Introduction

Effective cash flow management is crucial for the financial health and success of any enterprise. Understanding the difference between cash flow and profit is essential for making strategic business decisions and navigating market demands. Preempting cash shortages is vital to avoid severe consequences, and maintaining a symbiotic relationship with cash can foster innovation, expansion, and steadfastness.

By mastering cash flow, businesses can assure a continuous stream of liquidity for day-to-day operations and strategic growth. In this article, we will explore the importance of cash flow, the components of a cash flow statement, and how CFOs can interpret and analyze cash flow statements. We will also delve into discounted cash flow analysis, cash flow projections and forecasting, and best practices for cash flow management.

Effective cash flow management is not merely a financial practice but a vital pulse for any enterprise. As the steady ingress and egress of cash defines its ability to pivot, invest, and sustain operations, understanding the nuances of cash flow versus profit becomes imperative. They are distinct yet interdependent indicators of financial health.

Cash flow represents the real-time movement of funds into and out of a business, paramount for the immediacy of meeting financial commitments and capitalizing on growth opportunities. On the other hand, profit conveys the monetary success over a longer period after expenditures are accounted for. Distinguishing between these two allows for strategic business decisions, designed to navigate the natural ebbs and flows of market demands.

Preempting cash shortages is thus crucial, as they can abruptly thwart an organization's trajectory, leading to severe outcomes regardless of external appearances of success. A symbiotic relationship with cash is essential, as its sufficiency can foster an environment ripe for innovation, expansion, and steadfastness against unexpected shifts. By mastering cash flow, businesses erect a bulwark against the perils of financial uncertainty, assuring a continuous stream of liquidity vital for the day-to-day and strategic command of the enterprise.

Deconstructing a cash flow statement offers pivotal insights into an organization's fiscal wellness and operational prowess. It meticulously categorizes all cash transactions, thereby informing stakeholders about the company's capacity to generate liquid assets through core business activities, to fund expansions through investments, and to manage its capital structure through financing.

Operating activities, spotlighted for indicating the cash inflows and outflows from daily operations, factor in revenue from sales and outgoings linked to business operations, also taking into account non-cash elements like depreciation and changes like accounts receivable. Investment activities relate to assets purchased or sold, while financial activities reflect fluctuations in equity and long-term borrowing.

The essence of this financial tool is succinctly captured by experts who note the vitality of comprehending the nuanced dance of cash within a venture. A steady cash flow is likened to the bloodstream of a business, critical not only for maintaining operations but also ensuring survival against financial turbulence. Moreover, it's a financial barometer, illustrating how income and capital expenditures (CAPEX) together dictate the organization's free cash flow—indicative of growth potential and the capacity to delight shareholders with dividends or undertake further investments without the need for external financing. Key statistics reinforce the narrative: operating activities serve as significant focus points, while a company's free cash flow growth is a harbinger for attractive growth trajectories.

