Introduction

Forging the path of an organization's fiscal future requires more than number crunching; it demands insightful queries and a deep dive into the monetary landscape. In this article, we explore the roles of CFOs and Controllers in financial leadership and the key differences between them.

We also delve into their respective responsibilities and expertise, and provide guidance on when to bring on a CFO or Controller. Whether you're a CFO seeking to enhance strategic financial leadership or a Controller focused on tactical financial operations, this article offers practical insights and solutions to help you excel in your role.

The CFO: Strategic Financial Leadership

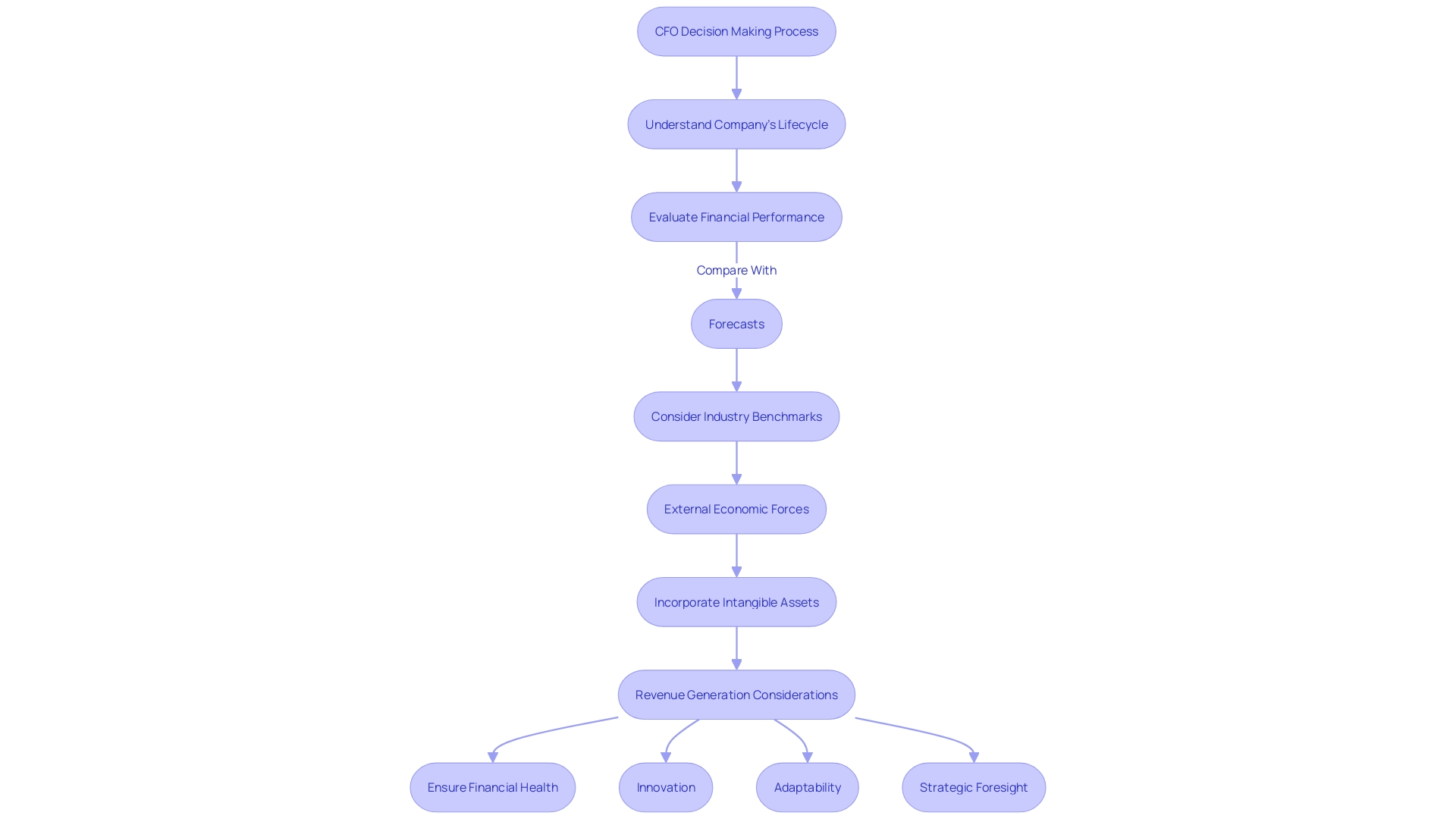

Forging the path of an organization's fiscal future requires more than number crunching; it demands insightful queries and a deep dive into the monetary landscape. A CFO's understanding begins with discerning where the company stands in its lifecycle, acknowledging the current stage of funding, and recognizing the stage-specific success indicators. For instance, fledgling enterprises experience less pressure to be profitable compared to their mature counterparts, thus guiding strategic decisions differently.

Reflecting on the past year, it is essential to evaluate how the actual numbers stack up against the forecasted plan, prompting necessary operational shifts for sustainability and growth. Financial prowess is paramount for a CFO, as day-to-day decisions are often shaped by an innate sense of what benefits employees and the organization over the long haul. This intuitive skill is honed through experiences across fast-growing companies, particularly within the Human Resources domain.

