Introduction

Understanding how efficiently a company manages its cash flow and pays off its suppliers is crucial for any CFO. The accounts payable turnover ratio serves as a crucial barometer in this regard, revealing the rate at which a company settles its debts with suppliers. A higher turnover rate suggests effective management of accounts payable and strong relationships with vendors, while a lower ratio may indicate potential cash flow issues or a tendency to delay payments.

Interpreting this metric within industry norms and credit terms is essential. In this article, we will explore the importance of accounts payable turnover, how to calculate it, factors affecting it, best practices for improving it, common mistakes to avoid, and real-world examples to bring the concepts to life. By delving into these topics, CFOs can gain practical insights and actionable strategies to optimize their accounts payable turnover and ensure the financial health and operational stability of their organizations.

What is Accounts Payable Turnover?

Understanding the frequency and efficiency with which a company settles its debts with suppliers is crucial. The accounts payable turnover ratio acts as a crucial barometer in this regard, indicating how efficiently a firm manages its cash flow and pays off its vendors within a given period. For the uninitiated, accounts payable represents money owed to suppliers and creditors – an inevitable aspect of most business operations.

As a measure of short-term liquidity, this ratio reveals the rate at which a company pays off its suppliers. A higher turnover rate may suggest effective management of accounts payable and good relationships with vendors by ensuring timely payments. Conversely, a lower ratio might indicate potential cash flow issues or a tendency to delay payments, which could strain supplier relations.

Interpreting this metric within the context of industry norms and the company's credit terms is essential. For instance, businesses with operations akin to Delivery Hero's vast employee infrastructure and the complexities of digital access management require diligent cash flow analyses to maintain uninterrupted operations. And as observed with the technical integration challenges of complex systems where different platforms struggle to communicate, like the issues faced by the council described by Mehmet Kaynakci, financial systems also necessitate seamless operation and interaction to optimize the accounts payable process.

Furthermore, recent events in print media, as well as the challenges encountered by the People and Money IT system at a university, underscore the importance of adept cash management. These cases, involving outstanding invoices and system backlogs, highlight how crucial managing accounts payable is to an organization's financial health and operational stability.

The essential duty of processing vendor invoices promptly, one of the core responsibilities of an accounts payable clerk, can't be overstated. This duty directly contributes to the financial health of a small business by ensuring financial compliance, controlling expenses, and fostering strong vendor relationships through timely payments.

Why is Accounts Payable Turnover Important?

Accounts payable turnover, far from being a mundane metric, emerges as a crucial cog in the financial machinery of a business. It not only serves as an indicator of liquidity but also offers a clear lens into the efficiency of vendor interactions. The turnover rate can preemptively reveal cash flow predicaments, allowing businesses to address these issues proactively rather than reactively.

Such financial diligence ensures the maintenance of a pulsating fiscal health, acting as a gauge to compare against the heartbeat of industry standards. In essence, monitoring this rate is not mere bookkeeping—it's a strategic move for astute businesses to stay afloat in the tumultuous sea of market competition.

