Introduction

In the world of finance, the roles of comptrollers and controllers are often used interchangeably. However, understanding the nuances between these positions is crucial for businesses seeking to establish robust financial practices. While both roles are essential for a company's financial health, they have distinct responsibilities and skill sets.

Comptrollers are strategic financial navigators, ensuring that financial objectives align with the organization's vision and guiding the company's financial course for future growth. Controllers, on the other hand, are responsible for the accuracy and integrity of financial records, crafting meticulous financial statements that form the backbone of strategic decision-making. In this article, we will explore the key differences between comptrollers and controllers, their respective responsibilities and scope of work, expertise and skill sets, and their roles in the financial reporting and decision-making processes.

By understanding these distinctions, businesses can make informed decisions about when to hire a comptroller or a controller to navigate their financial journey effectively.

Definitions: Comptroller and Controller

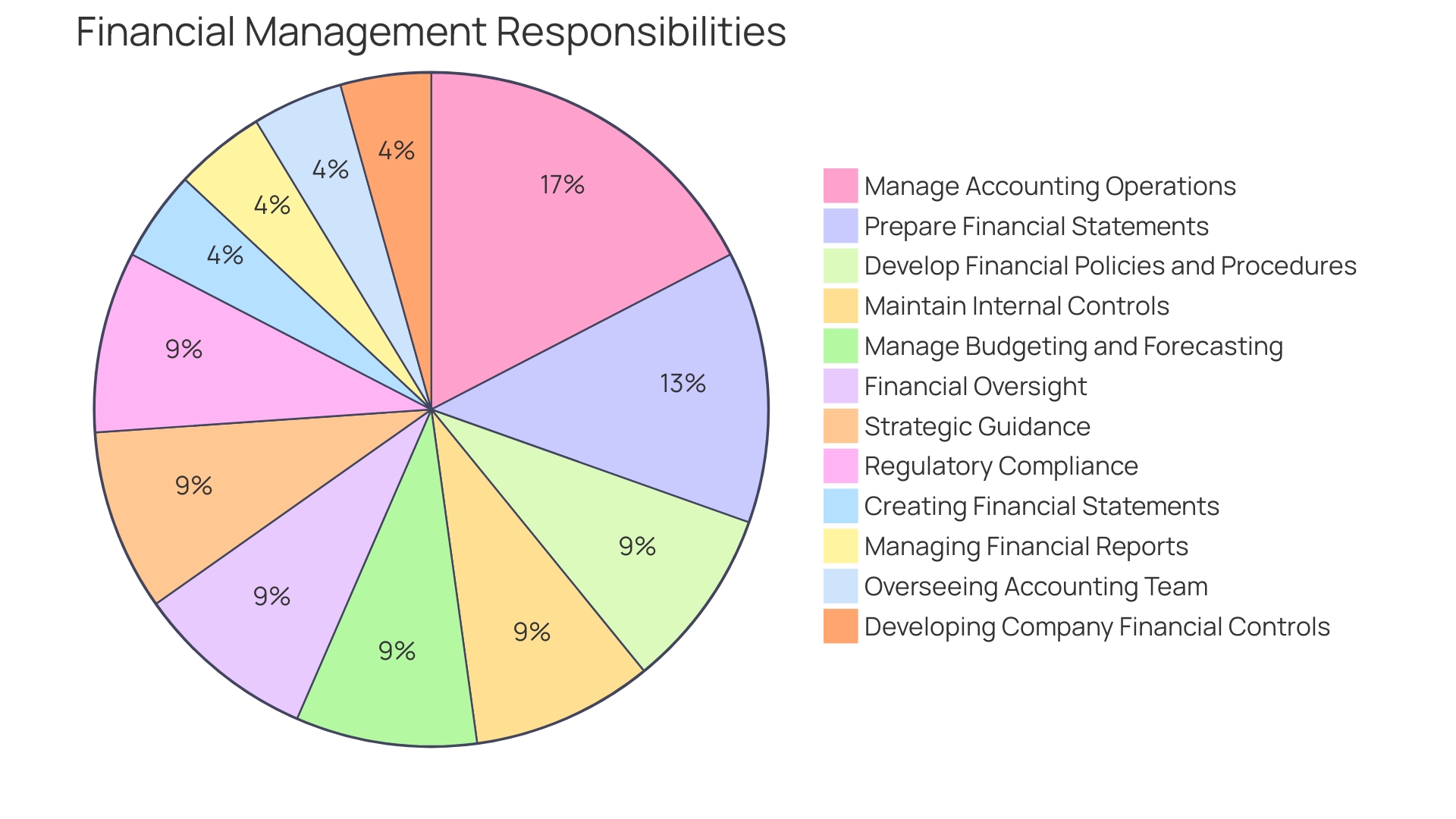

Understanding the nuanced roles in cost accounting is pivotal for a company's financial health. A financial controller, for instance, is not merely an accounting specialist; their influence extends across financial oversight and strategic guidance to regulatory compliance. They are tasked with ensuring the accuracy of financial statements which are integral for strategic decision-making.

