Introduction

Amortization is a crucial accounting concept that involves the gradual recognition of the cost of an intangible asset over its estimated useful life. It functions similarly to depreciation, but while depreciation applies to tangible assets, amortization pertains to intangible ones. The rationale behind amortization is to systematically allocate an intangible asset's cost in a way that reflects its consumption or benefit to the business over time.

By incorporating amortization expenses within the income statement, companies can present a more accurate depiction of how the value of intangible assets diminishes as they contribute to revenue generation. This accounting practice is key to ensuring that financial statements provide a true representation of a company's financial health by matching expenses with the income produced in a given period. In this article, we will explore the definition and purpose of amortization, its impact on the income statement, the calculation of amortization expense, examples of amortization expenses, the impact on financial ratios and cash flow, the differences between depreciation and amortization, and the tax implications of amortization.

Understanding these aspects of amortization is vital for CFOs as it influences financial planning and analysis, impacting decisions related to investments and the management of intangible assets.

Definition and Purpose of Amortization

Amortization is a crucial accounting concept that involves the gradual recognition of the cost of an intangible item over its estimated useful life. It operates in a comparable manner to depreciation, but whereas depreciation is applicable to physical possessions, amortization is applicable to intangible ones. The reason behind spreading out the cost of a non-physical resource is to methodically distribute it over time, taking into account its usage or advantage to the company. By including amortization costs in the income statement, companies can provide a more precise representation of how the value of intangible assets decreases as they contribute to revenue generation. This bookkeeping practice is crucial to guaranteeing that statements provide an accurate depiction of a company's fiscal well-being by aligning expenses with the income generated in a given period. For instance, when a business invests in software development, it's essential to recognize that the value of the software will not be consumed immediately but over several years. Amortization allows the cost to be expensed systematically, mirroring the software's usage and benefit to the company. Such cautious monetary management demonstrates a strategic approach to handling the company's resources, ensuring that the statements are aligned with the actual economic activities. Furthermore, comprehending amortization is crucial for CFOs as it affects financial planning and analysis, influencing decisions related to investments and the management of intangible resources.

Impact of Amortization on the Income Statement

Amortization is a methodical accounting practice that spreads the cost of an asset over its useful life, affecting the profitability of a company. This non-cash cost is shown on the income statement and results in a reduction in net income. It's not just about reducing profitability; the process of spreading expenses across time touches upon several monetary indicators. For example, earnings per share (EPS) and return on assets (ROA), both important measures in analysis of finance, can be greatly affected by costs associated with the gradual reduction of debt. Grasping the intricacies of repayment is crucial for accuracy in reporting and strategic decision-making. To illustrate, let's consider Monday.com, which has demonstrated remarkable efficiency in its growth trajectory, becoming free cash flow positive at an impressive pace. Their emphasis on efficiency, which is closely linked to the strategic management of costs like depreciation, has strengthened their standing, emphasizing the significance of such practices for sustainable growth and shareholder value. Additionally, it's essential to recognize that not all revenue is equal; the long-term viability and valuation of a company are deeply intertwined with its capability to generate free cash flow. As a result, CFOs must have the skill to understand how the gradual reduction and comparable costs impact the overall financial situation, guaranteeing that their approaches are in line with the company's goals and market anticipations.

