Introduction

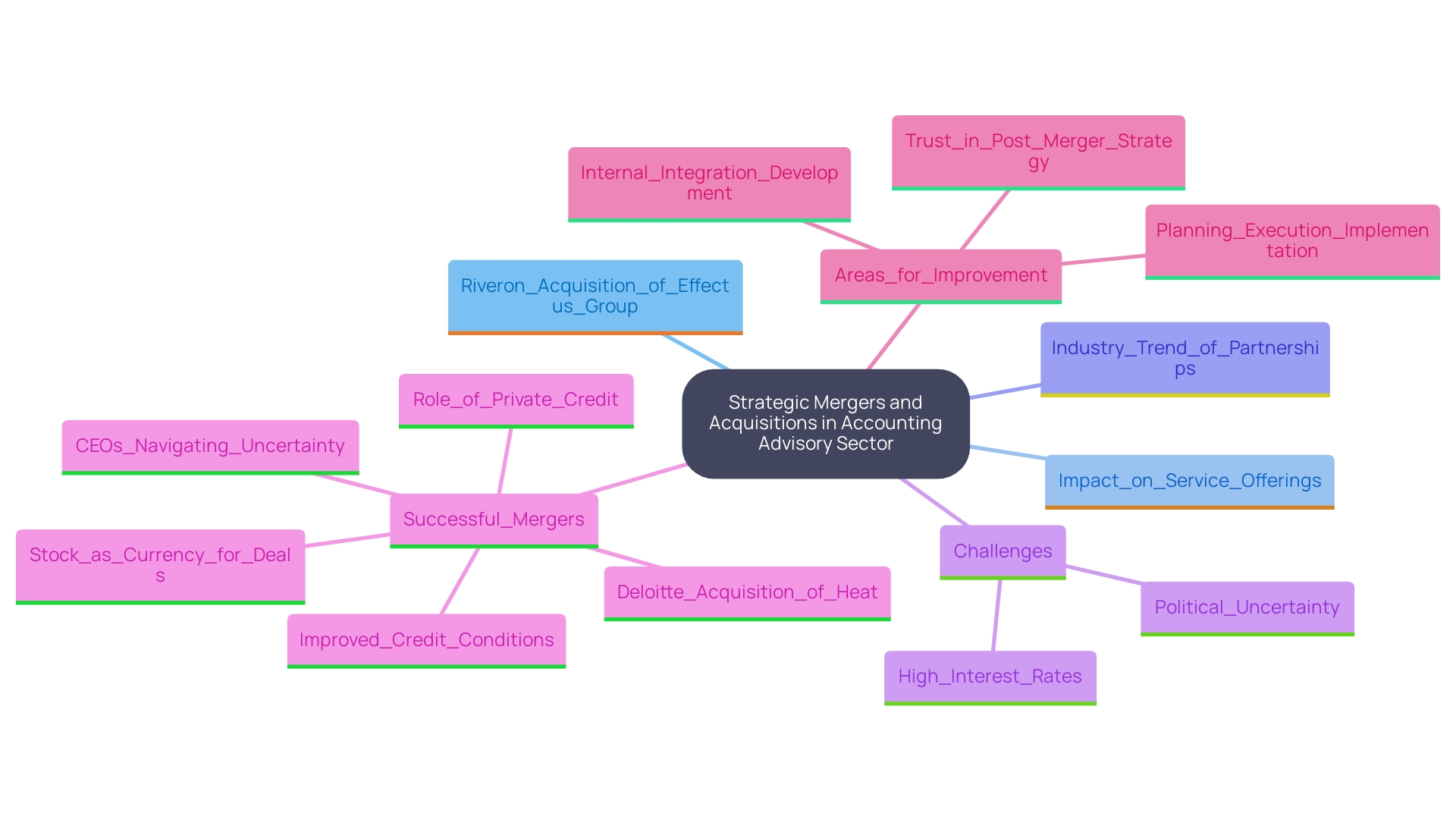

In a landscape defined by rapid technological advancements and shifting market dynamics, Riveron's recent acquisition of Effectus Group marks a pivotal moment in the accounting advisory sector. This strategic move not only enhances Riveron's capabilities by integrating cutting-edge financial technology but also reflects a broader trend of firms seeking to innovate and streamline their offerings through mergers and acquisitions. As organizations grapple with high interest rates and political uncertainties, the demand for effective cash flow management and data-driven insights has never been more critical.

