Introduction

Financial difficulties, poor management, lack of market research, insufficient funding, inadequate marketing, regulatory challenges, economic factors, and client/customer satisfaction are all critical areas that CFOs must navigate to ensure the financial health and success of their organizations. In this article, we will explore each of these challenges and provide practical advice and solutions for CFOs to overcome them. By addressing these key areas with confidence and taking action-oriented steps, CFOs can play a pivotal role in driving their companies towards stability, growth, and enhanced customer satisfaction.

Financial Issues

Financial difficulties remain a formidable hurdle, often predetermining a company's downfall. Unsustainable spending patterns, insufficient resource allocation, or depleted cash assets are precursors to corporate insolvency. For financial stewards, the imperative lies in diligent fiscal oversight—curbing expenditures, ensuring smooth cash flows, and maintaining debts at viable levels.

Strategic fiscal discipline, complemented by expert financial consultancy, serves as a bulwark against fiscal destabilization.

As evidenced by the Mitchell Gold Co.'s predicament, the volatile economic environment puts companies on the brink, with swift financial currents capable of eroding operational viability. In their case, the unforeseen inability to obtain essential financing heralded the cessation of business activities, showcasing the abruptness with which financial issues can arise. To combat such situations, a robust framework to evaluate, enact, and communicate business shifts or restructurings is paramount, exemplified by the adaptability in listening to team and client signals.

Warren Buffett's insights into the essence of success—transcending monetary achievement to positively impact others' lives—resonates deeply within the financial realm. Adhering to one's principles, embodying leadership, and imprinting lasting influences on teams and sectors underscore a CFO's true legacy.

Furthermore, with unforeseen disasters and challenges lurking, it's incumbent upon leadership to anticipate and prepare. Identification, prioritization, and mitigation of potential risks, coupled with responsive strategies, prepare organizations to weather adversity.

In deploying recovery strategies, reflecting on renowned methodologies such as the multivariate discriminant analysis (MDA), dating back to the seminal studies by Altman in 1968, might reveal pivotal financial patterns and indicators. Such steadfast attention to predictive analytics could be instrumental in averting a financial maelitre.

Hence, CFOs must navigate the tumultuous financial landscape with keen foresight, unwavering in their pursuit of stability while remaining grounded in the pursuit of broader, altruistic business goals.

Poor Management

The cornerstone of any successful business is excellent management, which encompasses proactive leadership, strategic foresight, and judicious resource management. CFOs play a pivotal role by closely collaborating with their management teams to establish clear objectives, craft cogent strategies, and continually fine-tune those plans in response to dynamic market conditions. This approach is evidenced by the adroit handling of unforeseen events, such as the sudden declaration of a federal holiday following President Ronald Reagan's death, which underscored the paramount importance of preparedness and adaptability in management practices.

Statistics demonstrate that key performance indicators (KPIs) are instrumental in managing progress and driving business improvements. Recognizing this, esteemed entrepreneur Mark Cuban emphasizes preparation and sales proficiency as essential skills for any successful business leader. Cuban advises, "have you done all your homework to know about your industry, your competition, your products, the profitability, your customer base, your demographics?"

Furthermore, fostering an environment of support, respect, and trust not only cultivates exceptional personnel but also ensures a robust and thriving organizational structure. According to renowned author and management consultant Peter Drucker, "What gets measured gets managed," asserting the critical nature of KPI tracking for maintaining financial health and operational efficiency. In summation, a CFO's duty to weave these threads—strategic planning, effective communication, and meticulous execution—into the organizational fabric cannot be overstated, as these elements collectively fortify the company against potential pitfalls associated with poor management practices.

Lack of Market Research

Ensuring a business's viability involves a comprehensive grasp of the target market—knowledge that stems from robust market research. Crucially, this includes intimate familiarity with customers' needs, preferences, and the broader competitive environment. Such research empowers a company to create offerings that truly resonate with consumer demand.

Encouragingly, CFOs hold a pivotal position in championing these market research efforts. This role encompasses setting in motion the mechanisms to acquire valuable data and cultivating the analytical capacity to distill insights from this data. A survey conducted by Qlik in 2022 highlights this point, noting that 85% of business leaders consider data literacy—understood as the ability to collect, interpret, and act on data—essential for success.