Unlike the common interchangeability of 'comptroller' and 'controller', in practice, these roles have distinct responsibilities. Controllers oversee the creation of comprehensive financial reports, such as cash flow statements, balance sheets, and income statements—tools vital for analyzing a company's fiscal stability and guiding its financial journey. With their expertise, controllers enable businesses to navigate through complex financial landscapes, ensuring compliance and informing strategic directions.

Their role is essential in any industry that requires meticulous financial management, from steel production with its myriad departments to small businesses seeking to establish robust financial practices.

Key Differences Between Comptroller and Controller

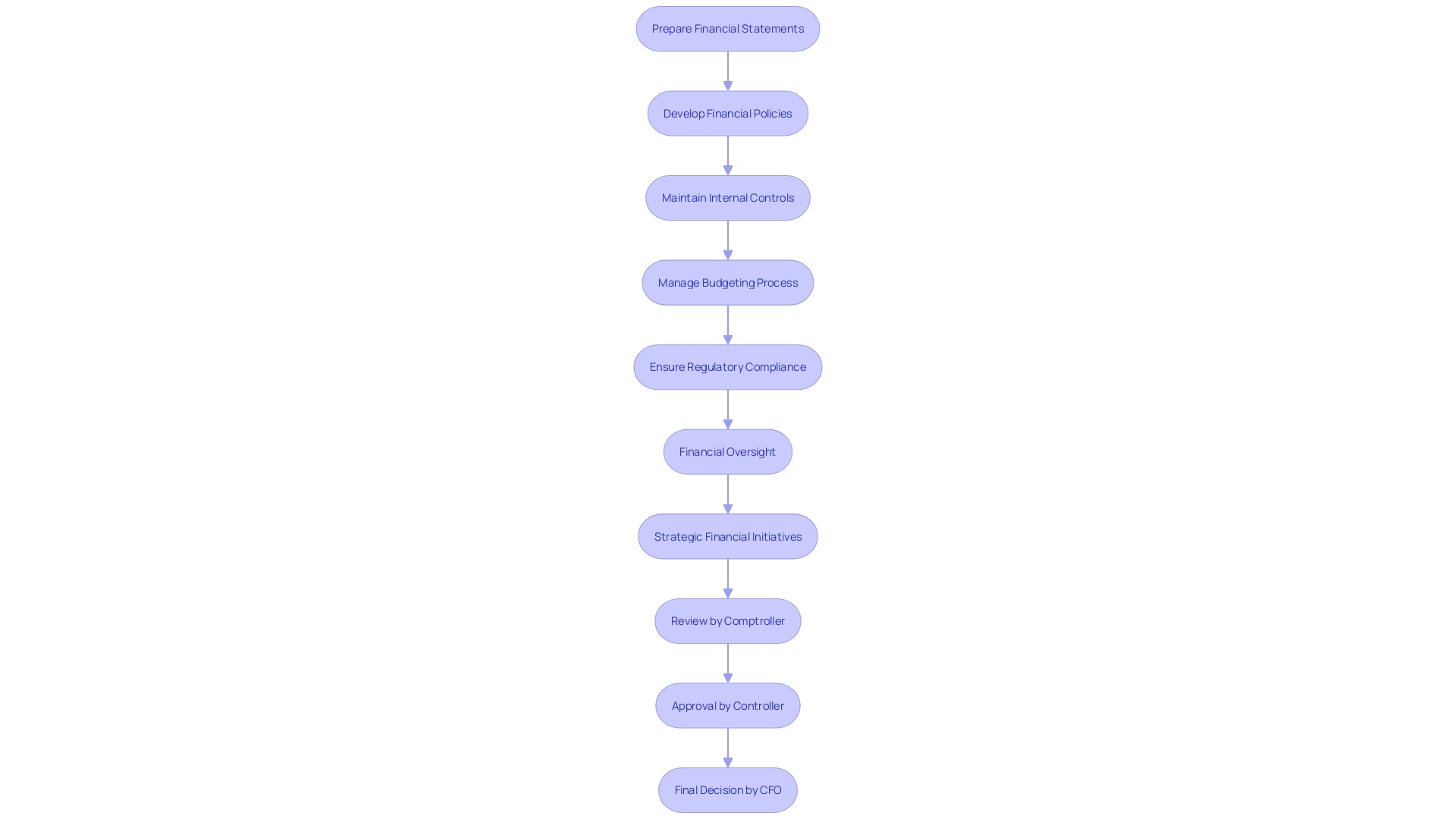

While the titles of comptroller and controller might appear synonymous, they embody distinct roles within the financial management realm of a business. A controller is integral to guiding a company's accounting functions, with a focus on financial reporting, accounts payable, and receivable management. They meticulously prepare financial statements, such as income statements and balance sheets, ensuring the organization's financial records are precise and timely.

Furthermore, controllers develop financial policies and oversee internal controls to protect company assets, while also managing the budgeting process to aid in strategic planning.

On the other hand, a comptroller's domain extends into a broader regulatory and compliance oversight, aligning financial strategies with legal requirements. They are entrusted with the responsibility of maintaining the financial integrity of a public entity or government body. This role often requires a comprehensive understanding of public funds management and regulatory standards.

These roles, both pivotal to the financial stewardship of an organization, involve distinct qualifications and skill sets. Controllers typically hold qualifications such as CPA certification and demonstrate proficiency in financial software, while comptrollers may require additional expertise in government finance regulations. Understanding the nuances of these positions is crucial for businesses to ensure that their financial operations are not only compliant but strategically poised for growth.

Responsibilities and Scope of Work

Within an organization, the roles of comptrollers and controllers are both pivotal but distinct in their focus and scope. Comptrollers are akin to strategic financial navigators, ensuring that the broader financial objectives align with the organization’s vision. Their purview extends into realms of financial management, budgeting, and setting the financial course for future growth and stability.

Controllers, on the other hand, have their fingers on the pulse of daily financial operations. They are responsible for the integrity and accuracy of financial records, crafting meticulous financial statements that form the backbone of strategic decision-making. Their duties are critical, encompassing the management of accounts payable and receivable, and ensuring regulatory compliance—a role that has been highlighted as profoundly impactful by industry news sources.