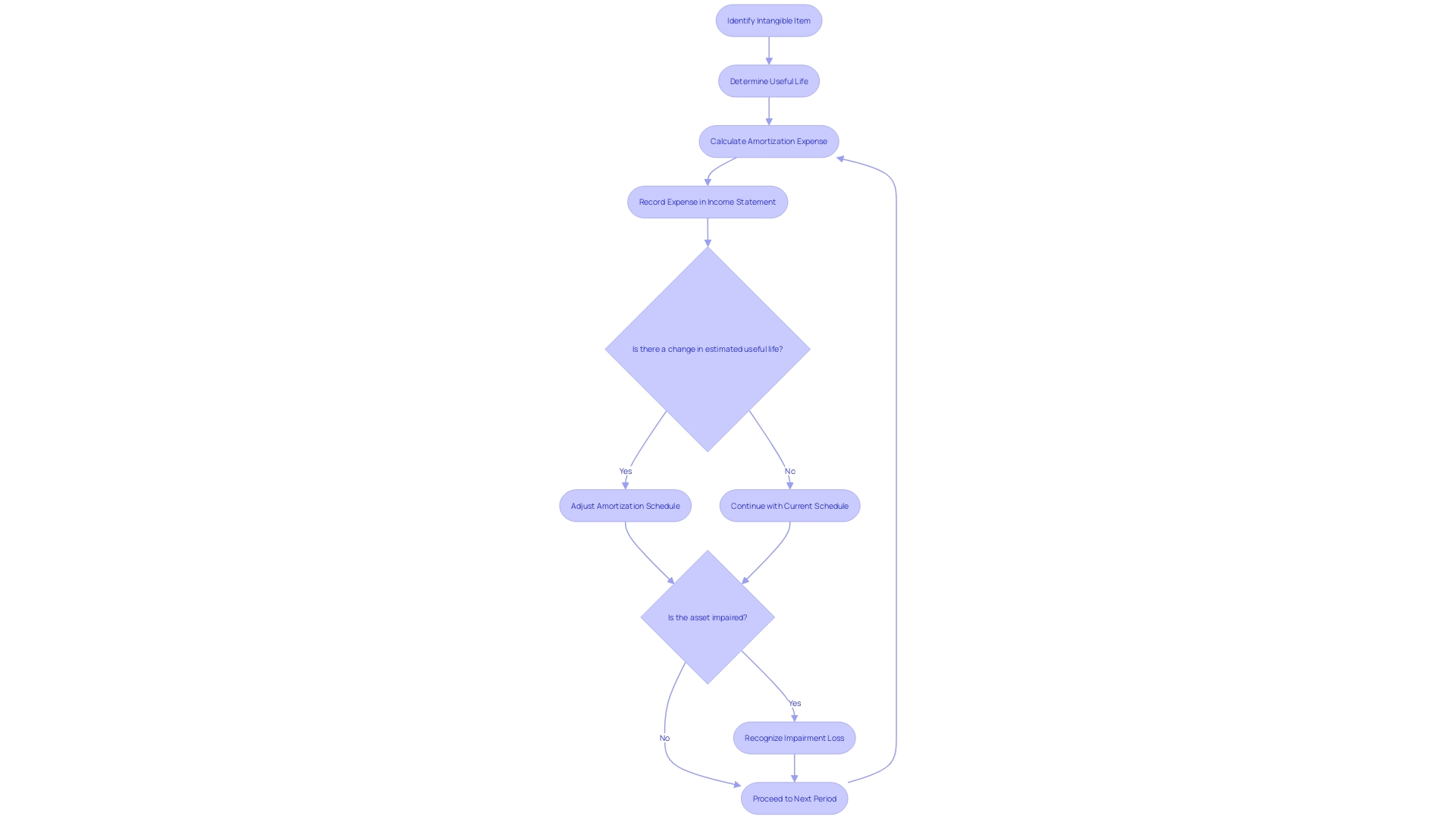

Calculation of Amortization Expense

When considering the accounting of intangible properties, comprehending the costs of depreciation is essential. Intangible resources, unlike concrete resources, are not physical items you can touch or see, like buildings or machinery, but include valuable non-physical resources such as brands and software. The procedure of allocating the expense of these intangible properties over their valuable life involves. To calculate the annual amortization cost, CFOs utilize a simple formula: deduct the residual value from the initial cost of the intangible asset and divide this by the asset's useful life.

The choice on how to manage these costs should not be underestimated, as it greatly affects the statements of finance. Materiality plays a key role here—it's the threshold above which missing or incorrect information in financial statements is considered to influence the economic decisions of users. This principle guides whether an expense should be immediately recognized in the profit and loss statement or initially recorded on the balance sheet and then gradually expensed. For instance, the IRS defines computer software and its upgrades as intangible assets, which are likely to be subject to amortization.