This sort of in-depth research isn't merely about aggregating information; it embraces primary research techniques to secure firsthand data. This includes conducting surveys, which have proven invaluable in uncovering customer experiences and satisfaction levels. Today, such surveys can be effortlessly administered online, increasing reach and responsiveness.

With data literacy, CFOs and their teams can discern the narratives hidden within the numbers, which in turn informs robust critical thinking and sophisticated decision-making processes. This approach is comprehensive, going beyond quantitative data to consider localization and the nuanced tastes and preferences of diverse markets, thereby sidestepping potential pitfalls like overlooking local competition, which is well-entrenched and keenly attuned to consumer expectations.

Insufficient Funding

A business's ability to secure sufficient funding stands as one of the pillars of its success. Without this vital support, endeavors face significant hurdles including meeting operational expenses, investing in growth initiatives, or buffering against economic fluctuations. A Chief Financial Officer's (CFO's) role is pivotal in collaborating with company executives and key stakeholders to identify and harness appropriate funding avenues, such as equity financing or business loans.

To ensure the organization's vitality, a robust financial plan is critical. This plan should elucidate the enterprise's funding requisites and present an array of financing solutions, thereby fortifying its financial underpinnings and enhancing its appeal to prospective investors who prioritize scalability and return on investment. Such proactive financial leadership is crucial to navigate the landscape of funding and investment, paving the path for enduring business success and innovation.

Inadequate Marketing

Business operations can be considerably hindered by subpar marketing efforts. Achieving brand visibility, luring in new customers, and carving out a distinctive market position becomes a herculean task without a robust marketing strategy. It is crucial for CFOs to team up with their marketing departments to craft campaigns that are in sync with wider company goals and cleverly utilize resources for an optimal return on marketing investments.

By incorporating thorough market research as a bedrock of the marketing approach, businesses can verify product demand, fine-tune target demographics, and gain an edge over competition. Islam Gouda, a renowned marketing academic, doesn't mince words about its importance: "Marketing isn't just about promoting products or services. It's about creating them, connecting with people."

This resonates with the experience of a hotel company which, after an unsuccessful stint with Google Ads, reformed their approach through using essential services like Google Analytics and a focus on keyword effectiveness, leading to a significant turnaround.