By examining the implications of this acquisition and the strategic considerations for future partnerships, CFOs can better navigate the complexities of the financial advisory landscape and position their firms for sustained growth and competitive advantage.

Overview of Riveron's Acquisition of Effectus Group

In 2023, Riveron, a prominent consulting company in accounting and advisory services, successfully acquired Effectus Group, a firm celebrated for its expertise in technology and consulting. This strategic move aligns with Riveron's initiative to bolster its . By integrating Effectus Group's advanced capabilities, Riveron is poised to deliver more comprehensive and innovative solutions to its clients, thereby strengthening its position in the competitive accounting advisory sector.

This purchase not only highlights Riveron's commitment to enhancing its service offerings but also illustrates a broader industry trend. Firms are increasingly seeking strategic partnerships and purchases to enhance cash flow and business valuation. With high interest rates, current valuations, and political uncertainty acting as significant barriers, the strategic need for mergers and acquisitions (M&A) has intensified. Brian Levy, Global Deals Industries Leader at PwC, underscores this by stating,

'The daunting combination of high interest rates, current valuations, and political uncertainty has been a showstopper for many deals. Nevertheless, the strategic need for M&A continues to grow stronger, creating pent-up demand which will be unleashed as these uncertainties resolve.'

As firms navigate their financial landscapes, mastering the Cash Conversion Cycle (CCC) emerges as a critical strategy for improving cash flow and profitability. Our Comprehensive Business Valuation Service provides essential insights for business owners and investors seeking to understand their business's worth, which is increasingly relevant in today's fluctuating market.

Furthermore, the latest news indicates that more quality assets are expected to come to market in the next six months. This presents a crucial time for companies seeking to improve their abilities through mergers. Riveron's takeover of Effectus Group exemplifies this trend, showcasing how strategic M&A can deliver significant benefits. These include an expanded portfolio of services, enhanced technological expertise, and a stronger competitive edge in the market.

Specific examples of successful takeovers in the accounting advisory sector, such as Deloitte's purchase of the consulting firm Heat, illustrate the growing trend of firms strategically expanding their capabilities through M&A. Expert opinions suggest that integrating technology within accounting firms is essential for staying competitive, driving innovation, and improving client services. The effect of such purchases is profound, not only in terms of immediate service enhancement but also in setting the stage for long-term growth and innovation in the accounting advisory sector.