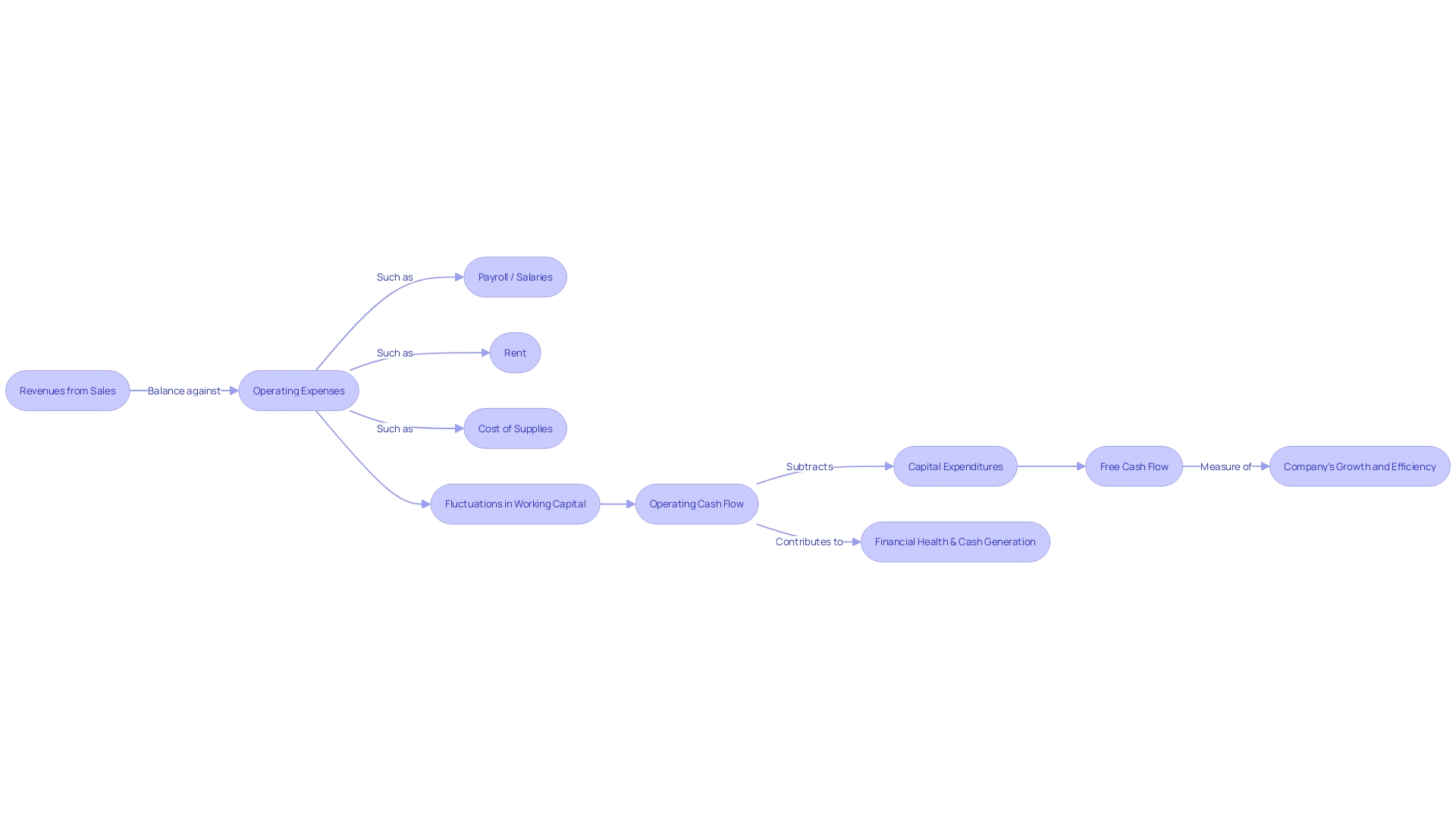

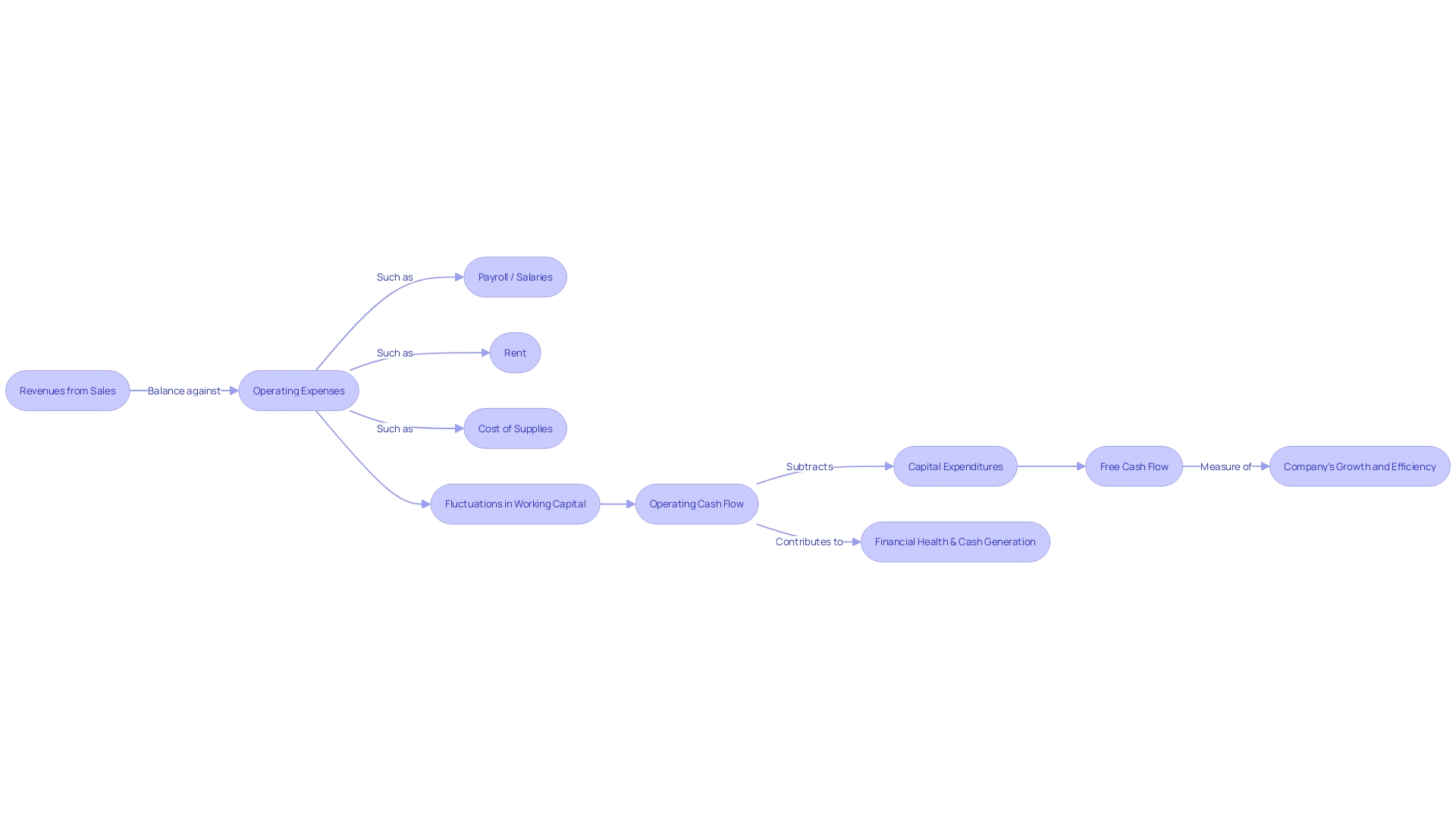

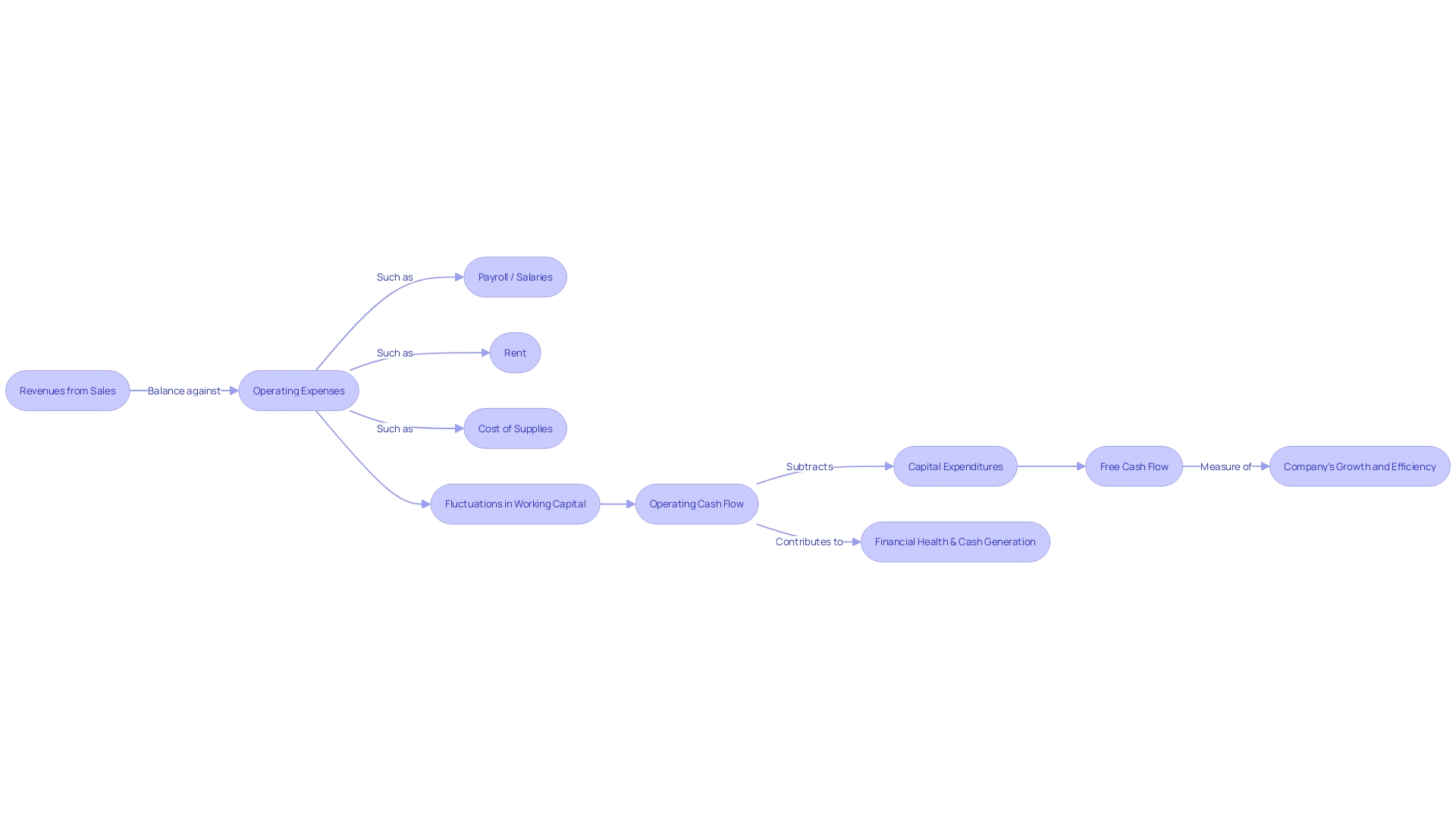

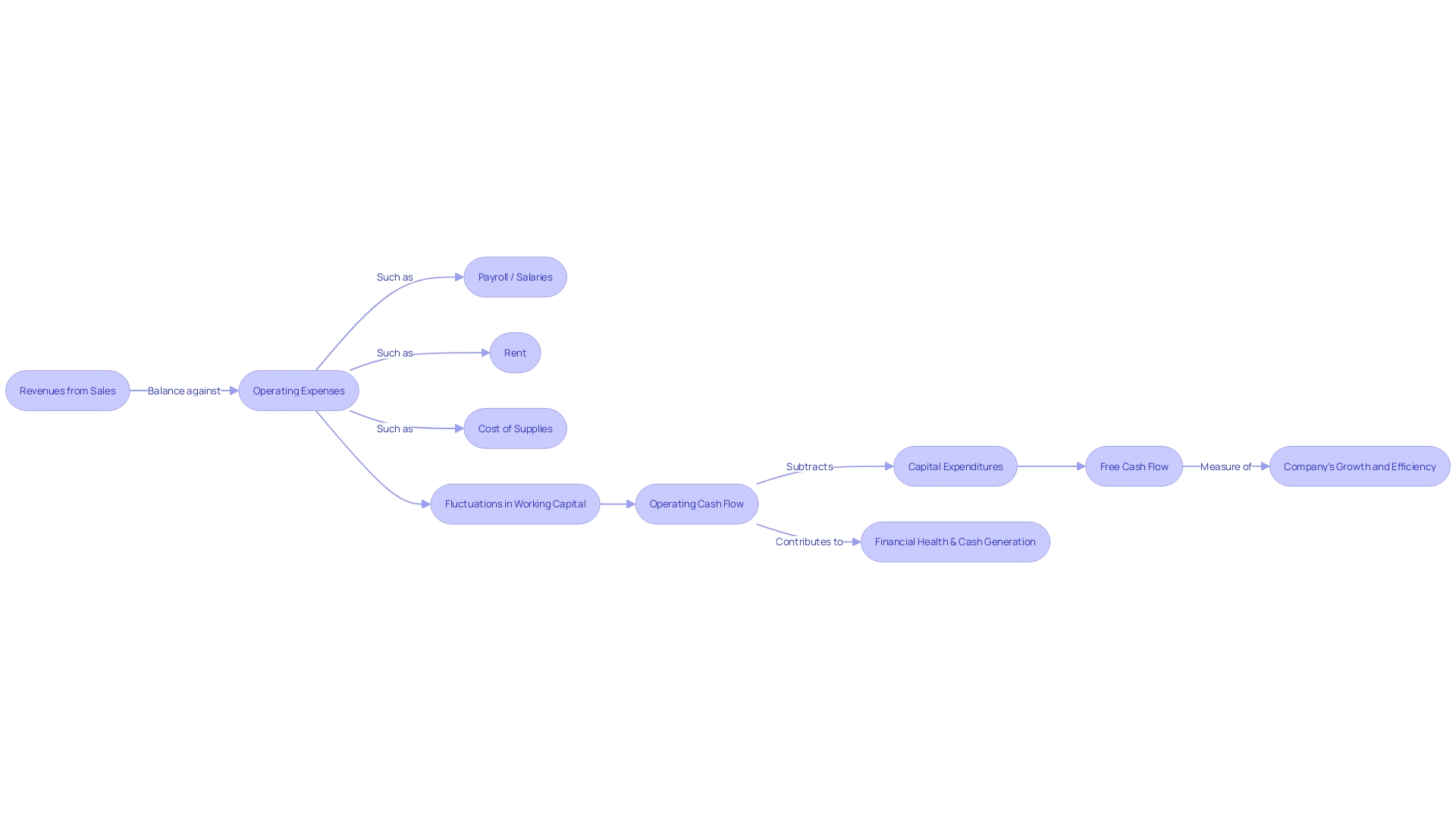

Operating cash flow is a critical gauge of a company's financial health, depicting the net cash generated from routine business activities. This measure accounts for the company's revenues from sales, balanced against operating expenses like salaries, rent, and the costs of supplies. It also reflects fluctuations in working capital.

By assessing this key performance indicator, we glean insights into the company's competency in managing day-to-day activities to sustain cash generation. Through the lens of Monday.com's experience, a business can discern the significance of efficient growth and its linkage to free cash flow positivity, particularly when growth rates taper. Learning from streamlined operations can help a business fine-tune its strategies for heightened cash efficiency.

As not all revenue is equal, companies aware of their gross margins can more adeptly navigate towards stability and shareholder satisfaction over time. Furthermore, proficiency in cash management is not simply advantageous; it's essential for business survival, as cash shortages have the potential to cripple even the most promising ventures. Thus, differentiating cash flow from profit and mastering its intricacies becomes a cornerstone of business acumen, paving the way for informed decision-making, operational efficiency, and sustained profitability.

Investing activities play a crucial role in the financial stability and growth of a business. When analyzing the cash flow statement, the section on investing activities is indispensable for Chief Financial Officers (CFOs). It details the cash expended and the returns received from various investment pursuits, such as the acquisition or disposal of long-term assets, establishing new ventures like an eCommerce store, which offers the potential of reaching a global market with relatively low startup costs, or initiating consulting services with predictable revenue streams from ongoing client relationships.

The cash flow from these investments is a vital indicator of how well a company's strategic financial decisions are performing. Moreover, a firm grasp of cash flows allows CFOs to anticipate and avoid potential cash shortages, which are often fatal to businesses, despite outward appearances of success. By understanding the movement of money associated with investments, a CFO can better navigate the fine line between generating sustainable profits and maintaining operational liquidity, ultimately ensuring the enterprise remains competitive and solvent.

Cash flow from financing is a crucial aspect of a company's financial dynamics, encompassing a range of activities such as issuing debt or equity, settling outstanding loans, distributing dividends to shareholders, and executing share repurchases. As small businesses, exemplified by eCommerce stores and consulting services, often aspire to stability and growth, understanding the intricate balance of financing activities becomes imperative.

Analyzing cash flow from financing sheds light on the intricacies of a company's financial decisions, reflecting not just the potential for dividend payouts but also broader strategic financial insights. These decisions signal investor confidence and can provide a bellwether for future business sustainability.

It's also about mastering the nuances of cash flow—being adept at predicting its ebbs and flows—to ensure there are no cash shortages that could spell disaster for a business, despite impressive profitability on paper. The CFO plays a pivotal role, employing the cash flow statement to track changes in cash levels due to financing decisions, which aligns with the goal of value maximization. Companies, especially those in burgeoning sectors like tech and green energy, must sometimes prioritize long-term value over immediate profitability, a strategy underpinned by robust financing decisions that are keenly reflected in cash flow. Therefore, to thrive and not just survive, a company must be proficient in cash flow management, where cash flow from financing is an essential component, indicating how well a business is navigating its path towards value maximization.

A cash flow statement is a financial compass, directing CFOs through the complexities of liquidity and financial sustainability. At the heart of this statement are operating activities, which paint a picture of the company's revenue and expenses from core business operations.

Here we scrutinize cash from sales, monitor operational expenses, and adjust for non-cash items like depreciation, providing a reliable snapshot of how effectively operational strategies are generating cash. Investment activities, detailed in another section of the cash flow statement, provide clarity on long-term commitments, including acquisitions of assets pivotal for growth and expansion.

By tracking purchases and sales of capital assets, CFOs gain visibility into cash flow dynamics related to critical investment decisions. Insight into cash flow statements becomes truly actionable when informed by real-world success stories, such as Monday.com's impressive path to positive free cash flow.

Recognizing that each revenue dollar is endowed with varying degrees of value, Monday.com's keen focus on gross margins propelled them toward efficient growth and enhanced shareholder value. Keeping abreast of diverse sectors like healthcare and semiconductors—where demands and revolutions drive cash flow changes—fosters an understanding that monitoring cash flow is foundational, not just within but beyond a company's walls. A well-interpreted cash flow statement serves as a testament to a company's vital signs, ensuring that despite the dynamic nature of markets, an enterprise remains a resilient 'going concern' as affirmed by GAAP guidelines. Ultimately, the command over cash flow empowers CFOs to navigate their companies prudently, sidestepping potential liquidity crisis, and paving the way for enduring profitability and operational excellence.

Discounted cash flow (DCF) analysis stands as a linchpin in the complex world of financial valuation. It assesses an investment's worth by calculating the present value of anticipated future cash flows, drawing on the wisdom that money available now is more valuable than the same amount later due to potential inflation and the lost opportunity for capital growth, an idea harking back to Aesop's ancient fable, where a bird in hand was deemed better than two in the bush.

The method involves a detailed projection of expected cash flows, which may encapsulate net income, tax implications, adjustments in working capital, and capital expenditure. To illustrate the power of this method, we can look to the example of Monday.com, a company whose savvy growth strategies have rapidly led to a positive free cash flow.

Free cash flow, a metric separating all incoming cash from outgoing expenses over a period, is the lifeblood of valuation, as it provides a clear view of the funds available after accounting for capital expenditures like property, plants, and equipment. A company's intrinsic value, or the present value of expected future cash flows over its lifetime, is deeply impacted by free cash flow.

Intangible assets, from brand reputation to management quality, feed into this valuation, bolstering expected cash flows or reducing perceived risk and thus affecting the discount rate. In practice, a CFO can calculate free cash flow by subtracting capital expenditures from operating cash flow, the money generated from day-to-day operations. This figure offers an unvarnished look at a company's ability to generate cash and hence its underlying health and investment appeal. A positive operating cash flow and growing free cash flow signify a firm's capacity for self-sustained growth, a cornerstone for sound investment decisions.

A deft understanding of cash flow is non-negotiable for any business to sustain profits and navigate the financial tide. At the heart of this lies the prowess to predict future cash movements through projections and forecasts. By leveraging historical financial data and accounting for projected business activities, CFOs can craft precise cash flow statements.

Such statements meticulously segment into operating activities, capital expenditures (CAPEX), and ultimately, free cash flow. Operating activities deserve meticulous attention since they encompass the cash generated directly from sales and business operations. It's critical to consider adjustments for non-cash items, such as depreciation, and modifications in working capital positions.

An astute CFO understands the paramount importance of managing the inflows and outflows within a company, ensuring the lifeblood of the enterprise—cash—remains abundant. When cash management holds the reigns, even the most auspicious firms can falter without a solid cash reserve. This financial metric not only reflects a company's health after all expenses but also helps ensure there's no dry spell leading to stagnation or collapse.

Indeed, the waveform of a business's finances reflects in its cash flow; it's essential to comprehend the oscillation between surpluses and deficits to devise a robust strategy that never tips the scale towards insolvency. In echoing the sentiment of industry experts, the judicious balancing of cash flow versus profit, while primarily intertwined, serves as the keystone for all business decisions. And in this tightrope walk, preventing cash shortages becomes as critical as maintaining profitability for the stability and future growth of the business.

