Introduction

Understanding the accounts payable turnover ratio is crucial for CFOs seeking to enhance their company's financial health. This financial analysis tool measures the speed at which a business settles its debt with suppliers, providing valuable insights into cash flow and working capital.

In this article, we will explore the importance of the accounts payable turnover ratio and how it can be calculated. We will also delve into the interpretation of this ratio and discuss strategies that CFOs can implement to optimize it. By understanding and leveraging this ratio, CFOs can make informed decisions, align expenditures with strategic goals, and foster business growth and profitability.

Definition of Accounts Payable Turnover Ratio

Understanding the accounts payable turnover ratio is an essential financial analysis tool that signifies the average rate at which a business settles its debt with suppliers. This calculation is adeptly performed by dividing a company's total credit-based purchases by the average accounts payable for a designated period. A higher ratio demonstrates a swift payment cadence to suppliers, whereas a lower ratio could signal challenges in liquidity and the need for improved cash flow measures.

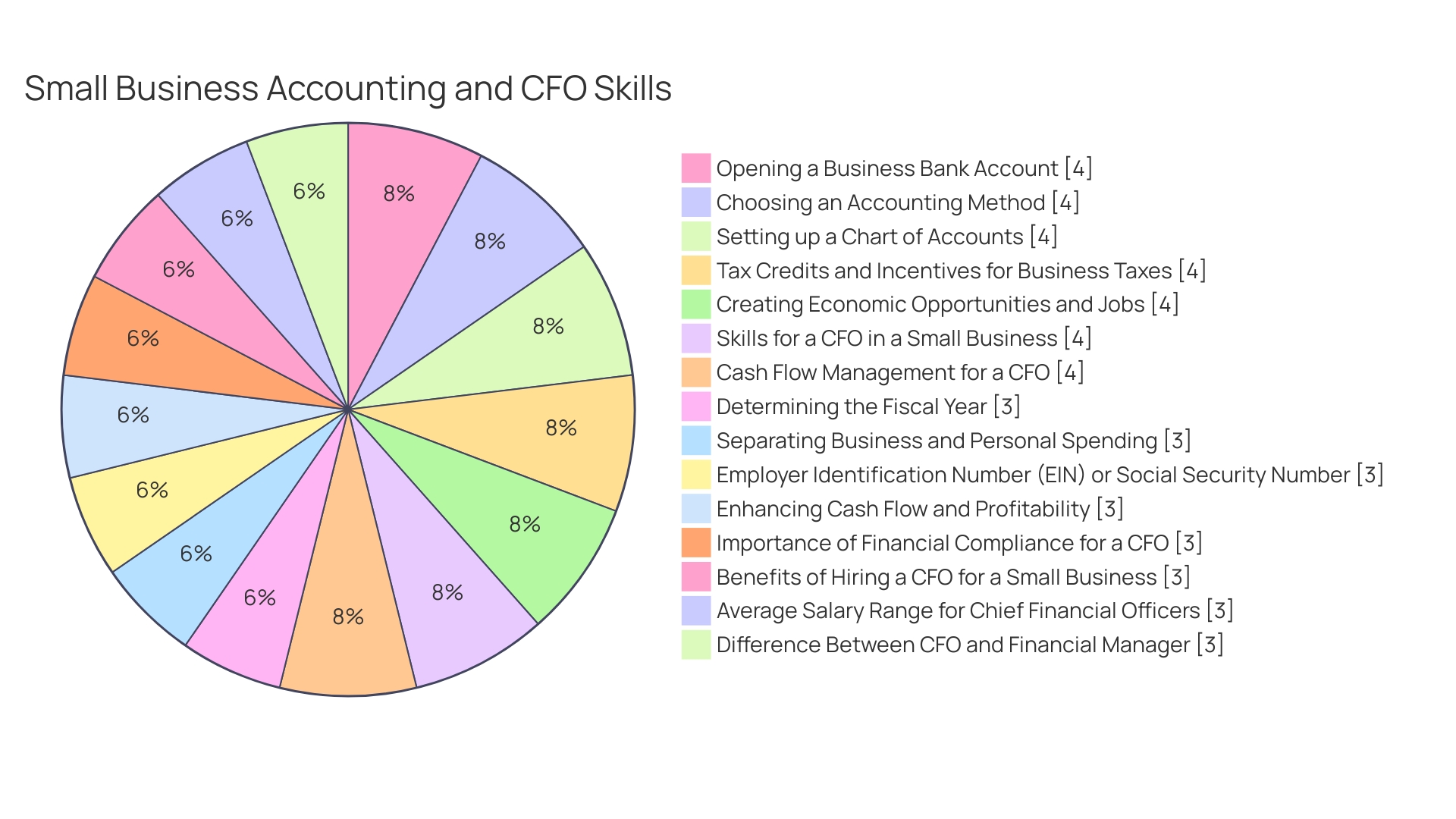

As part of prudent financial practices, a business must reevaluate all spending and prioritize expenses, ensuring alignment with strategic goals. This is especially pertinent to small business owners, who set themselves up for success by instituting foundational accounting activities such as delineating a clear fiscal year, selecting an appropriate accounting method (like cash or accrual), and opening a dedicated business bank account to streamline financial transactions. Separation of business and personal finances is not only advantageous for tax filings but is also critical for an accurate assessment of business performance.

The opening of a business account typically requires identifying documents, potentially including an Employer Identification Number (EIN) or Social Security number and possibly a business license. Being meticulous in these accounting processes supports effective cash management, an aspect underscored by industry leaders as vital for fostering business growth and profitability. Consistently positive cash flow can prevent the pitfalls of financial deficiencies and empower a business to thrive.

Importance of the Accounts Payable Turnover Ratio

In their role, CFOs tackle the challenge of enhancing accounts payable turnover, a crucial gauge of the company's payables process efficiency. Not just a number, the accounts payable turnover ratio reveals the pace at which a business settles its debts, which can have significant implications for its cash flow and working capital stance.

By dissecting this ratio, CFOs gain valuable insights into their payables process, unearthing opportunities for refinement. To improve this ratio and thus strengthen the company's financial health, reevaluating all expenditures becomes imperative; not just cutting costs blindly but aligning spend with the firm's strategic financial priorities is essential.

Developed with a keen understanding of the company's financial landscape, including the company's life stage and the current year's performance, this measure helps to define prudent operational shifts. CFOs and financial managers must realize that efficient cash generation via strategic operational and expenditure reviews is a forerunner to achieving the favorable free cash flow as demonstrated by forward-thinking companies such as Monday.com. This platform's leap to becoming free cash flow positive amidst slowed growth exemplifies the significance of the role that improved accounts payable turnover and gross margin analysis play in efficient business growth and the creation of shareholder value.