Yet, to truly thrive in finance and corporate leadership, one must cultivate a thorough comprehension of how a firm generates revenue, including the crucial impact of intangible assets on market growth and profit margins. Staying ahead necessitates an appreciation for industry benchmarks and external economic forces that can either boost or impede business progress. Stepping into the CFO role brings with it the responsibility to not only oversee the financial health of the organization but also to stir it towards perpetual innovation, adaptability, and strategic foresight.

The Controller: Tactical Financial Operations

Stepping away from the strategic horizon often occupied by a CFO, the realm of a Controller is one of tactical precision and day-to-day fiscal stewardship. Their keen oversight ensures financial transactions are recorded with utmost accuracy, which is pivotal for reliable financial reporting.

Tasked with the guardianship of company ledgers and cash flow management, Controllers are the linchpins in the budgeting process, fortifying regulatory adherence and accounting norms. This overarching role not only cements the financial foundation of a firm but also underwrites its operational finance support, shaping the narrative of fiscal integrity within the organization.

Controllers emerge as architects of financial statements, crafting these pivotal documents with both the frequency and meticulousness required to inform corporate trajectories and fulfil statutory mandates. Their diligent report preparation, often on a monthly and annual basis, forms the backbone for strategic decision-making. As they harness the complex dynamics of financial data, Controllers bring clarity to the fiscal outlook, enabling businesses to navigate the economic landscape with confidence and congruence to established financial practices. It is through such steadfast commitment to financial precision that a Controller's influence can be felt, guiding a company securely through fiscal challenges and opportunities alike.