At CalPERS, one of the nation’s largest public pension funds, the value placed on diverse talents and expertise underscores the importance of these financial roles. With its commitment to innovation and leadership, CalPERS exemplifies the type of organization where the distinct contributions of comptrollers and controllers are not only recognized but also celebrated as part of a dynamic workforce.

As financial reporting remains essential for strategic decision-making, the role of the controller is ever more significant in interpreting and summarizing financial data to guide a company safely through fiscal challenges. This critical analysis, paired with strategic insights, is what allows organizations to thrive in a competitive landscape, as observed in recent statistics revealing the expansive management of assets by registered investment advisers, highlighting the sheer scale and importance of accurate financial oversight.

Accountability and Reporting Structure

Comptrollers and controllers are integral to an organization's financial hierarchy, each with distinct roles in the financial reporting and decision-making processes. Comptrollers usually hold a prominent position, often reporting directly to the CFO or the CEO. Their responsibilities are broad, encompassing the provision of crucial financial insights and strategic recommendations to the organization's upper echelons.

This strategic role is demonstrated by the substantial impact they can have on a company's financial transparency and integrity. For instance, modern financial strategies, such as those implemented by PayPal Giving Fund and Topcon Positioning Systems, emphasize the importance of a unified financial system that comptroller's help to oversee, which can enhance data accuracy and operational efficiency.

Controllers, meanwhile, serve as the financial reporting experts within a company. They often report to either the comptroller or directly to the CFO. Their expertise is pivotal in ensuring the accuracy and timeliness of financial information, which is essential for informed decision-making across all levels of the organization.

As highlighted by Andreas Barckow's explanation of the new requirements for financial performance reporting, accurate and consistent financial reporting is critical for understanding a company's operating profit and overall financial health. The role of controllers is underscored by their ability to create comprehensive financial statements - a responsibility that has become increasingly complex as the International Accounting Standards Board (IASB) study reveals over 60 companies reported operating profit figures calculated in at least nine different ways.

By fulfilling their respective duties, both comptrollers and controllers contribute significantly to a company's financial stewardship, ensuring that financial strategies and reporting adhere to strict standards and regulations, such as those under the purview of the Securities and Exchange Commission (SEC).

