Introduction

The roles of comptrollers and controllers in financial management are crucial for both public and private sector organizations. While their titles may seem similar, there are key differences between the two positions.

Comptrollers, also known as financial controllers, play a pivotal role in steering public sector organizations towards financial integrity and operational efficiency. They are responsible for analyzing financial data, managing financial operations, and ensuring compliance with evolving regulations.

On the other hand, controllers serve as linchpins in private sector organizations, managing accounting operations, financial reporting, and internal controls. This article explores the responsibilities, focus, industry context, and salary considerations for both comptrollers and controllers, highlighting the unique challenges and opportunities they face in their respective roles. Whether you're a CFO or aspiring to be one, understanding the distinctions between comptrollers and controllers is essential in navigating the complex world of financial management.

What is a Comptroller?

The role of a comptroller, also known as a financial controller, is pivotal in steering public sector organizations towards financial integrity and operational efficiency. These senior-level executives are the guardians of an organization's financial health, tasked with the meticulous analysis of financial data, and the management of financial operations in accordance with evolving regulations.

The 2024 Yellow Book highlights a transformative shift in financial standards, with a pronounced movement from quality control to quality management. This shift underscores the comptroller's role in identifying and mitigating risks to financial quality and adapting to a scalable quality management system that caters to the unique needs of organizations of varying sizes and complexities.

In the quest for financial excellence, a comptroller must possess a thorough understanding of financial reporting, strategic planning, and risk management. As financial landscapes evolve, the role demands a proactive approach to managing engagement quality.

This is echoed by a professional who shared their journey, "I learned so much by going through the program. The program really covers a wide breadth of knowledge that pertains to real-life work in public finance, and it covers it all in some depth." Moreover, the public sector's distinctive characteristics mean that comparisons with private sector financial practices must be approached with caution. The complexity of work and the nature of public service operations demand a tailored approach to financial management, as manufacturing and sales activities prevalent in the private sector are rare within state and local governments. Therefore, a comptroller's expertise is not just in managing finances but in sculpting a financial framework that is both robust and flexible, ensuring public funds are managed with the utmost responsibility and foresight.

What is a Controller?

In the realm of financial management, a controller serves as the linchpin in private sector organizations, managing the intricate web of accounting operations. This crucial role encompasses the stewardship of financial reporting, the meticulous crafting of budgets, and the fortification of internal controls.

Collaborating closely with the CFO, controllers are instrumental in sculpting and enacting financial strategies, ensuring the organization's financial narrative is both accurate and compliant. Their impact extends to navigating the complexities of third-party dependencies and operational risks, particularly in an environment where outsourcing is commonplace to enhance efficiency and customer experience.

Controllers must judiciously assess the reliability and regulatory adherence of these external partners to uphold the organization's standards. As financial landscapes evolve with technological advancements, such as the extensive use of algorithmic tools for credit underwriting in the mortgage industry, controllers must remain agile and responsive.

The forward-looking and proportional regulations underscore the necessity for controllers to guide their organizations through the regulatory maze, ensuring adherence without stifling innovation. In the context of Llcs, the controller's domain includes the generation of monthly financial statements and the management of overall financial health, thereby shaping the organization's financial trajectory. With the growing number of self-employed individuals and small businesses—ranging from 16.5 million to potentially over 27 million in the U.S. alone—the role of controllers in ensuring accurate financial reporting becomes even more pivotal. Their expertise not only maintains compliance but also contributes to the strategic financial decision-making that propels the organization forward.