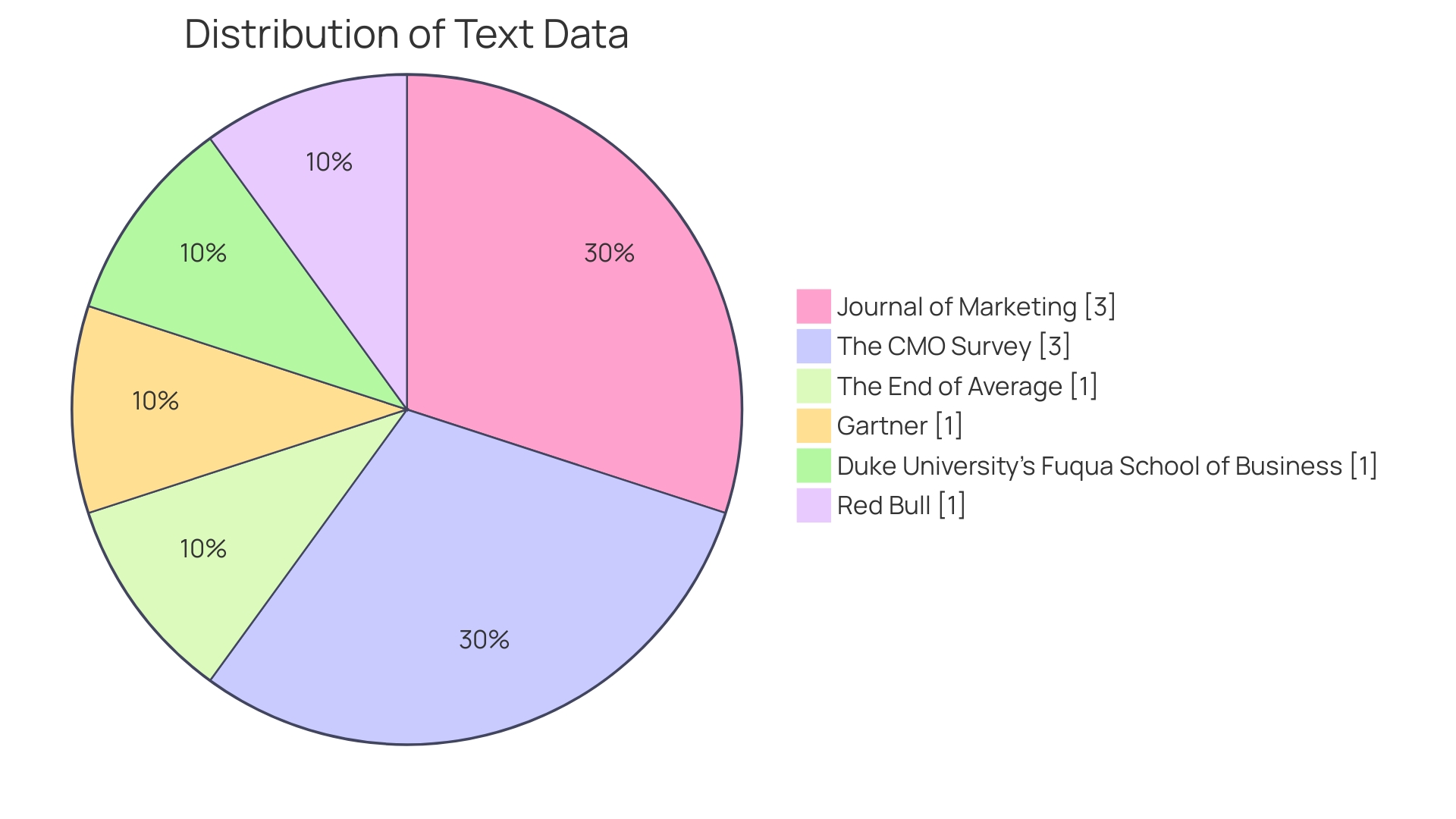

Mistakes in marketing expenditure can have serious repercussions. For instance, a proprietor of a car dealership realized the hard-fought battle in selling vehicles underscored the importance of a well-thought-out marketing plan. A case in point is MasterCard where a candid discussion on the CMO-CFO dynamic revealed a mutual distrust, with only a fifth believing in collaborative efforts.

This chasm can be bridged when both parties comprehend and respect the intricacies and potentials of each other's roles, with a strong marketing sector demonstrating clear ties between marketing initiatives and the overall business outcomes.

In actuality, marketing budgets have seen a surge, rising from 5% of revenue in 2011 to 8.7% in 2022, reflecting the urgency of winning over audiences amidst a deluge of average content vying for attention. With such stakes, it's no longer viable to roll the dice with marketing; instead a precisely cast net is far more effective. This is best elucidated by adopting niche marketing approaches, which after mastering, can progressively expand to cover broader markets.

Hence, a successful collaborative marketing plan is nimble, data-driven, and receptive to new trends, all while maintaining a consistent alignment with the core goals of the business. It ensures visibility and engagement with their target audiences optimally, much like Ineo Retail Media aims to do by integrating advertising solutions into retail environments, creating an enhanced and savvier shopping experience for consumers.

Regulatory Challenges

CFOs are often at the helm of navigating through the intricate and dynamic labyrinth of regulatory compliance. It's not just about staying afloat with current laws; it's critically examining legal counsel for their depth of understanding and ability to translate complex regulations into actionable insights. According to insights from industry leaders, creative legal solutions are the key to simplifying products while maintaining compliance.

They also emphasize the importance of avoiding over-decentralization in systems, suggesting a centralized approach may be more beneficial for compliance management, drawing lessons from cases in database management.

To stay competitive and avoid the stifling impact of over-regulation, fostering an environment where compliance can be synchronized with innovation is essential. However, this requires a carefully balanced approach. The University of Michigan provides a shining example of practical resources with their Online and Hybrid Programs Playbook.

Such tools can be adapted to ensure compliance without stifling creativity and growth.

Echoing recent sentiments expressed during regulatory discussions, there's a clear call for a more coordinated regulatory approach across federal agencies. Figures from The National Association of Manufacturers suggest substantial funds currently directed towards compliance could be reinvested in business growth and employee initiatives, underlining the urgency for a more streamlined regulatory environment.