Formula and Calculation of Accounts Payable Turnover Ratio

Gauging a company's financial efficiency regularly involves delving into various metrics, and the accounts payable turnover ratio is a critical measure of how swiftly a business pays off its suppliers. It's computed by dividing total credit purchases by the average balance of accounts payable.

Let's break this down: total purchases indicate the sum of all transactions made on credit within a period, readily retrieved from financial reports, while the average accounts payable is found by adding the beginning and ending balances of accounts payable, then halving the total for an intermediate figure. Reflecting on the real-world consequences of such financial metrics, consider how this ratio might reflect on a company's broader financial agility.

Take Monday.com, for instance, a company that managed a quick shift to positive cash flow due, in part, to efficiently navigating through their growth phase. Such efficiency can propel companies to deploy cash more effectively, lengthening the cash runway and maximizing shareholder value—demonstrating the profound impact this ratio has beyond mere accounting figures. Utilizing financial insights allows businesses to rally during drifts in economic conditions, such as the shifting focus from top-line revenue to the sustaining power of gross margins during the globally challenging times of the pandemic.

Interpretation of Accounts Payable Turnover Ratio

The financial health of a company cannot be overstated, and key indicators such as the accounts payable turnover ratio are essential in providing an insightful snapshot. As a barometer of payable efficiency, a high accounts payable turnover ratio signals rapid supplier payments, epitomizing efficient cash management, and often correlates with a robust cash flow landscape. Contrastingly, a low ratio may raise red flags regarding a company's cash flow adequacy or reveal inadequacies in vendor management strategies.

Drawing from Monday.com's journey towards becoming free cash flow positive, we understand the pivotal role efficiency plays in corporate growth and sustainability. It demonstrates that beyond sheer revenue generation, scrutiny of financial facets like gross margins offers a comprehensive view of a company’s financial potency and the creation of long-term shareholder value. Financial ratios carve out a streamlined path amid the often-dense financial data landscape, allowing a holistic and standardized comparison of business performance to peers and industry benchmarks.

It is through these ratios that CFOs and financial analysts discern the subtle nuances in financial statements, laying the groundwork for salient business decisions and astute strategies designed to bolster financial fortitude. In the context of accounts payable, performance is not gauged in isolation but rather evaluated against the industry's pulse to distill actionable insights. Such comparative analysis, enhanced by comprehension of the cost of goods sold (COGS) and gross margins, paves the way for data-driven decision making, ensuring a company remains resilient, thriving, and positioned for accomplishing its financial aspirations.