Implications of the Acquisition for Riveron and the Accounting Advisory Sector

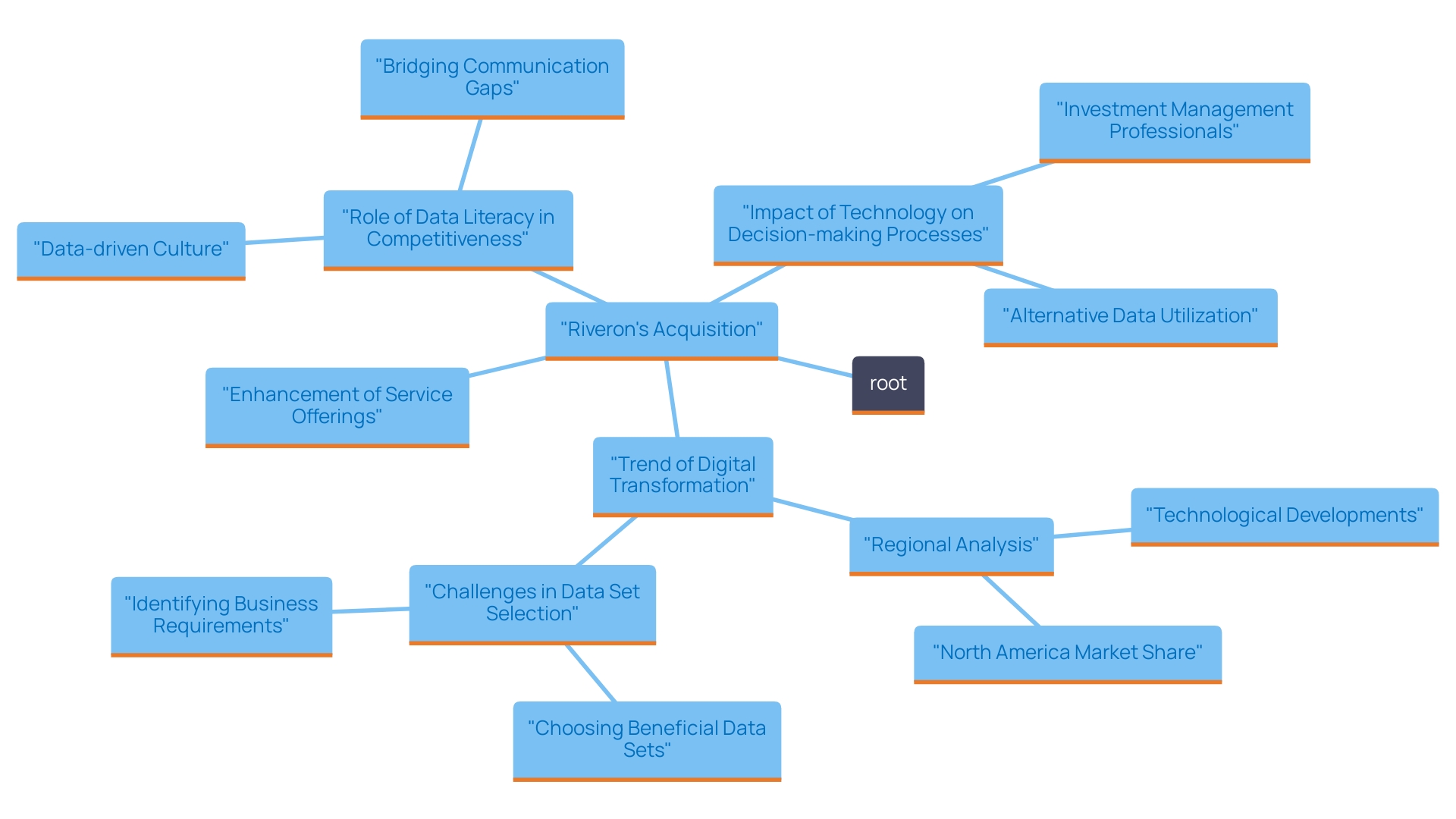

Riveron's acquisition of Effectus Group significantly enhances its accounting advisory capabilities, aligning with the demand for streamlined decision-making and real-time analytics crucial for effective business turnaround and performance monitoring. By leveraging advanced technology solutions alongside deep financial consulting expertise, Riveron is well-positioned to elevate its service offerings and support a shortened decision-making cycle throughout the turnaround process. This strategic action not only enhances Riveron's competitive positioning but also reflects a wider industry trend towards digital transformation and technology unification to meet evolving client needs.

As Miro Kazakoff, a senior lecturer at MIT Sloan, aptly notes, 'In a world of more data, the companies with more data-literate people are the ones that are going to win.' This focus on data literacy and technology integration is central to Riveron's approach, providing a distinct competitive edge through continuous business performance monitoring via their client dashboard, which offers real-time analytics to effectively diagnose business health. Furthermore, this purchase signals potential market consolidation, as firms increasingly seek specialized capabilities to maintain competitiveness.

For CFOs, recognizing these trends is essential for strategic planning and anticipating shifts in the advisory landscape. Just as the fashion industry prioritizes quality over quantity to enhance sustainability, there is a parallel need for high-quality, data-driven solutions in financial consulting. Firms like Deloitte and PwC have successfully implemented AI-driven analytics platforms, providing deeper insights and improving client outcomes. Understanding the impact of these and operationalizing lessons learned from turnaround processes is vital for navigating the future of accounting advisory services.