How to Calculate Accounts Payable Turnover

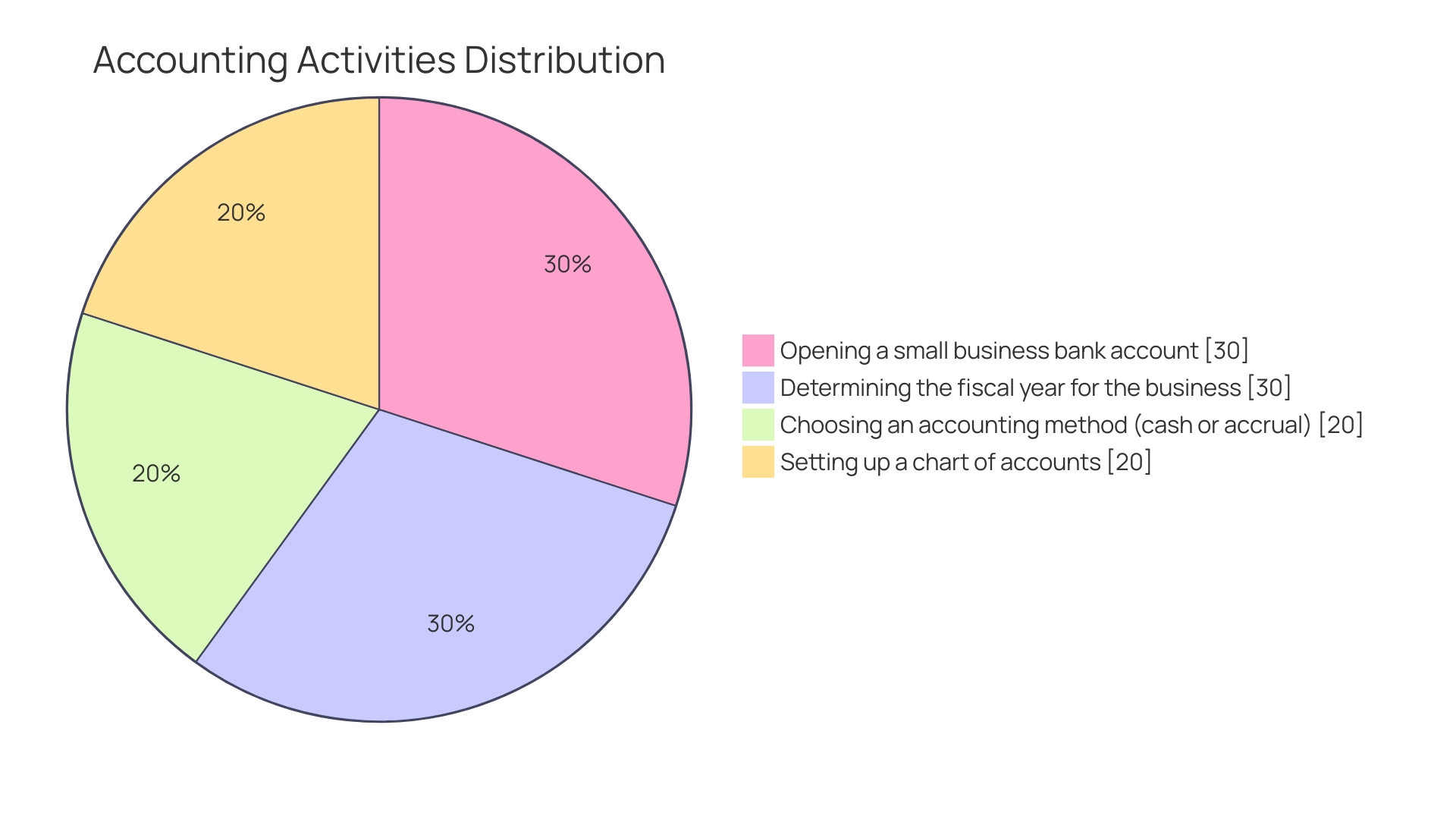

To discern the efficiency of your company's trade credit management and payment processes, an integral metric is the accounts payable turnover ratio. By leveraging the equation, Accounts Payable Turnover = Cost of Goods Sold / Average Accounts Payable, you gain insights into the frequency of settling payable accounts within a given timeframe. Start by calculating the average accounts payable balance—simply add the initial and concluding balances of the period and halve the sum.

Armed with the average balance and the COGS, compute the ratio to determine the agility of your payment mechanisms.

Understanding every financial metric's impact on your business reminds us of the anecdote where governmental indecision led to unmonitored automated financial reports—highlighting the importance of diligent oversight. Similarly, envisioning financial transactions as account transfers crystallizes their impacts: spending on assets, like a laptop purchase subtracted from your bank account, doesn't equate to vanished funds; rather, it represents a value shift from cash to a tangible asset.

Upholding meticulous accounting practices offers multiple benefits. It provides a backbone for thriving business operations, pinpoints growth areas, and optimizes spending to prevent cash flow predicaments. Investment in proficient accounting equips you with the finesse to spearhead financial success, steering you well clear of stagnation.

The accounts payable clerk encapsulates this practice by overseeing transaction processes, ensuring financial compliance, and nurturing pivotal vendor relationships. Their scrupulous management and reporting contribute significantly to your organization's fiscal vitality, aligning with the essential steps for establishing a solid financial foothold outlined by accounting experts.

Interpreting Accounts Payable Turnover Ratio

The Accounts Payable Turnover Ratio provides insight into the frequency at which a company settles its debts with suppliers within a specific timeframe. When this ratio is higher, it suggests a frequent clearance of payable accounts, which may be indicative of a robust cash flow management strategy. On the flipside, a lower ratio could signal potential cash flow issues, such as delayed payments that could strain vendor relations and affect credit terms.

It's critical to benchmark this ratio against industry norms to put it into proper perspective.