Key Differences Between Comptroller and Controller

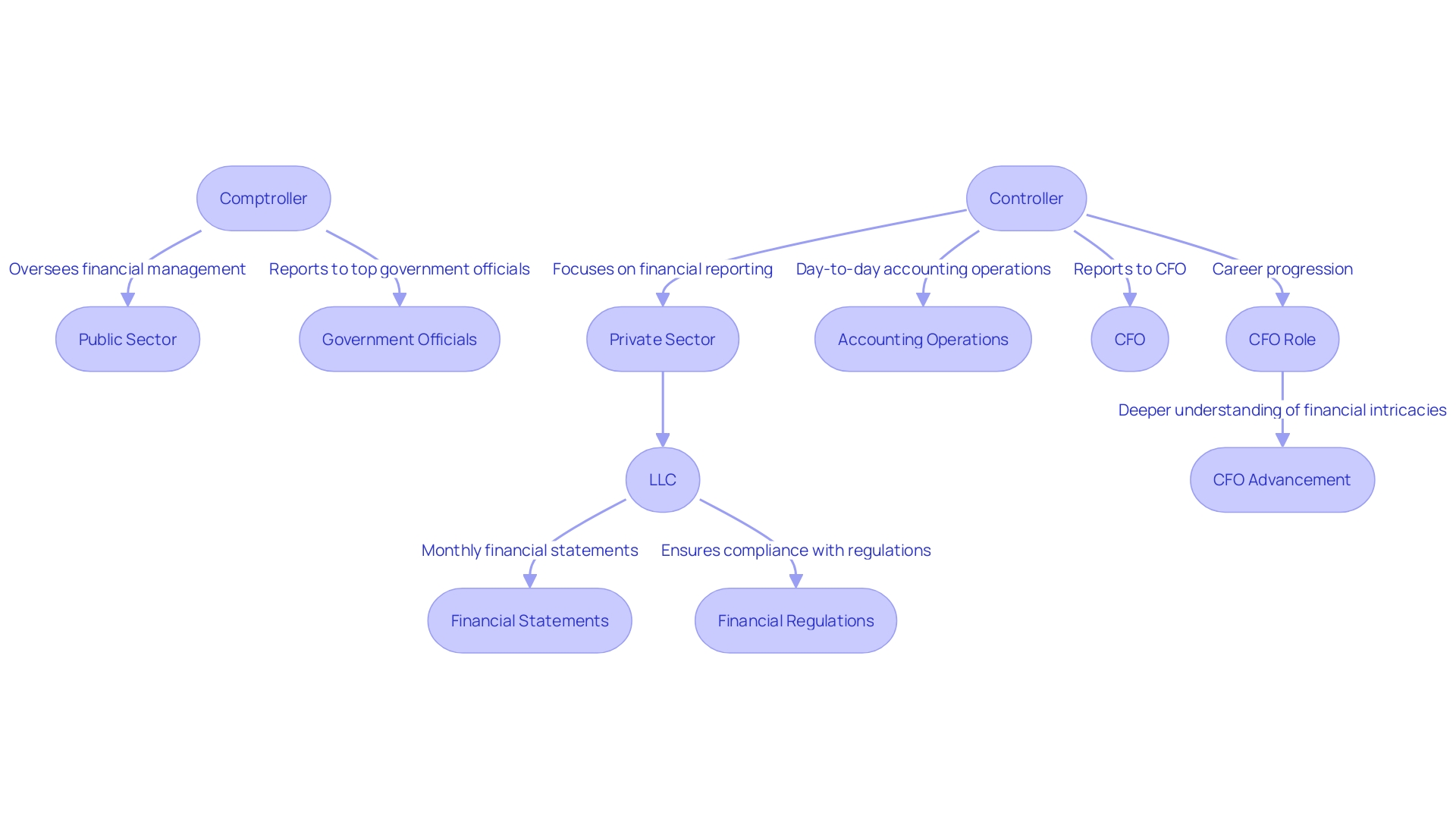

Comptrollers and controllers are both vital financial positions within an organization, yet they differ in several aspects. In the public sector, a comptroller oversees a broader range of financial management tasks and compliance, often reporting directly to top government officials.

This role is subject to rigorous regulatory scrutiny and plays an integral part in maintaining the financial integrity of public institutions. Controllers, more common in the private sector, are pivotal in driving accurate financial reporting and managing the day-to-day accounting operations.

They typically report to the CFO and contribute significantly to the financial health and compliance of the company. Controllers in Limited Liability Companies (LLCs) are instrumental in producing monthly financial statements and ensuring the reliability of financial reporting, which is fundamental to guiding the company's financial strategy.

Their expertise is not only essential for internal management but also for maintaining compliance with financial regulations. It's the controller's grasp of financial details that makes them a key player in the financial architecture of an organization and a potential candidate for the CFO role, which demands a deeper understanding of financial intricacies such as strategic planning, risk management, and financial analysis. Moreover, the evolving dynamics of corporate governance highlight the increasing complexity of financial roles. A controller's contribution to financial reporting is critical, and as the financial landscape continues to shift, these professionals are expected to adapt and enhance their expertise to meet the changing demands of the business environment.

Industry and Organizational Context

In the nuanced world of financial oversight, the roles of comptrollers and controllers are shaped by the specific sectors they serve. Comptrollers in the public sector are the guardians of fiscal integrity, ensuring that taxpayer-funded entities operate within the bounds of governmental regulations and maintain the highest levels of transparency and accountability. Their work is essential for upholding public trust and facilitating informed policy decisions.

In contrast, controllers in the private sector are the linchpins of financial strategy for corporations and businesses. They navigate the complexities of financial reporting, deftly managing the books to optimize performance and enhance profitability. These professionals are not just number crunchers; they are strategic partners in steering their organizations towards financial success, contributing to a robust, dynamic economy where the impact of financial decisions is carefully weighed against the backdrop of market demands and operational realities.

Responsibilities and Focus

Navigating the financial landscape of an organization requires a keen understanding of its unique challenges and goals. Controllers, particularly within Limited Liability Companies (Llcs), play a pivotal role in this domain.

Their expertise is not just confined to preparing monthly financial statements but extends to ensuring the integrity of financial reporting and steering the company's financial health. They are the linchpins in shaping financial strategy and maintaining compliance, a task that is as critical as it is complex.