With the recent introduction of IFRS 18 by the IASB, there are new standards to consider, especially concerning the presentation and disclosure in statements. These changes aim to streamline how financial information is communicated, making it easier for stakeholders to understand the financial performance of an entity.

Let's look at the example of mortgage payment scheduling to illustrate how the process works in practice. When a borrower makes installment payments on a loan, these are divided between the principal and interest. A longer amortization period means lower monthly payments but results in more interest paid over time. Understanding this schedule is crucial for informed financial decision-making.

Brands, as another example of intangible resources, are defined by their ability to create distinctive images and associations in stakeholders' minds, leading to economic benefits. The strength of a brand is measured by its performance on intangible measures relative to competitors. It's crucial to acknowledge the importance of such intangible resources accurately and amortize them appropriately to accurately reflect their contribution to a company's economic success.

In essence, appropriate spreading out practices offer a more transparent view of a company's economic well-being and assist in the effective administration of its accounting system, guaranteeing that costs are acknowledged in a way that reflects their genuine essence and timing.

Examples of Amortization Expense

Amortization costs, which indicate the gradual allocation of the value of intangible assets, are a vital element in statements of finance. Take, for example, the acquisition of a software license by a company. If this software license is purchased for $100,000 and is expected to benefit the company for 5 years without any salvage value, it results in an annual cost of $20,000. This is computed by evenly spreading the total cost over the software's useful life. Each year, this amount is methodically recorded on the income statement, reflecting the consumption of the software's economic benefits over time.

The handling of such costs can have a significant effect on financial reporting and decision-making. For instance, the recent IRS Notice elaborated on the definition of software development, including activities such as planning, designing, coding, and testing of software. This clarification has implications for the capitalization of software development costs and, subsequently, their gradual repayment.

In the context of a brand, acknowledged as a powerful intangible asset, the linked costs are amortized based on the brand's strength and performance. According to Brand Finance, a brand's strength index and rating affect its valuation and the amortization strategy.

The choice to record a cost directly to the income statement or to initially put it on the balance sheet carries significant importance. This decision should be influenced by the significance of the cost within the framework of the company's financials. A cost may be deemed significant due to its size or its nature, potentially changing the landscape of a business and impacting stakeholders' perceptions.

Impact on Financial Ratios and Cash Flow

Amortization plays a crucial role in shaping a company's outlook, especially when assessing profitability and cash flow. These costs, although not resulting in cash outflows, affect the net income disclosed on the income statement, as observed in the case of Monday.com. Their effective growth path and capability to generate positive free cash flow as expansion decelerated highlights the significance of comprehending the broader financial well-being of a company.

When significant costs related to the gradual reduction of an intangible asset's value over time are present, they can suppress key profitability metrics like gross profit margin and operating profit margin. This is because these costs are deducted from revenue in calculating net income, thus decreasing profitability ratios. In the software sector, where expansion and productivity are crucial, the control of depreciation costs is essential for sustaining a strong cash flow and improving investor worth.

Additionally, given that the deduction of costs related to the gradual reduction of a debt in the determination of profit, they have the potential to influence the disclosed profits of the organization without directly affecting immediate cash movement. However, their effect on net income does play into the perception of the company's performance and can influence future cash flows through impacts on investment and financing decisions.

It's essential to recognize that every dollar of revenue is not equal; gross margin stands as a primary indicator of a company's underlying financial strength. After the investor behavior observed during the 2021 boom, where revenue growth was frequently given more importance than profitability, the significance of comprehending the intricacies of cost allocation has become even more evident.

The statement of cash flows provides vital insights into a company's cash generation capabilities, accounting for cash involved in operations, investments, and financing. Amortization expenses are a significant consideration within the operating cash flow segment, as they are added back to net income in the reconciliation to cash generated from operations. This adjustment is a recognition of the non-cash nature of the process of allocating expenses over time, reinforcing the importance of a comprehensive analysis beyond the income statement to truly assess a company's financial health.