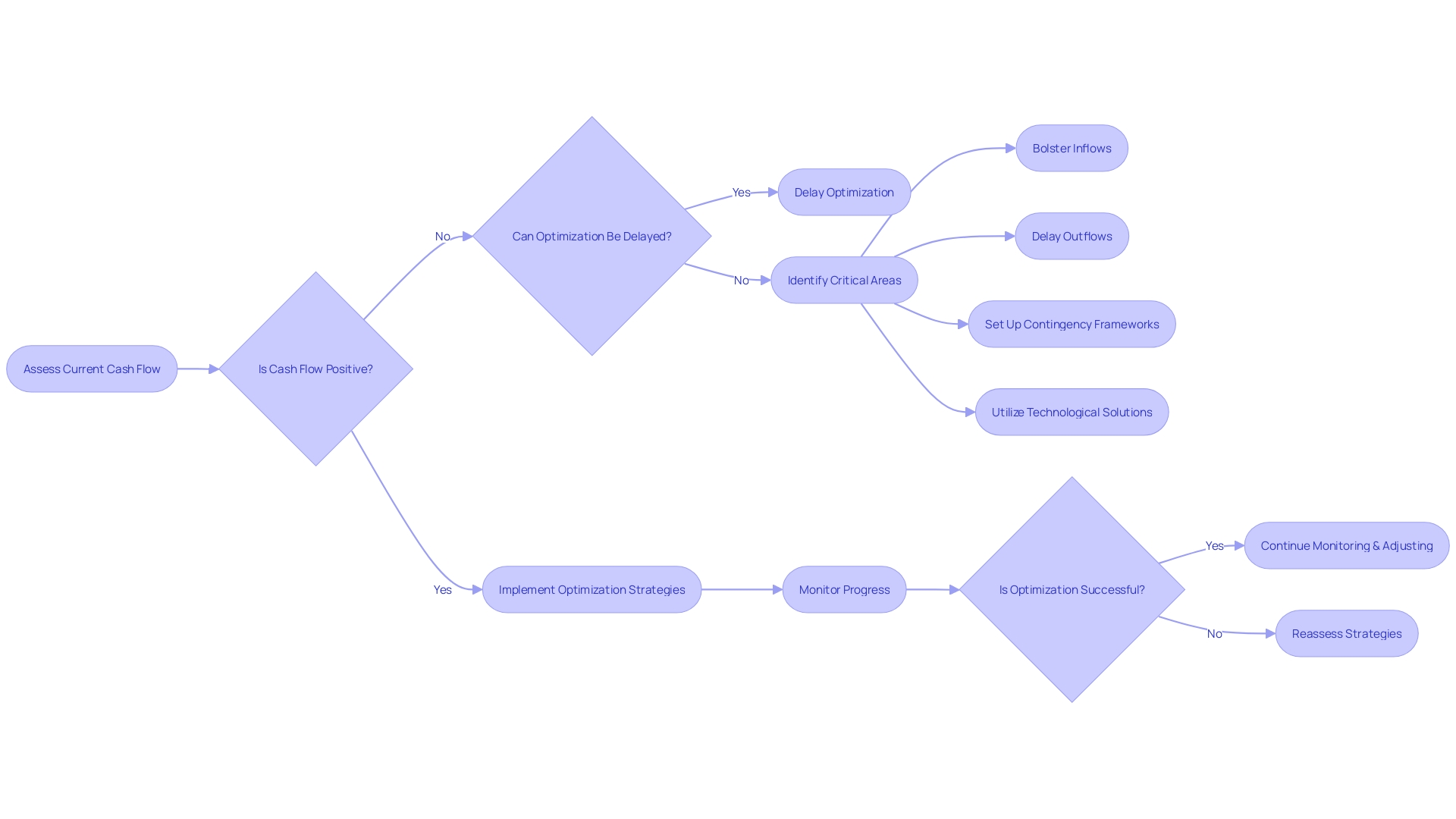

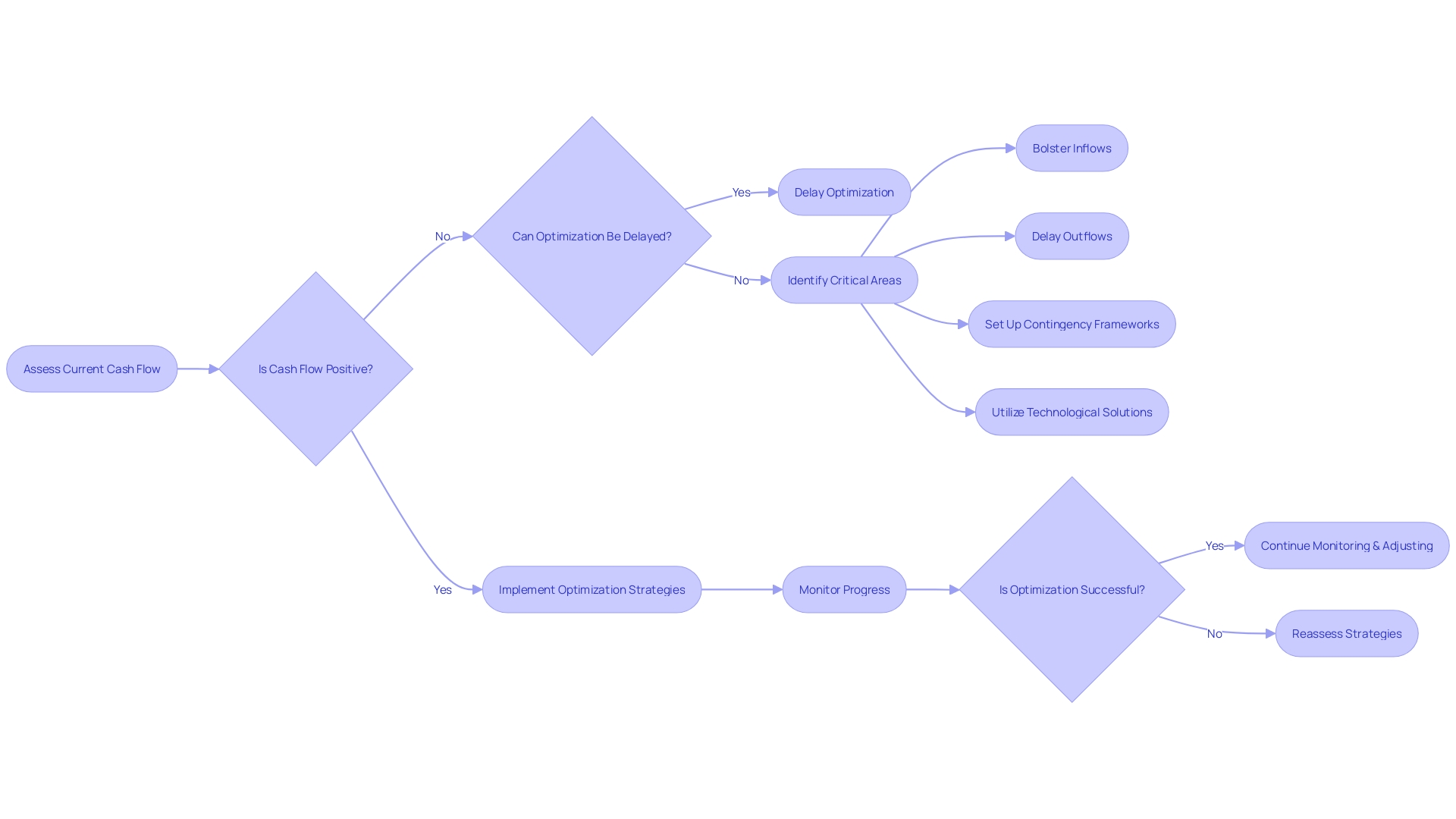

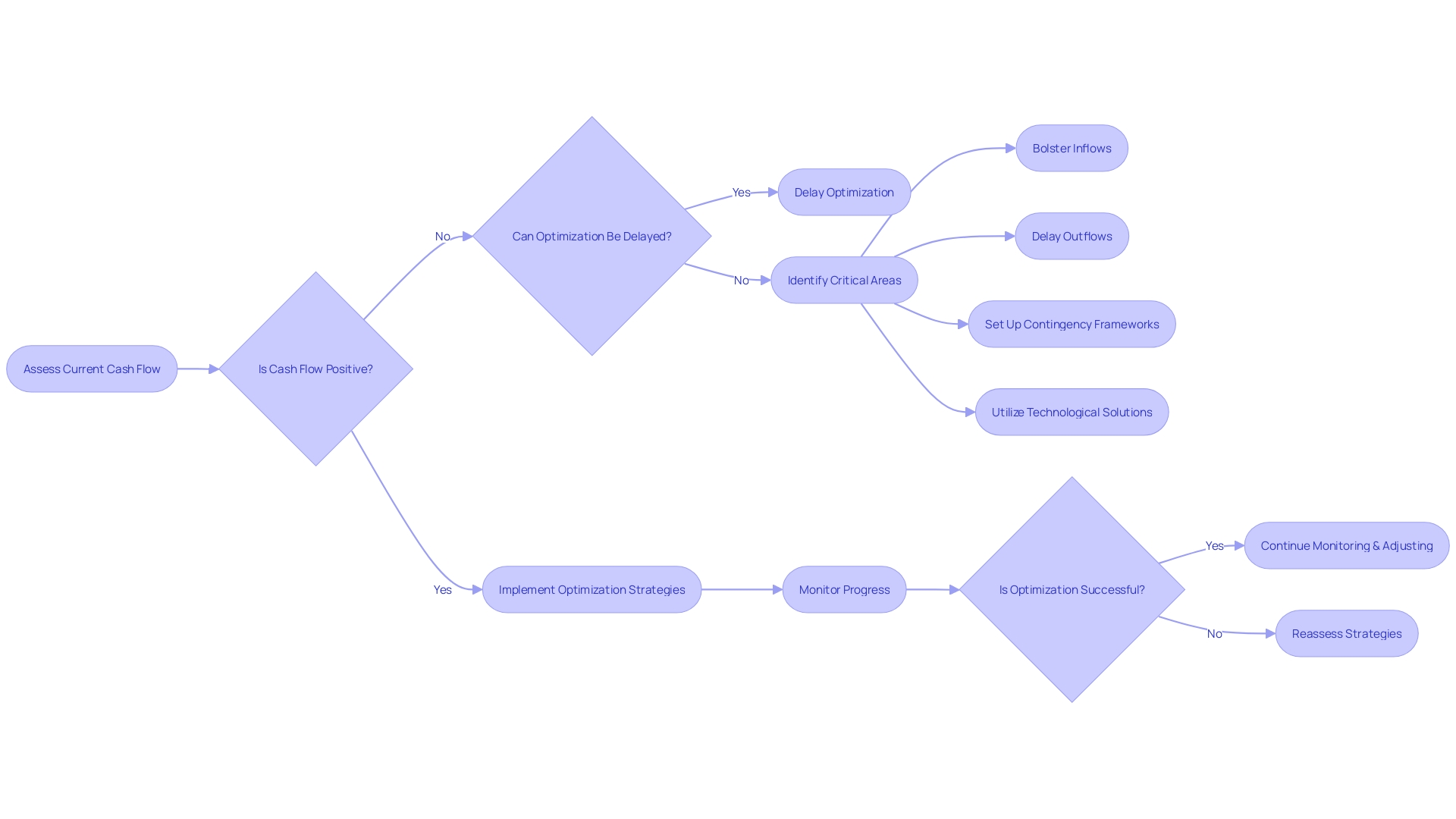

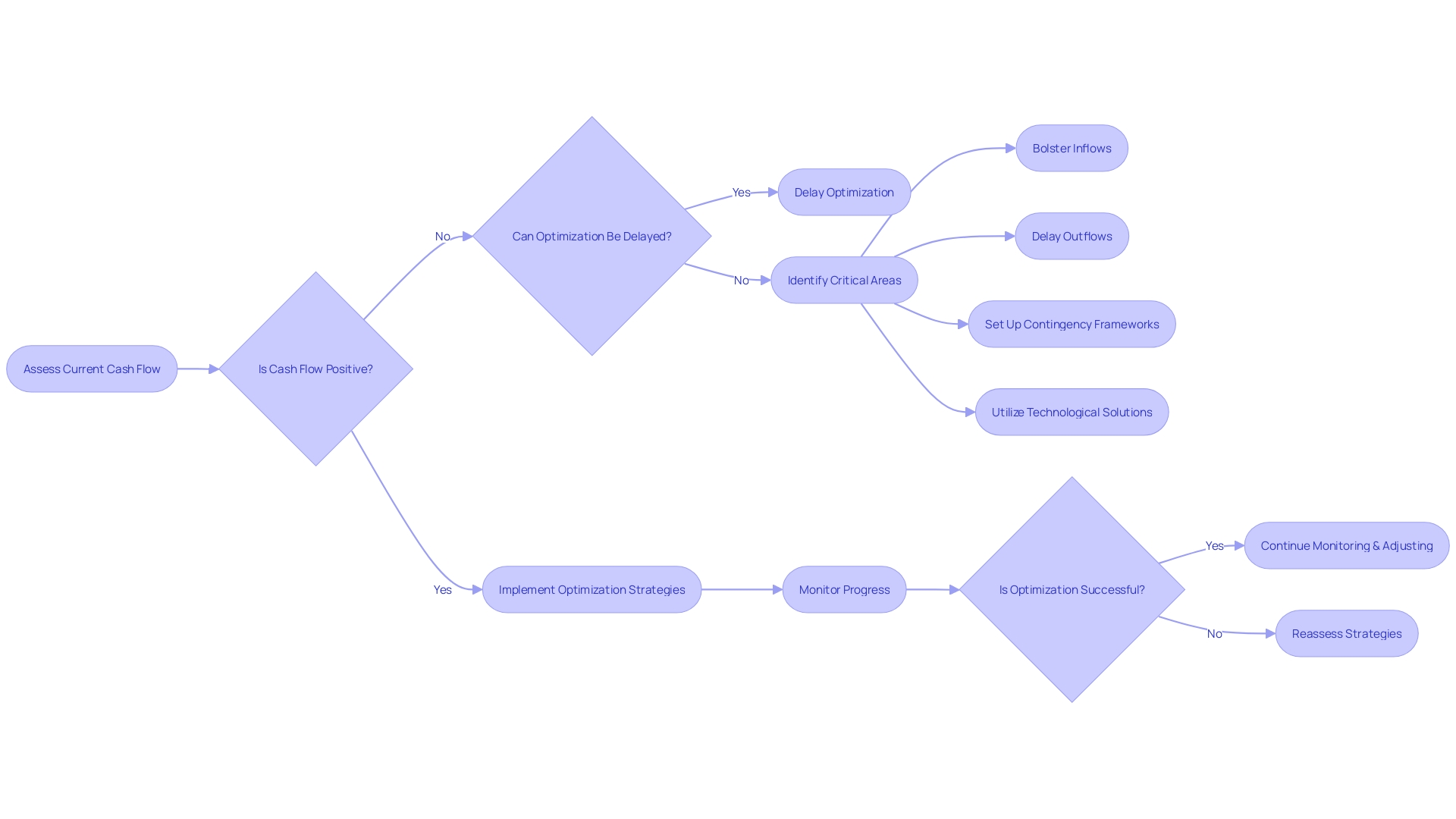

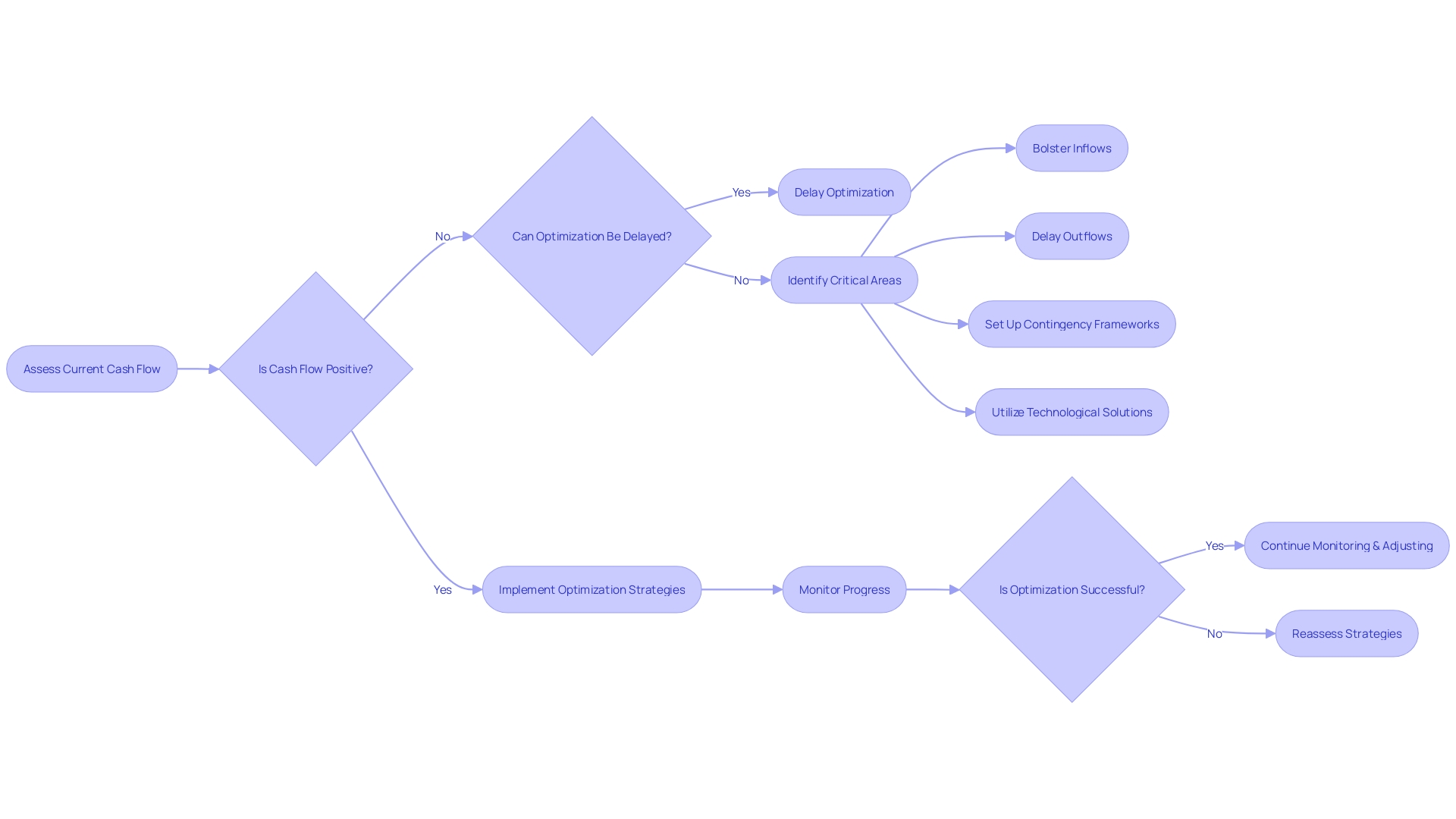

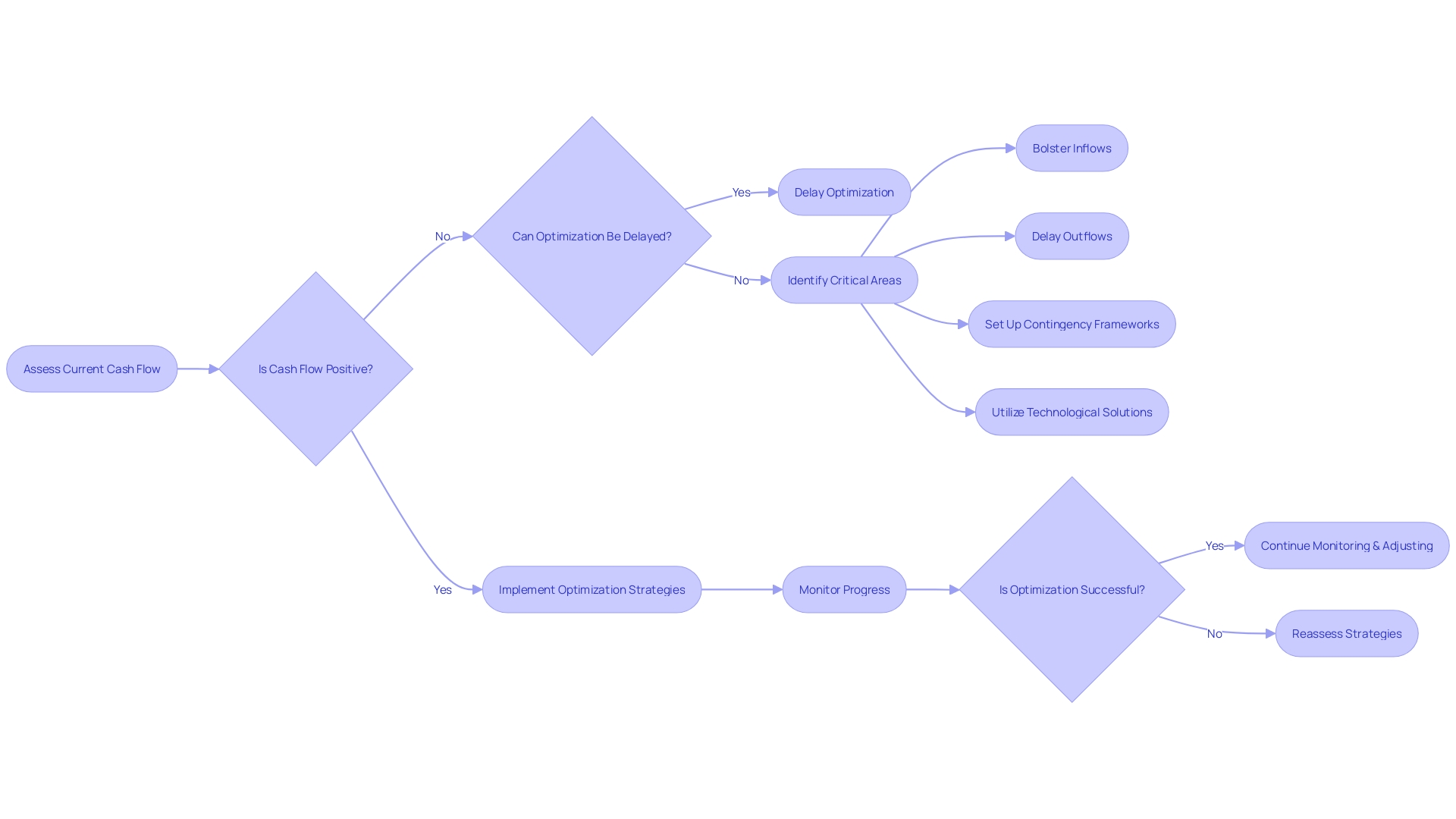

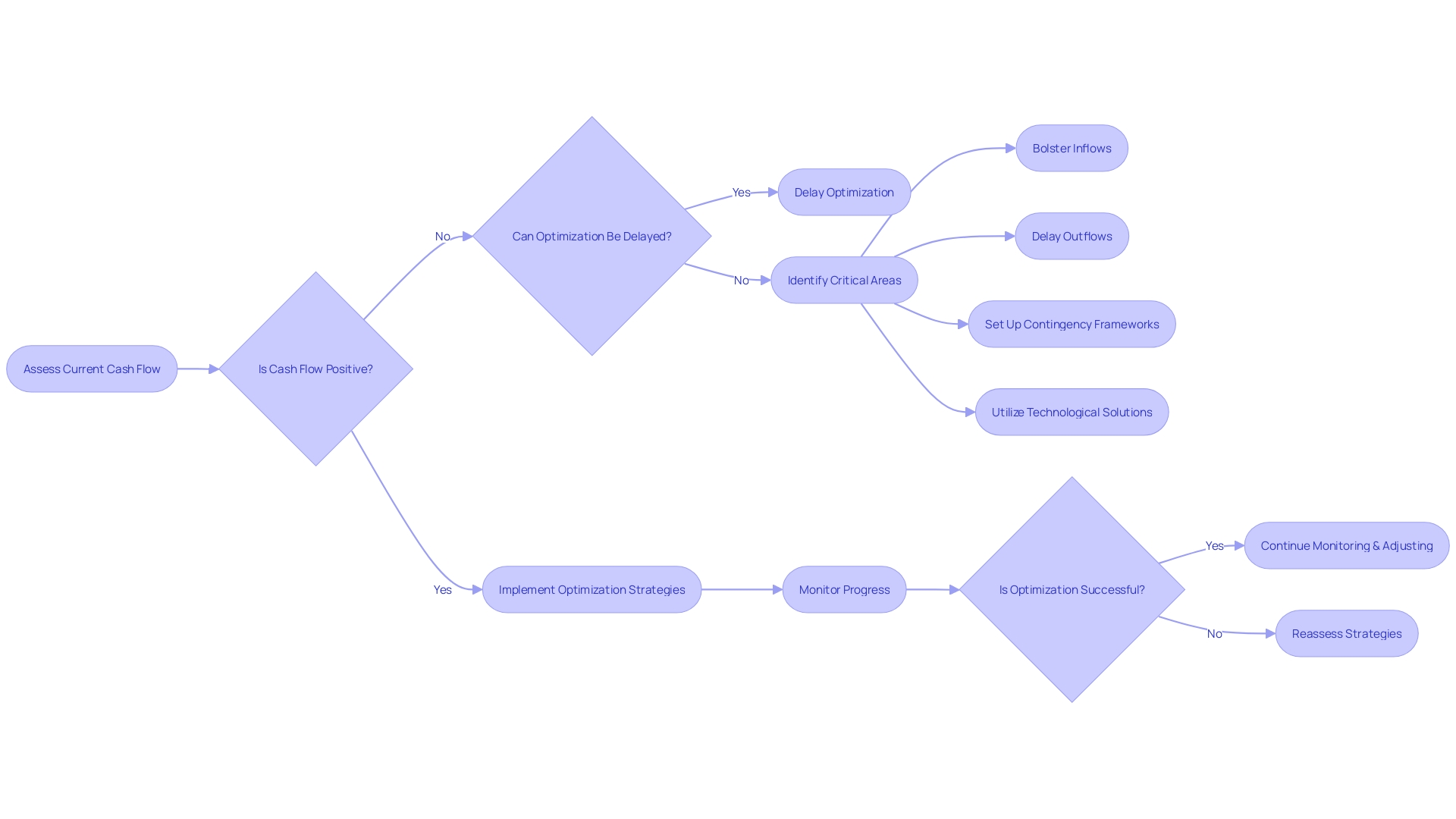

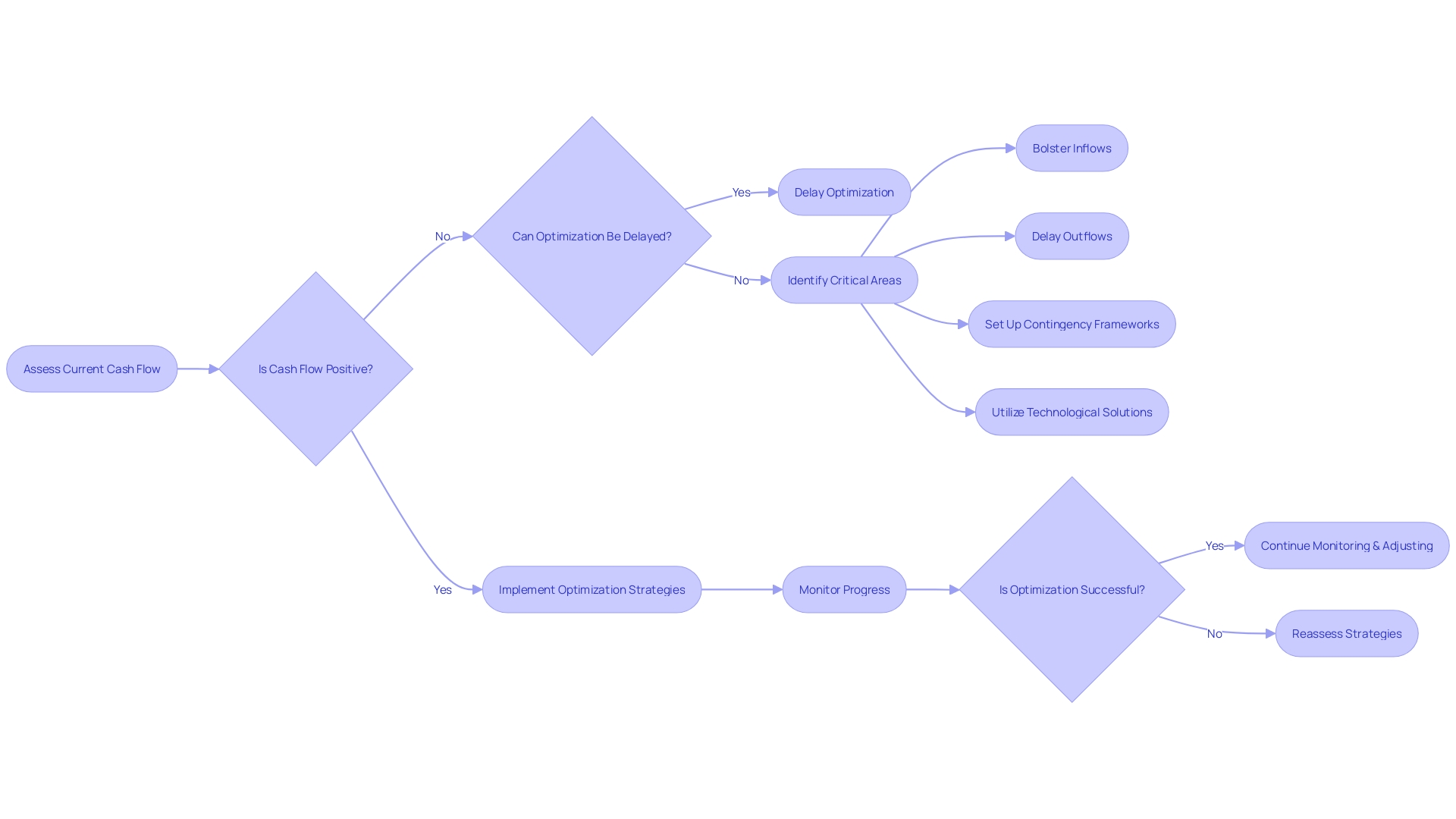

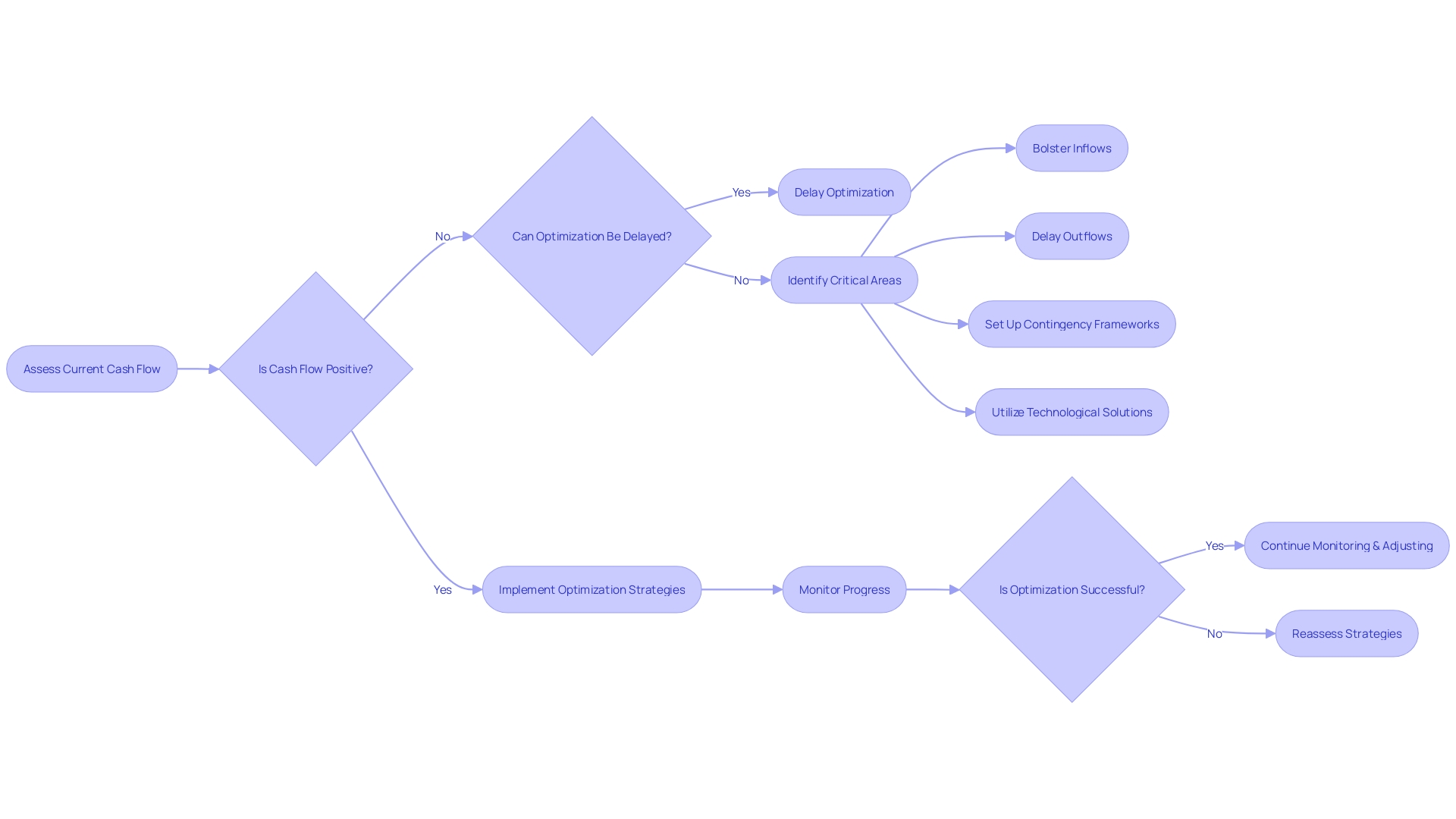

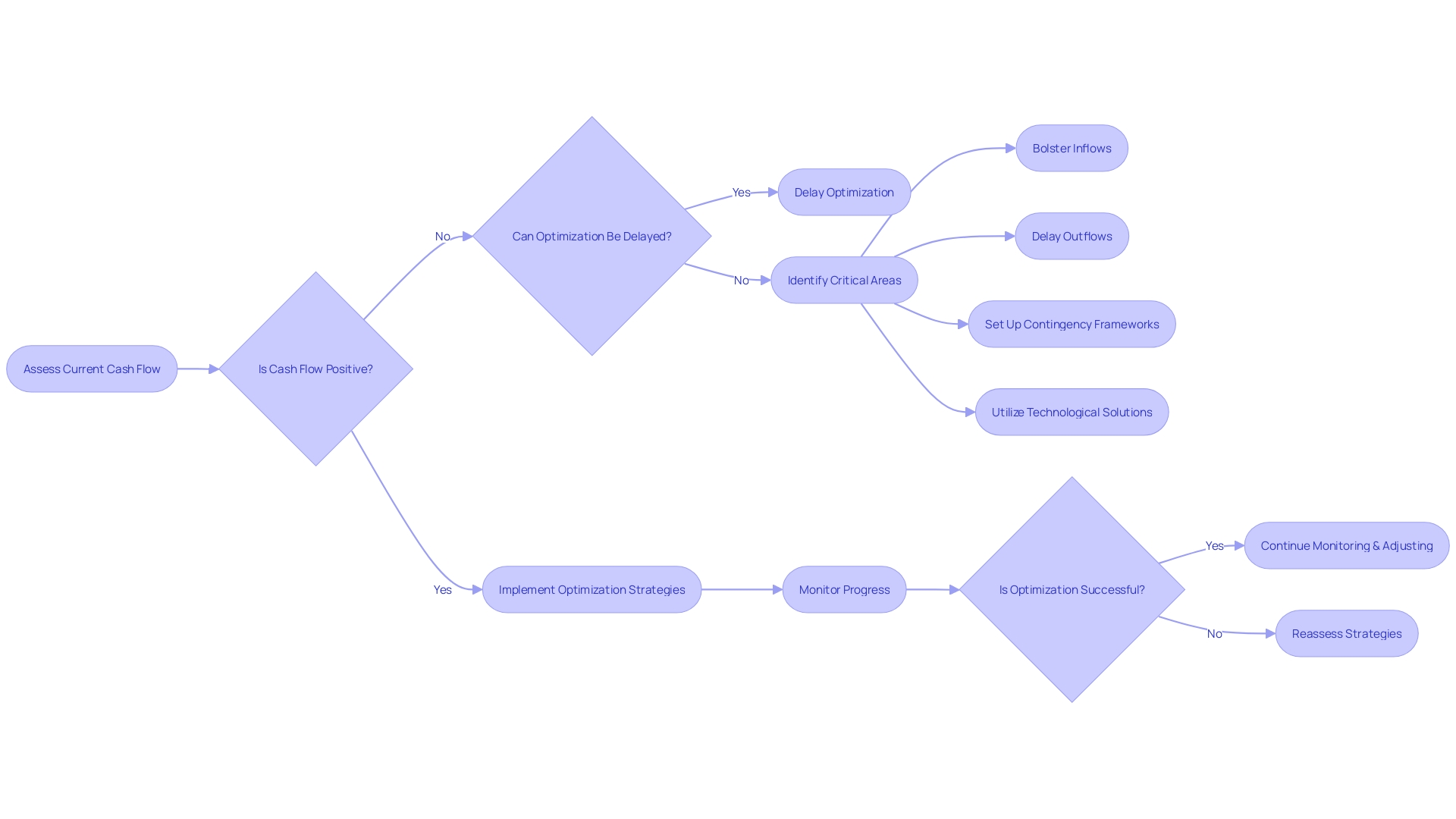

For any enterprise, liquidity is the royal decree upholding its kingdom. Recognizing that cash flow, not mere profit, is the paramount indicator of business vitality, CFOs must employ rigorous strategies to manage the steady torrent of cash entering and exiting company coffers. Best practices in cash flow optimization go beyond simply understanding financial ebbs and flows; they involve proactive measures to bolster inflows, tactically delay outflows, set up robust contingency frameworks, and apply technological solutions to monitor and fine-tune financial movement.

In the realm where cash is queen, shortfall prevention is foundational to enduring success—so much so that overlooking it can lead to an enterprise's downfall. This stark reality underscores the necessity of a business strategy that maintains uninterrupted solvency. According to recent observations, businesses that effectively manage cash flow can avoid dire consequences that result from running dry.

Indeed, this vigilance not only fulfills immediate financial obligations but also facilitates measured strategic investments for sustained growth and market presence. Amidst a business landscape where ecommerce stores and consulting services prevail with predictably streamlined transactions and reliable revenue streams, the skill in managing cash flow becomes even more pertinent. These operational models hinged on smooth cash circulation highlight the importance of constructing a firmly grounded financial game plan, where preventing cash shortages at any time frame is not merely a goal, but an imperative for staying operational and profitable.

In conclusion, effective cash flow management is crucial for the financial health and success of any enterprise. Understanding the difference between cash flow and profit is essential for strategic decision-making.

Preempting cash shortages and maintaining a symbiotic relationship with cash foster innovation and expansion. Analyzing the components of a cash flow statement provides insights into fiscal wellness and operational prowess.

Cash flow from operations reflects a company's ability to generate cash from daily activities, while investing activities contribute to stability and growth. Cash flow from financing signals financial decisions and investor confidence.

Interpreting and analyzing cash flow statements empowers CFOs to navigate their companies prudently, ensuring profitability and excellence. Discounted cash flow analysis assesses the value of investments, while cash flow projections enable precise forecasting.