Strategic Considerations for Future Acquisitions

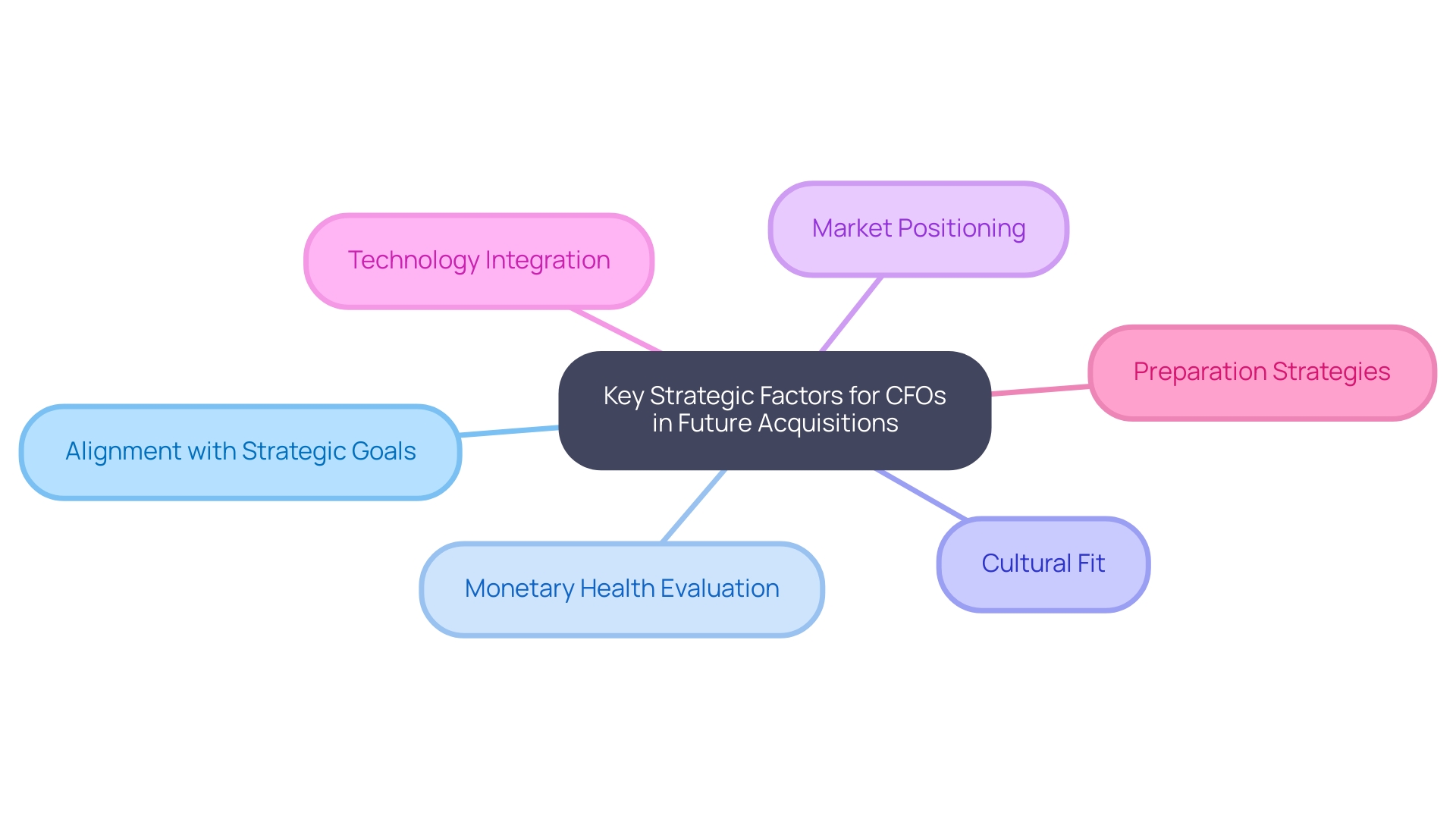

For CFOs planning future acquisitions, several strategic factors warrant close examination:

- Alignment with Strategic Goals: It's crucial that the target company aligns seamlessly with your organization's long-term objectives. This alignment ensures that the purchase will contribute positively to the overall vision and strategy.

- Monetary Health Evaluation: Conducting a rigorous economic analysis is paramount. Assessing the target's economic health aids in recognizing potential risks and opportunities that could influence the acquisition's success. More than 1/3 of analysts depart from inadequately managed teams within the first year, and over 1/2 by the second year, emphasizing the need for stable resource management. A thorough financial review, such as our Comprehensive Business Valuation Service, can provide detailed insights into the business’s worth and help preserve cash and reduce liabilities.

- Cultural Fit: Assessing the organizational culture of the target company is vital. A mismatch in cultures can lead to significant integration challenges. As mergersandacquisitions78, a Managing Director, notes, poor cultural fit can lead to high turnover rates and instability. For example, companies that prioritize cultural alignment during mergers often see smoother transitions and better employee retention.

- Market Positioning: Examine how the takeover will improve your market position and competitive edge. Fewer IPOs are prompting companies to rethink their leadership strategies to stay competitive.

- Technology Integration: Evaluate the technological capabilities of the target company. Assess how these technologies can be integrated into your existing operations to drive efficiency and innovation. For instance, if the target company utilizes advanced data analytics, consider how this could enhance your decision-making processes.

- Preparation Strategies: Utilizing external feedback and preparation strategies, such as structured review sessions, can help executives anticipate tough questions and improve their responses during investor days. This method not only enhances readiness for challenging discussions but also aids in refining the acquisition strategy by providing critical insights.