For a tangible example, consider Monday.com's experience. The company's efficient growth trajectory and swift achievement of free cash flow positivity, even amidst slowing growth, is admirable. This signifies not only a strong command over operating margins but also exemplifies the importance of generating sufficient cash to reinvest in the business, extend the cash runway, and ultimately enhance shareholder value—all crucial indicators beyond mere revenue figures.

In understanding financial health, balance sheets and profit & loss statements (P&L) illuminate much about a business’s operations. Delve deeper, for instance, into the way hotel profitability is parsed through P&L statements, and you begin to see a clear depiction of income versus expenses, as well as the performance of various departments.

And at the crux of financial analysis are financial ratios—as tools that streamline complex data into actionable figures. They not only diagnose a company’s financial wellness but also provide a baseline for comparison with industry counterparts. Accounts payable turnover is one such metric that, when utilized alongside others, gives a clearer view of a company’s operational efficacy and cash management prowess.

To draw from the words of industry experts, comparability in financial reporting is paramount. Incomplete or inconsistent data can lead to suboptimal investment decisions, hence the emphasis on comparable and standardized financial metrics for informed capital allocation. The story woven by these figures often leads to significant business decisions, such as establishing strategies for profit optimization and ensuring the financial fortitude of a company.

Factors Affecting Accounts Payable Turnover

Optimizing the accounts payable turnover ratio is akin to fine-tuning the engine of a business's financial operations. It isn't just about speed; it's about efficiency and timing. Key factors that influence this ratio are multifaceted.

They include not only the strategic payment terms secured with suppliers but also the company's own liquidity status – ensuring resources are available when needed and not sitting unnecessarily idle. The tempo of the industry’s payment practices sets a backdrop against which a company's turnover is compared, while the organizational fiscal soundness looms over these elements, being both influenced by and influencing the ratio.

Having a clear-cut strategy for managing cash flow is paramount. Industry reports highlight that cash flow influences are substantial and varied, such as the challenges posed by slow-paying customers that widen the gap between receivables and payables, or the pressure from high fixed costs that are less flexible and responsive to changing economic demands. These factors can fiercely impact liquidity and cash resources.

The role of an accounts payable clerk is pivotal to navigating these pressures. By ensuring that expenses are managed effectively through accurate and timely invoice processing, careful expense reporting, and diligent maintenance of vendor relationships, the clerk helps maintain financial compliance, thereby safeguarding the organization's financial health.

A proactive approach, as advised by financial experts, encourages businesses to reevaluate all spending and prioritize accordingly without resorting to hasty cost reductions. This involves a comprehensive review of both income and expenses against the strategic backdrop of the company’s long-term objectives.

Effective cash management, underscored by case studies, remains a central pillar in securing an organization’s growth and sustainability. It requires a keen analysis of profitability and financial stance, perhaps via critical tools like a break-even analysis that identifies the point at which a business becomes profitable.

In an environment teeming with economic uncertainties, firms must adopt integrated strategies to manage accounts receivable (AR) risks, preventing them from building up to crisis levels. For instance, manufacturers with substantial upfront investments may face liquidity challenges due to their capital-intensive nature. However, innovative financing solutions offering risk protection and support for large credit lines could be the answer to unlocking growth opportunities.

In summary, effectively managing the accounts payable turnover ratio is not just about paying suppliers on time. It's about strategic financial operation, astute management of liquidity, and ensuring robust financial health amidst a landscape of industry practices and economic fluctuations.