Regulatory compliance is far from being a static checklist. It's a strategic component of business operations, ever-changing and ever-demanding. A CFO's astute focus on aligning regulatory obligations with business innovation is not just a defensive strategy — it's about seizing opportunities for growth even within the constraints of compliance.

Economic Factors

Navigating the unpredictable waves of economic shifts, such as a recession characterized by reduced consumer spending and slowed growth, necessitates strategic agility from CFOs. External pressures like inflation or changes in consumer behavior can create abrupt challenges in maintaining financial equilibrium and operational smoothness. It is crucial for financial leaders to stay abreast of economic indicators and trends to mitigate risks effectively.

For example, companies like IBL, with diverse interests extending across numerous sectors, including the dynamic retail and energy landscapes, maintain resilience by balancing a robust portfolio of innovative initiatives, calibrating their focus beyond just sustaining innovations. Similarly, Kao (Thailand) Company's proactive stance in diversifying products, enhancing digital infrastructure, and fortifying supply chain management has cemented its financial performance and customer allegiance amidst a crisis.

In practice, combating economic downturns can be informed by patterns within resistant industries. The food and beverage sector, a notable recession-resilient field, generated a staggering $6.22 trillion in sales from 1992 to 2019, signifying the potential to weather financial storms. With the fast-food industry appealing to investors for its enduring performance during recessions, and healthcare services experiencing continuous growth driven by demand and scientific progress, these sectors provide operational models for CFOs to consider in crafting robust business strategies.

Strategies like optimizing sales channels and investing in human capital have proven fundamental, as underscored by industry leaders emphasizing the importance of sales skills and fostering an effective, respectful, and trust-based work environment for employees.

Client and Customer Satisfaction

Fortifying customer satisfaction is not a mere option, but a strategic imperative for the financial vitality of a business. Quality of product and customer service are paramount; a chasm between expectation and reality can precipitate a loss of clients. It is critical for CFOs to work in tandem with customer support teams to bolster services.

They should spearhead initiatives such as incorporating advanced training programs, which enable employees to provide sterling service and efficiently utilize contemporary technologies, ultimately fostering a climate of perpetual improvement. Robust training leads not just to operational excellence but, crucially, to an enhancement in consumer satisfaction and allegiance.

Centralizing informational resources through an agile Learning Management System (LMS) is one cogent example of such improvement. By doing so, not only is knowledge made accessible, but also it epitomizes a company's dedication to its cause and its clientele. Moreover, fostering a respectful environment for customers is indispensable.

An astonishing 61% of customers perceive their time as undervalued by businesses. In response, firms must diligently architect customer experiences that value customer time and echo their brand's core tenets.

Recent changes in customer satisfaction metrics underscore this, as businesses with heightened American Customer Satisfaction Index scores frequently outperform in the stock market. Evidently, the relationship between customer contentment and financial success is inextricably linked, underscoring the role of the CFO in steering organizational strategies that prioritize exemplary customer service and robust quality controls.

Conclusion

In conclusion, CFOs face numerous challenges in ensuring the financial health and success of their organizations. They must address financial difficulties through fiscal discipline and expert consultancy. Collaboration with management teams is crucial for effective management practices.

Market research efforts must be championed to understand and meet customer needs. CFOs play a vital role in securing sufficient funding and aligning marketing strategies with business goals.

Regulatory challenges require creative legal solutions and an approach that balances compliance with innovation. Staying informed about economic factors and adapting strategies accordingly is essential for financial stability. Prioritizing customer satisfaction through robust training programs and exceptional service is paramount.

By tackling these challenges with confidence and taking action-oriented steps, CFOs can drive stability, growth, and enhanced customer satisfaction. It is crucial for CFOs to employ strategic thinking, effective communication, and continuous improvement. With a proactive and strategic mindset, CFOs can navigate financial difficulties, orchestrate successful management practices, conduct thorough market research, secure funding, implement effective marketing strategies, tackle regulatory challenges, adapt to economic shifts, and prioritize customer satisfaction.

In summary, CFOs must embrace these challenges and take the necessary steps to overcome them. By doing so, they can play a crucial role in driving their companies towards stability, growth, and enhanced customer satisfaction. With a confident and action-oriented approach, CFOs can build financial resilience, optimize operations, and lead their organizations to long-term success.