In the public sector, comptrollers carry the mantle of financial stewards with a broader remit. Their purview includes not only financial management but also the meticulous oversight of government funds, ensuring legal compliance, and contributing to initiatives like the Compact.

By focusing on skills, digital transformation, and the green transition, comptrollers support the public administration’s capacity to address collective challenges and adhere to overarching principles that enhance the quality of governance. The role of a controller is multifaceted and evolving. It encompasses a deep dive into financial reporting, strategic financial planning, risk management, and financial analysis. The journey from controller to CFO is marked by a transition from technical financial expertise to a strategic, company-wide perspective on finance that significantly impacts the organization's trajectory. As the financial nerve center, controllers are instrumental in guiding the company towards growth, informed by a robust understanding of cost control and strategic decision-making.

Salary and Benefits

Compensation for comptrollers and controllers is influenced by a myriad of factors including the sector, company size, and geographic location. Public sector comptrollers often face a regulated pay structure, while their counterparts in the private sector, particularly in lucrative industries such as healthcare and technology, may enjoy greater salary prospects.

For instance, the dynamic healthcare sector is currently poised for growth, potentially leading to more competitive compensation for financial professionals within it. Similarly, the booming semiconductor industry, fuelled by increasing chip demand and technological advancements, could offer controllers substantial financial rewards.

The importance of a competitive compensation structure is underscored by Courtney McMillian of Vanguard HR Strategy Group, who asserts that understanding market trends is crucial to attract and retain top talent. In a fundraising environment that has seen a slowdown, as reported by Heidrick & Struggles, firms are now focusing on hiring individuals with deep product knowledge and sales operations expertise, suggesting a shift toward value-driven compensation strategies.

Controllers in LLCs play a pivotal role in maintaining financial health through meticulous financial reporting and strategic guidance. Amidst economic pressures, such as inflation and natural disasters impacting workforce stress, companies are increasingly called upon to support their employees, highlighting the significance of a well-considered benefits package in addition to salary. While manufacturing and sales dominate private industry, the public sector's compensation cannot be directly compared due to different occupational structures, as noted in the public domain publication on employee benefits. Therefore, those in financial controller positions must navigate these complexities to ensure their compensation aligns with industry standards and company objectives.

Similarities and Overlapping Roles

Comptrollers and controllers, despite the similarity in titles, each serve distinct yet critical roles within the financial framework of a company. A comptroller, often associated with government entities, ensures that the entity adheres to the appropriate accounting standards and financial regulations.

They are instrumental in the transparent and consistent disclosure of financial information. Controllers, on the other hand, are typically found in private sector organizations like Limited Liability Companies (Llcs), where they manage the accounting operations.

Their primary responsibilities include the production of accurate monthly financial statements and the overall management of the company's financial reporting. The roles of comptrollers and controllers converge in their shared obligation to guide financial strategy and maintain compliance.

Controllers, specifically, are pivotal in shaping the financial reporting processes within a company, ensuring that reports are both accurate and reflective of the company's financial health. As the financial landscape evolves, particularly with the rise of digital assets and the complexities they introduce, the need for clear, consistent financial reporting and robust financial oversight becomes ever more critical.

The challenges faced by financial professionals, including controllers, are exemplified by the difficulties in treating digital assets under current accounting standards. The definition of fair value for these assets remains unclear, leading to non-transparent disclosures and inconsistent reporting. As such, there's an increasing demand for automation and sophisticated software solutions to streamline the intricate data processing involved in financial management, especially in the burgeoning field of Web3. For those aspiring to the esteemed role of Chief Financial Officer (CFO), a comprehensive understanding of financial reporting, strategic financial planning, risk management, and financial analysis is imperative. Controllers with an eye on the CFO position must deepen their financial knowledge beyond the elementary skills to encompass these broader strategic competencies.

Conclusion

In conclusion, comptrollers and controllers play crucial roles in financial management. Comptrollers steer public sector organizations towards financial integrity and operational efficiency, while controllers manage accounting operations and financial reporting in the private sector. Comptrollers have a broader range of tasks and compliance responsibilities, while controllers focus on accurate reporting and day-to-day operations.

Public sector comptrollers uphold fiscal integrity, while private sector controllers contribute to financial strategy. Factors like sector, size, and location influence compensation for both positions. Public sector pay structures may differ from the potentially greater salary prospects in the private sector.

Both roles share similarities in guiding financial strategy and maintaining compliance. As digital assets and automation solutions evolve, clear financial reporting becomes increasingly important. For aspiring CFOs, understanding financial reporting, strategic planning, risk management, and analysis is crucial.

Controllers aiming for the CFO position should deepen their knowledge beyond technical skills. Understanding the distinctions between comptrollers and controllers is essential for effective decision-making in financial management. It allows CFOs to navigate challenges and seize opportunities based on each role's unique contributions.