Key Differences: CFO vs Controller

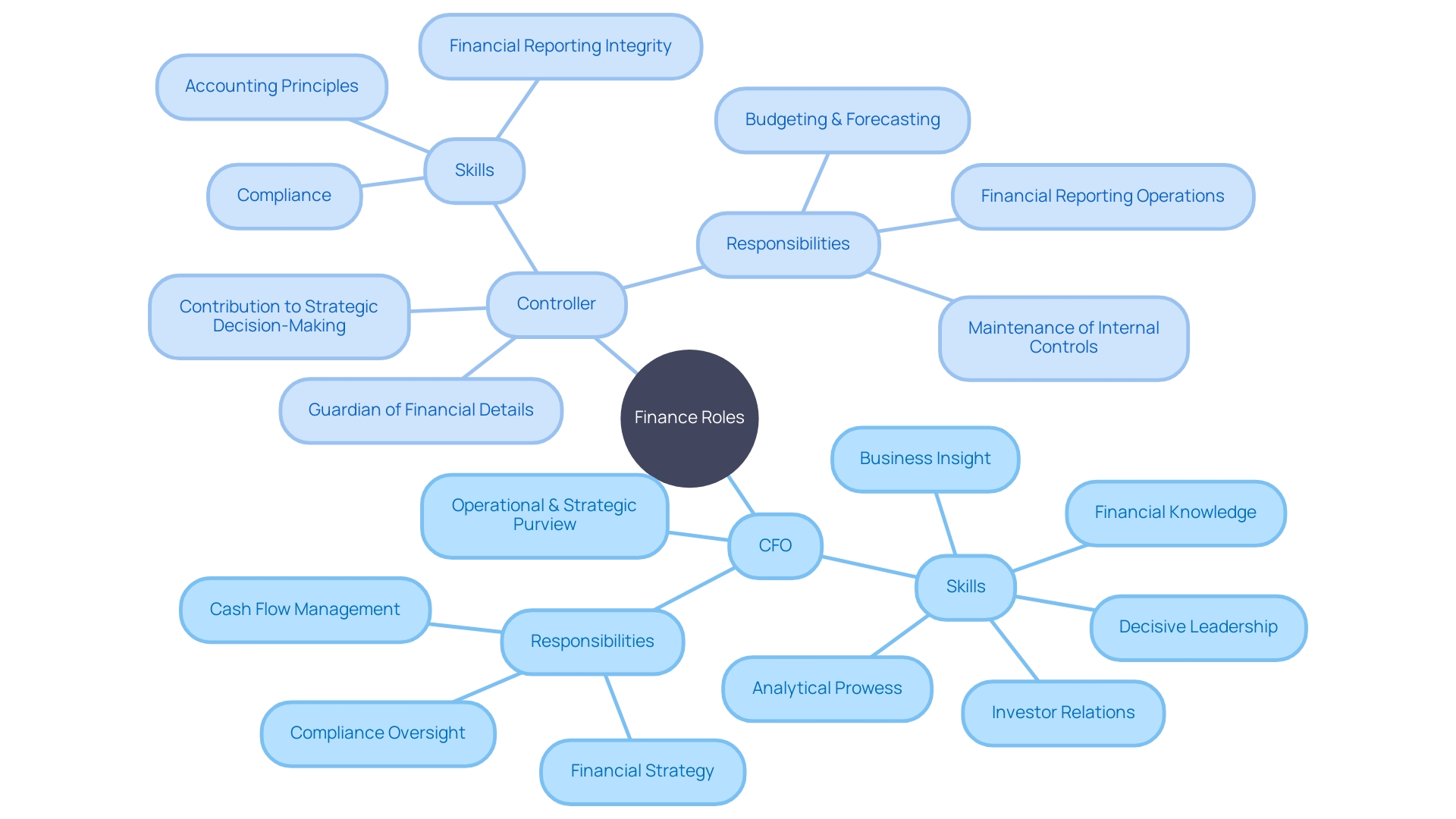

Clear delineation of roles within an organization's financial hierarchy is critical to its well-being. The Chief Financial Officer (CFO) serves as the linchpin for fiscal strategy, using sharp financial acumen to navigate future company finances and to communicate with investors and market analysts.

In contrast, a Controller is seen as the steward of compliance and accuracy, who aligns daily financial activities with established accounting practices. At the forefront of financial leadership, the CFO is tasked with formulating company financial strategies that resonate with overall business goals.

This strategic positioning often encompasses developing robust financial policies that ensure adherence to regulations and a sound system of internal controls. The CFO is also responsible for a comprehensive suite of financial reporting – from cash flow statements to balance sheets – that fuels informed decision-making and business planning.

In comparison, the Controller plays a vital role in managing the minutiae of the company's finances, with a strong emphasis on historical data accuracy. While the CFO looks outward and to the future, the Controller ensures the company's financial machinery runs smoothly, interfacing mainly with internal team members to support departments with precise financial data and insights. The distinction in stakeholder engagement is also pronounced: the CFO's realm extends to external stakeholder interaction, a role imperative for maintaining investor relations and securing capital. Meanwhile, the Controller's scope tends to be more introspective, focusing on internal audits and reports that help maintain the company's financial integrity. For a small business considering its financial leadership structure, understanding these roles' distinctions enhances its capacity to manage finances effectively, ensure compliance with financial norms, and craft a forward-looking fiscal strategy that supports sustainable growth.