Best practices in cash flow management involve proactive measures to optimize inflows and delay outflows. Preventing cash shortages is fundamental to success and enables strategic investments. By mastering cash flow management, CFOs assure a continuous stream of liquidity for day-to-day operations and growth. Effective cash flow management navigates financial challenges and fosters long-term success. In summary, cash flow management is vital for enterprises to make informed decisions and remain resilient. By understanding and mastering cash flow, CFOs steer their companies towards stability, growth, and profitability.

Take control of your cash flow today and ensure long-term success for your business.

Why is Cash Flow Important?

Effective cash flow management is not merely a financial practice but a vital pulse for any enterprise. As the steady ingress and egress of cash defines its ability to pivot, invest, and sustain operations, understanding the nuances of cash flow versus profit becomes imperative. They are distinct yet interdependent indicators of financial health.

Cash flow represents the real-time movement of funds into and out of a business, paramount for the immediacy of meeting financial commitments and capitalizing on growth opportunities. On the other hand, profit conveys the monetary success over a longer period after expenditures are accounted for. Distinguishing between these two allows for strategic business decisions, designed to navigate the natural ebbs and flows of market demands.

Preempting cash shortages is thus crucial, as they can abruptly thwart an organization's trajectory, leading to severe outcomes regardless of external appearances of success. A symbiotic relationship with cash is essential, as its sufficiency can foster an environment ripe for innovation, expansion, and steadfastness against unexpected shifts. By mastering cash flow, businesses erect a bulwark against the perils of financial uncertainty, assuring a continuous stream of liquidity vital for the day-to-day and strategic command of the enterprise.

Deconstructing a cash flow statement offers pivotal insights into an organization's fiscal wellness and operational prowess. It meticulously categorizes all cash transactions, thereby informing stakeholders about the company's capacity to generate liquid assets through core business activities, to fund expansions through investments, and to manage its capital structure through financing.

Operating activities, spotlighted for indicating the cash inflows and outflows from daily operations, factor in revenue from sales and outgoings linked to business operations, also taking into account non-cash elements like depreciation and changes like accounts receivable. Investment activities relate to assets purchased or sold, while financial activities reflect fluctuations in equity and long-term borrowing.