Best Practices for Improving Accounts Payable Turnover

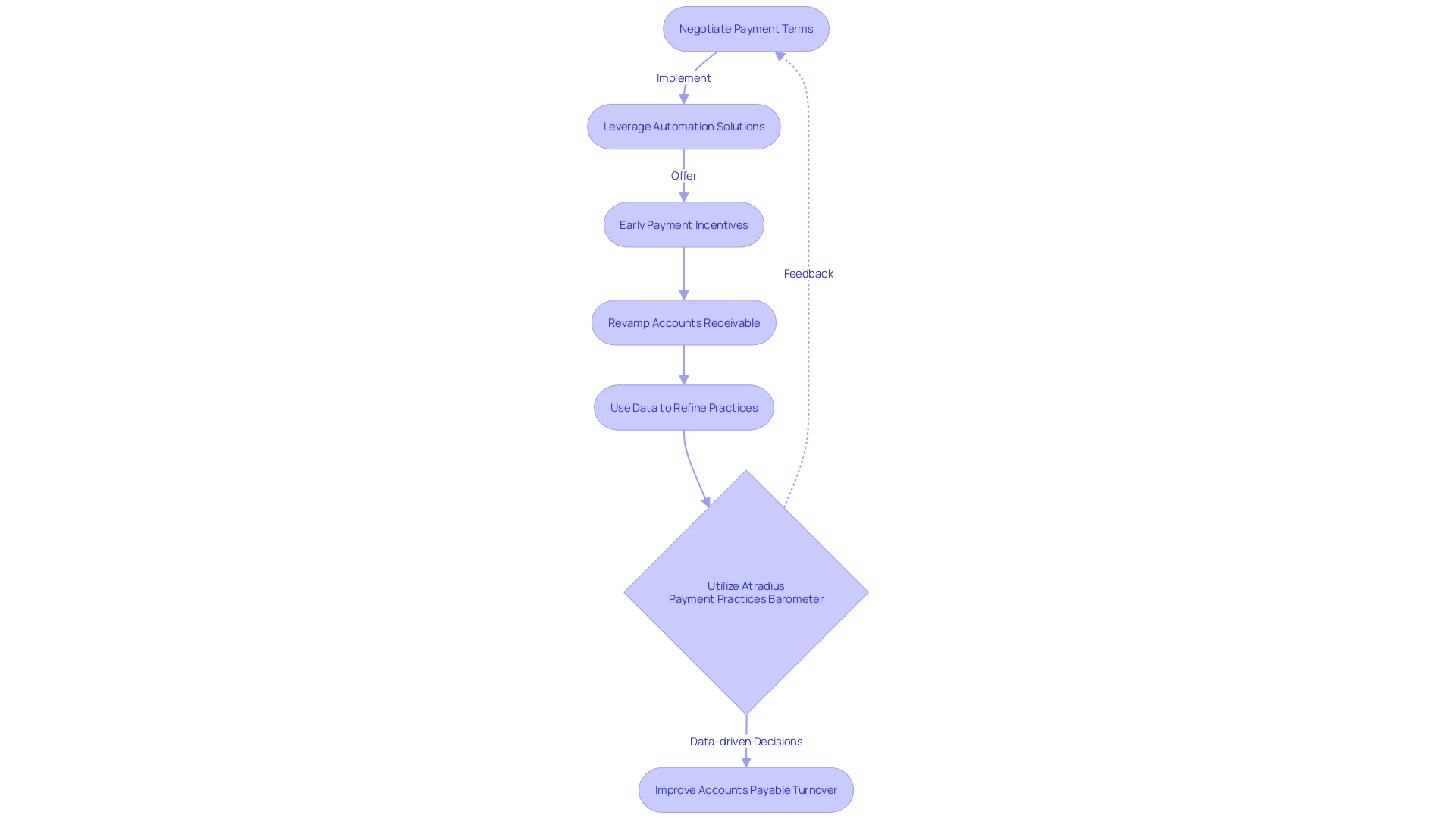

Refining accounts payable turnover is a multifaceted endeavor—with strategic steps akin to the careful planning of a "prix fixe" menu, where each element is thoughtfully chosen to enhance the dining experience. Similarly, optimizing the flow of a business's cash requires methodical adjustments to your financial practices. Start by negotiating optimal payment terms with suppliers, echoing the meticulous attention to service and cost balance that is critical to the hospitality industry.

Leverage modernized automation solutions, mirroring the efficiency that Gusto's automated payroll services bring to small businesses. Such technology reduces human error and shortens process time, freeing up resources and allowing you to centralize your focus on core business functions.

Early payment incentives can resemble a chef's special—they draw interest and prompt immediate action, which in this case manifests as timely payments from customers. Just as Hershey’s addressed cash flow issues through online sales channels, offer payment convenience to promote liquidity and keep your business's cash flow as dynamic and robust as possible.

Lastly, look to Hershey’s effective measures in revamping their Accounts Receivable (AR) by engaging in ongoing reviews and enhancements of your payment policies. Taking cues from how small businesses prioritize financial health, examine your expenditures and income within the whole spectrum of your budget with a view to foster growth and imminent stability, aligning with the essential responsibilities held by accounts payable clerks in expense management and reporting.