Role and Responsibilities

In the landscape of financial leadership within an organization, the roles of a CFO and a Controller are distinct but complementary. A CFO embodies the strategic financial vision, crafting long-term financial plans, guiding capital allocations, evaluating risks, and providing deep financial insights. This role involves not only a coherent grasp of the company's current financial health but also a nuanced recognition of its lifecycle and stage of funding, to develop strategies that resonate with the organization's overarching objectives.

On the other hand, a Controller provides tactical financial oversight, managing the nitty-gritty of daily accounting, ensuring rigorous financial reporting, and overseeing cash flow. Their responsibilities involve maintaining budgeting precision and unwavering compliance, foundational for operational stability. A CFO, in essence, takes on a senior management mantle, particularly critical in small businesses where every strategic decision materially influences growth trajectories.

Financial strategy development and stringent financial reporting—which includes income statements, balance sheets, and cash flow statements—bear testament to their central role. It is evident that while a Controller focuses on the tactical and procedural facets of finance, a CFO's purview is definitive and growth-oriented, encompassing strategic imperatives essential for steering the organization towards a prosperous future. This distinction, often underscored by rigorous financial analysis and compliance, underscores the dynamic nature of these roles in guiding business success.

Expertise and Expectations

To navigate the complexities of finance with dexterity, CFOs and Controllers must hone distinctive skill sets that align with their unique roles. CFOs are the strategic financial visionaries, steering the company's monetary course with a blend of analytical prowess, business insight, and robust financial knowledge.

Their expertise is not confined to numbers; it transcends to encompass investor relations and decisive leadership. A controller, conversely, is the guardian of financial details.

With a sharp eye for compliance and a command of accounting principles, they ensure the integrity of financial reporting and serve as the cornerstone for strategic decision-making. Razzak Jallow's journey to becoming CFO at FloQast underscores this shift, illustrating a transformation from traditional finance functions to a broader operational and strategic purview, augmented by cutting-edge technologies like automation that facilitate effective financial management and compliance. In the backdrop, comprehensive studies like the Global State of Business Analysis Report reveal trends and benchmarks crucial for those in financial roles. As the finance landscape evolves, it's clear that both CFOs and Controllers are indispensable, each contributing uniquely to the fiscal and strategic fabric of a business, equipped with the knowledge and tools needed to guide their companies to success.

When to Bring on a CFO or Controller

Selecting a financial officer for an organization calls for careful consideration of the specific needs and the stage the company is in. A CFO, equipped to steer a company through strategic financial leadership, is essential when entering capital markets and making complex financial decisions.

Notably, the aptitude for strategic financial planning, risk management, and in-depth analysis are key CFO skills that position them as navigators of a company's financial direction. On the other hand, a Controller is instrumental when prioritizing robust financial management, precise reporting, and daily compliance.

When delineating between the roles, a CFO typically focuses on molding the financial strategy to align with the organization’s overarching goals, while a Controller manages the seamless operation of accounting processes and financial statement preparation. In scenarios where an organization, akin to the Ford Foundation's evolution from modest content creation to a more frequent publishing schedule, experiences complexity and growth, both roles might be necessary. This ensures that both strategic and operational financial elements are effectively managed, safeguarding the company's assets and ensuring regulatory compliance. Setting a company on a path to financial proficiency and compliance starts with addressing critical questions about the company's lifecycle, funding stage, and current financial positioning relative to the annual plan, as these answers will influence how the financial operations need to be structured.

Conclusion

In conclusion, CFOs and Controllers have distinct but complementary roles in financial leadership. CFOs focus on strategic financial planning, risk evaluation, and providing deep insights, while Controllers prioritize accurate financial reporting and daily fiscal oversight. The key differences lie in their areas of focus and stakeholder engagement.

CFOs look outward, engaging with external stakeholders such as investors, while Controllers have an internal focus, ensuring compliance and precise reporting. When deciding to bring on a CFO or Controller, organizations should consider their specific needs and growth stage. CFOs are vital for complex financial decision-making and strategic planning, while Controllers excel in maintaining financial management and compliance.

Overall, CFOs and Controllers are integral in driving the financial success of an organization. Their expertise and knowledge guide effective financial leadership, fostering growth and ensuring compliance. Understanding these roles' distinctions allows organizations to make informed decisions that enhance their financial strategies and drive sustainable growth.