Example Calculation of Accounts Payable Turnover Ratio

Diving into the realms of accounting ratios, the accounts payable turnover ratio emerges as a vital tool, elegantly capturing how frequently a business settles its debts with suppliers within a specific period. Take for instance Company XYZ; the firm's credit purchases amount to a hefty sum of $500,000 over the annum, juxtaposed against an average accounts payable standing at $100,000.

By invoking the formula, one arrives at an accounts payable turnover of 5, anecdotal evidence of the company reconciling its payables quintuple times annually. At the heart of this discussion lies the inherent need for companies, much like XYZ, to enhance the efficiency of their growth trajectories, akin to the stellar example of Monday.com.

This firm has adeptly tread the path to cash-flow positivity by skewering inefficiencies, hence amplifying shareholder value. It brings to light the omnipresent conundrum faced by businesses: every dollar on the revenue line does not weigh the same, ensnaring the unassuming gross margin as a prime influencer in this complex equation.

Additionally, the distinction between 'turnover' and 'attrition' further enriches our conversation. While 'turnover' mirrors the cadence of employees departing an organization, 'attrition' captures the natural diminution of workforce without replacements. These concepts, although nuanced, leave an indelible mark on the structural dynamics of a business, be it in hospitality, retail, or manufacturing, mandating a lucid understanding of performance metrics like RevPAR and TRevPAR for a holistic insight into operation health. Moreover, as delineated by publicly listed entities in the U.S., these fiscal narrations are predominantly weaved using accrual basis accounting. In this approach, transactions are recorded when they occur, bridging the time gap between service provision and financial settlements, and consequently ensuring that financial statements paint an accurate picture of the company's fiscal standing.