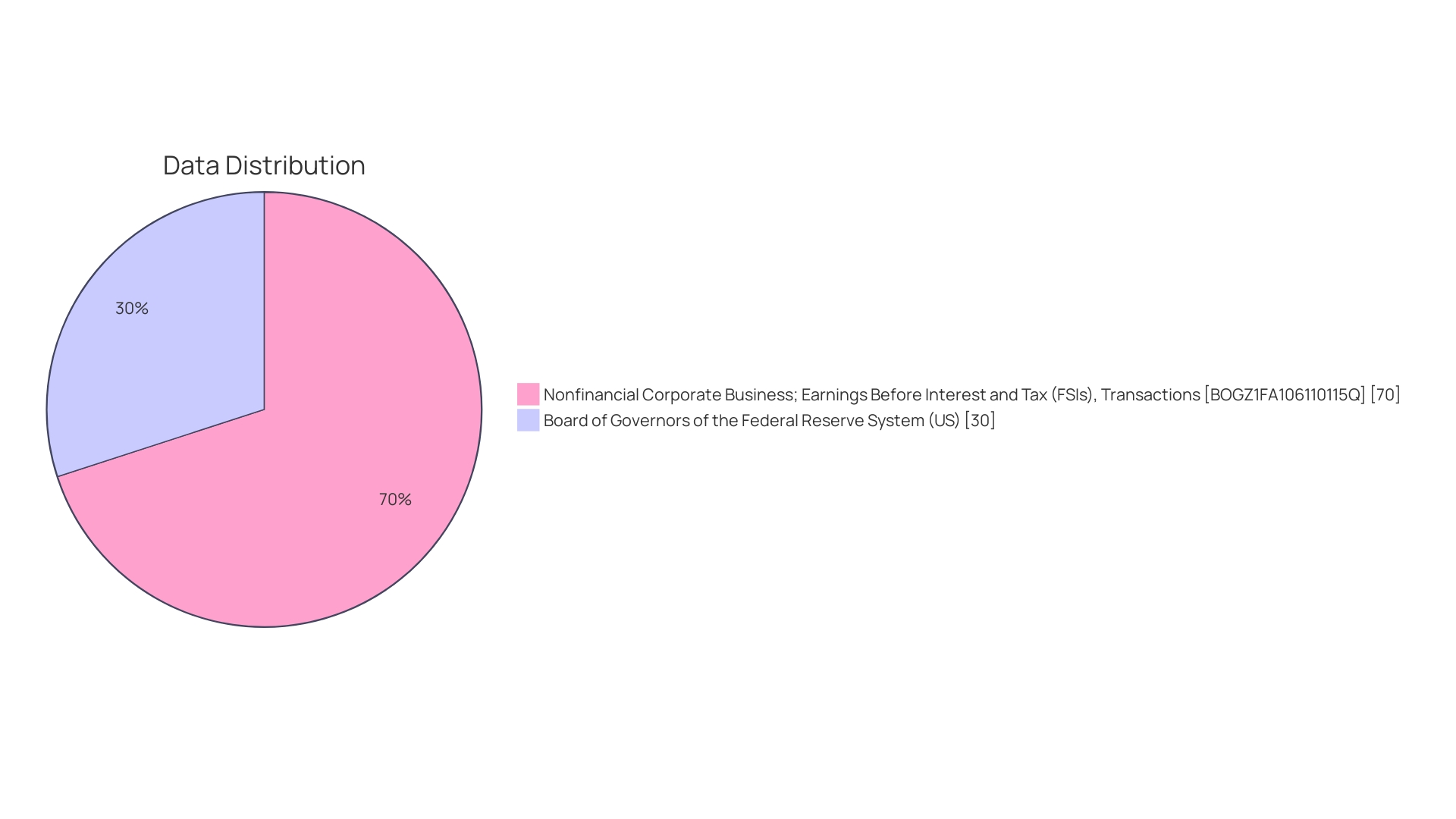

Data from the Atradius Payment Practices Barometer signals a necessary wake-up call as one-third of surveyed companies experienced increases in days-sales-outstanding rates, and 6% faced the reality of uncollectible receivables. Apply the lessons of these statistics to refine your accounts payable practices, fortify your business against similar risks, and reinforce the overall financial wellness of your operation.

Common Mistakes in Calculating Accounts Payable Turnover

Accuracy in accounting is a cornerstone for businesses to flourish and address both immediate and strategic financial requisites. While the act of computing the turnover of accounts payable seems deceptively simple, it can be fraught with potential errors. Mistakes range from inadvertently overlooking balances that are not part of trade payables, to inaccuracies in the numbers that represent cost of goods sold (COGS).

Moreover, overlooking fluctuations in accounts payable or COGS within the analysis timeframe can compromise the integrity of these calculations.