Expertise and Skill Sets

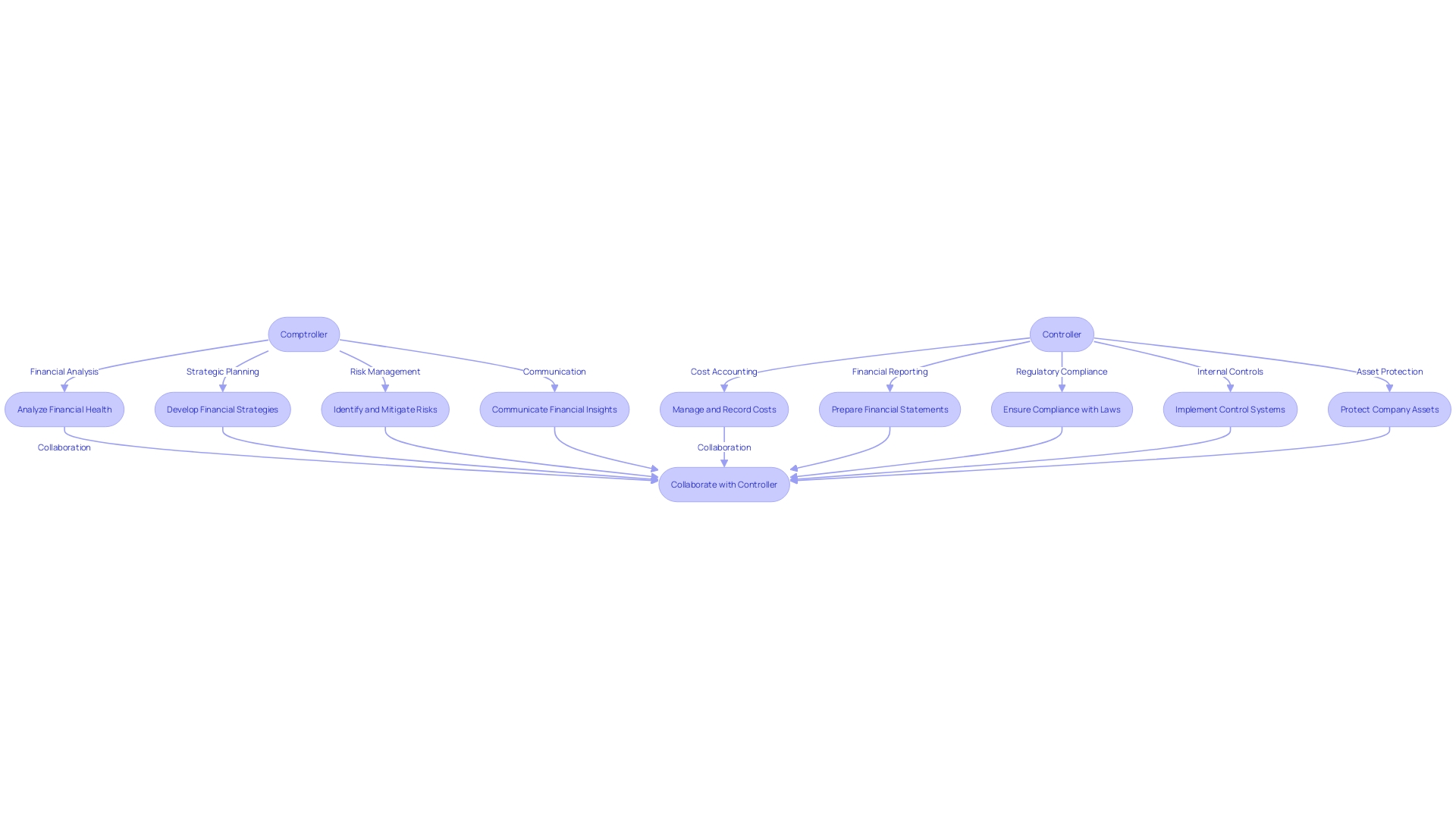

Comptrollers and controllers are pivotal in ensuring a business's financial health, yet their roles are distinct, each requiring specific expertise. Comptrollers, akin to financial strategists, delve into financial analysis and strategic planning, while also managing risks. Their leadership qualities and communication skills are essential for effective collaboration across various departments.

Their ability to navigate and manage complex situations, much like city comptrollers rapidly addressing emergencies such as the monkeypox virus outbreak or immediate risks posed by infrastructure failures, demonstrates their importance.

On the other side, controllers immerse themselves in the intricacies of cost accounting, embodying the role of chief accounting officers. They are the artisans of financial reporting, deftly ensuring adherence to accounting principles and regulatory compliance, with a keen eye for detail. Their expertise is invaluable in facilitating accurate financial reporting, which serves as the backbone of strategic decision-making within a business.