Advantages and Drawbacks of Accounts Payable Turnover Ratio

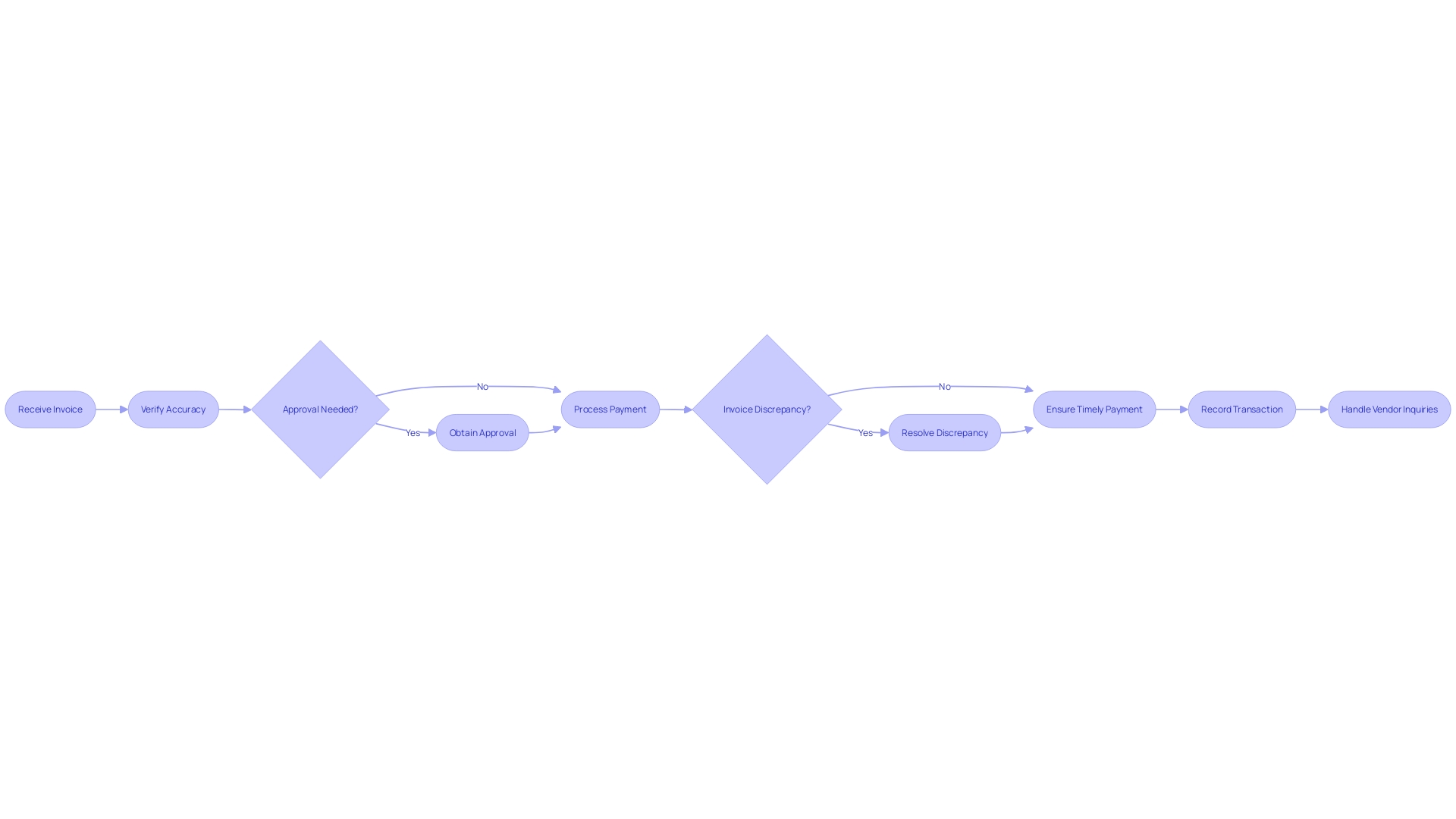

In the realm of small business financial management, the meticulous work of an accounts payable clerk is vital to maintaining robust financial health. By ensuring the precise and timely processing of invoices, they are pivotal in managing cash flow and working capital.

Their adherence to financial regulations and control procedures protects the company from compliance risks. Accounts payable personnel also serve as key points of contact for vendor queries, solidifying critical business relationships.

A small business CFO, much like their counterparts in larger organizations, benefits from a comprehensive understanding of the accounts payable turnover ratio. This ratio is reflective of not only the efficiency of short-term liquidity measures but also informs decisions related to vendor negotiations and terms. However, as part of a broader suite of financial metrics, it helps small business CFOs and financial managers gain incisive insights into operational effectiveness and areas in need of strategic enhancement.

Industry Benchmarks and Comparisons

The accounts payable clerk plays a pivotal role in the financial heart of a small business, with a broad array of responsibilities that directly impact the financial health and compliance of the company. Central to their duties is the management of invoice processing and payment, where precision and timeliness are paramount.

Streamlined invoice management ensures the business avoids late fees and enjoys good credit terms, bolstering the overall expense management. By vigilantly overseeing the accounts payable, the clerk ensures the company adheres to financial regulations, maintains robust financial controls, and nurtures positive vendor relationships through adept handling of inquiries and disputes. Moreover, possessing the essential qualifications, including a keen eye for detail and a solid grasp of accounting software, the accounts payable clerk fortifies the company's financial integrity, making them instrumental in maintaining a healthy accounts payable turnover ratio that stands up to industry scrutiny.

Strategies to Optimize Accounts Payable Turnover Ratio

There are several strategies that CFOs and financial managers can implement to optimize the accounts payable turnover ratio:1. Negotiate favorable payment terms with suppliers to extend payment deadlines and improve cash flow.

- Implement electronic invoicing and payment systems to streamline the accounts payable process and reduce errors.

- Evaluate vendor relationships regularly to ensure they align with the company's financial objectives and optimize pricing and terms.

- Improve internal processes for receiving, reviewing, and processing invoices to minimize delays and errors. 5. Develop a robust cash flow forecasting system to anticipate future cash needs and optimize payment scheduling. By implementing these strategies, CFOs can enhance their company's accounts payable process, improve cash flow management, and achieve a higher accounts payable turnover ratio.

Conclusion

In conclusion, the accounts payable turnover ratio is a vital financial analysis tool for CFOs. By understanding and leveraging this ratio, CFOs can align expenses with strategic goals, improve cash flow, and drive business growth.

The ratio provides valuable insights into payment efficiency and cash management. A higher ratio signifies efficient payment cadence, while a lower ratio may indicate liquidity challenges.

To calculate the ratio, divide total credit purchases by the average accounts payable for a specific period. This allows CFOs to identify areas for refinement and optimization.

Interpreting the ratio involves assessing its implications for cash flow and working capital. A high ratio reflects efficient cash management, while a low ratio may raise concerns about cash flow adequacy. To optimize the ratio, CFOs can negotiate favorable payment terms, implement electronic invoicing systems, evaluate vendor relationships, improve internal processes, and develop robust cash flow forecasting. In conclusion, leveraging the accounts payable turnover ratio enables CFOs to make informed decisions, improve cash flow management, and foster business growth. By implementing practical strategies, CFOs can enhance financial health and maximize shareholder value.