The essence of this financial tool is succinctly captured by experts who note the vitality of comprehending the nuanced dance of cash within a venture. A steady cash flow is likened to the bloodstream of a business, critical not only for maintaining operations but also ensuring survival against financial turbulence. Moreover, it's a financial barometer, illustrating how income and capital expenditures (CAPEX) together dictate the organization's free cash flow—indicative of growth potential and the capacity to delight shareholders with dividends or undertake further investments without the need for external financing. Key statistics reinforce the narrative: operating activities serve as significant focus points, while a company's free cash flow growth is a harbinger for attractive growth trajectories.

Operating cash flow is a critical gauge of a company's financial health, depicting the net cash generated from routine business activities. This measure accounts for the company's revenues from sales, balanced against operating expenses like salaries, rent, and the costs of supplies. It also reflects fluctuations in working capital.

By assessing this key performance indicator, we glean insights into the company's competency in managing day-to-day activities to sustain cash generation. Through the lens of Monday.com's experience, a business can discern the significance of efficient growth and its linkage to free cash flow positivity, particularly when growth rates taper. Learning from streamlined operations can help a business fine-tune its strategies for heightened cash efficiency.

As not all revenue is equal, companies aware of their gross margins can more adeptly navigate towards stability and shareholder satisfaction over time. Furthermore, proficiency in cash management is not simply advantageous; it's essential for business survival, as cash shortages have the potential to cripple even the most promising ventures. Thus, differentiating cash flow from profit and mastering its intricacies becomes a cornerstone of business acumen, paving the way for informed decision-making, operational efficiency, and sustained profitability.

Investing activities play a crucial role in the financial stability and growth of a business. When analyzing the cash flow statement, the section on investing activities is indispensable for Chief Financial Officers (CFOs). It details the cash expended and the returns received from various investment pursuits, such as the acquisition or disposal of long-term assets, establishing new ventures like an eCommerce store, which offers the potential of reaching a global market with relatively low startup costs, or initiating consulting services with predictable revenue streams from ongoing client relationships.

The cash flow from these investments is a vital indicator of how well a company's strategic financial decisions are performing. Moreover, a firm grasp of cash flows allows CFOs to anticipate and avoid potential cash shortages, which are often fatal to businesses, despite outward appearances of success. By understanding the movement of money associated with investments, a CFO can better navigate the fine line between generating sustainable profits and maintaining operational liquidity, ultimately ensuring the enterprise remains competitive and solvent.