Differences Between Depreciation and Amortization

Depreciation and amortization are accounting methods that acknowledge the cost of a property throughout its helpful life, but they apply to distinct kinds of properties and can use different approaches. Depreciation is usually linked to material, tangible properties. For example, vehicles like trucks and hybrids are recognized for their strong value retention over time, with specific models losing only 20% to 30% of their value within the initial year, compared to other holdings that may depreciate more quickly. On the contrary, the process of gradual reduction applies to intangible properties such as patents or software licenses, which lack a tangible form but are essential for a company's functioning and assessment.

The methods employed to calculate depreciation and amortization can also differ significantly. The straight-line method is a common approach for tangible resources, distributing the cost evenly over the resource's lifespan. On the other hand, intangible resources may frequently be depreciated utilizing expedited techniques like the double-declining balance, which permits for a more significant cost recognition in the initial years. This distinction is essential in the context of a company's financials, as the choice of method can impact the reported earnings and thus the company's valuation. As the nature of business assets shifts increasingly towards intangibles, the implications for reporting and equity valuations are profound, necessitating a deeper understanding of these accounting practices.

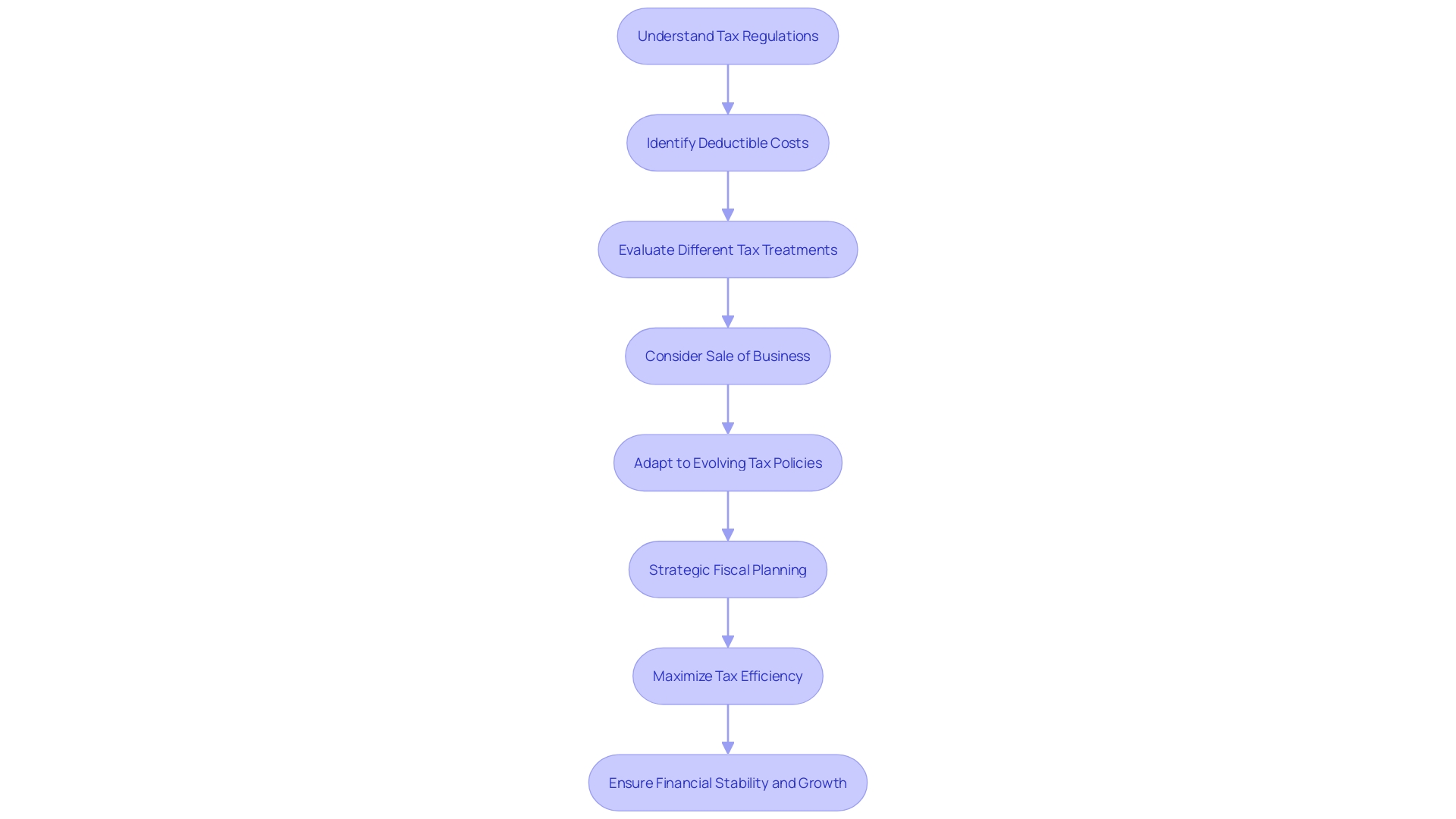

Tax Implications of Amortization

While businesses deal with the intricacies of tax regulations, the impact of the gradual reduction of costs on their economic well-being should not be underestimated. The ability to subtract these costs from taxable income is a crucial element that can result in a substantial decrease in tax responsibility, strengthening a company's cash flow. For instance, changes to Section 174 of the U.S. tax code recently sent shockwaves through the software industry, transforming previous norms for expensing costs related to research and development, including software development labor. This amendment meant that expenses once immediately deductible now require capitalization and amortization over a period of years, presenting a significant shift for affected businesses.

With the IRS's clarification on what constitutes software development, including activities from planning to testing, CFOs must remain vigilant in understanding these definitions and their associated tax treatments. It's not just about compliance; it's about strategic fiscal planning. For example, a hypothetical company, Acme Corp., with $1,000,000 in annual revenue from a SaaS service, could now face a drastically different financial statement due to the tax law alterations.