By addressing these strategic considerations—and leveraging insights from resources like our in-depth whitepaper, “Mastering the Cash Conversion Cycle: 20 Strategies for Optimal Business Performance”—CFOs can significantly enhance their chances of driving growth and innovation while ensuring effective cash flow management and risk mitigation.

Best Practices for Managing the Post-Acquisition Integration Process

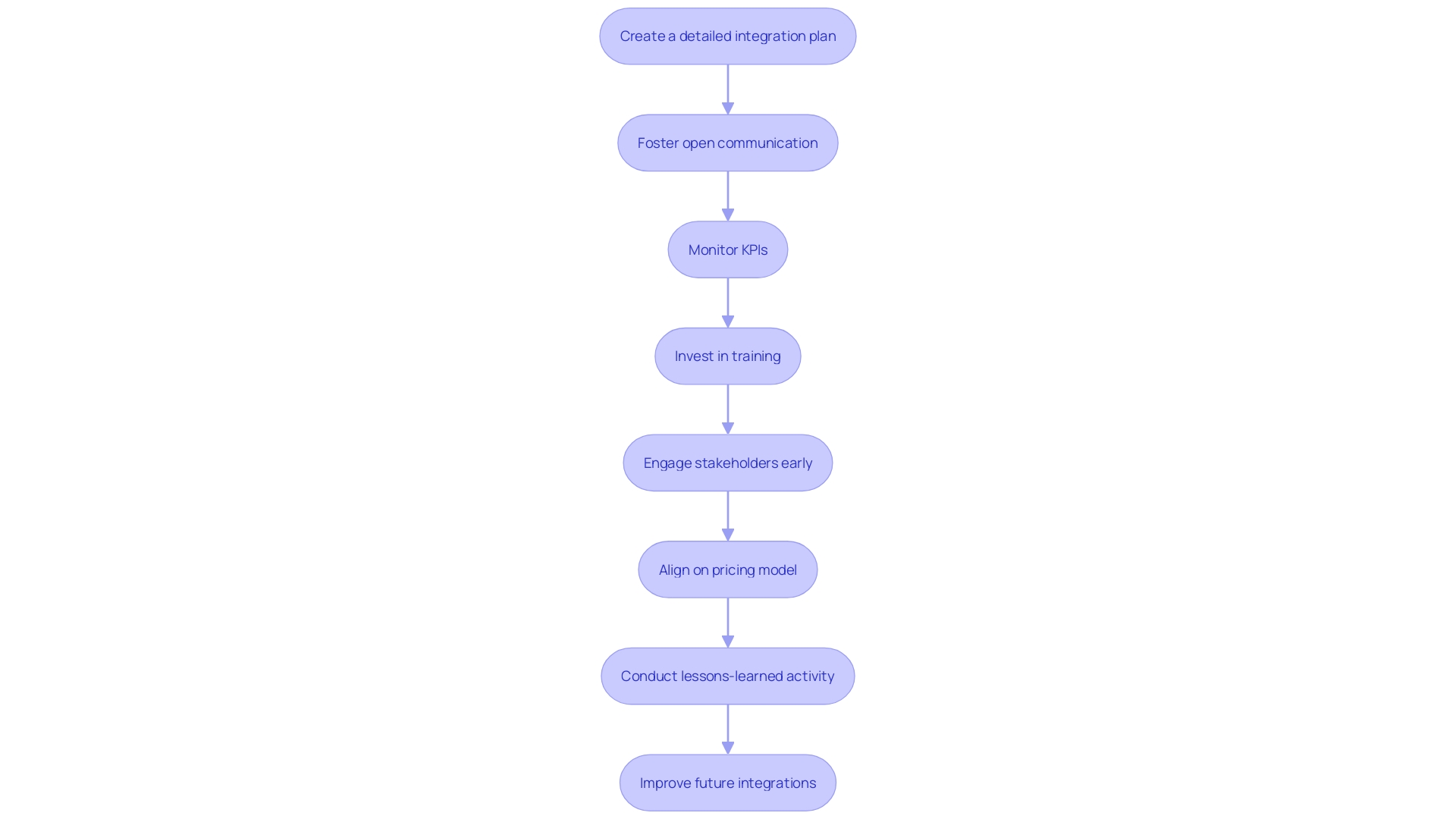

To ensure a successful post-acquisition integration, CFOs should consider the following best practices:

- Create a Detailed Integration Plan: Developing a comprehensive plan is crucial. This plan should outline specific timelines, objectives, and responsibilities for each task, ensuring clarity and direction from the outset.