Cash flow from financing is a crucial aspect of a company's financial dynamics, encompassing a range of activities such as issuing debt or equity, settling outstanding loans, distributing dividends to shareholders, and executing share repurchases. As small businesses, exemplified by eCommerce stores and consulting services, often aspire to stability and growth, understanding the intricate balance of financing activities becomes imperative.

Analyzing cash flow from financing sheds light on the intricacies of a company's financial decisions, reflecting not just the potential for dividend payouts but also broader strategic financial insights. These decisions signal investor confidence and can provide a bellwether for future business sustainability.

It's also about mastering the nuances of cash flow—being adept at predicting its ebbs and flows—to ensure there are no cash shortages that could spell disaster for a business, despite impressive profitability on paper. The CFO plays a pivotal role, employing the cash flow statement to track changes in cash levels due to financing decisions, which aligns with the goal of value maximization. Companies, especially those in burgeoning sectors like tech and green energy, must sometimes prioritize long-term value over immediate profitability, a strategy underpinned by robust financing decisions that are keenly reflected in cash flow. Therefore, to thrive and not just survive, a company must be proficient in cash flow management, where cash flow from financing is an essential component, indicating how well a business is navigating its path towards value maximization.

A cash flow statement is a financial compass, directing CFOs through the complexities of liquidity and financial sustainability. At the heart of this statement are operating activities, which paint a picture of the company's revenue and expenses from core business operations.

Here we scrutinize cash from sales, monitor operational expenses, and adjust for non-cash items like depreciation, providing a reliable snapshot of how effectively operational strategies are generating cash. Investment activities, detailed in another section of the cash flow statement, provide clarity on long-term commitments, including acquisitions of assets pivotal for growth and expansion.

By tracking purchases and sales of capital assets, CFOs gain visibility into cash flow dynamics related to critical investment decisions. Insight into cash flow statements becomes truly actionable when informed by real-world success stories, such as Monday.com's impressive path to positive free cash flow.

Recognizing that each revenue dollar is endowed with varying degrees of value, Monday.com's keen focus on gross margins propelled them toward efficient growth and enhanced shareholder value. Keeping abreast of diverse sectors like healthcare and semiconductors—where demands and revolutions drive cash flow changes—fosters an understanding that monitoring cash flow is foundational, not just within but beyond a company's walls. A well-interpreted cash flow statement serves as a testament to a company's vital signs, ensuring that despite the dynamic nature of markets, an enterprise remains a resilient 'going concern' as affirmed by GAAP guidelines. Ultimately, the command over cash flow empowers CFOs to navigate their companies prudently, sidestepping potential liquidity crisis, and paving the way for enduring profitability and operational excellence.

Discounted cash flow (DCF) analysis stands as a linchpin in the complex world of financial valuation. It assesses an investment's worth by calculating the present value of anticipated future cash flows, drawing on the wisdom that money available now is more valuable than the same amount later due to potential inflation and the lost opportunity for capital growth, an idea harking back to Aesop's ancient fable, where a bird in hand was deemed better than two in the bush.

The method involves a detailed projection of expected cash flows, which may encapsulate net income, tax implications, adjustments in working capital, and capital expenditure. To illustrate the power of this method, we can look to the example of Monday.com, a company whose savvy growth strategies have rapidly led to a positive free cash flow.

Free cash flow, a metric separating all incoming cash from outgoing expenses over a period, is the lifeblood of valuation, as it provides a clear view of the funds available after accounting for capital expenditures like property, plants, and equipment. A company's intrinsic value, or the present value of expected future cash flows over its lifetime, is deeply impacted by free cash flow.

Intangible assets, from brand reputation to management quality, feed into this valuation, bolstering expected cash flows or reducing perceived risk and thus affecting the discount rate. In practice, a CFO can calculate free cash flow by subtracting capital expenditures from operating cash flow, the money generated from day-to-day operations. This figure offers an unvarnished look at a company's ability to generate cash and hence its underlying health and investment appeal. A positive operating cash flow and growing free cash flow signify a firm's capacity for self-sustained growth, a cornerstone for sound investment decisions.

A deft understanding of cash flow is non-negotiable for any business to sustain profits and navigate the financial tide. At the heart of this lies the prowess to predict future cash movements through projections and forecasts. By leveraging historical financial data and accounting for projected business activities, CFOs can craft precise cash flow statements.

Such statements meticulously segment into operating activities, capital expenditures (CAPEX), and ultimately, free cash flow. Operating activities deserve meticulous attention since they encompass the cash generated directly from sales and business operations. It's critical to consider adjustments for non-cash items, such as depreciation, and modifications in working capital positions.

An astute CFO understands the paramount importance of managing the inflows and outflows within a company, ensuring the lifeblood of the enterprise—cash—remains abundant. When cash management holds the reigns, even the most auspicious firms can falter without a solid cash reserve. This financial metric not only reflects a company's health after all expenses but also helps ensure there's no dry spell leading to stagnation or collapse.

Indeed, the waveform of a business's finances reflects in its cash flow; it's essential to comprehend the oscillation between surpluses and deficits to devise a robust strategy that never tips the scale towards insolvency. In echoing the sentiment of industry experts, the judicious balancing of cash flow versus profit, while primarily intertwined, serves as the keystone for all business decisions. And in this tightrope walk, preventing cash shortages becomes as critical as maintaining profitability for the stability and future growth of the business.

For any enterprise, liquidity is the royal decree upholding its kingdom. Recognizing that cash flow, not mere profit, is the paramount indicator of business vitality, CFOs must employ rigorous strategies to manage the steady torrent of cash entering and exiting company coffers. Best practices in cash flow optimization go beyond simply understanding financial ebbs and flows; they involve proactive measures to bolster inflows, tactically delay outflows, set up robust contingency frameworks, and apply technological solutions to monitor and fine-tune financial movement.

In the realm where cash is queen, shortfall prevention is foundational to enduring success—so much so that overlooking it can lead to an enterprise's downfall. This stark reality underscores the necessity of a business strategy that maintains uninterrupted solvency. According to recent observations, businesses that effectively manage cash flow can avoid dire consequences that result from running dry.

Indeed, this vigilance not only fulfills immediate financial obligations but also facilitates measured strategic investments for sustained growth and market presence. Amidst a business landscape where ecommerce stores and consulting services prevail with predictably streamlined transactions and reliable revenue streams, the skill in managing cash flow becomes even more pertinent. These operational models hinged on smooth cash circulation highlight the importance of constructing a firmly grounded financial game plan, where preventing cash shortages at any time frame is not merely a goal, but an imperative for staying operational and profitable.

In conclusion, effective cash flow management is crucial for the financial health and success of any enterprise. Understanding the difference between cash flow and profit is essential for strategic decision-making.

Preempting cash shortages and maintaining a symbiotic relationship with cash foster innovation and expansion. Analyzing the components of a cash flow statement provides insights into fiscal wellness and operational prowess.

Cash flow from operations reflects a company's ability to generate cash from daily activities, while investing activities contribute to stability and growth. Cash flow from financing signals financial decisions and investor confidence.

Interpreting and analyzing cash flow statements empowers CFOs to navigate their companies prudently, ensuring profitability and excellence. Discounted cash flow analysis assesses the value of investments, while cash flow projections enable precise forecasting.

Best practices in cash flow management involve proactive measures to optimize inflows and delay outflows. Preventing cash shortages is fundamental to success and enables strategic investments. By mastering cash flow management, CFOs assure a continuous stream of liquidity for day-to-day operations and growth. Effective cash flow management navigates financial challenges and fosters long-term success. In summary, cash flow management is vital for enterprises to make informed decisions and remain resilient. By understanding and mastering cash flow, CFOs steer their companies towards stability, growth, and profitability.

Take control of your cash flow today and ensure long-term success for your business.

Components of a Cash Flow Statement

Deconstructing a cash flow statement offers pivotal insights into an organization's fiscal wellness and operational prowess. It meticulously categorizes all cash transactions, thereby informing stakeholders about the company's capacity to generate liquid assets through core business activities, to fund expansions through investments, and to manage its capital structure through financing.

Operating activities, spotlighted for indicating the cash inflows and outflows from daily operations, factor in revenue from sales and outgoings linked to business operations, also taking into account non-cash elements like depreciation and changes like accounts receivable. Investment activities relate to assets purchased or sold, while financial activities reflect fluctuations in equity and long-term borrowing.

The essence of this financial tool is succinctly captured by experts who note the vitality of comprehending the nuanced dance of cash within a venture. A steady cash flow is likened to the bloodstream of a business, critical not only for maintaining operations but also ensuring survival against financial turbulence. Moreover, it's a financial barometer, illustrating how income and capital expenditures (CAPEX) together dictate the organization's free cash flow—indicative of growth potential and the capacity to delight shareholders with dividends or undertake further investments without the need for external financing. Key statistics reinforce the narrative: operating activities serve as significant focus points, while a company's free cash flow growth is a harbinger for attractive growth trajectories.

Operating cash flow is a critical gauge of a company's financial health, depicting the net cash generated from routine business activities. This measure accounts for the company's revenues from sales, balanced against operating expenses like salaries, rent, and the costs of supplies. It also reflects fluctuations in working capital.

By assessing this key performance indicator, we glean insights into the company's competency in managing day-to-day activities to sustain cash generation. Through the lens of Monday.com's experience, a business can discern the significance of efficient growth and its linkage to free cash flow positivity, particularly when growth rates taper. Learning from streamlined operations can help a business fine-tune its strategies for heightened cash efficiency.

As not all revenue is equal, companies aware of their gross margins can more adeptly navigate towards stability and shareholder satisfaction over time. Furthermore, proficiency in cash management is not simply advantageous; it's essential for business survival, as cash shortages have the potential to cripple even the most promising ventures. Thus, differentiating cash flow from profit and mastering its intricacies becomes a cornerstone of business acumen, paving the way for informed decision-making, operational efficiency, and sustained profitability.

Investing activities play a crucial role in the financial stability and growth of a business. When analyzing the cash flow statement, the section on investing activities is indispensable for Chief Financial Officers (CFOs). It details the cash expended and the returns received from various investment pursuits, such as the acquisition or disposal of long-term assets, establishing new ventures like an eCommerce store, which offers the potential of reaching a global market with relatively low startup costs, or initiating consulting services with predictable revenue streams from ongoing client relationships.

The cash flow from these investments is a vital indicator of how well a company's strategic financial decisions are performing. Moreover, a firm grasp of cash flows allows CFOs to anticipate and avoid potential cash shortages, which are often fatal to businesses, despite outward appearances of success. By understanding the movement of money associated with investments, a CFO can better navigate the fine line between generating sustainable profits and maintaining operational liquidity, ultimately ensuring the enterprise remains competitive and solvent.

Cash flow from financing is a crucial aspect of a company's financial dynamics, encompassing a range of activities such as issuing debt or equity, settling outstanding loans, distributing dividends to shareholders, and executing share repurchases. As small businesses, exemplified by eCommerce stores and consulting services, often aspire to stability and growth, understanding the intricate balance of financing activities becomes imperative.

Analyzing cash flow from financing sheds light on the intricacies of a company's financial decisions, reflecting not just the potential for dividend payouts but also broader strategic financial insights. These decisions signal investor confidence and can provide a bellwether for future business sustainability.

It's also about mastering the nuances of cash flow—being adept at predicting its ebbs and flows—to ensure there are no cash shortages that could spell disaster for a business, despite impressive profitability on paper. The CFO plays a pivotal role, employing the cash flow statement to track changes in cash levels due to financing decisions, which aligns with the goal of value maximization. Companies, especially those in burgeoning sectors like tech and green energy, must sometimes prioritize long-term value over immediate profitability, a strategy underpinned by robust financing decisions that are keenly reflected in cash flow. Therefore, to thrive and not just survive, a company must be proficient in cash flow management, where cash flow from financing is an essential component, indicating how well a business is navigating its path towards value maximization.

A cash flow statement is a financial compass, directing CFOs through the complexities of liquidity and financial sustainability. At the heart of this statement are operating activities, which paint a picture of the company's revenue and expenses from core business operations.

Here we scrutinize cash from sales, monitor operational expenses, and adjust for non-cash items like depreciation, providing a reliable snapshot of how effectively operational strategies are generating cash. Investment activities, detailed in another section of the cash flow statement, provide clarity on long-term commitments, including acquisitions of assets pivotal for growth and expansion.

By tracking purchases and sales of capital assets, CFOs gain visibility into cash flow dynamics related to critical investment decisions. Insight into cash flow statements becomes truly actionable when informed by real-world success stories, such as Monday.com's impressive path to positive free cash flow.

Recognizing that each revenue dollar is endowed with varying degrees of value, Monday.com's keen focus on gross margins propelled them toward efficient growth and enhanced shareholder value. Keeping abreast of diverse sectors like healthcare and semiconductors—where demands and revolutions drive cash flow changes—fosters an understanding that monitoring cash flow is foundational, not just within but beyond a company's walls. A well-interpreted cash flow statement serves as a testament to a company's vital signs, ensuring that despite the dynamic nature of markets, an enterprise remains a resilient 'going concern' as affirmed by GAAP guidelines. Ultimately, the command over cash flow empowers CFOs to navigate their companies prudently, sidestepping potential liquidity crisis, and paving the way for enduring profitability and operational excellence.

Discounted cash flow (DCF) analysis stands as a linchpin in the complex world of financial valuation. It assesses an investment's worth by calculating the present value of anticipated future cash flows, drawing on the wisdom that money available now is more valuable than the same amount later due to potential inflation and the lost opportunity for capital growth, an idea harking back to Aesop's ancient fable, where a bird in hand was deemed better than two in the bush.

The method involves a detailed projection of expected cash flows, which may encapsulate net income, tax implications, adjustments in working capital, and capital expenditure. To illustrate the power of this method, we can look to the example of Monday.com, a company whose savvy growth strategies have rapidly led to a positive free cash flow.