When considering the sale of a business, the choice between a stock sale or a sale of the company's holdings becomes pivotal due to varying implications on the recognition of capital gains. This, alongside the guidelines for short and long-term capital gains rates, influences the ultimate tax efficiency of the transaction. Additionally, accurately establishing the value of business assets is essential, as it includes not just the purchase price but also ancillary costs such as installation and training.

Furthermore, the landscape of tax policy is ever-evolving. With proposals such as the “Tax Relief for American Families and Workers Act of 2024,” CFOs must be prepared for changes that could impact the deductibility of business expenses, such as the limitation on business interest expense deductions set by the Tax Cuts and Jobs Act of 2017. This underscores the necessity for continuous monitoring and adaptation to the dynamic world of tax regulation to safeguard the financial stability and growth of the organization.

Conclusion

In conclusion, understanding and effectively managing amortization expenses is crucial for CFOs. Amortization systematically allocates the cost of intangible assets over their useful life, ensuring accurate financial reporting and informed decision-making. It impacts the income statement, financial ratios, and cash flow.

Calculating amortization expenses involves a straightforward formula that considers materiality and accounting standards. Proper treatment of expenses related to intangible assets, such as software licenses and brands, is essential for accurate financial reporting.

Amortization expenses play a critical role in shaping a company's financial outlook. They affect profitability, cash flow, and financial ratios like earnings per share and return on assets. Efficient management of these expenses is vital for maintaining a healthy cash runway and enhancing shareholder value.

Differences between depreciation and amortization lie in the types of assets and calculation methods used. Depreciation applies to tangible assets, while amortization pertains to intangible assets. The choice of method impacts reported earnings and valuation.

Tax implications of amortization expenses can significantly reduce tax liability and improve cash flow. Changes in tax regulations require CFOs to stay vigilant and adapt their financial planning strategies.

In summary, understanding and managing amortization expenses enable CFOs to accurately reflect the value and consumption of intangible assets, make informed decisions, and ensure financial stability and growth. It is a vital aspect of financial planning and analysis for CFOs, impacting investments and intangible asset management.