Controllers maintain a rigorous system of internal controls to protect company assets, similar to how safety standards protect the public from risks like catastrophic wildfires.

Both roles are essential in a business landscape where financial stability and strategic direction are paramount. Comptrollers and controllers, much like the careful oversight needed in rapidly evolving fields such as AI and biotech, contribute to a company's resilience and success by expertly navigating financial challenges and ensuring compliance in an ever-changing economic environment.

Strategic vs. Tactical Roles

Distinguishing between comptrollers and controllers is essential for effective financial management within an organization. Comptrollers are the visionaries, delving into the financial data to chart out the long-term fiscal strategies that ensure organizational prosperity. They are akin to navigators, forecasting financial trends and crafting policies that align with the ever-evolving market context, including socio-cultural, economic, and technological shifts.

These leaders manage risks and opportunities with a holistic approach, distributing key financial knowledge throughout the team to avoid concentrated risk.

In contrast, controllers are the tactical force, deeply involved in the day-to-day financial operations. Their expertise lies in verifying the financial records' accuracy, setting up robust internal controls, and overseeing every aspect of the accounting process. Controllers are the custodians of financial integrity, providing the financial statements that form the backbone of strategic decisions.

These statements, including cash flow reports, balance sheets, and income statements, are pivotal for small businesses, guiding critical decision-making processes.

Controllers are much more than accounting specialists; they provide strategic guidance and ensure regulatory compliance, thereby shaping the company's financial course. The importance of their role is highlighted by recent industry news, such as the appointment of seasoned professionals like John Austin as Chief Strategy Officer at Capital.com. Austin's strategic leadership is expected to drive innovation and growth, reflecting the significant role that financial controllers play in steering companies toward success.

In sum, while comptrollers and controllers serve different functions, their collaboration is fundamental to a company's financial well-being. Comptrollers craft the roadmap for future growth, while controllers ensure the journey is smooth by managing the financial details with precision and expertise.

Comparison with CFO Roles

Comptrollers and controllers are crucial team members within an organization's finance department, but they do not shoulder the same comprehensive responsibilities as a Chief Financial Officer (CFO). The CFO's role extends beyond mere financial oversight to encompass the strategic management of the company's financial trajectory, including steering investor relations and optimizing overall financial health. Controllers and comptrollers contribute by ensuring the integrity of financial operations and providing insights that support the CFO's broader strategic initiatives.

Through meticulous preparation and presentation of financial statements—cash flow, balance sheets, and income statements—they provide the factual groundwork that underpins informed decision-making and strategic financial planning. Their expertise is vital in developing financial policies, maintaining rigorous internal controls, and managing the budgeting process, all of which are essential to uphold regulatory compliance and safeguard company assets.

When to Hire a Comptroller or Controller

Choosing between a comptroller and a controller is pivotal for steering an organization's financial direction. A comptroller, with a knack for strategic financial planning and analysis, is essential for companies looking to delve deeper into financial intricacies. Their expertise can illuminate paths to profitability and growth through detailed financial oversight and actionable insights.

Conversely, a controller is the linchpin for managing the nitty-gritty of daily accounting tasks, ensuring that every financial transaction aligns with regulatory standards and contributes to the company's financial stability. This role is indispensable in crafting precise financial statements which serve as the foundation for strategic decision-making. Both positions play distinct yet complementary roles in the financial health of a company, and the choice hinges on the unique financial dynamics and aspirations of the business.

Conclusion

In conclusion, comptrollers and controllers have distinct roles in a company's financial health. Comptrollers are strategic financial navigators, aligning financial objectives with the organization's vision and guiding future growth. Controllers ensure the accuracy and integrity of financial records, informing strategic decision-making.

Comptrollers provide crucial financial insights and strategic recommendations, reporting directly to top executives. Controllers excel in financial reporting and regulatory compliance, ensuring the accuracy of financial information. Both roles contribute significantly to financial stewardship and compliance.

When deciding between a comptroller and a controller, businesses should consider their specific financial dynamics. Comptrollers focus on strategic planning and analysis, guiding profitability and growth. Controllers specialize in cost accounting and financial reporting, ensuring stability.

Understanding the distinctions between comptrollers and controllers is vital for making informed decisions. Comptrollers are visionary leaders, crafting long-term fiscal strategies. Controllers are tactical experts, managing day-to-day financial operations.

Both roles are essential for a company's financial well-being.

In summary, comptrollers and controllers play distinct but complementary roles in financial management. By recognizing their unique responsibilities, businesses can navigate their financial journey, achieve their goals, and ensure stability and growth.