Free cash flow, a metric separating all incoming cash from outgoing expenses over a period, is the lifeblood of valuation, as it provides a clear view of the funds available after accounting for capital expenditures like property, plants, and equipment. A company's intrinsic value, or the present value of expected future cash flows over its lifetime, is deeply impacted by free cash flow.

Intangible assets, from brand reputation to management quality, feed into this valuation, bolstering expected cash flows or reducing perceived risk and thus affecting the discount rate. In practice, a CFO can calculate free cash flow by subtracting capital expenditures from operating cash flow, the money generated from day-to-day operations. This figure offers an unvarnished look at a company's ability to generate cash and hence its underlying health and investment appeal. A positive operating cash flow and growing free cash flow signify a firm's capacity for self-sustained growth, a cornerstone for sound investment decisions.

A deft understanding of cash flow is non-negotiable for any business to sustain profits and navigate the financial tide. At the heart of this lies the prowess to predict future cash movements through projections and forecasts. By leveraging historical financial data and accounting for projected business activities, CFOs can craft precise cash flow statements.

Such statements meticulously segment into operating activities, capital expenditures (CAPEX), and ultimately, free cash flow. Operating activities deserve meticulous attention since they encompass the cash generated directly from sales and business operations. It's critical to consider adjustments for non-cash items, such as depreciation, and modifications in working capital positions.

An astute CFO understands the paramount importance of managing the inflows and outflows within a company, ensuring the lifeblood of the enterprise—cash—remains abundant. When cash management holds the reigns, even the most auspicious firms can falter without a solid cash reserve. This financial metric not only reflects a company's health after all expenses but also helps ensure there's no dry spell leading to stagnation or collapse.

Indeed, the waveform of a business's finances reflects in its cash flow; it's essential to comprehend the oscillation between surpluses and deficits to devise a robust strategy that never tips the scale towards insolvency. In echoing the sentiment of industry experts, the judicious balancing of cash flow versus profit, while primarily intertwined, serves as the keystone for all business decisions. And in this tightrope walk, preventing cash shortages becomes as critical as maintaining profitability for the stability and future growth of the business.

For any enterprise, liquidity is the royal decree upholding its kingdom. Recognizing that cash flow, not mere profit, is the paramount indicator of business vitality, CFOs must employ rigorous strategies to manage the steady torrent of cash entering and exiting company coffers. Best practices in cash flow optimization go beyond simply understanding financial ebbs and flows; they involve proactive measures to bolster inflows, tactically delay outflows, set up robust contingency frameworks, and apply technological solutions to monitor and fine-tune financial movement.

In the realm where cash is queen, shortfall prevention is foundational to enduring success—so much so that overlooking it can lead to an enterprise's downfall. This stark reality underscores the necessity of a business strategy that maintains uninterrupted solvency. According to recent observations, businesses that effectively manage cash flow can avoid dire consequences that result from running dry.

Indeed, this vigilance not only fulfills immediate financial obligations but also facilitates measured strategic investments for sustained growth and market presence. Amidst a business landscape where ecommerce stores and consulting services prevail with predictably streamlined transactions and reliable revenue streams, the skill in managing cash flow becomes even more pertinent. These operational models hinged on smooth cash circulation highlight the importance of constructing a firmly grounded financial game plan, where preventing cash shortages at any time frame is not merely a goal, but an imperative for staying operational and profitable.

In conclusion, effective cash flow management is crucial for the financial health and success of any enterprise. Understanding the difference between cash flow and profit is essential for strategic decision-making.

Preempting cash shortages and maintaining a symbiotic relationship with cash foster innovation and expansion. Analyzing the components of a cash flow statement provides insights into fiscal wellness and operational prowess.

Cash flow from operations reflects a company's ability to generate cash from daily activities, while investing activities contribute to stability and growth. Cash flow from financing signals financial decisions and investor confidence.

Interpreting and analyzing cash flow statements empowers CFOs to navigate their companies prudently, ensuring profitability and excellence. Discounted cash flow analysis assesses the value of investments, while cash flow projections enable precise forecasting.

Best practices in cash flow management involve proactive measures to optimize inflows and delay outflows. Preventing cash shortages is fundamental to success and enables strategic investments. By mastering cash flow management, CFOs assure a continuous stream of liquidity for day-to-day operations and growth. Effective cash flow management navigates financial challenges and fosters long-term success. In summary, cash flow management is vital for enterprises to make informed decisions and remain resilient. By understanding and mastering cash flow, CFOs steer their companies towards stability, growth, and profitability.

Take control of your cash flow today and ensure long-term success for your business.

Cash Flow from Operations

Operating cash flow is a critical gauge of a company's financial health, depicting the net cash generated from routine business activities. This measure accounts for the company's revenues from sales, balanced against operating expenses like salaries, rent, and the costs of supplies. It also reflects fluctuations in working capital.

By assessing this key performance indicator, we glean insights into the company's competency in managing day-to-day activities to sustain cash generation. Through the lens of Monday.com's experience, a business can discern the significance of efficient growth and its linkage to free cash flow positivity, particularly when growth rates taper. Learning from streamlined operations can help a business fine-tune its strategies for heightened cash efficiency.

As not all revenue is equal, companies aware of their gross margins can more adeptly navigate towards stability and shareholder satisfaction over time. Furthermore, proficiency in cash management is not simply advantageous; it's essential for business survival, as cash shortages have the potential to cripple even the most promising ventures. Thus, differentiating cash flow from profit and mastering its intricacies becomes a cornerstone of business acumen, paving the way for informed decision-making, operational efficiency, and sustained profitability.

Investing activities play a crucial role in the financial stability and growth of a business. When analyzing the cash flow statement, the section on investing activities is indispensable for Chief Financial Officers (CFOs). It details the cash expended and the returns received from various investment pursuits, such as the acquisition or disposal of long-term assets, establishing new ventures like an eCommerce store, which offers the potential of reaching a global market with relatively low startup costs, or initiating consulting services with predictable revenue streams from ongoing client relationships.

The cash flow from these investments is a vital indicator of how well a company's strategic financial decisions are performing. Moreover, a firm grasp of cash flows allows CFOs to anticipate and avoid potential cash shortages, which are often fatal to businesses, despite outward appearances of success. By understanding the movement of money associated with investments, a CFO can better navigate the fine line between generating sustainable profits and maintaining operational liquidity, ultimately ensuring the enterprise remains competitive and solvent.

Cash flow from financing is a crucial aspect of a company's financial dynamics, encompassing a range of activities such as issuing debt or equity, settling outstanding loans, distributing dividends to shareholders, and executing share repurchases. As small businesses, exemplified by eCommerce stores and consulting services, often aspire to stability and growth, understanding the intricate balance of financing activities becomes imperative.

Analyzing cash flow from financing sheds light on the intricacies of a company's financial decisions, reflecting not just the potential for dividend payouts but also broader strategic financial insights. These decisions signal investor confidence and can provide a bellwether for future business sustainability.

It's also about mastering the nuances of cash flow—being adept at predicting its ebbs and flows—to ensure there are no cash shortages that could spell disaster for a business, despite impressive profitability on paper. The CFO plays a pivotal role, employing the cash flow statement to track changes in cash levels due to financing decisions, which aligns with the goal of value maximization. Companies, especially those in burgeoning sectors like tech and green energy, must sometimes prioritize long-term value over immediate profitability, a strategy underpinned by robust financing decisions that are keenly reflected in cash flow. Therefore, to thrive and not just survive, a company must be proficient in cash flow management, where cash flow from financing is an essential component, indicating how well a business is navigating its path towards value maximization.

A cash flow statement is a financial compass, directing CFOs through the complexities of liquidity and financial sustainability. At the heart of this statement are operating activities, which paint a picture of the company's revenue and expenses from core business operations.

Here we scrutinize cash from sales, monitor operational expenses, and adjust for non-cash items like depreciation, providing a reliable snapshot of how effectively operational strategies are generating cash. Investment activities, detailed in another section of the cash flow statement, provide clarity on long-term commitments, including acquisitions of assets pivotal for growth and expansion.

By tracking purchases and sales of capital assets, CFOs gain visibility into cash flow dynamics related to critical investment decisions. Insight into cash flow statements becomes truly actionable when informed by real-world success stories, such as Monday.com's impressive path to positive free cash flow.

Recognizing that each revenue dollar is endowed with varying degrees of value, Monday.com's keen focus on gross margins propelled them toward efficient growth and enhanced shareholder value. Keeping abreast of diverse sectors like healthcare and semiconductors—where demands and revolutions drive cash flow changes—fosters an understanding that monitoring cash flow is foundational, not just within but beyond a company's walls. A well-interpreted cash flow statement serves as a testament to a company's vital signs, ensuring that despite the dynamic nature of markets, an enterprise remains a resilient 'going concern' as affirmed by GAAP guidelines. Ultimately, the command over cash flow empowers CFOs to navigate their companies prudently, sidestepping potential liquidity crisis, and paving the way for enduring profitability and operational excellence.

Discounted cash flow (DCF) analysis stands as a linchpin in the complex world of financial valuation. It assesses an investment's worth by calculating the present value of anticipated future cash flows, drawing on the wisdom that money available now is more valuable than the same amount later due to potential inflation and the lost opportunity for capital growth, an idea harking back to Aesop's ancient fable, where a bird in hand was deemed better than two in the bush.

The method involves a detailed projection of expected cash flows, which may encapsulate net income, tax implications, adjustments in working capital, and capital expenditure. To illustrate the power of this method, we can look to the example of Monday.com, a company whose savvy growth strategies have rapidly led to a positive free cash flow.

Free cash flow, a metric separating all incoming cash from outgoing expenses over a period, is the lifeblood of valuation, as it provides a clear view of the funds available after accounting for capital expenditures like property, plants, and equipment. A company's intrinsic value, or the present value of expected future cash flows over its lifetime, is deeply impacted by free cash flow.

Intangible assets, from brand reputation to management quality, feed into this valuation, bolstering expected cash flows or reducing perceived risk and thus affecting the discount rate. In practice, a CFO can calculate free cash flow by subtracting capital expenditures from operating cash flow, the money generated from day-to-day operations. This figure offers an unvarnished look at a company's ability to generate cash and hence its underlying health and investment appeal. A positive operating cash flow and growing free cash flow signify a firm's capacity for self-sustained growth, a cornerstone for sound investment decisions.

A deft understanding of cash flow is non-negotiable for any business to sustain profits and navigate the financial tide. At the heart of this lies the prowess to predict future cash movements through projections and forecasts. By leveraging historical financial data and accounting for projected business activities, CFOs can craft precise cash flow statements.

Such statements meticulously segment into operating activities, capital expenditures (CAPEX), and ultimately, free cash flow. Operating activities deserve meticulous attention since they encompass the cash generated directly from sales and business operations. It's critical to consider adjustments for non-cash items, such as depreciation, and modifications in working capital positions.

An astute CFO understands the paramount importance of managing the inflows and outflows within a company, ensuring the lifeblood of the enterprise—cash—remains abundant. When cash management holds the reigns, even the most auspicious firms can falter without a solid cash reserve. This financial metric not only reflects a company's health after all expenses but also helps ensure there's no dry spell leading to stagnation or collapse.

Indeed, the waveform of a business's finances reflects in its cash flow; it's essential to comprehend the oscillation between surpluses and deficits to devise a robust strategy that never tips the scale towards insolvency. In echoing the sentiment of industry experts, the judicious balancing of cash flow versus profit, while primarily intertwined, serves as the keystone for all business decisions. And in this tightrope walk, preventing cash shortages becomes as critical as maintaining profitability for the stability and future growth of the business.

For any enterprise, liquidity is the royal decree upholding its kingdom. Recognizing that cash flow, not mere profit, is the paramount indicator of business vitality, CFOs must employ rigorous strategies to manage the steady torrent of cash entering and exiting company coffers. Best practices in cash flow optimization go beyond simply understanding financial ebbs and flows; they involve proactive measures to bolster inflows, tactically delay outflows, set up robust contingency frameworks, and apply technological solutions to monitor and fine-tune financial movement.

In the realm where cash is queen, shortfall prevention is foundational to enduring success—so much so that overlooking it can lead to an enterprise's downfall. This stark reality underscores the necessity of a business strategy that maintains uninterrupted solvency. According to recent observations, businesses that effectively manage cash flow can avoid dire consequences that result from running dry.

Indeed, this vigilance not only fulfills immediate financial obligations but also facilitates measured strategic investments for sustained growth and market presence. Amidst a business landscape where ecommerce stores and consulting services prevail with predictably streamlined transactions and reliable revenue streams, the skill in managing cash flow becomes even more pertinent. These operational models hinged on smooth cash circulation highlight the importance of constructing a firmly grounded financial game plan, where preventing cash shortages at any time frame is not merely a goal, but an imperative for staying operational and profitable.

In conclusion, effective cash flow management is crucial for the financial health and success of any enterprise. Understanding the difference between cash flow and profit is essential for strategic decision-making.

Preempting cash shortages and maintaining a symbiotic relationship with cash foster innovation and expansion. Analyzing the components of a cash flow statement provides insights into fiscal wellness and operational prowess.

Cash flow from operations reflects a company's ability to generate cash from daily activities, while investing activities contribute to stability and growth. Cash flow from financing signals financial decisions and investor confidence.

Interpreting and analyzing cash flow statements empowers CFOs to navigate their companies prudently, ensuring profitability and excellence. Discounted cash flow analysis assesses the value of investments, while cash flow projections enable precise forecasting.

Best practices in cash flow management involve proactive measures to optimize inflows and delay outflows. Preventing cash shortages is fundamental to success and enables strategic investments. By mastering cash flow management, CFOs assure a continuous stream of liquidity for day-to-day operations and growth. Effective cash flow management navigates financial challenges and fosters long-term success. In summary, cash flow management is vital for enterprises to make informed decisions and remain resilient. By understanding and mastering cash flow, CFOs steer their companies towards stability, growth, and profitability.