- Foster Open Communication: Transparent communication among stakeholders is essential. Leveraging modern communication channels can effectively address concerns and align expectations. As industry expert Jane Doe states, "Effective communication is the backbone of any successful unification strategy, allowing teams to navigate challenges collaboratively."

- Monitor Key Performance Indicators (KPIs): Establishing KPIs enables effective tracking of progress in combining systems. By using a client dashboard that offers real-time enterprise analytics, CFOs can quickly pinpoint areas requiring modification and ensure that coordination efforts stay on course. This continuous performance monitoring enables , preserving organizational health throughout the turnaround process.

- Invest in Training and Development: Providing adequate training is vital for facilitating smooth transitions. A well-trained workforce can better adapt to new processes, ensuring operational continuity and reinforcing new methodologies.

- Engage Stakeholders Early: Early involvement of key stakeholders from both organizations is crucial for securing buy-in and commitment. This approach ensures that all parties are aligned and committed to the merging process from the start.

By recognizing the evolving landscape of business operations and implementing these best practices, CFOs can significantly enhance their organization’s ability to realize the full value of the acquisition, ensuring a seamless and effective integration.

Conclusion

Riveron's acquisition of Effectus Group represents a significant turning point in the accounting advisory landscape, illustrating the importance of strategic partnerships in navigating today's complex market. By integrating Effectus Group's advanced financial technology, Riveron is not only enhancing its service offerings but also positioning itself to meet the increasing demand for data-driven insights and efficient cash flow management. This acquisition is a testament to the broader trend of firms seeking to innovate through mergers and acquisitions, underscoring the necessity for CFOs to adapt their strategies accordingly.

As firms face high interest rates and political uncertainties, understanding the implications of such acquisitions is crucial. The emphasis on technology integration and the mastery of the Cash Conversion Cycle will be vital for organizations aiming to thrive in this evolving financial landscape. CFOs must prioritize alignment with strategic goals, financial health assessments, cultural fit, and technological capabilities when considering future acquisitions.

These factors will not only enhance competitive positioning but also foster sustainable growth.

In the post-acquisition phase, implementing best practices such as detailed integration plans, open communication, and continuous performance monitoring will be essential for maximizing the value derived from these strategic moves. By embracing these approaches, CFOs can ensure that their organizations remain agile and resilient, effectively navigating the challenges and opportunities that lie ahead. Now is the time to act, leveraging these insights to drive innovation and secure a competitive advantage in the accounting advisory sector.

Frequently Asked Questions

What company did Riveron acquire in 2023?

In 2023, Riveron acquired Effectus Group, a firm known for its expertise in technology and consulting.

Why did Riveron acquire Effectus Group?

The acquisition aligns with Riveron's initiative to enhance its technology-enabled financial solutions, allowing it to deliver more comprehensive and innovative services to clients.

What industry trend does Riveron's acquisition of Effectus Group reflect?

The acquisition illustrates a broader industry trend where firms are seeking strategic partnerships and acquisitions to enhance cash flow and business valuation amid challenges like high interest rates and political uncertainty.

How does the acquisition affect Riveron's competitive positioning?

By integrating Effectus Group's advanced capabilities, Riveron strengthens its competitive position in the accounting advisory sector, improving its service offerings and technological expertise.

What is the significance of the Cash Conversion Cycle (CCC) in the context of this acquisition?

Mastering the Cash Conversion Cycle is crucial for improving cash flow and profitability, which is relevant as firms navigate their financial landscapes.

What are the expected market conditions following the acquisition?

More quality assets are anticipated to come to market in the next six months, providing opportunities for companies seeking to improve through mergers.

What are some successful examples of mergers in the accounting advisory sector?

An example includes Deloitte's purchase of the consulting firm Heat, highlighting the trend of firms expanding their capabilities through mergers and acquisitions.

What is the importance of data literacy in accounting firms?

Companies with more data-literate personnel are better positioned to succeed, emphasizing the need for technology integration and data-driven solutions in financial consulting.

What strategic factors should CFOs consider when planning future acquisitions?

CFOs should evaluate alignment with strategic goals, monetary health, cultural fit, market positioning, technology integration, and preparation strategies.

What best practices should CFOs follow for successful post-acquisition integration?

CFOs should create a detailed integration plan, foster open communication, monitor key performance indicators, invest in training and development, and engage stakeholders early.