One resonant instance that illuminates the dire consequences of accounting inaccuracies involves a duty manager with no accounting experience thrust into the role due to unforeseen circumstances, only to grapple with evaluating a food and beverage department's profitability. Such situations underscore the critical need for rigor in accounting tasks. Additionally, government offices, subjected to abrupt closures due to unforeseen events, exemplify how disruptions can lead to unmonitored financial reports, further magnifying the importance of maintaining vigilance in financial operations.

Modern accounting, which roots back to ancient civilizations and the revolutionary double-entry bookkeeping introduced in the 15th century, has evolved to include systems like cost accounting. Here, expenses are meticulously allocated to products or activities, granting managers vital insights into decision-making for pricing and budget management. The method's utility is evident when considering the responsibilities of an accounts payable clerk, whose role may encompass managing vendor relations and directly contributing to the business's financial health.

A clear illustration of the nuances in accounting is found in regulatory compliance, as detailed in a Government Accountability Office report highlighting federal agencies' oversight of improper payment estimates in fiscal year 2023. Such reports reflect the complexity and significance of maintaining thorough, precise accounts. An understanding of these intricacies not only helps sidestep errors but also fortifies a company's financial practice—a lesson particularly salient for small business owners who must parse through their financial transactions to draw actionable insights that fuel growth.

Real-World Examples of Accounts Payable Turnover

Delving into the practicalities of financial efficiency, let's deconstruct the accounts payable turnover ratio with tangible scenarios. Envision a scenario where Company A attains a cost of goods sold totaling $500,000 and sustains an average accounts payable balance of $100,000. It leads to an accounts payable turnover ratio of 5, computed by dividing the cost of goods sold by the average accounts payable balance.

Similarly, Company B, with a cost of goods sold of $1,000,000 and an average payable balance of $200,000, mirrors the ratio of 5. These scenarios shine a light on the operational efficiencies and how they compare across different corporate landscapes.

As we peek into the case of Monday.com, their journey to becoming free cash flow positive with decelerated growth stands out as a beacon, prompting us to question how to foster growth with heightened efficiency, leading to more investment capability, extended cash runways, and amplified shareholder wealth. This case underscores the significance of not solely relying on revenue but also focusing on gross margins and their impact on free cash flow—the lifeblood driving long-term company value.

Reflecting on a different sector, Pacific Steel emerged from the shadows of obscurity by challenging the status quo of health care costs and shifting towards a more transparent, Medicare rate-based price model. Their ambitious stride towards efficiency echoes across industries, emphasizing the importance of cost manipulation to maintain a robust financial health.

Even as we navigate the intricacies of cost allocation and financial compliance, news from ConocoPhillips serves as a testament to the efficiencies some companies achieve. With a reported net income of $18.7 billion and a slim workforce, their profit per employee ratio stands as a towering $1.97 million, marking them as a high-efficiency entity.

These insights collectively drive home the point that, whether it's managing the turnaround of accounts payable, harnessing gross margins for cash flow, or transforming healthcare costs, the pursuit of efficiency is multifaceted, with potent implications for a company's financial vitality.

Conclusion

To conclude, the accounts payable turnover ratio is a crucial metric for CFOs to assess cash flow management and vendor relationships. It provides insights into the efficiency of payable account management and supplier interactions. A higher turnover rate suggests effective management and strong relationships, while a lower ratio may indicate cash flow issues or delayed payments.

Calculating the ratio is simple using the formula Cost of Goods Sold divided by Average Accounts Payable. Benchmarking against industry standards provides valuable context for interpretation. Accurate accounting practices are essential for compliance and overall financial health.

Factors such as strategic payment terms and liquidity status influence accounts payable turnover. It is vital to have a clear cash flow management strategy and proactive expense management. Strong vendor relationships maintained by accounts payable clerks contribute significantly to financial health.

Improving accounts payable turnover can be achieved through negotiation of payment terms, leveraging automation solutions, and offering early payment incentives. Regular review of payment policies is key. Avoiding common mistakes like overlooking balances or calculation errors is important to maintain accuracy.

Real-world examples illustrate the significance of efficiency and financial stability across different industries. The pursuit of efficiency has implications for long-term value and growth opportunities.

In summary, effective management of the accounts payable turnover ratio involves strategic financial operations, meticulous cash flow management, and adherence to industry practices. CFOs can optimize their organizations' performance by using this metric to ensure financial health and operational stability.