Take control of your cash flow today and ensure long-term success for your business.

Cash Flow from Investing

Investing activities play a crucial role in the financial stability and growth of a business. When analyzing the cash flow statement, the section on investing activities is indispensable for Chief Financial Officers (CFOs). It details the cash expended and the returns received from various investment pursuits, such as the acquisition or disposal of long-term assets, establishing new ventures like an eCommerce store, which offers the potential of reaching a global market with relatively low startup costs, or initiating consulting services with predictable revenue streams from ongoing client relationships.

The cash flow from these investments is a vital indicator of how well a company's strategic financial decisions are performing. Moreover, a firm grasp of cash flows allows CFOs to anticipate and avoid potential cash shortages, which are often fatal to businesses, despite outward appearances of success. By understanding the movement of money associated with investments, a CFO can better navigate the fine line between generating sustainable profits and maintaining operational liquidity, ultimately ensuring the enterprise remains competitive and solvent.

Cash flow from financing is a crucial aspect of a company's financial dynamics, encompassing a range of activities such as issuing debt or equity, settling outstanding loans, distributing dividends to shareholders, and executing share repurchases. As small businesses, exemplified by eCommerce stores and consulting services, often aspire to stability and growth, understanding the intricate balance of financing activities becomes imperative.

Analyzing cash flow from financing sheds light on the intricacies of a company's financial decisions, reflecting not just the potential for dividend payouts but also broader strategic financial insights. These decisions signal investor confidence and can provide a bellwether for future business sustainability.

It's also about mastering the nuances of cash flow—being adept at predicting its ebbs and flows—to ensure there are no cash shortages that could spell disaster for a business, despite impressive profitability on paper. The CFO plays a pivotal role, employing the cash flow statement to track changes in cash levels due to financing decisions, which aligns with the goal of value maximization. Companies, especially those in burgeoning sectors like tech and green energy, must sometimes prioritize long-term value over immediate profitability, a strategy underpinned by robust financing decisions that are keenly reflected in cash flow. Therefore, to thrive and not just survive, a company must be proficient in cash flow management, where cash flow from financing is an essential component, indicating how well a business is navigating its path towards value maximization.

A cash flow statement is a financial compass, directing CFOs through the complexities of liquidity and financial sustainability. At the heart of this statement are operating activities, which paint a picture of the company's revenue and expenses from core business operations.

Here we scrutinize cash from sales, monitor operational expenses, and adjust for non-cash items like depreciation, providing a reliable snapshot of how effectively operational strategies are generating cash. Investment activities, detailed in another section of the cash flow statement, provide clarity on long-term commitments, including acquisitions of assets pivotal for growth and expansion.

By tracking purchases and sales of capital assets, CFOs gain visibility into cash flow dynamics related to critical investment decisions. Insight into cash flow statements becomes truly actionable when informed by real-world success stories, such as Monday.com's impressive path to positive free cash flow.

Recognizing that each revenue dollar is endowed with varying degrees of value, Monday.com's keen focus on gross margins propelled them toward efficient growth and enhanced shareholder value. Keeping abreast of diverse sectors like healthcare and semiconductors—where demands and revolutions drive cash flow changes—fosters an understanding that monitoring cash flow is foundational, not just within but beyond a company's walls. A well-interpreted cash flow statement serves as a testament to a company's vital signs, ensuring that despite the dynamic nature of markets, an enterprise remains a resilient 'going concern' as affirmed by GAAP guidelines. Ultimately, the command over cash flow empowers CFOs to navigate their companies prudently, sidestepping potential liquidity crisis, and paving the way for enduring profitability and operational excellence.

Discounted cash flow (DCF) analysis stands as a linchpin in the complex world of financial valuation. It assesses an investment's worth by calculating the present value of anticipated future cash flows, drawing on the wisdom that money available now is more valuable than the same amount later due to potential inflation and the lost opportunity for capital growth, an idea harking back to Aesop's ancient fable, where a bird in hand was deemed better than two in the bush.

The method involves a detailed projection of expected cash flows, which may encapsulate net income, tax implications, adjustments in working capital, and capital expenditure. To illustrate the power of this method, we can look to the example of Monday.com, a company whose savvy growth strategies have rapidly led to a positive free cash flow.

Free cash flow, a metric separating all incoming cash from outgoing expenses over a period, is the lifeblood of valuation, as it provides a clear view of the funds available after accounting for capital expenditures like property, plants, and equipment. A company's intrinsic value, or the present value of expected future cash flows over its lifetime, is deeply impacted by free cash flow.

Intangible assets, from brand reputation to management quality, feed into this valuation, bolstering expected cash flows or reducing perceived risk and thus affecting the discount rate. In practice, a CFO can calculate free cash flow by subtracting capital expenditures from operating cash flow, the money generated from day-to-day operations. This figure offers an unvarnished look at a company's ability to generate cash and hence its underlying health and investment appeal. A positive operating cash flow and growing free cash flow signify a firm's capacity for self-sustained growth, a cornerstone for sound investment decisions.

A deft understanding of cash flow is non-negotiable for any business to sustain profits and navigate the financial tide. At the heart of this lies the prowess to predict future cash movements through projections and forecasts. By leveraging historical financial data and accounting for projected business activities, CFOs can craft precise cash flow statements.

Such statements meticulously segment into operating activities, capital expenditures (CAPEX), and ultimately, free cash flow. Operating activities deserve meticulous attention since they encompass the cash generated directly from sales and business operations. It's critical to consider adjustments for non-cash items, such as depreciation, and modifications in working capital positions.

An astute CFO understands the paramount importance of managing the inflows and outflows within a company, ensuring the lifeblood of the enterprise—cash—remains abundant. When cash management holds the reigns, even the most auspicious firms can falter without a solid cash reserve. This financial metric not only reflects a company's health after all expenses but also helps ensure there's no dry spell leading to stagnation or collapse.

Indeed, the waveform of a business's finances reflects in its cash flow; it's essential to comprehend the oscillation between surpluses and deficits to devise a robust strategy that never tips the scale towards insolvency. In echoing the sentiment of industry experts, the judicious balancing of cash flow versus profit, while primarily intertwined, serves as the keystone for all business decisions. And in this tightrope walk, preventing cash shortages becomes as critical as maintaining profitability for the stability and future growth of the business.

For any enterprise, liquidity is the royal decree upholding its kingdom. Recognizing that cash flow, not mere profit, is the paramount indicator of business vitality, CFOs must employ rigorous strategies to manage the steady torrent of cash entering and exiting company coffers. Best practices in cash flow optimization go beyond simply understanding financial ebbs and flows; they involve proactive measures to bolster inflows, tactically delay outflows, set up robust contingency frameworks, and apply technological solutions to monitor and fine-tune financial movement.

In the realm where cash is queen, shortfall prevention is foundational to enduring success—so much so that overlooking it can lead to an enterprise's downfall. This stark reality underscores the necessity of a business strategy that maintains uninterrupted solvency. According to recent observations, businesses that effectively manage cash flow can avoid dire consequences that result from running dry.

Indeed, this vigilance not only fulfills immediate financial obligations but also facilitates measured strategic investments for sustained growth and market presence. Amidst a business landscape where ecommerce stores and consulting services prevail with predictably streamlined transactions and reliable revenue streams, the skill in managing cash flow becomes even more pertinent. These operational models hinged on smooth cash circulation highlight the importance of constructing a firmly grounded financial game plan, where preventing cash shortages at any time frame is not merely a goal, but an imperative for staying operational and profitable.

In conclusion, effective cash flow management is crucial for the financial health and success of any enterprise. Understanding the difference between cash flow and profit is essential for strategic decision-making.

Preempting cash shortages and maintaining a symbiotic relationship with cash foster innovation and expansion. Analyzing the components of a cash flow statement provides insights into fiscal wellness and operational prowess.

Cash flow from operations reflects a company's ability to generate cash from daily activities, while investing activities contribute to stability and growth. Cash flow from financing signals financial decisions and investor confidence.

Interpreting and analyzing cash flow statements empowers CFOs to navigate their companies prudently, ensuring profitability and excellence. Discounted cash flow analysis assesses the value of investments, while cash flow projections enable precise forecasting.

Best practices in cash flow management involve proactive measures to optimize inflows and delay outflows. Preventing cash shortages is fundamental to success and enables strategic investments. By mastering cash flow management, CFOs assure a continuous stream of liquidity for day-to-day operations and growth. Effective cash flow management navigates financial challenges and fosters long-term success. In summary, cash flow management is vital for enterprises to make informed decisions and remain resilient. By understanding and mastering cash flow, CFOs steer their companies towards stability, growth, and profitability.

Take control of your cash flow today and ensure long-term success for your business.

Cash Flow from Financing

Cash flow from financing is a crucial aspect of a company's financial dynamics, encompassing a range of activities such as issuing debt or equity, settling outstanding loans, distributing dividends to shareholders, and executing share repurchases. As small businesses, exemplified by eCommerce stores and consulting services, often aspire to stability and growth, understanding the intricate balance of financing activities becomes imperative.

Analyzing cash flow from financing sheds light on the intricacies of a company's financial decisions, reflecting not just the potential for dividend payouts but also broader strategic financial insights. These decisions signal investor confidence and can provide a bellwether for future business sustainability.

It's also about mastering the nuances of cash flow—being adept at predicting its ebbs and flows—to ensure there are no cash shortages that could spell disaster for a business, despite impressive profitability on paper. The CFO plays a pivotal role, employing the cash flow statement to track changes in cash levels due to financing decisions, which aligns with the goal of value maximization. Companies, especially those in burgeoning sectors like tech and green energy, must sometimes prioritize long-term value over immediate profitability, a strategy underpinned by robust financing decisions that are keenly reflected in cash flow. Therefore, to thrive and not just survive, a company must be proficient in cash flow management, where cash flow from financing is an essential component, indicating how well a business is navigating its path towards value maximization.

A cash flow statement is a financial compass, directing CFOs through the complexities of liquidity and financial sustainability. At the heart of this statement are operating activities, which paint a picture of the company's revenue and expenses from core business operations.

Here we scrutinize cash from sales, monitor operational expenses, and adjust for non-cash items like depreciation, providing a reliable snapshot of how effectively operational strategies are generating cash. Investment activities, detailed in another section of the cash flow statement, provide clarity on long-term commitments, including acquisitions of assets pivotal for growth and expansion.

By tracking purchases and sales of capital assets, CFOs gain visibility into cash flow dynamics related to critical investment decisions. Insight into cash flow statements becomes truly actionable when informed by real-world success stories, such as Monday.com's impressive path to positive free cash flow.

Recognizing that each revenue dollar is endowed with varying degrees of value, Monday.com's keen focus on gross margins propelled them toward efficient growth and enhanced shareholder value. Keeping abreast of diverse sectors like healthcare and semiconductors—where demands and revolutions drive cash flow changes—fosters an understanding that monitoring cash flow is foundational, not just within but beyond a company's walls. A well-interpreted cash flow statement serves as a testament to a company's vital signs, ensuring that despite the dynamic nature of markets, an enterprise remains a resilient 'going concern' as affirmed by GAAP guidelines. Ultimately, the command over cash flow empowers CFOs to navigate their companies prudently, sidestepping potential liquidity crisis, and paving the way for enduring profitability and operational excellence.

Discounted cash flow (DCF) analysis stands as a linchpin in the complex world of financial valuation. It assesses an investment's worth by calculating the present value of anticipated future cash flows, drawing on the wisdom that money available now is more valuable than the same amount later due to potential inflation and the lost opportunity for capital growth, an idea harking back to Aesop's ancient fable, where a bird in hand was deemed better than two in the bush.

The method involves a detailed projection of expected cash flows, which may encapsulate net income, tax implications, adjustments in working capital, and capital expenditure. To illustrate the power of this method, we can look to the example of Monday.com, a company whose savvy growth strategies have rapidly led to a positive free cash flow.

Free cash flow, a metric separating all incoming cash from outgoing expenses over a period, is the lifeblood of valuation, as it provides a clear view of the funds available after accounting for capital expenditures like property, plants, and equipment. A company's intrinsic value, or the present value of expected future cash flows over its lifetime, is deeply impacted by free cash flow.

Intangible assets, from brand reputation to management quality, feed into this valuation, bolstering expected cash flows or reducing perceived risk and thus affecting the discount rate. In practice, a CFO can calculate free cash flow by subtracting capital expenditures from operating cash flow, the money generated from day-to-day operations. This figure offers an unvarnished look at a company's ability to generate cash and hence its underlying health and investment appeal. A positive operating cash flow and growing free cash flow signify a firm's capacity for self-sustained growth, a cornerstone for sound investment decisions.

A deft understanding of cash flow is non-negotiable for any business to sustain profits and navigate the financial tide. At the heart of this lies the prowess to predict future cash movements through projections and forecasts. By leveraging historical financial data and accounting for projected business activities, CFOs can craft precise cash flow statements.

Such statements meticulously segment into operating activities, capital expenditures (CAPEX), and ultimately, free cash flow. Operating activities deserve meticulous attention since they encompass the cash generated directly from sales and business operations. It's critical to consider adjustments for non-cash items, such as depreciation, and modifications in working capital positions.

An astute CFO understands the paramount importance of managing the inflows and outflows within a company, ensuring the lifeblood of the enterprise—cash—remains abundant. When cash management holds the reigns, even the most auspicious firms can falter without a solid cash reserve. This financial metric not only reflects a company's health after all expenses but also helps ensure there's no dry spell leading to stagnation or collapse.

Indeed, the waveform of a business's finances reflects in its cash flow; it's essential to comprehend the oscillation between surpluses and deficits to devise a robust strategy that never tips the scale towards insolvency. In echoing the sentiment of industry experts, the judicious balancing of cash flow versus profit, while primarily intertwined, serves as the keystone for all business decisions. And in this tightrope walk, preventing cash shortages becomes as critical as maintaining profitability for the stability and future growth of the business.