managing vendor relationships, ensuring financial compliance, and contributing to the overall financial health of the company. For those managing software-based startups or Llcs, terminology might differ, but the essence of precise communication with your CPA remains the same.

Make use of accounts labeled by numbers to facilitate clarity in discussions.

Moreover, tools like YNAB, which utilizes a zero-based budgeting system, can aid small businesses in becoming more intentional about their spending. YNAB not only provides budgeting assistance but also offers a plethora of resources, such as workshops, videos, podcasts, and articles, to foster better financial management.

Lastly, staying abreast of the latest news, such as updates from the IRS regarding reporting requirements or new technology to streamline tax compliance, can also be beneficial. These insights help maintain financial controls and support compliance efforts, ensuring that your small business is on the right track financially.

Conclusion

The accounts payable cycle is a critical component of a company's financial operations. Efficient handling of this process enhances financial stability, streamlines operations, and builds strong vendor relationships.

Key steps in the accounts payable process include invoice receipt and verification, data entry and coding, approval and authorization, payment processing, and reconciliation and reporting. Each step plays a vital role in maintaining accurate financial records, managing cash flows, and fostering trust with suppliers.

Digital solutions streamline invoice receipt and verification, reducing manual burden and enabling timely financial reporting. Accurate data entry and coding practices provide a clear picture of a company's financial health. Innovative software solutions revolutionize the tracking and analysis of software costs.

The approval and authorization process ensures financial compliance and safeguards the company's financial health. Attention to detail and precision in invoicing are essential for timely payments and fiscal discipline. Payment processing methods are continuously advancing, offering more efficient and secure options.

Reconciliation and reporting are vital for financial health and operational efficiency. Comprehensive reports and innovative accounting solutions provide real-time insights. Selecting the right tools and software enhances the accounts payable process, automating and streamlining financial operations.

Optimizing the accounts payable cycle involves reevaluating expenditures, aligning them with strategic goals, and adopting best practices. Automation, electronic payments, and Straight Through Processing (STP) enhance efficiency and reduce errors.

Accounts payable clerks play a pivotal role in managing expenses, ensuring financial compliance, and maintaining vendor relationships. Resources for further reading include establishing a solid foundation in accounting practices, using tools for intentional spending, and staying updated with the latest news and technology advancements.

By implementing these concepts, businesses can enhance their financial stability, streamline operations, and build strong vendor relationships. The accounts payable cycle is critical for maintaining accurate financial records, managing cash flows, and supporting the overall financial health of a business.